GK 2014.6.28-10K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________

FORM 10-K

____________________________________________________________

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Fiscal Year Ended June 28, 2014

Commission file number 0-4063

____________________________________________________________

G&K SERVICES, INC.

(Exact name of registrant as specified in its charter)

|

| | |

MINNESOTA | | 41-0449530 |

(State of incorporation) | | (I.R.S. Employer Identification No.) |

5995 OPUS PARKWAY

MINNETONKA, MINNESOTA 55343

(Address of principal executive offices)

Registrant’s telephone number, including area code (952) 912-5500

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | | Name of Each Exchange on which Registered |

Class A Common Stock (par value $0.50 per share) | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

____________________________________________________________

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

Large accelerated filer | x | Accelerated filer | o |

Non-accelerated filer | o (do not check if a smaller reporting company) | Smaller reporting company | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of December 28, 2013 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the registrant’s voting common equity held by non-affiliates was approximately $1,266,860,670.

On August 14, 2014, 19,913,535 shares of the registrant's Class A Common Stock were outstanding.

____________________________________________________________

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this report, to the extent not set forth herein, is incorporated by reference from the registrant’s definitive proxy statement relating to the annual meeting of shareholders to be held in November 2014, which definitive proxy statement will be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

G&K Services, Inc.

Form 10-K

For the fiscal year ended June 28, 2014

Table of Contents

PART I

G&K Services, Inc., founded in 1902 and headquartered in Minnetonka, Minnesota, is a service-focused market leader of branded uniform and facility services programs. We deliver value to our customers by enhancing their image and brand, and by promoting workplace safety, security and cleanliness. We accomplish this by providing high quality branded work apparel programs, and a variety of facility products and services, including floor mats, towels, mops and restroom hygiene products. We have a team of 7,800 employees who operate from approximately 165 locations. These locations serve customers in 96 of the top 100 metropolitan markets across the United States and Canada.

Customers, Products and Services

We serve a diverse base of approximately 170,000 customer locations. We serve customers in virtually all industries, including automotive, warehousing, distribution, transportation, energy, manufacturing, food processing, pharmaceutical, retail, restaurants, hospitality, government, healthcare and others. We provide service to customers of almost every size, from Fortune 100 companies to small and midsize firms. No single customer represents more than 2.0% of our total revenue. We count over one million people within our customer base who wear G&K work apparel every work day.

Our customer focused relationships involve customers renting or directly purchasing uniforms and providing facility products and services to meet a variety of critical needs in the workplace, including:

| |

• | Image – work apparel helps companies project a professional image through their employees and frame the perception of credibility, knowledge, trust and quality to their customers. Employees in uniform are perceived as trained, competent and dependable. |

| |

• | Organization safety and security – uniforms and work apparel help identify employees working for a particular company or department. |

| |

• | Brand awareness – branded work apparel promotes a company's brand identity and allows employees in uniform to help convey a company's image. |

| |

• | Employee retention – work apparel enhances worker morale and helps build teamwork in addition to providing a tangible employee benefit. |

| |

• | Employee protection – work apparel helps protect employees from difficult environments, such as heavy soils, heat, flame or chemicals. |

| |

• | Product protection – work apparel and facility services help protect products against sources of contamination in various industries, including the food, pharmaceutical and health care industries. |

With a comprehensive understanding of our customers' requirements, we enhance our customers' image and safety by consistently providing superior service and high quality work apparel and facility products and services. Through proprietary tracking systems, a rigorous seven point inspection program, broad product inventories and an accurate measuring system, we promise our customers that deliveries are complete, on time and in good repair. By utilizing advanced technology and offering simple service agreements, we strive to make certain that billing is simple, accurate and predictable. In addition, we employ communication systems and perform closed-loop customer satisfaction practices to ensure our customers' needs are met promptly.

We utilize a collaborative approach to advise and assist our customers in choosing a work apparel program that best meets their unique brand, image, identity and safety needs. Our comprehensive range of work apparel and uniform rental programs offers flexibility in styles, colors and quantities, and sets service and distribution expectations to customer requirements. We can quickly source and access garments to provide rapid response as customer needs change due to increases, decreases or turnover in their work force. Professional cleaning, finishing, repair, embellishment and replacement of uniforms in use is a normal part of the rental service. Our handling of the details of a work apparel program allows our customers to focus on running their core business and not be concerned with the management time, operating costs and environmental exposures involved in running their own work apparel program or on-premise laundry.

We also offer complete facility services programs that provide a wide range of dust control, maintenance, hand care and hygiene products and services. These programs include floor mat offerings (traction control, logo, message, scraper, anti-fatigue), towel products (shop, kitchen, bar, bath, dish, continuous roll, microfiber), mop offerings (dust, microfiber, wet), fender covers, selected linen items and restroom hygiene products. Our regularly scheduled weekly service of these products and services helps our customers maintain a clean, safe and attractive environment within their facilities for their employees and customers.

Our customers also need a wide selection of branded apparel across a variety of jobs. Our comprehensive direct sale catalog business features a broad product selection, high quality embellishment, efficient distribution and various ordering and payment capabilities. We have developed a vast and comprehensive product offering of the best and hardest working brands in our industry tailored to the needs of our various market segments through our catalog offering. This branded apparel program can be used for uniform programs, employee rewards and recognition, trade shows and vendor appreciation programs.

For most of our customers, we provide weekly service, with our highly talented service professionals visiting customers' locations. This regular customer contact helps ensure we are meeting our customers' needs, while promoting strong relationships that lead to high customer retention and additional sales opportunities.

Acquisitions

Our industry continues to consolidate as many family-owned, local operators and regional companies have been acquired by larger providers. We have participated in this consolidation with an acquisition strategy focused on expanding our geographic presence and/or expanding our local market share in order to further leverage our existing production facilities. We remain active in evaluating quality acquisitions that would strengthen our business.

In the second quarter of fiscal 2013, we completed an acquisition in our rental operations business. The acquisition extended our rental operations footprint into five of the top 100 North American markets which we did not previously serve. In addition, we completed one small acquisition in fiscal 2012. We did not complete any acquisitions in fiscal year 2014. The results of the acquired businesses have been included in our Consolidated Financial Statements since the date of acquisition. The pro forma effect of these acquisitions, had they been acquired at the beginning of each fiscal year, were not material, either individually or in the aggregate. The total purchase consideration of these transactions was $18.5 million and $1.3 million in fiscal 2013 and 2012, respectively. The total purchase price exceeded the estimated fair values of identifiable assets acquired and liabilities assumed by $11.0 million and $0.7 million in fiscal 2013 and 2012, respectively.

Competition

We believe many customers in our industry choose providers based on the consistency of superior customer service received, hence our focus on service excellence. The customer-supplier relationship, unique business needs, brand awareness, quality image and improving safety are also key attributes in selecting a uniform provider. In addition, product quality, fit, comfort, price and breadth of products offered are factors in the decision process. We rank among the nation's largest work apparel providers and encounter competition from many companies in the geographic areas we serve. We compete effectively in our core work apparel and facility services business because of our focus on Delivering Uniform Service Excellence.

Manufacturing and Suppliers

We manufactured approximately 47% of the work apparel that we placed into service in fiscal year 2014. These garments are primarily manufactured in the Dominican Republic. Various outside vendors are used to supplement our additional product needs, including garments, floor mats, towels, mops, linens and related products. Although we occasionally experience product shortages, we are not currently aware of any circumstances that would materially limit our ability to obtain raw materials to support the manufacturing process or to obtain garments or other items to meet our customers' needs.

Environmental Matters

Our operations, like those of our competitors, are subject to various federal, state and/or local laws, rules and regulations respecting the environment, including potential discharges into water and air and the generation, handling, storage, transportation and disposal of waste and hazardous substances. We generate certain amounts of waste in connection with our laundry operations, including wastewater, wastewater sludge, waste oil and other residues. In a limited number of instances, certain of these wastes are classified as hazardous under applicable laws, rules and regulations. We continue to make significant investments in properly handling and disposing of these wastes, ensuring compliance with applicable regulations and operating our business with a keen eye on our environmental stewardship obligations and responsibilities.

We discuss certain legal matters in this Annual Report on Form 10-K under Part I, Item 1A. Risk Factors – Compliance with environmental laws and regulations could result in significant costs that adversely affect our operating results, Item 3. Legal Proceedings and Item 8. Financial Statements and Supplementary Data in Note 14 entitled "Commitments and Contingencies" of "Notes to Consolidated Financial Statements." While it is impossible to ascertain the ultimate legal and financial liability with respect to contingent liabilities, including lawsuits, legal matters, claims and environmental contingencies, based on information currently available and our assessment of the ultimate amount and timing of events, it is possible that we may incur additional losses in excess of established reserves. However, we believe the likelihood that any changes will have a material adverse effect on our results of operations or financial position is remote.

Employees

Our U.S. operations had approximately 6,500 employees as of June 28, 2014. Unions represent approximately 10% of our U.S. employees. Approximately 2% of our U.S. employees participate in collective bargaining agreements that expire in the next 12 months. Management believes its U.S. employee relations are good.

Our Canadian operations had approximately 1,300 employees as of June 28, 2014. Unions represent approximately 65% of our Canadian employees. Approximately 9% of our Canadian employees participate in collective bargaining agreements that expire in the next 12 months. Management believes its Canadian employee relations are likewise good.

Foreign and Domestic Operations

Financial information relating to foreign and domestic operations is set forth in Note 15, "Segment Information" of the Notes to the Consolidated Financial Statements included in Item 8 of this Form 10-K.

Intellectual Property

We own a portfolio of registered trademarks, trade names and licenses, and certain U.S. and foreign process and manufacturing patents relating to our business. These proprietary properties, in the aggregate, constitute a valuable asset. We do not believe, however, that our business is dependent upon any single proprietary property or any particular group of proprietary properties.

Seasonality and Working Capital

We do not consider our business to be seasonal to any significant extent or subject to any unusual working capital requirements.

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports are available free of charge, as soon as reasonably practicable, after we electronically file such material with, or furnish it to, the United States Securities and Exchange Commission ("SEC"). These reports are available on our website at http://www.gkservices.com and on the SEC's website at http://www.sec.gov. Information included on our website is not deemed to be incorporated into this Annual Report on Form 10-K.

The statements in this section, as well as statements described elsewhere in this Annual Report on Form 10-K, or in other filings made with the SEC, describe risks that could materially and adversely affect our business, financial condition and results of operations and the trading price of our securities. These risks are not the only risks that we face. Our business, financial condition and results of operations could also be materially affected by additional factors that are not presently known to us or that we currently consider to be immaterial to our operations.

In addition, this section sets forth statements which constitute our cautionary statements under the Private Securities Litigation Reform Act of 1995.

FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 provides a safe harbor from civil litigation for forward-looking statements. Forward-looking statements may be identified by words such as "estimates," "anticipates," "projects," "plans," "expects," "intends," "believes," "seeks," "could," "should," "may" and "will" or the negative versions thereof and similar expressions and by the context in which they are used. Such statements are based upon our current expectations and speak only as of the date made. These statements are subject to various risks, uncertainties and other factors that could cause actual results to differ from those set forth in or implied by this Annual Report on Form 10-K. Factors that might cause such a difference include, but are not limited to, the possibility of greater than anticipated operating costs, lower sales volumes, the performance and costs of integration of acquisitions or assumption of unknown liabilities in connection with acquisitions, fluctuations in costs of materials and labor, costs and possible effects of union organizing or other union activities, strikes, loss of key management, uncertainties regarding any existing or newly-discovered expenses and liabilities related to environmental compliance and remediation, failure to achieve and maintain effective internal controls for financial reporting required by the Sarbanes-Oxley Act of 2002, the initiation or outcome of arbitrations, litigation or governmental investigations, higher than assumed sourcing or distribution costs of products, the disruption of operations from catastrophic events, disruptions in capital markets, the liquidity of counterparties in financial transactions, changes in federal and state tax laws, economic uncertainties and the reactions of competitors in terms of price and service. We undertake no obligation to update any forward-looking statements to reflect events or circumstances arising after the date on which they are made, except as required by law.

Also note that we provide the following cautionary discussion of risks, uncertainties and assumptions relevant to our business. Actual results may differ from certain assumptions we have made causing actual events to vary from expected results. These are factors that, individually or in the aggregate, could cause our actual results to differ materially from expected and historical results. We note these factors for investors as permitted by the Private Securities Litigation Reform Act of 1995. You should

understand that it is not possible to predict or identify all such factors. Consequently, you should not consider the following to be a complete discussion of all potential risks or uncertainties.

General economic factors may adversely affect our financial performance.

General economic conditions may adversely affect our financial performance. High levels of unemployment, inflation, tax rates and other changes in tax laws and other economic factors could adversely affect the demand for our products and services. Increases in labor costs, including health care and potential increased costs under health care reform legislation, insurance costs, higher material costs for items, such as linens, other textiles and various raw materials, higher fuel and other energy costs, higher interest rates, inflation, higher tax rates and other changes in tax laws and other economic factors could increase our costs of rental and direct sales and selling and administrative expenses and could adversely affect our results of operations.

Increased competition could adversely affect our financial performance.

We operate in highly competitive industries and compete with national, regional and local providers. Service, product quality, design, fit, comfort, price, breadth of products offered and convenience to the customer are the primary competitive elements in these industries. If existing or future competitors seek to gain or retain market share by reducing prices, we may be required to lower prices, which could be detrimental to our operating results. Our competitors also generally compete with us for possible acquisitions, which can increase the price for acquisitions and reduce the number of available acquisitions. In addition, our customers and prospects may decide to perform certain services in-house instead of outsourcing such services. These competitive pressures could adversely affect our sales and operating results.

Risks associated with the suppliers from whom our products are sourced, and the cost of those products, could adversely affect our operating results.

The products we sell are sourced from a variety of domestic and international suppliers. Global sourcing of many of these products is an important factor in our financial performance. We endeavor that all of our suppliers comply with applicable laws, including, without limitation, labor and environmental laws. Our ability to secure and maintain qualified suppliers who meet our standards and to access products in a timely and efficient manner can be a significant challenge, especially with respect to suppliers located and goods sourced outside the United States. Political and economic stability in the countries in which foreign suppliers are located, the financial stability of suppliers, failure to meet our supplier standards, labor problems experienced by our suppliers, the availability and cost of raw materials to suppliers, currency exchange rates, transport availability and cost, inflation and other factors relating to the suppliers and the countries in which they are located are beyond our control. In addition, United States and Canadian foreign trade policies, tariffs and other impositions on imported goods, trade sanctions imposed on certain countries, the limitation on the importation of certain types of goods or of goods containing certain materials from other countries and other factors relating to foreign trade are beyond our control. The SEC has also finalized disclosure requirements relating to the sourcing of so-called conflict minerals from the Democratic Republic of Congo and certain other adjoining countries as required by the Dodd-Frank Act. Our continued disclosure and compliance is predicated upon the timely receipt of accurate information from suppliers, who may be unwilling or unable to provide us with the relevant information. As a result, these new requirements could adversely affect our costs, the availability of materials used in our products and our relationships with customers and suppliers. These and other factors affecting our suppliers and our access to products could adversely affect our operating results.

Failure to comply with the regulations of the U.S. Occupational Safety and Health Administration and other state and local agencies that oversee safety compliance could adversely affect our results of operations.

Various federal and provincial regulations apply to our business, as do various regulations promulgated by state and local agencies. For example, the Occupational Safety and Health Act of 1970, as amended, or "OSHA," establishes certain employer responsibilities, including maintenance of a workplace free of recognized hazards likely to cause death or serious injury, compliance with standards promulgated by OSHA and various record keeping, disclosure and procedural requirements. Various OSHA standards apply to our operations. Likewise, as a contractor to the United States government, various regulations promulgated by the Office of Federal Contract Compliance Programs apply to our business. We have incurred, and will continue to incur, capital and operating expenditures and other costs in the ordinary course of our business in complying with these various regulations. Any failure to comply with these regulations could result in fines by government authorities and payment of damages to private litigants, affect our ability to service our customers, result in debarment of us as a contractor to the United States government and adversely affect our financial condition, results of operations and prospects.

Compliance with environmental laws and regulations could result in significant costs that adversely affect our operating results.

Our operating facilities are subject to stringent environmental laws, rules and regulations relating to the protection of the environment and health and safety matters, including those governing the potential discharges of pollutants to the air and water, the management and disposal of hazardous substances and wastes and the clean-up of contaminated sites. The operation of our business entails risks under environmental laws and regulations. We could incur significant costs, including, without limitation,

clean-up costs, fines, sanctions and claims by regulators or third parties for property damage and personal injury, as a result of violations or liabilities under these laws and regulations. As a result of violations of these laws and regulations, among other things, we could be required to reduce or cease use of certain equipment and/or limit or stop production at certain facilities. These consequences could have a material adverse effect on our results of operations and financial condition and disrupt customer relationships. We are currently involved in a limited number of legal matters and remedial investigations and actions at various locations related to environmental laws and regulations. While it is impossible to ascertain the ultimate legal and financial liability with respect to contingent liabilities, including lawsuits, legal matters, claims and environmental contingencies, based on information currently available and our assessment of the ultimate amount and timing of environmental-related events, we believe that the cost of these environmental-related matters are not reasonably likely to have a material adverse effect on our results of operations or financial position. It is possible, however, that our future financial position or results of operations for any particular future period could be materially affected by changes in our assumptions or strategies related to these contingencies, the imposition of clean-up obligations, and the discovery of alleged contamination or changes out of our control. In addition, potentially significant expenditures could be required to comply with environmental laws and regulations, including requirements that may be adopted or imposed in the future.

Under environmental laws, an owner or operator of real estate may be required to pay the costs of removing or remediating hazardous materials located on or emanating from property, whether or not the owner or operator knew of or was responsible for the presence of such hazardous materials. We have a number of sites on which we are currently conducting remediation projects. Also, while we regularly engage in environmental due diligence in connection with acquisitions, we can give no assurance that locations that have been acquired or leased have been operated in compliance with environmental laws and regulations during prior periods, nor can we give any assurance that existing remediation projects or future uses or conditions will not make us liable under these laws or expose us to regulatory or third-party actions, including third party suits.

Additionally, we must maintain compliance with various permits and licenses issued to us in connection with our operations, or we must apply for and obtain such permits and licenses. Any failure on our part to maintain such compliance or to apply for and receive such permits and licenses could have a material adverse effect on our ability to continue operations at a particular location. At each reporting period, we assess our operations to determine whether the costs of resolution of legal matters or of investigation and remediation of environmental conditions are probable and can be reasonably estimated, as well as the adequacy of our reserves with respect to such costs. At June 28, 2014, our reserves for environmental matters were approximately $0.9 million. We cannot guarantee that our reserves with respect to environmental matters will be sufficient or that the costs of resolution of legal matters or of remediation and investigation will not substantially exceed our reserves as new facts, circumstances or estimates arise.

We may be subject to information technology system failures, network disruptions and breaches in data security.

We rely to a large extent upon sophisticated information technology systems and infrastructure. The size and complexity of our computer systems make them potentially vulnerable to breakdown, malicious intrusion and random attack. Likewise, data privacy breaches by employees and others with permitted access to our systems or intrusion by unauthorized persons may pose a risk that sensitive data may be exposed to unauthorized persons or to the public. While we have invested in protection of data and information technology, there can be no assurance that our efforts will prevent breakdowns or breaches in our systems that could adversely affect our business.

Fluctuations in demand for our products and services may adversely impact our financial results.

Continued uncertainty in global economic conditions may pose a risk to the overall economy as consumers and businesses may defer purchases in response to tighter credit and negative financial news. This could negatively impact our customers and consequently have a negative impact on our financial performance. If demand for our products and services fluctuates as a result of economic conditions or otherwise, our revenue and operating margin could be negatively impacted. Important factors that could cause demand for our products and services to fluctuate include:

| |

• | changes in business and economic conditions, including downturns in specific industry segments and/or the overall economy; |

| |

• | changes in consumer confidence caused by changes in market conditions, including changes in the credit market, expectations for inflation and energy prices; |

| |

• | competitive pressures, including pricing pressures, from companies that have competing products and services; |

| |

• | changes in customer needs; |

| |

• | changes in our customers' employment levels, which impacts the number of users of our products and services; |

| |

• | strategic actions taken by our competitors; and |

| |

• | market acceptance of our products and services. |

If our customers' demand for our products and services decreases, our plant and manufacturing capacity could be underutilized, and we may be required to record an impairment of our long-lived assets, including facilities and equipment, as well as intangible assets, which would increase our expenses. A change in demand for our products and services, and changes in our customers' needs, could have a variety of negative effects on our competitive position and our financial results, and, in certain cases, may reduce our revenue, increase our costs, lower our gross margin percentage, or require us to recognize impairments of our assets.

Legal proceedings may adversely affect our financial condition and operating results.

From time to time we are party to various legal claims and proceedings, including relating to employment and regulatory matters. Certain of these claims or proceedings or potential future proceedings, if decided adversely against us or settled by us, may result in a liability that is material to our financial condition and operating results. We discuss current lawsuits and other litigation to which we are party in greater detail under Item 3. Legal Proceedings and Item 8. Financial Statements and Supplementary Data in Note 14 entitled "Commitments and Contingencies" of "Notes to Consolidated Financial Statements."

Risks associated with our acquisition strategy could adversely affect our operating results.

Historically, a portion of our growth has come from acquisitions. We continue to evaluate opportunities for acquiring businesses that may supplement our internal growth. However, there can be no assurance that we will be able to identify and purchase suitable operations. In addition, the success of any acquisition depends in part on our ability to integrate the acquired business. The process of integrating acquired businesses may involve unforeseen difficulties and may require a disproportionate amount of our management's attention and our financial and other resources. Although we conduct due diligence investigations prior to each acquisition, there can be no assurance that we will discover all operational deficiencies or material liabilities of an acquired business for which we may be responsible as a successor owner or operator. The failure to successfully integrate these acquired businesses or to discover such liabilities could adversely affect our operating results.

Increases in fuel, energy and commodity costs could adversely affect our results of operations and financial condition.

Motor fuel, natural gas, electricity, cotton, polyester and other commodities represent a significant cost within our business. The price of these commodities, which are required to run our vehicles and equipment and manufacture our garments, can be unpredictable and can fluctuate based on events beyond our control, including geopolitical developments, supply and demand for oil and gas, actions by OPEC and other oil and gas producers, war, terrorism and unrest in oil producing countries, regional production patterns, limits on refining capacities, natural disasters and environmental concerns. Increases in the cost of these commodities could adversely affect our results of operations and financial condition.

Failure to preserve positive labor relationships could adversely impact our operations and financial results.

Significant portions of our Canadian labor force are unionized, and a lesser portion of United States employees are unionized. While we believe that our Canadian and U.S. employee relations are good, we continue to face pressure from labor unions, and could experience increased pressure. If we do encounter pressure from labor unions, any resulting labor unrest could disrupt our business by impairing our ability to produce and deliver our products and services. In addition, significant union representation would require us to negotiate with many of our employees collectively and could adversely affect our results by restricting our ability to maximize the efficiency of our operations.

Inability to attract and retain employees could adversely impact our operations.

Our ability to attract and retain employees is important to our operations. Our ability to expand our operations is in part impacted by our ability to increase our labor force. In the event of a labor shortage, or in the event of a change in prevailing labor and/or immigration laws, we could experience difficulty in delivering our services in a high-quality or timely manner and we could be forced to increase wages in order to attract and retain employees, which would result in higher operating costs.

Loss of our key management or other personnel could adversely impact our business.

Our success is dependent on the skills, experience and efforts of our senior management and other key personnel. If, for any reason, one or more senior executives or key personnel were not to remain active in our company, or if we are unable to attract and retain key personnel, our results of operations could be adversely affected.

Unexpected events could disrupt our operations and adversely affect our operating results.

Unexpected events, including, without limitation, fires at facilities, natural disasters, such as hurricanes and tornados, public health emergencies, war or terrorist activities, unplanned utility outages, supply disruptions, failure of equipment or systems or changes in laws and/or regulations impacting our business, could adversely affect our operating results. These events could result in disruption of customer service, physical damage or temporary closure of one or more key operating facilities, or the temporary disruption of information systems.

Failure to achieve and maintain effective internal controls could adversely affect our business and stock price.

Effective internal controls are necessary for us to provide reliable financial reports. All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. While we continue to evaluate our internal controls, we cannot be certain that these measures will ensure that we implement and maintain adequate controls over our financial processes and reporting in the future. If we fail to maintain the adequacy of our internal controls or if we or our independent registered public accounting firm were to discover material weaknesses in our internal controls, we will not be able to ensure that we can conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002. Failure to achieve and maintain an effective internal control environment could cause us to be unable to produce reliable financial reports or prevent or detect fraud. This may cause investors to lose confidence in our reported financial information, which could have a material adverse effect on our stock price.

Failure to execute our business plan could adversely affect our business and stock price.

Successful execution of our business plan is not assured as there are several obstacles to success, including the economic environment, a competitive industry and entries by us into new markets. In addition, there can be no assurance that our efforts, if properly executed, will result in our desired outcome of improved financial performance.

The financial condition of multi-employer (union) pension plans in which we participate may have a material adverse effect on our financial performance.

We previously participated in a number of multi-employer pension plans ("MEPPs"). Also called Taft-Hartley plans, MEPPs are pension plans that are jointly trusteed by union and management of member companies and that provide benefits to an employer's unionized work force if the collective bargaining agreement between the employer and union provide for participation in the MEPP. Employers who withdraw from MEPPs remain responsible for their proportionate share of the MEPPs' unfunded vested pension benefits, an amount also known as "withdrawal liability." We have completed our withdrawal from several MEPPs, the largest of which was the Central States Southeast and Southwest Areas Pension Fund ("Central States Fund"). Despite having withdrawn from these MEPPs, we remain responsible for our withdrawal liability amount. We have received two demands for payment of withdrawal liability, or payment demands, from the Central States Fund relating to our partial and complete withdrawals. We do not agree with the Central States Fund's payment demands and plan to vigorously contest this matter. We are currently engaged in arbitration with the Central States Fund to determine the amount of our liability. The amount ultimately determined to be our withdrawal liability amount may be greater than the amount we have already recognized on our financial statements and the increased amount could have a material adverse effect on our financial performance.

If in the future, other employers in the MEPP withdraw or experience financial difficulty, including bankruptcy, our liability under the associated MEPP could increase. That increase could have a material adverse impact on our financial performance and could be greater than estimated. We do not have the ability to predict or influence the timing of votes to decertify a union nor do we have any control over the continued participation or financial stability of other employers in a MEPP.

Fluctuations in Canadian and Dominican Republic currencies could have an adverse effect on our results of operations and financial condition.

Certain of our foreign revenues and operating expenses are transacted in local currencies. Therefore, our results of operations and certain receivables and payables are subject to foreign exchange rate fluctuations.

| |

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

We occupy approximately 165 facilities located primarily in the United States and Canada. These facilities include our processing, branch, garment manufacturing, distribution and administrative support locations. We clean and supply rental items from approximately 50 facilities located in 38 cities in the United States and nine cities in Canada. We own approximately 95% of our processing facilities, which average approximately 44,000 square feet in size.

We are involved in a variety of legal actions relating to personal injury, employment, environmental and other legal matters arising in the normal course of business, including, without limitation, those described below.

The United States Office of Federal Contract Compliance Programs, or OFCCP, is, as part of routine audits, conducting a review of our employment practices. The OFCCP has issued a Predetermination Notice to one of our facilities and a Notice of

Violation to another. Audits of six other facilities, where the OFCCP may claim there are similar alleged violations, are ongoing. We have been engaged in discussions with the OFCCP and believe that our practices are lawful and without bias.

See Note 13, "Employee Benefit Plans" of the Notes to the Consolidated Financial Statements for information on our arbitration related to our withdrawal from the Central States Plan.

We cannot predict the ultimate outcome of these or other similar matters with certainty and it is possible that we may incur additional losses in excess of established reserves. However, we believe the possibility of a material adverse effect on our results of operations or financial condition is remote.

PART II

| |

ITEM 5. | MARKET FOR REGISTRANT'S COMMON STOCK, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our Class A Common Stock, referred to herein as our "common stock," is quoted on the Global Select Market of The NASDAQ Stock Market LLC under the symbol "GK." The following table sets forth the high and low reported sale prices for the common stock as quoted on the Global Select Market of The NASDAQ Stock Market LLC, for the periods indicated.

|

| | | | | | | |

| High | | Low |

Fiscal 2014 | | | |

1st Quarter | $ | 59.20 |

| | $ | 47.54 |

|

2nd Quarter | 64.48 |

| | 54.88 |

|

3rd Quarter | 65.36 |

| | 53.89 |

|

4th Quarter | 63.55 |

| | 48.20 |

|

| | | |

Fiscal 2013 | | | |

1st Quarter | $ | 34.17 |

| | $ | 30.08 |

|

2nd Quarter | 36.71 |

| | 29.80 |

|

3rd Quarter | 45.83 |

| | 33.39 |

|

4th Quarter | 50.02 |

| | 42.57 |

|

As of August 14, 2014, we had 694 registered holders of record of our common stock.

We paid dividends of $140.9 million, $15.1 million and $123.9 million in fiscal years 2014, 2013 and 2012, respectively. Dividends per share were $7.08, $0.78 and $6.585 in fiscal years 2014, 2013 and 2012 respectively. The dividends for each of the fiscal years 2014 and 2012 include a $6.00 per share special dividend. We anticipate regular dividends in fiscal year 2015 will total $1.24 per share, or approximately $24.7 million. Our debt agreements contain a minimum net worth covenant, which could limit the amount of cash dividends.

ISSUER PURCHASE OF EQUITY SECURITIES

The table below sets forth information regarding repurchases we made of our common stock during the periods indicated.

|

| | | | | | | | | | | | | | |

Period | | Total Number of Shares Purchased |

| | Average Price Paid Per Share |

| | Total Number of Shares Purchased as Part of Publicly Announced Plan |

| | Maximum Dollar Value of Shares that May Yet Be Purchased Under the Plan |

|

March 30, 2014 - May 3, 2014 | | 2,000 |

| | $ | 53.24 |

| | 2,000 |

| | $ | 49,111,260 |

|

May 4, 2014 - May 31, 2014 | | 40,000 | | $ | 52.86 |

| | 40,000 |

| | $ | 46,996,856 |

|

June 1, 2014 - June 28, 2014 | | 16,000 | | $ | 52.03 |

| | 16,000 |

| | $ | 46,164,397 |

|

Total | | 58,000 | | $ | 52.64 |

| | 58,000 |

| | $ | 46,164,397 |

|

As of June 28, 2014, we had a $175.0 million share repurchase program which was originally authorized by our Board of Directors in May 2007 for $100.0 million and increased to $175.0 million in May 2008. Under this repurchase program, we repurchased 204,819 shares in open market transactions totaling $11.7 million in fiscal year 2014. We did not repurchase any shares in fiscal years 2013 or 2012. At the end of fiscal year 2014, we had approximately $46.2 million remaining under this authorization.

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth certain information as of June 28, 2014 with respect to equity compensation plans under which securities are authorized for issuance:

|

| | | | | | | | | |

Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (A) | | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights (B) | | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (A)) |

Equity compensation plans approved by security holders (1): | | | | | |

Restated Equity Incentive Plan (2013) (2) | 933,603 |

| (3) | $ | 24.66 |

| (4) | 1,536,160 |

|

Employee Plans (5) | 63,899 |

| | 26.78 |

| | — |

|

1996 Directors’ Stock Option Plan | 11,000 |

| | 27.88 |

| | — |

|

Total: | 1,008,502 |

| | $ | 24.86 |

| | 1,536,160 |

|

Equity compensation plans not approved by security holders: | | | | | |

None | — |

| | — |

| | — |

|

Total | 1,008,502 |

| | $ | 24.86 |

| | 1,536,160 |

|

| |

(1) | See Note 11, "Stockholders' Equity" of the Notes to the Consolidated Financial Statements. |

| |

(2) | Our Restated Equity Incentive Plan (2013) was approved at our November 6, 2013 annual meeting of shareholders. The outstanding shares listed for this plan include the initial shares authorized under our 2006 and 2010 Equity Incentive Plans, as well as the additional shares authorized when the restated plan was approved. |

| |

(3) | Includes 783,603 outstanding options and 150,000 performance based restricted stock awards, which assumes the maximum number of performance share awards that may be earned. |

| |

(4) | The weighted-average exercise price does not include the performance shares discussed in note 3 above. |

| |

(5) | Includes our 1998 Stock Option and Compensation Plan. |

STOCKHOLDER RETURN PERFORMANCE GRAPH

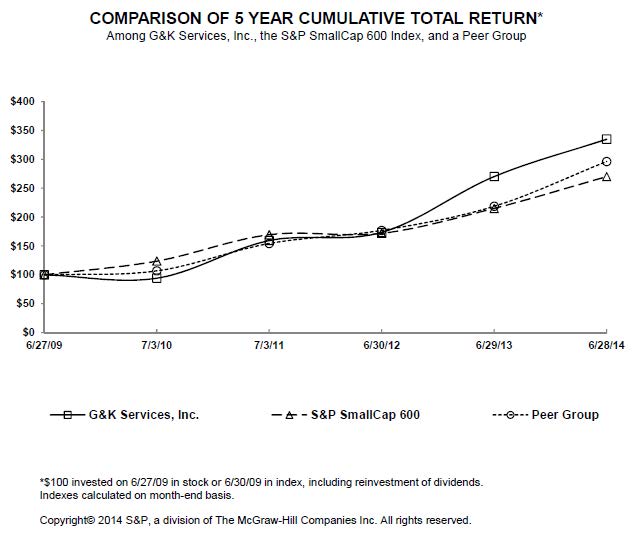

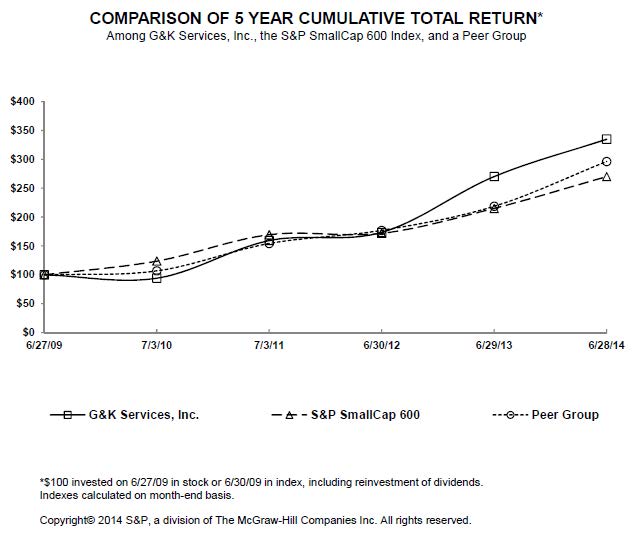

The following graph shows a five-year comparison of the cumulative total return on $100 invested in our common stock, the Standard and Poor’s ("S&P") SmallCap 600 Index and a Peer Group in the uniform services industry, consisting of Cintas Corporation and UniFirst Corporation.

The graph illustrates the cumulative values at the end of each succeeding fiscal year resulting from the change in the stock price, assuming a reinvestment of dividends. Over the five year period, G&K stock grew to $334.85, compared to $270.02 for the S&P SmallCap 600 and $296.29 for the Peer Group.

| |

ITEM 6. | SELECTED FINANCIAL DATA |

The following table sets forth certain selected financial data. All amounts are in thousands, except per share data.

|

| | | | | | | | | | | | | | | | | | | |

| 2014 | | 2013 | | 2012 | | 2011 | | 2010 |

Revenues | $ | 900,869 |

| | $ | 866,018 |

| | $ | 828,953 |

| | $ | 788,749 |

| | $ | 800,685 |

|

Net Income from Continuing Operations | 56,065 |

| | 50,506 |

| | 24,487 |

| | 33,495 |

| | 28,646 |

|

Per Share Data: | | | | | | | | | |

Basic earnings per share from continuing operations | 2.83 |

| | 2.62 |

| | 1.32 |

| | 1.82 |

| | 1.57 |

|

Diluted earnings per share from continuing operations | 2.78 |

| | 2.58 |

| | 1.31 |

| | 1.81 |

| | 1.56 |

|

Dividends per share: | | | | | | | | | |

Regular | 1.080 |

| | 0.780 |

| | 0.585 |

| | 0.380 |

| | 0.300 |

|

Special | 6.00 |

| | — |

| | 6.00 |

| | — |

| | — |

|

Total Assets | 923,519 |

| | 897,286 |

| | 873,731 |

| | 865,920 |

| | 813,868 |

|

Long-Term Debt | 266,230 |

| | 175,000 |

| | 218,018 |

| | 95,188 |

| | 160,398 |

|

Stockholders' Equity | 374,044 |

| | 467,008 |

| | 403,059 |

| | 514,906 |

| | 466,896 |

|

We utilize a 52 or 53 week fiscal year ending on the Saturday nearest June 30. Fiscal year 2010 was a 53 week year; all other fiscal years were 52 week years. Fiscal year 2012 includes a pretax charge of $24.0 million associated with withdrawing from a multi-employer pension plan (see Note 13, "Employee Benefit Plans" of the Notes to the Consolidated Financial Statements for further information). Fiscal year 2013 includes net pretax charges of $8.2 million related to restructuring and impairment charges and an increase in our estimated liability associated with the exit of a multi-employer pension plan, offset by the benefit of the change in estimated merchandise in-service amortization lives. See Note 1, "Summary of Significant Accounting Policies" and Note 9, "Restructuring and Impairment Charges" of the Notes to the Consolidated Financial Statements for further information. Fiscal year 2014 includes a pretax charge of $9.9 million associated with the withdrawal from several multi-employer pension plans (see Note 13, "Employee Benefit Plans" of the Notes to the Consolidated Financial Statements for further information) and a pretax loss of $12.8 million on the divestiture of our Direct Sale Program Business and our Ireland Business (see Note 10, "Discontinued Operations" of the Notes to the Consolidated Financial Statements for further information), offset by the benefit of the change in estimated merchandise in-service amortization lives of $6.1 million.

| |

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion and analysis should be read in conjunction with the Consolidated Financial Statements and related notes thereto which are included herein. We utilize a 52 or 53 week fiscal year ending on the Saturday nearest June 30. Fiscal years 2014, 2013 and 2012 were 52 week years.

Overview

G&K Services, Inc., founded in 1902 and headquartered in Minnetonka, Minnesota, is a service-focused market leader of branded uniform and facility services programs. We deliver value to our customers by enhancing their image and brand, and by promoting workplace safety, security and cleanliness. We accomplish this by providing high quality branded work apparel programs, and a variety of facility products and services, including floor mats, towels, mops and restroom hygiene products.

From fiscal year 2010 through fiscal year 2012, we made broad-based improvements to our business, by pursuing a strategy which included four key elements: focusing on customer satisfaction; improving day-to-day execution; increasing our focus on cost management; and addressing underperforming locations and assets. Executing this strategy led to significant improvements in our financial results, including positive organic revenue growth, expanded operating margins and strong cash flows.

In fiscal year 2013, we modified our strategy, building on the improvements made in the past. We continued to drive this same strategy in fiscal year 2014. Our approach has four parts:

1. Keep our customer promise

2. Improve how we target customers

3. Drive operational excellence

4. Strengthen our high performing team

To measure the progress of our strategy, in fiscal year 2010, we established two primary long-term financial objectives, which were achieving operating income margin of 10% and return on invested capital (ROIC) of 10%. We define ROIC as adjusted income from operations after tax, divided by total debt plus stockholders' equity less cash. In the second quarter of fiscal year 2013, we achieved the first of these two targets by achieving a 10% operating margin and in the second quarter of fiscal year 2014, we achieved the second target by achieving 10% ROIC. During fiscal year 2014, we established new long-term financial goals called the "12+ Plan," which includes achieving 12% operating margin, 12% ROIC, plus an added focus on revenue growth, within a two to four year time frame. We are also focused on maximizing free cash flow, which we define as net cash provided by operating activities less investments in property, plant and equipment.

Our industry continues to consolidate as many family-owned, local operators and regional companies have been acquired by larger providers. We have participated in this consolidation with an acquisition strategy focused on expanding our geographic presence and/or expanding our local market share in order to further leverage our existing production facilities. We remain active in evaluating quality acquisitions that would strengthen our business. During fiscal year 2013, we made one acquisition. The proforma effect of this acquisition, had it been acquired at the beginning of the fiscal year was not material. The total purchase consideration was $18.5 million. The total purchase price exceeded the fair value of identifiable assets acquired and liabilities assumed by $11.0 million.

Our operating results are affected by the volatility in commodities, especially cotton, polyester, crude oil and foreign currency exchange rates, which may contribute to significant changes in merchandise and energy costs.

We periodically adjust our operations to serve our customers in the most efficient and cost effective manner. As part of these adjustments, we may realign our workforce, close production or branch facilities or divest operations. We are continuously assessing our business and making adjustments as necessary.

In the second quarter of fiscal 2014, we divested our Ireland Business and in the third quarter of fiscal year 2014, we sold our Direct Sale Program Business. These divestitures have been reflected as Discontinued Operations in our Consolidated Statements of Operations. See Note 10, "Discontinued Operations" of the Notes to the Consolidated Financial Statements for additional information.

Critical Accounting Policies

The discussion of the financial condition and results of operations are based upon the Consolidated Financial Statements, which have been prepared in conformity with United States generally accepted accounting principles (GAAP). As such, management is required to make certain estimates, judgments and assumptions that are believed to be reasonable based on the information available. These estimates and assumptions affect the reported amount of assets and liabilities, revenues and expenses, and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results may differ from these estimates under different assumptions or conditions.

Critical accounting policies are defined as the most important and pervasive accounting policies used, areas most sensitive to material changes from external factors and those that are reflective of significant judgments and uncertainties. See Note 1, "Summary of Significant Accounting Policies" of the Notes to the Consolidated Financial Statements for additional discussion of the application of these and other accounting policies.

Revenue Recognition and Allowance for Doubtful Accounts

Our rental operations business is largely based on written service agreements whereby we agree to pick-up soiled merchandise, launder and then deliver clean uniforms and other related products. The service agreements generally provide for weekly billing upon completion of the laundering process and delivery to the customer. Accordingly, we recognize revenue from rental operations in the period in which the services are provided. Revenue from rental operations also includes billings to customers for lost or damaged uniforms and replacement fees for non-personalized merchandise that is lost or damaged. Direct sale revenue is recognized in the period in which the product is shipped. Total revenues do not include sales tax as we consider ourselves a pass-through conduit for collecting and remitting sales tax.

Estimates are used in determining the collectability of accounts receivable. Management analyzes specific accounts receivable and historical bad debt experience, customer credit worthiness, current economic trends and the age of outstanding balances when evaluating the adequacy of the allowance for doubtful accounts. Significant management judgments and estimates are used in connection with establishing the allowance in any accounting period. We generally write-off uncollectible accounts receivable after all internal avenues of collection have been exhausted.

Inventories

Inventories consist of new goods and rental merchandise in service. New goods are stated at the lower of first-in, first-out (FIFO) cost or market. Merchandise placed in service to support our rental operations is amortized into cost of rental operations over the estimated useful lives of the underlying inventory items, on a straight-line basis, which results in a matching of the cost of the merchandise with the weekly rental revenue generated by the merchandise. Estimated lives of rental merchandise in

service range from six months to four years. In establishing estimated lives for merchandise in service, management considers historical experience and the intended use of the merchandise.

We review the estimated useful lives of our in-service inventory assets on a periodic basis or when trends in our business indicate that the useful lives for certain products might have changed. The selection of estimated useful lives is a sensitive estimate in which a change in lives can have a material impact on our results of operations. For example, during the fourth quarter of fiscal year 2013, we completed an analysis of certain in-service inventory assets which resulted in the estimated useful lives for these assets being extended to better reflect the estimated periods in which the assets will remain in service. The effect of the change in estimate increased income from operations by $6.1 million, net income by $3.9 million and basic and diluted earnings per common share by $0.19 in fiscal year 2014 and increased income from operations by $2.6 million, net income by $1.7 million and basic and diluted earnings per common share by $0.09 in fiscal year 2013. In addition, this change resulted in an increase in merchandise in service on the balance sheet of $8.7 million and $2.6 million as of June 28, 2014 and June 29, 2013, respectively.

We estimate losses related to inventory obsolescence by examining our inventory to determine if there are indicators that carrying values exceed the net realizable value. Significant factors that could indicate the need for inventory write-downs include the age of the inventory, anticipated demand for our products, historical inventory usage, revenue trends and current economic conditions. We believe that adequate adjustments have been made in the Consolidated Financial Statements; however, in the future, product lines and customer requirements may change, which could result in an increase in obsolete inventory reserves or additional inventory impairments.

During the fourth quarter of fiscal year 2013, we recorded additional inventory write downs of $3.6 million as a result of the restructuring of our direct sale businesses, and an evaluation of the recoverability of certain inventory. See Note 9, "Restructuring and Impairment Charges" of the Notes to the Consolidated Financial Statements for additional details. Of this $3.6 million, approximately $3.0 million has been reclassified to Discontinued Operations as a result of the divestiture of our Direct Sale Program Business in fiscal year 2014. See Note 10, "Discontinued Operations" of the Notes to the Consolidated Financial Statements for additional details.

Environmental Costs

We accrue various environmental related costs, which consist primarily of estimated clean-up costs, fines and penalties, when it is probable that we have incurred a liability and the amount can be reasonably estimated. When a single amount cannot be reasonably estimated but the cost can be estimated within a range, we accrue the minimum estimated amount. This accrued amount reflects our assumptions regarding the nature of the remedy and the outcome of discussions with regulatory agencies. Changes in the estimates on which the accruals are based, including unanticipated government enforcement actions or changes in environmental regulations, could result in higher or lower costs. Accordingly, as investigations and other actions proceed, it is likely that adjustments in our accruals will be necessary to reflect new information. While we cannot predict the ultimate outcome of any of these matters with certainty, we believe the possibility of a material adverse effect on our results of operations or financial position is remote.

Accruals for environmental liabilities are included in the "Accrued expenses - Other" line item in the Consolidated Balance Sheets. Environmental costs are capitalized if they extend the life of the related property, increase its capacity and/or mitigate or prevent future contamination. The cost of operating and maintaining environmental control equipment is charged to expense in the period incurred.

For additional information see Note 14, "Commitments and Contingencies" of the Notes to the Consolidated Financial Statements.

Goodwill, Intangible Assets and Other Long-Lived Assets

The fair value of the purchase price of acquisitions in excess of the fair value of the underlying net assets is recorded as goodwill. Non-competition agreements that limit the seller from competing with us for a fixed period of time and acquired customer contracts are stated at fair value less accumulated amortization and are amortized over the terms of the respective agreements or estimated average life of an account, which ranges from five to 20 years.

We test goodwill for impairment in the fourth quarter of each fiscal year or upon the occurrence of events or changes in circumstances that indicate that the asset might be impaired. We have determined that the reporting units for our goodwill impairment review are our operating segments, or components of an operating segment, that constitute a business for which discrete financial information is available, and for which segment management regularly reviews the operating results. Based on this analysis, we have identified two reporting units within our operating segments as of the fiscal year 2014 testing date. Our reporting units are U.S. Rental operations and Canadian Rental operations, with respective goodwill balances of $270.0 million and $63.2 million, at June 28, 2014. During fiscal year 2014, we divested our Direct Sales reporting unit. There have been no other changes to our reporting units or in the allocation of goodwill to each respective reporting unit in fiscal years 2014, 2013 or 2012.

In fiscal year 2014, we performed a qualitative assessment to test our reporting units' goodwill for impairment. Based on our qualitative assessment, we determined that it is more likely than not (i.e. a likelihood of more than 50 percent) that the fair value of all reporting units is greater than their carrying amount and therefore no impairment of goodwill was identified. In fiscal 2013 and 2012, we used a market valuation approach to determine the fair value of each reporting unit for our annual impairment test. The results of this test indicated that the estimated fair value exceeded the carrying value of our goodwill by more than 50% for our U.S. Rental and Canadian Rental reporting units for both fiscal years and therefore no impairment existed. All goodwill associated with our Direct Sales reporting unit had been previously impaired and written off. During the second quarter of fiscal year 2014, we recorded an impairment loss related to the divestiture of our Ireland business of $0.3 million.

Long-lived assets, including definite-lived intangible assets, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable. Recoverability is measured by comparison of the carrying amount of the asset to the future undiscounted cash flows the asset is expected to generate. If the asset is considered to be impaired, the amount of any impairment is measured as the difference between the carrying value and the fair value of the impaired asset. During the fourth quarter of fiscal year 2013, we recorded an impairment loss related to customer contracts totaling $1.6 million. See Note 10, "Discontinued Operations" of the Notes to the Consolidated Financial Statements for details on the impairment. There were no impairment charges for intangible assets in fiscal year 2014 or 2012.

Future events could cause management to conclude that impairment indicators exist and that goodwill, other intangibles and other long-lived assets associated with acquired businesses are impaired. Any resulting impairment loss could have a material impact on our financial condition and results of operations.

Insurance

We carry large deductible insurance policies for certain obligations related to health, workers' compensation, auto and general liability programs. These deductibles range from $0.4 million to $0.8 million per occurrence. Estimates are used in determining the potential liability associated with reported claims and for losses that have occurred, but have not been reported. Management estimates generally consider historical claims experience, escalating medical cost trends, expected timing of claim payments and actuarial analyses provided by third parties. Changes in the cost of medical care, our ability to settle claims and the present value estimates and judgments used by management could have a material impact on the amount and timing of expense for any period.

Income Taxes

Provisions for federal, state, and foreign income taxes are calculated based on reported pretax earnings and current tax law. Significant judgment is required in determining income tax provisions and evaluating tax positions. We periodically assess our liabilities and contingencies for all periods that are currently open to examination or have not been effectively settled based on the most current available information. If it is not more likely than not that our tax position will be sustained, we record our best estimate of the resulting tax liability and any applicable interest and penalties in the Consolidated Financial Statements.

Deferred tax assets and liabilities are recorded for temporary differences between the tax basis of assets and liabilities and their reported amounts in the financial statements, using statutory rates in effect for the year in which the differences are expected to reverse. We present the tax effects of these deferred tax assets and liabilities separately for each major tax jurisdiction. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the results of operations in the period that the changes are enacted. We record valuation allowances to reduce deferred tax assets when it is more likely than not that some portion of the asset may not be realized. We evaluate our deferred tax assets and liabilities on a periodic basis. We believe that we have adequately provided for our future income tax obligations based upon current facts, circumstances and tax law.

Results of Operations

The percentage relationships to revenues of certain income and expense items for the three fiscal years ended June 28, 2014, June 29, 2013 and June 30, 2012, and the percentage changes in these income and expense items between years are presented in the following table:

|

| | | | | | | | | | | | | | |

| Percentage of Revenues | | Percentage Change |

| Years Ended | | Between Years |

| | | FY 2014 vs. | | FY 2013 vs. |

| Fiscal 2014 | | Fiscal 2013 | | Fiscal 2012 | | FY 2013 | | FY 2012 |

Rental and direct sale revenue | 100.0 | % | | 100.0 | % | | 100.0 | % | | 4.0 | % | | 4.5 | % |

| | | | | | | | | |

Cost of rental and direct sale revenue | 66.0 |

| | 67.6 |

| | 69.3 |

| | 1.6 |

| | 1.9 |

|

Gross margin | 34.0 |

| | 32.4 |

| | 30.7 |

| | 9.1 |

| | 10.3 |

|

Pension withdrawal and associated expenses | 1.1 |

| | 0.1 |

| | 2.9 |

| | 885.4 |

| | (95.8 | ) |

Selling and administrative | 22.2 |

| | 22.6 |

| | 22.6 |

| | 2.4 |

| | 4.2 |

|

Income from continuing operations | 10.7 |

| | 9.7 |

| | 5.2 |

| | 14.4 |

| | 96.7 |

|

Interest expense | 0.7 |

| | 0.6 |

| | 0.7 |

| | 30.2 |

| | (19.8 | ) |

Income from continuing operations before income taxes | 10.0 |

| | 9.1 |

| | 4.4 |

| | 13.4 |

| | 115.9 |

|

Provision for income taxes | 3.7 |

| | 3.3 |

| | 1.5 |

| | 17.7 |

| | 135.4 |

|

Net income from continuing operations | 6.2 |

| | 5.8 |

| | 3.0 |

| | 11.0 |

| | 106.3 |

|

Net income (loss) from discontinued operations | (0.9 | ) | | (0.4 | ) | | — |

| |

|

| |

|

|

Net income | 5.3 | % | | 5.4 | % | | 2.9 | % | | 2.0 | % | | 93.5 | % |

Fiscal Year 2014 Compared to Fiscal Year 2013

Fiscal Years. Our fiscal year ends on the Saturday closest to June 30. As a result, we will periodically have a fiscal year that consists of 53 weeks. Fiscal years 2014 and 2013 both had 52 weeks.

Rental and Direct Sale Revenue. Total revenues in fiscal year 2014 increased 4.0% to $900.9 million from $866.0 million in fiscal year 2013.

Our organic rental growth rate was 4.9% compared to 4.2% in the prior fiscal year. The improvement in the rental organic growth rate from the prior year was primarily due to record new account sales in fiscal 2014, improved customer retention, improved execution related to merchandise recovery billings and uniform preparation services and strong pricing. The carry over impact of an acquisition from fiscal 2013 added approximately 0.5% to our rental operations growth rate. These increases were offset by the negative impact of foreign currency translation rates and a decline in direct sale revenue. Our organic rental growth rate is calculated using rental revenue, adjusted to exclude the impact of foreign currency exchange rate changes, divestitures and acquisitions. We believe that the organic rental revenue reflects the growth of our existing rental business and is, therefore, useful in analyzing our financial condition and results of operations.

Cost of Rental and Direct Sale Revenue. Cost of rental and direct sale revenue, which includes merchandise, production, delivery and cost of direct sale expenses, increased 1.6% to $595.0 million in fiscal year 2014 from $585.7 million in fiscal year 2013. As a percentage of revenue, our gross margin improved to 34.0% in fiscal year 2014 from 32.4% in the prior fiscal year. Cost of rental and direct sale revenue was favorably impacted by $6.1 million or 0.7% of revenue in fiscal year 2014 and $2.6 million or 0.3% of revenue in fiscal year 2013 due to the change in the estimated useful lives for certain in-service merchandise assets, as discussed in Note 1, "Summary of Significant Accounting Policies - Inventories" of the Notes to the Consolidated Financial Statements. Fiscal year 2013 also included a $0.6 million restructuring and impairment charge as discussed in Note 9, "Restructuring and Impairment Charges" of the Notes to the Consolidated Financial Statements. Excluding these items, gross margin was 33.3% in fiscal year 2014 and 32.1% in fiscal year 2013 and represented an improvement of 1.2%. This improvement was primarily due to the favorable impact of fixed costs absorbed over a higher revenue base, lower payroll taxes, merchandise costs, workers compensation expenses, motor fuel costs and a decreased percentage of incentive compensation costs allocated to cost of rental and direct sale revenue. In addition, gross margins from direct sale improved as a result of the restructuring of our catalog business. These favorable items were partially offset by higher natural gas and vehicle related costs.

Pension Withdrawal and Associated Expenses. As discussed in Note 13, "Employee Benefit Plans" of the Notes to the Consolidated Financial Statements, we recorded total charges of $9.9 million in fiscal year 2014 related to the probable

withdrawal from four MEPPs and an increase to our previously recorded MEPP withdrawal liability. In the prior year, we recorded a $1.0 million charge related to our withdrawal from another MEPP.

Selling and Administrative. Selling and administrative expenses increased to $199.9 million in fiscal year 2014 from $195.3 million in fiscal year 2013. As a percentage of total revenues, selling and administrative expenses decreased to 22.2% in fiscal year 2014 from 22.6% in fiscal year 2013. The decrease was primarily driven by a $2.6 million restructuring and impairment charge in the prior year, as discussed in Note 9, "Restructuring and Impairment Charges" of the Notes to the Consolidated Financial Statements which totaled 0.3% of revenue. Excluding this charge, selling and administrative costs were 22.3% of revenue in fiscal year 2013, which is consistent with fiscal year 2014. Improvements resulting from effective cost control as we leveraged our fixed costs over a higher revenue base, decreased amortization expense and lower payroll taxes and pension expense were offset by higher selling, depreciation and equity compensation expense.

Income from Continuing Operations. The following is a summary of each operating segment's income from operations (in thousands):

|

| | | | | | | | | | | |

| For the Fiscal Years | | |

| 2014 | | 2013 | | Change |

United States | $ | 79,290 |

| | $ | 66,144 |

| | $ | 13,146 |

|

Canada | 16,825 |

| | 17,861 |

| | (1,036 | ) |

Total | $ | 96,115 |

| | $ | 84,005 |

| | $ | 12,110 |

|

United States. Income from operations increased $13.1 million to $79.3 million in fiscal year 2014 from $66.1 million in fiscal year 2013. The current year operating income included a $5.3 million benefit from the change in merchandise lives previously reported and additional expense of $9.9 million associated with our MEPP withdrawal liability. The prior year operating income included a $2.3 million benefit from the change in inventory lives and additional expense of $3.2 million related to restructuring and impairment charges and $1.0 million associated with a MEPP liability adjustment. Excluding these items, income from operations increased $15.9 million. The increase was primarily driven by additional income from increased revenue, continued productivity improvements in our laundry operations, improved direct sale margins, lower payroll tax, pension and incentive compensation expenses. These improvements were partially offset by higher selling and employee health care expenses.

Canada. Income from operations decreased approximately $1.0 million to $16.8 million in fiscal year 2014 from $17.9 million in fiscal year 2013. The current year operating income included a $0.8 million benefit from the change in merchandise lives previously reported. The prior year operating income included a $0.3 million benefit from the change in inventory lives. Excluding these items, income from operations decreased $1.5 million. The decrease was primarily driven by a decrease in the Canadian foreign exchange rate, which decreased operating income by $1.2 million. In addition, higher selling, natural gas and electricity costs and lower direct sale margins were partially offset by lower merchandise and depreciation expenses.