UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________ to _____________

Commission file number:

H.B. FULLER COMPANY

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| | | |

Securities registered pursuant to Section 12(g) of the Act: none

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” or “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Accelerated filer ☐ | |

| Non-accelerated filer ☐ | Smaller reporting company |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

The aggregate market value of the Common Stock, par value $1.00 per share, held by non-affiliates of the registrant as of June 3, 2023 was approximately $

The number of shares outstanding of the Registrant’s Common Stock, par value $1.00 per share, was

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference to portions of the registrant’s Proxy Statement for the Annual Meeting of Shareholders to be held on April 11, 2024.

H.B. FULLER COMPANY

2023 Annual Report on Form 10-K

H.B. Fuller Company was founded in 1887 and incorporated as a Minnesota corporation in 1915. Our stock is traded on the New York Stock Exchange (“NYSE”) under the ticker symbol FUL. As used herein, “H.B. Fuller,” “we," “us,” “our,” “management” or “company” includes H.B. Fuller and its subsidiaries unless otherwise indicated. Where we refer to 2023, 2022 and 2021 herein, the reference is to our fiscal years ended December 2, 2023, December 3, 2022, and November 27, 2021, respectively.

We are a leading worldwide formulator, manufacturer and marketer of adhesives, sealants and other specialty chemical products. Sales operations span 35 countries in North America, Europe, Latin America, Asia Pacific, India, the Middle East and Africa. Industrial adhesives represent our core product offering, which help improve the performance of our customers’ products or improve their manufacturing processes. Customers use our adhesives products in manufacturing common consumer and industrial goods, including food and beverage containers, disposable diapers, medical products, windows, doors, appliances, sportswear, footwear, multi-wall bags, water filtration products, insulation, textiles, automobiles, recreational vehicles, buses, trucks and trailers, marine products, solar energy systems, electronics and products for the aerospace and defense industries. In addition, we have established a variety of product offerings for residential, commercial and industrial construction markets, including sealing and waterproofing solutions for airports, roads, highways, bridges and utilities; pressure-sensitive adhesives, tapes and sealants for the commercial roofing industry; and level-setting products, ready-to-use grouts, mortars, and pressure sensitive adhesives that enable contractors and do-it-yourself consumers to quickly install flooring and tiling applications more reliably and efficiently. We also provide our customers with technical support and unique solutions designed to address their specific needs.

We have three reportable segments: Hygiene, Health and Consumable Adhesives, Engineering Adhesives and Construction Adhesives. See Management’s Discussion and Analysis of Financial Condition and Results of Operations (the “MD&A”) in Item 7 of this Annual Report for a description of our segment operating results.

Non-U.S. Operations

The principal markets, products and methods of distribution outside the United States vary with each of our regional operations generally maintaining integrated business units that contain dedicated supplier networks, manufacturing, logistics and sales organizations. The vast majority of the products sold within any region are produced within the region, and the respective regions do not import significant amounts of product from other regions. As of December 2, 2023, we had sales offices and manufacturing plants in 25 countries outside the United States and satellite sales offices in another 9 countries.

We have a Code of Business Conduct and detailed Core Policies that we apply across all of our operations around the world. These policies represent a set of common values that apply to all employees and all of our business dealings. We have adopted policies and processes, and conduct employee training, intended to ensure compliance with various economic sanctions and export controls, including the regulations of the U.S. Treasury Department’s Office of Foreign Assets Control (“OFAC”). We do not conduct any business in the following countries that are subject to U.S. economic sanctions: Cuba, Iran, North Korea, Syria and the Crimea region of the Ukraine.

Competition

Many of our markets are highly competitive. However, we compete effectively due to the quality and breadth of our adhesives, sealants and specialty chemical portfolio and the experience and expertise of our commercial organizations. Within the adhesives and other specialty chemical markets, we believe few suppliers have comparable global reach and corresponding ability to deliver quality and consistency to multinational customers. Our competition is made up generally of two types of companies: (1) similar multinational suppliers and (2) regional or specialty suppliers that typically compete in only one region or within a narrow geographic area within a region. The multinational competitors typically maintain a broad product offering and range of technology, while regional or specialty companies tend to have limited or more focused product ranges and technology.

Principal competitive factors in the sale of adhesives and other specialty chemicals are product performance, supply assurance, technical service, quality, price and customer service.

Customers

We have cultivated strong, integrated relationships with a diverse set of customers worldwide. Our customers are among the technology and market leaders in consumer goods, construction and industrial markets. We pride ourselves on long-term, collaborative customer relationships and a diverse portfolio of customers in which no single customer accounted for more than 10 percent of consolidated net revenue.

Our leading customers include manufacturers of food and beverages, hygiene products, clothing, major appliances, electronics, automobiles, aerospace and defense products, solar energy systems, filters, construction materials, wood flooring, furniture, cabinetry, windows, doors, tissue and towel, corrugation, tube winding, packaging, and tapes and labels.

Our products are delivered directly to customers primarily from our manufacturing and distribution facilities, with additional deliveries made through distributors and retailers.

Human Capital Resources and Management

Employees and Labor Relations

As of December 2, 2023, we have approximately 7,200 employees in 45 countries, including approximately 2,600 employees based in the U.S. Approximately 450 U.S. employees are subject to collective bargaining agreements with various unions. Approximately 750 employees in foreign countries are subject to collective bargaining agreements. Overall, we consider our employee relations to be good.

Health and Safety

The health and safety of our employees and anyone who enters our workplace is important, and we believe that nothing we do is worth getting hurt for. We have a strong environmental, health and safety program that focuses on implementing policies and training programs, as well as performing self-audits to enhance workplace safety.

Competitive Pay and Benefits

Our primary compensation strategy is “Pay for Performance”, which supports a culture of accountability and performance. Our compensation guiding principles are to structure compensation that is simple, aligned and balanced. We believe that these principles are strongly aligned with the strategic priorities of our business and our objective to deliver value for our shareholders.

We are committed to fair pay and strive to be externally competitive while ensuring internal equity across our organization. We conduct global pay equity assessments and compensation reviews, and when necessary, we take action to address areas of concern.

Quality, affordable health care is the foundation of the comprehensive benefits package we offer our employees. It is one of the tools we use to recruit and retain, and it is seen as the preferred benefit by most employees. Employees in the United States earning below $54,000 each year have 100% of their individual medical premiums covered by the Company in the form of a medical premium reimbursement.

Results-Driven, Collaborative Culture

Our purpose is connecting what matters for all stakeholders and we go about this by winning the right way through our core values. We expect employees to act with integrity and hold each other accountable for our actions. We value our global team’s diverse perspectives, backgrounds and experiences. We make daily, conscious choices to excel, by always bringing passion and creativity to our work, and by striving for innovation ethically and fairly. Our worldwide network of culture champions supports our focus on being At Our Best. Our communication on goals, targets and performance is frequent and transparent. We continue to leverage flexible work options available to employees who don't need our facilities to perform their jobs and this continues to enhance connections across the company, as well as with customers and external partners. This supports our desire to be first and fastest in finding solutions for customers and improving our overall effectiveness. Finally, we continue to take great pride in our focus on giving back to the communities in which we operate through the giving efforts of the H.B. Fuller Foundation and the thousands of employee volunteer hours each year.

Inclusion and Diversity

As a global company, we currently have employees present in 45 countries around the world. We place strong value on collaboration and we believe that working together leads to better outcomes for our customers. This extends to the way we treat each other as team members. We strive to create an environment where innovative ideas can flourish by demonstrating respect for each other and valuing the diverse opinions, background and viewpoints of employees. We believe that diversity in our teams leads to new ideas, helps us solve problems and allows us to better connect with our global customer base.

We are taking specific actions to foster inclusion and diversity into our culture. Learning resources have been implemented to support greater awareness and understanding of the behaviors expected from employees. We have introduced employee networking groups, an expanded and enhanced mentoring program and focused development programs with the goal of creating meaningful opportunities for employees. We have adjusted our recruiting practices to ensure we are getting the right level of exposure to diverse candidates.

Talent Development

We recognize how important it is for our colleagues to develop and progress in their careers. We provide a variety of resources to help our colleagues grow in their current roles and build new skills, including online development resources focused on specific business imperatives with access to hundreds of online courses in our learning management system. We have implemented an innovative delivery method for leadership training to drive experiential learning and to increase access to leaders around the world. Individual development planning is a part of our annual goal setting process and people managers are expected to have regular discussions with employees to measure progress and make needed adjustments. We focus on getting employees into roles with greater responsibility and opportunities for advancement that are also aligned with their career path to facilitate development and maximize potential. Finally, we provide ambitious employees with short-term opportunities in unique assignments in addition to their current roles. These assignments support the employees’ development while also supporting company initiatives that are required to be resourced with talented employees.

Raw Materials

We use several principal raw materials in our manufacturing processes, including tackifying resins, polymers, synthetic rubbers, vinyl acetate monomer and plasticizers. We generally avoid sole source supplier arrangements for raw materials.

The majority of our raw materials are petroleum/natural gas-based derivatives, therefore the cost of crude oil and natural gas can impact the cost of our raw materials. Under normal conditions, raw materials are available on the open market. Prices and availability are subject to supply and demand market mechanisms. Raw material costs, including costs for unique or specialty chemicals used in the manufacturing of our products, are primarily determined by the balance of supply against the aggregate demand from the adhesives industry and other industries that use the same raw material streams.

Patents, Trademarks and Licenses

Much of the technology we use in our products and manufacturing processes is available in the public domain. For technology not available in the public domain, we rely on trade secrets and patents when appropriate to protect our competitive position. We also license some patented technology from other sources. Our business is not materially dependent upon licenses or similar rights or on any single patent or group of related patents.

We enter into agreements with many employees to protect rights to technology and intellectual property. Confidentiality commitments also are routinely obtained from customers, suppliers and others to safeguard proprietary information.

We own numerous trademarks and service marks in various countries. Trademarks, such as H.B. Fuller®, Swift®, Advantra®, Clarity®, Earthic™, Sesame®, TEC®, Foster®, Rakoll®, Rapidex®, Full-Care®, Thermonex®, Silaprene®, Eternabond®, Cilbond®, HydroArmor®, Ködispace®, Weld Mount® and TONSAN® are important in marketing products. Many of our trademarks and service marks are registered. U.S. trademark registrations are for a term of ten years and are renewable every ten years as long as the trademarks are used in the regular course of trade.

Research and Development

Our investment in research and development creates new and innovative adhesive technology platforms, enhances product performance, ensures a competitive cost structure and leverages available raw materials. New product development is a key research and development outcome, providing higher-value solutions to existing customers or meeting new customers’ needs. Projects are developed in local laboratories in each region, where we understand our customer base the best. Platform developments are coordinated globally through our network of laboratories.

Through designing and developing new polymers and new formulations, we expect to continue to grow in our current markets. We also develop new applications for existing products and technologies, and improve manufacturing processes to enhance productivity and product quality. Research and development efforts are closely aligned to customer needs. We foster open innovation, seek supplier-driven new technology and use relationships with academic and other institutions to enhance our capabilities.

As climate change and other sustainability concerns become more prevalent, governmental and non-governmental organizations, customers and investors are increasingly focusing on these issues. We continue to monitor our markets to ensure we are developing the adhesives and sealants to support our customers’ responses to changing consumer demand, new product designs and upcoming regulatory and sustainability efforts. We invest significantly in innovation, research and expertise, which are crucial for the continuous extraction of value from our business strategy. This also facilitates the creation of new high-performance solutions that enable customers to improve their products and processes to better achieve their sustainability programs.

Regulatory Compliance

We comply with applicable federal, state, local and foreign laws and regulations relating to environmental protection and workers' safety, including those required by the U.S. Environmental Protection Agency (the “EPA”) and the European Union’s ("EU") Registration, Evaluation, Authorization and Restriction of Chemicals (“REACH”) regulation. This includes regular review of and upgrades to environmental, health and safety policies, practices and procedures as well as improved production methods to minimize our facilities’ outgoing waste, based on evolving societal standards and increased environmental understanding. Expenditures to comply with environmental regulations over the next two years are estimated to be approximately $21.4 million, including approximately $0.9 million of capital expenditures. See additional disclosure under Item 3. Legal Proceedings.

Various legislation, regulations and international accords pertaining to climate change have been implemented or are being considered for implementation, particularly as they relate to the reduction of greenhouse gas emissions, such as the EU's Corporate Sustainability Reporting Directive ("CSRD"), California’s Climate Corporate Data Accountability Act and Climate Related Financial Risk Act, and similar regulations under consideration by the Securities and Exchange Commission ("SEC"). These laws may directly impact the Company, however we have not determined the extent of potential disclosures or other reporting requirements. We continue to monitor the development and implementation of such legislation and regulations. We also continue to regularly report our sustainability efforts and metrics under the Global Reporting Initiative (“GRI”) framework and report our goals and progress in our annual Sustainability Report.

The Foreign Corrupt Practices Act (the “FCPA”) prohibits bribery of government officials to benefit business interests. We operate and sell our products in countries that are rated as high-risk for corruption, which creates the risk of unauthorized conduct by our employees, customs brokers, distributors or other third party intermediaries that could be in violation of the FCPA or similar local regulations. We comply with the FCPA’s requirements to make and keep accurate books and records that accurately and fairly reflect our transactions and to devise and maintain an adequate system of internal accounting controls.

We are also subject to and comply with increasingly complex privacy and data protection laws and regulations in the United States and other jurisdictions. This includes the EU’s General Data Protection Regulation (“GDPR”), which enforces rules relating to the protection of processing and movement of personal data. The interpretation and enforcement of such regulations are continuously evolving and there may be uncertainty with respect to how to comply with them. Noncompliance with GDPR and other data protection laws could result in damage to our reputation and payment of monetary penalties.

Seasonality

Our operating segments have historically had lower net revenue in winter months, which is primarily our first fiscal quarter, mainly due to international holidays and the seasonal decline in construction and consumer spending activities.

Information About Our Executive Officers

The following table shows the name, age and business experience for the past five years of the executive officers as of January 16, 2024. Unless otherwise noted, the positions described are positions with the company or its subsidiaries.

| Name |

Age |

Positions |

Period Served |

|

|

|

|

|

| Celeste B. Mastin |

55 |

President and Chief Executive Officer Executive Vice President and Chief Operating Officer Chief Executive Officer, PetroChoice Lubrication Solutions (leading lubricant distributor, providing solutions across the industrial, commercial and passenger vehicle customer segments) |

December 2022 - Present March - December 2022 2018 - 2022

|

|

|

|

|

|

| Zhiwei Cai |

61 |

Executive Vice President, Engineering Adhesives |

August 2019 - Present |

| Senior Vice President, Engineering Adhesives | February 2016 - August 2019 | ||

| Heather A. Campe |

50 |

Senior Vice President, International Growth | December 2021 - Present |

| Senior Vice President, Global Hygiene, Health and Consumable Adhesives | August 2019 - November 2021 | ||

| Senior Vice President, Americas Adhesives | October 2016 - August 2019 | ||

| John J. Corkrean |

58 |

Executive Vice President and Chief Financial Officer |

May 2016 - Present |

| James J. East | 59 | Executive Vice President, Hygiene, Health and Consumable Adhesives | December 2022 - Present |

| Senior Vice President, Hygiene, Health and Consumable Adhesives | October 2021 - December 2022 | ||

| Vice President, Engineering Adhesives Americas and Global Director Automotive | April 2018 - October 2021 |

| Traci L. Jensen |

57 |

Executive Vice President and Chief Administrative Officer |

December 2022 - Present |

| Vice President, Global Business Process Improvement | December 2019 - December 2022 | ||

| Senior Vice President, Global Construction Products | July 2016 - December 2019 | ||

| M. Shahbaz Malik |

56 |

Senior Vice President, Construction Adhesives |

December 2019 - Present |

| Vice President and Business Leader, North America Distribution, Masonite International Corporation (global residential doors business) | 2018 - 2019 | ||

| Gregory O. Ogunsanya | 49 | Senior Vice President, General Counsel and Corporate Secretary | October 2023 - Present |

| Vice President, Assistant General Counsel, Securities and Governance, Stanley Black & Decker Inc. | June 2022 - September 2023 | ||

| Vice President Legal, Stanley Industrial, a division of Stanley Black & Decker, Inc. (the world’s largest tool company) | October 2020 - June 2022 | ||

| Vice President and Deputy General Counsel, Safety and Productivity Solutions, Honeywell International, Inc. | November 2019 - October 2020 | ||

| Vice President and General Counsel, Industrial Safety, Honeywell International, Inc. (advanced technology company that manufactures aerospace and automotive products; residential, commercial, and industrial control systems; specialty chemicals and plastics; and engineered materials) | October 2018 - November 2019 | ||

| Nathaniel D. Weaver |

48 |

Senior Vice President, Human Resources |

December 2022 - Present |

| Vice President, Human Resources | March 2020 - December 2022 | ||

| Director, Human Resources | 2017 - March 2020 |

The Board of Directors elects the executive officers annually.

Available Information

For more information about us, visit our website at: www.hbfuller.com.

We file annual, quarterly and current reports, proxy statements and other information with the SEC via EDGAR. Our SEC filings are available free of charge to the public on the SEC website at www.sec.gov and on our website as soon as reasonably practicable after they have been filed with or furnished to the SEC.

As a global manufacturer of adhesives, sealants and other specialty chemical products, we operate in a business environment that is subject to various risks and uncertainties. Below are the most significant factors that could adversely affect our business, financial condition and results of operations.

Strategic and Operational Risks

Increases in prices and declines in the availability of raw materials have adversely affected, and could continue to erode, our profit margins, and could negatively impact our operating results.

In 2023, raw material costs made up approximately 75 percent of our cost of sales. Based on 2023 financial results, a hypothetical one percent change in our raw material costs would have resulted in a change in net income of approximately $13.3 million or $0.24 per diluted share. Accordingly, changes in the cost of raw materials, due to scarcity, supplier disruptions, inflation and for other reasons, can significantly impact our earnings. Raw materials needed to manufacture products are obtained from a number of suppliers and many of the raw materials are petroleum and natural gas based derivatives. Under normal market conditions, these raw materials are generally available on the open market from a variety of producers. While alternate supplies of most key raw materials are available, supplier production outages may lead to strained supply-demand situations for certain raw materials. The substitution of key raw materials requires us to identify new supply sources, reformulate and re-test and may require seeking re-approval from our customers using those products. From time to time, the prices and availability of these raw materials may fluctuate, which could impair our ability to procure necessary materials, or increase the cost of manufacturing products. If the prices of raw materials increase in a short period of time, we may be unable to pass these increases on to our customers in a timely manner and could experience reductions to our profit margins.

We are at risk of cyber-attacks or other security breaches that could compromise sensitive business information, undermine our ability to operate effectively and expose us to liability, which could cause our business and reputation to suffer.

Increasingly, companies are subject to a wide variety of attacks on their networks on an ongoing basis. In addition to traditional computer “hackers,” malicious code (such as viruses and worms), phishing attempts, ransomware, employee theft or misuse, and denial of service attacks, sophisticated nation-state and nation-state supported actors engage in intrusions and attacks (including advanced persistent threat intrusions) and add to the risks to internal networks, cloud deployed enterprise and customer-facing environments and the information they store and process. Despite significant efforts to create security barriers to such threats, it is virtually impossible for us to entirely mitigate these risks. We, and our third-party software and service providers, have experienced and will continue to experience security threats and attacks from a variety of sources.

As part of our business, we store our data, including intellectual property, and certain data about our employees, customers and vendors in our information technology systems. Our security measures may be breached as a result of third-party action, including intentional misconduct by computer hackers, employee error, malfeasance or otherwise. Third parties may attempt to fraudulently induce employees or customers into disclosing sensitive information such as usernames, passwords, or other information to gain access to our customers' data or our data, including our intellectual property and other confidential business information, or our information technology systems. In addition, given their size and complexity, our information systems could be vulnerable to service interruptions or to security breaches from inadvertent or intentional actions by our employees, third-party vendors and/or business partners, or from cyber-attacks by malicious third parties attempting to gain unauthorized access to our products, systems or confidential information.

We are subject to increasingly complex and evolving laws, regulations and customer-imposed controls, that govern privacy and cybersecurity. These laws and regulations have been adopted by multiple agencies at the federal and state level, as well as in foreign jurisdictions, and the regimes have not been harmonized. Our failure to comply with these regulatory regimes may result in significant liabilities or penalties.

If a third party gained unauthorized access to our data, including any data regarding our employees, customers or vendors, the security breach could expose us to risks. Such unauthorized access and a failure to effectively recover from breaches could compromise confidential information, disrupt our business, harm our reputation, result in the loss of customer confidence, business and assets (including trade secrets and other intellectual property), result in regulatory proceedings and legal claims, and have a negative impact on our financial results.

Our business and operations have been, and may in the future, be adversely affected by epidemics, pandemics, outbreaks of disease and other adverse public health developments.

Epidemics, pandemics, outbreaks of novel diseases and other adverse public health developments in countries and states where we operate may arise at any time. Such developments, including the COVID-19 pandemic, have had, and in the future may have, an adverse effect on our business, financial condition and results of operations. These effects include a potentially negative impact on the availability of our key personnel, labor shortages and increased turnover, temporary closures of our facilities or facilities of our business partners, customers, suppliers, third-party service providers or other vendors, and interruption of domestic and global supply chains, distribution channels and liquidity and capital or financial markets. In particular, restrictions on or disruptions of transportation, port closures or increased border controls or closures, or other impacts on domestic and global supply chains or distribution channels, could increase our costs for raw materials and commodity costs, increase demand for raw materials and commodities from competing purchasers, limit our ability to meet customer demand or otherwise have a material adverse effect on our business, financial condition and results of operations or cash flows. Precautionary measures that we may take in the future intended to limit the impact of any epidemic, pandemic, disease outbreak or other public health development, may result in additional costs. In addition, such epidemics, pandemics, disease outbreaks or other public health developments may adversely affect economies and financial markets throughout the world, such as the effect that COVID-19 has had on world economies and financial markets, which may affect our ability to obtain additional financing for our businesses and demand for our products and services. The extent to which major public health issues impact our business and our financial results in the future will depend on future developments, which are highly uncertain and cannot be predicted. As a result, it is not possible to predict the overall future impact of major public health issues on our business, liquidity, capital resources and financial results.

We experience substantial competition in each of the operating segments and geographic areas in which we operate.

Our wide variety of products are sold in numerous markets, each of which is highly competitive. Our competitive position in markets is, in part, subject to external factors. For example, supply and demand for certain of our products is driven by end-use markets and worldwide capacities which, in turn, impact demand for and pricing of our products. Many of our direct competitors are part of large multinational companies and may have more resources than we do. Any increase in competition may result in lost market share or reduced prices, which could result in reduced profit margins. This may impair the ability to grow or even to maintain current levels of revenues and earnings. While we have an extensive customer base, loss of certain top customers could adversely affect our financial condition and results of operations until such business is replaced, and no assurances can be made that we would be able to regain or replace any lost customers.

Failure to develop and/or acquire new products and protect our intellectual property could negatively impact our future performance and growth.

Ongoing innovation and product development are important factors in our competitiveness, as is acquisition of new technologies. Failure to create and/or acquire new products and generate new ideas could negatively impact our ability to grow and deliver strong financial results. We may face difficulties marketing products produced using new technologies including, but not limited to, sustainable adhesives, which may adversely impact our sales and financial results. Failure of the products to work as predicted could lead to liability and damage to our reputation.

We continually apply for and obtain U.S. and foreign patents to protect the results of our research for use in our operations and licensing. We are party to a number of patent licenses and other technology agreements. We rely on patents, confidentiality agreements and internal security measures to protect our intellectual property. Failure to protect this intellectual property could negatively affect our future performance and growth.

Our operations may present health and safety risks.

Notwithstanding our emphasis on the safety of our employees and contractors and the precautions we take related to health and safety, we may be unable to avoid safety incidents relating to our operations that result in injuries or deaths. Certain safety incidents may result in legal or regulatory action that could result in increased expenses or reputational damage. We maintain workers' compensation insurance to address the risk of incurring material liabilities for injuries or deaths, but there can be no assurance that the insurance coverage will be adequate or will continue to be available on terms acceptable to us, or at all, which could result in material liabilities to us for any injuries or deaths. Changes to federal, state and local employee health and safety regulations, and legislative, regulatory or societal responses to safety incidents may result in heightened regulations or public scrutiny that may increase our compliance costs or result in reputational damage.

A failure in our information technology systems could negatively impact our business.

We rely on information technology to record and process transactions, manage our business and maintain the financial accuracy of our records. Our computer systems are subject to damage or interruption from various sources, including power outages, computer and telecommunications failures, computer viruses, security breaches, vandalism, catastrophic events and human error. Interruptions of our computer systems could disrupt our business, for example by leading to plant downtime and/or power outages and could result in the loss of business and cause us to incur additional expense.

We are in the process of implementing a global Enterprise Resource Planning (“ERP”) system, including upgrading to SAP S/4HANA® which is anticipated to occur at the beginning of fiscal 2025, that we refer to as Project ONE, which will upgrade and standardize our information system. Implementation of Project ONE began in our North America adhesives business in 2014 and, through 2023, we completed implementation of this system in various parts of our business including Latin America (except Brazil), Australia and various other businesses in North America and Europe, India, Middle East and Africa (EIMEA). During 2024 and beyond, we will continue implementation in North America; Europe, India, the Middle East and Africa ("EIMEA"); Brazil and Asia Pacific.

Any delays or other failure to achieve our implementation goals may adversely impact our financial results. In addition, the failure to either deliver the application on time or anticipate the necessary readiness and training needs could lead to business disruption and loss of business. Failure or abandonment of any part of the ERP system could result in a write-off of part or all of the costs that have been capitalized on the project.

Risks associated with acquisitions could have an adverse effect on us and the inability to execute organizational restructuring may affect our results.

As part of our growth strategy, we have made, and will likely continue to make, acquisitions of complementary businesses or products. The ability to grow through acquisitions depends upon our ability to identify, negotiate, complete and integrate suitable acquisitions. If we fail to successfully integrate acquisitions into our existing business, our results of operations and our cash flows could be adversely affected. Our acquisition strategy also involves other risks and uncertainties, including distraction of management from current operations, greater than expected liabilities and expenses, inadequate return on capital, unidentified issues not discovered in our investigations and evaluations of those strategies and acquisitions, and difficulties implementing and maintaining consistent standards, controls, procedures, policies and systems. Future acquisitions could result in additional debt and other liabilities, and increased interest expense, restructuring charges and amortization expense related to intangible assets.

Our growth strategy depends in part on our ability to further penetrate markets outside the United States, where there is the potential for significant economic and political disruptions. Our operations in these markets may be subject to greater risks than those faced by our operations in the United States, including political and economic instability, project delay or abandonment due to unanticipated government actions, inadequate investment in infrastructure, undeveloped property rights and legal systems, unfamiliar regulatory environments, relationships with local partners, language and cultural differences and increased difficulty recruiting, training and retaining qualified employees.

In addition, our profitability is dependent on our ability to drive sustainable productivity improvements such as cost savings through organizational restructuring. Delays or unexpected costs may prevent us from realizing the full operational and financial benefits of such restructuring initiatives and may potentially disrupt our operations.

Macroeconomic Risks

Uncertainties in foreign economic, political, regulatory and social conditions and fluctuations in foreign currency may adversely affect our results.

Approximately 56 percent, or $2.0 billion, of our net revenue was generated outside the United States in 2023. International operations could be adversely affected by changes in economic, political, regulatory, and social conditions, especially in Brazil, Russia, China, the Middle East, including Turkey and Egypt, and other developing or emerging markets where we do business. An economic downturn in the businesses or geographic areas in which we sell our products could reduce demand for these products and result in a decrease in sales volume that could have a negative impact on our results of operations. Product demand often depends on end-use markets. Economic conditions that reduce consumer confidence or discretionary spending may reduce product demand. Challenging economic conditions may also impair the ability of our customers to pay for products they have purchased, and as a result, our reserves for doubtful accounts and write-offs of accounts receivable may increase. In addition, trade protection measures, anti-bribery and anti-corruption regulations, restrictions on repatriation of earnings and cash, currency controls implemented by foreign governments, differing intellectual property rights and changes in legal and regulatory requirements that restrict the sales of products or increase costs could adversely affect our results of operations.

Fluctuations and volatility in exchange rates between the U.S. dollar and other currencies could potentially result in increases or decreases in net revenue, cost of raw materials and earnings and may adversely affect the value of our assets outside the United States. In 2023, the change in foreign currencies negatively impacted our net revenue by approximately $88.5 million. In 2023, we spent approximately $1.9 billion for raw materials worldwide of which approximately $1.0 billion was purchased outside the United States. Based on 2023 financial results, a hypothetical one percent change in our cost of sales due to foreign currency rate changes would have resulted in a change in net income of approximately $9.4 million or $0.17 per diluted share. Although we utilize risk management tools, including hedging, as appropriate, to mitigate market fluctuations in foreign currencies, any changes in strategy in regard to risk management tools can also affect revenue, expenses and results of operations and there can be no assurance that such measures will result in cost savings or that all market fluctuation exposure will be eliminated.

Distressed financial markets may result in dramatic deflation of financial asset valuations and high interest rates may disrupt the availability of capital.

Adverse equity market conditions and volatility in the credit markets could have a negative impact on the value of our pension trust assets, our future estimated pension liabilities and other postretirement benefit plans. In addition, we could be required to provide increased pension plan funding. As a result, our financial results could be negatively impacted.

In a rising interest rate environment, more costly debt and reduced access to capital markets may affect our ability to invest in strategic growth initiatives such as acquisitions. In addition, the reduced credit availability could limit our customers’ ability to invest in their businesses, refinance maturing debt obligations, or meet their ongoing working capital needs. If these customers do not have sufficient access to the financial markets, demand for our products may decline.

The military conflicts between Russia and Ukraine and Israel and Hamas, and the global response to these events, could adversely impact our revenues, gross margins and financial results.

The U.S. government and other nations have imposed significant restrictions on most companies’ ability to do business in Russia as a result of the military conflict between Russia and Ukraine. Increases in energy demand and supply disruptions caused by the Russia and Ukraine conflict have resulted in significantly higher energy prices, particularly in Europe. Further, in October 2023, a military conflict commenced between Israel and Hamas. It is not possible to predict the broader or longer-term consequences of these conflicts, which could include further sanctions, embargoes, regional instability, energy shortages, geopolitical shifts and adverse effects on macroeconomic conditions, security conditions, currency exchange rates and financial markets. Such geopolitical instability and uncertainty could have a negative impact on our ability to sell to, ship products to, collect payments from, and support customers in certain regions based on trade restrictions, embargoes and export control law restrictions, and logistics restrictions including closures of air space, and could increase the costs, risks and adverse impacts from these new challenges. We may also be the subject of increased cyber-attacks. While the countries involved in these conflicts do not constitute a material portion of our business, a significant escalation or expansion of economic disruption or the conflicts' current scope could have a material adverse effect on our results of operations.

Catastrophic events could disrupt our operations or the operations of our suppliers or customers, having a negative impact on our financial results.

Unexpected events, including global pandemics, natural disasters and severe weather events, fires or explosions at our facilities or those of our suppliers, acts of war or terrorism, supply disruptions or breaches of security of our information technology systems could increase the cost of doing business or otherwise harm our operations, our customers and our suppliers. Such events could reduce demand for our products or make it difficult or impossible for us to receive raw materials from suppliers and deliver products to our customers.

Legal and Regulatory Risks

The impact of changing laws or regulations or the manner of interpretation or enforcement of existing laws or regulations could adversely impact our financial performance and restrict our ability to operate our business or execute our strategies.

New laws or regulations, or changes in existing laws or regulations or the manner of their interpretation or enforcement, could increase our cost of doing business and restrict our ability to operate our business or execute our strategies. In addition, compliance with laws and regulations is complicated by our substantial global footprint, which will require significant and additional resources to ensure compliance with applicable laws and regulations in the various countries where we conduct business.

Our global operations expose us to trade and economic sanctions and other restrictions imposed by the U.S., the EU and other governments and organizations. The U.S. Departments of Justice, Commerce, State, Homeland Security, and Treasury and other federal agencies and authorities have a broad range of civil and criminal penalties they may seek to impose against corporations and individuals for violations of economic sanctions laws, export control laws, the FCPA and other federal statutes and regulations, including those established by the OFAC. Under these laws and regulations, as well as other anti-corruption laws, anti-money-laundering laws, export control laws, customs laws, sanctions laws and other laws governing our operations, various government agencies may require export licenses, may seek to impose modifications to business practices, including cessation of business activities in sanctioned countries or with sanctioned persons or entities and modifications to compliance programs, including import restrictions, which may increase compliance costs, and may subject us to fines, penalties and other sanctions. A violation of these laws, regulations, policies or procedures could adversely impact our business, results of operations and financial condition.

Although we have implemented policies and procedures in these areas, we cannot assure that our policies and procedures are sufficient or that directors, officers, employees, representatives, manufacturers, suppliers and agents have not engaged and will not engage in conduct in violation of such policies and procedures.

Costs and expenses resulting from compliance with environmental laws and regulations may negatively impact our operations and financial results.

We are subject to numerous environmental laws and regulations that impose various environmental controls on us or otherwise relate to environmental protection, the sale and export of certain chemicals or hazardous materials, and various health and safety matters. The costs of complying with these laws and regulations can be significant and may increase as applicable requirements and their enforcement become more stringent and new rules are implemented. Adverse developments and/or periodic settlements could negatively impact our results of operations and cash flows. See Item 3. Legal Proceedings for a discussion of current environmental matters.

Climate change, or legal, regulatory or market measures to address climate change, may materially adversely affect our financial condition and business operations.

Climate change resulting from increased concentrations of carbon dioxide and other greenhouse gases in the atmosphere could present risks to our future operations from natural disasters and extreme weather conditions, such as hurricanes, tornadoes, earthquakes, wildfires or flooding. Such extreme weather conditions could pose physical risks to our facilities and disrupt operation of our supply chain and may increase operational costs. The impacts of climate change on global water resources may result in water scarcity, which could in the future impact our ability to access sufficient quantities of water in certain locations and result in increased costs. Concern over climate change continues to result in new legal or regulatory requirements designed to mitigate the effects of climate change on the environment, such as the EU's CSRD, California’s Climate Corporate Data Accountability Act and Climate Related Financial Risk Act, and similar regulations under consideration by the SEC. We are experiencing increased compliance burdens and costs to meet the regulatory obligations and these regulatory obligations may adversely affect raw material sourcing, manufacturing operations and the distribution of our products.

Our business exposes us to potential product liability, warranty, and tort claims, and recalls, which may negatively impact our operations, financial results, and reputation.

The development, manufacture and sale of adhesives, sealants, and other specialty chemical products by us, including products produced for the medical device, automotive, food and beverage, aerospace and defense, construction, and hygiene products end markets, involves a risk of exposure to product liability, warranty, and tort claims, product recalls, product seizures and related adverse publicity. A product liability, warranty, or tort claim or judgment against us could also result in substantial and unexpected expenditures, affect customer confidence in our products, and divert management's attention from other responsibilities. Although we maintain product liability insurance, there can be no assurance that the level of coverage is adequate, that coverage will apply, or that we will be able to continue to maintain our existing insurance or obtain comparable insurance at a reasonable cost, if at all. We also have contracting policies and controls in place to limit our exposure to third party claims, though we might not always be able to limit our exposure to those claims.

We have lawsuits and claims against us with uncertain outcomes.

Our operations from time to time are parties to or targets of lawsuits, claims, investigations and proceedings, including product liability, personal injury, asbestos, patent and intellectual property, commercial, contract, environmental, antitrust, health and safety, and employment matters, which are handled and defended in the ordinary course of business. The results of any future litigation or settlement of such lawsuits and claims are inherently unpredictable, but such outcomes could be adverse and material in amount. See Item 3. Legal Proceedings for a discussion of current litigation.

The Company’s effective tax rate could be volatile and materially change as a result of the adoption of new tax legislation and other factors.

A change in tax laws is one of many factors that impact the Company’s effective tax rate. The U.S. Congress and other government agencies in jurisdictions where the Company does business have had an extended focus on issues related to the taxation of multinational corporations. As a result, the tax laws in the U.S. and other countries in which the Company does business could change, and any such changes could adversely impact our effective tax rate, financial condition and results of operations.

The Organization for Economic Co-operation and Development ("OECD"), an international association of 38 countries including the United States, finalized and adopted numerous changes to long-standing tax principles. Certain of these changes become effective for the Company in 2025 and will likely increase tax uncertainty and may adversely affect our provision for income taxes.

Additional income tax expense or exposure to additional income tax liabilities could have a negative impact on our financial results.

We are subject to income tax laws and regulations in the United States and various foreign jurisdictions. Significant judgment is required in evaluating and estimating our provision and accruals for these taxes. Our income tax liabilities are dependent upon the location of earnings among these different jurisdictions. Our income tax provision and income tax liabilities could be adversely affected by the jurisdictional mix of earnings, changes in valuation of deferred tax assets and liabilities and changes in tax laws and regulations. In the ordinary course of our business, we are also subject to continuous examinations of our income tax returns by tax authorities. Although we believe our tax estimates are reasonable, the final results of any tax examination or related litigation could be materially different from our related historical income tax provisions and accruals. Adverse developments in an audit, examination or litigation related to previously filed tax returns, or in the relevant jurisdiction’s tax laws, regulations, administrative practices, principles and interpretations could have a material effect on our results of operations and cash flows in the period or periods for which that development occurs, as well as for prior and subsequent periods. The decision to repatriate foreign earnings could result in higher withholding taxes.

Financial Risks

We may be required to record impairment charges on our goodwill or long-lived assets.

Weak demand may cause underutilization of our manufacturing capacity or elimination of product lines; contract terminations or customer shutdowns may force sale or abandonment of facilities and equipment; or other events associated with weak economic conditions or specific product or customer events may require us to record an impairment on tangible assets, such as facilities and equipment, as well as intangible assets, such as intellectual property or goodwill, which would have a negative impact on our financial results.

Our current indebtedness could have a negative impact on our liquidity or restrict our activities.

Our current indebtedness contains various covenants that limit our ability to engage in specified types of transactions. Our overall leverage and the terms of our financing arrangements could:

| ● |

limit our ability to obtain additional financing in the future for working capital, capital expenditures and acquisitions, even when necessary to maintain adequate liquidity, particularly if any ratings assigned to our debt securities by rating organizations were revised downward; |

| ● |

make it more difficult to satisfy our obligations under the terms of our indebtedness; |

| ● |

limit our ability to refinance our indebtedness on terms acceptable to us or at all; |

| ● |

limit our flexibility to plan for and adjust to changing business and market conditions in the industries in which we operate and increase our vulnerability to general adverse economic and industry conditions; |

| ● |

require us to dedicate a substantial portion of our cash flow to make interest and principal payments on our debt, thereby limiting the availability of our cash flow to fund future acquisitions, working capital, business activities and other general corporate requirements; |

| ● |

subject us to higher levels of indebtedness than our competitors, which may cause a competitive disadvantage and may reduce our flexibility in responding to increased competition; and |

| ● |

expose us to interest rate risk since a portion of our debt obligations are at variable rates. This could negatively impact our earnings, cash flows and our ability to grow. For example, a one percentage point increase in the average interest rate on our floating rate debt at December 2, 2023 would increase future interest expense by approximately $5.3 million per year. |

In addition, the restrictive covenants require us to maintain specified financial ratios and satisfy other financial condition tests. Our ability to meet those financial ratios and tests will depend on our ongoing financial and operating performance, which, in turn, will be subject to economic conditions and to financial, market and competitive factors, many of which are beyond our control. A breach of any of these covenants could result in a default under the instruments governing our indebtedness.

Item 1B. Unresolved Staff Comments

None.

Principal executive offices and central research facilities are located in the St. Paul, Minnesota area. These facilities are company-owned. Manufacturing operations are carried out at 36 plants located throughout the United States and at 45 plants located in 25 other countries. In addition, numerous sales and service offices are located throughout the world. We believe that the properties owned or leased are suitable and adequate for our business. Operating capacity varies by product line, but additional production capacity is available for most product lines by increasing the number of shifts worked. The following is a list of our manufacturing plants as of December 2, 2023 (each of the listed properties are owned by us, unless otherwise specified):

| Segment |

Segment |

||||

| Hygiene, Health and Consumable Adhesives |

Engineering Adhesives |

||||

| Argentina | Buenos Aires2 |

France | Surbourg | ||

| Australia |

Dandenong South | Germany |

Wunstorf | ||

| Australia |

Sydney1 |

Germany | Nienburg | ||

| Brazil |

Sorocaba2 |

Germany |

Langelsheim1 | ||

| Brazil |

Curitiba1 |

Germany |

Pirmasens | ||

| Brazil |

Guarulhos |

Italy |

Pianezze | ||

| Chile |

Santiago |

People's Republic of China |

Beijing | ||

| Colombia |

Rionegro |

People's Republic of China | Chongqing1 | ||

| Egypt | 6th of October City - 3rd Industrial Zone2 | People's Republic of China | Nanjing - ShanXu Road | ||

| Egypt |

6th of October City - CPC Industrial Park |

People's Republic of China |

Nanjing - Xinjinhu Road1 | ||

| Finland | Valkeakoski1 | People's Republic of China | Suzhou | ||

| France |

Blois |

` |

People's Republic of China |

Yantai |

|

| Germany | Luneburg | Portugal | Mindelo |

||

| Germany | Frankfurt - Kilianstädter1 | United Kingdom | Preston1 | ||

| Germany | Frankfurt - Vibeler1 | United States | California - Irvine1 | ||

| Greece | Lamia | United States | California - Wilmington1 | ||

| India | Pune | United States | Connecticut - Enfield1 | ||

| Indonesia | Mojokerto | United States |

Georgia - Norcross1 | ||

| Kenya | Nairobi1 | United States |

Georgia - Ball Ground1 | ||

| Malaysia | Selangor | United States |

Illinois - Frankfort - Corsair | ||

| New Zealand | Auckland1 | United States |

Illinois - Frankfort - West Drive |

||

| People's Republic of China | Guangzhou | United States |

Indiana - South Bend | ||

| Philippines | Manila | United States | Massachusetts - Peabody1 | ||

| Sweden | Landskrona | United States |

Michigan - Grand Rapids | ||

| United Kingdom | Dukinfield | United States | Minnesota - Fridley | ||

| United Kingdom | Milton Keynes1 | United States | Minnesota - Maple Grove1 | ||

| United States | Georgia - Covington | United States |

New Hampshire - Raymond1 | ||

| United States | California - Roseville | United States | Ohio - Bellevue1 | ||

| United States |

Georgia - Tucker |

|

|||

| United States |

Illinois - Seneca | Construction Adhesives |

|||

| United States | Kentucky - Paducah | Belgium | Antwerp | ||

| United States |

Ohio - Blue Ash | Canada |

Ontario - Toronto1 |

||

| United States | Minnesota - Vadnais Heights | Mexico | Coahuila1 | ||

| United States | New York - Syracuse1 | United Arab Emirates | Ras Al-Khaimah1 | ||

| United States | North Carolina - Charlotte | United Kingdom | Kirby in Ashfield | ||

| United States | North Carolina - Hudson | United Kingdom | Mansfield1 | ||

| United States | South Carolina - Simpsonville | United Kingdom | Staffordshire | ||

| United States | Texas - Mesquite | United Kingdom | Tibshelf1 | ||

| United States | Washington - Vancouver | United States |

California - La Mirada |

||

| United States | Florida - Gainesville | ||||

|

|

United States |

Georgia - Dalton |

|||

|

|

|

United States |

Illinois - Aurora |

||

|

|

|

United States |

Michigan - Michigan Center |

||

|

|

|

United States |

New Jersey - Edison |

||

| United States |

Ohio - Chagrin Falls |

||||

| United States |

Texas - Houston |

||||

| United States |

Texas - Mansfield |

||||

1 Leased Property

2 Idle Property

Environmental Matters

From time to time, we become aware of compliance matters relating to, or receive notices from, federal, state or local entities regarding possible or alleged violations of environmental, health or safety laws and regulations. Also, from time to time, we are identified as a potentially responsible party (“PRP”) under the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”) and/or similar state laws that impose liability for costs relating to the clean up of contamination resulting from past spills, disposal or other release of hazardous substances. We are also subject to similar laws in some of the countries where current and former facilities are located. Our environmental, health and safety department monitors compliance with applicable laws on a global basis.

Currently, we are involved in various environmental investigations, clean up activities and administrative proceedings and lawsuits. In particular, we are currently deemed a PRP in conjunction with numerous other parties, in a number of government enforcement actions associated with landfills and/or hazardous waste sites. As a PRP, we may be required to pay a share of the costs of investigation and clean up of these sites.

We are also engaged in environmental remediation and monitoring efforts at a number of current and former operating facilities. To the extent we can reasonably estimate the amount of our probable liabilities for environmental matters, we establish a financial provision. It is reasonably possible that we may have additional liabilities related to these known environmental matters. However, the full extent of our future liability for environmental matters is difficult to predict because of uncertainty as to the cost of investigation and clean up of the sites, our responsibility for such hazardous substances and the number of and financial condition of other potentially responsible parties.

While uncertainties exist with respect to the amounts and timing of the ultimate environmental liabilities, based on currently available information, we have concluded that these matters, individually or in the aggregate, will not have a material adverse effect on our results of operations, financial condition or cash flow. However, adverse developments and/or periodic settlements could negatively impact the results of operations or cash flows in one or more future periods.

Other Legal Proceedings

From time to time and in the ordinary course of business, we are a party to, or a target of, lawsuits, claims, investigations and proceedings, including product liability, personal injury, asbestos, contract, patent and intellectual property, environmental, health and safety, tax and employment matters. While we are unable to predict the outcome of these matters, we have concluded, based upon currently available information, that the ultimate resolution of any pending matter, individually or in the aggregate, will not have a material adverse effect on our results of operations, financial condition or cash flow. However, adverse developments and/or periodic settlements could negatively impact the results of operations or cash flows in one or more future periods.

For additional information regarding environmental matters and other legal proceedings, see Note 14 to the Consolidated Financial Statements.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the New York Stock Exchangeunder the symbol FUL. As of January 17, 2024, there were 1,268 common shareholders of record for our common stock.

Issuer Purchases of Equity Securities

Information on our purchases of equity securities during the fourth quarter of 2023 is as follows:

| Total Number of |

Approximate Dollar |

|||||||||||||||

| Shares |

Value of Shares that |

|||||||||||||||

| Total |

Purchased as |

may yet be |

||||||||||||||

| Number of |

Average |

Part of a Publicly |

Purchased Under the |

|||||||||||||

| Shares |

Price Paid |

Announced Plan |

Plan or Program |

|||||||||||||

| Period |

Purchased1 |

per Share |

or Program |

(thousands) |

||||||||||||

| September 3, 2023 - October 7, 2023 |

16 | $ | 68.61 | - | $ | 300,000 | ||||||||||

| October 8, 2023 - November 4, 2023 |

70 | $ | 65.93 | - | $ | 300,000 | ||||||||||

| November 5, 2023 - December 2,2023 |

8 | $ | 75.41 | - | $ | 300,000 | ||||||||||

1 The total number of shares purchased are shares withheld to satisfy the employees' withholding taxes upon vesting of restricted stock. Repurchases of common stock are made to support our stock-based employee compensation plans and for other corporate purposes. Upon vesting of restricted stock awarded to employees, shares are withheld to cover the employees' minimum withholding taxes.

On April 7, 2022, the Board of Directors authorized a new share repurchase program of up to $300.0 million of our outstanding common shares for a period of up to five years. Under the program, we are authorized to repurchase shares for cash on the open market, from time to time, in privately negotiated transactions or block transactions, or through an accelerated repurchase agreement. The timing of such repurchases is dependent on price, market conditions and applicable regulatory requirements. Upon repurchase of the shares, we reduce our common stock for the par value of the shares with the excess being applied against additional paid in capital. This authorization replaces the April 6, 2017 authorization to repurchase shares.

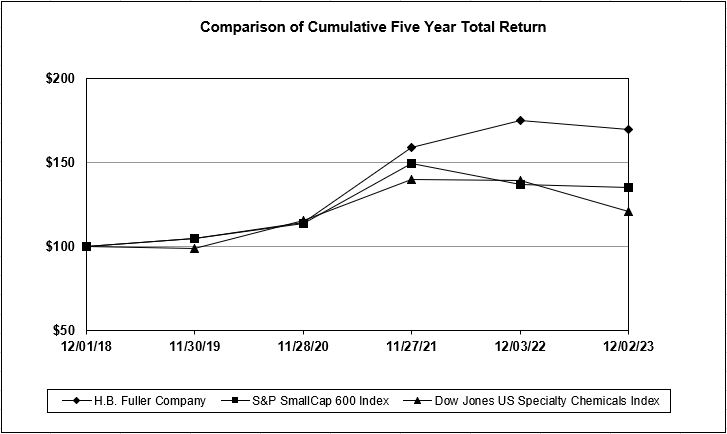

Total Shareholder Return Graph

The line graph below compares the cumulative total shareholder return on our common stock for the last five fiscal years with cumulative total return on the S&P Small Cap 600 Index and Dow Jones U.S. Specialty Chemicals Index. This graph assumes a $100 investment in each of H.B. Fuller, the S&P Small Cap 600 Index and the Dow Jones U.S. Specialty Chemicals Index at the close of trading on December 1, 2018, and also assumes the reinvestment of all dividends.

Item 6. Selected Financial Data

Reserved.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Overview

H.B. Fuller Company is a global formulator, manufacturer and marketer of adhesives and other specialty chemical products. We have three reportable segments: Hygiene, Health and Consumable Adhesives, Engineering Adhesives and Construction Adhesives.

The Hygiene, Health and Consumable Adhesives operating segment manufactures and supplies adhesives products in the assembly, packaging, converting, nonwoven and hygiene, health and beauty, flexible packaging, graphic arts and envelope markets. The Engineering Adhesives operating segment provides high-performance adhesives to the transportation, electronics, clean energy, aerospace and defense, performance wood, insulating glass, textile, appliance and heavy machinery markets. The Construction Adhesives operating segment manufactures and provides specialty adhesives, sealants, tapes, mortars, grouts, and application devices for commercial building roofing systems, heavy infrastructure projects, road/highway/airport transportation applications, telecom/5G utilities, industrial LNG plants, building envelope applications, HVAC insulation systems, and for both residential and commercial flooring underlayment solutions.

Total Company

When reviewing our financial statements, it is important to understand how certain external factors impact us. These factors include:

| ● |

Changes in the prices of our raw materials that are primarily derived from refining crude oil and natural gas, |

| ● |

Global supply of and demand for raw materials, |

| ● |

Economic growth rates, and |

| ● |

Currency exchange rates compared to the U.S. dollar. |

We purchase thousands of raw materials, the majority of which are petroleum/natural gas derivatives. The price of these derivatives impacts the cost of our raw materials. However, the supply of and demand for key raw materials has a greater impact on our costs. As demand increases in high-growth areas, the supply of key raw materials may tighten, resulting in certain materials being put on allocation. Natural disasters, such as hurricanes, also can have an impact as key raw material producers are shut down for extended periods of time. We continually monitor capacity utilization figures, market supply and demand conditions, feedstock costs and inventory levels, as well as derivative and intermediate prices, which affect our raw materials. With approximately 75 percent of our cost of sales accounted for by raw materials, our financial results are extremely sensitive to changing costs in this area.

The pace of economic growth directly impacts certain industries to which we supply products. For example, adhesives-related revenues from durable goods customers in areas such as appliances, furniture and other woodworking applications tend to fluctuate with the overall economic activity. In business components such as Construction Adhesives and insulating glass in Engineering Adhesives, revenues tend to move with more specific economic indicators such as housing starts and other construction-related activity.

The movement of foreign currency exchange rates as compared to the U.S. dollar impacts the translation of the foreign entities’ financial statements into U.S. dollars. As foreign currencies weaken against the U.S. dollar, our revenues and costs decrease as the foreign currency-denominated financial statements translate into fewer U.S. dollars. The fluctuations of the Euro, Chinese renminbi, British pound sterling, Egyptian pound, Turkish lira, Brazilian real, Canadian dollar, Australian dollar and Mexican peso against the U.S. dollar have the largest impact on our financial results as compared to all other currencies. In 2023, currency fluctuations had a negative impact on net revenue of approximately $88.5 million as compared to 2022.

Key financial results andtransactions for 2023 included the following:

| ● |

Net revenue decreased 6.4 percent from 2022 primarily driven by an 8.4 percent decrease in sales volume and a 2.4 percent decrease due to currency fluctuations, partially offset by a 3.3 percent increase due to acquisitions and 2.9 percent increase in product pricing. Additionally, in 2022, we had a 53-week year compared to a 52-week year in 2023, and 2023 revenue was lower by 1.8 percent due to the extra week in 2022. |

| ● |

Gross profit margin increased to 28.7 percent in 2023 from 25.7 percent in 2022, due to an increase in product pricing and lower raw material costs partially offset by the impact of lower sales volume. |

| ● |

Cash flow generated by operating activities was $378.4 million in 2023 as compared to $256.5 million in 2022. |

Our total year organic revenue growth, which we define as the combined variances from sales volume and product pricing, decreased 5.5 percent for 2023 compared to 2022 due to a decrease in sales volume, partially offset by an increase in product pricing.

In 2023, our diluted earnings per share was $2.59 compared to $3.26 in 2022. The lower earnings per share in 2023 compared to 2022 was primarily due to lower net revenue, higher operating costs, interest expense and income tax expense, partially offset by lower raw material costs.

Information pertaining to fiscal year 2021 was included in the Company’s Annual Report on Form 10-K for the year ended December 3, 2022, under Part II, Item 7 “Management’s Discussion and Analysis of Financial Position and Results of Operations,” which was filed with the SEC on January 24, 2023.

Project ONE

In December 2012, our Board of Directors approved a multi-year project to replace and enhance our existing core information technology platforms. The scope for this project includes most of the basic transaction processing for the company including customer orders, procurement, manufacturing and financial reporting. The project envisions harmonized business processes for all of our operating segments supported with one standard software configuration. The execution of this project, which we refer to as Project ONE, is being supported by internal resources and consulting services. Implementation of Project ONE began in our North America adhesives business in 2014 and, through 2023, we completed implementation of this system in various parts of our business including Latin America (except Brazil), Australia, and various other businesses in North America and EIMEA. During 2024 and beyond, we will continue implementation in North America, EIMEA, Brazil and Asia Pacific.

Total expenditures for Project ONE are estimated to be $240 to $260 million, of which 60-65% is expected to be capital expenditures. Our total project-to-date expenditures are approximately $200 million, of which approximately $120 million are capital expenditures. Given the complexity of the implementation, the total investment to complete the project may exceed our estimate.

Restructuring Plans

During the second and third quarters of 2023, the Company approved restructuring plans (the “Plans”) related to organizational changes and other actions to optimize operations and integrate acquired businesses. In implementing the Plans, the Company currently expects to incur costs of approximately $39.1 million to $44.1 million ($30.4 million to $34.4 million after-tax), which include (i) cash expenditures of approximately $28.4 million to $29.6 million ($22.0 million to $23.0 million after-tax) for severance and related employee costs globally and (ii) other restructuring costs related to the streamlining of processes and the payment of anticipated income taxes in certain jurisdictions related to the Plans. We have incurred costs of $27.0 million under the Plans as of December 2, 2023. The Plans began to be implemented in the second quarter of fiscal year 2023 and are currently expected to be completed during fiscal year 2026. The restructuring costs will be spread across the next several fiscal quarters as the measures are implemented with the majority of the charges recognized and cash payments occurring in fiscal 2023 and 2024.

Critical Accounting Policies and Significant Estimates