0000038725FALSEDEF 14A00000387252022-01-012022-12-31iso4217:USDiso4217:USDxbrli:shares00000387252021-01-012021-12-3100000387252020-01-012020-12-310000038725ecd:PeoMemberfele:GrantDateFairValueOfEquityAwardsAndChangeInPensionValueReportedInTheSummaryCompensationTableMember2022-01-012022-12-310000038725ecd:PeoMemberfele:GrantDateFairValueOfEquityAwardsAndChangeInPensionValueReportedInTheSummaryCompensationTableMember2021-01-012021-12-310000038725ecd:PeoMemberfele:GrantDateFairValueOfEquityAwardsAndChangeInPensionValueReportedInTheSummaryCompensationTableMember2020-01-012020-12-310000038725fele:ActuariallyDeterminedServiceCostForServicesRenderedDuringTheFiscalYearAndChangeInPensionValueAttributableToPlanAmendmentsMadeInTheCurrentYearMemberecd:PeoMember2022-01-012022-12-310000038725fele:ActuariallyDeterminedServiceCostForServicesRenderedDuringTheFiscalYearAndChangeInPensionValueAttributableToPlanAmendmentsMadeInTheCurrentYearMemberecd:PeoMember2021-01-012021-12-310000038725fele:ActuariallyDeterminedServiceCostForServicesRenderedDuringTheFiscalYearAndChangeInPensionValueAttributableToPlanAmendmentsMadeInTheCurrentYearMemberecd:PeoMember2020-01-012020-12-310000038725fele:YearEndFairValueOfAwardsGrantedInTheCurrentYearMemberecd:PeoMember2022-01-012022-12-310000038725fele:YearEndFairValueOfAwardsGrantedInTheCurrentYearMemberecd:PeoMember2021-01-012021-12-310000038725fele:YearEndFairValueOfAwardsGrantedInTheCurrentYearMemberecd:PeoMember2020-01-012020-12-310000038725ecd:PeoMemberfele:ChangeInFairValueFromPriorYearEndToVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInTheCurrentYearMember2022-01-012022-12-310000038725ecd:PeoMemberfele:ChangeInFairValueFromPriorYearEndToVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInTheCurrentYearMember2021-01-012021-12-310000038725ecd:PeoMemberfele:ChangeInFairValueFromPriorYearEndToVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInTheCurrentYearMember2020-01-012020-12-310000038725ecd:PeoMemberfele:ChangeInFairValueFromPriorYearEndToCurrentYearEndOfOutstandingAndUnvestedEquityAwardsGrantedInPriorYearsMember2022-01-012022-12-310000038725ecd:PeoMemberfele:ChangeInFairValueFromPriorYearEndToCurrentYearEndOfOutstandingAndUnvestedEquityAwardsGrantedInPriorYearsMember2021-01-012021-12-310000038725ecd:PeoMemberfele:ChangeInFairValueFromPriorYearEndToCurrentYearEndOfOutstandingAndUnvestedEquityAwardsGrantedInPriorYearsMember2020-01-012020-12-310000038725ecd:PeoMemberfele:FairValueAtTheEndOfThePriorYearOfEquityAwardsThatWereForfeitedInTheCurrentYearMember2022-01-012022-12-310000038725ecd:PeoMemberfele:FairValueAtTheEndOfThePriorYearOfEquityAwardsThatWereForfeitedInTheCurrentYearMember2021-01-012021-12-310000038725ecd:PeoMemberfele:FairValueAtTheEndOfThePriorYearOfEquityAwardsThatWereForfeitedInTheCurrentYearMember2020-01-012020-12-310000038725ecd:PeoMemberfele:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMember2022-01-012022-12-310000038725ecd:PeoMemberfele:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMember2021-01-012021-12-310000038725ecd:PeoMemberfele:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMember2020-01-012020-12-310000038725fele:GrantDateFairValueOfEquityAwardsAndChangeInPensionValueReportedInTheSummaryCompensationTableMemberecd:NonPeoNeoMember2022-01-012022-12-310000038725fele:GrantDateFairValueOfEquityAwardsAndChangeInPensionValueReportedInTheSummaryCompensationTableMemberecd:NonPeoNeoMember2021-01-012021-12-310000038725fele:GrantDateFairValueOfEquityAwardsAndChangeInPensionValueReportedInTheSummaryCompensationTableMemberecd:NonPeoNeoMember2020-01-012020-12-310000038725fele:ActuariallyDeterminedServiceCostForServicesRenderedDuringTheFiscalYearAndChangeInPensionValueAttributableToPlanAmendmentsMadeInTheCurrentYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000038725fele:ActuariallyDeterminedServiceCostForServicesRenderedDuringTheFiscalYearAndChangeInPensionValueAttributableToPlanAmendmentsMadeInTheCurrentYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000038725fele:ActuariallyDeterminedServiceCostForServicesRenderedDuringTheFiscalYearAndChangeInPensionValueAttributableToPlanAmendmentsMadeInTheCurrentYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000038725fele:YearEndFairValueOfAwardsGrantedInTheCurrentYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000038725fele:YearEndFairValueOfAwardsGrantedInTheCurrentYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000038725fele:YearEndFairValueOfAwardsGrantedInTheCurrentYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000038725fele:ChangeInFairValueFromPriorYearEndToVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInTheCurrentYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000038725fele:ChangeInFairValueFromPriorYearEndToVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInTheCurrentYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000038725fele:ChangeInFairValueFromPriorYearEndToVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInTheCurrentYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000038725fele:ChangeInFairValueFromPriorYearEndToCurrentYearEndOfOutstandingAndUnvestedEquityAwardsGrantedInPriorYearsMemberecd:NonPeoNeoMember2022-01-012022-12-310000038725fele:ChangeInFairValueFromPriorYearEndToCurrentYearEndOfOutstandingAndUnvestedEquityAwardsGrantedInPriorYearsMemberecd:NonPeoNeoMember2021-01-012021-12-310000038725fele:ChangeInFairValueFromPriorYearEndToCurrentYearEndOfOutstandingAndUnvestedEquityAwardsGrantedInPriorYearsMemberecd:NonPeoNeoMember2020-01-012020-12-310000038725ecd:NonPeoNeoMemberfele:FairValueAtTheEndOfThePriorYearOfEquityAwardsThatWereForfeitedInTheCurrentYearMember2022-01-012022-12-310000038725ecd:NonPeoNeoMemberfele:FairValueAtTheEndOfThePriorYearOfEquityAwardsThatWereForfeitedInTheCurrentYearMember2021-01-012021-12-310000038725ecd:NonPeoNeoMemberfele:FairValueAtTheEndOfThePriorYearOfEquityAwardsThatWereForfeitedInTheCurrentYearMember2020-01-012020-12-310000038725fele:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMemberecd:NonPeoNeoMember2022-01-012022-12-310000038725fele:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMemberecd:NonPeoNeoMember2021-01-012021-12-310000038725fele:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMemberecd:NonPeoNeoMember2020-01-012020-12-31000003872512022-01-012022-12-31000003872522022-01-012022-12-31000003872532022-01-012022-12-31000003872542022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

(Rule 14a-101)

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box: | | | | | |

| o | Preliminary Proxy Statement |

| | | | | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | | | |

| ý | Definitive Proxy Statement |

| | | | | |

| o | Definitive Additional Materials |

| | | | | |

| o | Soliciting Material Pursuant to §240.14a-12 |

Franklin Electric Co., Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | | | | | |

| ý | No fee required |

| o | Fee paid previously with preliminary materials |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

FRANKLIN ELECTRIC CO., INC.

9255 Coverdale Road

Fort Wayne, Indiana 46809

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held

May 5, 2023 at 8:00 a.m., Eastern Time

To the Shareholders of

Franklin Electric Co., Inc.

The Annual Meeting of Shareholders of Franklin Electric Co., Inc. (the "Company"), an Indiana corporation, will be held at Franklin Electric Global Headquarters and Engineering Design Center, 9255 Coverdale Road, Fort Wayne, Indiana 46809 on Friday, May 5, 2023, at 8:00 a.m., Eastern Time. The purposes of the meeting are to:

1.Elect Victor D. Grizzle, Alok Maskara, and Thomas R. VerHage as directors for the terms expiring at the 2026 Annual Meeting of Shareholders;

2.Ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the 2023 fiscal year;

3.Approve, on an advisory basis, the executive compensation of the named executive officers as disclosed in the Proxy Statement;

4.Approve the Franklin Electric Co., Inc. Amended and Restated 2017 Stock Plan;

5.Approve, on an advisory basis, the frequency of future advisory votes on the compensation of the named executive officers as disclosed in the Proxy Statement; and

6.Transact any other business that may properly come before the Annual Meeting of Shareholders or any adjournment or postponement thereof.

Only shareholders of record at the close of business on March 1, 2023 will be entitled to notice of and to vote at the Annual Meeting.

You are urged to vote your proxy whether or not you plan to attend the Annual Meeting of Shareholders. If you do attend, you may choose to vote in person which will revoke any previously executed proxy.

By order of the Board of Directors.

Jonathan M. Grandon

Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary

Fort Wayne, Indiana

March 21, 2023

TABLE OF CONTENTS

FRANKLIN ELECTRIC CO., INC.

9255 Coverdale Road, Fort Wayne, Indiana 46809

______________________________

PROXY STATEMENT

______________________________

Annual Meeting of Shareholders to be Held on May 5, 2023

GENERAL INFORMATION

This Proxy Statement and the enclosed proxy are furnished to shareholders in connection with the solicitation of proxies by the Board of Directors of Franklin Electric Co., Inc. (the "Company"), 9255 Coverdale Road, Fort Wayne, Indiana 46809 for use at the Annual Meeting of Shareholders to be held on May 5, 2023, or any adjournment or postponement thereof. Shareholders were sent a Notice of the Annual Meeting of Shareholders (the "Annual Meeting"), as well as information regarding how to access this Proxy Statement and the Company's 2022 Annual Report, including the financial statements contained therein, beginning on or about March 21, 2023.

The expenses of solicitation, including the cost of printing and mailing, will be paid by the Company. Officers and employees of the Company, without additional compensation, may solicit proxies personally, by telephone, email, or by facsimile. Arrangements will also be made with brokerage firms and other custodians, nominees, and fiduciaries to forward proxy solicitation materials to the beneficial owners of shares held of record by such persons, and the Company will reimburse such entities for reasonable out-of-pocket expenses incurred by them in connection therewith.

NOTICE AND VOTING INSTRUCTIONS

Shareholders will receive a Notice Card with information regarding the availability of proxy materials over the internet. Shareholders who wish to receive a paper or email copy of the proxy materials must request one by submitting the request to the Secretary of the Company at the Company's address listed on the first page of this Proxy Statement. There is no charge for receiving a copy. Requests can also be made at the voting website, via telephone, or via email, as described in the Notice Card.

Voting by Internet: Use the internet link and control number provided to you on your Proxy Card. You may vote until 11:59 p.m., Eastern Time, on May 4, 2023. You will need the control number provided on your Proxy Card to access the website.

Voting by Telephone: Call the toll-free telephone number provided to you on your Proxy Card. Telephone voting will be available until 11:59 p.m., Eastern Time, on May 4, 2023. Detailed instructions will be provided during the call. The procedures are designed to authenticate votes cast by using the last 4 digits of a shareholder’s social security/taxpayer I.D. number.

Voting by Mail: Request a hard copy of the proxy materials by submitting your request to the Secretary of the Company at the Company's address listed on the first page of this Proxy Statement. Then complete the Proxy Card, date and sign it, and return it in the envelope provided. Shareholders may also vote their shares in person at the Annual Meeting.

Employees who are participants in the Company’s Retirement Program (401(k) plan) will receive a notice and instructions by email or other method that explains how to vote shares credited to their Retirement Program accounts.

If a shareholder does not specify the manner in which the proxy shall be voted, the shares represented thereby will be voted:

•FOR the election of the nominees for director as set forth in this Proxy Statement;

•FOR the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the 2023 fiscal year;

•FOR approval of the compensation of the Company’s named executive officers;

•FOR approval of the Franklin Electric Co., Inc. Amended and Restated 2017 Stock Plan;

•FOR "one year" as the frequency of future advisory votes on compensation of the Company's named executive officers; and

•In accordance with the recommendations of management with respect to other matters that may properly come before the Annual Meeting.

A shareholder who has executed a proxy has the power to revoke it at any time before it is voted by (i) delivering written notice of such revocation to Mr. Jonathan M. Grandon, Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary, 9255 Coverdale Road, Fort Wayne, Indiana, 46809, (ii) executing and delivering a subsequently dated proxy by mail, or voting by telephone or through the internet at a later date, or (iii) attending the Annual Meeting and voting in person.

SHAREHOLDERS ENTITLED TO VOTE AND SHARES OUTSTANDING

The Board of Directors of the Company fixed the close of business on March 1, 2023, as the record date (the "Record Date") for determining shareholders entitled to notice of and to vote at the Annual Meeting. As of the Record Date, there were 65,000,000 shares of Common Stock, $.10 par value (the "Common Stock"), authorized, of which 46,225,759 shares of Common Stock were outstanding. Each share of Common Stock is entitled to one vote on each matter submitted to a vote of the shareholders of the Company. Votes cast by proxy or in person at the Annual Meeting will be tabulated by the inspectors of election appointed for the Annual Meeting and will be counted as present for purposes of determining whether a quorum is present. A majority of the outstanding shares of Common Stock, present in person or represented by proxy, will constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes (which occur when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received instructions from the beneficial owner) will be counted for purposes of determining the presence or absence of a quorum but will not be counted as votes cast on any matter submitted to shareholders. As a result, abstentions and broker non-votes will not have any effect on the voting results with respect to any of the matters scheduled to be submitted to shareholders at the Annual Meeting.

LETTER TO SHAREHOLDERS

Fellow Shareholders,

Franklin Electric employees around the globe should take great pride in their achievements individually and as a team executing our 2022 plan, marking another exceptional year both strategically and financially. Facing the significant global headwinds – supply disruptions, labor shortages, significant inflation in the U.S. and Europe, the war in Ukraine, and remnants of the global pandemic – our team maintained its focus on our Key Factors for Success: Quality, Availability, Service, Innovation, and Cost Control. In 2022, the most challenging of these factors was Availability – impacted by each of the macro headwinds as well as exceptional levels of demand, resulting in record backlog and past-due levels last summer. Even with our record financial results, our supply chain is still recovering. We expect our operational and delivery performance to continue improving.

From a financial perspective, 2022 was the most successful year in our nearly 80-year history. We achieved record sales and operating income in each of our reporting segments driven by robust demand throughout the year. Water Systems results were driven by healthy demand in residential and agricultural applications in the U.S., increased crop and metal prices, as well as global economic growth, and dry weather in some regions. Fueling Systems also experienced strong sales, driven by consolidation and marketer conversions in the U.S. and a continued focus on environmental protection globally, particularly in India. Our Distribution segment had another solid year, growing organically and through strategic acquisitions, as we continued our network expansion to more than 400 branch and OSI (On Site Inventory) locations serving contractors across the U.S.

We continue to execute on our strategy by growing as a global provider of water and fuel systems through geographic expansion and product line extensions as well as leveraging our global platform and competency in system design. Our commitment to this strategy has yielded outstanding results. In the summer of 2018, we set strategic and 2023 financial objectives. Since then, we’ve been focused on executing on those objectives and have exceeded our revenue goal of $2 billion, our operating income goal of $250 million, and our pre-tax return on invested capital goal of 20 percent in 2022, in each case a full year ahead of our initial forecasts.

With supply challenges and record demand, our inventory levels increased significantly in 2022. While our cash conversion rate has been solid over the last four years, it remains below target primarily due to this large increase. With our supply chain stabilizing and improving, we expect a reduction in inventory levels in 2023 which should increase cash generation and exceed our conversion goal of 100 percent of net income. Even with our increase in working capital investments in 2022 our leverage ratio remains low. This financial strength and flexibility enabled our Board to approve the Company’s 31st consecutive annual dividend increase.

We remain focused on using our scale to gain operating leverage. We have integrated the 2021 year-end groundwater distribution acquisition and moved all our acquired water treatment businesses onto a common ERP platform. This positions us to realize better operating leverage over the months and years to come. We see water treatment as a natural extension of our groundwater business and additive to our increased focus on commercial and industrial pumping systems. We continue to identify and evaluate acquisition opportunities that extend our product lines and geographic reach.

Guiding our growth strategy, our goal is to be an indispensable partner to our customers. We deliver a positive impact to the communities we operate in by expanding the availability of clean water on a global scale, developing new innovations such as higher efficiency water and fuel delivery systems, as well as addressing the safety and lowest total cost of ownership in the maintenance and operation of fueling stations. Environmental protection and sustainability are intertwined with the long-term success of our business, and we are constantly looking for ways to communicate progress to our stakeholders.

On behalf of the management team and our Board of Directors, I want to thank our employees around the world for their commitment and service to our customers, colleagues, business partners, and communities. We have had another incredible year due to their hard work and we are blessed to work with such an engaged and enthusiastic team. We are continuing to explore opportunities to make their experience with Franklin more flexible and fulfilling and to allow their diverse experiences and perspectives to be heard and celebrated. We look forward to another successful year in 2023.

Sincerely,

Gregg Sengstack

Chairperson of the Board and Chief Executive Officer

Franklin Electric Co., Inc.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table shows the persons known by the Company to be the beneficial owners of more than five percent of the Company’s Common Stock as of March 1, 2023, unless otherwise noted. The nature of beneficial ownership is sole voting and dispositive power, unless otherwise noted. | | | | | | | | | | | |

| Name and address of beneficial owner | Amount and nature of beneficial ownership | Percent of class |

BlackRock, Inc. 55 East 52nd Street New York, NY 10055 | 7,916,306 | | (1) | 17.13 | % |

The Vanguard Group

100 Vanguard Blvd.

Malvern, PA 19355 | 4,642,378 | | (2) | 10.04 | % |

Patricia Schaefer

5400 Deer Run Court

Muncie, IN 47304 | 3,200,168 | | (3) | 6.92 | % |

Diane D. Humphrey

2279 East 250 North

Bluffton, IN 46714 | 2,784,147 | | (4) | 6.02 | % |

State Street Corporation

One Lincoln Street

Boston, MA 02111 | 2,368,925 | | (5) | 5.12 | % |

(1)According to a Schedule 13G filed with the SEC, as of December 31, 2022, BlackRock. Inc. has sole voting power with respect to 7,715,434 shares and sole dispositive power with respect to 7,916,306 shares.

(2)According to a Schedule 13G filed with the SEC, as of February 28, 2023, The Vanguard Group has shared voting power with respect to 77,360 shares, sole dispositive power with respect to 4,524,507 shares and shared dispositive power with respect to 117,871 shares.

(3)Pursuant to agreements with Ms. Schaefer, the Company has a right of first refusal with respect to 2,616,080 shares owned by Ms. Schaefer.

(4)Pursuant to agreements with Ms. Humphrey, the Company has a right of first refusal with respect to 2,478,443 shares owned by Ms. Humphrey.

(5)According to a Schedule 13G filed with the SEC, as of December 31, 2022, State Street Corporation has shared voting power with respect to 2,268,986 shares and shared dispositive power with respect to 2,368,925 shares.

SECURITY OWNERSHIP OF MANAGEMENT

The following table shows the number of shares of Common Stock beneficially owned by directors, nominees, each of the executive officers named in the "Summary Compensation Table" on page 31 of this Proxy Statement and all executive officers and directors as a group, as of March 1, 2023. The nature of beneficial ownership is sole voting and investment power, unless otherwise noted, except for restricted shares, with respect to which the holder has investment power only after the shares vest. | | | | | | | | |

| Name of beneficial owner | Amount and nature of beneficial ownership | Percent of class |

| Victor D. Grizzle | 0(2) | * |

| Alok Maskara | 5,731 | * |

| Renee J. Peterson | 0(2) | * |

| Jennifer L. Sherman | 0(2) | * |

| Thomas R. VerHage | 0(2) | * |

| Chris Villavarayan | 1,838(2) | * |

| David M. Wathen | 1,838(2) | * |

| | |

| Gregg C. Sengstack | 983,195(1)(5)(6)(7) | 2.13 |

| Jeffery L. Taylor | 16,494(1)(4) | * |

| Donald P. Kenney | 155,070(1)(3)(5)(7) | * |

| DeLancey W. Davis | 20,986(1)(3)(5)(7) | * |

| Jay J. Walsh | 33,818(1)(3)(4)(5)(7) | * |

| All directors and executive officers as a group | 1,311,746(1)(2)(3)(4)(5)(6)(7) | 2.84 |

* Less than 1 percent of class

(1)Includes shares issuable pursuant to stock options exercisable within 60 days after March 1, 2023 as follows: Mr. Sengstack, 546,621; Mr. Taylor, 3,262; Mr. Kenney, 95,961; Mr. Davis, 11,367; and Mr. Walsh, 20,606. All directors and executive officers as a group, 741,668.

(2)Does not include stock units credited pursuant to the terms of the Non-Employee Directors’ Deferred Compensation Plan described under “Director Compensation” to: Mr. Grizzle, 9,216; Ms. Peterson, 35,068; Ms. Sherman, 37,673; Mr. VerHage, 55,349; Mr. Villavarayan, 1,246; and Mr. Wathen, 92,059.

(3)Includes shares held by the 401(k) Plan Trustee as of March 1, 2023: Mr. Kenney, 32,508; Mr. Davis, 125; and Mr. Walsh, 21. All executive officers as a group, 36,901.

(4)Includes unvested restricted shares as follows: Mr. Taylor, 9,135 and Mr. Walsh, 1,641. All executive officers as a group, 20,221.

(5)Does not include unvested restricted stock units as follows: Mr. Sengstack, 39,318; Mr. Kenney, 9,347; Mr. Davis, 5,169; and Mr. Walsh, 2,646. All executive officers as a group, 60,365.

(6)Includes 275,000 shares owned by a trust.

(7)Includes shares based on estimated release of performance share units earned in 2022 as follows: Mr. Sengstack, 33,160; Mr. Kenney, 8,038; Mr. Davis, 4,372, and Mr. Walsh, 2,964. All executive officers as a group, 53,106. See the "Compensation Discussion and Analysis" section for further information.

PROPOSAL 1: ELECTION OF DIRECTORS

The Company's Amended and Restated By-laws provide that the Board of Directors shall consist of at least seven directors and not more than eleven members, divided into three classes. Each year, the directors of one of the three classes are elected to serve terms of three years or until their successors have been elected and qualified. Three directors will be elected at the Annual Meeting this year. Directors are elected by the affirmative vote of a majority of the shares voted, unless the number of nominees for director exceeds the number of directors to be elected, in which case directors shall be elected by a plurality of the shares voted (i.e., the three nominees who receive the most votes will be elected).

Victor D. Grizzle, Alok Maskara, and Thomas R. VerHage have been nominated to serve as directors of the Company for terms expiring in 2026. The nominees are current directors of the Company and have indicated their willingness to continue to serve as directors if elected. If, however, any nominee is unwilling or unable to serve as a director, shares represented by the proxies will be voted for the election of another nominee proposed by the Board of Directors or the Board may reduce the number of directors to be elected at the Annual Meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

THAT YOU VOTE FOR THE ELECTION OF EACH NOMINEE.

INFORMATION CONCERNING NOMINEES AND CONTINUING DIRECTORS

Set forth below for the director nominees and continuing directors are their ages, year they first became a director, principal occupations and directorships for at least the past five years, and legal proceedings, if any, for the past ten years. With respect to each nominee or continuing director, we describe under the heading “Relevant Experience” the particular experience and other attributes that have led to the conclusion that the individual should serve on the Board of Directors of the Company.

| | | | | | | | |

Directors with terms expiring in 2023 |

Victor D. Grizzle Alok Maskara Thomas R. VerHage

| | | | | | | | |

| |

| |

| |

| |

| |

| |

| Victor D. Grizzle | Age: 61 |

| Director of the Company | Director Since: 2020 |

| Principal Occupation: President and Chief Executive Officer of Armstrong World Industries, Inc., a leading designer and manufacturer of commercial and residential ceiling, wall and suspension system solutions, since 2016. |

| Formerly: Executive Vice President and Chief Executive Officer of Armstrong Building Products from 2011 to 2016; prior thereto, Group President of Global Structures, Coatings and Tubing for Valmont Industries, a global leader of infrastructure and manufacturer of mechanized irrigation equipment for large scale farming. And prior to Valmont Industries, held several General Management positions over 16 years with the General Electric Company. |

| Relevant Experience: Mr. Grizzle received his Bachelor of Science in Mechanical Engineering from California Polytechnic University. He brings to the Board his experience as CEO of Armstrong, in addition to extensive senior leadership experience in the areas of international business, acquisitions, process improvement, sales and marketing for large, publicly traded manufacturing companies. |

| Alok Maskara | Age: 51 |

| Director of the Company | Director Since: 2021 |

| Principal Occupation: Chief Executive Officer of Lennox International Inc. since May 2022. |

| Formerly: Chief Executive Officer of Luxfer Holdings PLC, an international industry company focused on advanced materials. Prior thereto, business segment President at Pentair PLC, a water solutions company, for eight years where he led businesses of progressively larger sizes. Prior to Pentair, Mr. Maskara was employed by General Electric Corporation where he gained significant experience in Lean Manufacturing. Mr. Maskara also worked at McKinsey & Company in both their Chicago and Amsterdam offices where he advised businesses on industrial turnarounds and driving growth through customer insights and segmentation. |

| Relevant Experience: Mr. Maskara holds an M.B.A. from the J.L. Kellogg Graduate School of Management at Northwestern University, an M.S. in Chemical Engineering from the University of New Mexico, and a Bachelor of Technology degree in Chemical Engineering from the Indian Institute of Technology, Mumbai. He has nearly thirty years of leadership experience in multiple manufacturing and technology industries, including advanced materials, water and flow technologies, and electrical protection. His background enables him to serve as an “audit committee financial expert.” |

| Thomas R. VerHage | Age: 70 |

| Director of the Company | Director Since: 2010 |

| Principal Occupation: Retired in 2011. |

| Formerly: Vice President and Chief Financial Officer, Donaldson Company, Inc., a worldwide provider of filtration systems and replacement parts, from 2004 until 2011; prior thereto, Partner, Deloitte & Touche, LLP, an international accounting and consulting firm, from 2002 to 2004; prior thereto, Partner, Arthur Andersen, LLP, a consulting and accounting firm, from 1976 to 2002. |

| Relevant Experience: Mr. VerHage received his bachelor’s degree in business administration and his MBA from the University of Wisconsin. Mr. VerHage adds to the Board his financial and accounting expertise from his experience as CFO of Donaldson Company, Inc. and his prior experience with two major public accounting firms. His background enables him to serve as an “audit committee financial expert.” |

| | | | | |

Directors with terms expiring in 2024 |

Gregg C. Sengstack David M. Wathen

| | | | | | | | |

| Gregg C. Sengstack | Age: 64 |

| Director and Chief Executive Officer of the Company | Director Since: 2014 |

| Principal Occupation: Chief Executive Officer of the Company since 2014. | |

| Formerly: President and Chief Operating Officer of the Company from 2011-2014; prior thereto, Senior Vice President and President, Franklin Fueling Systems and International Water Group from 2005-2011; prior thereto, Chief Financial Officer of the Company from 1999-2005. |

| Directorships - Public Companies: Woodward, Inc. | |

| Relevant Experience: Mr. Sengstack received his bachelor's degree in math and economics from Bucknell University and his MBA from the University of Chicago. Mr. Sengstack joined the Company in 1988 and has significant experience holding various positions in the Company, which provides the Board with a unique depth of understanding of the Company's markets and businesses that is beneficial to the Board in its deliberations. Mr. Sengstack's long tenure with the Company also helps give the Board a historical perspective of the Company. |

| David M. Wathen | Age: 70 |

| Director of the Company | Director Since: 2005 |

| Principal Occupation: Retired in 2016. | |

| Formerly: President and Chief Executive Officer of TriMas Corporation, a manufacturer of engineered products, that serve a variety of industrial, commercial and consumer end markets worldwide, from 2009-2016; prior thereto, President and Chief Executive Officer, Balfour Beatty, Inc. (U.S. Operations), an engineering, construction and building management services company, from 2002-2006; prior thereto, Group Executive/Corporate Officer, Eaton Corporation, a global technology leader in diversified power management solutions, from 1997-2000. |

| Relevant Experience: Mr. Wathen received his bachelor's degree in mechanical engineering from Purdue University and his MBA from Saint Francis College, Fort Wayne, Indiana. Mr. Wathen brings to the Board his experience as CEO of two companies and leadership positions in others, including over twenty years direct technical and general management experience in the same industry as the Company and direct experience managing electrical businesses serving pump OEMs and distributor channels similar to those served by the Company. His background enables him to serve as an "audit committee financial expert". His experience on the Board of the Company also helps give the Board a historical perspective in its deliberations. |

| | | | | |

Directors with terms expiring in 2025 |

Renee J. Peterson Jennifer L. Sherman Chris Villavarayan | | | | | | | | |

| Renee J. Peterson | Age: 61 |

| Director of the Company | Director Since: 2015 |

| Principal Occupation: Vice President and Chief Financial Officer of The Toro Company, a leading provider of solutions for the outdoor environment, including turf maintenance, snow and ice management, landscape, retail and specialty construction equipment, and irrigation and outdoor lighting solutions, since 2011. |

| Formerly: Vice President, Finance and Planning of Eaton Corporation from 2008 to 2011; prior thereto, Vice President and Division Chief Financial Officer of the Aerospace and Defense Segment of Honeywell International Inc. Ms. Peterson held a variety of positions of increasing responsibility throughout her Honeywell career from 1983 to 2008. |

| Relevant Experience: Ms. Peterson received her bachelor's degree in accounting from Saint Cloud State University and her MBA from the University of Minnesota. Ms. Peterson brings financial and operational experience at three large manufacturers that provides the Board with specific expertise and assists in its deliberations. At Toro, Ms. Peterson also provides leadership oversight of the Information Systems function. Her background enables her to serve as an "audit committee financial expert." |

| Jennifer L. Sherman | Age: 58 |

| Director of the Company | Director Since: 2015 |

| Principal Occupation: President and Chief Executive Officer of Federal Signal Corporation, a diversified manufacturer of specialized vehicles and systems in maintenance and infrastructure as well as safety and security products, including audible and visual warning devices, since 2016. |

| Formerly: Chief Operating Officer of Federal Signal from 2014 to 2015; prior thereto, Chief Administrative Officer of Federal Signal from 2010 to 2014; prior thereto, General Counsel of Federal Signal from 2004 to 2010. |

| Relevant Experience: Ms. Sherman received her bachelor's degree in business administration and her Juris Doctor from the University of Michigan. She is also a fellow of the Kellogg School of Management at Northwestern University. Ms. Sherman's background has provided her with a broad range of experiences that will complement the Board. Specifically, Ms. Sherman’s experience includes, but is not limited to, compliance, human resources, legal issues, governance and business operations. Consequently, Ms. Sherman has the background and capability to serve as an important member of the Board. |

| Chris Villavarayan | Age: 52 |

| Director of the Company | Director Since: 2022 |

| Principal Occupation: Chief Executive Officer and President of Axalta Coating Systems Ltd., since 2023. |

| Formerly: Former Chief Executive Officer and President of Meritor, Inc., a leading global supplier of drivetrain, mobility, braking, aftermarket and electric powertrain solutions for commercial vehicle and industrial markets. |

| Relevant Experience: Mr. Villavarayan holds a bachelor’s degree in engineering from McMaster University in Hamilton, Ontario. Mr. Villavarayan has over twenty years of significant global manufacturing operations experience, providing the Board with specific expertise in the areas of engineering, product development, manufacturing, plant management and operations. |

INFORMATION ABOUT THE BOARD AND ITS COMMITTEES

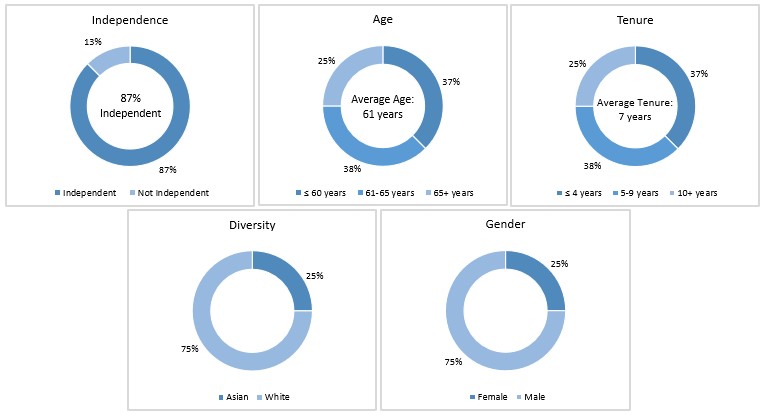

Director Independence

The Board of Directors of the Company has determined that each of the current directors, except for Gregg C. Sengstack, Chief Executive Officer, is an “independent director” in compliance with the independence standards set forth in the Company’s Corporate Governance Guidelines and under the applicable rules adopted by The NASDAQ Stock Market, Inc. (“NASDAQ”). In making its independence determinations, the Board concluded that no director, other than Mr. Sengstack, has any material relationship in the Company, except as a director and shareholder.

Board Leadership Structure and Risk Oversight

The Board is led by Mr. Sengstack, who has served as Chairperson of the Board and Chief Executive Officer since 2015. The Board consists of Mr. Sengstack and seven other directors. The Board has three standing committees - Audit, Management Organization and Compensation, and Corporate Governance. The Audit Committee is primarily responsible for risk oversight and the full Board receives regular reports from the Audit Committee and from the Company's officers and other management personnel regarding risk management. Each of the other two committees also considers risk as it falls within its area of responsibility.

The Company’s Corporate Governance Guidelines provide for an independent non-executive director to act as Lead Independent Director. The Lead Independent Director is appointed by a majority of the independent directors and serves for a two-year term; however, he or she may be removed or replaced by a majority of the independent directors at any time. Thomas R. VerHage currently serves as the Company’s Lead Independent Director. The Lead Independent Director receives additional compensation for his or her services, as the Board determines from time to time.

The specific responsibilities of the Lead Independent Director when acting as such include the following:

•Acting as a liaison between the Chairperson and the Independent Directors;

•Assisting the Chairperson and Secretary in setting the Board agenda and determining what materials will be provided to the directors in advance of Board meetings and ensuring that the agenda items receive adequate time for discussion and deliberation;

•Providing leadership to the Board to ensure that the Board works cohesively and independently;

•Determining when the Board should meet in executive session without management present, coordinating and developing the agenda for, and chairing, such executive sessions; and

•In the event of the incapacitation of the Chairperson, serving as non-executive chairperson until a permanent chairperson is appointed.

The Lead Independent Director also performs any additional responsibilities delegated to the Lead Independent Director by the Board.

The Board believes that the Chairperson and Chief Executive Officer should consist of a single individual who is seen by the Company’s customers, business partners, investors, and shareholders as someone who provides strong leadership for the Company and is viewed as such in the industries in which the Company operates. The Company believes that the Lead Independent Director, the Board committees, all of which are chaired by and consist of independent directors, and the full Board of Directors, provide effective oversight of the Company’s businesses and the risks involved in them.

Meetings

The Board held five meetings during 2022. Each director attended at least 75 percent of the aggregate meetings of the Board and Board committees of which he or she was a member during the period that each served as a director. All directors attended the 2022 Annual Meeting of Shareholders.

Committees

Audit Committee

The members of the Audit Committee during 2022 were Renee J. Peterson (Chairperson), Alok Maskara, Chris Villavarayan, and David M. Wathen. The Board of Directors has determined that each member of the Audit Committee is an “independent director” in compliance with the independence standards set forth in the Company’s Corporate Governance Guidelines and under the applicable NASDAQ rules. The Board of Directors has adopted an Audit Committee charter, a copy of which is available on the Company’s website at www.franklin-electric.com under “Governance,” that sets forth the duties and

responsibilities of the Audit Committee. Under its charter, the Audit Committee appoints the Company’s independent registered public accounting firm and assists the Board of Directors in fulfilling its oversight responsibilities by reviewing the Company’s financial information, the Company’s system of internal control, the Company’s processes for monitoring compliance with laws and regulations and the Company’s audit and risk management processes. It is the general responsibility of the Audit Committee to advise and make recommendations to the Board of Directors in all matters regarding the Company’s accounting methods and internal control procedures. The Audit Committee held four meetings in 2022.

The Audit Committee is also responsible for the review, approval, or ratification of transactions between the Company and “related persons.” The Audit Committee reviews information compiled in response to the Directors' and Officers' Questionnaires or otherwise developed by the Company with respect to any transactions with the Company in which any director, executive officer, 5 percent beneficial holders, or any member of his or her immediate family, has a direct or indirect material interest that would require disclosure under applicable SEC regulations. In 2022, there were no such transactions.

The Board of Directors has determined that all members of the Audit Committee are “audit committee financial experts” as defined by Item 407(d)(5)(ii) of Regulation S-K of the Exchange Act and are “independent” under the applicable NASDAQ rules.

Management Organization and Compensation Committee

The members of the Management Organization and Compensation Committee (the "Compensation Committee") during 2022 were Jennifer L. Sherman (Chairperson), Victor D. Grizzle, Alok Maskara, and Thomas R. VerHage. The Board of Directors has determined that each member of the Compensation Committee is an “independent director” in compliance with the independence standards set forth in the Company’s Corporate Governance Guidelines and under applicable NASDAQ rules. The Board of Directors has adopted a Compensation Committee charter, a copy of which is available on the Company’s website at www.franklin-electric.com under “Governance,” that sets forth the duties and responsibilities of the Compensation Committee. Under its charter, the Compensation Committee recommends to the Board of Directors the annual salary and bonus for the Chief Executive Officer, determines and approves the equity awards for the Chief Executive Officer and the annual salary, bonus and equity awards of the other executive officers of the Company; reviews and submits to the Board of Directors recommendations concerning bonus and stock plans; periodically reviews the Company's policies in the area of management benefits; and oversees the Company's management development and organization structure. As part of its oversight responsibilities, the Compensation Committee evaluated the risks arising from the Company’s compensation policies and practices, with the assistance of Meridian Compensation Partners, LLC, an independent executive consulting firm. The Committee considered, among other factors, the design of the incentive compensation programs, which are closely linked to corporate performance and capped the mix of long- and short-term compensation, the distribution of compensation as between equity and cash, and other factors that mitigate risk. The Committee concluded that the Company’s compensation policies and practices do not involve undue risk. The Compensation Committee held five meetings in 2022.

Corporate Governance Committee

The members of the Corporate Governance Committee (the “Governance Committee”) during 2022 were Victor D. Grizzle (Chairperson), Jennifer L. Sherman, and Thomas R. VerHage. The Board of Directors has determined that each member of the Governance Committee is an “independent director” in compliance with the independence standards set forth in the Company’s Corporate Governance Guidelines and under applicable NASDAQ rules. The Board of Directors has adopted a Governance Committee charter, a copy of which is available on the Company’s website at www.franklin-electric.com under “Governance,” that sets forth the duties and responsibilities of the Governance Committee. Under its charter, the Governance Committee reviews the size of the Company’s Board of Directors and committee structure and recommends appointments to the Board and the Board Committees; reviews and recommends to the Board of Directors the compensation of non-employee directors, including awards to non-employee directors under the Company’s equity-based compensation plans; and develops and recommends to the Board corporate governance guidelines deemed necessary for the Company. The Governance Committee held three meetings in 2022.

Director Nomination Process

The Governance Committee is responsible for identifying and recommending to the Board candidates for director. The Governance Committee considers diversity when identifying candidates for directorships. Although the Company does not have a written policy regarding diversity, the Governance Committee seeks to identify persons from various backgrounds and with a variety of life experiences who have a reputation for, and a record of, integrity and good business judgment and the willingness to make an appropriate time commitment. The Governance Committee also considers whether a person has experience in a highly responsible position in a profession or industry relevant to the conduct of the Company’s business. The Governance Committee takes into account the current composition of the Board and the extent to which a person’s particular expertise, experience and ability will complement the expertise and experience of other directors. Candidates for director should

also be free of conflicts of interest or relationships that may interfere with the performance of their duties. Based on its evaluation and consideration, the Governance Committee submits its recommendation for director candidates to the full Board of Directors, which is then responsible for selecting the candidates to be elected by the shareholders. The Governance Committee evaluates its success in achieving these goals for Board composition from time to time, particularly when considering Board succession and candidates to fill vacancies.

The Governance Committee will consider as candidates for director persons recommended or nominated by shareholders. Shareholders may recommend candidates for director by writing to the Secretary of the Company at the address listed below under “Other Corporate Governance Matters.” Nominations of directors may be made by any shareholder entitled to vote in the election of directors, provided that written notice of intent to make a nomination is given to the Secretary of the Company not later than 90 days prior to the anniversary date of the immediately preceding Annual Meeting of shareholders. The notice must set forth (i) information regarding the proposed nominee as would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC, and (ii) the consent of such nominee to serve as a director of the Company if so elected.

Board Diversity

The Board of Directors considers and recognizes the diverse attributes of its directors. The Board does not establish specific goals with respect to diversity, rather diversity is a consideration in the overall director nomination process and is a component of the overall assessment of the Board’s composition and effectiveness. The Board includes two female directors and two racially/ethnically diverse director. In addition, both female directors serve the Board in leadership roles, with female Chairs of the Audit Committee and the Management, Organization and Compensation Committee.

Environmental, Social and Governance Items

In April 2022, the Company published an updated annual Sustainability Report, highlighting the Company’s commitment to environmental protection, safety of our employees and customers, and social and governance concerns. The Sustainability Report also provides information on the Company’s corporate governance and compliance practices and details the Board’s oversight of sustainability initiatives and enterprise risk management. The Sustainability Report can be found on the Company’s website at www.franklin-electric.com.

Other Corporate Governance Matters

The Board of Directors has adopted Corporate Governance Guidelines, a copy of which is available on the Company’s website at www.franklin-electric.com under “Governance,” that provide, among other things, that the Company’s independent

directors will meet in executive session, outside the presence of the non-independent directors and management, at least twice each year. In 2022, the independent directors met in executive session five times.

Each Board committee, on an annual basis, conducts and reviews with the Board a performance evaluation of the committee, which evaluation compares the committee's performance against the requirements of the committee's charter and sets the committee's goals for the coming year.

Anyone may contact the Board of Directors, any Board Committee, the Lead Independent Director, any independent director or any other director by writing to the Secretary of the Company as follows:

Franklin Electric Co., Inc.

Attention: [Board of Directors], [Board Committee], [Board Member]

c/o Corporate Secretary

9255 Coverdale Road

Fort Wayne, IN 46809

The independent directors of the Board have approved a process for collecting, organizing and responding to written shareholder communications addressed to the Board, Board Committees or individual directors.

Copies of the Company’s corporate governance documents, including the Board Committee charters and the Corporate Governance Guidelines are available upon written request to the Secretary of the Company at the address listed above or on the Company's website at www.franklin-electric.com under "Governance."

In compliance with Section 406 of the Sarbanes-Oxley Act of 2002, the Company has adopted a code of business conduct and ethics for its directors, principal financial officer, controller, principal executive officer, and other employees (the "Code"). The Company has posted the Code on the Company’s website at www.franklin-electric.com under "Governance." The Company will disclose any amendments to the Code and any waivers from the Code for directors and executive officers by posting such information on its website.

MANAGEMENT ORGANIZATION AND

COMPENSATION COMMITTEE REPORT

The Management Organization and Compensation Committee of the Board of Directors hereby furnishes the following report to the shareholders of the Company in accordance with rules adopted by the Securities and Exchange Commission.

The Management Organization and Compensation Committee has reviewed and discussed with management the Company’s Compensation Discussion and Analysis contained in this Proxy Statement.

Based upon this review and discussion, the Management Organization and Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement.

This report is submitted on behalf of the 2022 members of the Management Organization and Compensation Committee.

| | | | | |

| Jennifer L. Sherman (Chairperson) |

| Victor D. Grizzle |

| Alok Maskara |

| Thomas R. VerHage |

COMPENSATION DISCUSSION AND ANALYSIS

This section of the proxy statement is intended to provide shareholders with information about the compensation awarded in fiscal 2022 to the Company’s executives, including the “named executive officers.” This information includes a discussion of the key elements of the Company’s compensation program and the philosophy and rationale behind the Management Organization and Compensation Committee’s executive compensation decisions. The named executive officers are those listed below and in the Summary Compensation Table of this proxy statement:

| | | | | |

Gregg C. Sengstack: | Chairperson of the Board and Chief Executive Officer (CEO) |

| Jeffery L. Taylor: | VP, Chief Financial Officer (CFO) |

Donald P. Kenney: | VP and President, Global Water |

DeLancey W. Davis: | VP and President, Headwater Companies |

Jay J. Walsh: | VP and President, Franklin Fueling Systems |

You should review this Compensation, Discussion and Analysis section together with the tabular disclosures beginning on page 31. Executive Summary

The Management Organization and Compensation Committee of the Board (the “Committee”) believes that a significant portion of the total compensation opportunity for each executive should be tied to performance, both of the Company and of the individual executive. This summary contains a discussion of the 2022 executive compensation highlights, 2022 performance and the prior year Advisory Vote on Executive compensation ("say on pay") results.

2022 Executive Compensation Overview

•Performance-based compensation represented between 53 percent and 64 percent of the named executive officers’ total targeted compensation for fiscal 2022.

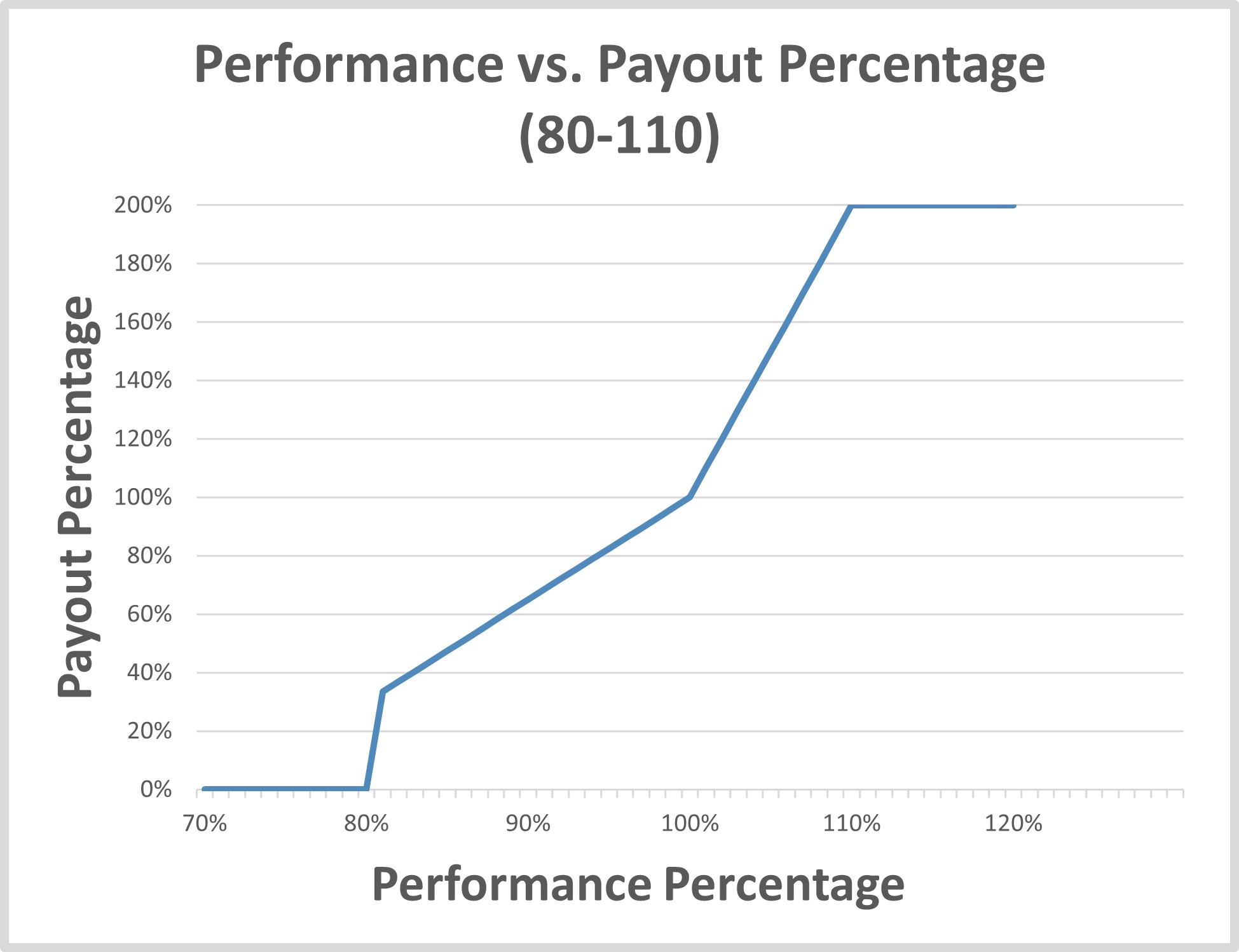

•The annual cash incentive awards are directly aligned with critical one-year operating results. No cash awards are earned unless a threshold level of performance is attained. Earned payouts cannot exceed 200 percent of the target opportunity.

•Performance is evaluated holistically and include assessment of objectives relative to applicable Environmental, Social and Governance risk and metrics, which are aligned to the Company’s key strategic objectives;

•Long-term incentive awards are equity-based and are designed to align management’s interests with those of the Company’s shareholders and to foster retention of key executives. The 2022 long-term incentive grants are predominantly performance-based, with 40 percent of the targeted value awarded as performance-based share units (earned units cannot exceed 200 percent of the target number of units) and 30 percent of the targeted value awarded as stock options. The remaining 30 percent of the targeted value is awarded as time-based restricted stock or restricted stock units. These awards focus executives on delivering results that drive shareholder value.

•In 2023, additional weight will be added to performance-based share units (from 40 percent to 50 percent). Beginning in 2023, the LTI mix will consist of 50 percent performance-based share units, 25 percent stock options and 25 percent time-based restricted stock units. This change emphasizes the Company’s commitment to linking executive pay with company performance.

•The Company generally does not provide perquisites to the named executive officers, but will, in certain circumstances, such as relocation, provide perquisites.

•The Company has stock ownership requirements in place to further align the interests of the Company’s executives with those of the Company’s shareholders.

•The Company has a recoupment policy that permits the recovery of incentive compensation paid to executives in instances where misconduct results in a restatement of financial statements or material harm to the Company. Recoupment policy will be reviewed and revised to comply with the Securities Exchange Commission’s (SEC’s) Final Rule on the Dodd-Frank mandatory compensation recoupment policy once listing standards have been proposed and approved.

•The Company has anti-hedging and anti-pledging provisions that prohibit executives and directors from hedging the value of Company securities or pledging Company securities held by them.

2022 Company Performance

The financial results achieved by the Company included sales of $2,043.7 million compared to $1,661.9 million in the prior year. The sales increase was primarily due to price and acquisitions. Full year 2022 operating income was $257.2 million, up from $189.2 million in 2021, an increase of 36 percent. Full year 2022 GAAP fully diluted earnings per share (EPS) was $3.97, versus GAAP fully diluted EPS in 2021 of $3.25. Water Segment sales were $1,157.5 million in 2022, an increase of $193.9 million compared to 2021. Fueling Segment sales were $334.1 million in 2022, an increase of $45.0 million from 2021. Distribution sales were $668.1 million versus 2021 sales of $497.6 million, an increase of $170.5 million.

After launching its first ever employee survey in 2021, the Company’s leadership team used the results in 2022 to drive improvement in employee engagement. The Company issued its third Sustainability Report, available on its website, detailing important Environmental, Social and Governance initiatives and increasing transparency of non-financial metrics that are important to our stakeholders.

Water Systems Segment

Water Systems is a global leader in the production and marketing of water pumping systems and is a technical leader in submersible motors, pumps, drives, electronic controls, water treatment systems, and monitoring devices. The Water Systems segment designs, manufactures and sells motors, pumps, drives, electronic controls, monitoring devices, and related parts and equipment primarily for use in groundwater, water transfer and wastewater.

Water Systems motors, pumps and controls are used principally for pumping clean water and wastewater in a variety of residential, agricultural, municipal and industrial applications. Water Systems also manufactures electronic drives and controls for the motors which control functionality and provide protection from various hazards, such as electrical surges, over- heating and dry wells or dry tanks. In the last three years, the Company acquired First Sales, LLC; Waterite, Inc.; Puronics, Inc.; New Aqua, LLC; and B&R Industries, Inc. expanding its portfolio to include water treatment systems and acquired Minetuff Dewatering Pumps Australia Pty Ltd expanding its industrial dewatering product line.

Water Systems products are sold in highly competitive markets. Water Systems contributes about 60 percent of the Company’s total revenue. Significant portions of segment revenue come from selling groundwater and surface pumps, motors, and controls for residential and commercial buildings, as well as agricultural sales which are more seasonal and subject to commodity price changes. The Water Systems segment generates approximately 30 to 35 percent of its revenue in developing markets, which often lack municipal water systems. As those countries install water systems, the Company views those markets as an opportunity. The Company has had 6 to 9 percent compounded annual sales growth in developing regions in recent years. Water Systems competes in each of its targeted markets based on product design, quality of products and services, performance, availability, and price. The Company’s principal competitors in the specialty water products industry are Grundfos Management A/S, Pentair, Inc. and Xylem, Inc.

2022 Water Systems research and development expenditures were primarily related to the following activities:

•Electronic variable frequency drives and controls for Pump and HVAC applications, including enhancements of mobile application capabilities for SubDrive Connect and Cerus X-Drive and development of standard panels to support HES (High Efficiency Systems) motors

•Development of new standard electric skid pump package designs and electronic variable frequency drive skid packages for mining and municipal dewatering markets

•Greywater pumping equipment, including the development of 60Hz electrical submersible pumps from the acquisition of Minetuff and the expansion of grinder pumps for the Brazil market

•Submersible and surface pumps for residential, commercial, municipal, and agricultural applications including the development of a standard global 4” pump family, developing a new cast stainless submersible turbine line, and upgrading the performance of line shaft turbine product offerings

•Submersible motor technology development, including the introduction of energy efficient permanent magnet motors into submersible water pumping systems, substantially reducing energy usage in residential pumping applications, 4 pole motor designs for 8” and 10” diameter products, and 4” Oil-filled motors

•Water treatment products focused on component improvements and IOT enabled sensing systems

Fueling Systems Segment

Fueling Systems is a global leader in the production and marketing of fuel pumping systems, fuel containment systems, and monitoring and control systems. The Fueling Systems segment designs, manufactures and sells pumps, pipe, sumps, fittings, vapor recovery components, electronic controls, monitoring devices and related parts and equipment primarily for use in fueling system applications.

Fueling Systems offers a complete array of components between the tank and the dispenser, including submersible pumps, station hardware, piping, sumps, vapor recovery, corrosion control systems, and electronic controls. The Fueling Systems segment growth has been sustained by a commitment to protecting human health and the environment while delivering the lowest total cost of ownership. Fueling Systems takes steps to ensure its products are installed and maintained properly through robust global certification tools for their third-party contractors. The segment serves other energy markets such as power reliability systems and includes intelligent electronic devices that are designed for online monitoring for the power utility, hydroelectric, and telecommunication and data center infrastructure.

Fueling Systems products are sold in highly competitive markets. Rising vehicle use is leading to more investment in fueling stations which, in turn, leads to increased demand for the Company’s Fueling Systems products. The Company believes there is growth opportunity in developing markets. Fueling Systems competes in each of its targeted markets based on product design, quality of products and services, performance, availability, and value. The Company’s principal competitors in the petroleum equipment industry are Vontier Corporation, formerly a part of Fortive Corporation, and Dover Corporation.

2022 Fueling Systems research and development expenditures were primarily related to the following activities:

•Developed and launched new distribution transformer monitor

•Developed new vapor flow meter for Chinese vapor recovery monitoring regulation

•Developed and launched UNITE, server software to collect data from battery monitoring, battery testers, NexPhase, and distribution monitoring

•Developed Press-Fit Connector for Cabletight electrical conduit

•Developed testable termination fitting for APT fueling piping system

•Developed and launched NexPhase Electric Vehicle Switchgear

•Developed car wash monitor of detergent liquids at car wash stations

•Developed new hybrid wired battery monitoring system

Distribution Segment

The Distribution Segment is operated as a collection of wholly owned leading groundwater distributors known as the Headwater Companies. Headwater Companies deliver quality products and leading brands to the industry, providing contractors with the availability and service they demand to meet their application challenges. The Distribution segment operates within the U.S. professional groundwater market.

Prior Year Say on Pay Results

At the May 6, 2022 shareholders meeting, the “Advisory Vote on Executive Compensation” proposal (the “say on pay” vote) received support from 94.6 percent of votes cast. The Committee considered these results and determined that the results of the vote did not call for any significant changes to the executive compensation plans and programs already in place for 2022 or for 2023.

Management Organization and Compensation Committee

The Committee, consisting entirely of independent directors, has the responsibility for establishing, implementing and monitoring adherence with the Company’s compensation program and providing input to the Board with respect to management development and succession planning. The role of the Committee is to oversee, on behalf of the Board, the Company’s compensation and benefit plans and policies, administer its stock plans (including reviewing and approving equity grants to the CEO and all other executive officers), review and approve all other compensation decisions relating to the executive officers of the Company other than the CEO, and recommend CEO compensation to the Board for its approval.

In addition, the Committee (i) reviews the Company’s organization structure, (ii) reviews the recruitment of key employees and management’s development plans for key employees, (iii) makes recommendations to the Board with respect to the CEO succession plan and (iv) reviews compensation risk to determine whether the compensation policies and practices are reasonably likely to have a material adverse effect on the Company. The Committee meets a minimum of three times annually to discharge its duties and held five meetings in 2022.

Compensation Philosophy and Pay Objectives

The Company and the Committee believe that compensation paid to executive officers, including the named executive officers, should be aligned with the strategy and performance of the Company on both a short-term and long-term basis, and that such compensation should assist the Company in attracting and retaining key executives critical to the Company’s success.

Compensation is structured to ensure that a significant portion of the executive’s compensation opportunities will be directly related to Company performance and other factors that directly and indirectly influence shareholder value, including performance evaluated against the achievement of objectives relative to applicable Environmental, Social and Governance risks and metrics.

The Committee encourages superior short-term performance through annual cash incentive awards and superior long-term performance through equity incentive awards. For the Company’s CEO, CFO and CAO the cash incentive compensation is designed to reward Company-wide performance by tying 100 percent of their target cash incentive opportunity to corporate financial goals, including earnings per share and consolidated working capital ratio. For other named executive officers, the cash incentive compensation is weighted to reward the achievement of specific financial metrics within areas under his control or influence, although Company-wide performance is still an important factor. Stock-based compensation consists of a combination of stock options, restricted stock (or restricted stock units for retirement-eligible executives) and performance share units. The Committee believes that all three equity-based components create a strong link to shareholder value creation, with the majority of the awards in the form of stock options and performance share units.

Historically, the Committee has set executive pay opportunities based on a number of factors deemed appropriate by the Committee, including market competitive pay data, individual performance and the experience level of the executive. Subject to the factors set forth above, the Committee used the following pay objectives as a guide in assessing competitiveness of pay opportunities at a peer group of companies for 2022 pay decisions (the same levels were used in 2021). The higher targeted pay objectives for annual bonus and long-term incentive components reflect the Committee’s objective to attract and retain high quality executive talent in order to meet the aggressive performance goals of the Company and its belief that a significant portion of total compensation should be at risk and variable.

| | | | | |

| Pay Component | Targeted Pay Objectives |

| Base Salary | 50th percentile |

| Annual Bonus Opportunity | 65th percentile |

| Long-Term Incentives | 65th percentile |

Role of Management in Compensation Decisions

The Committee makes CEO compensation recommendations to the Board, for its review and approval, and makes all compensation decisions with respect to all other executive officers of the Company.

The CEO reviews the performance of other executive officers, including the other named executive officers, and makes recommendations to the Committee with respect to their annual salary adjustments, annual cash incentive opportunities and payments, and grants of long-term incentive awards. The Committee approves the compensation of these executives after considering the CEO’s input and recommendations and its own judgment of each executive’s performance during the period.

The Committee and the CEO also review the financial metrics to be used to measure the performance of the Company and its business units, taking into account the strategic goals of the Company, including those related to performance against Environmental, Social and Governance risks and metrics. For this purpose, the CEO provides information and commentary relevant to the Committee’s review and ultimate determination.

Although the CEO regularly attends Committee meetings, he is present only by invitation of the Committee and has no independent right to attend such meetings. In fiscal 2022, Mr. Sengstack attended all of the Committee meetings but did not participate in any of the executive sessions.

Role of Compensation Consultant and Advisers in Compensation Decisions

The Committee utilizes the Company’s Human Resources department and has the authority under its charter to engage the services of outside consultants to assist the Committee. In accordance with this authority, the Committee has engaged the services of Meridian Compensation Partners, LLC (“Meridian”), an independent executive compensation consulting firm, to conduct reviews of its total compensation program for executive officers and to provide advice to the Committee in the design and implementation of its executive compensation program. Pursuant to its charter and NASDAQ listing standards, the

Committee regularly reviews Meridian’s independence relative to key factors, including: (i) whether Meridian provides any other services to the Company; (ii) the amount of fees paid to Meridian relative to the total revenue of the firm; (iii) policies in place to prevent conflicts of interest; (iv) any personal or business relationships with members of the Committee; (v) ownership of Company stock; and (vi) any personal or business relationships with executive officers.

One or more representatives from Meridian are invited by the Committee to attend the relevant portions of its meetings. During 2022, Meridian participated in all five of the Committee meetings in person or virtually. In the course of fulfilling its consulting responsibilities, representatives of Meridian frequently communicate with the Chairperson of the Committee outside of regular Committee meetings. A representative of Meridian meets with the Committee in executive session at most meetings. Meridian also interacts with management from time to time to exchange information and to review proposals that management may present to the Committee.

Peer Group Benchmarking

In late 2021, the Committee, with the assistance of Meridian, conducted an analysis of the current peer group used for compensation benchmarking purposes to ensure that all included companies continued to be relevant comparators. As part of this process, the Committee considered revenue size and industry, as well as companies that compete with the Company for executive talent. Based on this review and input from Meridian, no changes were made to the current peer group. As a result, the Committee approved the 24- company peer group listed below (the “2022 Peer Group”) for purposes of updating the executive pay study to assist in 2022 pay decisions. The companies in the 2022 Peer Group are primarily engaged in manufacturing, are publicly traded, and had trailing twelve-month revenue (as of 9/30/2021) between $354 million and $3.875 billion. Due to the differences in size among the companies in the 2022 Peer Group, Meridian used a form of regression analysis to adjust the pay study results based on Company revenue as compared to revenue of other companies in the 2022 Peer Group and each executive’s level of responsibility as compared to executives in comparable positions in the 2022 Peer Group.

| | | | | | | | |

| Chart Industries, Inc. | Hillenbrand, Inc. | SPX FLOW, Inc. |

| CIRCOR International, Inc. | IDEX Corporation | Standex International Corp. |

| Crane Holdings Co. | ITT, Inc. | The Gorman-Rupp Co. |

| Curtiss-Wright Corporation | Lindsay Corporation | The Timken Co. |

| Donaldson Company, Inc. | Lydall, Inc. | The Toro Co. |

| Enerpac Tool Group Corporation | Mueller Water Products, Inc. | TriMas Corporation |

| ESCO Technologies, Inc. | Nordson Corporation | Watts Water Technologies, Inc. |

| Graco, Inc. | RBC Bearings, Inc. | Woodward, Inc. |

Setting Executive Compensation

In General

The Company compensates its executives through programs that emphasize performance-based compensation. For the executive officers, including the named executive officers, the compensation package for 2022 included base salary, an annual cash incentive opportunity and an annual long-term incentive opportunity in the form of stock options, performance share units, and restricted stock/units. Base salary is intended to provide a certain level of fixed compensation commensurate with an executive’s position, responsibilities and contributions to the Company. The Company has structured annual and long-term incentive compensation to motivate executives to achieve the strategic objectives set by the CEO and the Board, to tie executives’ long- term interests to those of the Company’s shareholders, to reward the executives for achieving such goals, and to provide a retention incentive.

The mix of compensation among base salary, annual bonus opportunity and long-term incentives is a result of the targeted pay objective for each component of pay. This approach results in a significant portion of the compensation of those executive officers having the greatest ability to influence the Company’s performance being performance-based, which the Committee believes is appropriate. Additionally, after setting each separate component of pay, the Committee reviews the total compensation package of each named executive officer to assess the level of total target compensation provided in relation to the competitive range of market practice and may make adjustments to one or more components of pay based on this assessment.

Each year Meridian provides a study of market competitive compensation data. The updated study included 2021 compensation data for the companies in the 2022 Peer Group, with cash data “aged” at an annualized rate of 3.0 percent to reflect expected 2022 compensation levels for the 2022 Peer Group. In February 2022, the Committee set the specific components of the compensation of the named executive officers, with the overall goal of providing compensation opportunities at levels generally competitive with the 2022 pay study.

The following table shows the 2022 total targeted compensation (the sum of base salary, target annual bonus opportunity and long-term incentives) for the named executive officers, using targets of the 50th percentile of the 2022 Peer Group for base salary and the 65th percentile of the 2022 Peer Group for annual bonus opportunity and long-term incentives:

| | | | | | | | | | | |

| Named Executive Officer | | 2022 Targeted Total Compensation(1) ($) |

| Gregg C. Sengstack | | | 5,890,000 |

| Jeffery L. Taylor | | | 1,711,875 |

| Donald P. Kenney | | | 1,771,875 |

| DeLancey W. Davis | | | 1,216,250 |

| Jay J. Walsh | | | 1,100,000 |

(1)Based on annualized base salary rates plus target annual bonus opportunity (based on salary targeted to be paid for 2022) and economic value of long-term incentives.

The following sections discuss the individual elements of the Company’s compensation program, including any changes made for fiscal 2022.

Base Salary

The Company pays its executives annual salaries, which provide a degree of financial stability and are intended to reflect the competitive marketplace and help attract and retain quality executives. In determining the 2022 base salary for each executive, the Committee took into account the targeted annual salary objective for the position based on the results of the pay study for 2022 and assessed the responsibilities associated with the position, individual contribution and performance, skill set, prior experience and external pressures to attract and retain talent.

Applying these factors, the 2022 salaries are shown in the table below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Named Executive Officer | | 2022 Base Salary Rate ($) | | 2021 Base Salary Rate ($) | % Change | | |