UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________________

FORM 10-K

_______________________________________________________________________

X | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2015

or

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

For the transition period from _______ to _______

Commission File Number 1-2376

__________________________________________________________________________

FMC CORPORATION

(Exact name of registrant as specified in its charter)

__________________________________________________________________________

Delaware | 94-0479804 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

1735 Market Street Philadelphia, Pennsylvania | 19103 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: 215-299-6000

__________________________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, $0.10 par value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act:

None

INDICATE BY CHECK MARK IF THE REGISTRANT IS A WELL-KNOWN SEASONED ISSUER, AS DEFINED IN RULE 405 OF THE SECURITIES ACT. YES x NO ¨

INDICATE BY CHECK MARK IF THE REGISTRANT IS NOT REQUIRED TO FILE REPORTS PURSUANT TO SECTION 13 AND SECTION 15(d) OF THE ACT. YES ¨ NO x

INDICATE BY CHECK MARK WHETHER THE REGISTRANT (1) HAS FILED ALL REPORTS REQUIRED TO BE FILED BY SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 DURING THE PRECEDING 12 MONTHS (OR FOR SUCH SHORTER PERIOD THAT THE REGISTRANT WAS REQUIRED TO FILE SUCH REPORTS), AND (2) HAS BEEN SUBJECT TO SUCH FILING REQUIREMENTS FOR THE PAST 90 DAYS. YES x NO ¨

INDICATE BY CHECK MARK WHETHER THE REGISTRANT HAS SUBMITTED ELECTRONICALLY AND POSTED ON ITS CORPORATE WEBSITE, IF ANY, EVERY INTERACTIVE DATA FILE REQUIRED TO BE SUBMITTED AND POSTED PURSUANT TO RULE 405 OF REGULATION S-T DURING THE PRECEDING 12 MONTHS (OR FOR SUCH SHORTER PERIOD THAT THE REGISTRANT WAS REQUIRED TO SUBMIT AND POST SUCH FILES) YES x NO ¨

INDICATE BY CHECK MARK IF DISCLOSURE OF DELINQUENT FILERS PURSUANT TO ITEM 405 OF REGULATION S-K IS NOT CONTAINED HEREIN, AND WILL NOT BE CONTAINED, TO THE BEST OF REGISTRANT’S KNOWLEDGE, IN DEFINITIVE PROXY OR INFORMATION STATEMENTS INCORPORATED BY REFERENCE IN PART III OF THIS FORM 10-K OR ANY AMENDMENT TO THIS FORM 10-K x

INDICATE BY CHECK MARK WHETHER THE REGISTRANT IS A LARGE ACCELERATED FILER, AN ACCELERATED FILER, A NON-ACCELERATED FILER OR A SMALLER REPORTING COMPANY. SEE DEFINITIONS OF “LARGE ACCELERATED FILER,” “ACCELERATED FILER,” AND “SMALLER REPORTING COMPANY” IN RULE 12B-2 OF THE EXCHANGE ACT. (CHECK ONE):

LARGE ACCELERATED FILER | X | ACCELERATED FILER | ||||

NON-ACCELERATED FILER | SMALLER REPORTING COMPANY | |||||

INDICATE BY CHECK MARK WHETHER THE REGISTRANT IS A SHELL COMPANY (AS DEFINED IN RULE 12B-2 OF THE EXCHANGE ACT) YES ¨ NO x

THE AGGREGATE MARKET VALUE OF VOTING STOCK HELD BY NON-AFFILIATES OF THE REGISTRANT AS OF JUNE 30, 2015, THE LAST DAY OF THE REGISTRANT’S SECOND FISCAL QUARTER WAS $6,983,610,763. THE MARKET VALUE OF VOTING STOCK HELD BY NON-AFFILIATES EXCLUDES THE VALUE OF THOSE SHARES HELD BY EXECUTIVE OFFICERS AND DIRECTORS OF THE REGISTRANT.

INDICATE THE NUMBER OF SHARES OUTSTANDING OF EACH OF THE ISSUER’S CLASSES OF COMMON STOCK, AS OF THE LATEST PRACTICABLE DATE

Class | December 31, 2015 | |

Common Stock, par value $0.10 per share | 133,655,777 | |

DOCUMENTS INCORPORATED BY REFERENCE

DOCUMENT | FORM 10-K REFERENCE | |

Portions of Proxy Statement for 2016 Annual Meeting of Stockholders | Part III | |

FMC Corporation

2015 Form 10-K Annual Report

Table of Contents

Page | |

3

PART I

FMC Corporation (FMC) was incorporated in 1928 under Delaware law and has its principal executive offices at 1735 Market Street, Philadelphia, Pennsylvania 19103. Throughout this Annual Report on Form 10-K, except where otherwise stated or indicated by the context, “FMC”, “We,” “Us,” or “Our” means FMC Corporation and its consolidated subsidiaries and their predecessors. Copies of the annual, quarterly and current reports we file with the Securities and Exchange Commission (“SEC”), and any amendments to those reports, are available on our website at www.FMC.com as soon as practicable after we furnish such materials to the SEC.

ITEM 1. | BUSINESS |

General

We are a diversified chemical company serving agricultural, consumer and industrial markets globally with innovative solutions, applications and market-leading products. We operate in three distinct business segments: FMC Agricultural Solutions, FMC Health and Nutrition and FMC Lithium. Our FMC Agricultural Solutions segment develops, markets and sells all three major classes of crop protection chemicals – insecticides, herbicides and fungicides. These products are used in agriculture to enhance crop yield and quality by controlling a broad spectrum of insects, weeds and disease, as well as in non-agricultural markets for pest control. The FMC Health and Nutrition segment focuses on nutritional ingredients, health excipients, and functional health ingredients. Nutritional ingredients are used to enhance texture, color, structure and physical stability. Health excipients are used for binding, encapsulation and disintegrant applications. Functional health ingredients are used as active ingredients in nutraceutical and pharmaceutical markets. Our FMC Lithium segment manufactures lithium for use in a wide range of lithium products, which are used primarily in energy storage, specialty polymers and chemical synthesis application.

Discontinued Operations - FMC Alkali Chemicals

On April 1, 2015, we completed the sale of our FMC Alkali Chemicals division ("ACD") for $1,649.8 million to a wholly owned subsidiary of Tronox Limited ("Tronox"). The sale resulted in approximately $1,198.5 million in after-tax cash proceeds. The sale resulted in a pre-tax gain of $1,080.2 million ($702.1 million net of tax) for the year ended December 31, 2015. The results of ACD have been reclassified to reflect the business as a discontinued operation for all periods presented throughout this document.

Cheminova A/S

On April 21, 2015, pursuant to the terms and conditions set forth in the Purchase Agreement, we completed the acquisition of 100 percent of the outstanding equity of Cheminova A/S, a Denmark Aktieselskab ("Cheminova") from Auriga Industries A/S, a Denmark Aktieselskab for an aggregate purchase price of $1.2 billion, excluding assumed net debt and hedged-related costs of approximately $0.6 billion (the “Acquisition”).

Cheminova is being integrated into our FMC Agricultural Solutions segment. Since the closing date, Cheminova has been included within our reported results of operations for FMC Agricultural Solutions for the twelve months ended December 31, 2015.

FMC Strategy

2015 marked the completion of FMC’s multi-year portfolio transformation. Today, FMC is a company operating in attractive market segments that are supported by growth trends in agriculture, pharmaceuticals, nutrition, and energy storage. Each of FMC’s businesses has the right elements in place to deliver continued growth in earnings and returns.

In Agricultural Solutions, the acquisition of Cheminova has expanded market access across Europe, Latin America and key Asia-Pacific markets such as India and Australia, and has brought greater balance to the revenue mix of FMC Agricultural Solutions across each of the major growing regions. The integration strengthens our leadership position in crop protection chemistry and expands our position in a variety of crop segments. Our complementary technologies will lead to improved formulation capabilities and a broader innovation pipeline. We continue to invest in R&D and remain committed to developing and commercializing new and differentiated products to address grower demands. We will also benefit from deeper regulatory expertise and access to local markets. FMC with the acquisition of Cheminova, has the scale to operate with greater resources and global reach to address changing market conditions.

In Health and Nutrition, we have a portfolio of naturally-derived, functional ingredients that serve health, nutraceutical and nutrition end markets. We provide innovative solutions to our customers by leveraging our application know-how in the nutrition, nutraceutical and pharmaceutical markets as well as differentiating the manufacture and delivery of our market leading products

4

through best in class Quality, Service, Reliability (QSR). With QSR at the forefront, we have recently undertaken an effort to improve our cost competition by optimizing our organizational and manufacturing footprints. We are implementing Manufacturing Excellence programs to drive operating improvements across our portfolio. As a technology-focused company, we continue to pursue process technology improvements and develop innovative application solutions to drive the highest value for customers.

In Lithium, FMC remains one of the leading global producers of specialty lithium products. We will continue to invest in these higher growth, higher value segments of the market, including lithium hydroxide for energy storage and butyllithium for use in chemical synthesis and high purity lithium metal for aerospace applications.

We maintain our commitment to enterprise sustainability, including responsible stewardship. As we grow, we will do so in a responsible way. Safety and business ethics will remain of utmost importance. Meeting and exceeding our customers’ expectations will continue to be a primary focus.

5

Financial Information About Our Business Segments

(Financial Information (in Millions))

See Note 19 "Segment Information" to our consolidated financial statements included in this Form 10-K. Also see below for selected financial information related to our segments.

The following table shows the principal products produced by our three business segments, their raw materials and uses:

Segment | Product | Raw Materials | Uses |

FMC Agricultural Solutions | Insecticides | Synthetic chemical intermediates | Protection of crops, including soybean, corn, fruits and vegetables, cotton, sugarcane, rice, and cereals, from insects and for non-agricultural applications including pest control for home, garden and other specialty markets |

Herbicides | Synthetic chemical intermediates | Protection of crops, including cotton, sugarcane, rice, corn, soybeans, cereals, fruits and vegetables from weed growth and for non-agricultural applications including turf and roadsides | |

Fungicides | Synthetic and biological chemical intermediates | Protection of crops, including fruits and vegetables from fungal disease | |

FMC Health and Nutrition | Microcrystalline Cellulose | Specialty pulp | Drug dry tablet binder and disintegrant, food ingredient |

Carrageenan | Refined seaweed | Food ingredient for thickening and stabilizing, pharmaceutical and nutraceutical encapsulates | |

Alginates | Refined seaweed | Food ingredient, pharmaceutical excipient, healthcare and industrial uses | |

Natural Colorants | Plant sources, select insect species | Food, pharmaceutical and cosmetics | |

Omega-3 EPA/DHA | Fish oils | Nutraceutical and pharmaceutical uses | |

FMC Lithium | Lithium | Various lithium products | Batteries, polymers, pharmaceuticals, greases and lubricants, glass and ceramics and other industrial uses |

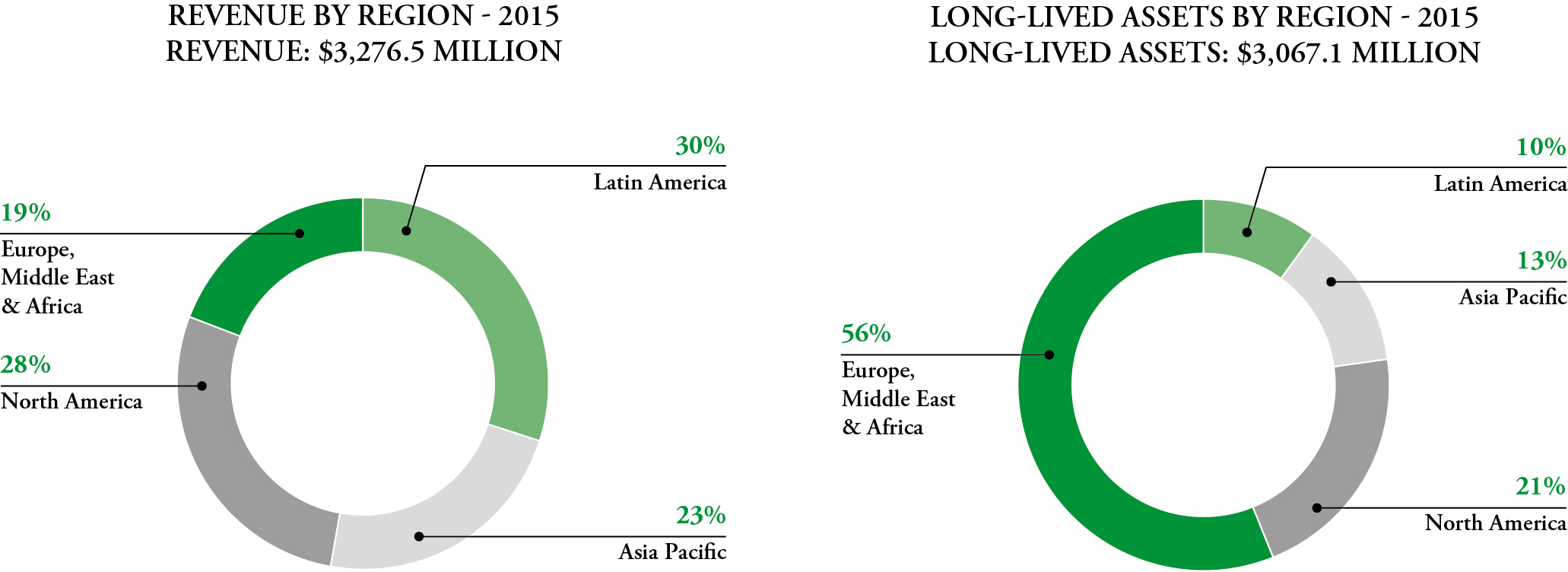

With a worldwide manufacturing and distribution infrastructure, we are better able to respond rapidly to global customer needs, offset downward economic trends in one region with positive trends in another and match local revenues to local costs to reduce the impact of currency volatility. The charts below detail our sales and long-lived assets by major geographic region.

6

FMC Agricultural Solutions

Overview

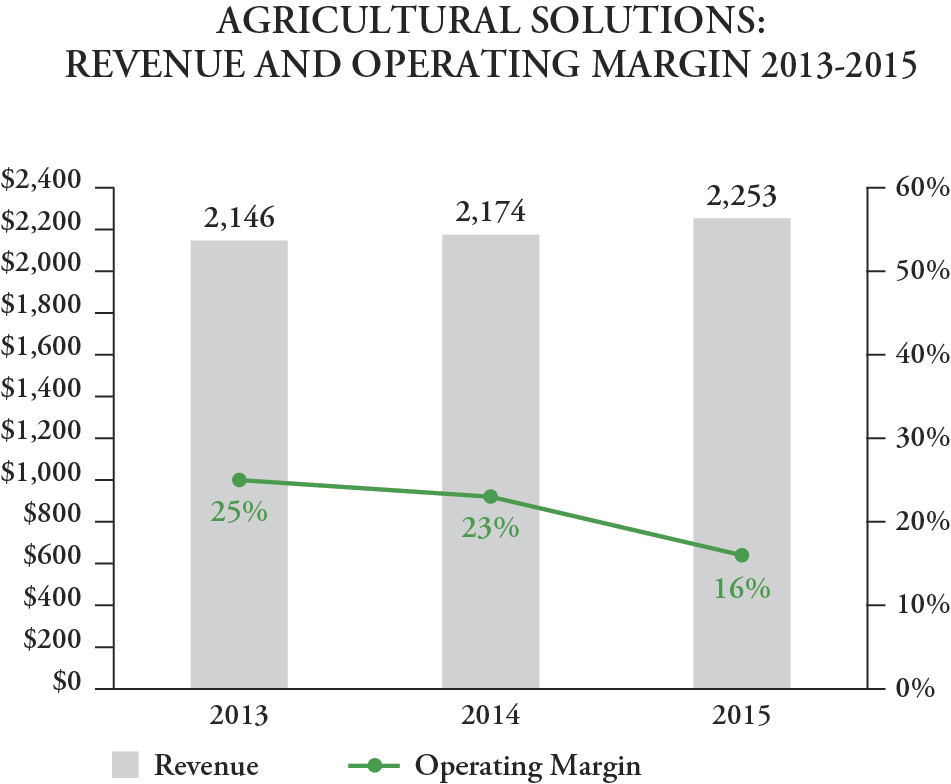

Our FMC Agricultural Solutions segment, which represents approximately 69 percent of our 2015 consolidated revenues, operates in the agrochemicals industry. This segment develops, manufactures and sells a portfolio of crop protection, professional pest control and lawn and garden products.

Products and Markets

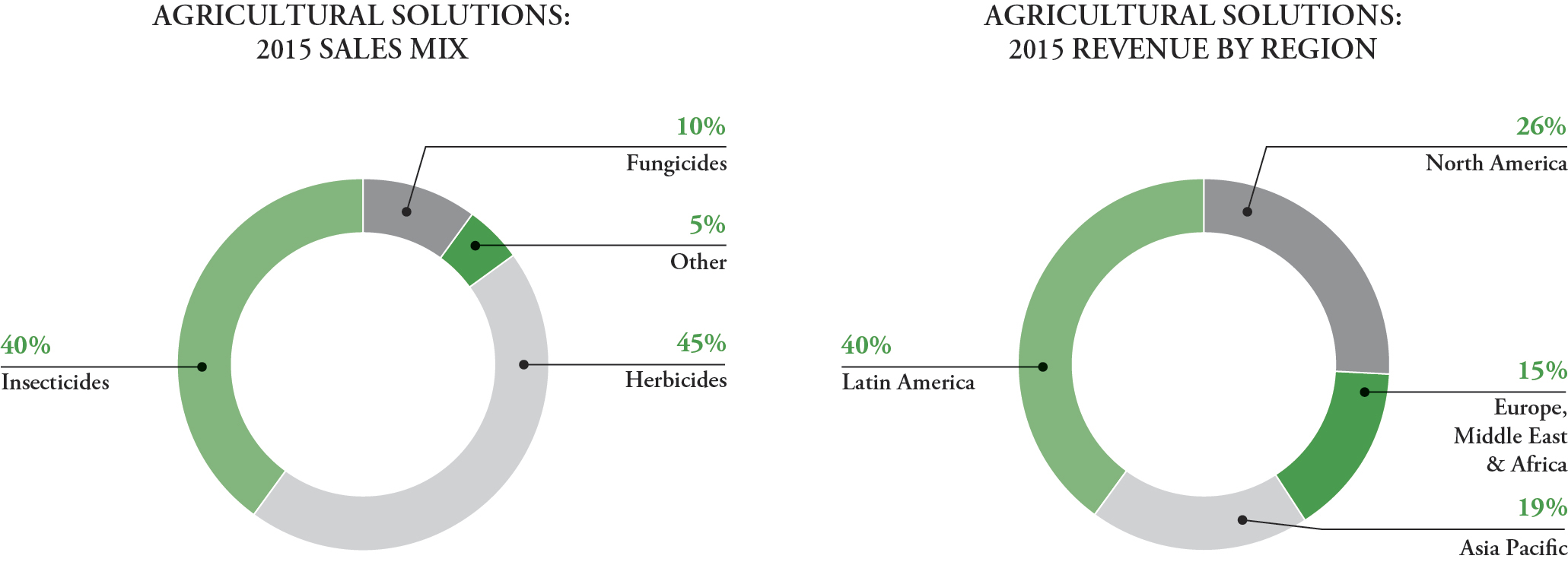

FMC Agricultural Solutions' portfolio is comprised of three major pesticide categories: insecticides, herbicides and fungicides. The majority our product line consists of insecticides and herbicides, and we have a small but fast-growing portfolio of fungicides mainly used in high value crop segments. Our insecticides are used to control a wide spectrum of pests, while our herbicide portfolio primarily targets a large variety of difficult-to-control weeds. We are also investing substantially in a plant health program that includes biological crop protection products, seed treatments and micronutrients.

In the Latin American region, which includes the large agricultural market of Brazil, we sell directly to large growers through our own sales and marketing organization, and we access the market through independent distributors. In North America, we access the market through several major national and regional distributors and have our own sales and marketing organization in Canada. With the Cheminova acquisition, we now access a majority of the European markets through our own sales and marketing organizations. We access key Asian markets either through local independent distributors or our own sales and marketing organizations. Through these and other alliances, along with our own targeted marketing efforts, access to novel technologies and

7

our innovation initiatives, we expect to maintain and enhance our access in key agricultural and non-crop markets and develop new products that will help us continue to compete effectively.

Industry Overview

The three principal categories of agricultural and non-crop chemicals are: herbicides, insecticides and fungicides, representing approximately 40 percent, 30 percent and 25 percent of global industry revenue, respectively.

The agrochemicals industry is relatively consolidated. Leading crop protection companies, Syngenta AG, Bayer AG, Monsanto Company, BASF AG, The Dow Chemical Company and E. I. du Pont de Nemours and Company (DuPont), currently represent approximately 65 percent of the industry’s global sales. The next tier of agrochemical producers include FMC, ADAMA Agricultural Solutions, Ltd., Sumitomo Chemical Company Ltd., Nufarm Ltd., Platform Specialty Products Corporation, and United Phosphorous Ltd. FMC employs various differentiated strategies and competes with unique technologies focusing on certain crops, markets and geographies, while also being supported by a low-cost manufacturing model.

Growth

The acquisition of Cheminova positions FMC among leading agrochemical producers in the world. Our complementary technologies will lead to improved formulation capabilities and a broader innovation pipeline, resulting in new and differentiated products. We will take advantage of enhanced market access positions and an expanded portfolio to deliver near-term growth.

We will continue to grow by obtaining new and approved uses for existing product lines and acquiring, accessing, developing, marketing, distributing and/or selling complementary chemistries and related technologies in order to strengthen our product portfolio and our capabilities to effectively service our target markets and customers.

Our growth efforts focus on developing environmentally compatible and sustainable solutions that can effectively increase farmers’ yields and provide cost-effective alternatives to chemistries which may be prone to resistance. We are committed to providing unique, differentiated products to our customers by acquiring and further developing technologies as well as investing in innovation to extend product life cycles. Our external growth efforts include product acquisitions, in-licensing of chemistries and technologies and alliances that bolster our market access, complement our existing product portfolio or provide entry into adjacent spaces. We have entered into a range of development and distribution agreements with other companies that provide access to new technologies and products which we can subsequently commercialize.

8

FMC Health and Nutrition

Overview

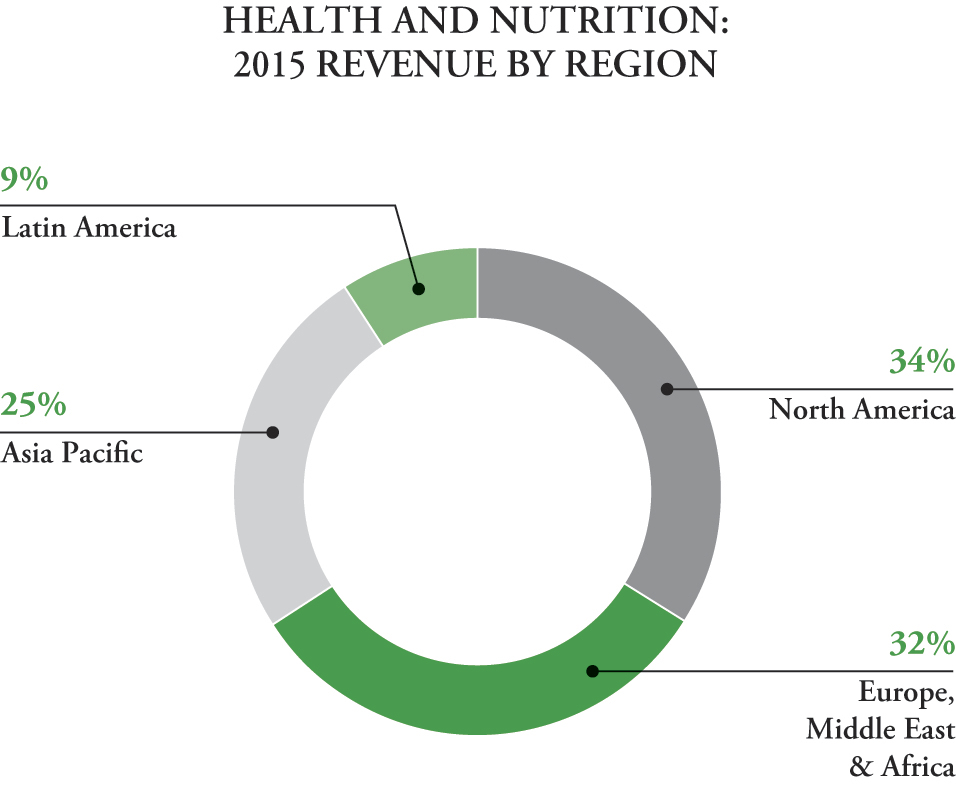

Our FMC Health and Nutrition segment, which represents 24 percent of our 2015 consolidated revenues, is focused on high-performance food ingredients, pharmaceutical excipients and Omega-3 oils. The majority of FMC Health and Nutrition sales are to customers in non-cyclical end markets. We believe our future growth in this segment will continue to be based on the value-added performance of these products and our research and development capabilities, as well as on the alliances and close working relationships we have developed with key global customers.

Products and Markets

Our product offerings into nutrition markets principally provide texture, structure and physical stability ("TSPS") solutions to thicken and stabilize certain food products. Our formulation ingredients serve the health excipient industry functioning as binders, disintegrants, suspending agents, and control-release compounds for the production of both solid and liquid pharmaceutical products. The majority of our functional ingredient product offerings are high purity Omega-3 products as well as certain alginate products which are considered to be active pharmaceutical ingredients

FMC Health and Nutrition is a supplier of microcrystalline cellulose ("MCC"), carrageenan, alginates, natural colorants, and omega-3, all naturally derived ingredients that have high value-added applications in the production of processed and convenience foods, oral dose form pharmaceuticals and nutraceuticals. MCC, processed from specialty grades of renewable hardwood and

9

softwood pulp, provides binding and disintegrant properties for dry tablets and capsules and has unique functionality that improves the texture and stability of many nutrition products. Carrageenan and alginates, both processed from natural seaweeds, are used in a wide variety of food, pharmaceutical and oral care applications. Natural colorants are utilized in specialty products used in the food, beverage, personal care, nutrition and health excipient markets. Omega-3 is sourced from fish oils and use in other pharmaceutical and nutraceutical applications

Industry Overview

Nutritional Ingredients

The industry is dispersed geographically, with sales in Europe, North America and Asia. The nutritional ingredients market is comprised of a large number of suppliers due to the broad spectrum of chemistries employed. Segment leadership, global position and investment in technology are key factors to sustaining profitability. The top suppliers of TSPS ingredients include FMC, DuPont, J.M. Huber Corporation, Kerry Group plc and Cargill Incorporated.

Health Excipients and Functional Health Ingredients

Competitors tend to be grouped by chemistry. Our principal MCC competitors include J. Rettenmaier & Sôhne GmbH, Ming Tai Chemical Co., Ltd., Asahi Kasei Corporation and Blanver Farmoquimica Ltda. While pricing pressure from low-cost producers is a common competitive dynamic, companies look to offset that pressure by providing the most reliable and broadest range of products and services. Our customers are pharmaceutical firms who depend upon reliable therapeutic performance of their drug products. In Omega-3, our competitors include DSM, BASF, Croda and other smaller producers. Competition has intensified in this market over the past several years as many smaller producers attempt to enter in what is considered by many as an attractive growth market. Differentiation among higher end producers such as FMC is achieved through know-how to produce high concentration oils at high levels of purity.

FMC Lithium

Overview

Our FMC Lithium segment, represents seven percent of our 2015 consolidated revenues.

While lithium is sold into a variety of end markets, we have focused our strategy on specialty products that require a high level of manufacturing and technical know-how to meet customer requirements.

The electrochemical properties of lithium make it an ideal material for portable energy storage in high performance applications, including smart phones, tablets, laptop computers, military devices and other next-generation energy storage technologies. Lithium is a critical element in advanced batteries for use in hybrid electric, plug-in hybrids and all-electric vehicles.

10

Organolithium products are highly valued in the polymer market as initiators in the production of synthetic rubbers and elastomers. Organolithiums are also sold to fine chemical and pharmaceutical customers who use lithium's unique chemical properties to synthesize high value-added products.

Industry Overview

Our FMC Lithium serves a diverse group of markets. Our product offerings are primarily inorganic and generally have few cost-effective substitutes. A major growth driver for lithium in the future will be the rate of adoption of electric and hybrid electric batteries in automobiles.

Most markets for lithium chemicals are global with significant growth occurring both in Asia and North America, primarily driven by the development and manufacture of lithium ion batteries. There are three key producers of lithium compounds: FMC, Albemarle Corporation (previously Rockwood Holdings, Inc.) and Sociedad Química y Minera de Chile S.A. Spodumene ore is also converted to lithium compounds by a large number of Chinese producers. We expect a few new producers to add capacity within the next 24 months. FMC and Albemarle Corporation are the primary producers of lithium specialty products.

Source and Availability of Raw Materials

Raw materials used by FMC Agricultural Solutions, primarily processed chemicals, are obtained from a variety of suppliers worldwide. Raw materials used by FMC Health and Nutrition include various types of seaweed, specialty pulps, natural colorant raw materials and fish oils that are all sourced on a global basis and purchased from selected global producers/suppliers. We extract ores used in FMC Lithium’s manufacturing processes from lithium brines in Argentina.

Patents

We own a number of U.S. and foreign patents, trademarks and licenses that are cumulatively important to our business. We do not believe that the loss of any individual or combination of related patents, trademarks or licenses would have a material adverse effect on the overall business of FMC. The duration of our patents depends on their respective jurisdictions.

Seasonality

The seasonal nature of the crop protection market and the geographic spread of the FMC Agricultural Solutions business can result in significant variations in quarterly earnings among geographic locations. FMC Agricultural Solutions' products sold in the northern hemisphere (North America, Europe and parts of Asia) serve seasonal agricultural markets from March through September, generally resulting in earnings in the first, second and third quarters. Markets in the southern hemisphere (Latin America and parts of the Asia Pacific region, including Australia) are served from July through February, generally resulting in earnings in the third, fourth and first quarters. The remainder of our business is generally not subject to significant seasonal fluctuations.

Competition

We encounter substantial competition in each of our three business segments. We market our products through our own sales organization and through alliance partners, independent distributors and sales representatives. The number of our principal competitors varies from segment to segment. In general, we compete by providing advanced technology, high product quality, reliability, quality customer and technical service, and by operating in a cost-efficient manner.

Our FMC Agricultural Solutions segment competes primarily in the global chemical crop protection market for insecticides, herbicides and fungicides. Industry products include crop protection chemicals and, for certain major competitors, genetically engineered (crop biotechnology) products. Competition from generic agrochemical producers is significant as a number of key product patents held industry-wide have expired in the last decade. In general, we compete as an innovator by focusing on product development, including novel formulations, proprietary mixes, and advanced delivery systems and by acquiring or licensing (mostly) proprietary chemistries or technologies that complement our product and geographic focus. We also differentiate ourselves by our global cost-competitiveness through our manufacturing strategies, establishing effective product stewardship programs and developing strategic alliances that strengthen market access in key countries and regions.

Our FMC Health and Nutrition segment has significant positions in markets that include alginate, carrageenan, and microcrystalline cellulose. We compete with both direct suppliers of cellulose and seaweed extract as well as suppliers of other hydrocolloids, which may provide similar functionality in specific applications. In microcrystalline cellulose, competitors are typically smaller than FMC, while in seaweed extracts (carrageenan and alginates) and Omega-3 fish oils, we compete with other broad-based chemical companies.

11

FMC Lithium segment sells lithium-based products worldwide. We and our two most significant competitors in lithium extract the element from naturally occurring lithium-rich brines located in the Andes Mountains of Argentina and Chile, which are believed to be the world’s most significant and lowest cost sources of lithium.

Research and Development Expense

We perform research and development in all of our segments with the majority of our efforts focused in the FMC Agricultural Solutions segment. The development efforts in the FMC Agricultural Solutions segment focus on developing environmentally sound solutions and new product formulations that cost-effectively increase farmers’ yields and provide alternatives to existing and new chemistries. Our research and development expenses in the last three years are set forth below:

Year Ended December 31, | |||||||||||

(in Millions) | 2015 | 2014 | 2013 | ||||||||

FMC Agricultural Solutions | $ | 132.4 | $ | 111.8 | $ | 100.5 | |||||

FMC Health and Nutrition | 7.8 | 10.0 | 10.5 | ||||||||

FMC Lithium | 3.5 | 4.5 | 4.6 | ||||||||

Total | $ | 143.7 | $ | 126.3 | $ | 115.6 | |||||

Environmental Laws and Regulations

A discussion of environmental related factors can be found in Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in Note 10 “Environmental Obligations” in the notes to our consolidated financial statements included in this Form 10-K.

Employees

We employ approximately 6,000 people with about 1,200 people in our domestic operations and 4,800 people in our foreign operations.

Approximately 10 percent of our U.S.-based and 35 percent of our foreign-based employees, respectively, are represented by collective bargaining agreements. We have successfully concluded most of our recent contract negotiations without any material work stoppages. In those rare instances where a work stoppage has occurred, there has been no material effect on consolidated sales and earnings. We cannot predict, however, the outcome of future contract negotiations. In 2016, eight foreign collective-bargaining agreements and one U.S. collective-bargaining agreements will expire. These contracts affect about 15 percent of our foreign-based employees and five percent of our U.S employees.

Securities and Exchange Commission Filings

Securities and Exchange Commission (SEC) filings are available free of charge on our website, www.fmc.com. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports are posted as soon as practicable after we furnish such materials to the SEC.

In accordance with New York Stock Exchange (NYSE) rules, on May 18, 2015, we filed a certification signed by our Chief Executive Officer (CEO) that, as of the date of the certification, he was unaware of any violation by FMC of the NYSE’s corporate governance listing standards. We also file with each Form 10-Q and our Form 10-K certifications by the CEO and Chief Financial Officer under sections 302 and 906 of the Sarbanes-Oxley Act of 2002.

ITEM 1A. | RISK FACTORS |

Below lists our risk factors updated for these events.

Among the factors that could have an impact on our ability to achieve operating results and meet our other goals are:

Industry Risks:

Pricing and volumes in our markets are sensitive to a number of industry specific and global issues and events including:

• | Capacity utilization - Our businesses are sensitive to industry capacity utilization. As a result, pricing tends to fluctuate when capacity utilization changes occur within our industry. |

• | Competition - All of our segments face competition, which could affect our ability to maintain or raise prices, successfully enter certain markets or retain our market position. Competition for our FMC Agricultural Solutions business, includes not only generic suppliers of the same pesticidal active ingredients, but also alternative proprietary pesticide chemistries, and crop protection technologies that are bred into or applied onto seeds. Increased generic presence in agricultural |

12

chemical markets has been driven by the number of significant product patents and product data protections that have expired in the last decade, and this trend is expected to continue.

• | Changes in our customer base - Our customer base has the potential to change, especially when long-term supply contracts are renegotiated. Our FMC Lithium and FMC Health and Nutrition businesses are most sensitive to this risk. |

• | Climatic conditions - Our FMC Agricultural Solutions markets are affected by climatic conditions, which could adversely impact crop pricing and pest infestations. Adverse weather conditions can impact our ability to extract lithium efficiently from our lithium reserves in Argentina. Natural disasters can impact production at our facilities in various parts of the world. The nature of these events makes them difficult to predict. |

• | Changing regulatory environment - Changes in the regulatory environment, particularly in the United States, Brazil, China, Argentina and the European Union, could adversely impact our ability to continue producing and/or selling certain products in our domestic and foreign markets or could increase the cost of doing so. Our FMC Agricultural Solutions business is most sensitive to this general regulatory risk given the need to obtain and maintain pesticide registrations in every country in which we sell our products. Compliance with changing laws and regulations may involve significant costs or capital expenditures or require changes in business practice that could result in reduced profitability. In the European Union, the regulatory risk specifically includes chemicals regulation known as REACH (Registration, Evaluation, and Authorization of Chemicals), which affects each of our business segments to varying degrees. The fundamental principle behind the REACH regulation is that manufacturers must verify through a special registration system that their chemicals can be marketed safely. |

• | Geographic concentration - Although we have operations in most regions, the majority of our FMC Agricultural Solutions sales outside the United States have principally been to customers in Latin America, including Brazil, Argentina and Mexico. With the acquisition of Cheminova, we are expanding our international sales, particularly in Europe and key Asian countries such as India. Accordingly, developments in those parts of the world will generally have a more significant effect on our operations. Our operations outside the United States are subject to special risks and restrictions, including: fluctuations in currency values; exchange control regulations; changes in local political or economic conditions; governmental pricing directives; import and trade restrictions; import or export licensing requirements and trade policy; restrictions on the ability to repatriate funds; and other potentially detrimental domestic and foreign governmental practices or policies affecting U.S. companies doing business abroad. |

• | Food and pharmaceutical regulation - Some of our manufacturing processes and facilities, as well as some of our customers, are subject to regulation by the U.S. Food and Drug Administration (FDA) or similar foreign agencies. Regulatory requirements of the FDA are complex, and any failure to comply with them including as a result of contamination due to acts of sabotage could subject us and/or our customers to fines, injunctions, civil penalties, lawsuits, recall or seizure of products, total or partial suspension of production, denial of government approvals, withdrawal of marketing approvals and criminal prosecution. Any of these actions could adversely impact our net sales, undermine goodwill established with our customers, damage commercial prospects for our products and materially adversely affect our results of operations. |

• | Climate change regulation - Changes in the regulation of greenhouse gases, depending on their nature and scope, could subject our manufacturing operations to significant additional costs or limits on operations. |

• | Fluctuations in commodity prices - Our operating results could be significantly affected by the cost of commodities such as raw materials and energy, including natural gas. We may not be able to raise prices or improve productivity sufficiently to offset future increases in commodity pricing. Accordingly, increases in commodity prices may negatively affect our financial results. Where practical, we use hedging strategies to address material commodity price risks, where hedge strategies are available on reasonable terms. We also use raw material supply agreements that contain terms designed to mitigate the risk of short-term changes in commodity prices. However, we are unable to avoid the risk of medium- and long-term increases. Additionally, fluctuations in commodity prices could negatively impact our customers' ability to sell their products at previously forecasted prices resulting in reduced customer liquidity. Inadequate customer liquidity could affect our customers’ abilities to pay for our products and, therefore, affect existing and future sales or our ability to collect on customer receivables. |

• | Supply arrangements - Certain raw materials are critical to our production process. While we have made supply arrangements to meet planned operating requirements, an inability to obtain the critical raw materials or operate under contract manufacturing arrangements would adversely impact our ability to produce certain products. We increasingly source critical intermediates and finished products from a number of suppliers. An inability to obtain these products or execute under contract sourcing arrangements would adversely impact our ability to sell products. In FMC Lithium, geological conditions can affect production of raw materials. |

• | Economic and political change - Our business has been and could continue be adversely affected by economic and political changes in the markets where we compete including: inflation rates, recessions, trade restrictions, foreign ownership restrictions and economic embargoes imposed by the United States or any of the foreign countries in which we do business; changes in laws, taxation, and regulations and the interpretation and application of these laws, taxes, and regulations; restrictions imposed by foreign governments through exchange controls or taxation policy; nationalization or |

13

expropriation of property, undeveloped property rights, and legal systems or political instability; other governmental actions; and other external factors over which we have no control. Economic and political conditions within foreign jurisdictions or strained relations between countries can cause fluctuations in demand, price volatility, supply disruptions, or loss of property. In Argentina, continued inflation and tightening of foreign exchange controls along with deteriorating economic and financial conditions could adversely affect our business. In Brazil, which makes up a larger portion of our Agricultural Solutions business in Latin America since our acquisition of Cheminova in the second quarter of 2015, continued high inflation and economic recession could continue to adversely affect our business.

Operational Risks:

• | Market access risk - Our results may be affected by changes in distribution channels, which could impact our ability to access the market. |

• | Business disruptions - Although more recently, FMC Agricultural Solutions has engaged in pesticide active ingredient contract manufacturing rather than owned and operated FMC own manufacturing facilities, Cheminova owns and operates large-scale manufacturing facilities in Denmark and India. This will present us with additional operating risks, in that our operating results will be dependent in part on the continued operation of the various acquired production facilities and the ability to manufacture products on schedule. Interruptions at these facilities may materially reduce the productivity and profitability of a particular manufacturing facility, or our business as a whole, during and after the period of such operational difficulties. Although we take precautions to enhance the safety of our operations and minimize the risk of disruptions, our operations and those of our contract manufacturers are subject to hazards inherent in chemical manufacturing and the related storage and transportation of raw materials, products and wastes. These potential hazards include explosions, fires, severe weather and natural disasters, mechanical failure, unscheduled downtimes, supplier disruptions, labor shortages or other labor difficulties, information technology systems outages, disruption in our supply chain or manufacturing and distribution operations, transportation interruptions, chemical spills, discharges or releases of toxic or hazardous substances or gases, shipment of incorrect or off-specification product to customers, storage tank leaks, other environmental risks, or other sudden disruption in business operations beyond our control as a result of events such as acts of sabotage, terrorism or war, civil or political unrest, natural disasters, pandemic situations and large scale power outages. Some of these hazards may cause severe damage to or destruction of property and equipment or personal injury and loss of life and may result in suspension of operations or the shutdown of affected facilities. |

• | Information technology security risks - As with all enterprise information systems, our information technology systems could be penetrated by outside parties intent on extracting information, corrupting information, or disrupting business processes. Our systems have in the past been, and likely will in the future be, subject to unauthorized access attempts. Unauthorized access could disrupt our business operations and could result in failures or interruptions in our computer systems and in the loss of assets and could have a material adverse effect on our business, financial condition or results of operations. In addition, breaches of our security measures or the accidental loss, inadvertent disclosure, or unapproved dissemination of proprietary information or sensitive or confidential information about the company, our employees, our vendors, or our customers, could result in litigation and potential liability for us, damage our reputation, or otherwise harm our business, financial condition, or results of operations. |

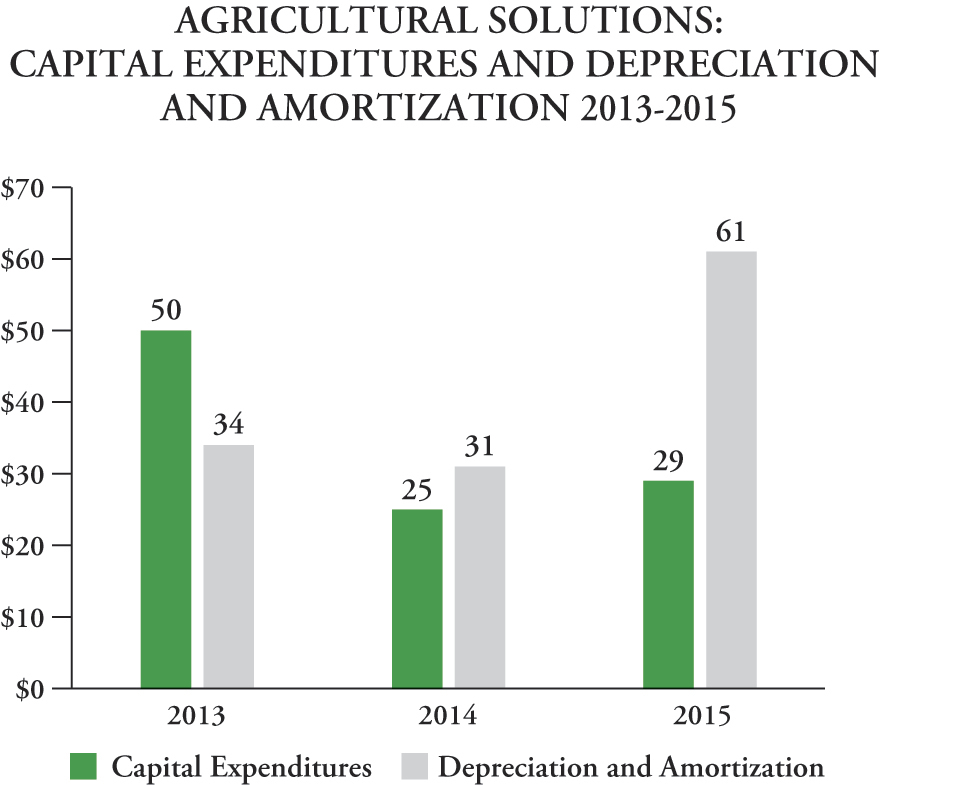

• | Capital-intensive business - With the acquisition of Cheminova, our business is more capital intensive than it has been historically. We rely on cash generated from operations and external financing to fund our growth and ongoing capital needs. Limitations on access to external financing could adversely affect our operating results. Moreover, interest payments, dividends and the expansion of our business or other business opportunities may require significant amounts of capital. We believe that our cash from operations and available borrowings under our revolving credit facility will be sufficient to meet these needs in the foreseeable future. However, if we need external financing, our access to credit markets and pricing of our capital will be dependent upon maintaining sufficient credit ratings from credit rating agencies and the state of the capital markets generally. There can be no assurances that we would be able to obtain equity or debt financing on terms we deem acceptable, and it is possible that the cost of any financings could increase significantly, thereby increasing our expenses and decreasing our net income. If we are unable to generate sufficient cash flow or raise adequate external financing, including as a result of significant disruptions in the global credit markets, we could be forced to restrict our operations and growth opportunities, which could adversely affect our operating results. |

• | We may use our existing revolving credit facility to meet our cash needs, to the extent available. In the event of a default this credit facility or any of our senior notes, we could be required to immediately repay all outstanding borrowings and make cash deposits as collateral for all obligations the facility supports, which we may not be able to do. Any default under any of our credit arrangements could cause a default under many of our other credit agreements and debt instruments. Without waivers from lenders party to those agreements, any such default could have a material adverse effect on our ability to continue to operate. |

• | Litigation and environmental risks - Current reserves relating to our ongoing litigation and environmental liabilities may ultimately prove to be inadequate. |

14

• | Hazardous materials - We manufacture and transport certain materials that are inherently hazardous due to their toxic or volatile nature. While we take precautions to handle and transport these materials in a safe manner, if they are mishandled or released into the environment, they could cause property damage or result in personal injury claims against us. |

• | Environmental Compliance - We are subject to extensive federal, state, local, and foreign environmental and safety laws. regulations, directives, rules and ordinances concerning, among other things, emissions in the air, discharges to land and water, and the generation, handling, treatment, disposal and remediation of hazardous waste and other materials. We may face liability arising out of the normal course of business, including alleged personal injury or property damage due to exposure to chemicals or other hazardous substances at our current or former facilities or chemicals that we manufacture, handle or own. We take our environmental responsibilities very seriously, but there is a risk of environmental impact inherent in our manufacturing operations and transportation of chemicals. Any substantial liability for environmental damage could have a material adverse effect on our financial condition, results of operations and cash flows. |

• | Inability to attract and retain key employees - The inability to recruit and retain key personnel or the unexpected loss of key personnel may adversely affect our operations. In addition, our future success depends in part on our ability to identify and develop talent to succeed senior management and other key members of the organization. |

Technology Risks:

• | Our ability to compete successfully depends in part upon our ability to maintain a superior technological capability and to continue to identify, develop and commercialize new and innovative, high value-added products for existing and future customers. |

• | Failure to continue to make process improvements to reduce costs could impede our competitive position. |

• | Some of our competitors may secure patents on production methods or uses of products that may limit our ability to compete cost-effectively. |

Portfolio Management Risks:

• | We continuously review our portfolio which includes the evaluation of potential business acquisitions that may strategically fit our business and strategic growth initiatives. If we are unable to successfully integrate and develop our acquired businesses, we could fail to achieve anticipated synergies which would include expected cost savings and revenue growth. Failure to achieve these anticipated synergies, could materially and adversely affect our financial results. In addition to strategic acquisitions we evaluate the diversity of our portfolio in light of our objectives and alignment with our growth strategy. In implementing this strategy we may not be successful in separating underperforming or non-strategic assets. The gains or losses on the divestiture of, or lost operating income from, such assets (e.g., divesting) may affect the company’s earnings. Moreover, we may incur asset impairment charges related to acquisitions or divestitures that reduce earnings. |

In particular, an inability to successfully integrate and develop Cheminova as planned could result in our inability to achieve the synergies we have projected and could thereby cause our future results of operations to be materially and adversely worse than expected. We expect to generate synergies as a result of i) improving Cheminova operating cost-efficiencies, ii) changing the mix of Cheminova’s sales from generic, lower margin products to more differentiated and higher margin products, and iii) rationalizing of the distribution channels used by FMC and Cheminova in overlapping European markets. However, there can be no assurances that we will be successful in achieving these planned synergies.

Financial Risks:

• | Deterioration in the global economy and worldwide credit and foreign exchange markets could adversely affect our business. A worsening of global or regional economic conditions or financial markets could adversely affect our customers ability to meet the terms of sale or our suppliers ability to perform all their commitments to us. A slowdown in economic growth in our international markets, particularly Latin American regions, or a deterioration of credit or foreign exchange markets could adversely affect customers, suppliers and our overall business there. Customers in weakened economies may be unable to purchase our products, or it could become more expensive for them to purchase imported products in their local currency, or sell their commodities at prevailing international prices, and we may be unable to collect receivables from such customers. The ongoing economic recession in Brazil has adversely impacted and could continue to adversely impact our business there. |

• | We are an international company and face foreign exchange rate risks in the normal course of our business. We are particularly sensitive to the Brazilian real, the euro, the Argentine peso and the Chinese yuan. To a lesser extent, we are sensitive to the Mexican peso, the British pound sterling and several Asian currencies. Our acquisition of Cheminova has significantly expanded our operations and sales in foreign countries and correspondingly increased our exposure to foreign exchange risks. During 2015, adverse changes in the Brazilian real exchange rate adversely impacted our financial results and continued weakness in the real could continue to adversely impact our financial results. |

15

• | Our future effective tax rates may be materially impacted by numerous items including: a future change in the composition of earnings from foreign and domestic tax jurisdictions, as earnings in foreign jurisdictions are typically taxed at more favorable rates than the United States federal statutory rate; accounting for uncertain tax positions; business combinations; expiration of statute of limitations or settlement of tax audits; changes in valuation allowance; changes in tax law; and the potential decision to repatriate certain future foreign earnings on which United States taxes have not been previously accrued. |

• | We have significant investments in long-lived assets and continually review the carrying value of these assets for recoverability in light of changing market conditions and alternative product sourcing opportunities. |

• | Obligations related to our pension and postretirement plans reflect certain assumptions. To the extent our plans' actual experience differs from these assumptions, our costs and funding obligations could increase or decrease significantly. |

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

ITEM 2. | PROPERTIES |

FMC leases executive offices in Philadelphia, Pennsylvania and operates 32 manufacturing facilities and mines in 19 countries. Our major research and development facilities are in Ewing, New Jersey and Shanghai, China.

We have long-term mineral rights to the Salar del Hombre Muerto lithium reserves in Argentina. Our FMC Lithium division requires the lithium brine that is mined from these reserves, without which other sources of raw materials would have to be obtained.

We believe our facilities are in good operating conditions. The number and location of our owned or leased production properties for continuing operations are:

United States | Latin America & Canada | Western Europe | Asia- Pacific | Total | |||||

FMC Agricultural Solutions | 2 | 1 | 4 | 5 | 12 | ||||

FMC Health and Nutrition | 2 | 1 | 7 | 3 | 13 | ||||

FMC Lithium | 1 | 2 | 1 | 3 | 7 | ||||

Total | 5 | 4 | 12 | 11 | 32 | ||||

ITEM 3. | LEGAL PROCEEDINGS |

Like hundreds of other industrial companies, we have been named as one of many defendants in asbestos-related personal injury litigation. Most of these cases allege personal injury or death resulting from exposure to asbestos in premises of FMC or to asbestos-containing components installed in machinery or equipment manufactured or sold by discontinued operations. The machinery and equipment businesses we owned or operated did not fabricate the asbestos-containing component parts at issue in the litigation, and to this day, neither the U.S. Occupational Safety and Health Administration nor the Environmental Protection Agency has banned the use of these components. Further, the asbestos-containing parts for this machinery and equipment were accessible only at the time of infrequent repair and maintenance. A few jurisdictions have permitted claims to proceed against equipment manufacturers relating to insulation installed by other companies on such machinery and equipment. We believe that, overall, the claims against FMC are without merit.

As of December 31, 2015, there were approximately 8,000 premises and product asbestos claims pending against FMC in several jurisdictions. Since the 1980s, approximately 111,000 asbestos claims against FMC have been discharged, the overwhelming majority of which have been dismissed without any payment to the claimant. Since the 1980s, settlements with claimants have totaled approximately $73.1 million.

We intend to continue managing these asbestos-related cases in accordance with our historical experience. We have established a reserve for this litigation within our discontinued operations and believe that any exposure of a loss in excess of the established reserve cannot be reasonably estimated. Our experience has been that the overall trends in asbestos litigation have changed over time. Over the last several years, we have seen changes in the jurisdictions where claims against FMC are being filed and changes in the mix of products named in the various claims. Because these claim trends have yet to form a predictable pattern, we are presently unable to reasonably estimate our asbestos liability with respect to claims that may be filed in the future.

16

See Note 1 “Principal Accounting Policies and Related Financial Information—Environmental Obligations,” Note 10 “Environmental Obligations” and Note 18 “Guarantees, Commitments and Contingencies” in the notes to our consolidated financial statements included in this Form 10-K, the content of which are incorporated by reference to this Item 3.

In September 2015, EPA Region 3 filed an administrative complaint against the Company, claiming that certain advertising and labeling regarding one of our pesticide products did not comply with the Federal Insecticide, Fungicide and Rodenticide Act (“FIFRA”) and has calculated a proposed penalty in excess of $100,000. We disagree with EPA on whether a violation occurred and, if a violation did occur, the appropriate penalty calculation, and will defend ourselves vigorously. We do not expect that any penalty associated with final judgment or other resolution would be material.

ITEM 4. | MINE SAFETY DISCLOSURES |

Not Applicable.

ITEM 4A. | EXECUTIVE OFFICERS OF THE REGISTRANT |

Information concerning directors, appearing under the caption "III. Board of Directors" in our Proxy Statement to be filed with the SEC in connection with the Annual Meeting of Stockholders scheduled to be held on April 26, 2016 (the "Proxy Statement"), information concerning the Audit Committee, appearing under the caption "IV. Information About the Board of Directors and Corporate Governance-Committees and Independence of Directors-Audit Committee" in the Proxy Statement, information concerning the Code of Ethics, appearing under the caption "IV. Information About the Board of Directors and Corporate Governance—Corporate Governance-Code of Ethics and Business Conduct Policy" in the Proxy Statement, and information about compliance with Section 16(a) of the Securities Exchange Act of 1934 appearing under the caption "VII. Other Matters—Section 16(a) Beneficial Ownership Reporting Compliance" in the Proxy Statement, is incorporated herein by reference in response to this Item 4A.

The executive officers of FMC Corporation, the offices they currently hold, their business experience since at least January 1, 2010 and their ages as of December 31, 2015, are as follows:

Name | Age on 12/31/2015 | Office, year of election and other information | ||

Pierre R. Brondeau | 58 | President, Chief Executive Officer and Chairman of the Board (10-present); President and Chief Executive Officer of Dow Advanced Materials, a specialty materials company (08-09); President and Chief Operating Officer of Rohm and Haas Company, a predecessor of Dow Advanced Materials (07-08); Board Member, T.E. Connectivity Electronics (07– Present), Marathon Oil Company (10-present) | ||

Paul W. Graves | 44 | Executive Vice President and Chief Financial Officer (12-present); Managing Director, Goldman Sachs Group (06-12) | ||

Andrea E. Utecht | 67 | Executive Vice President, General Counsel and Secretary (01-present) | ||

Eric W. Norris | 49 | President, FMC Health and Nutrition (15-present); Vice President, Global Business Director, FMC Lithium (12-14); Global Commercial Director, FMC Lithium (09-12) | ||

Mark A. Douglas | 53 | President, FMC Agricultural Solutions (12-present); President, Industrial Chemicals Group (11-12); Vice President, Global Operations and International Development (10-11); Vice President, President Asia, Dow Advanced Materials (09-10); Board Member, Quaker Chemical (13-present) | ||

Thomas C. Deas, Jr. | 65 | Vice President and Treasurer (01-present) | ||

All officers are elected to hold office for one year or until their successors are elected and qualified. No family relationships exist among any of the above-listed officers, and there are no arrangements or understandings between any of the above-listed officers and any other person pursuant to which they serve as an officer. The above-listed officers have not been involved in any legal proceedings during the past ten years of a nature for which the SEC requires disclosure that are material to an evaluation of the ability or integrity of any such officer.

PART II

ITEM 5. | MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDERS MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

17

FMC common stock of $0.10 par value is traded on the New York Stock Exchange (Symbol: FMC). There were 3,006 registered common stockholders as of December 31, 2015. Presented below are the 2015 and 2014 quarterly summaries of the high and low prices of the FMC common stock.

2015 | 2014 | ||||||||||||||||||||||||||||||

Common stock prices: | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | |||||||||||||||||||||||

High | $ | 64.72 | $ | 61.11 | $ | 52.74 | $ | 43.37 | $ | 83.94 | $ | 79.14 | $ | 71.53 | $ | 59.67 | |||||||||||||||

Low | $ | 55.41 | $ | 51.18 | $ | 32.58 | $ | 33.29 | $ | 67.31 | $ | 69.50 | $ | 56.98 | $ | 51.04 | |||||||||||||||

Our Board of Directors has declared regular quarterly dividends since 2006; however, any future payment of dividends will depend on our financial condition, results of operations, conditions in the financial markets and such other factors as are deemed relevant by our Board of Directors. Total cash dividends of $86.4 million, $78.1 million and $73.6 million were paid in 2015, 2014 and 2013, respectively.

FMC’s annual meeting of stockholders will be held at 2:00 p.m. on Tuesday, April 26, 2016, at The Top of the Tower, 1717 Arch Street, 50th Floor, Philadelphia, Pennsylvania. Notice of the meeting, together with proxy materials, will be mailed approximately 30 days prior to the meeting to stockholders of record as of March 1, 2016.

Transfer Agent and Registrar of Stock:

Wells Fargo Bank, N.A. | ||

Shareowner Services | ||

1110 Centre Pointe Curve, Suite 101 | or | P.O. Box 64874 |

Mendota Heights, MN 55120-4100 | St. Paul, MN 55164-0856 | |

Phone: 1-800-401-1957 | ||

(651-450-4064 local and outside the U.S.) | ||

www.wellsfargo.com/shareownerservices | ||

Stockholder Return Performance Presentation

The graph that follows shall not be deemed to be incorporated by reference into any filing made by FMC under the Securities Act of 1933 or the Securities Exchange Act of 1934.

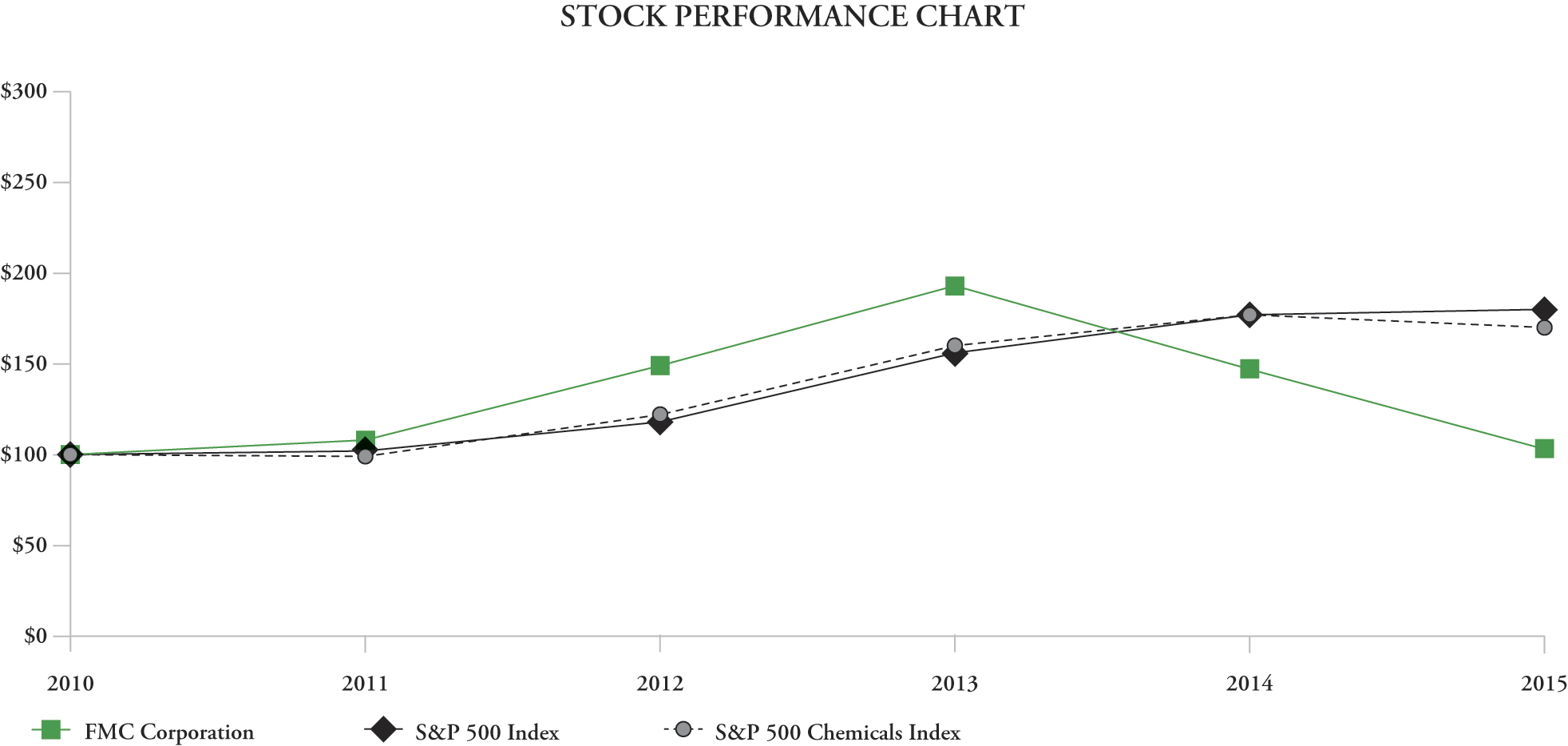

The following Stockholder Performance Graph compares the five-year cumulative total return on FMC’s Common Stock for the period from January 1, 2010 to December 31, 2015 with the S&P 500 Index and the S&P 500 Chemicals Index. The comparison assumes $100 was invested on December 31, 2010, in FMC’s Common Stock and in both of the indices, and the reinvestment of all dividends.

2010 | 2011 | 2012 | 2013 | 2014 | 2015 | ||||||||||||||||||

FMC Corporation | $ | 100.00 | $ | 108.45 | $ | 148.54 | $ | 192.91 | $ | 147.33 | $ | 102.79 | |||||||||||

S&P 500 Index | $ | 100.00 | $ | 102.09 | $ | 118.30 | $ | 156.21 | $ | 177.32 | $ | 179.76 | |||||||||||

S&P 500 Chemicals Index | $ | 100.00 | $ | 98.78 | $ | 121.89 | $ | 160.20 | $ | 177.26 | $ | 169.94 | |||||||||||

18

The following table summarizes information with respect to the purchase of our common stock during the three months ended December 31, 2015:

ISSUER PURCHASES OF EQUITY SECURITIES

Publicly Announced Program (1) | |||||||||||||||||

Period | Total Number of Shares Purchased (2) | Average Price Paid Per Share | Total Number of Shares Purchased | Total Dollar Amount Purchased | Maximum Dollar Value of Shares that May Yet be Purchased | ||||||||||||

October 1-31, 2015 | 14,538 | $ | 34.56 | — | $ | — | $ | 250,000,000 | |||||||||

November 1-30, 2015 | 339 | $ | 37.80 | — | — | 250,000,000 | |||||||||||

December 1-31, 2015 | — | $ | — | — | — | 250,000,000 | |||||||||||

Total | 14,877 | $ | 34.63 | — | $ | — | $ | 250,000,000 | |||||||||

____________________

(1) | This repurchase program does not include a specific timetable or price targets and may be suspended or terminated at any time. Shares may be purchased through open market or privately negotiated transactions at the discretion of management based on its evaluation of market conditions and other factors. |

(2) | Represents reacquired shares for employees exercises in connection with the vesting and forfeiture of awards under our equity compensation plans. |

19

ITEM 6. | SELECTED FINANCIAL DATA |

SELECTED CONSOLIDATED FINANCIAL DATA

The selected consolidated financial and other data presented below for, and as of the end of, each of the years in the five-year period ended December 31, 2015, are derived from our consolidated financial statements. The selected consolidated financial data should be read in conjunction with our consolidated financial statements for the year ended December 31, 2015.

Year Ended December 31, | |||||||||||||||||||

(in Millions, except per share data and ratios) | 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||

Income Statement Data: | |||||||||||||||||||

Revenue | $ | 3,276.5 | $ | 3,258.7 | $ | 3,130.7 | $ | 2,677.6 | $ | 2,343.6 | |||||||||

Income (loss) from continuing operations before equity in (earnings) loss of affiliates, interest income and expense and income taxes | (50.2 | ) | 414.8 | 538.7 | 487.7 | 447.7 | |||||||||||||

Income (loss) from continuing operations before income taxes | (130.5 | ) | 363.8 | 503.2 | 453.5 | 419.1 | |||||||||||||

Income (loss) from continuing operations | (177.9 | ) | 307.6 | 371.6 | 345.8 | 311.1 | |||||||||||||

Discontinued operations, net of income taxes (1) | 676.4 | 14.5 | (63.6 | ) | 89.9 | 71.1 | |||||||||||||

Net income | 498.5 | 322.1 | 308.0 | 435.7 | 382.2 | ||||||||||||||

Less: Net income attributable to noncontrolling interest | 9.5 | 14.6 | 14.1 | 19.5 | 16.3 | ||||||||||||||

Net income attributable to FMC stockholders | $ | 489.0 | $ | 307.5 | $ | 293.9 | $ | 416.2 | $ | 365.9 | |||||||||

Amounts attributable to FMC stockholders: | |||||||||||||||||||

Continuing operations, net of income taxes | (187.4 | ) | 298.2 | 365.1 | 341.3 | 308.9 | |||||||||||||

Discontinued operations, net of income taxes | 676.4 | 9.3 | (71.2 | ) | 74.9 | 57.0 | |||||||||||||

Net income | $ | 489.0 | $ | 307.5 | $ | 293.9 | $ | 416.2 | $ | 365.9 | |||||||||

Basic earnings (loss) per common share attributable to FMC stockholders: | |||||||||||||||||||

Continuing operations | $ | (1.40 | ) | 2.23 | 2.69 | 2.47 | 2.16 | ||||||||||||

Discontinued operations | 5.06 | 0.07 | (0.53 | ) | 0.54 | 0.41 | |||||||||||||

Net income | $ | 3.66 | 2.30 | 2.16 | 3.01 | 2.57 | |||||||||||||

Diluted earnings (loss) per common share attributable to FMC stockholders: | |||||||||||||||||||

Continuing operations | $ | (1.40 | ) | 2.22 | 2.68 | 2.46 | 2.16 | ||||||||||||

Discontinued operations | 5.06 | 0.07 | (0.52 | ) | 0.54 | 0.39 | |||||||||||||

Net income | $ | 3.66 | 2.29 | 2.16 | 3.00 | 2.55 | |||||||||||||

Balance Sheet Data: | |||||||||||||||||||

Total assets | $ | 6,325.9 | $ | 5,326.0 | $ | 5,224.6 | $ | 4,366.2 | $ | 3,734.4 | |||||||||

Long-term debt | 2,037.8 | 1,140.9 | 1,178.2 | 906.8 | 789.5 | ||||||||||||||

Other Data: | |||||||||||||||||||

Ratio of earnings (loss) to fixed charges (2) | (0.4)X | 6.3x | 11.2x | 10.8x | 10.7x | ||||||||||||||

Cash dividends declared per share | $ | 0.660 | $ | 0.600 | $ | 0.540 | $ | 0.405 | $ | 0.300 | |||||||||

____________________

(1) | Discontinued operations, net of income taxes includes our discontinued FMC Peroxygens and Alkali businesses and other historical discontinued gains and losses related to adjustments to our estimates of our retained liabilities for environmental exposures, general liability, workers’ compensation, postretirement benefit obligations, legal defense, property maintenance and other costs, losses for the settlement of litigation and gains related to property sales. Amounts in 2015 include the divestiture gain associated with the Alkali sale while 2014 and 2013 included charges associated with the sale of the Peroxygens business. |

(2) | In calculating this ratio, earnings consist of income (loss) from continuing operations before income taxes plus interest expense, net of amortization expense related to debt discounts, fees and expenses, amortization of capitalized interest, interest included in rental expenses (assumed to be one-third of rent) and Equity in (earnings) loss of affiliates. Fixed charges consist of interest expense, amortization of debt discounts, fees and expenses, interest capitalized as part of fixed assets and interest included in rental expenses. |

20

FORWARD-LOOKING INFORMATION

Statement under the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995: We and our representatives may from time to time make written or oral statements that are “forward-looking” and provide other than historical information, including statements contained in Management’s Discussion and Analysis of Financial Condition and Results of Operations within, in our other filings with the SEC, or in reports to our stockholders.

In some cases, we have identified forward-looking statements by such words or phrases as “will likely result,” “is confident that,” “expect,” “expects,” “should,” “could,” “may,” “will continue to,” “believe,” “believes,” “anticipates,” “predicts,” “forecasts,” “estimates,” “projects,” “potential,” “intends” or similar expressions identifying “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including the negative of those words and phrases. Such forward-looking statements are based on our current views and assumptions regarding future events, future business conditions and the outlook for the company based on currently available information. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any results, levels of activity, performance or achievements expressed or implied by any forward-looking statement. These factors include, among other things, the risk factors listed in Item 1A of this Form 10-K. We wish to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made.

21

ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Overview

We are a diversified chemical company serving agricultural, consumer and industrial markets globally with innovative solutions, applications and market-leading products. We operate in three distinct business segments: FMC Agricultural Solutions, FMC Health and Nutrition and FMC Lithium. Our FMC Agricultural Solutions segment develops, markets and sells all three major classes of crop protection chemicals – insecticides, herbicides and fungicides. These products are used in agriculture to enhance crop yield and quality by controlling a broad spectrum of insects, weeds and disease, as well as in non-agricultural markets for pest control. The FMC Health and Nutrition segment focuses on nutritional ingredients, health excipients, and functional health ingredients. Nutritional ingredients are used to enhance texture, color, structure and physical stability. Health excipients are used for binding, encapsulation and disintegrant applications. Functional health ingredients are used as active ingredients in nutraceutical and pharmaceutical markets. Our FMC Lithium segment manufactures lithium for use in a wide range of lithium products, which are used primarily in energy storage, specialty polymers and chemical synthesis application.

2015 Highlights

The following are the more significant developments in our businesses during the year ended December 31, 2015:

• | Revenue of $3,276.5 million in 2015 increased $17.8 million or one percent versus last year. The increase in revenue was attributable to FMC Agricultural Solutions as a result of additional revenue from the acquisition of Cheminova. This was offset by significant unfavorable currency impacts, primarily in our Agricultural Solutions segment within Brazil. A more detailed review of revenues by segment is included under the section entitled “Results of Operations”. On a regional basis, sales in Latin America decreased by18 percent, sales in North America were relatively flat, sales in Asia were up 13 percent and sales in Europe, Middle East and Africa (EMEA) increased by 29 percent. |

• | Our gross margin, excluding acquisition-related charges, of $1,133.2 million decreased approximately $82 million or approximately seven percent versus last year. Gross margin as a percent of revenue is approximately 34.5 percent versus 37.3 percent in 2014. The reduction in gross margin was due to lower volumes in Brazil within FMC Agricultural Solutions and unfavorable currency impact and product mix. The gross margin percentage decline was impacted by the same factors. |

• | Selling, general and administrative expenses increased 25 percent from $589.8 million to $737.9 million primarily related to acquisition related charges. Selling, general and administrative expenses, excluding non-operating pension and postretirement charges and acquisition-related charges, of $470.1 million increased $22.6 million or approximately five percent. The increased was driven primarily by the addition of the Cheminova acquisition. Non-operating pension and postretirement charges and acquisition-related charges are presented in our Adjusted Earnings Non-GAAP financial measurement below under the section titled “Results of Operations”. |

• | Research and Development expenses of $143.7 million increased $17.4 million or 13.8 percent. |

• | Adjusted earnings after-tax from continuing operations attributable to FMC stockholders of $332.6 million decreased approximately $94 million or 22 percent due to lower results in the FMC Agricultural Solutions primarily within Brazil. See the disclosure of our Adjusted Earnings Non-GAAP financial measurement below under the section titled “Results of Operations”. |

• | During 2015, we incurred significant restructuring and other charges. The increase was primarily the result of charges associated with the integration of Cheminova as well as charges within Health and Nutrition associated with the mothballing of Seal Sands facility in the UK. Charges associated with the integration of Cheminova also included the loss on sale of $64.5 million associated with the sale of our generic crop protection business in Brazil. |

Other 2015 Highlights

During 2015, we closed on two significant transactions - the divestiture of our Alkali Chemicals division and the acquisition of Cheminova. This marked the completion of our transformation to a technology-driven specialty company with leading market positions across agriculture, nutrition, pharmaceutical and specialty lithium applications.

In Agricultural Solutions, the acquisition of Cheminova strengthened our technology pipeline, brought greater regional balance, broadened our market access and expanded our portfolio. The acquisition and integration of Cheminova combined with the actions we have taken to restructure our Agricultural Solutions operations in Brazil have positioned FMC to better address current market conditions.

22

In Health and Nutrition, we focused on driving higher margins by capturing high-value commercial opportunities across our existing portfolio and by the implementation of Manufacturing Excellence programs and process technology improvements. And in Lithium, we continued to execute on our strategy of growing our differentiated, downstream specialty business to take advantage of favorable end market demand.

Finally, 2015 was also a year marked by significant foreign exchange volatility which impacted our results negatively as well as difficult conditions across the global agriculture market. To address this, we took decisive actions throughout the year to address these challenges which included accelerating the integration of Cheminova, restructuring our Agricultural Solutions business in Brazil, exercising discipline on pricing and aggressively controlling costs across the Company.

2016 Outlook

We expect to deliver earnings growth in all businesses in 2016, and will continue to position FMC firmly on the path of growth by leveraging the company’s unique business model that has defined our success. We remain a technology-driven company with low-cost asset light operations, a unique business research and development model that balances short-and mid-term development with long-term innovation, and global scale with strong regional expertise to support local customers.

Please see segment discussions under the section entitled “Results of Operations” for 2016 outlook for each segment. On a consolidated basis we expect our 2016 adjusted earnings per share to be between $2.50 and $2.80.

23

Results of Operations—2015, 2014 and 2013

Overview

The following presents a reconciliation of our segment operating profit to the net income attributable to FMC stockholders as seen through the eyes of our management. For management purposes, we report the operating performance of each of our business segments based on earnings before interest and income taxes excluding corporate expenses, other income (expense), net and corporate special income/(charges).

SEGMENT RESULTS RECONCILIATION | |||||||||||

(in Millions) | Year Ended December 31, | ||||||||||

2015 | 2014 | 2013 | |||||||||

Revenue | |||||||||||

FMC Agricultural Solutions | $ | 2,252.9 | $ | 2,173.8 | $ | 2,145.7 | |||||

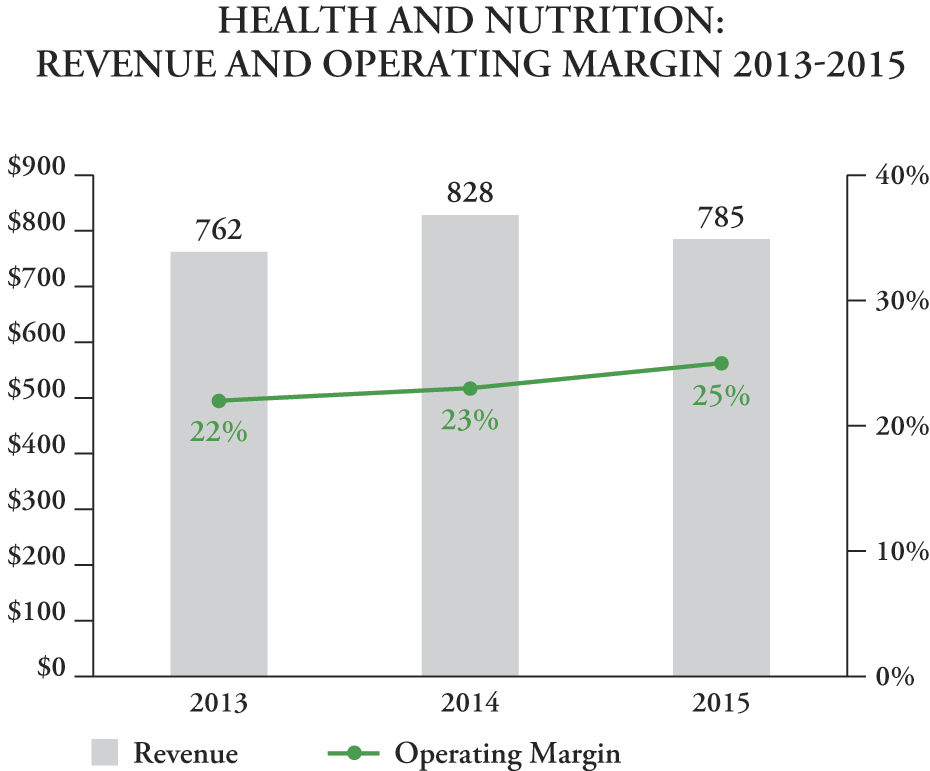

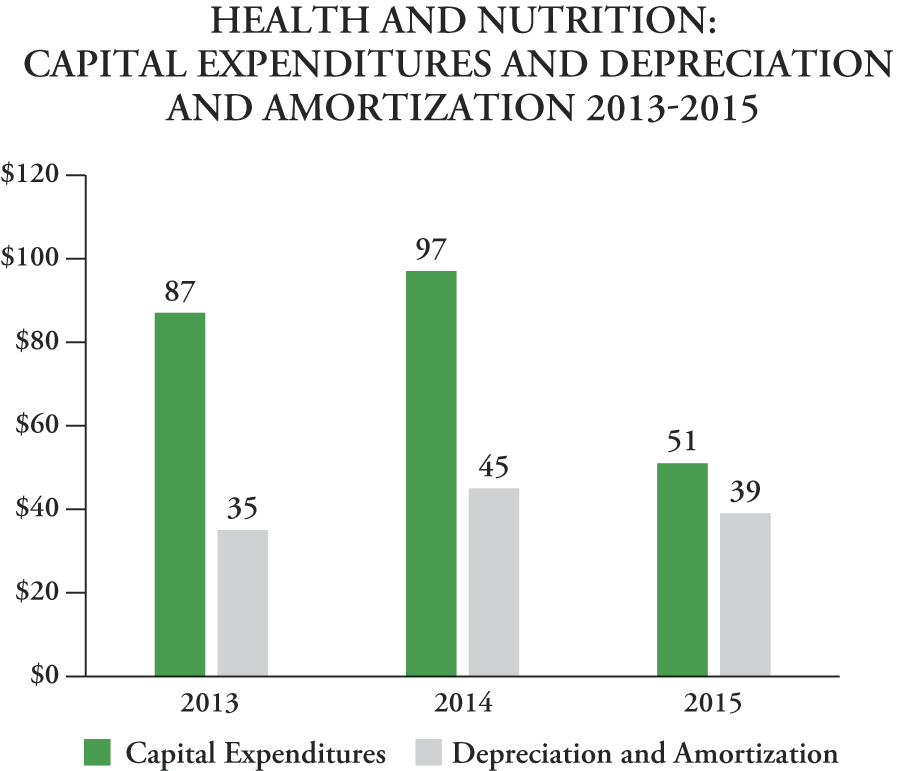

FMC Health and Nutrition | 785.5 | 828.2 | 762.0 | ||||||||

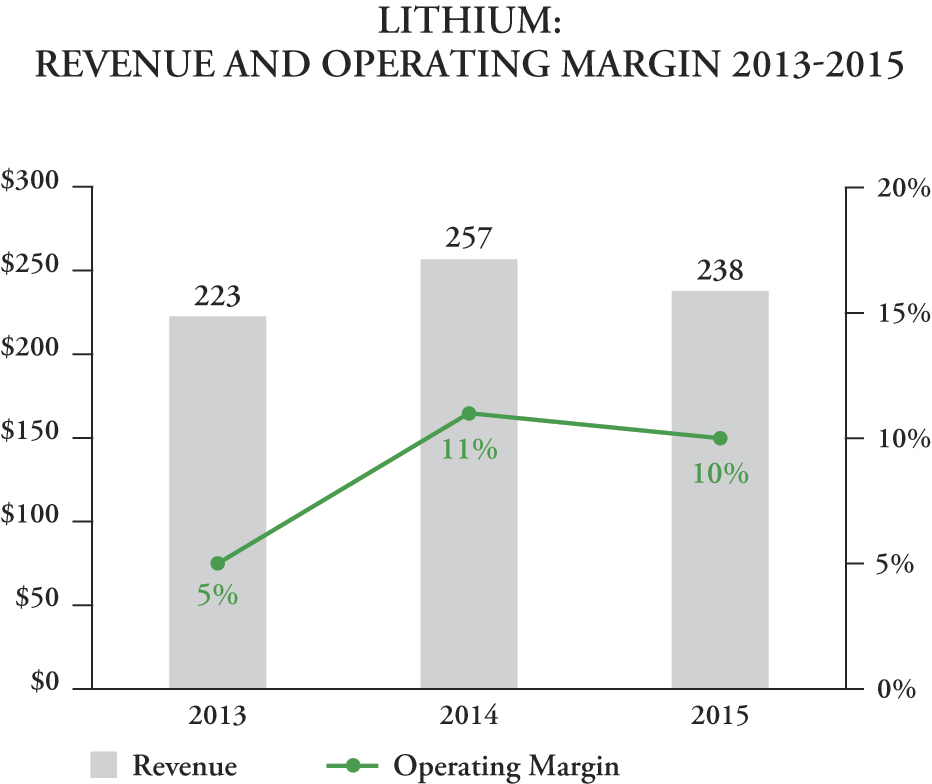

FMC Lithium | 238.1 | 256.7 | 223.0 | ||||||||

Total | $ | 3,276.5 | $ | 3,258.7 | $ | 3,130.7 | |||||

Income (loss) from continuing operations before income taxes | |||||||||||

FMC Agricultural Solutions | $ | 363.9 | $ | 497.8 | $ | 539.0 | |||||

FMC Health and Nutrition | 194.7 | 187.9 | 169.5 | ||||||||

FMC Lithium | 23.0 | 27.2 | 12.0 | ||||||||

Segment operating profit | $ | 581.6 | $ | 712.9 | $ | 720.5 | |||||

Corporate and other | (62.4 | ) | (71.4 | ) | (82.4 | ) | |||||

Operating profit before the items listed below | 519.2 | 641.5 | 638.1 | ||||||||

Interest expense, net | (80.1 | ) | (51.2 | ) | (36.3 | ) | |||||

Corporate special (charges) income: | |||||||||||

Restructuring and other (charges) income (1) | (244.0 | ) | (56.4 | ) | (50.5 | ) | |||||

Non-operating pension and postretirement charges (2) | (35.3 | ) | (10.5 | ) | (38.1 | ) | |||||

Business separation costs (3) | — | (23.6 | ) | — | |||||||

Acquisition-related charges (4) | (290.3 | ) | (136.0 | ) | (10.0 | ) | |||||

Provision for income taxes | (47.4 | ) | (56.2 | ) | (131.6 | ) | |||||

Discontinued operations, net of income taxes | 676.4 | 14.5 | (63.6 | ) | |||||||

Net income attributable to noncontrolling interests | (9.5 | ) | (14.6 | ) | (14.1 | ) | |||||

Net income attributable to FMC stockholders | $ | 489.0 | $ | 307.5 | $ | 293.9 | |||||

____________________

(1) | See Note 7 to the consolidated financial statements included within this Form 10-K for details of restructuring and other (charges) income by segment: |

Years Ended December 31 | ||||||||||||

(in Millions) | 2015 | 2014 | 2013 | |||||||||

FMC Agricultural Solutions | $ | (123.7 | ) | $ | 4.5 | $ | (32.6 | ) | ||||

FMC Health and Nutrition | (93.8 | ) | (14.1 | ) | (1.0 | ) | ||||||

FMC Lithium | (2.7 | ) | — | (9.0 | ) | |||||||

Corporate | (23.8 | ) | (46.8 | ) | (7.9 | ) | ||||||

Restructuring and other (charges) income | $ | (244.0 | ) | $ | (56.4 | ) | $ | (50.5 | ) | |||

(2)Our non-operating pension and postretirement costs are defined as those costs related to interest, expected return on plan assets,

amortized actuarial gains and losses and the impacts of any plan curtailments or settlements. These costs are primarily related

to changes in pension plan assets and liabilities which are tied to financial market performance and we consider these costs to be outside our operational performance. We exclude these non-operating pension and postretirement costs from our segments as we believe that removing them provides a better understanding of the underlying profitability of our businesses, provides increased transparency and clarity in the performance of our retirement plans and enhances period-over-period comparability. We continue to include the service cost and amortization of prior service cost in our operating segments noted above. We believe these elements reflect the current year operating costs to our businesses for the employment benefits provided to active employees.

(3) Charges are associated with the previously planned separation of our FMC Corporation into two independent public companies. On

24

September 8, 2014, we announced that we would no longer proceed with the planned separation. At that time we announced the acquisition of Cheminova. See Note 3 within these consolidated financial statements included within this Form 10-K for more information. These charges are included within "Business separation costs" on our consolidated income statement. These costs were primarily related to professional fees associated with separation activities within the finance and legal functions through September 8, 2014.

(4) Charges related to the expensing of the inventory fair value step-up resulting from the application of acquisition purchase accounting,