Vanguard Total Stock Market Index Fund

Prospectus

Institutional Select Shares

Vanguard Total Stock Market Index Fund Institutional Select Shares (VSTSX)

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

% |

|

12b-1 Distribution Fee |

|

|

Other Expenses |

% |

|

Total Annual Fund Operating Expenses |

% |

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

1

2

|

|

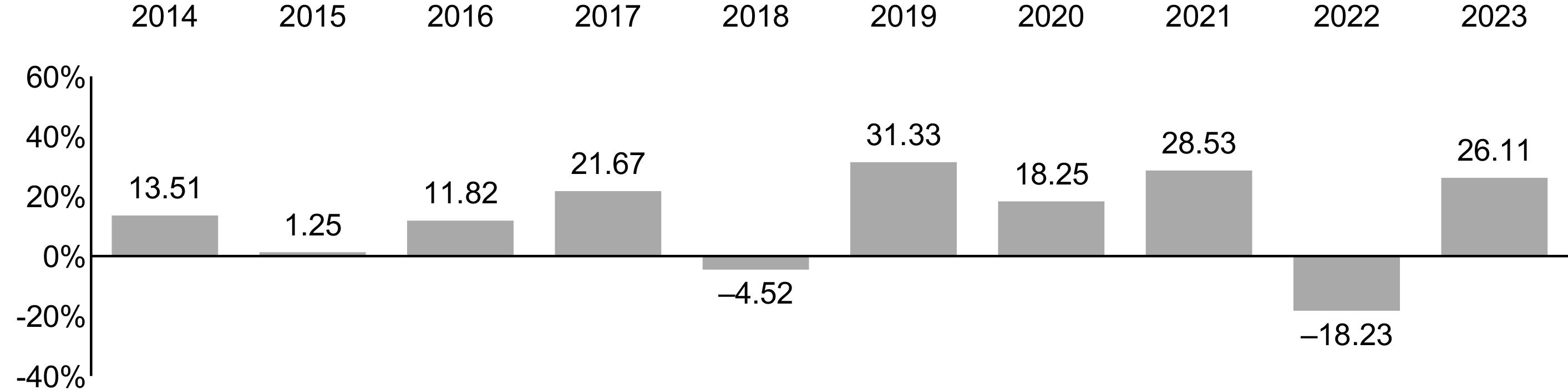

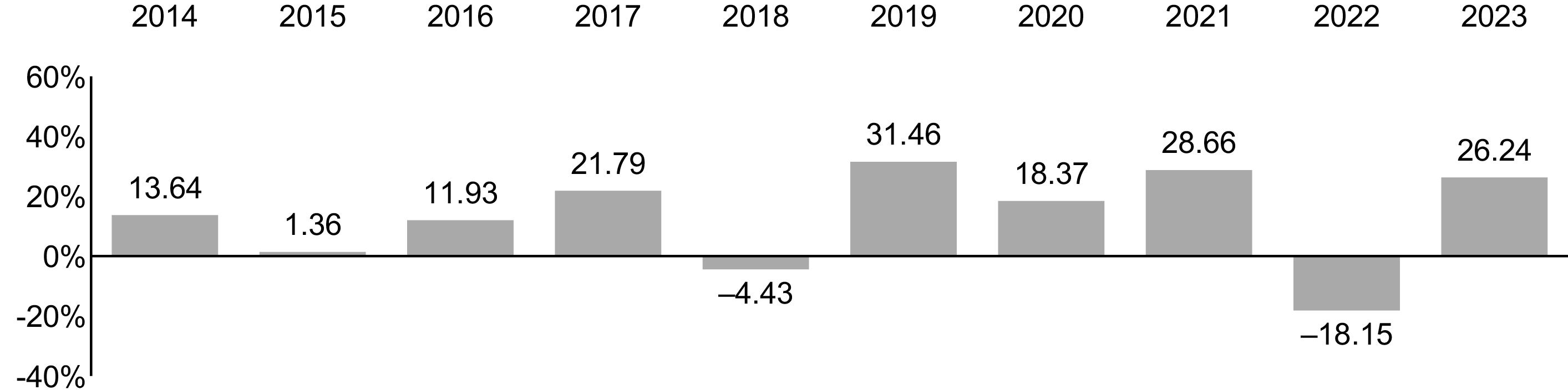

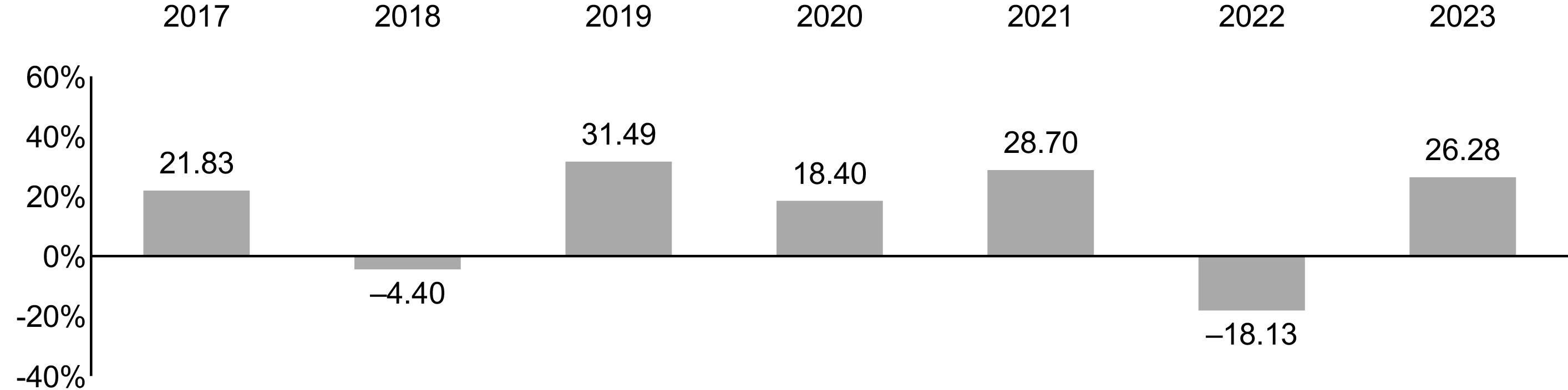

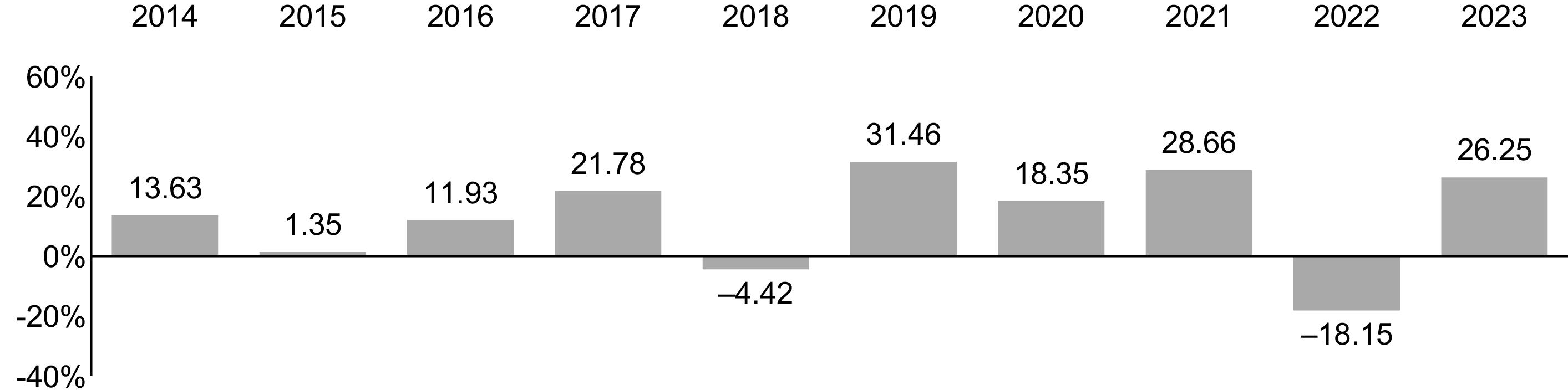

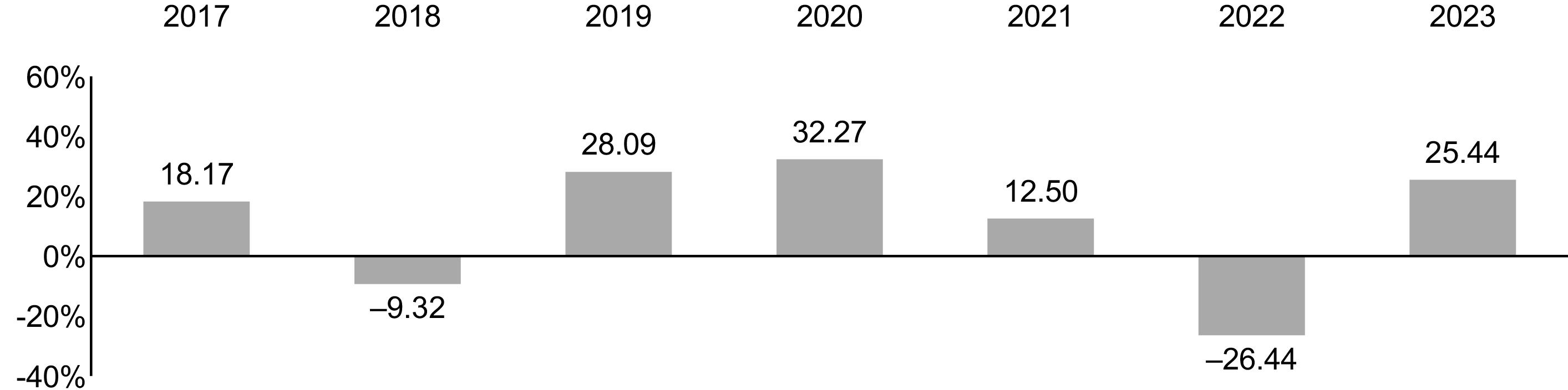

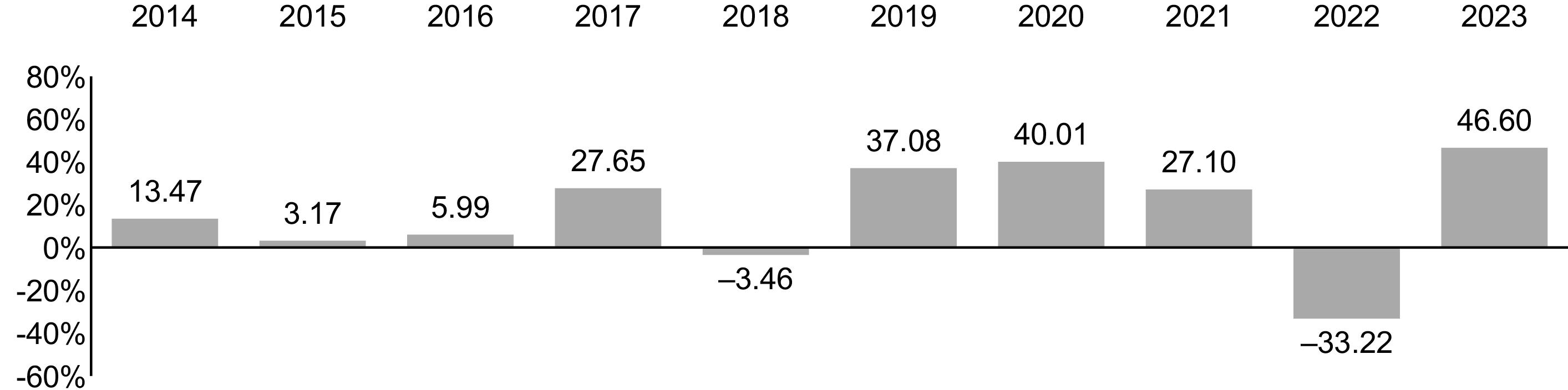

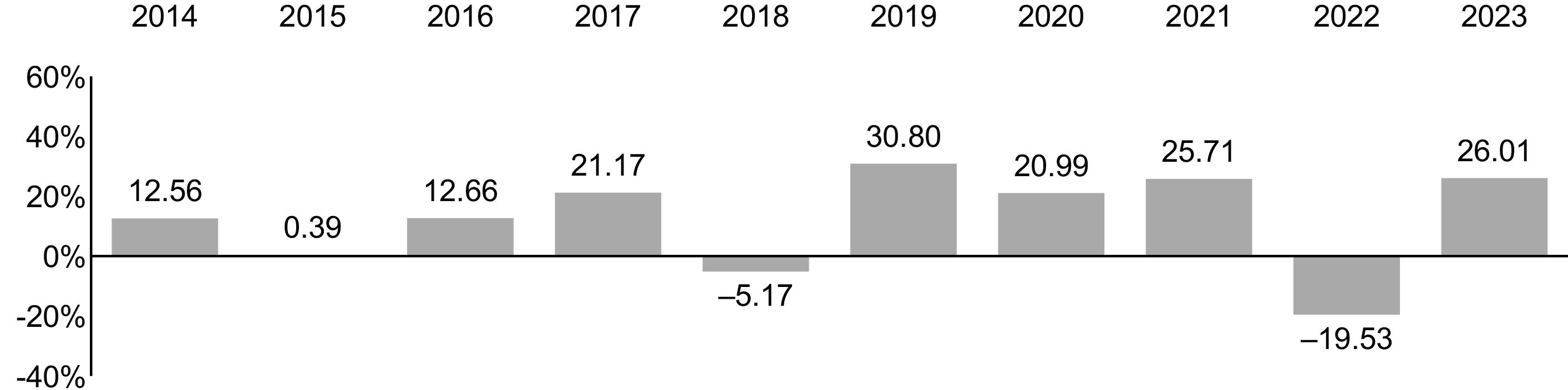

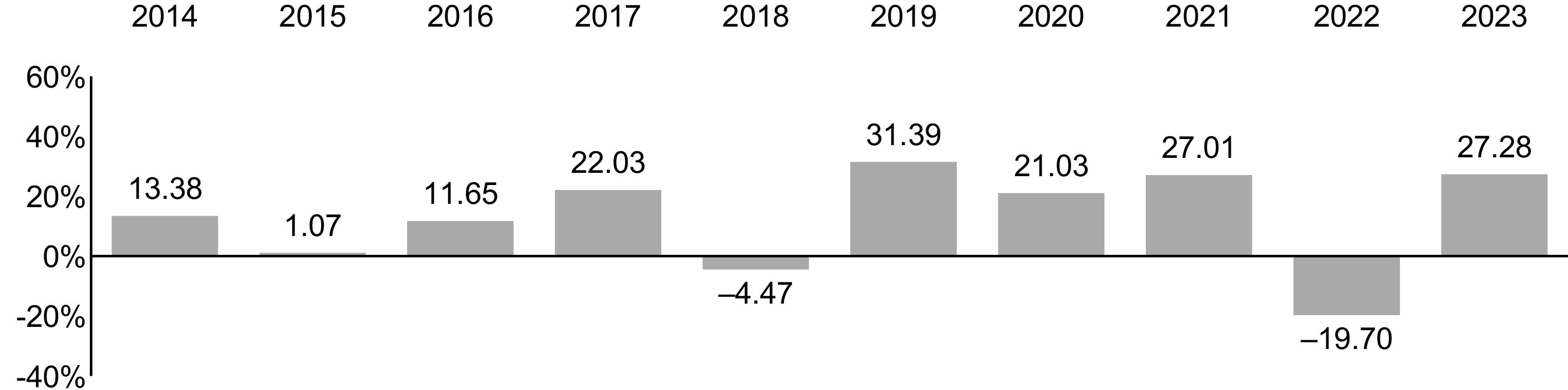

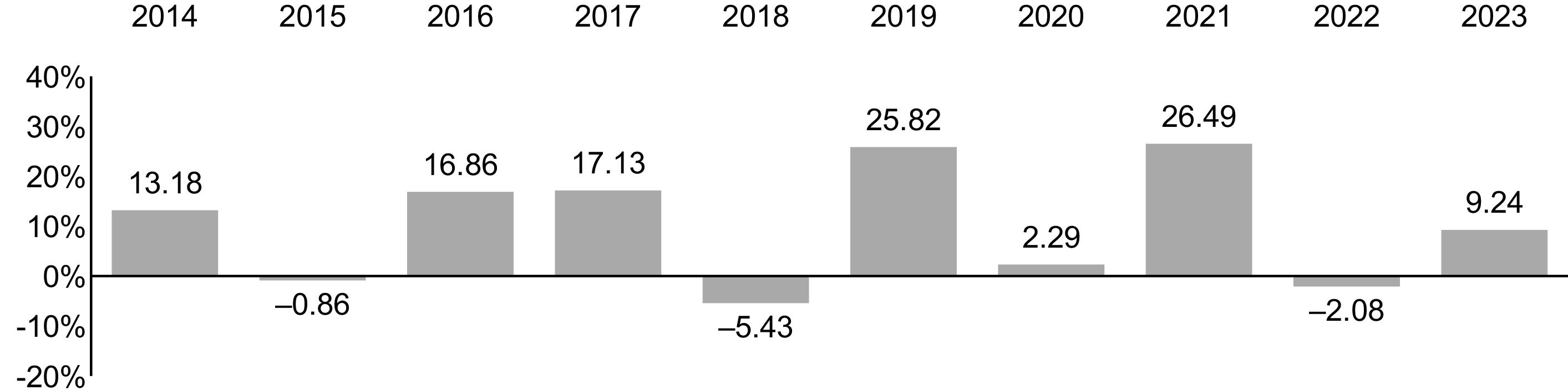

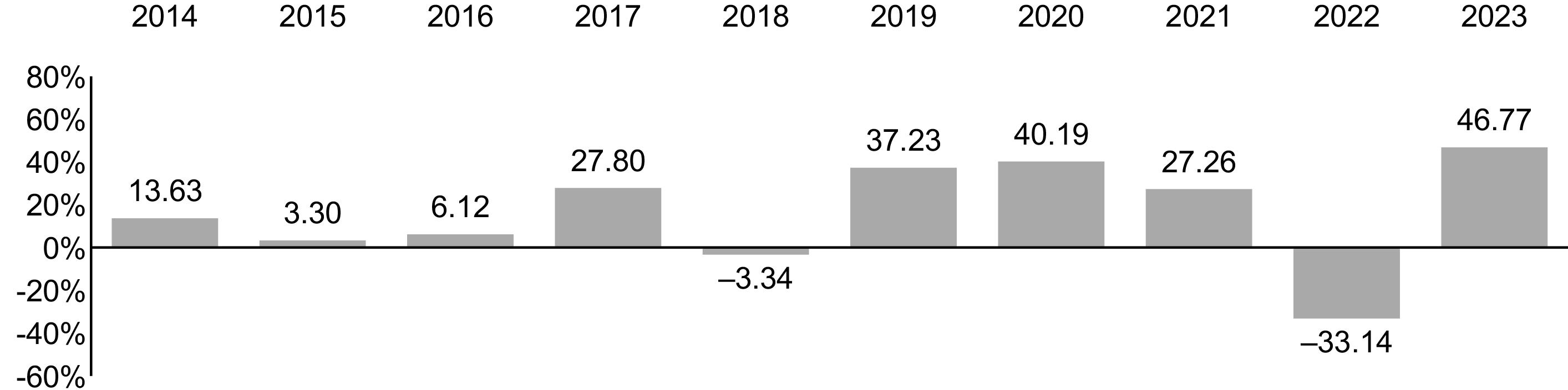

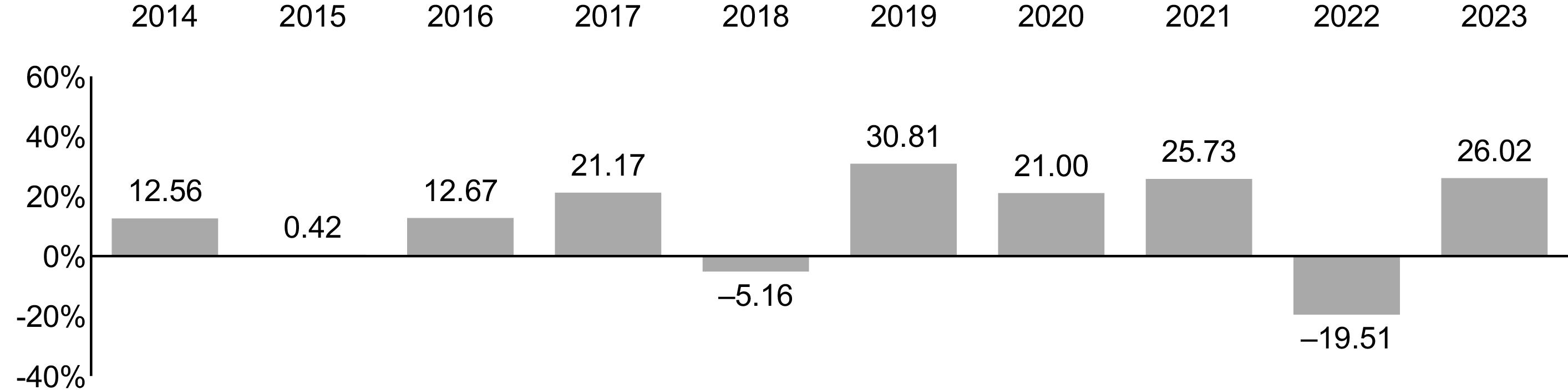

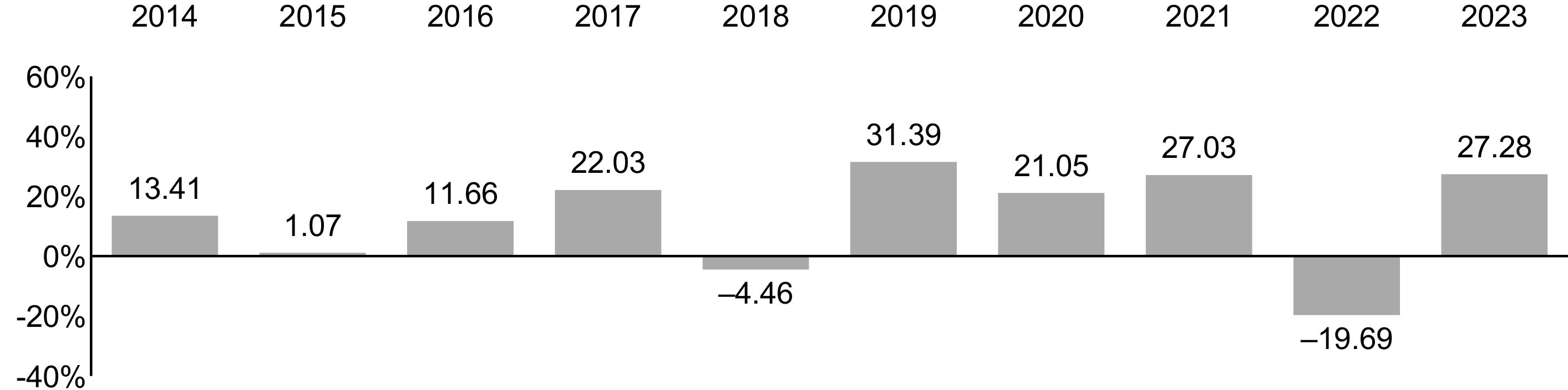

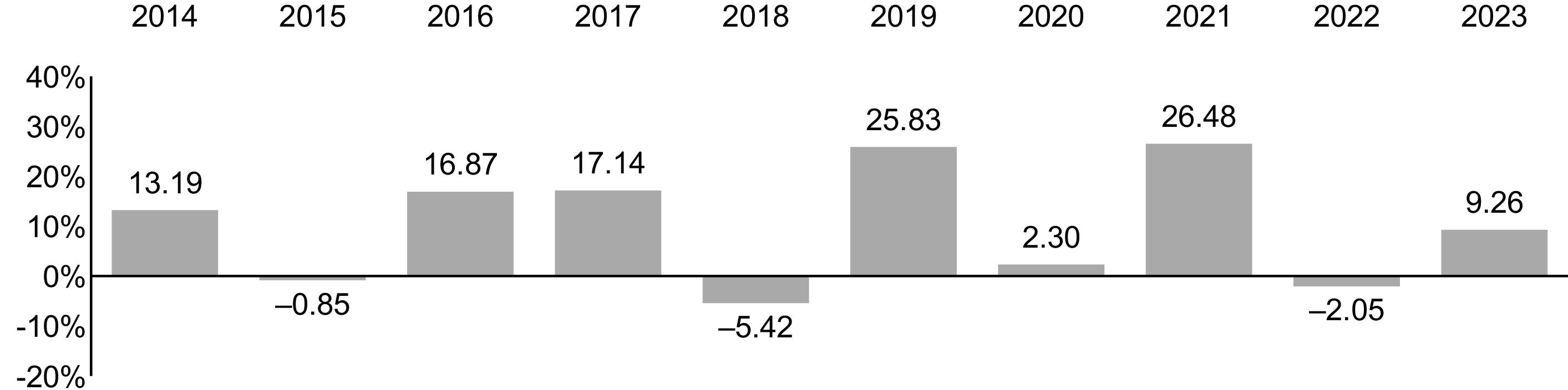

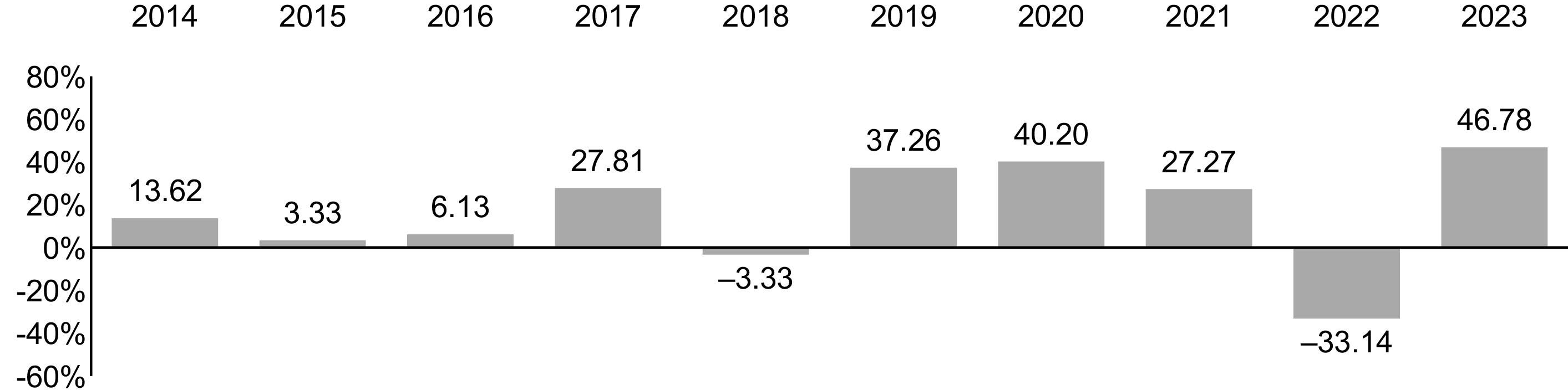

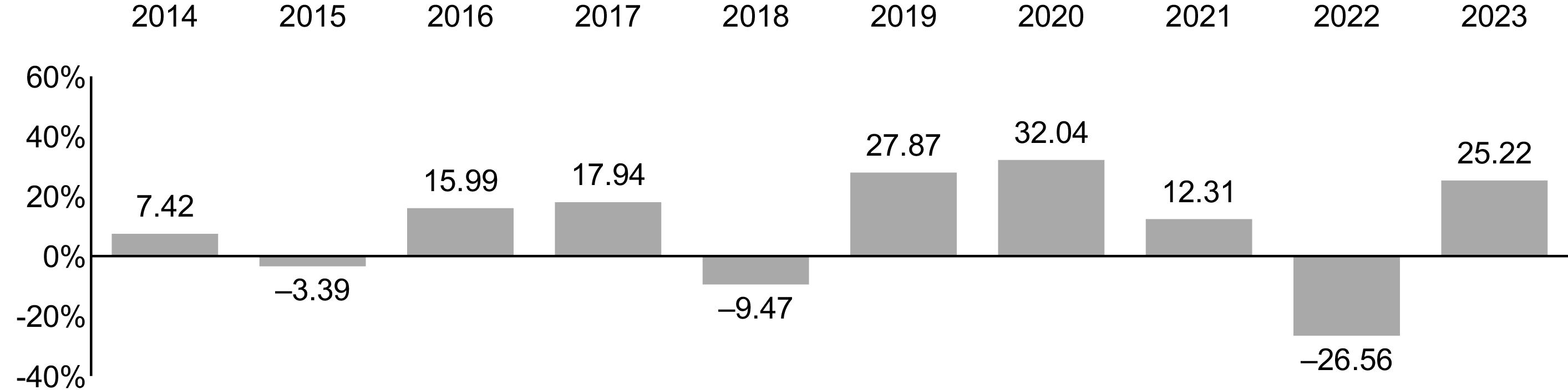

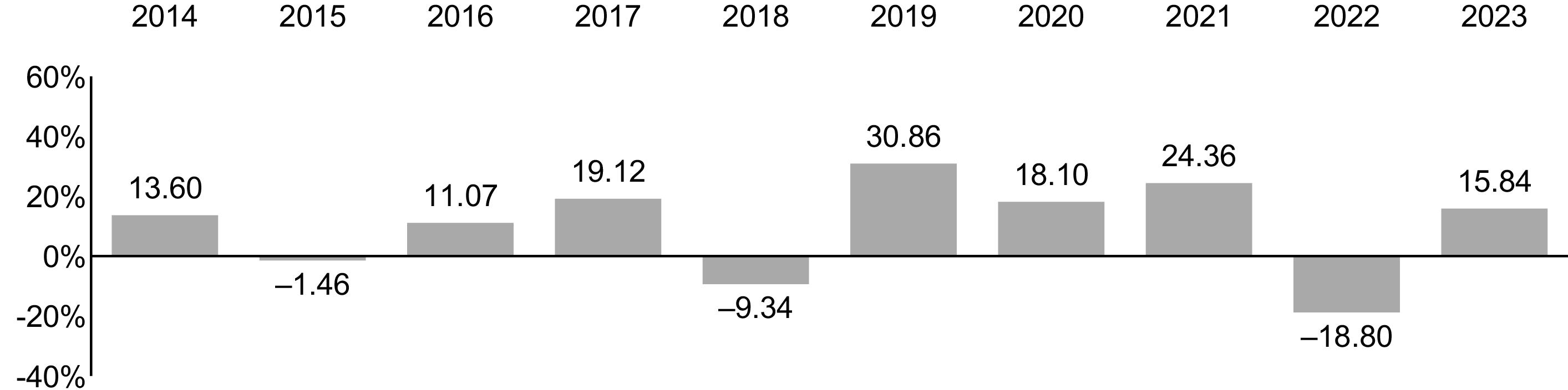

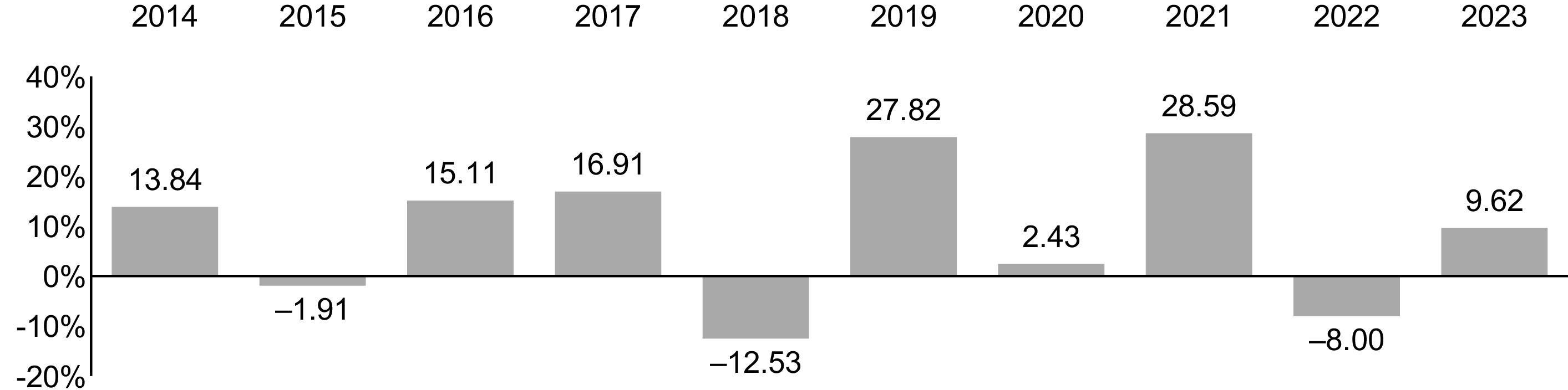

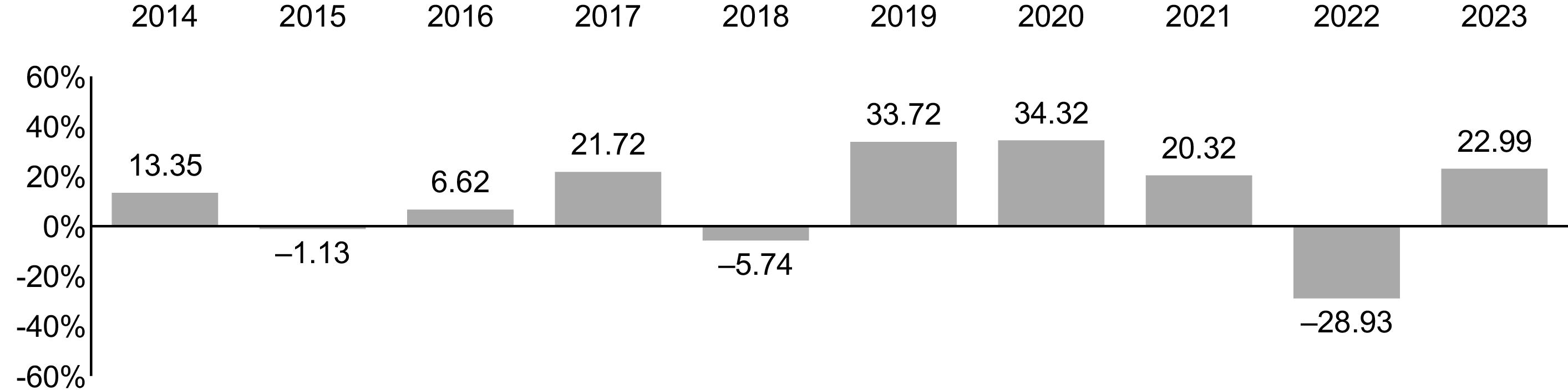

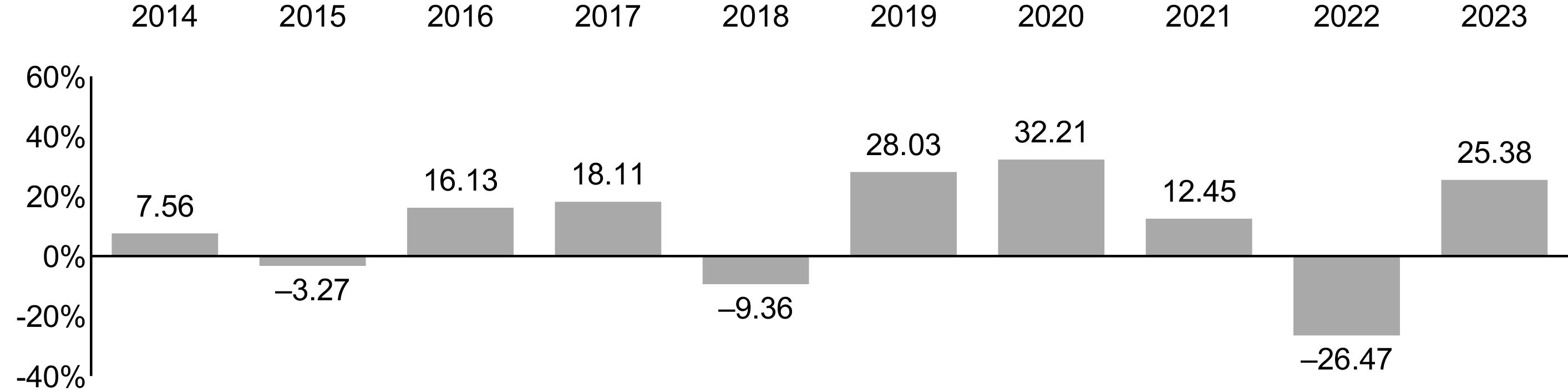

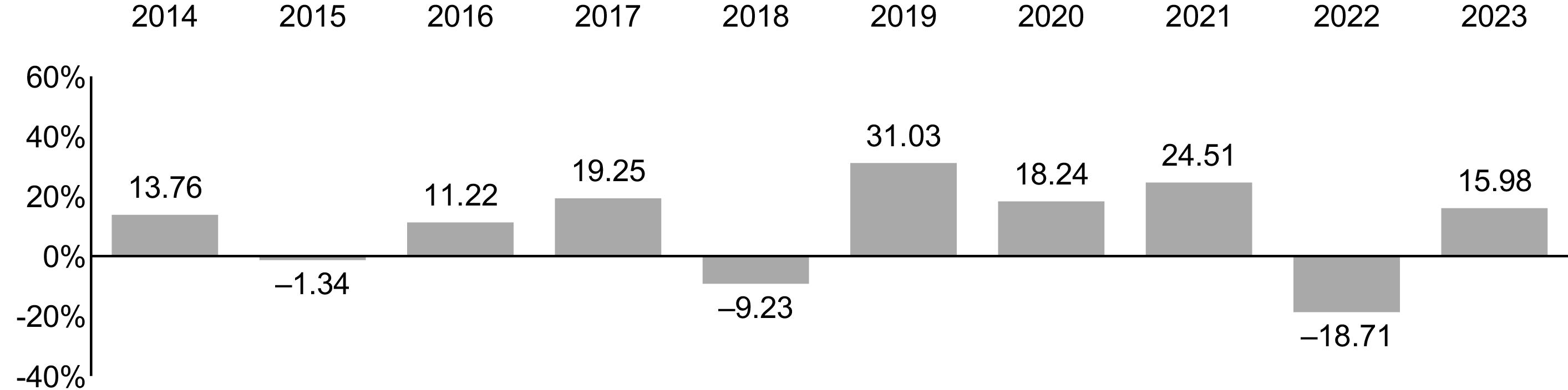

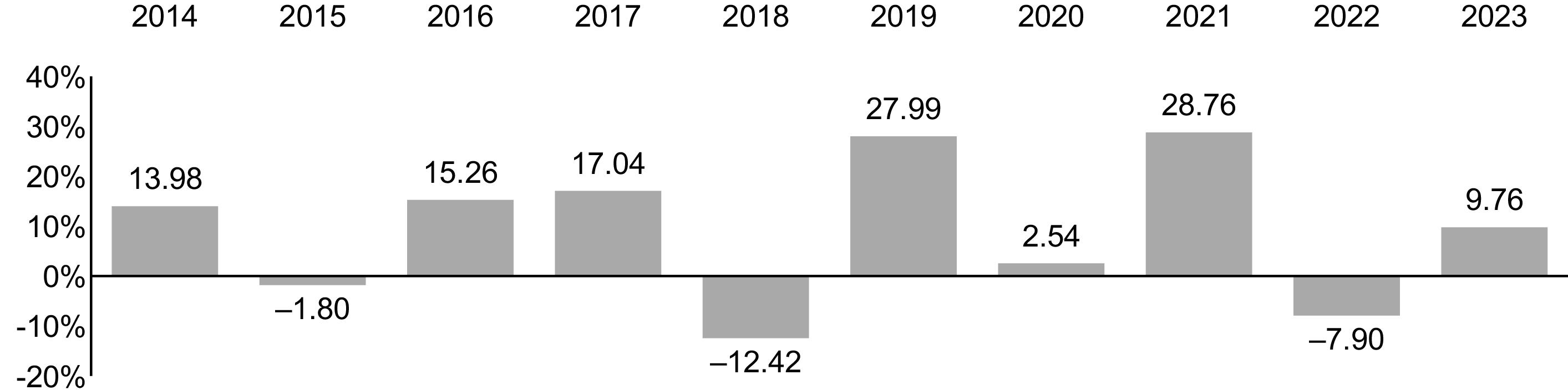

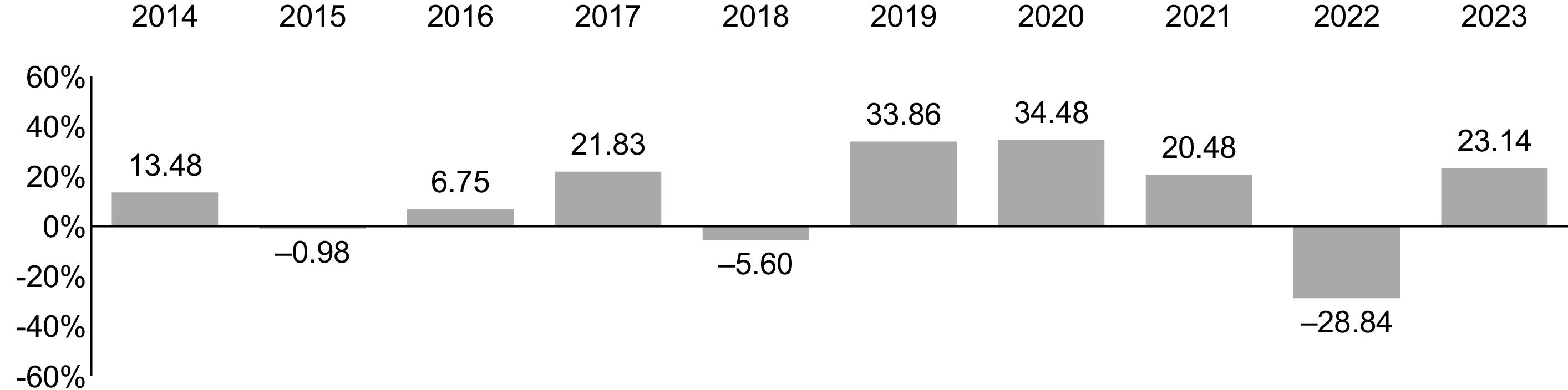

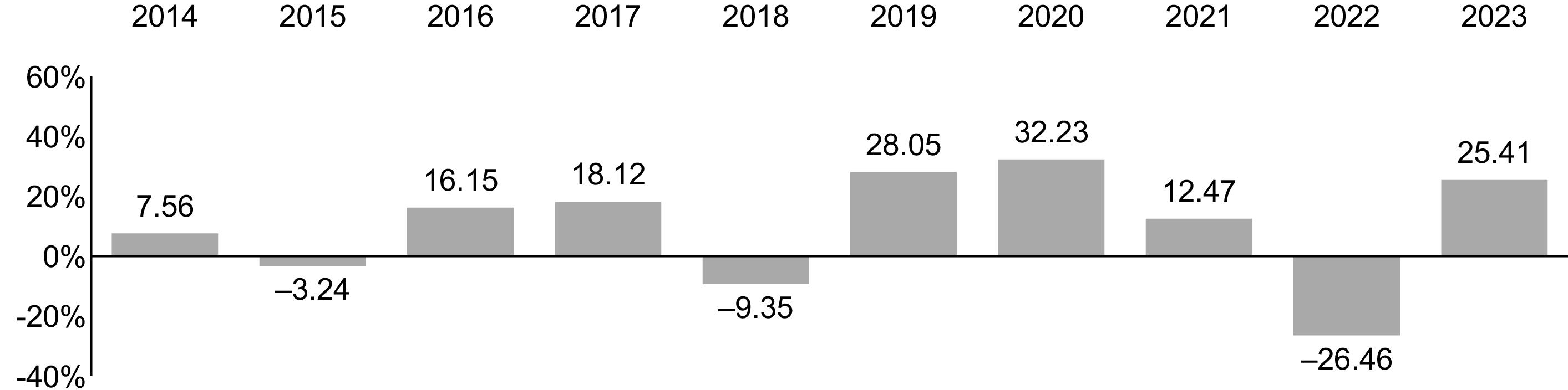

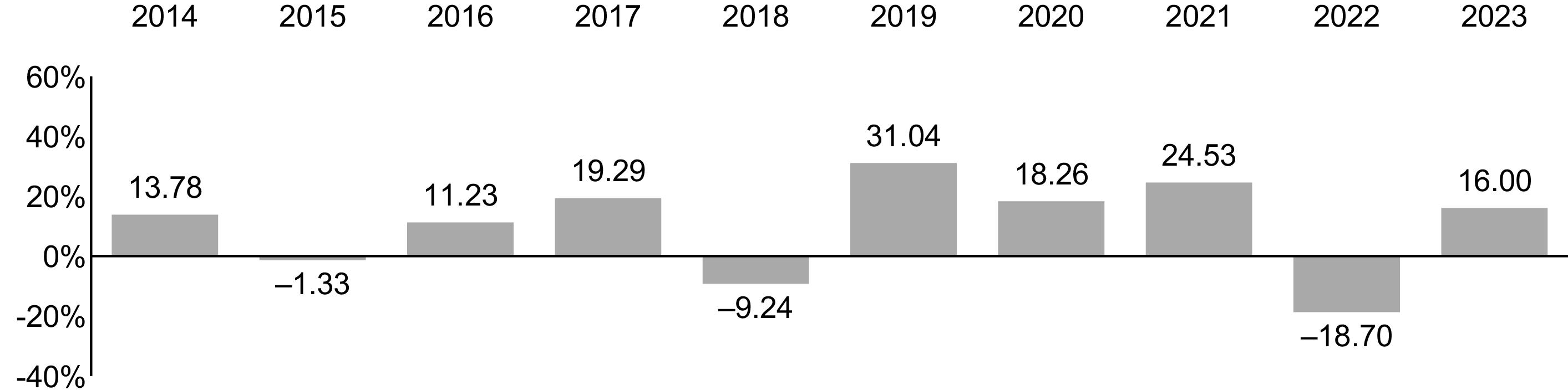

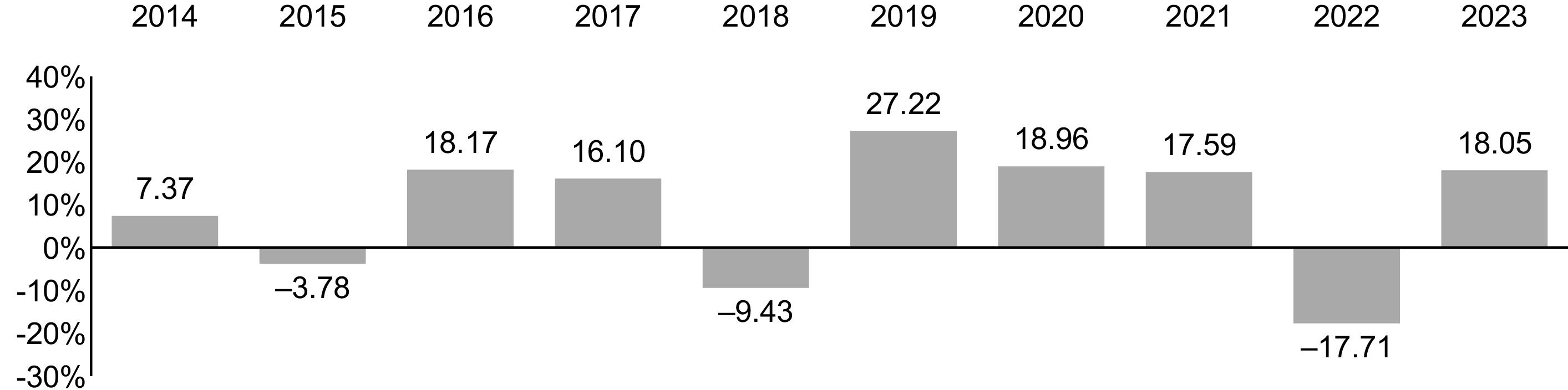

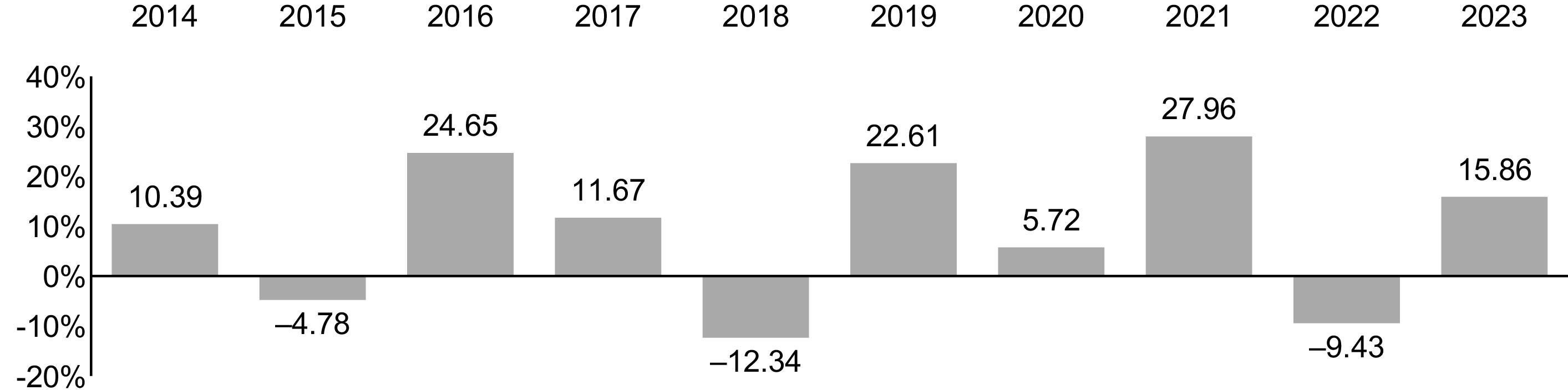

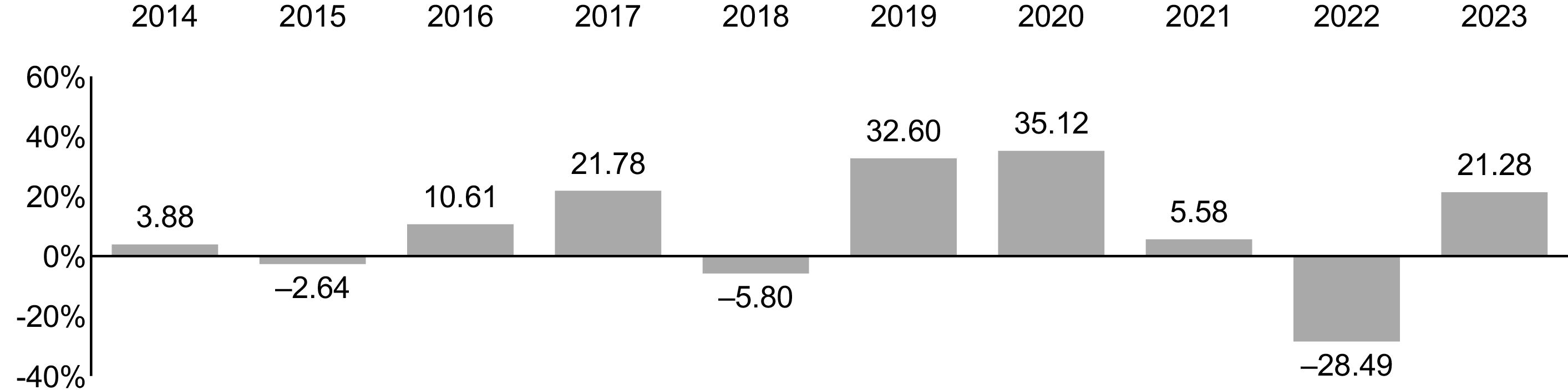

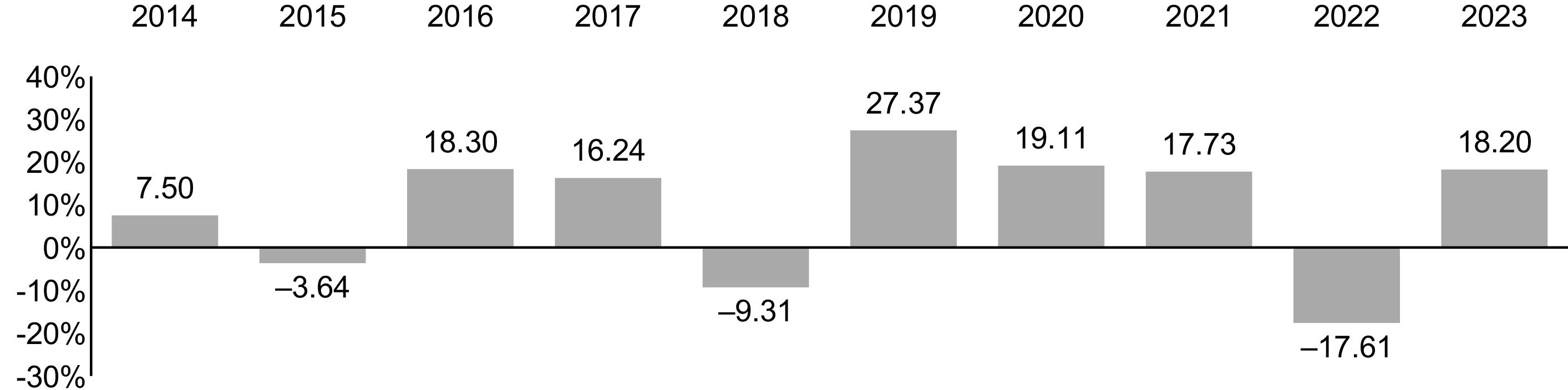

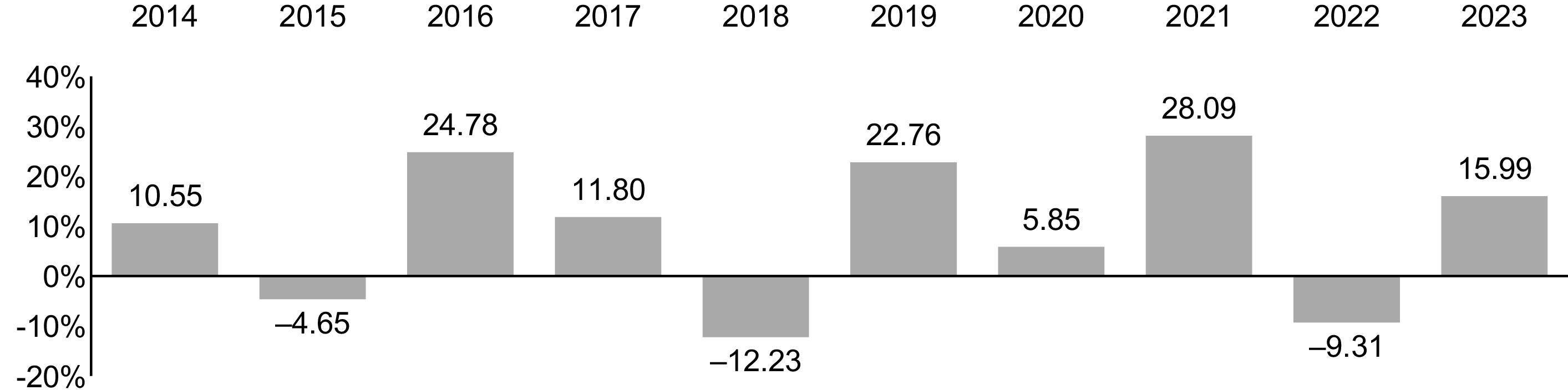

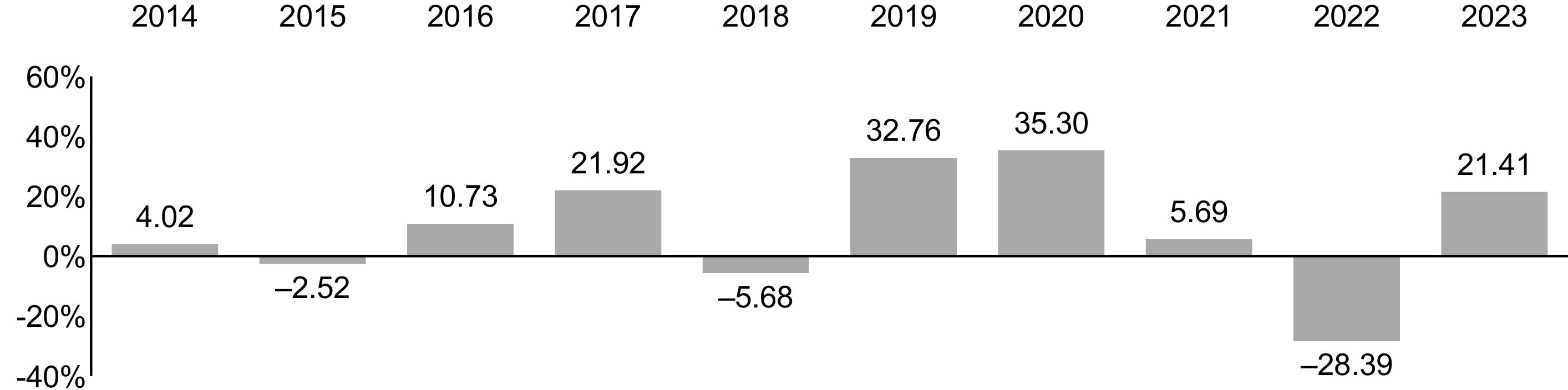

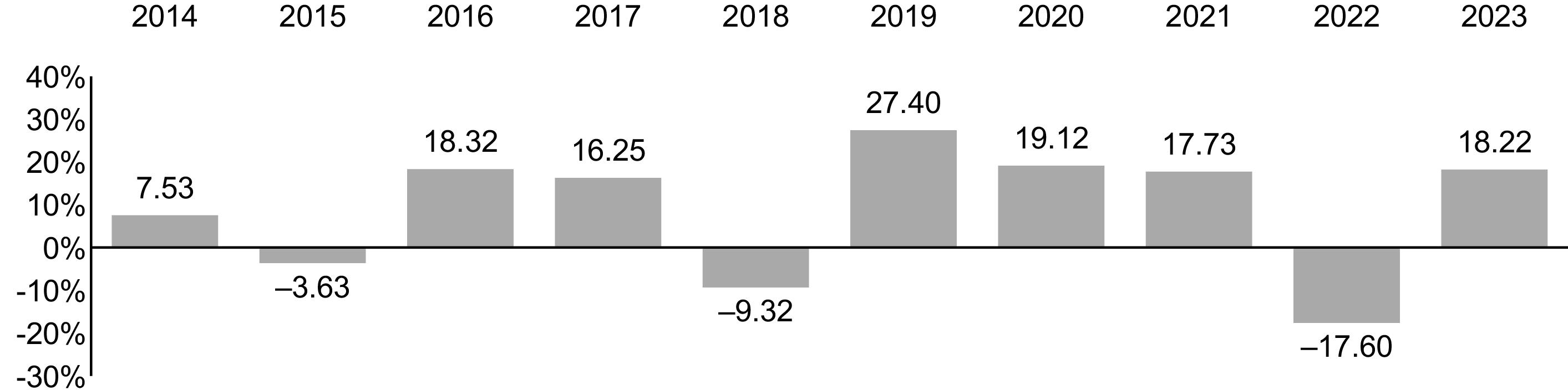

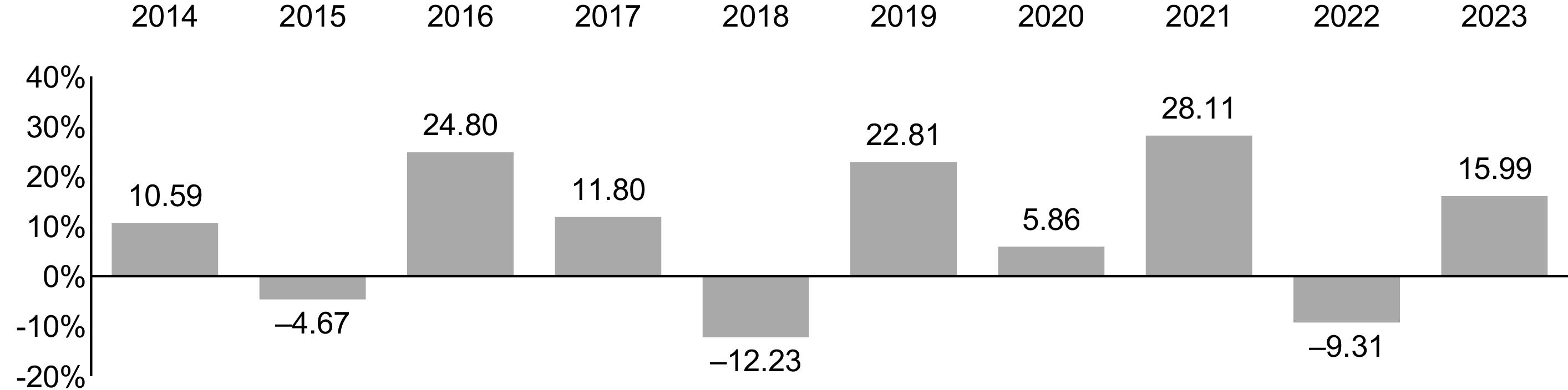

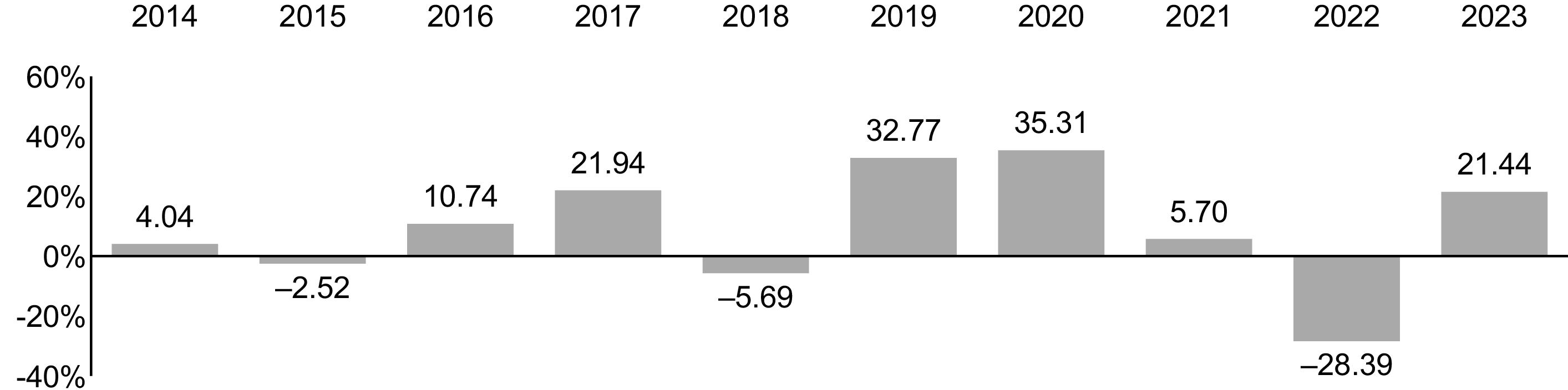

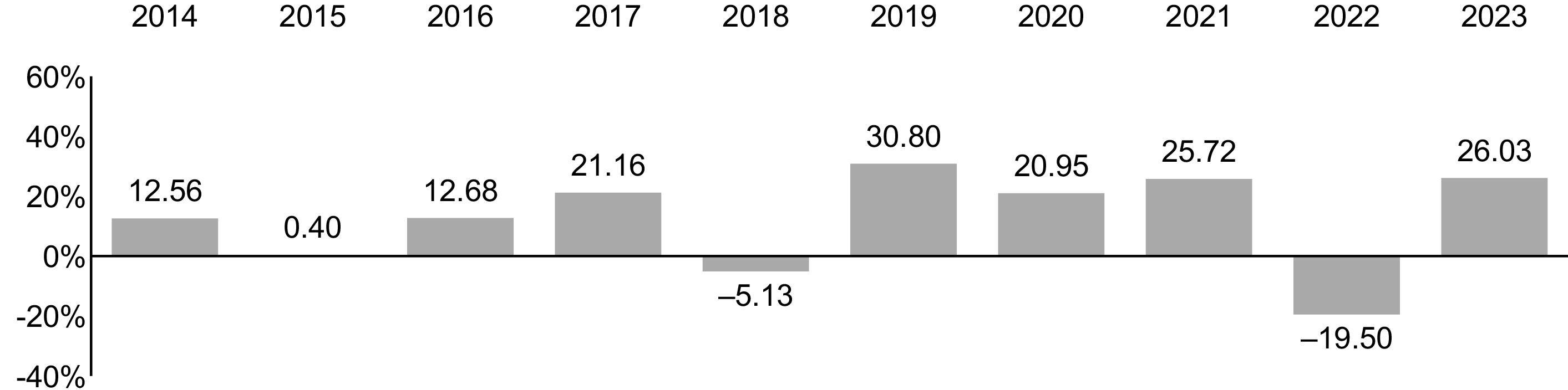

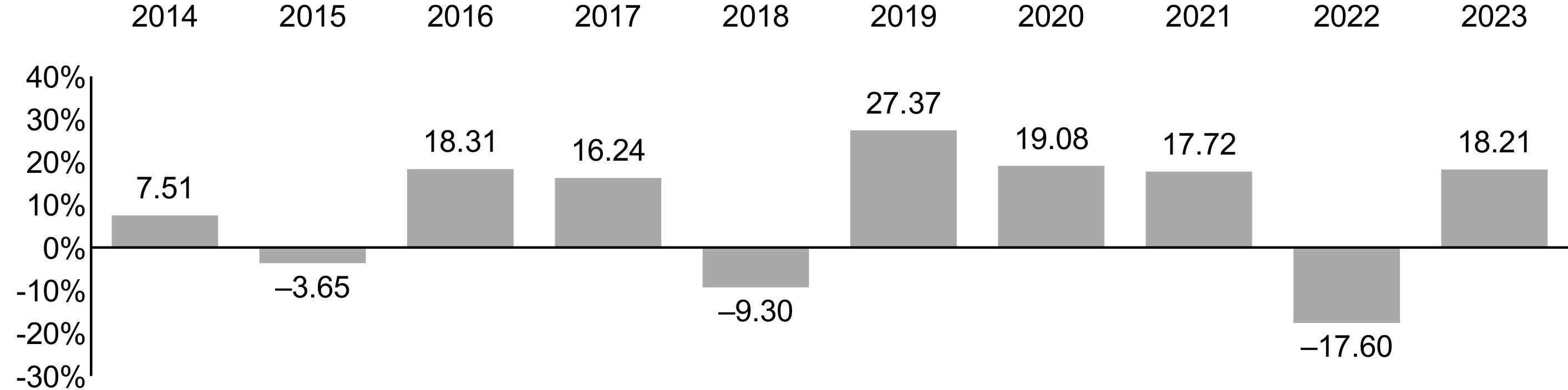

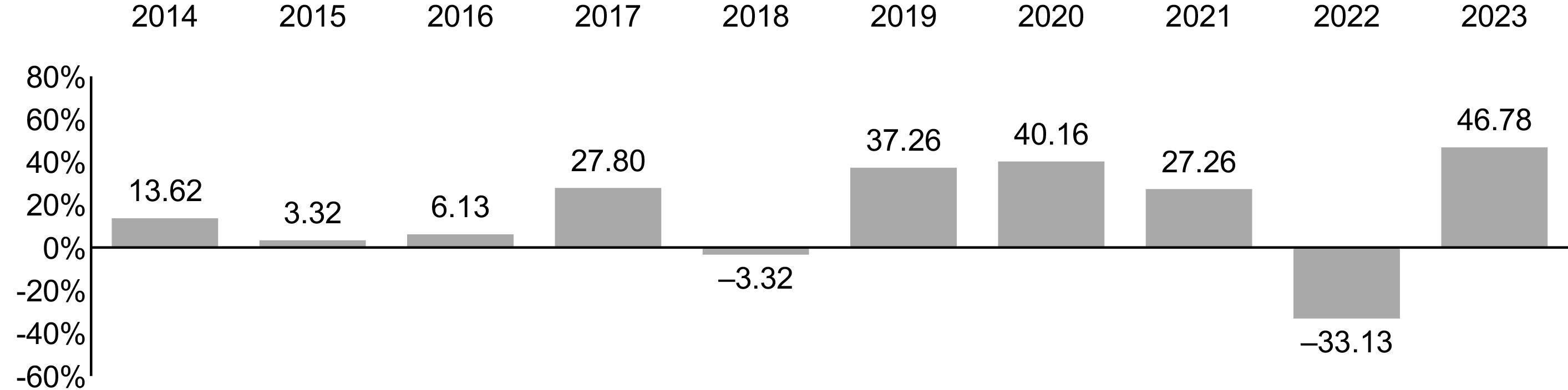

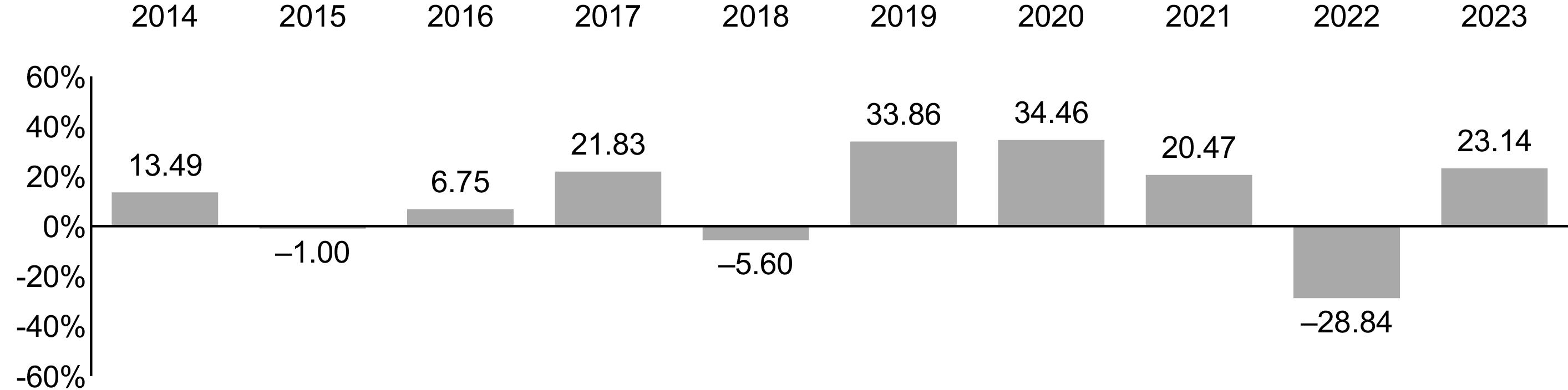

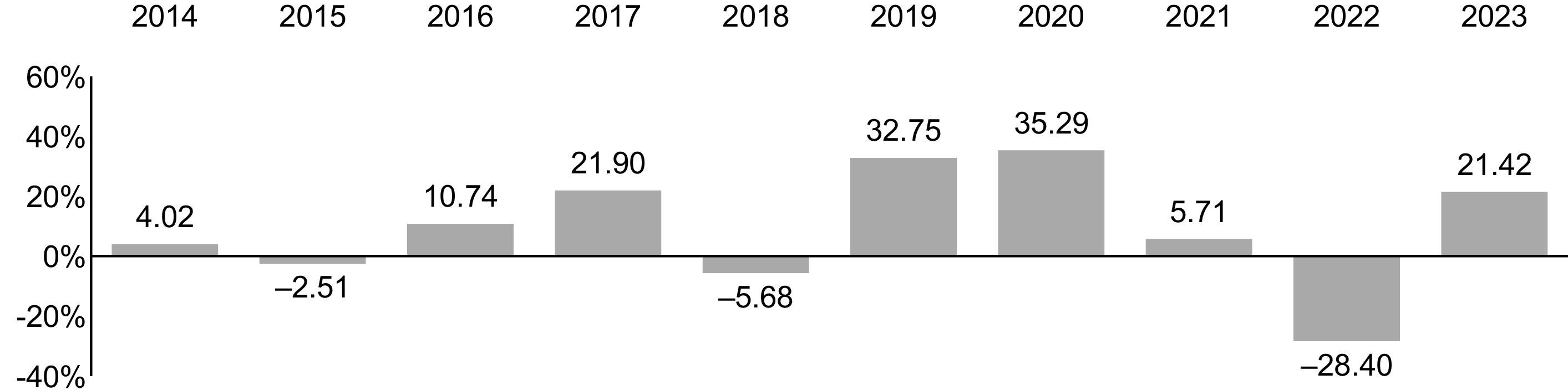

Total Return |

Quarter |

|

|

% |

|

|

|

-

% |

|

3

|

|

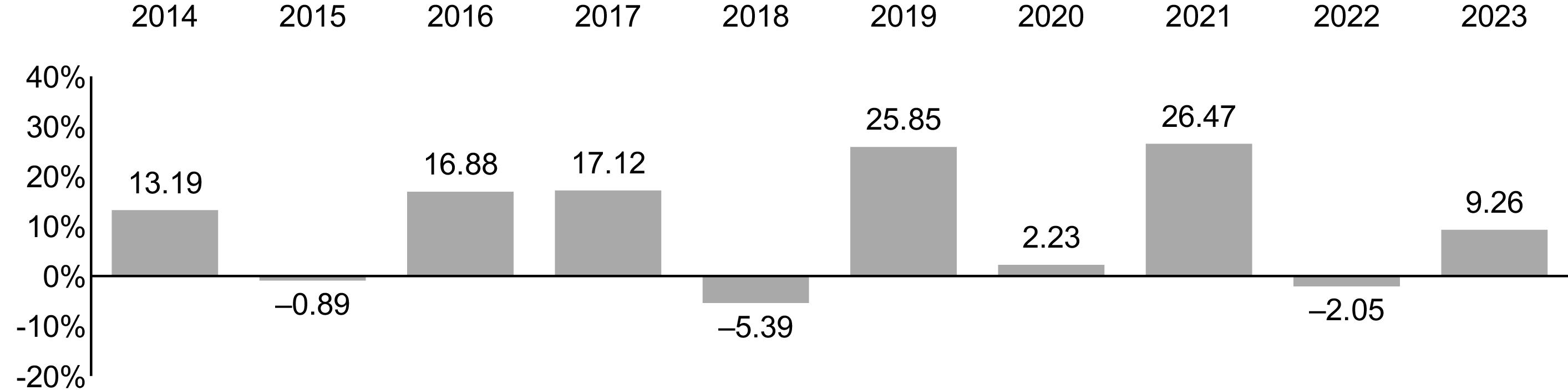

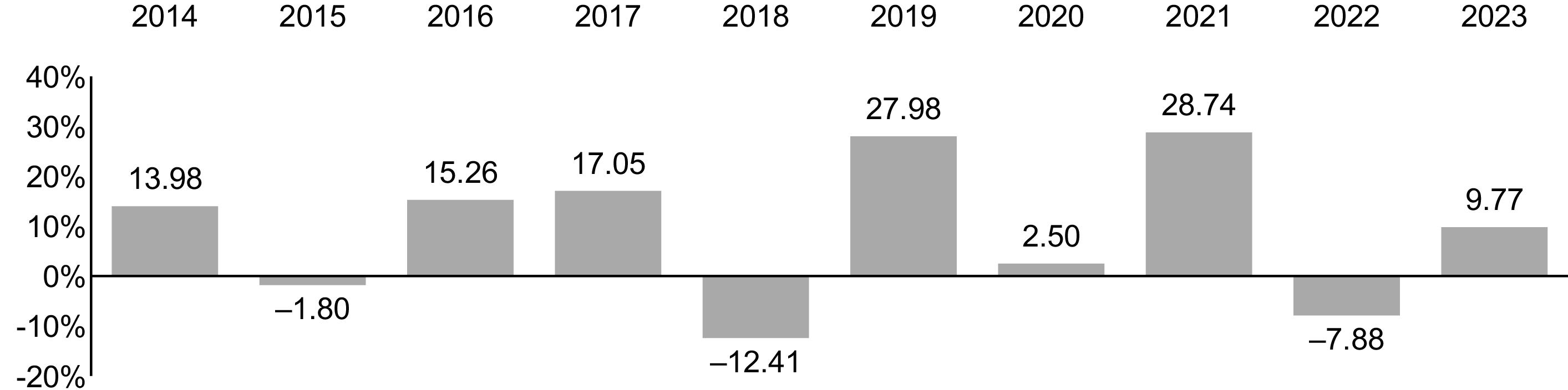

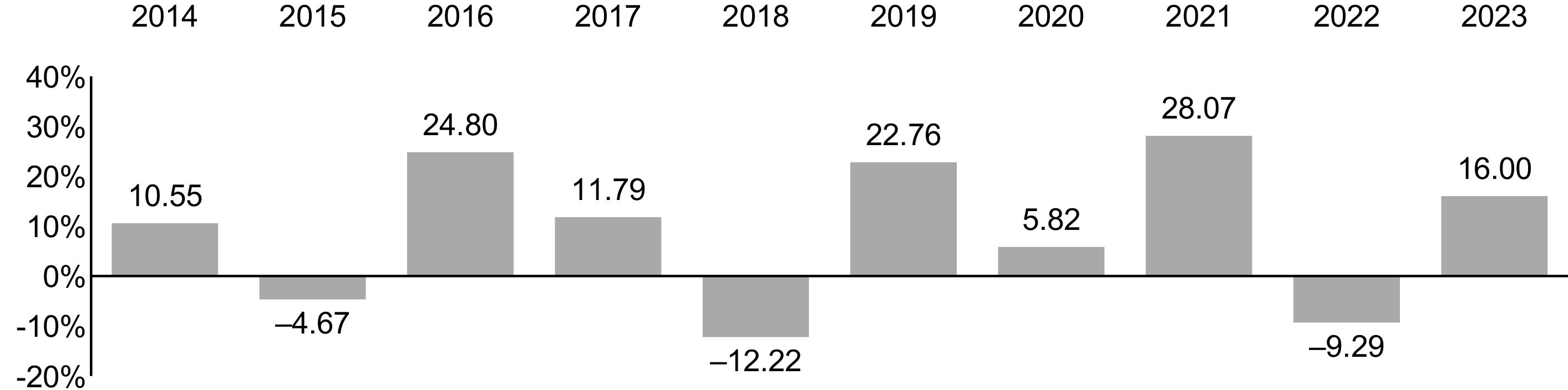

1 Year |

5 Years |

Since

Fund

Inception |

Fund

Inception

Date |

|

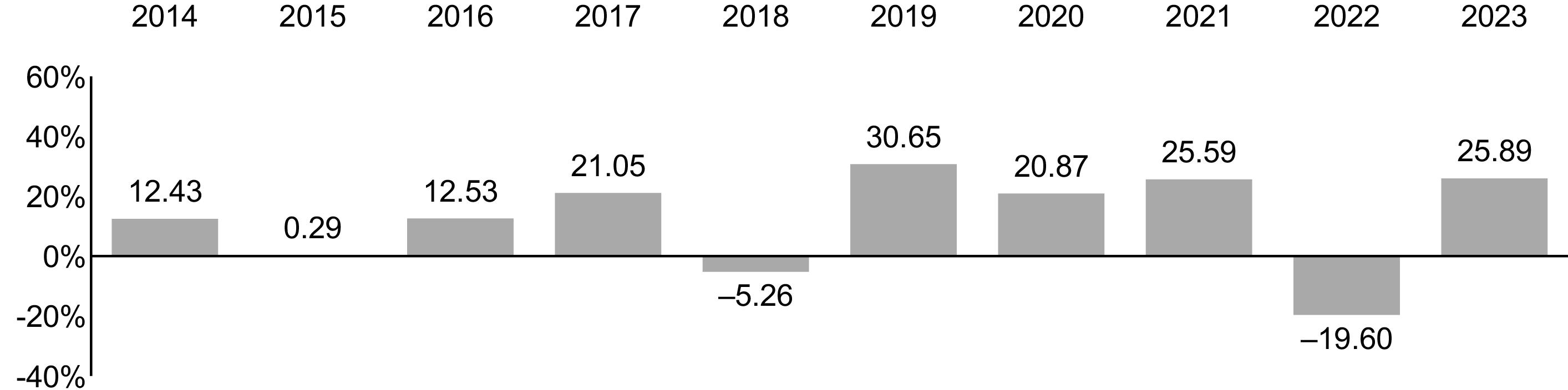

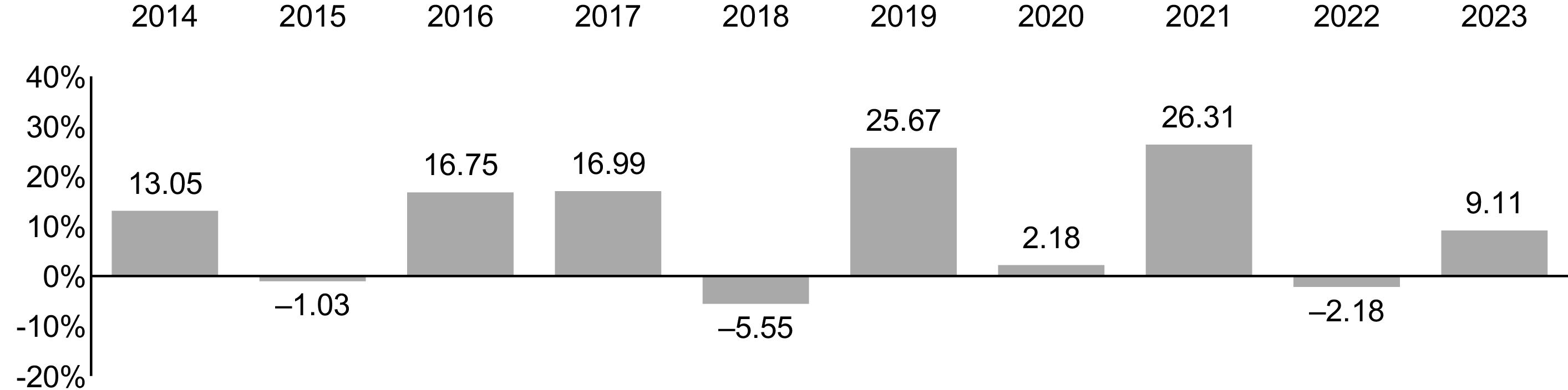

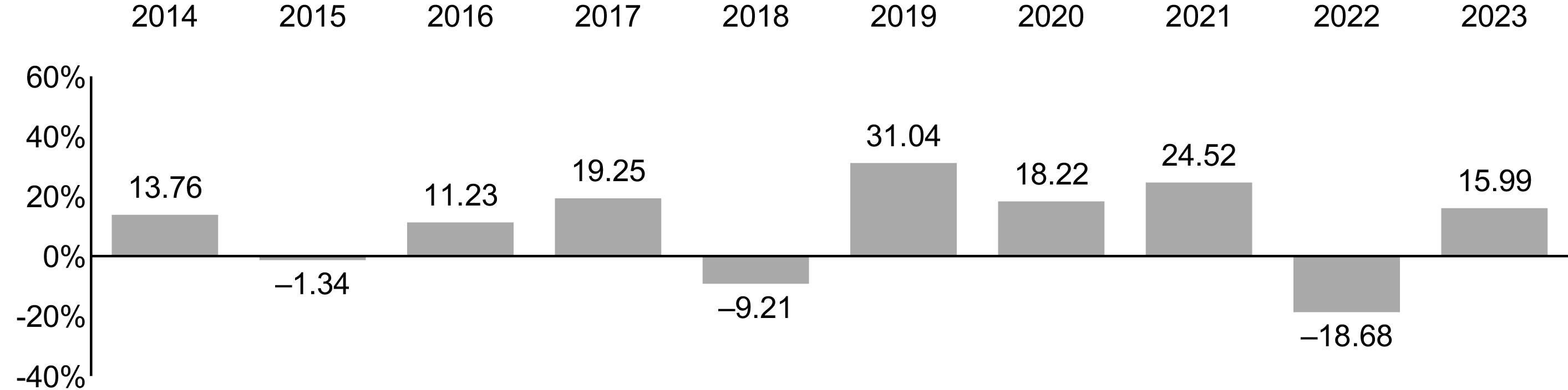

Vanguard Total Stock Market Index Fund

Institutional Select Shares |

|

|

|

|

|

Return Before Taxes |

% |

% |

% |

|

|

Return After Taxes on Distributions |

|

|

|

|

|

Return After Taxes on Distributions and Sale

of Fund Shares |

|

|

|

|

|

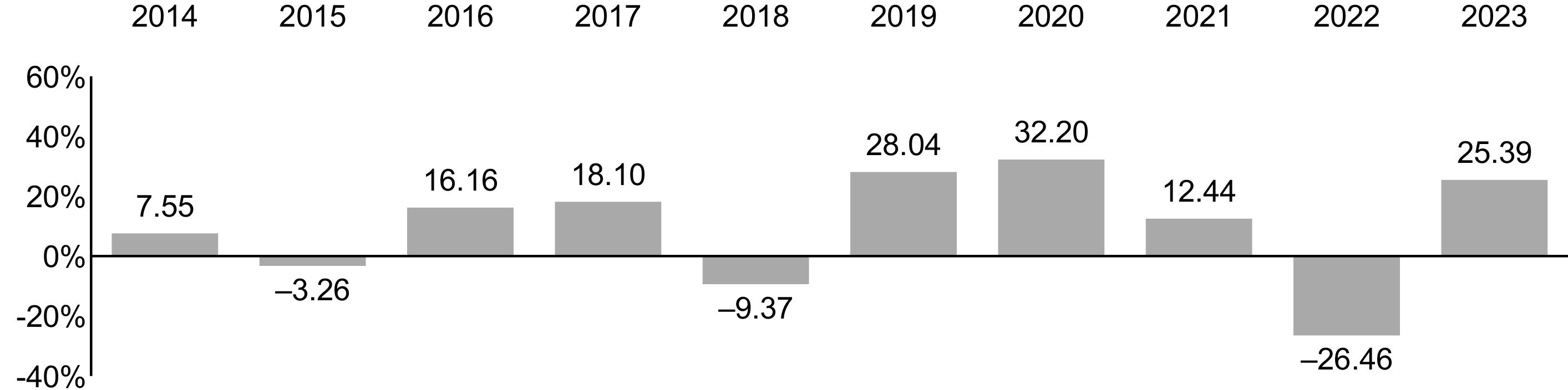

CRSP US Total Market Index

(reflects no deduction for fees, expenses,

or taxes) |

% |

% |

% |

|

|

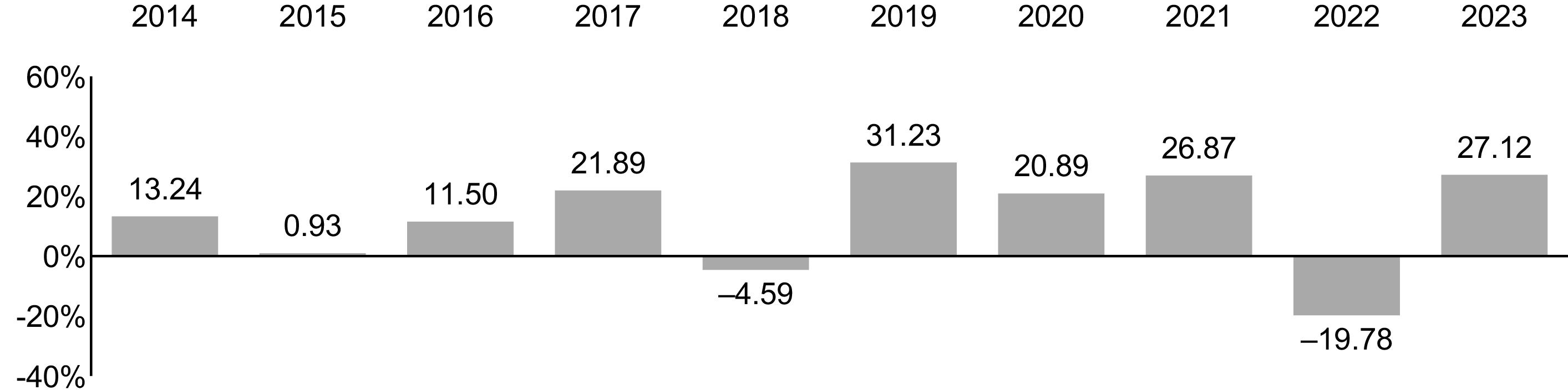

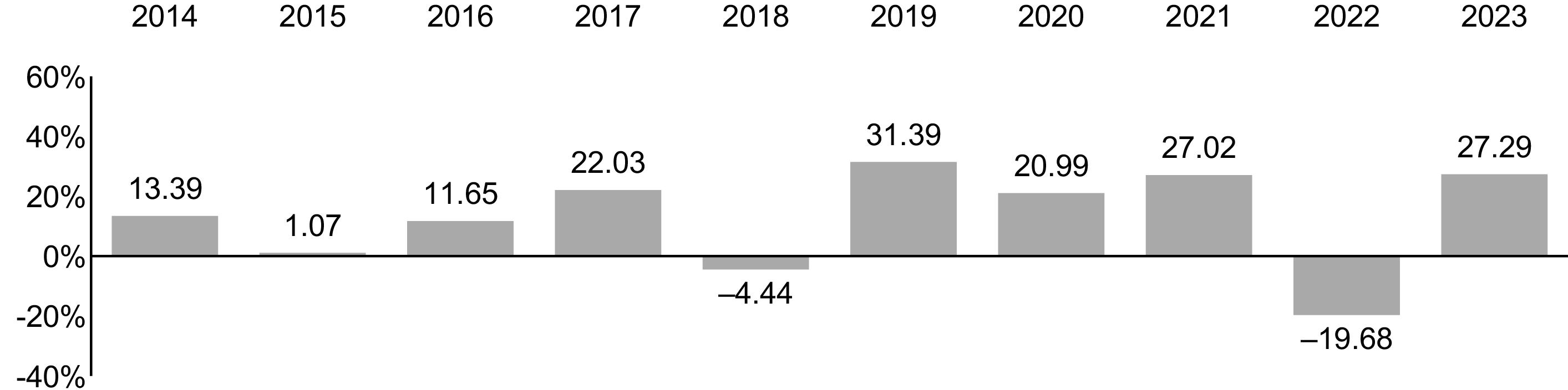

Dow Jones U.S. Total Stock Market Float

Adjusted Index

(reflects no deduction for fees, expenses,

or taxes) |

|

|

|

|

Investment Advisor

The Vanguard Group, Inc. (Vanguard)

Portfolio Managers

Walter Nejman, Portfolio Manager at Vanguard. He has co-managed the Fund since 2016.

Gerard C. O’Reilly, Portfolio Manager and Principal of Vanguard. He has managed the Fund since 1994 (co-managed since 2016).

Michelle Louie, CFA, Portfolio Manager and Principal of Vanguard. She has co-managed the Fund since 2023.

4

Purchase and Sale of Fund Shares

Institutional clients (such as defined contribution or benefit plans, endowments, foundations, and 529 plans) may purchase or redeem shares online (if you are registered for online access); through a trading platform; by mail (The Vanguard Group, P.O. Box 982901, El Paso, TX 79998-2901); or by telephone (800-523-1036). The minimum investment amount required to open and maintain a Fund account for Institutional Select Shares is generally $5 billion. The minimum investment amount required to add to an existing Fund account is generally $1.

Tax Information

The Fund’s distributions may be taxable as ordinary income or capital gain. If you are investing through a tax-advantaged account, such as a 401(k) plan, special tax rules apply.

Payments to Financial Intermediaries

The Fund and its investment advisor do not pay financial intermediaries for sales of Fund shares.

5

Investing in Index Funds

What Is Indexing?

Indexing is an investment strategy for tracking the performance of a specified market benchmark, or “index.” An index is a group of securities whose overall performance is used as a standard to measure the investment performance of a particular market. There are many types of indexes. Some represent entire markets—such as the U.S. stock market or the U.S. bond market. Other indexes cover market segments—such as small-capitalization stocks or short-term bonds. One cannot invest directly in an index.

The index provider determines the securities to include in the index and the weighting of each security in the index. Under normal circumstances, the index provider will rebalance an index on a regular schedule. An index provider may carry out additional ad hoc index rebalances or delay or cancel a scheduled rebalance. Generally, the index provider does not provide any warranty, or accept any liability, with respect to the quality, accuracy, or completeness of either the target index or its related data. Errors made by the index provider may occur from time to time and may not be identified by the index provider for a period of time or at all. Vanguard does not provide any warranty or guarantee against such errors. Therefore, the gains, losses, or costs associated with the index provider’s errors will generally be borne by the index fund and its shareholders.

An index fund seeks to hold all, or a representative sample, of the securities that make up its target index. Index funds attempt to mirror the performance of the target index, for better or worse. However, an index fund generally does not perform exactly like its target index. For example, index funds have operating expenses and transaction costs. Market indexes do not, and therefore they will usually have a slight performance advantage over funds that track them. The ability of an index fund to match its performance to that of its target index can also be impacted by, among other things, the timing and size of cash flows, asset valuation differences, and the size of the fund. Market disruptions could also have an adverse effect on a fund’s ability to adjust its exposure to the required levels in order to track the index. The risk that a fund may not track the performance of its target index may be heightened during times of increased market volatility or other unusual market conditions.

Index funds typically have the following characteristics:

• Variety of investments. Depending on a fund’s benchmark index, the fund may invest in the securities of a variety of companies, industries, and/or governments or government agencies.

• Relative performance consistency. Because they seek to track market benchmarks, index funds usually do not perform dramatically better or worse than their benchmarks.

• Low cost. Index funds are generally inexpensive to run compared with actively managed funds. They have low or no research costs and typically keep trading activity—and thus brokerage commissions and other transaction costs—to a minimum compared with actively managed funds.

6

More on the Fund

This prospectus describes the principal risks you would face as a Fund shareholder. It is important to keep in mind one of the main principles of investing: generally, the higher the risk of losing money, the higher the potential reward. The reverse, also, is generally true: the lower the risk, the lower the potential reward. As you consider an investment in any mutual fund, you should take into account your personal tolerance for fluctuations in the securities markets. Look for this

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether the Fund is the right investment for you. We suggest that you keep this prospectus for future reference.

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether the Fund is the right investment for you. We suggest that you keep this prospectus for future reference.

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether the Fund is the right investment for you. We suggest that you keep this prospectus for future reference.

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether the Fund is the right investment for you. We suggest that you keep this prospectus for future reference.Share Class Overview

This prospectus offers the Fund’s Institutional Select Shares, which are generally for investors who invest a minimum of $5 billion. Separate prospectuses offer the Fund’s Admiral™ Shares, which generally have an investment minimum of $3,000, and Investor Shares, which are generally available only to Vanguard funds that operate as funds of funds and to certain retirement plan clients that receive recordkeeping services from Vanguard. Another prospectus offers the Fund’s Institutional Shares and Institutional Plus Shares, which are generally for investors who invest a minimum of $5 million and $100 million, respectively. In addition, the Fund issues ETF Shares (an exchange-traded class of shares), which are also offered through a separate prospectus.

All share classes offered by the Fund have the same investment objective, strategies, and policies. However, because different share classes can have different expenses, their investment returns may differ.

|

Plain Talk About Costs of Investing |

|

Costs are an important consideration in choosing a mutual fund. That is

because you, as a shareholder, pay a proportionate share of the costs of

operating a fund and any transaction costs incurred when the fund buys or

sells securities, including costs generated by shareholders of other share

classes offered by the fund. These costs can erode a substantial portion of

the gross income or the capital appreciation a fund achieves. Even

seemingly small differences in expenses can, over time, have a dramatic

effect on a fund’s performance. |

7

The following sections explain the principal investment strategies and policies that the Fund uses in pursuit of its investment objective. The Fund’s board of trustees, which oversees the Fund’s management, may change investment strategies or policies in the interest of shareholders without a shareholder vote, unless those strategies or policies are designated as fundamental. Under normal circumstances, the Fund will invest at least 80% of its assets in the stocks that make up its target index. The Fund may change its 80% policy only upon 60 days‘ notice to shareholders.

Market Exposure

The Fund is subject to stock market risk, which is the chance that stock prices overall will decline. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices. In addition, the Fund’s target index may, at times, become focused in stocks of a particular market sector, which would subject the Fund to proportionately higher exposure to the risks of that sector.

Stocks of publicly traded companies are often classified according to market capitalization, which is the market value of a company’s outstanding shares. These classifications typically include small-cap, mid-cap, and large-cap. It is important to understand that there are no “official” definitions of small-, mid-, and large-cap, even among Vanguard fund advisors, and that market capitalization ranges can change over time. The asset-weighted median market capitalization of the Fund’s stock holdings as of December 31, 2023 was $149 billion.

Market disruptions can adversely affect local and global markets as well as normal market conditions and operations. Any such disruptions could have an adverse impact on the value of the Fund’s investments and Fund performance.

Security Selection

The Fund attempts to track the investment performance of a benchmark index that measures the return of the overall stock market. The Fund uses a sampling method of indexing, meaning that the Fund’s advisor, using quantitative and qualitative methods, generally selects from the target index a representative sample of securities that will resemble the target index in terms of key characteristics. These include industry weightings, market capitalization, and other financial characteristics of stocks.

The CRSP US Total Market Index represents approximately 100% of the investable U.S. stock market and includes large-, mid-, small-, and micro-cap stocks regularly traded on the New York Stock Exchange and Nasdaq.

8

The Fund is subject to index sampling risk, which is the chance that the securities selected for the Fund, in the aggregate, will not provide investment performance matching that of the Fund’s target index.

The ability of the advisor to purchase or dispose of certain Fund investments is or may be restricted or impaired because of limitations imposed by law, regulation, or by certain regulators or issuers. As a result, the advisor may be required to limit purchases or sell existing investments. If the Fund is required to limit its investment in a particular issuer, then the Fund may seek to obtain regulatory relief or special permission from an issuer to exceed a certain percentage ownership in that issuer’s shares. Other options the Fund may pursue include seeking to obtain economic exposure to that issuer through alternative means, such as through a derivative or through investment in a wholly owned subsidiary, both of which may be more costly than owning securities of the issuer directly. Ownership restrictions and limitations could result in unanticipated tax consequences to the Fund that may affect the amount, timing, and character of distributions to shareholders. See Other Investment Policies and Risks for further information related to derivatives.

Other Investment Policies and Risks

The Fund reserves the right to substitute a different index for the index it currently tracks if the current index is discontinued, if the Fund’s agreement with the provider of its target index is terminated, or for any other reason determined in good faith by the Fund’s board of trustees. In any such instance, the substitute index would represent the same market segment as the current index.

The Fund has the ability to invest in foreign securities to the extent necessary to carry out its investment strategy of holding a representative sample of the stocks that make up the index it tracks. It is not expected that the Fund will invest more than 5% of its assets in foreign securities.

To track its target index as closely as possible, the Fund attempts to remain fully invested in stocks. To help stay fully invested and to reduce transaction costs, the Fund may invest, to a limited extent, in derivatives, including equity futures. The Fund may also use derivatives such as total return swaps to obtain exposure to a stock, a basket of stocks, or an index. Generally speaking, a derivative is a financial contract whose value is based on the value of a financial asset (such as a stock, a bond, or a currency), a physical asset (such as gold, oil, or wheat), a market index, or a reference rate. Investments in derivatives may subject the Fund to risks different from, and possibly greater than, those of investments directly in the underlying securities or assets. The Fund will not use derivatives for speculation or for the purpose of leveraging (magnifying) investment returns.

9

Cash Management

The Fund’s daily cash balance may be invested in Vanguard Market Liquidity Fund and/or Vanguard Municipal Cash Management Fund (each, a CMT Fund), which are low-cost money market funds. When investing in a CMT Fund, the Fund bears its proportionate share of the expenses of the CMT Fund in which it invests. Vanguard receives no additional revenue from Fund assets invested in a CMT Fund.

Redemption Requests

Methods used to meet redemption requests. Under normal circumstances, the Fund typically expects to meet redemptions with positive cash flows. When this is not an option, the Fund seeks to maintain its risk exposure by selling a cross section of the Fund’s holdings to meet redemptions, while also factoring in transaction costs. Additionally, the Fund may work with larger clients to implement their redemptions in a manner that is least disruptive to the portfolio; see “Potentially disruptive redemptions” under Redeeming Shares in the Investing With Vanguard section.

Under certain circumstances, including under stressed market conditions, there are additional tools that the Fund may use in order to meet redemptions, including advancing the settlement of market trades with counterparties to match investor redemption payments or delaying settlement of an investor’s transaction to match trade settlement within regulatory requirements. The Fund may also suspend payment of redemption proceeds for up to seven days; see “Emergency circumstances” under Redeeming Shares in the Investing With Vanguard section. Additionally under these unusual circumstances, the Fund may borrow money (subject to certain regulatory conditions and if available under board-approved procedures) through an interfund lending facility; through a bank line-of-credit, including a joint committed credit facility; or through an uncommitted line-of-credit from Vanguard in order to meet redemption requests.

Potential redemption activity impacts. At times, the Fund may experience adverse effects when certain large shareholders, or multiple shareholders comprising significant ownership of the Fund, redeem large amounts of shares of the Fund. Large redemptions may cause the Fund to sell portfolio securities at times when it would not otherwise do so. This may result in the Fund distributing capital gains or other taxable income to non-redeeming shareholders. Large redemptions may also increase the Fund’s transaction costs. Redemption activity can occur for many reasons, including shareholder reactions to market movements or other events unrelated to Vanguard’s actions, or when Vanguard makes product changes that, for example, may result in a shareholder redeeming shares of the Fund to purchase shares of another similar fund or investment vehicle. When experiencing large redemptions, the Fund reserves the

10

right to pay all or part of the redemption in-kind and/or delay payment of the redemption proceeds for up to seven calendar days; see “Potentially disruptive redemptions” under Redeeming Shares in the Investing With Vanguard section.

Temporary Investment Measures

The Fund may temporarily depart from its normal investment policies and strategies when the advisor believes that doing so is in the Fund’s best interest, so long as the strategy or policy employed is consistent with the Fund’s investment objective. For instance, the Fund may invest beyond its normal limits in derivatives or exchange-traded funds that are consistent with the Fund’s investment objective when those instruments are more favorably priced or provide needed liquidity, as might be the case when the Fund receives large cash flows that it cannot prudently invest immediately.

Frequent Trading or Market-Timing

Background. Some investors try to profit from strategies involving frequent trading of mutual fund shares, such as market-timing. For funds holding foreign securities, investors may try to take advantage of an anticipated difference between the price of the fund’s shares and price movements in overseas markets, a practice also known as time-zone arbitrage. Investors also may try to engage in frequent trading of funds holding investments such as small-cap stocks and high-yield bonds. As money is shifted into and out of a fund by a shareholder engaging in frequent trading, the fund incurs costs for buying and selling securities, resulting in increased brokerage and administrative costs. These costs are borne by all fund shareholders, including the long-term investors who do not generate the costs. In addition, frequent trading may interfere with an advisor’s ability to efficiently manage the fund.

Policies to address frequent trading. The Vanguard funds (other than money market funds and short-term bond funds, but including Vanguard Short-Term Inflation-Protected Securities Index Fund) do not knowingly accommodate frequent trading. The board of trustees of each Vanguard fund (other than money market funds and short-term bond funds, but including Vanguard Short-Term Inflation-Protected Securities Index Fund) has adopted policies and procedures reasonably designed to detect and discourage frequent trading and, in some cases, to compensate the fund for the costs associated with it. These policies and procedures do not apply to ETF Shares because frequent trading in ETF Shares generally does not disrupt portfolio management or otherwise harm fund shareholders. Although there is no assurance that Vanguard will be able to detect or prevent frequent trading or market-timing in all circumstances, the following policies have been adopted to address these issues:

11

• Each Vanguard fund reserves the right to reject any purchase request—including exchanges from other Vanguard funds—without notice and regardless of size. For example, a purchase request could be rejected because the investor has a history of frequent trading or if Vanguard determines that such purchase may negatively affect a fund’s operation or performance.

• Each Vanguard fund (other than money market funds and short-term bond funds, but including Vanguard Short-Term Inflation-Protected Securities Index Fund) generally prohibits, except as otherwise noted in the Investing With Vanguard section, an investor’s purchases or exchanges into a fund account for 30 calendar days after the investor has redeemed or exchanged out of that fund account.

• Certain Vanguard funds charge shareholders purchase and/or redemption fees on transactions.

See the Investing With Vanguard section of this prospectus for further details on Vanguard’s transaction policies.

Each Vanguard fund (other than retail and government money market funds), in determining its net asset value, will use fair-value pricing when appropriate, as described in the Share Price section. Fair-value pricing may reduce or eliminate the profitability of certain frequent-trading strategies.

Do not invest with Vanguard if you are a market-timer.

A precautionary note to investment companies: The Fund’s shares are issued by a registered investment company, and therefore the acquisition of such shares by other investment companies and private funds is subject to the restrictions of Section 12(d)(1) of the Investment Company Act of 1940 (the 1940 Act). SEC Rule 12d1-4 under the 1940 Act permits registered investment companies to invest in other registered investment companies beyond the limits in Section 12(d)(1), subject to certain conditions, including that funds with different investment advisors must enter into a fund of funds investment agreement.

Turnover Rate

Although the Fund generally seeks to invest for the long term, it may sell securities regardless of how long they have been held. Generally, an index fund sells securities in response to redemption requests from shareholders of conventional (i.e., not exchange-traded) shares or to changes in the composition of its target index. Turnover rates for large-cap stock index funds tend to be low because large-cap indexes typically do not change significantly from year to year. Turnover rates for mid-cap and small-cap stock index funds tend to be higher than for large-cap stock index funds (although still relatively low, compared with

12

actively managed stock funds) because the indexes they track are more likely to change as a result of companies merging, growing, or failing. The Financial Highlights section of this prospectus shows historical turnover rates for the Fund. A turnover rate of 100%, for example, would mean that the Fund had sold and replaced securities valued at 100% of its net assets within a one-year period. In general, the greater the turnover rate, the greater the impact transaction costs will have on a fund’s return. Also, funds with high turnover rates may be more likely to generate capital gains, including short-term capital gains, that must be distributed to shareholders and will be taxable to shareholders investing through a taxable account.

The Fund and Vanguard

The Fund is a member of The Vanguard Group, Inc. (Vanguard), a family of over 200 funds. All of the funds that are members of Vanguard (other than funds of funds) share in the expenses associated with administrative services and business operations, such as personnel, office space, and equipment.

Vanguard Marketing Corporation provides marketing services to the funds. Although fund shareholders do not pay sales commissions or 12b-1 distribution fees, each fund (other than a fund of funds) or each share class of a fund (in the case of a fund with multiple share classes) pays its allocated share of the Vanguard funds’ marketing costs.

|

Plain Talk About Vanguard’s Unique Corporate Structure |

|

Vanguard is owned jointly by the funds it oversees and thus indirectly by the

shareholders in those funds. Most other mutual funds are operated by

management companies that are owned by third parties—either public or

private stockholders—and not by the funds they serve. |

Investment Advisor

The Vanguard Group, Inc., P.O. Box 2600, Valley Forge, PA 19482, which began operations in 1975, serves as advisor to the Fund through its Equity Index Group. As of December 31, 2023, Vanguard served as advisor for approximately $7.2 trillion in assets. Vanguard provides investment advisory services to the Fund pursuant to the Funds’ Service Agreement and subject to the supervision and oversight of the trustees and officers of the Fund.

13

For the fiscal year ended December 31, 2023, the advisory expenses represented an effective annual rate of less than 0.01% of the Fund’s average net assets.

Under the terms of an SEC exemption, the Fund’s board of trustees may, without prior approval from shareholders, change the terms of an advisory agreement with a third-party investment advisor or hire a new third-party investment advisor—either as a replacement for an existing advisor or as an additional advisor. Any significant change in the Fund’s advisory arrangements will be communicated to shareholders in writing. As the Fund’s sponsor and overall manager, Vanguard may provide investment advisory services to the Fund at any time. Vanguard may also recommend to the board of trustees that an advisor be hired, terminated, or replaced or that the terms of an existing advisory agreement be revised. The Fund has filed an application seeking a similar SEC exemption with respect to investment advisors that are wholly owned subsidiaries of Vanguard. If the exemption is granted, the Fund may rely on the new SEC relief.

For a discussion of why the board of trustees approved the Fund’s investment advisory arrangement, see the most recent semiannual report to shareholders covering the fiscal period ended June 30.

The managers primarily responsible for the day-to-day management of the Fund are:

Michelle Louie, CFA, Portfolio Manager and Principal of Vanguard. She has been with Vanguard since 2010, has worked in investment management since 2011, has managed investment portfolios since 2016, and has co-managed the Fund since 2023. Education: B.S., The American University; M.B.A., Georgia Institute of Technology.

Walter Nejman, Portfolio Manager at Vanguard. He has been with Vanguard since 2005, has worked in investment management since 2008, and has co-managed the Fund since 2016. Education: B.A., Arcadia University; M.B.A., Villanova University.

Gerard C. O’Reilly, Principal of Vanguard. He has been with Vanguard since 1992 and has managed investment portfolios, including the Fund, since 1994 (co-managed since 2016). Education: B.S., Villanova University

The Fund’s Statement of Additional Information provides information about each portfolio manager’s compensation, other accounts under management, and ownership of shares of the Fund.

14

Dividends, Capital Gains, and Taxes

Fund Distributions

The Fund distributes to shareholders virtually all of its net income (interest and dividends, less expenses) as well as any net short-term or long-term capital gains realized from the sale of its holdings. From time to time, the Fund may also make distributions that are treated as a return of capital. Income dividends generally are distributed quarterly in March, June, September, and December; capital gains distributions, if any, generally occur annually in December. In addition, the Fund may occasionally make a supplemental distribution at some other time during the year. You can receive distributions of income or capital gains in cash, or you can have them automatically reinvested in more shares of the Fund.

|

Plain Talk About Distributions |

|

As a shareholder, you are entitled to your portion of a fund’s income from

interest as well as capital gains from the fund’s sale of investments. Income

consists of interest the fund earns from its money market and bond

investments. Capital gains are realized whenever the fund sells securities for

higher prices than it paid for them. These capital gains are either short-term

or long-term, depending on whether the fund held the securities for one year

or less or for more than one year. |

Basic Tax Points

Investors in taxable accounts should be aware of the following basic federal income tax points:

• Distributions are taxable to you whether or not you reinvest these amounts in additional Fund shares.

• Distributions declared in December—if paid to you by the end of January—are taxable as if received in December.

• Any dividend distribution or short-term capital gains distribution that you receive is taxable to you as ordinary income. If you are an individual and meet certain holding-period requirements with respect to your Fund shares, you may be eligible for reduced tax rates on “qualified dividend income,” if any, or a special tax deduction on “qualified REIT dividends,” if any, distributed by the Fund.

• Any distribution of net long-term capital gains is taxable to you as long-term capital gains, no matter how long you have owned shares in the Funds.

15

• Capital gains distributions can occur when the Fund sells assets at a gain. Capital gains distributions vary from year to year as a result of the Fund’s investment activities and cash flows, including those due to redemption activity by Fund shareholders.

• Capital gains distributions may occur if Vanguard makes changes that would impact the Fund directly or indirectly, including if Vanguard makes changes to the Fund’s portfolio or to any other Vanguard fund or product that would involve the redemption of shares of the Fund and the related sale of the Fund’s investments.

• Your cost basis in the Fund will be decreased by the amount of any return of capital that you receive. This, in turn, will affect the amount of any capital gain or loss that you realize when selling or exchanging your Fund shares.

• Return of capital distributions generally are not taxable to you until your cost basis has been reduced to zero. If your cost basis is at zero, return of capital distributions will be treated as capital gains.

• A sale or exchange of Fund shares is a taxable event. This means that you may have a capital gain to report as income, or a capital loss to report as a deduction, when you complete your tax return.

• Any conversion between classes of shares of the same fund is a nontaxable event. By contrast, an exchange between classes of shares of different funds is a taxable event.

• Vanguard (or your intermediary) will send you a statement each year showing the tax status of all of your distributions.

Individuals, trusts, and estates whose income exceeds certain threshold amounts are subject to a 3.8% Medicare contribution tax on “net investment income.” Net investment income takes into account distributions paid by the Fund and capital gains from any sale or exchange of Fund shares.

Dividend distributions and capital gains distributions that you receive, as well as your gains or losses from any sale or exchange of Fund shares, may be subject to state and local income taxes.

This prospectus provides general tax information only. If you are investing through a tax-advantaged account, such as a 401(k) plan, special tax rules apply. Please consult your tax advisor for detailed information about any tax consequences for you.

16

|

Plain Talk About Buying a Dividend |

|

Unless you are a tax-exempt investor or investing through a tax-advantaged

account (such as an IRA or an employer-sponsored retirement or savings

plan), you should consider avoiding a purchase of fund shares shortly before

the fund makes a distribution, because doing so can cost you money in

taxes. This is known as “buying a dividend.” For example: On December 15,

you invest $5,000, buying 250 shares for $20 each. If the fund pays a

distribution of $1 per share on December 16, its share price will drop to $19

(not counting market change). You still have only $5,000 (250 shares x $19 =

$4,750 in share value, plus 250 shares x $1 = $250 in distributions), but you

owe tax on the $250 distribution you received—even if you reinvest it in more

shares. To avoid buying a dividend, check a fund’s distribution schedule

before you invest. |

General Information

Backup withholding. By law, Vanguard must withhold 24% of any taxable distributions or redemptions from your account if you do not:

• Provide your correct taxpayer identification number.

• Certify that the taxpayer identification number is correct.

• Confirm that you are not subject to backup withholding.

Similarly, Vanguard (or your intermediary) must withhold taxes from your account if the IRS instructs us to do so.

Foreign investors. Vanguard funds offered for sale in the United States (Vanguard U.S. funds), including the Fund offered in this prospectus, are not widely available outside the United States. Non-U.S. investors should be aware that U.S. withholding and estate taxes and certain U.S. tax reporting requirements may apply to any investments in Vanguard U.S. funds. Foreign investors should visit the non-U.S. investors page on our website at vanguard.com for information on Vanguard’s non-U.S. products.

Invalid addresses. If a dividend distribution or capital gains distribution check mailed to your address of record is returned as undeliverable, Vanguard will automatically reinvest the distribution and all future distributions until you provide us with a valid mailing address. Reinvestments will receive the net asset value calculated on the date of the reinvestment.

17

Share Price

Share price, also known as net asset value (NAV), is calculated as of the close of regular trading on the New York Stock Exchange (NYSE), generally 4 p.m., Eastern time, on each day that the NYSE is open for business (a business day). In the rare event the NYSE experiences unanticipated disruptions and is unavailable at the close of the trading day, NAVs will be calculated as of the close of regular trading on the Nasdaq (or another alternate exchange if the Nasdaq is unavailable, as determined at Vanguard’s discretion), generally 4 p.m., Eastern time. Each share class has its own NAV, which is computed by dividing the total assets, minus liabilities, allocated to the share class by the number of Fund shares outstanding for that class. On U.S. holidays or other days when the NYSE is closed, the NAV is not calculated, and the Fund does not sell or redeem shares. However, on those days the value of the Fund’s assets may be affected to the extent that the Fund holds securities that change in value on those days (such as foreign securities that trade on foreign markets that are open).

Stocks held by a Vanguard fund are valued at their market value when reliable market quotations are readily available from the principal exchange or market on which they are traded. Such securities are generally valued at their official closing price, the last reported sales price, or if there were no sales that day, the mean between the closing bid and asking prices. When a fund determines that market quotations either are not readily available or do not accurately reflect the value of a security, the security is priced at its fair value (the amount that the owner might reasonably expect to receive upon the current sale of the security).

The values of any foreign securities held by a fund are converted into U.S. dollars using an exchange rate obtained from an independent third party as of the close of regular trading on the NYSE. The values of any mutual fund shares, including institutional money market fund shares, held by a fund are based on the NAVs of the shares. The values of any ETF shares or closed-end fund shares held by a fund are based on the market value of the shares.

A fund also will use fair-value pricing if the value of a security it holds has been materially affected by events occurring before the fund’s pricing time but after the close of the principal exchange or market on which the security is traded. This most commonly occurs with foreign securities, which may trade on foreign exchanges that close many hours before the fund’s pricing time. Intervening events might be company-specific (e.g., earnings report, merger announcement) or country-specific or regional/global (e.g., natural disaster, economic or political news, interest rate change, act of terrorism). Intervening events include price movements in U.S. markets that exceed a specified threshold or that are otherwise deemed to affect the value of foreign securities.

18

Fair-value pricing may be used for domestic securities—for example, if (1) trading in a security is halted and does not resume before the fund’s pricing time or a security does not trade in the course of a day and (2) the fund holds enough of the security that its price could affect the NAV.

Fair-value prices are determined by Vanguard according to procedures adopted by the board of trustees. When fair-value pricing is employed, the prices of securities used by a fund to calculate the NAV may differ from quoted or published prices for the same securities.

The Fund has authorized certain financial intermediaries and their designees, and may, from time to time, authorize certain fund of funds for which Vanguard serves as the investment advisor (Vanguard Funds of Funds), to accept orders to buy or sell fund shares on its behalf. The Fund will be deemed to receive an order when accepted by the financial intermediary, its designee, or one of the Vanguard Funds of Funds, and the order will receive the NAV next computed by the Fund after such acceptance.

Vanguard fund share prices are published daily on our website at vanguard.com/prices.

19

Financial Highlights

Financial highlights information is intended to help you understand a fund’s performance for the past five years (or, if shorter, its period of operations). Certain information reflects financial results for a single fund share. Total return represents the rate that an investor would have earned or lost each period on an investment in a fund or share class (assuming reinvestment of all distributions). This information has been obtained from the financial statements audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, whose report, along with fund financial statements, is included in a fund’s most recent annual report to shareholders. You may obtain a free copy of a fund’s latest annual or semiannual report, which is available upon request.

Vanguard Total Stock Market Index Fund Institutional Select Shares

|

|

|

|

|

|

|

|

For a Share Outstanding Throughout Each Period |

Year Ended December 31, | ||||

|

2023 |

2022 |

2021 |

2020 |

2019 | |

|

Net Asset Value, Beginning of Period |

$183.25 |

$231.36 |

$186.45 |

$156.83 |

$122.20 |

|

Investment Operations |

|

|

|

|

|

|

Net Investment Income1 |

3.312 |

3.093 |

2.821 |

2.772 |

2.709 |

|

Capital Gain Distributions Received |

.0001,2 |

.0001,2 |

.0001,2 |

— |

— |

|

Net Realized and Unrealized Gain (Loss) on

Investments |

44.079 |

(48.139) |

44.937 |

29.532 |

34.731 |

|

Total from Investment Operations |

47.391 |

(45.046) |

47.758 |

32.304 |

37.440 |

|

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income |

(3.271) |

(3.064) |

(2.848) |

(2.684) |

(2.810) |

|

Distributions from Realized Capital Gains |

— |

— |

— |

— |

— |

|

Total Distributions |

(3.271) |

(3.064) |

(2.848) |

(2.684) |

(2.810) |

|

Net Asset Value, End of Period |

$227.37 |

$183.25 |

$231.36 |

$186.45 |

$156.83 |

|

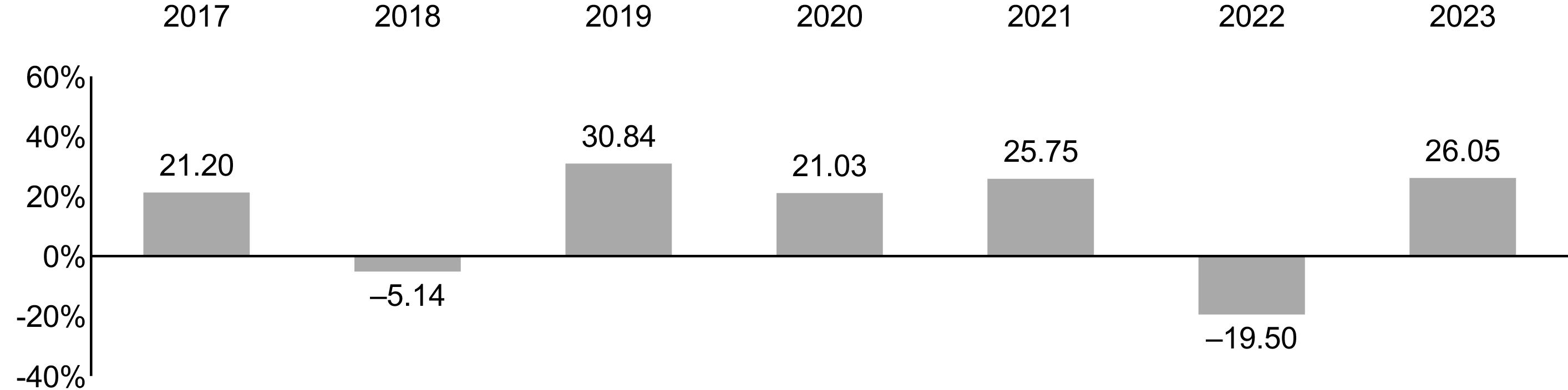

Total Return |

26.05% |

-19.50% |

25.75% |

21.03% |

30.84% |

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

$61,187 |

$44,101 |

$52,780 |

$44,296 |

$26,431 |

|

Ratio of Total Expenses to Average Net Assets |

0.01%3 |

0.01%3 |

0.01% |

0.01% |

0.01% |

|

Ratio of Net Investment Income to Average Net

Assets |

1.62% |

1.57% |

1.33% |

1.76% |

1.91% |

|

Portfolio Turnover Rate4 |

2% |

3% |

4% |

8% |

4% |

|

|

|

|

|

|

|

|

|

|

|

1 |

Calculated based on average shares outstanding. |

|

2 |

Distribution was less than $.001 per share. |

|

3 |

The ratio of expenses to average net assets for the period net of reduction from custody fee

offset arrangements was 0.01%. |

|

4 |

Excludes the value of portfolio securities received or delivered as a result of in-kind purchases

or redemptions of the fund’s capital shares, including ETF Creation Units. |

20

Investing With Vanguard

This section of the prospectus explains the basics of doing business with Vanguard. Vanguard fund shares can be held indirectly through an intermediary, such as a bank, a broker, or an investment advisor. If you hold Vanguard fund shares indirectly through an intermediary (including shares held in a brokerage account through Vanguard Brokerage Services®), please see Investing With Vanguard Through Other Firms, and also refer to your account agreement with the intermediary for information about transacting in that account. Vanguard reserves the right to change the policies in this section without notice. Please call or check online for current information. See Contacting Vanguard.

In certain circumstances, Vanguard fund shares can be held directly with Vanguard. If you hold Vanguard fund shares directly with Vanguard, you should carefully read each topic within this section that pertains to your relationship with Vanguard. Vanguard reserves the right, upon reasonable notice, to discontinue the ability to hold Vanguard fund shares directly with Vanguard for any or all investors and/or to transfer such shares to an affiliate or other financial institution.

In certain circumstances, Vanguard fund shares can be held directly with Vanguard. If you hold Vanguard fund shares directly with Vanguard, you should carefully read each topic within this section that pertains to your relationship with Vanguard. Vanguard reserves the right, upon reasonable notice, to discontinue the ability to hold Vanguard fund shares directly with Vanguard for any or all investors and/or to transfer such shares to an affiliate or other financial institution.

For Vanguard fund shares held directly with Vanguard, each fund you hold in an account is a separate “fund account.” For example, if you hold three funds in a corporate account and offer six funds in a defined contribution plan account, you have two fund accounts—and this is true even if you hold the same fund in multiple accounts. Note that each reference to “you” in this prospectus applies to any one or more registered account owners or persons authorized to transact on your account.

For Plan Participants

If Institutional Select Shares of the Fund are an investment option in your retirement or savings plan, your plan administrator or your employee benefits office can provide you with detailed information on how to participate in your plan and how to elect the Fund as an investment option. If you have any questions about the Fund or Vanguard, including those about the Fund’s investment objective, strategies, or risks, contact Vanguard Participant Services toll-free at 800-523-1188.

• If you have questions about your account, contact your plan administrator or the organization that provides recordkeeping services for your plan.

• Be sure to carefully read each topic that pertains to plan participant transactions with Vanguard.

Vanguard reserves the right to change its policies without notice to shareholders.

21

Investment Options and Allocations

Your plan’s specific provisions may allow you to change your investment selections, the amount of your contributions, or the allocation of your contributions among the investment choices available to you. Contact your plan administrator or employee benefits office for more details.

See Plan Participant Transactions.

Purchasing Shares

Vanguard reserves the right, without notice, to increase or decrease the minimum amount required to open, convert shares to, or maintain a fund account or to add to an existing fund account.

Investment minimums may differ for certain categories of investors.

Account Minimums for Institutional Select Shares

To open and maintain an account. Generally $5 billion. Available only to institutional clients (such as defined contribution or benefit plans, endowments, foundations, and 529 plans). If you request Institutional Select Shares when you open a new account but the investment amount does not meet the account minimum for Institutional Select Shares, your investment will be placed in another share class of the Fund, as appropriate.

Investment minimums may differ for a Vanguard collective investment trust with a similar mandate.

How to Initiate a Purchase Request

Be sure to check Exchanging Shares, Frequent-Trading Limitations, and Other Rules You Should Know before placing your purchase request.

New clients interested in purchasing Institutional Select Shares in a fund account should contact their Vanguard Sales Executive or call 800-523-1036.

Existing clients interested in purchasing additional shares or exchanging shares may make a request by contacting their Vanguard Relationship Manager, submitting a request through a trading platform, or making a request by mail (The Vanguard Group, P.O. Box 982901, El Paso, TX 79998-2901).

Certain Vanguard institutional clients may meet the minimum investment amount by aggregating separate accounts within the same fund. This aggregation policy does not apply to financial intermediaries.

22

Vanguard may charge additional recordkeeping fees for institutional clients whose accounts are recordkept by Vanguard. Please contact your Vanguard representative to determine whether additional recordkeeping fees apply to your account.

To add to an existing account. Generally $1.

How to Pay for a Purchase

By electronic bank transfer or wire. You may purchase Institutional Select Shares by an electronic bank transfer or by wire. Wiring instructions vary for different types of purchases. Please contact your Vanguard Relationship Manager or Vanguard Sales Executive for instructions and policies on purchasing shares by wire. See Contacting Vanguard.

By exchange. You may purchase shares of a Vanguard fund using the proceeds from the simultaneous redemption of shares of another Vanguard fund. You may initiate an exchange online (if you are registered for online access), by telephone, or by mail with an exchange form. See Exchanging Shares.

Your purchase or exchange request can be initiated online (if you are registered for online access), by telephone, or by mail. All new and existing clients are encouraged to contact their Vanguard Relationship Manager or Vanguard Sales Executive to discuss options for purchasing or exchanging shares.

Trade Date

The trade date for any purchase request received in good order will depend on the day and time Vanguard receives your request, the manner in which you are paying, and the type of fund you are purchasing. Your purchase will be executed using the NAV as calculated on the trade date. NAVs are calculated only on days that the NYSE is open for trading (a business day). In the rare event the NYSE experiences unanticipated disruptions and is unavailable at the close of the trading day, NAVs will be calculated as of the close of regular trading on the Nasdaq (or another alternate exchange if the Nasdaq is unavailable, as determined at Vanguard’s discretion), generally 4 p.m., Eastern time. The time selected for NAV calculation in this rare event shall also serve as the conclusion of the trading day. See Share Price.

For purchases by check into all funds other than money market funds and for purchases by exchange, wire, or electronic bank transfer into all funds: If the purchase request is received by Vanguard on a business day before the close of regular trading on the NYSE (generally 4 p.m., Eastern time), the trade date for

23

the purchase will be the same day. If the purchase request is received on a business day after the close of regular trading on the NYSE, or on a nonbusiness day, the trade date for the purchase will be the next business day.

For purchases by check into money market funds: If the purchase request is received by Vanguard on a business day before the close of regular trading on the NYSE (generally 4 p.m., Eastern time), the trade date for the purchase will be the next business day. If the purchase request is received on a business day after the close of regular trading on the NYSE, or on a nonbusiness day, the trade date for the purchase will be the second business day following the day Vanguard receives the purchase request. Because money market instruments must be purchased with federal funds and it takes a money market mutual fund one business day to convert check proceeds into federal funds, the trade date for the purchase will be one business day later than for other funds.

If applicable, orders by Vanguard Funds of Funds will be treated as received by the Fund at the same time that corresponding orders are received in proper form by the Vanguard Funds of Funds.

If your purchase request is not accurate and complete, it may be rejected. See Other Rules You Should Know—Good Order.

For further information about purchase transactions, consult our website at vanguard.com or see Contacting Vanguard.

Other Purchase Rules You Should Know

New accounts. We are required by law to obtain from you certain personal information that we will use to verify your identity. If you do not provide the information, we may not be able to open your account. If we are unable to verify your identity, Vanguard reserves the right, without notice, to close your account or take such other steps as we deem reasonable. Certain types of accounts may require additional documentation.

Refused or rejected purchase requests. Vanguard reserves the right to stop selling fund shares or to reject any purchase request at any time and without notice, including, but not limited to, purchases requested by exchange from another Vanguard fund. This also includes the right to reject any purchase request because the investor has a history of frequent trading or because the purchase may negatively affect a fund’s operation or performance.

Large purchases. Call Vanguard before attempting to invest a large dollar amount.

24

No cancellations. Vanguard will not accept your request to cancel any purchase request once processing has begun. Please be careful when placing a purchase request.

Converting Shares

When a conversion occurs, you receive shares of one class in place of shares of another class of the same fund. At the time of conversion, the dollar value of the “new” shares you receive equals the dollar value of the “old” shares that were converted. In other words, the conversion has no effect on the value of your investment in the fund at the time of the conversion. However, the number of shares you own after the conversion may be greater than or less than the number of shares you owned before the conversion, depending on the NAVs of the two share classes.

Vanguard will not accept your request to cancel any self-directed conversion request once processing has begun. Please be careful when placing a conversion request.

A conversion between share classes of the same fund is a nontaxable event.

Trade Date

The trade date for any conversion request received in good order will depend on the day and time Vanguard receives your request. Your conversion will be executed using the NAVs of the different share classes on the trade date. NAVs are calculated only on days that the NYSE is open for trading (a business day). In the rare event the NYSE experiences unanticipated disruptions and is unavailable at the close of the trading day, NAVs will be calculated as of the close of regular trading on the Nasdaq (or another alternate exchange if the Nasdaq is unavailable, as determined at Vanguard’s discretion), generally 4 p.m., Eastern time. The time selected for NAV calculation in this rare event shall also serve as the conclusion of the trading day. See Share Price.

For a conversion request (other than a request to convert to ETF Shares) received by Vanguard on a business day before the close of regular trading on the NYSE (generally 4 p.m., Eastern time), the trade date will be the same day. For a conversion request received on a business day after the close of regular trading on the NYSE, or on a nonbusiness day, the trade date will be the next business day. See Other Rules You Should Know.

25

Conversions to Institutional Select Shares

You are eligible for a self-directed conversion from another share class to Institutional Select Shares of the Fund, provided that your account meets all eligibility requirements. You may request a conversion through our website (if you are registered for online access), through a trading platform, by mail, or by telephone. Accounts that qualify for Institutional Select Shares will not be automatically converted.

Conversions to ETF Shares

Owners of conventional (i.e., not exchange-traded) shares issued by the Fund may convert those shares to ETF Shares of equivalent value of the same fund. Please note that investors who own conventional shares through a 401(k) plan or other employer-sponsored retirement or benefit plan generally may not convert those shares to ETF Shares and should check with their plan sponsor or recordkeeper. ETF Shares, whether acquired through a conversion or purchased on the secondary market, cannot be converted to conventional shares by a shareholder. Also, ETF Shares of one fund cannot be exchanged for ETF Shares of another fund.

ETF Shares must be held in a brokerage account. Thus, before converting conventional shares to ETF Shares, you must have an existing, or open a new, brokerage account. This account may be with Vanguard Brokerage Services or with any other brokerage firm.

Vanguard Brokerage Services does not impose a fee on conversions from conventional shares to Vanguard ETF Shares. However, other brokerage firms may charge a fee to process a conversion. Vanguard reserves the right, in the future, to impose a transaction fee on conversions or to limit, temporarily suspend, or terminate the conversion privilege. For additional information on converting conventional shares to ETF Shares, please contact Vanguard to obtain a prospectus for ETF Shares. See Contacting Vanguard.

Mandatory Conversions to Another Share Class

If an account no longer meets the balance requirements for a share class, Vanguard may automatically convert the shares in the account to another share class, as appropriate. A decline in the account balance because of market movement may result in such a conversion. Vanguard will notify the investor in writing before any mandatory conversion occurs.

26

Redeeming Shares

How to Initiate a Redemption Request

Be sure to check Exchanging Shares, Frequent-Trading Limitations, and Other Rules You Should Know before placing your redemption request.

Online. You may request a redemption of shares or request an exchange through our website or mobile application if your account is eligible and you are registered for online access.

By telephone. You may call your Vanguard Relationship Manager or Vanguard Client Account Manager to request a redemption of shares or an exchange. See Contacting Vanguard.

By mail. You may send a form (available online) to Vanguard to redeem from a fund account or to make an exchange.

How to Receive Redemption Proceeds

By electronic bank transfer. You may have the proceeds of a fund redemption sent directly to a designated bank account. Your redemption request can be initiated online (if you are registered for online access), by telephone, or by mail.

By wire. To receive your proceeds by wire, you may instruct Vanguard to wire your redemption proceeds to a previously designated bank account. To establish the wire redemption service, you generally must designate a bank account online, complete a form, or fill out the appropriate section of your account registration form.

By exchange. You may have the proceeds of a Vanguard fund redemption invested directly in shares of another Vanguard fund. You may initiate an exchange online (if you are registered for online access), by telephone, or by mail. See Exchanging Shares.

Trade Date

The trade date for any redemption request received in good order will depend on the day and time Vanguard receives your request and the manner in which you are redeeming. Your redemption will be executed using the NAV as calculated on the trade date. NAVs are calculated only on days that the NYSE is open for trading (a business day). In the rare event the NYSE experiences unanticipated disruptions and is unavailable at the close of the trading day, NAVs will be calculated as of the close of regular trading on the Nasdaq (or another alternate

27

exchange if the Nasdaq is unavailable, as determined at Vanguard’s discretion), generally 4 p.m., Eastern time. The time selected for NAV calculation in this rare event shall also serve as the conclusion of the trading day. See Share Price.

For redemptions by check, exchange, or wire: If the redemption request is received by Vanguard on a business day before the close of regular trading on the NYSE (generally 4 p.m., Eastern time), the trade date will be the same day. If the redemption request is received on a business day after the close of regular trading on the NYSE, or on a nonbusiness day, the trade date will be the next business day.

• Note on timing of wire redemptions from money market funds: For telephone requests received by Vanguard on a business day before 10:45 a.m., Eastern time (2 p.m., Eastern time, for Vanguard Cash Reserves Federal Money Market Fund; 12:30 p.m., Eastern time, for Vanguard Federal Money Market Fund), the redemption proceeds generally will leave Vanguard by the close of business the same day. For telephone requests received by Vanguard on a business day after those cut-off times, or on a nonbusiness day, and for all requests other than by telephone, the redemption proceeds generally will leave Vanguard by the close of business on the next business day.

• Note on timing of wire redemptions from all other funds: For requests received by Vanguard on a business day before the close of regular trading on the NYSE (generally 4 p.m., Eastern time), the redemption proceeds generally will leave Vanguard by the close of business on the next business day. For requests received by Vanguard on a business day after the close of regular trading on the NYSE, or on a nonbusiness day, the redemption proceeds generally will leave Vanguard by the close of business on the second business day after Vanguard receives the request.

If your redemption request is not accurate and complete, it may be rejected. If we are unable to send your redemption proceeds by wire or electronic bank transfer because the receiving institution rejects the transfer, Vanguard will make additional efforts to complete your transaction. If Vanguard is still unable to complete the transaction, we may send the proceeds of the redemption to you by check, generally payable to all registered account owners, or use your proceeds to purchase new shares of the fund from which you sold shares for the purpose of the wire or electronic bank transfer transaction. See Other Rules You Should Know—Good Order.

28

If your redemption request is received in good order, we typically expect that redemption proceeds will be paid by the Fund within one business day of the trade date; however, in certain circumstances, investors may experience a longer settlement period at the time of the transaction. For further information, see “Potentially disruptive redemptions” and “Emergency circumstances.”

For further information about redemption transactions, consult our website at vanguard.com or see Contacting Vanguard.

Other Redemption Rules You Should Know

Documentation for certain accounts. Special documentation may be required to redeem from certain types of accounts, such as trust, corporate, nonprofit, or retirement accounts. Please call us before attempting to redeem from these types of accounts.

Potentially disruptive redemptions. Vanguard reserves the right to pay all or part of a redemption in kind—that is, in the form of securities—if we reasonably believe that a cash redemption would negatively affect the fund’s operation or performance or that the shareholder may be engaged in market-timing or frequent trading. Under these circumstances, Vanguard also reserves the right to delay payment of the redemption proceeds for up to seven calendar days. By calling us before you attempt to redeem a large dollar amount, you may avoid in-kind or delayed payment of your redemption. Please see Frequent-Trading Limitations for information about Vanguard’s policies to limit frequent trading.

Recently purchased shares. Although you can redeem shares at any time, proceeds may not be made available to you until the fund collects payment for your purchase. This may take up to seven calendar days for shares purchased by check or by electronic bank transfer. If you have written a check on a fund in an account with checkwriting privileges, that check may be rejected if your fund account does not have a sufficient available balance.

Address change. If you change your address online or by telephone, there may be up to a 14-day restriction (starting on the business day after your address is changed) on your ability to request check redemptions online and by telephone. You can request a redemption in writing (using a form available online) at any time. Confirmations of address changes are sent to both the old and new addresses.

Payment to a different person or address. At your request, we can make your redemption check payable, or wire your redemption proceeds, to a different person or send it to a different address. However, this generally requires the written consent of all registered account owners and may require additional

29

documentation, such as a signature guarantee or a notarized signature. You may obtain a signature guarantee from some commercial or savings banks, credit unions, trust companies, or member firms of a U.S. stock exchange.

No cancellations. Vanguard will not accept your request to cancel any redemption request once processing has begun. Please be careful when placing a redemption request.

Emergency circumstances. Vanguard funds can postpone payment of redemption proceeds for up to seven calendar days. In addition, Vanguard funds can suspend redemptions and/or postpone payments of redemption proceeds beyond seven calendar days at times when the NYSE is closed or during emergency circumstances, as determined by the SEC.

Exchanging Shares

An exchange occurs when you use the proceeds from the redemption of shares of one Vanguard fund to simultaneously purchase shares of a different Vanguard fund. You can make exchange requests online (if you are registered for online access), by telephone, or by mail. See Purchasing Shares and Redeeming Shares.

If the NYSE is open for regular trading (generally until 4 p.m., Eastern time, on a business day) at the time an exchange request is received in good order, the trade date generally will be the same day. See Other Rules You Should Know—Good Order for additional information on all transaction requests.

Vanguard will not accept your request to cancel any exchange request once processing has begun. Please be careful when placing an exchange request.

Call Vanguard before attempting to exchange a large dollar amount. By calling us before you attempt to exchange a large dollar amount, you may avoid delayed or rejected transactions.

Please note that Vanguard reserves the right, without notice, to revise or terminate the exchange privilege, limit the amount of any exchange, or reject an exchange, at any time, for any reason. See Frequent-Trading Limitations for additional restrictions on exchanges.

Plan participants should consider the following before making an exchange to or from another fund available in your plan:

• Certain investment options, particularly funds made up of company stock or investment contracts, may be subject to unique restrictions.

30

• Vanguard can accept exchanges only as permitted by your plan. Contact your plan administrator for details on other exchange policies that apply to your plan.

Before making an exchange into another fund, it is important to read that fund’s prospectus. To obtain a copy, please contact Vanguard Participant Services toll-free at 800-523-1188.

Plan Participant Transactions

Plan participant transaction requests (e.g., a contribution, an exchange, or a redemption) must be in good order. Good order means that Vanguard has determined that (1) your transaction request includes complete information and (2) appropriate assets are already in your account or new assets have been received or, if funded via ACH, credited to your account.

Processing times for your transaction requests may differ among recordkeepers or among transaction and funding types. Your plan’s recordkeeper (which may also be Vanguard) will determine the necessary processing time frames for your transaction requests prior to submission to the Fund. Consult your recordkeeper or plan administrator for more information.

Your transaction will then be based on the next-determined NAV of the Fund’s Institutional Select Shares. If your transaction request is received in good order before the close of regular trading on the NYSE (generally 4 p.m., Eastern time), you will receive that day’s NAV and trade date. NAVs are calculated only on days that the NYSE is open for trading (a business day). In the rare event the NYSE experiences unanticipated disruptions and is unavailable at the close of the trading day, NAVs will be calculated as of the close of regular trading on the Nasdaq (or another alternate exchange if the Nasdaq is unavailable, as determined at Vanguard’s discretion), generally 4 p.m., Eastern time. The time selected for NAV calculation in this rare event shall also serve as the conclusion of the trading day. See Share Price.

If Vanguard is serving as your plan recordkeeper and if your transaction involves one or more investments with an early cut-off time for processing or another trading restriction, your entire transaction will be subject to the restriction when the trade date for your transaction is determined.

Frequent-Trading Limitations

Because excessive transactions can disrupt management of a fund and increase the fund’s costs for all shareholders, the board of trustees of each Vanguard fund places certain limits on frequent trading in the funds. Each Vanguard fund (other

31

than money market funds and short-term bond funds, but including Vanguard Short-Term Inflation-Protected Securities Index Fund) limits an investor’s purchases or exchanges into a fund account for 30 calendar days after the investor has redeemed or exchanged out of that fund account. ETF Shares are not subject to these frequent-trading limits.

For Vanguard Retirement Investment Program pooled plans, the limitations apply to exchanges made online or by telephone.

These frequent-trading limitations do not apply to the following:

• Certain transactions below dollar value or other thresholds specified by Vanguard.

• In-kind transactions to a shareholder’s donor advised fund managed by Vanguard Charitable.

• Purchases of shares with reinvested dividend or capital gains distributions.

• Transactions through Vanguard’s Automatic Investment Plan, Automatic Exchange Service, Direct Deposit Service, Automatic Withdrawal Plan, Required Minimum Distribution Service, Vanguard Small Business Online®, and certain transactions through intermediaries relating to systematic trades and required minimum distributions.

• Discretionary transactions through Vanguard Personal Advisor Services®, Vanguard Institutional Advisory Services®, Vanguard Digital Advisor™, and discretionary (advisor-directed) transactions through certain intermediaries.

• Redemptions of shares to pay fund or account fees.

• Redemptions of shares to remove excess shareholder contributions to certain types of retirement accounts (including, but not limited to, IRAs and Vanguard Individual 401(k) Plans).

• Transfers and reregistrations of shares within the same fund.

• Purchases of shares by asset transfer or direct rollover.

• Conversions of shares from one share class to another in the same fund.

• Checkwriting redemptions.

• Section 529 college savings plans.

• Certain approved institutional portfolios and asset allocation programs, as well as trades made by funds or trusts managed by Vanguard or its affiliates that invest in other Vanguard funds. (Please note that shareholders of Vanguard’s funds of funds are subject to the limitations.)

For participants in employer-sponsored defined contribution plans,* the frequent-trading limitations do not apply to:

32

• Purchases of shares with participant payroll or employer contributions or loan repayments.

• Purchases of shares with reinvested dividend or capital gains distributions.

• Distributions, loans, and in-service withdrawals from a plan.

• Redemptions of shares as part of a plan termination or at the direction of the plan.

• Transactions executed through the Vanguard Managed Account Program.

• Redemptions of shares to pay fund or account fees.

• Share or asset transfers or rollovers.

• Reregistrations of shares.

• Conversions of shares from one share class to another in the same fund.

• Exchange requests submitted by written request to Vanguard. (Exchange requests submitted by fax, if otherwise permitted, are subject to the limitations.)

The exchange privilege (your ability to purchase shares of a fund using the proceeds from the simultaneous redemption of shares of another fund) may be available to you through your plan. Although we make every effort to maintain the exchange privilege, Vanguard reserves the right to revise or terminate this privilege, limit the amount of an exchange, or reject any exchange, at any time, without notice. Because excessive exchanges can disrupt the management of the Vanguard funds and increase their transaction costs, Vanguard places certain limits on the exchange privilege.

If you are exchanging out of any Vanguard fund (other than money market funds and short-term bond funds, but including Vanguard Short-Term Inflation-Protected Securities Index Fund), you must wait 30 calendar days before exchanging back into the fund. This policy applies regardless of the dollar amount. Please note that the 30-day clock restarts after every exchange out of the fund.

*The following Vanguard fund accounts are also subject to the frequent-trading limitations: SEP-IRAs, SIMPLE IRAs, certain individual 403(b)(7) Custodial Accounts, and Vanguard Individual 401(k) Plans.

Plans for which Vanguard does not serve as recordkeeper. If Vanguard does not serve as recordkeeper for your plan, your plan’s recordkeeper will establish accounts in Vanguard funds for the benefit of its clients. In such accounts, we cannot always monitor the trading activity of individual clients. However, we review trading activity at the intermediary (omnibus) level, and if we detect suspicious activity, we will investigate and take appropriate action. If necessary,

33

Vanguard may prohibit additional purchases of fund shares by an intermediary, including for the benefit of certain of the intermediary’s clients. Intermediaries also may monitor participants’ trading activity with respect to Vanguard funds.

For those Vanguard funds that charge purchase and/or redemption fees, intermediaries that establish accounts in the Vanguard funds will be asked to assess these fees on participant accounts and remit these fees to the funds. The application of purchase and redemption fees and frequent-trading limitations may vary among intermediaries. There are no assurances that Vanguard will successfully identify all intermediaries or that intermediaries will properly assess purchase and redemption fees or administer frequent-trading limitations. If a firm other than Vanguard serves as recordkeeper for your plan, please read that firm’s materials carefully to learn of any other rules or fees that may apply.

Accounts Held by Institutions (Other Than Defined Contribution Plans)

Vanguard will systematically monitor for frequent trading in institutional clients’ accounts. If we detect suspicious trading activity, we will investigate and take appropriate action, which may include applying to a client’s accounts the 30-day policy previously described, prohibiting a client’s purchases of fund shares, and/or revoking the client’s exchange privilege.

Accounts Held by Intermediaries

When intermediaries establish accounts in Vanguard funds for the benefit of their clients, we cannot always monitor the trading activity of the individual clients. However, we review trading activity at the intermediary (omnibus) level, and if we detect suspicious activity, we will investigate and take appropriate action. If necessary, Vanguard may prohibit additional purchases of fund shares by an intermediary, including for the benefit of certain of the intermediary’s clients. Intermediaries also may monitor their clients’ trading activities with respect to Vanguard funds.

For those Vanguard funds that charge purchase and/or redemption fees, intermediaries will be asked to assess these fees on client accounts and remit these fees to the funds. The application of purchase and redemption fees and frequent-trading limitations may vary among intermediaries. There are no assurances that Vanguard will successfully identify all intermediaries or that intermediaries will properly assess purchase and redemption fees or administer frequent-trading limitations. If you invest with Vanguard through an intermediary, please read that firm’s materials carefully to learn of any other rules or fees that may apply.

34

Other Rules You Should Know

Prospectus and Shareholder Report Mailings

When two or more shareholders have the same last name and address, just one summary prospectus (or prospectus) and/or shareholder report may be sent in an attempt to eliminate the unnecessary expense of duplicate mailings. You may request individual prospectuses and reports by contacting our Client Services Department in writing, by telephone, or online. See Contacting Vanguard.

Vanguard.com

Registration. If you are a registered user of vanguard.com, you can review your account holdings; buy, sell, or exchange shares of most Vanguard funds; and perform most other transactions through our website. You must register for this service online.

Electronic delivery. Vanguard can deliver your account statements, transaction confirmations, prospectuses, certain tax forms, and shareholder reports electronically. If you are a registered user of vanguard.com, you can consent to the electronic delivery of these documents by logging on and changing your mailing preferences under “Account Maintenance.” You can revoke your electronic consent at any time through our website, and we will begin to send paper copies of these documents within 30 days of receiving your revocation.

Telephone Transactions

Automatic. When we set up your account, we will automatically enable you to do business with us by telephone, unless you instruct us otherwise in writing.

Proof of a caller’s authority. We reserve the right to refuse a telephone request if the caller is unable to provide the requested information or if we reasonably believe that the caller is not an individual authorized to act on the account. Before we allow a caller to act on an account, we may request the following information: