SECURITIES AND EXCHANGE COMMISSION

REGISTRATION STATEMENT

(NO. 2-56846)

(NO. 811-02652)

(Address of Principal Executive Office)

Registrant’s Telephone Number (610) 669-1000

P.O. Box 876

Valley Forge, PA 19482

This prospectus contains financial data for the Fund through the fiscal year ended December 31, 2021.

The Securities and Exchange Commission (SEC) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

|

Account Service Fee Per Year

(for certain fund account balances below $10,000) |

$ |

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

|

|

12b-1 Distribution Fee |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

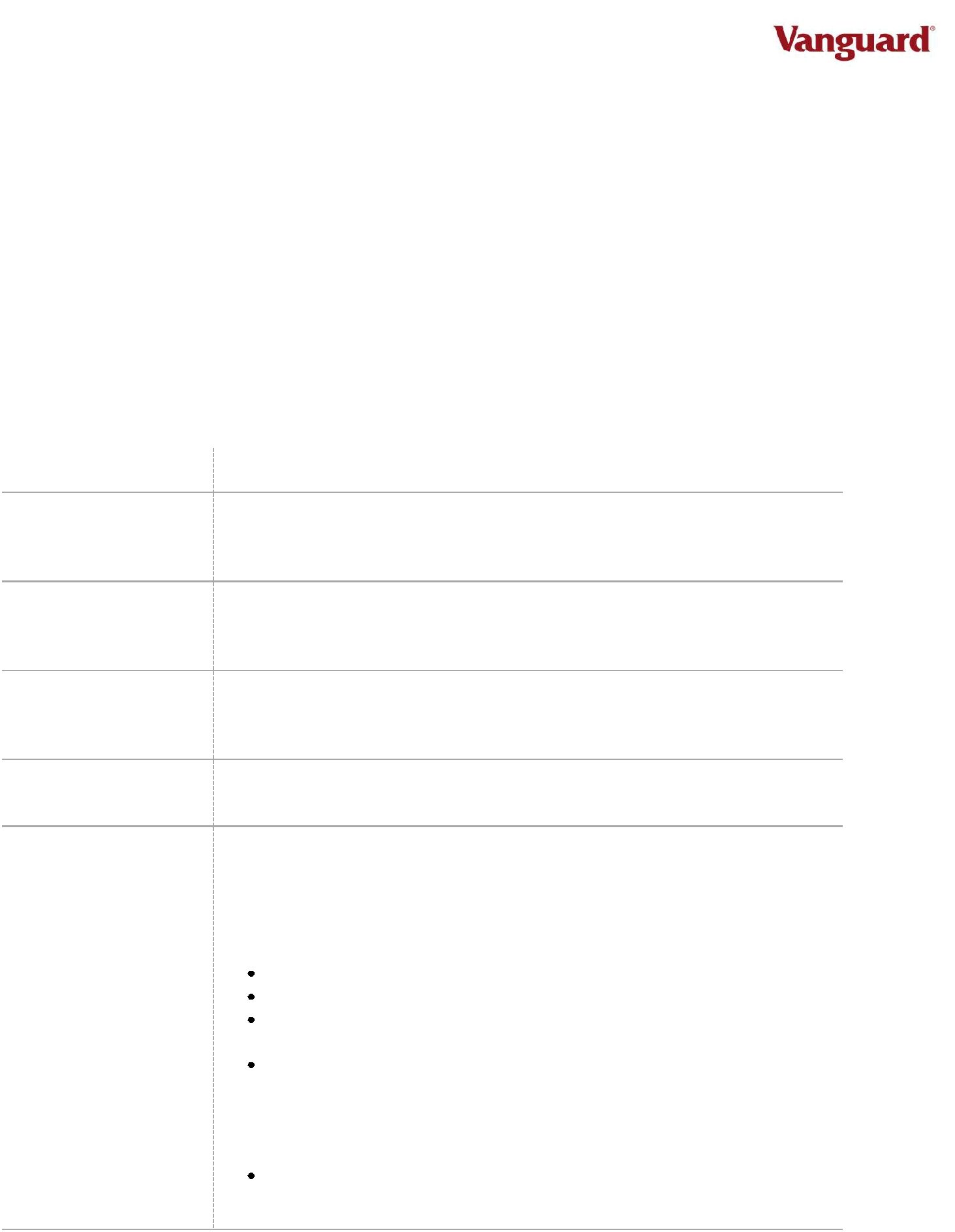

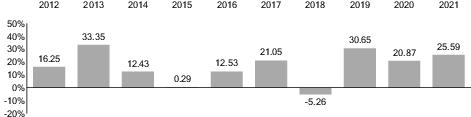

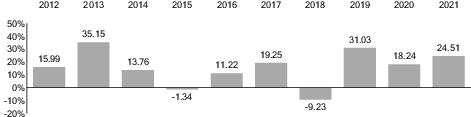

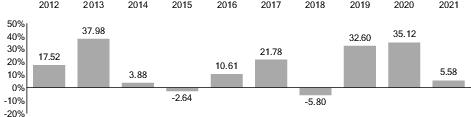

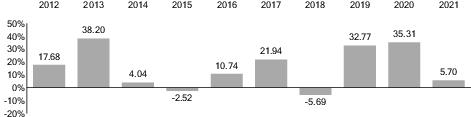

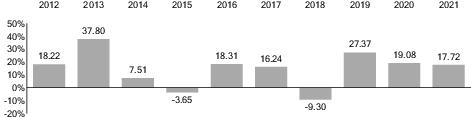

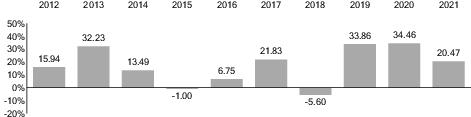

Total Return |

Quarter |

|

|

|

|

|

|

- |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard 500 Index Fund Investor Shares |

|

|

|

|

Return Before Taxes |

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

|

Standard & Poor's 500 Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

|

Dow Jones U.S. Total Stock Market Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether the Fund is the right investment for you. We suggest that you keep this prospectus for future reference.

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether the Fund is the right investment for you. We suggest that you keep this prospectus for future reference.|

Plain Talk About Fund Expenses |

|

All mutual funds have operating expenses. These expenses, which are

deducted from a fund’s gross income, are expressed as a percentage of the

net assets of the fund. Assuming that operating expenses remain as stated

in the Fees and Expenses section, Vanguard 500 Index Fund Investor Shares'

expense ratio would be 0.14%, or $1.40 per $1,000 of average net assets.

The average expense ratio for large-cap core funds in 2021 was 0.89%, or

$8.90 per $1,000 of average net assets (derived from data provided by

Lipper, a Thomson Reuters Company, which reports on the mutual

fund industry). |

|

Plain Talk About Costs of Investing |

|

Costs are an important consideration in choosing a mutual fund. That is

because you, as a shareholder, pay a proportionate share of the costs of

operating a fund and any transaction costs incurred when the fund buys or

sells securities. These costs can erode a substantial portion of the gross

income or the capital appreciation a fund achieves. Even seemingly small

differences in expenses can, over time, have a dramatic effect on a

fund’s performance. |

|

Plain Talk About Vanguard’s Unique Corporate Structure |

|

Vanguard is owned jointly by the funds it oversees and thus indirectly by the

shareholders in those funds. Most other mutual funds are operated by

management companies that are owned by third parties—either public or

private stockholders—and not by the funds they serve. |

|

Plain Talk About Distributions |

|

As a shareholder, you are entitled to your portion of a fund’s income from

interest and dividends as well as capital gains from the fund’s sale of

investments. Income consists of both the dividends that the fund earns from

any stock holdings and the interest it receives from any money market and

bond investments. Capital gains are realized whenever the fund sells

securities for higher prices than it paid for them. These capital gains are

either short-term or long-term, depending on whether the fund held the

securities for one year or less or for more than one year. |

|

Plain Talk About Buying a Dividend |

|

Unless you are a tax-exempt investor or investing through a tax-advantaged

account (such as an IRA or an employer-sponsored retirement or savings

plan), you should consider avoiding a purchase of fund shares shortly before

the fund makes a distribution, because doing so can cost you money in

taxes. This is known as “buying a dividend.” For example: On December 15,

you invest $5,000, buying 250 shares for $20 each. If the fund pays a

distribution of $1 per share on December 16, its share price will drop to $19

(not counting market change). You still have only $5,000 (250 shares x $19 =

$4,750 in share value, plus 250 shares x $1 = $250 in distributions), but you

owe tax on the $250 distribution you received—even if you reinvest it in

more shares. To avoid buying a dividend, check a fund’s distribution schedule

before you invest. |

|

|

Year Ended December 31, | ||||

|

For a Share Outstanding Throughout Each Period |

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net Asset Value, Beginning of Period |

$346.60 |

$298.16 |

$231.44 |

$246.82 |

$206.57 |

|

Investment Operations |

|

|

|

|

|

|

Net Investment Income1 |

4.910 |

5.128 |

4.801 |

4.896 |

4.221 |

|

Net Realized and Unrealized Gain (Loss) on

Investments |

93.389 |

48.323 |

67.211 |

(15.776) |

40.205 |

|

Total from Investment Operations |

98.299 |

53.451 |

72.012 |

(10.880) |

44.426 |

|

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income |

(5.039) |

(5.011) |

(5.292) |

(4.500) |

(4.176) |

|

Distributions from Realized Capital Gains |

— |

— |

— |

— |

— |

|

Total Distributions |

(5.039) |

(5.011) |

(5.292) |

(4.500) |

(4.176) |

|

Net Asset Value, End of Period |

$439.86 |

$346.60 |

$298.16 |

$231.44 |

$246.82 |

|

Total Return2 |

28.53% |

18.25% |

31.33% |

-4.52% |

21.67% |

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

$4,512 |

$4,504 |

$4,723 |

$23,162 |

$27,656 |

|

Ratio of Total Expenses to Average Net Assets |

0.14% |

0.14% |

0.14% |

0.14% |

0.14% |

|

Ratio of Net Investment Income to Average Net

Assets |

1.25% |

1.73% |

1.82% |

1.95% |

1.87% |

|

Portfolio Turnover Rate3 |

2% |

4% |

4% |

4% |

3% |

|

|

|

|

1 |

Calculated based on average shares outstanding. |

|

2 |

Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses

provide information about any applicable account service fees. |

|

3 |

Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of

the fund’s capital shares, including ETF Creation Units. |

|

Web |

|

|

Vanguard.com |

For the most complete source of Vanguard news

For fund, account, and service information

For most account transactions

For literature requests

24 hours a day, 7 days a week |

|

Phone | |

|

Vanguard Tele-Account®

800-662-6273 |

For automated fund and account information

Toll-free, 24 hours a day, 7 days a week |

|

Investor Information 800-662-7447

(Text telephone for people with

hearing impairment at 800-749-7273) |

For fund and service information

For literature requests |

|

Client Services 800-662-2739

(Text telephone for people with

hearing impairment at 800-749-7273) |

For account information

For most account transactions |

|

Participant Services 800-523-1188

(Text telephone for people with

hearing impairment at 800-749-7273) |

For information and services for participants in

employer-sponsored plans |

|

Institutional Division

888-809-8102 |

For information and services for large institutional

investors |

|

Financial Advisor and Intermediary

Sales Support 800-997-2798 |

For information and services for financial intermediaries

including financial advisors, broker-dealers, trust

institutions, and insurance companies |

|

Financial Advisory and Intermediary

Trading Support 800-669-0498 |

For account information and trading support for

financial intermediaries including financial advisors,

broker-dealers, trust institutions, and insurance

companies |

|

|

Inception

Date |

Newspaper

Abbreviation |

Vanguard

Fund Number |

CUSIP

Number |

|

500 Index Fund | ||||

|

Investor Shares |

8/31/1976 |

500 |

40 |

922908108 |

CGS identifiers have been provided by CUSIP Global Services, managed on behalf of the American Bankers Association by Standard & Poor’s Financial Services, LLC, and are not for use or dissemination in a manner that would serve as a substitute for any CUSIP service. The CUSIP Database, ©2022 American Bankers Association. “CUSIP” is a registered trademark of the American Bankers Association.

Telephone: 800-662-7447; Text telephone for people with hearing impairment: 800-749-7273

Telephone: 800-523-1188; Text telephone for people with hearing impairment: 800-749-7273

Telephone: 800-662-2739; Text telephone for people with hearing impairment: 800-749-7273

Vanguard Marketing Corporation, Distributor.

P 040 042022

This prospectus contains financial data for the Fund through the fiscal year ended December 31, 2021.

The Securities and Exchange Commission (SEC) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

|

Account Service Fee Per Year

(for certain fund account balances below $10,000) |

$ |

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

|

|

12b-1 Distribution Fee |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

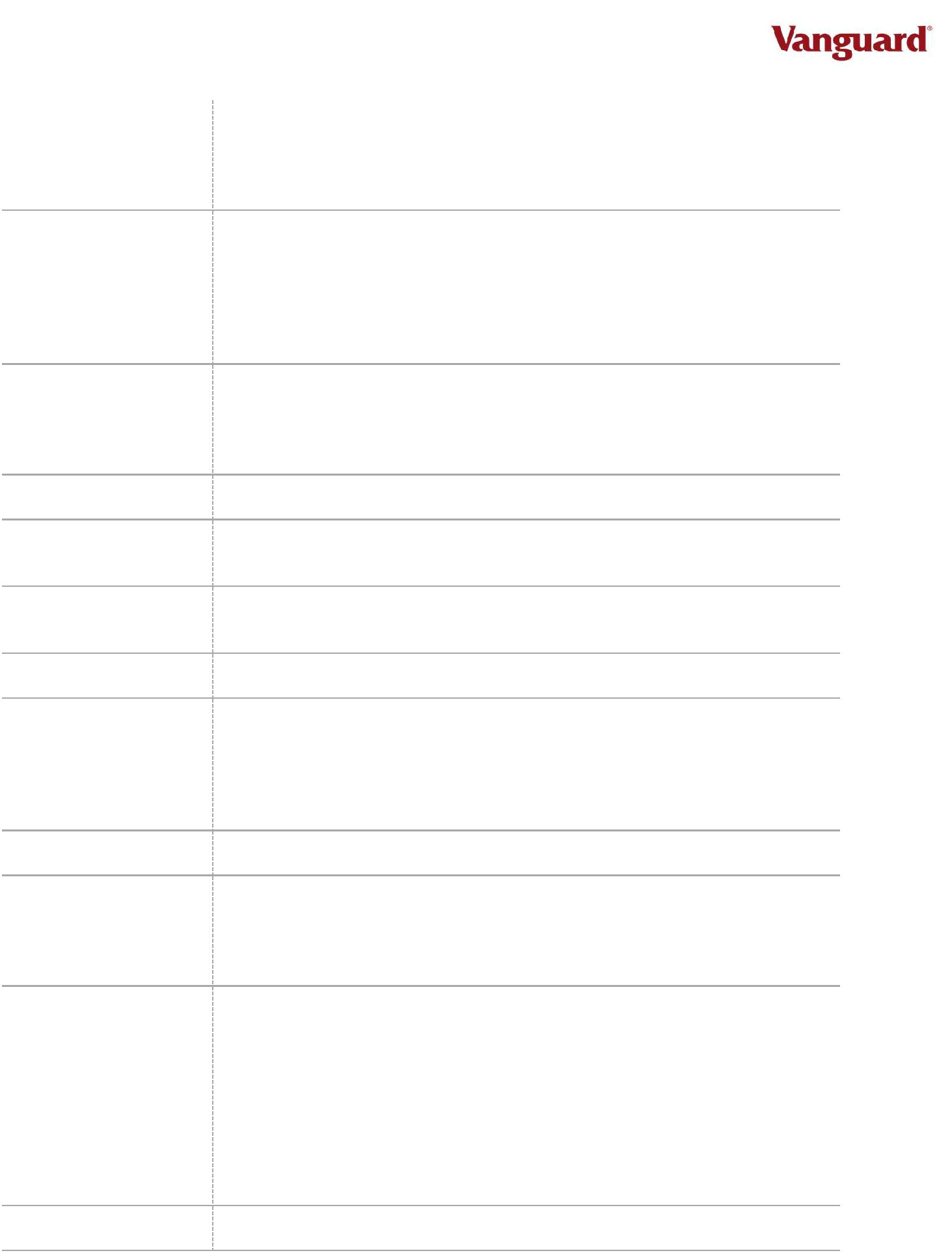

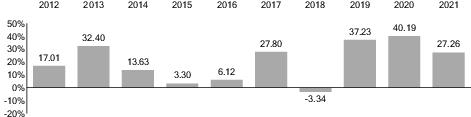

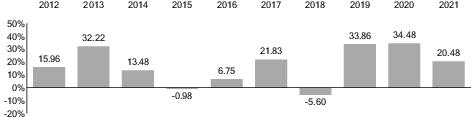

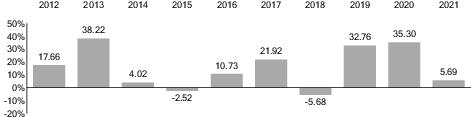

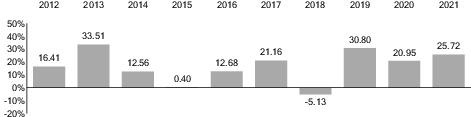

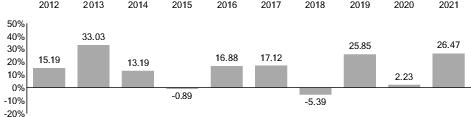

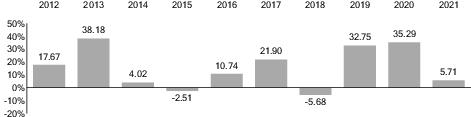

Total Return |

Quarter |

|

|

|

|

|

|

- |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard 500 Index Fund Admiral Shares |

|

|

|

|

Return Before Taxes |

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

|

Standard & Poor's 500 Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

|

Dow Jones U.S. Total Stock Market Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether the Fund is the right investment for you. We suggest that you keep this prospectus for future reference.

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether the Fund is the right investment for you. We suggest that you keep this prospectus for future reference.|

Plain Talk About Fund Expenses |

|

All mutual funds have operating expenses. These expenses, which are

deducted from a fund’s gross income, are expressed as a percentage of the

net assets of the fund. Assuming that operating expenses remain as stated

in the Fees and Expenses section, Vanguard 500 Index Fund Admiral Shares'

expense ratio would be 0.04%, or $0.40 per $1,000 of average net assets.

The average expense ratio for large-cap core funds in 2021 was 0.89%, or

$8.90 per $1,000 of average net assets (derived from data provided by

Lipper, a Thomson Reuters Company, which reports on the mutual

fund industry). |

|

Plain Talk About Costs of Investing |

|

Costs are an important consideration in choosing a mutual fund. That is

because you, as a shareholder, pay a proportionate share of the costs of

operating a fund and any transaction costs incurred when the fund buys or

sells securities. These costs can erode a substantial portion of the gross

income or the capital appreciation a fund achieves. Even seemingly small

differences in expenses can, over time, have a dramatic effect on a

fund’s performance. |

|

Plain Talk About Vanguard’s Unique Corporate Structure |

|

Vanguard is owned jointly by the funds it oversees and thus indirectly by the

shareholders in those funds. Most other mutual funds are operated by

management companies that are owned by third parties—either public or

private stockholders—and not by the funds they serve. |

|

Plain Talk About Distributions |

|

As a shareholder, you are entitled to your portion of a fund’s income from

interest and dividends as well as capital gains from the fund’s sale of

investments. Income consists of both the dividends that the fund earns from

any stock holdings and the interest it receives from any money market and

bond investments. Capital gains are realized whenever the fund sells

securities for higher prices than it paid for them. These capital gains are

either short-term or long-term, depending on whether the fund held the

securities for one year or less or for more than one year. |

|

Plain Talk About Buying a Dividend |

|

Unless you are a tax-exempt investor or investing through a tax-advantaged

account (such as an IRA or an employer-sponsored retirement or savings

plan), you should consider avoiding a purchase of fund shares shortly before

the fund makes a distribution, because doing so can cost you money in

taxes. This is known as “buying a dividend.” For example: On December 15,

you invest $5,000, buying 250 shares for $20 each. If the fund pays a

distribution of $1 per share on December 16, its share price will drop to $19

(not counting market change). You still have only $5,000 (250 shares x $19 =

$4,750 in share value, plus 250 shares x $1 = $250 in distributions), but you

owe tax on the $250 distribution you received—even if you reinvest it in

more shares. To avoid buying a dividend, check a fund’s distribution schedule

before you invest. |

|

|

Year Ended December 31, | ||||

|

For a Share Outstanding Throughout Each Period |

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net Asset Value, Beginning of Period |

$346.57 |

$298.14 |

$231.44 |

$246.82 |

$206.57 |

|

Investment Operations |

|

|

|

|

|

|

Net Investment Income1 |

5.326 |

5.427 |

5.319 |

5.181 |

4.458 |

|

Net Realized and Unrealized Gain (Loss) on

Investments |

93.371 |

48.314 |

66.962 |

(15.808) |

40.193 |

|

Total from Investment Operations |

98.697 |

53.741 |

72.281 |

(10.627) |

44.651 |

|

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income |

(5.437) |

(5.311) |

(5.581) |

(4.753) |

(4.401) |

|

Distributions from Realized Capital Gains |

— |

— |

— |

— |

— |

|

Total Distributions |

(5.437) |

(5.311) |

(5.581) |

(4.753) |

(4.401) |

|

Net Asset Value, End of Period |

$439.83 |

$346.57 |

$298.14 |

$231.44 |

$246.82 |

|

Total Return2 |

28.66% |

18.37% |

31.46% |

-4.43% |

21.79% |

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

$453,239 |

$359,553 |

$319,624 |

$230,375 |

$235,232 |

|

Ratio of Total Expenses to Average Net Assets |

0.04% |

0.04% |

0.04% |

0.04% |

0.04% |

|

Ratio of Net Investment Income to Average Net

Assets |

1.35% |

1.83% |

1.97% |

2.05% |

1.97% |

|

Portfolio Turnover Rate3 |

2% |

4% |

4% |

4% |

3% |

|

|

|

|

1 |

Calculated based on average shares outstanding. |

|

2 |

Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses

provide information about any applicable account service fees. |

|

3 |

Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of

the fund’s capital shares, including ETF Creation Units. |

|

Web |

|

|

Vanguard.com |

For the most complete source of Vanguard news

For fund, account, and service information

For most account transactions

For literature requests

24 hours a day, 7 days a week |

|

Phone | |

|

Vanguard Tele-Account®

800-662-6273 |

For automated fund and account information

Toll-free, 24 hours a day, 7 days a week |

|

Investor Information 800-662-7447

(Text telephone for people with

hearing impairment at 800-749-7273) |

For fund and service information

For literature requests |

|

Client Services 800-662-2739

(Text telephone for people with

hearing impairment at 800-749-7273) |

For account information

For most account transactions |

|

Participant Services 800-523-1188

(Text telephone for people with

hearing impairment at 800-749-7273) |

For information and services for participants in

employer-sponsored plans |

|

Institutional Division

888-809-8102 |

For information and services for large institutional

investors |

|

Financial Advisor and Intermediary

Sales Support 800-997-2798 |

For information and services for financial intermediaries

including financial advisors, broker-dealers, trust

institutions, and insurance companies |

|

Financial Advisory and Intermediary

Trading Support 800-669-0498 |

For account information and trading support for

financial intermediaries including financial advisors,

broker-dealers, trust institutions, and insurance

companies |

|

|

Inception

Date |

Newspaper

Abbreviation |

Vanguard

Fund Number |

CUSIP

Number |

|

500 Index Fund | ||||

|

Admiral Shares |

11/13/2000 |

500Adml |

540 |

922908710 |

CGS identifiers have been provided by CUSIP Global Services, managed on behalf of the American Bankers Association by Standard & Poor’s Financial Services, LLC, and are not for use or dissemination in a manner that would serve as a substitute for any CUSIP service. The CUSIP Database, ©2022 American Bankers Association. “CUSIP” is a registered trademark of the American Bankers Association.

Telephone: 800-662-7447; Text telephone for people with hearing impairment: 800-749-7273

Telephone: 800-662-2739; Text telephone for people with hearing impairment: 800-749-7273

Vanguard Marketing Corporation, Distributor.

P 540 042022

This prospectus contains financial data for the Fund through the fiscal year ended December 31, 2021.

The Securities and Exchange Commission (SEC) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

|

|

12b-1 Distribution Fee |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

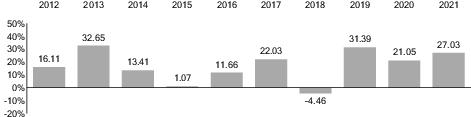

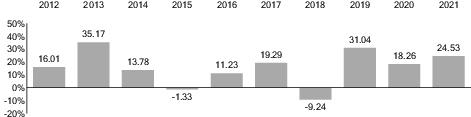

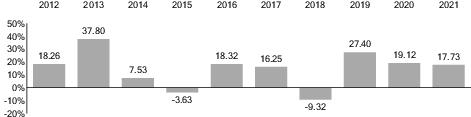

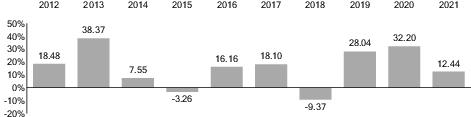

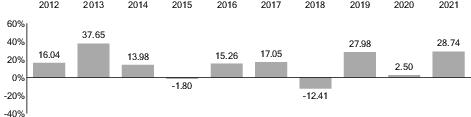

Total Return |

Quarter |

|

|

|

|

|

|

- |

|

|

|

1 Year |

5 Years |

Since

Fund

Inception |

Fund

Inception

Date |

|

Vanguard 500 Index Fund Institutional

Select Shares |

|

|

|

|

|

Return Before Taxes |

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

Return After Taxes on Distributions and Sale of

Fund Shares |

|

|

|

|

|

Standard & Poor's 500 Index

(reflects no deduction for fees, expenses,

or taxes) |

|

|

|

|

|

Dow Jones U.S. Total Stock Market Float

Adjusted Index

(reflects no deduction for fees, expenses,

or taxes) |

|

|

|

|

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether the Fund is the right investment for you. We suggest that you keep this prospectus for future reference.

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether the Fund is the right investment for you. We suggest that you keep this prospectus for future reference.|

Plain Talk About Fund Expenses |

|

All mutual funds have operating expenses. These expenses, which are

deducted from a fund’s gross income, are expressed as a percentage of the

net assets of the fund. Assuming that operating expenses remain as stated

in the Fees and Expenses section, Vanguard 500 Index Fund Institutional

Select Shares’ expense ratio would be 0.01%, or $0.10 per $1,000 of

average net assets. The average expense ratio for large-cap core funds in

2021 was 0.89%, or $8.90 per $1,000 of average net assets (derived from

data provided by Lipper, a Thomson Reuters Company, which reports on the

mutual fund industry). |

|

Plain Talk About Costs of Investing |

|

Costs are an important consideration in choosing a mutual fund. That is

because you, as a shareholder, pay a proportionate share of the costs of

operating a fund and any transaction costs incurred when the fund buys or

sells securities. These costs can erode a substantial portion of the gross

income or the capital appreciation a fund achieves. Even seemingly small

differences in expenses can, over time, have a dramatic effect on a

fund’s performance. |

|

Plain Talk About Vanguard’s Unique Corporate Structure |

|

Vanguard is owned jointly by the funds it oversees and thus indirectly by the

shareholders in those funds. Most other mutual funds are operated by

management companies that are owned by third parties—either public or

private stockholders—and not by the funds they serve. |

|

Plain Talk About Distributions |

|

As a shareholder, you are entitled to your portion of a fund’s income from

interest and dividends as well as capital gains from the fund’s sale of

investments. Income consists of both the dividends that the fund earns from

any stock holdings and the interest it receives from any money market and

bond investments. Capital gains are realized whenever the fund sells

securities for higher prices than it paid for them. These capital gains are

either short-term or long-term, depending on whether the fund held the

securities for one year or less or for more than one year. |

|

Plain Talk About Buying a Dividend |

|

Unless you are investing through a tax-advantaged account (such as a

401(k) plan), you should consider avoiding a purchase of fund shares shortly

before the fund makes a distribution, because doing so can cost you money

in taxes. This is known as “buying a dividend.” For example: On

December 15, you invest $5,000, buying 250 shares for $20 each. If the fund

pays a distribution of $1 per share on December 16, its share price will drop

to $19 (not counting market change). You still have only $5,000 (250 shares x

$19 = $4,750 in share value, plus 250 shares x $1 = $250 in distributions),

but you owe tax on the $250 distribution you received—even if you reinvest

it in more shares. To avoid buying a dividend, check a fund’s distribution

schedule before you invest. |

|

|

Year Ended December 31, | ||||

|

For a Share Outstanding Throughout Each Period |

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net Asset Value, Beginning of Period |

$183.64 |

$157.98 |

$122.64 |

$130.79 |

$109.45 |

|

Investment Operations |

|

|

|

|

|

|

Net Investment Income1 |

2.885 |

2.924 |

2.857 |

2.808 |

2.423 |

|

Net Realized and Unrealized Gain (Loss) on

Investments |

49.478 |

25.597 |

35.484 |

(8.400) |

21.283 |

|

Total from Investment Operations |

52.363 |

28.521 |

38.341 |

(5.592) |

23.706 |

|

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income |

(2.943) |

(2.861) |

(3.001) |

(2.558) |

(2.366) |

|

Distributions from Realized Capital Gains |

— |

— |

— |

— |

— |

|

Total Distributions |

(2.943) |

(2.861) |

(3.001) |

(2.558) |

(2.366) |

|

Net Asset Value, End of Period |

$233.06 |

$183.64 |

$157.98 |

$122.64 |

$130.79 |

|

Total Return |

28.70% |

18.40% |

31.49% |

-4.40% |

21.83% |

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

$118,481 |

$94,870 |

$81,230 |

$56,531 |

$44,907 |

|

Ratio of Total Expenses to Average Net Assets |

0.01% |

0.01% |

0.01% |

0.01% |

0.01% |

|

Ratio of Net Investment Income to Average Net

Assets |

1.38% |

1.86% |

2.00% |

2.08% |

2.00% |

|

Portfolio Turnover Rate2 |

2% |

4% |

4% |

4% |

3% |

|

|

|

|

1 |

Calculated based on average shares outstanding. |

|

2 |

Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of

the fund’s capital shares, including ETF Creation Units. |

The Fund reserves the right to convert an investor’s Institutional Select Shares to another share class, as appropriate, if the fund account balance falls below the account minimum for any reason, including market fluctuation. Any such conversion will be preceded by written notice to the investor.

|

Web |

|

|

Vanguard.com |

For the most complete source of Vanguard news

For fund, account, and service information

For most account transactions

For literature requests

24 hours a day, 7 days a week |

|

Phone | |

|

Vanguard Tele-Account®

800-662-6273 |

For automated fund and account information

Toll-free, 24 hours a day, 7 days a week |

|

Investor Information 800-662-7447

(Text telephone for people with

hearing impairment at 800-749-7273) |

For fund and service information

For literature requests |

|

Client Services 800-662-2739

(Text telephone for people with

hearing impairment at 800-749-7273) |

For account information

For most account transactions |

|

Participant Services 800-523-1188

(Text telephone for people with

hearing impairment at 800-749-7273) |

For information and services for participants in

employer-sponsored plans |

|

Institutional Division

888-809-8102 |

For information and services for large institutional

investors |

|

Financial Advisor and Intermediary

Sales Support 800-997-2798 |

For information and services for financial intermediaries

including financial advisors, broker-dealers, trust

institutions, and insurance companies |

|

Financial Advisory and Intermediary

Trading Support 800-669-0498 |

For account information and trading support for

financial intermediaries including financial advisors,

broker-dealers, trust institutions, and insurance

companies |

|

|

Inception

Date |

Newspaper

Abbreviation |

Vanguard

Fund Number |

CUSIP

Number |

|

500 Index Fund | ||||

|

Institutional Select Shares |

6/24/2016

Investor Shares

8/31/1976) |

Van500IxInstSel |

1940 |

922908348 |

CGS identifiers have been provided by CUSIP Global Services, managed on behalf of the American Bankers Association by Standard & Poor’s Financial Services, LLC, and are not for use or dissemination in a manner that would

Telephone: 800-662-7447; Text telephone for people with hearing impairment: 800-749-7273

Telephone: 800-662-2739; Text telephone for people with hearing impairment: 800-749-7273

Vanguard Marketing Corporation, Distributor.

I 1940 042022

This prospectus contains financial data for the Fund through the fiscal year ended December 31, 2021.

The Securities and Exchange Commission (SEC) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is

(Fees paid directly from your investment)

|

| |

|

Transaction Fee on Purchases and Sales |

|

|

Transaction Fee on Reinvested Dividends |

|

|

Transaction Fee on Conversion to ETF Shares |

|

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

|

|

12b-1 Distribution Fee |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

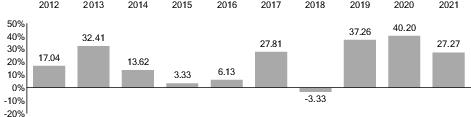

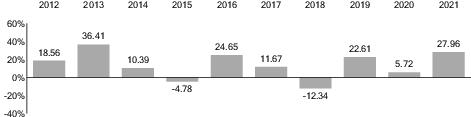

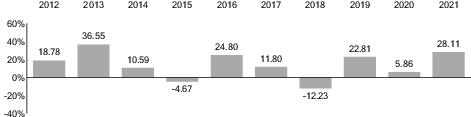

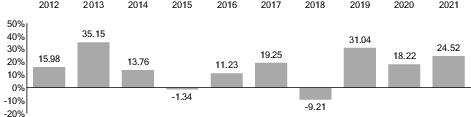

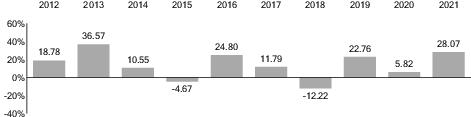

Total Return |

Quarter |

|

|

|

|

|

|

- |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard 500 Index Fund ETF Shares |

|

|

|

|

Based on NAV |

|

|

|

|

Return Before Taxes |

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

|

Based on Market Price |

|

|

|

|

Return Before Taxes |

|

|

|

|

Standard & Poor's 500 Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

|

Dow Jones U.S. Total Stock Market Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

An investor may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase ETF Shares (bid) and the lowest price a seller is willing to accept for ETF Shares (ask) when buying or selling shares in the secondary market (bid-ask spread). Recent information, including information on the Fund's NAV, market price, premiums and discounts, and bid-ask spreads, is available online at vanguard.com.

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether the Fund is the right investment for you. We suggest that you keep this prospectus for future reference.

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether the Fund is the right investment for you. We suggest that you keep this prospectus for future reference.All share classes offered by the Fund have the same investment objective, strategies, and policies. However, different share classes have different expenses; as a result, their investment returns will differ.

|

Plain Talk About Fund Expenses |

|

All funds have operating expenses. These expenses, which are deducted

from a fund’s gross income, are expressed as a percentage of the net assets

of the fund. Assuming that operating expenses remain as stated in the Fees

and Expenses section, Vanguard 500 Index Fund ETF Shares’ expense ratio

would be 0.03%, or $0.30 per $1,000 of average net assets. The average

expense ratio for large-cap core funds in 2021 was 0.89%, or $8.90 per

$1,000 of average net assets (derived from data provided by Lipper, a

Thomson Reuters Company, which reports on the fund industry). |

|

Plain Talk About Costs of Investing |

|

Costs are an important consideration in choosing an ETF. That is because

you, as a shareholder, pay a proportionate share of the costs of operating a

fund and any transaction costs incurred when the fund buys or sells

securities. These costs can erode a substantial portion of the gross income

or the capital appreciation a fund achieves. Even seemingly small differences

in expenses can, over time, have a dramatic effect on a fund’s performance. |

|

Plain Talk About Vanguard’s Unique Corporate Structure |

|

Vanguard is owned jointly by the funds it oversees and thus indirectly by the

shareholders in those funds. Most other mutual funds are operated by

management companies that are owned by third parties—either public or

private stockholders—and not by the funds they serve. |

|

Plain Talk About Distributions |

|

As a shareholder, you are entitled to your portion of a fund’s income from

interest and dividends as well as capital gains from the fund’s sale of

investments. Income consists of both the dividends that the fund earns from

any stock holdings and the interest it receives from any money market and

bond investments. Capital gains are realized whenever the fund sells

securities for higher prices than it paid for them. These capital gains are

either short-term or long-term, depending on whether the fund held the

securities for one year or less or for more than one year. |

|

|

Inception Date |

Vanguard

Fund Number |

CUSIP

Number |

|

500 Index Fund | |||

|

ETF Shares |

9/7/2010

(Investor Shares

8/31/1976) |

968 |

922908363 |

CGS identifiers have been provided by CUSIP Global Services, managed on behalf of the American Bankers Association by Standard & Poor’s Financial Services, LLC, and are not for use or dissemination in a manner that would serve as a substitute for any CUSIP service. The CUSIP Database, ©2022 American Bankers Association. “CUSIP” is a registered trademark of the American Bankers Association.

|

|

Year Ended December 31, | ||||

|

For a Share Outstanding Throughout Each Period |

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net Asset Value, Beginning of Period |

$343.93 |

$295.87 |

$229.68 |

$244.94 |

$205.00 |

|

Investment Operations |

|

|

|

|

|

|

Net Investment Income1

|

5.353 |

5.413 |

5.298 |

5.196 |

4.434 |

|

Net Realized and Unrealized Gain (Loss) on

Investments |

92.624 |

47.950 |

66.463 |

(15.719) |

39.874 |

|

Total from Investment Operations |

97.977 |

53.363 |

71.761 |

(10.523) |

44.308 |

|

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income |

(5.437) |

(5.303) |

(5.571) |

(4.737) |

(4.368) |

|

Distributions from Realized Capital Gains |

— |

— |

— |

— |

— |

|

Total Distributions |

(5.437) |

(5.303) |

(5.571) |

(4.737) |

(4.368) |

|

Net Asset Value, End of Period |

$436.47 |

$343.93 |

$295.87 |

$229.68 |

$244.94 |

|

Total Return |

28.66% |

18.35% |

31.46% |

-4.42% |

21.78% |

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

$279,850 |

$177,991 |

$130,728 |

$90,639 |

$83,640 |

|

Ratio of Total Expenses to Average Net Assets |

0.03% |

0.03% |

0.03% |

0.03% |

0.04% |

|

Ratio of Net Investment Income to Average Net

Assets |

1.36% |

1.83% |

1.98% |

2.06% |

1.97% |

|

Portfolio Turnover Rate2

|

2% |

4% |

4% |

4% |

3% |

|

|

|

|

1 |

Calculated based on average shares outstanding. |

|

2 |

Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of

the fund’s capital shares, including ETF Creation Units. |

CFA® is a registered trademark owned by CFA Institute.

U.S. Patent No6,879,964

Vanguard Marketing Corporation, Distributor.

P 968 042022

This prospectus contains financial data for the Fund through the fiscal year ended December 31, 2021.

The Securities and Exchange Commission (SEC) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

|

|

12b-1 Distribution Fee |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

Total Return |

Quarter |

|

|

|

|

|

|

- |

|

|

|

1 Year |

5 Years |

Since

Fund

Inception |

Fund

Inception

Date |

|

Vanguard Extended Market Index Fund

Institutional Select Shares |

|

|

|

|

|

Return Before Taxes |

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

Return After Taxes on Distributions and Sale of

Fund Shares |

|

|

|

|

|

Standard & Poor's Completion Index

(reflects no deduction for fees, expenses,

or taxes) |

|

|

|

|

|

Dow Jones U.S. Total Stock Market Float

Adjusted Index

(reflects no deduction for fees, expenses,

or taxes) |

|

|

|

|

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether the Fund is the right investment for you. We suggest that you keep this prospectus for future reference.

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether the Fund is the right investment for you. We suggest that you keep this prospectus for future reference.|

Plain Talk About Costs of Investing |

|

Costs are an important consideration in choosing a mutual fund. That is

because you, as a shareholder, pay a proportionate share of the costs of

operating a fund and any transaction costs incurred when the fund buys or

sells securities. These costs can erode a substantial portion of the gross

income or the capital appreciation a fund achieves. Even seemingly small

differences in expenses can, over time, have a dramatic effect on a

fund’s performance. |

|

Plain Talk About Vanguard’s Unique Corporate Structure |

|

Vanguard is owned jointly by the funds it oversees and thus indirectly by the

shareholders in those funds. Most other mutual funds are operated by

management companies that are owned by third parties—either public or

private stockholders—and not by the funds they serve. |

|

Plain Talk About Distributions |

|

As a shareholder, you are entitled to your portion of a fund’s income from

interest as well as capital gains from the fund’s sale of investments. Income

consists of interest the fund earns from its money market and bond

investments. Capital gains are realized whenever the fund sells securities for

higher prices than it paid for them. These capital gains are either short-term

or long-term, depending on whether the fund held the securities for one year

or less or for more than one year. |

|

Plain Talk About Buying a Dividend |

|

Unless you are investing through a tax-advantaged account (such as an IRA

or an employer sponsored retirement or savings plan), you should consider

avoiding a purchase of fund shares shortly before the fund makes a

distribution, because doing so can cost you money in taxes. This is known as

“buying a dividend.” For example: On December 15, you invest $5,000,

buying 250 shares for $20 each. If the fund pays a distribution of $1 per

share on December 16, its share price will drop to $19 (not counting market

change). You still have only $5,000 (250 shares x $19 = $4,750 in share value,

plus 250 shares x $1 = $250 in distributions), but you owe tax on the $250

distribution you received—even if you reinvest it in more shares. To avoid

buying a dividend, check a fund’s distribution schedule before you invest. |

|

|

Year Ended December 31, | ||||

|

For a Share Outstanding Throughout Each Period |

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net Asset Value, Beginning of Period |

$200.45 |

$153.63 |

$121.63 |

$136.19 |

$116.85 |

|

Investment Operations |

|

|

|

|

|

|

Net Investment Income1 |

2.352 |

1.855 |

2.059 |

2.184 |

1.891 |

|

Net Realized and Unrealized Gain (Loss) on

Investments |

22.661 |

47.179 |

31.999 |

(14.655) |

19.221 |

|

Total from Investment Operations |

25.013 |

49.034 |

34.058 |

(12.471) |

21.112 |

|

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income |

(2.603) |

(2.214) |

(2.058) |

(2.089) |

(1.772) |

|

Distributions from Realized Capital Gains |

— |

— |

— |

— |

— |

|

Total Distributions |

(2.603) |

(2.214) |

(2.058) |

(2.089) |

(1.772) |

|

Net Asset Value, End of Period |

$222.86 |

$200.45 |

$153.63 |

$121.63 |

$136.19 |

|

Total Return |

12.50% |

32.27% |

28.09% |

-9.32% |

18.17% |

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

$26,240 |

$24,472 |

$19,166 |

$13,390 |

$12,250 |

|

Ratio of Total Expenses to Average Net Assets |

0.02% |

0.02% |

0.02% |

0.02% |

0.02% |

|

Ratio of Net Investment Income to Average Net

Assets |

1.05% |

1.22% |

1.44% |

1.55% |

1.43% |

|

Portfolio Turnover Rate2 |

19% |

19% |

13% |

10% |

11% |

|

|

|

|

1 |

Calculated based on average shares outstanding. |

|

2 |

Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of

the fund’s capital shares, including ETF Creation Units. |

The Fund reserves the right to convert an investor’s Institutional Select Shares to another share class, as appropriate, if the fund account balance falls below the account minimum for any reason, including market fluctuation. Any such conversion will be preceded by written notice to the investor.

|

Web |

|

|

Vanguard.com |

For the most complete source of Vanguard news

For fund, account, and service information

For most account transactions

For literature requests

24 hours a day, 7 days a week |

|

Phone | |

|

Vanguard Tele-Account®

800-662-6273 |

For automated fund and account information

Toll-free, 24 hours a day, 7 days a week |

|

Client Services 800-662-2739

(Text telephone for people with

hearing impairment at 800-749-7273) |

For account information

For most account transactions |

|

Participant Services 800-523-1188

(Text telephone for people with

hearing impairment at 800-749-7273) |

For information and services for participants in

employer-sponsored plans |

|

Institutional Division

888-809-8102 |

For information and services for large institutional

investors |

|

Financial Advisor and Intermediary

Sales Support 800-997-2798 |

For information and services for financial intermediaries

including financial advisors, broker-dealers, trust

institutions, and insurance companies |

|

Financial Advisory and Intermediary

Trading Support 800-669-0498 |

For account information and trading support for

financial intermediaries including financial advisors,

broker-dealers, trust institutions, and insurance

companies |

|

|

Inception

Date |

Newspaper

Abbreviation |

Vanguard

Fund Number |

CUSIP

Number |

|

Extended Market Index Fund | ||||

|

Institutional Select

Shares |

6/27/2016

(Institutional Shares

7/7/1997) |

VanExMtIxInsSel |

1898 |

922908322 |

CGS identifiers have been provided by CUSIP Global Services, managed on behalf of the American Bankers Association by Standard & Poor’s Financial Services, LLC, and are not for use or dissemination in a manner that would serve as a substitute for any CUSIP service. The CUSIP Database, ©2022 American Bankers Association. “CUSIP” is a registered trademark of the American Bankers Association.

S&P DOW JONES INDICES DOES NOT GUARANTEE THE ADEQUACY, ACCURACY, TIMELINESS AND/OR THE COMPLETENESS OF THE INDEX OR ANY DATA RELATED THERETO OR ANY COMMUNICATION, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNICATION (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P DOW JONES INDICES SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES INDICES MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES, OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY VANGUARD, OWNERS OF VANGUARD EXTENDED MARKET INDEX FUND, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE INDEX OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P DOW JONES INDICES BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. THERE ARE NO THIRD PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P DOW JONES INDICES AND VANGUARD, OTHER THAN THE LICENSORS OF S&P DOW JONES INDICES.

Telephone: 888-809-8102; Text telephone for people with hearing impairment: 800-749-7273

Telephone: 800-662-2739; Text telephone for people with hearing impairment: 800-749-7273

Vanguard Marketing Corporation, Distributor.

I 1898 042022

Vanguard Large-Cap Index Fund Investor Shares (VLACX)

Vanguard Value Index Fund Investor Shares (VIVAX)

Vanguard Growth Index Fund Investor Shares (VIGRX)

This prospectus contains financial data for the Funds through the fiscal year ended December 31, 2021.

The Securities and Exchange Commission (SEC) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

|

Account Service Fee Per Year

(for certain fund account balances below $10,000) |

$ |

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

|

|

12b-1 Distribution Fee |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

Total Return |

Quarter |

|

|

|

|

|

|

- |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard Total Stock Market Index Fund Investor Shares |

|

|

|

|

Return Before Taxes |

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

|

Spliced Total Stock Market Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

|

CRSP US Total Market Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

|

Dow Jones U.S. Total Stock Market Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

|

Account Service Fee Per Year

(for certain fund account balances below $10,000) |

$ |

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

|

|

12b-1 Distribution Fee |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

Total Return |

Quarter |

|

|

|

|

|

|

- |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard Large-Cap Index Fund Investor Shares |

|

|

|

|

Return Before Taxes |

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

|

Spliced Large Cap Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

|

CRSP US Large Cap Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

|

Dow Jones U.S. Total Stock Market Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

|

Account Service Fee Per Year

(for certain fund account balances below $10,000) |

$ |

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

|

|

12b-1 Distribution Fee |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

Total Return |

Quarter |

|

|

|

|

|

|

- |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard Value Index Fund Investor Shares |

|

|

|

|

Return Before Taxes |

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

|

Spliced Value Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

|

CRSP US Large Cap Value Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

|

Dow Jones U.S. Total Stock Market Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

|

Account Service Fee Per Year

(for certain fund account balances below $10,000) |

$ |

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

|

|

12b-1 Distribution Fee |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

Total Return |

Quarter |

|

|

|

|

|

|

- |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard Growth Index Fund Investor Shares |

|

|

|

|

Return Before Taxes |

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

|

Spliced Growth Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

|

CRSP US Large Cap Growth Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

|

Dow Jones U.S. Total Stock Market Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether a Fund is the right investment for you. We suggest that you keep this prospectus for future reference.

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether a Fund is the right investment for you. We suggest that you keep this prospectus for future reference.|

Plain Talk About Costs of Investing |

|

Costs are an important consideration in choosing a mutual fund. That is

because you, as a shareholder, pay a proportionate share of the costs of

operating a fund and any transaction costs incurred when the fund buys or

sells securities. These costs can erode a substantial portion of the gross

income or the capital appreciation a fund achieves. Even seemingly small

differences in expenses can, over time, have a dramatic effect on a

fund’s performance. |

|

Vanguard Fund |

Asset-Weighted Median

Market Capitalization |

|

Total Stock Market Index Fund |

$138 billion |

|

Large-Cap Index Fund |

194 billion |

|

Value Index Fund |

120 billion |

|

Growth Index Fund |

354 billion |

|

Plain Talk About Growth Funds and Value Funds |

|

Growth investing and value investing are two styles employed by stock-fund

managers. Growth funds generally invest in stocks of companies believed to

have above-average potential for growth in revenue, earnings, cash flow, or

other similar criteria. These stocks typically have low dividend yields, if any,

and above-average prices in relation to measures such as earnings and book

value. Value funds typically invest in stocks whose prices are below average

in relation to those measures; these stocks often have above-average

dividend yields. Value stocks also may remain undervalued by the market for

long periods of time. Growth and value stocks have historically produced

similar long-term returns, though each category has periods when it

outperforms the other. |

|

Plain Talk About Vanguard’s Unique Corporate Structure |

|

Vanguard is owned jointly by the funds it oversees and thus indirectly by the

shareholders in those funds. Most other mutual funds are operated by

management companies that are owned by third parties—either public or

private stockholders—and not by the funds they serve. |

|

Plain Talk About Distributions |

|

As a shareholder, you are entitled to your portion of a fund’s income from

interest and dividends as well as capital gains from the fund’s sale of

investments. Income consists of both the dividends that the fund earns from

any stock holdings and the interest it receives from any money market and

bond investments. Capital gains are realized whenever the fund sells

securities for higher prices than it paid for them. These capital gains are

either short-term or long-term, depending on whether the fund held the

securities for one year or less or for more than one year. |

|

Plain Talk About Buying a Dividend |

|

Unless you are a tax-exempt investor or investing through a tax-advantaged

account (such as an IRA or an employer-sponsored retirement or savings

plan), you should consider avoiding a purchase of fund shares shortly before

the fund makes a distribution, because doing so can cost you money in

taxes. This is known as “buying a dividend.” For example: On December 15,

you invest $5,000, buying 250 shares for $20 each. If the fund pays a

distribution of $1 per share on December 16, its share price will drop to $19

(not counting market change). You still have only $5,000 (250 shares x $19 =

$4,750 in share value, plus 250 shares x $1 = $250 in distributions), but you

owe tax on the $250 distribution you received—even if you reinvest it in

more shares. To avoid buying a dividend, check a fund’s distribution schedule

before you invest. |

|

|

Year Ended December 31, | ||||

|

For a Share Outstanding Throughout Each Period |

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net Asset Value, Beginning of Period |

$94.71 |

$79.66 |

$62.08 |

$66.70 |

$56.06 |

|

Investment Operations |

|

|

|

|

|

|

Net Investment Income1 |

1.284 |

1.284 |

1.279 |

1.275 |

1.086 |

|

Capital Gain Distributions Received |

.0001,2 |

— |

— |

— |

— |

|

Net Realized and Unrealized Gain (Loss) on

Investments |

22.837 |

15.026 |

17.634 |

(4.703) |

10.630 |

|

Total from Investment Operations |

24.121 |

16.310 |

18.913 |

(3.428) |

11.716 |

|

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income |

(1.301) |

(1.260) |

(1.333) |

(1.192) |

(1.076) |

|

Distributions from Realized Capital Gains |

— |

— |

— |

— |

— |

|

Total Distributions |

(1.301) |

(1.260) |

(1.333) |

(1.192) |

(1.076) |

|

Net Asset Value, End of Period |

$117.53 |

$94.71 |

$79.66 |

$62.08 |

$66.70 |

|

Total Return3 |

25.59% |

20.87% |

30.65% |

-5.26% |

21.05% |

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

$133,977 |

$153,845 |

$139,686 |

$121,266 |

$126,766 |

|

Ratio of Total Expenses to Average Net Assets |

0.14% |

0.14% |

0.14% |

0.14% |

0.14% |

|

Ratio of Net Investment Income to Average Net

Assets |

1.20% |

1.62% |

1.78% |

1.86% |

1.77% |

|

Portfolio Turnover Rate4 |

4% |

8% |

4% |

3% |

3% |

|

|

|

|

1 |

Calculated based on average shares outstanding. |

|

2 |

Distribution was less than $.001 per share. |

|

3 |

Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses

provide information about any applicable account service fees. |

|

4 |

Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of

the fund’s capital shares, including ETF Creation Units. |

|

|

Year Ended December 31, | ||||

|

For a Share Outstanding Throughout Each Period |

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net Asset Value, Beginning of Period |

$71.00 |

$59.72 |

$46.36 |

$49.48 |

$41.31 |

|

Investment Operations |

|

|

|

|

|

|

Net Investment Income1 |

.956 |

.969 |

.918 |

.966 |

.819 |

|

Net Realized and Unrealized Gain (Loss) on Investments |

18.025 |

11.268 |

13.466 |

(3.184) |

8.161 |

|

Total from Investment Operations |

18.981 |

12.237 |

14.384 |

(2.218) |

8.980 |

|

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income |

(.951) |

(.957) |

(1.024) |

(.902) |

(.810) |

|

Distributions from Realized Capital Gains |

— |

— |

— |

— |

— |

|

Total Distributions |

(.951) |

(.957) |

(1.024) |

(.902) |

(.810) |

|

Net Asset Value, End of Period |

$89.03 |

$71.00 |

$59.72 |

$46.36 |

$49.48 |

|

Total Return2 |

26.87% |

20.89% |

31.23% |

-4.59% |

21.89% |

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

$36 |

$37 |

$30 |

$344 |

$387 |

|

Ratio of Total Expenses to Average Net Assets |

0.17% |

0.17% |

0.17% |

0.17% |

0.17% |

|

Ratio of Net Investment Income to Average Net Assets |

1.19% |

1.61% |

1.75% |

1.91% |

1.81% |

|

Portfolio Turnover Rate3 |

4% |

3% |

5% |

4% |

3% |

|

|

|

|

1 |

Calculated based on average shares outstanding. |

|

2 |

Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses

provide information about any applicable account service fees. |

|

3 |

Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of

the fund’s capital shares, including ETF Creation Units. |

|

|

Year Ended December 31, | ||||

|

For a Share Outstanding Throughout Each Period |

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net Asset Value, Beginning of Period |

$46.43 |

$46.78 |

$38.18 |

$41.42 |

$36.24 |

|

Investment Operations |

|

|

|

|

|

|

Net Investment Income1 |

1.177 |

1.142 |

1.093 |

1.009 |

.918 |

|

Net Realized and Unrealized Gain (Loss) on Investments |

10.945 |

(.362) |

8.623 |

(3.261) |

5.166 |

|

Total from Investment Operations |

12.122 |

.780 |

9.716 |

(2.252) |

6.084 |

|

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income |

(1.162) |

(1.130) |

(1.116) |

(.988) |

(.904) |

|

Distributions from Realized Capital Gains |

— |

— |

— |

— |

— |

|

Total Distributions |

(1.162) |

(1.130) |

(1.116) |

(.988) |

(.904) |

|

Net Asset Value, End of Period |

$57.39 |

$46.43 |

$46.78 |

$38.18 |

$41.42 |

|

Total Return2 |

26.31% |

2.18% |

25.67% |

-5.55% |

16.99% |

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

$264 |

$273 |

$328 |

$1,381 |

$1,626 |

|

Ratio of Total Expenses to Average Net Assets |

0.17% |

0.17% |

0.17% |

0.17% |

0.17% |

|

Ratio of Net Investment Income to Average Net Assets |

2.22% |

2.75% |

2.58% |

2.43% |

2.40% |

|

Portfolio Turnover Rate3 |

9% |

10% |

12% |

8% |

9% |

|

|

|

|

1 |

Calculated based on average shares outstanding. |

|

2 |

Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses

provide information about any applicable account service fees. |

|

3 |

Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of

the fund’s capital shares, including ETF Creation Units. |

|

|

Year Ended December 31, | ||||

|

For a Share Outstanding Throughout Each Period |

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net Asset Value, Beginning of Period |

$130.50 |

$93.87 |

$69.10 |

$72.36 |

$57.32 |

|

Investment Operations |

|

|

|

|

|

|

Net Investment Income1 |

.565 |

.728 |

.746 |

.823 |

.750 |

|

Net Realized and Unrealized Gain (Loss) on Investments |

34.731 |

36.631 |

24.802 |

(3.271) |

15.037 |

|

Total from Investment Operations |

35.296 |

37.359 |

25.548 |

(2.448) |

15.787 |

|

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income |

(.596) |

(.729) |

(.778) |

(.812) |

(.747) |

|

Distributions from Realized Capital Gains |

— |

— |

— |

— |

— |

|

Total Distributions |

(.596) |

(.729) |

(.778) |

(.812) |

(.747) |

|

Net Asset Value, End of Period |

$165.20 |

$130.50 |

$93.87 |

$69.10 |

$72.36 |

|

Total Return2 |

27.10% |

40.01% |

37.08% |

-3.46% |

27.65% |

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

$692 |

$750 |

$572 |

$2,654 |

$3,210 |

|

Ratio of Total Expenses to Average Net Assets |

0.17% |

0.17% |

0.17% |

0.17% |

0.17% |

|

Ratio of Net Investment Income to Average Net Assets |

0.39% |

0.69% |

0.92% |

1.08% |

1.15% |

|

Portfolio Turnover Rate3 |

8% |

6% |

11% |

11% |

8% |

|

|

|

|

1 |

Calculated based on average shares outstanding. |

|

2 |

Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses

provide information about any applicable account service fees. |

|

3 |

Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of

the fund’s capital shares, including ETF Creation Units. |

monitoring of frequent trading for accounts held by intermediaries.

|

Web |

|

|

Vanguard.com |

For the most complete source of Vanguard news

For fund, account, and service information

For most account transactions

For literature requests

24 hours a day, 7 days a week |

|

Phone | |

|

Vanguard Tele-Account®

800-662-6273 |

For automated fund and account information

Toll-free, 24 hours a day, 7 days a week |

|

Investor Information 800-662-7447

(Text telephone for people with

hearing impairment at 800-749-7273) |

For fund and service information

For literature requests |

|

Client Services 800-662-2739

(Text telephone for people with

hearing impairment at 800-749-7273) |

For account information

For most account transactions |

|

Participant Services 800-523-1188

(Text telephone for people with

hearing impairment at 800-749-7273) |

For information and services for participants in

employer-sponsored plans |

|

Institutional Division

888-809-8102 |

For information and services for large institutional

investors |

|

Financial Advisor and Intermediary

Sales Support 800-997-2798 |

For information and services for financial intermediaries