UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-02652

| Name of Registrant: | Vanguard Index Funds |

| Address of Registrant: | P.O. Box 2600 |

| Valley Forge, PA 19482 |

| Name and address of agent for service: | Anne E. Robinson, Esquire |

| P.O. Box 876 | |

| Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2023—December 31, 2023

Item 1: Reports to Shareholders

Your Fund’s Performance at a Glance | 1 |

About Your Fund’s Expenses | 2 |

Performance Summary | 4 |

Financial Statements | 7 |

| • | The financial markets delivered very robust returns for the 12 months ended December 31, 2023. Returns for Vanguard 500 Index Fund ranged from 26.11% for Investor Shares to 26.28% for Institutional Select Shares. It closely tracked its target index, the Standard & Poor’s 500 Index. The fund provides exposure to the stocks of the largest U.S. companies. |

| • | With inflation continuing to ease, a number of major central banks left off hiking interest rates. Global growth, employment, and consumer spending showed resilience, but the prospect of rates remaining high for an extended period spurred volatility at times. Toward year-end, however, global stocks and bonds rallied as falling inflation and softening economic growth raised market expectations for rate cuts in 2024. |

| • | All but two of the 11 industry sectors recorded positive returns for the 12 months. Information technology, communication services, and consumer discretionary all posted very strong results. |

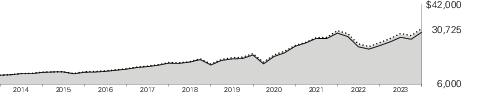

| • | For the 10 years ended December 31, the fund posted average annual returns of 11.88% for Investor Shares and 11.99% for both ETF Shares (based on net asset value) and Admiral Shares. Institutional Select Shares recorded an annualized return of 14.02% since their 2016 inception. |

| Average Annual Total Returns Periods Ended December 31, 2023 | |||

| One Year | Three Years | Five Years | |

| Stocks | |||

| Russell 1000 Index (Large-caps) | 26.53% | 8.97% | 15.52% |

| Russell 2000 Index (Small-caps) | 16.93 | 2.22 | 9.97 |

| Russell 3000 Index (Broad U.S. market) | 25.96 | 8.54 | 15.16 |

| FTSE All-World ex US Index (International) | 15.82 | 1.98 | 7.52 |

| Bonds | |||

| Bloomberg U.S. Aggregate Float Adjusted Index (Broad taxable market) | 5.60% | -3.33% | 1.17% |

| Bloomberg Municipal Bond Index (Broad tax-exempt market) | 6.40 | -0.40 | 2.25 |

| FTSE Three-Month U.S. Treasury Bill Index | 5.26 | 2.24 | 1.91 |

| CPI | |||

| Consumer Price Index | 3.35% | 5.60% | 4.07% |

| • | Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. |

| • | Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds. |

| Six Months Ended December 31, 2023 | |||

| Beginning Account Value 6/30/2023 | Ending Account Value 12/31/2023 | Expenses Paid During Period | |

| Based on Actual Fund Return | |||

| 500 Index Fund | |||

| Investor Shares | $1,000.00 | $1,079.60 | $0.73 |

| ETF Shares | 1,000.00 | 1,080.30 | 0.16 |

| Admiral™ Shares | 1,000.00 | 1,080.20 | 0.21 |

| Institutional Select Shares | 1,000.00 | 1,080.30 | 0.05 |

| Based on Hypothetical 5% Yearly Return | |||

| 500 Index Fund | |||

| Investor Shares | $1,000.00 | $1,024.50 | $0.71 |

| ETF Shares | 1,000.00 | 1,025.05 | 0.15 |

| Admiral Shares | 1,000.00 | 1,025.00 | 0.20 |

| Institutional Select Shares | 1,000.00 | 1,025.16 | 0.05 |

| Average Annual Total Returns Periods Ended December 31, 2023 | |||||

| One Year | Five Years | Ten Years | Final Value of a $10,000 Investment | ||

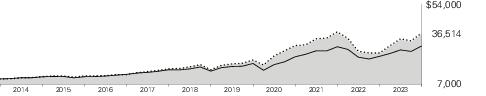

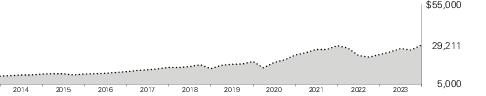

| 500 Index Fund Investor Shares | 26.11% | 15.53% | 11.88% | $30,725 |

| S&P 500 Index | 26.29 | 15.69 | 12.03 | 31,149 |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 26.06 | 15.05 | 11.40 | 29,422 |

| One Year | Five Years | Ten Years | Final Value of a $10,000 Investment | ||

| 500 Index Fund ETF Shares Net Asset Value | 26.25% | 15.65% | 11.99% | $31,037 | |

| 500 Index Fund ETF Shares Market Price | 26.33 | 15.66 | 12.00 | 31,054 | |

| S&P 500 Index | 26.29 | 15.69 | 12.03 | 31,149 | |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 26.06 | 15.05 | 11.40 | 29,422 | |

| Average Annual Total Returns Periods Ended December 31, 2023 | |||||

| One Year | Five Years | Ten Years | Final Value of a $10,000 Investment | ||

| 500 Index Fund Admiral Shares | 26.24% | 15.65% | 11.99% | $31,043 | |

| S&P 500 Index | 26.29 | 15.69 | 12.03 | 31,149 | |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 26.06 | 15.05 | 11.40 | 29,422 | |

| One Year | Five Years | Since Inception (6/24/2016) | Final Value of a $5,000,000,000 Investment | ||

| 500 Index Fund Institutional Select Shares | 26.28% | 15.68% | 14.02% | $13,406,371,500 | |

| S&P 500 Index | 26.29 | 15.69 | 14.02 | 13,410,327,500 | |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 26.06 | 15.05 | 13.49 | 12,946,697,500 | |

| One Year | Five Years | Ten Years | |

| 500 Index Fund ETF Shares Market Price | 26.33% | 106.99% | 210.54% |

| 500 Index Fund ETF Shares Net Asset Value | 26.25 | 106.84 | 210.37 |

| S&P 500 Index | 26.29 | 107.21 | 211.49 |

| Communication Services | 8.6% |

| Consumer Discretionary | 10.9 |

| Consumer Staples | 6.2 |

| Energy | 3.9 |

| Financials | 12.9 |

| Health Care | 12.6 |

| Industrials | 8.8 |

| Information Technology | 28.9 |

| Materials | 2.4 |

| Real Estate | 2.5 |

| Utilities | 2.3 |

| Shares | Market Value• ($000) | ||

| AES Corp. | 16,347,204 | 314,684 | |

| Evergy Inc. | 5,607,298 | 292,701 | |

| NRG Energy Inc. | 5,516,965 | 285,227 | |

| NiSource Inc. | 10,088,087 | 267,839 | |

| Pinnacle West Capital Corp. | 2,773,003 | 199,212 | |

| 22,874,545 | |||

| Total Common Stocks (Cost $588,003,536) | 976,810,547 | ||

| Temporary Cash Investments (0.3%) | |||

| Money Market Fund (0.3%) | |||

| 3,4 | Vanguard Market Liquidity Fund, 5.435% (Cost $2,581,279) | 25,824,367 | 2,581,920 |

| Total Investments (99.9%) (Cost $590,584,815) | 979,392,467 | ||

| Other Assets and Liabilities—Net (0.1%) | 955,501 | ||

| Net Assets (100%) | 980,347,968 | ||

| Cost is in $000. | |||

| • | See Note A in Notes to Financial Statements. |

| * | Non-income-producing security. |

| 1 | Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $37,536,000. |

| 2 | Security value determined using significant unobservable inputs. |

| 3 | Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield. |

| 4 | Collateral of $40,254,000 was received for securities on loan. |

| CVR—Contingent Value Rights. |

| Futures Contracts | ||||

| ($000) | ||||

| Expiration | Number of Long (Short) Contracts | Notional Amount | Value and Unrealized Appreciation (Depreciation) | |

| Long Futures Contracts | ||||

| E-mini S&P 500 Index | March 2024 | 11,305 | 2,724,505 | 70,958 |

| Over-the-Counter Total Return Swaps | ||||||

| Reference Entity | Termination Date | Counterparty | Notional Amount ($000) | Floating Interest Rate Received (Paid)1 (%) | Value and Unrealized Appreciation ($000) | Value and Unrealized (Depreciation) ($000) |

| Citigroup Inc. | 8/29/25 | BANA | 30,864 | (5.931) | — | (132) |

| Fidelity National Information Services Inc. | 8/30/24 | BANA | 33,639 | (5.881) | 136 | — |

| Fidelity National Information Services Inc. | 8/30/24 | BANA | 30,035 | (5.978) | 152 | — |

| Fidelity National Information Services Inc. | 8/30/24 | BANA | 30,035 | (5.977) | — | (93) |

| Fidelity National Information Services Inc. | 8/30/24 | BANA | 30,035 | (5.976) | — | (88) |

| Fidelity National Information Services Inc. | 8/30/24 | BANA | 30,035 | (5.976) | — | (83) |

| Fidelity National Information Services Inc. | 8/30/24 | BANA | 30,035 | (5.975) | — | (77) |

| Fidelity National Information Services Inc. | 8/30/24 | BANA | 18,021 | (5.881) | 73 | — |

| Global Payments Inc. | 8/30/24 | BANA | 172,085 | (5.931) | — | (415) |

| Goldman Sachs Group Inc. | 8/29/25 | BANA | 251,136 | (6.031) | 710 | — |

| Invesco Ltd. | 8/30/24 | BANA | 4,460 | (5.881) | 33 | — |

| Kroger Co. | 1/31/24 | GSI | 44,110 | (5.324) | 1,522 | — |

| Netflix Inc. | 8/30/24 | BANA | 48,688 | (5.331) | — | (204) |

| VICI Properties Inc. | 8/30/24 | BANA | 84,482 | (5.981) | 718 | — |

| Visa Inc. Class A | 8/30/24 | BANA | 65,088 | 5.231 | — | (140) |

| 3,344 | (1,232) | |||||

| 1 | Based on Overnight Bank Funding Rate as of the most recent reset date. Floating interest payment received/paid monthly. |

| BANA—Bank of America, N.A. | |

| GSI—Goldman Sachs International. |

| ($000s, except shares, footnotes, and per-share amounts) | Amount |

| Assets | |

| Investments in Securities, at Value1 | |

| Unaffiliated Issuers (Cost $588,003,536) | 976,810,547 |

| Affiliated Issuers (Cost $2,581,279) | 2,581,920 |

| Total Investments in Securities | 979,392,467 |

| Investment in Vanguard | 31,035 |

| Cash | 2,982 |

| Cash Collateral Pledged—Futures Contracts | 134,729 |

| Receivables for Investment Securities Sold | 60,221 |

| Receivables for Accrued Income | 928,234 |

| Receivables for Capital Shares Issued | 645,981 |

| Unrealized Appreciation—Over-the-Counter Swap Contracts | 3,344 |

| Total Assets | 981,198,993 |

| Liabilities | |

| Payables for Investment Securities Purchased | 247,045 |

| Collateral for Securities on Loan | 40,254 |

| Payables for Capital Shares Redeemed | 541,870 |

| Payables to Vanguard | 13,694 |

| Variation Margin Payable—Futures Contracts | 6,930 |

| Unrealized Depreciation—Over-the-Counter Swap Contracts | 1,232 |

| Total Liabilities | 851,025 |

| Net Assets | 980,347,968 |

| 1 Includes $37,536,000 of securities on loan. | |

| Statement of Assets and Liabilities (continued) | |

| At December 31, 2023, net assets consisted of: | |

| ($000s, except shares, footnotes, and per-share amounts) | Amount |

| Paid-in Capital | 609,117,816 |

| Total Distributable Earnings (Loss) | 371,230,152 |

| Net Assets | 980,347,968 |

| Investor Shares—Net Assets | |

| Applicable to 7,218,564 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | 3,176,561 |

| Net Asset Value Per Share—Investor Shares | $440.05 |

| ETF Shares—Net Assets | |

| Applicable to 852,102,904 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | 372,050,529 |

| Net Asset Value Per Share—ETF Shares | $436.63 |

| Admiral Shares—Net Assets | |

| Applicable to 1,038,239,890 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | 456,812,377 |

| Net Asset Value Per Share—Admiral Shares | $439.99 |

| Institutional Select Shares—Net Assets | |

| Applicable to 635,921,838 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | 148,308,501 |

| Net Asset Value Per Share—Institutional Select Shares | $233.22 |

| Year Ended December 31, 2023 | |

| ($000) | |

| Investment Income | |

| Income | |

| Dividends1 | 14,020,764 |

| Interest2 | 149,303 |

| Securities Lending—Net | 516 |

| Total Income | 14,170,583 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 18,349 |

| Management and Administrative—Investor Shares | 4,142 |

| Management and Administrative—ETF Shares | 66,283 |

| Management and Administrative—Admiral Shares | 136,013 |

| Management and Administrative—Institutional Select Shares | 9,506 |

| Marketing and Distribution—Investor Shares | 138 |

| Marketing and Distribution—ETF Shares | 14,875 |

| Marketing and Distribution—Admiral Shares | 16,088 |

| Marketing and Distribution—Institutional Select Shares | 249 |

| Custodian Fees | 3,015 |

| Auditing Fees | 45 |

| Shareholders’ Reports—Investor Shares | 4 |

| Shareholders’ Reports—ETF Shares | 3,958 |

| Shareholders’ Reports—Admiral Shares | 1,792 |

| Shareholders’ Reports—Institutional Select Shares | — |

| Trustees’ Fees and Expenses | 521 |

| Other Expenses | 23 |

| Total Expenses | 275,001 |

| Expenses Paid Indirectly | (175) |

| Net Expenses | 274,826 |

| Net Investment Income | 13,895,757 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold2,3 | 20,395,522 |

| Futures Contracts | 306,185 |

| Swap Contracts | 94,710 |

| Realized Net Gain (Loss) | 20,796,417 |

| Statement of Operations (continued) | |

| Year Ended December 31, 2023 | |

| ($000) | |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities2 | 164,440,380 |

| Futures Contracts | 130,883 |

| Swap Contracts | (994) |

| Change in Unrealized Appreciation (Depreciation) | 164,570,269 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 199,262,443 |

| 1 | Dividends are net of foreign withholding taxes of $3,752,000. |

| 2 | Interest income, realized net gain (loss), capital gain distributions received, and change in unrealized appreciation (depreciation) from an affiliated company of the fund were $142,398,000, $229,000, $15,000, and ($303,000), respectively. Purchases and sales are for temporary cash investment purposes. |

| 3 | Includes $25,287,854,000 of net gain (loss) resulting from in-kind redemptions. |

| Year Ended December 31, | ||

| 2023 ($000) | 2022 ($000) | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net Investment Income | 13,895,757 | 12,276,461 |

| Realized Net Gain (Loss) | 20,796,417 | 27,249,293 |

| Change in Unrealized Appreciation (Depreciation) | 164,570,269 | (197,719,707) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 199,262,443 | (158,193,953) |

| Distributions | ||

| Investor Shares | (46,502) | (51,118) |

| ETF Shares | (5,133,943) | (4,305,991) |

| Admiral Shares | (6,583,499) | (6,152,722) |

| Institutional Select Shares | (2,092,603) | (1,760,089) |

| Total Distributions | (13,856,547) | (12,269,920) |

| Capital Share Transactions | ||

| Investor Shares | (596,976) | (599,158) |

| ETF Shares | 42,127,992 | 39,905,931 |

| Admiral Shares | 331,303 | 2,645,315 |

| Institutional Select Shares | 8,310,030 | 17,199,992 |

| Net Increase (Decrease) from Capital Share Transactions | 50,172,349 | 59,152,080 |

| Total Increase (Decrease) | 235,578,245 | (111,311,793) |

| Net Assets | ||

| Beginning of Period | 744,769,723 | 856,081,516 |

| End of Period | 980,347,968 | 744,769,723 |

| Investor Shares | |||||

| For a Share Outstanding Throughout Each Period | Year Ended December 31, | ||||

| 2023 | 2022 | 2021 | 2020 | 2019 | |

| Net Asset Value, Beginning of Period | $354.17 | $439.86 | $346.60 | $298.16 | $231.44 |

| Investment Operations | |||||

| Net Investment Income1 | 5.990 | 5.605 | 4.910 | 5.128 | 4.801 |

| Net Realized and Unrealized Gain (Loss) on Investments | 85.860 | (85.733) | 93.389 | 48.323 | 67.211 |

| Total from Investment Operations | 91.850 | (80.128) | 98.299 | 53.451 | 72.012 |

| Distributions | |||||

| Dividends from Net Investment Income | (5.970) | (5.562) | (5.039) | (5.011) | (5.292) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (5.970) | (5.562) | (5.039) | (5.011) | (5.292) |

| Net Asset Value, End of Period | $440.05 | $354.17 | $439.86 | $346.60 | $298.16 |

| Total Return2 | 26.11% | -18.23% | 28.53% | 18.25% | 31.33% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $3,177 | $3,093 | $4,512 | $4,504 | $4,723 |

| Ratio of Total Expenses to Average Net Assets | 0.14%3 | 0.14%3 | 0.14% | 0.14% | 0.14% |

| Ratio of Net Investment Income to Average Net Assets | 1.52% | 1.47% | 1.25% | 1.73% | 1.82% |

| Portfolio Turnover Rate4 | 2% | 2% | 2% | 4% | 4% |

| 1 | Calculated based on average shares outstanding. |

| 2 | Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees. |

| 3 | The ratio of expenses to average net assets for the period net of reduction from custody fee offset arrangements was 0.14%. |

| 4 | Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units. |

| ETF Shares | |||||

| For a Share Outstanding Throughout Each Period | Year Ended December 31, | ||||

| 2023 | 2022 | 2021 | 2020 | 2019 | |

| Net Asset Value, Beginning of Period | $351.41 | $436.47 | $343.93 | $295.87 | $229.68 |

| Investment Operations | |||||

| Net Investment Income1 | 6.412 | 6.012 | 5.353 | 5.413 | 5.298 |

| Net Realized and Unrealized Gain (Loss) on Investments | 85.165 | (85.125) | 92.624 | 47.950 | 66.463 |

| Total from Investment Operations | 91.577 | (79.113) | 97.977 | 53.363 | 71.761 |

| Distributions | |||||

| Dividends from Net Investment Income | (6.357) | (5.947) | (5.437) | (5.303) | (5.571) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (6.357) | (5.947) | (5.437) | (5.303) | (5.571) |

| Net Asset Value, End of Period | $436.63 | $351.41 | $436.47 | $343.93 | $295.87 |

| Total Return2 | 26.25% | -18.15% | 28.66% | 18.35% | 31.46% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $372,051 | $262,211 | $279,850 | $177,991 | $130,728 |

| Ratio of Total Expenses to Average Net Assets | 0.03%3 | 0.03%3 | 0.03% | 0.03% | 0.03% |

| Ratio of Net Investment Income to Average Net Assets | 1.63% | 1.60% | 1.36% | 1.83% | 1.98% |

| Portfolio Turnover Rate4 | 2% | 2% | 2% | 4% | 4% |

| 1 | Calculated based on average shares outstanding. |

| 2 | Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees. |

| 3 | The ratio of expenses to average net assets for the period net of reduction from custody fee offset arrangements were 0.03%. |

| 4 | Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units. |

| Admiral Shares | |||||

| For a Share Outstanding Throughout Each Period | Year Ended December 31, | ||||

| 2023 | 2022 | 2021 | 2020 | 2019 | |

| Net Asset Value, Beginning of Period | $354.11 | $439.83 | $346.57 | $298.14 | $231.44 |

| Investment Operations | |||||

| Net Investment Income1 | 6.404 | 6.000 | 5.326 | 5.427 | 5.319 |

| Net Realized and Unrealized Gain (Loss) on Investments | 85.843 | (85.767) | 93.371 | 48.314 | 66.962 |

| Total from Investment Operations | 92.247 | (79.767) | 98.697 | 53.741 | 72.281 |

| Distributions | |||||

| Dividends from Net Investment Income | (6.367) | (5.953) | (5.437) | (5.311) | (5.581) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (6.367) | (5.953) | (5.437) | (5.311) | (5.581) |

| Net Asset Value, End of Period | $439.99 | $354.11 | $439.83 | $346.57 | $298.14 |

| Total Return2 | 26.24% | -18.15% | 28.66% | 18.37% | 31.46% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $456,812 | $367,498 | $453,239 | $359,553 | $319,624 |

| Ratio of Total Expenses to Average Net Assets | 0.04%3 | 0.04%3 | 0.04% | 0.04% | 0.04% |

| Ratio of Net Investment Income to Average Net Assets | 1.62% | 1.58% | 1.35% | 1.83% | 1.97% |

| Portfolio Turnover Rate4 | 2% | 2% | 2% | 4% | 4% |

| 1 | Calculated based on average shares outstanding. |

| 2 | Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees. |

| 3 | The ratio of expenses to average net assets for the period net of reduction from custody fee offset arrangements was 0.04%. |

| 4 | Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units. |

| Institutional Select Shares | |||||

| For a Share Outstanding Throughout Each Period | Year Ended December 31, | ||||

| 2023 | 2022 | 2021 | 2020 | 2019 | |

| Net Asset Value, Beginning of Period | $187.66 | $233.06 | $183.64 | $157.98 | $122.64 |

| Investment Operations | |||||

| Net Investment Income1 | 3.462 | 3.249 | 2.885 | 2.924 | 2.857 |

| Net Realized and Unrealized Gain (Loss) on Investments | 45.493 | (45.458) | 49.478 | 25.597 | 35.484 |

| Total from Investment Operations | 48.955 | (42.209) | 52.363 | 28.521 | 38.341 |

| Distributions | |||||

| Dividends from Net Investment Income | (3.395) | (3.191) | (2.943) | (2.861) | (3.001) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (3.395) | (3.191) | (2.943) | (2.861) | (3.001) |

| Net Asset Value, End of Period | $233.22 | $187.66 | $233.06 | $183.64 | $157.98 |

| Total Return | 26.28% | -18.13% | 28.70% | 18.40% | 31.49% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $148,309 | $111,968 | $118,481 | $94,870 | $81,230 |

| Ratio of Total Expenses to Average Net Assets | 0.01%2 | 0.01%2 | 0.01% | 0.01% | 0.01% |

| Ratio of Net Investment Income to Average Net Assets | 1.65% | 1.62% | 1.38% | 1.86% | 2.00% |

| Portfolio Turnover Rate3 | 2% | 2% | 2% | 4% | 4% |

| 1 | Calculated based on average shares outstanding. |

| 2 | The ratio of expenses to average net assets for the period net of reduction from custody fee offset arrangements was 0.01%. |

| 3 | Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units. |

| A. | The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements. |

| B. | In accordance with the terms of a Funds' Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund investment advisory, corporate management, administrative, marketing, and distribution services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees and are generally settled twice a month. |

| C. | The fund’s custodian bank has agreed to reduce its fees when the fund maintains cash on deposit in the non-interest-bearing custody account. For the year ended December 31, 2023, custodian fee offset arrangements reduced the fund’s expenses by $175,000 (an annual rate of less than 0.01% of average net assets). |

| D. | Various inputs may be used to determine the value of the fund’s investments and derivatives. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities. |

| Level 1 ($000) | Level 2 ($000) | Level 3 ($000) | Total ($000) | |

| Investments | ||||

| Assets | ||||

| Common Stocks | 976,810,547 | — | — | 976,810,547 |

| Temporary Cash Investments | 2,581,920 | — | — | 2,581,920 |

| Total | 979,392,467 | — | — | 979,392,467 |

| Derivative Financial Instruments | ||||

| Assets | ||||

| Futures Contracts1 | 70,958 | — | — | 70,958 |

| Swap Contracts | — | 3,344 | — | 3,344 |

| Total | 70,958 | 3,344 | — | 74,302 |

| Liabilities | ||||

| Swap Contracts | — | 1,232 | — | 1,232 |

| 1 | Includes cumulative appreciation (depreciation) on futures contracts and centrally cleared swaps, if any, as reported in the Schedule of Investments. Only current day’s variation margin is reported within the Statement of Assets and Liabilities. |

| E. | Permanent differences between book-basis and tax-basis components of net assets are reclassified among capital accounts in the financial statements to reflect their tax character. These reclassifications have no effect on net assets or net asset value per share. As of period end, permanent differences primarily attributable to the accounting for applicable in-kind redemptions and swap agreements were reclassified between the following accounts: |

| Amount ($000) | |

| Paid-in Capital | 25,288,331 |

| Total Distributable Earnings (Loss) | (25,288,331) |

| Amount ($000) | |

| Undistributed Ordinary Income | 212,833 |

| Undistributed Long-Term Gains | — |

| Net Unrealized Gains (Losses) | 388,378,108 |

| Capital Loss Carryforwards | (17,360,789) |

| Qualified Late-Year Losses | — |

| Other Temporary Differences | — |

| Total | 371,230,152 |

| Year Ended December 31, | ||

| 2023 Amount ($000) | 2022 Amount ($000) | |

| Ordinary Income* | 13,856,547 | 12,269,920 |

| Long-Term Capital Gains | — | — |

| Total | 13,856,547 | 12,269,920 |

| * | Includes short-term capital gains, if any. |

| Amount ($000) | |

| Tax Cost | 591,014,359 |

| Gross Unrealized Appreciation | 413,939,478 |

| Gross Unrealized Depreciation | (25,561,370) |

| Net Unrealized Appreciation (Depreciation) | 388,378,108 |

| F. | During the year ended December 31, 2023, the fund purchased $102,584,036,000 of investment securities and sold $52,488,052,000 of investment securities, other than temporary cash investments. Purchases and sales include $76,816,130,000 and $33,972,887,000, respectively, in connection with in-kind purchases and redemptions of the fund's capital shares. |

| G. | Capital share transactions for each class of shares were: |

| Year Ended December 31, | |||||

| 2023 | 2022 | ||||

| Amount ($000) | Shares (000) | Amount ($000) | Shares (000) | ||

| Investor Shares | |||||

| Issued | 148,701 | 374 | 156,806 | 409 | |

| Issued in Lieu of Cash Distributions | 46,496 | 117 | 51,111 | 142 | |

| Redeemed | (792,173) | (2,005) | (807,075) | (2,076) | |

| Net Increase (Decrease)—Investor Shares | (596,976) | (1,514) | (599,158) | (1,525) | |

| ETF Shares | |||||

| Issued | 73,338,523 | 182,751 | 85,049,475 | 222,763 | |

| Issued in Lieu of Cash Distributions | — | — | — | — | |

| Redeemed | (31,210,531) | (76,825) | (45,143,544) | (117,750) | |

| Net Increase (Decrease)—ETF Shares | 42,127,992 | 105,926 | 39,905,931 | 105,013 | |

| Admiral Shares | |||||

| Issued | 34,205,497 | 86,235 | 39,120,573 | 102,648 | |

| Issued in Lieu of Cash Distributions | 5,732,224 | 14,309 | 5,367,387 | 14,913 | |

| Redeemed | (39,606,418) | (100,108) | (41,842,645) | (110,248) | |

| Net Increase (Decrease)—Admiral Shares | 331,303 | 436 | 2,645,315 | 7,313 | |

| Institutional Select Shares | |||||

| Issued | 20,807,286 | 97,892 | 19,836,476 | 100,749 | |

| Issued in Lieu of Cash Distributions | 2,092,603 | 9,846 | 1,760,089 | 9,243 | |

| Redeemed | (14,589,859) | (68,463) | (4,396,573) | (21,716) | |

| Net Increase (Decrease)—Institutional Select Shares | 8,310,030 | 39,275 | 17,199,992 | 88,276 | |

| H. | Significant market disruptions, such as those caused by pandemics (e.g., COVID-19 pandemic), natural or environmental disasters, war (e.g., Russia’s invasion of Ukraine), acts of terrorism, or other events, can adversely affect local and global markets and normal market operations. Any such disruptions could have an adverse impact on the value of the fund’s investments and fund performance. |

| I. | Management has determined that no events or transactions occurred subsequent to December 31, 2023, that would require recognition or disclosure in these financial statements. |

Philadelphia, Pennsylvania

February 15, 2024

| Vanguard Small-Cap Index Fund |

| Vanguard Small-Cap Growth Index Fund |

| Vanguard Small-Cap Value Index Fund |

| 1 | |

| 2 | |

| 4 | |

| 46 | |

| 75 |

| • | The financial markets delivered robust returns for the 12 months ended December 31, 2023. Returns for the Vanguard Small-Cap Index Funds ranged from 15.86% for Investor Shares of the Small-Cap Value Index Fund to 21.44% for Institutional Shares of the Small-Cap Growth Index Fund. Strong net returns from securities lending helped most share classes of all three funds to slightly outperform their target indexes. |

| • | Major central banks stopped hiking interest rates as inflation continued to ease. Global growth, employment, and consumer spending proved resilient, but the prospect of rates remaining high for an extended period spurred occasional volatility. Toward year-end, however, stocks and bonds rallied worldwide as expectations for rate cuts in 2024 rose. |

| • | Strong equity returns were widespread. Consumer discretionary and industrial stocks were among the top sector-level contributors to all three funds’ target indexes. Technology shares also drove the Small-Cap Index Fund and the Small-Cap Growth Index Fund, while financials also boosted the Small-Cap Value Index Fund. Telecommunications slightly weighed on all three. |

| • | For the 10 years ended December 31, 2023, the funds’ annualized returns ranged from 7.73% for Investor Shares of the Small-Cap Growth Index Fund to 8.51% for Institutional Shares of the Small-Cap Value Index Fund. The funds closely tracked their indexes. |

| Average Annual Total Returns Periods Ended December 31, 2023 | |||

| One Year | Three Years | Five Years | |

| Stocks | |||

| Russell 1000 Index (Large-caps) | 26.53% | 8.97% | 15.52% |

| Russell 2000 Index (Small-caps) | 16.93 | 2.22 | 9.97 |

| Russell 3000 Index (Broad U.S. market) | 25.96 | 8.54 | 15.16 |

| FTSE All-World ex US Index (International) | 15.82 | 1.98 | 7.52 |

| Bonds | |||

| Bloomberg U.S. Aggregate Float Adjusted Index (Broad taxable market) | 5.60% | -3.33% | 1.17% |

| Bloomberg Municipal Bond Index (Broad tax-exempt market) | 6.40 | -0.40 | 2.25 |

| FTSE Three-Month U.S. Treasury Bill Index | 5.26 | 2.24 | 1.91 |

| CPI | |||

| Consumer Price Index | 3.35% | 5.60% | 4.07% |

| • | Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. |

| • | Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds. |

| Six Months Ended December 31, 2023 | |||

| Beginning Account Value 6/30/2023 | Ending Account Value 12/31/2023 | Expenses Paid During Period | |

| Based on Actual Fund Return | |||

| Small-Cap Index Fund | |||

| Investor Shares | $1,000.00 | $1,081.20 | $0.89 |

| ETF Shares | 1,000.00 | 1,081.80 | 0.26 |

| Admiral™ Shares | 1,000.00 | 1,081.80 | 0.26 |

| Institutional Shares | 1,000.00 | 1,081.90 | 0.21 |

| Institutional Plus Shares | 1,000.00 | 1,081.90 | 0.16 |

| Small-Cap Growth Index Fund | |||

| Investor Shares | $1,000.00 | $1,056.00 | $0.98 |

| ETF Shares | 1,000.00 | 1,056.60 | 0.36 |

| Admiral Shares | 1,000.00 | 1,056.70 | 0.36 |

| Institutional Shares | 1,000.00 | 1,056.70 | 0.31 |

| Small-Cap Value Index Fund | |||

| Investor Shares | $1,000.00 | $1,100.80 | $1.01 |

| ETF Shares | 1,000.00 | 1,101.40 | 0.37 |

| Admiral Shares | 1,000.00 | 1,101.40 | 0.37 |

| Institutional Shares | 1,000.00 | 1,101.40 | 0.32 |

| Based on Hypothetical 5% Yearly Return | |||

| Small-Cap Index Fund | |||

| Investor Shares | $1,000.00 | $1,024.35 | $0.87 |

| ETF Shares | 1,000.00 | 1,024.95 | 0.26 |

| Admiral Shares | 1,000.00 | 1,024.95 | 0.26 |

| Institutional Shares | 1,000.00 | 1,025.00 | 0.20 |

| Institutional Plus Shares | 1,000.00 | 1,025.05 | 0.15 |

| Small-Cap Growth Index Fund | |||

| Investor Shares | $1,000.00 | $1,024.25 | $0.97 |

| ETF Shares | 1,000.00 | 1,024.85 | 0.36 |

| Admiral Shares | 1,000.00 | 1,024.85 | 0.36 |

| Institutional Shares | 1,000.00 | 1,024.90 | 0.31 |

| Small-Cap Value Index Fund | |||

| Investor Shares | $1,000.00 | $1,024.25 | $0.97 |

| ETF Shares | 1,000.00 | 1,024.85 | 0.36 |

| Admiral Shares | 1,000.00 | 1,024.85 | 0.36 |

| Institutional Shares | 1,000.00 | 1,024.90 | 0.31 |

| Average Annual Total Returns Periods Ended December 31, 2023 | |||||

| One Year | Five Years | Ten Years | Final Value of a $10,000 Investment | ||

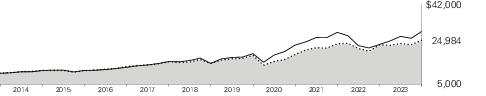

| Small-Cap Index Fund Investor Shares | 18.05% | 11.57% | 8.30% | $22,195 |

| CRSP US Small Cap Index | 18.09 | 11.66 | 8.41 | 22,413 |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 26.06 | 15.05 | 11.40 | 29,422 |

| One Year | Five Years | Ten Years | Final Value of a $10,000 Investment | ||

| Small-Cap Index Fund ETF Shares Net Asset Value | 18.21% | 11.70% | 8.43% | $22,469 | |

| Small-Cap Index Fund ETF Shares Market Price | 18.31 | 11.73 | 8.44 | 22,484 | |

| CRSP US Small Cap Index | 18.09 | 11.66 | 8.41 | 22,413 | |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 26.06 | 15.05 | 11.40 | 29,422 | |

| Average Annual Total Returns Periods Ended December 31, 2023 | |||||

| One Year | Five Years | Ten Years | Final Value of a $10,000 Investment | ||

| Small-Cap Index Fund Admiral Shares | 18.20% | 11.70% | 8.43% | $22,467 | |

| CRSP US Small Cap Index | 18.09 | 11.66 | 8.41 | 22,413 | |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 26.06 | 15.05 | 11.40 | 29,422 | |

| One Year | Five Years | Ten Years | Final Value of a $5,000,000 Investment | ||

| Small-Cap Index Fund Institutional Shares | 18.22% | 11.72% | 8.44% | $11,246,770 | |

| CRSP US Small Cap Index | 18.09 | 11.66 | 8.41 | 11,206,742 | |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 26.06 | 15.05 | 11.40 | 14,710,990 | |

| One Year | Five Years | Ten Years | Final Value of a $100,000,000 Investment | ||

| Small-Cap Index Fund Institutional Plus Shares | 18.22% | 11.73% | 8.46% | $225,184,560 | |

| CRSP US Small Cap Index | 18.09 | 11.66 | 8.41 | 224,134,830 | |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 26.06 | 15.05 | 11.40 | 294,219,800 | |

| Cumulative Returns of ETF Shares: December 31, 2013, Through December 31, 2023 | |||

| One Year | Five Years | Ten Years | |

| Small-Cap Index Fund ETF Shares Market Price | 18.31% | 74.13% | 124.84% |

| Small-Cap Index Fund ETF Shares Net Asset Value | 18.21 | 73.91 | 124.69 |

| CRSP US Small Cap Index | 18.09 | 73.60 | 124.13 |

| Basic Materials | 3.9% |

| Consumer Discretionary | 16.2 |

| Consumer Staples | 3.1 |

| Energy | 5.3 |

| Financials | 14.1 |

| Health Care | 11.0 |

| Industrials | 21.7 |

| Real Estate | 7.5 |

| Technology | 13.0 |

| Telecommunications | 1.3 |

| Utilities | 2.9 |

| Shares | Market Value• ($000) | |||||

| Northwest Natural Holding Co. | 893,879 | 34,808 | ||||

| Clearway Energy Inc. Class A | 878,788 | 22,479 | ||||

| * | Enviri Corp. | 1,017,687 | 9,159 | |||

| Excelerate Energy Inc. Class A | 468,159 | 7,238 | ||||

| *,1 | NuScale Power Corp. Class A | 1,464,713 | 4,819 | |||

| *,1 | Net Power Inc. | 342,741 | 3,462 | |||

| 3,928,146 | ||||||

| Total Common Stocks (Cost $100,156,763) | 133,504,067 | |||||

| Temporary Cash Investments (1.5%) | ||||||

| Money Market Fund (1.5%) | ||||||

| 3,4 | Vanguard Market Liquidity Fund, 5.435% (Cost $2,031,751) | 20,333,209 | 2,032,914 | |||

| Total Investments (101.3%) (Cost $102,188,514) | 135,536,981 | |||||

| Other Assets and Liabilities—Net (-1.3%) | (1,753,491) | |||||

| Net Assets (100%) | 133,783,490 | |||||

| Cost is in $000. |

| • | See Note A in Notes to Financial Statements. |

| * | Non-income-producing security. |

| 1 | Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $1,653,618,000. |

| 2 | Security value determined using significant unobservable inputs. |

| 3 | Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield. |

| 4 | Collateral of $1,839,571,000 was received for securities on loan. |

| REIT—Real Estate Investment Trust. |

| Futures Contracts | ||||

| ($000) | ||||

| Expiration | Number of Long (Short) Contracts | Notional Amount | Value and Unrealized Appreciation (Depreciation) | |

| Long Futures Contracts | ||||

| E-mini Russell 2000 Index | March 2024 | 793 | 81,191 | (375) |

| E-mini S&P 500 Index | March 2024 | 49 | 11,809 | 391 |

| E-mini S&P Mid-Cap 400 Index | March 2024 | 782 | 219,703 | 6,828 |

| 6,844 | ||||

| Over-the-Counter Total Return Swaps | ||||||

| Reference Entity | Termination Date | Counterparty | Notional Amount ($000) | Floating Interest Rate Received (Paid)1 (%) | Value and Unrealized Appreciation ($000) | Value and Unrealized (Depreciation) ($000) |

| Arbor Realty Trust Inc. | 1/31/24 | GSI | 7,690 | (5.331) | — | (113) |

| Invesco Ltd. | 8/30/24 | BANA | 3,996 | (5.882) | 1,037 | — |

| Ollie's Bargain Outlet Holdings Inc. | 1/31/24 | GSI | 20,634 | (5.331) | 2,100 | — |

| 3,137 | (113) | |||||

| 1 | Based on USD Overnight Bank Funding Rate as of the most recent reset date. Floating interest payment received/paid monthly. |

| BANA—Bank of America, N.A. | |

| GSI—Goldman Sachs International. |

| ($000s, except shares, footnotes, and per-share amounts) | Amount |

| Assets | |

| Investments in Securities, at Value1 | |

| Unaffiliated Issuers (Cost $100,156,763) | 133,504,067 |

| Affiliated Issuers (Cost $2,031,751) | 2,032,914 |

| Total Investments in Securities | 135,536,981 |

| Investment in Vanguard | 4,012 |

| Cash Collateral Pledged—Futures Contracts | 19,499 |

| Receivables for Investment Securities Sold | 44,876 |

| Receivables for Accrued Income | 155,324 |

| Receivables for Capital Shares Issued | 129,717 |

| Unrealized Appreciation—Over-the-Counter Swap Contracts | 3,137 |

| Total Assets | 135,893,546 |

| Liabilities | |

| Due to Custodian | 56,249 |

| Payables for Investment Securities Purchased | 2,791 |

| Collateral for Securities on Loan | 1,839,571 |

| Payables for Capital Shares Redeemed | 204,296 |

| Payables to Vanguard | 2,768 |

| Variation Margin Payable—Futures Contracts | 4,268 |

| Unrealized Depreciation—Over-the-Counter Swap Contracts | 113 |

| Total Liabilities | 2,110,056 |

| Net Assets | 133,783,490 |

| 1 Includes $1,653,618,000 of securities on loan. | |

| Statement of Assets and Liabilities (continued) | |

| At December 31, 2023, net assets consisted of: | |

| ($000s, except shares, footnotes, and per-share amounts) | Amount |

| Paid-in Capital | 114,056,266 |

| Total Distributable Earnings (Loss) | 19,727,224 |

| Net Assets | 133,783,490 |

| Investor Shares—Net Assets | |

| Applicable to 3,674,352 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | 375,455 |

| Net Asset Value Per Share—Investor Shares | $102.18 |

| ETF Shares—Net Assets | |

| Applicable to 236,757,474 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | 50,491,539 |

| Net Asset Value Per Share—ETF Shares | $213.26 |

| Admiral Shares—Net Assets | |

| Applicable to 507,421,002 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | 51,853,899 |

| Net Asset Value Per Share—Admiral Shares | $102.19 |

| Institutional Shares—Net Assets | |

| Applicable to 200,510,855 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | 20,489,629 |

| Net Asset Value Per Share—Institutional Shares | $102.19 |

| Institutional Plus Shares—Net Assets | |

| Applicable to 35,846,826 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | 10,572,968 |

| Net Asset Value Per Share—Institutional Plus Shares | $294.95 |

| Year Ended December 31, 2023 | |

| ($000) | |

| Investment Income | |

| Income | |

| Dividends1 | 1,846,241 |

| Interest2 | 35,924 |

| Securities Lending—Net | 165,861 |

| Total Income | 2,048,026 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 2,565 |

| Management and Administrative—Investor Shares | 632 |

| Management and Administrative—ETF Shares | 17,058 |

| Management and Administrative—Admiral Shares | 19,456 |

| Management and Administrative—Institutional Shares | 6,062 |

| Management and Administrative—Institutional Plus Shares | 2,238 |

| Marketing and Distribution—Investor Shares | 20 |

| Marketing and Distribution—ETF Shares | 2,345 |

| Marketing and Distribution—Admiral Shares | 2,182 |

| Marketing and Distribution—Institutional Shares | 604 |

| Marketing and Distribution—Institutional Plus Shares | 305 |

| Custodian Fees | 890 |

| Auditing Fees | 39 |

| Shareholders’ Reports—Investor Shares | 1 |

| Shareholders’ Reports—ETF Shares | 1,303 |

| Shareholders’ Reports—Admiral Shares | 603 |

| Shareholders’ Reports—Institutional Shares | 242 |

| Shareholders’ Reports—Institutional Plus Shares | 74 |

| Trustees’ Fees and Expenses | 72 |

| Other Expenses | 23 |

| Total Expenses | 56,714 |

| Net Investment Income | 1,991,312 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold2,3 | (603,602) |

| Futures Contracts | 58,011 |

| Swap Contracts | 6,635 |

| Realized Net Gain (Loss) | (538,956) |

| Statement of Operations (continued) | |

| Year Ended December 31, 2023 | |

| ($000) | |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities2 | 19,055,312 |

| Futures Contracts | 17,061 |

| Swap Contracts | 4,458 |

| Change in Unrealized Appreciation (Depreciation) | 19,076,831 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 20,529,187 |

| 1 | Dividends are net of foreign withholding taxes of $367,000. |

| 2 | Interest income, realized net gain (loss), capital gain distributions received, and change in unrealized appreciation (depreciation) from an affiliated company of the fund were $33,673,000, $102,000, $1,000, and $581,000, respectively. Purchases and sales are for temporary cash investment purposes. |

| 3 | Includes $4,282,164,000 of net gain (loss) resulting from in-kind redemptions. |

| Year Ended December 31, | ||

| 2023 ($000) | 2022 ($000) | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net Investment Income | 1,991,312 | 1,779,640 |

| Realized Net Gain (Loss) | (538,956) | 3,670,352 |

| Change in Unrealized Appreciation (Depreciation) | 19,076,831 | (30,136,638) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 20,529,187 | (24,686,646) |

| Distributions | ||

| Investor Shares | (6,045) | (6,214) |

| ETF Shares | (763,273) | (624,299) |

| Admiral Shares | (806,183) | (686,977) |

| Institutional Shares | (320,582) | (267,947) |

| Institutional Plus Shares | (166,742) | (147,092) |

| Total Distributions | (2,062,825) | (1,732,529) |

| Capital Share Transactions | ||

| Investor Shares | (106,228) | (85,166) |

| ETF Shares | 3,096,563 | 14,486 |

| Admiral Shares | (333,800) | 58,508 |

| Institutional Shares | 240,484 | (448,033) |

| Institutional Plus Shares | (50,188) | (1,200,734) |

| Net Increase (Decrease) from Capital Share Transactions | 2,846,831 | (1,660,939) |

| Total Increase (Decrease) | 21,313,193 | (28,080,114) |

| Net Assets | ||

| Beginning of Period | 112,470,297 | 140,550,411 |

| End of Period | 133,783,490 | 112,470,297 |

| Investor Shares | |||||

| For a Share Outstanding Throughout Each Period | Year Ended December 31, | ||||

| 2023 | 2022 | 2021 | 2020 | 2019 | |

| Net Asset Value, Beginning of Period | $87.93 | $108.35 | $93.20 | $79.35 | $63.21 |

| Investment Operations | |||||

| Net Investment Income1 | 1.412 | 1.256 | 1.230 | .928 | .832 |

| Net Realized and Unrealized Gain (Loss) on Investments | 14.314 | (20.439) | 15.130 | 13.897 | 16.319 |

| Total from Investment Operations | 15.726 | (19.183) | 16.360 | 14.825 | 17.151 |

| Distributions | |||||

| Dividends from Net Investment Income | (1.476) | (1.237) | (1.210) | (.975) | (1.011) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (1.476) | (1.237) | (1.210) | (.975) | (1.011) |

| Net Asset Value, End of Period | $102.18 | $87.93 | $108.35 | $93.20 | $79.35 |

| Total Return2 | 18.05% | -17.71% | 17.59% | 18.96% | 27.22% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $375 | $424 | $619 | $709 | $754 |

| Ratio of Total Expenses to Average Net Assets | 0.17% | 0.17%3 | 0.17% | 0.17% | 0.17% |

| Ratio of Net Investment Income to Average Net Assets | 1.52% | 1.34% | 1.17% | 1.26% | 1.14% |

| Portfolio Turnover Rate4 | 12% | 14% | 17% | 22% | 16% |

| 1 | Calculated based on average shares outstanding. |

| 2 | Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees. |

| 3 | The ratio of expenses to average net assets for the period net of reduction from custody fee offset arrangements was 0.17%. |

| 4 | Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units. |

| ETF Shares | |||||

| For a Share Outstanding Throughout Each Period | Year Ended December 31, | ||||

| 2023 | 2022 | 2021 | 2020 | 2019 | |

| Net Asset Value, Beginning of Period | $183.52 | $226.15 | $194.54 | $165.64 | $131.94 |

| Investment Operations | |||||

| Net Investment Income1 | 3.218 | 2.891 | 2.769 | 2.262 | 2.298 |

| Net Realized and Unrealized Gain (Loss) on Investments | 29.839 | (42.700) | 31.637 | 28.863 | 33.707 |

| Total from Investment Operations | 33.057 | (39.809) | 34.406 | 31.125 | 36.005 |

| Distributions | |||||

| Dividends from Net Investment Income | (3.317) | (2.821) | (2.796) | (2.225) | (2.305) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (3.317) | (2.821) | (2.796) | (2.225) | (2.305) |

| Net Asset Value, End of Period | $213.26 | $183.52 | $226.15 | $194.54 | $165.64 |

| Total Return | 18.21% | -17.60% | 17.72% | 19.08% | 27.37% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $50,492 | $40,593 | $50,187 | $37,492 | $27,442 |

| Ratio of Total Expenses to Average Net Assets | 0.05% | 0.05%2 | 0.05% | 0.05% | 0.05% |

| Ratio of Net Investment Income to Average Net Assets | 1.66% | 1.49% | 1.25% | 1.47% | 1.49% |

| Portfolio Turnover Rate3 | 12% | 14% | 17% | 22% | 16% |

| 1 | Calculated based on average shares outstanding. |

| 2 | The ratio of expenses to average net assets for the period net of reduction from custody fee offset arrangements was 0.05%. |

| 3 | Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units. |

| Admiral Shares | |||||

| For a Share Outstanding Throughout Each Period | Year Ended December 31, | ||||

| 2023 | 2022 | 2021 | 2020 | 2019 | |

| Net Asset Value, Beginning of Period | $87.94 | $108.37 | $93.22 | $79.37 | $63.23 |

| Investment Operations | |||||

| Net Investment Income1 | 1.534 | 1.383 | 1.358 | 1.029 | 1.108 |

| Net Realized and Unrealized Gain (Loss) on Investments | 14.305 | (20.461) | 15.131 | 13.887 | 16.136 |

| Total from Investment Operations | 15.839 | (19.078) | 16.489 | 14.916 | 17.244 |

| Distributions | |||||

| Dividends from Net Investment Income | (1.589) | (1.352) | (1.339) | (1.066) | (1.104) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (1.589) | (1.352) | (1.339) | (1.066) | (1.104) |

| Net Asset Value, End of Period | $102.19 | $87.94 | $108.37 | $93.22 | $79.37 |

| Total Return2 | 18.20% | -17.61% | 17.73% | 19.11% | 27.37% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $51,854 | $44,944 | $55,266 | $47,313 | $42,386 |

| Ratio of Total Expenses to Average Net Assets | 0.05% | 0.05%3 | 0.05% | 0.05% | 0.05% |

| Ratio of Net Investment Income to Average Net Assets | 1.65% | 1.48% | 1.29% | 1.40% | 1.50% |

| Portfolio Turnover Rate4 | 12% | 14% | 17% | 22% | 16% |

| 1 | Calculated based on average shares outstanding. |

| 2 | Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees. |

| 3 | The ratio of expenses to average net assets for the period net of reduction from custody fee offset arrangements was 0.05%. |

| 4 | Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units. |

| Institutional Shares | |||||

| For a Share Outstanding Throughout Each Period | Year Ended December 31, | ||||

| 2023 | 2022 | 2021 | 2020 | 2019 | |

| Net Asset Value, Beginning of Period | $87.93 | $108.36 | $93.22 | $79.37 | $63.22 |

| Investment Operations | |||||

| Net Investment Income1 | 1.544 | 1.392 | 1.367 | 1.034 | 1.101 |

| Net Realized and Unrealized Gain (Loss) on Investments | 14.314 | (20.461) | 15.123 | 13.889 | 16.161 |

| Total from Investment Operations | 15.858 | (19.069) | 16.490 | 14.923 | 17.262 |

| Distributions | |||||

| Dividends from Net Investment Income | (1.598) | (1.361) | (1.350) | (1.073) | (1.112) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (1.598) | (1.361) | (1.350) | (1.073) | (1.112) |

| Net Asset Value, End of Period | $102.19 | $87.93 | $108.36 | $93.22 | $79.37 |

| Total Return | 18.22% | -17.60% | 17.73% | 19.12% | 27.40% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $20,490 | $17,363 | $21,841 | $18,957 | $17,337 |

| Ratio of Total Expenses to Average Net Assets | 0.04% | 0.04%2 | 0.04% | 0.04% | 0.04% |

| Ratio of Net Investment Income to Average Net Assets | 1.66% | 1.49% | 1.29% | 1.41% | 1.49% |

| Portfolio Turnover Rate3 | 12% | 14% | 17% | 22% | 16% |

| 1 | Calculated based on average shares outstanding. |

| 2 | The ratio of expenses to average net assets for the period net of reduction from custody fee offset arrangements was 0.04%. |

| 3 | Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units. |

| Institutional Plus Shares | |||||

| For a Share Outstanding Throughout Each Period | Year Ended December 31, | ||||

| 2023 | 2022 | 2021 | 2020 | 2019 | |

| Net Asset Value, Beginning of Period | $253.81 | $312.78 | $269.07 | $229.09 | $182.49 |

| Investment Operations | |||||

| Net Investment Income1 | 4.479 | 3.998 | 4.029 | 2.988 | 3.186 |

| Net Realized and Unrealized Gain (Loss) on Investments | 41.301 | (59.013) | 43.607 | 40.111 | 46.645 |

| Total from Investment Operations | 45.780 | (55.015) | 47.636 | 43.099 | 49.831 |

| Distributions | |||||

| Dividends from Net Investment Income | (4.640) | (3.955) | (3.926) | (3.119) | (3.231) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (4.640) | (3.955) | (3.926) | (3.119) | (3.231) |

| Net Asset Value, End of Period | $294.95 | $253.81 | $312.78 | $269.07 | $229.09 |

| Total Return | 18.22% | -17.60% | 17.75% | 19.13% | 27.40% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $10,573 | $9,146 | $12,638 | $10,172 | $8,846 |

| Ratio of Total Expenses to Average Net Assets | 0.03% | 0.03%2 | 0.03% | 0.03% | 0.03% |

| Ratio of Net Investment Income to Average Net Assets | 1.67% | 1.48% | 1.32% | 1.41% | 1.49% |

| Portfolio Turnover Rate3 | 12% | 14% | 17% | 22% | 16% |

| 1 | Calculated based on average shares outstanding. |

| 2 | The ratio of expenses to average net assets for the period net of reduction from custody fee offset arrangements was 0.03%. |

| 3 | Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units. |

| Level 1 ($000) | Level 2 ($000) | Level 3 ($000) | Total ($000) | |

| Investments | ||||

| Assets | ||||

| Common Stocks | 133,504,067 | — | — | 133,504,067 |

| Temporary Cash Investments | 2,032,914 | — | — | 2,032,914 |

| Total | 135,536,981 | — | — | 135,536,981 |

| Derivative Financial Instruments | ||||

| Assets | ||||

| Futures Contracts1 | 7,219 | — | — | 7,219 |

| Swap Contracts | — | 3,137 | — | 3,137 |

| Total | 7,219 | 3,137 | — | 10,356 |

| Liabilities | ||||

| Futures Contracts1 | 375 | — | — | 375 |

| Swap Contracts | — | 113 | — | 113 |

| Total | 375 | 113 | — | 488 |

| 1 | Includes cumulative appreciation (depreciation) on futures contracts and centrally cleared swaps, if any, as reported in the Schedule of Investments. Only current day’s variation margin is reported within the Statement of Assets and Liabilities. | |||

| Amount ($000) | |

| Paid-in Capital | 4,280,774 |

| Total Distributable Earnings (Loss) | (4,280,774) |

| Amount ($000) | |

| Undistributed Ordinary Income | 29,306 |

| Undistributed Long-Term Gains | — |

| Net Unrealized Gains (Losses) | 32,985,908 |

| Capital Loss Carryforwards | (13,287,990) |

| Qualified Late-Year Losses | — |

| Other Temporary Differences | — |

| Total | 19,727,224 |

| Year Ended December 31, | ||

| 2023 Amount ($000) | 2022 Amount ($000) | |

| Ordinary Income* | 2,062,825 | 1,732,529 |

| Long-Term Capital Gains | — | — |

| Total | 2,062,825 | 1,732,529 |

| * | Includes short-term capital gains, if any. |

| Amount ($000) | |

| Tax Cost | 102,551,073 |

| Gross Unrealized Appreciation | 45,791,683 |

| Gross Unrealized Depreciation | (12,805,775) |

| Net Unrealized Appreciation (Depreciation) | 32,985,908 |

| Year Ended December 31, | |||||

| 2023 | 2022 | ||||

| Amount ($000) | Shares (000) | Amount ($000) | Shares (000) | ||

| Investor Shares | |||||

| Issued | 26,467 | 282 | 35,984 | 380 | |

| Issued in Lieu of Cash Distributions | 6,045 | 65 | 6,214 | 70 | |

| Redeemed | (138,740) | (1,494) | (127,364) | (1,341) | |

| Net Increase (Decrease)—Investor Shares | (106,228) | (1,147) | (85,166) | (891) | |

| ETF Shares | |||||

| Issued | 9,726,067 | 49,586 | 12,638,116 | 65,853 | |

| Issued in Lieu of Cash Distributions | — | — | — | — | |

| Redeemed | (6,629,504) | (34,025) | (12,623,630) | (66,575) | |

| Net Increase (Decrease)—ETF Shares | 3,096,563 | 15,561 | 14,486 | (722) | |

| Admiral Shares | |||||

| Issued | 5,408,237 | 58,050 | 5,970,913 | 63,999 | |

| Issued in Lieu of Cash Distributions | 717,481 | 7,692 | 610,188 | 6,862 | |

| Redeemed | (6,459,518) | (69,419) | (6,522,593) | (69,746) | |

| Net Increase (Decrease)—Admiral Shares | (333,800) | (3,677) | 58,508 | 1,115 | |

| Institutional Shares | |||||

| Issued | 2,724,886 | 29,484 | 2,809,736 | 30,018 | |

| Issued in Lieu of Cash Distributions | 302,453 | 3,242 | 252,294 | 2,838 | |

| Redeemed | (2,786,855) | (29,669) | (3,510,063) | (36,950) | |

| Net Increase (Decrease)—Institutional Shares | 240,484 | 3,057 | (448,033) | (4,094) | |

| Institutional Plus Shares | |||||

| Issued | 658,220 | 2,444 | 1,096,807 | 4,082 | |

| Issued in Lieu of Cash Distributions | 166,571 | 619 | 147,006 | 572 | |

| Redeemed | (874,979) | (3,252) | (2,444,547) | (9,024) | |

| Net Increase (Decrease)—Institutional Plus Shares | (50,188) | (189) | (1,200,734) | (4,370) | |

| Average Annual Total Returns Periods Ended December 31, 2023 | |||||

| One Year | Five Years | Ten Years | Final Value of a $10,000 Investment | ||

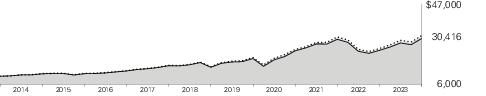

| Small-Cap Growth Index Fund Investor Shares | 21.28% | 10.41% | 7.73% | $21,053 |

| CRSP US Small Cap Growth Index | 21.28 | 10.51 | 7.82 | 21,234 |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 26.06 | 15.05 | 11.40 | 29,422 |

| One Year | Five Years | Ten Years | Final Value of a $10,000 Investment | ||

| Small-Cap Growth Index Fund ETF Shares Net Asset Value | 21.42% | 10.54% | 7.86% | $21,313 | |

| Small-Cap Growth Index Fund ETF Shares Market Price | 21.48 | 10.57 | 7.87 | 21,324 | |

| CRSP US Small Cap Growth Index | 21.28 | 10.51 | 7.82 | 21,234 | |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 26.06 | 15.05 | 11.40 | 29,422 | |

| Average Annual Total Returns Periods Ended December 31, 2023 | |||||

| One Year | Five Years | Ten Years | Final Value of a $10,000 Investment | ||

| Small-Cap Growth Index Fund Admiral Shares | 21.41% | 10.54% | 7.86% | $21,308 | |

| CRSP US Small Cap Growth Index | 21.28 | 10.51 | 7.82 | 21,234 | |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 26.06 | 15.05 | 11.40 | 29,422 | |

| One Year | Five Years | Ten Years | Final Value of a $5,000,000 Investment | ||

| Small-Cap Growth Index Fund Institutional Shares | 21.44% | 10.55% | 7.87% | $10,665,400 | |

| CRSP US Small Cap Growth Index | 21.28 | 10.51 | 7.82 | 10,617,188 | |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 26.06 | 15.05 | 11.40 | 14,710,990 | |

| Cumulative Returns of ETF Shares: December 31, 2013, Through December 31, 2023 | |||

| One Year | Five Years | Ten Years | |

| Small-Cap Growth Index Fund ETF Shares Market Price | 21.48% | 65.26% | 113.24% |

| Small-Cap Growth Index Fund ETF Shares Net Asset Value | 21.42 | 65.06 | 113.13 |

| CRSP US Small Cap Growth Index | 21.28 | 64.85 | 112.34 |

| Basic Materials | 2.0% |

| Consumer Discretionary | 16.2 |

| Consumer Staples | 3.2 |

| Energy | 6.1 |

| Financials | 4.9 |

| Health Care | 17.6 |

| Industrials | 19.1 |

| Real Estate | 5.6 |

| Technology | 22.4 |

| Telecommunications | 1.5 |

| Utilities | 1.4 |

| Shares | Market Value• ($000) | |||||

| Temporary Cash Investments (2.2%) | ||||||

| Money Market Fund (2.2%) | ||||||

| 3,4 | Vanguard Market Liquidity Fund, 5.435% (Cost $728,374) | 7,286,285 | 728,483 | |||

| Total Investments (101.9%) (Cost $26,720,486) | 33,017,733 | |||||

| Other Assets and Liabilities—Net (-1.9%) | (620,138) | |||||

| Net Assets (100%) | 32,397,595 | |||||

| Cost is in $000. |

| • | See Note A in Notes to Financial Statements. |

| * | Non-income-producing security. |

| 1 | Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $561,906,000. |

| 2 | Security value determined using significant unobservable inputs. |

| 3 | Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield. |

| 4 | Collateral of $629,622,000 was received for securities on loan. |

| Futures Contracts | ||||

| ($000) | ||||

| Expiration | Number of Long (Short) Contracts | Notional Amount | Value and Unrealized Appreciation (Depreciation) | |

| Long Futures Contracts | ||||

| E-mini Russell 2000 Index | March 2024 | 462 | 47,302 | 731 |

| Over-the-Counter Total Return Swaps | ||||||

| Reference Entity | Termination Date | Counterparty | Notional Amount ($000) | Floating Interest Rate Received (Paid)1 (%) | Value and Unrealized Appreciation ($000) | Value and Unrealized (Depreciation) ($000) |

| C3.ai Inc. Class A | 1/31/24 | GSI | 11,939 | (5.332) | — | (218) |

| Elastic NV | 8/30/24 | BANA | 3,214 | (5.332) | 1,280 | — |

| Fisker Inc. Class A | 1/31/24 | GSI | 1,296 | (5.331) | 102 | — |

| MicroStrategy Inc. Class A | 1/31/24 | CITNA | 10,713 | (5.332) | 2,822 | — |

| Middleby Corp. | 8/30/24 | BANA | 3,534 | (5.332) | 572 | — |

| Novocure Ltd. | 8/30/24 | BANA | 2,209 | (5.332) | 470 | — |

| Super Micro Computer Inc. | 1/31/24 | CITNA | 10,939 | (5.332) | 386 | — |

| Watsco Inc. | 8/30/24 | BANA | 7,645 | (5.332) | 893 | — |

| Watsco Inc. | 8/30/24 | BANA | 7,645 | (5.332) | 893 | — |

| Wolfspeed Inc. | 8/30/24 | BANA | 3,686 | (5.332) | 650 | — |

| 8,068 | (218) | |||||

| 1 | Based on USD Overnight Bank Funding Rate as of the most recent reset date. Floating interest payment received/paid monthly. |

| BANA—Bank of America, N.A. | |

| CITNA—Citibank, N.A. | |

| GSI—Goldman Sachs International. |

| ($000s, except shares, footnotes, and per-share amounts) | Amount |

| Assets | |

| Investments in Securities, at Value1 | |

| Unaffiliated Issuers (Cost $25,992,112) | 32,289,250 |

| Affiliated Issuers (Cost $728,374) | 728,483 |

| Total Investments in Securities | 33,017,733 |

| Investment in Vanguard | 962 |

| Cash Collateral Pledged—Futures Contracts | 3,140 |

| Cash Collateral Pledged—Over-the-Counter Swap Contracts | 40 |

| Receivables for Investment Securities Sold | 29,616 |

| Receivables for Accrued Income | 18,978 |

| Receivables for Capital Shares Issued | 13,525 |

| Unrealized Appreciation—Over-the-Counter Swap Contracts | 8,068 |

| Total Assets | 33,092,062 |

| Liabilities | |

| Due to Custodian | 27,806 |

| Payables for Investment Securities Purchased | 9,321 |

| Collateral for Securities on Loan | 629,622 |

| Payables for Capital Shares Redeemed | 25,757 |

| Payables to Vanguard | 982 |

| Variation Margin Payable—Futures Contracts | 761 |

| Unrealized Depreciation—Over-the-Counter Swap Contracts | 218 |

| Total Liabilities | 694,467 |

| Net Assets | 32,397,595 |

| 1 Includes $561,906,000 of securities on loan. | |

| Statement of Assets and Liabilities (continued) | |

| At December 31, 2023, net assets consisted of: | |

| ($000s, except shares, footnotes, and per-share amounts) | Amount |

| Paid-in Capital | 32,928,611 |

| Total Distributable Earnings (Loss) | (531,016) |

| Net Assets | 32,397,595 |

| Investor Shares—Net Assets | |

| Applicable to 1,316,714 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | 89,484 |

| Net Asset Value Per Share—Investor Shares | $67.96 |

| ETF Shares—Net Assets | |

| Applicable to 64,320,925 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | 15,546,221 |

| Net Asset Value Per Share—ETF Shares | $241.70 |

| Admiral Shares—Net Assets | |

| Applicable to 156,507,375 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | 13,300,222 |

| Net Asset Value Per Share—Admiral Shares | $84.98 |

| Institutional Shares—Net Assets | |

| Applicable to 50,865,473 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | 3,461,668 |

| Net Asset Value Per Share—Institutional Shares | $68.06 |

| Year Ended December 31, 2023 | |

| ($000) | |

| Investment Income | |

| Income | |

| Dividends1 | 164,122 |

| Interest2 | 2,226 |

| Securities Lending—Net | 45,193 |

| Total Income | 211,541 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 630 |

| Management and Administrative—Investor Shares | 154 |

| Management and Administrative—ETF Shares | 7,779 |

| Management and Administrative—Admiral Shares | 7,508 |

| Management and Administrative—Institutional Shares | 1,597 |

| Marketing and Distribution—Investor Shares | 5 |

| Marketing and Distribution—ETF Shares | 760 |

| Marketing and Distribution—Admiral Shares | 579 |

| Marketing and Distribution—Institutional Shares | 108 |

| Custodian Fees | 216 |

| Auditing Fees | 38 |

| Shareholders’ Reports—Investor Shares | — |

| Shareholders’ Reports—ETF Shares | 513 |

| Shareholders’ Reports—Admiral Shares | 156 |

| Shareholders’ Reports—Institutional Shares | 100 |

| Trustees’ Fees and Expenses | 17 |

| Other Expenses | 23 |

| Total Expenses | 20,183 |

| Net Investment Income | 191,358 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold2,3 | (914,715) |

| Futures Contracts | (326) |

| Swap Contracts | (18,542) |

| Realized Net Gain (Loss) | (933,583) |

| Statement of Operations (continued) | |

| Year Ended December 31, 2023 | |

| ($000) | |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities2 | 6,403,205 |

| Futures Contracts | 587 |

| Swap Contracts | 11,128 |

| Change in Unrealized Appreciation (Depreciation) | 6,414,920 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 5,672,695 |

| 1 | Dividends are net of foreign withholding taxes of $107,000. |

| 2 | Interest income, realized net gain (loss), capital gain distributions received, and change in unrealized appreciation (depreciation) from an affiliated company of the fund were $2,156,000, ($52,000), $1,000, and ($63,000), respectively. Purchases and sales are for temporary cash investment purposes. |

| 3 | Includes $1,429,578,000 of net gain (loss) resulting from in-kind redemptions. |

| Year Ended December 31, | ||

| 2023 ($000) | 2022 ($000) | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net Investment Income | 191,358 | 211,970 |

| Realized Net Gain (Loss) | (933,583) | (631,355) |

| Change in Unrealized Appreciation (Depreciation) | 6,414,920 | (10,014,591) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 5,672,695 | (10,433,976) |

| Distributions | ||

| Investor Shares | (527) | (378) |

| ETF Shares | (102,224) | (65,152) |

| Admiral Shares | (91,073) | (62,927) |

| Institutional Shares | (23,803) | (16,002) |

| Total Distributions | (217,627) | (144,459) |

| Capital Share Transactions | ||

| Investor Shares | (6,467) | (30,485) |

| ETF Shares | 962,195 | 383,979 |

| Admiral Shares | (478,614) | (400,974) |

| Institutional Shares | (67,568) | 230,883 |

| Net Increase (Decrease) from Capital Share Transactions | 409,546 | 183,403 |

| Total Increase (Decrease) | 5,864,614 | (10,395,032) |

| Net Assets | ||

| Beginning of Period | 26,532,981 | 36,928,013 |

| End of Period | 32,397,595 | 26,532,981 |

| Investor Shares | |||||

| For a Share Outstanding Throughout Each Period | Year Ended December 31, | ||||

| 2023 | 2022 | 2021 | 2020 | 2019 | |

| Net Asset Value, Beginning of Period | $56.38 | $79.21 | $75.20 | $55.89 | $42.36 |

| Investment Operations | |||||

| Net Investment Income1 | .326 | .371 | .257 | .241 | .178 |

| Net Realized and Unrealized Gain (Loss) on Investments | 11.639 | (22.943) | 3.938 | 19.331 | 13.617 |

| Total from Investment Operations | 11.965 | (22.572) | 4.195 | 19.572 | 13.795 |

| Distributions | |||||

| Dividends from Net Investment Income | (.385) | (.258) | (.185) | (.262) | (.265) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (.385) | (.258) | (.185) | (.262) | (.265) |

| Net Asset Value, End of Period | $67.96 | $56.38 | $79.21 | $75.20 | $55.89 |

| Total Return2 | 21.28% | -28.49% | 5.58% | 35.12% | 32.60% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $89 | $80 | $149 | $209 | $171 |

| Ratio of Total Expenses to Average Net Assets | 0.19% | 0.19%3 | 0.19% | 0.19% | 0.19% |

| Ratio of Net Investment Income to Average Net Assets | 0.53% | 0.60% | 0.32% | 0.42% | 0.35% |

| Portfolio Turnover Rate4 | 19% | 24% | 29% | 24% | 18% |

| 1 | Calculated based on average shares outstanding. |

| 2 | Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees. |

| 3 | The ratio of expenses to average net assets for the period net of reduction from custody fee offset arrangements was 0.19%. |

| 4 | Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units. |

| ETF Shares | |||||

| For a Share Outstanding Throughout Each Period | Year Ended December 31, | ||||

| 2023 | 2022 | 2021 | 2020 | 2019 | |

| Net Asset Value, Beginning of Period | $200.53 | $281.61 | $267.36 | $198.68 | $150.57 |

| Investment Operations | |||||

| Net Investment Income1 | 1.449 | 1.623 | 1.291 | 1.129 | 1.175 |

| Net Realized and Unrealized Gain (Loss) on Investments | 41.356 | (81.603) | 13.975 | 68.729 | 48.077 |

| Total from Investment Operations | 42.805 | (79.980) | 15.266 | 69.858 | 49.252 |

| Distributions | |||||

| Dividends from Net Investment Income | (1.635) | (1.100) | (1.016) | (1.178) | (1.142) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (1.635) | (1.100) | (1.016) | (1.178) | (1.142) |

| Net Asset Value, End of Period | $241.70 | $200.53 | $281.61 | $267.36 | $198.68 |

| Total Return | 21.42% | -28.40% | 5.71% | 35.29% | 32.75% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $15,546 | $12,036 | $16,379 | $14,436 | $9,833 |

| Ratio of Total Expenses to Average Net Assets | 0.07% | 0.07%2 | 0.07% | 0.07% | 0.07% |

| Ratio of Net Investment Income to Average Net Assets | 0.66% | 0.74% | 0.45% | 0.55% | 0.64% |

| Portfolio Turnover Rate3 | 19% | 24% | 29% | 24% | 18% |

| 1 | Calculated based on average shares outstanding. |

| 2 | The ratio of expenses to average net assets for the period net of reduction from custody fee offset arrangements was 0.07%. |

| 3 | Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units. |

| Admiral Shares | |||||

| For a Share Outstanding Throughout Each Period | Year Ended December 31, | ||||

| 2023 | 2022 | 2021 | 2020 | 2019 | |

| Net Asset Value, Beginning of Period | $70.51 | $99.01 | $94.02 | $69.87 | $52.95 |

| Investment Operations | |||||

| Net Investment Income1 | .503 | .568 | .448 | .392 | .419 |

| Net Realized and Unrealized Gain (Loss) on Investments | 14.542 | (28.682) | 4.899 | 24.172 | 16.902 |

| Total from Investment Operations | 15.045 | (28.114) | 5.347 | 24.564 | 17.321 |

| Distributions | |||||

| Dividends from Net Investment Income | (.575) | (.386) | (.357) | (.414) | (.401) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (.575) | (.386) | (.357) | (.414) | (.401) |

| Net Asset Value, End of Period | $84.98 | $70.51 | $99.01 | $94.02 | $69.87 |

| Total Return2 | 21.41% | -28.39% | 5.69% | 35.30% | 32.76% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $13,300 | $11,482 | $16,594 | $16,149 | $12,717 |

| Ratio of Total Expenses to Average Net Assets | 0.07% | 0.07%3 | 0.07% | 0.07% | 0.07% |

| Ratio of Net Investment Income to Average Net Assets | 0.65% | 0.73% | 0.45% | 0.54% | 0.65% |

| Portfolio Turnover Rate4 | 19% | 24% | 29% | 24% | 18% |

| 1 | Calculated based on average shares outstanding. |

| 2 | Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees. |

| 3 | The ratio of expenses to average net assets for the period net of reduction from custody fee offset arrangements was 0.07%. |

| 4 | Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units. |

| Institutional Shares | |||||

| For a Share Outstanding Throughout Each Period | Year Ended December 31, | ||||

| 2023 | 2022 | 2021 | 2020 | 2019 | |

| Net Asset Value, Beginning of Period | $56.46 | $79.29 | $75.29 | $55.95 | $42.40 |

| Investment Operations | |||||

| Net Investment Income1 | .410 | .465 | .367 | .319 | .327 |

| Net Realized and Unrealized Gain (Loss) on Investments | 11.656 | (22.979) | 3.927 | 19.358 | 13.550 |

| Total from Investment Operations | 12.066 | (22.514) | 4.294 | 19.677 | 13.877 |

| Distributions | |||||

| Dividends from Net Investment Income | (.466) | (.316) | (.294) | (.337) | (.327) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (.466) | (.316) | (.294) | (.337) | (.327) |

| Net Asset Value, End of Period | $68.06 | $56.46 | $79.29 | $75.29 | $55.95 |

| Total Return | 21.44% | -28.39% | 5.70% | 35.31% | 32.77% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $3,462 | $2,935 | $3,805 | $3,676 | $3,218 |

| Ratio of Total Expenses to Average Net Assets | 0.06% | 0.06%2 | 0.06% | 0.06% | 0.06% |

| Ratio of Net Investment Income to Average Net Assets | 0.66% | 0.75% | 0.46% | 0.55% | 0.64% |