| Vanguard Small-Cap Growth ETF |

| Summary Prospectus |

| April 27, 2016 |

| Exchange-traded fund shares that are not individually redeemable and are listed |

| on NYSE Arca |

| Vanguard Small-Cap Growth Index Fund ETF Shares (VBK) |

| The Fund’s statutory Prospectus and Statement of Additional Information dated |

| April 27, 2016, as may be amended or supplemented, are incorporated into and |

| made part of this Summary Prospectus by reference. |

| Before you invest, you may want to review the Fund’s Prospectus, which |

| contains more information about the Fund and its risks. You can find |

| the Fund’s Prospectus and other information about the Fund online at |

| www.vanguard.com/prospectus. You can also obtain this information at no |

| cost by calling 866-499-8473 or by sending an email request to |

| online@vanguard.com. |

| The Securities and Exchange Commission (SEC) has not approved or disapproved these securities or |

| passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense. |

Investment Objective

The Fund seeks to track the performance of a benchmark index that measures the investment return of small-capitalization growth stocks.

Fees and Expenses

The following table describes the fees and expenses you may pay if you buy and hold ETF Shares of the Fund.

Shareholder Fees

(Fees paid directly from your investment)

| Transaction Fee on Purchases and Sales | None through Vanguard |

| (Broker fees vary) | |

| Transaction Fee on Reinvested Dividends | None through Vanguard |

| (Broker fees vary) | |

| Transaction Fee on Conversion to ETF Shares | None through Vanguard |

| (Broker fees vary) |

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment)

| Management Fees | 0.06% |

| 12b-1 Distribution Fee | None |

| Other Expenses | 0.02% |

| Total Annual Fund Operating Expenses | 0.08% |

1

Example

The following example is intended to help you compare the cost of investing in the Fund’s ETF Shares with the cost of investing in other funds. It illustrates the hypothetical expenses that you would incur over various periods if you invested $10,000 in the Fund’s shares. This example assumes that the Shares provide a return of 5% each year and that total annual fund operating expenses remain as stated in the preceding table. You would incur these hypothetical expenses whether or not you redeem your investment at the end of the given period. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years |

| $8 | $26 | $45 | $103 |

This example does not include the brokerage commissions that you may pay to buy and sell ETF Shares of the Fund.

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in more taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the previous expense example, reduce the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 23% of the average value of its portfolio.

Principal Investment Strategies

The Fund employs an indexing investment approach designed to track the performance of the CRSP US Small Cap Growth Index, a broadly diversified index of growth stocks of small U.S. companies. The Fund attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the Index, holding each stock in approximately the same proportion as its weighting in the Index.

2

Principal Risks

An investment in the Fund could lose money over short or even long periods. You should expect the Fund’s share price and total return to fluctuate within a wide range. The Fund is subject to the following risks, which could affect the Fund’s performance:

• Stock market risk, which is the chance that stock prices overall will decline. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices. The Fund’s target index tracks a subset of the U.S. stock market, which could cause the Fund to perform differently from the overall stock market. In addition, the Fund’s target index may, at times, become focused in stocks of a particular market sector, which would subject the Fund to proportionately higher exposure to the risks of that sector.

• Investment style risk, which is the chance that returns from small-capitalization growth stocks will trail returns from the overall stock market. Historically, small-cap stocks have been more volatile in price than the large-cap stocks that dominate the overall market, and they often perform quite differently. Small companies tend to have greater stock volatility because, among other things, these companies are more sensitive to changing economic conditions.

Because ETF Shares are traded on an exchange, they are subject to additional risks:

• The Fund’s ETF Shares are listed for trading on NYSE Arca and are bought and sold on the secondary market at market prices. Although it is expected that the market price of an ETF Share typically will approximate its net asset value (NAV), there may be times when the market price and the NAV differ significantly. Thus, you may pay more or less than NAV when you buy ETF Shares on the secondary market, and you may receive more or less than NAV when you sell those shares.

• Although the Fund’s ETF Shares are listed for trading on NYSE Arca, it is possible that an active trading market may not be maintained.

• Trading of the Fund’s ETF Shares may be halted by the activation of individual or marketwide trading halts (which halt trading for a specific period of time when the price of a particular security or overall market prices decline by a specified percentage). Trading of the Fund’s ETF Shares may also be halted if (1) the shares are delisted from NYSE Arca without first being listed on another exchange or (2) NYSE Arca officials determine that such action is appropriate in the interest of a fair and orderly market or for the protection of investors.

An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

3

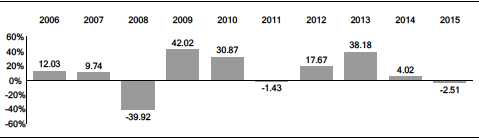

Annual Total Returns

The following bar chart and table are intended to help you understand the risks of investing in the Fund. The bar chart shows how the performance of the Fund‘s ETF Shares (based on NAV) has varied from one calendar year to another over the periods shown. The table shows how the average annual total returns of the ETF Shares compare with those of the Fund‘s target index and other comparative indexes, which have investment characteristics similar to those of the Fund. Keep in mind that the Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447.

Annual Total Returns — Vanguard Small-Cap Growth Index Fund ETF Shares

During the periods shown in the bar chart, the highest return for a calendar quarter was 24.60% (quarter ended June 30, 2009), and the lowest return for a quarter was –27.91% (quarter ended December 31, 2008).

4

| Average Annual Total Returns for Periods Ended December 31, 2015 | |||

| 1 Year | 5 Years | 10 Years | |

| Vanguard Small-Cap Growth Index Fund ETF Shares | |||

| Based on NAV | |||

| Return Before Taxes | –2.51% | 10.20% | 8.36% |

| Return After Taxes on Distributions | –2.82 | 9.95 | 8.17 |

| Return After Taxes on Distributions and Sale of Fund Shares | –1.32 | 8.05 | 6.79 |

| Based on Market Price | |||

| Return Before Taxes | –2.57 | 10.17 | 8.37 |

| Comparative Indexes | |||

| (reflect no deduction for fees, expenses, or taxes) | |||

| MSCI US Small Cap Growth Index | –3.05% | 11.17% | 8.78% |

| Spliced Small Cap Growth Index | –2.60 | 10.09 | 8.25 |

| CRSP US Small Cap Growth Index | –2.60 | — | — |

Actual after-tax returns depend on your tax situation and may differ from those shown in the preceding table. When after-tax returns are calculated, it is assumed that the shareholder was in the highest individual federal marginal income tax bracket at the time of each distribution of income or capital gains or upon redemption. State and local income taxes are not reflected in the calculations. Please note that after-tax returns are not relevant for a shareholder who holds fund shares in a tax-deferred account, such as an individual retirement account or a 401(k) plan. Also, figures captioned Return After Taxes on Distributions and Sale of Fund Shares may be higher than other figures for the same period if a capital loss occurs upon redemption and results in an assumed tax deduction for the shareholder.

Investment Advisor

The Vanguard Group, Inc. (Vanguard)

Portfolio Managers

Gerard C. O’Reilly, Principal of Vanguard. He has managed the Fund since 2004 (co-managed since 2016).

William Coleman, Portfolio Manager at Vanguard. He has co-managed the Fund since 2016.

5

Purchase and Sale of Fund Shares

You can buy and sell ETF Shares of the Fund through a brokerage firm. The price you pay or receive for ETF Shares will be the prevailing market price, which may be more or less than the NAV of the shares. The brokerage firm may charge you a commission to execute the transaction. Unless imposed by your brokerage firm, there is no minimum dollar amount you must invest and no minimum number of shares you must buy. ETF Shares of the Fund cannot be directly purchased from or redeemed with the Fund, except by certain authorized broker-dealers. These broker-dealers may purchase and redeem ETF Shares only in large blocks (Creation Units) worth several million dollars, typically in exchange for baskets of securities. For this Fund, the number of ETF Shares in a Creation Unit is 25,000.

Tax Information

The Fund’s distributions may be taxable as ordinary income or capital gain. If you are investing through a tax-deferred retirement account, such as an IRA, special tax rules apply.

Payments to Financial Intermediaries

The Fund and its investment advisor do not pay financial intermediaries for sales of Fund shares.

Vanguard Small-Cap Growth Index Fund ETF Shares—Fund Number 938

Vanguard funds are not sponsored, endorsed, sold, or promoted by the University of Chicago or its Center for Research in Security Prices, and neither the University of Chicago nor its Center for Research in Security Prices makes any representation regarding the advisability of investing in the funds.

© 2016 The Vanguard Group, Inc. All rights reserved.

U.S. Patent Nos. 6,879,964; 7,337,138; 7,720,749; 7,925,573; 8,090,646; and 8,417,623.

Vanguard Marketing Corporation, Distributor.

SP 938 042016