Exhibit 99.1

0 Investor Presentation September 2022

DISCLAIMER Forward - Looking Statements This presentation contains, and from time - to - time in connection with this presentation our management may make, forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward - looking statements reflect our views at such time with respect to, among other things, future events and our financial performance. These statements are often, but not always , m ade through the use of words or phrases such as “may,” “might,” “should,” “could,” “predict,” “potential,” “believe,” “expect,” “continu e,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would,” “annualized,” and “outlook,” or the negative version of these w ord s or other comparable words or phrases of a future or forward - looking nature. These forward - looking statements are not historical facts an d are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by m ana gement, and any such forward - looking statements are subject to risks, assumptions, estimates and uncertainties that are difficult to pre dict. Further, statements about the potential effects of the COVID - 19 pandemic on our businesses and financial results and conditions may const itute forward - looking statements and are subject to the risk that the actual effects may differ, possibly materially, from what is ref lected in those forward - looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond our control, including the scope and duration of the pandemic, actions taken by governmental authorities in response to the pandemic, and the direct and indirect impact of the pandemic on our customers, third parties and us. Actual results may prove to be materially different fro m the results expressed or implied by the forward - looking statements. Factors that could cause our actual results to differ materially from th ose described in the forward - looking statements, including (without limitation) the risks and uncertainties associated with the ongoing impacts o f COVID - 19, the domestic and global economic environment and capital market conditions and other risk factors, can be found in our SEC filing s, including, but not limited to, our Annual Report on Form 10 - K for the year ended December 31, 2021, and our Quarterly Reports on Form 10 - Q for the quarters ended March 31 and June 30, 2022, which are available on our website (www.fhb.com) and the SEC’s website (www.sec.go v). Any forward - looking statement speaks only as of the date on which it is made, and we do not undertake any obligation to update or re view any forward - looking statement, whether as a result of new information, future developments or otherwise, except as required by appli cable law. Use of Non - GAAP Financial Measures The information provided herein includes certain non - GAAP financial measures. We believe that these measures provide useful inf ormation about our operating results and enhance the overall understanding of our past performance and future performance. Although t hes e non - GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytic al tools and should not be considered in isolation or as a substitute for analysis of our results or financial condition as reported under GA AP. Investors should consider our performance and financial condition as reported under GAAP and all other relevant information when assess ing our performance or financial condition. The reconciliation of such measures to the comparable GAAP figures are included in the a ppe ndix of this presentation. Other References to “we,” “us,” “our,” “FHI,” “FHB,” “Company,” and “First Hawaiian” refer to First Hawaiian, Inc. and its consolid ate d subsidiaries. 1

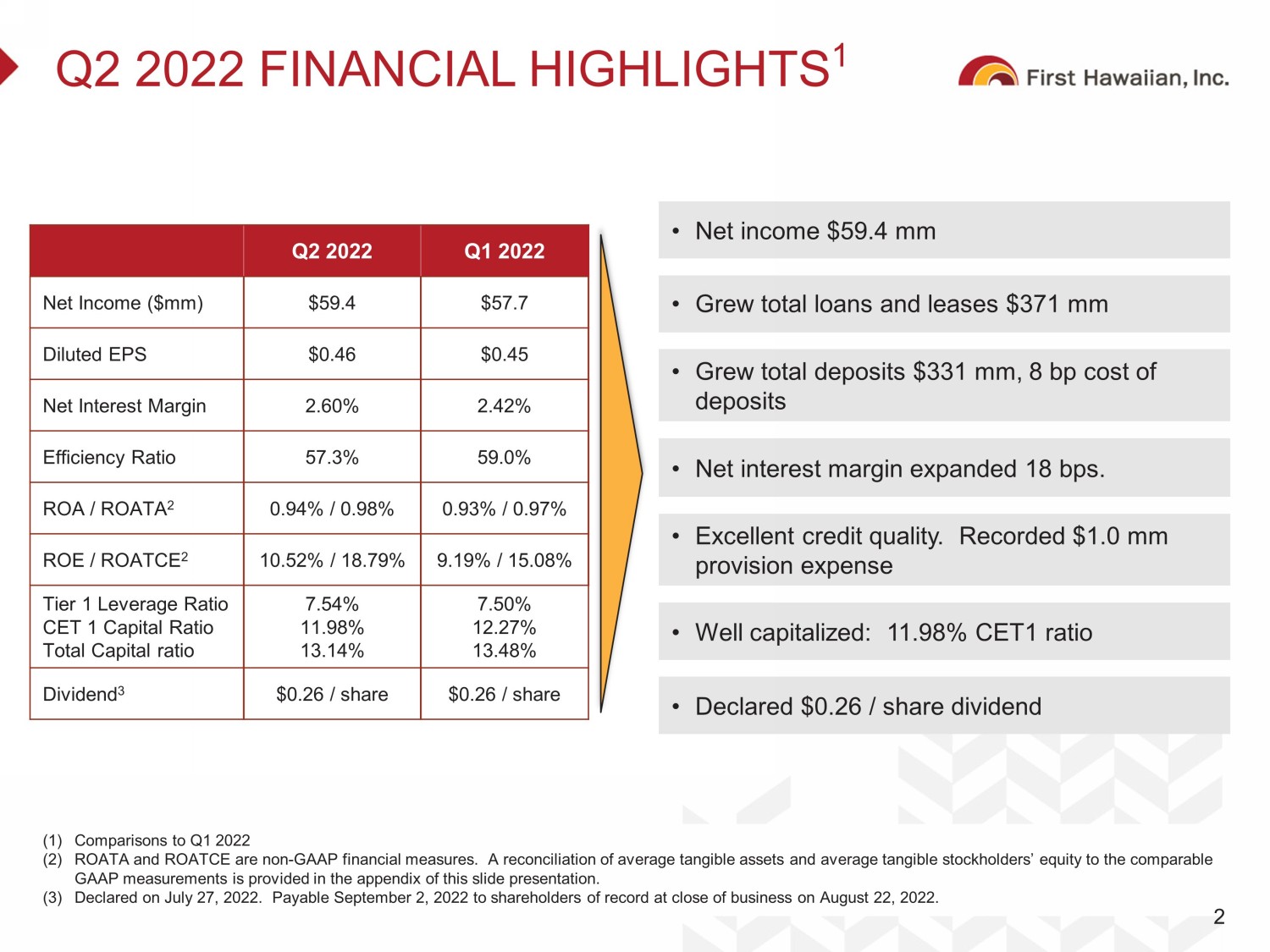

Q2 2022 FINANCIAL HIGHLIGHTS 1 (1) Comparisons to Q1 2022 (2) ROATA and ROATCE are non - GAAP financial measures. A reconciliation of average tangible assets and average tangible stockholders ’ equity to the comparable GAAP measurements is provided in the appendix of this slide presentation. (3) Declared on July 27, 2022. Payable September 2, 2022 to shareholders of record at close of business on August 22, 2022. 2 • Net income $59.4 mm • Grew total loans and leases $371 mm • Grew total deposits $331 mm, 8 bp cost of deposits • Net interest margin expanded 18 bps. • Excellent credit quality. Recorded $1.0 mm provision expense • Well capitalized: 11.98% CET1 ratio • Declared $0.26 / share dividend Q2 2022 Q1 2022 Net Income ($mm) $59.4 $57.7 Diluted EPS $0.46 $0.45 Net Interest Margin 2.60% 2.42% Efficiency Ratio 57.3% 59.0% ROA / ROATA 2 0.94% / 0.98% 0.93% / 0.97% ROE / ROATCE 2 10.52% / 18.79% 9.19% / 15.08% Tier 1 Leverage Ratio CET 1 Capital Ratio Total Capital ratio 7.54% 11.98% 13.14% 7.50% 12.27% 13.48% Dividend 3 $0.26 / share $0.26 / share

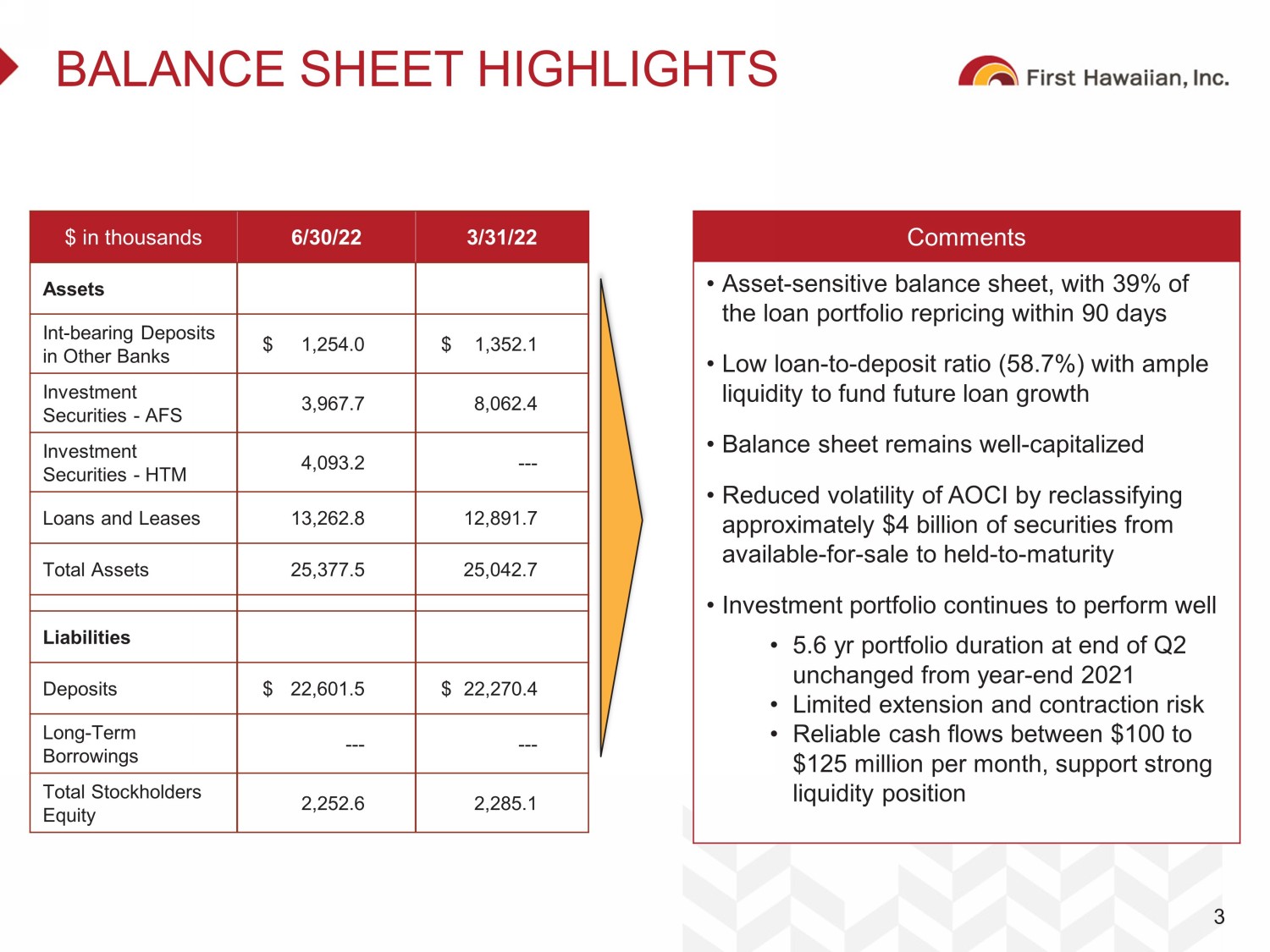

BALANCE SHEET HIGHLIGHTS 3 $ in thousands 6/30/22 3/31/22 Assets Int - bearing Deposits in Other Banks $ 1,254.0 $ 1,352.1 Investment Securities - AFS 3,967.7 8,062.4 Investment Securities - HTM 4,093.2 --- Loans and Leases 13,262.8 12,891.7 Total Assets 25,377.5 25,042.7 Liabilities Deposits $ 22,601.5 $ 22,270.4 Long - Term Borrowings --- --- Total Stockholders Equity 2,252.6 2,285.1 Comments • Asset - sensitive balance sheet, with 39% of the loan portfolio repricing within 90 days • Low loan - to - deposit ratio (58.7%) with ample liquidity to fund future loan growth • Balance sheet remains well - capitalized • Reduced volatility of AOCI by reclassifying approximately $4 billion of securities from available - for - sale to held - to - maturity • Investment portfolio continues to perform well • 5.6 yr portfolio duration at end of Q2 unchanged from year - end 2021 • Limited extension and contraction risk • Reliable cash flows between $100 to $125 million per month, support strong liquidity position

INVESTMENT HIGHLIGHTS 4 Strong, Consistent Financial Performance Leading Position In Attractive Markets Experienced Leadership Team High Quality Balance Sheet Proven Through The Cycle Performance Well - Capitalized With Attractive Dividend 1 2 3 4 5 6

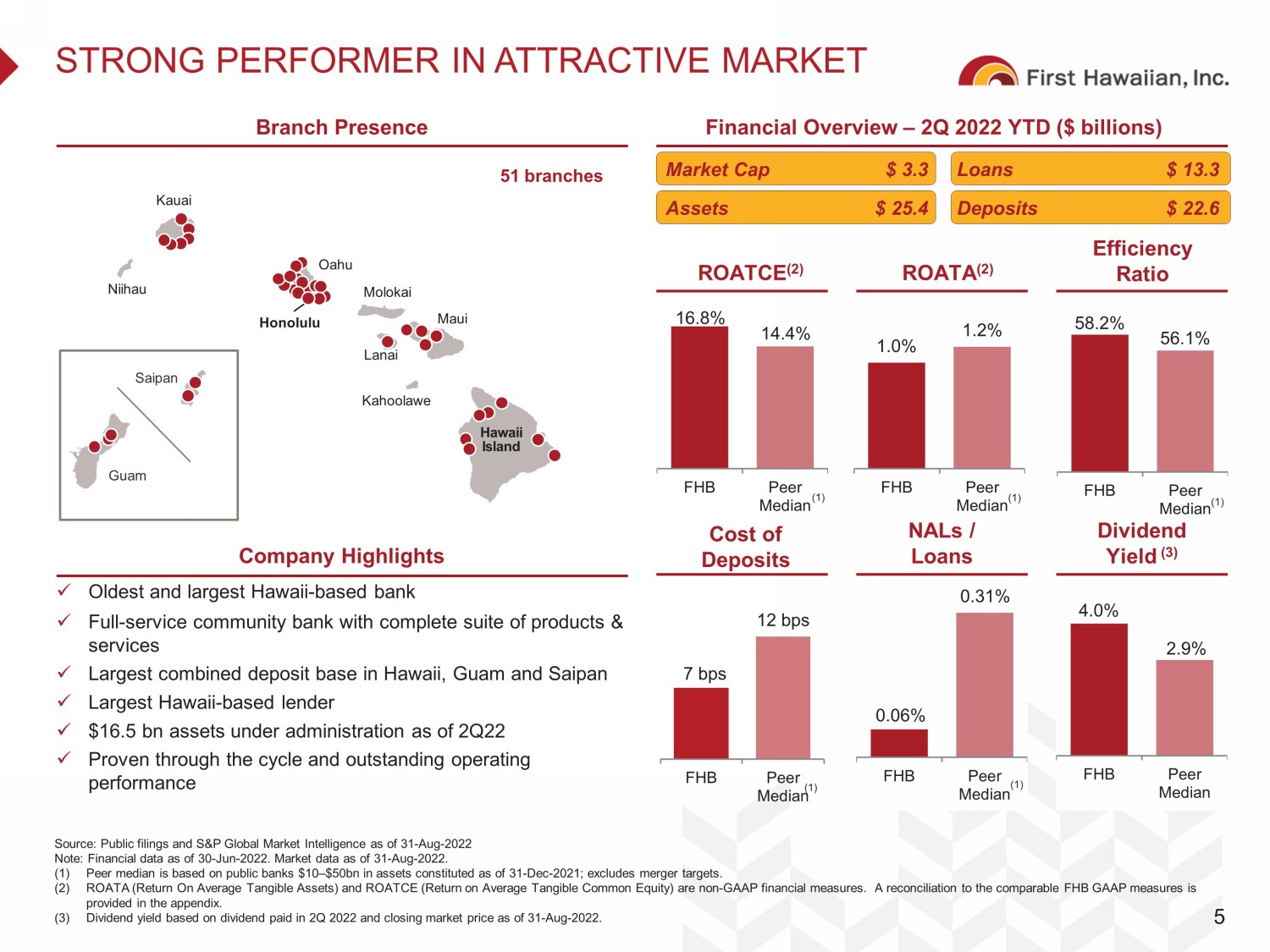

NALs / Loans 58.2% 56.1% FHB Peer Median 16.8% 14.4% FHB Peer Median STRONG PERFORMER IN ATTRACTIVE MARKET 5 Branch Presence Financial Overview – 2Q 2022 YTD ($ billions) Source: Public filings and S&P Global Market Intelligence as of 31 - Aug - 2022 Note: Financial data as of 30 - Jun - 2022. Market data as of 31 - Aug - 2022. (1) Peer median is based on public banks $10 – $50bn in assets constituted as of 31 - Dec - 2021; excludes merger targets. (2) ROATA (Return On Average Tangible Assets) and ROATCE (Return on Average Tangible Common Equity) are non - GAAP financial measures. A reconciliation to the comparable FHB GAAP measures is provided in the appendix. (3) Dividend yield based on dividend paid in 2Q 2022 and closing market price as of 31 - Aug - 2022. Company Highlights x Oldest and largest Hawaii - based bank x Full - service community bank with complete suite of products & services x Largest combined deposit base in Hawaii, Guam and Saipan x Largest Hawaii - based lender x $16.5 bn assets under administration as of 2Q22 x Proven through the cycle and outstanding operating performance Efficiency Ratio ROATCE (2) Dividend Yield (3) Maui Kahoolawe Lanai Oahu Kauai Niihau Honolulu Hawaii Island Molokai 0.06% 0.31% FHB Peer Median Market Cap $ 3.3 Loans $ 13.3 Assets $ 25.4 Deposits $ 22.6 Guam Saipan (1) (1) (1) (1) 7 bps 12 bps FHB Peer Median Cost of Deposits (1) 1.0% 1.2% FHB Peer Median ROATA (2) (1) 51 branches 4.0% 2.9% FHB Peer Median

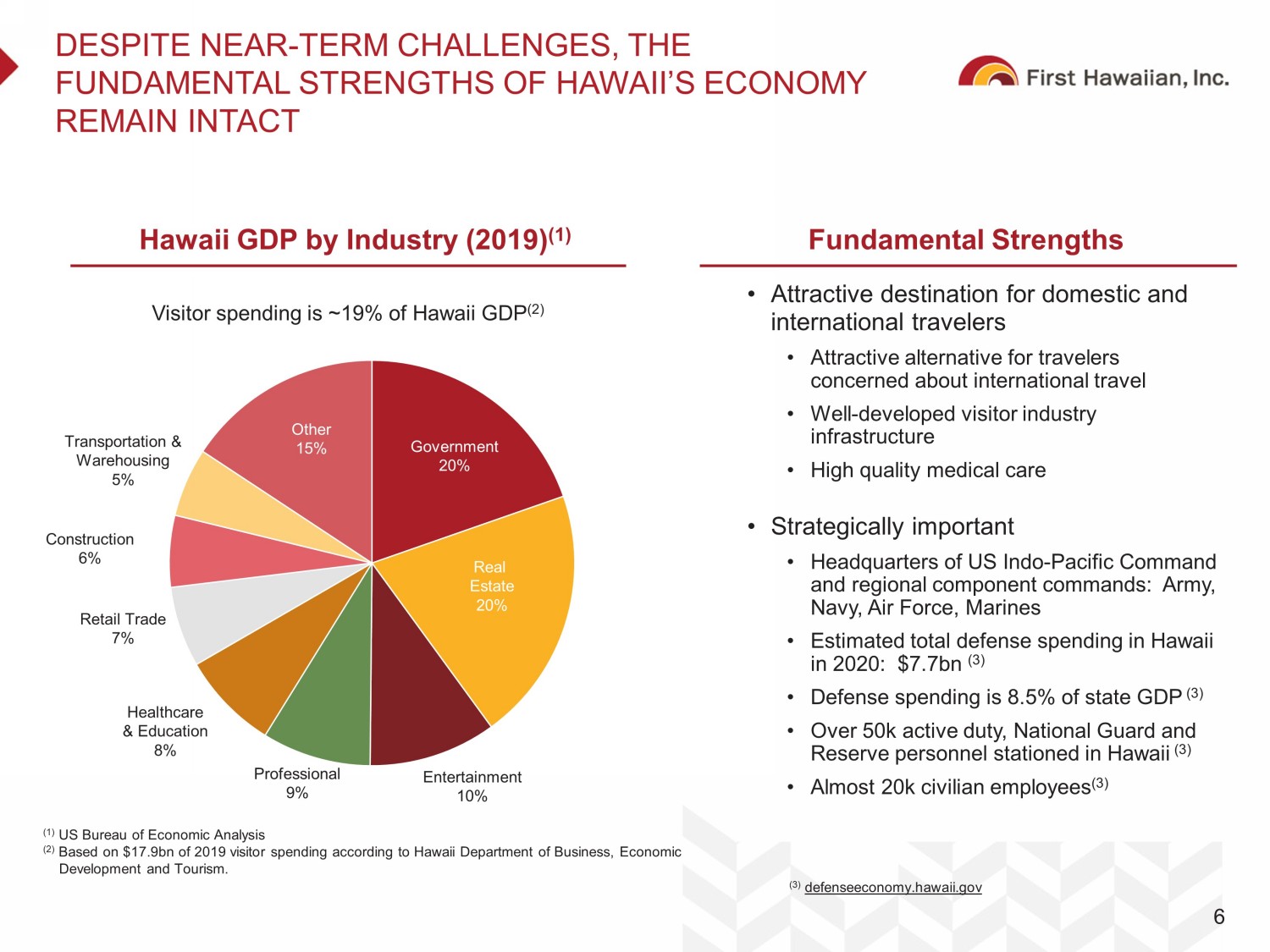

DESPITE NEAR - TERM CHALLENGES, THE FUNDAMENTAL STRENGTHS OF HAWAII’S ECONOMY REMAIN INTACT 6 • Attractive destination for domestic and international travelers • Attractive alternative for travelers concerned about international travel • Well - developed visitor industry infrastructure • High quality medical care • Strategically important • Headquarters of US Indo - Pacific Command and regional component commands: Army, Navy, Air Force, Marines • Estimated total defense spending in Hawaii in 2020: $7.7bn (3) • Defense spending is 8.5% of state GDP (3) • Over 50k active duty, National Guard and Reserve personnel stationed in Hawaii (3) • Almost 20k civilian employees (3) Government 20% Real Estate 20% Residential RE 23% Other 15% Transportation & Warehousing 5% Entertainment 10% Professiona l 9 % Construction 6% Retail Trade 7 % Healthcare & Education 8% Hawaii GDP by Industry (2019) (1) Visitor spending is ~19% of Hawaii GDP (2) (1) US Bureau of Economic Analysis (2) Based on $17.9bn of 2019 visitor spending according to Hawaii Department of Business, Economic Development and Tourism. Fundamental Strengths (3) defenseeconomy.hawaii.gov

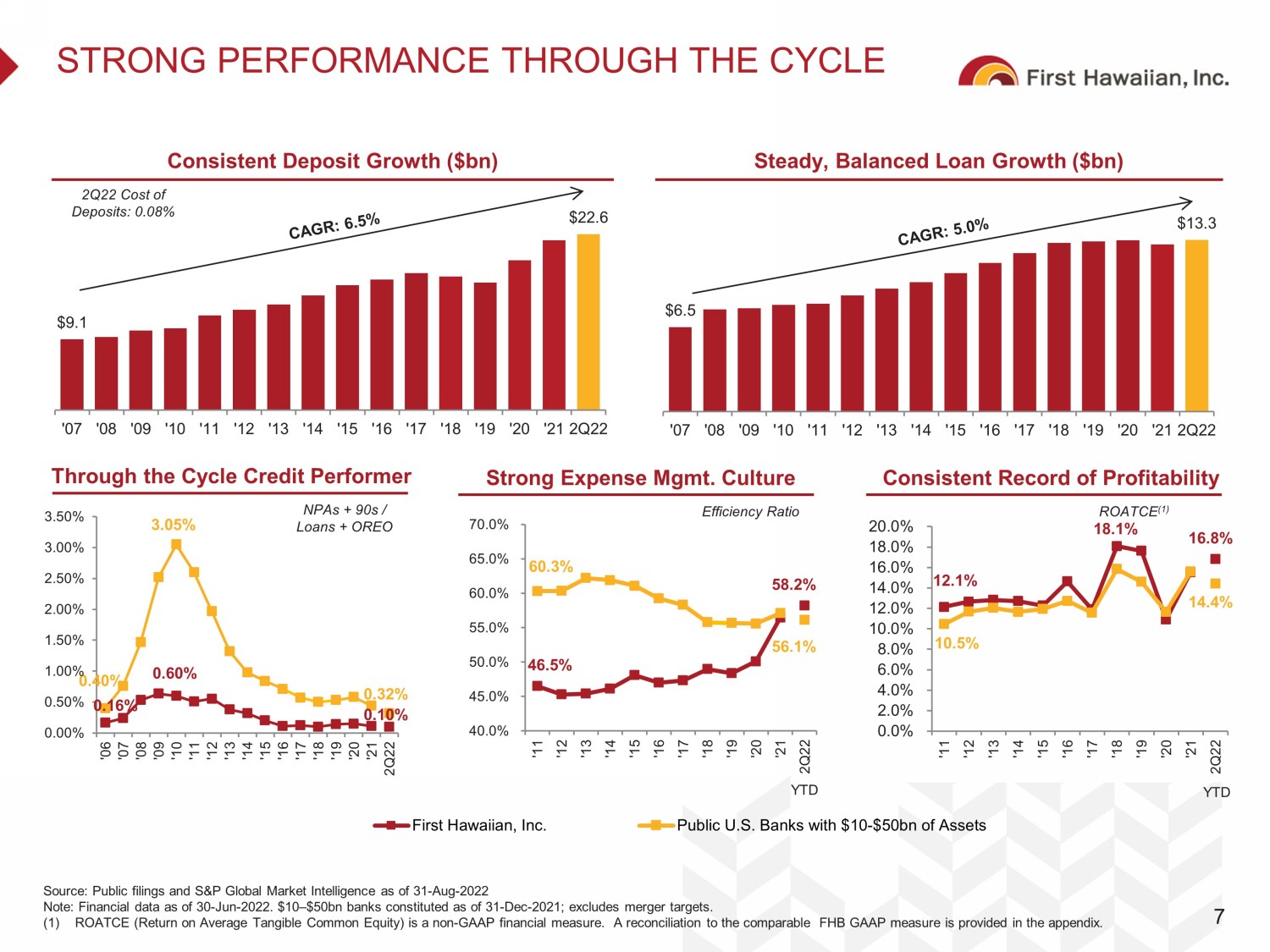

$9.1 $22.6 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 2Q22 Source: Public filings and S&P Global Market Intelligence as of 31 - Aug - 2022 Note: Financial data as of 30 - Jun - 2022. $10 – $50bn banks constituted as of 31 - Dec - 2021; excludes merger targets. (1) ROATCE (Return on Average Tangible Common Equity) is a non - GAAP financial measure. A reconciliation to the comparable FHB GAAP measure is provided in the appendix. 12.1% 18.1% 16.8% 10.5% 14.4% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 2Q22 46.5% 58.2% 60.3% 56.1% 40.0% 45.0% 50.0% 55.0% 60.0% 65.0% 70.0% '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 2Q22 STRONG PERFORMANCE THROUGH THE CYCLE 7 Through the Cycle Credit Performer Strong Expense Mgmt. Culture Consistent Record of Profitability Consistent Deposit Growth ($ bn ) Steady, Balanced Loan Growth ($ bn ) $6.5 $13.3 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 2Q22 NPAs + 90s / Loans + OREO Efficiency Ratio ROATCE (1) 2Q22 Cost of Deposits: 0.08% First Hawaiian, Inc. Public U.S. Banks with $10-$50bn of Assets 0.16% 0.60% 0.10% 0.40% 3.05% 0.32% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 2Q22 YTD YTD

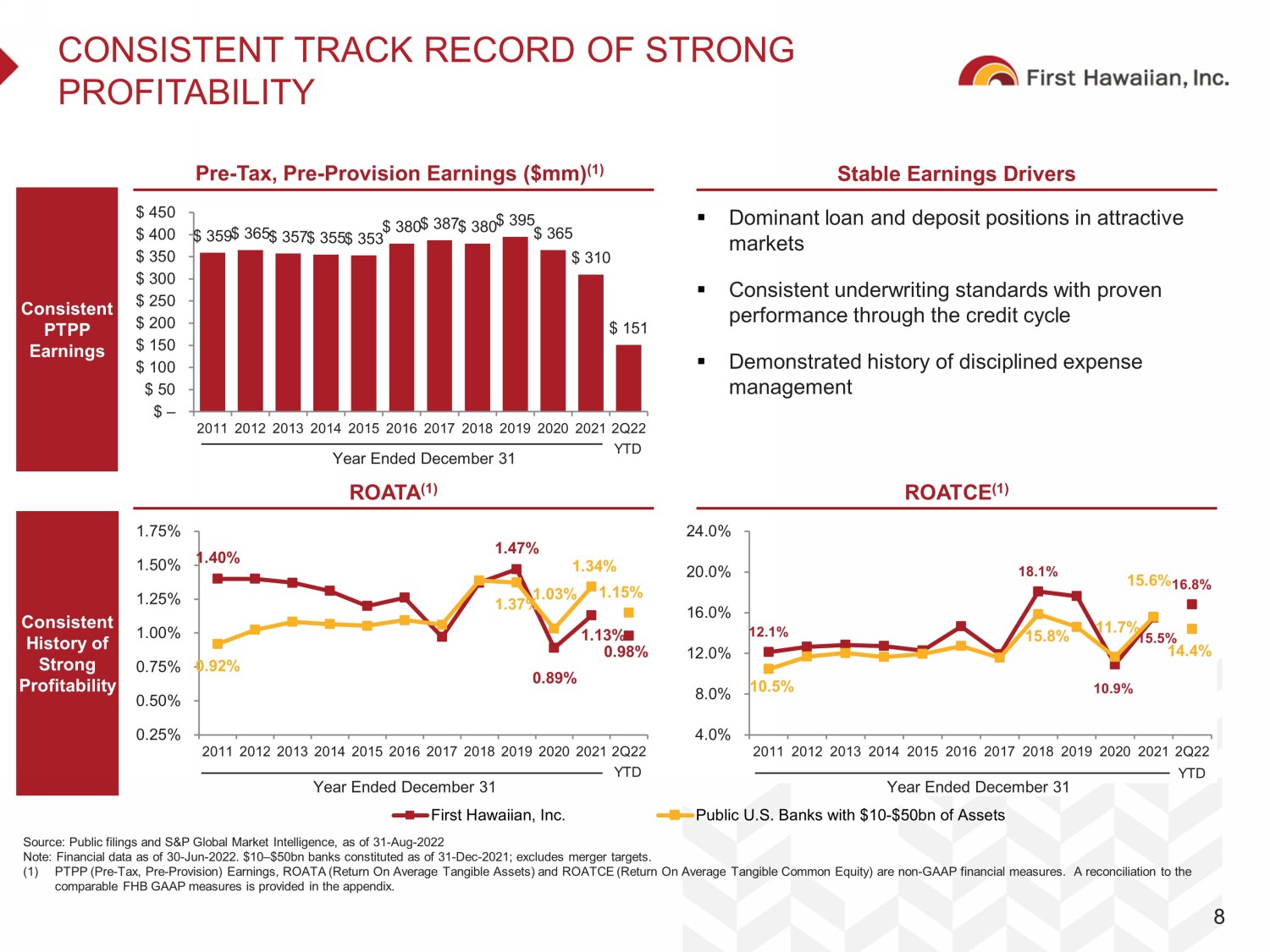

$ 359 $ 365 $ 357 $ 355 $ 353 $ 380 $ 387 $ 380 $ 395 $ 365 $ 310 $ 151 $ – $ 50 $ 100 $ 150 $ 200 $ 250 $ 300 $ 350 $ 400 $ 450 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2Q22 1.40% 1.47% 0.89% 1.13% 0.98% 0.92% 1.37% 1.03% 1.34% 1.15% 0.25% 0.50% 0.75% 1.00% 1.25% 1.50% 1.75% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2Q22 CONSISTENT TRACK RECORD OF STRONG PROFITABILITY 8 Source: Public filings and S&P Global Market Intelligence, as of 31 - Aug - 2022 Note: Financial data as of 30 - Jun - 2022. $10 – $50bn banks constituted as of 31 - Dec - 2021; excludes merger targets. (1) PTPP (Pre - Tax, Pre - Provision) Earnings, ROATA (Return On Average Tangible Assets) and ROATCE (Return On Average Tangible Common Equity) are non - GAAP financial measures. A reconciliation to the comparable FHB GAAP measures is provided in the appendix. 12.1% 18.1% 10.9% 15.5% 16.8% 10.5% 15.8% 11.7% 15.6% 14.4% 4.0% 8.0% 12.0% 16.0% 20.0% 24.0% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2Q22 Year Ended December 31 Pre - Tax, Pre - Provision Earnings ($mm) (1) ROATA (1) Stable Earnings Drivers ROATCE (1) Year Ended December 31 Consistent PTPP Earnings Consistent History of Strong Profitability First Hawaiian, Inc. Public U.S. Banks with $10-$50bn of Assets Year Ended December 31 ▪ Dominant loan and deposit positions in attractive markets ▪ Consistent underwriting standards with proven performance through the credit cycle ▪ Demonstrated history of disciplined expense management YTD YTD YTD

0.21% 0.73% 0.08% 0.10% 1.05% 0.02% 0.00% 0.50% 1.00% 1.50% '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 2Q22 PROVEN, CONSISTENT, AND CONSERVATIVE CREDIT RISK MANAGEMENT Strong through the cycle credit performance driven by conservative approach to credit risk management 9 Year Ended December 31 0.16% 0.63% 0.10% 0.39% 3.05% 0.39% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 2Q22 As of December 31 1.43% 1.12% 1.18% 1.98% 1.07% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 2Q22 71.4x 19.0x 3.7x 3.7x '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 2Q22 As of December 31 As of December 31 First Hawaiian, Inc. Public U.S. Banks with $10-$50bn of Assets Source: Public filings and SNL Financial, available as of 31 - Aug - 2022 Note: Financial data as of 30 - Jun - 2022. $10 – $50bn banks constituted as of 31 - Dec - 2021; excludes merger targets. NCOs / Average Loans NPAs + 90s / Loans + OREO Reserves / Loans Reserves / Non - Accrual Loans 75.0x 30.0x 20.0x 10.0x 40.0x YTD

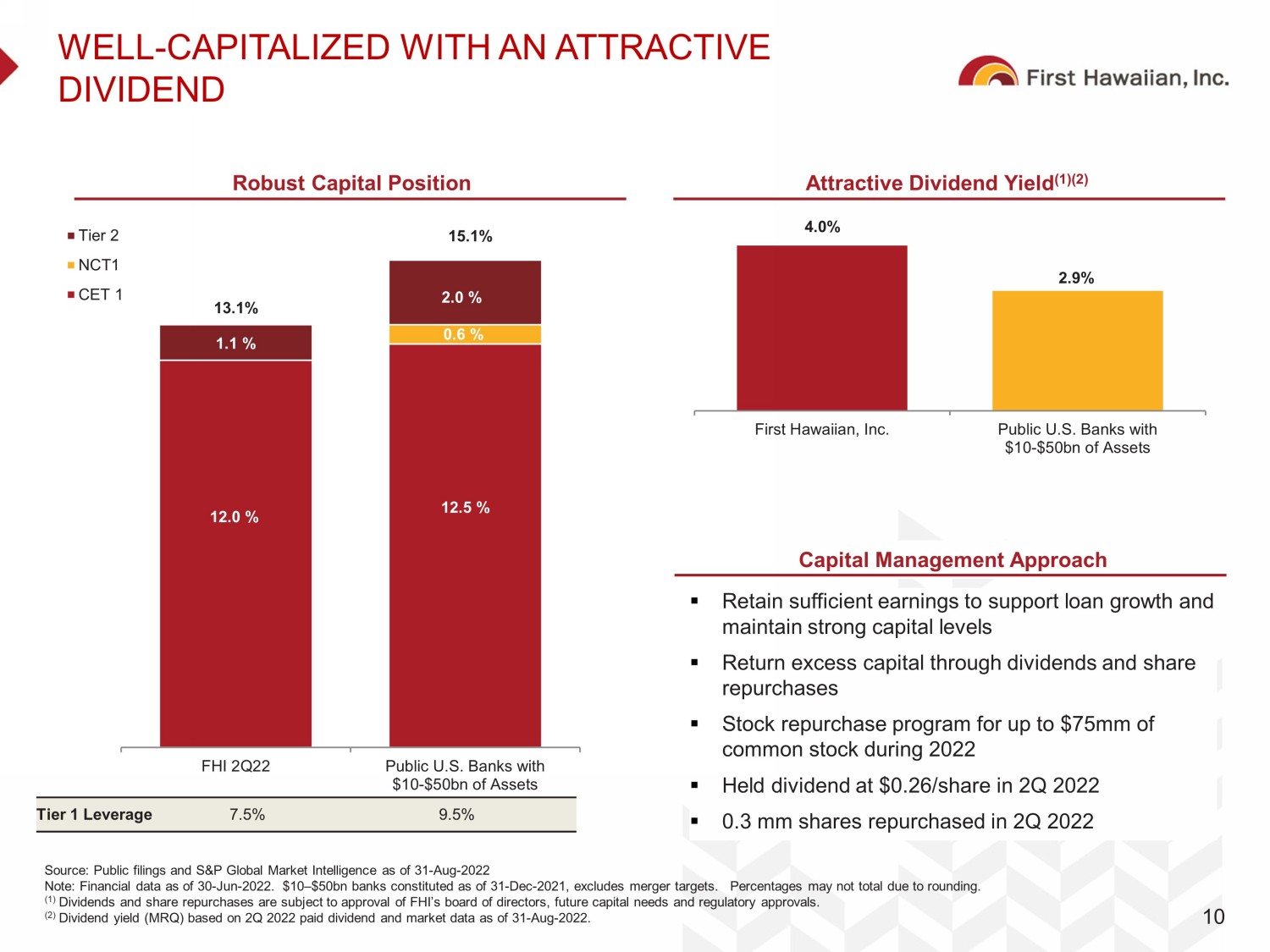

WELL - CAPITALIZED WITH AN ATTRACTIVE DIVIDEND 10 Source: Public filings and S&P Global Market Intelligence as of 31 - Aug - 2022 Note: Financial data as of 30 - Jun - 2022. $10 – $50bn banks constituted as of 31 - Dec - 2021, excludes merger targets. Percentages m ay not total due to rounding. (1) Dividends and share repurchases are subject to approval of FHI’s board of directors, future capital needs and regulatory appr ov als. (2) Dividend yield (MRQ) based on 2Q 2022 paid dividend and market data as of 31 - Aug - 2022. Robust Capital Position Attractive Dividend Yield (1)(2) Capital Management Approach 12.0 % 12.5 % 0.6 % 1.1 % 2.0 % 13.1% 15.1% FHI 2Q22 Public U.S. Banks with $10-$50bn of Assets Tier 2 NCT1 CET 1 Tier 1 Leverage 7.5% 9.5% ▪ Retain sufficient earnings to support loan growth and maintain strong capital levels ▪ Return excess capital through dividends and share repurchases ▪ Stock repurchase program for up to $75mm of common stock during 2022 ▪ Held dividend at $0.26/share in 2Q 2022 ▪ 0.3 mm shares repurchased in 2Q 2022 4.0% 2.9% First Hawaiian, Inc. Public U.S. Banks with $10-$50bn of Assets

11 Appendix

FULL SUITE OF PRODUCTS AND SERVICES 12 • Largest commercial lender in Hawaii • 58 commercial bankers (2) • Relationship - based lending • Primary focus on Hawaii, additional focus on California • C&I, leases, auto dealer flooring, CRE, and C&D • Strong relationships with proven local real estate developers • $16.5 bn of AUA (3) and 30 financial advisors (2) • Personal services include financial planning, insurance, trust, estate, and private banking • Institutional services include investment management, retirement plan administration, and custody • Mutual funds provided by Bishop Street Capital Management • 33.8% deposit market share in Hawaii (1) • Retail deposit products offered through branch, online, mobile, and direct channels • Commercial deposits, treasury and cash management products • Hawaii state and municipal relationships Commercial Lending Wealth Management Deposits • Services provided to individuals and small to mid - sized businesses • Full service branches, online and mobile channels • Exclusively in - footprint focus • First mortgages, home equity, indirect auto financing, and other consumer loans Consumer Lending • Leading credit card issuer among Hawaii banks • Approximately 157,000 accounts with more than $2.1bn annual spend (2) • Consumer, small businesses, and commercial cards • Issuer of M asterCard Credit Cards • Largest merchant processor in Hawaii • Spans Hawaii, Guam and Saipan • Over 3,400 terminals processed ~38.4 mm transactions in 2021 • Relationships with all major U.S. card companies and select foreign cards Merchant Processing First Hawaiian is a full - service community bank focused on building relationships with our customers (1) Source: FDIC as of 30 - Jun - 2021 (2) As of 31 - Dec - 2021 (3) As of 30 - Jun - 2022

A LEADER IN HAWAII 13 The banking market in Hawaii is dominated by local banks, with the top 4 banks accounting for ~93% of deposits Sources: S&P Global Market Intelligence, FDIC, SEC and company filings. Company filings used for peers where available, othe rwi se regulatory data used. Note: Financial data as of 30 - Jun - 2022. (1) ROATCE (return on average tangible common equity) and ROATA (return on average tangible assets) are non - GAAP financial measures. Reconciliations to the comparable FHB GAAP measures are provided in the appendix. (2) Deposit market share based on FDIC data as of 30 - Jun - 2021. Branches 51 54 38 30 FTEs 2,021 2,114 1,075 774 Assets ($bn) 25.4 23.2 9.2 7.3 Loans ($bn) 13.3 13.0 5.4 5.3 Deposits ($bn) 22.6 21.0 8.3 6.6 YTD 2Q 2022 ROATCE 16.8% (1) 15.2% 15.0% 14.8% YTD 2Q 2022 ROATA 0.98% (1) 0.98% 0.90% 1.02% Loan Portfolio Deposit Portfolio Hawaii Deposits 2 Balance ($bn) $19.1 $19.2 $7.9 $6.4 Share 33.8% 34.0% 14.0% 11.3 % Commercial Commercial RE Residential RE Consumer & Other Transaction Accounts Savings / MMDA Time Deposits 11% 15% 35% 32% 10% 10% 29% 35% 16% 4 % 11% 25% 50% 10% 14% 10% 27% 36% 13% 7% 43% 50% 6% 56% 38% 6% 89% 5% 10% 56% 34% 7% HELOC

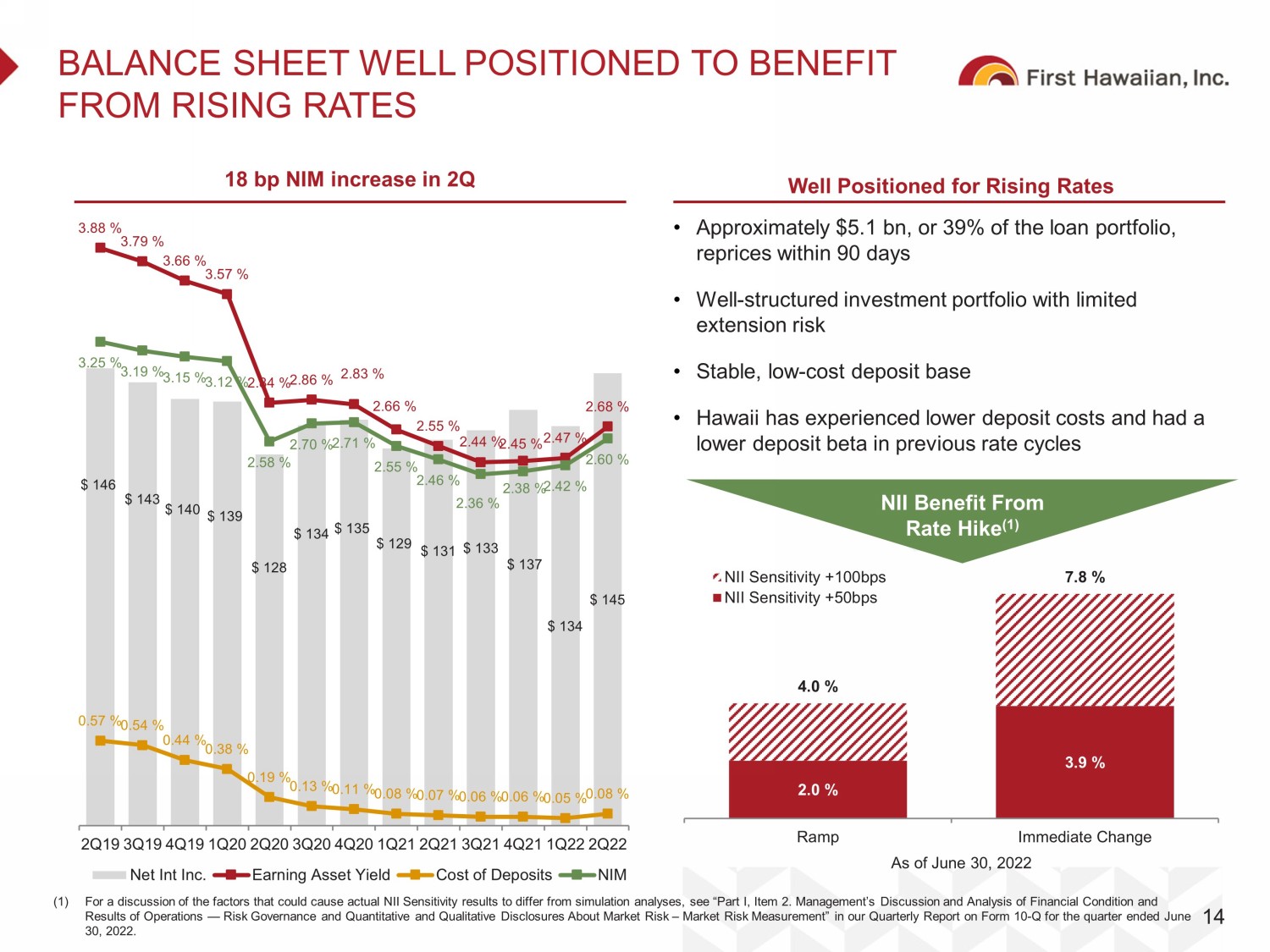

BALANCE SHEET WELL POSITIONED TO BENEFIT FROM RISING RATES 14 18 bp NIM increase in 2Q Well Positioned for Rising Rates 2.0 % 3.9 % 4.0 % 7.8 % Ramp Immediate Change NII Sensitivity +100bps NII Sensitivity +50bps • Approximately $5.1 bn, or 39% of the loan portfolio, reprices within 90 days • Well - structured investment portfolio with limited extension risk • Stable, low - cost deposit base • Hawaii has experienced lower deposit costs and had a lower deposit beta in previous rate cycles (1) For a discussion of the factors that could cause actual NII Sensitivity results to differ from simulation analyses, see “Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Risk Governance and Quantitative and Qualitative Disclosures About Market Risk – Market Risk Measurement ” in our Quarterly Report on Form 10 - Q for the quarter ended June 30, 2022. NII Benefit From Rate Hike (1) As of June 30, 2022 $ 146 $ 143 $ 140 $ 139 $ 128 $ 134 $ 135 $ 129 $ 131 $ 133 $ 137 $ 134 $ 145 3.88 % 3.79 % 3.66 % 3.57 % 2.84 % 2.86 % 2.83 % 2.66 % 2.55 % 2.44 % 2.45 % 2.47 % 2.68 % 0.57 % 0.54 % 0.44 % 0.38 % 0.19 % 0.13 % 0.11 % 0.08 % 0.07 % 0.06 % 0.06 % 0.05 % 0.08 % 3.25 % 3.19 % 3.15 % 3.12 % 2.58 % 2.70 % 2.71 % 2.55 % 2.46 % 2.36 % 2.38 % 2.42 % 2.60 % 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 Net Int Inc. Earning Asset Yield Cost of Deposits NIM

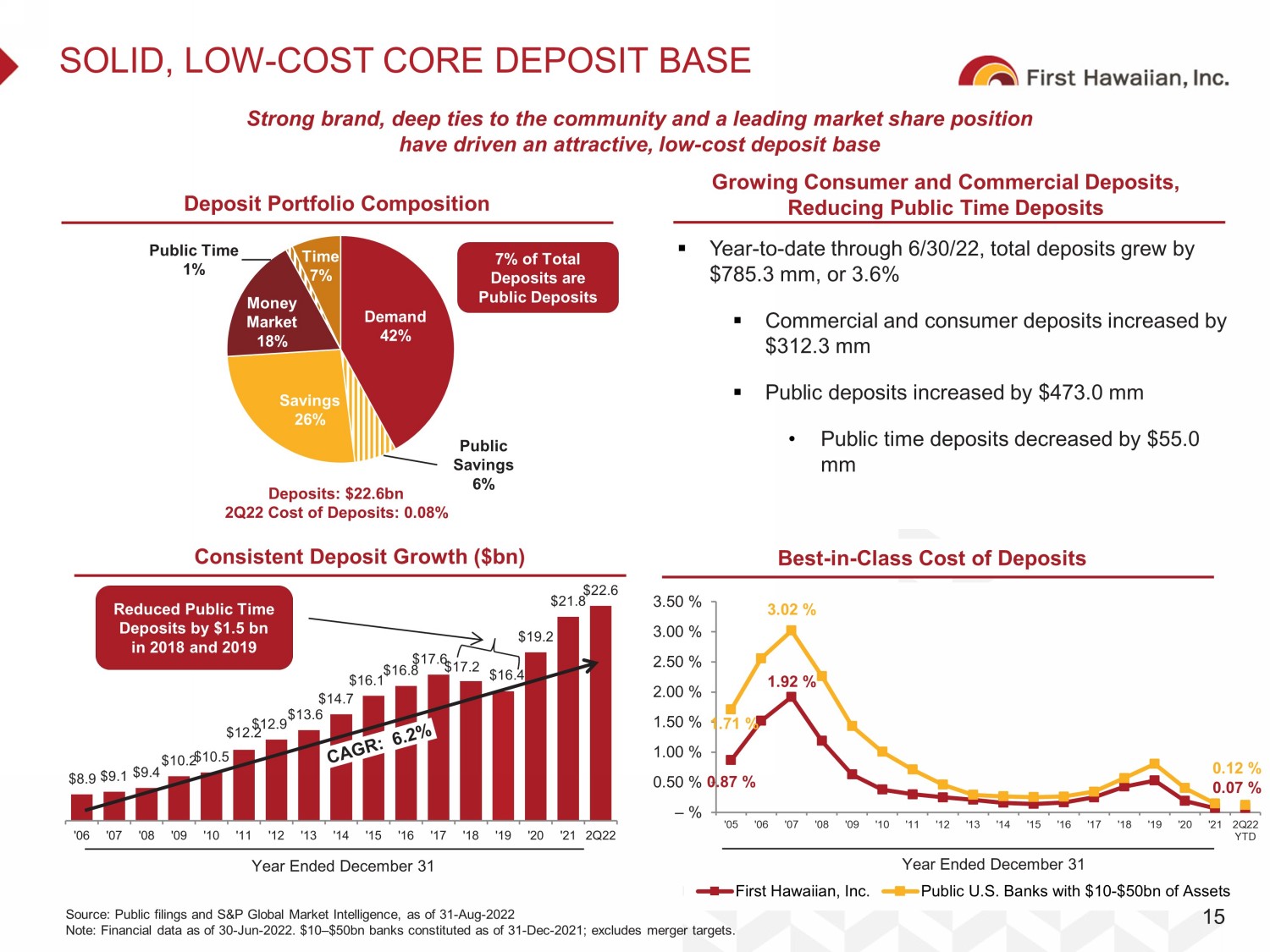

$8.9 $9.1 $9.4 $10.2 $10.5 $12.2 $12.9 $13.6 $14.7 $16.1 $16.8 $17.6 $17.2 $16.4 $19.2 $21.8 $22.6 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 2Q22 Demand 42% Money Market 18% Savings 26% Time 7% SOLID, LOW - COST CORE DEPOSIT BASE Strong brand, deep ties to the community and a leading market share position have driven an attractive, low - cost deposit base Deposits: $22.6bn 2Q22 Cost of Deposits: 0.08% Year Ended December 31 Deposit Portfolio Composition Consistent Deposit Growth ($bn) Best - in - Class Cost of Deposits 0.87 % 1.92 % 0.07 % 1.71 % 3.02 % 0.12 % – % 0.50 % 1.00 % 1.50 % 2.00 % 2.50 % 3.00 % 3.50 % '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 2Q22 YTD First Hawaiian, Inc. Public U.S. Banks with $10-$50bn of Assets Year Ended December 31 Source: Public filings and S&P Global Market Intelligence, as of 31 - Aug - 2022 Note: Financial data as of 30 - Jun - 2022. $10 – $50bn banks constituted as of 31 - Dec - 2021; excludes merger targets. 7% of Total Deposits are Public Deposits Public Savings 6% Reduced Public Time Deposits by $1.5 bn in 2018 and 2019 Public Time 1% ▪ Year - to - date through 6/30/22, total deposits grew by $785.3 mm, or 3.6% ▪ Commercial and consumer deposits increased by $312.3 mm ▪ Public deposits increased by $473.0 mm • Public time deposits decreased by $55.0 mm Growing Consumer and Commercial Deposits, Reducing Public Time Deposits 15

$6.4 $6.5 $7.9 $8.0 $8.3 $8.3 $9.0 $9.5 $10.0 $10.7 $11.5 $12.3 $13.1 $13.2 $13.3 $13.0 $13.3 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 2Q22 STEADY ORGANIC GROWTH AND BALANCED LOAN PORTFOLIO Steady through the cycle organic loan growth and balanced loan portfolio Expect mid - to - high single digit loan growth (ex PPP) in 2022 16 Well - positioned to serve clients during the financial crisis Loans: $13.3 bn 2Q22 Loan Yield: 3.4% Loans / Deposits 71% 72% 84% 78% 79% 69% 70% 70% 68% 67% 69% 70% 76% 80% 69% 59% 57% Year Ended December 31, Balanced Loan Portfolio (as of 6/30/22) Steady Loan Growth ($bn) Note: Financial data as of 30 - Jun - 2022 ▪ Largest Hawaii - based lender ▪ Balanced Portfolio ▪ 52% Commercial, 48% Consumer ▪ 78 % Hawaii/Guam/Saipan, 22% Mainland ▪ Commercial ▪ Hawaii’s leading commercial bank with most experienced lending team. ▪ Average commercial loan officer experience > 25 years ▪ 59 % Hawaii/Guam/Saipan, 41% Mainland ▪ $ 1,429 mm Shared National Credit portfolio ▪ Participating in SNC lending for over 20 years ▪ 20% Hawaii - based, 80% Mainland ▪ Leading SBA lender Hawaii ▪ SBA Lender of the Year (Category 1) 2017, 2018, 2019 ▪ Leveraged SBA experience to quickly launch PPP program ▪ Originated over 10k PPP loans for over $1.4bn in principal balances in 2020 and 2021 ▪ Consumer ▪ Primarily a Prime and Super Prime lender ▪ ~90% of portfolio collateralized ▪ Financing consumer auto loans for over 40 years C&I $1,942 mm 15% CRE $3,957 mm 30% Construction $728 mm 5% Leasing $245 mm 2% Residential $4,213 mm 32% Home Equity $972 mm 7% Consumer Auto $807 mm 6% Credit Card $287 mm 2% Other Consumer $113 mm 1% Loan Portfolio Highlights (as of 6/30/22) Sold $409 mm SNC loans in 2019

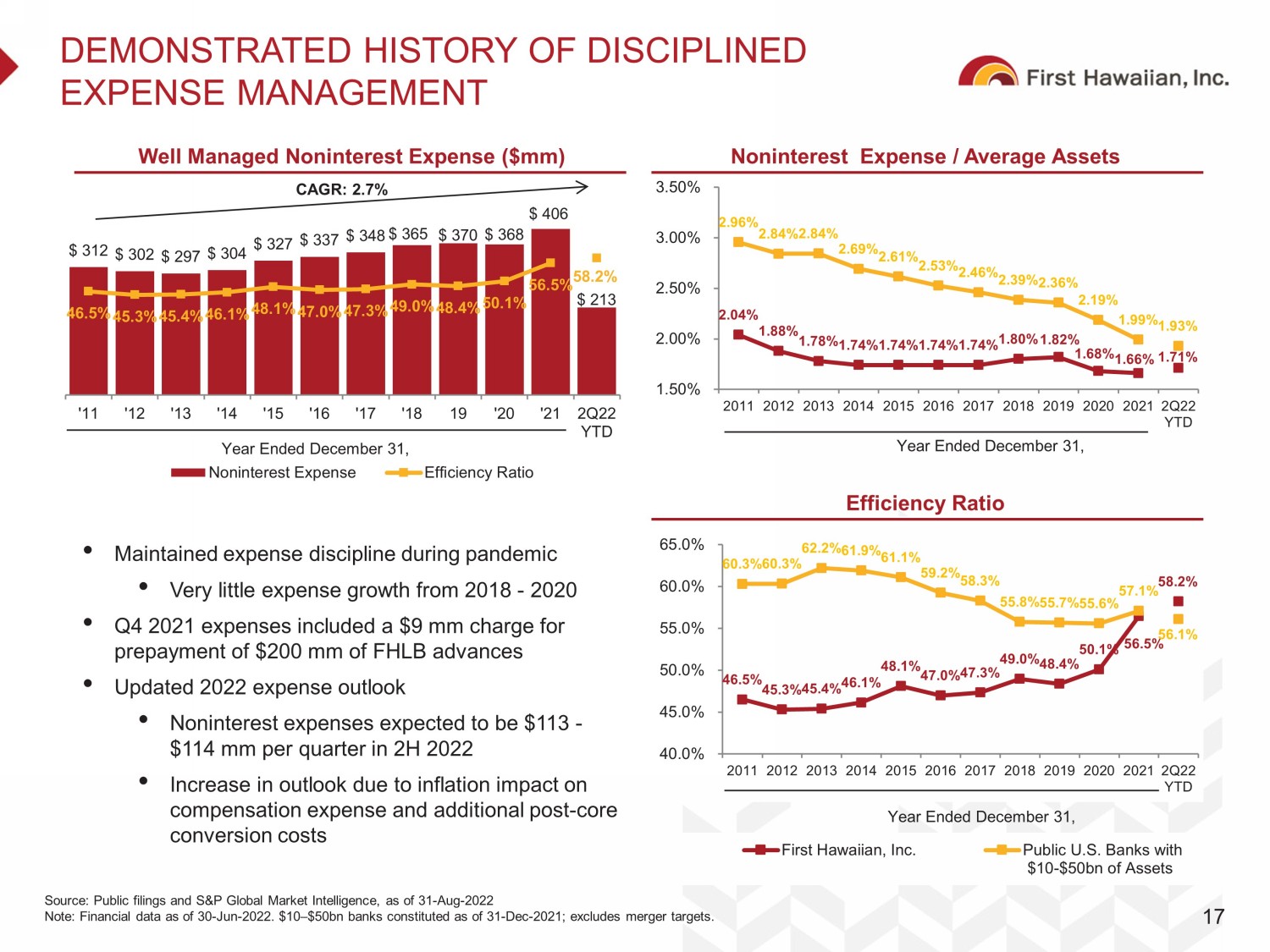

46.5% 45.3% 45.4% 46.1% 48.1% 47.0% 47.3% 49.0% 48.4% 50.1% 56.5% 58.2% 60.3% 60.3% 62.2% 61.9% 61.1% 59.2% 58.3% 55.8% 55.7% 55.6% 57.1% 56.1% 40.0% 45.0% 50.0% 55.0% 60.0% 65.0% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2Q22 YTD First Hawaiian, Inc. Public U.S. Banks with $10-$50bn of Assets 2.04% 1.88% 1.78% 1.74% 1.74% 1.74% 1.74% 1.80% 1.82% 1.68% 1.66% 1.71% 2.96% 2.84% 2.84% 2.69% 2.61% 2.53% 2.46% 2.39% 2.36% 2.19% 1.99% 1.93% 1.50% 2.00% 2.50% 3.00% 3.50% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2Q22 YTD DEMONSTRATED HISTORY OF DISCIPLINED EXPENSE MANAGEMENT 17 Source: Public filings and S&P Global Market Intelligence, as of 31 - Aug - 2022 Note: Financial data as of 30 - Jun - 2022. $10 – $50bn banks constituted as of 31 - Dec - 2021; excludes merger targets. Year Ended December 31, Year Ended December 31, Noninterest Expense / Average Assets Well Managed Noninterest Expense ($mm) Efficiency Ratio • Maintained expense discipline during pandemic • Very little expense growth from 2018 - 2020 • Q4 2021 expenses included a $9 mm charge for prepayment of $200 mm of FHLB advances • Updated 2022 expense outlook • Noninterest expenses expected to be $113 - $114 mm per quarter in 2H 2022 • Increase in outlook due to inflation impact on compensation expense and additional post - core conversion costs $ 312 $ 302 $ 297 $ 304 $ 327 $ 337 $ 348 $ 365 $ 370 $ 368 $ 406 $ 213 46.5% 45.3% 45.4% 46.1% 48.1% 47.0% 47.3% 49.0% 48.4% 50.1% 56.5% 58.2% '11 '12 '13 '14 '15 '16 '17 '18 19 '20 '21 2Q22 YTD Noninterest Expense Efficiency Ratio CAGR: 2.7% Year Ended December 31,

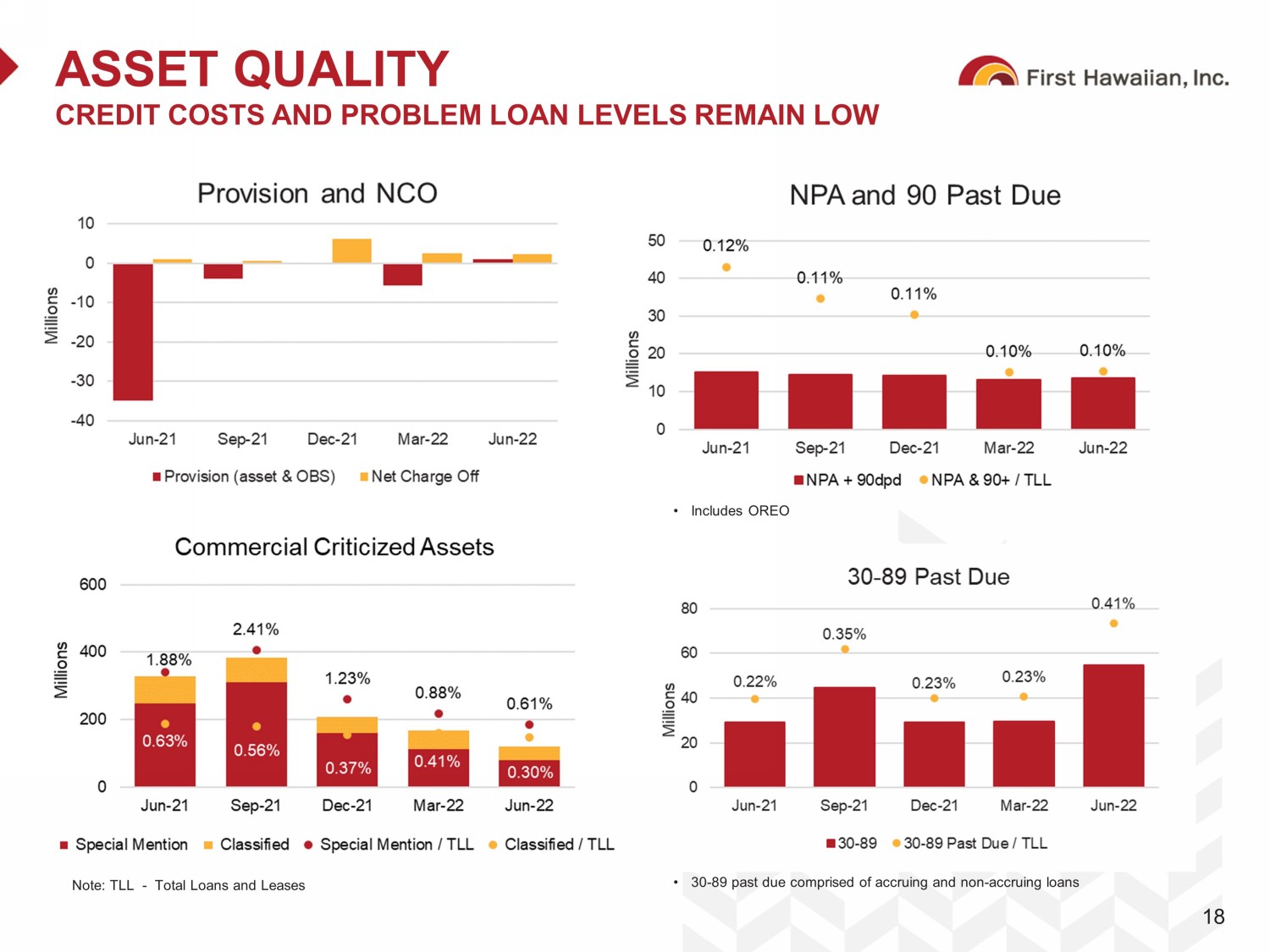

ASSET QUALITY CREDIT COSTS AND PROBLEM LOAN LEVELS REMAIN LOW 18 • 30 - 89 past due comprised of accruing and non - accruing loans Note: TLL - Total Loans and Leases • 90 past due comprised of accruing loans • Includes OREO

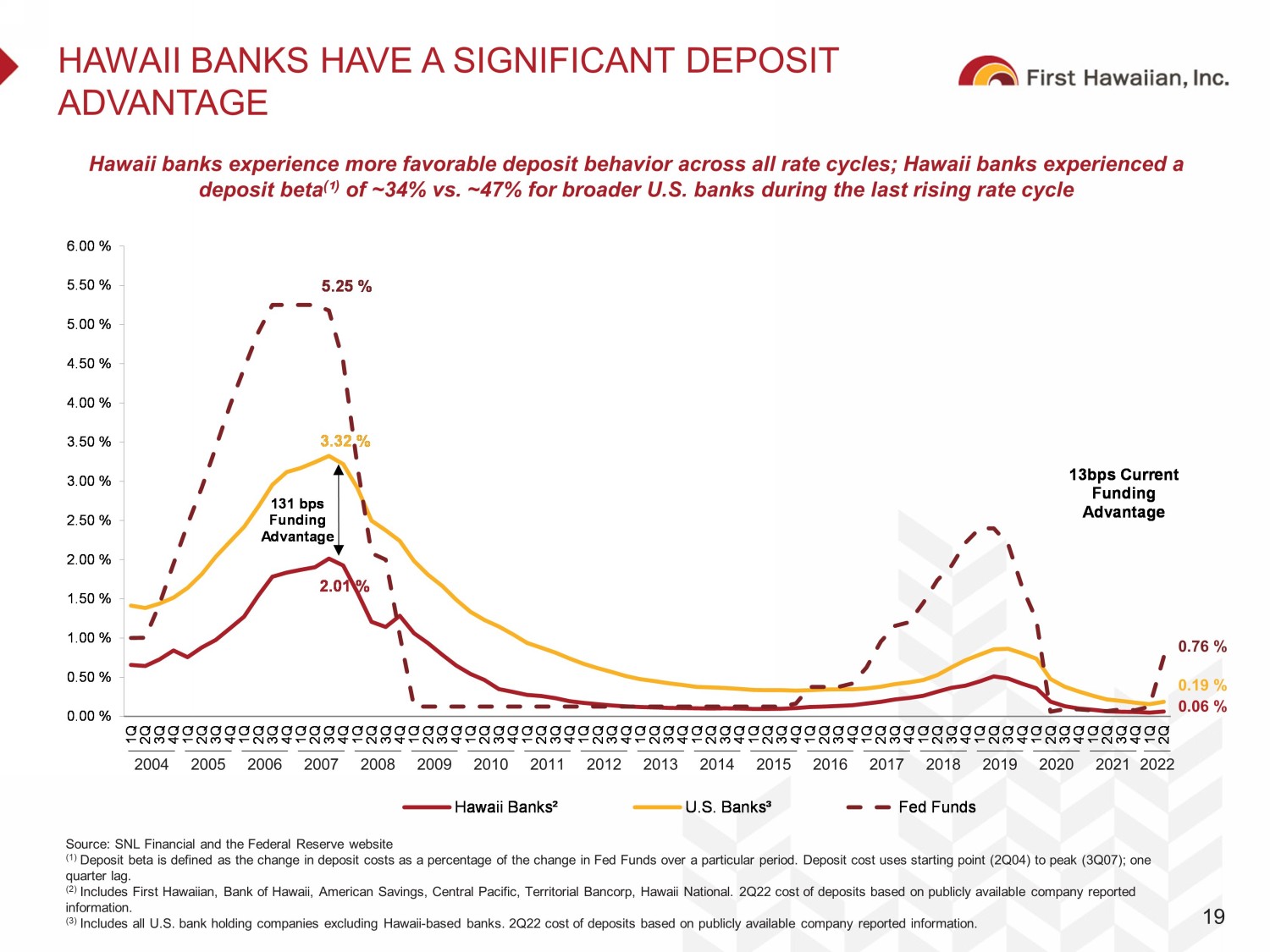

0.00 % 0.50 % 1.00 % 1.50 % 2.00 % 2.50 % 3.00 % 3.50 % 4.00 % 4.50 % 5.00 % 5.50 % 6.00 % 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q Hawaii Banks² U.S. Banks³ Fed Funds 13bps Current Funding Advantage 3.32 % 2.01 % 5.25 % 131 bps Funding Advantage HAWAII BANKS HAVE A SIGNIFICANT DEPOSIT ADVANTAGE 19 Source: SNL Financial and the Federal Reserve website (1) Deposit beta is defined as the change in deposit costs as a percentage of the change in Fed Funds over a particular period. D ep osit cost uses starting point (2Q04) to peak (3Q07); one quarter lag. (2) Includes First Hawaiian, Bank of Hawaii, American Savings, Central Pacific, Territorial Bancorp, Hawaii National. 2Q22 cost o f deposits based on publicly available company reported information. (3) Includes all U.S. bank holding companies excluding Hawaii - based banks. 2Q22 cost of deposits based on publicly available compan y reported information. Hawaii banks experience more favorable deposit behavior across all rate cycles; Hawaii banks experienced a deposit beta ( ¹ ) of ~34% vs. ~47% for broader U.S. banks during the last rising rate cycle 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 0.76 % 0.19 % 0.06 %

GAAP TO NON - GAAP RECONCILIATIONS We present pre - tax, pre - provision earnings on an adjusted basis as a non - GAAP financial measure. We believe that the presentation of this non - GAAP financial measure helps identify underlying trends in our business from period to period that could otherwise be distorted by the effect of certain expenses included in our operating results . Investors should consider our performance and financial condition as reported under GAAP and all other relevant information when assessing our performance or financial condition. Return on average tangible stockholders’ equity, return on average tangible assets and tangible stockholders’ equity to tangible assets are non - GAAP financial measures. We compute our return on average tangible stockholders’ equity as the ratio of net income to average tangible stockholders’ equity, which is calculated by subtracting (and thereby effectively excluding) amounts related to the effect of goodwill from our average total stockholders’ equity. We compute our return on average tangible assets as the ratio of net income to average tangible assets, which is calculated by subtracting (and thereby effectively excluding) amounts related to the effect of goodwill from our average total assets. We compute our tangible stockholders’ equity to tangible assets as the ratio of tangible stockholders’ equity to tangible assets, each of which we calculate by subtracting (and thereby effectively excluding) the value of our goodwill. We believe that these measurements are useful for investors, regulators, management and others to evaluate financial performance and capital adequacy relative to other financial institutions. Although these non - GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results or financial condition as reported under GAAP. Investors should consider our performance and capital adequacy as reported under GAAP and all other relevant information when assessing our performance and capital adequacy. The following tables provide a reconciliation of these non - GAAP financial measures with their most directly comparable GAAP measures. 20

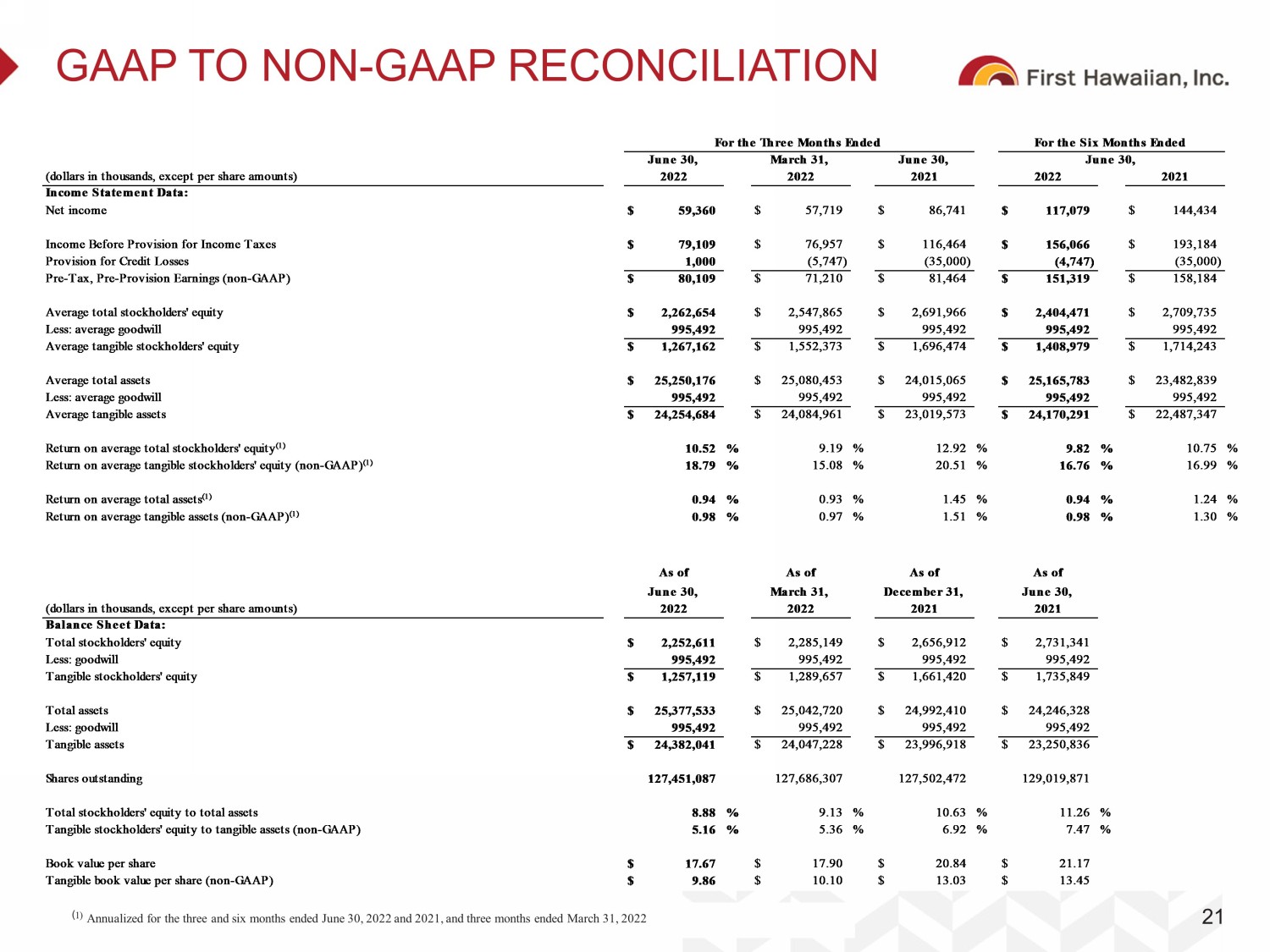

GAAP TO NON - GAAP RECONCILIATION 21 ( 1) Annualized for the three and six months ended June 30, 2022 and 2021, and three months ended March 31, 2022 (dollars in thousands, except per share amounts) Income Statement Data: Net income $ 59,360 $ 57,719 $ 86,741 $ 117,079 $ 144,434 Income Before Provision for Income Taxes $ 79,109 $ 76,957 $ 116,464 $ 156,066 $ 193,184 Provision for Credit Losses 1,000 (5,747) (35,000) (4,747) (35,000) Pre-Tax, Pre-Provision Earnings (non-GAAP) $ 80,109 $ 71,210 $ 81,464 $ 151,319 $ 158,184 Average total stockholders' equity $ 2,262,654 $ 2,547,865 $ 2,691,966 $ 2,404,471 $ 2,709,735 Less: average goodwill 995,492 995,492 995,492 995,492 995,492 Average tangible stockholders' equity $ 1,267,162 $ 1,552,373 $ 1,696,474 $ 1,408,979 $ 1,714,243 Average total assets $ 25,250,176 $ 25,080,453 $ 24,015,065 $ 25,165,783 $ 23,482,839 Less: average goodwill 995,492 995,492 995,492 995,492 995,492 Average tangible assets $ 24,254,684 $ 24,084,961 $ 23,019,573 $ 24,170,291 $ 22,487,347 Return on average total stockholders' equity(1) 10.52 % 9.19 % 12.92 % 9.82 % 10.75 % Return on average tangible stockholders' equity (non-GAAP)(1) 18.79 % 15.08 % 20.51 % 16.76 % 16.99 % Return on average total assets(1) 0.94 % 0.93 % 1.45 % 0.94 % 1.24 % Return on average tangible assets (non-GAAP)(1) 0.98 % 0.97 % 1.51 % 0.98 % 1.30 % (dollars in thousands, except per share amounts) Balance Sheet Data: Total stockholders' equity $ 2,252,611 $ 2,285,149 $ 2,656,912 $ 2,731,341 Less: goodwill 995,492 995,492 995,492 995,492 Tangible stockholders' equity $ 1,257,119 $ 1,289,657 $ 1,661,420 $ 1,735,849 Total assets $ 25,377,533 $ 25,042,720 $ 24,992,410 $ 24,246,328 Less: goodwill 995,492 995,492 995,492 995,492 Tangible assets $ 24,382,041 $ 24,047,228 $ 23,996,918 $ 23,250,836 Shares outstanding 127,451,087 127,686,307 127,502,472 129,019,871 Total stockholders' equity to total assets 8.88 % 9.13 % 10.63 % 11.26 % Tangible stockholders' equity to tangible assets (non-GAAP) 5.16 % 5.36 % 6.92 % 7.47 % Book value per share $ 17.67 $ 17.90 $ 20.84 $ 21.17 Tangible book value per share (non-GAAP) $ 9.86 $ 10.10 $ 13.03 $ 13.45 June 30, March 31, December 31, June 30, 2022 2022 2021 2021 As of As of As of As of For the Three Months Ended For the Six Months Ended June 30, March 31, June 30, June 30, 2022 2022 2021 2022 2021

GAAP TO NON - GAAP RECONCILIATION - ANNUAL 22 Note: Totals may not sum due to rounding. As of and for the Twelve Months Ended December 31, (Dollars in millions, except per share data) 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 Net Income $265.7 $185.8 $ 284.4 $ 264.4 $ 183.7 $230.2 $213.8 $216.7 $214.5 $211.1 $199.7 Average Total Stockholders’ Equity $2,708.4 $2,698.9 $ 2,609.4 $ 2,457.8 $ 2,538.3 $2,568.2 $2,735.8 $2,698.4 $2,667.4 $2,664.2 $2,640.6 Less: Average Goodwill 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 Average Tangible Stockholders’ Equity $1,712.9 $1,703.4 $ 1,613.9 $ 1,462.3 $ 1,542.8 $1,572.7 $1,740.3 $1,702.9 $1,672.0 $1,668.7 $1,645.1 Total Stockholders’ Equity 2,656.9 2,744.1 2,640.3 2,524.8 2,532.6 2,476.5 2,736.9 2,675.0 2,651.1 2,654.2 2,677.4 Less: Goodwill 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 Tangible Stockholders’ Equity $1,661.4 $1,748.6 $ 1,644.8 $ 1,529.3 $ 1,537.1 $1,481.0 $1,741.4 $1,679.5 $1,655.6 $1,658.7 $1,681.9 Average Total Assets 24,426.3 21,869.1 20,325.7 20,247.1 19,942.8 19,334.7 18,785.7 17,493.2 16,653.6 16,085.7 15,246.8 Less: Average Goodwill 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 Average Tangible Assets $23,430.8 $20,873.6 $ 19,330.2 $ 19,251.6 $ 18,947.3 $18,339.2 $17,790.2 $16,497.7 $15,658.1 $15,090.2 $14,251.3 Total Assets 24,992.4 22,662.8 20,166.7 20,695.7 20,549.5 19,661.8 19,352.7 18,133.7 17,118.8 16,646.7 15,839.4 Less: Goodwill 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 Tangible Assets $23,996.9 $21,667.3 $ 19,171.2 $ 19,700.2 $ 19,554.0 $18,666.3 $18,357.2 $17,138.2 $16,123.3 $15,651.2 $14,843.9 Return on Average Total Stockholders’ Equity 9.81% 6.88% 10.90% 10.76% 7.24% 8.96% 7.81% 8.03% 8.04% 7.92% 7.56% Return on Average Tangible Stockholders’ Equity (non - GAAP) 15.51% 10.91% 17.62% 18.08% 11.91% 14.64% 12.28% 12.72% 12.83% 12.65% 12.14% Return on Average Total Assets 1.09% 0.85% 1.40% 1.31% 0.92% 1.19% 1.14% 1.24% 1.29% 1.31% 1.31% Return on Average Tangible Assets (non - GAAP) 1.13% 0.89% 1.47% 1.37% 0.97% 1.26% 1.20% 1.31% 1.37% 1.40% 1.40% Income Before Provision for Income Taxes $ 349.0 $ 243.7 $ 381.7 $ 358.2 $ 368.4 $ 371.8 $ 343.2 $ 344.2 $ 344.5 $ 329.8 $ 316.4 Provision For Credit Losses (39.0) 121.7 13.8 22.2 18.5 8.6 9.9 11.1 12.2 34.9 42.1 Pre - Tax, Pre - Provision Earnings (Non - GAAP) $ 310.0 $ 365.4 $ 395.5 $ 380.4 $ 386.9 $ 380.4 $ 353.1 $ 355.3 $ 356.7 $ 364.7 $ 358.5