UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☒ | Soliciting Material under § 240.14a-12 | |

CORELOGIC, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of filing fee (Check the appropriate box):

| ☒ | No fee required | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing fee for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 7, 2020 (July 6, 2020)

CORELOGIC, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware | 001-13585 | 95-1068610 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

40 Pacifica

Irvine

California

92618-7471

(Street Address) (City) (State) (Zip Code)

Registrant’s telephone number, including area code (949) 214-1000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

Trading symbol(s) |

Name of exchange on which registered | ||

| Common Stock, $0.00001 par value | CLGX | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement. |

On July 6, 2020, the Board of Directors (the “Board”) of CoreLogic, Inc., a Delaware corporation (the “Company”), authorized and declared a dividend distribution of one right (each, a “Right”) for each outstanding share of common stock, par value $0.00001 per share, of the Company (the “Common Stock”). The dividend is payable to holders of record as of the close of business on July 17, 2020 (the “Record Date”).

Each Right entitles the registered holder thereof to purchase from the Company, when exercisable and subject to adjustment, a unit consisting of one one-thousandth (1/1,000) of a share (a “Unit”) of Series A Junior Participating Preferred Stock, par value $0.00001 per share (the “Preferred Stock”), at a purchase price of $308.00 per Unit, subject to adjustment (the “Purchase Price”). The description and complete terms of the Rights are set forth in a Rights Agreement (the “Rights Agreement”), dated as of July 6, 2020, between the Company and Equiniti Trust Company, as rights agent.

The following is a summary of the material terms of the Rights Agreement, and is qualified in its entirety by reference to the full text of the Rights Agreement, which is attached hereto as Exhibit 4.1 and is incorporated by reference herein.

Rights Certificates; Exercise Period; Term

Initially, the Rights will be attached to all Common Stock certificates then outstanding (or for book entry shares of Common Stock, the Rights will be represented by notations in the respective book entry accounts), and no separate rights certificates (“Rights Certificates”) will be distributed. Subject to certain exceptions specified in the Rights Agreement, the Rights will separate from the Common Stock and a distribution date for the Rights (the “Distribution Date”) will occur upon the earlier of the (i) tenth (10th) business day following a public announcement (or, if the tenth (10th) business day after such public announcement occurs before the Record Date, the close of business on the Record Date) that a person or group of affiliated or associated persons (such person or group being an “Acquiring Person”), other than certain exempt persons, has acquired beneficial ownership of ten percent (10%) or more of the outstanding shares of Common Stock (or twenty percent (20%) or more of the outstanding shares of Common Stock in the case of passive institutional investors reporting beneficial ownership on Schedule 13G (a “Schedule 13G Institutional Investor”) under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”)), other than as a result of (a) pre-existing beneficial ownership in excess of the applicable threshold (in which case such person or group of affiliated or associated persons shall become an Acquiring Person if they become the beneficial owner of any additional shares of Common Stock; provided, for the avoidance of doubt, that the modification (directly or indirectly) of any derivative instrument or transaction that is not by its terms exchangeable or exercisable for, or convertible into, Common Stock to provide for the possibility of, or the exchange or settlement of any such instrument or transaction for, the issuance or transfer of shares of Common Stock or an instrument or transaction providing for the issuance or transfer of shares of Common Stock of the Company shall be deemed to be an acquisition of beneficial ownership of additional shares of Common Stock of the Company (regardless of whether thereafter or as a result thereof there is an increase, decrease or no change in the percentage of Common Stock then outstanding beneficially owned by such person or group of affiliated or associated persons)), (b) repurchases of Common Stock or securities convertible or exchangeable into Common Stock by the Company, (c) certain inadvertent acquisitions or (d) certain other situations (as specified in the Rights Agreement) and (ii) tenth (10th) business day (or such later date as the Board may determine) following the

2

commencement of a tender or exchange offer by any person that would result in a person or group becoming an Acquiring Person. For purposes of the Rights Agreement, beneficial ownership is defined to include derivative securities.

Until the Distribution Date, (i) the Rights will be evidenced by the Common Stock certificates (or, for book entry Common Stock, by the notations in the respective book entry accounts) and will be transferred with, and only with, such Common Stock, (ii) new Common Stock certificates issued after the Record Date will contain a notation incorporating the Rights Agreement by reference (for book entry Common Stock, this legend will be contained in the notations in book entry accounts) and (iii) the surrender for transfer of any Common Stock outstanding will also constitute the transfer of the Rights associated with such Common Stock. Pursuant to the Rights Agreement, the Company reserves the right to require, prior to the occurrence of a Triggering Event (as defined below), that, upon any exercise of Rights, a number of Rights be exercised so that only whole shares of Preferred Stock will be issued.

The Rights are not exercisable until the Distribution Date and will expire on July 6, 2021, unless the Rights are earlier redeemed, exchanged or terminated.

As soon as practicable after the Distribution Date, Rights Certificates will be mailed to holders of record of Common Stock (or notices will be provided to holders of book entry Common Stock) as of the close of business on the Distribution Date and, thereafter, the separate Rights Certificates alone will represent the Rights. Except as otherwise determined by the Board, only Common Stock issued prior to the Distribution Date will be issued with the Rights.

Change of Exercise of Rights Following Certain Events

The following described events are referred to as “Triggering Events.”

(a) Flip-In Event. In the event that a person or group of affiliated or associated persons becomes an Acquiring Person, each holder of a Right will thereafter have the right to receive, upon exercise, Common Stock (or, in certain circumstances, other securities, cash or other assets of the Company) having a value equal to two (2) times the Purchase Price. Notwithstanding any of the foregoing, following the occurrence of a person becoming an Acquiring Person, all Rights that are, or (under certain circumstances specified in the Rights Agreement) were, beneficially owned by any Acquiring Person (or by certain related parties) will be null and void and any holder of such Rights (including any purported transferee or subsequent holder) will be unable to exercise or transfer any such Rights. However, Rights are not exercisable following the occurrence of a person becoming an Acquiring Person until the Distribution Date.

(b) Flip-Over Events. In the event that, at any time after a person has become an Acquiring Person, (i) the Company engages in a merger or other business combination transaction in which the Company is not the continuing or surviving corporation, (ii) the Company engages in a merger or other business combination transaction in which the Company is the continuing or surviving corporation and the shares of Common Stock of the Company are changed or exchanged or (iii) fifty percent (50%) or more of the Company’s assets, cash flow or earning power is sold or transferred, each holder of a Right (except Rights that have previously been voided as set forth above) shall thereafter have the right to receive, upon exercise, common stock of the acquiring company having a value equal to two (2) times the Purchase Price.

3

Redemption

At any time until the earlier of (i) ten (10) business days following public announcement that an Acquiring Person has become such (the “Stock Acquisition Date”) (or, if the Stock Acquisition Date shall have occurred prior to the Record Date, ten (10) business days following the Record Date) or (ii) the expiration of the Rights Agreement, the Board may direct the Company to redeem all but not less than all of the then outstanding Rights, at a price of $0.001 per Right (payable in cash, Common Stock or other consideration deemed appropriate by the Board), subject to adjustment as provided in the Rights Agreement (the “Redemption Price”). Immediately upon the action of the Board directing the Company to redeem the Rights, the Rights will terminate and the only right of the holders of Rights will be to receive the Redemption Price.

Exchange of Rights

At any time after a person or group of affiliated or associated persons becomes an Acquiring Person but before any person acquires beneficial ownership of fifty percent (50%) or more of the outstanding shares of Common Stock, the Board may direct the Company to exchange the Rights (other than Rights owned by such person or group or certain related parties, which will have become null and void and non-transferable as described above), in whole or in part, at an exchange ratio of one share of Common Stock per Right (subject to adjustment). The Company may substitute Preferred Stock (or shares of a class or series of the Company’s preferred stock having equivalent rights, preferences and privileges) for Common Stock at an initial rate of one Unit of Preferred Stock (or of a share of a class or series of the Company’s preferred stock having equivalent rights, preferences and privileges) per share of Common Stock. Immediately upon the action of the Board directing the Company to exchange the Rights, the Rights will terminate and the only right of the holders of Rights will be to receive the number of shares of Common Stock (or Units of Preferred Stock or of a share of a class or series of the Company’s preferred stock having equivalent rights, preferences and privileges) equal to the number of Rights held by such holder multiplied by the exchange ratio.

Certain Adjustments

In order to preserve the actual or potential economic value of the Rights, the number of shares of Preferred Stock or other securities issuable upon exercise of the Rights, the Purchase Price, the Redemption Price and the number of Rights associated with each outstanding share of Common Stock are all subject to adjustment by the Board pursuant to certain customary anti-dilution provisions.

No Stockholder Rights Prior to Exercise

Until a Right is exercised, the holder thereof, as such, will have no rights as a stockholder of the Company, including, without limitation, the right to vote or to receive dividends.

Amendment of Rights Agreement

Subject to certain exceptions specified in the Rights Agreement, for so long as the Rights are then redeemable, the terms of the Rights and the Rights Agreement may be amended by the Company without the approval of any holders of Rights. Subject to certain exceptions specified in the Rights Agreement, after the Rights are no longer redeemable, the provisions of the Rights Agreement may be amended by the Company, without the approval of any holder of Rights, including to shorten or lengthen any time period under the Rights Agreement, so long as no such amendment (a) adversely affects the interests of

4

the holders of the Rights as such, (b) causes the Rights Agreement to become amendable other than as already provided in the Rights Agreement or (c) causes the Rights to again become redeemable.

Certain Anti-Takeover Effects; Miscellaneous

The Rights are not intended to prevent a takeover of the Company and should not interfere with any merger or other business combination approved by the Board. However, the Rights may cause substantial dilution to a person or group of affiliated or associated persons that acquires beneficial ownership of ten percent (10%) (or twenty percent (20%) in the case of a Schedule 13G Institutional Investor) or more of the outstanding shares of Common Stock. As a result, the overall effect of the Rights may be to render more difficult or discourage a merger, tender offer or other business combination involving the Company that is not supported by the Board.

A copy of the Rights Agreement is available free of charge from the Company. This summary description of the Rights does not purport to be complete and is qualified in its entirety by reference to the full text of the Rights Agreement, which is attached hereto as Exhibit 4.1 and is incorporated by reference herein.

| Item 3.03 | Material Modification to Rights of Security Holders. |

See the description set out under “Item 1.01—Entry into a Material Definitive Agreement,” which is incorporated by reference into this Item 3.03.

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

Certificate of Designation

In connection with the adoption of the Rights Agreement described in Item 1.01 above, the Board approved a Certificate of Designation, Preferences, and Rights of Series A Junior Participating Preferred Stock of CoreLogic, Inc. (the “Certificate of Designation”). The Certificate of Designation was filed with the Secretary of State of the State of Delaware and became effective on July 7, 2020.

The shares of Preferred Stock shall not be redeemable. Each share of Preferred Stock shall be entitled to receive, when, as and if declared by the Board out of funds legally available for the purpose, quarterly dividends payable in cash on the first day of February, May, August, and November in each year (each such date being referred to herein as a “Quarterly Dividend Payment Date”), commencing on the first Quarterly Dividend Payment Date after the first issuance of a share or fraction of a share of Preferred Stock, in an amount per share (rounded to the nearest cent) equal to the greater of (a) one dollar ($1.00) or (b) subject to the provision for adjustment hereinafter set forth, one thousand (1,000) times the aggregate per share amount of all cash dividends, and one thousand (1,000) times the aggregate per share amount (payable in kind) of all non-cash dividends or other distributions, other than a dividend payable in Common Stock or a subdivision of the outstanding shares of Common Stock (by reclassification or otherwise), declared on the Common Stock since the immediately preceding Quarterly Dividend Payment Date, or, with respect to the first Quarterly Dividend Payment Date, since the first issuance of any share or fraction of a share of Preferred Stock. In the event the Company shall at any time after July 6, 2020, (i) declare and pay any dividend on the Common Stock payable in Common Stock, (ii) subdivide the outstanding shares of Common Stock, or (iii) combine the outstanding shares of Common Stock into a smaller number of shares, then in each such case the amount to which holders of shares of Preferred Stock were entitled immediately prior to such event under clause (b) of the immediately preceding sentence shall be adjusted by multiplying such amount by a fraction, the numerator of which is the total number of shares of Common Stock outstanding immediately after such event and the denominator of which is the total number of shares of Common Stock that were outstanding immediately prior to such event.

5

The foregoing description of the rights of the Preferred Stock does not purport to be complete and is qualified in its entirety by reference to the full text of the Certificate of Designation, which is attached hereto as Exhibit 3.1 and is incorporated by reference herein.

Amended and Restated Bylaws

On July 6, 2020, the Board approved and adopted, effective as of such date, the Amended and Restated Bylaws of the Company (as so amended and restated, the “Bylaws”). In addition to correcting a typographical error in Section 2.11(f), the Bylaws were amended to add Article X (Forum for Adjudication of Certain Disputes) to provide that, unless the Company consents in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware (or, only if the Court of Chancery in the State of Delaware lacks subject matter jurisdiction over any such action or proceeding, another state or federal court located within the State of Delaware) shall be the sole and exclusive forum for the resolution of certain legal actions, including any (i) derivative action, (ii) action asserting a breach of fiduciary duty by the directors or officers of the Company, (iii) action based on the General Corporation Law of the State of Delaware, the Bylaws or the Amended and Restated Certificate of Incorporation of the Company, dated as of May 28, 2010 (each, as may be amended) and (iv) action asserting a claim governed by the internal affairs doctrine of the Company.

The foregoing summary of the Bylaws is qualified in its entirety by reference to the full text of the Bylaws, which is attached hereto as Exhibit 3.2 and is incorporated by reference herein.

| Item 7.01 | Regulation FD Disclosure. |

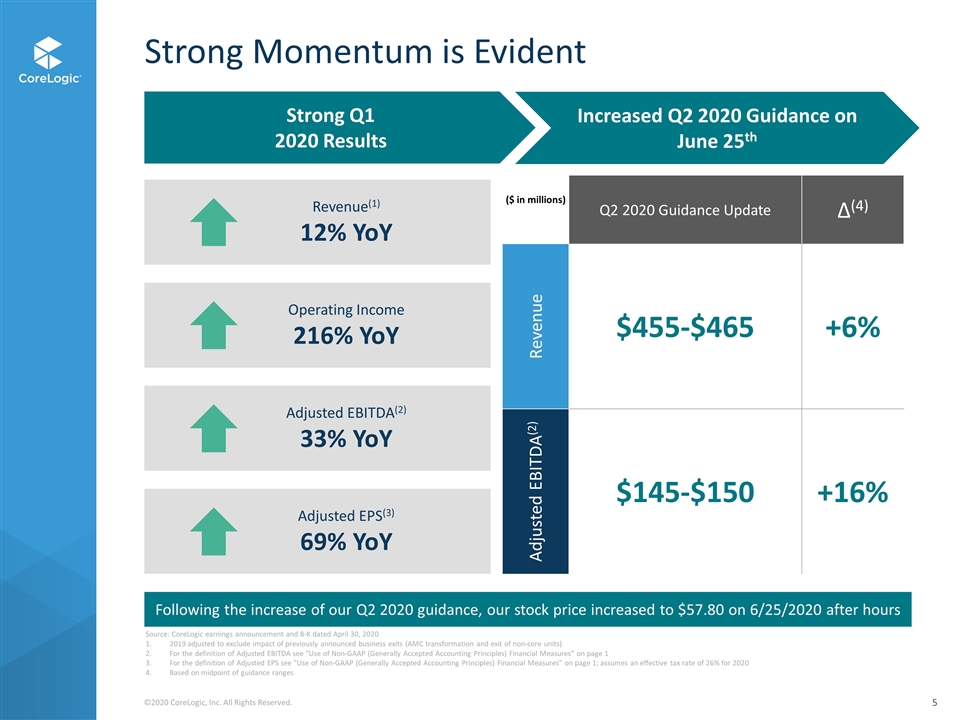

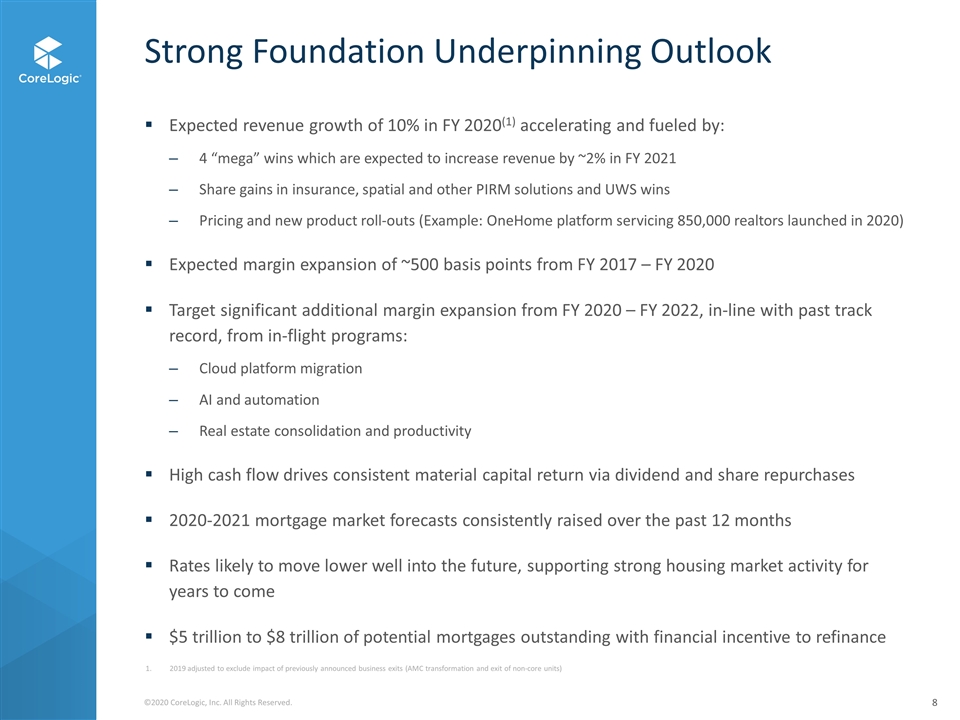

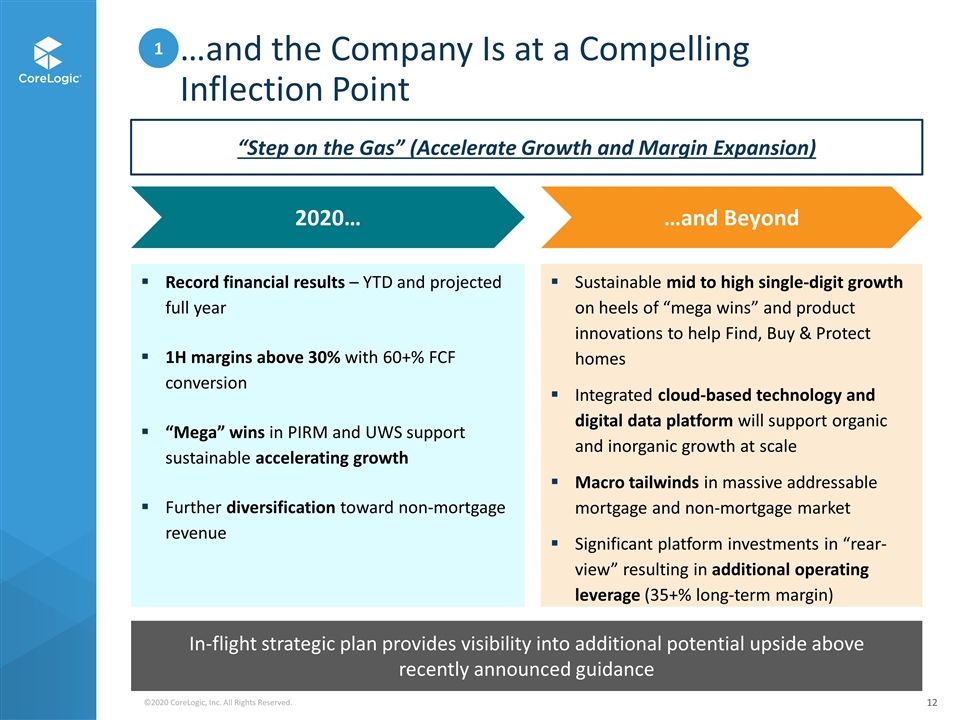

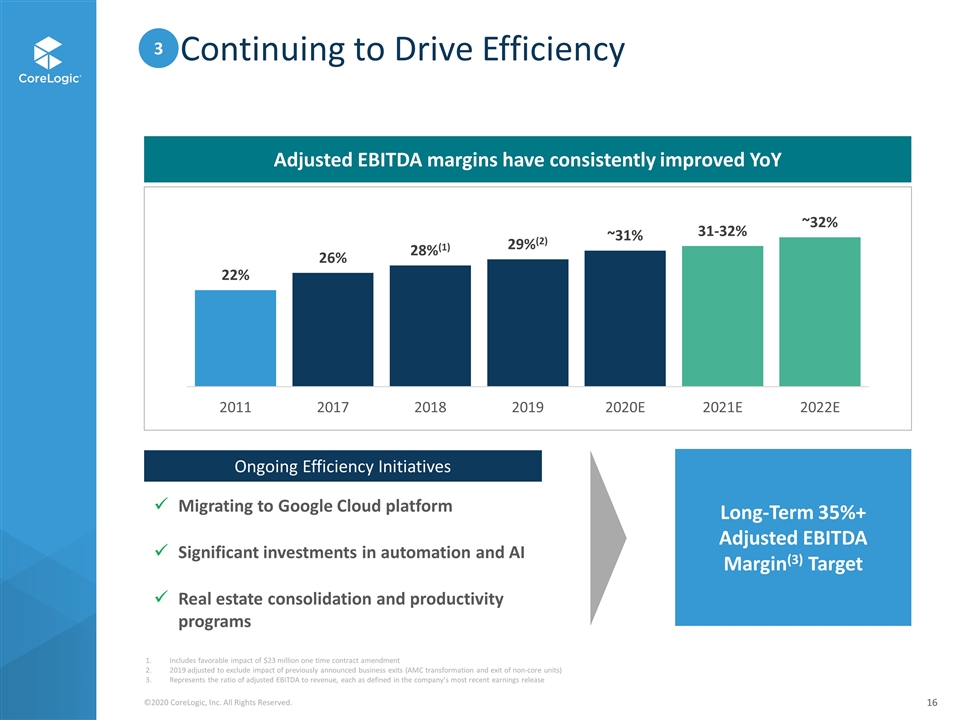

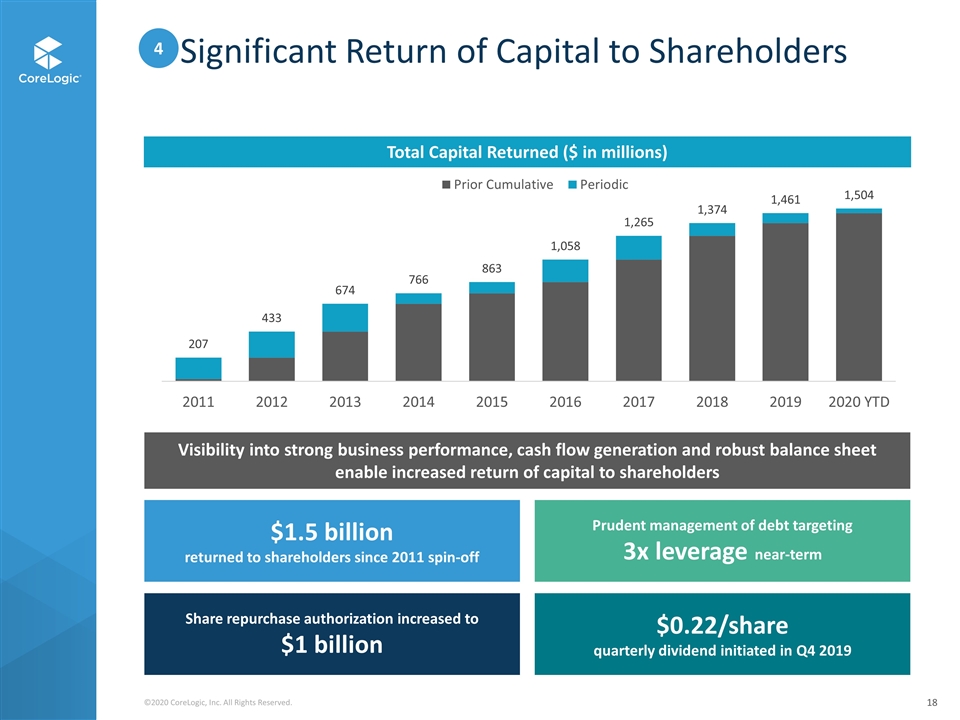

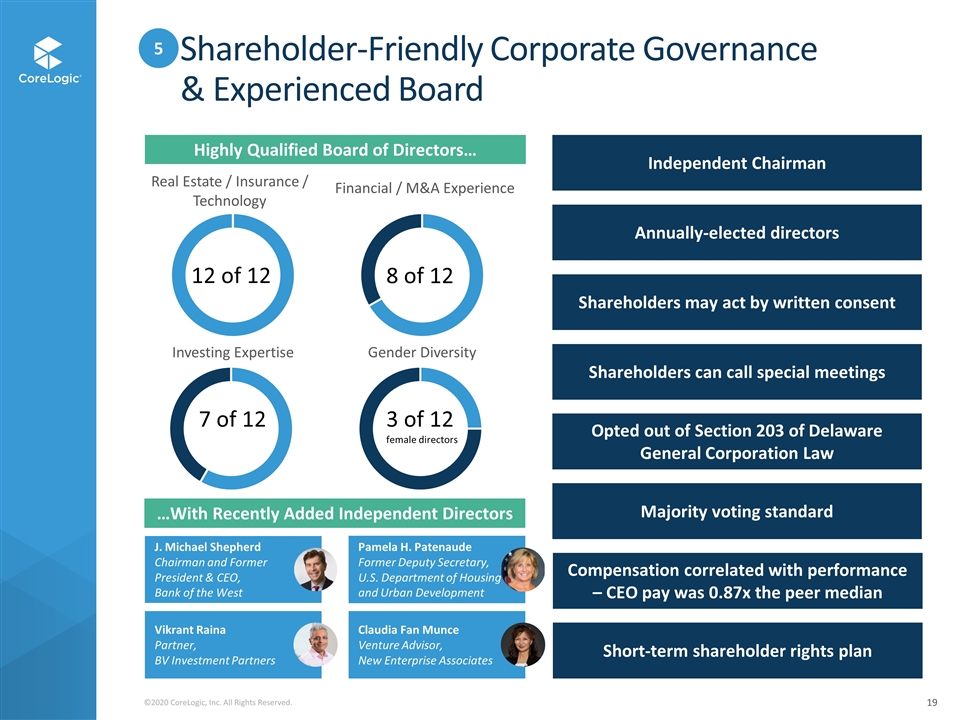

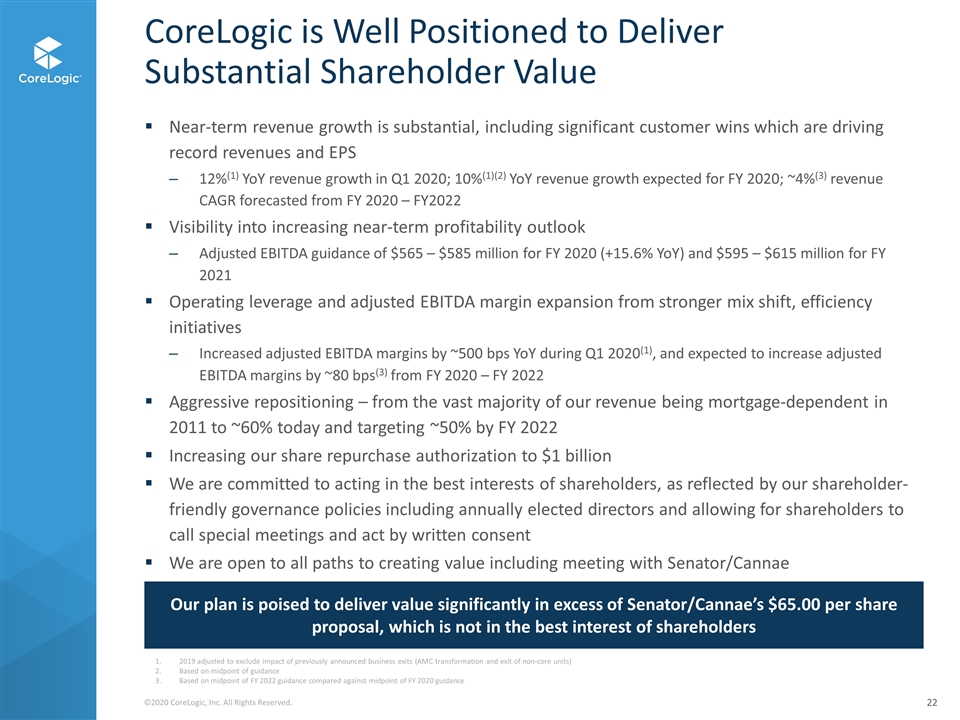

On July 7, 2020, the Company issued a press release (the “Press Release”), released an investor presentation (the “Investor Presentation”), and delivered to Cannae and Senator the Unsolicited Bid Response Letter (each as defined below), each of which contained, among other matters, information regarding updated guidance for the fiscal year ended 2020 and guidance for the fiscal years ended 2021 and 2022.

The full texts of the Press Release, Investor Presentation and Unsolicited Bid Response Letter are attached hereto as Exhibit 99.1, Exhibit 99.2, and Exhibit 99.3, respectively, and are being “furnished” in accordance with General Instruction B.2 of Form 8-K and, as such, are not deemed to be “filed” for the purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that Section, and are not incorporated by reference into any filings with the Securities and Exchange Commission unless explicitly so incorporated in such filings.

| Item 8.01 | Other Events. |

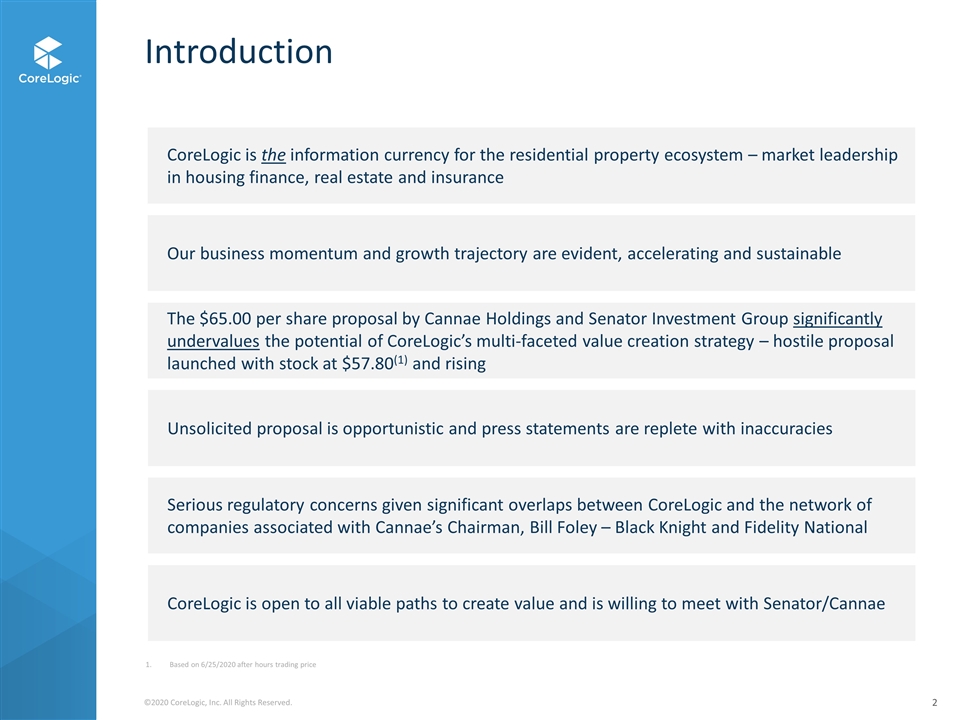

On July 7, 2020, the Company issued the Press Release, announcing that its Board, in consultation with its independent financial and legal advisors, unanimously determined to reject the previously announced unsolicited proposal from Senator Investment Group, LP (“Senator”) and Cannae Holdings, Inc. (“Cannae”) received on June 26, 2020 to acquire the Company for $65.00 per share in cash, as it significantly undervalues the Company, raises serious regulatory concerns and is not in the best interests of the Company and its stockholders. In connection with the announcement, the Company sent a letter to its stockholders on July 7, 2020 regarding the unsolicited proposal, a copy of which is contained in the Press Release, and released the Investor Presentation. The Company informed Cannae and Senator of its decision in a letter on July 7, 2020, a copy of which is attached hereto as Exhibit 99.3 (the “Unsolicited Bid Response Letter”).

6

The Company also announced in the Press Release that its Board established a share repurchase authorization of $1 billion, which supersedes the Company’s previous share repurchase authorization.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. |

Description | |

| 3.1 | Certificate of Designation, Preferences, and Rights of Series A Junior Participating Preferred Stock of CoreLogic, Inc., dated July 7, 2020 | |

| 3.2 | Amended and Restated Bylaws of CoreLogic, Inc. | |

| 4.1 | Rights Agreement dated as of July 6, 2020, by and between the Company and Equiniti Trust Company, as rights agent, which includes as Exhibit B the Form of Rights Certificate | |

| 99.1 | Press Release dated July 7, 2020 | |

| 99.2 | Investor Presentation dated July 7, 2020 | |

| 99.3 | Letter to Cannae Holdings, Inc. and Senator Investment Group, LP dated July 7, 2020 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

7

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: July 7, 2020

| CORELOGIC, INC. | ||

| By: | /s/ Frank D. Martell | |

| Name: | Frank D. Martell | |

| Title: | President and Chief Executive Officer | |

8

Exhibit 3.1

CERTIFICATE OF DESIGNATION, PREFERENCES AND

RIGHTS OF SERIES A JUNIOR PARTICIPATING PREFERRED STOCK

OF

CORELOGIC, INC.

Pursuant to Section 151 of the General Corporation Law of the State of Delaware;

CoreLogic, Inc., a corporation organized and existing under the General Corporation Law of the State of Delaware (the “Corporation”), in accordance with the provisions of Section 103 thereof, DOES HEREBY CERTIFY:

That pursuant to the authority vested in the board of directors of the Corporation (the “Board”) in accordance with the provisions of the Amended and Restated Certificate of Incorporation of the Corporation (as it may be amended, supplemented, corrected or restated from time to time, the “Certificate of Incorporation”), the Board on July 6, 2020, duly adopted the following resolution creating a series of shares of Preferred Stock, par value $0.00001 per share, of the Corporation (the “Preferred Stock”) designated as Series A Junior Participating Preferred Stock:

RESOLVED, that pursuant to the authority granted to and vested in the Board in accordance with the provisions of the Certificate of Incorporation, a series of Preferred Stock of the Corporation be and it hereby is created, and that the designation and number of shares and the voting powers, preferences and relative, participating, optional and other special rights of the shares of such series, and the qualifications, limitations or restrictions thereof are as follows:

Section 1. Designation and Amount. The shares of such series shall be designated as “Series A Junior Participating Preferred Stock” and the number of shares constituting such series shall be 100,000. Such number of shares may be increased or decreased by resolution of the Board; provided, however, that no decrease shall reduce the number of shares of Series A Junior Participating Preferred Stock to a number less than the number of shares then-outstanding plus the number of shares reserved for issuance upon the exercise of outstanding options, rights or warrants or upon the exercise of any options, rights or warrants issuable upon conversion of any outstanding securities issued by the Corporation convertible into the Series A Junior Participating Preferred Stock.

Section 2. Dividends and Distributions.

(A) Subject to the prior and superior rights of the holders of any shares of any series of Preferred Stock (or other similar stock) ranking prior and superior to the shares of Series A Junior Participating Preferred Stock with respect to dividends, the holders of shares of Series A Junior Participating Preferred Stock, in preference to the holders of common stock, par value $0.00001 per share, of the Corporation (the “Common Stock”), and of any other junior stock, shall be entitled to receive, when, as and if declared by the Board out of funds legally available for the purpose, quarterly dividends payable in cash on the first day of February, May, August and November in each year (each such date being referred to herein as a “Quarterly

1

Dividend Payment Date”), commencing on the first Quarterly Dividend Payment Date after the first issuance of a share or fraction of a share of Series A Junior Participating Preferred Stock, in an amount per share (rounded to the nearest cent) equal to the greater of (a) one dollar ($1.00) or (b) subject to the provision for adjustment hereinafter set forth, one thousand (1,000) times the aggregate per share amount of all cash dividends, and one thousand (1,000) times the aggregate per share amount (payable in kind) of all non-cash dividends or other distributions other than a dividend payable in shares of Common Stock or a subdivision of the outstanding shares of Common Stock (by reclassification or otherwise), declared on the Common Stock since the immediately preceding Quarterly Dividend Payment Date, or, with respect to the first Quarterly Dividend Payment Date, since the first issuance of any share or fraction of a share of Series A Junior Participating Preferred Stock. In the event the Corporation shall at any time after July 6, 2020 (the “Rights Dividend Declaration Date”) (i) declare and pay any dividend on Common Stock payable in shares of Common Stock, (ii) subdivide the outstanding Common Stock, or (iii) combine or consolidate the outstanding Common Stock into a smaller number of shares, then in each such case the amount to which holders of shares of Series A Junior Participating Preferred Stock were entitled immediately prior to such event under clause (b) of the preceding sentence shall be adjusted by multiplying such amount by a fraction, the numerator of which shall be the total number of shares of Common Stock outstanding immediately prior to the occurrence of such event and the denominator of which shall be the total number of shares of Common Stock that were outstanding immediately following the occurrence of such event.

(B) The Corporation shall declare a dividend or distribution on the Series A Junior Participating Preferred Stock as provided in paragraph (A) of this Section 2 immediately after it declares a dividend or distribution on the Common Stock (other than a dividend payable in shares of Common Stock); provided that, in the event no dividend or distribution shall have been declared on the Common Stock during the period between any Quarterly Dividend Payment Date and the next subsequent Quarterly Dividend Payment Date, a dividend of one dollar ($1.00) per share on the Series A Junior Participating Preferred Stock shall nevertheless be payable on such subsequent Quarterly Dividend Payment Date (the actual payment, however, may be deferred if prohibited under any debt instruments).

(C)

(i) If at any time dividends on any Series A Junior Participating Preferred Stock shall be in arrears in an amount equal to six (6) quarterly dividends thereon, the occurrence of such contingency shall mark the beginning of a period (herein called a “default period”) which shall extend until such time when all accrued and unpaid dividends for all previous quarterly dividend periods and for the current quarterly dividend period on all shares of Series A Junior Participating Preferred Stock then outstanding shall have been declared and paid or set apart for payment. During each default period, all holders of Preferred Stock (including holders of the Series A Junior Participating Preferred Stock) with dividends in arrears in an amount equal to six (6) quarterly dividends thereon, voting as a class, irrespective of series, shall have the right to elect two (2) directors.

2

(ii) During any default period, such voting right of the holders of Series A Junior Participating Preferred Stock may be exercised initially at a special meeting called pursuant to Section 2(C)(iii) or at any annual meeting of stockholders, and thereafter at annual meetings of stockholders; provided that such voting right shall not be exercised unless the holders of a majority of the number of shares of Preferred Stock outstanding shall be present in person or by proxy. The absence of a quorum of the holders of Common Stock shall not affect the exercise by the holders of Preferred Stock of such voting right. At any meeting at which the holders of Preferred Stock shall exercise such voting right initially during an existing default period, they shall have the right, voting as a class, to elect directors to fill such vacancies, if any, in the Board as may then exist up to two (2) directors or, if such right is exercised at an annual meeting, to elect two (2) directors. After the holders of the Preferred Stock shall have exercised their right to elect directors in any default period and during the continuance of such period, the number of directors shall not be increased or decreased except by vote of the holders of Preferred Stock as herein provided or pursuant to the rights of any equity securities ranking senior to or pari passu with the Series A Junior Participating Preferred Stock.

(iii) Unless the holders of Preferred Stock shall, during an existing default period, have previously exercised their right to elect directors, the Board may order, or any stockholder or stockholders owning in the aggregate not less than ten percent (10%) of the total number of shares of Preferred Stock outstanding, irrespective of series, may request, the calling of a special meeting of the holders of Preferred Stock, which meeting shall thereupon be called by the Chief Executive Officer or the Corporate Secretary of the Corporation. Notice of such meeting and of any annual meeting at which holders of Preferred Stock are entitled to vote pursuant to this Section 2(C)(iii) shall be given to each holder of record of Preferred Stock by mailing a copy of such notice to him at his last address as the same appears on the books of the Corporation. Such meeting shall be called for a time not earlier than ten (10) days and not later than sixty (60) days after such order or request or in default of the calling of such meeting within sixty (60) days after such order or request, such meeting may be called on similar notice by any stockholder or stockholders owning in the aggregate not less than ten percent (10%) of the total number of shares of Preferred Stock outstanding. Notwithstanding the provisions of this Section 2(C)(iii), no such special meeting shall be called during the period within sixty (60) days immediately preceding the date fixed for the next annual meeting of the stockholders.

(iv) In any default period, the holders of Common Stock, and other classes of stock of the Corporation, if applicable, shall continue to be entitled to elect the whole number of directors until the holders of Preferred Stock shall have exercised their right to elect two (2) directors voting as a class, after the exercise of which right (x) the directors so elected by the holders of Preferred Stock shall continue in office until their successors shall have been elected by such holders or until the expiration of the default period, and (y) any vacancy in the Board may (except as provided in Section 2(C)(iii)) be filled by vote of a majority of the remaining directors theretofore elected by the holders of the class of stock which elected the director whose office shall have become vacant. References in this Section 2(C) to directors elected by the holders of a particular class of stock shall include directors elected by such directors to fill vacancies as provided in clause (y) of the foregoing sentence.

3

(v) Immediately upon the expiration of a default period, (x) the right of the holders of Preferred Stock as a class to elect directors shall cease, (y) the term of any directors elected by the holders of Preferred Stock as a class shall terminate, and (z) the number of directors shall be such number as may be provided for in the Certificate of Incorporation or the Amended and Restated Bylaws of the Corporation (as the same may be amended, supplemented, corrected or restated from time to time, the “Bylaws”) irrespective of any increase made pursuant to the provisions of Section 2(C)(ii) (such number being subject, however, to change thereafter in any manner provided by law or in the Certificate of Incorporation or Bylaws).

(D) Dividends shall begin to accrue and be cumulative on outstanding shares of Series A Junior Participating Preferred Stock from the Quarterly Dividend Payment Date next preceding the date of issue of such shares of Series A Junior Participating Preferred Stock, unless the date of issue of such shares is prior to the record date for the first Quarterly Dividend Payment Date, in which case dividends on such shares shall begin to accrue from the date of issue of such shares, or unless the date of issue is a Quarterly Dividend Payment Date or is a date after the record date for the determination of holders of shares of Series A Junior Participating Preferred Stock entitled to receive a quarterly dividend and before such Quarterly Dividend Payment Date, in either of which events such dividends shall begin to accrue and be cumulative from such Quarterly Dividend Payment Date. Accrued but unpaid dividends shall not bear interest. Dividends paid on the shares of Series A Junior Participating Preferred Stock in an amount less than the total amount of such dividends at the time accrued and payable on such shares shall be allocated pro rata on a share-by-share basis among all such shares at the time outstanding. The Board may fix a record date for the determination of holders of shares of Series A Junior Participating Preferred Stock entitled to receive payment of a dividend or distribution declared thereon, which record date shall be no more than thirty (30) days prior to the date fixed for the payment thereof.

Section 3. Voting Rights. The holders of shares of Series A Junior Participating Preferred Stock shall have the following voting rights:

(A) Subject to the provision for adjustment hereinafter set forth, each share of Series A Junior Participating Preferred Stock shall entitle the holder thereof to one thousand (1,000) votes on all matters submitted to a vote of the stockholders of the Corporation. In the event the Corporation shall at any time after the Rights Dividend Declaration Date (i) declare any dividend on Common Stock payable in shares of Common Stock, (ii) subdivide the outstanding Common Stock, or (iii) combine or consolidate the outstanding Common Stock into a smaller number of shares, then in each such case the number of votes per share to which holders of shares of Series A Junior Participating Preferred Stock were entitled immediately prior to such event shall be adjusted by multiplying such number by a fraction, the numerator of which is the number of shares of Common Stock outstanding immediately after such event and the denominator of which is the number of shares of Common Stock that were outstanding immediately prior to such event.

(B) Except as otherwise provided herein, in the Certificate of Incorporation or by law, the holders of shares of Series A Junior Participating Preferred Stock and the holders of shares of Common Stock and any other capital stock of the Corporation having general voting rights shall vote together as one class on all matters submitted to a vote of stockholders of the Corporation.

4

(C) Except as set forth herein, holders of Series A Junior Participating Preferred Stock shall have no special voting rights and their consent shall not be required (except to the extent they are entitled to vote with holders of Common Stock as set forth herein) for taking any corporate action.

Section 4. Certain Restrictions.

(A) Whenever quarterly dividends or other dividends or distributions payable on the Series A Junior Participating Preferred Stock as provided in Section 2 are in arrears, thereafter and until all accrued and unpaid dividends and distributions, whether or not declared, on shares of Series A Junior Participating Preferred Stock outstanding shall have been paid in full, the Corporation shall not:

(i) declare or pay dividends on, make any other distributions on, or redeem or purchase or otherwise acquire for consideration any shares of stock ranking junior (either as to dividends or upon liquidation, dissolution or winding up) to the Series A Junior Participating Preferred Stock;

(ii) declare or pay dividends on or make any other distributions on any shares of stock ranking on a parity (either as to dividends or upon liquidation, dissolution or winding up) with the Series A Junior Participating Preferred Stock, except dividends paid ratably on the Series A Junior Participating Preferred Stock and all such parity stock on which dividends are payable or in arrears in proportion to the total amounts to which the holders of all such shares are then entitled;

(iii) redeem or purchase or otherwise acquire for consideration shares of any stock ranking on a parity (either as to dividends or upon liquidation, dissolution or winding up) with the Series A Junior Participating Preferred Stock; provided that the Corporation may at any time redeem, purchase or otherwise acquire shares of any such parity stock in exchange for shares of any stock of the Corporation ranking junior (either as to dividends or upon dissolution, liquidation or winding up) to the Series A Junior Participating Preferred Stock; or

(iv) purchase or otherwise acquire for consideration any shares of Series A Junior Participating Preferred Stock, or any shares of stock ranking on a parity with the Series A Junior Participating Preferred Stock, except in accordance with a purchase offer made in writing or by publication (as determined by the Board) to all holders of such shares upon such terms as the Board, after consideration of the respective annual dividend rates and other relative rights and preferences of the respective series and classes, shall determine in good faith will result in fair and equitable treatment among the respective series or classes.

(B) The Corporation shall not permit any subsidiary of the Corporation to purchase or otherwise acquire for consideration any shares of stock of the Corporation unless the Corporation could, under paragraph (A) of this Section 4, purchase or otherwise acquire such shares at such time and in such manner.

5

Section 5. Reacquired Shares. Any shares of Series A Junior Participating Preferred Stock purchased or otherwise acquired by the Corporation in any manner whatsoever shall be retired and cancelled promptly after the acquisition thereof. All such shares shall upon their cancellation become authorized but unissued shares of Preferred Stock and may be reissued as part of a new series of Preferred Stock to be created by resolution or resolutions of the Board, subject to the conditions and restrictions on issuance set forth herein, in the Certificate of Incorporation or as otherwise required by law.

Section 6. Liquidation, Dissolution or Winding Up.

(A) Upon any liquidation, dissolution or winding up of the Corporation, voluntary or otherwise, no distribution shall be made to the holders of shares of stock ranking junior (either as to dividends or upon liquidation, dissolution or winding up) to the Series A Junior Participating Preferred Stock unless, prior thereto, the holders of shares of Series A Junior Participating Preferred Stock shall have received an amount per share (the “Series A Liquidation Preference”) equal to the greater of (i) one dollar ($1.00) plus an amount equal to accrued and unpaid dividends and distributions thereon, whether or not declared, to the date of such payment or (ii) the Adjustment Number times the per share amount of all cash and other property to be distributed in respect of the Common Stock upon such liquidation, dissolution or winding up of the Corporation. The “Adjustment Number” shall initially be one thousand (1,000). In the event the Corporation shall at any time after July 6, 2020 (the “Rights Dividend Declaration Date”) (i) declare and pay any dividend on Common Stock payable in shares of Common Stock, (ii) subdivide the outstanding Common Stock or (iii) combine or consolidate the outstanding Common Stock into a smaller number of shares, then in each such case the Adjustment Number in effect immediately prior to such event shall be adjusted by multiplying such Adjustment Number by a fraction the numerator of which is the number of shares of Common Stock outstanding immediately after such event and the denominator of which is the number of shares of Common Stock that were outstanding immediately prior to such event.

(B) In the event, however, that there are not sufficient assets available to permit payment in full of the Series A Liquidation Preference and the liquidation preferences of all other classes and series of stock of the Corporation, if any, that rank on a parity with the Series A Junior Participating Preferred Stock in respect thereof, then the assets available for such distribution shall be distributed ratably to the holders of the Series A Junior Participating Preferred Stock and the holders of such parity shares in proportion to their respective liquidation preferences.

(C) Neither the merger or consolidation of the Corporation into or with another entity nor the merger or consolidation of any other entity into or with the Corporation shall be deemed to be a liquidation, dissolution or winding up of the Corporation within the meaning of this Section 6.

Section 7. Consolidation, Merger, Etc. In case the Corporation shall enter into any consolidation, merger, combination or other transaction in which the outstanding shares of

6

Common Stock are exchanged for or changed into other stock or securities, cash and/or any other property, then in any such case each share of Series A Junior Participating Preferred Stock shall at the same time be similarly exchanged or changed in an amount per share (subject to the provision for adjustment hereinafter set forth) equal to the Adjustment Number times the aggregate amount of stock, securities, cash and/or any other property (payable in kind), as the case may be, into which or for which each share of Common Stock is changed or exchanged.

Section 8. No Redemption. The shares of Series A Junior Participating Preferred Stock shall not be redeemable.

Section 9. Ranking. The Series A Junior Participating Preferred Stock shall rank junior to all other series of the Preferred Stock as to the payment of dividends and the distribution of assets, unless the terms of any such series shall provide otherwise, and shall rank senior to the Common Stock as to such matters.

Section 10. Amendment. At any time when any shares of Series A Junior Participating Preferred Stock are outstanding, neither the Certificate of Incorporation nor this Certificate of Designation, Preferences and Rights of Series A Junior Participating Preferred Stock shall be amended in any manner which would materially alter or change the powers, preferences or special rights of the Series A Junior Participating Preferred Stock so as to affect them adversely without the affirmative vote of the holders of a majority or more of the outstanding shares of Series A Junior Participating Preferred Stock, voting separately as a class.

Section 11. Fractional Shares. Series A Junior Participating Preferred Stock may be issued in fractions of a share which shall entitle the holder, in proportion to such holder’s fractional shares, to exercise voting rights, receive dividends, participate in distributions and to have the benefit of all other rights of holders of Series A Junior Participating Preferred Stock.

[Signature Page Follows]

7

IN WITNESS WHEREOF, this Certificate of Designation, Preferences and Rights of Series A Junior Participating Preferred Stock is executed on behalf of the Corporation by its duly authorized officer as of this 7th day of July, 2020.

| /s/ Frank D. Martell | ||

| Name: |

Frank D. Martell | |

| Title: |

President and Chief Executive Officer | |

[Signature Page to Certificate of Designation]

Exhibit 3.2

AMENDED AND RESTATED

BYLAWS

OF

CORELOGIC, INC.

(a Delaware corporation)

ARTICLE I

CORPORATE OFFICES

Section 1.1 Registered Office. The registered office of the Corporation shall be fixed in the Certificate of Incorporation of the Corporation.

Section 1.2 Other Offices. The Corporation may also have an office or offices, and keep the books and records of the Corporation, except as may otherwise be required by law, at such other place or places, either within or without the State of Delaware, as the Board of Directors may from time to time determine or the business of the Corporation may require.

ARTICLE II

MEETINGS OF STOCKHOLDERS

Section 2.1 Annual Meeting. The annual meeting of stockholders, for the election of directors and for the transaction of such other business as may properly come before the meeting, shall be held at such place, if any, on such date, and at such time as may be determined by the Board of Directors. The Corporation may postpone, reschedule or cancel any annual meeting of stockholders previously scheduled by the Board of Directors.

Section 2.2 Special Meeting. A special meeting of the stockholders may be called at any time only by the Board of Directors, or by the Chairman of the Board of Directors or the Chief Executive Officer with the concurrence of a majority of the Board of Directors and shall be called by the Board of Directors upon written request to the Secretary by the holders of shares entitled to cast not less than 10% of the shares entitled to vote at the proposed special meeting. A stockholder request for a special meeting shall be directed to the Secretary and shall be signed by each stockholder, or a duly authorized agent of such stockholder, requesting the special meeting and shall be accompanied by a written notice setting forth the information required by Section 2.10(b) as to the business proposed to be conducted and any nominations proposed to be presented at the special meeting and as to the stockholder(s) proposing such business or nominations. At any special meeting requested by stockholders, the business transacted shall be

1

limited to the purpose(s) stated in the request for meeting; provided, however, that the Board of Directors shall have the authority in its discretion to submit additional matters to the stockholders and to cause other business to be transacted. A special meeting requested by stockholders in accordance with this Section 2.2 shall be held at such date, time and place within or without the State of Delaware as may be designated by the Board of Directors; provided, however, that the date of any such special meeting shall be not more than ninety (90) days after the request to call the special meeting is received by the Secretary. Notwithstanding the foregoing, a special meeting requested by stockholders shall not be held if (i) the stated business to be brought before the special meeting is not a proper subject for stockholder action under applicable law, (ii) the Board of Directors has called or calls for an annual or special meeting of stockholders to be held within ninety (90) days after the Secretary receives the request for the special meeting and the Board of Directors determines in good faith that the business of such meeting includes (among any other matters properly brought before the annual meeting) the business specified in the special meeting request, (iii) the request for the special meeting is received by the Secretary during the period commencing ninety (90) days prior to the anniversary date of the prior year’s annual meeting of stockholders and ending on the date of the next annual meeting of stockholders, or (iv) an identical or substantially similar item (a “Similar Item”) was presented at any meeting of stockholders held within ninety (90) days prior to receipt by the Secretary of the request for special meeting (and, for purposes of this clause (iv), the election of directors shall be deemed a “Similar Item” with respect to all items of business involving the election or removal of directors). A stockholder may revoke a request for a special meeting at any time by written revocation delivered to the Secretary; provided, however, that if, following such revocation, there are unrevoked requests from stockholders holding in the aggregate less than the requisite number of shares entitling the stockholders to request the calling of a special meeting, the Board of Directors, in its discretion, may cancel the special meeting. Subject to the foregoing, the Corporation may postpone, reschedule or cancel any special meeting of stockholders previously scheduled by the Board of Directors.

Section 2.3 Notice of Stockholders’ Meetings.

(a) Notice of the place, if any, date, and time of all meetings of the stockholders, and the means of remote communications, if any, by which stockholders and proxyholders may be deemed to be present in person and vote at such meeting, shall be given, not less than ten (10) nor more than sixty (60) days before the date on which the meeting is to be held, to each stockholder entitled to vote at such meeting, except as otherwise provided herein or required by law. Each such notice shall state the place, if any (or the means of remote communication, if any, by which stockholders and proxyholders may be deemed to be present in person to vote at such meeting), date and hour of the meeting and, in the case of a special meeting, the purpose or purposes for which the meeting is called. Notice may be given personally, by mail or by electronic transmission in accordance with Section 232 of the General Corporation Law of the State of Delaware (the “DGCL”). If mailed, such notice shall be deemed given when deposited in the

2

United States mail, postage prepaid, directed to each stockholder at such stockholder’s address appearing on the books of the Corporation or given by the stockholder for such purpose. Notice by electronic transmission shall be deemed given as provided in Section 232 of the DGCL. An affidavit of the mailing or other means of giving any notice of any stockholders’ meeting, executed by the Secretary, Assistant Secretary or any transfer agent or other agent of the Corporation giving the notice, shall be prima facie evidence of the giving of such notice or report. Notice shall be deemed to have been given to all stockholders of record who share an address if notice is given in accordance with the “householding” rules set forth in Rule 14a-3(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 233 of the DGCL or any successor provisions.

(b) When a meeting is adjourned to another time or place, notice need not be given of the adjourned meeting if the place, if any, date and time thereof, and the means of remote communications, if any, by which stockholders and proxyholders may be deemed to be present in person and vote at such adjourned meeting are announced at the meeting at which the adjournment is taken; provided, however, that if the date of any adjourned meeting is more than thirty (30) days after the date for which the meeting was originally called, or if a new record date is fixed for the adjourned meeting, notice of the place, if any, date, and time of the adjourned meeting and the means of remote communications, if any, by which stockholders and proxyholders may be deemed to be present in person and vote at such adjourned meeting shall be given in conformity herewith.

(c) Notice of the time, place and purpose of any meeting of stockholders may be waived in writing, either before or after the meeting, and to the extent permitted by law, will be waived by any stockholder by attendance thereat, in person or by proxy, except when the person attends a meeting for the express purpose of objecting at the beginning of the meeting to the transaction of any business because the meeting is not lawfully called or convened. Neither the business to be transacted at nor the purpose of any regular or special meeting of the stockholders need be specified in a waiver of notice.

Section 2.4 Organization.

(a) Meetings of stockholders shall be presided over by the Chairman of the Board of Directors, if any, or in the absence of the Chairman of the Board by the Chief Executive Officer, or in the absence of the foregoing persons by a person designated by the Board of Directors, or in the absence of a person so designated by the Board of Directors, by a Chairman chosen at the meeting by the holders of a majority in voting power of the stock entitled to vote thereat, present in person or represented by proxy. The Secretary, or in his or her absence, an Assistant Secretary, or in the absence of the Secretary and all Assistant Secretaries, a person whom the Chairman of the meeting shall appoint, shall act as Secretary of the meeting and keep a record of the proceedings thereof.

3

(b) The date and time of the opening and the closing of the polls for each matter upon which the stockholders will vote at a meeting shall be announced at the meeting by the Chairman of the meeting. The Board of Directors shall be entitled to make such rules or regulations for the conduct of meetings of stockholders as it shall deem necessary, appropriate or convenient. Subject to such rules and regulations of the Board of Directors, if any, the Chairman of the meeting shall have the right and authority to convene and (for any or no reason) to postpone, recess and/or adjourn the meeting and to prescribe such rules, regulations and procedures and to do all such acts as, in the judgment of such Chairman, are necessary, appropriate or convenient for the proper conduct of the meeting, including, without limitation, establishing an agenda or order of business for the meeting, rules and procedures for maintaining order at the meeting and the safety of those present (including, without limitation, rules and procedures for removal of disruptive persons from the meeting), limitations on attendance at or participation in the meeting to stockholders entitled to vote at the meeting, their duly authorized and constituted proxies and such other persons as the Chairman shall permit, restrictions on entry to the meeting after the time fixed for the commencement thereof, limitations on the time allotted to questions or comments by participants and regulation of the opening and closing of the polls for balloting and matters which are to be voted on by ballot.

Section 2.5 List of Stockholders. A complete list of stockholders entitled to vote at any meeting of stockholders, arranged in alphabetical order for each class of stock and showing the address of each such stockholder and the number of shares registered in such stockholder’s name, shall be prepared by the Secretary or other officer having charge of the stock ledger and shall be open to the examination of any stockholder for a period of at least ten (10) days prior to the meeting in the manner provided by law. The stockholder list shall also be open to the examination of any stockholder during the whole time of the meeting as provided by law. Such list shall presumptively determine the identity of the stockholders entitled to vote in person or by proxy at the meeting and entitled to examine the list required by this Section 2.5.

Section 2.6 Quorum. At any meeting of stockholders, the holders of a majority in voting power of all issued and outstanding stock entitled to vote thereat, present in person or represented by proxy, shall constitute a quorum for the transaction of business; provided that where a separate vote by a class or series is required, the holders of a majority in voting power of all issued and outstanding stock of such class or series entitled to vote on such matter, present in person or represented by proxy, shall constitute a quorum entitled to take action with respect to such matter. If a quorum is not present or represented at any meeting of stockholders, then the Chairman of the meeting or the holders of a majority in voting power of the stock entitled to vote thereon, present in person or represented by proxy, shall have power to adjourn the meeting from time to time in accordance with Section 2.7, without notice other than announcement at the

4

meeting and except as provided in Section 2.3(b), until a quorum is present or represented. If a quorum initially is present at any meeting of stockholders, the stockholders may continue to transact business until adjournment, notwithstanding the withdrawal of enough stockholders to leave less than a quorum, but if a quorum is not present at least initially, no business other than adjournment may be transacted.

Section 2.7 Adjourned Meeting. Any annual or special meeting of stockholders, whether or not a quorum is present, may be adjourned for any reason from time to time by either the Chairman of the meeting or the holders of a majority in voting power of the stock entitled to vote thereon, present in person or represented by proxy. At any such adjourned meeting at which a quorum may be present, any business may be transacted that might have been transacted at the meeting as originally called.

Section 2.8 Voting.

(a) Except as otherwise provided by law or the Certificate of Incorporation, each holder of stock of the Corporation shall be entitled to one (1) vote for each share of such stock held of record by such holder on all matters submitted to a vote of stockholders of the Corporation.

(b) Except as otherwise provided by law, the Certificate of Incorporation or these Bylaws, at each meeting of stockholders at which a quorum is present, all corporate actions to be taken by vote of the stockholders shall be authorized by the affirmative vote of the holders of a majority in voting power of the stock entitled to vote thereon, present in person or represented by proxy, and where a separate vote by class or series is required, if a quorum of such class or series is present, such act shall be authorized by the affirmative vote of the holders of a majority in voting power of the stock of such class or series entitled to vote thereon, present in person or represented by proxy.

Section 2.9 Proxies. Every person entitled to vote for directors, or on any other matter, shall have the right to do so either in person or by one or more agents authorized by a written proxy, which may be in the form of a telegram, cablegram or other means of electronic transmission, signed by the person and filed with the Secretary of the Corporation, but no such proxy shall be voted or acted upon after three (3) years from its date, unless the proxy provides for a longer period. A proxy shall be deemed signed if the stockholder’s name is placed on the proxy by the stockholder or the stockholder’s attorney-in-fact. A duly executed proxy shall be irrevocable if it states that it is irrevocable and if, and only as long as, it is coupled with an interest sufficient in law to support an irrevocable power. A stockholder may revoke any proxy which is not irrevocable by attending the meeting and voting in person or by filing an instrument in writing revoking the proxy or by filing another duly executed proxy bearing a later date with the Secretary of the Corporation. A proxy is not revoked by the death or incapacity of the maker unless, before the vote is counted, written notice of such death or incapacity is received by the Corporation.

5

Section 2.10 Notice of Stockholder Business and Nominations.

(a) Annual Meeting.

(i) Nominations of persons for election to the Board of Directors of the Corporation and the proposal of business other than nominations to be considered by the stockholders may be made at an annual meeting of stockholders only (A) pursuant to the Corporation’s notice of meeting (or any supplement thereto), (B) by or at the direction of the Board of Directors or (C) by any stockholder of the Corporation who is a stockholder of record at the time the notice provided for in this Section 2.10(a) is delivered to the Secretary of the Corporation, who is entitled to vote at the meeting and who complies with the notice procedures set forth in this Section 2.10(a).

(ii) For nominations or other business to be properly brought before an annual meeting by a stockholder pursuant to clause (C) of the foregoing paragraph, the stockholder must have given timely notice thereof in writing to the Secretary of the Corporation and such business must be a proper subject for stockholder action. To be timely, a stockholder’s notice must be delivered to the Secretary at the principal executive offices of the Corporation not later than the close of business on the ninetieth (90th) day nor earlier than the close of business on the one hundred twentieth (120th) day prior to the first anniversary of the preceding year’s annual meeting; provided, however, that in the event that the date of the annual meeting is more than thirty (30) days before or more than seventy (70) days after such anniversary date, notice by the stockholder to be timely must be so delivered not earlier than the close of business on the one hundred twentieth (120th) day prior to such annual meeting and not later than the close of business on the later of the ninetieth (90th) day prior to such annual meeting or the tenth (10th) day following the date on which public announcement (as defined below) of the date of such meeting is first made by the Corporation. In no event shall the public announcement of an adjournment or postponement of an annual meeting commence a new time period (or extend any time period) for the giving of a stockholder’s notice as described above. Such stockholder’s notice shall set forth:

(A) as to each person whom the stockholder proposes to nominate for election or re-election as a director (1) all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, in each case pursuant to and in accordance with Regulation 14A under the Exchange Act, (2) such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if

6

elected, (3) such other information as the Corporation may reasonably require to determine the eligibility of such proposed nominee to serve as a director of the Corporation and (4) include a completed and signed questionnaire, representation and agreement required by Section 2.10(c) of these Bylaws;

(B) as to any other business that the stockholder proposes to bring before the meeting, a brief description of the business desired to be brought before the meeting, the text of the proposal or business (including the text of any resolutions proposed for consideration and in the event that such business includes a proposal to amend the Bylaws of the Corporation, the language of the proposed amendment), the reasons for conducting such business at the meeting and any material interest in such business of such stockholder and the beneficial owner (within the meaning of Section 13(d) of the Exchange Act), if any, on whose behalf the proposal is made;

(C) as to the stockholder giving the notice and the beneficial owner, if any, on whose behalf the nomination or proposal is made:

(1) the name and address of such stockholder, as they appear on the Corporation’s books, and the name and address of such beneficial owner,

(2) the class or series and number of shares of capital stock of the Corporation which are owned of record by such stockholder and such beneficial owner as of the date of the notice, and a representation that the stockholder will notify the Corporation in writing within five business days after the record date for such meeting of the class or series and number of shares of capital stock of the Corporation owned of record by the stockholder and such beneficial owner as of the record date for the meeting, and

(3) a representation that the stockholder intends to appear in person or by proxy at the meeting to propose such nomination or business;

(D) as to the stockholder giving the notice or, if the notice is given on behalf of a beneficial owner on whose behalf the nomination or proposal is made, as to such beneficial owner:

(1) the class or series and number of shares of capital stock of the Corporation which are beneficially owned by such stockholder or beneficial owner as of the date of the notice, and a representation that the stockholder will notify the Corporation in writing within five business days after the record date for such meeting of the class or series and number of shares of capital stock of the Corporation beneficially owned by such stockholder or beneficial owner as of the record date for the meeting,

7

(2) a description of any agreement, arrangement or understanding, including without limitation any agreements that would be required to be disclosed pursuant to Item 5 or Item 6 of Exchange Act Schedule 13D (regardless of whether the requirement to file a Schedule 13D is applicable to the stockholder or beneficial owner), with respect to the nomination or other business between or among such stockholder and/or beneficial owner, any of their respective affiliates or associates, and any other person acting in concert with any of the foregoing (including, in the case of a nomination, the nominee) and a representation that the stockholder will notify the Corporation in writing within five (5) business days after the record date for such meeting of any such agreement, arrangement or understanding in effect as of the record date for the meeting,

(3) a description of any agreement, arrangement or understanding (including any short position, any contract, derivative, swap, option, warrant, or similar right, any repurchase or so-called “stock borrowing” agreement, or similar transaction or series of transactions that is in effect as of the date of the notice) involving such stockholder or beneficial owner, the effect or intent of which is to mitigate loss, manage risk or benefit from decreases in the share price of any class or series of the Corporation’s capital stock or decrease the voting power of the stockholder or beneficial owner with respect to shares of capital stock of the Corporation, or which provides, directly or indirectly, the opportunity to profit or share in any profit derived from any decrease in the price or value of the shares of capital stock of the Corporation (any of the foregoing, a “Short Interest”), and the class or series and number of shares of the Corporation’s capital stock that relate to such agreements, arrangements or understandings and a representation that the stockholder will notify the Corporation in writing within five business days after the record date for such meeting of any agreement, arrangement or understanding of this nature in effect as of the record date for the meeting,

(4) a description of any option, warrant, convertible security, stock appreciation right, or similar right with an exercise or conversion privilege or a settlement payment or mechanism at a price related to any shares of capital stock of the Corporation or with a value derived in whole or in part from the value of any shares of capital stock of the Corporation, or any derivative or synthetic arrangement having the characteristics of a long position in any shares of capital stock of the Corporation, or any contract, derivative, swap or other transaction or series of transactions designed to produce economic benefits and risks that correspond substantially to the

8

ownership of shares of capital stock of the Corporation that is in effect as of the date of the notice and the class or series and number of shares of the Corporation’s capital stock relating to such options, warrants, convertible security, stock appreciation right or similar right, including due to the fact that the value of such contract, derivative, swap or other transaction or series of transactions is determined by reference to the price, value or volatility of any shares of capital stock of the Corporation or which contract, derivative, swap or other transaction or series of transactions provide, directly or indirectly, the opportunity to profit from any increase in the price or value of shares of capital stock of the Corporation (any of the foregoing, a “Synthetic Equity Interest”), directly or indirectly beneficially owned by such stockholder or such beneficial owner as of the date of the notice, which Synthetic Equity Interest shall be disclosed whether or not such instrument, contract or right shall be subject to settlement in the underlying shares of capital stock of the Corporation, through the delivery of cash or other property, or otherwise, and without regard to whether such instrument, contract or right conveys any voting rights in such shares to such stockholder or beneficial owner or whether such stockholder or beneficial owner may have entered into other transactions that hedge or mitigate the economic effect of such instrument, contract or right, and a representation that the stockholder will notify the Corporation in writing within five business days after the record date for such meeting of any Synthetic Equity Interest in effect as of the record date for the meeting,

(5) a description of any proxy (other than a revocable proxy or consent given in response to a solicitation made pursuant to, and in accordance with, Section 14(a) of the Exchange Act by way of a solicitation statement filed on Schedule 14A), agreement, arrangement, understanding or relationship in effect as of the date of the notice pursuant to which such stockholder or such beneficial owner has or shares a right to vote or direct any third party to vote any shares of capital stock of the Corporation and a representation that the stockholder will notify the Corporation in writing within five business days after the record date for such meeting of any proxy, agreement, arrangement, understanding or relationship of this nature in effect as of the record date for the meeting,

(6) a description of any proportionate interest in shares of capital stock of the Corporation, Short Interest or Synthetic Equity Interest held, directly or indirectly, as of the date of the notice by (x) a general or limited partnership in which any such stockholder or beneficial owner is a

9

general partner or, directly or indirectly, beneficially owns an interest, (y) a limited liability company in which any such stockholder or beneficial owner is a member or, directly or indirectly, beneficially owns an interest or (z) any other entity in which any such stockholder or beneficial owner, directly or indirectly, beneficially owns an interest, and a representation that the stockholder will notify the Corporation in writing within five business days after the record date for such meeting of any such proportionate interest in effect as of the record date for the meeting,

(7) a description of any carried interest, profits interest, or other performance-related fees (other than an asset-based fee) that such stockholder or such beneficial owner is or may be entitled to as of the date of the notice based directly or indirectly on any past, present or future increase or decrease in the price or value of shares of capital stock of the Corporation, Short Interest or Synthetic Equity Interest, if any, including, without limitation, any such interests held by members of any such stockholder’s or such beneficial owner’s immediate family sharing the same household, and a representation that the stockholder will notify the Corporation in writing within five business days after the record date for such meeting of any such performance-related fees in effect as of the record date for the meeting,

(8) a description of any significant equity interests or Short Interests or any Synthetic Equity Interests in any principal competitor of the Corporation held by such stockholder or such beneficial owner as of the date of the notice, and the class or series and number of shares of such principal competitor’s capital stock relating to any such equity interests, Short Interests or Synthetic Equity Interests, and a representation that the stockholder will notify the Corporation in writing within five business days after the record date for such meeting of any such equity interests, Short Interests or Synthetic Equity Interests in effect as of the record date for the meeting,

(9) a representation whether the stockholder or the beneficial owner, if any, intends or is part of a group which intends (x) to deliver a proxy statement and/or form of proxy to holders of at least the percentage of the Corporation’s outstanding capital stock required to elect the nominee or approve or adopt the proposal and/or (y) otherwise to solicit proxies from stockholders in support of such nomination or proposal, and

(10) any other information relating to such stockholder or such beneficial owner that would be required to be disclosed in a proxy statement or other filing required to be made in connection with solicitations of proxies

10

or consents by such stockholder or beneficial owner in support of the business proposed to be brought before the meeting pursuant to Section 14(a) of the Exchange Act and the rules and regulations promulgated thereunder (the disclosures to be made pursuant to the foregoing clauses (1) through (10) being referred to as “Disclosable Interests”;

provided that Disclosable Interests shall not include any such disclosures with respect to the ordinary course business activities of any broker, dealer, commercial bank, trust company or other nominee who is a proposing person solely as a result of being the stockholder directed to prepare and submit the notice required by these Bylaws on behalf of a beneficial owner.

The foregoing notice requirements of this Section 2.10(a)(ii) shall not apply to any stockholder proposal if (i) a stockholder has notified the Corporation of his or her intention to present such stockholder proposal at an annual meeting only pursuant to and in compliance with Rule 14a-8 under the Exchange Act and (ii) such proposal has been included in a proxy statement that has been prepared by the Corporation to solicit proxies for such annual meeting.

(iii) Notwithstanding anything in the second sentence of paragraph (a)(ii) of this Section 2.10 to the contrary, in the event that the number of directors to be elected to the Board of Directors of the Corporation at the annual meeting is increased effective after the time period for which nominations would otherwise be due under paragraph (a)(ii) of this Section 2.10 and there is no public announcement by the Corporation naming the nominees for the additional directorships at least one hundred (100) days prior to the first anniversary of the preceding year’s annual meeting, a stockholder’s notice required by this Section 2.10 shall also be considered timely, but only with respect to nominees for the additional directorships, if it shall be delivered to the Secretary at the principal executive offices of the Corporation not later than the close of business on the tenth (10th) day following the day on which such public announcement is first made by the Corporation.