UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

|

|

|

[ ] |

|

Preliminary Proxy Statement |

[ ] |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

[X] |

|

Definitive Proxy Statement |

[ ] |

|

Definitive Additional Materials |

[ ] |

|

Soliciting Material Pursuant to Rule 14a-12

|

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

[X] |

|

No fee required. |

||

[ ] |

|

Fee paid previously with preliminary materials. |

||

[ ] |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

||

400 Pine Street

Abilene, Texas 79601

325.627.7038

NOTICE OF THE 2023 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD APRIL 25, 2023

To our valued shareholders:

We cordially invite you to attend the 2023 annual meeting of shareholders of First Financial Bankshares, Inc., which will be held in the Abilene Convention Center, 1100 North 6th Street, Abilene, Texas, at 10:30 a.m., Central time, on Tuesday, April 25, 2023, for the following purposes:

The record date for the determination of the shareholders entitled to receive notice of and vote at the annual meeting or any adjournments or postponements thereof was the close of business on March 1, 2023. On or about March 23, 2023, we mailed to shareholders of record this notice of the 2023 annual meeting of shareholders, the proxy statement, our annual report on Form 10-K, and our annual report to shareholders, which describes our activities during 2022, a proxy card, and an invitation to attend the annual meeting and our luncheon following the meeting together with RSVP instructions. Our annual report to shareholders and the invitation do not form any part of the materials for solicitation of proxies.

We hope that you will be present at the annual meeting. We respectfully urge you to vote by proxy as promptly as possible, whether or not you plan to join us at the annual meeting. It is important that your shares be represented. Please take a moment to carefully read this proxy statement and the voting instructions. You may submit your proxy via the internet, by telephone or by mail following the instructions on the proxy card. As always, if you are the record owner of our stock, you may vote by attending the annual meeting in person. You can revoke your proxy at any time prior to the call to order of the annual meeting by following the instructions in the proxy statement.

We will be hosting a luncheon after the annual meeting this year. We kindly request that you confirm your attendance by completing the reply card enclosed with the invitation to our luncheon and returning it to us by April 14, 2023, or by calling 325.627.7038 or e-mailing awatkins@ffin.com to RSVP before this date.

Our shareholders and any interested individuals that are not able to attend the annual meeting in person may access a live video stream of our annual meeting by visiting www.ffin.com/live-events. Please note that shareholders who wish to vote or ask questions at the annual meeting should plan to attend the meeting in person or vote in advance by proxy as the live video stream will not offer the ability to vote or ask questions. A replay of the presentation will be available after the event.

Important Notice Regarding the Availability of Proxy Materials for the 2023 Annual Meeting of Shareholders to be Held on April 25, 2023, the proxy statement, 2022 annual report to shareholders, 2022 annual report on Form 10-K, and other proxy information are available free of charge at www.ffin.com/sec.

|

By order of the Board of Directors, |

|

|

March 15, 2023 |

F. Scott Dueser |

|

Chairman, President and Chief Executive Officer |

FIRST FINANCIAL BANKSHARES, INC.

PROXY STATEMENT

TABLE OF CONTENTS

|

Page |

2 |

|

3 |

|

3 |

|

4 |

|

4 |

|

4 |

|

4 |

|

5 |

|

5 |

|

5 |

|

5 |

|

SUMMARY OF ENVIRONMENTAL, SOCIAL AND GOVERNANCE (“ESG”) ACTIVITIES |

6 |

9 |

|

9 |

|

9 |

|

10 |

|

11 |

|

18 |

|

19 |

|

20 |

|

21 |

|

21 |

|

21 |

|

21 |

|

22 |

|

23 |

|

23 |

|

23 |

|

23 |

|

24 |

|

26 |

|

26 |

|

PROPOSAL 2 – RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS |

27 |

27 |

|

PROPOSAL 3 – ADVISORY, NON-BINDING VOTE ON THE COMPENSATION OF NAMED EXECUTIVE OFFICERS |

28 |

|

Page |

PROPOSAL 4 – ADVISORY, NON-BINDING VOTE ON FREQUENCY OF THE ADVISORY VOTE ON EXECUTIVE COMPENSATION |

29 |

30 |

|

32 |

|

32 |

|

32 |

|

36 |

|

39 |

|

42 |

|

47 |

|

48 |

|

58 |

|

59 |

|

59 |

|

60 |

|

60 |

|

62 |

Forward-Looking Statements and Website References: This proxy statement contains forward-looking statements. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “target,” “projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,” “can,” and similar references to future periods. In particular, forward-looking statements include, but are not limited to, statements we make about our expectations for our operations and business and our corporate responsibility progress, plans, and goals (including environmental and human capital matters). Forward-looking statements are not based on historical facts, but instead represent our current expectations and assumptions regarding our business, the economy and other future conditions. The inclusion of such statements is not an indication that these contents are necessarily material to investors or required to be disclosed in the Company’s filings with the Securities and Exchange Commission. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual results may differ materially from our forward-looking statements due to several factors. Factors that could cause our actual results to differ materially from our forward-looking statements are described in our Annual Report on Form 10-K for the year ended December 31, 2022. We caution you, therefore, against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Any forward-looking statement made by us speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, and notwithstanding any historical practice of doing so, except as may be required by law. In addition, historical, current, and forward-looking sustainability-related statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future.

PROXY SUMMARY

This proxy summary highlights important information contained elsewhere in the proxy statement. Since it does not contain all the information you should consider before voting your shares, please read the entire proxy statement carefully before voting.

General Information About the Meeting

Date: |

Tuesday, April 25, 2023 |

Time: |

10:30 a.m. Central Time |

Location: |

Abilene Convention Center, 1100 North 6th Street, Abilene, Texas |

Record Date: |

March 1, 2023 |

How to Vote

Shareholders of record as of the close of business on March 1, 2023 may vote.

|

|

|

|

Online |

By Phone |

By Mail |

In Person |

Visit www.proxydocs.com/FFIN You will need the control number on your proxy card that was mailed to you.

|

Call 1-866-367-4074 and follow the simple recorded instructions. You will need the control number on your proxy card that was mailed to you. |

Complete and mail your proxy card in the postage paid envelope provided. Proxy cards submitted by mail must be received prior to the annual meeting being called to order. |

Attend the annual meeting and vote in person. |

Your vote is important. Please submit your proxy as soon as possible via the internet, mail or telephone. If your shares are held by a broker, it is important that you provide instructions to your broker so that your vote is counted on all matters.

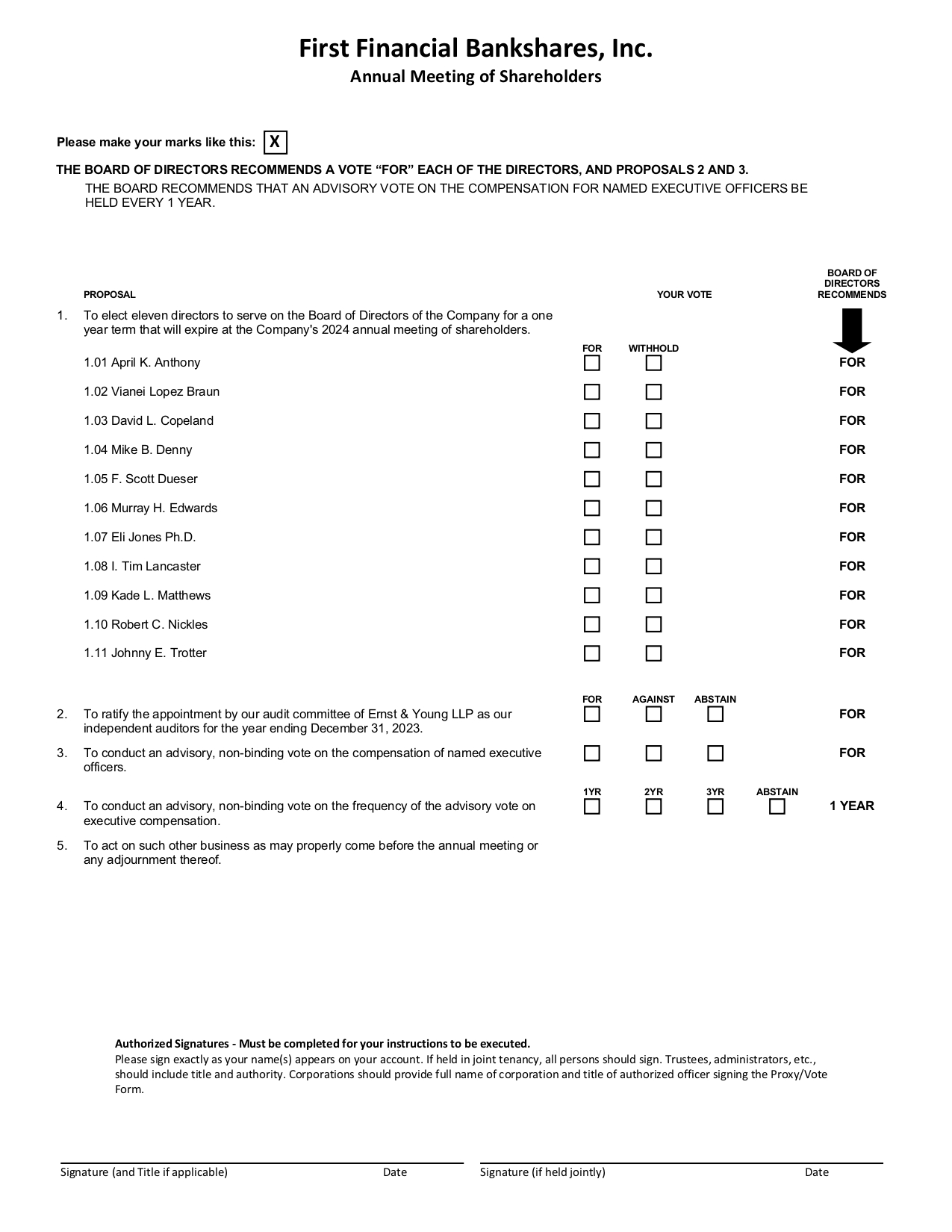

Proposals

Item |

|

Board Recommendation |

1. |

To elect eleven directors to serve on the Board of Directors of the Company for a one year term that will expire at the Company's 2024 annual meeting of shareholders; |

FOR |

2. |

To ratify the appointment by our audit committee of Ernst & Young LLP as our independent auditors for the year ending December 31, 2023; |

FOR |

3. |

To conduct an advisory, non-binding vote on the compensation of named executive officers; |

FOR |

4. |

To conduct an advisory, non-binding vote on the frequency of the advisory vote on executive compensation; and |

One (1) Year |

5. |

To act on such other business as may properly come before the annual meeting or any adjournment thereof. |

|

First Financial Bankshares, Inc. - 1 - 2023 Proxy Statement

FIRST FINANCIAL BANKSHARES, INC.

400 Pine Street

Abilene, Texas 79601

325.627.7038

PROXY STATEMENT

2023 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD APRIL 25, 2023

INTRODUCTION

The Board of Directors of First Financial Bankshares, Inc. hereby solicits your proxy for use at the 2023 annual meeting of our shareholders and any continuation of the meeting if it is adjourned. The annual meeting will be held in the Abilene Convention Center, 1100 North 6th Street, Abilene, Texas, at 10:30 a.m., Central time, on Tuesday, April 25, 2023.

We kindly request that you confirm your attendance either by responding with the completed reply card, calling 325.627.7038 or e-mailing awatkins@ffin.com to RSVP by April 14, 2023.

Our shareholders and any interested individuals that are not able to attend the annual meeting in person may access a live video stream of our annual meeting by visiting www.ffin.com/live-events. Please note that shareholders that wish to vote or ask questions at the annual meeting should plan to attend the meeting in person or vote in advance by proxy as the live video stream will not offer the ability to vote or ask questions. A replay of the presentation will be available after the event.

Our principal executive office is located at 400 Pine Street, Suite 310, Abilene, Texas 79601. Our telephone number is 325.627.7038.

On or about March 23rd, 2023, we mailed to shareholders of record as of the close of business on March 1, 2023, the record date for the annual meeting, this notice of the 2023 annual meeting of shareholders, the proxy statement, our annual report on Form 10-K, and our 2022 annual report to shareholders, which describes our activities during 2022, a proxy card, and an invitation to attend the annual meeting and our luncheon following the meeting together with RSVP instructions. Our annual report to shareholders and the invitation do not form any part of the materials for solicitation of proxies. You should read our entire proxy statement carefully before voting.

In this proxy statement, First Financial Bankshares, Inc. is referred to as “FFIN,” “First Financial,” “we,” “us,” or the “Company,” First Financial Bank, N.A. is referred to as the “Bank,” and First Financial Trust and Asset Management, N.A. is referred to as the “Trust Company.”

First Financial Bankshares, Inc. - 2 - 2023 Proxy Statement

VOTING OF SECURITIES

Important Voting Information

You may only vote if you hold shares directly in your own name.

If your shares are held in the name of a bank, broker, or another nominee, you are considered the beneficial owner of these shares, and your shares are held in “street name.” The proxy materials, including any proxy cards or voting instructions, are being forwarded to you by your broker or another nominee. As the beneficial owner, you have the right to direct your broker concerning how to vote your shares by using the voting instructions your broker included in the mailing or by following its instructions for voting. Pursuant to the rules of The Nasdaq Stock Market LLC (“Nasdaq”), you must instruct your broker how you wish your shares to be voted on all non-routine matters. If you did not receive the meeting invitation and RSVP request from your broker, please contact your broker because the invitations were sent with the annual report to the brokerage firm.

We are providing this proxy statement to the shareholders of First Financial Bankshares, Inc. in connection with the solicitation of proxies by its Board of Directors for use at the 2023 annual meeting of shareholders of First Financial Bankshares, Inc. to be held at 10:30 a.m., Central time, on Tuesday, April 25, 2023, including any adjournments or postponements of the meeting.

You should read our entire proxy statement carefully before voting.

Voting Procedures. Shareholders of record may vote by:

Internet and telephone |

In-Person |

|

Visit www.proxydocs.com/FFIN You will need the control number on your proxy card that was mailed to you. or Call 1-866-367-4074 and follow the simple recorded instructions. You will need the control number on your proxy card that was mailed to you.

You may vote by Internet or telephone until 10:30 a.m., Central Time, on April 25, 2023. |

Complete and mail your proxy card in the postage paid envelope provided. Proxy cards submitted by mail must be received prior to the annual meeting being called to order. |

Attending the annual meeting and voting in person. |

If your shares are held in “street name,” you should contact the broker, bank, or other nominee holding your shares in “street name” and follow the voting procedures that they provide to you.

Voting Rule. Your broker is not permitted to vote on your behalf on the election of directors, the advisory vote on compensation paid to our named executive officers or the advisory vote on the frequency of the advisory vote on the compensation paid to our named executive officers, unless you provide specific instructions by following the instructions from your broker about voting your shares by telephone or Internet or completing and returning the voting instruction card. For your vote to be counted, you will need to communicate your voting decisions to your bank, broker, or other holder of record sufficiently in advance of the date of the annual meeting in accordance with the instructions you receive from them.

Your Participation in Voting the Shares You Own is Important. Voting your shares is important to ensure that you have a say in the governance of the Company. Please review the proxy materials and follow the relevant instructions to vote your shares. We encourage you to exercise your rights and fully participate as a shareholder.

More Information is Available. If you have any questions about the proxy voting process in general, please contact the bank, broker, or other holder of record through which you hold your shares.

First Financial Bankshares, Inc. - 3 - 2023 Proxy Statement

Record Date

Our Board of Directors has established the close of business on March 1, 2023, as the record date for determining the shareholders entitled to notice of, and to vote at, the annual meeting. On the record date, we had 142,701,931 common shares outstanding. Each of our shareholders is entitled to one vote for each common share held as of the record date.

Quorum

In order for any business to be conducted at the annual meeting, a quorum consisting of shareholders having voting rights with respect to a majority of our outstanding common shares on the record date must be present in person or by proxy. For purposes of determining the presence or absence of a quorum, we intend to count as present shares present in person but not voting and shares for which we have received proxies but for which holders thereof have abstained. Furthermore, shares represented by proxies returned by a broker holding the shares in nominee or “street name” will be counted as present for purposes of determining whether a quorum is present, even if the shares are not entitled to be voted on matters where discretionary voting by the broker is not allowed (“broker non-votes”).

If a quorum is not present at the annual meeting, we will adjourn the meeting, and the Board of Directors will continue to solicit proxies.

Required Vote

As discussed in more detail under “Proposal 1 - Election of Directors,” each director is required to be elected by the affirmative vote of a majority of the votes cast at the annual meeting and entitled to vote on this matter. Withheld votes have the effect of voting against the director nominee. Shares not represented at the annual meeting will have no effect on the election of directors. Brokers are not entitled to vote on director elections, and thus broker non-votes are not treated as votes cast and will have no effect on the election of directors.

The matter described in “Proposal 2 - Ratification of Appointment of Independent Auditors” is required to be approved by the affirmative vote of the majority of the votes cast at the annual meeting and entitled to vote on this matter. Abstentions and shares not represented at the meeting will not be counted for purposes of determining whether such matter has been approved. Brokers may vote in their discretion on this proposal on behalf of clients who have not furnished voting instructions. As a result, broker non-votes will not arise in connection with and will have no effect on this proposal.

With respect to “Proposal 3 - Advisory, Non-Binding Vote on the Compensation of Named Executive Officers,” the affirmative vote of a majority of the votes cast at the annual meeting and entitled to vote on this matter is required for approval of the compensation of our named executive officers. Voting for Proposal 3 is being conducted on an advisory basis, and, therefore, the voting results will not be binding on the Company, the Board of Directors, or the Compensation Committee. Abstentions, broker non-votes, and shares not otherwise represented at the meeting will have no effect on the outcome of such matter.

With respect to “Proposal 4 – Advisory, Non-Binding Vote on Frequency of Executive Compensation Vote,” we are asking shareholders whether the advisory vote on executive compensation should occur every three years, every two years or every year. The option of once every three years, every two years or every year that receives the greatest number of votes will be the frequency approved by shareholders. Voting on Proposal 4 is being conducted on an advisory basis, and, therefore, the voting results will not be binding on the Company, the Board or the compensation committee. Abstentions, broker non-votes, and shares not otherwise represented at the meeting will have no effect on the outcome of such matter.

The Board of Directors unanimously recommends that you vote "FOR" the election of all eleven director nominees, "FOR" the ratification of the appointment of our independent auditors, "FOR" the resolution approving the compensation of our named executive officers AND "FOR" THE ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS TO OCCUR EVERY (1) YEAR.

Failure to Provide Specific Voting Instructions

If you are a shareholder of record and you properly sign, date, and return a proxy card, but do not indicate how you wish to vote with respect to a particular nominee or proposal, then your shares will be voted FOR the eleven director

First Financial Bankshares, Inc. - 4 - 2023 Proxy Statement

nominees, FOR the ratification of the appointment of our independent auditors, FOR the resolution approving the compensation of our named executive officers, and for the advisory vote on the compensation of our named executive officers to occur EVERY (1) YEAR.

A list of shareholders registered with our stock transfer company entitled to vote at the annual meeting, which will show each shareholder’s address and the number of shares registered in his, her, or its name, will be open to any shareholder to examine for any purpose related to the annual meeting. Any shareholder may examine this list at our principal office, 400 Pine Street, Suite 310, Abilene, Texas 79601, during ordinary business hours commencing April 15, 2023, and continuing through the date of the annual meeting.

SOLICITATION AND REVOCABILITY OF PROXIES

Solicitation

We will bear the expense to solicit proxies, which will include reimbursement of expenses incurred by brokerage firms and other custodians, nominees, and fiduciaries to forward solicitation materials regarding the annual meeting to beneficial owners. Our officers and directors may further solicit proxies from shareholders and other persons by telephone, electronic communication, or other means. We will not pay these officers and directors any extra compensation for participating in this solicitation. We may engage Georgeson LLC to assist us with the solicitation of proxies and if so, would expect to pay that firm approximately $20,000 for their services, plus out-of-pocket expenses.

Proxies and Revocation

Each executed and returned proxy card will be voted according to the directions indicated on that proxy card. If no direction is indicated, the proxy will be voted according to the Board of Directors’ recommendations, which are contained in this proxy statement. The Board of Directors does not intend to present and has no information that others will present any business at the annual meeting that requires a vote on any other matter. If any other matter requiring a vote properly comes before the annual meeting, the proxies will be voted in the discretion of the proxy holders in accordance with the terms of the proxy.

Each shareholder giving a proxy has the power to revoke it at any time before the annual meeting is called to order. Shareholders of record may change their vote or revoke their proxy by:

If your shares are held in “street name,” and you desire to change any voting instructions you have previously given to the record holder of the shares of which you are the beneficial owner, you should contact the broker, bank, or other nominee holding your shares in “street name” in order to direct a change in the manner your shares will be voted.

First Financial Bankshares, Inc. - 5 - 2023 Proxy Statement

For over 133 years, First Financial has been committed to making our communities better with the core belief that strong, vibrant communities are at the foundation of our success today and in the future. While this commitment is not new, our actions continue to demonstrate leadership in the communities we serve. We are extremely proud of our associates who demonstrate this core belief by being engaged and connected through our common purpose of excellence in customer service while creating our vision of being the employer of choice.

We continue to assess our ESG activities utilizing overall materiality assessments developed with our ESG advisory consultants. This assessment is being used to guide our ongoing approach to ESG activities. As part of this process, we are working towards more formal reporting utilizing the Sustainability Accounting Standards Board (SASB) commercial bank standards under the guidance and oversight of the Nominating/Corporate Governance Committee and Board of Directors.

Commitment to Employees

As of December 31, 2022 we had 1,415 full time and 86 part time employees located in Abilene and our 12 regions throughout Texas. We know our employees are one of our greatest assets and they are foundational to our current and future success. We are committed to maintaining competitive compensation in our markets. During 2022, we evaluated our hourly wages and increased minimum pay for many of our employees that work directly with customers in our branches or provide customer service in our call center.

Our employee benefits focus on providing ongoing health and wellness benefits including not only physical but mental health services with access to telemedicine, funded health savings accounts, employee assistance programs that offer confidential emotional support and work-life solutions. We also provide programs that emphasize and protect financial wellness through our profit-sharing plan and generous 401(k) matching policy. The Company has a robust employee recognition program that highlights employees that create “Wows” for our customers as well as recognizes employees that save customers from fraudulent activity, known as “Fraudbusters.”

Employee training is fundamental to our vision and is one of our 21 Service Non-Negotiables. We believe that “knowledge of our job and the financial industry is essential in providing the appropriate expertise. We encourage our employees to take advantage of the numerous training opportunities available to them and obtain certifications and degrees for current and future roles. During 2022, we provided over 27,000 internally developed training programs. Our employees also completed approximately 27,000 classes through the American Bankers Association (ABA). In addition, we have a generous college tuition reimbursement program to assist employees in obtaining degrees that will open opportunities at higher levels in our Company. In the past 5 years, we have provided tuition assistance to 127 employees.

The Company values the recruitment and retention of a diverse and inclusive workforce that is representative of the communities that we serve. Our focus on diversity, equity and inclusion is also included in our 21 Service Non-Negotiables. By promoting and fostering a workforce that we believe is reflective of our customers and communities, we seek to better understand the financial needs of our prospects and customers and provide them with relevant financial service products. This philosophy enables us to provide different solutions to issues where we can achieve the greatest outcome. We will continue to be an organization that embraces diversity and provides an employee experience that is inclusive and where we treat each other with grace, understanding and acceptance. As of December 31, 2022, 30% of our leadership positions were held by women and 14% were held by ethnic minorities.

|

Our People |

|

|

|

||

|

|

|

|

|

|

|

First Financial Bankshares, Inc. - 6 - 2023 Proxy Statement

Our Governance

We are committed to operating with robust corporate governance and ethical business practices. We continually work to improve the effectiveness of our Board and regional boards of directors and management teams as well as our corporate governance policies and activities.

Board Composition and Activities

All but one of our 11 nominees to the Board are independent under NASDAQ rules. In addition, 30% of the independent nominees are female, minority or both which allows for diverse perspectives and experiences.

The lead outside director transitioned during 2022 with Murray Edwards, assuming that role. Mr. Edwards has been a Board member since 2006 and has significant risk management, merger and acquisitions, and strategic planning skills.

Each of the twelve bank regions, plus two divisions, have local advisory boards. These boards include 32 female and or minority directors out of a total of 158 outside board members.

ESG oversight is provided by the Nominating/Corporate Governance Committee which has established a formal set of Corporate Governance Guidelines. ESG activities were reported to the Board quarterly in 2022.

We have established a Risk Appetite statement that is monitored and reported to the Risk Committee annually or more often as needed.

Information Security

The Information Security Program uses a variety of safeguards to protect the confidentiality, integrity and availability of information. The program uses a formal set of industry standards to protect data, and the Information Security Program’s information security standards are reviewed, updated and re-approved annually. The Company regularly assesses the threats and vulnerabilities to its environment so it can update and maintain its systems and controls to effectively mitigate these risks. Layered security controls are designed to complement each other to protect customer information and transactions. There are regular tests of the control environment using internal and external assessment methods such as penetration testing and more targeted assessments to ensure its controls are working as expected.

The Company has a robust information security awareness program. All Company employees are trained on cyber and fraud threats at New Employee Orientation and receive daily information security tips via email. Employees also receive monthly awareness video training and annual computer-based training. The Company also provides information security awareness training to business customers and individuals in our communities.

The Company’s system of internal controls also incorporates a protocol for the appropriate reporting and escalation of information security matters to management and the Board of Directors, to ensure effective and efficient resolution and, if necessary, disclosure of any matters. The Board of Directors is actively engaged in the oversight of the Company’s continuous efforts to reinforce and enhance its operational resilience and receives education to ensure that their oversight efforts accommodate for the ever-evolving information security threat landscape. The Board of Directors monitors the Company’s information management risk policies and practices primarily through its Risk Committee, which oversees areas of operational risk such as information technology activities; risks associated with development, infrastructure, and cybersecurity; oversight of information security risk assessments, strategies, policies, and programs; and disaster recovery, business continuity, and incident response process.

First Financial Bankshares, Inc. - 7 - 2023 Proxy Statement

Our Communities

The Company has always had the philosophy that we are only as good as the communities which we serve. We strive to improve the quality of life in every community that is in our footprint. We support schools, cities, counties, nonprofits and churches with the latest in financial services, as well as our time and money. We encourage our employees to be active in communities and charitable organizations by being on their boards, volunteering their time and helping raise funding. The impact our team has is highlighted by our annual Day of Service, where we had 1,056 employees serve 80 organizations across our footprint.

In addition to volunteering, the Company provided over $2.4 million in support to charitable organizations and schools during 2022 and over $23 million in the past 10 years. We also committed $5.5 million out of a $9 million investment to fund a low-income senior living project south of downtown in Abilene, Texas, which is home to our corporate offices.

We are committed to expand access to financial services in underserved majority minority and low-income areas within our footprint by providing financial literacy, fraud and home ownershp classes. The Company developed an Individual Tax Identification Number (ITIN) residential mortgage loan product for legal immigrants in late 2021, to help them achieve the dream of home ownership. We have continued to emphasize this product in our markets and grow this program and other affordable housing loan products throughout 2022.

Our Environment

We are committed to operating our Company responsibly and understand that this creates long-term sustainable value for our Company by reducing costs, increasing revenue, reducing risks, enhancing our reputation, strengthening our communities, and helping us meet the expectations of our shareholders, our customers, our communities, as well as future generations.

We recognize the environmental impact associated with our use of natural resources and the importance of resource efficiency and conservation. Several of the communities we serve have faced drought conditions where conservation of water is at a premium. Therefore, we strive to operate efficiently, reducing our reliance on natural resources, and wherever possible diverting our waste from landfills through recycling and reuse.

Over the last few years, we have upgraded lighting in our facilities to LED lights and low-heat emission bulbs. We also work with a third-party vendor to shred and recycle most of the paper we use as part of our privacy program and to reduce environmental impact. In 2022, we shredded and recycled about 140,000 pounds of paper.

Environmental concerns also inform our decisions on product offerings. We have continued to emphasize e-Statement enrollment for depository accounts which has increased to 59% of total deposit accounts and 50% of deposit customers access accounts digitally. We also offer digital online mortgage and consumer loan applications which reduces paper usage as well as limits a customer’s travel to a branch and allows for electronic versus paper document storage. Significant adoption of electronic signature tools for customer account documents as well as internal documents serves to significantly reduce paper usage throughout the Company.

First Financial Bankshares, Inc. - 8 - 2023 Proxy Statement

PROPOSAL 1 – ELECTION OF DIRECTORS

General

While our amended and restated bylaws fix the number of directors at a number not less than seven nor more than fifteen, the Board of Directors has fixed the number of current directors at eleven. Although we do not contemplate that any of the nominees will be unable to serve, if such a situation arises before the annual meeting, the proxies will be voted to elect any substitute nominee or nominees designated by the Board of Directors. At the annual meeting, eleven directors are to be elected, each for a term of one year and until their respective successors have been duly elected and qualified.

Identifying and Evaluating Nominees for Director

The Board of Directors, acting through the Nominating/Corporate Governance Committee and pursuant to the Board of Directors’ Nominating/Corporate Governance Committee Charter and our Corporate Governance Guidelines, is responsible for identifying and evaluating candidates for membership on the Board of Directors. The Nominating/Corporate Governance Committee is responsible for recommending nominees who have the experience, qualifications, attributes, and skills appropriate to function collaboratively and effectively as the Board of Directors for the Company. The Board of Directors is committed to promoting diversity and inclusion in the governance and operations of the Company. These values are reflected in identifying candidates for Board service and in the overall makeup of the Board of Directors so that it is inclusive of members who reflect racial, gender, and ethnic diversity.

The Company’s Board of Directors elects the Boards of Directors for First Financial Bank, N.A. and First Financial Trust and Asset Management Company, N.A. The Bank’s Board of Directors appoints the Bank’s regional advisory boards, the Bank’s board committees, and elects the Board of Directors for First Technology Services Inc. The regional advisory and subsidiary boards serve as a training ground for prospective Company directors. At present, there are 32 minority and/or women members on these boards.

The Board of Directors and the Nominating/Corporate Governance Committee believe that the Board of Directors as a whole and its members individually should possess a combination of skills, professional experience, and diversity of backgrounds and viewpoints necessary to oversee our Company’s current and future needs. The attributes that the Board of Directors and every director should possess are set forth in our Nominating/Corporate Governance Committee charter. These criteria include:

First Financial Bankshares, Inc. - 9 - 2023 Proxy Statement

The Nominating/Corporate Governance Committee and the Board of Directors may, from time to time, establish and consider other specific skills and experience that they believe our Company should seek in order to constitute a diverse, balanced, collaborative, and effective Board of Directors. For an incumbent director, the Nominating/Corporate Governance Committee and the Board of Directors also consider the past performance of such director on our Board. Our Corporate Governance Guidelines also provide that an individual may not stand for election or reelection as a director upon attaining seventy-five (75) years of age. See “Nominees” below for the qualifications of each nominee for election at the annual meeting.

The Nominating/Corporate Governance Committee regularly reviews the composition of the Board of Directors in light of our Company’s business and structure; the changing needs of our Company because of the business environment; our operations, financial conditions, and complexity; its assessment of the Board of Directors’ performance; through evaluations of each board member, committee, and the board as a whole; and input from shareholders and other key constituencies. As part of this review, the Nominating/Corporate Governance Committee evaluates the effectiveness of the Board of Directors’ director nomination standards.

The Nominating/Corporate Governance Committee will, in consultation with the Chairman of the Board of Directors and in accordance with its charter, consider candidates proposed or suggested by members of the Board of Directors, management, third-party search firms retained by the Nominating/Corporate Governance Committee and shareholders. The Nominating/Corporate Governance Committee follows the same process and uses the same criteria for evaluating candidates whether they are proposed by members of the Board of Directors, management, third-party search firms, or shareholders. Any shareholder wishing to recommend a candidate to be considered by the Nominating/Corporate Governance Committee for nomination at an annual meeting of shareholders should review the procedure outlined under “Committees of the Board of Directors − Nominating/Corporate Governance Committee” beginning on page 24 of this proxy statement.

Summary of Board Diversity

The following matrix, as required by Nasdaq listing rules, demonstrates our ongoing commitment to diversity:

Board Diversity Matrix (As of March 15, 2023) |

|

|

|

|

|

|

Total Number of Directors |

|

|

|

11 |

|

|

|

|

Female |

|

|

Male |

|

Part 1: Gender Identity |

|

|

|

|

|

|

Directors |

|

2 |

|

|

9 |

|

Part II: Demographic Background |

|

|

|

|

|

|

African American or Black |

|

- |

|

|

1 |

|

Hispanic or Latinx |

|

1 |

|

|

- |

|

White |

|

1 |

|

|

8 |

|

First Financial Bankshares, Inc. - 10 - 2023 Proxy Statement

Additionally, the following graphs illustrate the independence, average tenure, average age, and diversity of our Board of Directors, following the Annual Meeting:

Board Composition

|

|

|

|

|

|

Nominees

Based upon recommendations of the Nominating/Corporate Governance Committee, the Board of Directors has nominated the individuals below for election to the Board of Directors at the annual meeting to serve a one-year term and until their respective successors have duly been elected and qualified.

In light of the Company’s business and structure, the business environment, and the Company’s long-term strategy, the Board of Directors, upon recommendation of the Nominating/Corporate Governance Committee, selected a slate of nominees whose diversity, experience, qualification, attributes, and skills in leadership, commercial and investment banking and financial advisory services, finance and accounting, risk management, operations management, strategic planning, business development, marketing, technology, regulatory and government affairs, corporate governance, and public policy, led the Board of Directors to conclude that these persons should serve as our directors at this time.

First Financial Bankshares, Inc. - 11 - 2023 Proxy Statement

Pursuant to the Nasdaq rules, a majority of the Board of Directors must be comprised of independent directors. The Board of Directors has determined that each director nominated, except Mr. Dueser, is independent under applicable Nasdaq rules.

Each nominee’s biography and the specific experiences, qualifications, attributes, and skills of each nominee are described below.

Dallas, Texas Director Since: 2015 Board Committees: • Audit Financial Expert

|

|

April K. Anthony Biographical Information April K. Anthony, Dallas, Texas, has served as a director of the Company since 2015. She serves on the Audit Committee and is designated as a “financial expert.” She is also a director of First Financial Bank, N.A. (the “Bank”), a wholly-owned subsidiary of the Company, and of First Technology Services, Inc. (the “Technology Company”), a wholly-owned subsidiary of the Bank. Currently, Ms. Anthony serves as the Chief Executive Officer of VitalCaring Group, a Dallas-based home health and hospice provider with locations in 5 states. Ms. Anthony has a long career in home health care and was the Founder and Chief Executive Officer of Encompass Health - Home Health and Hospice from 1998 to 2021. Under Ms. Anthony’s leadership, Encompass Health - Home Health and Hospice grew to be the nation’s 4th largest provider of Medicare certified home health services, was consistently recognized as a best place to work, and was an industry leader in quality patient care outcomes. Ms. Anthony was also the Founder and Chief Executive Officer of Homecare Homebase from 2001 to 2019, at which time she transitioned to her current role as Executive Chairman. Homecare Homebase is the leading provider of enterprise technology solutions for the home health and hospice industry, with over 40% of the industry’s volume being managed via the Homecare Homebase solution. She is a graduate of Abilene Christian University and is a certified public accountant. She is a member of the Board of Trustees of Abilene Christian University, serving for 20 years, and currently serves as Board Chair. She was named Outstanding Alumnus in February 2018. Qualifications & Experience Her experience and qualifications provide sound leadership to the Board of Directors. In addition, as a certified public accountant, Ms. Anthony brings strong accounting, management, strategic planning, technology, and financial skills important to the oversight of our financial reporting, enterprise, and operational risk management. |

|

|

|

Fort Worth, Texas Director Since: 2020 Board Committees: • Compensation • Risk

|

|

Vianei Lopez Braun Biographical Information Vianei Lopez Braun, Fort Worth, Texas, was elected to the Board of Directors on January 28, 2020. She serves on the Compensation and Risk Committees. She also serves as a director of the Bank and as the Chair of the advisory board of the Bank’s Fort Worth Region. She leads the labor and employment division for Decker Jones, P.C., a full-service law firm based in Fort Worth, and serves as Chief Development Officer for the firm. She has been practicing law for more than 30 years, with previous tenures in Houston and Abilene. She is an honors graduate of Princeton University and the University of Texas School of Law. She has been recognized as a Texas Monthly “Super Lawyer” in Labor & Employment law and has been selected as a “Top Lawyer” in Labor & Employment law by Fort Worth Texas and 360 West magazines and by H Texas and Houstonia magazines when she was practicing law in Houston. She has also been honored as a “Great Woman of Texas” by the Fort Worth Business Press. Qualifications & Experience Her experience and qualifications provide sound leadership to the Board of Directors. In 2022 she earned a Certificate on Systemic Cyber Risk from the Digital Directors Network, as well as Climate Leadership Certification from the Diligent Institute. In addition, as an attorney specializing in labor and employment law, she brings strong legal, human resources, compensation and benefits, management, and corporate governance experience. |

|

|

|

First Financial Bankshares, Inc. - 12 - 2023 Proxy Statement

Abilene, Texas Director Since: 1998 Board Committees: • Audit • Executive • Risk • Nominating/Corporate Governance Financial Expert

|

|

David L. Copeland Biographical Information David L. Copeland, Abilene, Texas, has served as director of the Company since 1998. He serves as Chairman of the Audit Committee and as a member of the Executive, Risk, and Nominating/Corporate Governance Committees. He is designated as a “financial expert” for our Audit Committee. He also is a director of the Bank, serving on the asset-liability management committee, and a director of First Financial Trust & Asset Management Company, N.A. (the “Trust Company”), a wholly-owned subsidiary of the Company. He also serves as an advisory director of the Bank’s Abilene Region. He is president of the Shelton Family Foundation, a private charitable foundation, and SIPCO, Inc., the management and investment company for the Andrew B. Shelton family. He also serves as a director of Harte-Hanks, Inc., a publicly-traded, targeted marketing company. He is a graduate of Abilene Christian University and is a certified public accountant and chartered financial analyst. Mr. Copeland’s service as a director to public companies adds administration and operational management experience, as well as corporate governance expertise to the Board of Directors. Qualifications & Experience His experience and qualifications provide sound leadership to the Board of Directors. In addition, as a certified public accountant and chartered financial analyst, Mr. Copeland brings strong investment, accounting, and financial skills important to the oversight of our financial reporting, enterprise, and operational risk management. |

|

|

|

Abilene, Texas Director Since: 2019 Board Committees: • Audit

|

|

Mike B. Denny Biographical Information Mike B. Denny, Abilene, Texas, has served as a director of the Company since 2019. He serves on the Audit Committee. Mr. Denny is also a director of the Bank, serving on the Directors’ Loan Committee and as an advisory director of the Bank’s Abilene Region. He is an owner and President of Batjer and Associates, Inc., the largest mechanical contractor in the Abilene area, having been with the company for over 47 years. He also is Vice President and Partner in Batjer Services, LLC. He is a graduate of the University of Texas in Austin with a finance degree. He currently serves on the Hendrick Medical Center Doctor Recruitment Committee; as a board member on the Abilene Restoration Ministries (Men of Nehemiah) and the Church of the Heavenly Rest Foundation. Additionally, he has served on several non-profit boards in Abilene and the Abilene Industrial Foundation through 2020. Qualifications & Experience His experience and qualifications provide sound leadership to the Board of Directors. Mr. Denny brings strong finance and construction lending and other lending skills important to the oversight of our financial reporting, enterprise, and operational risk management. |

|

|

|

First Financial Bankshares, Inc. - 13 - 2023 Proxy Statement

Abilene, Texas Director Since: 1991 Board Committees: • Executive

|

|

F. Scott Dueser Biographical Information F. Scott Dueser, Abilene, Texas, has served as a director of the Company since 1991. He is Chairman, President, and Chief Executive Officer of the Company and the Bank. He serves as chairman of the Executive Committee. He is also a director of the Bank, serving on the asset-liability management committee, the Trust Company, and Technology Company. He became CEO/President in 2001 and Chairman in 2008. Prior to his role at the Company, he was CEO/President of the Bank from 1991 to 2001 and assumed these roles again as well as Chairman of the Board effective December 30, 2012. He is a graduate of Texas Tech University with finance and accounting degrees and served on the Board of Regents of Texas Tech University from 2005 to 2009, the last two years as Chairman. He currently serves on the board of Breck Minerals LP, which is a privately held oil and gas company. He was selected as Abilene’s Outstanding Citizen of the Year in 2009 and has been awarded the Distinguished Alumni Awards by the Texas Tech University Alumni Association in 2019, Rawls College of Business in 2006, and Southwestern Graduate School of Banking at SMU in 2013. Qualifications & Experience Mr. Dueser adds financial services experience, especially lending, oil and gas expertise, and asset-liability management, to the Board of Directors, as well as a deep understanding of the Company’s business and operations. Mr. Dueser also brings risk and operations management and strategic planning expertise to the Board of Directors, skills that are important as we continue to implement our business strategy and acquire and integrate growth opportunities. |

|

|

|

Clyde, Texas Director Since: 2006 Board Committees: • Executive • Risk • Nominating/Corporate Governance

|

|

Murray H. Edwards Biographical Information Murray H. Edwards, Clyde, Texas, has served as director of the Company since 2006, and as lead director since 2022. He currently serves on the Executive, Nominations and Governance and Risk Committees. He also is a director of the Bank, serving as chairman of the Directors’ Loan Committee, and serves as an advisory director of the Bank’s Abilene and Fort Worth Regions. He is Principal of The Edwards Group, a privately owned investment company, and has an undergraduate degree from Texas A&M University and a Master of Business Administration from Harvard Business School. He has successfully owned and managed several businesses, including Automated Farm Systems, Alderman-Cave Feeds, Abilene Cattle Feeders, Cape & Son, Bluebonnet Feeds, and Innovation Event Management. In 2018, he received the Texas A&M University Outstanding Agribusiness Entrepreneur Award, and in 2019 was awarded the Outstanding Alumnus Award by the College of Agriculture and Life Sciences of Texas A&M. He was the largest shareholder and a director of Peoples State Bank, Clyde, Texas, prior to it being acquired by the Company. Qualifications & Experience Mr. Edwards has significant risk management, merger and acquisitions, and strategic planning skills. In addition, he brings strong agriculture, accounting, lending, and financial skills important to the oversight of our financial reporting, enterprise, and operational risk management. |

|

|

|

First Financial Bankshares, Inc. - 14 - 2023 Proxy Statement

Bryan, Texas Director Since: 2022 Board Committees: • Compensation |

|

Eli Jones Ph.D. Biographical Information Eli Jones, Ph.D., Bryan, Texas, has served as a director of the Company since 2022. He is also a director of the Bank and serves as an advisory director of the Bank’s Bryan/College Station Region. Dr. Jones is a Professor of Marketing, the Lowry and Peggy Mays Eminent Scholar, and the former Dean of Mays Business School at his alma mater, Texas A&M University. He served as the Dean of three flagship business schools over 13 of his 26 years in higher education; Dean of Mays Business School; Dean of the Sam M. Walton College of Business and holder of the Sam M. Walton Leadership Chair at the University of Arkansas; and as Dean of the E. J. Ourso College of Business and the E. J. Ourso Distinguished Professor of Business at Louisiana State University. He has published sales and sales management research in top academic journals and is a co-author of three professional books. Peers have cited Eli’s academic publications more than 9,100 times, according to Google Scholar. Also, Jones is the recipient of Excellence in Teaching awards on the university, national, and international levels at the undergraduate, MBA levels, and in executive education programs in Belgium, China, France, India, Malaysia, Trinidad, the U.K., and U.S. Before becoming a professor, Jones worked in sales and sales management for three Fortune 500 global companies. He is currently on the boards of Invesco Funds, Insperity, First Financial Bank, and the American Marketing Association (AMA).

Qualifications & Experience Dr. Jones brings public company experience, marketing, and sales experience, strategic planning, and other skills for the oversight of our operations, including prior bank board experience. |

|

|

|

Lubbock, Texas Director Since: 2013 Board Committees: • Audit • Compensation • Executive • Nominating/Corporate Governance

|

|

I. Tim Lancaster Biographical Information I. Tim Lancaster, Lubbock, Texas, has served as a director of the Company since 2013. He serves as chairman of the Compensation Committee and is a member of the Audit, Executive and Nominating/Corporate Governance Committees. He also is a director of the Bank, serving on the Directors’ Loan Committee. He retired in 2019 as President and CEO of Hendrick Health Systems, a 525-bed regional hospital based in Abilene, Texas, having served in this capacity since 2004. From 1998 to 2004, he was CEO of Brownwood Regional Medical Center, Brownwood, Texas. He has a Bachelor of Finance degree from Texas Tech University and a masters in health care administration from Texas Women’s University. He is a past Chair of the Board of Trustees of the Texas Hospital Association and was honored in February 2018 with the Earl M. Collier Award for Distinguished Health Care Administration in Texas. He has served on numerous healthcare-related boards on a national and state level. He is past Chairman of the Board of Regents of Texas Tech University System and currently serves on the Texas Tech University Foundation Board as Vice Chairman. He also serves on the Buckner International Board of Directors, serving as Chair of the Finance Commitee. He was selected as Abilene’s Outstanding Citizen of the Year in 2018. Qualifications & Experience Mr. Lancaster adds significant operational, risk management, strategic planning, and administrative experiences, as well as corporate governance expertise that is important to the Company. His past leadership as the chief executive officer of a large hospital system brings strong accounting, management skills, and medical industry expertise to the oversight of our financial reporting and operational risk management. Mr. Lancaster had ten years in the banking industry prior to going into hospital administration. |

|

|

|

First Financial Bankshares, Inc. - 15 - 2023 Proxy Statement

Clarendon, Texas Director Since: 1998 Board Committees: • Compensation • Risk

|

|

Kade L. Matthews Biographical Information Kade L. Matthews, Clarendon, Texas, has served as a director of the Company since 1998. He serves on the Compensation and Risk Committees. He also is a director of the Bank. He is President of the Legett Foundation, a private charitable foundation in Texas; President of the Dodge Jones Legacy Foundation, a private charitable foundation in Abilene; President of Kickapoo Springs Foundation, a private charitable foundation in Abilene; a former member of the Amarillo Area Foundation, and an Emeritus Trustee of Texas Christian University, where he is a graduate. He also is on the board of visitors of the MD Anderson Cancer Center in Houston. Mr. Matthews is also a former regent of Clarendon College and former president of the Clarendon College Foundation. He is a rancher and manages investments. Qualifications & Experience Mr. Matthews provides excellent agriculture and wealth management experience, local knowledge of economic trends in the communities that we serve, as well as compensation and benefits experience and corporate governance experience garnered through his leadership position and board service with other entities. |

|

|

|

Houston, Texas Director Since: 2019 Board Committees: • Executive • Nominating/Corporate Governance • Risk

|

|

Robert C. Nickles, Jr. Biographical Information Robert C. Nickles, Jr., Houston, Texas, has served as a director of the Company since 2019. He currently serves as Chairman of the Risk Committee and also serves on the Executive and Nominating & Corporate Governance Committees. He also serves as Chairman of the advisory board of the Bank’s Kingwood Region. He is the founder and executive chairman of Alegacy Group, LLC, one of the largest gas compressor packagers in the world, with over $2 billion in revenue since its inception. He is also managing director of 3MCB Investments, LLC, and Nickles Investments, LLC, and serves on the board of directors of Fast Fusion LLC. Mr. Nickles previously served in management roles, including CEO of Nickles Industries, senior vice president of operations and senior vice president of sales for Cooper Cameron, and COO of Valerus Compression Services. He is a graduate of Oklahoma State University. In 2010, he was elected to the Commercial State Bank, Kingwood, Texas board of directors and served on that board until the Company’s acquisition of that bank on January 1, 2018. Mr. Nickles serves as Chairman of the Finance Council for St. Matthias Catholic Church in Magnolia, TX. Qualifications & Experience His experience and qualifications provide sound leadership to the Board of Directors. Mr. Nickles brings strong financial, oil and gas expertise and investment and lending skills important to the oversight of our financial reporting, enterprise, and operational risk management. |

|

|

|

First Financial Bankshares, Inc. - 16 - 2023 Proxy Statement

Hereford, Texas Director Since: 2003 Board Committees: • Compensation • Executive • Nominating/Corporate Governance

|

|

Johnny E. Trotter Biographical Information Johnny E. Trotter, Hereford, Texas, has served as a director of the Company since 2003. He serves on the Compensation, Executive and Nominating/Corporate Governance Committees. He also is a director of the Bank and serves as an advisory director of the Bank’s Hereford Region. He is president of Livestock Investors, LTD., one of the largest cattle feeders in the United States, as well as an officer in Deaf Smith Enterprises LLC, a privately owned real estate company. Mr. Trotter received the Chester A. Reynolds Memorial Award at the National Cowboy & Western Heritage Museum in Oklahoma City, Oklahoma, in 2017, was inducted into the Cattle Feeder Hall of Fame in 2021 inducted into the Texas Cowboy Hall of Fame, the Texas Horse Racing Hall of Fame and the American Quarter Horse Hall of Fame, and is the recipient of the 2023 West Texas Rehab Center Harry Holt Award. He also is the president of Whiteface Ford dealership in Hereford, Texas, officer/co-owner of Panhandle Express Transportation of Hereford, and owns and manages ranches/farms in Texas, New Mexico, Oklahoma, and Mississippi. He also is a director of First United Bank, Dimmitt, Texas, an unaffiliated bank. He is also a director and became president of the American Quarter Horse Association in March 2014 and is active in numerous other cattle/horse associations and philanthropic/community involvement. He was named 2004 Citizen of the Year in Hereford/Deaf Smith County, Texas. He received an honorary doctorate from West Texas A&M University in December 2015. Qualifications & Experience Mr. Trotter brings key leadership, risk management, operations, strategic planning, and auto industry/agricultural expertise that assist the Board of Directors in overseeing the Company’s operations. |

The Board of Directors recommends that you vote "FOR" the election of all eleven director nominees.

First Financial Bankshares, Inc. - 17 - 2023 Proxy Statement

Beneficial Ownership Summary

The names and principal occupations of our current directors and nominees, together with the length of service as a director and the number of our common shares beneficially owned by each of them on March 1, 2023, are set forth in the following tables. Except as otherwise indicated, the named beneficial owner has sole voting and investment power with respect to shares held by him or her. The address for each individual is 400 Pine Street, Suite 310, Abilene, Texas 79601.

Name |

|

Age |

|

|

Years as |

|

Principal Occupation |

|

Shares |

|

Percent |

|

April K. Anthony |

|

|

55 |

|

|

8 |

|

Managing Partner, Anthony Family Investment Partners, LTD. since 2021; CEO, Encompass Health – Home Health and Hospice from 1988 to 2021; and Executive Chairman of Homecare Homebase since 2019 |

|

104,663 |

(2) |

* |

Vianei Lopez Braun |

|

|

54 |

|

|

3 |

|

Attorney, Decker Jones, P.C. |

|

5,730 |

|

* |

David L. Copeland |

|

|

67 |

|

|

25 |

|

President, SIPCO and Shelton Family Foundation, a private charitable foundation |

|

286,372 |

(3) |

* |

Mike B. Denny |

|

|

69 |

|

|

4 |

|

Owner/President of Batjer and Associates, Inc. |

|

93,258 |

(4) |

* |

F. Scott Dueser |

|

|

69 |

|

|

32 |

|

Chairman, President and Chief Executive Officer of First Financial Bankshares, Inc. and First Financial Bank, N.A. |

|

2,103,120 |

(5)(6) |

1.47% |

Murray H. Edwards |

|

|

71 |

|

|

17 |

|

Principal, The Edwards Group |

|

376,071 |

(7) |

* |

Eli Jones, PhD |

|

|

61 |

|

|

1 |

|

Professor and former Dean, Texas A&M University Mays School of Business |

|

4,573 |

|

* |

I. Tim Lancaster |

|

|

69 |

|

|

10 |

|

Retired President and CEO, Hendrick Health System |

|

32,770 |

|

* |

Kade L. Matthews |

|

|

65 |

|

|

25 |

|

Ranching and Investments |

|

1,281,590 |

(8) |

* |

Robert C. Nickles, Jr. |

|

|

56 |

|

|

4 |

|

Executive Chairman of Alegacy Group, LLC |

|

70,461 |

(9) |

* |

Johnny E. Trotter |

|

|

71 |

|

|

20 |

|

President & CEO, Livestock Investors, LTD. |

|

974,557 |

(10) |

* |

Shares beneficially owned by all executive officers and directors** |

|

4.11% |

||||||||||

* Less than 1%

** See “Executive Officers” on pages 30-31

First Financial Bankshares, Inc. - 18 - 2023 Proxy Statement

Security Ownership of Certain Beneficial Owners

The following table sets forth the beneficial ownership of our common shares as of December 31, 2022, by each entity or person who is known to beneficially own 5% or more of our common shares:

|

|

Common Shares |

||

Name and Address of Beneficial Owner |

|

No. of Shares |

|

Percent of Class |

BlackRock, Inc. |

|

14,936,110 (1) |

|

10.50% |

The Vanguard Group, Inc. |

|

14,342,470 (2) |

|

10.05% |

In addition, as of March 1, 2023, First Financial Trust & Asset Management Company, N.A. (the “Trust Company”), a wholly-owned subsidiary of the Company, acted as sole or co-fiduciary with respect to trusts and other accounts which owned, held or controlled in the aggregate 7,842,290 shares, or 5.50% of the outstanding common shares, of the Company over which the Trust Company had, indirectly, sole, shared or contingent authority to vote such shares. No single trust or other account held or controlled a beneficial ownership interest of 5% or more. Of these shares, the Trust Company had sole voting power with respect to 5,540,291 shares, or 3.88%, of the outstanding common shares of the Company, the Trust Company shared voting authority with respect to 170,943 shares, or 0.12% of the outstanding common shares of the Company and the Trust Company has contingent right to vote under the Company’s Employee Stock Ownership Plan up to 2,131,056 shares, or 1.49%, of the outstanding common shares of the Company. The shares held by the Trust Company which are registered in its name or in the name of its nominee, are associated with many different accounts, each of which is governed by a separate instrument or instructions that set forth the powers of the Trust Company with regard to the shares held in such accounts. The Board of Directors historically has not attempted and does not intend to attempt in the future, to exercise any power to vote such shares except as prescribed under the Company’s Employee Stock Ownership Plan for those shares allocated to the stock account of an Employee Participant under such Plan for which no voting instructions have been timely received.

See “Proposal 1—Election of Directors—Nominees” and “—Executive Officers” for information with respect to the beneficial ownership of our common shares by each director nominee and named executive officers as of March 1, 2023. In the aggregate, all director nominees and executive officers as a group (19 individuals) beneficially owned 5,862,544 shares of our common stock, or 4.11%, of our total outstanding shares, as of March 1, 2023.

First Financial Bankshares, Inc. - 19 - 2023 Proxy Statement

Director Compensation

For 2022, we had ten non-employee directors who received fees for attendance at Board of Director meetings and committee meetings. Directors who are also our executive officers or employees receive no compensation for service as members of either the Board of Directors or committees thereof. Director fees were paid as follows:

Description |

|

Annual ($) |

|

|

Annual Cash Retainer fee (paid quarterly) |

|

|

50,000 |

|

Annual Restricted Share grant |

|

|

60,000 |

|

Board Meeting fee |

|

|

3,000 |

|

Committee Meeting fee |

|

|

1,500 |

|

Lead Director fee |

|

|

20,000 |

|

Chair Fee: |

|

|

|

|

Audit Committee |

|

|

20,000 |

|

Compensation Committee |

|

|

15,000 |

|

Nominating/Corporate Governance Committee |

|

|

15,000 |

|

Risk Committee |

|

|

15,000 |

|

Director fees are paid in cash, but a director may elect to defer receipt of fees into a non-qualified “Rabbi Trust” wherein the funds are used to purchase Company common shares on the open market. Because these shares are held in a “Rabbi Trust,” shares under this plan are not included in the director’s shares beneficially owned as disclosed on page 19. As of December 31, 2022, the Rabbi trust held 404,565 shares in trust for the Company’s directors. On April 26, 2022, each non-employee director received 1,481 shares of Company common shares with respect to their annual $60,000 restricted share grant under the 2021 Omnibus Plan approved by shareholders on April 27, 2021. The closing Company stock price on issuance date was $40.53 and vests from issuance date to the 2023 shareholder meeting on April 25, 2023. Non-employee directors do not participate in the Company’s profit sharing or other benefits. Directors are reimbursed for actual travel costs to attend the respective meetings. In addition, a director serving on the board of a subsidiary or a regional advisory board receives director and committee fees per meeting, which are included in the table below. Director compensation for the year ended December 31, 2022, was as follows:

Name |

|

Fees Earned |

|

|

Stock Awards ($) |

|

|

Total ($) (1) |

|

|||

April Anthony |

|

|

75,500 |

|

|

|

60,000 |

|

|

|

135,500 |

|

Vianei Braun |

|

|

80,100 |

|

|

|

60,000 |

|

|

|

140,100 |

|

David Copeland |

|

|

121,000 |

|

|

|

60,000 |

|

|

|

181,000 |

|

Mike Denny |

|

|

89,500 |

|

|

|

60,000 |

|

|

|

149,500 |

|

Murray Edwards |

|

|

159,250 |

|

|

|

60,000 |

|

|

|

219,250 |

|

Eli Jones, PhD |

|

|

61,750 |

|

|

|

90,500 |

|

|

|

152,250 |

|

Tim Lancaster |

|

|

107,500 |

|

|

|

60,000 |

|

|

|

167,500 |

|

Kade L. Matthews |

|

|

76,000 |

|

|

|

60,000 |

|

|

|

136,000 |

|

Robert Nickles |

|

|

98,500 |

|

|

|

60,000 |

|

|

|

158,500 |

|

Johnny E. Trotter |

|

|

83,000 |

|

|

|

60,000 |

|

|

|

143,000 |

|

First Financial Bankshares, Inc. - 20 - 2023 Proxy Statement

CORPORATE GOVERNANCE

Overview

We have long believed that good corporate governance is important to ensure that the Company is managed for the long-term benefit of our shareholders. We periodically review our corporate governance policies and practices and compare them to those suggested by various authorities in corporate governance and the practices of other public companies. We also monitor new and proposed rules of the Securities and Exchange Commission, the Nasdaq, and the bank regulatory authorities. We may amend our governance policies and procedures when required by law, Nasdaq rules, or when we otherwise deem it prudent to do so. Each of our Audit, Compensation, and Nominating/Corporate Governance and Risk Committees has adopted a charter. Our corporate governance policies, including our code of conduct applicable to all our employees, officers, and directors, as well as the charters of our Audit, Compensation, Nominating/Corporate Governance, and Risk Committees, are available at www.ffin.com under the “Investor Relations/Shareholder Information/Governance Documents” section. Copies of these documents are also available in print to any shareholder who requests them in writing.

Board Leadership Structure and Role in Risk Oversight

We are committed to a strong, independent Board of Directors and believe that objective oversight of the performance of our management is a critical aspect of effective corporate governance. As described under “Director Independence” below, we believe that all our directors are independent apart from Mr. Dueser given his position as Chairman, President, and Chief Executive Officer. Apart from our Executive Committee, which Mr. Dueser chairs, all our committees are comprised solely of and chaired by independent directors. In addition, at each regularly scheduled Board meeting, the non-management directors meet in executive sessions without management directors.

Mr. Dueser serves as our Chairman of the Board of Directors and Chief Executive Officer of the Company. The Company believes that Mr. Dueser’s leadership has served the Company and its shareholders well and that despite Mr. Dueser's status as an executive of the Company, the overall benefit of Mr. Dueser's leadership in both roles outweighs any potential disadvantage of this structure, and that any concerns are mitigated by existing safeguards, including:

Independent Lead Director

Mr. Edwards serves as our Lead Independent Director. The Board of Directors recognizes that the Company and its shareholders are well served under corporate governance best practices through the designation and empowerment of an independent lead director for several reasons, the foremost being that Mr. Dueser, our Chairman of the Board, is a non-independent director. The independent lead director’s duties include:

First Financial Bankshares, Inc. - 21 - 2023 Proxy Statement

Mr. Edwards serves as a liaison between the Chairman and the independent directors, presides over executive sessions of the Board and consults regularly with the Chairman on significant corporate decisions. The Board of Directors periodically considers its structure and the role and responsibilities of the independent lead director to reflect its commitment to corporate governance best practices.

The Board of Directors, together with the Audit, Compensation, Executive, Nominating/Corporate Governance and Risk Committees, coordinate with each other to provide enterprise-wide oversight of our management and handling of risk. These committees regularly report to the entire Board of Directors on risk-related matters and provide the Board of Directors with integrated insight about our management of strategic, credit, interest rate, financial reporting, technology (including cybersecurity), liquidity, compliance, operational and reputational risks. In addition, our subsidiary bank has its own board of directors (which is comprised of the same members as the Company's Board of Directors) and audit, compensation, directors’ loan, and asset-liability management committees, which provide risk management oversight. The management and board of directors of our subsidiary bank also provide reports to our management and Board of Directors regarding risk management oversight.

In addition, the consolidation of the management of our securities portfolio, loan review, internal audit, compliance, technology, and asset-liability/liquidity management at the holding company level provides additional risk oversight, which further mitigates overall risk to the Company. The Board of Directors believes that sound credit underwriting to manage credit risk and a conservative investment portfolio to manage liquidity and interest rate risk contribute to effective oversight of the Company’s risk. Enterprise risk is monitored through our Risk Appetite Statement. Furthermore, as a financial holding company responsible for safeguarding sensitive information, our Board of Directors believes a robust cybersecurity strategy is vital to effective cyber risk management. Accordingly, our Board is actively engaged in the oversight of the Company’s cyber risk profile and key cyber initiatives.

At meetings of the Board of Directors and its committees, directors receive regular updates from management regarding risk management. Mr. Dueser and the executive officers, who are responsible for instituting risk management practices that are consistent with our overall business strategy and risk tolerance, lead management’s risk discussions at Board and committee meetings. Outside of formal meetings, the Board of Directors, its committees, and individual Board members have regular access to senior executives, including all executive officers.

In October 2018, the Nominating/Corporate Governance Committee established minimum common shareholdings for its non-employee directors. Directors are required to own common shares of the Company common having a value equal to five times the annual cash retainer fee. The stock ownership level must be achieved within the later to occur of (a) October 23, 2023 (i.e., the fifth anniversary of the date of adoption of the minimum ownership guidelines), or (b) five years after their first election as a director. Directors are expected to accumulate the required number of shares ratably over the applicable five-year period. Once achieved, the minimum share ownership amount should be maintained as long as the person serves as a director of the Company.

Failure to maintain the minimum requirements of the guidelines may result in a director receiving future payments of director fees in the form of equity until he or she has satisfied the minimum ownership guidelines. The Board of Directors may also bar the director from selling Company shares until the minimum share guidelines have been achieved. On December 31, 2022, each non-employee director, except Ms. Braun and Dr. Jones, met the minimum shares holdings, including applicable phase-in periods. Ms. Braun joined the Board of Directors in January 2020 and Dr. Jones joined in January 2022 and have not yet reached their minimum stock holdings but each expects to comply over the five year period.