UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03395

Franklin Federal Tax-Free Income Fund

(Exact name of registrant as specified in charter)

One Franklin Parkway,

San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle,

One Franklin Parkway,

San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: 650 312-2000

Date of fiscal year end: 4/30

Date of reporting period: 4/30/19

| Item 1. | Reports to Stockholders. |

Internet Delivery of Fund Reports Unless You Request Paper Copies: Effective January 1, 2021, as permitted by the SEC, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request them from the Fund or your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you have not signed up for electronic delivery, we would encourage you to join fellow shareholders who have. You may elect to receive shareholder reports and other communications electronically from the Fund by calling (800) 632-2301 or by contacting your financial intermediary.

You may elect to continue to receive paper copies of all your future shareholder reports free of charge by contacting your financial intermediary or, if you invest directly with a Fund, calling (800) 632-2301 to let the Fund know of your request. Your election to receive reports in paper will apply to all funds held in your account.

Franklin Templeton

Successful investing begins with ambition. And achievement only comes when you reach for it. That’s why we continually strive to deliver better outcomes for investors. No matter what your goals are, our deep, global investment expertise allows us to offer solutions that can help.

During our more than 70 years of experience, we’ve managed through all kinds of markets—up, down and those in between. We’re always preparing for what may come next. It’s because of this, combined with our strength as one of the world’s largest asset managers that we’ve earned the trust of millions of investors around the world.

Dear Shareholder:

|

Not FDIC Insured | May Lose Value | No Bank Guarantee

|

| franklintempleton.com | Not part of the annual report | 1 | ||

| 2 |

Annual Report | franklintempleton.com | ||

Annual Report

Franklin Federal Tax-Free Income Fund

1. Dividends are generally subject to state and local taxes, if any. For investors subject to alternative minimum tax, a small portion of Fund dividends may be taxable. Distributions of capital gains are generally taxable. To avoid imposition of 28% backup withholding on all Fund distributions and redemption proceeds, U.S. investors must be properly certified on Form W-9 and non-U.S. investors on Form W-8BEN.

2. The distribution amount is the sum of all net investment income distributions for the period shown. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 16.

| franklintempleton.com | Annual Report | 3 | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

3. Source: Morningstar. Treasuries, if held to maturity, offer a fixed rate of return and a fixed principal value; their interest payments and principal are guaranteed.

4. Source: The Bond Buyer, Thomson Reuters.

5. Source: Investment Company Institute.

See www.franklintempletondatasources.com for additional data provider information.

| 4 |

Annual Report | franklintempleton.com | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

| franklintempleton.com | Annual Report | 5 | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

Performance Summary as of April 30, 2019

The performance tables and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 4/30/19

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 3.75% and the minimum is 0%. Class A: 3.75% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| Share Class | Cumulative Total Return1 |

Average Annual Total Return2 |

||||||||||

| A3,4 |

||||||||||||

| 1-Year |

+4.96% | +1.02% | ||||||||||

| 5-Year |

+16.62% | +2.34% | ||||||||||

| 10-Year |

+56.88% | +4.21% | ||||||||||

| Advisor |

||||||||||||

| 1-Year |

+5.15% | +5.15% | ||||||||||

| 5-Year |

+17.34% | +3.25% | ||||||||||

| 10-Year |

+58.70% | +4.73% | ||||||||||

| Share Class | Distribution Rate5 |

Taxable Equivalent Distribution Rate6 |

30-Day Standardized Yield7 | Taxable Equivalent 30-Day Standardized Yield6 |

||||||||||||

| A |

3.18% | 5.37% | 1.72% | 2.91% | ||||||||||||

| Advisor |

3.54% | 5.98% | 2.04% | 3.45% | ||||||||||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 9 for Performance Summary footnotes.

| 6 |

Annual Report | franklintempleton.com | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

PERFORMANCE SUMMARY

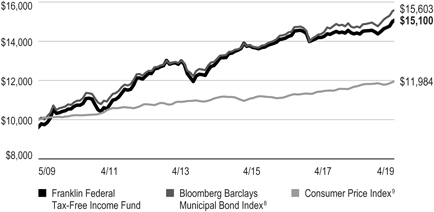

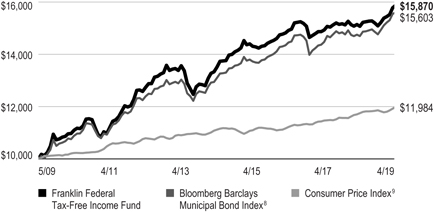

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

Class A (5/1/09–4/30/19)

Advisor Class (5/1/09–4/30/19)

| franklintempleton.com | Annual Report | 7 | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

PERFORMANCE SUMMARY

Net Asset Value

| Share Class (Symbol) | 4/30/19 | 9/10/18 | 4/30/18 | Change | ||||||||||||||||||||||||

| A (FFQAX) |

$11.82 | $ | 11.62 | N/A | +$0.20 | |||||||||||||||||||||||

| A1 (FKTIX) |

$11.82 | N/A | $11.68 | +$0.14 | ||||||||||||||||||||||||

| C (FRFTX) |

$11.81 | N/A | $11.68 | +$0.13 | ||||||||||||||||||||||||

| R6 (FFTQX) |

$11.83 | N/A | $11.69 | +$0.14 | ||||||||||||||||||||||||

| Advisor (FAFTX) |

$11.83 | N/A | $11.69 | +$0.14 | ||||||||||||||||||||||||

| Distributions (5/1/18–4/30/19) |

|

|||||||||||||||||||||||||||

| Share Class | Net Investment Income |

|||||||||||||||||||||||||||

| A (9/10/18–4/30/19) |

$0.2425 | |||||||||||||||||||||||||||

| A1 |

$0.4355 | |||||||||||||||||||||||||||

| C |

$0.3709 | |||||||||||||||||||||||||||

| R6 |

$0.4508 | |||||||||||||||||||||||||||

| Advisor |

$0.4463 | |||||||||||||||||||||||||||

| Total Annual Operating Expenses10 |

| |||||||||||||||||||||||||||

| Share Class | ||||||||||||||||||||||||||||

| A |

0.77% | |||||||||||||||||||||||||||

| Advisor |

0.52% | |||||||||||||||||||||||||||

See page 9 for Performance Summary footnotes.

| 8 |

Annual Report | franklintempleton.com | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

PERFORMANCE SUMMARY

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Because municipal bonds are sensitive to interest rate movements, the Fund’s yield and share price will fluctuate with market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Puerto Rico municipal bonds have been impacted by recent adverse economic and market changes, which may cause the Fund’s share price to decline. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value. The Fund may invest a significant part of its assets in municipal securities that finance similar types of projects, such as utilities, hospitals, higher education and transportation. A change that affects one project would likely affect all similar projects, thereby increasing market risk. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

3. Effective 9/10/18, Class A shares closed to new investors, were renamed Class A1 shares, and a new Class A share with a different expense structure became available. Class A performance shown has been calculated as follows: (a) for periods prior to 9/10/18, a restated figure is used based on the Fund’s Class A1 performance that includes any Rule 12b-1 rate differential that exists between Class A1 and Class A; and (b) for periods after 9/10/18, actual Class A performance is used, reflecting all charges and fees applicable to that class.

4. Prior to 3/1/19, these shares were offered at a higher initial sales charge of 4.25%, thus actual returns would have differed. Total returns with sales charges have been restated to reflect the current maximum initial sales charge of 3.75%.

5. Distribution rate is based on an annualization of the respective class’s April dividend (minus the 0.65 cent per share supplemental dividend) and the maximum offering price (NAV for Advisor Class) per share on 4/30/19.

6. Taxable equivalent distribution rate and yield assume the 2019 maximum federal income tax rate of 37.00% plus 3.80% Medicare tax.

7. The Fund’s 30-day standardized yield is calculated over a trailing 30-day period using the yield to maturity on bonds and/or the dividends accrued on stocks. It may not equal the Fund’s actual income distribution rate, which reflects the Fund’s past dividends paid to shareholders.

8. Source: Morningstar. The Bloomberg Barclays Municipal Bond Index is a market value-weighted index engineered for the long-term tax-exempt bond market. To be included in the index, bonds must be fixed rate, have at least one year to final maturity and be rated investment grade (Baa3/BB- or higher) by at least two of the following agencies: Moody’s, Standard & Poor’s and Fitch.

9. Source: Bureau of Labor Statistics, bls.gov/cpi. The Consumer Price Index is a commonly used measure of the inflation rate.

10. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| franklintempleton.com | Annual Report | 9 | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual (actual return after expenses) |

Hypothetical (5% annual return before expenses) |

|||||||||||||||||||

| Share Class |

Beginning Account Value 11/1/18 |

Ending Account |

Expenses Paid During 11/1/18–4/30/191,2 |

Ending Account Value 4/30/19 |

Expenses Paid During 11/1/18–4/30/191,2 |

Net Annualized Ratio2 | ||||||||||||||

| A |

$1,000 | $1,049.10 | $4.01 | $1,020.88 | $3.96 | 0.79% | ||||||||||||||

| A1 |

$1,000 | $1,049.90 | $3.25 | $1,021.62 | $3.21 | 0.64% | ||||||||||||||

| C |

$1,000 | $1,047.10 | $6.04 | $1,018.89 | $5.96 | 1.19% | ||||||||||||||

| R6 |

$1,000 | $1,050.60 | $2.49 | $1,022.36 | $2.46 | 0.49% | ||||||||||||||

| Advisor |

$1,000 | $1,050.40 | $2.75 | $1,022.12 | $2.71 | 0.54% | ||||||||||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 181/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements, for Class R6.

| 10 |

Annual Report | franklintempleton.com | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

| Year Ended April 30, 2019a |

||||

| Class A |

||||

| Per share operating performance |

||||

| (for a share outstanding throughout the year) |

||||

| Net asset value, beginning of year |

$11.62 | |||

| Income from investment operationsb: |

||||

| Net investment incomec |

0.25 | |||

| Net realized and unrealized gains (losses) |

0.19 | |||

| Total from investment operations |

0.44 | |||

| Less distributions from: |

||||

| Net investment income |

(0.24 | ) | ||

| Net asset value, end of year |

$11.82 | |||

| Total returnd |

3.87% | |||

| Ratios to average net assetse |

||||

| Expensesf |

0.78% | |||

| Net investment income |

3.45% | |||

| Supplemental data |

||||

| Net assets, end of year (000’s) |

$567,500 | |||

| Portfolio turnover rate |

14.58% | |||

aFor the period September 10, 2018 (effective date) to April 30, 2019.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fBenefit of expense reduction rounds to less than 0.01%.

| franklintempleton.com | The accompanying notes are an integral part of these financial statements. | Annual Report | 11 | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

FINANCIAL HIGHLIGHTS

| Year Ended April 30, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| Class A1 |

||||||||||||||||||||

| Per share operating performance |

||||||||||||||||||||

| (for a share outstanding throughout the year) |

||||||||||||||||||||

| Net asset value, beginning of year |

$11.68 | $12.02 | $12.48 | $12.45 | $12.22 | |||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||

| Net investment incomeb |

0.42 | 0.44 | 0.47 | 0.48 | 0.47 | |||||||||||||||

| Net realized and unrealized gains (losses) |

0.16 | (0.34 | ) | (0.47 | ) | 0.02 | 0.23 | |||||||||||||

| Total from investment operations |

0.58 | 0.10 | — | 0.50 | 0.70 | |||||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

(0.44 | ) | (0.44 | ) | (0.46 | ) | (0.47 | ) | (0.47 | ) | ||||||||||

| Net asset value, end of year |

$11.82 | $11.68 | $12.02 | $12.48 | $12.45 | |||||||||||||||

| Total returnc |

5.06% | 0.85% | 0.01% | 4.16% | 5.82% | |||||||||||||||

| Ratios to average net assets |

||||||||||||||||||||

| Expenses |

0.63% | d | 0.63% | 0.62% | 0.61% | 0.62% | ||||||||||||||

| Net investment income |

3.60% | 3.66% | 3.82% | 3.87% | 3.80% | |||||||||||||||

| Supplemental data |

||||||||||||||||||||

| Net assets, end of year (000’s) |

$7,821,881 | $8,616,659 | $9,342,715 | $8,384,079 | $8,505,853 | |||||||||||||||

| Portfolio turnover rate |

14.58% | 16.46% | 13.86% | 6.07% | 5.49% | |||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

dBenefit of expense reduction rounds to less than 0.01%.

| 12 |

Annual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

FINANCIAL HIGHLIGHTS

| Year Ended April 30, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| Class C |

||||||||||||||||||||

| Per share operating performance |

||||||||||||||||||||

| (for a share outstanding throughout the year) |

||||||||||||||||||||

| Net asset value, beginning of year |

$11.68 | $12.01 | $12.47 | $12.44 | $12.21 | |||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||

| Net investment incomeb |

0.35 | 0.37 | 0.40 | 0.41 | 0.40 | |||||||||||||||

| Net realized and unrealized gains (losses) |

0.15 | (0.32 | ) | (0.47 | ) | 0.03 | 0.23 | |||||||||||||

| Total from investment operations |

0.50 | 0.05 | (0.07 | ) | 0.44 | 0.63 | ||||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

(0.37 | ) | (0.38 | ) | (0.39 | ) | (0.41 | ) | (0.40 | ) | ||||||||||

| Net asset value, end of year |

$11.81 | $11.68 | $12.01 | $12.47 | $12.44 | |||||||||||||||

| Total returnc |

4.39% | 0.37% | (0.55)% | 3.59% | 5.24% | |||||||||||||||

| Ratios to average net assets |

||||||||||||||||||||

| Expenses |

1.18% | d | 1.18% | 1.17% | 1.16% | 1.17% | ||||||||||||||

| Net investment income |

3.05% | 3.11% | 3.27% | 3.32% | 3.25% | |||||||||||||||

| Supplemental data |

||||||||||||||||||||

| Net assets, end of year (000’s) |

$841,909 | $1,220,402 | $1,411,391 | $1,215,034 | $1,166,771 | |||||||||||||||

| Portfolio turnover rate |

14.58% | 16.46% | 13.86% | 6.07% | 5.49% | |||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

dBenefit of expense reduction rounds to less than 0.01%.

| franklintempleton.com | The accompanying notes are an integral part of these financial statements. | Annual Report | 13 | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

FINANCIAL HIGHLIGHTS

| Year Ended April 30, | ||||||||

| 2019 | 2018a | |||||||

| Class R6 |

||||||||

| Per share operating performance |

||||||||

| (for a share outstanding throughout the year) |

||||||||

| Net asset value, beginning of year |

$11.69 | $12.03 | ||||||

| Income from investment operationsb: |

||||||||

| Net investment incomec |

0.44 | 0.34 | ||||||

| Net realized and unrealized gains (losses) |

0.15 | (0.38 | ) | |||||

| Total from investment operations |

0.59 | (0.04 | ) | |||||

| Less distributions from: |

||||||||

| Net investment income |

(0.45 | ) | (0.30 | ) | ||||

| Net asset value, end of year |

$11.83 | $11.69 | ||||||

| Total returnd |

5.19% | (0.32)% | ||||||

| Ratios to average net assetse |

||||||||

| Expensesf |

0.49% | g | 0.49% | |||||

| Net investment income |

3.74% | 3.80% | ||||||

| Supplemental data |

||||||||

| Net assets, end of year (000’s) |

$177,983 | $365,406 | ||||||

| Portfolio turnover rate |

14.58% | 16.46% | ||||||

aFor the period August 1, 2017 (effective date) to April 30, 2018.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fBenefit of waiver and payments by affiliates rounds to less than 0.01%.

gBenefit of expense reduction rounds to less than 0.01%.

| 14 |

Annual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

FINANCIAL HIGHLIGHTS

| Year Ended April 30, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| Advisor Class |

||||||||||||||||||||

| Per share operating performance |

||||||||||||||||||||

| (for a share outstanding throughout the year) |

||||||||||||||||||||

| Net asset value, beginning of year |

$11.69 | $12.03 | $12.49 | $12.46 | $12.23 | |||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||

| Net investment incomeb |

0.43 | 0.45 | 0.48 | 0.49 | 0.49 | |||||||||||||||

| Net realized and unrealized gains (losses) |

0.16 | (0.33 | ) | (0.47 | ) | 0.03 | 0.22 | |||||||||||||

| Total from investment operations |

0.59 | 0.12 | 0.01 | 0.52 | 0.71 | |||||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

(0.45 | ) | (0.46 | ) | (0.47 | ) | (0.49 | ) | (0.48 | ) | ||||||||||

| Net asset value, end of year |

$11.83 | $11.69 | $12.03 | $12.49 | $12.46 | |||||||||||||||

| Total return |

5.15% | 0.95% | 0.11% | 4.26% | 5.92% | |||||||||||||||

| Ratios to average net assets |

||||||||||||||||||||

| Expenses |

0.53% | c | 0.53% | 0.52% | 0.51% | 0.52% | ||||||||||||||

| Net investment income |

3.70% | 3.76% | 3.92% | 3.97% | 3.90% | |||||||||||||||

| Supplemental data |

||||||||||||||||||||

| Net assets, end of year (000’s) |

$1,210,861 | $1,207,490 | $1,633,602 | $1,443,272 | $1,689,267 | |||||||||||||||

| Portfolio turnover rate |

14.58% | 16.46% | 13.86% | 6.07% | 5.49% | |||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cBenefit of expense reduction rounds to less than 0.01%.

| franklintempleton.com | The accompanying notes are an integral part of these financial statements. | Annual Report | 15 | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

Statement of Investments, April 30, 2019

| Principal Amount |

Value | |||||||

| Municipal Bonds 97.9% |

||||||||

| Alabama 1.3% |

||||||||

| Alabama State Incentives Financing Authority Special Obligation Revenue, Series A, 5.00%, 9/01/42 |

$ | 14,300,000 | $ | 15,389,946 | ||||

| Alabama State Port Authority Docks Facilities Revenue, Pre-Refunded, 6.00%, 10/01/40 |

6,000,000 | 6,371,880 | ||||||

| Alabama State Public Health Care Authority Lease Revenue, Department of Public Health Facilities, Refunding, 5.00%, 9/01/44 |

17,085,000 | 19,177,571 | ||||||

| Birmingham Airport Authority Airport Revenue, AGMC Insured, 5.50%, 7/01/40 |

20,000,000 | 20,722,200 | ||||||

| Birmingham Water Works Board Water Revenue, |

||||||||

| Series B, 5.00%, 1/01/38 |

3,500,000 | 3,826,445 | ||||||

| Series B, 5.00%, 1/01/43 |

8,000,000 | 8,725,520 | ||||||

| Subordinate, Refunding, Series B, 5.00%, 1/01/43 |

10,000,000 | 11,482,300 | ||||||

| Chatom IDB Gulf Opportunity Zone Revenue, |

||||||||

| PowerSouth Energy Cooperative, Refunding, Series A, Assured Guaranty, 5.00%, 8/01/30 |

5,250,000 | 5,445,142 | ||||||

| PowerSouth Energy Cooperative, Refunding, Series A, Assured Guaranty, 5.00%, 8/01/37 |

5,000,000 | 5,168,250 | ||||||

| Chilton County Health Care Authority Limited Obligation Sales Tax Revenue, Chilton County Hospital Project, Series A, 5.00%, 11/01/40 |

8,425,000 | 7,460,759 | ||||||

| Limestone County Water and Sewer Authority Water Revenue, BAM Insured, 5.00%, 12/01/45 |

10,500,000 | 11,945,640 | ||||||

| Mobile Water and Sewer Commissioners Water and Sewer Revenue, Refunding, 5.00%, 1/01/36 |

11,300,000 | 12,408,191 | ||||||

| Phenix City Water and Sewer Revenue, wts., Series A, AGMC Insured, 5.00%, 8/15/40 |

8,090,000 | 8,368,458 | ||||||

| University of South Alabama Revenue, University Facilities, Series A, BAM Insured, 5.00%, 4/01/49 |

5,000,000 | 5,757,800 | ||||||

|

|

|

|||||||

| 142,250,102 | ||||||||

|

|

|

|||||||

| Alaska 0.9% |

||||||||

| Alaska Municipal Bond Bank GO, |

||||||||

| Refunding, Series Three, 5.25%, 10/01/36 |

16,045,000 | 18,451,429 | ||||||

| Refunding, Series Three, 5.00%, 10/01/39 |

12,950,000 | 14,553,728 | ||||||

| Alaska State Industrial Development and Export Authority Revenue, Providence Health and Services, Series A, 5.00%, 10/01/40 |

10,000,000 | 10,565,700 | ||||||

| Alaska State International Airports System Revenue, Refunding, Series C, 5.00%, 10/01/33 |

12,565,000 | 13,044,732 | ||||||

| Anchorage Electric Revenue, senior lien, Refunding, Series A, 5.00%, 12/01/41 |

8,875,000 | 9,925,800 | ||||||

| Matanuska-Susitna Borough Lease Revenue, Goose Creek Correctional Center Project, Assured Guaranty, Pre-Refunded, 6.00%, 9/01/32 |

30,000,000 | 30,431,400 | ||||||

|

|

|

|||||||

| 96,972,789 | ||||||||

|

|

|

|||||||

| Arizona 2.5% |

||||||||

| Arizona Board of Regents Arizona State University System Revenue, Series C, 5.00%, 7/01/42 |

9,000,000 | 10,422,720 | ||||||

| Arizona Board of Regents University of Arizona System Revenue, Speed, Stimulus Plan for Economic and Educational Development, 5.00%, 8/01/44 |

10,000,000 | 11,124,000 | ||||||

| Arizona State COP, |

||||||||

| Department of Administration, Series A, AGMC Insured, 5.25%, 10/01/26 |

8,500,000 | 8,628,775 | ||||||

| Department of Administration, Series A, AGMC Insured, 5.00%, 10/01/27 |

14,440,000 | 14,643,893 | ||||||

| Department of Administration, Series A, AGMC Insured, 5.25%, 10/01/28 |

10,000,000 | 10,151,500 | ||||||

| Department of Administration, Series A, AGMC Insured, 5.00%, 10/01/29 |

5,000,000 | 5,070,600 | ||||||

| Department of Administration, Series B, AGMC Insured, 5.00%, 10/01/27 |

8,000,000 | 8,227,920 | ||||||

| Arizona State Lottery Revenue, Department of Administration, Series A, AGMC Insured, 5.00%, 7/01/27 |

15,000,000 | 15,333,150 | ||||||

| Glendale Municipal Property Corp. Excise Tax Revenue, Subordinate, Refunding, Series C, 5.00%, 7/01/38 |

15,500,000 | 16,957,155 | ||||||

| Lake Havasu Wastewater System Revenue, senior lien, Refunding, Series B, AGMC Insured, 5.00%, 7/01/40 |

15,000,000 | 17,046,000 | ||||||

| Maricopa County IDA Senior Living Facilities Revenue, Christian Care Retirement Apartments Inc. |

5,000,000 | 5,610,050 | ||||||

| Maricopa County IDAR, Banner Health, Series A, 4.00%, 1/01/41 |

10,000,000 | 10,599,900 | ||||||

| Mesa Utility Systems Revenue, 4.00%, 7/01/36 |

19,000,000 | 19,865,640 | ||||||

| 16 |

Annual Report | franklintempleton.com | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

STATEMENT OF INVESTMENTS

| Principal Amount |

Value | |||||||

| Municipal Bonds (continued) |

||||||||

| Arizona (continued) |

||||||||

| Phoenix Civic Improvement Corp. Airport Revenue, |

||||||||

| junior lien, Refunding, Series D, 4.00%, 7/01/40 |

$ | 25,000,000 | $ | 26,684,000 | ||||

| junior lien, Series A, Pre-Refunded, 5.00%, 7/01/40 |

24,000,000 | 24,936,720 | ||||||

| Phoenix Civic Improvement Corp. Distribution Revenue, |

||||||||

| Capital Appreciation, Civic Plaza Expansion Project, Series B, NATL Insured, 5.50%, 7/01/32 |

6,000,000 | 7,991,640 | ||||||

| Capital Appreciation, Civic Plaza Expansion Project, Series B, NATL Insured, 5.50%, 7/01/34 |

5,000,000 | 6,801,150 | ||||||

| Capital Appreciation, Civic Plaza Expansion Project, Series B, NATL Insured, 5.50%, 7/01/35 |

9,860,000 | 13,538,076 | ||||||

| Phoenix Civic Improvement Corp. Water System Revenue, junior lien, Series A,

Pre-Refunded, |

10,000,000 | 10,056,600 | ||||||

| Pima County Sewer System Revenue, Obligations, AGMC Insured, Pre-Refunded, 5.00%, 7/01/25 |

7,000,000 | 7,273,210 | ||||||

| Pinal County Electrical District No. 3 Electric System Revenue, Pre-Refunded, 5.25%, 7/01/36 |

10,000,000 | 10,773,000 | ||||||

|

|

|

|||||||

| 261,735,699 | ||||||||

|

|

|

|||||||

| Arkansas 0.5% |

||||||||

| Bentonville School District No. 6 GO, Benton County, Construction and Refunding, Series B, 4.00%, 6/01/47 |

27,935,000 | 29,489,024 | ||||||

| University of Arkansas Revenue, |

||||||||

| Various Facilities, Fayetteville Campus, 5.00%, 11/01/47 |

6,500,000 | 7,599,410 | ||||||

| Various Facilities, Fayetteville Campus, Series B, 5.00%, 11/01/37 |

3,100,000 | 3,354,944 | ||||||

| Various Facilities, Fayetteville Campus, Series B, 5.00%, 11/01/42 |

9,360,000 | 10,109,923 | ||||||

|

|

|

|||||||

| 50,553,301 | ||||||||

|

|

|

|||||||

| California 10.3% |

||||||||

| California Health Facilities Financing Authority Revenue, |

||||||||

| Children’s Hospital of Orange County, Series A, 6.50%, 11/01/24 |

5,000,000 | 5,125,650 | ||||||

| Children’s Hospital of Orange County, Series A, 6.50%, 11/01/38 |

8,000,000 | 8,182,880 | ||||||

| California Infrastructure and Economic Development Bank Revenue, Bay Area Toll Bridges Seismic Retrofit, first lien, Series A, AMBAC Insured, Pre-Refunded, 5.00%, 7/01/33 |

24,500,000 | 31,100,055 | ||||||

| California State Economic Recovery GO, Series A, Pre-Refunded, 5.25%, 7/01/21 |

18,225,000 | 18,339,635 | ||||||

| California State Educational Facilities Authority Revenue, Carnegie Institution of Washington, Refunding, Series A, 5.00%, 7/01/40 |

24,525,000 | 25,417,465 | ||||||

| California State GO, |

||||||||

| Refunding, NATL Insured, 5.00%, 10/01/32 |

20,000 | 20,050 | ||||||

| Various Purpose, 5.90%, 4/01/23 |

1,200,000 | 1,222,032 | ||||||

| Various Purpose, 5.00%, 10/01/29 |

15,000,000 | 15,207,450 | ||||||

| Various Purpose, 6.00%, 11/01/39 |

25,000,000 | 25,555,250 | ||||||

| Various Purpose, 5.25%, 11/01/40 |

50,000,000 | 52,387,000 | ||||||

| Various Purpose, FGIC Insured, 6.00%, 5/01/20 |

850,000 | 869,346 | ||||||

| Various Purpose, Refunding, 5.25%, 3/01/30 |

30,000,000 | 30,899,100 | ||||||

| Various Purpose, Refunding, 6.00%, 3/01/33 |

12,000,000 | 12,445,800 | ||||||

| Various Purpose, Refunding, 5.50%, 3/01/40 |

25,000,000 | 25,711,750 | ||||||

| California State Public Works Board Lease Revenue, |

||||||||

| Various Capital Projects, Series A, 5.00%, 4/01/30 |

18,000,000 | 19,628,100 | ||||||

| Various Capital Projects, Series A, 5.00%, 4/01/33 |

12,475,000 | 13,550,095 | ||||||

| Various Capital Projects, Series A, AGMC Insured, 5.00%, 4/01/28 |

13,030,000 | 14,211,691 | ||||||

| Various Capital Projects, Series A, AGMC Insured, 5.00%, 4/01/29 |

21,000,000 | 22,873,200 | ||||||

| Various Capital Projects, Series G, Subseries G-1, Assured Guaranty, Pre-Refunded, 5.25%, 10/01/24 |

5,000,000 | 5,079,500 | ||||||

| Various Capital Projects, Series I, Pre-Refunded, 6.125%, 11/01/29 |

29,300,000 | 29,986,499 | ||||||

| California Statewide CDA, PCR, Southern California Edison Co., Refunding, Series A, 4.50%, 9/01/29 |

14,830,000 | 15,208,313 | ||||||

| Colton Joint USD, GO, San Bernardino and Riverside Counties, Election of 2008, Series A, Assured Guaranty, Pre-Refunded, 5.375%, 8/01/34 |

25,000,000 | 25,241,750 | ||||||

| franklintempleton.com | Annual Report | 17 | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

STATEMENT OF INVESTMENTS

| Principal Amount |

Value | |||||||

|

Municipal Bonds (continued) |

||||||||

| California (continued) |

||||||||

| Corona-Norco USD, |

||||||||

| GO, Riverside County, Capital Appreciation, Election of 2006, Series C, AGMC Insured, 6.20%, 8/01/29 |

$ | 3,250,000 | $ | 4,353,993 | ||||

| GO, Riverside County, Capital Appreciation, Election of 2006, Series C, AGMC Insured, 6.80%, 8/01/39 |

8,500,000 | 11,378,440 | ||||||

| GO, Riverside County, Capital Appreciation, Election of 2006, Series C, AGMC Insured, zero cpn., 8/01/39 |

7,500,000 | 3,585,000 | ||||||

| East Side UHSD Santa Clara County GO, Election of 2008, Series B, Assured Guaranty, Pre-Refunded, 5.25%, 8/01/35 |

23,800,000 | 24,022,768 | ||||||

| Foothill/Eastern Transportation Corridor Agency Toll Road Revenue, |

||||||||

| Capital Appreciation, Refunding, Series A, AGMC Insured, zero cpn. to 1/15/24, 5.40% thereafter, 1/15/30 |

15,475,000 | 15,561,815 | ||||||

| Capital Appreciation, Refunding, Series A, zero cpn. to 1/14/24, 6.85% thereafter, 1/15/42 |

20,000,000 | 19,541,200 | ||||||

| Refunding, Series A, 5.75%, 1/15/46 |

25,000,000 | 28,774,750 | ||||||

| Refunding, Series A, 6.00%, 1/15/49 |

20,000,000 | 23,415,600 | ||||||

| Hartnell Community College District GO, Monterey and San Benito Counties, Capital Appreciation, Election of 2002, Series D, Pre-Refunded, zero cpn., 8/01/39 |

45,000,000 | 10,437,750 | ||||||

| Jefferson UHSD San Mateo County GO, |

||||||||

| Capital Appreciation, Election of 2006, Series D, Pre-Refunded, zero cpn., 8/01/35 |

10,500,000 | 3,241,035 | ||||||

| Capital Appreciation, Election of 2006, Series D, Pre-Refunded, zero cpn., 8/01/40 |

10,000,000 | 2,038,500 | ||||||

| Capital Appreciation, Election of 2006, Series D, Pre-Refunded, zero cpn., 8/01/41 |

13,590,000 | 2,547,581 | ||||||

| Los Angeles Community College District GO, Election of 2008, Series C, Pre-Refunded, 5.25%, 8/01/39 |

30,000,000 | 31,414,800 | ||||||

| Los Angeles Department of Airports Revenue, |

||||||||

| Los Angeles International Airport, Senior, Refunding, Series A, 5.00%, 5/15/40 |

25,485,000 | 26,360,665 | ||||||

| Los Angeles International Airport, Senior, Series D, 5.00%, 5/15/40 |

50,000,000 | 51,718,000 | ||||||

| Los Angeles Department of Water and Power Revenue, Power System, Series B, 5.00%, 7/01/31 |

20,000,000 | 22,601,600 | ||||||

| Los Angeles USD, GO, Series KRY, 5.25%, 7/01/34 |

36,625,000 | 38,054,107 | ||||||

| M-S-R Energy Authority Gas Revenue, Series B, 6.50%, 11/01/39 |

12,500,000 | 18,445,375 | ||||||

| New Haven USD, |

||||||||

| GO, Alameda County, Capital Appreciation, Assured Guaranty, zero cpn., 8/01/31 |

2,055,000 | 1,439,877 | ||||||

| GO, Alameda County, Capital Appreciation, Assured Guaranty, zero cpn., 8/01/32 |

7,830,000 | 5,247,274 | ||||||

| GO, Alameda County, Capital Appreciation, Assured Guaranty, zero cpn., 8/01/33 |

7,660,000 | 4,922,546 | ||||||

| Pomona USD, GO, Los Angeles County, Election of 2008, Series A, Assured Guaranty, Pre-Refunded, 5.00%, 8/01/29 |

5,585,000 | 5,633,869 | ||||||

| Rialto USD, GO, Capital Appreciation, Election of 2010, Series A, AGMC Insured, zero cpn., 8/01/36 |

20,000,000 | 10,865,800 | ||||||

| Richmond Joint Powers Financing Authority Lease Revenue, Civic Center Project, Refunding, Assured Guaranty, 5.75%, 8/01/29 |

13,315,000 | 13,442,291 | ||||||

| San Diego Public Facilities Financing Authority Water Revenue, Series B, Pre-Refunded, 5.375%, 8/01/34 |

15,000,000 | 15,145,050 | ||||||

| San Francisco City and County Airport Commission International Airport Revenue, Refunding, Second Series, Series A, 5.00%, 5/01/49 |

25,000,000 | 29,422,750 | ||||||

| San Francisco City and County COP, Multiple Capital Improvement Projects, Series A, 5.25%, 4/01/31 |

10,000,000 | 10,030,400 | ||||||

| San Joaquin Hills Transportation Corridor Agency Toll Road Revenue, |

||||||||

| Capital Appreciation, senior lien, ETM, zero cpn., 1/01/23 |

7,000,000 | 6,600,580 | ||||||

| senior lien, Refunding, Series A, 5.00%, 1/15/34 |

50,000,000 | 56,240,000 | ||||||

| San Jose USD Santa Clara County GO, Election of 2012, Series E, 4.00%, 8/01/42 |

10,600,000 | 11,368,818 | ||||||

| San Mateo UHSD, |

||||||||

| GO, Capital Appreciation, Election of 2010, Refunding, Series A, zero cpn. to 9/01/28, 6.70% thereafter, 9/01/41 |

20,000,000 | 19,124,200 | ||||||

| GO, Capital Appreciation, Election of 2010, Series A, zero cpn. to 9/01/28, 6.45% thereafter, 9/01/33 |

6,065,000 | 5,312,637 | ||||||

| 18 |

Annual Report | franklintempleton.com | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

STATEMENT OF INVESTMENTS

| Principal Amount |

Value | |||||||

| Municipal Bonds (continued) |

||||||||

| California (continued) |

||||||||

| San Mateo-Foster City School District GO, Capital Appreciation, Election of 2008, Series A, zero cpn. to 8/01/26, 6.625% thereafter, 8/01/42 |

$ | 50,000,000 | $ | 47,790,500 | ||||

| Santa Ana USD, |

||||||||

| GO, Orange County, Capital Appreciation, Election of 2008, Series B, Assured Guaranty, zero cpn., 8/01/35 |

10,000,000 | 6,036,000 | ||||||

| GO, Orange County, Capital Appreciation, Election of 2008, Series B, Assured Guaranty, zero cpn., 8/01/36 |

18,865,000 | 10,916,798 | ||||||

| GO, Orange County, Capital Appreciation, Election of 2008, Series B, Assured Guaranty, zero cpn., 8/01/37 |

10,000,000 | 5,529,700 | ||||||

| Santa Clara County GO, Election of 2008, Series A, Pre-Refunded, 5.00%, 8/01/34 |

25,000,000 | 25,222,000 | ||||||

| Upland USD, GO, San Bernardino County, Election of 2008, Series B, Pre-Refunded, zero cpn., 8/01/39 |

50,075,000 | 13,800,169 | ||||||

| Washington Township Health Care District Revenue, Series A, 6.25%, 7/01/39 |

3,000,000 | 3,018,420 | ||||||

| West Contra Costa USD, |

||||||||

| GO, Contra Costa County, Election of 2005, Series C-1, Assured Guaranty, zero cpn., 8/01/29 |

10,000,000 | 7,653,300 | ||||||

| GO, Contra Costa County, Election of 2005, Series C-1, Assured Guaranty, zero cpn., 8/01/30 |

20,845,000 | 15,300,230 | ||||||

| GO, Contra Costa County, Election of 2005, Series C-1, Assured Guaranty, zero cpn., 8/01/31 |

20,000,000 | 14,064,200 | ||||||

| GO, Contra Costa County, Election of 2005, Series C-1, Assured Guaranty, zero cpn., 8/01/32 |

10,730,000 | 7,256,699 | ||||||

| Whittier UHSD, GO, Los Angeles County, Capital Appreciation, Election of 2008, Refunding, Series A, zero cpn., 8/01/34 |

20,000,000 | 7,727,800 | ||||||

|

|

|

|||||||

| 1,094,867,498 | ||||||||

|

|

|

|||||||

| Colorado 2.6% |

||||||||

| Colorado Health Facilities Authority Revenue, |

||||||||

| Children’s Hospital Colorado Project, Series A, 5.00%, 12/01/41 |

5,000,000 | 5,688,300 | ||||||

| Children’s Hospital Colorado Project, Series A, 5.00%, 12/01/44 |

10,200,000 | 11,582,508 | ||||||

| The Evangelical Lutheran Good Samaritan Society Project, Refunding, Series A, 5.00%, 6/01/45 |

19,000,000 | 20,749,710 | ||||||

| Hospital, Adventist Health System Sunbelt Obligated Group, Refunding, Series A, 5.00%, 11/15/41 |

30,505,000 | 34,682,660 | ||||||

| Colorado State Health Facilities Authority Hospital Revenue, Adventist Health System/Sunbelt Obligated Group, Series A, 5.00%, 11/15/48 |

12,000,000 | 13,868,400 | ||||||

| Denver City and County Airport System Revenue, |

||||||||

| Department of Aviation, Refunding, Subordinate, Series A, 5.00%, 12/01/38 |

12,000,000 | 14,126,640 | ||||||

| Department of Aviation, Refunding, Subordinate, Series A, 5.00%, 12/01/43 |

11,000,000 | 12,837,660 | ||||||

| Department of Aviation, Refunding, Subordinate, Series A, 5.25%, 12/01/48 |

26,000,000 | 30,865,900 | ||||||

| Department of Aviation, Refunding, Subordinate, Series B, 5.25%, 11/15/33 |

16,405,000 | 18,494,833 | ||||||

| Series C, NATL Insured, ETM, 6.125%, 11/15/25 |

3,590,000 | 4,346,126 | ||||||

| Series C, NATL Insured, Pre-Refunded, 6.125%, 11/15/25 |

4,410,000 | 4,595,617 | ||||||

| Denver City and County Dedicated Tax Revenue, |

||||||||

| Capital Appreciation Bonds, Series A-2, zero cpn., 8/01/35 |

2,000,000 | 1,105,460 | ||||||

| Capital Appreciation Bonds, Series A-2, zero cpn., 8/01/36 |

2,500,000 | 1,310,600 | ||||||

| Capital Appreciation Bonds, Series A-2, zero cpn., 8/01/37 |

2,455,000 | 1,220,798 | ||||||

| Capital Appreciation Bonds, Series A-2, zero cpn., 8/01/38 |

2,000,000 | 944,880 | ||||||

| Current Interest Bonds, Series A-1, 5.00%, 8/01/48 |

39,690,000 | 45,705,019 | ||||||

| Park Creek Metropolitan District Revenue, |

||||||||

| Senior Limited Property Tax Supported, Improvement, Assured Guaranty,

Pre-Refunded, |

6,000,000 | 6,161,880 | ||||||

| Senior Limited Property Tax Supported, Refunding, Series A, 5.00%, 12/01/46 |

2,875,000 | 3,281,007 | ||||||

| Public Authority for Colorado Energy Natural Gas Purchase Revenue, 6.50%, 11/15/38 |

20,000,000 | 29,835,000 | ||||||

| Regional Transportation District Sales Tax Revenue, FasTracks Project, Series A, 5.00%, 11/01/32 |

10,000,000 | 10,998,900 | ||||||

| University of Colorado Enterprise Revenue, Series A, Pre-Refunded, 5.375%, 6/01/32 |

3,500,000 | 3,510,675 | ||||||

|

|

|

|||||||

| 275,912,573 | ||||||||

|

|

|

|||||||

| franklintempleton.com | Annual Report | 19 | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

STATEMENT OF INVESTMENTS

| Principal Amount |

Value | |||||||

| Municipal Bonds (continued) |

||||||||

| Delaware 0.0%† |

||||||||

| Kent County Student Housing and Dining Facility Revenue, |

||||||||

| CHF-Dover LLC- Delaware State University Project, Series A, 5.00%, 7/01/40 |

$ | 1,100,000 | $ | 1,210,187 | ||||

| CHF-Dover LLC-Delaware State University Project, Series A, 5.00%, 7/01/48 |

1,485,000 | 1,621,947 | ||||||

| CHF-Dover LLC-Delaware State University Project, Series A, 5.00%, 7/01/53 |

1,100,000 | 1,197,163 | ||||||

|

|

|

|||||||

| 4,029,297 | ||||||||

|

|

|

|||||||

| District of Columbia 3.0% |

||||||||

| District of Columbia Ballpark Revenue, |

||||||||

| Series B-1, BHAC Insured, 5.00%, 2/01/24 |

12,120,000 | 12,153,330 | ||||||

| Series B-1, BHAC Insured, 5.00%, 2/01/25 |

7,000,000 | 7,019,250 | ||||||

| Series B-1, BHAC Insured, 5.00%, 2/01/26 |

9,950,000 | 9,977,363 | ||||||

| District of Columbia GO, Refunding, Series A, 5.00%, 10/15/44 |

25,000,000 | 30,014,000 | ||||||

| District of Columbia Hospital Revenue, Children’s Hospital Obligated Group Issue, Refunding, 5.00%, 7/15/40 |

6,830,000 | 7,661,621 | ||||||

| District of Columbia Income Tax Secured Revenue, |

||||||||

| Refunding, Series A, 5.00%, 12/01/31 |

10,000,000 | 10,342,700 | ||||||

| Series A, 5.25%, 12/01/34 |

11,000,000 | 11,230,890 | ||||||

| District of Columbia Revenue, |

||||||||

| Assn. of American Medical Colleges Issue, Series B, 5.25%, 10/01/41 |

15,000,000 | 15,820,350 | ||||||

| The Catholic University of America Issue, Refunding, 5.00%, 10/01/43 |

4,000,000 | 4,594,960 | ||||||

| The Catholic University of America Issue, Refunding, Series B, 5.00%, 10/01/42 |

20,660,000 | 23,576,985 | ||||||

| The Catholic University of America Issue, Refunding, Series B, 5.00%, 10/01/47 |

24,985,000 | 28,471,157 | ||||||

| Deed Tax, Housing Production Trust Fund, New Communities Project, Series A, NATL Insured, |

5,000,000 | 5,012,100 | ||||||

| Georgetown University Issue, Growth and Income Securities,

Pre-Refunded, AMBAC Insured, |

15,370,000 | 16,350,913 | ||||||

| National Academy of Sciences Project, Series A, Pre-Refunded, 5.00%, 4/01/35 |

10,905,000 | 11,240,874 | ||||||

| National Academy of Sciences Project, Series A, Pre-Refunded, 5.00%, 4/01/40 |

16,960,000 | 17,482,368 | ||||||

| National Public Radio Inc. Issue, Pre-Refunded, 5.00%, 4/01/35 |

7,750,000 | 7,981,570 | ||||||

| District of Columbia Tobacco Settlement FICO Revenue, Asset-Backed, Refunding, 6.50%, 5/15/33 |

25,880,000 | 28,467,741 | ||||||

| District of Columbia Water and Sewer Authority Public Utility Revenue, Green Bonds, senior lien, Series A, 5.00%, 10/01/49 |

25,000,000 | 29,458,000 | ||||||

| Metropolitan Washington Airports Authority Airport System Revenue, |

||||||||

| Refunding, Series A, 5.00%, 10/01/35 |

5,000,000 | 5,202,300 | ||||||

| Series A, 5.00%, 10/01/39 |

5,000,000 | 5,190,900 | ||||||

| Metropolitan Washington Airports Authority Dulles Toll Road Revenue, Dulles Metrorail and Capital Improvement Projects, Convertible Capital Appreciation, second senior lien, Series C, Assured Guaranty, 6.50%, 10/01/41 |

25,000,000 | 31,813,000 | ||||||

|

|

|

|||||||

| 319,062,372 | ||||||||

|

|

|

|||||||

| Florida 5.1% |

||||||||

| Atlantic Beach Health Care Facilities Revenue, |

||||||||

| Fleet Landing Project, Refunding, Series A, 5.00%, 11/15/48 |

3,000,000 | 3,303,120 | ||||||

| Fleet Landing Project, Series A, 5.00%, 11/15/53 |

6,000,000 | 6,590,520 | ||||||

| Broward County HFAR, |

||||||||

| MFH, Heron Pointe Apartments Project, Series A, SPA FHLMC, 5.65%, 11/01/22 |

330,000 | 331,073 | ||||||

| MFH, Heron Pointe Apartments Project, Series A, SPA FHLMC, 5.70%, 11/01/29 |

225,000 | 225,707 | ||||||

| Cape Coral Water and Sewer Revenue, |

||||||||

| Refunding, 5.00%, 10/01/39 |

10,000,000 | 11,648,200 | ||||||

| Series A, AGMC Insured, Pre-Refunded, 5.00%, 10/01/42 |

21,510,000 | 23,234,672 | ||||||

| Central Expressway Authority Revenue, senior lien, Refunding, 5.00%, 7/01/48 |

16,000,000 | 18,681,760 | ||||||

| Citizens Property Insurance Corp. Revenue, Coastal Account, senior secured, Series A-1, 5.00%, 6/01/20 |

20,000,000 | 20,692,400 | ||||||

| 20 |

Annual Report | franklintempleton.com | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

STATEMENT OF INVESTMENTS

| Principal Amount |

Value | |||||||

|

Municipal Bonds (continued) |

||||||||

| Florida (continued) |

||||||||

| Clearwater City Water and Sewer Revenue, Series A, Pre-Refunded, 5.25%, 12/01/39 |

$ | 7,000,000 | $ | 7,150,640 | ||||

| Cocoa Water and Sewer Revenue, System, Series B, 5.00%, 10/01/48 |

10,325,000 | 12,243,282 | ||||||

| Dade County HFA, MFMR, Siesta Pointe Apartments, Series A, AGMC Insured, SPA FHLMC, 5.75%, 9/01/29 |

1,890,000 | 1,903,551 | ||||||

| Deltona Utility System Revenue, Refunding, AGMC Insured, 5.125%, 10/01/39 |

5,000,000 | 5,572,100 | ||||||

| Florida State Board of Education GO, Public Education Capital Outlay, Refunding, Series D, 6.00%, 6/01/23 |

17,500,000 | 20,533,975 | ||||||

| Florida State Municipal Loan Council Revenue, Series D, AGMC Insured, 5.50%, 10/01/41 |

4,750,000 | 5,133,135 | ||||||

| Gainesville Utilities System Revenue, |

||||||||

| Refunding, Series A, 5.00%, 10/01/47 |

15,000,000 | 17,973,600 | ||||||

| Series A, 5.00%, 10/01/36 |

7,150,000 | 8,543,463 | ||||||

| Hillsborough County Aviation Authority Revenue, |

||||||||

| Tampa International Airport, Passenger Facility Charge, Subordinated, Series A, 5.00%, 10/01/48 |

20,000,000 | 23,140,800 | ||||||

| Tampa International Airport, Subordinated, Refunding, Series B, 5.00%, 10/01/44 |

10,000,000 | 11,251,500 | ||||||

| Hillsborough County School Board COP, Master Lease Program, Refunding, Series A, 5.00%, 7/01/28 |

520,000 | 568,360 | ||||||

| Lee Memorial Health System Hospital Revenue, |

||||||||

| Refunding, Series A-1, 5.00%, 4/01/44 |

4,220,000 | 4,905,623 | ||||||

| Series A, AMBAC Insured, 5.00%, 4/01/37 |

11,000,000 | 11,004,180 | ||||||

| Martin County Health Facilities Authority Hospital Revenue, |

||||||||

| Martin Memorial Medical Center, 5.50%, 11/15/42 |

3,800,000 | 4,082,986 | ||||||

| Martin Memorial Medical Center, AGMC Insured, 5.50%, 11/15/42 |

3,800,000 | 4,087,356 | ||||||

| a Miami Beach GO, Refunding, 4.00%, 5/01/44 |

15,000,000 | 16,212,300 | ||||||

| Miami Beach RDA Tax Increment Revenue, City Center/Historic Convention Village, Refunding, Series A, AGMC Insured, 5.00%, 2/01/44 |

12,000,000 | 13,412,400 | ||||||

| Miami Beach Resort Tax Revenue, 5.00%, 9/01/40 |

11,000,000 | 12,590,710 | ||||||

| Miami-Dade County Aviation Revenue, Miami International Airport, Hub of the Americas, Series A, Pre-Refunded, 5.50%, 10/01/36 |

20,000,000 | 20,323,400 | ||||||

| Miami-Dade County Expressway Authority Toll System Revenue, |

||||||||

| Refunding, Series A, 5.00%, 7/01/29 |

10,000,000 | 10,946,100 | ||||||

| Refunding, Series A, 5.00%, 7/01/32 |

6,375,000 | 6,978,712 | ||||||

| Series A, 5.00%, 7/01/40 |

30,265,000 | 31,303,392 | ||||||

| Miami-Dade County School Board COP, Master Lease Purchase Agreement, Refunding, Series A, |

10,000,000 | 11,060,600 | ||||||

| Miami-Dade County Special Obligation Revenue, |

||||||||

| sub. bond, Refunding, Series B, 5.00%, 10/01/31 |

5,000,000 | 5,472,750 | ||||||

| sub. bond, Refunding, Series B, 5.00%, 10/01/32 |

4,500,000 | 4,924,305 | ||||||

| sub. bond, Refunding, Series B, 5.00%, 10/01/35 |

3,250,000 | 3,547,765 | ||||||

| Miami-Dade County Transit System Sales Surtax Revenue, Refunding, 5.00%, 7/01/35 |

7,000,000 | 7,947,520 | ||||||

| Miami-Dade County Water and Sewer System Revenue, Refunding, Series A, 5.00%, 10/01/42 |

20,000,000 | 21,782,200 | ||||||

| Orange County Health Facilities Authority Revenue, |

||||||||

| Hospital, Orlando Health Obligated Group, Refunding, Series A, 5.00%, 10/01/39 |

6,000,000 | 6,814,200 | ||||||

| Hospital, Orlando Health Obligated Group, Series A, 5.00%, 10/01/47 |

5,000,000 | 5,781,050 | ||||||

| Presbyterian Retirement Communities Project, 5.00%, 8/01/47 |

14,000,000 | 15,189,440 | ||||||

| Orange County School Board COP, Series A, Assured Guaranty, Pre-Refunded, 5.50%, 8/01/34 |

15,000,000 | 15,146,700 | ||||||

| Orlando-Orange County Expressway Authority Revenue, |

||||||||

| Series A, Pre-Refunded, 5.00%, 7/01/40 |

3,005,000 | 3,122,285 | ||||||

| Series A, Pre-Refunded, 5.00%, 7/01/40 |

1,995,000 | 2,071,688 | ||||||

| Series C, Pre-Refunded, 5.00%, 7/01/40 |

15,000,000 | 15,576,600 | ||||||

| Pinellas County Sewer Revenue, AGMC Insured, 5.00%, 10/01/32 |

610,000 | 611,720 | ||||||

| South Broward Hospital District Revenue, Hospital, South Broward Hospital District Obligated Group, |

20,715,000 | 24,059,851 | ||||||

| South Lake County Hospital District Revenue, South Lake Hospital Inc., Series A, 6.25%, 4/01/39 |

5,735,000 | 5,751,345 | ||||||

| franklintempleton.com | Annual Report | 21 | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

STATEMENT OF INVESTMENTS

| Principal Amount |

Value | |||||||

| Municipal Bonds (continued) |

||||||||

| Florida (continued) |

||||||||

| South Miami Health Facilities Authority Hospital Revenue, Baptist Health South Florida, Refunding, |

$ | 15,000,000 | $ | 17,220,750 | ||||

| St. Petersburg Public Utility Revenue, Refunding, 4.00%, 10/01/43 |

15,000,000 | 16,068,450 | ||||||

| Sunrise Utilities System Revenue, AMBAC Insured, Pre-Refunded, 5.20%, 10/01/22 |

860,000 | 884,321 | ||||||

| Tampa-Hillsborough County Expressway Authority Revenue, 5.00%, 7/01/47 |

10,000,000 | 11,485,800 | ||||||

| Tohopekaliga Water Authority Utility System Revenue, Refunding, 5.00%, 10/01/46 |

5,000,000 | 5,805,000 | ||||||

| Town of Davie Water and Sewer Revenue, AGMC Insured, 5.00%, 10/01/32 |

8,575,000 | 9,180,824 | ||||||

|

|

|

|||||||

| 544,074,181 | ||||||||

|

|

|

|||||||

| Georgia 3.8% |

||||||||

| Albany Dougherty Payroll Development Authority Revenue, Darton College Project, AGMC Insured, |

5,550,000 | 5,775,163 | ||||||

| Atlanta Airport General Revenue, |

||||||||

| Refunding, Series C, 6.00%, 1/01/30 |

15,000,000 | 16,075,050 | ||||||

| Series A, AGMC Insured, 5.00%, 1/01/40 |

9,215,000 | 9,393,126 | ||||||

| The Atlanta Development Authority Revenue, |

||||||||

| New Downtown Atlanta Stadium Project, senior lien, Series A-1, 5.25%, 7/01/44 |

3,000,000 | 3,452,370 | ||||||

| Tuff Yamacraw LLC Project, Refunding, Series A, AMBAC Insured, 5.00%, 1/01/24 |

6,385,000 | 6,910,230 | ||||||

| Tuff Yamacraw LLC Project, Refunding, Series A, AMBAC Insured, 5.00%, 1/01/25 |

6,955,000 | 7,636,520 | ||||||

| Tuff Yamacraw LLC Project, Refunding, Series A, AMBAC Insured, 5.00%, 1/01/26 |

5,000,000 | 5,538,850 | ||||||

| Tuff Yamacraw LLC Project, Refunding, Series A, AMBAC Insured, 5.00%, 1/01/27 |

5,000,000 | 5,598,150 | ||||||

| Atlanta Water and Wastewater Revenue, |

||||||||

| Refunding, 5.00%, 11/01/40 |

29,500,000 | 33,676,020 | ||||||

| Refunding, Series A, 5.00%, 11/01/40 |

4,655,000 | 5,514,406 | ||||||

| Refunding, Series A, 5.00%, 11/01/41 |

4,845,000 | 5,727,178 | ||||||

| Refunding, Series B, AGMC Insured, 5.25%, 11/01/34 |

10,545,000 | 10,727,956 | ||||||

| Refunding, Series B, AGMC Insured, 5.375%, 11/01/39 |

7,940,000 | 8,079,506 | ||||||

| Refunding, Series C, 4.00%, 11/01/38 |

13,550,000 | 14,731,424 | ||||||

| Series A, Pre-Refunded, 6.25%, 11/01/34 |

20,000,000 | 20,462,800 | ||||||

| Series B, AGMC Insured, Pre-Refunded, 5.25%, 11/01/34 |

19,455,000 | 19,809,276 | ||||||

| Series B, AGMC Insured, Pre-Refunded, 5.375%, 11/01/39 |

15,060,000 | 15,343,429 | ||||||

| Burke County Development Authority PCR, |

||||||||

| Oglethorpe Power Corp. Vogtle Project, Refunding, Series C, 4.125%, 11/01/45 |

2,500,000 | 2,569,600 | ||||||

| Oglethorpe Power Corp. Vogtle Project, Refunding, Series D, 4.125%, 11/01/45 |

18,500,000 | 19,015,040 | ||||||

| Clarke County Hospital Authority Revenue, Piedmont Health Care Inc. Project, Refunding, Series A, |

10,835,000 | 12,218,846 | ||||||

| DeKalb Newton and Gwinnett County Joint Development Authority Revenue, GGC Foundation LLC Project, Pre-Refunded, 6.00%, 7/01/34 |

10,000,000 | 10,071,200 | ||||||

| Fayette County Hospital Authority Revenue, Anticipation Certificates, Piedmont Fayette Hospital Project, Refunding, Series A, 5.00%, 7/01/39 |

11,420,000 | 12,599,001 | ||||||

| Fulton County Development Authority Hospital Revenue, Anticipation Certificates, Wellstar Health System Inc. Project, Series A, 5.00%, 4/01/47 |

5,000,000 | 5,678,750 | ||||||

| Fulton County Development Authority Revenue, Piedmont Healthcare Inc. Project, Refunding, Series A, |

11,005,000 | 12,410,559 | ||||||

| Gainesville and Hall County Hospital Authority Revenue, Anticipation Certificates, Northeast Georgia Health System Inc. Project, Refunding, Series A, 5.00%, 2/15/45 |

13,040,000 | 14,749,022 | ||||||

| Georgia State GO, Series A-2, 4.00%, 2/01/36 |

10,000,000 | 10,973,800 | ||||||

| Georgia State Higher Education Facilities Authority Revenue, |

||||||||

| USG Real Estate Foundation II LLC Project, Series A, 5.50%, 6/15/34 |

7,800,000 | 7,836,426 | ||||||

| USG Real Estate Foundation II LLC Project, Series A, Pre-Refunded, 5.50%, 6/15/34 |

2,200,000 | 2,210,142 | ||||||

| USG Real Estate Foundation III LLC Project, Series A, 5.00%, 6/15/40 |

3,700,000 | 3,810,408 | ||||||

| USG Real Estate Foundation III LLC Project, Series A, Assured Guaranty, 5.00%, 6/15/38 |

6,845,000 | 7,053,841 | ||||||

| 22 |

Annual Report | franklintempleton.com | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

STATEMENT OF INVESTMENTS

| Principal Amount |

Value | |||||||

| Municipal Bonds (continued) |

||||||||

| Georgia (continued) |

||||||||

| Georgia State Higher Education Facilities Authority Revenue, (continued) |

||||||||

| USG Real Estate Foundation III LLC Project, Series A, Assured Guaranty, Pre-Refunded, 5.00%, 6/15/38 |

$ | 2,405,000 | $ | 2,493,961 | ||||

| USG Real Estate Foundation III LLC Project, Series A, Pre-Refunded, 5.00%, 6/15/40 |

1,300,000 | 1,348,828 | ||||||

| Glynn-Brunswick Memorial Hospital Authority Revenue, Anticipation Certificates, Southeast Georgia Health System Project, 5.00%, 8/01/47 |

2,250,000 | 2,508,548 | ||||||

| Main Street Natural Gas Inc. Gas Supply Revenue, Series A, 5.00%, 5/15/49 |

11,500,000 | 14,410,995 | ||||||

| Main Street Natural Gas Inc. Revenue, Gas Project, Series A, 5.50%, 9/15/28 |

5,000,000 | 6,254,700 | ||||||

| Medical Center Hospital Authority Revenue, Anticipation Certificates, Columbus Regional Healthcare System Inc. Project, AGMC Insured, Pre-Refunded, 5.00%, 8/01/41 |

7,500,000 | 7,803,975 | ||||||

| Private Colleges and Universities Authority Revenue, |

||||||||

| Emory University, Refunding, Series A, 5.00%, 9/01/41 |

10,000,000 | 10,656,800 | ||||||

| Emory University, Refunding, Series A, 5.00%, 10/01/43 |

10,000,000 | 11,049,800 | ||||||

| Emory University, Refunding, Series C, 5.25%, 9/01/39 |

21,000,000 | 21,232,680 | ||||||

| Savannah EDA Revenue, SSU Community Development I LLC Project, Assured Guaranty, 5.75%, 6/15/41 |

10,000,000 | 10,433,000 | ||||||

|

|

|

|||||||

| 403,841,376 | ||||||||

|

|

|

|||||||

| Hawaii 0.6% |

||||||||

| Hawaii State Airports System Revenue, Series A, 5.00%, 7/01/43 |

15,000,000 | 17,441,700 | ||||||

| Hawaii State Department of Budget and Finance Special Purpose Revenue, Hawaiian Electric Co. Inc. and Subsidiary Projects, 6.50%, 7/01/39 |

7,500,000 | 7,571,175 | ||||||

| Honolulu City and County Wastewater System Revenue, |

||||||||

| First Bond Resolution, Senior Series A, 5.00%, 7/01/47 |

25,000,000 | 29,311,000 | ||||||

| First Bond Resolution, Senior Series A, Pre-Refunded, 5.00%, 7/01/38 |

10,000,000 | 10,724,500 | ||||||

|

|

|

|||||||

| 65,048,375 | ||||||||

|

|

|

|||||||

| Idaho 0.1% |

||||||||

| Idaho Health Facilities Authority Hospital Revenue, Trinity Health Credit Group, Series D, 4.00%, 12/01/43 |

6,000,000 | 6,397,320 | ||||||

| Idaho State Health Facilities Authority Revenue, |

||||||||

| St. Luke’s Health System Project, Refunding, Series A, 5.00%, 3/01/36 |

4,200,000 | 4,854,234 | ||||||

| St. Luke’s Health System Project, Refunding, Series A, 5.00%, 3/01/37 |

3,500,000 | 4,024,090 | ||||||

|

|

|

|||||||

| 15,275,644 | ||||||||

|

|

|

|||||||

| Illinois 3.8% |

||||||||

| Bolingbrook GO, Will and DuPage Counties, Capital Appreciation, Refunding, Series A, zero cpn., 1/01/36 |

19,000,000 | 8,472,290 | ||||||

| Chicago GO, Lakefront Millennium Project, Parking Facilities, NATL Insured, ETM, 5.75%, 1/01/23 |

8,955,000 | 10,040,077 | ||||||

| Chicago Midway Airport Revenue, |

||||||||

| Refunding, Series B, 5.00%, 1/01/46 |

18,420,000 | 20,677,371 | ||||||

| Refunding, Series C, Assured Guaranty, 5.50%, 1/01/24 |

15,780,000 | 17,296,931 | ||||||

| Chicago O’Hare International Airport Revenue, |

||||||||

| General Airport, senior lien, Series D, 5.25%, 1/01/42 |

10,000,000 | 11,662,900 | ||||||

| General Airport, senior lien, Series D, 5.00%, 1/01/47 |

18,000,000 | 20,590,920 | ||||||

| General Airport, third lien, Series A, 5.75%, 1/01/39 |

840,000 | 891,332 | ||||||

| General Airport, third lien, Series A, Pre-Refunded, 5.75%, 1/01/39 |

4,160,000 | 4,445,792 | ||||||

| General Airport, third lien, Series C, Assured Guaranty, 5.25%, 1/01/35 |

39,485,000 | 40,389,601 | ||||||

| Chicago Transit Authority Sales Tax Receipts Revenue, 5.25%, 12/01/40 |

10,000,000 | 10,529,100 | ||||||

| Illinois State Finance Authority Revenue, |

||||||||

| Art Institute of Chicago, Refunding, Series A, 5.25%, 3/01/40 |

16,000,000 | 16,443,200 | ||||||

| Carle Foundation, Refunding, Series A, 5.00%, 2/15/45 |

20,000,000 | 22,292,600 | ||||||

| Mercy Health System Corp., Refunding, 5.00%, 12/01/46 |

30,000,000 | 32,877,300 | ||||||

| Riverside Health System, Pre-Refunded, 6.25%, 11/15/35 |

2,930,000 | 3,002,254 | ||||||

| franklintempleton.com | Annual Report | 23 | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

STATEMENT OF INVESTMENTS

| Principal Amount |

Value | |||||||

| Municipal Bonds (continued) |

||||||||

| Illinois (continued) |

||||||||

| Illinois State Finance Authority Revenue, (continued) |

||||||||

| Riverside Health System, Refunding, 6.25%, 11/15/35 |

$ | 2,070,000 | $ | 2,116,430 | ||||

| Southern Illinois HealthCare Enterprise Inc., AGMC Insured, Pre-Refunded, 5.375%, 3/01/35 |

8,500,000 | 8,761,375 | ||||||

| Illinois State Finance Authority Student Housing Revenue, |

||||||||

| CHF-DeKalb II LLC, Northern Illinois University Project, 6.875%, 10/01/43 |

15,000,000 | 15,953,700 | ||||||

| CHF-Normal LLC, Illinois State University Project, Pre-Refunded, 7.00%, 4/01/43 |

7,500,000 | 8,245,275 | ||||||

| Illinois State GO, |

||||||||

| AGMC Insured, 5.00%, 3/01/27 |

11,500,000 | 12,246,235 | ||||||

| Refunding, AGMC Insured, 5.00%, 1/01/23 |

10,000,000 | 10,189,300 | ||||||

| Illinois State Toll Highway Authority Revenue, Toll Highway, Senior, Refunding, Series A-1, 5.00%, 1/01/31 |

10,245,000 | 10,447,749 | ||||||

| Metropolitan Pier and Exposition Authority Dedicated State Tax Revenue, |

||||||||

| McCormick Place Expansion Project, Capital Appreciation, Refunding, Series B, NATL Insured, 5.50%, 6/15/20 |

1,080,000 | 1,084,093 | ||||||

| McCormick Place Expansion Project, Capital Appreciation, Refunding, Series B, NATL Insured, 5.55%, 6/15/21 |

2,540,000 | 2,549,703 | ||||||

| McCormick Place Expansion Project, Capital Appreciation, Series B, NATL Insured, 5.65%, 6/15/22 |

24,500,000 | 26,744,935 | ||||||

| McCormick Place Expansion Project, Capital Appreciation, Series B, NATL Insured, ETM, 5.65%, 6/15/22 |

2,855,000 | 3,198,000 | ||||||

| McCormick Place Expansion Project, Capital Appreciation, Series B, NATL Insured, ETM, 5.65%, 6/15/22 |

2,645,000 | 2,958,485 | ||||||

| Metropolitan Pier and Exposition Authority Hospitality Facilities Revenue, McCormick Place Convention Center, ETM, 7.00%, 7/01/26 |

10,995,000 | 13,191,361 | ||||||

| Railsplitter Tobacco Settlement Authority Revenue, Pre-Refunded, 6.00%, 6/01/28 |

14,530,000 | 15,817,213 | ||||||

| Regional Transportation Authority GO, Cook DuPage Kane Lake McHenry and Will Counties, Series A, AMBAC Insured, 7.20%, 11/01/20 |

325,000 | 342,362 | ||||||

| Southwestern Illinois Development Authority Revenue, |

||||||||

| Capital Appreciation, Local Government Program, AGMC Insured, zero cpn., 12/01/24 |

3,850,000 | 3,289,902 | ||||||

| Capital Appreciation, Local Government Program, AGMC Insured, zero cpn., 12/01/26 |

7,700,000 | 6,162,541 | ||||||

| St. Clair County School District No. 189 East St. Louis GO, Alternate Revenue Source, Refunding, AMBAC Insured, 5.125%, 1/01/28 |

7,135,000 | 7,139,852 | ||||||

| University of Illinois University Revenue, |

||||||||

| Auxiliary Facilities System, Refunding, Series A, 5.125%, 4/01/36 |

2,950,000 | 3,072,868 | ||||||

| Auxiliary Facilities System, Refunding, Series A, 5.25%, 4/01/41 |

5,000,000 | 5,213,150 | ||||||

| Upper Illinois River Valley Development Authority MFHR, |

||||||||

| Prairie View and Timber Oaks Apartments, Series A1, 5.00%, 12/01/43 |

8,550,000 | 8,849,934 | ||||||

| Prairie View and Timber Oaks Apartments, Series A1, 5.00%, 12/01/54 |

11,000,000 | 11,303,050 | ||||||

| Upper River Valley Development Authority Environmental Facilities Revenue, General Electric Co. Project, 5.45%, 2/01/23 |

3,600,000 | 3,608,316 | ||||||

|

|

|

|||||||

| 402,097,497 | ||||||||

|

|

|

|||||||

| Indiana 3.0% |

||||||||

| Hammond Multi-School Building Corp. Revenue, Lake County, first mortgage, 5.00%, 7/15/38 |

3,000,000 | 3,412,620 | ||||||

| Indiana Finance Authority Revenue, |

||||||||

| Baptist Homes of Indiana Senior Living, Series A, 5.25%, 11/15/46 |

11,955,000 | 13,172,019 | ||||||

| Baptist Homes of Indiana Senior Living, Series A, 5.00%, 11/15/48 |

5,000,000 | 5,459,100 | ||||||

| Baptist Homes of Indiana Senior Living, Series A, 5.00%, 11/15/53 |

10,000,000 | 10,886,200 | ||||||

| Deaconess Health System Obligated Group, Refunding, Series A, 5.00%, 3/01/39 |

5,000,000 | 5,561,050 | ||||||

| Educational Facilities, Marian University Project, 6.375%, 9/15/41 |

12,500,000 | 13,384,625 | ||||||

| Stadium Project, Refunding, Series A, 5.25%, 2/01/37 |

10,000,000 | 11,763,300 | ||||||

| 24 |

Annual Report | franklintempleton.com | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

STATEMENT OF INVESTMENTS

| Principal Amount |

Value | |||||||

| Municipal Bonds (continued) |

||||||||

| Indiana (continued) |

||||||||

| Indiana Finance Authority Wastewater Utility Revenue, |

||||||||

| Citizens Wastewater of Westfield Project, Series A, 5.00%, 10/01/48 |

$ | 16,665,000 | $ | 19,572,376 | ||||

| CWA Authority Project, first lien, Refunding, Series A, 5.00%, 10/01/39 |

30,000,000 | 33,907,200 | ||||||

| CWA Authority Project, first lien, Series A, 5.00%, 10/01/37 |

5,000,000 | 5,466,650 | ||||||

| CWA Authority Project, first lien, Series A, 5.25%, 10/01/38 |

12,000,000 | 12,879,960 | ||||||

| CWA Authority Project, first lien, Series A, 4.00%, 10/01/42 |

24,690,000 | 25,313,916 | ||||||

| Indiana State Finance Authority Environmental Revenue, Duke Energy Indiana Inc. Project, Refunding, Series B, 6.00%, 8/01/39 |

10,000,000 | 10,103,500 | ||||||

| Indiana State Municipal Power Agency Revenue, |

||||||||

| Power Supply System, Refunding, Series A, 4.00%, 1/01/42 |

5,860,000 | 6,188,043 | ||||||

| Power Supply System, Refunding, Series A, 5.00%, 1/01/42 |

21,290,000 | 24,352,992 | ||||||

| Indianapolis Local Public Improvement Bond Bank Revenue, |

||||||||

| Community Justice Campus, Courthouse and Jail Project, Refunding, Series A, 4.00%, 2/01/44 |

6,050,000 | 6,545,314 | ||||||

| Community Justice Campus, Courthouse and Jail Project, Refunding, Series A, 5.00%, 2/01/49 |

41,970,000 | 49,714,304 | ||||||

| Pilot Infrastructure Project, Refunding, Series C, 5.00%, 1/01/40 |

23,225,000 | 27,274,047 | ||||||

| Pilot Infrastructure Project, Series F, AGMC Insured, Pre-Refunded, 5.00%, 1/01/35 |

10,000,000 | 10,225,400 | ||||||

| Indianapolis Water System Revenue, first lien, Refunding, Series B, 5.00%, 10/01/37 |

15,000,000 | 17,523,750 | ||||||

| Northern Indiana Commuter Transportation District Revenue, Limited Obligation, 5.00%, 7/01/41 |

6,000,000 | 6,800,640 | ||||||

| University of Southern Indiana Revenue, Student Fee, Series J, Assured Guaranty, Pre-Refunded, 5.75%, 10/01/28 |

2,000,000 | 2,034,400 | ||||||

|

|

|

|||||||

| 321,541,406 | ||||||||

|

|

|

|||||||

| Iowa 0.3% |

||||||||

| Iowa State Finance Authority Revenue, |

||||||||

| Green Bond, Refunding, 5.00%, 8/01/42 |

16,000,000 | 18,820,000 | ||||||

| UnityPoint Health, Refunding, Series B, 5.00%, 2/15/48 |

7,500,000 | 8,607,225 | ||||||

|

|

|

|||||||

| 27,427,225 | ||||||||

|

|

|

|||||||

| Kansas 0.8% |

||||||||

| Butler County USD No. 490 GO, School Building, El Dorado, Series B, BAM Insured, 4.00%, 9/01/43 |

10,000,000 | 10,572,400 | ||||||

| Kansas State Development Finance Authority Hospital Revenue, |

||||||||

| Adventist Health System/Sunbelt Obligated Group, Series C, Pre-Refunded, 5.75%, 11/15/38 |

6,110,000 | 6,244,420 | ||||||

| Adventist Health System/Sunbelt Obligated Group, Series C, Pre-Refunded, 5.75%, 11/15/38 |

140,000 | 142,967 | ||||||

| University of Kansas Hospital Authority Health Facilities Revenue, Kansas University Health System, Refunding, Series A, 5.00%, 3/01/47 |

23,115,000 | 26,380,918 | ||||||

| Wyandotte County Kansas City Unified Government Utility System Revenue, |

||||||||

| Improvement, Refunding, Series A, 5.00%, 9/01/44 |

3,000,000 | 3,329,550 | ||||||

| Improvement, Series A, 5.00%, 9/01/45 |

10,000,000 | 11,257,400 | ||||||

| Improvement, Series C, 5.00%, 9/01/41 |

5,000,000 | 5,683,500 | ||||||

| Improvement, Series C, 5.00%, 9/01/46 |

16,565,000 | 18,826,785 | ||||||

|

|

|

|||||||

| 82,437,940 | ||||||||

|

|

|

|||||||

| Kentucky 0.2% |

||||||||

| Kentucky State Municipal Power Agency Power System Revenue, |

||||||||

| Prairie State Project, Refunding, Series A, NATL Insured, 5.00%, 9/01/35 |

7,750,000 | 8,798,265 | ||||||

| Prairie State Project, Refunding, Series A, NATL Insured, 5.00%, 9/01/42 |

10,000,000 | 11,279,500 | ||||||

|

|

|

|||||||

| 20,077,765 | ||||||||

|

|

|

|||||||

| franklintempleton.com | Annual Report | 25 | ||

FRANKLIN FEDERAL TAX-FREE INCOME FUND

STATEMENT OF INVESTMENTS

| Principal Amount |

Value | |||||||

| Municipal Bonds (continued) |

||||||||

| Louisiana 2.2% |

||||||||

| Lafayette Communications System Revenue, Refunding, AGMC Insured, 5.00%, 11/01/30 |

$ | 5,000,000 | $ | 5,784,250 | ||||

| Lafayette Public Trust Financing Authority Revenue, |

||||||||

| Ragin’ Cajun Facilities Inc. Housing and Parking Project, AGMC Insured,

Pre-Refunded, |

5,500,000 | 5,760,315 | ||||||

| Ragin’ Cajun Facilities Inc. Housing and Parking Project, AGMC Insured,

Pre-Refunded, |

6,000,000 | 6,325,740 | ||||||

| Ragin’ Cajun Facilities Inc. Housing and Parking Project, AGMC Insured,

Pre-Refunded, |

15,000,000 | 15,814,350 | ||||||