| As filed with the Securities and Exchange Commission on | ||

| January 18, 2019 | ||

| Registration No. 811-03386 | ||

| 2-75863 | ||

| ---------------------------------------------------------------- | ||

| SECURITIES AND EXCHANGE COMMISSION | ||

| WASHINGTON, D.C. 20549 | ||

| ---------------- | ||

| FORM N-1A | ||

| ---- | ||

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | / X / | |

| ---- | ||

| ---- | ||

| Pre-Effective Amendment No. | / / | |

| ---- | ||

| ---- | ||

| Post-Effective Amendment No. 48 | / X / | |

| and | ---- | |

| ---- | ||

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY | / X / | |

| ACT OF 1940 | ---- | |

| ---- | ||

| Amendment No. 49 | / X / | |

| (Check appropriate box or boxes) | ---- | |

| --------------- | ||

| PUTNAM GLOBAL HEALTH CARE FUND | ||

| (Exact name of registrant as specified in charter) | ||

| 100 Federal Street, Boston, Massachusetts 02110 | ||

| (Address of principal executive offices) | ||

| Registrant's Telephone Number, including Area Code | ||

| (617) 292-1000 | ||

| ---------------- | ||

| It is proposed that this filing will become effective | ||

| (check appropriate box) | ||

| ---- | ||

| / / | immediately upon filing pursuant to paragraph (b) | |

| ---- | ||

| ---- | ||

| / X / | on December 30, 2018 pursuant to paragraph (b) | |

| ---- | ||

| ---- | ||

| / / | 60 days after filing pursuant to paragraph (a) (1) | |

| ---- | ||

| ---- | ||

| / / | on (date) pursuant to paragraph (a) (1) | |

| ---- | ||

| ---- | ||

| / / | 75 days after filing pursuant to paragraph (a) (2) | |

| ---- | ||

| ---- | ||

| / / | on (date) pursuant to paragraph (a) (2) of Rule 485. | |

| ---- | ||

| If appropriate, check the following box: | ||

| ---- | ||

| / / | this post-effective amendment designates a new | |

| ---- | effective date for a previously filed post-effective amendment. | |

| -------------- | ||

| ROBERT T. BURNS, Vice President | ||

| PUTNAM GLOBAL HEALTH CARE FUND | ||

| 100 Federal Street | ||

| Boston, Massachusetts 02110 | ||

| (Name and address of agent for service) | ||

| --------------- | ||

| Copy to: | ||

| BRYAN CHEGWIDDEN, Esquire | ||

| ROPES & GRAY LLP | ||

| 1211 Avenue of the Americas | ||

| New York, New York 10036 | ||

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, and the Investment Company Act of 1940, as amended, the Registrant certifies that it meets all of the requirements for effectiveness of this Registration Statement under Rule 485(b) under the Securities Act of 1933, as amended, and has duly caused this Amendment to its Registration Statement to be signed on its behalf by the undersigned, duly authorized, in the City of Boston, and The Commonwealth of Massachusetts, on the 18th day of January, 2019.

| PUTNAM GLOBAL HEALTH CARE FUND |

| By: /s/ Jonathan S. Horwitz, Executive Vice President, Principal Executive Officer and Compliance Liaison |

Pursuant to the requirements of the Securities Act of 1933, as amended, this Amendment to the Registration Statement has been signed below by the following persons in the capacities and on the date indicated:

| Signature | Title |

| Kenneth R. Leibler* | Chair, Board of Trustees |

| Robert L. Reynolds* | President and Trustee |

| Jonathan S. Horwitz* | Executive Vice President, Principal Executive Officer and Compliance Liaison |

| Janet C. Smith* | Vice President, Principal Financial Officer, Principal Accounting Officer and Assistant Treasurer |

| Liaquat Ahamed* | Trustee |

| Ravi Akhoury* | Trustee |

| Barbara M. Baumann* | Trustee |

| Katinka Domotorffy* | Trustee |

| Catherine Bond Hill* | Trustee |

| Paul L. Joskow* | Trustee |

| Robert E. Patterson* | Trustee |

| George Putnam, III* | Trustee |

| Manoj P. Singh* | Trustee |

| By: /s/ Jonathan S. Horwitz, as Attorney-in-Fact January 18, 2019 | |

| *Signed pursuant to power of attorney filed in Post-Effective Amendment No. 47 to the Registrant's Registration Statement on December 27, 2018. |

0/U&

M\W%Q<0'1S1=$[)HS9PYB8V,! "4E)6%S0Q*Q[

| Putnam Global Health Care Fund | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fund Summary | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Goal | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Putnam Global Health Care Fund seeks capital appreciation. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fees and expenses | ||||||||||||||||||||||||||||||||||||||||||||||||||

| The following table describes the fees and expenses you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in Putnam funds. More information about these and other discounts is available from your financial advisor and in How do I buy fund shares? beginning on page 50 of the fund's prospectus, in the Appendix to the fund's prospectus, and in How to buy shares beginning on page II-1 of the fund's statement of additional information (SAI). | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder fees (fees paid directly from your investment) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual fund operating expenses (expenses you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| Example | ||||||||||||||||||||||||||||||||||||||||||||||||||

| The following hypothetical example is intended to help you compare the cost of investing in the fund with the cost of investing in other funds. It assumes that you invest $10,000 in the fund for the time periods indicated and then, except as indicated, redeem all your shares at the end of those periods. It assumes a 5% return on your investment each year and that the fund’s operating expenses remain the same. Your actual costs may be higher or lower. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio turnover | ||||||||||||||||||||||||||||||||||||||||||||||||||

| The fund pays transaction-related costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher turnover rate may indicate higher transaction costs and may result in higher taxes when the fund’s shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or the above example, affect fund performance. The fund’s turnover rate in the most recent fiscal year was 49%. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Investments, risks, and performance Investments | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Investments For this non-diversified fund concentrating in the health care industries, we invest mainly in common stocks (growth or value stocks or both) of large and midsize companies worldwide that we believe have favorable investment potential. Under normal circumstances, we invest at least 80% of the fund’s net assets in securities of companies in the health care industries. This policy may be changed only after 60 days’ notice to shareholders. Potential investments include companies that manufacture health care supplies or provide health care-related services, and companies in the research, development, production and marketing of pharmaceuticals and biotechnology products. We may purchase stocks of companies with stock prices that reflect a value lower than that which we place on the company. We may also consider other factors that we believe will cause the stock price to rise. We may consider, among other factors, a company’s valuation, financial strength, growth potential, competitive position in its industry, projected future earnings, cash flows and dividends when deciding whether to buy or sell investments. We may also use derivatives, such as futures, options, certain foreign currency transactions, warrants and swap contracts, for both hedging and non-hedging purposes, and may engage in short sales of securities. The use of the term “global” in the fund’s name is meant to emphasize that we look for investment opportunities on a worldwide basis and that our investment strategies are not constrained by the countries or regions in which companies are located. Under normal market conditions, the fund intends to invest in at least five different countries and at least 40% of its net assets in securities of foreign companies (or, if less, at least the percentage of net assets that is 10% less than the percentage of the fund’s benchmark represented by foreign companies, as determined by the providers of the benchmark). | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Risks | ||||||||||||||||||||||||||||||||||||||||||||||||||

| It is important to understand that you can lose money by investing in the fund. The value of stocks in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including general financial market conditions, changing market perceptions, changes in government intervention in the financial markets, and factors related to a specific issuer or industry. These and other factors may lead to increased volatility and reduced liquidity in the fund’s portfolio holdings. Growth stocks may be more susceptible to earnings disappointments, and value stocks may fail to rebound. These risks are generally greater for small and midsize companies. The health care industries may be affected by technological obsolescence, changes in regulatory approval policies for drugs, medical devices or procedures and changes in governmental and private payment systems. Our policy of concentrating on a limited group of industries and the fund’s “non-diversified” status, which means the fund may invest a greater percentage of its assets in fewer issuers than a “diversified fund,” can increase the fund’s vulnerability to adverse developments affecting a single industry or issuer, which may result in greater losses and volatility for the fund. The value of international investments traded in foreign currencies may be adversely impacted by fluctuations in exchange rates. International investments, particularly investments in emerging markets, may carry risks associated with potentially less stable economies or governments (such as the risk of seizure by a foreign government, the imposition of currency or other restrictions, or high levels of inflation), and may be illiquid. Our use of derivatives may increase the risks of investing in the fund by increasing investment exposure (which may be considered leverage) or, in the case of many over-the-counter instruments, because of the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations. Our use of short selling may result in losses if the securities appreciate in value. The fund may not achieve its goal, and it is not intended to be a complete investment program. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Performance | ||||||||||||||||||||||||||||||||||||||||||||||||||

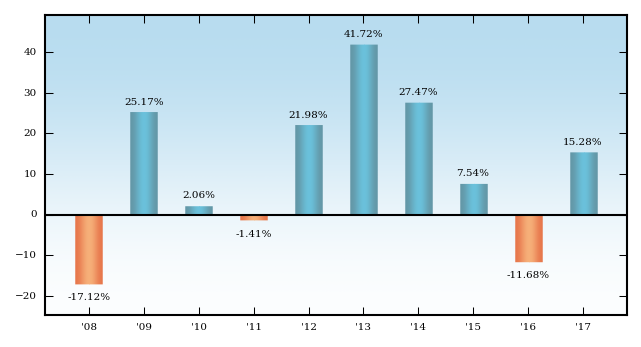

| The performance information below gives some indication of the risks associated with an investment in the fund by showing the fund’s performance year to year and over time. The bar chart does not reflect the impact of sales charges. If it did, performance would be lower. Please remember that past performance is not necessarily an indication of future results. Monthly performance figures for the fund are available at putnam.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual total returns for class A shares before sales charges | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| Year-to-date performance through 9/30/18 10.88% Best calendar quarter Q1 2013 13.14% Worst calendar quarter Q3 2011 −17.98% | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Average annual total returns after sales charges (for periods ended 12/31/17) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| After-tax returns reflect the historical highest individual federal marginal income tax rates and do not reflect state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are shown for class A shares only and will vary for other classes. These after-tax returns do not apply if you hold your fund shares through a 401(k) plan, an IRA, or another tax-advantaged arrangement.

Class B share performance reflects conversion to class A shares after eight years. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Label | Element | Value | ||||||

|---|---|---|---|---|---|---|---|---|

| Risk Return Abstract | rr_RiskReturnAbstract | |||||||

| Document Type | dei_DocumentType | 485BPOS | ||||||

| Document Period End Date | dei_DocumentPeriodEndDate | Dec. 31, 2017 | ||||||

| Registrant Name | dei_EntityRegistrantName | PUTNAM GLOBAL HEALTH CARE FUND | ||||||

| Central Index Key | dei_EntityCentralIndexKey | 0000357295 | ||||||

| Amendment Flag | dei_AmendmentFlag | false | ||||||

| Trading Symbol | dei_TradingSymbol | PHSTX | ||||||

| Document Creation Date | dei_DocumentCreationDate | Dec. 27, 2018 | ||||||

| Document Effective Date | dei_DocumentEffectiveDate | Dec. 30, 2018 | ||||||

| Prospectus Date | rr_ProspectusDate | Dec. 30, 2018 | ||||||

| Putnam Global Health Care Fund | ||||||||

| Risk Return Abstract | rr_RiskReturnAbstract | |||||||

| Risk/Return [Heading] | rr_RiskReturnHeading | Fund Summary | ||||||

| Objective [Heading] | rr_ObjectiveHeading | Goal | ||||||

| Objective, Primary [Text Block] | rr_ObjectivePrimaryTextBlock | Putnam Global Health Care Fund seeks capital appreciation. | ||||||

| Expense [Heading] | rr_ExpenseHeading | Fees and expenses | ||||||

| Expense Narrative [Text Block] | rr_ExpenseNarrativeTextBlock | The following table describes the fees and expenses you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in Putnam funds. More information about these and other discounts is available from your financial advisor and in How do I buy fund shares? beginning on page 50 of the fund's prospectus, in the Appendix to the fund's prospectus, and in How to buy shares beginning on page II-1 of the fund's statement of additional information (SAI). | ||||||

| Shareholder Fees Caption [Text] | rr_ShareholderFeesCaption | Shareholder fees (fees paid directly from your investment) | ||||||

| Operating Expenses Caption [Text] | rr_OperatingExpensesCaption | Annual fund operating expenses (expenses you pay each year as a percentage of the value of your investment) | ||||||

| Portfolio Turnover [Heading] | rr_PortfolioTurnoverHeading | Portfolio turnover | ||||||

| Portfolio Turnover [Text Block] | rr_PortfolioTurnoverTextBlock | The fund pays transaction-related costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher turnover rate may indicate higher transaction costs and may result in higher taxes when the fund’s shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or the above example, affect fund performance. The fund’s turnover rate in the most recent fiscal year was 49%. | ||||||

| Portfolio Turnover, Rate | rr_PortfolioTurnoverRate | 49.00% | ||||||

| Expense Breakpoint Discounts [Text] | rr_ExpenseBreakpointDiscounts | You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in Putnam funds. More information about these and other discounts is available from your financial advisor and in How do I buy fund shares? beginning on page 50 of the fund's prospectus, in the Appendix to the fund's prospectus, and in How to buy shares beginning on page II-1 of the fund's statement of additional information (SAI). | ||||||

| Expense Breakpoint, Minimum Investment Required [Amount] | rr_ExpenseBreakpointMinimumInvestmentRequiredAmount | $ 50,000 | ||||||

| Expense Example [Heading] | rr_ExpenseExampleHeading | Example | ||||||

| Expense Example Narrative [Text Block] | rr_ExpenseExampleNarrativeTextBlock | The following hypothetical example is intended to help you compare the cost of investing in the fund with the cost of investing in other funds. It assumes that you invest $10,000 in the fund for the time periods indicated and then, except as indicated, redeem all your shares at the end of those periods. It assumes a 5% return on your investment each year and that the fund’s operating expenses remain the same. Your actual costs may be higher or lower. | ||||||

| Strategy [Heading] | rr_StrategyHeading | Investments, risks, and performance Investments | ||||||

| Strategy Narrative [Text Block] | rr_StrategyNarrativeTextBlock | Investments For this non-diversified fund concentrating in the health care industries, we invest mainly in common stocks (growth or value stocks or both) of large and midsize companies worldwide that we believe have favorable investment potential. Under normal circumstances, we invest at least 80% of the fund’s net assets in securities of companies in the health care industries. This policy may be changed only after 60 days’ notice to shareholders. Potential investments include companies that manufacture health care supplies or provide health care-related services, and companies in the research, development, production and marketing of pharmaceuticals and biotechnology products. We may purchase stocks of companies with stock prices that reflect a value lower than that which we place on the company. We may also consider other factors that we believe will cause the stock price to rise. We may consider, among other factors, a company’s valuation, financial strength, growth potential, competitive position in its industry, projected future earnings, cash flows and dividends when deciding whether to buy or sell investments. We may also use derivatives, such as futures, options, certain foreign currency transactions, warrants and swap contracts, for both hedging and non-hedging purposes, and may engage in short sales of securities. The use of the term “global” in the fund’s name is meant to emphasize that we look for investment opportunities on a worldwide basis and that our investment strategies are not constrained by the countries or regions in which companies are located. Under normal market conditions, the fund intends to invest in at least five different countries and at least 40% of its net assets in securities of foreign companies (or, if less, at least the percentage of net assets that is 10% less than the percentage of the fund’s benchmark represented by foreign companies, as determined by the providers of the benchmark). |

||||||

| Risk [Heading] | rr_RiskHeading | Risks | ||||||

| Risk Narrative [Text Block] | rr_RiskNarrativeTextBlock | It is important to understand that you can lose money by investing in the fund. The value of stocks in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including general financial market conditions, changing market perceptions, changes in government intervention in the financial markets, and factors related to a specific issuer or industry. These and other factors may lead to increased volatility and reduced liquidity in the fund’s portfolio holdings. Growth stocks may be more susceptible to earnings disappointments, and value stocks may fail to rebound. These risks are generally greater for small and midsize companies. The health care industries may be affected by technological obsolescence, changes in regulatory approval policies for drugs, medical devices or procedures and changes in governmental and private payment systems. Our policy of concentrating on a limited group of industries and the fund’s “non-diversified” status, which means the fund may invest a greater percentage of its assets in fewer issuers than a “diversified fund,” can increase the fund’s vulnerability to adverse developments affecting a single industry or issuer, which may result in greater losses and volatility for the fund. The value of international investments traded in foreign currencies may be adversely impacted by fluctuations in exchange rates. International investments, particularly investments in emerging markets, may carry risks associated with potentially less stable economies or governments (such as the risk of seizure by a foreign government, the imposition of currency or other restrictions, or high levels of inflation), and may be illiquid. Our use of derivatives may increase the risks of investing in the fund by increasing investment exposure (which may be considered leverage) or, in the case of many over-the-counter instruments, because of the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations. Our use of short selling may result in losses if the securities appreciate in value. The fund may not achieve its goal, and it is not intended to be a complete investment program. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. |

||||||

| Risk Lose Money [Text] | rr_RiskLoseMoney | It is important to understand that you can lose money by investing in the fund. | ||||||

| Risk Nondiversified Status [Text] | rr_RiskNondiversifiedStatus | Our policy of concentrating on a limited group of industries and the fund's "non-diversified" status, which means the fund may invest a greater percentage of its assets in fewer issuers than a "diversified fund," can increase the fund's vulnerability to adverse developments affecting a single industry or issuer, which may result in greater losses and volatility for the fund. | ||||||

| Risk Not Insured Depository Institution [Text] | rr_RiskNotInsuredDepositoryInstitution | An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. | ||||||

| Bar Chart and Performance Table [Heading] | rr_BarChartAndPerformanceTableHeading | Performance | ||||||

| Performance Narrative [Text Block] | rr_PerformanceNarrativeTextBlock | The performance information below gives some indication of the risks associated with an investment in the fund by showing the fund’s performance year to year and over time. The bar chart does not reflect the impact of sales charges. If it did, performance would be lower. Please remember that past performance is not necessarily an indication of future results. Monthly performance figures for the fund are available at putnam.com. | ||||||

| Performance Information Illustrates Variability of Returns [Text] | rr_PerformanceInformationIllustratesVariabilityOfReturns | The performance information below gives some indication of the risks associated with an investment in the fund by showing the fund’s performance year to year and over time. | ||||||

| Performance Availability Website Address [Text] | rr_PerformanceAvailabilityWebSiteAddress | putnam.com | ||||||

| Performance Past Does Not Indicate Future [Text] | rr_PerformancePastDoesNotIndicateFuture | Please remember that past performance is not necessarily an indication of future results. | ||||||

| Bar Chart [Heading] | rr_BarChartHeading | Annual total returns for class A shares before sales charges | ||||||

| Bar Chart Does Not Reflect Sales Loads [Text] | rr_BarChartDoesNotReflectSalesLoads | The bar chart does not reflect the impact of sales charges. If it did, performance would be lower. | ||||||

| Bar Chart Closing [Text Block] | rr_BarChartClosingTextBlock | Year-to-date performance through 9/30/18 10.88% Best calendar quarter Q1 2013 13.14% Worst calendar quarter Q3 2011 −17.98% |

||||||

| Year to Date Return, Label | rr_YearToDateReturnLabel | Year-to-date performance through | ||||||

| Bar Chart, Year to Date Return, Date | rr_BarChartYearToDateReturnDate | Sep. 30, 2018 | ||||||

| Bar Chart, Year to Date Return | rr_BarChartYearToDateReturn | 10.88% | ||||||

| Highest Quarterly Return, Label | rr_HighestQuarterlyReturnLabel | Best calendar quarter | ||||||

| Highest Quarterly Return, Date | rr_BarChartHighestQuarterlyReturnDate | Mar. 31, 2013 | ||||||

| Highest Quarterly Return | rr_BarChartHighestQuarterlyReturn | 13.14% | ||||||

| Lowest Quarterly Return, Label | rr_LowestQuarterlyReturnLabel | Worst calendar quarter | ||||||

| Lowest Quarterly Return, Date | rr_BarChartLowestQuarterlyReturnDate | Sep. 30, 2011 | ||||||

| Lowest Quarterly Return | rr_BarChartLowestQuarterlyReturn | (17.98%) | ||||||

| Performance Table Heading | rr_PerformanceTableHeading | Average annual total returns after sales charges (for periods ended 12/31/17) | ||||||

| Performance Table Uses Highest Federal Rate | rr_PerformanceTableUsesHighestFederalRate | After-tax returns reflect the historical highest individual federal marginal income tax rates and do not reflect state and local taxes. | ||||||

| Performance Table Not Relevant to Tax Deferred | rr_PerformanceTableNotRelevantToTaxDeferred | Actual after-tax returns depend on an investor's tax situation and may differ from those shown. | ||||||

| Performance Table One Class of after Tax Shown [Text] | rr_PerformanceTableOneClassOfAfterTaxShown | After-tax returns are shown for class A shares only and will vary for other classes. | ||||||

| Performance Table Closing [Text Block] | rr_PerformanceTableClosingTextBlock | After-tax returns reflect the historical highest individual federal marginal income tax rates and do not reflect state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are shown for class A shares only and will vary for other classes. These after-tax returns do not apply if you hold your fund shares through a 401(k) plan, an IRA, or another tax-advantaged arrangement.

Class B share performance reflects conversion to class A shares after eight years. |

||||||

| Putnam Global Health Care Fund | Class A | ||||||||

| Risk Return Abstract | rr_RiskReturnAbstract | |||||||

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice | 5.75% | ||||||

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) | rr_MaximumDeferredSalesChargeOverOther | 1.00% | [1] | |||||

| Management fees | rr_ManagementFeesOverAssets | 0.62% | ||||||

| Distribution and service (12b-1) fees | rr_DistributionAndService12b1FeesOverAssets | 0.25% | ||||||

| Other expenses | rr_OtherExpensesOverAssets | 0.21% | ||||||

| Total annual fund operating expenses | rr_ExpensesOverAssets | 1.08% | ||||||

| Expense Example, with Redemption, 1 Year | rr_ExpenseExampleYear01 | $ 679 | ||||||

| Expense Example, with Redemption, 3 Years | rr_ExpenseExampleYear03 | 899 | ||||||

| Expense Example, with Redemption, 5 Years | rr_ExpenseExampleYear05 | 1,136 | ||||||

| Expense Example, with Redemption, 10 Years | rr_ExpenseExampleYear10 | $ 1,816 | ||||||

| Annual Return 2008 | rr_AnnualReturn2008 | (17.12%) | ||||||

| Annual Return 2009 | rr_AnnualReturn2009 | 25.17% | ||||||

| Annual Return 2010 | rr_AnnualReturn2010 | 2.06% | ||||||

| Annual Return 2011 | rr_AnnualReturn2011 | (1.41%) | ||||||

| Annual Return 2012 | rr_AnnualReturn2012 | 21.98% | ||||||

| Annual Return 2013 | rr_AnnualReturn2013 | 41.72% | ||||||

| Annual Return 2014 | rr_AnnualReturn2014 | 27.47% | ||||||

| Annual Return 2015 | rr_AnnualReturn2015 | 7.54% | ||||||

| Annual Return 2016 | rr_AnnualReturn2016 | (11.68%) | ||||||

| Annual Return 2017 | rr_AnnualReturn2017 | 15.28% | ||||||

| Label | rr_AverageAnnualReturnLabel | before taxes | ||||||

| 1 Year | rr_AverageAnnualReturnYear01 | 8.65% | ||||||

| 5 Years | rr_AverageAnnualReturnYear05 | 13.26% | ||||||

| 10 Years | rr_AverageAnnualReturnYear10 | 9.03% | ||||||

| Putnam Global Health Care Fund | Class B | ||||||||

| Risk Return Abstract | rr_RiskReturnAbstract | |||||||

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice | none | ||||||

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) | rr_MaximumDeferredSalesChargeOverOther | 5.00% | [2] | |||||

| Management fees | rr_ManagementFeesOverAssets | 0.62% | ||||||

| Distribution and service (12b-1) fees | rr_DistributionAndService12b1FeesOverAssets | 1.00% | ||||||

| Other expenses | rr_OtherExpensesOverAssets | 0.21% | ||||||

| Total annual fund operating expenses | rr_ExpensesOverAssets | 1.83% | ||||||

| Expense Example, with Redemption, 1 Year | rr_ExpenseExampleYear01 | $ 686 | ||||||

| Expense Example, with Redemption, 3 Years | rr_ExpenseExampleYear03 | 876 | ||||||

| Expense Example, with Redemption, 5 Years | rr_ExpenseExampleYear05 | 1,190 | ||||||

| Expense Example, with Redemption, 10 Years | rr_ExpenseExampleYear10 | 1,951 | ||||||

| Expense Example, No Redemption, 1 Year | rr_ExpenseExampleNoRedemptionYear01 | 186 | ||||||

| Expense Example, No Redemption, 3 Years | rr_ExpenseExampleNoRedemptionYear03 | 576 | ||||||

| Expense Example, No Redemption, 5 Years | rr_ExpenseExampleNoRedemptionYear05 | 990 | ||||||

| Expense Example, No Redemption, 10 Years | rr_ExpenseExampleNoRedemptionYear10 | $ 1,951 | ||||||

| Label | rr_AverageAnnualReturnLabel | before taxes | ||||||

| 1 Year | rr_AverageAnnualReturnYear01 | 9.94% | ||||||

| 5 Years | rr_AverageAnnualReturnYear05 | 13.56% | ||||||

| 10 Years | rr_AverageAnnualReturnYear10 | 9.02% | ||||||

| Putnam Global Health Care Fund | Class C | ||||||||

| Risk Return Abstract | rr_RiskReturnAbstract | |||||||

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice | none | ||||||

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) | rr_MaximumDeferredSalesChargeOverOther | 1.00% | [3] | |||||

| Management fees | rr_ManagementFeesOverAssets | 0.62% | ||||||

| Distribution and service (12b-1) fees | rr_DistributionAndService12b1FeesOverAssets | 1.00% | ||||||

| Other expenses | rr_OtherExpensesOverAssets | 0.21% | ||||||

| Total annual fund operating expenses | rr_ExpensesOverAssets | 1.83% | ||||||

| Expense Example, with Redemption, 1 Year | rr_ExpenseExampleYear01 | $ 286 | ||||||

| Expense Example, with Redemption, 3 Years | rr_ExpenseExampleYear03 | 576 | ||||||

| Expense Example, with Redemption, 5 Years | rr_ExpenseExampleYear05 | 990 | ||||||

| Expense Example, with Redemption, 10 Years | rr_ExpenseExampleYear10 | 2,148 | ||||||

| Expense Example, No Redemption, 1 Year | rr_ExpenseExampleNoRedemptionYear01 | 186 | ||||||

| Expense Example, No Redemption, 3 Years | rr_ExpenseExampleNoRedemptionYear03 | 576 | ||||||

| Expense Example, No Redemption, 5 Years | rr_ExpenseExampleNoRedemptionYear05 | 990 | ||||||

| Expense Example, No Redemption, 10 Years | rr_ExpenseExampleNoRedemptionYear10 | $ 2,148 | ||||||

| Label | rr_AverageAnnualReturnLabel | before taxes | ||||||

| 1 Year | rr_AverageAnnualReturnYear01 | 13.46% | ||||||

| 5 Years | rr_AverageAnnualReturnYear05 | 13.75% | ||||||

| 10 Years | rr_AverageAnnualReturnYear10 | 8.85% | ||||||

| Putnam Global Health Care Fund | Class M | ||||||||

| Risk Return Abstract | rr_RiskReturnAbstract | |||||||

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice | 3.50% | ||||||

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) | rr_MaximumDeferredSalesChargeOverOther | none | ||||||

| Management fees | rr_ManagementFeesOverAssets | 0.62% | ||||||

| Distribution and service (12b-1) fees | rr_DistributionAndService12b1FeesOverAssets | 0.75% | ||||||

| Other expenses | rr_OtherExpensesOverAssets | 0.21% | ||||||

| Total annual fund operating expenses | rr_ExpensesOverAssets | 1.58% | ||||||

| Expense Example, with Redemption, 1 Year | rr_ExpenseExampleYear01 | $ 505 | ||||||

| Expense Example, with Redemption, 3 Years | rr_ExpenseExampleYear03 | 831 | ||||||

| Expense Example, with Redemption, 5 Years | rr_ExpenseExampleYear05 | 1,180 | ||||||

| Expense Example, with Redemption, 10 Years | rr_ExpenseExampleYear10 | $ 2,163 | ||||||

| Label | rr_AverageAnnualReturnLabel | before taxes | ||||||

| 1 Year | rr_AverageAnnualReturnYear01 | 10.70% | ||||||

| 5 Years | rr_AverageAnnualReturnYear05 | 13.24% | ||||||

| 10 Years | rr_AverageAnnualReturnYear10 | 8.74% | ||||||

| Putnam Global Health Care Fund | Class R | ||||||||

| Risk Return Abstract | rr_RiskReturnAbstract | |||||||

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice | none | ||||||

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) | rr_MaximumDeferredSalesChargeOverOther | none | ||||||

| Management fees | rr_ManagementFeesOverAssets | 0.62% | ||||||

| Distribution and service (12b-1) fees | rr_DistributionAndService12b1FeesOverAssets | 0.50% | ||||||

| Other expenses | rr_OtherExpensesOverAssets | 0.21% | ||||||

| Total annual fund operating expenses | rr_ExpensesOverAssets | 1.33% | ||||||

| Expense Example, with Redemption, 1 Year | rr_ExpenseExampleYear01 | $ 135 | ||||||

| Expense Example, with Redemption, 3 Years | rr_ExpenseExampleYear03 | 421 | ||||||

| Expense Example, with Redemption, 5 Years | rr_ExpenseExampleYear05 | 729 | ||||||

| Expense Example, with Redemption, 10 Years | rr_ExpenseExampleYear10 | $ 1,601 | ||||||

| Label | rr_AverageAnnualReturnLabel | before taxes | ||||||

| 1 Year | rr_AverageAnnualReturnYear01 | 14.95% | ||||||

| 5 Years | rr_AverageAnnualReturnYear05 | 14.32% | ||||||

| 10 Years | rr_AverageAnnualReturnYear10 | 9.40% | ||||||

| Putnam Global Health Care Fund | Class Y | ||||||||

| Risk Return Abstract | rr_RiskReturnAbstract | |||||||

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice | none | ||||||

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) | rr_MaximumDeferredSalesChargeOverOther | none | ||||||

| Management fees | rr_ManagementFeesOverAssets | 0.62% | ||||||

| Other expenses | rr_OtherExpensesOverAssets | 0.21% | ||||||

| Total annual fund operating expenses | rr_ExpensesOverAssets | 0.83% | ||||||

| Expense Example, with Redemption, 1 Year | rr_ExpenseExampleYear01 | $ 85 | ||||||

| Expense Example, with Redemption, 3 Years | rr_ExpenseExampleYear03 | 265 | ||||||

| Expense Example, with Redemption, 5 Years | rr_ExpenseExampleYear05 | 460 | ||||||

| Expense Example, with Redemption, 10 Years | rr_ExpenseExampleYear10 | $ 1,025 | ||||||

| Label | rr_AverageAnnualReturnLabel | before taxes | ||||||

| 1 Year | rr_AverageAnnualReturnYear01 | 15.55% | ||||||

| 5 Years | rr_AverageAnnualReturnYear05 | 14.90% | ||||||

| 10 Years | rr_AverageAnnualReturnYear10 | 9.95% | ||||||

| Putnam Global Health Care Fund | after taxes on distributions | Class A | ||||||||

| Risk Return Abstract | rr_RiskReturnAbstract | |||||||

| 1 Year | rr_AverageAnnualReturnYear01 | 4.83% | ||||||

| 5 Years | rr_AverageAnnualReturnYear05 | 10.16% | ||||||

| 10 Years | rr_AverageAnnualReturnYear10 | 6.88% | ||||||

| Putnam Global Health Care Fund | after taxes on distributions and sale of fund shares | Class A | ||||||||

| Risk Return Abstract | rr_RiskReturnAbstract | |||||||

| 1 Year | rr_AverageAnnualReturnYear01 | 8.04% | ||||||

| 5 Years | rr_AverageAnnualReturnYear05 | 10.25% | ||||||

| 10 Years | rr_AverageAnnualReturnYear10 | 7.03% | ||||||

| Putnam Global Health Care Fund | MSCI World Health Care Index (ND) (no deduction for fees, expenses or taxes) | ||||||||

| Risk Return Abstract | rr_RiskReturnAbstract | |||||||

| 1 Year | rr_AverageAnnualReturnYear01 | 19.80% | ||||||

| 5 Years | rr_AverageAnnualReturnYear05 | 13.88% | ||||||

| 10 Years | rr_AverageAnnualReturnYear10 | 8.94% | ||||||

| ||||||||