DELAWARE STRATEGIC INCOME II FUND

DELAWARE FLOATING RATE II FUND

DELAWARE LIMITED DURATION BOND FUND

100 Independence, 610 Market Street

Philadelphia, Pennsylvania 19106-2354

800 523-1918

IMPORTANT SHAREHOLDER INFORMATION

This Prospectus/Information Statement is being provided to inform you that each of Delaware Strategic Income II Fund, Delaware Floating Rate II Fund, and Delaware Limited Duration Bond Fund (each, an Acquired Fund and together, the Acquired Funds) will each be reorganized with and into other funds (each, an Acquiring Fund and together, the Acquiring Funds), as follows (each, a Reorganization and together, the Reorganizations), on or about Sept. 17, 2021 (Reorganization Date):

| Acquired Funds | Acquiring Funds |

| Delaware Strategic Income II Fund, a series of Delaware Group® Equity Funds IV |

Delaware Strategic Income Fund, a series of Delaware Group Government Fund |

| Delaware Floating Rate II Fund, a series of Delaware Group Equity Funds IV |

Delaware Floating Rate Fund, a series of Delaware Group Income Funds |

| Delaware Limited Duration Bond Fund, a series of Delaware Group Equity Funds IV |

Delaware Limited-Term Diversified Income Fund, a series of Delaware Group Limited- Term Government Funds |

The Prospectus/Information Statement discusses the Reorganizations and provides you with information that you should consider. The Board of Trustees of Delaware Group Equity Funds IV (Acquired Trust) approved the Reorganizations and concluded that each Reorganization is in the best interests of each Acquired Fund and its shareholders.

Please review the information in the Prospectus/Information Statement. You do not need to take any action regarding your account because no shareholder vote is required. On the Reorganization Date, your shares of the Acquired Fund(s) will be converted automatically at net asset value into shares of the corresponding class of the related Acquiring Fund.

The investment objectives, strategies, and risks of each Acquired Fund are similar, but also differ in certain respects, from those of the related Acquiring Fund. The enclosed Prospectus/Information Statement provides important information regarding such differences, as well as similarities, that shareholders should consider in determining whether an investment in the Acquiring Fund(s) is appropriate for them. Shareholders may redeem their shares of an Acquired Fund at any time prior to the closing of the relevant Reorganization (or shares of the Acquiring Fund received as part of the Reorganization). No contingent deferred sales charge will be assessed in connection with any redemption of your shares of an Acquired Fund prior to the Reorganization.

If you have any questions, please call 800 523-1918.

PROSPECTUS/INFORMATION STATEMENT

TABLE OF CONTENTS

| THE REORGANIZATIONS | 3 | |

| COMPARISON OF INVESTMENT OBJECTIVES, STRATEGIES, RISKS, AND INVESTMENT RESTRICTIONS | 3 | |

| How do the investment objectives, principal strategies, principal risks, and fundamental investment restrictions of the Acquired Funds compare against those of the Acquiring Funds? | 3 | |

| INFORMATION ABOUT THE FUNDS | 24 | |

| What are the fees and expenses of each Fund and what are the anticipated fees and expenses after the Reorganization? | 24 | |

| How can I compare the costs of investing in Acquired Fund shares with the cost of investing in Acquiring Fund shares of the comparable class? | 27 | |

| What are the general tax consequences of the Reorganizations? | 29 | |

| Who manages the Funds? | 29 | |

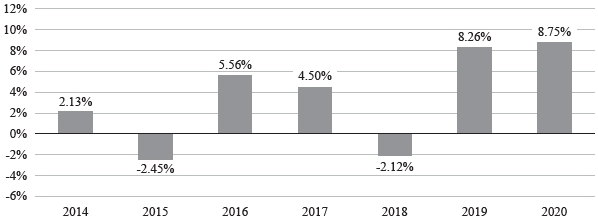

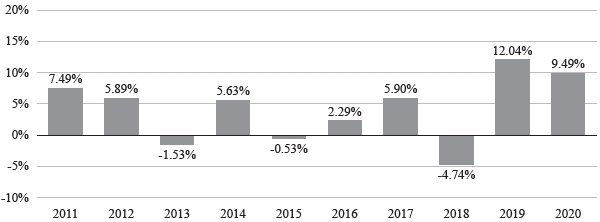

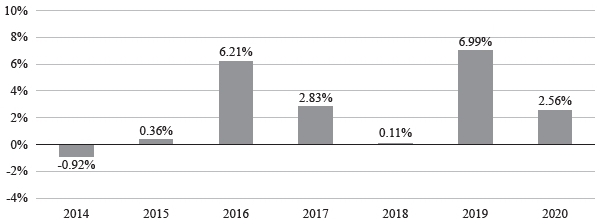

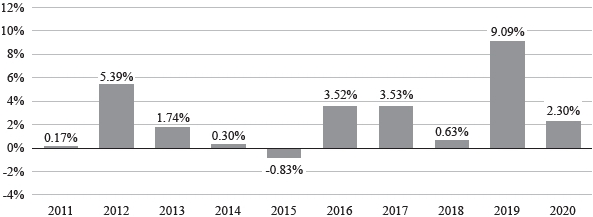

| How do the performance records of the Funds compare? | 31 | |

| Where can I find more financial information about the Funds? | 38 | |

| What are other key features of the Funds? | 39 | |

| REASONS FOR THE REORGANIZATIONS | 59 | |

| INFORMATION ABOUT THE REORGANIZATIONS AND THE PLAN | 60 | |

| How will the Reorganizations be carried out? | 60 | |

| Who will pay the expenses of the Reorganization? | 60 | |

| What are the tax consequences of each Reorganization? | 61 | |

| What should I know about shares of the Acquired Fund and Acquiring Fund? | 64 | |

| What are the capitalizations of the Funds and what might the capitalization be after the Reorganizations? | 65 | |

| Do the Trustees and Officers own shares of the Funds? | 68 | |

| Who are the control persons and owners of record or beneficially 5% or more of any class of a Fund’s outstanding equity securities? | 68 | |

| MORE INFORMATION ABOUT THE FUNDS | 76 | |

| EXHIBITS TO PROSPECTUS/INFORMATION STATEMENT | 78 |

DELAWARE STRATEGIC INCOME II FUND

DELAWARE FLOATING RATE II FUND

DELAWARE LIMITED DURATION BOND FUND

100 Independence, 610 Market Street

Philadelphia, Pennsylvania 19106-2354

800 523-1918

PROSPECTUS/INFORMATION STATEMENT

Dated Aug. 3, 2021

|

Acquisition of the Assets of: |

|

Acquisition of the Assets of: |

|

Acquisition of the Assets of: |

This Prospectus/Information Statement is being furnished to shareholders of Delaware Strategic Income II Fund, Delaware Floating Rate II Fund, and Delaware Limited Duration Bond Fund (each, an Acquired Fund and together, the Acquired Funds). Each Acquired Fund is a series of Delaware Group Equity Funds IV (Acquired Trust) Each of the Acquired Funds will be reorganized into its corresponding Delaware Funds by Macquarie fund as indicated below (each an Acquiring Fund and together the Acquiring Funds), on or about Sept. 17, 2021 (Reorganization Date):

| Acquired Funds | Acquiring Funds |

| Delaware Strategic Income II Fund, a series of Delaware Group Equity Funds IV |

Delaware Strategic Income Fund, a series of Delaware Group Government Fund |

| Delaware Floating Rate II Fund, a series of Delaware Group Equity Funds IV |

Delaware Floating Rate Fund, a series of Delaware Group Income Funds |

| Delaware Limited Duration Bond Fund, a series of Delaware Group Equity Funds IV |

Delaware Limited-Term Diversified Income Fund, a series of Delaware Group Limited- Term Government Funds |

Delaware Group Government Fund, Delaware Group Income Funds, and Delaware Group Limited-Term Government Funds are each referred to individually as the “Acquiring Trust” and together as the “Acquiring Trusts.” The Acquired Funds and Acquiring Funds together are referred to as the “Funds.”

Pursuant to an Agreement and Plan of Reorganization (the Plan): (i) all of the property, assets, and goodwill (Assets) of each Acquired Fund will be acquired by the corresponding Acquiring Fund, and (ii) each Acquiring Trust, on behalf of the corresponding Acquiring Fund, will assume the liabilities of the Acquired Fund, in exchange for shares of the Acquiring Fund. According to the Plan, each Acquired Fund will be liquidated and dissolved following the Reorganization. The Boards of Trustees of the Acquired Trust and the Acquiring Trusts (each, a Board and together, the Boards) have approved the Plan and each Reorganization. Shareholders of the Acquired Funds are not required to and are not being asked to approve the Plan or the Reorganizations. Pursuant to the Plan, holders of Class A, Class R6, and Institutional Class shares of each Acquired Fund will receive the equivalent aggregate net asset value of Class A, Class R6, and Institutional Class shares, respectively, of the Acquiring Fund. Each Acquiring Fund will be the accounting survivor of the related Reorganization.

Each Fund is a diversified series of its respective trust. Delaware Management Company (DMC or the Manager), a series of Macquarie Investment Management Business Trust (a Delaware statutory trust) serves as the primary investment advisor for the Funds.

This Prospectus/Information Statement sets forth the information that you should know about the Reorganizations. You should retain this Prospectus/Information Statement for future reference. A Statement of Additional Information dated Aug. 3, 2021 (the Statement of Additional Information), relating to this Prospectus/ Information Statement, contains additional information about the Acquiring Funds and the Reorganizations, and has been filed with the U.S. Securities and Exchange Commission (the SEC) and is incorporated herein by reference.

The prospectuses of the Acquiring Funds (the Acquiring Fund Prospectuses) are intended to provide you with information about each Acquiring Fund. The prospectuses of the Acquired Funds (the Acquired Fund Prospectus) provide additional information about the Acquired Funds and are incorporated herein by reference. Relevant information about the Acquired Fund Prospectus and Acquiring Fund Prospectuses are as follows:

| Acquired Fund Prospectuses | Acquiring Fund Prospectuses |

| Delaware Strategic Income II Fund – dated Jan. 28, 2021 (1933 Act File No. 033-00442) |

Delaware Strategic Income Fund – dated Nov. 27, 2020 (1933 Act File No. 002-97889) |

| Delaware Floating Rate II Fund – dated Jan. 28, 2021 (1933 Act File No. 033-00442) |

Delaware Floating Rate Fund – dated Nov. 27, |

| Delaware Limited Duration Bond Fund – dated Jan. 28, 2021 (1933 Act File No. 033-00442) |

Delaware Limited-Term Diversified Income Fund – dated April 30, 2021 (1933 Act File No. 002-75526) |

You can request a free copy of any of the Funds’ Prospectuses, Statements of Additional Information (SAIs), Annual Reports, or Semiannual Reports by calling 800 523-1918 or by writing to the Funds c/o Delaware Funds by Macquarie, P.O. Box 9876, Providence, RI 02940-8076 (regular mail) or c/o Delaware Funds® by Macquarie Service Center, 4400 Computer Drive, Westborough, MA 01581-1722 (overnight courier service).

Additional information about each Acquiring Fund can be viewed online or downloaded from the EDGAR database without charge on the SEC’s internet site at www.sec.gov.

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The SEC has not approved or disapproved these securities or passed upon the adequacy of this Prospectus/Information Statement. Any representation to the contrary is a criminal offense.

2

THE REORGANIZATIONS

At a meeting held on May 26-27, 2021, the Boards, including a majority of the Trustees who are not “interested persons” (as defined by the Investment Company Act of 1940 (the 1940 Act)) (the Independent Trustees), on behalf of each of the Funds, considered the proposal to reorganize each Acquired Fund with and into the corresponding Acquiring Fund, and approved the Plan.

The Reorganizations will result in your Acquired Fund shares being exchanged for Acquiring Fund shares equal in value (but having a different price per share) to your shares of the Acquired Fund(s). In particular, shareholders of Class A, Class R6, and Institutional Class shares of each Acquired Fund will receive the equivalent aggregate net asset value of Class A, Class R6, and Institutional Class shares, respectively, of the Acquiring Fund. This means that you will cease to be an Acquired Fund shareholder and will become an Acquiring Fund shareholder. This exchange will occur on a date agreed upon by the parties to the Plan (Reorganization Date), which is currently anticipated to occur on or around the Reorganization Date. Class A shareholders of the Acquired Funds, as applicable, will not be assessed sales charges, including any limited contingent deferred sales charge, for the exchange of their shares for Class A shares of the Acquiring Funds. As applicable, subsequent purchases of Class A shares of an Acquiring Fund will, however, be subject to applicable sales charges.

For the following reasons and the reasons set forth below under “Reasons for the Reorganization,” the Boards have determined that each Reorganization is in the best interests of each Acquired Fund and its corresponding Acquiring Fund. The Boards have also concluded that the interests of the existing shares of each Acquired Fund and the existing shares of each Acquiring Fund will not be diluted as a result of the Reorganizations. In making these determinations, the Boards noted the recommendation of Delaware Management Company, the Funds’ investment manager, and the fact that (i) each Acquiring Fund and its corresponding Acquired Fund share similar investment objectives, strategies and risks, and identical fundamental investment restrictions, (ii) each Acquiring Fund and its corresponding Acquired Fund have a high degree of portfolio holding overlap and the same portfolio management teams, which should minimize transaction costs due to the Reorganization; (iii) each Acquiring Fund’s net expenses will remain the same following the Reorganization, and, for each Acquired Fund, the Fund’s net expenses are expected to decrease, and the Reorganization will have the effect of reducing the net expense ratio for shareholders of the Acquired Funds; (iv) each Acquiring Fund’s assets will increase as a result of the Reorganization which may result in increased economies of scale and lower operating expenses for shareholders; and (v) the reduced number of substantially similar Funds should benefit distribution efforts and shelf space eligibility, amongst other reasons.

COMPARISON OF INVESTMENT OBJECTIVES, STRATEGIES, RISKS, AND INVESTMENT RESTRICTIONS

How do the investment objectives, principal strategies, principal risks, and fundamental investment restrictions of the Acquired Funds compare against those of the Acquiring Funds?

This section will help you compare the investment objectives, principal strategies, principal risks, and fundamental investment restrictions of the Acquired Funds and the Acquiring Funds. More complete information may be found in the Funds’ Prospectuses and SAIs. For a complete description of an Acquiring Fund’s investment objectives, strategies, and risks, you should read the Acquiring Fund Prospectus.

REORGANIZATION OF DELAWARE STRATEGIC INCOME II FUND INTO DELAWARE STRATEGIC INCOME FUND

Investment Objectives. The Acquired Fund and Acquiring Fund have similar, but not identical, principal investment objectives, as described in each of their Prospectuses, and included below. Each Fund’s investment objective is nonfundamental, and may be changed without shareholder approval.

| Delaware Strategic Income II Fund (Acquired Fund) |

Delaware Strategic Income Fund (Acquiring Fund) |

| What is the Fund’s investment objective? Delaware Strategic Income II Fund seeks a high level of current income. |

What is the Fund’s investment objective? Delaware Strategic Income Fund seeks high current income and, secondarily, long-term total return. |

3

Principal Investment Strategies. The Acquired Fund and Acquiring Fund have similar, but not identical, principal investment strategies, as described in each of their Prospectuses, and included below.

Each Fund is classified as “diversified” under applicable federal law and neither Fund will concentrate its investments in any one industry.

The investment strategies of the Funds are similar in some ways, but also differ in certain respects. The Funds have the same duration and maturity.

Under normal circumstances, the Manager will invest at least 80% of each Fund’s respective net assets, plus the amount of any borrowings for investment purposes, in US and foreign debt securities, including those in emerging markets (80% policy). Debt securities include all varieties of fixed, variable and floating rate income securities, including bonds, US and foreign government and agency securities, corporate loans (and loan participations), mortgage-backed securities and other asset-backed securities and convertible securities. The 80% policy of each Fund is nonfundamental and may be changed without shareholder approval. Fund shareholders would be given at least 60 days’ notice prior to any such change.

For each Fund, the Manager allocates investment among various sectors of debt securities and at any given time may have a substantial amount of its assets invested in any class of debt security. The relative proportion of the Fund’s respective assets are allocated among the following sectors: (i) US investment grade sector; (ii) high yield sector; and (iii) international sector. The Funds may invest up to 100% of its assets in any one sector at any time. The Manager will determine how much of the Funds’ assets to allocate to each of the various sectors based on its evaluation of economic and market conditions and its assessment of the yields and potential for appreciation that can be achieved from investments in each of the sectors. The Manager will periodically reallocate the Funds’ assets, as deemed appropriate.

Both Funds may invest up to 100% of their net assets in high yield, lower-quality debt securities (also known as “junk bonds”).

Both Funds may invest up to 100% of their net assets in foreign securities, including emerging markets securities. The Funds’ total non-US dollar currency exposure may reach 100% of net assets. Due to the manner in which the Funds are managed, they may be subject of a high rate of portfolio turnover. To the extent that the Funds invest internationally, both Funds share the same geographic focus and define emerging markets in the same manner.

Both Funds may hold a substantial portion of their assets in cash or short-term fixed income obligations in unusual market conditions to meet redemption requests, for temporary defensive purposes, and pending investment.

Both Funds may also use a wide range of derivatives instruments, typically including forward foreign currency contracts, options, futures contracts, options on futures contracts, and swaps. The Funds may use derivatives for both hedging and nonhedging purposes. For example, the Funds may invest in: futures and options to manage duration and for defensive purposes, such as to protect gains or hedge against potential losses in the portfolio without actually selling a security, or to stay fully invested; forward foreign currency contracts to manage foreign currency exposure; interest rate swaps to neutralize the impact of interest rate changes; credit default swaps to hedge against a credit event, to gain exposure to certain securities or markets, or to enhance total return; and index swaps to enhance return or to affect diversification.

Under normal circumstances, both Funds will invest at least 80% of the Funds’ assets, plus the amount of any borrowings for investment purposes, in US and foreign debt securities, including those in emerging markets. This 80% policy is nonfundamental and may be changed without shareholder approval. Fund shareholders would be given at least 60 days’ notice prior to any such change.

Both Funds may invest in asset-backed and mortgaged-backed securities.

Both Funds may invest in collateralized mortgage obligations (CMOs) and real estate mortgage investment conduits (REMICs). The Acquired Fund may invest without limit in CMOs and REMICs issued by private entities which are not collateralized by securities issued or guaranteed by the US government, its agencies or instrumentalities, so called nonagency mortgage-backed securities. Meanwhile, the Acquiring Fund may invest up to 20% of net assets in nonagency mortgaged-backed securities.

Both Funds may invest in other investment companies to the extent permitted by the 1940 Act. The Acquired Fund may invest in exchange-traded funds (ETFs) to gain exposure to stocks.

4

Both Funds may invest in privately placed securities, including those that are eligible for resale only among certain institutional buyers without registration, which are commonly known as “Rule 144A Securities.”

Each Fund may invest up to 15% of its net assets in illiquid investments.

Each Fund may hold a substantial portion of its assets in cash or short-term fixed income obligations in unusual market conditions to meet redemption requests, for temporary defensive purposes, and pending investment.

| Delaware Strategic Income II Fund (Acquired Fund) |

Delaware Strategic Income Fund (Acquiring Fund) |

| What are the Fund’s principal investment strategies? Under normal circumstances, the Fund’s investment manager, Delaware Management Company (Manager), will invest at least 80% of the Fund’s net assets, plus the amount of any borrowings for investment purposes, in US and foreign debt securities, including those in emerging markets (80% policy). Foreign debt securities are fixed income securities of issuers organized or having a majority of their assets or deriving a majority of their operating income in foreign countries. These fixed income securities include, but are not limited to, foreign government securities, debt obligations of foreign companies, and securities issued by supranational entities. Emerging market countries include those currently considered to be developing or emerging countries by the World Bank, the United Nations, or the countries’ governments. These countries typically are located in the Asia-Pacific region, Eastern Europe, the Middle East, Central America, South America, and Africa. Debt securities include all varieties of fixed, variable and floating rate income securities, including bonds, US and foreign government and agency securities, corporate loans (and loan participations), mortgage-backed securities and other asset-backed securities and convertible securities. To achieve the Fund’s investment objective, the Manager will allocate investments among various sectors of debt securities and at any given time may have a substantial amount of its assets invested in any class of debt security. In addition, the Manager may seek investment advice and recommendations from its affiliates: Macquarie Investment Management Europe Limited, Macquarie Investment Management Austria Kapitalanlage AG, and Macquarie Investment Management Global Limited (together, the “Affiliated Sub-Advisors”). The Manager may also permit these Affiliated Sub-Advisors to execute Fund security trades on behalf of the Manager and exercise investment discretion for securities in certain markets where the Manager believes it will be beneficial to utilize an Affiliated Sub-Advisor’s specialized market knowledge. |

What are the Fund’s principal investment strategies? Under normal circumstances, the Manager will invest at least 80% of the Fund’s net assets, plus the amount of any borrowings for investment purposes, in US and foreign debt securities, including those in emerging markets (80% policy). Debt securities include all varieties of fixed, variable and floating rate income securities, including bonds, US and foreign government and agency securities, corporate loans (and loan participations), mortgage-backed securities and other asset-backed securities and convertible securities. To achieve the Fund’s investment objective, the Manager will allocate investments among various sectors of debt securities and at any given time may have a substantial amount of its assets invested in any class of debt security. In addition, the Manager may seek investment advice and recommendations from its affiliates: Macquarie Investment Management Austria Kapitalanlage AG (MIMAK), Macquarie Investment Management Europe Limited (MIMEL), and Macquarie Investment Management Global Limited (MIMGL) (together, the “Affiliated Sub-Advisors”). The Manager may also permit these Affiliated Sub-Advisors to execute Fund security trades on behalf of the Manager and exercise investment discretion for securities in certain markets where the Manager believes it will be beneficial to utilize an Affiliated Sub-Advisor’s specialized market knowledge. The Fund may invest up to 100% of its net assets in high yield, lower-quality debt securities (also known as “junk bonds”). The Fund may invest up to 100% of its net assets in foreign securities, including emerging markets securities. The Fund’s total non-US dollar currency exposure may reach 100% of net assets. Due to the manner in which the Fund is managed, it may be subject to a high rate of portfolio turnover. |

5

| Delaware Strategic Income II Fund (Acquired Fund) |

Delaware Strategic Income Fund (Acquiring Fund) |

| The Fund may invest up to 100% of its net assets in high yield, lower-quality debt securities (also known as “junk bonds”). The Fund may invest up to 100% of its net assets in foreign securities, including emerging markets securities. The Fund’s total non-US dollar currency exposure may reach 100% of net assets. Due to the manner in which the Fund is managed, it may be subject to a high rate of portfolio turnover. The Fund may hold a substantial portion of its assets in cash or short-term fixed income obligations in unusual market conditions to meet redemption requests, for temporary defensive purposes, and pending investment. The Fund may also use a wide range of derivatives instruments, typically including forward foreign currency contracts, options, futures contracts, options on futures contracts, and swaps. The Fund may use derivatives for both hedging and nonhedging purposes. For example, the Fund may invest in: futures and options to manage duration and for defensive purposes, such as to protect gains or hedge against potential losses in the portfolio without actually selling a security, or to stay fully invested; forward foreign currency contracts to manage foreign currency exposure; interest rate swaps to neutralize the impact of interest rate changes; credit default swaps to hedge against a credit event, to gain exposure to certain securities or markets, or to enhance total return; and index swaps to enhance return or to affect diversification. The 80% policy is nonfundamental and may be changed without shareholder approval. Fund shareholders would be given at least 60 days’ notice prior to any such change. |

The Fund may hold a substantial portion of its assets in cash or short-term fixed income obligations in unusual market conditions to meet redemption requests, for temporary defensive purposes, and pending investment. The Fund may also use a wide range of derivatives instruments, typically including forward foreign currency contracts, options, futures contracts, options on futures contracts, and swaps. The Fund may use derivatives for both hedging and nonhedging purposes. For example, the Fund may invest in: futures and options to manage duration and for defensive purposes, such as to protect gains or hedge against potential losses in the portfolio without actually selling a security, or to stay fully invested; forward foreign currency contracts to manage foreign currency exposure; interest rate swaps to neutralize the impact of interest rate changes; credit default swaps to hedge against a credit event, to gain exposure to certain securities or markets, or to enhance total return; and index swaps to enhance return or to affect diversification. |

Principal Investment Risks. Investing in any mutual fund involves the risk that you may lose part or all of the money you invest. Over time, the value of your investment in a Fund will increase and decrease according to changes in the value of the securities in the Fund’s portfolio. An investment in the Fund may not be appropriate for all investors. Each Fund’s principal risks, as listed in their Prospectuses, are included below.

6

The principal investment risks for the Acquired Fund and Acquiring Fund are similar, but do have differences. Both Funds are subject to market risk, interest rate risk, high-yield (junk bond) risk, IBOR risk, credit risk, loans and other indebtedness risk, adjustable rate risk, foreign and emerging markets risk, derivatives risk, leveraging risk, mortgage-backed and asset-backed securities risk, prepayment risk, valuation risk, portfolio turnover risk, liquidity risk, and active management and selection risk. The Acquiring Fund is also subject to currency risk and government and regulatory risk. Even though the Acquired Fund and Acquiring Fund share many of the same types of risks, the degree of such risks may vary. Each Fund’s relative risk/return profile cannot be determined by the following risk descriptions and comparisons alone. However, the Acquired Fund and Acquiring Fund share a similar risk/return profile.

| Acquired Fund | Acquiring Fund |

| Market risk | Market risk |

| Interest rate risk | Interest rate risk |

| High-yield (junk bond) risk | High-yield (junk bond) risk |

| IBOR risk | IBOR risk |

| Credit risk | Credit risk |

| Loans and other indebtedness risk | Loans and other indebtedness risk |

| Adjustable rate risk | Adjustable rate risk |

| Foreign and emerging markets risk | Foreign and emerging markets risk |

| Currency risk | |

| Derivatives risk | Derivatives risk |

| Leveraging risk | Leveraging risk |

| Mortgage-backed and asset-backed securities risk | Mortgage-backed and asset-backed securities risk |

| Prepayment risk | Prepayment risk |

| Valuation risk | Valuation risk |

| Portfolio turnover risk | Portfolio turnover risk |

| Liquidity risk | Liquidity risk |

| Government and regulatory risk | |

| Active management and selection risk | Active management and selection risk |

Market risk. (Acquired Fund and Acquiring Fund) The risk that all or a majority of the securities in a certain market — such as the stock or bond market — will decline in value because of factors such as adverse political or economic conditions, future expectations, investor confidence, or heavy institutional selling.

Interest rate risk. (Acquired Fund and Acquiring Fund) The risk that securities will decrease in value if interest rates rise. The risk is generally associated with bonds; however, because small- and medium-sized companies and companies in the real estate sector often borrow money to finance their operations, they may be adversely affected by rising interest rates. A fund may be subject to a greater risk of rising interest rates due to the current period of historically low interest rates.

High yield (junk bond) risk. (Acquired Fund and Acquiring Fund) The risk that high yield securities, commonly known as “junk bonds,” are subject to reduced creditworthiness of issuers, increased risk of default, and a more limited and less liquid secondary market. High yield securities may also be subject to greater price volatility and risk of loss of income and principal than are higher-rated securities. High yield bonds are sometimes issued by municipalities that have less financial strength and therefore have less ability to make projected debt payments on the bonds.

IBOR risk. (Acquired Fund and Acquiring Fund) The risk that potential changes related to the use of the London Interbank Offered Rate (LIBOR) or similar interbank offered rates (“IBORs,” such as the Euro Overnight Index Average (EONIA)) could have adverse impacts on financial instruments that reference LIBOR or a similar rate. While some instruments may contemplate a scenario where LIBOR or a similar rate is no longer available

7

by providing for an alternative rate setting methodology, not all instruments have such fallback provisions and the effectiveness of replacement rates is uncertain. The abandonment of LIBOR and similar rates could affect the value and liquidity of instruments that reference such rates, especially those that do not have fallback provisions. The use of alternative reference rate products may impact investment strategy performance.

Credit risk. (Acquired Fund and Acquiring Fund) The risk that an issuer of a debt security, including a governmental issuer or an entity that insures a bond, may be unable to make interest payments and/or repay principal in a timely manner.

Loans and other indebtedness risk. (Acquired Fund and Acquiring Fund) The risk that a fund will not receive payment of principal, interest, and other amounts due in connection with these investments and will depend primarily on the financial condition of the borrower and the lending institution. A fund’s ability to sell its loans or to realize their full value upon sale may also be impaired due to the lack of an active trading market, irregular trading activity, wide bid/ask spreads, contractual restrictions, and extended trade settlement periods. In addition, certain loans in which a fund invests may not be considered securities. A fund therefore may not be able to rely upon the anti-fraud provisions of the federal securities laws with respect to these investments.

Adjustable rate securities risk. (Acquired Fund and Acquiring Fund) During periods of rising interest rates, because changes in interest rates on adjustable rate securities may lag behind changes in market rates, the value of such securities may decline until their interest rates reset to market rates. During periods of declining interest rates, because the interest rates on adjustable rate securities generally reset downward, their market value is unlikely to rise to the same extent as the value of comparable fixed rate securities.

Foreign and emerging markets risk. (Acquired Fund and Acquiring Fund) The risk that international investing (particularly in emerging markets) may be adversely affected by political instability; changes in currency exchange rates; inefficient markets and higher transaction costs; foreign economic conditions; the imposition of economic or trade sanctions; or inadequate or different regulatory and accounting standards. The risk associated with international investing will be greater in emerging markets than in more developed foreign markets because, among other things, emerging markets may have less stable political and economic environments. In addition, there often is substantially less publicly available information about issuers and such information tends to be of a lesser quality. Economic markets and structures tend to be less mature and diverse and the securities markets may also be smaller, less liquid, and subject to greater price volatility.

Currency risk. (Acquiring Fund) The risk that fluctuations in exchange rates between the US dollar and foreign currencies and between various foreign currencies may cause the value of an investment to decline.

Derivatives risk. (Acquired Fund and Acquiring Fund) Derivatives contracts, such as futures, forward foreign currency contracts, options, and swaps, may involve additional expenses (such as the payment of premiums) and are subject to significant loss if a security, index, reference rate, or other asset or market factor to which a derivatives contract is associated, moves in the opposite direction from what the portfolio manager anticipated. When used for hedging, the change in value of the derivatives instrument may also not correlate specifically with the currency, rate, or other risk being hedged, in which case a fund may not realize the intended benefits. Derivatives contracts are also subject to the risk that the counterparty may fail to perform its obligations under the contract due to, among other reasons, financial difficulties (such as a bankruptcy or reorganization).

Leveraging risk. (Acquired Fund and Acquiring Fund) The risk that certain fund transactions, such as reverse repurchase agreements, short sales, loans of portfolio securities, and the use of when-issued, delayed delivery or forward commitment transactions, or derivatives instruments, may give rise to leverage, causing a fund to be more volatile than if it had not been leveraged, which may result in increased losses to the fund.

8

Mortgage-backed and asset-backed securities risk. (Acquired Fund and Acquiring Fund) The risk that the principal on mortgage-backed or asset-backed securities may be prepaid at any time, which will reduce the yield and market value.

Prepayment risk. (Acquired Fund and Acquiring Fund) The risk that the principal on a bond that is held by a fund will be prepaid prior to maturity at a time when interest rates are lower than what that bond was paying. A fund may then have to reinvest that money at a lower interest rate.

Valuation risk. (Acquired Fund and Acquiring Fund) The risk that a less liquid secondary market may make it more difficult for a fund to obtain precise valuations of certain securities in its portfolio.

Portfolio turnover risk. (Acquired Fund and Acquiring Fund) High portfolio turnover rates may increase a fund’s transaction costs and lower returns.

Liquidity risk. (Acquired Fund and Acquiring Fund) The possibility that investments cannot be readily sold within seven calendar days at approximately the price at which a fund has valued them.

Government and regulatory risk. (Acquiring Fund) The risk that governments or regulatory authorities may take actions that could adversely affect various sectors of the securities markets and affect fund performance.

Active management and selection risk. (Acquired Fund and Acquiring Fund) The risk that the securities selected by a fund’s management will underperform the markets, the relevant indices, or the securities selected by other funds with similar investment objectives and investment strategies. The securities and sectors selected may vary from the securities and sectors included in the relevant index.

Fundamental Investment Restrictions. The Acquired Trust and Acquiring Trust have adopted materially identical fundamental investment restrictions. Each Trust has adopted the following restrictions that cannot be changed without approval by the holders of a “majority” of a Fund’s outstanding shares, which is a vote by the holders of the lesser of (i) 67% or more of the voting securities present in person or by proxy at a meeting, if the holders of more than 50% of the outstanding voting securities are present or represented by proxy; or (ii) more than 50% of the outstanding voting securities. The percentage limitations contained in the restrictions and policies set forth herein apply at the time of purchase of securities.

Each Fund shall not:

1. Make investments that will result in the concentration (as that term may be defined in the 1940 Act, any rule or order thereunder, or U.S. Securities and Exchange Commission (“SEC”) staff interpretation thereof) of its investments in the securities of issuers primarily engaged in the same industry, provided that this restriction does not limit the Fund from investing in obligations issued or guaranteed by the U.S. government, its agencies or instrumentalities, or in tax-exempt obligations.

2. Borrow money or issue senior securities, except as the 1940 Act, any rule or order thereunder, or SEC staff interpretation thereof, may permit.

3. Underwrite the securities of other issuers, except that the Fund may engage in transactions involving the acquisition, disposition, or resale of its portfolio securities under circumstances where it may be considered to be an underwriter under the Securities Act of 1933, as amended (the “1933 Act”).

4. Purchase or sell real estate, unless acquired as a result of ownership of securities or other instruments and provided that this restriction does not prevent the Fund from investing in issuers which invest, deal, or otherwise engage in transactions in real estate or interests therein, or investing in securities that are secured by real estate or interests therein.

5. Purchase or sell physical commodities, unless acquired as a result of ownership of securities or other instruments and provided that this restriction does not prevent the Fund from engaging in transactions involving futures contracts and options thereon or investing in securities that are secured by physical commodities.

9

6. Make personal loans or loans of its assets to persons who control or are under common control with the Fund, except as the 1940 Act, any rule or order thereunder, or SEC staff interpretation thereof, may permit. This restriction does not prevent the Fund from, among other things, purchasing debt obligations, entering into repurchase agreements, loaning its assets to broker/dealers or institutional investors, or investing in loans, including assignments and participation interests.

REORGANIZATION OF DELAWARE FLOATING RATE II FUND INTO DELAWARE FLOATING RATE FUND

Investment Objectives. The Acquired Fund and Acquiring Fund have similar, but not identical, principal investment objectives, as described in each of their Prospectuses, and included below. Each Fund’s investment objective is nonfundamental, and may be changed without shareholder approval.

| Delaware Floating Rate II Fund (Acquired Fund) |

Delaware Floating Rate Fund (Acquiring Fund) |

What is the Fund’s investment objective? Delaware Floating Rate II Fund seeks a high level of current income. |

What is the Fund’s investment objective? Delaware Floating Rate Fund seeks high current income and, secondarily, long-term total return. |

Principal Investment Strategies. The Acquired Fund and Acquiring Fund have similar, but not identical, principal investment strategies, as described in each of their Prospectuses, and included below.

Each Fund is classified as “diversified” under applicable federal law and neither Fund will concentrate its investments in any one industry.

The investment strategies of the Funds are similar in some ways, but also differ in certain respects. The Funds have the same duration and maturity.

Both Funds primarily invest in floating rate loans and/or other floating rate debt securities. Under normal circumstances, each Fund will invest at least 80% of its net assets, plus any borrowings for investment purposes, in floating rate loans and other floating rate debt securities. This is a nonfundamental policy of both the Acquired and Acquiring Fund, and may be changed without shareholder approval.

For each Fund, the average portfolio duration of the Fund will generally not exceed one year.

Before selecting securities for the Funds, the Manager carefully evaluates and monitors each individual security, including its income potential and the size of the bond issuance. The size of the issuance helps the Manager evaluate how easily it may be able to buy and sell the security. The Manager also does a thorough credit analysis of the issuer to determine whether that company or entity has the financial ability to meet the security’s payments. The Manager maintains a well-diversified portfolio of investments for each Fund that represents many different asset classes, sectors, industries, and global markets.

Both Funds may invest in loan participations, commonly known as bank loans. Some of the Funds’ investments in bank loans may also include a “floor,” or for the Acquiring Fund a “LIBOR floor” or an “IBOR floor.”

Both Funds may invest in investment grade corporate debt obligations including but not limited to bonds, notes (which may be convertible or nonconvertible), units consisting of bonds with stock or warrants to buy stock attached, debentures and convertible debentures, and commercial paper of US companies.

Both Funds may also invest up to 100% of its total assets in below-investment-grade securities. Both Funds may invest in both rated and unrated bonds. The rated bonds that the Funds may purchase in the high yield sector will generally be rated lower than BBB- by Standard & Poor’s Financial Services LLC (S&P), Baa3 by Moody’s Investors Service, Inc. (Moody’s), or similarly rated by another nationally recognized statistical rating organization (NRSRO).

10

Both Funds may also invest in foreign securities, including up to 15% of its total assets in securities of issuers located in emerging markets. These fixed income securities may include foreign government securities, debt obligations of foreign companies, and securities issued by supranational entities. To the extent that the Funds invest internationally, both Funds share the same geographic focus and define emerging markets in the same manner.

The Funds may invest in securities issued in any currency and may hold non-US currencies. Securities of issuers within a given country may be denominated in the currency of another country or in multinational currency units, such as the euro. For each Fund, the Manager will limit non-US-dollar-denominated securities to no more than 50% of net assets. Each Fund’s total non-US-dollar currency exposure will be limited, in the aggregate, to no more than 25% of net assets. The Funds may, from time to time, purchase or sell foreign currencies and/or engage in forward foreign currency transactions in order to facilitate or expedite settlement of Fund transactions and to minimize the impact of currency value fluctuations on the portfolio.

The Funds may also invest in mortgage-backed securities issued or guaranteed by the US government, its agencies or instrumentalities, or by government-sponsored corporations. Other mortgage-backed securities in which the Funds may invest are issued by certain private, nongovernment entities. The Funds may also invest in securities that are backed by assets such as receivables on home equity and credit card loans, automobile, mobile home, recreational vehicle and other loans, wholesale dealer floor plans, and leases.

The Funds may invest in debt obligations issued or guaranteed by the US government, its agencies or instrumentalities. The US government securities in which the Funds may invest include a variety of securities which are issued or guaranteed as to the payment of principal and interest by the US government, and by various agencies or instrumentalities which have been established or are sponsored by the US government. The Funds may also invest in municipal debt obligations that are issued by state and local governments to raise funds for various public purposes such as hospitals, schools, and general capital expenses.

Both Funds may also invest up to 50% of its total assets in a wide range of derivatives instruments, including forward foreign currency contracts, options, futures contracts, options on futures contracts, and swaps. Derivatives instruments may be utilized for a variety of purposes, including to effectively convert the fixed-rate interest payments from a group of certain Fund portfolio securities into floating-rate interest payments.

Both Funds may invest in privately placed securities, including those that are eligible for resale only among certain institutional buyers without registration, which are commonly known as “Rule 144A Securities.”

11

Each Fund is permitted to invest up to 15% of its respective net assets in illiquid investments.

| Delaware Floating Rate II Fund (Acquired Fund) |

Delaware Floating Rate Fund (Acquiring Fund) |

|

What are the Fund’s principal investment strategies? Under normal circumstances, the Fund will invest at least 80% of its net assets (plus any borrowings for investment purposes) in floating rate loans and/or bonds (80% policy). Floating rate loans represent amounts borrowed by companies or other entities from banks and other lenders, which have interest rates that reset periodically (annually or more frequently), generally based on a common interest rate index or another base rate. In many cases, they are issued in connection with recapitalizations, acquisitions, leveraged buyouts and refinancings. Delaware Management Company (Manager) will determine how much of the Fund’s assets to allocate among the different types of securities in which the Fund may invest based on its evaluation of economic and market conditions and its assessment of the returns and potential for appreciation that can be achieved from various sectors of the fixed income market. In addition, the Manager may seek investment advice and recommendations from its affiliates: Macquarie Investment Management Europe Limited, Macquarie Investment Management Austria Kapitalanlage AG, and Macquarie Investment Management Global Limited (together, the “Affiliated Sub-Advisors”). The Manager may also permit these Affiliated Sub-Advisors to execute Fund security trades on behalf of the Manager and exercise investment discretion for securities in certain markets where the Manager believes it will be beneficial to utilize an Affiliated Sub-Advisor's specialized market knowledge. The Fund's investments may be variable- and floating-rate debt securities that generally pay interest at rates that adjust whenever a specified interest rate changes and/or reset on predetermined dates (such as the last day of a month or calendar quarter). Derivatives instruments may be utilized to effectively convert the fixed-rate interest payments from a group of certain Fund portfolio securities into floating-rate interest payments. The average portfolio duration (that is, the sensitivity to general changes in interest rates) of this Fund will generally not exceed one year. Up to 100% of the Fund’s total assets may be allocated to below-investment-grade securities within the Fund. Investments in emerging markets will, in the aggregate, be limited to no more than 15% of the Fund’s total assets. The Manager will limit non-US-dollar-denominated securities to no more than 50% of net assets, but total non-US-dollar currency exposure will be limited, in the aggregate, to no more than 25% of net assets. The Fund may also invest up to 50% of its total assets in a wide range of derivatives instruments, including forward foreign currency contracts, options, futures contracts, options on futures contracts, and swaps, for both hedging and nonhedging purposes. In addition, the Fund may hold a portion of its assets in cash or cash equivalents. |

What are the Fund’s principal investment strategies? Under normal circumstances, the Fund will invest at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in floating rate loans and other floating rate debt securities (80% policy). Delaware Management Company (Manager) will determine how much of the Fund’s assets to allocate among the different types of securities in which the Fund may invest based on its evaluation of economic and market conditions and its assessment of the returns and potential for appreciation that can be achieved from various sectors of the fixed income market. In addition, the Manager may seek investment advice and recommendations from its affiliates: Macquarie Investment Management Austria Kapitalanlage AG (MIMAK), Macquarie Investment Management Europe Limited (MIMEL), and Macquarie Investment Management Global Limited (MIMGL) (together, the “Affiliated Sub-Advisors”). The Manager may also permit these Affiliated Sub-Advisors to execute Fund security trades on behalf of the Manager and exercise investment discretion for securities in certain markets where the Manager believes it will be beneficial to utilize an Affiliated Sub-Advisor's specialized market knowledge. The Fund's investments may be variable- and floating-rate debt securities that generally pay interest at rates that adjust whenever a specified interest rate changes and/or reset on predetermined dates (such as the last day of a month or calendar quarter). Derivatives instruments may be utilized to effectively convert the fixed-rate interest payments from a group of certain Fund portfolio securities into floating-rate interest payments. The average portfolio duration (that is, the sensitivity to general changes in interest rates) of this Fund will generally not exceed one year. Up to 100% of the Fund’s total assets may be allocated to below-investment-grade securities within the Fund. Investments in emerging markets will, in the aggregate, be limited to no more than 15% of the Fund’s total assets. The Manager will limit non-US-dollar-denominated securities to no more than 50% of net assets, but total non-US-dollar currency exposure will be limited, in the aggregate, to no more than 25% of net assets. The Fund may also invest up to 50% of its total assets in a wide range of derivatives instruments, including forward foreign currency contracts, options, futures contracts, options on futures contracts, and swaps, for both hedging and nonhedging purposes. In addition, the Fund may hold a portion of its assets in cash or cash equivalents. The 80% policy is nonfundamental and may be changed without shareholder approval. Fund shareholders would be given at least 60 days’ notice prior to any such change. |

12

Principal Investment Risks. Investing in any mutual fund involves the risk that you may lose part or all of the money you invest. Over time, the value of your investment in a Fund will increase and decrease according to changes in the value of the securities in the Fund’s portfolio. An investment in the Fund may not be appropriate for all investors. Each Fund’s principal risks, as listed in their Prospectuses, are included below.

The principal investment risks for the Acquired Fund and Acquiring Fund are nearly identical. Both Funds are subject to market risk, credit risk, loans and other indebtedness risk, interest rate risk, high yield (junk bond) risk, adjustable rate securities risk, prepayment risk, foreign and emerging markets risk, IBOR risk, derivatives risk, leveraging risk, valuation risk, government and regulatory risk, liquidity risk, active management and selection risk. Even though the Acquired Fund and Acquiring Fund share many of the same types of risks, the degree of such risks may vary. Each Fund’s relative risk/return profile cannot be determined by the following risk descriptions and comparisons alone. However, the Acquired Fund and Acquiring Fund share a similar risk/return profile.

| Acquired Fund | Acquiring Fund |

| Market risk | Market risk |

| Credit risk | Credit risk |

| Loans and other indebtedness risk | Loans and other indebtedness risk |

| Interest rate risk | Interest rate risk |

| High yield (junk bond) risk | High yield (junk bond) risk |

| Adjustable rate securities risk | Adjustable rate securities risk |

| Prepayment risk | Prepayment risk |

| Foreign and emerging markets risk | Foreign and emerging markets risk |

| IBOR risk | IBOR risk |

| Derivatives risk | Derivatives risk |

| Leveraging risk | Leveraging risk |

| Valuation risk | Valuation risk |

| Government and regulatory risk | Government and regulatory risk |

| Liquidity risk | Liquidity risk |

| Active management and selection risk | Active management and selection risk |

Market risk. (Acquired Fund and Acquiring Fund) The risk that all or a majority of the securities in a certain market — such as the stock or bond market — will decline in value because of factors such as adverse political or economic conditions, future expectations, investor confidence, or heavy institutional selling.

Credit risk. (Acquired Fund and Acquiring Fund) The risk that an issuer of a debt security, including a governmental issuer or an entity that insures a bond, may be unable to make interest payments and/or repay principal in a timely manner.

Loans and other indebtedness risk. (Acquired Fund and Acquiring Fund) The risk that a fund will not receive payment of principal, interest, and other amounts due in connection with these investments and will depend primarily on the financial condition of the borrower and the lending institution. A fund’s ability to sell its loans or to realize their full value upon sale may also be impaired due to the lack of an active trading market, irregular trading activity, wide bid/ask spreads, contractual restrictions, and extended trade settlement periods. In addition, certain loans in which a fund invests may not be considered securities. A fund therefore may not be able to rely upon the anti-fraud provisions of the federal securities laws with respect to these investments.

Interest rate risk. (Acquired Fund and Acquiring Fund) The risk that the prices of bonds and other fixed income securities will increase as interest rates fall and decrease as interest rates rise. Interest rate changes are influenced by a number of factors, such as government policy, monetary policy, inflation expectations, and the supply and demand of bonds. Bonds and other fixed income securities with longer maturities or duration generally are more sensitive to interest rate changes. A fund may be subject to a greater risk of rising interest rates due to the current period of historically low interest rates.

13

High yield (junk bond) risk. (Acquired Fund and Acquiring Fund) The risk that high yield securities, commonly known as “junk bonds,” are subject to reduced creditworthiness of issuers, increased risk of default, and a more limited and less liquid secondary market. High yield securities may also be subject to greater price volatility and risk of loss of income and principal than are higher-rated securities. High yield bonds are sometimes issued by municipalities that have less financial strength and therefore have less ability to make projected debt payments on the bonds.

Adjustable rate securities risk. (Acquired Fund and Acquiring Fund) During periods of rising interest rates, because changes in interest rates on adjustable rate securities may lag behind changes in market rates, the value of such securities may decline until their interest rates reset to market rates. During periods of declining interest rates, because the interest rates on adjustable rate securities generally reset downward, their market value is unlikely to rise to the same extent as the value of comparable fixed rate securities.

Prepayment risk. (Acquired Fund and Acquiring Fund) The risk that the principal on a bond that is held by a fund will be prepaid prior to maturity at a time when interest rates are lower than what that bond was paying. A fund may then have to reinvest that money at a lower interest rate.

Foreign and emerging markets risk. (Acquired Fund and Acquiring Fund) The risk that international investing (particularly in emerging markets) may be adversely affected by political instability; changes in currency exchange rates; inefficient markets and higher transaction costs; foreign economic conditions; the imposition of economic or trade sanctions; or inadequate or different regulatory and accounting standards. The risk associated with international investing will be greater in emerging markets than in more developed foreign markets because, among other things, emerging markets may have less stable political and economic environments. In addition, there often is substantially less publicly available information about issuers and such information tends to be of a lesser quality. Economic markets and structures tend to be less mature and diverse and the securities markets may also be smaller, less liquid, and subject to greater price volatility.

IBOR risk. (Acquired Fund and Acquiring Fund) The risk that potential changes related to the use of the London Interbank Offered Rate (LIBOR) or similar interbank offered rates (“IBORs,” such as the Euro Overnight Index Average (EONIA)) could have adverse impacts on financial instruments that reference LIBOR or a similar rate. While some instruments may contemplate a scenario where LIBOR or a similar rate is no longer available by providing for an alternative rate setting methodology, not all instruments have such fallback provisions and the effectiveness of replacement rates is uncertain. The abandonment of LIBOR and similar rates could affect the value and liquidity of instruments that reference such rates, especially those that do not have fallback provisions. The use of alternative reference rate products may impact investment strategy performance.

Derivatives risk. (Acquired Fund and Acquiring Fund) Derivatives contracts, such as futures, forward foreign currency contracts, options, and swaps, may involve additional expenses (such as the payment of premiums) and are subject to significant loss if a security, index, reference rate, or other asset or market factor to which a derivatives contract is associated, moves in the opposite direction from what the portfolio manager anticipated. When used for hedging, the change in value of the derivatives instrument may also not correlate specifically with the currency, rate, or other risk being hedged, in which case a fund may not realize the intended benefits. Derivatives contracts are also subject to the risk that the counterparty may fail to perform its obligations under the contract due to, among other reasons, financial difficulties (such as a bankruptcy or reorganization).

Leveraging risk. (Acquired Fund and Acquiring Fund) The risk that certain fund transactions, such as reverse repurchase agreements, short sales, loans of portfolio securities, and the use of when-issued, delayed delivery or forward commitment transactions, or derivatives instruments, may give rise to leverage, causing a fund to be more volatile than if it had not been leveraged, which may result in increased losses to the fund.

Valuation risk. (Acquired Fund and Acquiring Fund) The risk that a less liquid secondary market may make it more difficult for a fund to obtain precise valuations of certain securities in its portfolio.

14

Government and regulatory risk. (Acquired Fund and Acquiring Fund) The risk that governments or regulatory authorities may take actions that could adversely affect various sectors of the securities markets and affect fund performance.

Liquidity risk. (Acquired Fund and Acquiring Fund) The possibility that investments cannot be readily sold within seven calendar days at approximately the price at which a fund has valued them.

Active management and selection risk. (Acquired Fund and Acquiring Fund) The risk that the securities selected by a fund’s management will underperform the markets, the relevant indices, or the securities selected by other funds with similar investment objectives and investment strategies. The securities and sectors selected may vary from the securities and sectors included in the relevant index.

Fundamental Investment Restrictions. The Acquired Trust and Acquiring Trust have adopted materially identical fundamental investment restrictions. Each Trust has adopted the following restrictions that cannot be changed without approval by the holders of a “majority” of a Fund’s outstanding shares, which is a vote by the holders of the lesser of (i) 67% or more of the voting securities present in person or by proxy at a meeting, if the holders of more than 50% of the outstanding voting securities are present or represented by proxy; or (ii) more than 50% of the outstanding voting securities. The percentage limitations contained in the restrictions and policies set forth herein apply at the time of purchase of securities.

Each Fund shall not:

1. Make investments that will result in the concentration (as that term may be defined in the 1940 Act, any rule or order thereunder, or U.S. Securities and Exchange Commission (“SEC”) staff interpretation thereof) of its investments in the securities of issuers primarily engaged in the same industry, provided that this restriction does not limit the Fund from investing in obligations issued or guaranteed by the U.S. government, its agencies or instrumentalities, or in tax-exempt obligations.

2. Borrow money or issue senior securities, except as the 1940 Act, any rule or order thereunder, or SEC staff interpretation thereof, may permit.

3. Underwrite the securities of other issuers, except that the Fund may engage in transactions involving the acquisition, disposition, or resale of its portfolio securities under circumstances where it may be considered to be an underwriter under the Securities Act of 1933, as amended (the “1933 Act”).

4. Purchase or sell real estate, unless acquired as a result of ownership of securities or other instruments and provided that this restriction does not prevent the Fund from investing in issuers which invest, deal, or otherwise engage in transactions in real estate or interests therein, or investing in securities that are secured by real estate or interests therein.

5. Purchase or sell physical commodities, unless acquired as a result of ownership of securities or other instruments and provided that this restriction does not prevent the Fund from engaging in transactions involving futures contracts and options thereon or investing in securities that are secured by physical commodities.

6. Make personal loans or loans of its assets to persons who control or are under common control with a Fund, except as the 1940 Act, any rule or order thereunder, or SEC staff interpretation thereof, may permit. This restriction does not prevent a Fund from, among other things, purchasing debt obligations, entering into repurchase agreements, loaning its assets to broker/dealers or institutional investors, or investing in loans, including assignments and participation interests.

15

REORGANIZATION OF DELAWARE LIMITED DURATION BOND FUND INTO DELAWARE LIMITED-TERM DIVERSIFIED INCOME FUND

Investment Objectives. The Acquired Fund and Acquiring Fund have different principal investment objectives, as described in each of their Prospectuses, and included below. Each Fund’s investment objective is nonfundamental, and may be changed without shareholder approval.

| Delaware Limited Duration Bond Fund (Acquired Fund) |

Delaware Limited-Term Diversified Income Fund (Acquiring Fund) |

|

What is the Fund’s investment objective? Delaware Limited Duration Bond Fund seeks current income consistent with low volatility of principal. |

What is the Fund’s investment objective? Delaware Limited-Term Diversified Income Fund seeks maximum total return, consistent with reasonable risk. |

Principal Investment Strategies. The Acquired Fund and Acquiring Fund have similar principal investment strategies, but there are some differences, as described in each of their Prospectuses, and included below.

Each Fund is classified as “diversified” under applicable federal law and neither Fund will concentrate its investments in any one industry.

The investment strategies of the Funds are similar in some ways, but also differ in certain respects. The Funds have the same duration and maturity.

Under normal circumstances, both the Acquired Fund and Acquiring Fund invest at least 80% of its net assets, plus any borrowings for investment purposes, in investment grade fixed income securities (80% policy). These are nonfundamental investment policies of the Funds that may be changed without prior shareholder approval.

For both the Acquired Fund and Acquiring Fund, investment grade debt securities include those that are rated within the four highest ratings categories by Moody’s or S&P or that are unrated but determined by the Fund’s Manager, to be of equivalent quality.

The corporate debt obligations in which each Fund may invest include bonds, notes, debentures, and commercial paper of US companies and non-US companies. The Funds may also invest in a variety of securities that are issued or guaranteed as to the payment of principal and interest by the US government, and by various agencies or instrumentalities, which have been established or are sponsored by the US government, and securities issued by foreign governments.

Both Funds may also invest in investment grade and below-investment-grade corporate bonds; nonagency mortgage-backed securities (MBS), asset-backed securities (ABS), commercial mortgage-backed securities (CMBS), collateralized mortgage obligations (CMOs), and real estate mortgage investment conduits (REMICs). Whereas the Acquiring Fund may invest up to 20% of its total assets in CMOs and REMICs issued by private entities that are not collateralized by securities issued or guaranteed by the US government, its agencies or instrumentalities, so called “nonagency mortgage-backed securities,” the Acquired Fund may invest without limit in “nonagency” mortgage-backed securities.

Both Funds maintain an average effective duration from one to three years.

Both Funds may invest up to 20% of their respective net assets in high yield corporate bonds (“junk bonds”). In addition, each Fund may invest up to 30% of its respective total assets in foreign securities, including up to 10% of its respective net assets in emerging markets, but each Fund’s total non-US-dollar currency exposure will be limited, in the aggregate, to no more than 10% of its net assets. To the extent that the Funds invest internationally, both Funds share the same geographic focus and define emerging markets in the same manner.

16

Both Funds may also invest up to 30% of its respective net assets in foreign securities, including up to 10% of its respective net assets in securities of issuers located in emerging markets. The Manager will limit each Fund’s investments in total non-US dollar currency to no more than 10% of its net assets. The Funds will hedge its total foreign currency exposure. These fixed income securities may include foreign government securities, debt obligations of foreign companies, and securities issued by supranational entities.

Both Funds may invest in sponsored and unsponsored American depositary receipts (ADRs), European depositary receipts (EDRs), or global depositary receipts (GDRs). The Funds may also invest in zero coupon bonds and may purchase shares of other investment companies.

Both Funds will invest in both rated and unrated foreign securities.

Both Funds are permitted to, from time to time, purchase or sell foreign currencies and/or engage in forward foreign currency contracts in order to facilitate or expedite settlement of Fund transactions and to minimize currency value fluctuations.

Both Funds may use a wide range of derivatives instruments, typically including options, futures contracts, options on futures contracts, forward foreign currency contracts, and swaps. The Funds will use derivatives for both hedging and nonhedging purposes. The Funds will not use derivatives for reasons inconsistent with its investment objective and will limit its respective investments in derivatives instruments to 20% of its net assets. In addition, the Acquiring Fund will not invest in swaps with maturities of more than 10 years, while the Acquired Fund has no such duration limitation.

For each Fund, the Manager may establish short positions in exchange traded funds in an attempt to isolate, manage, or reduce the risk of individual securities positions held by the Funds, of a decline in a particular market sector to which the Fund has significant exposure, or of the exposure to securities owned by the Fund in the aggregate. The Manager will not engage in short sales for speculative purposes for either Fund.

| Delaware Limited Duration Bond Fund (Acquired Fund) |

Delaware Limited-Term Diversified Income Fund (Acquiring Fund) |

|

What are the Fund’s principal investment strategies? Under normal circumstances, the Fund will invest at least 80% of its net assets (plus any borrowings for investment purposes) in investment grade bonds (80% policy). For purposes of the 80% policy, investment grade bonds also include other investment grade fixed income securities. Investment grade debt securities include those that are rated within the four highest ratings categories by Moody’s or S&P or that are unrated but determined by the Manager to be of equivalent quality. The Fund will maintain an average effective duration from one to three years. The Fund’s investment manager, Delaware Management Company (Manager), will determine how much of the Fund’s assets to allocate among the different types of fixed income securities in which the Fund may invest based on the Manager’s evaluation of economic and market conditions and its assessment of the returns and potential for appreciation that can be achieved from various sectors of the fixed income market. The Manager may seek investment advice and recommendations from its affiliates: Macquarie |

What are the Fund’s principal investment strategies? Under normal circumstances, the Fund will invest at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in investment grade fixed income securities, including, but not limited to, fixed income securities issued or guaranteed by the US government, its agencies or instrumentalities, and by US corporations (80% policy). Investment grade fixed income securities are securities rated BBB- or higher by Standard & Poor’s Financial Services LLC (S&P) and Baa3 or higher by Moody’s Investors Service, Inc. (Moody’s), or similarly rated by another nationally recognized statistical rating organization (NRSRO), or those that are deemed to be of comparable quality. The Fund will maintain an average effective duration from one to three years. The Fund’s investment manager, Delaware Management Company (Manager), will determine how much of the Fund’s assets to allocate among the different types of fixed income securities in which the Fund may invest based on the Manager’s evaluation of economic and market conditions and its assessment of the returns and potential for appreciation that can be achieved from various sectors of the fixed income market. |

17

| Delaware Limited Duration Bond Fund (Acquired Fund) |

Delaware Limited-Term Diversified Income Fund (Acquiring Fund) |

|

Investment Management Europe Limited, Macquarie Investment Management Austria Kapitalanlage AG, and Macquarie Investment Management Global Limited (together, the “Affiliated Sub-Advisors”). The Manager may also permit these Affiliated Sub-Advisors to execute Fund security trades on behalf of the Manager and exercise investment discretion for securities in certain markets where the Manager believes it will be beneficial to utilize an Affiliated Sub-Advisor’s specialized market knowledge. The corporate debt obligations in which the Fund may invest include bonds, notes, debentures, and commercial paper of US companies and, subject to the limitations described below, non-US companies. The Fund may also invest in a variety of securities that are issued or guaranteed as to the payment of principal and interest by the US government, and by various agencies or instrumentalities, which have been established or are sponsored by the US government, and, subject to the limitations described below, securities issued by foreign governments. Additionally, the Fund may invest in mortgage-backed securities issued or guaranteed by the US government, its agencies or instrumentalities, government-sponsored corporations, and mortgage-backed securities issued by certain private, nongovernment entities. The Fund may also invest in securities that are backed by assets such as receivables on home equity and credit card loans, automobile, mobile home, recreational vehicle and other loans, wholesale dealer floor plans, and leases. The Fund may invest up to 20% of its net assets in below-investment-grade securities (also known as high yield or “junk” bonds). The Fund may also invest up to 30% of its net assets in foreign securities, including up to 10% of its net assets in securities of issuers located in emerging markets. The Fund’s total non-US dollar currency exposure will be limited, in the aggregate, to no more than 10% of its net assets. The Fund may use a wide range of derivatives instruments, typically including options, futures contracts, options on futures contracts, forward foreign currency contracts, and swaps. The Fund will use derivatives for both hedging and nonhedging purposes. For example, the Fund may invest in: futures and options to manage duration and for defensive purposes, such as to protect gains or hedge against potential losses |

The Manager may seek investment advice and recommendations from its affiliates: Macquarie Investment Management Austria Kapitalanlage AG (MIMAK), Macquarie Investment Management Europe Limited (MIMEL), and Macquarie Investment Management Global Limited (MIMGL) (together, the “Affiliated Sub-Advisors”). The Manager may also permit these Affiliated Sub-Advisors to execute Fund security trades on behalf of the Manager and exercise investment discretion for securities in certain markets where the Manager believes it will be beneficial to utilize an Affiliated Sub-Advisor’s specialized market knowledge. The corporate debt obligations in which the Fund may invest include bonds, notes, debentures, and commercial paper of US companies and, subject to the limitations described below, non-US companies. The Fund may also invest in a variety of securities that are issued or guaranteed as to the payment of principal and interest by the US government, and by various agencies or instrumentalities, which have been established or are sponsored by the US government, and, subject to the limitations described below, securities issued by foreign governments. Additionally, the Fund may invest in mortgage-backed securities issued or guaranteed by the US government, its agencies or instrumentalities, government-sponsored corporations, and mortgage-backed securities issued by certain private, nongovernment entities. The Fund may also invest in securities that are backed by assets such as receivables on home equity and credit card loans, automobile, mobile home, recreational vehicle and other loans, wholesale dealer floor plans, and leases. The Fund may invest up to 20% of its net assets in below-investment-grade securities (also known as high yield or “junk” bonds). The Fund may also invest up to 30% of its net assets in foreign securities, including up to 10% of its net assets in securities of issuers located in emerging markets. The Fund’s total non-US dollar currency exposure will be limited, in the aggregate, to no more than 10% of its net assets. The Fund may use a wide range of derivatives instruments, typically including options, futures contracts, options on futures contracts, forward foreign currency contracts, and swaps. The Fund will use derivatives for both hedging and nonhedging purposes. |

18

| Delaware Limited Duration Bond Fund (Acquired Fund) |

Delaware Limited-Term Diversified Income Fund (Acquiring Fund) |

|

in the portfolio without actually selling a security, or to stay fully invested; forward foreign currency contracts to manage foreign currency exposure; interest rate swaps to neutralize the impact of interest rate changes; credit default swaps to hedge against a credit event, to gain exposure to certain securities or markets, or to enhance total return; and index swaps to enhance return or to effect diversification. The Fund will not use derivatives for reasons inconsistent with its investment objective and will limit its investments in derivatives instruments to 20% of its net assets. |