UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-03363 | |

| Exact name of registrant as specified in charter: | Delaware Group® Limited-Term Government Funds | |

| Address of principal executive offices: | 610 Market Street | |

| Philadelphia, PA 19106 | ||

| Name and address of agent for service: | David F. Connor, Esq. | |

| 610 Market Street | ||

| Philadelphia, PA 19106 | ||

| Registrant’s telephone number, including area code: | (800) 523-1918 | |

| Date of fiscal year end: | December 31 | |

| Date of reporting period: | December 31, 2020 |

Item 1. Reports to Stockholders

|

|

Annual report

Fixed income mutual fund

Delaware Limited-Term Diversified Income Fund

December 31, 2020

|

Beginning on or about June 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your Fund’s shareholder reports will no longer be sent to you by mail, unless you specifically request them from the Fund or from your financial intermediary, such as a broker/dealer, bank, or insurance company. Instead, you will be notified by mail each time a report is posted on the website and provided with a link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you do not need to take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by signing up at delawarefunds.com/edelivery. If you own these shares through a financial intermediary, you may contact your financial intermediary. You may elect to receive paper copies of all future shareholder reports free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting us at 800 523-1918. If you own these shares through a financial intermediary, you may contact your financial intermediary to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the Delaware Funds® by Macquarie or your financial intermediary. |

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and its summary prospectus, which may be obtained by visiting delawarefunds.com/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

You can obtain shareholder reports and prospectuses online instead of in the mail. Visit delawarefunds.com/edelivery.

Experience Delaware Funds® by Macquarie

Macquarie Investment Management (MIM) is a global asset manager with offices in the United States, Europe, Asia, and Australia. As active managers, we prioritize autonomy and accountability at the investment team level in pursuit of opportunities that matter for clients. Delaware Funds is one of the longest-standing mutual fund families, with more than 80 years in existence.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Funds or obtain a prospectus for Delaware Limited-Term Diversified Income Fund at delawarefunds.com/literature.

| ● | Check your account balance and transactions |

| ● | View statements and tax forms |

| ● | Make purchases and redemptions |

Visit delawarefunds.com/account-access.

Macquarie Asset Management (MAM) offers a diverse range of products including securities investment management, infrastructure and real asset management, and fund and equity-based structured products. MIM is the marketing name for certain companies comprising the asset management division of Macquarie Group. This includes the following investment advisers: Macquarie Investment Management Business Trust (MIMBT), Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, and Macquarie Investment Management Europe S.A.

The Fund is distributed by Delaware Distributors, L.P. (DDLP), an affiliate of MIMBT and Macquarie Group Limited.

Other than Macquarie Bank Limited (MBL), none of the entities noted are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise.

The Fund is governed by US laws and regulations.

| Table of contents | ||

| Portfolio management review | 1 | |

| Performance summary | 4 | |

| Disclosure of Fund expenses | 9 | |

| Security type / sector allocation | 11 | |

| Schedule of investments | 12 | |

| Statement of assets and liabilities | 30 | |

| Statement of operations | 32 | |

| Statements of changes in net assets | 34 | |

| Financial highlights | 36 | |

| Notes to financial statements | 46 | |

| Report of independent registered public accounting firm |

66 | |

| Other Fund information | 67 | |

| Board of trustees / directors and officers addendum |

71 | |

| About the organization | 79 |

Unless otherwise noted, views expressed herein are current as of December 31, 2020, and subject to change for events occurring after such date.

The Fund is not FDIC insured and is not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor.

All third-party marks cited are the property of their respective owners.

© 2021 Macquarie Management Holdings, Inc.

| Portfolio management review | |

| Delaware Limited-Term Diversified Income Fund | January 12, 2021 (Unaudited) |

| Performance preview (for the year ended December 31, 2020) | ||||

| Delaware Limited-Term Diversified Income Fund (Institutional Class shares) | 1-year return | +4.31% | ||

| Delaware Limited-Term Diversified Income Fund (Class A shares) | 1-year return | +4.16% | ||

| Bloomberg Barclays 1-3 Year US Government/Credit Index | 1-year return | +3.33% |

For complete, annualized performance for Delaware Limited-Term Diversified Income Fund, please see the table on page 4.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. The performance of both Institutional Class shares and Class A shares reflects the reinvestment of all distributions.

Please see page 7 for a description of the index. Index performance returns do not reflects any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investment objective

The Fund seeks maximum total return, consistent with reasonable risk.

Market review

As 2020 began, the economy appeared to be entering a mature credit cycle, and investors were concerned with the possibility of a mild recession. Instead, the coronavirus pandemic struck and spread rapidly. The global community was unprepared. Initial uncertainty was quickly followed by an extreme market selloff and global economic collapse.

Governments and central banks applied lessons learned from the recession of 2008-2009, and in March they intervened with substantial monetary- and fiscal-policy measures. The effective use of global fiscal and monetary support defined how the economy and financial markets evolved in 2020.

Investors’ uncertainty in March 2020 provoked a risk-premium explosion in the market and economic shutdowns. However, backstopped by the US Federal Reserve’s unprecedented, aggressive asset-purchase programs, which included purchasing corporate bonds, some confidence returned to markets. As the world

| Consistent with our outlook, we reduced exposure to areas we believe offer limited upside, such as higher-quality credit and ABS, and replaced them with agency MBS and securities with more attractive yield profiles, such as CLOs. We have retained exposure to the reflationary theme, including airlines and certain consumer goods, and we continue to search for areas where we believe there is potential to capture yield without altering the Fund’s risk exposure. |

1

Portfolio management

review

Delaware Limited-Term

Diversified Income Fund

began to understand how the virus behaved and how to help bring it under control, the US and global economies began to reopen. Credit markets, which had widened substantially as markets collapsed, started to compress, bolstered by now dual Fed and congressional puts. Then came the race to develop vaccines, along with a better understanding of how to manage the virus.

Although the markets and parts of the economy generally adapted quickly, COVID-19-affected sectors, particularly services, experienced extreme distress. These included transportation and other consumer-related areas such as retail. Damage to labor markets was significant, with unemployment still standing higher than 6% at year end. However, with monetary and fiscal policy in place and a clear commitment to support the economy for as long as it would take, the path to the other side of the pandemic became clearer.

Within the Fund

For its fiscal year ended December 31, 2020, Delaware Limited-Term Diversified Income Fund outperformed its benchmark, the Bloomberg Barclays 1-3 Year US Government/Credit Index. The Fund’s Institutional Class shares gained 4.31%. The Fund’s Class A shares advanced 4.16% at net asset value and 1.34% at maximum offer price (both returns reflect all distributions reinvested). For the same period, the Fund’s benchmark gained 3.33%. Complete annualized performance for Delaware Limited-Term Diversified Income Fund is shown in the table on page 4.

We viewed 2020 from the prism of different market regimes, each of which called for a distinct approach to managing risk. Entering the year, because compensation for risk was poor, we cut back on the Fund’s risk exposure and built a capital reserve to spend as opportunities arose, nearly eliminating exposure to higher-risk parts of the market, such as higher yield bonds. The year became a litmus test for managing risk, and we believe our agile approach to risk management was critical in helping the Fund outperform its benchmark for the 12-month period.

With the Fund’s capital reserve in hand, we began to look for investment opportunities created by market dislocations in the initial phase of the pandemic. Investors’ anticipated liquidity needs no longer seemed to a major concern. We focused on issuers that we assessed would more likely survive the pandemic. Accordingly, we began to spend the Fund’s liquid capital reserve, selecting higher yielding parts of the securitized bond sector and high-quality investment grade issuers, such as Bank of America Corp., which we felt offered attractive compensation for the underlying risk.

As visibility gradually increased, we expanded our search for opportunities to also include traditionally higher-beta (more volatile) parts of the market that had experienced dislocations, specifically within the high yield and emerging markets sectors. We added to issuers that we felt were strongest within COVID-19-sensitive areas, such as Delta Air Lines Inc. We viewed Delta as well positioned to survive the pandemic while offering historically high yields. In addition, an overweight to certain higher-quality emerging market issuers, such as Banco Santander S.A., benefited performance as well. The Fund continues to hold these securities as we believe they have retained their relative value potential.

While security selection overall was additive, some individual securities did underperform amid the demand contraction. This was the case with General Motors Financial Co. Inc., which underperformed during the peak of the crisis but has since recovered as monetary support improved liquidity prospects. We maintain the Fund’s position given our outlook for continued economic recovery with the vaccine rollout.

The Fund’s positioning also benefited from our decision early in the year to increase duration for

2

the purpose of mitigating risk, as we thought that a high degree of uncertainty would likely result in a dramatic decline in interest rates as the Fed intervened. That willingness to dynamically manage interest rate risk paid off.

There were few detractors from the Fund’s benchmark-relative returns for the fiscal year. Our use of mortgage-backed securities (MBS) as a funding source detracted marginally; however, the Fund was better compensated within investment grade bonds. The Fund’s modest allocation to bank loans, which remained static throughout the year, modestly detracted from returns. A moderate overweight to energy securities, albeit strongly positioned to manage through the pandemic, detracted as the sector had not fully recovered.

We also focused on higher-quality issuers within investment grade, whose business models we thought were more likely to survive the pandemic. By summer, we also added somewhat to the Fund’s exposure to the higher yielding areas of the fixed income market, such as emerging markets debt and high yield bonds (from 2% to 10%). Within the securitized bond sector, we increased the Fund’s allocation to collateralized loan obligations (CLOs) from 0% to 7%, funded with Treasurys and lower yielding floating-rate asset-backed securities (ABS).

Key risks and opportunities

As we enter 2021, COVID-19 vaccines’ high efficacy and their production and distribution have redefined the outlook for the pandemic and the global economy. Nonetheless, the near-term reality is that the virus is still raging, and mutations could make the virus more resistant to vaccines.

On the political front, Democrats control both houses of Congress and the White House, increasing the possibility of additional fiscal stimulus, which would support an economic recovery.

Consistent with our outlook, we reduced exposure to areas we believe offer limited upside, such as higher-quality credit and ABS, and replaced them with agency MBS and securities with what we view as more attractive yield profiles, such as CLOs. We have retained exposure to the reflationary theme, including airlines and certain consumer goods, and we continue to search for areas where we believe there is potential to capture yield without altering the Fund’s risk exposure.

Finally, from a risk perspective, the Fund remains driven by a fundamental, bond-by-bond investment approach. Our goal is to construct the Fund’s portfolio to comprise issuers that have a business model, liquidity, and adequate debt leverage profile to perform well regardless of the degree of volatility we may experience.

The Fund used derivatives during the fiscal year, primarily for risk management purposes, including the use of interest rate futures to manage yield-curve risk and broader portfolio risks. The Fund used currency forwards to hedge non-US-dollar risk back to US dollars. The Fund also used foreign exchange (FX) forwards to gain access to a given currency, though we generally do this more directly through the bond market. The Fund also used credit default swaps to manage credit risk. Overall, these derivatives had a positive effect that was generally not material to the Fund’s performance.

3

| Performance summary | |

| Delaware Limited-Term Diversified Income Fund | December 31, 2020 (Unaudited) |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | Average annual total returns through December 31, 2020 | ||||||||

| 1 year | 5 year | 10 year | Lifetime | ||||||

| Class A (Est. November 24, 1985) | |||||||||

| Excluding sales charge | +4.16% | +2.40% | +1.73% | +4.62% | |||||

| Including sales charge | +1.34% | +1.83% | +1.45% | +4.53% | |||||

| Class C (Est. November 28, 1995) | |||||||||

| Excluding sales charge | +3.28% | +1.56% | +0.88% | +2.86% | |||||

| Including sales charge | +2.28% | +1.56% | +0.88% | +2.86% | |||||

| Class R (Est. June 2, 2003) | |||||||||

| Excluding sales charge | +3.66% | +2.05% | +1.37% | +2.47% | |||||

| Including sales charge | +3.66% | +2.05% | +1.37% | +2.47% | |||||

| Institutional Class (Est. June 1, 1992) | |||||||||

| Excluding sales charge | +4.31% | +2.56% | +1.88% | +3.97% | |||||

| Including sales charge | +4.31% | +2.56% | +1.88% | +3.97% | |||||

| Class R6 (Est. May 1, 2017) | |||||||||

| Excluding sales charge | +4.38% | — | — | +2.56% | |||||

| Including sales charge | +4.38% | — | — | +2.56% | |||||

| Bloomberg Barclays 1-3 Year US | |||||||||

| Government/Credit Index | +3.33% | +2.21% | +1.60% | +3.85%* | |||||

| * | The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the month end prior to the Fund’s Institutional Class inception date. |

| 1 | Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares. |

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund expense ratios” table on page 6. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service (12b-1) fee.

Class A shares are sold with a maximum front-end sales charge of 2.75%, and have an annual 12b-1 fee of 0.25% of average daily net assets. Performance for Class A shares, excluding sales

4

charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual 12b-1 fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual 12b-1 fee of 0.50% of average daily net assets.

Class R6 shares are available only to certain investors. In addition, Class R6 shares do not pay any service fees, sub-accounting fees, and/or sub-transfer agency fees to any brokers, dealers, or other financial intermediaries. Class R6 shares pay no 12b-1 fee.

Fixed income securities and bond investments can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds.

The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for the Fund to obtain precise valuations of the high yield securities in its portfolio.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivatives transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

International investments entail risks including fluctuation in currency values, differences in accounting principles, or economic or political instability. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility, lower trading volume, and higher risk of market closures. In many emerging markets, there is substantially less publicly available information and the available information may be incomplete or misleading. Legal claims are generally more difficult to pursue.

If and when the Fund invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Fund will be subject to special risks, including counterparty risk.

Diversification may not protect against market risk.

IBOR risk is the risk that changes related to the use of the London interbank offered rate (LIBOR) or similar rates (such as EONIA) could have adverse impacts on financial instruments that reference these rates. The abandonment of these rates and transition to alternative rates could affect the value and liquidity of instruments that reference them and could affect investment strategy performance.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Fund from executing advantageous investment

5

Performance summary

Delaware Limited-Term Diversified Income Fund

decisions in a timely manner and could negatively impact the Fund’s ability to achieve its investment objective and the value of the Fund’s investments.

| 2 | The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.39% of the Fund’s average daily net assets for all share classes other than R6, and 0.32% of the Fund’s Class R6 shares’ average daily net assets from January 1, 2020 to December 31, 2020.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios. |

| Institutional | |||||||||||

| Fund expense ratios | Class A | Class C | Class R | Class | Class R6 | ||||||

| Total annual operating expenses | |||||||||||

| (without fee waivers) | 0.96% | 1.71% | 1.21% | 0.71% | 0.64% | ||||||

| Net expenses (including fee | |||||||||||

| waivers, if any) | 0.54% | 1.39% | 0.89% | 0.39% | 0.32% | ||||||

| Type of waiver | Contractual | Contractual | Contractual | Contractual | Contractual |

| * | The aggregate contractual waiver period covering this report is from May 1, 2019 through April 30, 2021. |

6

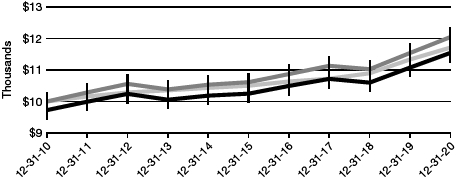

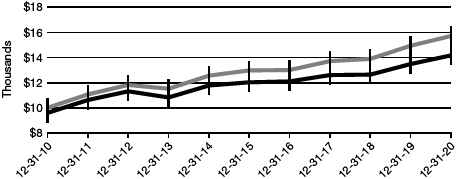

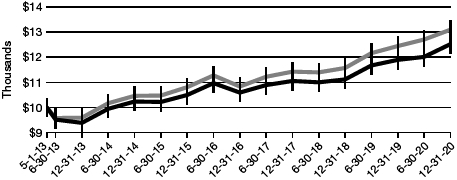

Performance of a $10,000 Investment1

Average annual total returns from December 31, 2010 through December 31, 2020

| For period beginning December 31, 2010 through December 31, 2020 | Starting value | Ending value | ||||||

|

|

Delaware Limited-Term Diversified Income Fund — Institutional Class shares | $10,000 | $12,049 | |||||

|

|

Bloomberg Barclays 1-3 Year US Government/Credit Index | $10,000 | $11,715 | |||||

|

|

Delaware Limited-Term Diversified Income Fund — Class A shares | $9,725 | $11,546 | |||||

| 1 | The “Performance of a $10,000 investment” graph assumes $10,000 invested in Institutional Class and Class A shares of the Fund on December 31, 2010, and includes the effect of a 2.75% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 6. Please note additional details on pages 4 through 8. |

The graph also assumes $10,000 invested in the Bloomberg Barclays 1-3 Year US Government/ Credit Index as of December 31, 2010.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

7

Performance summary

Delaware Limited-Term Diversified Income Fund

| Nasdaq symbols | CUSIPs | ||||||

| Class A |

DTRIX |

245912308 | |||||

| Class C |

DTICX |

245912704 | |||||

| Class R |

DLTRX |

245912803 | |||||

| Institutional Class |

DTINX |

245912506 | |||||

| Class R6 |

DLTZX |

245912886 | |||||

8

Disclosure of Fund expenses

For the six-month period from July 1, 2020 to December 31, 2020 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from July 1, 2020 to December 31, 2020.

Actual expenses

The first section of the table shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Fund’s expenses shown in the table reflect fee waivers in effect and assume reinvestment of all dividends and distributions.

9

Disclosure of Fund expenses

For the six-month period from July 1, 2020 to December 31, 2020 (Unaudited)

Delaware Limited-Term Diversified Income Fund

Expense analysis of an investment of $1,000

| Beginning | Ending | Expenses | ||||||||||||||||||

| Account Value | Account Value | Annualized | Paid During Period | |||||||||||||||||

| 7/1/20 | 12/31/20 | Expense Ratio | 7/1/20 to 12/31/20* | |||||||||||||||||

| Actual Fund return† | ||||||||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,014.90 | 0.54 | % | $ | 2.73 | ||||||||||||

| Class C | 1,000.00 | 1,011.80 | 1.39 | % | 7.03 | |||||||||||||||

| Class R | 1,000.00 | 1,013.10 | 0.89 | % | 4.50 | |||||||||||||||

| Institutional Class | 1,000.00 | 1,015.70 | 0.39 | % | 1.98 | |||||||||||||||

| Class R6 | 1,000.00 | 1,017.20 | 0.32 | % | 1.62 | |||||||||||||||

| Hypothetical 5% return (5% return before expenses) | ||||||||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,022.42 | 0.54 | % | $ | 2.75 | ||||||||||||

| Class C | 1,000.00 | 1,018.15 | 1.39 | % | 7.05 | |||||||||||||||

| Class R | 1,000.00 | 1,020.66 | 0.89 | % | 4.52 | |||||||||||||||

| Institutional Class | 1,000.00 | 1,023.18 | 0.39 | % | 1.98 | |||||||||||||||

| Class R6 | 1,000.00 | 1,023.53 | 0.32 | % | 1.63 | |||||||||||||||

| * | “Expenses Paid During Period” are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

| † | Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns. |

In addition to the Fund’s expenses reflected above, the Fund also indirectly bears its portion of the fees and expenses of the investment companies (Underlying Funds) in which it invests. The table above does not reflect the expenses of the Underlying Funds.

10

| Security type / sector allocation | |

| Delaware Limited-Term Diversified Income Fund | As of December 31, 2020 (Unaudited) |

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications.

| Security type / sector | Percentage of net assets | ||||

| Agency Asset-Backed Securities | 0.00 | % | |||

| Agency Collateralized Mortgage Obligations | 2.17 | % | |||

| Agency Commercial Mortgage-Backed Securities | 0.30 | % | |||

| Agency Mortgage-Backed Securities | 12.82 | % | |||

| Collateralized Debt Obligations | 6.99 | % | |||

| Convertible Bond | 0.01 | % | |||

| Corporate Bonds | 46.02 | % | |||

| Banking | 10.70 | % | |||

| Banks | 0.37 | % | |||

| Basic Industry | 4.00 | % | |||

| Capital Goods | 2.91 | % | |||

| Communications | 3.51 | % | |||

| Consumer Cyclical | 3.37 | % | |||

| Consumer Non-Cyclical | 6.02 | % | |||

| Electric | 4.36 | % | |||

| Energy | 4.85 | % | |||

| Finance Companies | 2.15 | % | |||

| Healthcare | 0.46 | % | |||

| Insurance | 0.65 | % | |||

| Real Estate | 0.34 | % | |||

| Services | 0.82 | % | |||

| Technology | 0.44 | % | |||

| Transportation | 1.07 | % | |||

| Non-Agency Asset-Backed Securities | 8.19 | % | |||

| Non-Agency Collateralized Mortgage Obligations | 0.47 | % | |||

| Non-Agency Commercial Mortgage-Backed Securities | 1.23 | % | |||

| Loan Agreements | 0.30 | % | |||

| Sovereign Bonds | 3.17 | % | |||

| Supranational Bank | 0.12 | % | |||

| US Treasury Obligations | 16.32 | % | |||

| Preferred Stock | 0.34 | % | |||

| Short-Term Investments | 2.91 | % | |||

| Total Value of Securities | 101.36 | % | |||

| Liabilities Net of Receivables and Other Assets | (1.36 | %) | |||

| Total Net Assets | 100.00 | % | |||

11

| Schedule of investments | |

| Delaware Limited-Term Diversified Income Fund | December 31, 2020 |

| Principal amount° | Value (US $) | ||||||

| Agency Asset-Backed Securities — 0.00% | |||||||

| Fannie Mae REMIC Trust | |||||||

| Series 2001-W2 AS5 6.473% 10/25/31 ϕ | 3 | $ | 3 | ||||

| Freddie Mac Structured Pass Through Certificates | |||||||

| Series T-30 A5 8.61% 12/25/30 ⧫, ● | 3,391 | 3,820 | |||||

| Total Agency Asset-Backed Securities (cost $3,547) | 3,823 | ||||||

| Agency Collateralized Mortgage Obligations — 2.17% | |||||||

| Fannie Mae Grantor Trust | |||||||

| Series 2001-T5 A2 6.977% 6/19/41 ● | 18,336 | 21,567 | |||||

| Fannie Mae REMICs | |||||||

| Series 2011-105 FP 0.548% (LIBOR01M + 0.40%, | |||||||

| Cap 6.50%, Floor 0.40%) 6/25/41 ● | 968,158 | 971,252 | |||||

| Series 2017-94 CZ 3.50% 11/25/47 | 35,745 | 38,421 | |||||

| Freddie Mac REMICs | |||||||

| Series 3067 FA 0.509% (LIBOR01M + 0.35%, | |||||||

| Cap 7.00%, Floor 0.35%) 11/15/35 ● | 1,371,278 | 1,377,074 | |||||

| Series 3800 AF 0.659% (LIBOR01M + 0.50%, | |||||||

| Cap 7.00%, Floor 0.50%) 2/15/41 ● | 803,801 | 811,893 | |||||

| Series 4650 JG 3.00% 11/15/46 | 1,997,000 | 2,182,116 | |||||

| Series 4994 AV 2.00% 12/25/45 | 1,200,000 | 1,232,351 | |||||

| Freddie Mac Structured Agency Credit Risk REMIC | |||||||

| Trust | |||||||

| Series 2020-DNA6 M1 144A 0.977% (SOFR + | |||||||

| 0.90%) 12/25/50 #, ● | 1,700,000 | 1,700,267 | |||||

| Freddie Mac Structured Pass Through Certificates | |||||||

| Series T-54 2A 6.50% 2/25/43 ⧫ | 586 | 715 | |||||

| Series T-58 2A 6.50% 9/25/43 ⧫ | 336,095 | 390,705 | |||||

| GNMA | |||||||

| Series 2017-88 PB 3.00% 1/20/47 | 304,000 | 333,199 | |||||

| Series 2017-163 KH 3.50% 3/20/44 | 455,000 | 472,758 | |||||

| Total Agency Collateralized Mortgage Obligations (cost $9,019,677) | 9,532,318 | ||||||

| Agency Commercial Mortgage-Backed Securities — 0.30% | |||||||

| FREMF Mortgage Trust | |||||||

| Series 2011-K15 B 144A 4.965% 8/25/44 #, ● | 95,000 | 96,852 | |||||

| Series 2014-K717 B 144A 3.63% 11/25/47 #, ● | 245,000 | 248,649 | |||||

| Series 2014-K717 C 144A 3.63% 11/25/47 #, ● | 80,000 | 80,905 | |||||

12

| Principal amount° | Value (US $) | ||||||

| Agency Commercial Mortgage-Backed Securities (continued) | |||||||

| FREMF Mortgage Trust | |||||||

| Series 2016-K722 B 144A 3.845% 7/25/49 #, ● | 430,000 | $ | 455,665 | ||||

| NCUA Guaranteed Notes Trust | |||||||

| Series 2011-C1 2A 0.682% (LIBOR01M + 0.53%, | |||||||

| Cap 8.00%, Floor 0.53%) 3/9/21 ● | 451,589 | 449,764 | |||||

| Total Agency Commercial Mortgage-Backed Securities (cost $1,319,908) | 1,331,835 | ||||||

| Agency Mortgage-Backed Securities — 12.82% | |||||||

| Fannie Mae S.F. 15 yr | |||||||

| 2.50% 8/1/35 | 944,093 | 986,693 | |||||

| Fannie Mae S.F. 30 yr | |||||||

| 2.50% 7/1/50 | 2,430,270 | 2,571,464 | |||||

| 2.50% 9/1/50 | 159,994 | 171,190 | |||||

| 2.50% 10/1/50 | 2,263,324 | 2,393,342 | |||||

| 2.50% 11/1/50 | 853,051 | 899,891 | |||||

| 3.00% 5/1/46 | 864,160 | 909,259 | |||||

| 3.00% 1/1/47 | 1,268,147 | 1,347,650 | |||||

| 3.00% 11/1/49 | 194,624 | 211,240 | |||||

| 3.00% 3/1/50 | 1,137,991 | 1,222,099 | |||||

| 3.00% 7/1/50 | 3,398,207 | 3,567,440 | |||||

| 3.00% 8/1/50 | 1,173,089 | 1,249,865 | |||||

| 3.50% 7/1/47 | 334,105 | 359,021 | |||||

| 3.50% 11/1/48 | 196,689 | 207,756 | |||||

| 3.50% 3/1/50 | 86,734 | 93,451 | |||||

| 3.50% 7/1/50 | 2,560,739 | 2,724,168 | |||||

| 3.50% 9/1/50 | 832,196 | 933,036 | |||||

| 4.00% 6/1/48 | 210,519 | 231,266 | |||||

| 4.00% 10/1/48 | 1,291,094 | 1,421,800 | |||||

| 4.50% 10/1/45 | 936,244 | 1,045,436 | |||||

| 4.50% 5/1/46 | 1,157,988 | 1,293,888 | |||||

| 4.50% 9/1/49 | 1,691,111 | 1,872,289 | |||||

| 5.00% 7/1/47 | 1,612,073 | 1,871,942 | |||||

| 5.00% 8/1/49 | 4,007,054 | 4,555,622 | |||||

| 5.50% 4/1/33 | 42,046 | 48,892 | |||||

| 5.50% 6/1/33 | 39,891 | 46,413 | |||||

| 5.50% 10/1/33 | 20,109 | 22,460 | |||||

| 5.50% 12/1/33 | 172,357 | 201,019 | |||||

| 5.50% 2/1/34 | 80,114 | 93,926 | |||||

| 5.50% 9/1/34 | 111,104 | 129,254 | |||||

| 5.50% 8/1/37 | 222,920 | 260,448 | |||||

| 5.50% 1/1/38 | 224,472 | 261,568 | |||||

| 5.50% 7/1/41 | 37,075 | 43,584 | |||||

13

Schedule of investments

Delaware Limited-Term

Diversified Income Fund

| Principal amount° | Value (US $) | ||||

| Agency Mortgage-Backed Securities (continued) | |||||

| Fannie Mae S.F. 30 yr | |||||

| 5.50% 5/1/44 | 4,007,752 | $ | 4,701,112 | ||

| 6.00% 6/1/41 | 381,977 | 458,765 | |||

| 6.00% 7/1/41 | 4,392,160 | 5,299,949 | |||

| 6.00% 1/1/42 | 239,265 | 285,407 | |||

| Fannie Mae S.F. 30 yr TBA | |||||

| 2.00% 1/1/50 | 3,317,000 | 3,445,141 | |||

| 2.50% 1/1/50 | 1,928,000 | 2,032,079 | |||

| Freddie Mac ARM | |||||

| 2.68% (LIBOR12M + 1.93%, Cap 9.697%, Floor | |||||

| 1.93%) 8/1/38 ● | 3,468 | 3,481 | |||

| Freddie Mac S.F. 30 yr | |||||

| 2.00% 11/1/50 | 860,366 | 897,921 | |||

| 3.00% 7/1/50 | 1,820,568 | 1,909,315 | |||

| 4.50% 8/1/48 | 1,227,779 | 1,346,908 | |||

| 4.50% 1/1/49 | 129,850 | 144,323 | |||

| 4.50% 4/1/49 | 278,882 | 306,423 | |||

| 4.50% 5/1/49 | 748,149 | 820,563 | |||

| 5.50% 1/1/34 | 27,915 | 32,782 | |||

| 5.50% 6/1/34 | 240,602 | 283,003 | |||

| 5.50% 6/1/35 | 60,636 | 70,819 | |||

| 5.50% 7/1/37 | 90,604 | 106,521 | |||

| 5.50% 8/1/37 | 76,392 | 89,832 | |||

| 5.50% 10/1/37 | 80,410 | 94,557 | |||

| 5.50% 7/1/38 | 174,436 | 206,484 | |||

| 5.50% 11/1/38 | 171,153 | 201,241 | |||

| 5.50% 4/1/40 | 38,711 | 44,200 | |||

| 5.50% 6/1/41 | 193,672 | 227,725 | |||

| 6.00% 5/1/39 | 25,192 | 29,899 | |||

| Total Agency Mortgage-Backed Securities (cost $55,430,884) | 56,285,822 | ||||

| Collateralized Debt Obligations — 6.99% | |||||

| AMMC CLO 23 | |||||

| Series 2020-23A A1L 144A 1.635% (LIBOR03M + | |||||

| 1.40%, Floor 1.40%) 10/17/31 #, ● | 1,200,000 | 1,198,486 | |||

| Ballyrock CLO | |||||

| Series 2018-1A A1 144A 1.218% (LIBOR03M + | |||||

| 1.00%) 4/20/31 #, ● | 2,000,000 | 1,979,054 | |||

| Series 2020-2A A1 144A 1.529% (LIBOR03M + | |||||

| 1.32%, Floor 1.32%) 10/20/31 #, ● | 1,500,000 | 1,498,105 | |||

14

| Principal amount° | Value (US $) | ||||

| Collateralized Debt Obligations (continued) | |||||

| Battalion CLO 18 | |||||

| Series 2020-18A A1 144A 2.035% (LIBOR03M + | |||||

| 1.80%, Floor 1.80%) 10/15/32 #, ● | 2,000,000 | $ | 2,006,392 | ||

| Benefit Street Partners CLO IX | |||||

| Series 2016-9A AR 144A 1.328% (LIBOR03M + | |||||

| 1.11%) 7/20/31 #, ● | 500,000 | 498,621 | |||

| BlueMountain CLO XXX | |||||

| Series 2020-30A A 144A 1.549% (LIBOR03M + | |||||

| 1.39%, Floor 1.39%) 1/15/33 #, ● | 1,250,000 | 1,248,433 | |||

| Carlyle Global Market Strategies CLO | |||||

| Series 2014-2RA A1 144A 1.271% (LIBOR03M + | |||||

| 1.05%) 5/15/31 #, ● | 985,635 | 977,052 | |||

| Series 2015-5A A1R 144A 1.538% (LIBOR03M + | |||||

| 1.32%, Floor 1.32%) 1/20/32 #, ● | 1,000,000 | 998,801 | |||

| CBAM | |||||

| Series 2020-13A A 144A 1.585% (LIBOR03M + | |||||

| 1.43%, Floor 1.43%) 1/20/34 #, ● | 2,200,000 | 2,197,241 | |||

| Cedar Funding IX CLO | |||||

| Series 2018-9A A1 144A 1.198% (LIBOR03M + | |||||

| 0.98%, Floor 0.98%) 4/20/31 #, ● | 575,000 | 572,866 | |||

| CIFC Funding | |||||

| Series 2013-4A A1RR 144A 1.277% (LIBOR03M + | |||||

| 1.06%, Floor 1.06%) 4/27/31 #, ● | 2,000,000 | 1,988,756 | |||

| Dryden 83 CLO | |||||

| Series 2020-83A A 144A 0.000% (LIBOR03M + | |||||

| 1.22%, Floor 1.22%) 1/18/32 #, ●, ^ | 2,200,000 | 2,200,000 | |||

| Galaxy XXI CLO | |||||

| Series 2015-21A AR 144A 1.238% (LIBOR03M + | |||||

| 1.02%) 4/20/31 #, ● | 1,000,000 | 990,306 | |||

| KKR CLO 32 | |||||

| Series 32A A1 144A 1.545% (LIBOR03M + | |||||

| 1.32%, Floor 1.32%) 1/15/32 #, ● | 1,200,000 | 1,198,496 | |||

| LCM XVIII | |||||

| Series 18A A1R 144A 1.238% (LIBOR03M + | |||||

| 1.02%) 4/20/31 #, ● | 1,500,000 | 1,491,309 | |||

| Octagon Investment Partners 33 | |||||

| Series 2017-1A A1 144A 1.408% (LIBOR03M + | |||||

| 1.19%) 1/20/31 #, ● | 2,350,000 | 2,346,228 | |||

| Octagon Investment Partners 48 | |||||

| Series 2020-3A A 144A 1.732% (LIBOR03M + | |||||

| 1.50%, Floor 1.50%) 10/20/31 #, ● | 2,000,000 | 2,003,022 | |||

| Sound Point CLO XXI | |||||

| Series 2018-3A A1A 144A 1.395% (LIBOR03M + | |||||

| 1.18%, Floor 1.18%) 10/26/31 #, ● | 2,300,000 | 2,292,352 | |||

15

Schedule of investments

Delaware Limited-Term

Diversified Income Fund

| Principal amount° | Value (US $) | ||||

| Collateralized Debt Obligations (continued) | |||||

| York CLO-6 | |||||

| Series 2019-1A A1 144A 1.566% (LIBOR03M + | |||||

| 1.35%) 7/22/32 #, ● | 1,000,000 | $ | 999,404 | ||

| Zais CLO 16 | |||||

| Series 2020-16A A1 144A 2.48% (LIBOR03M + | |||||

| 2.19%, Floor 2.19%) 10/20/31 #, ● | 2,000,000 | 1,998,192 | |||

| Total Collateralized Debt Obligations (cost $30,611,451) | 30,683,116 | ||||

| Convertible Bond — 0.01% | |||||

| Cheniere Energy PIK 144A 4.875% exercise price | |||||

| $93.64, maturity date 5/28/21 #, > | 38,826 | 39,068 | |||

| Total Convertible Bond (cost $39,149) | 39,068 | ||||

| Corporate Bonds — 46.02% | |||||

| Banking — 10.70% | |||||

| Banco Continental 144A 2.75% 12/10/25 # | 200,000 | 199,500 | |||

| Banco de Credito del Peru 144A 2.70% 1/11/25 # | 200,000 | 209,052 | |||

| Banco de Credito e Inversiones 144A 4.00% | |||||

| 2/11/23 # | 200,000 | 212,330 | |||

| Banco del Estado de Chile 144A 2.704% 1/9/25 # | 220,000 | 232,790 | |||

| Banco Santander 3.50% 4/11/22 | 1,600,000 | 1,661,691 | |||

| Banco Santander Mexico 144A 4.125% 11/9/22 # | 150,000 | 158,438 | |||

| Bancolombia 3.00% 1/29/25 | 215,000 | 223,804 | |||

| Bank of America | |||||

| 2.738% 1/23/22 µ | 1,370,000 | 1,371,678 | |||

| 3.458% 3/15/25 µ | 2,845,000 | 3,098,574 | |||

| Bank of Georgia 144A 6.00% 7/26/23 # | 200,000 | 212,500 | |||

| Bank of Montreal 1.85% 5/1/25 | 345,000 | 362,344 | |||

| Barclays Bank 1.70% 5/12/22 | 2,420,000 | 2,463,200 | |||

| BBVA Bancomer | |||||

| 144A 1.875% 9/18/25 # | 1,135,000 | 1,147,769 | |||

| 144A 6.75% 9/30/22 # | 150,000 | 162,300 | |||

| Citigroup 4.044% 6/1/24 µ | 2,430,000 | 2,643,242 | |||

| Citizens Financial Group 2.85% 7/27/26 | 1,545,000 | 1,721,196 | |||

| Credit Agricole 144A 1.907% 6/16/26 #, µ | 370,000 | 384,097 | |||

| Credit Suisse Group 144A 2.593% 9/11/25 #, µ | 2,295,000 | 2,415,833 | |||

| Development Bank of Mongolia 144A 7.25% | |||||

| 10/23/23 # | 200,000 | 214,718 | |||

| Emirates NBD Bank 2.625% 2/18/25 | 200,000 | 211,100 | |||

| Goldman Sachs Group 3.50% 4/1/25 | 180,000 | 200,320 | |||

| ICICI Bank 3.25% 9/9/22 | 320,000 | 328,917 | |||

16

| Principal amount° | Value (US $) | ||||

| Corporate Bonds (continued) | |||||

| Banking (continued) | |||||

| JPMorgan Chase & Co. | |||||

| 4.023% 12/5/24 µ | 4,240,000 | $ | 4,672,508 | ||

| 4.60% µ, ψ | 135,000 | 139,556 | |||

| KEB Hana Bank 144A 3.375% 1/30/22 # | 500,000 | 515,219 | |||

| KeyBank | |||||

| 2.40% 6/9/22 | 250,000 | 257,370 | |||

| 3.18% 5/22/22 | 1,335,000 | 1,384,611 | |||

| Kookmin Bank 144A 2.875% 3/25/23 # | 200,000 | 210,281 | |||

| Morgan Stanley | |||||

| 2.188% 4/28/26 µ | 415,000 | 438,615 | |||

| 2.75% 5/19/22 | 1,075,000 | 1,110,373 | |||

| 3.622% 4/1/31 µ | 305,000 | 354,466 | |||

| National Securities Clearing 144A 1.20% 4/23/23 # | 520,000 | 530,526 | |||

| Natwest Group 8.625% µ, ψ | 1,285,000 | 1,336,567 | |||

| PNC Bank 2.70% 11/1/22 | 3,280,000 | 3,418,166 | |||

| Popular 6.125% 9/14/23 | 523,000 | 566,746 | |||

| QNB Finance 3.50% 3/28/24 | 330,000 | 354,703 | |||

| Regions Financial 3.80% 8/14/23 | 1,070,000 | 1,161,230 | |||

| Truist Bank 2.636% 9/17/29 µ | 1,465,000 | 1,550,479 | |||

| Truist Financial 2.70% 1/27/22 | 2,785,000 | 2,851,497 | |||

| UBS 144A 1.75% 4/21/22 # | 200,000 | 203,590 | |||

| UBS Group | |||||

| 144A 1.364% 1/30/27 #, µ | 205,000 | 207,398 | |||

| 144A 3.00% 4/15/21 # | 2,700,000 | 2,720,917 | |||

| US Bank 3.40% 7/24/23 | 1,380,000 | 1,483,151 | |||

| USB Capital IX 3.50% (LIBOR03M + 1.02%) ψ, ● | 1,710,000 | 1,684,350 | |||

| 46,987,712 | |||||

| Banks — 0.37% | |||||

| Morgan Stanley 1.433% LIBOR03M + 1.22% | |||||

| 5/8/24 ● | 1,605,000 | 1,636,508 | |||

| 1,636,508 | |||||

| Basic Industry — 4.00% | |||||

| Avient 144A 5.75% 5/15/25 # | 822,000 | 874,402 | |||

| BMC East 144A 5.50% 10/1/24 # | 500,000 | 513,750 | |||

| DuPont de Nemours 2.169% 5/1/23 | 1,495,000 | 1,515,231 | |||

| Equate Petrochemical 144A 3.00% 3/3/22 # | 265,000 | 270,804 | |||

| First Quantum Minerals 144A 7.50% 4/1/25 # | 1,085,000 | 1,131,112 | |||

| Georgia-Pacific 144A 1.75% 9/30/25 # | 285,000 | 298,104 | |||

| Gold Fields Orogen Holdings BVI 144A 5.125% | |||||

| 5/15/24 # | 250,000 | 277,214 | |||

| Hudbay Minerals 144A 7.625% 1/15/25 # | 861,000 | 895,978 | |||

17

Schedule of investments

Delaware Limited-Term

Diversified Income Fund

| Principal amount° | Value (US $) | ||||

| Corporate Bonds (continued) | |||||

| Basic Industry (continued) | |||||

| Inversiones CMPC 144A 4.75% 9/15/24 # | 2,200,000 | $ | 2,439,943 | ||

| Kraton Polymers 144A 7.00% 4/15/25 # | 1,500,000 | 1,580,250 | |||

| LYB International Finance III 2.875% 5/1/25 | 225,000 | 245,424 | |||

| New Gold 144A 6.375% 5/15/25 # | 166,000 | 173,781 | |||

| Novolipetsk Steel Via Steel Funding DAC 144A | |||||

| 4.50% 6/15/23 # | 250,000 | 268,219 | |||

| Nutrien 1.90% 5/13/23 | 1,995,000 | 2,061,791 | |||

| OCP 144A 4.50% 10/22/25 # | 1,000,000 | 1,091,749 | |||

| PowerTeam Services 144A 9.033% 12/4/25 # | 605,000 | 674,642 | |||

| Sociedad Quimica y Minera de Chile 144A 3.625% | |||||

| 4/3/23 # | 200,000 | 210,531 | |||

| Steel Dynamics 2.80% 12/15/24 | 1,455,000 | 1,565,706 | |||

| Syngenta Finance | |||||

| 144A 3.933% 4/23/21 # | 620,000 | 624,197 | |||

| 144A 4.441% 4/24/23 # | 200,000 | 210,008 | |||

| WESCO Distribution 144A 7.125% 6/15/25 # | 605,000 | 666,199 | |||

| 17,589,035 | |||||

| Capital Goods — 2.91% | |||||

| Bombardier 144A 6.00% 10/15/22 # | 500,000 | 492,075 | |||

| General Dynamics 3.00% 5/11/21 | 2,920,000 | 2,948,221 | |||

| General Electric 3.45% 5/1/27 | 245,000 | 276,695 | |||

| Mauser Packaging Solutions Holding 144A 5.50% | |||||

| 4/15/24 # | 1,802,000 | 1,840,184 | |||

| Otis Worldwide 2.056% 4/5/25 | 1,245,000 | 1,320,572 | |||

| Roper Technologies 2.35% 9/15/24 | 2,295,000 | 2,444,475 | |||

| Spirit AeroSystems 144A 5.50% 1/15/25 # | 890,000 | 939,974 | |||

| Terex 144A 5.625% 2/1/25 # | 890,000 | 918,480 | |||

| TransDigm 144A 8.00% 12/15/25 # | 820,000 | 908,224 | |||

| Turkiye Sise ve Cam Fabrikalari 144A 6.95% | |||||

| 3/14/26 # | 200,000 | 223,000 | |||

| Welbilt 9.50% 2/15/24 | 433,000 | 448,335 | |||

| 12,760,235 | |||||

| Communications — 3.51% | |||||

| AMC Networks 5.00% 4/1/24 | 1,096,000 | 1,115,180 | |||

| Charter Communications Operating 4.908% | |||||

| 7/23/25 | 1,515,000 | 1,761,245 | |||

| Clear Channel International 144A 6.625% 8/1/25 # | 475,000 | 502,906 | |||

| Clear Channel Worldwide Holdings 9.25% 2/15/24 | 525,000 | 532,930 | |||

| Crown Castle International 5.25% 1/15/23 | 3,110,000 | 3,403,937 | |||

| CSC Holdings 6.75% 11/15/21 | 375,000 | 392,578 | |||

18

| Principal amount° | Value (US $) | |||||

| Corporate Bonds (continued) | ||||||

| Communications (continued) | ||||||

| Fox | ||||||

| 3.666% 1/25/22 | 880,000 | $ | 911,010 | |||

| 4.03% 1/25/24 | 2,280,000 | 2,512,143 | ||||

| IHS Netherlands Holdco 144A 7.125% 3/18/25 # | 200,000 | 210,500 | ||||

| Ooredoo International Finance 144A 5.00% | ||||||

| 10/19/25 # | 200,000 | 233,689 | ||||

| Sirius XM Radio 144A 4.625% 7/15/24 # | 250,000 | 259,375 | ||||

| Sprint Spectrum 144A 4.738% 3/20/25 # | 450,000 | 488,797 | ||||

| Tencent Holdings 144A 3.28% 4/11/24 # | 200,000 | 213,232 | ||||

| Time Warner Entertainment 8.375% 3/15/23 | 1,795,000 | 2,099,310 | ||||

| T-Mobile USA | ||||||

| 144A 1.50% 2/15/26 # | 250,000 | 256,436 | ||||

| 144A 3.50% 4/15/25 # | 290,000 | 320,734 | ||||

| Turk Telekomunikasyon 144A 4.875% 6/19/24 # | 200,000 | 207,396 | ||||

| 15,421,398 | ||||||

| Consumer Cyclical – 3.37% | ||||||

| Boyd Gaming 144A 8.625% 6/1/25 # | 791,000 | 880,731 | ||||

| Caesars Entertainment 144A 6.25% 7/1/25 # | 675,000 | 719,722 | ||||

| Carnival 144A 7.625% 3/1/26 # | 685,000 | 747,585 | ||||

| Ford Motor 8.50% 4/21/23 | 1,256,000 | 1,418,244 | ||||

| Ford Motor Credit 3.375% 11/13/25 | 1,200,000 | 1,230,372 | ||||

| General Motors Financial | ||||||

| 3.45% 4/10/22 | 1,195,000 | 1,229,022 | ||||

| 4.15% 6/19/23 | 1,390,000 | 1,495,812 | ||||

| IRB Holding 144A 7.00% 6/15/25 # | 129,000 | 141,161 | ||||

| JD.com 3.875% 4/29/26 | 1,500,000 | 1,679,454 | ||||

| L Brands 144A 6.875% 7/1/25 # | 810,000 | 880,705 | ||||

| Meituan 144A 2.125% 10/28/25 # | 250,000 | 254,227 | ||||

| MGM Resorts International 5.75% 6/15/25 | 1,100,000 | 1,218,277 | ||||

| Sands China 144A 3.80% 1/8/26 # | 200,000 | 214,092 | ||||

| Scientific Games International 144A 5.00% | ||||||

| 10/15/25 # | 1,085,000 | 1,120,957 | ||||

| Six Flags Entertainment 144A 4.875% 7/31/24 # | 665,000 | 668,006 | ||||

| Station Casinos 144A 5.00% 10/1/25 # | 541,000 | 548,263 | ||||

| VF 2.40% 4/23/25 | 330,000 | 352,156 | ||||

| 14,798,786 | ||||||

| Consumer Non-Cyclical – 6.02% | ||||||

| AbbVie | ||||||

| 2.60% 11/21/24 | 2,915,000 | 3,126,527 | ||||

| 2.95% 11/21/26 | 10,000 | 11,071 | ||||

| Anheuser-Busch InBev Worldwide 4.15% 1/23/25 | 2,965,000 | 3,377,301 | ||||

19

Schedule of investments

Delaware Limited-Term Diversified Income Fund

| Principal amount° | Value (US $) | |||||

| Corporate Bonds (continued) | ||||||

| Consumer Non-Cyclical (continued) | ||||||

| Cigna | ||||||

| 1.127% LIBOR03M + 0.89% 7/15/23 ● | 2,055,000 | $ | 2,079,280 | |||

| 3.75% 7/15/23 | 935,000 | 1,010,976 | ||||

| CK Hutchison International 17 144A 2.875% | ||||||

| 4/5/22 # | 200,000 | 205,205 | ||||

| CVS Health | ||||||

| 3.70% 3/9/23 | 387,000 | 414,399 | ||||

| 4.30% 3/25/28 | 116,000 | 138,159 | ||||

| Diageo Capital 1.375% 9/29/25 | 435,000 | 447,789 | ||||

| DP World Crescent 144A 3.908% 5/31/23 # | 200,000 | 211,630 | ||||

| General Mills 3.70% 10/17/23 | 2,075,000 | 2,261,747 | ||||

| Global Payments 2.65% 2/15/25 | 1,412,000 | 1,512,679 | ||||

| Mondelez International | ||||||

| 1.50% 5/4/25 | 1,210,000 | 1,252,482 | ||||

| 2.125% 4/13/23 | 1,320,000 | 1,371,673 | ||||

| PayPal Holdings 1.35% 6/1/23 | 3,025,000 | 3,098,983 | ||||

| Pilgrim’s Pride 144A 5.75% 3/15/25 # | 870,000 | 894,230 | ||||

| Primo Water Holdings 144A 5.50% 4/1/25 # | 847,000 | 875,586 | ||||

| Royalty Pharma | ||||||

| 144A 1.20% 9/2/25 # | 345,000 | 350,590 | ||||

| 144A 1.75% 9/2/27 # | 230,000 | 236,852 | ||||

| Tenet Healthcare 5.125% 5/1/25 | 1,160,000 | 1,184,058 | ||||

| Teva Pharmaceutical Finance Netherlands III 6.00% | ||||||

| 4/15/24 | 250,000 | 265,581 | ||||

| Viatris | ||||||

| 144A 1.65% 6/22/25 # | 1,960,000 | 2,027,589 | ||||

| 144A 2.30% 6/22/27 # | 80,000 | 85,260 | ||||

| 26,439,647 | ||||||

| Electric – 4.36% | ||||||

| AEP Texas 2.40% 10/1/22 | 2,810,000 | 2,900,085 | ||||

| Avangrid 3.20% 4/15/25 | 505,000 | 553,285 | ||||

| Azure Power Energy 144A 5.50% 11/3/22 # | 215,000 | 220,912 | ||||

| Centrais Eletricas Brasileiras 144A 3.625% 2/4/25 # | 200,000 | 207,752 | ||||

| Cleveland Electric Illuminating 5.50% 8/15/24 | 1,430,000 | 1,648,247 | ||||

| CLP Power Hong Kong Financing 2.875% 4/26/23 | 200,000 | 209,090 | ||||

| Duke Energy | ||||||

| 1.80% 9/1/21 | 2,250,000 | 2,269,741 | ||||

| 4.875% µ, ψ | 570,000 | 618,638 | ||||

| Engie Energia Chile 144A 4.50% 1/29/25 # | 2,200,000 | 2,443,816 | ||||

| Entergy 4.00% 7/15/22 | 1,050,000 | 1,101,250 | ||||

| Entergy Louisiana 4.05% 9/1/23 | 1,125,000 | 1,222,993 | ||||

20

| Principal amount° | Value (US $) | |||||

| Corporate Bonds (continued) | ||||||

| Electric (continued) | ||||||

| ITC Holdings 2.70% 11/15/22 | 1,570,000 | $ | 1,634,700 | |||

| NRG Energy 144A 3.75% 6/15/24 # | 1,200,000 | 1,314,303 | ||||

| Pacific Gas and Electric 2.10% 8/1/27 | 980,000 | 995,943 | ||||

| Vistra Operations 144A 3.55% 7/15/24 # | 1,650,000 | 1,787,640 | ||||

| 19,128,395 | ||||||

| Energy – 4.85% | ||||||

| Apache 4.625% 11/15/25 | 785,000 | 825,231 | ||||

| Cheniere Corpus Christi Holdings 7.00% 6/30/24 | 1,955,000 | 2,284,267 | ||||

| Continental Resources 3.80% 6/1/24 | 625,000 | 644,922 | ||||

| Energy Transfer Operating 5.25% 4/15/29 | 1,235,000 | 1,442,256 | ||||

| Greenko Mauritius 144A 6.25% 2/21/23 # | 210,000 | 217,153 | ||||

| Marathon Oil 2.80% 11/1/22 | 765,000 | 786,538 | ||||

| MPLX | ||||||

| 1.75% 3/1/26 | 210,000 | 217,438 | ||||

| 4.875% 12/1/24 | 1,955,000 | 2,243,927 | ||||

| Murphy Oil 5.75% 8/15/25 | 905,000 | 902,833 | ||||

| NiSource 0.95% 8/15/25 | 1,850,000 | 1,862,012 | ||||

| NuStar Logistics 5.75% 10/1/25 | 715,000 | 762,548 | ||||

| Occidental Petroleum 5.50% 12/1/25 | 905,000 | 945,259 | ||||

| ONEOK 7.50% 9/1/23 | 1,655,000 | 1,916,288 | ||||

| Petroleos Mexicanos 4.625% 9/21/23 | 130,000 | 135,281 | ||||

| Sabine Pass Liquefaction 5.75% 5/15/24 | 1,990,000 | 2,275,822 | ||||

| Saudi Arabian Oil 144A 1.625% 11/24/25 # | 205,000 | 210,168 | ||||

| Southwestern Energy 6.45% 1/23/25 | 983,000 | 1,021,706 | ||||

| Tengizchevroil Finance Co International 144A | ||||||

| 2.625% 8/15/25 # | 1,200,000 | 1,250,755 | ||||

| Tullow Oil 144A 6.25% 4/15/22 # | 250,000 | 200,000 | ||||

| Western Midstream Operating 4.10% 2/1/25 | 465,000 | 479,954 | ||||

| WPX Energy 5.25% 9/15/24 | 621,000 | 677,989 | ||||

| 21,302,347 | ||||||

| Finance Companies – 2.15% | ||||||

| AerCap Ireland Capital 3.15% 2/15/24 | 1,780,000 | 1,866,699 | ||||

| Air Lease 2.875% 1/15/26 | 780,000 | 825,923 | ||||

| Ally Financial 5.75% 11/20/25 | 771,000 | 898,211 | ||||

| Avolon Holdings Funding 144A 3.95% 7/1/24 # | 555,000 | 586,555 | ||||

| China Overseas Finance Cayman V 3.95% | ||||||

| 11/15/22 | 205,000 | 214,118 | ||||

| DAE Funding 144A 5.75% 11/15/23 # | 750,000 | 771,562 | ||||

| DAE Sukuk DIFC 144A 3.75% 2/15/26 # | 200,000 | 206,000 | ||||

| GE Capital Funding 144A 3.45% 5/15/25 # | 485,000 | 535,624 | ||||

21

Schedule of investments

Delaware Limited-Term Diversified Income Fund

| Principal amount° | Value (US $) | |||||

| Corporate Bonds (continued) | ||||||

| Finance Companies (continued) | ||||||

| SURA Asset Management 144A 4.875% 4/17/24 # | 500,000 | $ | 548,880 | |||

| USAA Capital 144A 1.50% 5/1/23 # | 2,900,000 | 2,975,524 | ||||

| 9,429,096 | ||||||

| Healthcare – 0.46% | ||||||

| Bausch Health 144A 6.125% 4/15/25 # | 1,025,000 | 1,057,451 | ||||

| Ortho-Clinical Diagnostics 144A 7.375% 6/1/25 # | 900,000 | 960,188 | ||||

| 2,017,639 | ||||||

| Insurance – 0.65% | ||||||

| AIA Group 3.125% 3/13/23 | 210,000 | 220,370 | ||||

| Equitable Holdings 3.90% 4/20/23 | 1,620,000 | 1,743,392 | ||||

| USI 144A 6.875% 5/1/25 # | 850,000 | 873,897 | ||||

| 2,837,659 | ||||||

| Real Estate – 0.34% | ||||||

| Arabian Centres Sukuk 144A 5.375% 11/26/24 # | 200,000 | 203,580 | ||||

| Goodman HK Finance 4.375% 6/19/24 | 200,000 | 217,544 | ||||

| HAT Holdings I 144A 6.00% 4/15/25 # | 821,000 | 879,496 | ||||

| Kaisa Group Holdings 9.375% 6/30/24 | 200,000 | 194,375 | ||||

| 1,494,995 | ||||||

| Services – 0.82% | ||||||

| GFL Environmental 144A 3.75% 8/1/25 # | 375,000 | 383,203 | ||||

| Prime Security Services Borrower 144A 5.25% | ||||||

| 4/15/24 # | 649,000 | 693,619 | ||||

| Sabre GLBL | ||||||

| 144A 7.375% 9/1/25 # | 1,250,000 | 1,358,125 | ||||

| 144A 9.25% 4/15/25 # | 785,000 | 935,131 | ||||

| Shimao Group Holdings 6.125% 2/21/24 | 200,000 | 212,401 | ||||

| 3,582,479 | ||||||

| Technology – 0.44% | ||||||

| Baidu 1.72% 4/9/26 | 200,000 | 203,177 | ||||

| Broadcom | ||||||

| 3.15% 11/15/25 | 260,000 | 284,007 | ||||

| 4.70% 4/15/25 | 165,000 | 189,122 | ||||

| International Business Machines 3.00% 5/15/24 | 1,090,000 | 1,181,163 | ||||

| NXP 144A 2.70% 5/1/25 # | 55,000 | 59,233 | ||||

| 1,916,702 | ||||||

| Transportation – 1.07% | ||||||

| Adani Ports & Special Economic Zone 144A 3.375% | ||||||

| 7/24/24 # | 235,000 | 244,772 | ||||

22

| Principal amount° | Value (US $) | ||||||

| Corporate Bonds (continued) | |||||||

| Transportation (continued) | |||||||

| Aerovias de Mexico 144A 7.00% 2/5/25 #, ‡ | 200,000 | $ | 80,500 | ||||

| ASG Finance Designated Activity 144A 7.875% | |||||||

| 12/3/24 # | 217,000 | 187,705 | |||||

| Delta Air Lines | |||||||

| 144A 7.00% 5/1/25 # | 1,510,000 | 1,744,377 | |||||

| 7.375% 1/15/26 | 621,000 | 709,822 | |||||

| Penske Truck Leasing 144A 1.20% 11/15/25 # | 910,000 | 918,431 | |||||

| Spirit Loyalty Cayman 144A 8.00% 9/20/25 # | 740,000 | 832,500 | |||||

| 4,718,107 | |||||||

| Total Corporate Bonds (cost $195,277,265) | 202,060,740 | ||||||

| Non-Agency Asset-Backed Securities – 8.19% | |||||||

| American Express Credit Account Master Trust | |||||||

| Series 2017-2 A 0.609% (LIBOR01M + 0.45%) | |||||||

| 9/16/24 ● | 270,000 | 271,174 | |||||

| Series 2017-5 A 0.539% (LIBOR01M + 0.38%) | |||||||

| 2/18/25 ● | 575,000 | 577,602 | |||||

| Series 2018-6 A 3.06% 2/15/24 | 1,145,000 | 1,162,509 | |||||

| ARI Fleet Lease Trust | |||||||

| Series 2018-B A2 144A 3.22% 8/16/27 # | 356,097 | 358,918 | |||||

| BA Credit Card Trust | |||||||

| Series 2020-A1 A1 0.34% 5/15/26 | 2,000,000 | 2,002,425 | |||||

| BMW Floorplan Master Owner Trust | |||||||

| Series 2018-1 A2 144A 0.479% (LIBOR01M + | |||||||

| 0.32%) 5/15/23 #, ● | 1,500,000 | 1,501,175 | |||||

| Chase Auto Credit Linked Notes | |||||||

| Series 2020-2 B 144A 0.84% 2/25/28 # | 1,750,000 | 1,751,684 | |||||

| Dell Equipment Finance Trust | |||||||

| Series 2020-2 A2 144A 0.47% 10/24/22 # | 2,400,000 | 2,404,260 | |||||

| Ford Credit Auto Lease Trust | |||||||

| Series 2020-A A2 1.80% 7/15/22 | 1,112,474 | 1,117,586 | |||||

| Ford Credit Auto Owner Trust | |||||||

| Series 2017-2 A 144A 2.36% 3/15/29 # | 2,100,000 | 2,171,998 | |||||

| Series 2017-C A3 2.01% 3/15/22 | 9,098 | 9,108 | |||||

| Ford Credit Floorplan Master Owner Trust A | |||||||

| Series 2020-1 A1 | |||||||

| 0.70% 9/15/25 | 4,000,000 | 4,028,298 | |||||

| GM Financial Automobile Leasing Trust | |||||||

| Series 2020-3 A2A 0.35% 11/21/22 | 1,000,000 | 1,000,760 | |||||

| GMF Floorplan Owner Revolving Trust | |||||||

| Series 2020-1 A 144A 0.68% 8/15/25 # | 500,000 | 502,957 | |||||

23

Schedule of investments

Delaware Limited-Term Diversified Income Fund

| Principal amount° | Value (US $) | |||||

| Non-Agency Asset-Backed Securities (continued) | ||||||

| Harley-Davidson Motorcycle Trust | ||||||

| Series 2020-A A2A 1.83% 1/17/23 | 431,196 | $ | 433,005 | |||

| HOA Funding | ||||||

| Series 2014-1A A2 144A 4.846% 8/20/44 # | 231,875 | 218,046 | ||||

| Hyundai Auto Receivables Trust | ||||||

| Series 2019-B A2 1.93% 7/15/22 | 305,027 | 306,096 | ||||

| Series 2020-C A2 0.26% 9/15/23 | 1,500,000 | 1,500,468 | ||||

| Invitation Homes Trust | ||||||

| Series 2018-SFR1 A 144A 0.853% (LIBOR01M + | ||||||

| 0.70%) 3/17/37 #, ● | 810,155 | 803,413 | ||||

| Mercedes-Benz Auto Lease Trust | ||||||

| Series 2019-B A2 2.01% 12/15/21 | 117,383 | 117,619 | ||||

| Mercedes-Benz Master Owner Trust | ||||||

| Series 2019-BA A 144A 2.61% 5/15/24 # | 1,200,000 | 1,239,728 | ||||

| MMAF Equipment Finance | ||||||

| Series 2015-AA A5 144A 2.49% 2/19/36 # | 714,153 | 722,095 | ||||

| Series 2020-BA A2 144A 0.38% 8/14/23 # | 4,300,000 | 4,302,537 | ||||

| Nissan Master Owner Trust Receivables | ||||||

| Series 2019-B A 0.589% (LIBOR01M + 0.43%) | ||||||

| 11/15/23 ● | 150,000 | 150,372 | ||||

| PFS Financing | ||||||

| Series 2020-G A 144A 0.97% 2/15/26 # | 1,000,000 | 1,005,244 | ||||

| Tesla Auto Lease Trust | ||||||

| Series 2018-B A 144A 3.71% 8/20/21 # | 642,093 | 646,160 | ||||

| Series 2019-A A2 144A 2.13% 4/20/22 # | 1,754,039 | 1,770,179 | ||||

| Towd Point Mortgage Trust | ||||||

| Series 2015-5 A1B 144A 2.75% 5/25/55 #, ● | 91,806 | 92,475 | ||||

| Series 2015-6 A1B 144A 2.75% 4/25/55 #, ● | 160,525 | 162,990 | ||||

| Trafigura Securitisation Finance | ||||||

| Series 2018-1A A1 144A 0.889% (LIBOR01M + | ||||||

| 0.73%) 3/15/22 #, ● | 200,000 | 199,902 | ||||

| Verizon Owner Trust | ||||||

| Series 2020-C A 0.41% 4/21/25 | 1,000,000 | 1,001,851 | ||||

| Volkswagen Auto Lease Trust | ||||||

| Series 2020-A A4 0.45% 7/21/25 | 150,000 | 150,232 | ||||

| Volvo Financial Equipment | ||||||

| Series 2020-1A A2 | ||||||

| 144A 0.37% 4/17/23 # | 2,200,000 | 2,201,453 | ||||

| Wheels SPV 2 | ||||||

| Series 2018-1A A2 144A 3.06% 4/20/27 # | 79,713 | 79,998 | ||||

| Total Non-Agency Asset-Backed Securities (cost $35,887,182) | 35,964,317 | |||||

24

| Principal amount° | Value (US $) | |||||

| Non-Agency Collateralized Mortgage Obligations – 0.47% | ||||||

| GSMPS Mortgage Loan Trust | ||||||

| Series 1998-2 A 144A 7.75% 5/19/27 #, ● | 19,755 | $ | 19,753 | |||

| JPMorgan Mortgage Trust | ||||||

| Series 2014-IVR6 2A4 144A 2.269% 7/25/44 #, ● | 320,962 | 326,237 | ||||

| Silverstone Master Issuer | ||||||

| Series 2018-1A 1A 144A 0.599% (LIBOR03M + | ||||||

| 0.39%) 1/21/70 #, ● | 1,680,000 | 1,678,454 | ||||

| Wells Fargo Mortgage-Backed Securities Trust | ||||||

| Series 2006-AR5 2A1 4.006% 4/25/36 ● | 36,684 | 35,728 | ||||

| Total Non-Agency Collateralized Mortgage Obligations (cost $2,035,280) | 2,060,172 | |||||

| Non-Agency Commercial Mortgage-Backed Securities – 1.23% | ||||||

| Benchmark Mortgage Trust | ||||||

| Series 2020-B17 A5 2.289% 3/15/53 | 5,000,000 | 5,320,955 | ||||

| DB-UBS Mortgage Trust | ||||||

| Series 2011-LC1A C 144A 5.565% 11/10/46 #, ● | 100,000 | 100,247 | ||||

| Total Non-Agency Commercial Mortgage-Backed Securities (cost $5,352,055) | 5,421,202 | |||||

| Loan Agreements – 0.30% | ||||||

| Applied Systems 1st Lien 4.00% (LIBOR03M + | ||||||

| 3.00%) 9/19/24 ● | 246,881 | 247,190 | ||||

| AssuredPartners 3.646% (LIBOR01M + 3.50%) | ||||||

| 2/12/27 ● | 261,843 | 258,461 | ||||

| Berry Global Tranche W 2.149% (LIBOR01M + | ||||||

| 2.00%) 10/1/22 ● | 129,391 | 129,440 | ||||

| Blue Ribbon 1st Lien 5.00% (LIBOR02M + 4.00%) | ||||||

| 11/15/21 ● | 266,671 | 253,115 | ||||

| Charter Communications Operating | ||||||

| Tranche B2 1.90% (LIBOR01M + 1.75%) 2/1/27 ● | 242,516 | 241,590 | ||||

| Gardner Denver Tranche B-1 1.897% (LIBOR01M + | ||||||

| 1.75%) 3/1/27 ● | 206,705 | 204,232 | ||||

| Total Loan Agreements (cost $1,349,476) | 1,334,028 | |||||

| Sovereign BondsΔ – 3.17% | ||||||

| Croatia – 0.05% | ||||||

| Croatia Government International Bond 144A 5.50% | ||||||

| 4/4/23 # | 200,000 | 220,605 | ||||

| 220,605 | ||||||

25

Schedule of investments

Delaware Limited-Term Diversified Income Fund

| Principal amount° | Value (US $) | ||||||

| Sovereign Bonds (continued) | |||||||

| Georgia – 0.05% | |||||||

| Georgia Government International Bond 6.875% | |||||||

| 4/12/21 | 200,000 | $ | 203,440 | ||||

| 203,440 | |||||||

| Indonesia – 0.07% | |||||||

| Indonesia Government International Bond 144A | |||||||

| 3.375% 4/15/23 # | 310,000 | 329,378 | |||||

| 329,378 | |||||||

| Kenya – 0.05% | |||||||

| Kenya Government International Bond 144A 6.875% | |||||||

| 6/24/24 # | 200,000 | 219,602 | |||||

| 219,602 | |||||||

| Nigeria – 0.06% | |||||||

| Nigeria Government International Bond 5.625% | |||||||

| 6/27/22 | 250,000 | 259,226 | |||||

| 259,226 | |||||||

| Republic of Korea – 0.11% | |||||||

| Export-Import Bank of Korea 1.00% 6/1/23 ● | 500,000 | 505,587 | |||||

| 505,587 | |||||||

| Saudi Arabia – 0.06% | |||||||

| Kingdom of Saudi Arabia Sukuk 144A 2.894% | |||||||

| 4/20/22 # | 250,000 | 257,811 | |||||

| 257,811 | |||||||

| Senegal – 0.05% | |||||||

| Senegal Government International Bond 144A | |||||||

| 6.25% 7/30/24 # | 200,000 | 220,937 | |||||

| 220,937 | |||||||

| Spain – 2.62% | |||||||

| Spanish Treasury Bill 0.00% 1/15/21 ~ | EUR | 9,410,000 | 11,498,861 | ||||

| 11,498,861 | |||||||

| Uzbekistan – 0.05% | |||||||

| Republic of Uzbekistan Bond 144A 4.75% 2/20/24 # | 200,000 | 217,722 | |||||

| 217,722 | |||||||

| Total Sovereign Bonds (cost $13,789,330) | 13,933,169 | ||||||

26

| Principal amount° | Value (US $) | |||||

| Supranational Bank – 0.12% | ||||||

| Banque Ouest Africaine de Developpement | ||||||

| 144A 5.50% 5/6/21 # | 500,000 | $ | 508,520 | |||

| Total Supranational Bank (cost $529,500) | 508,520 | |||||

| US Treasury Obligations – 16.32% | ||||||

| US Treasury Floating Rate Note | ||||||

| 0.145% (USBMMY3M + 0.055%) 7/31/22 ● | 35,745,000 | 35,749,268 | ||||

| US Treasury Notes | ||||||

| 0.375% 11/30/25 | 34,080,000 | 34,122,600 | ||||

| 1.625% 12/31/21 | 1,775,000 | 1,801,802 | ||||

| Total US Treasury Obligations (cost $71,577,820) | 71,673,670 | |||||

| Number of shares | ||||||

| Preferred Stock – 0.34% | ||||||

| Morgan Stanley 4.047% (LIBOR03M + | ||||||

| 3.81%) ● | 1,180,000 | 1,174,442 | ||||

| USB Realty 144A | ||||||

| 1.384% (LIBOR03M + 1.147%) #, ● | 400,000 | 300,000 | ||||

| Total Preferred Stock (cost $1,490,000) | 1,474,442 | |||||

| Short-Term Investments – 2.91% | ||||||

| Money Market Mutual Funds – 2.91% | ||||||

| BlackRock FedFund – Institutional Shares | ||||||

| (seven-day effective yield 0.00%) | 3,197,567 | 3,197,567 | ||||

| Fidelity Investments Money Market Government | ||||||

| Portfolio – Class I (seven-day effective yield | ||||||

| 0.01%) | 3,197,567 | 3,197,567 | ||||

| GS Financial Square Government Fund – | ||||||

| Institutional Shares (seven-day effective yield | ||||||

| 0.02%) | 3,197,567 | 3,197,567 | ||||

| Morgan Stanley Government Portfolio – Institutional | ||||||

| Share Class (seven-day effective yield 0.00%) | 3,197,567 | 3,197,567 | ||||

| Total Short-Term Investments (cost $12,790,268) | 12,790,268 | |||||

| Total Value of Securities–101.36% | ||||||

| (cost $436,502,792) | $ | 445,096,510 | ||||

| ° | Principal amount shown is stated in USD unless noted that the security is denominated in another currency. |

| ϕ | Step coupon bond. Stated rate in effect at December 31, 2020 through maturity date. |

27

Schedule of investments

Delaware Limited-Term Diversified Income Fund

| ⧫ | Pass Through Agreement. Security represents the contractual right to receive a proportionate amount of underlying payments due to the counterparty pursuant to various agreements related to the rescheduling of obligations and the exchange of certain notes. |

| ● | Variable rate investment. Rates reset periodically. Rate shown reflects the rate in effect at December 31, 2020. For securities based on a published reference rate and spread, the reference rate and spread are indicated in their descriptions. The reference rate descriptions (i.e. LIBOR03M, LIBOR06M, etc.) used in this report are identical for different securities, but the underlying reference rates may differ due to the timing of the reset period. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions, or for mortgage-backed securities, are impacted by the individual mortgages which are paying off over time. These securities do not indicate a reference rate and spread in their descriptions. |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At December 31, 2020, the aggregate value of Rule 144A securities was $125,943,386, which represents 28.68% of the Fund’s net assets. See Note 11 in “Notes to financial statements.” |

| ^ | Zero-coupon security. The rate shown is the effective yield at the time of purchase. |

| > | PIK. 100% of the income received was in the form of cash. |

| µ | Fixed to variable rate investment. The rate shown reflects the fixed rate in effect at December 31, 2020. Rate will reset at a future date. |

| ψ | No contractual maturity date. |

| ‡ | Non-income producing security. Security is currently in default. |

| Δ | Securities have been classified by country of origin. |

| ~ | The rate shown is the effective yield at the time of purchase. |

The following foreign currency exchange contracts and futures contracts were outstanding at December 31, 2020:1

Foreign Currency Exchange Contracts

| Currency to | Settlement | Unrealized | Unrealized | ||||||||||||

| Counterparty | Receive (Deliver) | In Exchange For | Date | Appreciation | Depreciation | ||||||||||

| TD | EUR | (9,410,000) | USD | 11,430,091 | 1/15/21 | $ | – | $ | (70,147 | ) | |||||

Futures Contracts

Exchange-Traded

| Variation | |||||||||||||||||||

| Margin | |||||||||||||||||||

| Notional | Value/ | Due from | |||||||||||||||||

| Notional | Cost | Expiration | Unrealized | (Due to) | |||||||||||||||

| Contracts to Buy (Sell) | Amount | (Proceeds) | Date | Depreciation | Brokers | ||||||||||||||

| (22) US Treasury 10 yr Notes | $ | (3,037,719 | ) | $ | (3,034,227 | ) | 3/22/21 | $ | (3,492 | ) | $ | (2,406 | ) | ||||||

The use of foreign currency exchange contracts and futures contracts involve elements of market risk and risks in excess of the amounts disclosed in these financial statements. The foreign currency exchange contracts and notional amounts

28

presented on the previous page represent the Fund’s total exposure in such contracts, whereas only the net unrealized appreciation (depreciation) and variation margin are reflected in the Fund’s net assets.

| 1 | See Note 8 in “Notes to financial statements.” |

Summary of abbreviations:

ARM

– Adjustable Rate Mortgage

CLO – Collateralized Loan Obligation

DAC – Designated Activity

Company

DIFC – Dubai International Financial Centre

FREMF – Freddie Mac Multifamily

GNMA –

Government National Mortgage Association

GS – Goldman Sachs

GSMPS – Goldman Sachs Reperforming Mortgage

Securities

ICE – Intercontinental Exchange, Inc.

LIBOR – London interbank

offered rate

LIBOR01M – ICE LIBOR USD 1 Month

LIBOR02M – ICE LIBOR USD 2 Month

LIBOR03M – ICE

LIBOR USD 3 Month

LIBOR06M – ICE LIBOR USD 6 Month

LIBOR12M – ICE LIBOR USD 12 Month

NCUA –

National Credit Union Administration

PIK – Payment-in-kind

REMIC – Real Estate Mortgage Investment

Conduit

S.F. – Single Family

SOFR – Secured Overnight Financing Rate

TBA – To be announced

TD

– TD Bank

USBMMY3M – US Treasury 3 Month Bill Money Market Yield

yr – Year

Summary of currencies:

EUR – European Monetary Unit

USD – US Dollar

See accompanying notes, which are an integral part of the financial statements.

29

| Delaware Limited-Term Diversified Income Fund | December 31, 2020 | |||

| Assets: | ||||

| Investments, at value* | $ | 445,096,510 | ||

| Cash collateral due from brokers | 143,880 | |||

| Receivable for securities sold | 365,577 | |||

| Dividends and interest receivable | 2,276,773 | |||

| Receivable for fund shares sold | 951,650 | |||

| Total Assets | 448,834,390 | |||

| Liabilities: | ||||

| Due to custodian | 1,200 | |||

| Payable for securities purchased | 8,013,259 | |||

| Payable for fund shares redeemed | 1,167,623 | |||

| Other accrued expenses | 165,773 | |||

| Distribution payable | 163,950 | |||

| Investment management fees payable to affiliates | 80,319 | |||

| Unrealized depreciation on foreign currency exchange contracts | 70,147 | |||

| Distribution fees payable to affiliates | 38,624 | |||

| Audit and tax fees payable | 6,500 | |||

| Dividend disbursing and transfer agent fees and expenses payable to affiliates | 3,308 | |||

| Variation margin due to broker on futures contracts | 2,406 | |||

| Accounting and administration expenses payable to affiliates | 1,617 | |||

| Trustees’ fees and expenses payable to affiliates | 1,422 | |||

| Legal fees payable to affiliates | 675 | |||

| Reports and statements to shareholders expenses payable to affiliates | 441 | |||

| Total Liabilities | 9,717,264 | |||

| Total Net Assets | $ | 439,117,126 | ||

| Net Assets Consist of: | ||||

| Paid-in capital | $ | 470,779,336 | ||

| Total distributable earnings (loss) | (31,662,210 | ) | ||

| Total Net Assets | $ | 439,117,126 | ||

30

| Net Asset Value | ||||

| Class A: | ||||

| Net assets | $ | 148,185,242 | ||

| Shares of beneficial interest outstanding, unlimited authorization, no par | 17,547,627 | |||

| Net asset value per share | $ | 8.44 | ||

| Sales charge | 2.75 | % | ||

| Offering price per share, equal to net asset value per share / (1 - sales charge) | $ | 8.68 | ||

| Class C: | ||||

| Net assets | $ | 22,565,422 | ||

| Shares of beneficial interest outstanding, unlimited authorization, no par | 2,674,177 | |||

| Net asset value per share | $ | 8.44 | ||

| Class R: | ||||

| Net assets | $ | 946,089 | ||

| Shares of beneficial interest outstanding, unlimited authorization, no par | 112,042 | |||

| Net asset value per share | $ | 8.44 | ||

| Institutional Class: | ||||

| Net assets | $ | 262,774,498 | ||

| Shares of beneficial interest outstanding, unlimited authorization, no par | 31,127,957 | |||

| Net asset value per share | $ | 8.44 | ||

| Class R6: | ||||

| Net assets | $ | 4,645,875 | ||

| Shares of beneficial interest outstanding, unlimited authorization, no par | 550,616 | |||

| Net asset value per share | $ | 8.44 | ||

____________________ |

||||

| * Investments, at cost | $ | 436,502,792 | ||

See accompanying notes, which are an integral part of the financial statements.

31

| Delaware Limited-Term Diversified Income Fund | Year ended December 31, 2020 | |||