| Summary prospectus |

Fixed income mutual fund

Delaware Limited-Term Diversified Income Fund

|

Nasdaq ticker symbols |

|

|

Class A |

DTRIX |

|

Class B |

DTIBX |

|

Class C |

DTICX |

|

Class R |

DLTRX |

|

Institutional Class |

DTINX |

April 30, 2013

Before you invest, you may want to review the Fund's statutory prospectus (and any supplements thereto), which contains more information about the Fund and its risks. You can find the Fund's statutory prospectus and other information about the Fund, including its statement of additional information and most recent reports to shareholders, online at delawareinvestments.com/literature. You can also get this information at no cost by calling 800 523-1918. The Fund's statutory prospectus and statement of additional information, both dated April 30, 2013 (and any supplements thereto), are incorporated by reference into this summary prospectus.

Delaware Limited-Term Diversified Income Fund

What is the Fund's investment objective?

Delaware Limited-Term Diversified Income Fund seeks maximum total return, consistent with reasonable risk.

What are the Fund's fees and expenses?

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales-charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in Delaware Investments® Funds. More information about these and other discounts is available from your financial advisor, in the Fund's prospectus under the section entitled "About your account," and in the Fund's statement of additional information under the section entitled "Purchasing shares."

|

Shareholder fees (fees paid directly from your investment) |

||||||||||

|

Class |

A |

B |

C |

R |

Inst. |

|||||

|

Maximum sales charge (load) imposed on purchases as a percentage of offering price |

2.75% |

none |

none |

none |

none |

|||||

|

Maximum contingent deferred sales charge (load) as a percentage of original purchase price or redemption price, whichever is lower |

none |

2.00%1 |

1.00%1 |

none |

none |

|||||

|

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment) |

||||||||||

|

Class |

A |

B |

C |

R |

Inst. |

|||||

|

Management fees |

0.46% |

0.46% |

0.46% |

0.46% |

0.46% |

|||||

|

Distribution and service (12b-1) fees |

0.30% |

1.00% |

1.00% |

0.60% |

none |

|||||

|

Other expenses |

0.20% |

0.20% |

0.20% |

0.20% |

0.20% |

|||||

|

Total annual fund operating expenses |

0.96% |

1.66% |

1.66% |

1.26% |

0.66% |

|||||

|

Fee waivers and expense reimbursements |

(0.15%)2 |

(0.85%)2 |

— |

(0.10%)2 |

— |

|||||

|

Total annual fund operating expenses after fee waivers and expense reimbursements |

0.81% |

0.81% |

1.66% |

1.16% |

0.66% |

|||||

| 1 |

If you redeem Class B shares during the first year after you buy them, you will pay a contingent deferred sales charge (CDSC) of 2.00%, which declines to 1.00% during the second and third years, and 0% thereafter. Class C shares redeemed within one year of purchase are subject to a 1.00% CDSC. |

| 2 |

The Fund's distributor, Delaware Distributors, L.P. (Distributor), has contracted to limit the Fund's Class A and Class R shares' 12b-1 fees to no more than 0.15% and 0.50% of average daily net assets, respectively, from April 30, 2013 through April 30, 2014. The Distributor has also contracted to limit the Fund's Class B shares' 12b-1 fee to no more than 0.15% of average daily net assets from March 1, 2013 through February 28, 2014. The waivers may be terminated only by agreement of the Distributor and the Fund. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and reflects the applicable Distributor's expense waivers for the 1-year contractual period and the total operating expenses without waivers for years 2 through 10. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

(if not |

(if not |

||||||

|

redeemed) |

redeemed) |

||||||

|

Class |

A |

B |

B |

C |

C |

R |

Inst. |

|

1 year |

$355 |

$83 |

$283 |

$169 |

$269 |

$118 |

$67 |

|

3 years |

$558 |

$440 |

$540 |

$523 |

$523 |

$390 |

$211 |

|

5 years |

$777 |

$822 |

$822 |

$902 |

$902 |

$682 |

$368 |

|

10 years |

$1,407 |

$1,453 |

$1,453 |

$1,965 |

$1,965 |

$1,514 |

$822 |

Portfolio turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 262% of the average value of its portfolio.

What are the Fund's principal investment strategies?

Under normal circumstances, the Fund will invest at least 80% of its net assets in investment grade fixed income securities, including, but not limited to, fixed income securities issued or guaranteed by the U.S. government, its agencies or instrumentalities, and by U.S. corporations. Investment grade fixed income securities are securities rated BBB- or higher by Standard & Poor's (S&P), Baa3 or higher by Moody's Investors Service (Moody's), or similarly rated by another nationally recognized statistical rating organization (NRSRO), or those that are deemed to be of comparable quality. The Fund will maintain an average effective duration from one to three years. The Fund's investment manager, Delaware Management Company (Manager or we), will determine how much of the Fund's assets to allocate among the different types of fixed income securities in which the Fund may invest based on our evaluation of economic and market conditions and our assessment of the returns and potential for appreciation that can be achieved from various sectors of the fixed income market.

The corporate debt obligations in which the Fund may invest include bonds, notes, debentures, and commercial paper of U.S. companies and, subject to the limitations described below, non-U.S. companies. The Fund may also invest in a variety of securities that are issued or guaranteed as to the payment of principal and interest by the U.S. government, and by various agencies or instrumentalities, which have been established or are sponsored by the U.S. government, and, subject to the limitations described below, securities issued by foreign governments.

Additionally, the Fund may invest in mortgage-backed securities issued or guaranteed by the U.S. government, its agencies or instrumentalities, government-sponsored corporations, and mortgage-backed securities issued by certain private, nongovernment entities. The Fund may also invest in securities that are backed by assets such as receivables on home equity and credit card loans, automobile, mobile home, recreational vehicle and other loans, wholesale dealer floor plans, and leases.

The Fund may invest up to 20% of its net assets in below-investment-grade securities (also known as high yield or "junk" bonds). In general, the below-investment-grade securities that the Fund may purchase in this sector will generally be rated BB or lower by S&P and Ba or lower by Moody's, or similarly rated by another NRSRO.

The Fund may also invest up to 30% of its net assets in foreign securities, including up to 10% of its net assets in securities of issuers located in emerging markets. The Fund's total non-U.S. dollar currency exposure will be limited, in the aggregate, to no more than 10% of net assets.

The Fund may use a wide range of derivative instruments, typically including options, futures contracts, options on futures contracts, and swaps. The Fund will use derivatives for both hedging and nonhedging purposes. For example, the Fund may invest in: futures and options to manage duration and for defensive purposes, such as to protect gains or hedge against potential losses in the portfolio without actually selling a security, or to stay fully invested; forward foreign currency contracts to manage foreign currency exposure; interest rate swaps to neutralize the impact of interest rate changes; credit default swaps to hedge against bond defaults, to manage credit exposure or to enhance total return; and index swaps to enhance return or to affect diversification. The Fund will not use derivatives for reasons inconsistent with its investment objective and will limit its investments in derivative instruments to 20% of net assets.

What are the principal risks of investing in the Fund?

Investing in any mutual fund involves the risk that you may lose part or all of the money you invest. Over time, the value of your investment in the Fund will increase and decrease according to changes in the value of the securities in the Fund's portfolio. Principal risks include:

Investments not guaranteed by Delaware Management Company (Manager) or its affiliates — Investments in the Fund are not and will not be deposits with or liabilities of Macquarie Bank Limited ABN 46 008 583 542 and its holding companies, including their subsidiaries or related companies (Macquarie Group), and are subject to investment risk, including possible delays in repayment and loss of income and capital invested. No Macquarie Group company guarantees or will guarantee the performance of the Fund, the repayment of capital from the Fund, or any particular rate of return.

Market risk — The risk that all or a majority of the securities in a certain market — such as the stock or bond market — will decline in value because of factors such as adverse political or economic conditions, future expectations, investor confidence, or heavy institutional selling.

Interest rate risk — The risk that securities will decrease in value if interest rates rise. This risk is generally associated with bonds.

Credit risk — The risk that an issuer of a debt security, including a governmental issuer, or an entity that insures a bond may be unable to make interest payments and repay principal in a timely manner.

High yield (junk bond) risk — The risk that high yield securities, commonly known as "junk bonds," are subject to reduced creditworthiness of issuers; increased risk of default and a more limited and less liquid secondary market; and greater price volatility and risk of loss of income and principal than are higher-rated securities.

Prepayment risk — The risk that the principal on a bond that is held by a portfolio will be prepaid prior to maturity at a time when interest rates are lower than what that bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

Liquidity risk — The possibility that securities cannot be readily sold within seven days at approximately the price at which a fund has valued them.

Derivatives risk — Derivative contracts, such as options, futures, and swaps, may involve additional expenses (such as the payment of premiums) and are subject to significant loss if a security, or a securities index to which a derivative contract is associated, moves in the opposite direction from what the portfolio manager anticipated. Derivative contracts are also subject to the risk that the counterparty may fail to perform its obligations under the contract due to financial difficulties (such as a bankruptcy or reorganization).

Foreign risk — The risk that foreign securities (particularly in emerging markets) may be adversely affected by political instability; changes in currency exchange rates; inefficient markets and higher transaction costs; foreign economic conditions; or inadequate or different regulatory and accounting standards.

Bank loans and other indebtedness risk — The risk that the portfolio will not receive payment of principal, interest, and other amounts due in connection with these investments and will depend primarily on the financial condition of the borrower and the lending institution.

Valuation risk — The risk that a less liquid secondary market may make it more difficult for a fund to obtain precise valuations of certain securities in its portfolio.

Government and regulatory risk — The risk that governments or regulatory authorities have, from time to time, taken or considered actions that could adversely affect various sectors of the securities markets.

How has Delaware Limited-Term Diversified Income Fund performed?

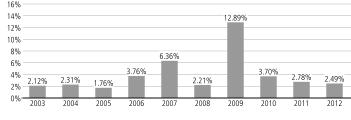

The bar chart and table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's

performance from year to year and by showing how the Fund's average annual total returns for the 1-, 5-, and 10-year or lifetime periods

compare with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily

an indication of how it will perform in the future. The returns reflect expense caps in effect during certain of these periods.

The returns would be lower without the expense caps. You may obtain the Fund's most recently available month-end performance

by calling

800 523-1918 or by visiting our website at delawareinvestments.com/performance.

Effective November 30, 2007, the Fund's investment objective, strategies, and policies were changed to permit the Fund to invest in a diversified portfolio of limited-term fixed income securities. These changes allowed the Fund to invest in a broader range of fixed income securities, including U.S. government securities, foreign government securities, and corporate and high yield securities of domestic and foreign issuers. Prior to November 30, 2007, the Fund invested primarily in U.S. government securities. The returns prior to this time reflect the Fund's prior investment objective, strategies, and policies and may not be indicative of future returns.

Year-by-year total return (Class A)*

During the periods illustrated in this bar chart, Class A's highest quarterly return was 4.76% for the quarter ended June 30, 2009 and its lowest quarterly return was -1.33% for the quarter ended June 30, 2004. The maximum Class A sales charge of 2.75%, which is normally deducted when you purchase shares, is not reflected in the highest/lowest quarterly returns or in the bar chart. If this sales charge were included, the returns would be less than those shown. The average annual total returns in the table below do include the sales charge.

Average annual total returns for periods ended December 31, 2012*

|

|

1 year |

5 years |

10 years or lifetime |

|||

|

Class A return before taxes |

-0.34% |

4.14% |

3.70% |

|||

|

Class A return after taxes on distributions |

-1.06% |

2.94% |

2.35% |

|||

|

Class A return after taxes on distributions and sale of Fund shares |

-0.21% |

2.85% |

2.36% |

|||

|

Class B return before taxes |

-0.38% |

3.88% |

3.54% |

|||

|

Class C return before taxes |

0.62% |

3.88% |

3.11% |

|||

|

Class R return before taxes (lifetime: 6/2/03-12/31/12) |

2.13% |

4.37% |

3.58% |

|||

|

Institutional Class return before taxes |

2.64% |

4.89% |

4.15% |

|||

|

Barclays 1–3 Year Government/Credit Index |

1.26% |

2.88% |

3.13% |

*The Fund has combined its prospectuses for the retail and institutional classes. The bar chart and the after-tax returns in the average annual total returns table show the performance of the Fund's Class A shares only.

After-tax performance is presented only for Class A shares of the Fund. The after-tax returns for other Fund classes may vary. Actual after-tax returns depend on the investor's individual tax situation and may differ from the returns shown. After-tax returns are not relevant for shares held in tax-deferred investment vehicles such as employer-sponsored 401(k) plans and individual retirement accounts (IRAs). The after-tax returns shown are calculated using the highest individual federal marginal income tax rates in effect during the periods presented and do not reflect the impact of state and local taxes.

Who manages the Fund?

Investment manager

Delaware Management Company, a series of Delaware Management Business Trust

|

Portfolio managers |

Title with Delaware Management Company |

Start date on the Fund |

|

Paul Grillo, CFA |

Senior Vice President, Co-Chief Investment Officer — Total Return Fixed Income Strategy |

February 1999 |

|

Roger A. Early, CPA, CFA, CFP |

Senior Vice President, Co-Chief Investment Officer — Total Return Fixed Income Strategy |

May 2007 |

|

Brian C. McDonnell, CFA |

Senior Vice President, Senior Portfolio Manager, Senior Structured Products Analyst, Trader |

April 2012 |

Purchase and redemption of Fund shares

You may purchase or redeem shares of the Fund on any day that the New York Stock Exchange (NYSE) is open for business (Business

Day). Shares may be purchased or redeemed: through

your financial advisor; through the Fund's website at delawareinvestments.com; by calling

800 523-1918; by regular mail (c/o Delaware Investments, P.O. Box 9876, Providence, RI 02940-8076); by overnight courier

service (c/o Delaware Service Center, 4400 Computer Drive, Westborough, MA 01581-1722); or by wire. Please refer to the Fund's

prospectus and statement of additional information for more details regarding the purchase and sale of Fund shares.

For Class A and Class C shares, the minimum initial investment is generally $1,000 and subsequent investments can be made for as little as $100. The minimum initial investment for IRAs, Uniform Gifts/Transfers to Minors Act accounts, direct deposit purchase plans and automatic investment plans is $250 and through Coverdell Education Savings Accounts is $500, and subsequent investments in these accounts can be made for as little as $25. For Class R and Institutional Class shares, there is no minimum initial purchase requirement, but certain eligibility requirements must be met. The eligibility requirements are described in the prospectus under "Choosing a share class" and on the Fund's website. We may reduce or waive the minimums or eligibility requirements in certain cases. No new or subsequent investments currently are allowed in the Fund's Class B shares, except through a reinvestment of dividends or capital gains or permitted exchanges.

Tax information

The Fund's distributions generally are taxable to you as ordinary income, capital gains, or some combination of both, unless

you are investing through a tax-deferred arrangement, such as a

401(k) plan or an IRA.

Payments to broker/dealers and

other financial intermediaries

If you purchase shares of the Fund through a broker/dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker/dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

SMPR-022 [12/12] DG3 18728 [5/13]