United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-3352

(Investment Company Act File Number)

Federated Hermes Government Income Trust

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

Peter J. Germain, Esquire

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 01/31/22

Date of Reporting Period: 01/31/22

| Item 1. | Reports to Stockholders |

|

Share Class | Ticker

|

Institutional | FICMX

|

Service | FITSX

|

|

|

Federated Hermes Government Income Fund

A Portfolio of Federated Hermes Government Income Trust

|

|

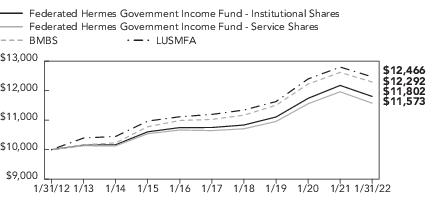

1 Year

|

5 Years

|

10 Years

|

|

Institutional Shares

|

-3.07%

|

1.88%

|

1.67%

|

|

Service Shares

|

-3.25%

|

1.69%

|

1.47%

|

|

BMBS

|

-2.59%

|

2.20%

|

2.08%

|

|

LUSMFA

|

-1.95%

|

2.20%

|

2.20%

|

|

Type of Investments

|

Percentage of

Total Net Assets

|

|

U.S. Government Agency Mortgage-Backed Securities2

|

92.9%

|

|

U.S. Government Agency Securities

|

1.6%

|

|

Cash Equivalents3

|

19.0%

|

|

Derivative Contracts4,5

|

(0.0)%

|

|

Other Assets and Liabilities—Net6

|

(13.5)%

|

|

TOTAL

|

100%

|

|

1

|

See the Fund’s Prospectus and Statement of Additional Information for a description of the

types of securities in which the Fund invests.

|

|

2

|

All or a portion of these securities may be subject to dollar-roll transactions.

|

|

3

|

Cash Equivalents include any investments in money market mutual funds and/or overnight

repurchase agreements, including those that are segregated subject to dollar-roll transactions

equal to 13.7% of net assets.

|

|

4

|

Based upon net unrealized appreciation (depreciation) or value of the derivative contracts as

applicable. Derivative contracts may consist of futures, forwards, options and swaps. The impact

of a derivative contract on the Fund’s performance may be larger than its unrealized

appreciation (depreciation) or value may indicate. In many cases, the notional value or amount of

a derivative contract may provide a better indication of the contract’s significance to the

portfolio. More complete information regarding the Fund’s direct investments in derivative

contracts, including unrealized appreciation (depreciation), value and notional values or amounts

of such contracts, can be found in the table at the end of the Portfolio of Investments included

in this Report.

|

|

5

|

Represents less than 0.1%.

|

|

6

|

Assets, other than investments in securities and derivative contracts, less liabilities. See

Statement of Assets and Liabilities.

|

|

Principal

Amount

or Shares

|

|

|

Value

|

|

|

1

|

MORTGAGE-BACKED SECURITIES— 92.9%

|

|

|

|

|

Federal Home Loan Mortgage Corporation— 26.4%

|

|

|

$ 2,713,719

|

|

1.500%, 11/1/2050

|

$ 2,569,685

|

|

3,465,335

|

|

2.000%, 6/1/2050

|

3,386,751

|

|

3,711,220

|

|

2.000%, 4/1/2051

|

3,622,420

|

|

7,665,422

|

|

3.000%, 1/1/2046

|

8,047,701

|

|

9,127,917

|

|

3.000%, 10/1/2050

|

9,357,073

|

|

4,101,050

|

|

3.500%, 4/1/2050

|

4,278,366

|

|

7,116,014

|

|

3.500%, 4/1/2050

|

7,443,701

|

|

3,767,464

|

|

4.000%, 4/1/2049

|

4,055,062

|

|

89,613

|

|

4.000%, 6/1/2049

|

94,655

|

|

1,608,700

|

|

4.000%, 4/1/2050

|

1,698,701

|

|

92,715

|

|

4.500%, 3/1/2024

|

95,277

|

|

203,732

|

|

4.500%, 11/1/2039

|

221,637

|

|

268,310

|

|

4.500%, 5/1/2040

|

292,105

|

|

441,258

|

|

4.500%, 6/1/2040

|

480,675

|

|

86,998

|

|

4.500%, 9/1/2040

|

94,718

|

|

39,273

|

|

5.000%, 8/1/2023

|

40,120

|

|

433,641

|

|

5.500%, 5/1/2034

|

482,255

|

|

17,483

|

|

5.500%, 12/1/2035

|

19,609

|

|

62,793

|

|

5.500%, 3/1/2036

|

70,871

|

|

177,845

|

|

5.500%, 1/1/2038

|

200,792

|

|

80,051

|

|

5.500%, 3/1/2038

|

90,572

|

|

64,881

|

|

5.500%, 11/1/2038

|

73,630

|

|

59,197

|

|

5.500%, 1/1/2039

|

66,982

|

|

62,297

|

|

6.000%, 3/1/2038

|

71,730

|

|

15,334

|

|

6.500%, 9/1/2029

|

16,847

|

|

27,494

|

|

7.000%, 2/1/2031

|

31,879

|

|

27,740

|

|

7.000%, 10/1/2031

|

30,876

|

|

21,052

|

|

7.000%, 1/1/2032

|

24,595

|

|

30,593

|

|

7.000%, 3/1/2032

|

34,773

|

|

50,653

|

|

7.500%, 6/1/2027

|

55,945

|

|

4,018

|

|

7.500%, 1/1/2031

|

4,600

|

|

42,159

|

|

7.500%, 2/1/2031

|

48,553

|

|

|

|

TOTAL

|

47,103,156

|

|

|

|

Federal National Mortgage Association— 48.7%

|

|

|

11,392,297

|

|

2.000%, 9/1/2050

|

11,133,949

|

|

5,070,083

|

|

2.000%, 11/1/2050

|

4,950,354

|

|

Principal

Amount

or Shares

|

|

|

Value

|

|

|

1

|

MORTGAGE-BACKED SECURITIES— continued

|

|

|

|

|

Federal National Mortgage Association— continued

|

|

|

$ 5,644,732

|

|

2.500%, 10/1/2050

|

$ 5,642,229

|

|

1,299,320

|

|

3.000%, 6/1/2027

|

1,344,578

|

|

781,305

|

|

3.000%, 7/1/2027

|

808,520

|

|

1,014,869

|

|

3.000%, 8/1/2045

|

1,051,844

|

|

8,910,891

|

|

3.000%, 10/1/2046

|

9,229,973

|

|

3,601,503

|

|

3.000%, 9/1/2047

|

3,736,093

|

|

8,126,770

|

|

3.000%, 3/1/2050

|

8,349,839

|

|

3,250,022

|

|

3.500%, 12/1/2041

|

3,446,909

|

|

1,717,923

|

|

3.500%, 9/1/2042

|

1,823,070

|

|

196,917

|

|

3.500%, 9/1/2042

|

208,600

|

|

522,087

|

|

3.500%, 12/1/2042

|

552,736

|

|

3,831,588

|

|

3.500%, 5/1/2049

|

4,039,760

|

|

3,391,478

|

|

3.500%, 9/1/2049

|

3,582,098

|

|

3,187,670

|

|

3.500%, 12/1/2049

|

3,353,387

|

|

3,361,443

|

|

3.500%, 12/1/2049

|

3,517,286

|

|

1,735,743

|

|

4.000%, 12/1/2031

|

1,856,989

|

|

1,166,829

|

|

4.000%, 12/1/2041

|

1,253,998

|

|

4,780,106

|

|

4.000%, 12/1/2041

|

5,134,157

|

|

906,489

|

|

4.000%, 6/1/2042

|

975,759

|

|

2,783,849

|

|

4.000%, 12/1/2042

|

2,999,187

|

|

1,293,677

|

|

4.500%, 9/1/2041

|

1,416,994

|

|

517,415

|

|

4.500%, 10/1/2041

|

565,120

|

|

1,047,725

|

|

4.500%, 11/1/2041

|

1,144,323

|

|

147,829

|

|

4.500%, 11/1/2041

|

161,459

|

|

1,704,698

|

|

4.500%, 8/1/2049

|

1,856,673

|

|

46,534

|

|

5.000%, 10/1/2023

|

47,702

|

|

28,568

|

|

5.000%, 4/1/2024

|

29,438

|

|

523,839

|

|

5.000%, 1/1/2040

|

581,046

|

|

203,555

|

|

5.500%, 12/1/2035

|

227,792

|

|

427,576

|

|

6.000%, 2/1/2033

|

480,605

|

|

19,938

|

|

6.000%, 5/1/2036

|

22,819

|

|

74,187

|

|

6.000%, 7/1/2036

|

85,131

|

|

214,215

|

|

6.000%, 1/1/2037

|

245,639

|

|

18,884

|

|

6.000%, 9/1/2037

|

21,691

|

|

27,971

|

|

6.000%, 9/1/2037

|

32,183

|

|

64,434

|

|

6.000%, 6/1/2038

|

73,854

|

|

54,345

|

|

6.000%, 8/1/2038

|

62,700

|

|

36,974

|

|

6.000%, 10/1/2038

|

42,604

|

|

582

|

|

6.500%, 12/1/2027

|

632

|

|

Principal

Amount

or Shares

|

|

|

Value

|

|

|

1

|

MORTGAGE-BACKED SECURITIES— continued

|

|

|

|

|

Federal National Mortgage Association— continued

|

|

|

$ 7,582

|

|

6.500%, 7/1/2029

|

$ 8,467

|

|

5,231

|

|

6.500%, 8/1/2029

|

5,818

|

|

1,275

|

|

6.500%, 8/1/2029

|

1,419

|

|

2,590

|

|

6.500%, 6/1/2029

|

2,895

|

|

117,328

|

|

6.500%, 5/1/2032

|

132,935

|

|

21,322

|

|

6.500%, 12/1/2035

|

24,868

|

|

248,504

|

|

6.500%, 8/1/2037

|

292,135

|

|

62,265

|

|

6.500%, 9/1/2037

|

73,570

|

|

4,931

|

|

7.000%, 1/1/2032

|

5,712

|

|

43,837

|

|

7.000%, 11/1/2031

|

51,155

|

|

11,870

|

|

7.000%, 12/1/2031

|

13,739

|

|

835

|

|

7.000%, 7/1/2029

|

941

|

|

745

|

|

7.000%, 9/1/2029

|

752

|

|

109

|

|

7.000%, 10/1/2031

|

116

|

|

41,872

|

|

7.000%, 12/1/2031

|

48,853

|

|

11,584

|

|

7.000%, 12/1/2031

|

13,517

|

|

30,240

|

|

7.000%, 2/1/2032

|

35,415

|

|

15,564

|

|

7.500%, 7/1/2028

|

17,544

|

|

25,080

|

|

7.500%, 8/1/2031

|

29,038

|

|

45,654

|

|

8.000%, 12/1/2026

|

50,154

|

|

|

|

TOTAL

|

86,898,763

|

|

|

|

Government National Mortgage Association— 4.2%

|

|

|

4,330,195

|

|

3.000%, 9/20/2050

|

4,435,863

|

|

128,465

|

|

5.500%, 4/15/2034

|

140,922

|

|

292,251

|

|

5.500%, 6/15/2034

|

321,153

|

|

42,120

|

|

6.000%, 1/15/2032

|

47,037

|

|

131,644

|

|

6.000%, 5/15/2036

|

149,244

|

|

4,521

|

|

6.500%, 5/15/2027

|

4,890

|

|

7,726

|

|

6.500%, 1/20/2032

|

8,645

|

|

3,119

|

|

6.500%, 11/20/2029

|

3,450

|

|

9,921

|

|

6.500%, 6/20/2031

|

11,081

|

|

6,480

|

|

6.500%, 7/20/2029

|

7,137

|

|

3,879

|

|

6.500%, 1/15/2029

|

4,292

|

|

10,384

|

|

6.500%, 1/15/2029

|

11,430

|

|

5,109

|

|

6.500%, 1/20/2029

|

5,589

|

|

3,062

|

|

6.500%, 2/15/2029

|

3,244

|

|

1,668

|

|

6.500%, 3/20/2029

|

1,830

|

|

2,544

|

|

6.500%, 5/20/2029

|

2,798

|

|

2,932

|

|

6.500%, 8/20/2029

|

3,232

|

|

Principal

Amount

or Shares

|

|

|

Value

|

|

|

1

|

MORTGAGE-BACKED SECURITIES— continued

|

|

|

|

|

Government National Mortgage Association— continued

|

|

|

$ 1,400

|

|

6.500%, 10/20/2029

|

$ 1,536

|

|

2,460

|

|

6.500%, 10/20/2030

|

2,732

|

|

3,381

|

|

6.500%, 4/20/2031

|

3,773

|

|

1,925

|

|

6.500%, 5/20/2031

|

2,148

|

|

2,360

|

|

6.500%, 7/15/2031

|

2,651

|

|

695

|

|

6.500%, 7/15/2031

|

784

|

|

2,837

|

|

6.500%, 7/20/2031

|

3,173

|

|

3,057

|

|

6.500%, 10/20/2031

|

3,421

|

|

2,598

|

|

6.500%, 11/20/2031

|

2,909

|

|

106,452

|

|

6.500%, 10/20/2038

|

122,795

|

|

10,848

|

|

7.000%, 6/15/2026

|

11,695

|

|

3,473

|

|

7.000%, 12/15/2026

|

3,740

|

|

4,660

|

|

7.000%, 6/15/2027

|

5,024

|

|

840

|

|

7.000%, 10/15/2027

|

914

|

|

2,644

|

|

7.000%, 11/15/2027

|

2,853

|

|

2,962

|

|

7.000%, 2/15/2028

|

3,233

|

|

8,154

|

|

7.000%, 4/15/2028

|

8,926

|

|

2,013

|

|

7.000%, 6/15/2028

|

2,218

|

|

12,795

|

|

7.000%, 6/15/2028

|

14,099

|

|

7,140

|

|

7.000%, 7/15/2028

|

7,793

|

|

39,231

|

|

7.000%, 8/15/2028

|

43,455

|

|

3,860

|

|

7.000%, 8/15/2028

|

4,234

|

|

2,838

|

|

7.000%, 1/15/2029

|

3,069

|

|

713

|

|

7.000%, 1/15/2029

|

727

|

|

9,439

|

|

7.000%, 1/15/2029

|

10,506

|

|

11,606

|

|

7.000%, 1/15/2029

|

12,938

|

|

26,552

|

|

7.000%, 1/15/2029

|

29,577

|

|

43,660

|

|

7.000%, 11/15/2028

|

48,520

|

|

11,743

|

|

7.000%, 12/15/2028

|

13,070

|

|

27,399

|

|

7.000%, 12/15/2028

|

29,786

|

|

12,560

|

|

7.000%, 12/15/2028

|

13,827

|

|

8,902

|

|

7.000%, 3/15/2031

|

10,009

|

|

3,428

|

|

7.000%, 6/15/2026

|

3,687

|

|

11,481

|

|

7.000%, 7/15/2028

|

12,569

|

|

6,630

|

|

7.000%, 8/15/2029

|

7,362

|

|

3,142

|

|

7.000%, 9/15/2028

|

3,455

|

|

763

|

|

7.000%, 9/15/2028

|

835

|

|

3,469

|

|

7.000%, 10/15/2028

|

3,833

|

|

13,449

|

|

7.000%, 10/15/2028

|

14,765

|

|

Principal

Amount

or Shares

|

|

|

Value

|

|

|

1

|

MORTGAGE-BACKED SECURITIES— continued

|

|

|

|

|

Government National Mortgage Association— continued

|

|

|

$ 9,278

|

|

7.000%, 12/15/2028

|

$ 10,214

|

|

3,271

|

|

7.000%, 1/15/2029

|

3,632

|

|

2,273

|

|

7.000%, 1/15/2029

|

2,532

|

|

4,069

|

|

7.000%, 1/15/2029

|

4,463

|

|

1,861

|

|

7.000%, 1/15/2029

|

1,960

|

|

2,052

|

|

7.000%, 1/15/2029

|

2,271

|

|

10,342

|

|

7.000%, 1/15/2029

|

11,446

|

|

898

|

|

7.000%, 2/15/2029

|

989

|

|

2,432

|

|

7.000%, 2/15/2029

|

2,707

|

|

5,683

|

|

7.000%, 2/15/2029

|

6,316

|

|

1,885

|

|

7.000%, 2/15/2029

|

2,090

|

|

8,667

|

|

7.000%, 2/15/2029

|

9,624

|

|

183

|

|

7.000%, 2/15/2029

|

202

|

|

49

|

|

7.000%, 2/15/2029

|

54

|

|

1,057

|

|

7.000%, 3/15/2029

|

1,162

|

|

6,478

|

|

7.000%, 3/15/2029

|

7,085

|

|

1,917

|

|

7.000%, 3/15/2029

|

2,134

|

|

525

|

|

7.000%, 3/15/2029

|

585

|

|

906

|

|

7.000%, 3/15/2029

|

1,011

|

|

1,427

|

|

7.000%, 3/15/2029

|

1,587

|

|

922

|

|

7.000%, 3/15/2029

|

1,025

|

|

1,388

|

|

7.000%, 3/15/2029

|

1,540

|

|

39,146

|

|

7.000%, 4/15/2029

|

43,538

|

|

2,146

|

|

7.000%, 4/15/2029

|

2,386

|

|

970

|

|

7.000%, 4/15/2029

|

1,078

|

|

4,239

|

|

7.000%, 4/15/2029

|

4,719

|

|

7,246

|

|

7.000%, 4/15/2029

|

7,932

|

|

4,273

|

|

7.000%, 4/15/2029

|

4,533

|

|

192

|

|

7.000%, 4/15/2029

|

214

|

|

2,419

|

|

7.000%, 5/15/2029

|

2,684

|

|

580

|

|

7.000%, 5/15/2029

|

644

|

|

1,203

|

|

7.000%, 5/15/2029

|

1,281

|

|

2,446

|

|

7.000%, 5/15/2029

|

2,718

|

|

5,187

|

|

7.000%, 6/15/2029

|

5,783

|

|

2,377

|

|

7.000%, 6/15/2029

|

2,658

|

|

3,137

|

|

7.000%, 6/15/2029

|

3,474

|

|

259

|

|

7.000%, 6/15/2029

|

290

|

|

616

|

|

7.000%, 6/15/2029

|

689

|

|

7,636

|

|

7.000%, 6/15/2029

|

8,499

|

|

Principal

Amount

or Shares

|

|

|

Value

|

|

|

1

|

MORTGAGE-BACKED SECURITIES— continued

|

|

|

|

|

Government National Mortgage Association— continued

|

|

|

$ 678

|

|

7.000%, 6/15/2029

|

$ 753

|

|

5,238

|

|

7.000%, 7/15/2029

|

5,816

|

|

1,444

|

|

7.000%, 7/15/2029

|

1,553

|

|

7,545

|

|

7.000%, 7/15/2029

|

8,424

|

|

44,752

|

|

7.000%, 7/15/2029

|

50,039

|

|

8,823

|

|

7.000%, 7/15/2029

|

9,873

|

|

915

|

|

7.000%, 7/15/2029

|

1,010

|

|

1,777

|

|

7.000%, 7/15/2029

|

1,990

|

|

4,905

|

|

7.000%, 7/15/2029

|

5,489

|

|

1,650

|

|

7.000%, 7/15/2029

|

1,815

|

|

5,982

|

|

7.000%, 7/15/2029

|

6,663

|

|

846

|

|

7.000%, 8/15/2029

|

945

|

|

1,701

|

|

7.000%, 8/15/2029

|

1,906

|

|

1,855

|

|

7.000%, 8/15/2029

|

2,060

|

|

1,302

|

|

7.000%, 8/15/2029

|

1,459

|

|

1,777

|

|

7.000%, 9/15/2029

|

1,980

|

|

10,322

|

|

7.000%, 9/15/2029

|

11,443

|

|

5,222

|

|

7.000%, 9/15/2029

|

5,856

|

|

4,022

|

|

7.000%, 9/15/2029

|

4,500

|

|

6,169

|

|

7.000%, 9/15/2029

|

6,898

|

|

15,723

|

|

7.000%, 12/15/2029

|

17,487

|

|

2,969

|

|

7.000%, 12/15/2029

|

3,299

|

|

2,959

|

|

7.000%, 1/15/2030

|

3,325

|

|

17,274

|

|

7.000%, 1/15/2030

|

19,422

|

|

15,552

|

|

7.000%, 2/15/2030

|

17,025

|

|

3,838

|

|

7.000%, 2/15/2030

|

4,313

|

|

8,566

|

|

7.000%, 2/15/2030

|

9,638

|

|

23,015

|

|

7.000%, 2/15/2030

|

25,895

|

|

44,424

|

|

7.000%, 3/15/2030

|

49,673

|

|

18,189

|

|

7.000%, 3/15/2030

|

20,278

|

|

2,935

|

|

7.000%, 4/15/2030

|

3,305

|

|

14,608

|

|

7.000%, 6/15/2030

|

16,480

|

|

2,270

|

|

7.000%, 6/15/2030

|

2,554

|

|

21,591

|

|

7.000%, 8/15/2030

|

24,357

|

|

6,221

|

|

7.000%, 8/15/2030

|

6,929

|

|

5,763

|

|

7.000%, 9/15/2030

|

6,105

|

|

12,561

|

|

7.000%, 10/15/2030

|

14,133

|

|

2,640

|

|

7.000%, 10/15/2030

|

2,764

|

|

3,266

|

|

7.000%, 11/15/2030

|

3,697

|

|

Principal

Amount

or Shares

|

|

|

Value

|

|

|

1

|

MORTGAGE-BACKED SECURITIES— continued

|

|

|

|

|

Government National Mortgage Association— continued

|

|

|

$ 8,178

|

|

7.000%, 2/15/2031

|

$ 9,257

|

|

96,932

|

|

7.000%, 2/15/2031

|

109,498

|

|

3,553

|

|

7.000%, 3/15/2031

|

4,006

|

|

887

|

|

7.000%, 7/15/2031

|

996

|

|

348

|

|

7.000%, 9/15/2031

|

388

|

|

19,334

|

|

7.000%, 10/15/2031

|

21,965

|

|

8,609

|

|

7.000%, 11/15/2031

|

9,781

|

|

7,496

|

|

7.000%, 1/15/2032

|

8,324

|

|

2,645

|

|

7.000%, 4/15/2032

|

2,907

|

|

11,276

|

|

7.000%, 5/15/2032

|

12,826

|

|

557

|

|

7.000%, 11/15/2032

|

606

|

|

526

|

|

7.000%, 1/15/2033

|

598

|

|

124,112

|

|

7.500%, 11/15/2027

|

136,938

|

|

92,497

|

|

7.500%, 11/15/2027

|

102,164

|

|

6,393

|

|

7.500%, 1/15/2030

|

7,195

|

|

8,237

|

|

7.500%, 10/15/2029

|

9,069

|

|

15,384

|

|

7.500%, 10/15/2029

|

17,209

|

|

2,819

|

|

7.500%, 10/15/2029

|

3,193

|

|

38,249

|

|

7.500%, 10/15/2030

|

41,063

|

|

8,478

|

|

7.500%, 10/15/2030

|

9,581

|

|

14,779

|

|

7.500%, 10/15/2031

|

16,972

|

|

24,003

|

|

7.500%, 8/15/2029

|

26,726

|

|

20,919

|

|

7.500%, 8/15/2029

|

23,545

|

|

8,121

|

|

7.500%, 8/15/2029

|

9,185

|

|

31,440

|

|

7.500%, 8/15/2029

|

35,586

|

|

12,561

|

|

7.500%, 8/15/2030

|

14,126

|

|

27,226

|

|

7.500%, 9/15/2029

|

30,566

|

|

423

|

|

7.500%, 4/15/2029

|

471

|

|

3,714

|

|

7.500%, 7/15/2029

|

4,043

|

|

327

|

|

7.500%, 7/15/2029

|

365

|

|

918

|

|

7.500%, 8/15/2029

|

1,027

|

|

392

|

|

7.500%, 8/15/2029

|

440

|

|

15,536

|

|

7.500%, 8/20/2029

|

17,419

|

|

3,954

|

|

7.500%, 9/15/2029

|

4,439

|

|

3,949

|

|

7.500%, 12/15/2029

|

4,437

|

|

9,775

|

|

7.500%, 3/20/2030

|

11,012

|

|

10,986

|

|

7.500%, 10/15/2030

|

12,554

|

|

6,152

|

|

7.500%, 11/20/2030

|

6,962

|

|

6,650

|

|

7.500%, 1/15/2031

|

7,616

|

|

Principal

Amount

or Shares

|

|

|

Value

|

|

|

1

|

MORTGAGE-BACKED SECURITIES— continued

|

|

|

|

|

Government National Mortgage Association— continued

|

|

|

$ 5,421

|

|

7.500%, 2/15/2031

|

$ 6,199

|

|

16,718

|

|

7.500%, 4/20/2031

|

19,050

|

|

24,277

|

|

7.500%, 7/15/2031

|

27,916

|

|

1,400

|

|

7.500%, 9/15/2031

|

1,591

|

|

10,862

|

|

7.500%, 11/15/2031

|

12,499

|

|

8,578

|

|

7.500%, 12/15/2031

|

9,295

|

|

7,224

|

|

7.500%, 3/15/2032

|

8,238

|

|

6,036

|

|

7.500%, 5/15/2032

|

6,968

|

|

420

|

|

8.000%, 11/15/2023

|

434

|

|

19,854

|

|

8.000%, 11/15/2027

|

21,851

|

|

4,949

|

|

8.000%, 4/15/2030

|

5,595

|

|

2,788

|

|

8.000%, 4/15/2030

|

3,177

|

|

2,836

|

|

8.000%, 5/15/2030

|

3,241

|

|

7,099

|

|

8.000%, 5/15/2030

|

8,024

|

|

7,805

|

|

8.000%, 6/15/2030

|

8,837

|

|

57,112

|

|

8.000%, 6/15/2030

|

65,023

|

|

28,095

|

|

8.000%, 6/15/2030

|

32,170

|

|

2,317

|

|

8.000%, 6/15/2030

|

2,437

|

|

2,214

|

|

8.000%, 7/15/2030

|

2,522

|

|

3,638

|

|

8.000%, 7/15/2030

|

4,166

|

|

17,211

|

|

8.000%, 8/15/2029

|

19,551

|

|

61,404

|

|

8.000%, 11/15/2029

|

69,857

|

|

26,094

|

|

8.000%, 12/15/2029

|

29,709

|

|

2,351

|

|

8.000%, 1/15/2030

|

2,671

|

|

12,077

|

|

8.000%, 1/15/2030

|

13,771

|

|

227

|

|

8.000%, 3/15/2030

|

230

|

|

10,831

|

|

8.000%, 4/15/2030

|

12,385

|

|

377

|

|

8.000%, 4/15/2030

|

431

|

|

5,713

|

|

8.000%, 4/15/2030

|

6,504

|

|

623

|

|

8.000%, 4/15/2030

|

701

|

|

1,816

|

|

8.000%, 5/15/2030

|

2,078

|

|

1,140

|

|

8.000%, 5/15/2030

|

1,291

|

|

219

|

|

8.000%, 5/15/2030

|

245

|

|

1,074

|

|

8.000%, 5/15/2030

|

1,223

|

|

3,752

|

|

8.000%, 6/15/2030

|

4,106

|

|

852

|

|

8.000%, 6/15/2030

|

973

|

|

861

|

|

8.000%, 6/15/2030

|

982

|

|

3,919

|

|

8.000%, 6/15/2030

|

4,419

|

|

39,589

|

|

8.000%, 7/15/2030

|

45,237

|

|

Principal

Amount

or Shares

|

|

|

Value

|

|

|

1

|

MORTGAGE-BACKED SECURITIES— continued

|

|

|

|

|

Government National Mortgage Association— continued

|

|

|

$ 18,501

|

|

8.500%, 6/15/2030

|

$ 21,046

|

|

|

|

TOTAL

|

7,405,076

|

|

|

2

|

Uniform Mortgage-Backed Securities, TBA— 13.6%

|

|

|

10,250,000

|

|

2.500%, 2/1/2052

|

10,233,179

|

|

14,000,000

|

|

2.500%, 2/20/2052

|

14,087,972

|

|

|

|

TOTAL

|

24,321,151

|

|

|

|

TOTAL MORTGAGE-BACKED SECURITIES

(IDENTIFIED COST $167,894,554)

|

165,728,146

|

|

|

|

GOVERNMENT AGENCY— 1.6%

|

|

|

|

|

Federal Farm Credit System— 1.6%

|

|

|

3,000,000

|

|

0.700%, 1/27/2027

(IDENTIFIED COST $3,000,000)

|

2,856,265

|

|

|

|

INVESTMENT COMPANY— 19.0%

|

|

|

33,813,456

|

|

Federated Hermes Government Obligations Fund, Premier Shares,

0.03%3

(IDENTIFIED COST $33,813,456)

|

33,813,456

|

|

|

|

TOTAL INVESTMENT IN SECURITIES—113.5%

(IDENTIFIED COST $204,708,010)4

|

202,397,867

|

|

|

|

OTHER ASSETS AND LIABILITIES - NET—(13.5)%5

|

(24,069,054)

|

|

|

|

TOTAL NET ASSETS—100%

|

$178,328,813

|

|

Description

|

Number of

Contracts

|

Notional

Value

|

Expiration

Date

|

Value and

Unrealized

Appreciation

(Depreciation)

|

|

Long Futures:

|

|

|

|

|

|

6United States Treasury Ultra Bond

Long Futures

|

2

|

$377,875

|

March 2022

|

$(12,836)

|

|

Short Futures:

|

|

|

|

|

|

6United States Treasury Note 10-Year

Short Futures

|

25

|

$3,199,219

|

March 2022

|

$5,022

|

|

NET UNREALIZED DEPRECIATION ON FUTURES CONTRACTS

|

$(7,814)

|

|||

|

|

Federated

Hermes

Government

Obligations Fund,

Premier Shares

|

|

Value as of 1/31/2021

|

$8,455,721

|

|

Purchases at Cost

|

$125,573,800

|

|

Proceeds from Sales

|

$(100,216,065)

|

|

Change in Unrealized Appreciation/Depreciation

|

N/A

|

|

Net Realized Gain/(Loss)

|

N/A

|

|

Value as of 1/31/2022

|

$33,813,456

|

|

Shares Held as of 1/31/2022

|

33,813,456

|

|

Dividend Income

|

$9,101

|

|

1

|

Due to monthly principal payments, the average lives of the Federal Home Loan Mortgage

Corporation, Federal National Mortgage Association and Government National Mortgage

Association securities approximates one to ten years.

|

|

2

|

All or a portion of these To Be Announced Securities (TBAs) are subject to dollar-roll

transactions.

|

|

3

|

7-day net yield.

|

|

4

|

The cost of investments for federal tax purposes amounts to $205,415,197.

|

|

5

|

Assets, other than investments in securities, less liabilities. A significant portion of this balance is

the result of dollar-roll transactions as of January 31, 2022.

|

|

6

|

Non-income-producing security.

|

The following is a summary of the inputs used, as of January 31, 2022, in valuing the Fund’s assets carried at fair value:

|

Valuation Inputs

|

||||

|

|

Level 1—

Quoted

Prices

|

Level 2—

Other

Significant

Observable

Inputs

|

Level 3—

Significant

Unobservable

Inputs

|

Total

|

|

Debt Securities:

|

|

|

|

|

|

Mortgage-Backed Securities

|

$—

|

$165,728,146

|

$—

|

$165,728,146

|

|

Government Agency

|

—

|

2,856,265

|

—

|

2,856,265

|

|

Investment Company

|

33,813,456

|

—

|

—

|

33,813,456

|

|

TOTAL SECURITIES

|

$33,813,456

|

$168,584,411

|

$—

|

$202,397,867

|

|

Other Financial Instruments:1

|

|

|

|

|

|

Assets

|

$5,022

|

$—

|

$—

|

$5,022

|

|

Liabilities

|

(12,836)

|

—

|

—

|

(12,836)

|

|

TOTAL OTHER

FINANCIAL INSTRUMENTS

|

$(7,814)

|

$—

|

$—

|

$(7,814)

|

|

1

|

Other financial instruments are futures contracts.

|

|

|

Year Ended January 31,

|

||||

|

|

2022

|

2021

|

2020

|

2019

|

2018

|

|

Net Asset Value, Beginning of Period

|

$10.56

|

$10.31

|

$9.97

|

$9.97

|

$10.13

|

|

Income From Investment Operations:

|

|

|

|

|

|

|

Net investment income (loss)1

|

0.02

|

0.09

|

0.21

|

0.24

|

0.21

|

|

Net realized and unrealized gain (loss)

|

(0.34)

|

0.29

|

0.35

|

(0.00)2

|

(0.13)

|

|

Total From Investment Operations

|

(0.32)

|

0.38

|

0.56

|

0.24

|

0.08

|

|

Less Distributions:

|

|

|

|

|

|

|

Distributions from net investment income

|

(0.07)

|

(0.13)

|

(0.22)

|

(0.24)

|

(0.24)

|

|

Distributions from net realized gain

|

(0.02)

|

—

|

—

|

—

|

—

|

|

Total Distributions

|

(0.09)

|

(0.13)

|

(0.22)

|

(0.24)

|

(0.24)

|

|

Net Asset Value, End of Period

|

$10.15

|

$10.56

|

$10.31

|

$9.97

|

$9.97

|

|

Total Return3

|

(3.07)%

|

3.73%

|

5.69%

|

2.51%

|

0.78%

|

|

Ratios to Average Net Assets:

|

|

|

|

|

|

|

Net expenses4

|

0.63%

|

0.63%

|

0.63%

|

0.63%

|

0.63%

|

|

Net investment income

|

0.29%

|

0.86%

|

2.09%

|

2.46%

|

2.07%

|

|

Expense waiver/reimbursement5

|

0.16%

|

0.13%

|

0.12%

|

0.12%

|

0.08%

|

|

Supplemental Data:

|

|

|

|

|

|

|

Net assets, end of period (000 omitted)

|

$163,080

|

$235,598

|

$240,047

|

$267,582

|

$356,449

|

|

Portfolio turnover6

|

227%

|

336%

|

302%

|

56%

|

201%

|

|

Portfolio turnover (excluding purchases and sales from

dollar-roll transactions)6

|

21%

|

85%

|

49%

|

33%

|

29%

|

|

1

|

Per share numbers have been calculated using the average shares method.

|

|

2

|

Represents less than $0.01.

|

|

3

|

Based on net asset value.

|

|

4

|

Amount does not reflect net expenses incurred by investment companies in which the Fund

may invest.

|

|

5

|

This expense decrease is reflected in both the net expense and the net investment income ratios

shown above. Amount does not reflect expense waiver/reimbursement recorded by investment

companies in which the Fund may invest.

|

|

6

|

Securities that mature are considered sales for purposes of this calculation.

|

|

|

Year Ended January 31,

|

||||

|

|

2022

|

2021

|

2020

|

2019

|

2018

|

|

Net Asset Value, Beginning of Period

|

$10.56

|

$10.31

|

$9.97

|

$9.97

|

$10.13

|

|

Income From Investment Operations:

|

|

|

|

|

|

|

Net investment income (loss)1

|

0.01

|

0.14

|

0.19

|

0.22

|

0.19

|

|

Net realized and unrealized gain (loss)

|

(0.35)

|

0.22

|

0.35

|

(0.00)2

|

(0.13)

|

|

Total From Investment Operations

|

(0.34)

|

0.36

|

0.54

|

0.22

|

0.06

|

|

Less Distributions:

|

|

|

|

|

|

|

Distributions from net investment income

|

(0.05)

|

(0.11)

|

(0.20)

|

(0.22)

|

(0.22)

|

|

Distributions from net realized gain

|

(0.02)

|

—

|

—

|

—

|

—

|

|

Total Distributions

|

(0.07)

|

(0.11)

|

(0.20)

|

(0.22)

|

(0.22)

|

|

Net Asset Value, End of Period

|

$10.15

|

$10.56

|

$10.31

|

$9.97

|

$9.97

|

|

Total Return3

|

(3.25)%

|

3.52%

|

5.48%

|

2.31%

|

0.58%

|

|

Ratios to Average Net Assets:

|

|

|

|

|

|

|

Net expenses4

|

0.83%

|

0.83%

|

0.83%

|

0.83%

|

0.83%

|

|

Net investment income

|

0.10%

|

1.36%

|

1.91%

|

2.26%

|

1.87%

|

|

Expense waiver/reimbursement5

|

0.12%

|

0.10%

|

0.09%

|

0.09%

|

0.06%

|

|

Supplemental Data:

|

|

|

|

|

|

|

Net assets, end of period (000 omitted)

|

$15,249

|

$16,292

|

$17,083

|

$23,873

|

$28,203

|

|

Portfolio turnover6

|

227%

|

336%

|

302%

|

56%

|

201%

|

|

Portfolio turnover (excluding purchases and sales from dollar-

roll transactions)6

|

21%

|

85%

|

49%

|

33%

|

29%

|

|

1

|

Per share numbers have been calculated using the average shares method.

|

|

2

|

Represents less than $0.01.

|

|

3

|

Based on net asset value.

|

|

4

|

Amount does not reflect net expenses incurred by investment companies in which the Fund

may invest.

|

|

5

|

This expense decrease is reflected in both the net expense and the net investment income ratios

shown above. Amount does not reflect expense waiver/reimbursement recorded by investment

companies in which the Fund may invest.

|

|

6

|

Securities that mature are considered sales for purposes of this calculation.

|

January 31, 2022

|

Assets:

|

|

|

Investment in securities, at value including $33,813,456 of investments in an affiliated

holding* (identified cost $204,708,010)

|

$202,397,867

|

|

Due from broker (Note 2)

|

65,050

|

|

Income receivable

|

395,852

|

|

Income receivable from an affiliated holding

|

680

|

|

Receivable for investments sold

|

1,378

|

|

Receivable for shares sold

|

25,222

|

|

Receivable for variation margin on futures contracts

|

27,022

|

|

Total Assets

|

202,913,071

|

|

Liabilities:

|

|

|

Payable for investments purchased

|

24,393,113

|

|

Payable for shares redeemed

|

61,729

|

|

Income distribution payable

|

17,481

|

|

Payable for investment adviser fee (Note 5)

|

3,908

|

|

Payable for administrative fee (Note 5)

|

382

|

|

Payable for other service fees (Notes 2 and 5)

|

12,587

|

|

Accrued expenses (Note 5)

|

95,058

|

|

Total Liabilities

|

24,584,258

|

|

Net assets for 17,568,385 shares outstanding

|

$178,328,813

|

|

Net Assets Consist of:

|

|

|

Paid-in capital

|

$187,833,319

|

|

Total distributable earnings (loss)

|

(9,504,506)

|

|

Total Net Assets

|

$178,328,813

|

|

Net Asset Value, Offering Price and Redemption Proceeds Per Share:

|

|

|

Institutional Shares:

|

|

|

Net asset value per share ($163,079,560 ÷ 16,065,760 shares outstanding), no par

value, unlimited shares authorized

|

$10.15

|

|

Service Shares:

|

|

|

Net asset value per share ($15,249,253 ÷ 1,502,625 shares outstanding), no par value,

unlimited shares authorized

|

$10.15

|

|

*

|

See information listed after the Fund’s Portfolio of Investments.

|

Year Ended January 31, 2022

|

Investment Income:

|

|

|

Interest

|

$1,973,390

|

|

Dividends received from an affiliated holding*

|

9,101

|

|

TOTAL INCOME

|

1,982,491

|

|

Expenses:

|

|

|

Investment adviser fee (Note 5)

|

857,783

|

|

Administrative fee (Note 5)

|

173,652

|

|

Custodian fees

|

33,727

|

|

Transfer agent fees

|

149,126

|

|

Directors’/Trustees’ fees (Note 5)

|

8,207

|

|

Auditing fees

|

41,900

|

|

Legal fees

|

10,427

|

|

Portfolio accounting fees

|

143,326

|

|

Other service fees (Notes 2 and 5)

|

205,001

|

|

Share registration costs

|

50,443

|

|

Printing and postage

|

31,784

|

|

Miscellaneous (Note 5)

|

24,551

|

|

TOTAL EXPENSES

|

1,729,927

|

|

Waiver and Reimbursements:

|

|

|

Waiver/reimbursement of investment adviser fee (Note 5)

|

(163,410)

|

|

Reimbursement of other operating expenses (Notes 2 and 5)

|

(172,338)

|

|

TOTAL WAIVER AND REIMBURSEMENTS

|

(335,748)

|

|

Net expenses

|

1,394,179

|

|

Net investment income

|

588,312

|

|

Realized and Unrealized Gain (Loss) on Investments and Futures Contracts:

|

|

|

Net realized loss on investments

|

(264,451)

|

|

Net realized gain on futures contracts

|

853,713

|

|

Net change in unrealized appreciation of investments

|

(7,306,500)

|

|

Net change in unrealized appreciation of futures contracts

|

(179,030)

|

|

Net realized and unrealized gain (loss) on investments and futures contracts

|

(6,896,268)

|

|

Change in net assets resulting from operations

|

$(6,307,956)

|

|

*

|

See information listed after the Fund’s Portfolio of Investments.

|

|

Year Ended January 31

|

2022

|

2021

|

|

Increase (Decrease) in Net Assets

|

|

|

|

Operations:

|

|

|

|

Net investment income

|

$588,312

|

$2,352,593

|

|

Net realized gain (loss)

|

589,262

|

5,127,348

|

|

Net change in unrealized appreciation/depreciation

|

(7,485,530)

|

1,977,433

|

|

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS

|

(6,307,956)

|

9,457,374

|

|

Distributions to Shareholders:

|

|

|

|

Institutional Shares

|

(1,605,307)

|

(3,135,876)

|

|

Service Shares

|

(107,250)

|

(173,866)

|

|

CHANGE IN NET ASSETS RESULTING FROM DISTRIBUTIONS

TO SHAREHOLDERS

|

(1,712,557)

|

(3,309,742)

|

|

Share Transactions:

|

|

|

|

Proceeds from sale of shares

|

16,970,796

|

78,994,260

|

|

Net asset value of shares issued to shareholders in payment of

distributions declared

|

1,370,266

|

2,712,400

|

|

Cost of shares redeemed

|

(83,881,168)

|

(93,094,469)

|

|

CHANGE IN NET ASSETS RESULTING FROM

SHARE TRANSACTIONS

|

(65,540,106)

|

(11,387,809)

|

|

Change in net assets

|

(73,560,619)

|

(5,240,177)

|

|

Net Assets:

|

|

|

|

Beginning of period

|

251,889,432

|

257,129,609

|

|

End of period

|

$178,328,813

|

$251,889,432

|

|

|

Other Service

Fees Incurred

|

Other Service

Fees Reimbursed

|

|

Institutional Shares

|

$165,139

|

$(165,139)

|

|

Service Shares

|

39,862

|

(7,199)

|

|

TOTAL

|

$205,001

|

$(172,338)

|

|

Fair Value of Derivative Instruments

|

||

|

|

Assets

|

|

|

|

Statement of

Assets and

Liabilities

Location

|

Fair

Value

|

|

Derivatives not accounted for as hedging instruments

under ASC Topic 815

|

|

|

|

Interest rate contracts

|

Receivable for variation margin on

futures contracts

|

$(7,814)*

|

|

*

|

Includes cumulative net depreciation of futures contracts as reported in the footnotes to the

Portfolio of Investments. Only the current day’s variation margin is reported within the Statement

of Assets and Liabilities.

|

|

Amount of Realized Gain or (Loss) on Derivatives Recognized in Income

|

|

|

|

Futures

Contracts

|

|

Interest rate contracts

|

$853,713

|

|

Change in Unrealized Appreciation or (Depreciation) on Derivatives Recognized in Income

|

|

|

|

Futures

Contracts

|

|

Interest rate contracts

|

$(179,030)

|

|

|

Year Ended

1/31/2022

|

Year Ended

1/31/2021

|

||

|

Institutional Shares:

|

Shares

|

Amount

|

Shares

|

Amount

|

|

Shares sold

|

1,266,646

|

$13,173,509

|

7,079,571

|

$74,036,350

|

|

Shares issued to shareholders in payment of

distributions declared

|

123,091

|

1,277,895

|

242,352

|

2,543,812

|

|

Shares redeemed

|

(7,640,818)

|

(79,581,415)

|

(8,298,630)

|

(86,780,260)

|

|

NET CHANGE RESULTING FROM

INSTITUTIONAL SHARE TRANSACTIONS

|

(6,251,081)

|

$(65,130,011)

|

(976,707)

|

$(10,200,098)

|

|

|

Year Ended

1/31/2022

|

Year Ended

1/31/2021

|

||

|

Service Shares:

|

Shares

|

Amount

|

Shares

|

Amount

|

|

Shares sold

|

364,251

|

$3,797,287

|

473,348

|

$4,957,910

|

|

Shares issued to shareholders in payment of

distributions declared

|

8,906

|

92,371

|

16,066

|

168,588

|

|

Shares redeemed

|

(413,758)

|

(4,299,753)

|

(603,765)

|

(6,314,209)

|

|

NET CHANGE RESULTING FROM SERVICE

SHARE TRANSACTIONS

|

(40,601)

|

$(410,095)

|

(114,351)

|

$(1,187,711)

|

|

NET CHANGE RESULTING FROM TOTAL FUND

SHARE TRANSACTIONS

|

(6,291,682)

|

$(65,540,106)

|

(1,091,058)

|

$(11,387,809)

|

|

Increase (Decrease)

|

|

|

Paid-In Capital

|

Total Distributable

Earnings (Loss)

|

|

$(315,318)

|

$315,318

|

|

|

2022

|

2021

|

|

Ordinary income

|

$1,397,239

|

$3,309,742

|

|

Long-term capital gains

|

$315,318

|

$—

|

|

Distributions payable

|

$(17,481)

|

|

Net unrealized depreciation

|

$(3,017,330)

|

|

Capital loss carryforwards

|

$(6,469,695)

|

|

Short-Term

|

Long-Term

|

Total

|

|

$6,469,695

|

$—

|

$6,469,695

|

|

Administrative Fee

|

Average Daily Net Assets

of the Investment Complex

|

|

0.100%

|

on assets up to $50 billion

|

|

0.075%

|

on assets over $50 billion

|

March 24, 2022

|

|

Beginning

Account Value

8/1/2021

|

Ending

Account Value

1/31/2022

|

Expenses Paid

During Period1

|

|

Actual:

|

|

|

|

|

Institutional Shares

|

$1,000

|

$975.60

|

$3.14

|

|

Service Shares

|

$1,000

|

$974.60

|

$4.13

|

|

Hypothetical (assuming a 5% return

before expenses):

|

|

|

|

|

Institutional Shares

|

$1,000

|

$1,022.03

|

$3.21

|

|

Service Shares

|

$1,000

|

$1,021.02

|

$4.23

|

|

1

|

Expenses are equal to the Fund’s annualized net expense ratios, multiplied by the average

account value over the period, multiplied by 184/365 (to reflect the one-half-year period). The

annualized net expense ratios are as follows:

|

|

Institutional Shares

|

0.63%

|

|

Service Shares

|

0.83%

|

|

Name

Birth Date

Positions Held with Fund

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held and Previous Position(s)

|

|

J. Christopher Donahue*

Birth Date: April 11, 1949

President and Trustee

Indefinite Term

Began serving: July 1999

|

Principal Occupations: Principal Executive Officer and President of

certain of the Funds in the Federated Hermes Fund Family; Director or

Trustee of the Funds in the Federated Hermes Fund Family; President,

Chief Executive Officer and Director, Federated Hermes, Inc.;

Chairman and Trustee, Federated Investment Management Company;

Trustee, Federated Investment Counseling; Chairman and Director,

Federated Global Investment Management Corp.; Chairman and

Trustee, Federated Equity Management Company of Pennsylvania;

Trustee, Federated Shareholder Services Company; Director,

Federated Services Company.

Previous Positions: President, Federated Investment Counseling;

President and Chief Executive Officer, Federated Investment

Management Company, Federated Global Investment Management

Corp. and Passport Research, Ltd; Chairman, Passport Research, Ltd.

|

|

Name

Birth Date

Positions Held with Fund

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held and Previous Position(s)

|

|

John B. Fisher*

Birth Date: May 16, 1956

Trustee

Indefinite Term

Began serving: May 2016

|

Principal Occupations: Principal Executive Officer and President of

certain of the Funds in the Federated Hermes Fund Family; Director or

Trustee of certain of the Funds in the Federated Hermes Fund Family;

Vice President, Federated Hermes, Inc.; President, Director/Trustee

and CEO, Federated Advisory Services Company, Federated Equity

Management Company of Pennsylvania, Federated Global Investment

Management Corp., Federated Investment Counseling, Federated

Investment Management Company; President of some of the Funds in

the Federated Hermes Fund Family and Director, Federated Investors

Trust Company.

Previous Positions: President and Director of the Institutional Sales

Division of Federated Securities Corp.; President and Director of

Federated Investment Counseling; President and CEO of Passport

Research, Ltd.; Director, Edgewood Securities Corp.; Director,

Federated Services Company; Director, Federated Hermes, Inc.;

Chairman and Director, Southpointe Distribution Services, Inc. and

President, Technology, Federated Services Company.

|

|

Name

Birth Date

Positions Held with Fund

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held, Previous Position(s) and Qualifications

|

|

John T. Collins

Birth Date: January 24, 1947

Trustee

Indefinite Term

Began serving: October 2013

|

Principal Occupations: Director or Trustee, and Chair of the Board

of Directors or Trustees, of the Federated Hermes Fund Family;

formerly, Chairman and CEO, The Collins Group, Inc. (a private equity

firm) (Retired).

Other Directorships Held: Director, KLX Energy Services Holdings,

Inc. (oilfield services); former Director of KLX Corp. (aerospace).

Qualifications: Mr. Collins has served in several business and financial

management roles and directorship positions throughout his career.

Mr. Collins previously served as Chairman and CEO of The Collins

Group, Inc. (a private equity firm) and as a Director of KLX Corp.

Mr. Collins serves as Chairman Emeriti, Bentley University. Mr. Collins

previously served as Director and Audit Committee Member, Bank of

America Corp.; Director, FleetBoston Financial Corp.; and Director,

Beth Israel Deaconess Medical Center (Harvard University

Affiliate Hospital).

|

|

Name

Birth Date

Positions Held with Fund

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held, Previous Position(s) and Qualifications

|

|

G. Thomas Hough

Birth Date: February 28, 1955

Trustee

Indefinite Term

Began serving: August 2015

|

Principal Occupations: Director or Trustee, Chair of the Audit

Committee of the Federated Hermes Fund Family; formerly, Vice

Chair, Ernst & Young LLP (public accounting firm) (Retired).

Other Directorships Held: Director, Chair of the Audit Committee,

Equifax, Inc.; Lead Director, Member of the Audit and Nominating and

Corporate Governance Committees, Haverty Furniture Companies,

Inc.; formerly, Director, Member of Governance and Compensation

Committees, Publix Super Markets, Inc.

Qualifications: Mr. Hough has served in accounting, business

management and directorship positions throughout his career.

Mr. Hough most recently held the position of Americas Vice Chair of

Assurance with Ernst & Young LLP (public accounting firm). Mr. Hough

serves on the President’s Cabinet and Business School Board of

Visitors for the University of Alabama. Mr. Hough previously served on

the Business School Board of Visitors for Wake Forest University, and

he previously served as an Executive Committee member of the

United States Golf Association.

|

|

Maureen Lally-Green

Birth Date: July 5, 1949

Trustee

Indefinite Term

Began serving: August 2009

|

Principal Occupations: Director or Trustee of the Federated Hermes

Fund Family; Adjunct Professor Emerita of Law, Duquesne University

School of Law; formerly, Dean of the Duquesne University School of

Law and Professor of Law and Interim Dean of the Duquesne

University School of Law; formerly, Associate General Secretary and

Director, Office of Church Relations, Diocese of Pittsburgh.

Other Directorships Held: Director, CNX Resources Corporation

(formerly known as CONSOL Energy Inc.).

Qualifications: Judge Lally-Green has served in various legal and

business roles and directorship positions throughout her career. Judge

Lally-Green previously held the position of Dean of the School of Law

of Duquesne University (as well as Interim Dean). Judge Lally-Green

previously served as a member of the Superior Court of Pennsylvania

and as a Professor of Law, Duquesne University School of Law. Judge

Lally-Green was appointed by the Supreme Court of Pennsylvania to

serve on the Supreme Court’s Board of Continuing Judicial Education

and the Supreme Court’s Appellate Court Procedural Rules

Committee. Judge Lally-Green also currently holds the positions on

not for profit or for profit boards of directors as follows: Director

and Chair, UPMC Mercy Hospital; Regent, Saint Vincent Seminary;

Member, Pennsylvania State Board of Education (public); Director,

Catholic Charities, Pittsburgh; and Director CNX Resources

Corporation (formerly known as CONSOL Energy Inc.). Judge

Lally-Green has held the positions of: Director, Auberle; Director,

Epilepsy Foundation of Western and Central Pennsylvania; Director,

Ireland Institute of Pittsburgh; Director, Saint Thomas More Society;

Director and Chair, Catholic High Schools of the Diocese of

Pittsburgh, Inc.; Director, Pennsylvania Bar Institute; Director,

St. Vincent College; Director and Chair, North Catholic High

School, Inc.; Director and Vice Chair, Our Campaign for the Church

Alive!, Inc.; and Director, Saint Francis University.

|

|

Name

Birth Date

Positions Held with Fund

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held, Previous Position(s) and Qualifications

|

|

Thomas M. O’Neill

Birth Date: June 14, 1951

Trustee

Indefinite Term

Began serving: August 2006

|

Principal Occupations: Director or Trustee of the Federated Hermes

Fund Family; Sole Proprietor, Navigator Management Company

(investment and strategic consulting).

Other Directorships Held: None.

Qualifications: Mr. O’Neill has served in several business, mutual fund

and financial management roles and directorship positions throughout

his career. Mr. O’Neill serves as Director, Medicines for Humanity.

Mr. O’Neill previously served as Chief Executive Officer and President,

Managing Director and Chief Investment Officer, Fleet Investment

Advisors; President and Chief Executive Officer, Aeltus Investment

Management, Inc.; General Partner, Hellman, Jordan Management

Co., Boston, MA; Chief Investment Officer, The Putnam Companies,

Boston, MA; Credit Analyst and Lending Officer, Fleet Bank; Director

and Consultant, EZE Castle Software (investment order management

software); Director, The Golisano Children’s Museum of Naples,

Florida; and Director, Midway Pacific (lumber).

|

|

Madelyn A. Reilly

Birth Date: February 2, 1956

Trustee

Indefinite Term

Began serving:

November 2020

|

Principal Occupations: Director or Trustee of the Federated Hermes

Fund Family; formerly, Senior Vice President for Legal Affairs, General

Counsel and Secretary to the Board of Directors, Duquesne University.

Other Directorships Held: None.

Qualifications: Ms. Reilly has served in various business and legal

management roles throughout her career. Ms. Reilly previously served

as Senior Vice President for Legal Affairs, General Counsel and

Secretary to the Board of Directors and Assistant General Counsel and

Director of Risk Management, Duquesne University. Prior to her work

at Duquesne University, Ms. Reilly served as Assistant General

Counsel of Compliance and Enterprise Risk as well as Senior Counsel

of Environment, Health and Safety, PPG Industries.

|

|

P. Jerome Richey

Birth Date: February 23, 1949

Trustee

Indefinite Term

Began serving: October 2013

|

Principal Occupations: Director or Trustee of the Federated Hermes

Fund Family; Management Consultant; Retired; formerly, Senior Vice

Chancellor and Chief Legal Officer, University of Pittsburgh and

Executive Vice President and Chief Legal Officer, CONSOL Energy Inc.

(now split into two separate publicly traded companies known as

CONSOL Energy Inc. and CNX Resources Corp.).

Other Directorships Held: None.

Qualifications: Mr. Richey has served in several business and legal

management roles and directorship positions throughout his career.

Mr. Richey most recently held the positions of Senior Vice Chancellor

and Chief Legal Officer, University of Pittsburgh. Mr. Richey previously

served as Chairman of the Board, Epilepsy Foundation of Western

Pennsylvania and Chairman of the Board, World Affairs Council of

Pittsburgh. Mr. Richey previously served as Chief Legal Officer and

Executive Vice President, CONSOL Energy Inc. and CNX Gas

Company; and Board Member, Ethics Counsel and Shareholder,

Buchanan Ingersoll & Rooney PC (a law firm).

|

|

Name

Birth Date

Positions Held with Fund

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held, Previous Position(s) and Qualifications

|

|

John S. Walsh

Birth Date:

November 28, 1957

Trustee

Indefinite Term

Began serving: June 1999

|

Principal Occupations: Director or Trustee of the Federated Hermes

Fund Family; President and Director, Heat Wagon, Inc. (manufacturer

of construction temporary heaters); President and Director,

Manufacturers Products, Inc. (distributor of portable construction

heaters); President, Portable Heater Parts, a division of Manufacturers

Products, Inc.

Other Directorships Held: None.

Qualifications: Mr. Walsh has served in several business management

roles and directorship positions throughout his career. Mr. Walsh

previously served as Vice President, Walsh & Kelly, Inc.

(paving contractors).

|

|

Name

Birth Date

Positions Held with Fund

Date Service Began

|

Principal Occupation(s) for Past Five Years

and Previous Position(s)

|

|

Lori A. Hensler

Birth Date: January 6, 1967

TREASURER

Officer since: April 2013

|

Principal Occupations: Principal Financial Officer and Treasurer of the

Federated Hermes Fund Family; Senior Vice President, Federated

Administrative Services; Financial and Operations Principal for

Federated Securities Corp.; and Assistant Treasurer, Federated

Investors Trust Company. Ms. Hensler has received the Certified

Public Accountant designation.

Previous Positions: Controller of Federated Hermes, Inc.; Senior Vice

President and Assistant Treasurer, Federated Investors Management

Company; Treasurer, Federated Investors Trust Company; Assistant

Treasurer, Federated Administrative Services, Federated

Administrative Services, Inc., Federated Securities Corp., Edgewood

Services, Inc., Federated Advisory Services Company, Federated

Equity Management Company of Pennsylvania, Federated Global

Investment Management Corp., Federated Investment Counseling,

Federated Investment Management Company, Passport Research,

Ltd., and Federated MDTA, LLC; Financial and Operations Principal for

Federated Securities Corp., Edgewood Services, Inc. and Southpointe

Distribution Services, Inc.

|

|

Name

Birth Date

Positions Held with Fund

Date Service Began

|

Principal Occupation(s) for Past Five Years

and Previous Position(s)

|

|

Peter J. Germain

Birth Date:

September 3, 1959

CHIEF LEGAL OFFICER,

SECRETARY and EXECUTIVE

VICE PRESIDENT

Officer since: January 2005

|

Principal Occupations: Mr. Germain is Chief Legal Officer, Secretary

and Executive Vice President of the Federated Hermes Fund Family.

He is General Counsel, Chief Legal Officer, Secretary and Executive

Vice President, Federated Hermes, Inc.; Trustee and Senior Vice

President, Federated Investors Management Company; Trustee and

President, Federated Administrative Services; Director and President,

Federated Administrative Services, Inc.; Director and Vice President,

Federated Securities Corp.; Director and Secretary, Federated Private

Asset Management, Inc.; Secretary, Federated Shareholder Services

Company; and Secretary, Retirement Plan Service Company of

America. Mr. Germain joined Federated Hermes, Inc. in 1984 and is a

member of the Pennsylvania Bar Association.

Previous Positions: Deputy General Counsel, Special Counsel,

Managing Director of Mutual Fund Services, Federated Hermes, Inc.;

Senior Vice President, Federated Services Company; and Senior

Corporate Counsel, Federated Hermes, Inc.

|

|

Stephen Van Meter

Birth Date: June 5, 1975

CHIEF COMPLIANCE

OFFICER AND SENIOR

VICE PRESIDENT

Officer since: July 2015

|

Principal Occupations: Senior Vice President and Chief Compliance

Officer of the Federated Hermes Fund Family; Vice President and

Chief Compliance Officer of Federated Hermes, Inc. and Chief

Compliance Officer of certain of its subsidiaries. Mr. Van Meter joined

Federated Hermes, Inc. in October 2011. He holds FINRA licenses

under Series 3, 7, 24 and 66.

Previous Positions: Mr. Van Meter previously held the position of

Compliance Operating Officer, Federated Hermes, Inc. Prior to joining

Federated Hermes, Inc., Mr. Van Meter served at the United States

Securities and Exchange Commission in the positions of Senior

Counsel, Office of Chief Counsel, Division of Investment Management

and Senior Counsel, Division of Enforcement.

|

|

Robert J. Ostrowski

Birth Date: April 26, 1963

Chief Investment Officer

Officer since: May 2004

|