lng-202012310000003570false--12-312020FY1175010305.625LIBOR or base rateLIBOR or base rateLIBOR or base rateLIBOR or base rateLIBOR or base rateLIBOR or base rateP3YP3Y43five hundred seventeenP1YP2YP3YP4YP2YP3YP4Y00000035702020-01-012020-12-31iso4217:USD00000035702020-06-30xbrli:shares00000035702021-02-190000003570lng:LiquefiedNaturalGasMember2020-01-012020-12-310000003570lng:LiquefiedNaturalGasMember2019-01-012019-12-310000003570lng:LiquefiedNaturalGasMember2018-01-012018-12-310000003570lng:RegasificationServiceMember2020-01-012020-12-310000003570lng:RegasificationServiceMember2019-01-012019-12-310000003570lng:RegasificationServiceMember2018-01-012018-12-310000003570us-gaap:ProductAndServiceOtherMember2020-01-012020-12-310000003570us-gaap:ProductAndServiceOtherMember2019-01-012019-12-310000003570us-gaap:ProductAndServiceOtherMember2018-01-012018-12-3100000035702019-01-012019-12-3100000035702018-01-012018-12-31iso4217:USDxbrli:shares00000035702020-12-3100000035702019-12-310000003570lng:CheniereEnergyPartnersLPMember2020-12-310000003570us-gaap:CommonStockMember2017-12-310000003570us-gaap:TreasuryStockMember2017-12-310000003570us-gaap:AdditionalPaidInCapitalMember2017-12-310000003570us-gaap:RetainedEarningsMember2017-12-310000003570us-gaap:NoncontrollingInterestMember2017-12-3100000035702017-12-310000003570us-gaap:CommonStockMember2018-01-012018-12-310000003570us-gaap:TreasuryStockMember2018-01-012018-12-310000003570us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310000003570us-gaap:RetainedEarningsMember2018-01-012018-12-310000003570us-gaap:NoncontrollingInterestMember2018-01-012018-12-310000003570us-gaap:CommonStockMember2018-12-310000003570us-gaap:TreasuryStockMember2018-12-310000003570us-gaap:AdditionalPaidInCapitalMember2018-12-310000003570us-gaap:RetainedEarningsMember2018-12-310000003570us-gaap:NoncontrollingInterestMember2018-12-3100000035702018-12-310000003570us-gaap:CommonStockMember2019-01-012019-12-310000003570us-gaap:TreasuryStockMember2019-01-012019-12-310000003570us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310000003570us-gaap:RetainedEarningsMember2019-01-012019-12-310000003570us-gaap:NoncontrollingInterestMember2019-01-012019-12-310000003570us-gaap:CommonStockMember2019-12-310000003570us-gaap:TreasuryStockMember2019-12-310000003570us-gaap:AdditionalPaidInCapitalMember2019-12-310000003570us-gaap:RetainedEarningsMember2019-12-310000003570us-gaap:NoncontrollingInterestMember2019-12-310000003570us-gaap:CommonStockMember2020-01-012020-12-310000003570us-gaap:TreasuryStockMember2020-01-012020-12-310000003570us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310000003570us-gaap:RetainedEarningsMember2020-01-012020-12-310000003570us-gaap:NoncontrollingInterestMember2020-01-012020-12-310000003570us-gaap:CommonStockMember2020-12-310000003570us-gaap:TreasuryStockMember2020-12-310000003570us-gaap:AdditionalPaidInCapitalMember2020-12-310000003570us-gaap:RetainedEarningsMember2020-12-310000003570us-gaap:NoncontrollingInterestMember2020-12-31lng:unitlng:trains0000003570lng:SabinePassLNGTerminalMember2020-01-012020-12-31lng:milliontonnesutr:Ylng:itemutr:mi0000003570lng:CreoleTrailPipelineMember2020-01-012020-12-31xbrli:pure0000003570lng:CheniereEnergyPartnersLPMember2020-01-012020-12-310000003570lng:CorpusChristiLNGTerminalMember2020-01-012020-12-310000003570lng:CorpusChristiPipelineMember2020-01-012020-12-310000003570lng:CorpusChristiLNGTerminalExpansionMembersrt:MaximumMember2020-01-012020-12-310000003570lng:CorpusChristiLNGTerminalExpansionMember2020-01-012020-12-310000003570us-gaap:AccountingStandardsUpdate201602Member2019-01-010000003570lng:SPACustomersMemberlng:SabinePassLiquefactionMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-31lng:customer0000003570lng:SPACustomersMemberlng:CorpusChristiLiquefactionMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310000003570lng:SabinePassLNGLPMemberus-gaap:CustomerConcentrationRiskMemberlng:TUACustomersMember2020-01-012020-12-310000003570lng:SabinePassLNGTerminalMember2020-12-310000003570srt:MaximumMemberlng:SabinePassLNGTerminalMember2020-12-310000003570lng:CorpusChristiPipelineMember2020-12-310000003570lng:CreoleTrailPipelineMember2020-12-310000003570lng:SPLProjectMember2020-12-310000003570lng:SPLProjectMember2019-12-310000003570lng:CCLProjectMember2020-12-310000003570lng:CCLProjectMember2019-12-310000003570lng:SubsidiaryCashMember2020-12-310000003570lng:SubsidiaryCashMember2019-12-310000003570lng:SabinePassLiquefactionAndCorpusChristiLiquefactionMember2020-12-310000003570lng:SabinePassLiquefactionAndCorpusChristiLiquefactionMember2019-12-310000003570lng:CheniereMarketingLLCMember2020-12-310000003570lng:CheniereMarketingLLCMember2019-12-310000003570lng:NaturalGasInventoryMember2020-12-310000003570lng:NaturalGasInventoryMember2019-12-310000003570lng:LiquefiedNaturalGasInventoryMember2020-12-310000003570lng:LiquefiedNaturalGasInventoryMember2019-12-310000003570lng:LiquefiedNaturalGasInTransitInventoryMember2020-12-310000003570lng:LiquefiedNaturalGasInTransitInventoryMember2019-12-310000003570lng:MaterialsAndOtherInventoryMember2020-12-310000003570lng:MaterialsAndOtherInventoryMember2019-12-310000003570lng:LngTerminalMember2020-12-310000003570lng:LngTerminalMember2019-12-310000003570lng:LngSiteAndRelatedCostsNetMember2020-12-310000003570lng:LngSiteAndRelatedCostsNetMember2019-12-310000003570us-gaap:ConstructionInProgressMember2020-12-310000003570us-gaap:ConstructionInProgressMember2019-12-310000003570lng:LngTerminalCostsMember2020-12-310000003570lng:LngTerminalCostsMember2019-12-310000003570us-gaap:OfficeEquipmentMember2020-12-310000003570us-gaap:OfficeEquipmentMember2019-12-310000003570us-gaap:FurnitureAndFixturesMember2020-12-310000003570us-gaap:FurnitureAndFixturesMember2019-12-310000003570us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2020-12-310000003570us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2019-12-310000003570us-gaap:LeaseholdImprovementsMember2020-12-310000003570us-gaap:LeaseholdImprovementsMember2019-12-310000003570us-gaap:LandMember2020-12-310000003570us-gaap:LandMember2019-12-310000003570us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2020-12-310000003570us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2019-12-310000003570lng:FixedAssetsMember2020-12-310000003570lng:FixedAssetsMember2019-12-310000003570us-gaap:AssetsHeldUnderCapitalLeasesMember2020-12-310000003570us-gaap:AssetsHeldUnderCapitalLeasesMember2019-12-310000003570srt:MinimumMember2020-01-012020-12-310000003570srt:MaximumMember2020-01-012020-12-310000003570lng:LNGStorageTanksMember2020-01-012020-12-310000003570us-gaap:PipelinesMember2020-01-012020-12-310000003570lng:MarineBerthElectricalFacilityAndRoadsMember2020-01-012020-12-310000003570lng:WaterPipelinesMember2020-01-012020-12-310000003570lng:RegasificationProcessingEquipmentRecondensersVaporizationAndVentsMember2020-01-012020-12-310000003570lng:SendoutPumpsMember2020-01-012020-12-310000003570srt:MinimumMemberlng:LiquefactionProcessingEquipmentMember2020-01-012020-12-310000003570srt:MaximumMemberlng:LiquefactionProcessingEquipmentMember2020-01-012020-12-310000003570us-gaap:OtherEnergyEquipmentMembersrt:MinimumMember2020-01-012020-12-310000003570us-gaap:OtherEnergyEquipmentMembersrt:MaximumMember2020-01-012020-12-310000003570lng:CCHInterestRateDerivativesMemberus-gaap:FairValueInputsLevel1Member2020-12-310000003570lng:CCHInterestRateDerivativesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000003570lng:CCHInterestRateDerivativesMemberus-gaap:FairValueInputsLevel3Member2020-12-310000003570lng:CCHInterestRateDerivativesMember2020-12-310000003570lng:CCHInterestRateDerivativesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000003570lng:CCHInterestRateDerivativesMemberus-gaap:FairValueInputsLevel2Member2019-12-310000003570lng:CCHInterestRateDerivativesMemberus-gaap:FairValueInputsLevel3Member2019-12-310000003570lng:CCHInterestRateDerivativesMember2019-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:CCHInterestRateForwardStartDerivativesMember2020-12-310000003570us-gaap:FairValueInputsLevel2Memberlng:CCHInterestRateForwardStartDerivativesMember2020-12-310000003570us-gaap:FairValueInputsLevel3Memberlng:CCHInterestRateForwardStartDerivativesMember2020-12-310000003570lng:CCHInterestRateForwardStartDerivativesMember2020-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:CCHInterestRateForwardStartDerivativesMember2019-12-310000003570us-gaap:FairValueInputsLevel2Memberlng:CCHInterestRateForwardStartDerivativesMember2019-12-310000003570us-gaap:FairValueInputsLevel3Memberlng:CCHInterestRateForwardStartDerivativesMember2019-12-310000003570lng:CCHInterestRateForwardStartDerivativesMember2019-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel1Member2020-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel2Member2020-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel3Member2020-12-310000003570us-gaap:PriceRiskDerivativeMember2020-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel1Member2019-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel2Member2019-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel3Member2019-12-310000003570us-gaap:PriceRiskDerivativeMember2019-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:LNGTradingDerivativeMember2020-12-310000003570us-gaap:FairValueInputsLevel2Memberlng:LNGTradingDerivativeMember2020-12-310000003570us-gaap:FairValueInputsLevel3Memberlng:LNGTradingDerivativeMember2020-12-310000003570lng:LNGTradingDerivativeMember2020-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:LNGTradingDerivativeMember2019-12-310000003570us-gaap:FairValueInputsLevel2Memberlng:LNGTradingDerivativeMember2019-12-310000003570us-gaap:FairValueInputsLevel3Memberlng:LNGTradingDerivativeMember2019-12-310000003570lng:LNGTradingDerivativeMember2019-12-310000003570us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeContractMember2020-12-310000003570us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMember2020-12-310000003570us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel3Member2020-12-310000003570us-gaap:ForeignExchangeContractMember2020-12-310000003570us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeContractMember2019-12-310000003570us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMember2019-12-310000003570us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel3Member2019-12-310000003570us-gaap:ForeignExchangeContractMember2019-12-310000003570us-gaap:FairValueInputsLevel3Memberlng:PhysicalLiquefactionSupplyDerivativesMember2020-12-310000003570srt:MinimumMemberus-gaap:MarketApproachValuationTechniqueMemberus-gaap:FairValueInputsLevel3Memberlng:PhysicalLiquefactionSupplyDerivativesMember2020-01-012020-12-310000003570us-gaap:MarketApproachValuationTechniqueMembersrt:MaximumMemberus-gaap:FairValueInputsLevel3Memberlng:PhysicalLiquefactionSupplyDerivativesMember2020-01-012020-12-310000003570srt:WeightedAverageMemberus-gaap:MarketApproachValuationTechniqueMemberus-gaap:FairValueInputsLevel3Memberlng:PhysicalLiquefactionSupplyDerivativesMember2020-01-012020-12-310000003570us-gaap:ValuationTechniqueOptionPricingModelMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Memberlng:PhysicalLiquefactionSupplyDerivativesMember2020-01-012020-12-310000003570us-gaap:ValuationTechniqueOptionPricingModelMembersrt:MaximumMemberus-gaap:FairValueInputsLevel3Memberlng:PhysicalLiquefactionSupplyDerivativesMember2020-01-012020-12-310000003570us-gaap:ValuationTechniqueOptionPricingModelMembersrt:WeightedAverageMemberus-gaap:FairValueInputsLevel3Memberlng:PhysicalLiquefactionSupplyDerivativesMember2020-01-012020-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesMember2019-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesMember2018-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesMember2017-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesMember2020-01-012020-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesMember2019-01-012019-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesMember2018-01-012018-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesMember2020-12-310000003570us-gaap:InterestRateContractMember2020-01-012020-12-310000003570lng:CCHInterestRateDerivativesMember2020-01-012020-12-310000003570lng:CCHInterestRateDerivativesMemberus-gaap:GainLossOnDerivativeInstrumentsMember2020-01-012020-12-310000003570lng:CCHInterestRateDerivativesMemberus-gaap:GainLossOnDerivativeInstrumentsMember2019-01-012019-12-310000003570lng:CCHInterestRateDerivativesMemberus-gaap:GainLossOnDerivativeInstrumentsMember2018-01-012018-12-310000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateForwardStartDerivativesMember2020-01-012020-12-310000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateForwardStartDerivativesMember2019-01-012019-12-310000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateForwardStartDerivativesMember2018-01-012018-12-310000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CQPInterestRateDerivativesMember2020-01-012020-12-310000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CQPInterestRateDerivativesMember2019-01-012019-12-310000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CQPInterestRateDerivativesMember2018-01-012018-12-310000003570srt:MaximumMemberlng:PhysicalLiquefactionSupplyDerivativesMember2020-01-012020-12-310000003570us-gaap:CommodityContractMember2020-01-012020-12-31lng:tbtu0000003570us-gaap:SalesMemberlng:LNGTradingDerivativeMember2020-01-012020-12-310000003570us-gaap:SalesMemberlng:LNGTradingDerivativeMember2019-01-012019-12-310000003570us-gaap:SalesMemberlng:LNGTradingDerivativeMember2018-01-012018-12-310000003570us-gaap:CostOfSalesMemberlng:LNGTradingDerivativeMember2020-01-012020-12-310000003570us-gaap:CostOfSalesMemberlng:LNGTradingDerivativeMember2019-01-012019-12-310000003570us-gaap:CostOfSalesMemberlng:LNGTradingDerivativeMember2018-01-012018-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:SalesMember2020-01-012020-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:SalesMember2019-01-012019-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:SalesMember2018-01-012018-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:CostOfSalesMember2020-01-012020-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:CostOfSalesMember2019-01-012019-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:CostOfSalesMember2018-01-012018-12-310000003570us-gaap:ForeignExchangeContractMember2020-01-012020-12-310000003570us-gaap:ForeignExchangeContractMemberus-gaap:SalesMember2020-01-012020-12-310000003570us-gaap:ForeignExchangeContractMemberus-gaap:SalesMember2019-01-012019-12-310000003570us-gaap:ForeignExchangeContractMemberus-gaap:SalesMember2018-01-012018-12-310000003570lng:CCHInterestRateDerivativesMemberus-gaap:DerivativeFinancialInstrumentsAssetsMember2020-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberlng:CCHInterestRateForwardStartDerivativesMember2020-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberus-gaap:PriceRiskDerivativeMember2020-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberlng:LNGTradingDerivativeMember2020-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberus-gaap:ForeignExchangeContractMember2020-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMember2020-12-310000003570lng:CCHInterestRateDerivativesMemberlng:NoncurrentDerivativeAssetsMember2020-12-310000003570lng:NoncurrentDerivativeAssetsMemberlng:CCHInterestRateForwardStartDerivativesMember2020-12-310000003570us-gaap:PriceRiskDerivativeMemberlng:NoncurrentDerivativeAssetsMember2020-12-310000003570lng:NoncurrentDerivativeAssetsMemberlng:LNGTradingDerivativeMember2020-12-310000003570us-gaap:ForeignExchangeContractMemberlng:NoncurrentDerivativeAssetsMember2020-12-310000003570lng:NoncurrentDerivativeAssetsMember2020-12-310000003570lng:CCHInterestRateDerivativesMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2020-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberlng:CCHInterestRateForwardStartDerivativesMember2020-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2020-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberlng:LNGTradingDerivativeMember2020-12-310000003570us-gaap:ForeignExchangeContractMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2020-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2020-12-310000003570lng:CCHInterestRateDerivativesMemberlng:NoncurrentDerivativeLiabilitiesMember2020-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberlng:CCHInterestRateForwardStartDerivativesMember2020-12-310000003570us-gaap:PriceRiskDerivativeMemberlng:NoncurrentDerivativeLiabilitiesMember2020-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberlng:LNGTradingDerivativeMember2020-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberus-gaap:ForeignExchangeContractMember2020-12-310000003570lng:NoncurrentDerivativeLiabilitiesMember2020-12-310000003570lng:CCHInterestRateDerivativesMemberus-gaap:DerivativeFinancialInstrumentsAssetsMember2019-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberlng:CCHInterestRateForwardStartDerivativesMember2019-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberus-gaap:PriceRiskDerivativeMember2019-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberlng:LNGTradingDerivativeMember2019-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberus-gaap:ForeignExchangeContractMember2019-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMember2019-12-310000003570lng:CCHInterestRateDerivativesMemberlng:NoncurrentDerivativeAssetsMember2019-12-310000003570lng:NoncurrentDerivativeAssetsMemberlng:CCHInterestRateForwardStartDerivativesMember2019-12-310000003570us-gaap:PriceRiskDerivativeMemberlng:NoncurrentDerivativeAssetsMember2019-12-310000003570lng:NoncurrentDerivativeAssetsMemberlng:LNGTradingDerivativeMember2019-12-310000003570us-gaap:ForeignExchangeContractMemberlng:NoncurrentDerivativeAssetsMember2019-12-310000003570lng:NoncurrentDerivativeAssetsMember2019-12-310000003570lng:CCHInterestRateDerivativesMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2019-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberlng:CCHInterestRateForwardStartDerivativesMember2019-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2019-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberlng:LNGTradingDerivativeMember2019-12-310000003570us-gaap:ForeignExchangeContractMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2019-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2019-12-310000003570lng:CCHInterestRateDerivativesMemberlng:NoncurrentDerivativeLiabilitiesMember2019-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberlng:CCHInterestRateForwardStartDerivativesMember2019-12-310000003570us-gaap:PriceRiskDerivativeMemberlng:NoncurrentDerivativeLiabilitiesMember2019-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberlng:LNGTradingDerivativeMember2019-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberus-gaap:ForeignExchangeContractMember2019-12-310000003570lng:NoncurrentDerivativeLiabilitiesMember2019-12-310000003570lng:CCHInterestRateDerivativeAssetMember2020-12-310000003570lng:CCHInterestRateForwardStartDerivativesAssetMember2020-12-310000003570lng:PriceRiskDerivativeAssetMember2020-12-310000003570lng:LNGTradingDerivativeAssetMember2020-12-310000003570lng:ForeignExchangeContractAssetMember2020-12-310000003570lng:CCHInterestRateDerivativeLiabilityMember2020-12-310000003570lng:CCHInterestRateForwardStartDerivativesLiabilityMember2020-12-310000003570lng:PriceRiskDerivativeLiabilityMember2020-12-310000003570lng:LNGTradingDerivativesLiabilityMember2020-12-310000003570lng:ForeignExchangeContractLiabilityMember2020-12-310000003570lng:CCHInterestRateDerivativeAssetMember2019-12-310000003570lng:CCHInterestRateForwardStartDerivativesAssetMember2019-12-310000003570lng:PriceRiskDerivativeAssetMember2019-12-310000003570lng:LNGTradingDerivativeAssetMember2019-12-310000003570lng:ForeignExchangeContractAssetMember2019-12-310000003570lng:CCHInterestRateDerivativeLiabilityMember2019-12-310000003570lng:CCHInterestRateForwardStartDerivativesLiabilityMember2019-12-310000003570lng:PriceRiskDerivativeLiabilityMember2019-12-310000003570lng:LNGTradingDerivativesLiabilityMember2019-12-310000003570lng:ForeignExchangeContractLiabilityMember2019-12-310000003570lng:MidshipHoldingsLLCMember2020-01-012020-12-310000003570lng:MidshipHoldingsLLCMember2020-12-310000003570lng:MidshipHoldingsLLCMember2019-12-310000003570lng:CommonUnitsMemberlng:CheniereEnergyPartnersLPMember2020-12-310000003570lng:ClassBUnitsMemberlng:CheniereEnergyPartnersLPMemberlng:BlackstoneCqpHoldcoLpMember2012-01-012012-12-310000003570lng:CheniereEnergyPartnersGPLLCMemberlng:BlackstoneCqpHoldcoLpMember2020-01-012020-12-310000003570lng:CheniereEnergyPartnersGPLLCMemberlng:CheniereEnergyIncMember2020-01-012020-12-310000003570lng:CheniereEnergyPartnersGPLLCMemberlng:BlackstoneCQPHoldcoLPAndCheniereEnergyIncMember2020-01-012020-12-310000003570lng:BlackstoneCqpHoldcoLpMember2020-01-012020-12-310000003570lng:DirectorAppointmentEntitlementMinimumMemberlng:CheniereEnergyPartnersLPMemberlng:BlackstoneCqpHoldcoLpMember2020-01-012020-12-310000003570lng:CheniereEnergyPartnersLPMember2020-01-012020-12-310000003570lng:CheniereEnergyPartnersLPMember2019-12-310000003570us-gaap:SeniorNotesMembersrt:MinimumMemberlng:SabinePassLiquefactionMember2020-12-310000003570us-gaap:SeniorNotesMemberlng:SabinePassLiquefactionMembersrt:MaximumMember2020-12-310000003570lng:SabinePassLiquefactionMember2020-12-310000003570lng:SabinePassLiquefactionMember2019-12-310000003570us-gaap:SeniorNotesMembersrt:MinimumMemberlng:CheniereEnergyPartnersLPMember2020-12-310000003570us-gaap:SeniorNotesMembersrt:MaximumMemberlng:CheniereEnergyPartnersLPMember2020-12-310000003570us-gaap:SeniorNotesMembersrt:MinimumMemberlng:CheniereCorpusChristiHoldingsLLCMember2020-12-310000003570us-gaap:SeniorNotesMemberlng:CheniereCorpusChristiHoldingsLLCMembersrt:MaximumMember2020-12-310000003570lng:CheniereCorpusChristiHoldingsLLCMember2020-12-310000003570lng:CheniereCorpusChristiHoldingsLLCMember2019-12-310000003570lng:CheniereCCHHoldcoIILLCMemberlng:A2025CCHHoldCoIIConvertibleNotesMember2020-12-310000003570lng:CheniereCCHHoldcoIILLCMember2020-12-310000003570lng:CheniereCCHHoldcoIILLCMember2019-12-310000003570lng:A2028CheniereSeniorSecuredNotesMembersrt:ParentCompanyMember2020-12-310000003570srt:ParentCompanyMember2020-12-310000003570srt:ParentCompanyMember2019-12-310000003570us-gaap:LongTermDebtMember2020-12-310000003570us-gaap:LongTermDebtMember2019-12-310000003570lng:WorkingCapitalFacilityMemberlng:SabinePassLiquefactionMember2020-12-310000003570lng:CorpusChristiHoldingsWorkingCapitalFacilityMemberlng:CheniereCorpusChristiHoldingsLLCMember2020-12-310000003570srt:ParentCompanyMemberlng:A2021ConvertibleUnsecuredNotesMember2020-12-310000003570srt:ParentCompanyMemberlng:A2021ConvertibleUnsecuredNotesMember2019-12-310000003570us-gaap:ShortTermDebtMember2020-12-310000003570us-gaap:ShortTermDebtMember2019-12-310000003570lng:A2030SabinePassLiquefactionSeniorNotesMemberlng:SabinePassLiquefactionMember2020-12-310000003570lng:CheniereCorpusChristiHoldingsLLCMemberlng:A2039352CorpusChristiHoldingsSeniorNotesMember2020-12-310000003570srt:ParentCompanyMemberlng:CheniereTermLoanFacilityMember2020-01-012020-12-310000003570srt:ParentCompanyMemberlng:CheniereRevolvingCreditFacilityMember2020-01-012020-12-310000003570lng:A2021SabinePassLiquefactionSeniorNotesMemberlng:SabinePassLiquefactionMember2020-12-310000003570lng:A2021SabinePassLiquefactionSeniorNotesMemberlng:SabinePassLiquefactionMember2020-01-012020-12-310000003570lng:CheniereCCHHoldcoIILLCMemberlng:A2025CCHHoldCoIIConvertibleNotesMember2020-01-012020-12-310000003570lng:CheniereCorpusChristiHoldingsLLCMemberlng:CCHCreditFacilityMember2020-01-012020-12-310000003570srt:ParentCompanyMemberlng:A2021ConvertibleUnsecuredNotesMember2020-01-012020-12-310000003570lng:A2030SabinePassLiquefactionSeniorNotesMemberlng:SabinePassLiquefactionMember2020-01-012020-12-310000003570lng:CheniereCorpusChristiHoldingsLLCMemberlng:A2039352CorpusChristiHoldingsSeniorNotesMember2020-01-012020-12-310000003570lng:CheniereTermLoanFacilityMemberus-gaap:CashMember2020-01-012020-12-310000003570lng:CheniereTermLoanFacilityMember2020-01-012020-12-310000003570lng:CheniereTermLoanFacilityMember2020-12-310000003570lng:A2025CCHHoldCoIIConvertibleNotesMemberus-gaap:CashMember2020-01-012020-12-310000003570lng:A2025CCHHoldCoIIConvertibleNotesMember2020-12-310000003570lng:A2021ConvertibleUnsecuredNotesMember2020-07-012020-07-310000003570lng:A2025CCHHoldCoIIConvertibleNotesAnd2021CheniereConvertibleNotesMember2020-01-012020-12-310000003570lng:A2020SPLWorkingCapitalFacilityMember2020-12-310000003570lng:A2019CQPCreditFacilitiesMember2020-12-310000003570lng:A2015CCHTermLoanFacilityMember2020-12-310000003570lng:CorpusChristiHoldingsWorkingCapitalFacilityMember2020-12-310000003570lng:CheniereRevolvingCreditFacilityMember2020-12-31utr:Rate0000003570us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MinimumMemberlng:A2020SPLWorkingCapitalFacilityMember2020-01-012020-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMemberlng:A2020SPLWorkingCapitalFacilityMember2020-01-012020-12-310000003570srt:MinimumMemberus-gaap:BaseRateMemberlng:A2020SPLWorkingCapitalFacilityMember2020-01-012020-12-310000003570us-gaap:BaseRateMembersrt:MaximumMemberlng:A2020SPLWorkingCapitalFacilityMember2020-01-012020-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:A2019CQPCreditFacilitiesMembersrt:MinimumMember2020-01-012020-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:A2019CQPCreditFacilitiesMembersrt:MaximumMember2020-01-012020-12-310000003570lng:A2019CQPCreditFacilitiesMembersrt:MinimumMemberus-gaap:BaseRateMember2020-01-012020-12-310000003570lng:A2019CQPCreditFacilitiesMemberus-gaap:BaseRateMembersrt:MaximumMember2020-01-012020-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:A2015CCHTermLoanFacilityMember2020-01-012020-12-310000003570lng:A2015CCHTermLoanFacilityMemberus-gaap:BaseRateMember2020-01-012020-12-310000003570lng:CorpusChristiHoldingsWorkingCapitalFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMembersrt:MinimumMember2020-01-012020-12-310000003570lng:CorpusChristiHoldingsWorkingCapitalFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMember2020-01-012020-12-310000003570lng:CorpusChristiHoldingsWorkingCapitalFacilityMembersrt:MinimumMemberus-gaap:BaseRateMember2020-01-012020-12-310000003570lng:CorpusChristiHoldingsWorkingCapitalFacilityMemberus-gaap:BaseRateMembersrt:MaximumMember2020-01-012020-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MinimumMemberlng:CheniereRevolvingCreditFacilityMember2020-01-012020-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMemberlng:CheniereRevolvingCreditFacilityMember2020-01-012020-12-310000003570srt:MinimumMemberus-gaap:BaseRateMemberlng:CheniereRevolvingCreditFacilityMember2020-01-012020-12-310000003570us-gaap:BaseRateMembersrt:MaximumMemberlng:CheniereRevolvingCreditFacilityMember2020-01-012020-12-310000003570lng:A2020SPLWorkingCapitalFacilityMember2020-01-012020-12-310000003570lng:A2019CQPCreditFacilitiesMember2020-01-012020-12-310000003570lng:A2015CCHTermLoanFacilityMember2020-01-012020-12-310000003570lng:CorpusChristiHoldingsWorkingCapitalFacilityMember2020-01-012020-12-310000003570lng:CheniereRevolvingCreditFacilityMember2020-01-012020-12-310000003570srt:MinimumMemberlng:A2020SPLWorkingCapitalFacilityMember2020-01-012020-12-310000003570srt:MaximumMemberlng:A2020SPLWorkingCapitalFacilityMember2020-01-012020-12-310000003570lng:FirstAnniversaryofClosingDateMemberlng:CheniereTermLoanFacilityMember2020-01-012020-12-310000003570lng:SecondAnniversaryofClosingDateMemberlng:CheniereTermLoanFacilityMember2020-01-012020-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:CheniereTermLoanFacilityMembersrt:MinimumMemberlng:Year1Member2020-01-012020-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:CheniereTermLoanFacilityMemberlng:Year1Membersrt:MaximumMember2020-01-012020-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:CheniereTermLoanFacilityMembersrt:MinimumMemberlng:Year2Member2020-01-012020-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:CheniereTermLoanFacilityMembersrt:MaximumMemberlng:Year2Member2020-01-012020-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:CheniereTermLoanFacilityMembersrt:MinimumMemberlng:Year3ThroughMaturityMember2020-01-012020-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:CheniereTermLoanFacilityMembersrt:MaximumMemberlng:Year3ThroughMaturityMember2020-01-012020-12-310000003570lng:CheniereTermLoanFacilityMembersrt:MinimumMemberus-gaap:BaseRateMemberlng:Year1Member2020-01-012020-12-310000003570lng:CheniereTermLoanFacilityMemberus-gaap:BaseRateMemberlng:Year1Membersrt:MaximumMember2020-01-012020-12-310000003570lng:CheniereTermLoanFacilityMembersrt:MinimumMemberus-gaap:BaseRateMemberlng:Year2Member2020-01-012020-12-310000003570lng:CheniereTermLoanFacilityMemberus-gaap:BaseRateMembersrt:MaximumMemberlng:Year2Member2020-01-012020-12-310000003570lng:CheniereTermLoanFacilityMembersrt:MinimumMemberus-gaap:BaseRateMemberlng:Year3ThroughMaturityMember2020-01-012020-12-310000003570lng:CheniereTermLoanFacilityMemberus-gaap:BaseRateMembersrt:MaximumMemberlng:Year3ThroughMaturityMember2020-01-012020-12-310000003570lng:A2021ConvertibleUnsecuredNotesMember2020-12-310000003570lng:A2045ConvertibleSeniorNotesMember2020-12-310000003570lng:A2021ConvertibleUnsecuredNotesMember2020-01-012020-12-310000003570lng:A2045ConvertibleSeniorNotesMember2020-01-012020-12-310000003570us-gaap:ConvertibleDebtMember2020-01-012020-12-310000003570us-gaap:ConvertibleDebtMember2019-01-012019-12-310000003570us-gaap:ConvertibleDebtMember2018-01-012018-12-310000003570lng:DebtExcludingCapitalLeaseAndConvertibleDebtMember2020-01-012020-12-310000003570lng:DebtExcludingCapitalLeaseAndConvertibleDebtMember2019-01-012019-12-310000003570lng:DebtExcludingCapitalLeaseAndConvertibleDebtMember2018-01-012018-12-310000003570us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310000003570us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000003570us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2019-12-310000003570us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310000003570us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310000003570us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000003570us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2019-12-310000003570us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310000003570us-gaap:LineOfCreditMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310000003570us-gaap:LineOfCreditMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000003570us-gaap:LineOfCreditMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2019-12-310000003570us-gaap:LineOfCreditMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310000003570lng:A2021ConvertibleUnsecuredNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310000003570lng:A2021ConvertibleUnsecuredNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000003570lng:A2021ConvertibleUnsecuredNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2019-12-310000003570lng:A2021ConvertibleUnsecuredNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310000003570lng:A2025CCHHoldCoIIConvertibleNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310000003570lng:A2025CCHHoldCoIIConvertibleNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000003570lng:A2025CCHHoldCoIIConvertibleNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2019-12-310000003570lng:A2025CCHHoldCoIIConvertibleNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310000003570lng:A2045ConvertibleSeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310000003570lng:A2045ConvertibleSeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000003570lng:A2045ConvertibleSeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2019-12-310000003570lng:A2045ConvertibleSeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310000003570lng:OperatingLeaseAssetsMember2020-12-310000003570lng:OperatingLeaseAssetsMember2019-12-310000003570us-gaap:PropertyPlantAndEquipmentMember2020-12-310000003570us-gaap:PropertyPlantAndEquipmentMember2019-12-310000003570lng:CurrentOperatingLeaseLiabilitiesMember2020-12-310000003570lng:CurrentOperatingLeaseLiabilitiesMember2019-12-310000003570us-gaap:OtherCurrentLiabilitiesMember2020-12-310000003570us-gaap:OtherCurrentLiabilitiesMember2019-12-310000003570lng:NonCurrentOperatingLeaseLiabilitiesMember2020-12-310000003570lng:NonCurrentOperatingLeaseLiabilitiesMember2019-12-310000003570us-gaap:OtherNoncurrentLiabilitiesMember2020-12-310000003570us-gaap:OtherNoncurrentLiabilitiesMember2019-12-310000003570us-gaap:OperatingExpenseMember2020-01-012020-12-310000003570us-gaap:OperatingExpenseMember2019-01-012019-12-310000003570lng:DepreciationandAmortizationExpenseMember2020-01-012020-12-310000003570lng:DepreciationandAmortizationExpenseMember2019-01-012019-12-310000003570us-gaap:InterestExpenseMember2020-01-012020-12-310000003570us-gaap:InterestExpenseMember2019-01-012019-12-310000003570srt:MaximumMember2020-12-310000003570lng:SuspensionFeesandLNGCoverDamagesRevenueMember2020-01-012020-12-310000003570lng:SuspensionFeesandLNGCoverDamagesRevenueMemberlng:SubsequentPeriodMember2020-01-012020-12-310000003570lng:LiquefiedNaturalGasProcuredFromThirdPartiesMember2020-01-012020-12-310000003570lng:LiquefiedNaturalGasProcuredFromThirdPartiesMember2019-01-012019-12-310000003570lng:LiquefiedNaturalGasProcuredFromThirdPartiesMember2018-01-012018-12-31lng:bcfutr:D0000003570lng:TUACustomersMember2020-01-012020-12-310000003570lng:EachTUACustomerMember2020-01-012020-12-310000003570lng:TerminalUseAgreementRegasificationCapacityPartialMember2020-01-012020-12-310000003570lng:TerminalUseAgreementRegasificationCapacityPartialMember2019-01-012019-12-310000003570lng:TerminalUseAgreementRegasificationCapacityPartialMember2018-01-012018-12-3100000035702021-01-01lng:LiquefiedNaturalGasMember2020-12-3100000035702020-01-01lng:LiquefiedNaturalGasMember2019-12-3100000035702021-01-01lng:RegasificationServiceMember2020-12-3100000035702020-01-01lng:RegasificationServiceMember2019-12-3100000035702021-01-012020-12-3100000035702020-01-012019-12-310000003570lng:NaturalGasSupplyAgreementMemberlng:SabinePassLiquefactionMember2020-01-012020-12-310000003570lng:NaturalGasSupplyAgreementMemberlng:SabinePassLiquefactionMember2020-12-310000003570lng:NaturalGasSupplyAgreementMemberlng:CorpusChristiLiquefactionMember2020-12-310000003570lng:NaturalGasSupplyAgreementMemberlng:CorpusChristiLiquefactionMember2019-12-310000003570lng:NaturalGasSupplyAgreementMember2020-01-012020-12-310000003570us-gaap:PriceRiskDerivativeMemberlng:NaturalGasSupplyAgreementMemberlng:CorpusChristiLiquefactionMember2020-12-310000003570us-gaap:PriceRiskDerivativeMemberlng:NaturalGasSupplyAgreementMemberlng:CorpusChristiLiquefactionMember2019-12-310000003570lng:NaturalGasSupplyAgreementMemberlng:CorpusChristiLiquefactionMember2020-01-012020-12-310000003570lng:NaturalGasSupplyAgreementMemberlng:CorpusChristiLiquefactionMember2019-01-012019-12-310000003570lng:NaturalGasSupplyAgreementMemberlng:CorpusChristiLiquefactionMember2018-01-012018-12-310000003570us-gaap:PriceRiskDerivativeMemberlng:NaturalGasSupplyAgreementMemberlng:CorpusChristiLiquefactionMember2020-01-012020-12-310000003570us-gaap:PriceRiskDerivativeMemberlng:NaturalGasSupplyAgreementMemberlng:CorpusChristiLiquefactionMember2019-01-012019-12-310000003570us-gaap:PriceRiskDerivativeMemberlng:NaturalGasSupplyAgreementMemberlng:CorpusChristiLiquefactionMember2018-01-012018-12-310000003570lng:NaturalGasTransportationAndStorageAgreementsMemberlng:SabinePassLiquefactionLLCAndCheniereCreoleTrailPipelineLPMembersrt:MaximumMember2020-01-012020-12-310000003570lng:NaturalGasTransportationAndStorageAgreementsMemberlng:SabinePassLiquefactionLLCAndCheniereCreoleTrailPipelineLPMembersrt:MaximumMember2020-12-310000003570lng:CheniereLNGOMServicesLLCMemberlng:OperationAndMaintenanceAgreementMemberus-gaap:ProductAndServiceOtherMember2020-01-012020-12-310000003570lng:CheniereLNGOMServicesLLCMemberlng:OperationAndMaintenanceAgreementMemberus-gaap:ProductAndServiceOtherMember2019-01-012019-12-310000003570lng:CheniereLNGOMServicesLLCMemberlng:OperationAndMaintenanceAgreementMemberus-gaap:ProductAndServiceOtherMember2018-01-012018-12-310000003570lng:CheniereLNGOMServicesLLCMemberlng:OperationAndMaintenanceAgreementMember2020-12-310000003570lng:CheniereLNGOMServicesLLCMemberlng:OperationAndMaintenanceAgreementMember2019-12-310000003570lng:BeforeEnactmentOfNewActMember2020-01-012020-12-310000003570lng:AfterEnactmentOfNewActMember2020-01-012020-12-310000003570us-gaap:DomesticCountryMember2020-12-310000003570us-gaap:StateAndLocalJurisdictionMember2020-12-310000003570us-gaap:ForeignCountryMember2020-12-310000003570us-gaap:DomesticCountryMemberus-gaap:InvestmentCreditMember2020-12-310000003570lng:A2011IncentivePlanMemberus-gaap:CommonStockMember2020-12-310000003570lng:A2020IncentivePlanMemberus-gaap:CommonStockMember2020-12-310000003570lng:EquityAwardsMember2020-01-012020-12-310000003570lng:EquityAwardsMember2019-01-012019-12-310000003570lng:EquityAwardsMember2018-01-012018-12-310000003570lng:LiabilityAwardsMember2020-01-012020-12-310000003570lng:LiabilityAwardsMember2019-01-012019-12-310000003570lng:LiabilityAwardsMember2018-01-012018-12-310000003570us-gaap:RestrictedStockMember2020-12-310000003570us-gaap:RestrictedStockMember2020-01-012020-12-310000003570lng:RestrictedShareUnitAndPerformanceStockUnitAwardsMember2020-12-310000003570lng:RestrictedShareUnitAndPerformanceStockUnitAwardsMember2020-01-012020-12-310000003570us-gaap:PhantomShareUnitsPSUsMember2020-12-310000003570us-gaap:PhantomShareUnitsPSUsMember2020-01-012020-12-310000003570us-gaap:RestrictedStockMember2019-12-310000003570us-gaap:RestrictedStockMember2019-01-012019-12-310000003570us-gaap:RestrictedStockMember2018-01-012018-12-310000003570us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310000003570us-gaap:PerformanceSharesMember2020-01-012020-12-310000003570srt:MinimumMemberus-gaap:PerformanceSharesMember2020-01-012020-12-310000003570us-gaap:PerformanceSharesMembersrt:MaximumMember2020-01-012020-12-310000003570lng:RestrictedShareUnitAndPerformanceStockUnitAwardsMember2019-12-310000003570us-gaap:CommonStockMember2020-01-012020-12-310000003570lng:RestrictedShareUnitAndPerformanceStockUnitAwardsMember2019-01-012019-12-310000003570lng:RestrictedShareUnitAndPerformanceStockUnitAwardsMember2018-01-012018-12-310000003570us-gaap:PhantomShareUnitsPSUsMember2019-12-310000003570us-gaap:PhantomShareUnitsPSUsMember2019-01-012019-12-310000003570us-gaap:PhantomShareUnitsPSUsMember2018-01-012018-12-310000003570lng:UnvestedStockMember2020-01-012020-12-310000003570lng:UnvestedStockMember2019-01-012019-12-310000003570lng:UnvestedStockMember2018-01-012018-12-310000003570lng:A2021CheniereConvertibleNotesMember2020-01-012020-12-310000003570lng:A2021CheniereConvertibleNotesMember2019-01-012019-12-310000003570lng:A2021CheniereConvertibleNotesMember2018-01-012018-12-310000003570lng:A2025CCHHoldCoIIConvertibleNotesMember2020-01-012020-12-310000003570lng:A2025CCHHoldCoIIConvertibleNotesMember2019-01-012019-12-310000003570lng:A2025CCHHoldCoIIConvertibleNotesMember2018-01-012018-12-310000003570lng:A2045ConvertibleSeniorNotesMember2020-01-012020-12-310000003570lng:A2045ConvertibleSeniorNotesMember2019-01-012019-12-310000003570lng:A2045ConvertibleSeniorNotesMember2018-01-012018-12-310000003570lng:RestrictedStockWithUnsatisfiedPerformanceConditionsMember2020-01-012020-12-310000003570lng:RestrictedStockWithUnsatisfiedPerformanceConditionsMember2019-01-012019-12-310000003570lng:RestrictedStockWithUnsatisfiedPerformanceConditionsMember2018-01-012018-12-310000003570srt:ParentCompanyMember2020-01-012020-12-310000003570srt:ParentCompanyMember2019-01-012019-12-310000003570lng:SabinePassLiquefactionMemberlng:BechtelEPCContractTrainSixMember2020-01-012020-12-310000003570lng:BechtelEPCContractTrainThreeMemberlng:CorpusChristiLiquefactionMember2020-01-012020-12-310000003570lng:SabinePassLiquefactionAndCorpusChristiLiquefactionMemberlng:BechtelEPCContractsMember2020-01-012020-12-310000003570lng:SabinePassLiquefactionCorpusChristiLiquefactionandCheniereCorpusChristiLiquefactionStageIIIMemberus-gaap:InventoriesMembersrt:MaximumMember2020-01-012020-12-310000003570us-gaap:InventoriesMemberlng:SabinePassLiquefactionMembersrt:MaximumMember2020-12-310000003570us-gaap:InventoriesMembersrt:MaximumMemberlng:CorpusChristiLiquefactionMember2020-12-310000003570us-gaap:InventoriesMembersrt:MaximumMemberlng:CorpusChristiStage3LiquefactionMember2020-12-310000003570lng:SabinePassLiquefactionAndCorpusChristiLiquefactionMembersrt:MaximumMemberus-gaap:NaturalGasGatheringTransportationMarketingAndProcessingMember2020-01-012020-12-310000003570us-gaap:NaturalGasStorageMemberlng:SabinePassLiquefactionMembersrt:MaximumMember2020-01-012020-12-310000003570us-gaap:NaturalGasStorageMembersrt:MaximumMemberlng:CorpusChristiLiquefactionMember2020-01-012020-12-310000003570lng:SabinePassLiquefactionCorpusChristiLiquefactionandCheniereCorpusChristiLiquefactionStageIIIMemberlng:NaturalGasSupplyTransportationAndStorageServiceAgreementsMember2020-01-012020-12-310000003570lng:SabinePassLiquefactionCorpusChristiLiquefactionandCheniereCorpusChristiLiquefactionStageIIIMemberlng:NaturalGasSupplyTransportationAndStorageServiceAgreementsMember2020-12-310000003570lng:CustomerAMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310000003570lng:CustomerAMemberus-gaap:SalesRevenueNetMember2019-01-012019-12-310000003570lng:CustomerAMemberus-gaap:SalesRevenueNetMember2018-01-012018-12-310000003570lng:CustomerAMemberlng:AccountsReceivableAndContractAssetsMember2020-01-012020-12-310000003570lng:CustomerAMemberlng:AccountsReceivableAndContractAssetsMember2019-01-012019-12-310000003570us-gaap:SalesRevenueNetMemberlng:CustomerBMember2020-01-012020-12-310000003570us-gaap:SalesRevenueNetMemberlng:CustomerBMember2019-01-012019-12-310000003570us-gaap:SalesRevenueNetMemberlng:CustomerBMember2018-01-012018-12-310000003570lng:AccountsReceivableAndContractAssetsMemberlng:CustomerBMember2020-01-012020-12-310000003570us-gaap:SalesRevenueNetMemberlng:CustomerCMember2020-01-012020-12-310000003570us-gaap:SalesRevenueNetMemberlng:CustomerCMember2019-01-012019-12-310000003570us-gaap:SalesRevenueNetMemberlng:CustomerCMember2018-01-012018-12-310000003570lng:AccountsReceivableAndContractAssetsMemberlng:CustomerCMember2019-01-012019-12-310000003570us-gaap:SalesRevenueNetMemberlng:CustomerDMember2020-01-012020-12-310000003570us-gaap:SalesRevenueNetMemberlng:CustomerDMember2019-01-012019-12-310000003570us-gaap:SalesRevenueNetMemberlng:CustomerDMember2018-01-012018-12-310000003570country:IEus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570country:IEus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310000003570country:IEus-gaap:GeographicConcentrationRiskMember2018-01-012018-12-310000003570country:ESus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570country:ESus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310000003570country:ESus-gaap:GeographicConcentrationRiskMember2018-01-012018-12-310000003570country:INus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570country:INus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310000003570country:INus-gaap:GeographicConcentrationRiskMember2018-01-012018-12-310000003570country:KRus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570country:KRus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310000003570country:KRus-gaap:GeographicConcentrationRiskMember2018-01-012018-12-310000003570country:USus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570country:USus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310000003570country:USus-gaap:GeographicConcentrationRiskMember2018-01-012018-12-310000003570us-gaap:GeographicConcentrationRiskMembercountry:GB2020-01-012020-12-310000003570us-gaap:GeographicConcentrationRiskMembercountry:GB2019-01-012019-12-310000003570us-gaap:GeographicConcentrationRiskMembercountry:GB2018-01-012018-12-310000003570country:SGus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570country:SGus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310000003570country:SGus-gaap:GeographicConcentrationRiskMember2018-01-012018-12-310000003570us-gaap:GeographicConcentrationRiskMemberlng:OtherNonUsMember2020-01-012020-12-310000003570us-gaap:GeographicConcentrationRiskMemberlng:OtherNonUsMember2019-01-012019-12-310000003570us-gaap:GeographicConcentrationRiskMemberlng:OtherNonUsMember2018-01-012018-12-310000003570lng:SabinePassLiquefactionMemberus-gaap:SubsequentEventMemberlng:A2952037SPLSeniorSecuredNotesMember2021-02-280000003570lng:SabinePassLiquefactionMemberus-gaap:SubsequentEventMemberlng:A2952037SPLSeniorSecuredNotesMember2021-02-012021-02-2800000035702020-01-012020-03-3100000035702020-04-012020-06-3000000035702020-07-012020-09-3000000035702020-10-012020-12-3100000035702019-01-012019-03-3100000035702019-04-012019-06-3000000035702019-07-012019-09-3000000035702019-10-012019-12-310000003570srt:ParentCompanyMember2018-01-012018-12-310000003570srt:ParentCompanyMember2018-12-310000003570srt:ParentCompanyMember2017-12-310000003570srt:ParentCompanyMemberus-gaap:LongTermDebtMember2020-12-310000003570srt:ParentCompanyMemberus-gaap:LongTermDebtMember2019-12-310000003570srt:ParentCompanyMemberus-gaap:ShortTermDebtMember2020-12-310000003570srt:ParentCompanyMemberus-gaap:ShortTermDebtMember2019-12-310000003570lng:OperatingLeaseAssetsMembersrt:ParentCompanyMember2020-12-310000003570lng:OperatingLeaseAssetsMembersrt:ParentCompanyMember2019-12-310000003570srt:ParentCompanyMemberlng:CurrentOperatingLeaseLiabilitiesMember2020-12-310000003570srt:ParentCompanyMemberlng:CurrentOperatingLeaseLiabilitiesMember2019-12-310000003570srt:ParentCompanyMemberlng:NonCurrentOperatingLeaseLiabilitiesMember2020-12-310000003570srt:ParentCompanyMemberlng:NonCurrentOperatingLeaseLiabilitiesMember2019-12-310000003570us-gaap:AllowanceForCreditLossMember2019-12-310000003570us-gaap:AllowanceForCreditLossMember2020-01-012020-12-310000003570us-gaap:AllowanceForCreditLossMember2020-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-01-012020-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310000003570us-gaap:AllowanceForCreditLossMember2018-12-310000003570us-gaap:AllowanceForCreditLossMember2019-01-012019-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-01-012019-12-310000003570us-gaap:AllowanceForCreditLossMember2017-12-310000003570us-gaap:AllowanceForCreditLossMember2018-01-012018-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2017-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-01-012018-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-16383

CHENIERE ENERGY, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 95-4352386 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

700 Milam Street, Suite 1900

Houston, Texas 77002

(Address of principal executive offices) (Zip Code)

(713) 375-5000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $ 0.003 par value | LNG | NYSE American |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s Common Stock held by non-affiliates of the registrant was approximately $12.1 billion as of June 30, 2020.

As of February 19, 2021, the issuer had 253,529,085 shares of Common Stock outstanding.

Documents incorporated by reference: The definitive proxy statement for the registrant’s Annual Meeting of Stockholders (to be filed within 120 days of the close of the registrant’s fiscal year) is incorporated by reference into Part III.

CHENIERE ENERGY, INC.

TABLE OF CONTENTS

DEFINITIONS

As used in this annual report, the terms listed below have the following meanings:

Common Industry and Other Terms

| | | | | | | | |

| Bcf | | billion cubic feet |

| Bcf/d | | billion cubic feet per day |

| Bcf/yr | | billion cubic feet per year |

| Bcfe | | billion cubic feet equivalent |

| DOE | | U.S. Department of Energy |

| EPC | | engineering, procurement and construction |

| FERC | | Federal Energy Regulatory Commission |

| FTA countries | | countries with which the United States has a free trade agreement providing for national treatment for trade in natural gas |

| GAAP | | generally accepted accounting principles in the United States |

| Henry Hub | | the final settlement price (in USD per MMBtu) for the New York Mercantile Exchange’s Henry Hub natural gas futures contract for the month in which a relevant cargo’s delivery window is scheduled to begin |

| LIBOR | | London Interbank Offered Rate |

| LNG | | liquefied natural gas, a product of natural gas that, through a refrigeration process, has been cooled to a liquid state, which occupies a volume that is approximately 1/600th of its gaseous state |

| MMBtu | | million British thermal units, an energy unit |

| mtpa | | million tonnes per annum |

| | |

| non-FTA countries | | countries with which the United States does not have a free trade agreement providing for national treatment for trade in natural gas and with which trade is permitted |

| SEC | | U.S. Securities and Exchange Commission |

| SPA | | LNG sale and purchase agreement |

| TBtu | | trillion British thermal units, an energy unit |

| Train | | an industrial facility comprised of a series of refrigerant compressor loops used to cool natural gas into LNG |

| TUA | | terminal use agreement |

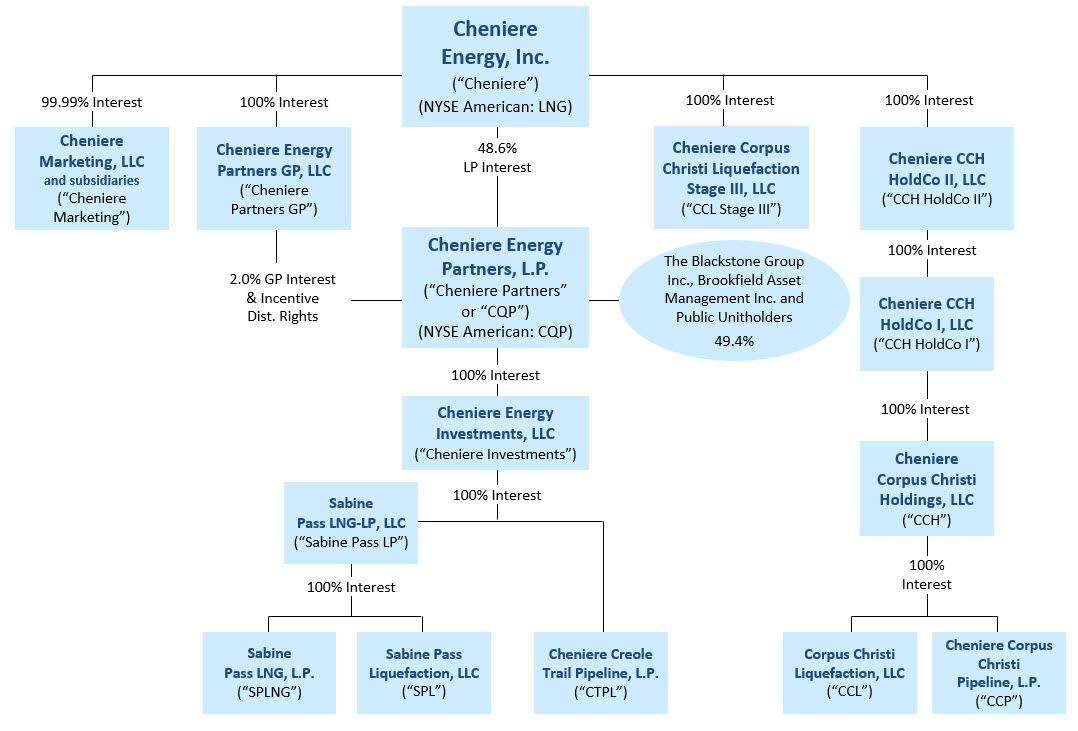

Abbreviated Legal Entity Structure

The following diagram depicts our abbreviated legal entity structure as of December 31, 2020, including our ownership of certain subsidiaries, and the references to these entities used in this annual report:

Unless the context requires otherwise, references to “Cheniere,” the “Company,” “we,” “us” and “our” refer to Cheniere Energy, Inc. and its consolidated subsidiaries, including our publicly traded subsidiary, Cheniere Partners.

Unless the context requires otherwise, references to the “CCH Group” refer to CCH HoldCo II, CCH HoldCo I, CCH, CCL and CCP, collectively.

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical or present facts or conditions, included herein or incorporated herein by reference are “forward-looking statements.” Included among “forward-looking statements” are, among other things:

•statements that we expect to commence or complete construction of our proposed LNG terminals, liquefaction facilities, pipeline facilities or other projects, or any expansions or portions thereof, by certain dates, or at all;

•statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure or demand for and prices related to natural gas, LNG or other hydrocarbon products;

•statements regarding any financing transactions or arrangements, or our ability to enter into such transactions;

•statements regarding the amount and timing of share repurchases;

•statements relating to the construction of our Trains and pipelines, including statements concerning the engagement of any EPC contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto;

•statements regarding any SPA or other agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total LNG regasification, natural gas liquefaction or storage capacities that are, or may become, subject to contracts;

•statements regarding counterparties to our commercial contracts, construction contracts and other contracts;

•statements regarding our planned development and construction of additional Trains or pipelines, including the financing of such Trains or pipelines;

•statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities;

•statements regarding our business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections, or objectives, including anticipated revenues, capital expenditures, maintenance and operating costs and cash flows, any or all of which are subject to change;

•statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions;

•statements regarding our anticipated LNG and natural gas marketing activities;

•statements regarding the outbreak of COVID-19 and its impact on our business and operating results, including any customers not taking delivery of LNG cargoes, the ongoing credit worthiness of our contractual counterparties, any disruptions in our operations or construction of our Trains and the health and safety of our employees, and on our customers, the global economy and the demand for LNG;

•any other statements that relate to non-historical or future information; and

All of these types of statements, other than statements of historical or present facts or conditions, are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “achieve,” “anticipate,” “believe,” “contemplate,” “continue,” “estimate,” “expect,” “intend,” “plan,” “potential,” “predict,” “project,” “pursue,” “target,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this annual report are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe that such estimates are reasonable, they are inherently uncertain and involve a number of risks and uncertainties beyond our control. In addition, assumptions may prove to be inaccurate. We caution that the forward-looking statements contained in this annual report are not guarantees of future performance and that such statements may not be realized or the forward-looking statements or events may not occur. Actual results may differ materially from those anticipated or implied in forward-looking statements as a result of a variety of factors described in this annual report and in the

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

other reports and other information that we file with the SEC. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these risk factors. These forward-looking statements speak only as of the date made, and other than as required by law, we undertake no obligation to update or revise any forward-looking statement or provide reasons why actual results may differ, whether as a result of new information, future events or otherwise.

PART I

ITEMS 1. AND 2. BUSINESS AND PROPERTIES

General

Cheniere Energy, Inc. (“Cheniere”), a Delaware corporation, is a Houston-based energy infrastructure company primarily engaged in LNG-related businesses. We provide clean, secure and affordable LNG to integrated energy companies, utilities and energy trading companies around the world. We aspire to conduct our business in a safe and responsible manner, delivering a reliable, competitive and integrated source of LNG to our customers.

LNG is natural gas (methane) in liquid form. The LNG we produce is shipped all over the world, turned back into natural gas (called “regasification”) and then transported via pipeline to homes and businesses and used as an energy source that is essential for heating, cooking and other industrial uses. Natural gas is a cleaner-burning, abundant and affordable source of energy. When LNG is converted back to natural gas, it can be used instead of coal, which reduces the amount of pollution traditionally produced from burning fossil fuels, like sulfur dioxide and particulate matter that enters the air we breathe. Additionally, compared to coal, it produces significantly fewer carbon emissions. By liquefying natural gas, we are able to reduce its volume by 600 times so that we can load it onto special LNG carriers designed to keep the LNG cold and in liquid form for efficient transport overseas.

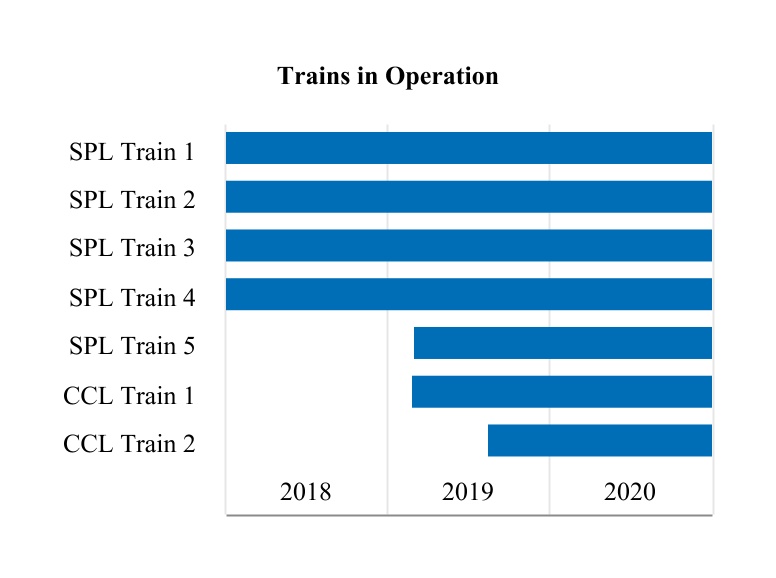

We own and operate the Sabine Pass LNG terminal in Louisiana, one of the largest LNG production facilities in the world, through our ownership interest in and management agreements with Cheniere Energy Partners, L.P. (“Cheniere Partners”), which is a publicly traded limited partnership that we created in 2007. As of December 31, 2020, we owned 100% of the general partner interest and 48.6% of the limited partner interest in Cheniere Partners. We also own and operate the Corpus Christi LNG terminal in Texas, which is wholly owned by us.

The Sabine Pass LNG terminal is located in Cameron Parish, Louisiana, on the Sabine-Neches Waterway less than four miles from the Gulf Coast. Cheniere Partners, through its subsidiary Sabine Pass Liquefaction, LLC (“SPL”), is currently operating five natural gas liquefaction Trains and is constructing one additional Train that is expected to be substantially completed in the second half of 2022, for a total production capacity of approximately 30 mtpa of LNG (the “SPL Project”) at the Sabine Pass LNG terminal. The Sabine Pass LNG terminal has operational regasification facilities owned by Cheniere Partners’ subsidiary, Sabine Pass LNG, L.P. (“SPLNG”), that include pre-existing infrastructure of five LNG storage tanks with aggregate capacity of approximately 17 Bcfe, two existing marine berths and one under construction that can each accommodate vessels with nominal capacity of up to 266,000 cubic meters and vaporizers with regasification capacity of approximately 4 Bcf/d. Cheniere Partners also owns a 94-mile pipeline through its subsidiary, Cheniere Creole Trail Pipeline, L.P. (“CTPL”), that interconnects the Sabine Pass LNG terminal with a number of large interstate pipelines (the “Creole Trail Pipeline”).

We also own the Corpus Christi LNG terminal near Corpus Christi, Texas, and are currently operating two Trains and one additional Train is undergoing commissioning for a total production capacity of approximately 15 mtpa of LNG. Additionally, we are operating a 23-mile natural gas supply pipeline that interconnects the Corpus Christi LNG terminal with several interstate and intrastate natural gas pipelines (the “Corpus Christi Pipeline” and together with the Trains, the “CCL Project”) through our subsidiaries Corpus Christi Liquefaction, LLC (“CCL”) and Cheniere Corpus Christi Pipeline, L.P. (“CCP”), respectively. The CCL Project, once fully constructed, will contain three LNG storage tanks with aggregate capacity of approximately 10 Bcfe and two marine berths that can each accommodate vessels with nominal capacity of up to 266,000 cubic meters.

We have contracted approximately 85% of the total production capacity from the SPL Project and the CCL Project (collectively, the “Liquefaction Projects”) on a term basis, with approximately 18 years of average remaining life as of December 31, 2020. This includes volumes contracted under SPAs in which the customers are required to pay a fixed fee with respect to the contracted volumes irrespective of their election to cancel or suspend deliveries of LNG cargoes, as well as volumes contracted under integrated production marketing (“IPM”) gas supply agreements.

Additionally, separate from the CCH Group, we are developing an expansion of the Corpus Christi LNG terminal adjacent to the CCL Project (“Corpus Christi Stage 3”) through our subsidiary Cheniere Corpus Christi Liquefaction Stage III,

LLC (“CCL Stage III”) for up to seven midscale Trains with an expected total production capacity of approximately 10 mtpa of LNG. We received approval from FERC in November 2019 to site, construct and operate the expansion project.

We remain focused on operational excellence and customer satisfaction. Increasing demand of LNG has allowed us to expand our liquefaction infrastructure in a financially disciplined manner. We have increased available liquefaction capacity at our Liquefaction Projects as a result of debottlenecking and other optimization projects. We hold significant land positions at both the Sabine Pass LNG terminal and the Corpus Christi LNG terminal which provide opportunity for further liquefaction capacity expansion. The development of these sites or other projects, including infrastructure projects in support of natural gas supply and LNG demand, will require, among other things, acceptable commercial and financing arrangements before we can make a final investment decision (“FID”).

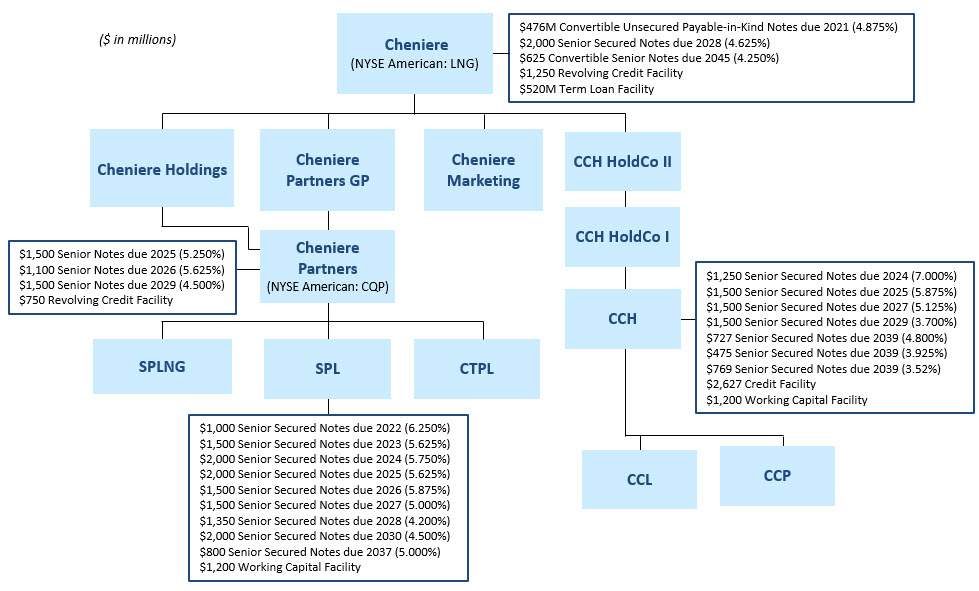

Although results are consolidated for financial reporting, Cheniere, Cheniere Partners, SPL and the CCH Group operate with independent capital structures. The following diagram depicts our abbreviated capital structure as of December 31, 2020:

Our Business Strategy

Our primary business strategy is to be a full service LNG provider to worldwide end-use customers. We accomplish this objective by owning, constructing and operating LNG and natural gas infrastructure facilities to meet our long-term customers’ energy demands and:

•safely, efficiently and reliably operating and maintaining our assets;

•procuring natural gas and pipeline transport capacity to our facilities;

•providing value to our customers through destination flexibility, options not to lift cargoes and diversity of price and geography;

•commencing commercial delivery for our long-term SPA and IPM customers, of which we have initiated for 17 of 20 long-term SPA and IPM customers as of December 31, 2020;

•safely, on-time and on-budget completing our expansion construction projects;

•maximizing the production of LNG to serve our customers and generating steady and stable revenues and operating cash flows;

•maintaining a flexible capital structure to finance the acquisition, development, construction and operation of the energy assets needed to supply our customers; and

•strategically identifying actionable environmental solutions.

LNG Terminals and Marketing

We shipped our first LNG cargo in February 2016 and we shipped our 1,000th cargo in January 2020. Cheniere’s LNG has been shipped to 35 countries and regions around the world.

Sabine Pass LNG Terminal

Liquefaction Facilities

The SPL Project is one of the largest LNG production facilities in the world. Through Cheniere Partners, we are currently operating five Trains and two marine berths at the SPL Project, and are constructing one additional Train that is expected to be substantially completed in the second half of 2022, and a third marine berth. We have received authorization from the FERC to site, construct and operate Trains 1 through 6, as well as for the construction of the third marine berth. We have achieved substantial completion of the first five Trains of the SPL Project and commenced commercial operating activities for each Train at various times starting in May 2016. The following table summarizes the project completion and construction status of Train 6 of the SPL Project as of December 31, 2020:

| | | | | | | | | | | |

| | SPL Train 6 |

| Overall project completion percentage | | 77.6% |

| Completion percentage of: | | |

| Engineering | | 99.0% |

| Procurement | | 99.9% |

| Subcontract work | | 54.9% |

| Construction | | 49.2% |

| Date of expected substantial completion | | 2H 2022 |

The following orders have been issued by the DOE authorizing the export of domestically produced LNG by vessel from the Sabine Pass LNG terminal:

•Trains 1 through 4—FTA countries and non-FTA countries through December 31, 2050, in an amount up to a combined total of the equivalent of 16 mtpa (approximately 803 Bcf/yr of natural gas).

•Trains 1 through 4—FTA countries and non-FTA countries through December 31, 2050, in an amount up to a combined total of the equivalent of approximately 203 Bcf/yr of natural gas (approximately 4 mtpa).

•Trains 5 and 6—FTA countries and non-FTA countries through December 31, 2050 in an amount up to a combined total of 503.3 Bcf/yr of natural gas (approximately 10 mtpa).

In December 2020, the DOE announced a new policy in which it would no longer issue short-term export authorizations separately from long-term authorizations. Accordingly, the DOE amended each of SPL’s long-term authorizations to include short-term export authority, and vacated the short-term orders.

An application was filed in September 2019 seeking authorization to make additional exports from the SPL Project to FTA countries for a 25-year term and to non-FTA countries for a 20-year term in an amount up to the equivalent of approximately 153 Bcf/yr of natural gas, for a total SPL Project export capacity of approximately 1,662 Bcf/yr. The terms of the authorizations are requested to commence on the date of first commercial export from the SPL Project of the volumes contemplated in the application. In April 2020, the DOE issued an order authorizing SPL to export to FTA countries related to this application, for which the term was subsequently extended through December 31, 2050, but has not yet issued an order authorizing SPL to export to non-FTA countries for the corresponding LNG volume. A corresponding application for authorization to increase the total LNG production capacity of the SPL Project from the currently authorized level to approximately 1,662 Bcf/yr was also submitted to the FERC and is currently pending.

Customers

SPL has entered into fixed price long-term SPAs generally with terms of 20 years (plus extension rights) and with a weighted average remaining contract length of approximately 17 years (plus extension rights) with eight third parties for Trains 1 through 6 of the SPL Project. Under these SPAs, the customers will purchase LNG from SPL for a price consisting of a fixed fee per MMBtu of LNG (a portion of which is subject to annual adjustment for inflation) plus a variable fee per MMBtu of LNG generally equal to approximately 115% of Henry Hub. The customers may elect to cancel or suspend deliveries of LNG cargoes, with advance notice as governed by each respective SPA, in which case the customers would still be required to pay the fixed fee with respect to the contracted volumes that are not delivered as a result of such cancellation or suspension. We refer to the fee component that is applicable regardless of a cancellation or suspension of LNG cargo deliveries under the SPAs as the fixed fee component of the price under SPL’s SPAs. We refer to the fee component that is applicable only in connection with LNG cargo deliveries as the variable fee component of the price under SPL’s SPAs. The variable fees under SPL’s SPAs were generally sized at the time of entry into each SPA with the intent to cover the costs of gas purchases and transportation and liquefaction fuel to produce the LNG to be sold under each such SPA. The SPAs and contracted volumes to be made available under the SPAs are not tied to a specific Train; however, the term of each SPA generally commences upon the date of first commercial delivery of a specified Train.

In aggregate, the annual fixed fee portion to be paid by the third-party SPA customers is approximately $2.9 billion for Trains 1 through 5. After giving effect to an SPA that Cheniere has committed to provide to SPL, the annual fixed fee portion to be paid by the third-party SPA customers would increase to at least $3.3 billion, which is expected to occur upon the date of first commercial delivery of Train 6.

In addition, Cheniere Marketing has an agreement with SPL to purchase at Cheniere Marketing’s option, any LNG produced by SPL in excess of that required for other customers. See Marketing section for additional information regarding agreements entered into by Cheniere Marketing.

The annual contracted cash flows from fixed fees of each buyer of LNG under SPL’s third-party SPAs that constitute more than 10% of SPL’s aggregate fixed fees under all its SPAs are:

•approximately $720 million from BG Gulf Coast LNG, LLC (“BG”), which is guaranteed by BG Energy Holdings Limited;

•approximately $550 million from Korea Gas Corporation (“KOGAS”);

•approximately $550 million from GAIL;

•approximately $450 million from Naturgy LNG GOM, Limited (formerly known as Gas Natural Fenosa LNG GOM, Limited) (“Naturgy”), which is guaranteed by Naturgy Energy Group, S.A. (formerly known as Gas Natural SDG S.A.); and

•approximately $310 million from Total Gas & Power North America, Inc. (“Total”), which is guaranteed by Total S.A.

The annual aggregate fixed fees for all of SPL’s other SPAs with third-parties is approximately $490 million, prior to giving effect to an SPA that Cheniere has committed to provide to SPL.

Natural Gas Transportation, Storage and Supply

To ensure SPL is able to transport adequate natural gas feedstock to the Sabine Pass LNG terminal, it has entered into transportation precedent and other agreements to secure firm pipeline transportation capacity with CTPL and third-party pipeline companies. SPL has entered into firm storage services agreements with third parties to assist in managing variability in natural gas needs for the SPL Project. SPL has also entered into enabling agreements and long-term natural gas supply contracts with third parties in order to secure natural gas feedstock for the SPL Project. As of December 31, 2020, SPL had secured up to approximately 4,950 TBtu of natural gas feedstock through long-term and short-term natural gas supply contracts with remaining terms that range up to 10 years, a portion of which is subject to conditions precedent.

Construction

SPL entered into lump sum turnkey contracts with Bechtel Oil, Gas and Chemicals, Inc. (“Bechtel”) for the engineering, procurement and construction of Trains 1 through 6 of the SPL Project, under which Bechtel charges a lump sum for all work

performed and generally bears project cost, schedule and performance risks unless certain specified events occur, in which case Bechtel may cause SPL to enter into a change order, or SPL agrees with Bechtel to a change order.

The total contract price of the EPC contract for Train 6 of the SPL Project is approximately $2.5 billion, including estimated costs for the third marine berth that is currently under construction. As of December 31, 2020, we have incurred $1.9 billion under this contract.

Regasification Facilities

The Sabine Pass LNG terminal has operational regasification capacity of approximately 4 Bcf/d and aggregate LNG storage capacity of approximately 17 Bcfe. Approximately 2 Bcf/d of the regasification capacity at the Sabine Pass LNG terminal has been reserved under two long-term third-party TUAs, under which SPLNG’s customers are required to pay fixed monthly fees, whether or not they use the LNG terminal. Each of Total and Chevron U.S.A. Inc. (“Chevron”) has reserved approximately 1 Bcf/d of regasification capacity and is obligated to make monthly capacity payments to SPLNG aggregating approximately $125 million annually, prior to inflation adjustments, for 20 years that commenced in 2009. Total S.A. has guaranteed Total’s obligations under its TUA up to $2.5 billion, subject to certain exceptions, and Chevron Corporation has guaranteed Chevron’s obligations under its TUA up to 80% of the fees payable by Chevron.

The remaining approximately 2 Bcf/d of capacity has been reserved under a TUA by SPL. SPL is obligated to make monthly capacity payments to SPLNG aggregating approximately $250 million annually, prior to inflation adjustments, continuing until at least May 2036. SPL entered into a partial TUA assignment agreement with Total, whereby upon substantial completion of Train 5 of the SPL Project, SPL gained access to substantially all of Total’s capacity and other services provided under Total’s TUA with SPLNG. This agreement provides SPL with additional berthing and storage capacity at the Sabine Pass LNG terminal that may be used to provide increased flexibility in managing LNG cargo loading and unloading activity, permit SPL to more flexibly manage its LNG storage capacity and accommodate the development of Train 6. Notwithstanding any arrangements between Total and SPL, payments required to be made by Total to SPLNG will continue to be made by Total to SPLNG in accordance with its TUA. During the years ended December 31, 2020, 2019 and 2018, SPL recorded $129 million, $104 million and $30 million, respectively, as operating and maintenance expense under this partial TUA assignment agreement.

Under each of these TUAs, SPLNG is entitled to retain 2% of the LNG delivered to the Sabine Pass LNG terminal.

Corpus Christi LNG Terminal

Liquefaction Facilities

We are currently operating two Trains and two marine berths at the CCL Project and commissioning one additional Train that is expected to be substantially completed in the first quarter of 2021. We have received authorization from the FERC to site, construct and operate Trains 1 through 3 of the CCL Project. We completed construction of Trains 1 and 2 of the CCL Project and commenced commercial operating activities in February 2019 and August 2019, respectively. The following table summarizes the project completion and construction status of Train 3 of the CCL Project, including the related infrastructure, as of December 31, 2020:

| | | | | | | | | | | | | |

| | | CCL Train 3 |

| Overall project completion percentage | | | 99.6% |

| Completion percentage of: | | | |

| Engineering | | | 100.0% |

| Procurement | | | 100.0% |

| Subcontract work | | | 99.9% |

| Construction | | | 99.0% |

| Expected date of substantial completion | | | | 1Q 2021 |

| | | | | |