UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2016

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

CHENIERE ENERGY, INC.

(Exact name of registrant as specified in its charter)

Delaware | 001-16383 | 95-4352386 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

700 Milam Street, Suite 1900 | ||

Houston, Texas | 77002 | |

(Address of principal executive offices) | (Zip code) | |

(713) 375-5000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x | Accelerated filer ¨ | |||||

Non-accelerated filer ¨ | Smaller reporting company ¨ | |||||

(Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of April 29, 2016, the issuer had 235,503,063 shares of Common Stock outstanding.

CHENIERE ENERGY, INC.

TABLE OF CONTENTS

i

DEFINITIONS

As commonly used in the liquefied natural gas industry, to the extent applicable and as used in this quarterly report, the terms listed below have the following meanings:

Common Industry and Other Terms

Bcf/d | billion cubic feet per day | |

Bcf/yr | billion cubic feet per year | |

Bcfe | billion cubic feet equivalent | |

DOE | U.S. Department of Energy | |

EPC | engineering, procurement and construction | |

FERC | Federal Energy Regulatory Commission | |

FTA countries | countries with which the United States has a free trade agreement providing for national treatment for trade in natural gas | |

GAAP | generally accepted accounting principles in the United States | |

Henry Hub | the final settlement price (in USD per MMBtu) for the New York Mercantile Exchange’s Henry Hub natural gas futures contract for the month in which a relevant cargo’s delivery window is scheduled to begin | |

LIBOR | London Interbank Offered Rate | |

LNG | liquefied natural gas, a product of natural gas consisting primarily of methane (CH4) that is in liquid form at near atmospheric pressure | |

MMBtu | million British thermal units, an energy unit | |

mtpa | million tonnes per annum | |

non-FTA countries | countries without a free trade agreement providing for national treatment for trade in natural gas and with which trade is permitted | |

SEC | Securities and Exchange Commission | |

SPA | LNG sale and purchase agreement | |

Train | an industrial facility comprised of a series of refrigerant compressor loops used to cool natural gas into LNG | |

TUA | terminal use agreement | |

1

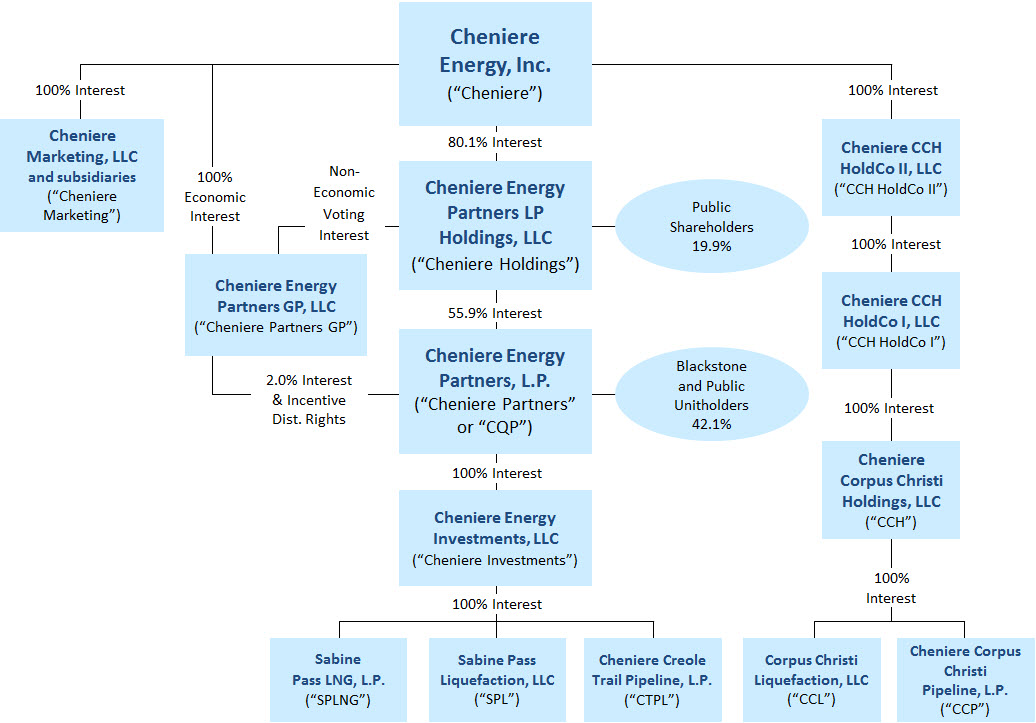

Abbreviated Organizational Structure

The following diagram depicts our abbreviated organizational structure as of March 31, 2016, including our ownership of certain subsidiaries, and the references to these entities used in this quarterly report:

Unless the context requires otherwise, references to “Cheniere,” the “Company,” “we,” “us” and “our” refer to Cheniere Energy, Inc. (NYSE MKT: LNG) and its consolidated subsidiaries, including our publicly traded subsidiaries, Cheniere Partners (NYSE MKT: CQP) and Cheniere Holdings (NYSE MKT: CQH).

Unless the context requires otherwise, references to the “CCH Group” refer to CCH HoldCo II, CCH HoldCo I, CCH, CCL and CCP, collectively.

2

PART I. | FINANCIAL INFORMATION |

ITEM 1. | CONSOLIDATED FINANCIAL STATEMENTS |

CHENIERE ENERGY, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

March 31, | December 31, | ||||||

2016 | 2015 | ||||||

ASSETS | (unaudited) | ||||||

Current assets | |||||||

Cash and cash equivalents | $ | 1,094,833 | $ | 1,201,112 | |||

Restricted cash | 732,551 | 503,397 | |||||

Accounts and interest receivable | 23,979 | 5,749 | |||||

Inventory | 31,243 | 18,125 | |||||

Other current assets | 63,509 | 54,203 | |||||

Total current assets | 1,946,115 | 1,782,586 | |||||

Non-current restricted cash | 31,724 | 31,722 | |||||

Property, plant and equipment, net | 17,674,548 | 16,193,907 | |||||

Debt issuance costs, net | 409,894 | 378,677 | |||||

Non-current derivative assets | 29,361 | 30,887 | |||||

Goodwill | 76,819 | 76,819 | |||||

Other non-current assets | 262,486 | 314,455 | |||||

Total assets | $ | 20,430,947 | $ | 18,809,053 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Current liabilities | |||||||

Accounts payable | $ | 35,398 | $ | 22,820 | |||

Accrued liabilities | 670,584 | 427,199 | |||||

Current debt, net | 1,785,318 | 1,673,379 | |||||

Deferred revenue | 26,669 | 26,669 | |||||

Derivative liabilities | 50,561 | 35,201 | |||||

Other current liabilities | 93 | — | |||||

Total current liabilities | 2,568,623 | 2,185,268 | |||||

Long-term debt, net | 16,348,099 | 14,920,427 | |||||

Non-current deferred revenue | 8,500 | 9,500 | |||||

Non-current derivative liabilities | 239,372 | 79,387 | |||||

Other non-current liabilities | 61,668 | 53,068 | |||||

Commitments and contingencies (see Note 14) | |||||||

Stockholders’ equity | |||||||

Preferred stock, $0.0001 par value, 5.0 million shares authorized, none issued | — | — | |||||

Common stock, $0.003 par value | |||||||

Authorized: 480.0 million shares at March 31, 2016 and December 31, 2015 | |||||||

Issued and outstanding: 235.5 million shares and 235.6 million shares at March 31, 2016 and December 31, 2015, respectively | 707 | 708 | |||||

Treasury stock: 11.7 million shares and 11.6 million shares at March 31, 2016 and December 31, 2015, respectively, at cost | (354,903 | ) | (353,927 | ) | |||

Additional paid-in-capital | 3,088,648 | 3,075,317 | |||||

Accumulated deficit | (3,944,786 | ) | (3,623,948 | ) | |||

Total stockholders’ deficit | (1,210,334 | ) | (901,850 | ) | |||

Non-controlling interest | 2,415,019 | 2,463,253 | |||||

Total equity | 1,204,685 | 1,561,403 | |||||

Total liabilities and equity | $ | 20,430,947 | $ | 18,809,053 | |||

The accompanying notes are an integral part of these consolidated financial statements.

3

CHENIERE ENERGY, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited)

Three Months Ended March 31, | |||||||

2016 | 2015 | ||||||

Revenues | |||||||

Regasification revenues | $ | 65,551 | $ | 66,802 | |||

LNG revenues | 2,704 | 662 | |||||

Other revenues | 826 | 905 | |||||

Total revenues | 69,081 | 68,369 | |||||

Operating costs and expenses | |||||||

Cost of sales (excluding depreciation and amortization expense shown separately below) | 14,507 | 693 | |||||

Operating and maintenance expense | 36,317 | 35,706 | |||||

Development expense | 1,547 | 16,096 | |||||

Marketing expense | 24,978 | 13,046 | |||||

General and administrative expense | 47,924 | 44,971 | |||||

Depreciation and amortization expense | 24,089 | 17,769 | |||||

Impairment expense | 10,166 | 176 | |||||

Other | 112 | 156 | |||||

Total operating costs and expenses | 159,640 | 128,613 | |||||

Loss from operations | (90,559 | ) | (60,244 | ) | |||

Other income (expense) | |||||||

Interest expense, net of capitalized interest | (76,337 | ) | (59,612 | ) | |||

Loss on early extinguishment of debt | (1,457 | ) | (88,992 | ) | |||

Derivative loss, net | (180,934 | ) | (126,690 | ) | |||

Other income | 929 | 372 | |||||

Total other expense | (257,799 | ) | (274,922 | ) | |||

Loss before income taxes and non-controlling interest | (348,358 | ) | (335,166 | ) | |||

Income tax provision | (616 | ) | (678 | ) | |||

Net loss | (348,974 | ) | (335,844 | ) | |||

Less: net loss attributable to non-controlling interest | (28,136 | ) | (68,135 | ) | |||

Net loss attributable to common stockholders | $ | (320,838 | ) | $ | (267,709 | ) | |

Net loss per share attributable to common stockholders—basic and diluted | $ | (1.41 | ) | $ | (1.18 | ) | |

Weighted average number of common shares outstanding—basic and diluted | 228,138 | 226,328 | |||||

The accompanying notes are an integral part of these consolidated financial statements.

4

CHENIERE ENERGY, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

(in thousands)

(unaudited)

Total Stockholders’ Equity | |||||||||||||||||||||||||||||

Common Stock | Treasury Stock | Additional Paid-in Capital | Accumulated Deficit | Non-controlling Interest | Total Equity | ||||||||||||||||||||||||

Shares | Par Value Amount | Shares | Amount | ||||||||||||||||||||||||||

Balance at December 31, 2015 | 235,639 | $ | 708 | 11,649 | $ | (353,927 | ) | $ | 3,075,317 | $ | (3,623,948 | ) | $ | 2,463,253 | $ | 1,561,403 | |||||||||||||

Forfeitures of restricted stock | (78 | ) | (1 | ) | — | — | 1 | — | — | — | |||||||||||||||||||

Share-based compensation | — | — | — | — | 13,329 | — | — | 13,329 | |||||||||||||||||||||

Shares repurchased related to share-based compensation | (31 | ) | — | 31 | (976 | ) | — | — | — | (976 | ) | ||||||||||||||||||

Loss attributable to non-controlling interest | — | — | — | — | — | — | (28,136 | ) | (28,136 | ) | |||||||||||||||||||

Distributions to non-controlling interest | — | — | — | — | — | — | (20,098 | ) | (20,098 | ) | |||||||||||||||||||

Net loss | — | — | — | — | — | (320,838 | ) | — | (320,838 | ) | |||||||||||||||||||

Balance at March 31, 2016 | 235,530 | $ | 707 | 11,680 | $ | (354,903 | ) | $ | 3,088,648 | $ | (3,944,786 | ) | $ | 2,415,019 | $ | 1,204,685 | |||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

5

CHENIERE ENERGY, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Three Months Ended March 31, | |||||||

2016 | 2015 | ||||||

Cash flows from operating activities | |||||||

Net loss | $ | (348,974 | ) | $ | (335,844 | ) | |

Adjustments to reconcile net loss to net cash used in operating activities: | |||||||

Non-cash LNG inventory write-downs | 216 | 17,502 | |||||

Depreciation and amortization expense | 24,089 | 17,769 | |||||

Share-based compensation | 16,171 | 16,140 | |||||

Amortization of debt issuance costs and discount | 12,817 | 9,116 | |||||

Loss on early extinguishment of debt | 1,457 | 88,992 | |||||

Total losses on derivatives, net | 182,169 | 126,183 | |||||

Net cash used for settlement of derivative instruments | (8,817 | ) | (37,262 | ) | |||

Impairment expense | 10,166 | 176 | |||||

Other | 303 | 8,627 | |||||

Changes in restricted cash for certain operating activities | 43,366 | 75,233 | |||||

Changes in operating assets and liabilities: | |||||||

Accounts and interest receivable | 1,092 | (28,083 | ) | ||||

Inventory | (1,531 | ) | (29,676 | ) | |||

Accounts payable and accrued liabilities | (27,831 | ) | 73,002 | ||||

Deferred revenue | (1,000 | ) | (1,003 | ) | |||

Other, net | 7,617 | (15,052 | ) | ||||

Net cash used in operating activities | (88,690 | ) | (14,180 | ) | |||

Cash flows from investing activities | |||||||

Property, plant and equipment, net | (1,149,827 | ) | (590,998 | ) | |||

Use of restricted cash for the acquisition of property, plant and equipment | 1,151,073 | 572,623 | |||||

Other | (17,861 | ) | (46,164 | ) | |||

Net cash used in investing activities | (16,615 | ) | (64,539 | ) | |||

Cash flows from financing activities | |||||||

Proceeds from issuances of debt | 1,908,000 | 2,500,000 | |||||

Repayments of debt | (415,000 | ) | — | ||||

Debt issuance and deferred financing costs | (49,307 | ) | (58,395 | ) | |||

Investment in restricted cash | (1,423,595 | ) | (1,929,288 | ) | |||

Distributions and dividends to non-controlling interest | (20,098 | ) | (20,050 | ) | |||

Proceeds from exercise of stock options | — | 958 | |||||

Payments related to tax withholdings for share-based compensation | (976 | ) | (3,771 | ) | |||

Other | 2 | 20 | |||||

Net cash provided by (used in) financing activities | (974 | ) | 489,474 | ||||

Net increase (decrease) in cash and cash equivalents | (106,279 | ) | 410,755 | ||||

Cash and cash equivalents—beginning of period | 1,201,112 | 1,747,583 | |||||

Cash and cash equivalents—end of period | $ | 1,094,833 | $ | 2,158,338 | |||

The accompanying notes are an integral part of these consolidated financial statements.

6

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

NOTE 1—BASIS OF PRESENTATION

The accompanying unaudited Consolidated Financial Statements of Cheniere have been prepared in accordance with GAAP for interim financial information and with Rule 10-01 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In our opinion, all adjustments, consisting only of normal recurring adjustments necessary for a fair presentation, have been included. Certain reclassifications have been made to conform prior period information to the current presentation. The reclassifications had no effect on our overall consolidated financial position, operating results or cash flows.

In 2016, we started production at our natural gas liquefaction facilities at the Sabine Pass LNG terminal (the “SPL Project”). As a result, we introduced two new line items entitled “Cost of sales” and “Marketing expense” on our Consolidated Statements of Operations. To conform to the new presentation, reclassifications were made in the prior period into these new line items. The components of these new line items are as follows:

• | Cost of sales includes costs incurred directly for the production of LNG from the SPL Project such as natural gas feedstock, variable transportation and storage costs, derivative gains and losses associated with economic hedges to secure natural gas feedstock for the SPL Project, vessel chartering costs and other costs related to converting natural gas into LNG, all to the extent not utilized for the commissioning process. These costs were reclassified from operating and maintenance expense, which now primarily includes costs associated with operating and maintaining the SPL Project such as third-party service and maintenance contract costs, payroll and benefit costs of operations personnel, natural gas transportation and storage capacity demand charges, derivative gains and losses related to the sale and purchase of LNG associated with the regasification terminal, insurance and regulatory costs. |

• | Marketing expense includes costs directly associated with our LNG and natural gas marketing activities by Cheniere Marketing such as payroll and benefit costs of LNG marketing and origination personnel, professional services and other support costs to contract LNG customers throughout the global marketplace for the SPL Project and our second natural gas liquefaction and export facility at the Corpus Christi LNG terminal (the “CCL Project”). These costs were reclassified from general and administrative expense. |

Additionally, we distinguished and reclassified our historical “LNG terminal revenues” line item into “regasification revenues” and “LNG revenues.” Regasification revenues include LNG regasification capacity reservation fees that are received pursuant to our TUAs and tug services fees that are received by Sabine Pass Tug Services, LLC, a wholly owned subsidiary of SPLNG. LNG revenues include fees that will be received pursuant to our SPAs and related LNG marketing activities.

Results of operations for the three months ended March 31, 2016 are not necessarily indicative of the operating results that will be realized for the year ending December 31, 2016.

For further information, refer to the Consolidated Financial Statements and accompanying notes included in our annual report on Form 10-K for the year ended December 31, 2015.

7

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

NOTE 2—RESTRICTED CASH

Restricted cash consists of funds that are contractually restricted as to usage or withdrawal and have been presented separately from cash and cash equivalents on our Consolidated Balance Sheets. Restricted cash consisted of the following (in thousands):

March 31, | December 31, | |||||||

2016 | 2015 | |||||||

Current restricted cash | ||||||||

SPLNG debt service and interest payment | $ | 115,469 | $ | 77,415 | ||||

SPL Project | 177,609 | 189,260 | ||||||

CTPL construction and interest payment | — | 7,882 | ||||||

CQP and cash held by guarantor subsidiaries | 108,894 | — | ||||||

CCL Project | 295,316 | 46,770 | ||||||

Cash held by our subsidiaries restricted to Cheniere | 10,511 | 147,138 | ||||||

Other | 24,752 | 34,932 | ||||||

Total current restricted cash | $ | 732,551 | $ | 503,397 | ||||

Non-current restricted cash | ||||||||

SPLNG debt service | $ | 13,650 | $ | 13,650 | ||||

Other | 18,074 | 18,072 | ||||||

Total non-current restricted cash | $ | 31,724 | $ | 31,722 | ||||

Under the indentures governing the senior notes issued by SPLNG (the “SPLNG Indentures”), except for permitted tax distributions, SPLNG may not make distributions until certain conditions are satisfied, including: (1) there must be on deposit in an interest payment account an amount equal to one-sixth of the semi-annual interest payment multiplied by the number of elapsed months since the last semi-annual interest payment, and (2) there must be on deposit in a permanent debt service reserve fund an amount equal to one semi-annual interest payment. Distributions are permitted only after satisfying the foregoing funding requirements, a fixed charge coverage ratio test of 2:1 and other conditions specified in the SPLNG Indentures. During the three months ended March 31, 2016 and 2015, SPLNG made distributions of $63.4 million and $70.8 million, respectively, after satisfying all the applicable conditions in the SPLNG Indentures.

In February 2016, Cheniere Partners entered into a $2.8 billion credit facility (the “2016 CQP Credit Facilities”). Under the terms of the 2016 CQP Credit Facilities and the related depositary agreement governing the extension of credit to Cheniere Partners, Cheniere Partners, and Cheniere Investments and CTPL as Cheniere Partners’ guarantor subsidiaries, are subject to limitations on the use of cash. Specifically, Cheniere Partners, Cheniere Investments and CTPL may only withdraw funds from collateral accounts held at a designated depositary bank on a monthly basis and for specific purposes, including for the payment of operating expenses. In addition, distributions and capital expenditures may only be made quarterly and are subject to certain restrictions.

NOTE 3—INVENTORY

As of March 31, 2016 and December 31, 2015, inventory consisted of the following (in thousands):

March 31, | December 31, | |||||||

2016 | 2015 | |||||||

Natural gas | $ | 3,333 | $ | 5,724 | ||||

LNG | 5,546 | 5,148 | ||||||

Materials and other | 22,364 | 7,253 | ||||||

Total inventory | $ | 31,243 | $ | 18,125 | ||||

8

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

NOTE 4—PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment consists of LNG terminal costs and fixed assets and other, as follows (in thousands):

March 31, | December 31, | |||||||

2016 | 2015 | |||||||

LNG terminal costs | ||||||||

LNG terminal | $ | 2,748,474 | $ | 2,487,759 | ||||

LNG terminal construction-in-process (1) | 15,116,545 | 13,875,204 | ||||||

LNG site and related costs, net | 38,612 | 33,512 | ||||||

Accumulated depreciation | (430,757 | ) | (413,545 | ) | ||||

Total LNG terminal costs, net | 17,472,874 | 15,982,930 | ||||||

Fixed assets and other | ||||||||

Computer and office equipment | 12,159 | 12,153 | ||||||

Furniture and fixtures | 17,201 | 17,101 | ||||||

Computer software | 72,234 | 69,340 | ||||||

Leasehold improvements | 41,930 | 40,136 | ||||||

Land | 60,612 | 60,612 | ||||||

Other | 38,786 | 49,376 | ||||||

Accumulated depreciation | (41,248 | ) | (37,741 | ) | ||||

Total fixed assets and other, net | 201,674 | 210,977 | ||||||

Property, plant and equipment, net | $ | 17,674,548 | $ | 16,193,907 | ||||

(1) | As of March 31, 2016, LNG terminal construction-in-process is presented net of amounts received from the sale of commissioning cargoes because the related costs were capitalized as testing costs for the construction of the SPL Project. |

NOTE 5—DERIVATIVE INSTRUMENTS

We have entered into the following derivative instruments that are reported at fair value:

• | interest rate swaps to hedge the exposure to volatility in a portion of the floating-rate interest payments under certain of our credit facilities (“Interest Rate Derivatives”); |

• | commodity derivatives to hedge the exposure to price risk attributable to future: (1) sales of our LNG inventory and (2) purchases of natural gas to operate the Sabine Pass LNG terminal (“Natural Gas Derivatives”); |

• | commodity derivatives consisting of natural gas purchase agreements for the commissioning and operation of the SPL Project (“Physical Liquefaction Supply Derivatives”) and associated economic hedges (“Financial Liquefaction Supply Derivatives”, and collectively with the Physical Liquefaction Supply Derivatives, the “Liquefaction Supply Derivatives”); |

• | financial derivatives to hedge the exposure to the commodity markets in which we have contractual arrangements to purchase or sell physical LNG (“LNG Trading Derivatives”); and |

• | foreign currency exchange (“FX”) contracts to hedge exposure to currency risk associated with operations in countries outside of the United States (“FX Derivatives”). |

None of our derivative instruments are designated as cash flow hedging instruments, and changes in fair value are recorded within our Consolidated Statements of Operations.

9

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

The following table (in thousands) shows the fair value of our derivative instruments that are required to be measured at fair value on a recurring basis as of March 31, 2016 and December 31, 2015, which are classified as other current assets, non-current derivative assets, derivative liabilities or non-current derivative liabilities in our Consolidated Balance Sheets.

Fair Value Measurements as of | |||||||||||||||||||||||||||||||

March 31, 2016 | December 31, 2015 | ||||||||||||||||||||||||||||||

Quoted Prices in Active Markets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | Quoted Prices in Active Markets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | ||||||||||||||||||||||||

SPL Interest Rate Derivatives liability | $ | — | $ | (18,009 | ) | $ | — | $ | (18,009 | ) | $ | — | $ | (8,740 | ) | $ | — | $ | (8,740 | ) | |||||||||||

CQP Interest Rate Derivatives liability | — | (9,490 | ) | — | (9,490 | ) | — | — | — | — | |||||||||||||||||||||

CCH Interest Rate Derivatives liability | — | (259,305 | ) | — | (259,305 | ) | — | (104,999 | ) | — | (104,999 | ) | |||||||||||||||||||

Liquefaction Supply Derivatives asset (liability) | — | (151 | ) | 30,054 | 29,903 | — | (25 | ) | 32,492 | 32,467 | |||||||||||||||||||||

LNG Trading Derivatives asset | — | 5,814 | — | 5,814 | — | 1,053 | — | 1,053 | |||||||||||||||||||||||

Natural Gas Derivatives liability | — | — | — | — | — | (66 | ) | — | (66 | ) | |||||||||||||||||||||

FX Derivatives liability | — | (2,527 | ) | — | (2,527 | ) | — | — | — | — | |||||||||||||||||||||

We value our Interest Rate Derivatives using valuations based on the initial trade prices. Using an income-based approach, subsequent valuations are based on observable inputs to the valuation model including interest rate curves, risk adjusted discount rates, credit spreads and other relevant data. The estimated fair values of our economic hedges related to the LNG Trading Derivatives and our Natural Gas Derivatives are the amounts at which the instruments could be exchanged currently between willing parties. We value these derivatives using observable commodity price curves and other relevant data. We estimate the fair values of our FX Derivatives with a market approach using observable FX rates and other relevant data.

The fair value of substantially all of our Physical Liquefaction Supply Derivatives is developed through the use of internal models which are impacted by inputs that are unobservable in the marketplace. As a result, the fair value of our Physical Liquefaction Supply Derivatives is designated as Level 3 within the valuation hierarchy. The curves used to generate the fair value of our Physical Liquefaction Supply Derivatives are based on basis adjustments applied to forward curves for a liquid trading point. In addition, there may be observable liquid market basis information in the near term, but terms of a particular Physical Liquefaction Supply Derivatives contract may exceed the period for which such information is available, resulting in a Level 3 classification. In these instances, the fair value of the contract incorporates extrapolation assumptions made in the determination of the market basis price for future delivery periods in which applicable commodity basis prices were either not observable or lacked corroborative market data. Internal fair value models include conditions precedent to the respective long-term natural gas purchase agreements. As of March 31, 2016 and December 31, 2015, some of our Physical Liquefaction Supply Derivatives existed within markets for which the pipeline infrastructure has not been developed to accommodate marketable physical gas flow. In the absence of infrastructure to accommodate marketable physical gas flow, our internal fair value models are based on a market price that equates to our own contractual pricing due to: (1) the inactive and unobservable market and (2) conditions precedent and their impact on the uncertainty in the timing of our actual receipt of the physical volumes associated with each forward. The fair value of our Physical Liquefaction Supply Derivatives is predominantly driven by market commodity basis prices and our assessment of the associated conditions precedent, including evaluating whether the respective market is available as pipeline infrastructure is developed. Upon the completion and placement into service of relevant pipeline infrastructure to accommodate marketable physical gas flow, we recognize a gain or loss based on the fair value of the respective natural gas purchase agreements as of the reporting date.

10

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

There were no transfers into or out of Level 3 Physical Liquefaction Supply Derivatives for the three months ended March 31, 2016 and 2015. As all of our Physical Liquefaction Supply Derivatives are either purely index-priced or index-priced with a fixed basis, we do not believe that a significant change in market commodity prices would have a material impact on our Level 3 fair value measurements. The following table includes quantitative information for the unobservable inputs for our Level 3 Physical Liquefaction Supply Derivatives as of March 31, 2016:

Net Fair Value Asset (in thousands) | Valuation Technique | Significant Unobservable Input | Significant Unobservable Inputs Range | |||||

Physical Liquefaction Supply Derivatives | $30,054 | Income Approach | Basis Spread | $ (0.350) - $0.020 | ||||

The following table (in thousands) shows the changes in the fair value of our Level 3 Physical Liquefaction Supply Derivatives during the three months ended March 31, 2016 and 2015:

Three Months Ended March 31, | ||||||||

2016 | 2015 | |||||||

Balance, beginning of period | $ | 32,492 | $ | 342 | ||||

Realized and mark-to-market losses: | ||||||||

Included in cost of sales (1) | (2,653 | ) | — | |||||

Purchases and settlements: | ||||||||

Purchases | 215 | — | ||||||

Settlements (1) | — | — | ||||||

Balance, end of period | $ | 30,054 | $ | 342 | ||||

Change in unrealized gains relating to instruments still held at end of period | $ | (2,194 | ) | $ | — | |||

(1) | Does not include the decrease in fair value of $0.5 million related to the realized gains capitalized during the three months ended March 31, 2016. |

Derivative assets and liabilities arising from our derivative contracts with the same counterparty are reported on a net basis, as all counterparty derivative contracts provide for net settlement. The use of derivative instruments exposes us to counterparty credit risk, or the risk that a counterparty will be unable to meet its commitments in instances when our derivative instruments are in an asset position.

Interest Rate Derivatives

SPL Interest Rate Derivatives

SPL has entered into interest rate swaps (“SPL Interest Rate Derivatives”) to protect against volatility of future cash flows and hedge a portion of the variable interest payments on the $4.6 billion credit facilities (the “2015 SPL Credit Facilities”). The SPL Interest Rate Derivatives hedge a portion of the expected outstanding borrowings over the term of the 2015 SPL Credit Facilities.

In March 2015, SPL settled a portion of the SPL Interest Rate Derivatives and recognized a derivative loss of $34.7 million within our Consolidated Statements of Operations in conjunction with the termination of approximately $1.8 billion of commitments under the previous credit facilities.

CQP Interest Rate Derivatives

In March 2016, Cheniere Partners entered into interest rate swaps (“CQP Interest Rate Derivatives”) to protect against volatility of future cash flows and hedge a portion of the variable interest payments on the 2016 CQP Credit Facilities. The CQP Interest Rate Derivatives hedge a portion of the expected outstanding borrowings over the term of the 2016 CQP Credit Facilities.

11

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

CCH Interest Rate Derivatives

CCH has entered into interest rate swaps (“CCH Interest Rate Derivatives”) to protect against volatility of future cash flows and hedge a portion of the variable interest payments on its $8.4 billion credit facility (the “2015 CCH Credit Facility”). The CCH Interest Rate Derivatives hedge a portion of the expected outstanding borrowings over the term of the 2015 CCH Credit Facility.

As of March 31, 2016, we had the following Interest Rate Derivatives outstanding:

Initial Notional Amount | Maximum Notional Amount | Effective Date | Maturity Date | Weighted Average Fixed Interest Rate Paid | Variable Interest Rate Received | ||||||||

SPL Interest Rate Derivatives | $20.0 million | $628.8 million | August 14, 2012 | July 31, 2019 | 1.98 | % | One-month LIBOR | ||||||

CQP Interest Rate Derivatives | $225.0 million | $1.3 billion | March 22, 2016 | February 29, 2020 | 1.19 | % | One-month LIBOR | ||||||

CCH Interest Rate Derivatives | $28.8 million | $5.5 billion | May 20, 2015 | May 31, 2022 | 2.29 | % | One-month LIBOR | ||||||

The following table (in thousands) shows the fair value and location of our Interest Rate Derivatives on our Consolidated Balance Sheets:

March 31, 2016 | December 31, 2015 | |||||||||||||||||||||||||||||||

SPL Interest Rate Derivatives | CQP Interest Rate Derivatives | CCH Interest Rate Derivatives | Total | SPL Interest Rate Derivatives | CQP Interest Rate Derivatives | CCH Interest Rate Derivatives | Total | |||||||||||||||||||||||||

Balance Sheet Location | ||||||||||||||||||||||||||||||||

Derivative liabilities | (6,759 | ) | (4,530 | ) | (36,926 | ) | (48,215 | ) | (5,940 | ) | — | (28,559 | ) | (34,499 | ) | |||||||||||||||||

Non-current derivative liabilities | (11,250 | ) | (4,960 | ) | (222,379 | ) | (238,589 | ) | (2,800 | ) | — | (76,440 | ) | (79,240 | ) | |||||||||||||||||

Total derivative liabilities | (18,009 | ) | (9,490 | ) | (259,305 | ) | (286,804 | ) | (8,740 | ) | — | (104,999 | ) | (113,739 | ) | |||||||||||||||||

Derivative liability, net | $ | (18,009 | ) | $ | (9,490 | ) | $ | (259,305 | ) | $ | (286,804 | ) | $ | (8,740 | ) | $ | — | $ | (104,999 | ) | $ | (113,739 | ) | |||||||||

The following table (in thousands) shows the changes in the fair value and settlements of our Interest Rate Derivatives recorded in derivative loss, net on our Consolidated Statements of Operations during the three months ended March 31, 2016 and 2015:

Three Months Ended March 31, | ||||||||

2016 | 2015 | |||||||

SPL Interest Rate Derivatives loss | $ | (11,278 | ) | $ | (37,138 | ) | ||

CQP Interest Rate Derivatives loss | (9,530 | ) | — | |||||

CCH Interest Rate Derivatives loss | (160,176 | ) | (89,552 | ) | ||||

Commodity Derivatives

We recognize all commodity derivative instruments, including our Liquefaction Supply Derivatives, LNG Trading Derivatives and Natural Gas Derivatives (collectively, “Commodity Derivatives”), as either assets or liabilities and measure those instruments at fair value. Changes in the fair value of our Commodity Derivatives are reported in earnings.

12

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

The following table (in thousands) shows the fair value and location of our Commodity Derivatives on our Consolidated Balance Sheets:

March 31, 2016 | December 31, 2015 | ||||||||||||||||||||||||||||||

Liquefaction Supply Derivatives (1) | LNG Trading Derivatives | Natural Gas Derivatives | Total | Liquefaction Supply Derivatives | LNG Trading Derivatives | Natural Gas Derivatives (2) | Total | ||||||||||||||||||||||||

Balance Sheet Location | |||||||||||||||||||||||||||||||

Other current assets | $ | 2,222 | $ | 4,663 | $ | — | $ | 6,885 | $ | 2,737 | $ | 640 | $ | — | $ | 3,377 | |||||||||||||||

Non-current derivative assets | 28,210 | 1,151 | — | 29,361 | 30,304 | 583 | — | 30,887 | |||||||||||||||||||||||

Total derivative assets | 30,432 | 5,814 | — | 36,246 | 33,041 | 1,223 | — | 34,264 | |||||||||||||||||||||||

Derivative liabilities | (529 | ) | — | — | (529 | ) | (490 | ) | (107 | ) | (66 | ) | (663 | ) | |||||||||||||||||

Non-current derivative liabilities | — | — | — | — | (84 | ) | (63 | ) | — | (147 | ) | ||||||||||||||||||||

Total derivative liabilities | (529 | ) | — | — | (529 | ) | (574 | ) | (170 | ) | (66 | ) | (810 | ) | |||||||||||||||||

Derivative asset (liabilities), net | $ | 29,903 | $ | 5,814 | $ | — | $ | 35,717 | $ | 32,467 | $ | 1,053 | $ | (66 | ) | $ | 33,454 | ||||||||||||||

(1) | Does not include collateral of $1.5 million deposited for such contracts, which is included in other current assets in our Consolidated Balance Sheet as of March 31, 2016. |

(2) | Does not include collateral of $5.5 million deposited for such contracts, which is included in other current assets in our Consolidated Balance Sheet as of December 31, 2015. |

The following table (in thousands) shows the changes in the fair value and settlements and location of our Commodity Derivatives recorded on our Consolidated Statements of Operations during the three months ended March 31, 2016 and 2015:

Three Months Ended March 31, | |||||||||

Statement of Operations Location | 2016 | 2015 | |||||||

Liquefaction Supply Derivatives gain | LNG revenues | $ | 28 | $ | — | ||||

Liquefaction Supply Derivatives loss (1) | Cost of sales | (3,594 | ) | — | |||||

LNG Trading Derivatives gain | LNG revenues | 4,762 | — | ||||||

Natural Gas Derivatives loss | LNG revenues | (5 | ) | (247 | ) | ||||

Natural Gas Derivatives gain | Operating and maintenance expense | 174 | 754 | ||||||

(1) Does not include the realized value associated with derivative instruments that settle through physical delivery.

The use of Commodity Derivatives exposes us to counterparty credit risk, or the risk that a counterparty will be unable to meet its commitments in instances when our Commodity Derivatives are in an asset position.

Liquefaction Supply Derivatives

SPL has entered into index-based physical natural gas supply contracts and associated economic hedges to purchase natural gas for the commissioning and operation of the SPL Project. The terms of the physical natural gas supply contracts primarily range from approximately one to seven years and commence upon the occurrence of conditions precedent, including the date of first commercial operation of specified Trains of the SPL Project. We recognize our Physical Liquefaction Supply Derivatives as either assets or liabilities and measure those instruments at fair value. Changes in the fair value of our Physical Liquefaction Supply Derivatives are reported in earnings. As of March 31, 2016, SPL has secured up to approximately 2,047.9 million MMBtu of natural gas feedstock through natural gas purchase agreements. The notional natural gas position of our Physical Liquefaction Supply Derivatives was approximately 1,134.9 million MMBtu as of March 31, 2016.

Our Financial Liquefaction Supply Derivatives are executed through over-the-counter contracts which are subject to nominal

13

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

credit risk as these transactions are settled on a daily margin basis with investment grade financial institutions. We are required by these financial institutions to use margin deposits as credit support for our Financial Liquefaction Supply Derivatives activities.

LNG Trading Derivatives

As of March 31, 2016, we have entered into certain LNG Trading Derivatives representing a short position of 9.2 million MMBtu, and we may from time to time enter into certain financial derivatives in the form of swaps, forwards, options or futures to economically hedge exposure to the commodity markets in which we have contractual arrangements to purchase or sell physical LNG. We have entered into LNG Trading Derivatives to secure a fixed price position to minimize future cash flow variability associated with such LNG transactions.

Natural Gas Derivatives

Our Natural Gas Derivatives were executed through over-the-counter contracts which were subject to nominal credit risk as these transactions settled on a daily margin basis with investment grade financial institutions. We were required by these financial institutions to use margin deposits as credit support for our Natural Gas Derivatives activities. As of March 31, 2016, we did not have any open Natural Gas Derivatives positions or margin deposits at financial institutions.

FX Derivatives

Cheniere Marketing has entered into FX Derivatives to protect against the volatility in future cash flows attributable to changes in international currency exchange rates. The FX Derivatives economically hedge the foreign currency exposure arising from cash flows expended for both general and administrative expenses and physical and financial LNG transactions related to operations in countries outside of the United States. The total notional amount of our FX Derivatives was approximately $56.7 million as of March 31, 2016.

The following table (in thousands) shows the fair value and location of our FX Derivatives on our Consolidated Balance Sheets:

Fair Value Measurements as of | ||||||||||

Balance Sheet Location | March 31, 2016 | December 31, 2015 | ||||||||

FX Derivatives | Other current assets | $ | 73 | $ | — | |||||

FX Derivatives | Derivative liabilities | (1,817 | ) | — | ||||||

FX Derivatives | Non-current derivative liabilities | (783 | ) | — | ||||||

The following table (in thousands) shows the changes in the fair value of our FX Derivatives recorded on our Consolidated Statements of Operations during the three months ended March 31, 2016 and 2015:

Three Months Ended March 31, | ||||||||||

Statement of Operations Location | 2016 | 2015 | ||||||||

FX Derivatives gain | Derivative loss, net | $ | 50 | $ | — | |||||

FX Derivatives loss | LNG revenues | (2,600 | ) | — | ||||||

14

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

Balance Sheet Presentation

Our Interest Rate Derivatives and Commodity Derivatives are presented on a net basis on our Consolidated Balance Sheets as described above. The following table (in thousands) shows the fair value of our derivatives outstanding on a gross and net basis:

Gross Amounts Recognized | Gross Amounts Offset in the Consolidated Balance Sheets | Net Amounts Presented in the Consolidated Balance Sheets | ||||||||||

Offsetting Derivative Assets (Liabilities) | ||||||||||||

As of March 31, 2016 | ||||||||||||

SPL Interest Rate Derivatives | $ | (18,009 | ) | $ | — | $ | (18,009 | ) | ||||

CQP Interest Rate Derivatives | (9,490 | ) | — | (9,490 | ) | |||||||

CCH Interest Rate Derivatives | (259,304 | ) | — | (259,304 | ) | |||||||

Liquefaction Supply Derivatives | 30,618 | (186 | ) | 30,432 | ||||||||

Liquefaction Supply Derivatives | (1,668 | ) | 1,139 | (529 | ) | |||||||

LNG Trading Derivatives | 15,412 | (9,598 | ) | 5,814 | ||||||||

FX Derivatives | 73 | — | 73 | |||||||||

FX Derivatives | (2,600 | ) | — | (2,600 | ) | |||||||

As of December 31, 2015 | ||||||||||||

SPL Interest Rate Derivatives | $ | (8,740 | ) | $ | — | $ | (8,740 | ) | ||||

CCH Interest Rate Derivatives | (104,999 | ) | — | (104,999 | ) | |||||||

Liquefaction Supply Derivatives | 33,636 | (595 | ) | 33,041 | ||||||||

Liquefaction Supply Derivatives | (574 | ) | — | (574 | ) | |||||||

LNG Trading Derivatives | 1,922 | (699 | ) | 1,223 | ||||||||

LNG Trading Derivatives | (2,826 | ) | 2,656 | (170 | ) | |||||||

Natural Gas Derivatives | 188 | (254 | ) | (66 | ) | |||||||

NOTE 6—OTHER NON-CURRENT ASSETS

As of March 31, 2016 and December 31, 2015, other non-current assets consisted of the following (in thousands):

March 31, | December 31, | |||||||

2016 | 2015 | |||||||

Advances made under EPC and non-EPC contracts | $ | 19,766 | $ | 83,579 | ||||

Advances made to municipalities for water system enhancements | 88,151 | 89,953 | ||||||

Tax-related payments and receivables | 29,197 | 31,712 | ||||||

Equity method investments | 20,543 | 20,295 | ||||||

Other | 104,829 | 88,916 | ||||||

Total other non-current assets | $ | 262,486 | $ | 314,455 | ||||

NOTE 7—VARIABLE INTEREST ENTITY

Cheniere Holdings

On January 1, 2016, we adopted ASU 2015-02, Consolidation (Topic 810): Amendments to the Consolidation Analysis. This guidance changed (1) the identification of variable interests, (2) the variable interest entity characteristics for a limited partnership or similar entity and (3) the primary beneficiary determination.

Cheniere Holdings is a limited liability company formed by us in 2013 to hold our Cheniere Partners limited partner interests. As of March 31, 2016, we owned 80.1% of Cheniere Holdings as well as a director voting share. The director voting share is the sole share entitled to vote in the election of Cheniere Holdings’ board of directors and allows us to remove members of the board of directors at any time and for any reason. If we cease to own greater than 25% of the common shares of Cheniere Holdings or if we choose to relinquish the director voting share, the director voting share will be extinguished.

The board of directors makes all major operating and financial decisions on behalf of Cheniere Holdings. Because ownership of the director voting share allows us to control Cheniere Holdings, irrespective of our majority ownership interest, and the director voting share cannot be removed from our control by the other equity holders of Cheniere Holdings, we have determined that

15

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

Cheniere Holdings is now a variable interest entity. However, this determination has not changed the consolidation of Cheniere Holdings as we have determined that we are its primary beneficiary. Therefore, the determination that Cheniere Holdings is now a variable interest entity had no impact on our Consolidated Financial Statements.

NOTE 8—NON-CONTROLLING INTEREST

Cheniere Holdings was formed by us to hold our limited partner interest in Cheniere Partners and in December 2013, completed its initial public offering. As of both March 31, 2016 and December 31, 2015, our ownership interest in Cheniere Holdings was 80.1%, with the remaining non-controlling interest held by the public. Cheniere Holdings owns a 55.9% limited partner interest in Cheniere Partners in the form of 12.0 million common units, 45.3 million Class B units and 135.4 million subordinated units, with the remaining non-controlling interest held by Blackstone CQP Holdco LP and the public. We also own 100% of the general partner interest and the incentive distribution rights in Cheniere Partners.

NOTE 9—ACCRUED LIABILITIES

As of March 31, 2016 and December 31, 2015, accrued liabilities consisted of the following (in thousands):

March 31, | December 31, | |||||||

2016 | 2015 | |||||||

Interest expense and related debt fees | $ | 169,921 | $ | 159,968 | ||||

Compensation and benefits | 43,991 | 99,511 | ||||||

Liquefaction projects costs | 434,990 | 145,105 | ||||||

LNG terminal costs | 4,230 | 3,918 | ||||||

Other accrued liabilities | 17,452 | 18,697 | ||||||

Total accrued liabilities | $ | 670,584 | $ | 427,199 | ||||

16

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

NOTE 10—DEBT

As of March 31, 2016 and December 31, 2015, our debt consisted of the following (in thousands):

March 31, | December 31, | |||||||

2016 | 2015 | |||||||

Long-term debt: | ||||||||

SPLNG | ||||||||

6.50% Senior Secured Notes due 2020 (“2020 SPLNG Senior Notes”) (1) | $ | 420,000 | $ | 420,000 | ||||

SPL | ||||||||

5.625% Senior Secured Notes due 2021 (“2021 SPL Senior Notes”), net of unamortized premium of $8,341 and $8,718 | 2,008,341 | 2,008,718 | ||||||

6.25% Senior Secured Notes due 2022 (“2022 SPL Senior Notes”) | 1,000,000 | 1,000,000 | ||||||

5.625% Senior Secured Notes due 2023 (“2023 SPL Senior Notes”), net of unamortized premium of $6,212 and $6,392 | 1,506,212 | 1,506,392 | ||||||

5.75% Senior Secured Notes due 2024 (“2024 SPL Senior Notes”) | 2,000,000 | 2,000,000 | ||||||

5.625% Senior Secured Notes due 2025 (“2025 SPL Senior Notes”) | 2,000,000 | 2,000,000 | ||||||

2015 SPL Credit Facilities | 1,505,000 | 845,000 | ||||||

CTPL | ||||||||

$400.0 million Term Loan Facility (“CTPL Term Loan”), net of unamortized discount of zero and $1,429 | — | 398,571 | ||||||

Cheniere Partners | ||||||||

2016 CQP Credit Facilities | 450,000 | — | ||||||

CCH | ||||||||

2015 CCH Credit Facility | 3,386,000 | 2,713,000 | ||||||

CCH HoldCo II | ||||||||

11.0% Convertible Senior Notes due 2025 (“2025 CCH HoldCo II Convertible Senior Notes”) | 1,079,479 | 1,050,588 | ||||||

Cheniere | ||||||||

4.875% Convertible Unsecured Notes due 2021 (“2021 Cheniere Convertible Unsecured Notes”), net of unamortized discount of $165,738 and $174,095 | 888,296 | 879,938 | ||||||

4.25% Convertible Senior Notes due 2045 (“2045 Cheniere Convertible Senior Notes”), net of unamortized discount of $318,535 and $319,062 | 306,465 | 305,938 | ||||||

Unamortized debt issuance costs (2) | (201,694 | ) | (207,718 | ) | ||||

Total long-term debt, net | 16,348,099 | 14,920,427 | ||||||

Current debt: | ||||||||

7.50% Senior Secured Notes due 2016 (“2016 SPLNG Senior Notes”), net of unamortized discount of $3,130 and $4,303 (3) | 1,662,370 | 1,661,197 | ||||||

$1.2 billion SPL Working Capital Facility (“SPL Working Capital Facility”) | 125,000 | 15,000 | ||||||

Unamortized debt issuance costs (2) | (2,052 | ) | (2,818 | ) | ||||

Total current debt, net | 1,785,318 | 1,673,379 | ||||||

Total debt, net | $ | 18,133,417 | $ | 16,593,806 | ||||

(1) | Must be redeemed or repaid concurrently with the 2016 Senior Notes under the terms of the 2016 CQP Credit Facilities if the obligations under the 2016 Senior Notes are satisfied with borrowings under the 2016 CQP Credit Facilities. |

(2) | Effective January 1, 2016, we adopted ASU 2015-03 and ASU 2015-15, which require debt issuance costs related to term notes to be presented in the balance sheet as a direct deduction from the debt liability, rather than as an asset, retrospectively for each reporting period presented. As a result, we reclassified $207.8 million and $2.8 million from debt issuance costs, net to long-term debt, net and current debt, net, respectively, as of December 31, 2015. |

(3) | Matures on November 30, 2016. We currently anticipate satisfying this obligation with borrowings under the 2016 CQP Credit Facilities. |

17

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

2016 Debt Issuances and Redemptions

2016 CQP Credit Facilities

In February 2016, Cheniere Partners entered into the $2.8 billion 2016 CQP Credit Facilities which consist of: (1) a $450.0 million CTPL tranche term loan that was used to prepay the $400.0 million CTPL Term Loan in February 2016, (2) an approximately $2.1 billion SPLNG tranche term loan that will be used to redeem or repay the approximately $2.1 billion of the 2016 SPLNG Senior Notes and the 2020 SPLNG Senior Notes (which must be redeemed or repaid concurrently under the terms of the 2016 CQP Credit Facilities), (3) a $125.0 million debt service reserve credit facility (the “DSR Facility”) that may be used to satisfy a six-month debt service reserve requirement and (4) a $115.0 million revolving credit facility that may be used for general business purposes.

The 2016 CQP Credit Facilities accrue interest at a variable rate per annum equal to LIBOR or the base rate (equal to the highest of the prime rate, the federal funds effective rate, as published by the Federal Reserve Bank of New York, plus 0.50% and adjusted one month LIBOR plus 1.0%), plus the applicable margin. The applicable margin for LIBOR loans is 2.25% per annum, and the applicable margin for base rate loans is 1.25% per annum, in each case with a 0.50% step-up beginning on February 25, 2019. Interest on LIBOR loans is due and payable at the end of each applicable LIBOR period (and at the end of every three month period within the LIBOR period, if any), and interest on base rate loans is due and payable at the end of each calendar quarter.

Cheniere Partners incurred $48.7 million of debt issuance costs during the three months ended March 31, 2016, and will incur an additional $21.5 million of debt issuance costs when the SPLNG tranche is funded. The prepayment of the CTPL Term Loan resulted in a write-off of unamortized discount and debt issuance costs of $1.5 million during the three months ended March 31, 2016. Cheniere Partners pays a commitment fee equal to an annual rate of 40% of the margin for LIBOR loans multiplied by the average daily amount of the undrawn commitment, payable quarterly in arrears. The DSR Facility and the revolving credit facility are both available for the issuance of letters of credit, which incur a fee equal to an annual rate of 2.25% of the undrawn portion with a 0.50% step-up beginning on February 25, 2019.

The 2016 CQP Credit Facilities mature on February 25, 2020, and the outstanding balance may be repaid, in whole or in part, at any time without premium or penalty, except for interest hedging and interest rate breakage costs. The 2016 CQP Credit Facilities contain conditions precedent for extensions of credit, as well as customary affirmative and negative covenants and limit Cheniere Partners’ ability to make restricted payments, including distributions, to once per fiscal quarter as long as certain conditions are satisfied. Under the terms of the 2016 CQP Credit Facilities, Cheniere Partners is required to hedge not less than 50% of the variable interest rate exposure on its projected aggregate outstanding balance, maintain a minimum debt service coverage ratio of at least 1.15x at the end of each fiscal quarter beginning March 31, 2019 and have a projected debt service coverage ratio of 1.55x in order to incur additional indebtedness to refinance a portion of the existing obligations.

The 2016 CQP Credit Facilities are unconditionally guaranteed by each subsidiary of Cheniere Partners other than: (1) SPL, (2) SPLNG until funding of its tranche term loan and (3) certain of the subsidiaries of Cheniere Partners owning other development projects, as well as certain other specified subsidiaries and members of the foregoing entities.

18

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

Credit Facilities

Below is a summary of our credit facilities outstanding as of March 31, 2016 (in thousands):

2015 SPL Credit Facilities | SPL Working Capital Facility | 2016 CQP Credit Facilities | 2015 CCH Term Loan Facilities | |||||||||||||

Total facility size | $ | 4,600,000 | $ | 1,200,000 | $ | 2,800,000 | $ | 8,403,714 | ||||||||

Outstanding balance | 1,505,000 | 125,000 | 450,000 | 3,386,000 | ||||||||||||

Letters of credit issued | — | 236,459 | 7,500 | — | ||||||||||||

Available commitment | $ | 3,095,000 | $ | 838,541 | $ | 2,342,500 | $ | 5,017,714 | ||||||||

Interest rate | LIBOR plus 1.30% - 1.75% or base rate plus 1.75% | LIBOR plus 1.75% or base rate plus 0.75% | LIBOR plus 2.25% or base rate plus 1.25% (1) | LIBOR plus 2.25% or base rate plus 1.25% (2) | ||||||||||||

Maturity date | Earlier of December 31, 2020 or second anniversary of SPL Trains 1 through 5 completion date | December 31, 2020, with various terms for underlying loans | February 25, 2020, with principals due quarterly commencing on February 19, 2019 | Earlier of May 13, 2022 or second anniversary of CCL Trains 1 and 2 completion date | ||||||||||||

(1) | There is a 0.50% step-up for both LIBOR and base rate loans beginning on February 25, 2019. |

(2) | There is a 0.25% step-up for both LIBOR and base rate loans following completion of the first two Trains of the CCL Project. |

Convertible Notes

Below is a summary of our convertible notes outstanding as of March 31, 2016 (in thousands):

2021 Cheniere Convertible Unsecured Notes | 2025 CCH HoldCo II Convertible Senior Notes | 2045 Cheniere Convertible Senior Notes | ||||||||||

Aggregate principal | $ | 1,000,000 | $ | 1,000,000 | $ | 625,000 | ||||||

Debt component, net of discount | $ | 888,296 | $ | 1,079,479 | $ | 306,465 | ||||||

Equity component | $ | 203,035 | $ | — | $ | 194,082 | ||||||

Interest payment method | Paid-in-kind | Paid-in-kind (1) | Cash | |||||||||

Conversion by us (2) | — | (3) | (4) | |||||||||

Conversion by holders (2) | (5) | (6) | (7) | |||||||||

Conversion basis | Cash and/or stock | Stock | Cash and/or stock | |||||||||

Conversion value in excess of principal | $ | — | $ | — | $ | — | ||||||

Maturity date | May 28, 2021 | March 1, 2025 | March 15, 2045 | |||||||||

Effective interest rate | 9.6 | % | 11.9 | % | 9.4 | % | ||||||

Remaining debt discount and debt issuance costs amortization period (8) | 5.2 years | 4.5 years | 29.0 years | |||||||||

(1) | Prior to the substantial completion of Train 2 of the CCL Project, interest will be paid entirely in kind. Following this date, the interest generally must be paid in cash; however, a portion of the interest may be paid in kind under certain specified circumstances. |

(2) | Conversion is subject to various limitations and conditions. |

(3) | Convertible on or after the later of March 1, 2020 and the substantial completion of Train 2 of the CCL Project, provided that our market capitalization is not less than $10.0 billion (“Eligible Conversion Date”). The conversion price is the lower of (1) a 10% discount to the average of the daily volume-weighted average price (“VWAP”) of our common stock for the 90 trading day period prior to the date notice is provided, and (2) a 10% discount to the closing price of our common stock on the trading day preceding the date notice is provided. |

(4) | Redeemable at any time after March 15, 2020 at a redemption price payable in cash equal to the accreted amount of the 2045 Cheniere Convertible Senior Notes to be redeemed, plus accrued and unpaid interest, if any, to such redemption date. |

19

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

(5) | Initially convertible at $93.64 (subject to adjustment upon the occurrence of certain specified events), provided that the closing price of our common stock is greater than or equal to the conversion price on the conversion date. |

(6) | Convertible on or after the six-month anniversary of the Eligible Conversion Date, provided that our total market capitalization is not less than $10.0 billion, at a price equal to the average of the daily VWAP of our common stock for the 90 trading day period prior to the date on which notice of conversion is provided. |

(7) | Prior to December 15, 2044, convertible only under certain circumstances as specified in the indenture; thereafter, holders may convert their notes regardless of these circumstances. The conversion rate will initially equal 7.2265 shares of our common stock per $1,000 principal amount of the 2045 Cheniere Convertible Senior Notes, which corresponds to an initial conversion price of approximately $138.38 per share of our common stock (subject to adjustment upon the occurrence of certain specified events). |

(8) | We amortize any debt discount and debt issuance costs using the effective interest over the period through contractual maturity except for the 2025 CCH HoldCo II Convertible Senior Notes, which are amortized through the date they are first convertible into our common stock. |

Interest Expense

Total interest expense, including interest expense related to our convertible notes, consisted of the following (in thousands):

Three Months Ended March 31, | ||||||||

2016 | 2015 | |||||||

Interest cost on convertible notes: | ||||||||

Interest per contractual rate | $ | 49,040 | $ | 13,939 | ||||

Amortization of debt discount | 8,885 | 6,598 | ||||||

Amortization of debt issuance costs | 1,151 | 14 | ||||||

Total interest cost related to convertible notes | 59,076 | 20,551 | ||||||

Interest cost on other debt | 234,216 | 160,087 | ||||||

Total interest cost | 293,292 | 180,638 | ||||||

Capitalized interest | (216,955 | ) | (121,026 | ) | ||||

Total interest expense, net | $ | 76,337 | $ | 59,612 | ||||

Fair Value Disclosures

The following table (in thousands) shows the carrying amount and estimated fair value of our debt:

March 31, 2016 | December 31, 2015 | |||||||||||||||

Carrying Amount | Estimated Fair Value | Carrying Amount | Estimated Fair Value | |||||||||||||

Senior Notes, net of premium or discount (1) | $ | 10,596,923 | $ | 10,299,660 | $ | 10,596,307 | $ | 9,525,809 | ||||||||

CTPL Term Loan, net of discount (2) | — | — | 398,571 | 400,000 | ||||||||||||

Credit facilities (2) (3) | 5,466,000 | 5,466,000 | 3,573,000 | 3,573,000 | ||||||||||||

2021 Cheniere Convertible Unsecured Notes, net of discount (4) | 888,296 | 858,091 | 879,938 | 825,413 | ||||||||||||

2025 CCH HoldCo II Convertible Senior Notes (4) | 1,079,479 | 1,071,219 | 1,050,588 | 914,363 | ||||||||||||

2045 Cheniere Convertible Senior Notes, net of discount (5) | 306,465 | 334,375 | 305,938 | 331,919 | ||||||||||||

(1) | Includes 2016 SPLNG Senior Notes, net of discount; 2020 SPLNG Senior Notes; 2021 SPL Senior Notes, net of premium; 2022 SPL Senior Notes; 2023 SPL Senior Notes, net of premium; 2024 SPL Senior Notes and 2025 SPL Senior Notes (collectively, the “Senior Notes”). The Level 2 estimated fair value was based on quotes obtained from broker-dealers or market makers of our Senior Notes and other similar instruments. |

(2) | The Level 3 estimated fair value approximates the principal amount because the interest rates are variable and reflective of market rates and the debt may be repaid, in full or in part, at any time without penalty. |

(3) | Includes 2015 SPL Credit Facilities, SPL Working Capital Facility, 2016 CQP Credit Facilities and 2015 CCH Credit Facility. |

20

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

(4) | The Level 3 estimated fair value was calculated based on inputs that are observable in the market or that could be derived from, or corroborated with, observable market data, including our stock price and interest rates based on debt issued by parties with comparable credit ratings to us and inputs that are not observable in the market. |

(5) | The Level 1 estimated fair value was based on unadjusted quoted prices in active markets for identical liabilities that we had the ability to access at the measurement date. |

NOTE 11—INCOME TAXES

We are not presently a taxpayer for federal or state income tax purposes and have not recorded a provision for federal or state income taxes in any of the periods included in the accompanying Consolidated Financial Statements. However, we are presently an international taxpayer and have recorded a net provision of $0.6 million and $0.7 million for the three months ended March 31, 2016 and 2015, respectively, for international income taxes.

We experienced an ownership change within the provisions of Internal Revenue Code (“IRC”) Section 382 in 2008, 2010 and 2012. An analysis of the annual limitation on the utilization of our net operating losses (“NOLs”) was performed in accordance with IRC Section 382. It was determined that IRC Section 382 will not limit the use of our NOLs in full over the carryover period. We will continue to monitor trading activity in our shares which may cause an additional ownership change which could ultimately affect our ability to fully utilize our existing tax NOL carryforwards.

NOTE 12—SHARE-BASED COMPENSATION

We have granted stock, restricted stock, phantom units and options to purchase common stock to employees, outside directors and a consultant under the Amended and Restated 2003 Stock Incentive Plan, as amended (the “2003 Plan”), 2011 Incentive Plan, as amended (the “2011 Plan”) and the 2015 Long-Term Cash Incentive Plan (the “2015 Plan”).

The 2003 Plan and 2011 Plan provide for the issuance of 21.0 million shares and 35.0 million shares, respectively, of our common stock that may be in the form of non-qualified stock options, incentive stock options, purchased stock, restricted (non-vested) stock, bonus (unrestricted) stock, stock appreciation rights, phantom units and other share-based performance awards deemed by the Compensation Committee of our Board of Directors (the “Compensation Committee”) to be consistent with the purposes of the 2003 Plan and 2011 Plan. As of March 31, 2016, all of the shares under the 2003 Plan have been granted and 26.8 million shares, net of cancellations, have been granted under the 2011 Plan. The 2015 Plan generally provides for cash-settled awards in the form of stock appreciation rights, phantom unit awards, performance unit awards, other-stock based awards and cash awards. The 2014-2018 Long-Term Cash Incentive Program (the “2014-2018 LTIP”) is a sub-plan of the 2015 Plan and provides for performance-based phantom unit awards. As of March 31, 2016, 5.4 million phantom units have been granted under the 2015 Plan.

Total share-based compensation expense consisted of the following (in thousands):

Three Months Ended March 31, | ||||||||

2016 | 2015 | |||||||

Total share-based compensation | $ | 17,525 | $ | 17,991 | ||||

Capitalized share-based compensation | (1,354 | ) | (1,851 | ) | ||||

Total share-based compensation expense, net | $ | 16,171 | $ | 16,140 | ||||

The total unrecognized compensation cost at March 31, 2016 relating to non-vested share-based compensation arrangements was $132.6 million, which is expected to be recognized over a weighted average period of 2.0 years.

We received zero and $1.0 million in the three months ended March 31, 2016 and 2015, respectively, of proceeds from the exercise of stock options.

21

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

NOTE 13—NET LOSS PER SHARE ATTRIBUTABLE TO COMMON STOCKHOLDERS

Basic net loss per share attributable to common stockholders (“EPS”) excludes dilution and is computed by dividing net loss attributable to common stockholders by the weighted average number of common shares outstanding during the period. Diluted EPS reflects potential dilution and is computed by dividing net loss attributable to common stockholders by the weighted average number of common shares outstanding during the period increased by the number of additional common shares that would have been outstanding if the potential common shares had been issued.

The following table (in thousands, except for loss per share) reconciles basic and diluted weighted average common shares outstanding for the three months ended March 31, 2016 and 2015:

Three Months Ended March 31, | ||||||||

2016 | 2015 | |||||||

Weighted average common shares outstanding: | ||||||||

Basic | 228,138 | 226,328 | ||||||

Dilutive common stock options (1) | — | — | ||||||

Diluted | 228,138 | 226,328 | ||||||

Basic and diluted net loss per share attributable to common stockholders | $ | (1.41 | ) | $ | (1.18 | ) | ||

(1) | Stock options and unvested stock of 7.4 million shares and 10.3 million shares as of March 31, 2016 and 2015, respectively, representing securities that could potentially dilute basic EPS in the future, were not included in the diluted net loss per share computations because their effect would have been anti-dilutive. In addition, 82.7 million and 21.1 million shares in aggregate, issuable upon conversion of the 2021 Cheniere Convertible Unsecured Notes, the 2025 CCH HoldCo II Convertible Senior Notes and the 2045 Cheniere Convertible Senior Notes, were not included in the computation of diluted net loss per share for the three months ended March 31, 2016 and 2015, respectively, because the computation of diluted net loss per share utilizing the “if-converted” method at the share price as of March 31, 2016 and 2015, respectively, would be anti-dilutive. |

NOTE 14—COMMITMENTS AND CONTINGENCIES

Cheniere has various contractual obligations which are recorded as liabilities in our Consolidated Financial Statements. Other items, such as certain purchase commitments and other executed contracts which do not meet the definition of a liability as of March 31, 2016, are not recognized as liabilities.

Parallax Litigation

In 2015, our wholly owned subsidiary, Cheniere LNG Terminals, LLC (“CLNGT”), entered into discussions with Parallax Enterprises, LLC (“Parallax Enterprises”) regarding the potential joint development of two liquefaction plants in Louisiana (the “Potential Liquefaction Transactions”). While the parties negotiated regarding the Potential Liquefaction Transactions, CLNGT loaned Parallax Enterprises approximately $46 million, as reflected in a secured note dated April 23, 2015, as amended on June 30, 2015, September 30, 2015, and November 4, 2015 (the “Secured Note”). The Secured Note was secured by all assets of Parallax Enterprises and its subsidiary entities. On June 30, 2015, Parallax Enterprises’ parent entity, Parallax Energy LLC (“Parallax Energy”), executed a Pledge and Guarantee Agreement further securing repayment of the Secured Note by providing a parent guaranty and a pledge of all of the equity of Parallax Enterprises in satisfaction of the Secured Note (the “Pledge Agreement”). CLNGT and Parallax Enterprises never executed a definitive agreement to pursue the Potential Liquefaction Transactions. The Secured Note matured on December 11, 2015, and Parallax Enterprises failed to make payment. On February 3, 2016, CLNGT filed an action against Parallax Energy, Parallax Enterprises, and certain of Parallax Enterprises’ subsidiary entities, styled Cause No. 4:16-cv-00286, Cheniere LNG Terminals, LLC v. Parallax Energy LLC, et al., in the United States District Court for the Southern District of Texas (the “Texas Suit”). CLNGT asserted claims in the Texas Suit for (1) recovery of all amounts due under the Secured Note and (2) declaratory relief establishing that CLNGT is entitled to enforce its rights under the Secured Note and Pledge Agreement in accordance with each instrument’s terms and that CLNGT has no obligations of any sort to Parallax Enterprises concerning the Potential Liquefaction Transactions. On March 11, 2016, Parallax Enterprises and the other defendants in the Texas Suit moved to dismiss the suit for lack of subject matter jurisdiction. CLNGT has responded to that motion, and it remains pending before the court.

22

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

On March 11, 2016, Parallax Enterprises filed a suit against us and CLNGT styled Civil Action No. 62-810, Parallax Enterprises LLP v. Cheniere Energy, Inc. and Cheniere LNG Terminals, LLC, in the 25th Judicial District Court of Plaquemines Parish, Louisiana (the “Louisiana Suit”), wherein Parallax Enterprises asserted claims for breach of contract, fraudulent inducement, negligent misrepresentation, detrimental reliance, unjust enrichment, and violation of the Louisiana Unfair Trade Practices Act. Parallax Enterprises predicated its claims in the Louisiana Suit on an allegation that we and CLNGT breached a purported agreement to jointly develop the Potential Liquefaction Transactions. Parallax Enterprises seeks $400 million in alleged economic damages and rescission of the Secured Note. On April 11, 2016, we and CLNGT removed the Louisiana Suit to the United States District Court for the Eastern District of Louisiana, where it is pending as Civil Action No. 2:16-cv-03209-CJB-SS. On April 18, 2016, we and CLNGT filed a motion in the Louisiana Suit seeking (1) dismissal of all claims against us for lack of personal jurisdiction, (2) dismissal, stay, or transfer of the suit to the United States District Court for the Southern District of Texas in deference to the first-filed Texas Suit, and (3) alternatively, transfer of the suit for convenience of the parties and witnesses. Our motion is set for oral argument on May 18, 2016. We do not expect that the resolution of this litigation will have a material adverse impact on our financial results.

Obligations under Certain Guarantee Contracts

Cheniere and certain of its subsidiaries enter into guarantee arrangements in the normal course of business to facilitate transactions with third parties. These arrangements include financial guarantees, letters of credit and debt guarantees. As of March 31, 2016 and December 31, 2015, there were no liabilities recognized under these guarantee arrangements.

NOTE 15—BUSINESS SEGMENT INFORMATION

We have two reportable segments: LNG terminal segment and LNG and natural gas marketing segment. We determine our reportable segments by identifying each segment that engaged in business activities from which it may earn revenues and incur expenses, had operating results regularly reviewed by the entities’ chief operating decision maker for purposes of resource allocation and performance assessment, and had discrete financial information. Substantially all of our revenues from external customers are attributed to the United States. Substantially all of our long-lived assets are located in the United States.

Our LNG terminal segment consists of the Sabine Pass and Corpus Christi LNG terminals. We own and operate the Sabine Pass LNG terminal located on the Sabine-Neches Waterway less than four miles from the Gulf Coast through our ownership interest in and management agreements with Cheniere Partners. We own 100% of the general partner interest in Cheniere Partners and 80.1% of the common shares of Cheniere Holdings, which owns a 55.9% limited partner interest in Cheniere Partners. We are also developing and constructing a second natural gas liquefaction and export facility at the Corpus Christi LNG terminal near Corpus Christi, Texas.

Our LNG and natural gas marketing segment consists of LNG and natural gas marketing activities by Cheniere Marketing. Cheniere Marketing is developing a platform for LNG sales to international markets with professional staff based in the United States, United Kingdom, Singapore and Chile.

23

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

The following table (in thousands) summarizes revenues (losses) and loss from operations for each of our reporting segments:

Segments | |||||||||||||||

LNG Terminal | LNG & Natural Gas Marketing | Corporate and Other (1) | Total Consolidation | ||||||||||||

Three Months Ended March 31, 2016 | |||||||||||||||

Revenues from external customers (2) | $ | 65,551 | $ | 2,704 | $ | 826 | $ | 69,081 | |||||||

Intersegment revenues (losses) (3) | 918 | 7,594 | (8,512 | ) | — | ||||||||||

Depreciation and amortization expense | 17,973 | 315 | 5,801 | 24,089 | |||||||||||

Loss from operations | (12,549 | ) | (30,547 | ) | (47,463 | ) | (90,559 | ) | |||||||

Interest expense, net of capitalized interest | (51,366 | ) | — | (24,971 | ) | (76,337 | ) | ||||||||

Loss before income taxes and non-controlling interest (4) | (240,971 | ) | (30,680 | ) | (76,707 | ) | (348,358 | ) | |||||||

Share-based compensation | 2,777 | 4,889 | 9,859 | 17,525 | |||||||||||

Expenditures for additions to long-lived assets | 1,501,378 | 235 | 6,446 | 1,508,059 | |||||||||||

Three Months Ended March 31, 2015 | |||||||||||||||

Revenues from external customers (2) | $ | 66,802 | $ | 662 | $ | 905 | $ | 68,369 | |||||||

Intersegment revenues (losses) (3) | 103 | 7,017 | (7,120 | ) | — | ||||||||||

Depreciation and amortization expense | 14,941 | 200 | 2,628 | 17,769 | |||||||||||

Loss from operations | (24,335 | ) | (5,183 | ) | (30,726 | ) | (60,244 | ) | |||||||

Interest expense, net of capitalized interest | (42,845 | ) | — | (16,767 | ) | (59,612 | ) | ||||||||

Loss before income taxes and non-controlling interest (4) | (277,655 | ) | (5,390 | ) | (52,121 | ) | (335,166 | ) | |||||||

Share-based compensation | 3,197 | 4,035 | 10,759 | 17,991 | |||||||||||

Expenditures for additions to long-lived assets | 590,245 | 714 | 28,781 | 619,740 | |||||||||||

(1) | Includes corporate activities, business development, oil and gas exploration, development and exploitation, strategic activities and certain intercompany eliminations. These activities have been included in the corporate and other column due to the lack of a material impact that these activities have on our Consolidated Financial Statements. |

(2) | Substantially all of the LNG terminal revenues relate to regasification capacity reservation fee payments made by Total Gas & Power North America, Inc. and Chevron U.S.A. Inc. LNG and natural gas marketing and trading revenue consists primarily of the domestic marketing of natural gas imported into the Sabine Pass LNG terminal. |