Calvert Conservative Allocation Fund

Class A Shares - CCLAX Class C Shares - CALCX Class I Shares - CFAIX Class R6 Shares - CAARX

Calvert Moderate Allocation Fund

Class A Shares - CMAAX Class C Shares - CMACX Class I Shares - CLAIX Class R6 Shares - CAMRX

Calvert Growth Allocation Fund

Class A Shares - CAAAX Class C Shares - CAACX Class I Shares – CAGIX Class R6 Shares - CGARX

Prospectus Dated

February 1, 2023

The Securities and Exchange Commission (“SEC”) has not approved or disapproved these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This Prospectus contains important information about the Funds and the services available to shareholders. Please save it for reference.

Table of Contents

Fund Summaries | 3 |

Conservative Allocation Fund | 3 |

Moderate Allocation Fund | 9 |

Growth Allocation Fund | 15 |

Important Information Regarding Fund Shares | 21 |

Investment Objectives & Principal Policies and Risks | 22 |

About Responsible Investing | 40 |

Management and Organization | 42 |

Valuing Shares | 42 |

Purchasing Shares | 43 |

Sales Charges | 48 |

Redeeming Shares | 50 |

Shareholder Account Features | 51 |

Potential Conflicts of Interest | 53 |

Additional Tax Information | 55 |

Financial Highlights | 57 |

Conservative Allocation Fund | 57 |

Moderate Allocation Fund | 59 |

Growth Allocation Fund | 61 |

Appendix A - The Calvert Principles for Responsible Investment | 63 |

Appendix B - Financial Intermediary Sales Charge Variations | 65 |

Calvert Allocation Funds2Prospectus dated February 1, 2023

Fund Summaries

Calvert Conservative Allocation Fund

The Fund's investment objective is to seek current income and capital appreciation, consistent with the preservation of capital.

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. Investors may also pay commissions or other fees to their financial intermediary, which are not reflected below.

| Class A | Class C | Class I | Class R6 |

Maximum Sales Charge (load) Imposed on Purchases (as a percentage of offering price) | ||||

Maximum Deferred Sales Charge (load) (as a percentage of the lower of net asset value at purchase or redemption) |

(1)

| Class A | Class C | Class I | Class R6 |

Management Fees | ||||

Distribution and Service (12b-1) Fees | ||||

Other Expenses | ||||

Acquired Fund Fees and Expenses (1) | ||||

Total Annual Fund Operating Expenses |

(1)

| Expenses with Redemption | Expenses without Redemption | ||||||

1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | |

Class A shares | $ | $ | $ | $ | $ | $ | $ | $ |

Class C shares | $ | $ | $ | $ | $ | $ | $ | $ |

Class I shares | $ | $ | $ | $ | $ | $ | $ | $ |

Class R6 shares | $ | $ | $ | $ | $ | $ | $ | $ |

Calvert Allocation Funds3Prospectus dated February 1, 2023

Incidental to its main investment strategy, the Fund may also invest in (1) derivative instruments, including, but not limited to, futures, options and swaps; (2) exchange-traded funds (“ETFs”); and (3) U.S. Treasury securities, including Treasury-Inflation Protected Securities. The Fund will use these instruments to facilitate the periodic rebalancing of the Fund’s portfolio to maintain its target asset allocation, to make tactical asset allocations (including to gain or limit exposure to certain asset classes and/or sectors, and/or to manage duration) and to assist in managing cash. The Fund may also lend its securities.

The above asset allocation percentages are allocation targets. The Adviser has discretion to reallocate the Fund’s assets among underlying Calvert funds. The Adviser monitors the Fund’s allocation and may rebalance or reallocate the Fund’s assets (1) based on its view of economic and market factors and events or (2) to adjust for shifts in the style biases of the underlying funds. The Adviser also evaluates any necessary rebalancing to reflect different target asset class allocations based on changed economic and market conditions.

Responsible Investing. In accordance with its asset allocation strategy, the Fund will invest in Calvert income and equity funds that consider responsible investment criteria. The underlying fund portfolio manager(s) seek to invest in companies that manage environmental, social and governance (“ESG”) risk exposures adequately and that are not exposed to excessive ESG risk through their principal business activities. Companies are analyzed by the investment adviser’s ESG analysts utilizing The Calvert Principles for Responsible Investment (“Principles”), a framework for considering ESG factors (a copy of which is included as an appendix to the Fund’s Prospectus). Each company is evaluated relative to an appropriate peer group based on material ESG factors as determined by the investment adviser. The underlying funds generally invest in issuers that are believed by the investment adviser to operate in accordance with the Principles and may also invest in issuers that the investment adviser believes are likely to operate in accordance with the Principles pending the investment adviser’s engagement activity with such issuer.

Fund-of-Funds Structure. The Fund invests in other Calvert funds (“underlying funds”) in a fund-of-funds structure. The Fund’s asset allocation strategy and its selection of particular underlying funds may cause the Fund to underperform funds with similar investment objectives. The Fund’s performance is dependent upon the performance of the underlying funds and the Fund is subject to all of the risks of the underlying funds. The risks discussed below are the principal risks applicable to the Fund either directly or through its investment in the underlying funds and accordingly, references to the Fund below may be to the Fund or one or more underlying funds.

Market Risk. The value of investments held by the Fund may increase or decrease in response to social, economic, political, financial, public health crises or other disruptive events (whether real, expected or perceived) in the U.S. and global markets and include events such as war, natural disasters, epidemics and pandemics, terrorism, conflicts and social unrest. These events may negatively impact broad segments of businesses and populations and may exacerbate pre-existing risks to the Fund. The frequency and magnitude of resulting changes in the value of the Fund’s investments cannot be predicted. Certain securities and other investments held by the Fund may experience increased volatility, illiquidity, or other potentially adverse effects in reaction to changing market conditions. Monetary and/or fiscal actions taken by U.S. or foreign governments to stimulate or stabilize the global economy may not be effective and could lead to high market volatility. No active trading market may exist for certain investments held by the Fund, which may impair the ability of the Fund to sell or to realize the current valuation of such investments in the event of the need to liquidate such assets.

Calvert Allocation Funds4Prospectus dated February 1, 2023

Interest Rate Risk. In general, the value of income securities will fluctuate based on changes in interest rates. The value of these securities is likely to increase when interest rates fall and decline when interest rates rise. Duration measures the time-weighted expected cash flows of a fixed-income security, while maturity refers to the amount of time until a fixed-income security matures. Generally, securities with longer durations or maturities are more sensitive to changes in interest rates than securities with shorter durations or maturities, causing them to be more volatile. Conversely, fixed-income securities with shorter durations or maturities will be less volatile but may provide lower returns than fixed-income securities with longer durations or maturities. In a rising interest rate environment, the duration of income securities that have the ability to be prepaid or called by the issuer may be extended. In a declining interest rate environment, the proceeds from prepaid or maturing instruments may have to be reinvested at a lower interest rate. Certain instruments held by the Fund pay an interest rate based on the London Interbank Offered Rate (“LIBOR”), which is the average offered rate for various maturities of short-term loans between certain major international banks. LIBOR is used throughout global banking and financial industries to determine interest rates for a variety of financial instruments (such as debt instruments and derivatives) and borrowing arrangements. The ICE Benchmark Administration Limited, the administrator of LIBOR, ceased publishing certain LIBOR settings on December 31, 2021, and is expected to cease publishing the remaining LIBOR settings on June 30, 2023. Although the transition process away from LIBOR has become increasingly well defined, the impact on certain debt securities, derivatives and other financial instruments that utilize LIBOR remains uncertain. The phase-out of LIBOR may result in, among other things, increased volatility or illiquidity in markets for instruments based on LIBOR and changes in the value of such instruments.

Credit Risk. Investments in fixed income and other debt obligations, including loans, (referred to below as “debt instruments”) are subject to the risk of non-payment of scheduled principal and interest. Changes in economic conditions or other circumstances may reduce the capacity of the party obligated to make principal and interest payments on such instruments and may lead to defaults. Such non-payments and defaults may reduce the value of Fund shares and income distributions. The value of debt instruments also may decline because of concerns about the issuer’s ability to make principal and interest payments. In addition, the credit ratings of debt instruments may be lowered if the financial condition of the party obligated to make payments with respect to such instruments deteriorates. In the event of bankruptcy of the issuer of a debt instrument, the Fund could experience delays or limitations with respect to its ability to realize the benefits of any collateral securing the instrument. In order to enforce its rights in the event of a default, bankruptcy or similar situation, the Fund may be required to retain legal or similar counsel, which may increase the Fund’s operating expenses and adversely affect net asset value.

Mortgage- and Asset-Backed Securities Risk. Mortgage- and asset-backed securities represent interests in “pools” of commercial or residential mortgages or other assets, including consumer loans or receivables. Movements in interest rates (both increases and decreases) may quickly and significantly reduce the value of certain types of mortgage- and asset-backed securities. Although certain mortgage- and asset-backed securities are guaranteed as to timely payment of interest and principal by a government entity, the market price for such securities is not guaranteed and will fluctuate. The purchase of mortgage- and asset-backed securities issued by non-government entities may entail greater risk than such securities that are issued or guaranteed by a government entity. Mortgage- and asset-backed securities issued by non-government entities may offer higher yields than those issued by government entities, but may also be subject to greater volatility than government issues and can also be subject to greater credit risk and the risk of default on the underlying mortgages or other assets. Investments in mortgage- and asset-backed securities are subject to both extension risk, where borrowers pay off their debt obligations more slowly in times of rising interest rates, and prepayment risk, where borrowers pay off their debt obligations sooner than expected in times of declining interest rates.

U.S. Government Securities Risk. Although certain U.S. Government-sponsored agencies (such as the Federal Home Loan Mortgage Corporation and the Federal National Mortgage Association) may be chartered or sponsored by acts of Congress, their securities are neither issued nor guaranteed by the U.S. Treasury. U.S. Treasury securities generally have a lower return than other obligations because of their higher credit quality and market liquidity.

Lower Rated Investments Risk. Investments rated below investment grade and comparable unrated investments (sometimes referred to as “junk”) have speculative characteristics because of the credit risk associated with their issuers. Changes in economic conditions or other circumstances typically have a greater effect on the ability of issuers of lower rated investments to make principal and interest payments than they do on issuers of higher rated investments. An economic downturn generally leads to a higher non-payment rate, and a lower rated investment may lose significant value before a default occurs. Lower rated investments typically are subject to greater price volatility and illiquidity than higher rated investments.

Calvert Allocation Funds5Prospectus dated February 1, 2023

Absolute Return Strategy. The Fund may invest in underlying funds that employ an “absolute return” investment approach. A fund that employs an absolute return strategy typically benchmarks itself to an index of cash instruments and seeks to achieve returns that are largely independent of broad movements in stocks and bonds. Unlike equity funds, such funds should not be expected to benefit from general equity market returns. Different from fixed income funds, such funds may not generate current income and should not be expected to experience price appreciation as interest rates decline. Although an underlying fund’s investment adviser seeks to maximize absolute return, an underlying fund may not generate positive returns.

Additional Risks of Loans. Loans are traded in a private, unregulated inter-dealer or inter-bank resale market and are generally subject to contractual restrictions that must be satisfied before a loan can be bought or sold. These restrictions may impede the Fund’s ability to buy or sell loans (thus affecting their liquidity) and may negatively impact the transaction price. See also “Market Risk” above. It also may take longer than seven days for transactions in loans to settle. Due to the possibility of an extended loan settlement process, the Fund may hold cash, sell investments or temporarily borrow from banks or other lenders to meet short-term liquidity needs, such as to satisfy redemption requests from Fund shareholders. The types of covenants included in loan agreements generally vary depending on market conditions, the creditworthiness of the issuer, the nature of the collateral securing the loan and possibly other factors. Loans with fewer covenants that restrict activities of the borrower may provide the borrower with more flexibility to take actions that may be detrimental to the loan holders and provide fewer investor protections in the event of such actions or if covenants are breached. The Fund may experience relatively greater realized or unrealized losses or delays and expense in enforcing its rights with respect to loans with fewer restrictive covenants. Loans to entities located outside of the U.S. (including loans to sovereign entities) may have substantially different lender protections and covenants as compared to loans to U.S. entities and may involve greater risks. The Fund may have difficulties and incur expense enforcing its rights with respect to non-U.S. loans and such loans could be subject to bankruptcy laws that are materially different than in the U.S. Loans may be structured such that they are not securities under securities law, and in the event of fraud or misrepresentation by a borrower, lenders may not have the protection of the anti-fraud provisions of the federal securities laws. Loans are also subject to risks associated with other types of income investments, including credit risk and risks of lower rated investments.

Borrowing Risk. The Fund may invest in underlying funds that borrow for investment purposes. Borrowing cash to increase investments (sometimes referred to as “leverage”) may exaggerate the effect on the Fund’s net asset value of any increase or decrease in the value of the security purchased with the borrowing. There can be no assurance that the use of borrowings will be successful. In connection with its borrowings, the Fund will be required to maintain specified asset coverage with respect to such borrowings by applicable federal securities laws and the terms of its credit facility with the lender. The Fund may be required to dispose of portfolio investments on unfavorable terms if market fluctuations or other factors cause the required asset coverage to be less than the prescribed amount. Borrowings involve additional expense to the Fund.

Foreign Investment Risk. Foreign investments can be adversely affected by political, economic and market developments abroad, including the imposition of economic and other sanctions by the United States or another country against a particular country or countries, organizations, entities and/or individuals. There may be less publicly available information about foreign issuers because they may not be subject to reporting practices, requirements or regulations comparable to those to which United States companies are subject. Adverse changes in investment regulations, capital requirements or exchange controls could adversely affect the value of the Fund's investments. Foreign markets may be smaller, less liquid and more volatile than the major markets in the United States and, as a result, Fund share values may be more volatile. Trading in foreign markets typically involves higher expense than trading in the United States. The Fund may have difficulties enforcing its legal or contractual rights in a foreign country. Depositary receipts are subject to many of the risks associated with investing directly in foreign instruments.

Currency Risk. Exchange rates for currencies fluctuate daily. The value of foreign investments may be affected favorably or unfavorably by changes in currency exchange rates in relation to the U.S. dollar. Currency markets generally are not as regulated as securities markets and currency transactions are subject to settlement, custodial and other operational risks.

Emerging Markets Investment Risk. Investment markets within emerging market countries are typically smaller, less liquid, less developed and more volatile than those in more developed markets like the United States, and may be focused in certain sectors. Emerging market securities often involve greater risks than developed market securities. The information available about an emerging market issuer may be less reliable than for comparable issuers in more developed capital markets.

Calvert Allocation Funds6Prospectus dated February 1, 2023

Equity Securities Risk. The value of equity securities and related instruments may decline in response to adverse changes in the economy or the economic outlook; deterioration in investor sentiment; interest rate, currency, and commodity price fluctuations; adverse geopolitical, social or environmental developments; issuer and sector-specific considerations; unexpected trading activity among retail investors; or other factors. Market conditions may affect certain types of stocks to a greater extent than other types of stocks. If the stock market declines in value, the value of the Fund’s equity securities will also likely decline. Although prices can rebound, there is no assurance that values will return to previous levels.

Smaller and Mid-Sized Company Risk. The stocks of smaller and mid-sized companies are generally subject to greater price fluctuations, limited liquidity, higher transaction costs and higher investment risk than the stocks of larger, more established companies. Such companies may have limited product lines, markets or financial resources, may be dependent on a limited management group, and may lack substantial capital reserves or an established performance record. There may be generally less publicly available information about such companies than for larger, more established companies. Stocks of these companies frequently have lower trading volumes making them more volatile and potentially less liquid and more difficult to value.

Large-Cap Growth and Value Risk. Because the Fund may invest in stocks of large-cap growth and/or value companies, it is subject to the risk of underperforming the overall stock market during periods in which stocks of such companies are out of favor and generate lower returns than the market as a whole.

Money Market Instrument Risk. Money market instruments may be adversely affected by market and economic events, such as a sharp rise in prevailing short-term interest rates; adverse developments in the banking industry, which issues or guarantees many money market instruments; adverse economic, political or other developments affecting issuers of money market instruments; changes in the credit quality of issuers; and default by a counterparty.

Derivatives Risk. The Fund’s exposure to derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other investments. The use of derivatives can lead to losses because of adverse movements in the price or value of the security, instrument, index, currency, commodity, economic indicator or event underlying a derivative (“reference instrument”), due to failure of a counterparty or due to tax or regulatory constraints. Derivatives may create leverage in the Fund, which represents a non-cash exposure to the underlying reference instrument. Leverage can increase both the risk and return potential of the Fund. Derivatives risk may be more significant when derivatives are used to enhance return or as a substitute for a cash investment position, rather than solely to hedge the risk of a position held by the Fund. Use of derivatives involves the exercise of specialized skill and judgment, and a transaction may be unsuccessful in whole or in part because of market behavior or unexpected events. Changes in the value of a derivative (including one used for hedging) may not correlate perfectly with the underlying reference instrument. Derivative instruments traded in over-the-counter markets may be difficult to value, may be illiquid, and may be subject to wide swings in valuation caused by changes in the value of the underlying reference instrument. If a derivative’s counterparty is unable to honor its commitments, the value of Fund shares may decline and the Fund could experience delays in (or be unable to achieve) the return of collateral or other assets held by the counterparty. The loss on derivative transactions may substantially exceed the initial investment. A derivative investment also involves the risks relating to the reference instrument underlying the investment.

ETF Risk. ETFs are subject to the risks of investing in the underlying securities or other investments. ETF shares may trade at a premium or discount to net asset value and are subject to secondary market trading risks. In addition, the Fund will bear a pro rata portion of the operating expenses of an ETF in which it invests.

Liquidity Risk. The Fund is exposed to liquidity risk when trading volume, lack of a market maker or trading partner, large position size, market conditions, or legal restrictions impair its ability to sell particular investments or to sell them at advantageous market prices. Consequently, the Fund may have to accept a lower price to sell an investment or continue to hold it or keep the position open, sell other investments to raise cash or abandon an investment opportunity, any of which could have a negative effect on the Fund’s performance. These effects may be exacerbated during times of financial or political stress.

Securities Lending Risk. Securities lending involves a possible delay in recovery of the loaned securities or a possible loss of rights in the collateral if the borrower fails financially. The Fund could also lose money if the value of the collateral decreases.

Calvert Allocation Funds7Prospectus dated February 1, 2023

Responsible Investing Risk. Investing primarily in responsible investments carries the risk that, under certain market conditions, the Fund may underperform funds that do not utilize a responsible investment strategy. The application of responsible investment criteria may affect the Fund’s exposure to certain sectors or types of investments, and may impact the Fund’s relative investment performance depending on whether such sectors or investments are in or out of favor in the market. An investment’s ESG performance or the investment adviser's assessment of such performance may change over time, which could cause the Fund to temporarily hold securities that do not comply with the Fund’s responsible investment criteria. In evaluating an investment, the investment adviser is dependent upon information and data that may be incomplete, inaccurate or unavailable, which could adversely affect the analysis of the ESG factors relevant to a particular investment. Successful application of the Fund’s responsible investment strategy will depend on the investment adviser's skill in properly identifying and analyzing material ESG issues.

General Fund Investing Risks.

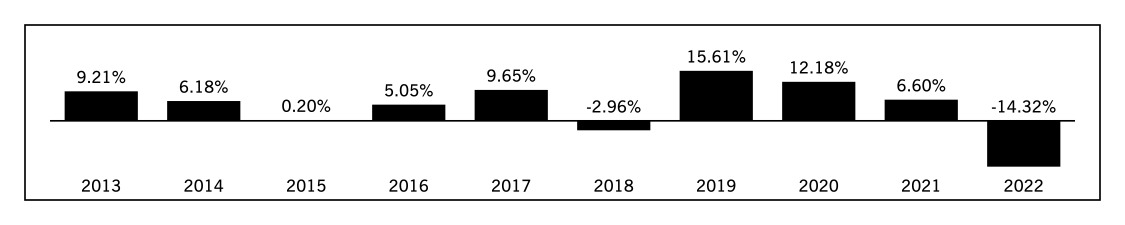

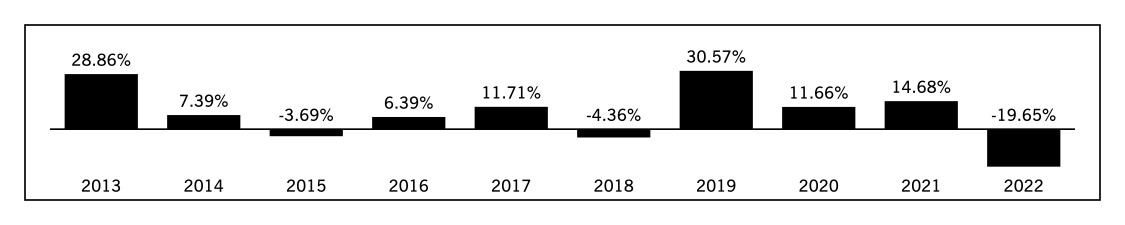

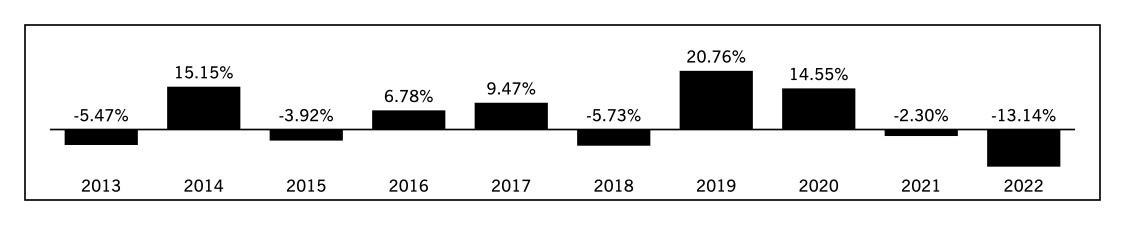

CRM became the investment adviser to the Fund on December 31, 2016. Performance reflected prior to such date is that of the Fund’s former investment adviser. The Fund’s performance for certain periods reflects the effects of expense reductions. Absent these reductions, performance for certain periods would have been lower. Updated Fund performance information can be obtained by visiting

Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

Year Total Return | - | - |

For the ten years ended December 31, 2022, the

Calvert Allocation Funds8Prospectus dated February 1, 2023

| One Year | Five Years | Ten Years |

Class A Return Before Taxes | - | ||

Class A Return After Taxes on Distributions | - | ||

Class A Return After Taxes on Distributions and Sale of Class A Shares | - | ||

Class C Return Before Taxes | - | ||

Class I Return Before Taxes | - | ||

Class R6 Return Before Taxes | - | ||

Bloomberg U.S. Aggregate Bond Index | - | ||

Conservative Allocation Blended Benchmark* | - |

*

Management

Investment Adviser. Calvert Research and Management (“CRM” or the “Adviser”).

Portfolio Managers

Justin H. Bourgette, CFA, Vice President of CRM, has managed the Fund since December 31, 2016.

Schuyler Hooper, CFA, Vice President of CRM, has managed the Fund since November 12, 2021.

For important information about purchase and sale of shares, taxes and financial intermediary compensation, please turn to “Important Information Regarding Fund Shares” on page 24 of this Prospectus.

Calvert Allocation Funds9Prospectus dated February 1, 2023

Calvert Moderate Allocation Fund

The Fund's investment objective is to seek long-term capital appreciation and growth of income, with current income a secondary objective.

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. Investors may also pay commissions or other fees to their financial intermediary, which are not reflected below.

| Class A | Class C | Class I | Class R6 |

Maximum Sales Charge (load) Imposed on Purchases (as a percentage of offering price) | ||||

Maximum Deferred Sales Charge (load) (as a percentage of the lower of net asset value at purchase or redemption) |

(1)

| Class A | Class C | Class I | Class R6 |

Management Fees | ||||

Distribution and Service (12b-1) Fees | ||||

Other Expenses | ||||

Acquired Fund Fees and Expenses (1) | ||||

Total Annual Fund Operating Expenses |

(1)

| Expenses with Redemption | Expenses without Redemption | ||||||

1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | |

Class A shares | $ | $ | $ | $ | $ | $ | $ | $ |

Class C shares | $ | $ | $ | $ | $ | $ | $ | $ |

Class I shares | $ | $ | $ | $ | $ | $ | $ | $ |

Class R6 shares | $ | $ | $ | $ | $ | $ | $ | $ |

Calvert Allocation Funds10Prospectus dated February 1, 2023

Incidental to its main investment strategy, the Fund may also invest in (1) derivative instruments, including, but not limited to, futures, options and swaps; (2) exchange-traded funds (“ETFs”); and (3) U.S. Treasury securities, including Treasury-Inflation Protected Securities. The Fund will use these instruments to facilitate the periodic rebalancing of the Fund’s portfolio to maintain its target asset allocation, to make tactical asset allocations (including to gain or limit exposure to certain asset classes and/or sectors, and/or to manage duration) and to assist in managing cash. The Fund may also lend its securities.

The above asset allocation percentages are allocation targets. The Adviser has discretion to reallocate the Fund’s assets among underlying Calvert funds. The Adviser monitors the Fund’s allocation and may rebalance or reallocate the Fund’s assets (1) based on its view of economic and market factors and events or (2) to adjust for shifts in the style biases of the underlying funds. The Adviser also evaluates any necessary rebalancing to reflect different target asset class allocations based on changed economic and market conditions.

Responsible Investing. In accordance with its asset allocation strategy, the Fund will invest in Calvert income and equity funds that consider responsible investment criteria. The underlying fund portfolio manager(s) seek to invest in companies that manage environmental, social and governance (“ESG”) risk exposures adequately and that are not exposed to excessive ESG risk through their principal business activities. Companies are analyzed by the investment adviser’s ESG analysts utilizing The Calvert Principles for Responsible Investment (“Principles”), a framework for considering ESG factors (a copy of which is included as an appendix to the Fund’s Prospectus). Each company is evaluated relative to an appropriate peer group based on material ESG factors as determined by the investment adviser. The underlying funds generally invest in issuers that are believed by the investment adviser to operate in accordance with the Principles and may also invest in issuers that the investment adviser believes are likely to operate in accordance with the Principles pending the investment adviser’s engagement activity with such issuer.

Fund-of-Funds Structure. The Fund invests in other Calvert funds (“underlying funds”) in a fund-of-funds structure. The Fund’s asset allocation strategy and its selection of particular underlying funds may cause the Fund to underperform funds with similar investment objectives. The Fund’s performance is dependent upon the performance of the underlying funds and the Fund is subject to all of the risks of the underlying funds. The risks discussed below are the principal risks applicable to the Fund either directly or through its investment in the underlying funds and accordingly, references to the Fund below may be to the Fund or one or more underlying funds.

Market Risk. The value of investments held by the Fund may increase or decrease in response to social, economic, political, financial, public health crises or other disruptive events (whether real, expected or perceived) in the U.S. and global markets and include events such as war, natural disasters, epidemics and pandemics, terrorism, conflicts and social unrest. These events may negatively impact broad segments of businesses and populations and may exacerbate pre-existing risks to the Fund. The frequency and magnitude of resulting changes in the value of the Fund’s investments cannot be predicted. Certain securities and other investments held by the Fund may experience increased volatility, illiquidity, or other potentially adverse effects in reaction to changing market conditions. Monetary and/or fiscal actions taken by U.S. or foreign governments to stimulate or stabilize the global economy may not be effective and could lead to high market volatility. No active trading market may exist for certain investments held by the Fund, which may impair the ability of the Fund to sell or to realize the current valuation of such investments in the event of the need to liquidate such assets.

Calvert Allocation Funds11Prospectus dated February 1, 2023

Equity Securities Risk. The value of equity securities and related instruments may decline in response to adverse changes in the economy or the economic outlook; deterioration in investor sentiment; interest rate, currency, and commodity price fluctuations; adverse geopolitical, social or environmental developments; issuer and sector-specific considerations; unexpected trading activity among retail investors; or other factors. Market conditions may affect certain types of stocks to a greater extent than other types of stocks. If the stock market declines in value, the value of the Fund’s equity securities will also likely decline. Although prices can rebound, there is no assurance that values will return to previous levels.

Large-Cap Growth and Value Risk. Because the Fund may invest in stocks of large-cap growth and/or value companies, it is subject to the risk of underperforming the overall stock market during periods in which stocks of such companies are out of favor and generate lower returns than the market as a whole.

Interest Rate Risk. In general, the value of income securities will fluctuate based on changes in interest rates. The value of these securities is likely to increase when interest rates fall and decline when interest rates rise. Duration measures the time-weighted expected cash flows of a fixed-income security, while maturity refers to the amount of time until a fixed-income security matures. Generally, securities with longer durations or maturities are more sensitive to changes in interest rates than securities with shorter durations or maturities, causing them to be more volatile. Conversely, fixed-income securities with shorter durations or maturities will be less volatile but may provide lower returns than fixed-income securities with longer durations or maturities. In a rising interest rate environment, the duration of income securities that have the ability to be prepaid or called by the issuer may be extended. In a declining interest rate environment, the proceeds from prepaid or maturing instruments may have to be reinvested at a lower interest rate. Certain instruments held by the Fund pay an interest rate based on the London Interbank Offered Rate (“LIBOR”), which is the average offered rate for various maturities of short-term loans between certain major international banks. LIBOR is used throughout global banking and financial industries to determine interest rates for a variety of financial instruments (such as debt instruments and derivatives) and borrowing arrangements. The ICE Benchmark Administration Limited, the administrator of LIBOR, ceased publishing certain LIBOR settings on December 31, 2021, and is expected to cease publishing the remaining LIBOR settings on June 30, 2023. Although the transition process away from LIBOR has become increasingly well defined, the impact on certain debt securities, derivatives and other financial instruments that utilize LIBOR remains uncertain. The phase-out of LIBOR may result in, among other things, increased volatility or illiquidity in markets for instruments based on LIBOR and changes in the value of such instruments.

Credit Risk. Investments in fixed income and other debt obligations, including loans, (referred to below as “debt instruments”) are subject to the risk of non-payment of scheduled principal and interest. Changes in economic conditions or other circumstances may reduce the capacity of the party obligated to make principal and interest payments on such instruments and may lead to defaults. Such non-payments and defaults may reduce the value of Fund shares and income distributions. The value of debt instruments also may decline because of concerns about the issuer’s ability to make principal and interest payments. In addition, the credit ratings of debt instruments may be lowered if the financial condition of the party obligated to make payments with respect to such instruments deteriorates. In the event of bankruptcy of the issuer of a debt instrument, the Fund could experience delays or limitations with respect to its ability to realize the benefits of any collateral securing the instrument. In order to enforce its rights in the event of a default, bankruptcy or similar situation, the Fund may be required to retain legal or similar counsel, which may increase the Fund’s operating expenses and adversely affect net asset value.

Mortgage- and Asset-Backed Securities Risk. Mortgage- and asset-backed securities represent interests in “pools” of commercial or residential mortgages or other assets, including consumer loans or receivables. Movements in interest rates (both increases and decreases) may quickly and significantly reduce the value of certain types of mortgage- and asset-backed securities. Although certain mortgage- and asset-backed securities are guaranteed as to timely payment of interest and principal by a government entity, the market price for such securities is not guaranteed and will fluctuate. The purchase of mortgage- and asset-backed securities issued by non-government entities may entail greater risk than such securities that are issued or guaranteed by a government entity. Mortgage- and asset-backed securities issued by non-government entities may offer higher yields than those issued by government entities, but may also be subject to greater volatility than government issues and can also be subject to greater credit risk and the risk of default on the underlying mortgages or other assets. Investments in mortgage- and asset-backed securities are subject to both extension risk, where borrowers pay off their debt obligations more slowly in times of rising interest rates, and prepayment risk, where borrowers pay off their debt obligations sooner than expected in times of declining interest rates.

U.S. Government Securities Risk. Although certain U.S. Government-sponsored agencies (such as the Federal Home Loan Mortgage Corporation and the Federal National Mortgage Association) may be chartered or sponsored by acts of Congress, their securities are neither issued nor guaranteed by the U.S. Treasury. U.S. Treasury securities generally have a lower return than other obligations because of their higher credit quality and market liquidity.

Calvert Allocation Funds12Prospectus dated February 1, 2023

Lower Rated Investments Risk. Investments rated below investment grade and comparable unrated investments (sometimes referred to as “junk”) have speculative characteristics because of the credit risk associated with their issuers. Changes in economic conditions or other circumstances typically have a greater effect on the ability of issuers of lower rated investments to make principal and interest payments than they do on issuers of higher rated investments. An economic downturn generally leads to a higher non-payment rate, and a lower rated investment may lose significant value before a default occurs. Lower rated investments typically are subject to greater price volatility and illiquidity than higher rated investments.

Absolute Return Strategy. The Fund may invest in underlying funds that employ an “absolute return” investment approach. A fund that employs an absolute return strategy typically benchmarks itself to an index of cash instruments and seeks to achieve returns that are largely independent of broad movements in stocks and bonds. Unlike equity funds, such funds should not be expected to benefit from general equity market returns. Different from fixed income funds, such funds may not generate current income and should not be expected to experience price appreciation as interest rates decline. Although an underlying fund’s investment adviser seeks to maximize absolute return, an underlying fund may not generate positive returns.

Additional Risks of Loans. Loans are traded in a private, unregulated inter-dealer or inter-bank resale market and are generally subject to contractual restrictions that must be satisfied before a loan can be bought or sold. These restrictions may impede the Fund’s ability to buy or sell loans (thus affecting their liquidity) and may negatively impact the transaction price. See also “Market Risk” above. It also may take longer than seven days for transactions in loans to settle. Due to the possibility of an extended loan settlement process, the Fund may hold cash, sell investments or temporarily borrow from banks or other lenders to meet short-term liquidity needs, such as to satisfy redemption requests from Fund shareholders. The types of covenants included in loan agreements generally vary depending on market conditions, the creditworthiness of the issuer, the nature of the collateral securing the loan and possibly other factors. Loans with fewer covenants that restrict activities of the borrower may provide the borrower with more flexibility to take actions that may be detrimental to the loan holders and provide fewer investor protections in the event of such actions or if covenants are breached. The Fund may experience relatively greater realized or unrealized losses or delays and expense in enforcing its rights with respect to loans with fewer restrictive covenants. Loans to entities located outside of the U.S. (including loans to sovereign entities) may have substantially different lender protections and covenants as compared to loans to U.S. entities and may involve greater risks. The Fund may have difficulties and incur expense enforcing its rights with respect to non-U.S. loans and such loans could be subject to bankruptcy laws that are materially different than in the U.S. Sovereign entities may be unable or unwilling to meet their obligations under a loan due to budgetary limitations or economic or political changes within the country. Loans may be structured such that they are not securities under securities law, and in the event of fraud or misrepresentation by a borrower, lenders may not have the protection of the anti-fraud provisions of the federal securities laws. Loans are also subject to risks associated with other types of income investments, including credit risk and risks of lower rated investments.

Borrowing Risk. The Fund may invest in underlying funds that borrow for investment purposes. Borrowing cash to increase investments (sometimes referred to as “leverage”) may exaggerate the effect on the Fund’s net asset value of any increase or decrease in the value of the security purchased with the borrowing. There can be no assurance that the use of borrowings will be successful. In connection with its borrowings, the Fund will be required to maintain specified asset coverage with respect to such borrowings by applicable federal securities laws and the terms of its credit facility with the lender. The Fund may be required to dispose of portfolio investments on unfavorable terms if market fluctuations or other factors cause the required asset coverage to be less than the prescribed amount. Borrowings involve additional expense to the Fund.

Foreign Investment Risk. Foreign investments can be adversely affected by political, economic and market developments abroad, including the imposition of economic and other sanctions by the United States or another country against a particular country or countries, organizations, entities and/or individuals. There may be less publicly available information about foreign issuers because they may not be subject to reporting practices, requirements or regulations comparable to those to which United States companies are subject. Adverse changes in investment regulations, capital requirements or exchange controls could adversely affect the value of the Fund's investments. Foreign markets may be smaller, less liquid and more volatile than the major markets in the United States and, as a result, Fund share values may be more volatile. Trading in foreign markets typically involves higher expense than trading in the United States. The Fund may have difficulties enforcing its legal or contractual rights in a foreign country. Depositary receipts are subject to many of the risks associated with investing directly in foreign instruments.

Calvert Allocation Funds13Prospectus dated February 1, 2023

Emerging Markets Investment Risk. Investment markets within emerging market countries are typically smaller, less liquid, less developed and more volatile than those in more developed markets like the United States, and may be focused in certain sectors. Emerging market securities often involve greater risks than developed market securities. The information available about an emerging market issuer may be less reliable than for comparable issuers in more developed capital markets.

Currency Risk. Exchange rates for currencies fluctuate daily. The value of foreign investments may be affected favorably or unfavorably by changes in currency exchange rates in relation to the U.S. dollar. Currency markets generally are not as regulated as securities markets and currency transactions are subject to settlement, custodial and other operational risks.

Smaller and Mid-Sized Company Risk. The stocks of smaller and mid-sized companies are generally subject to greater price fluctuations, limited liquidity, higher transaction costs and higher investment risk than the stocks of larger, more established companies. Such companies may have limited product lines, markets or financial resources, may be dependent on a limited management group, and may lack substantial capital reserves or an established performance record. There may be generally less publicly available information about such companies than for larger, more established companies. Stocks of these companies frequently have lower trading volumes making them more volatile and potentially less liquid and more difficult to value.

Money Market Instrument Risk. Money market instruments may be adversely affected by market and economic events, such as a sharp rise in prevailing short-term interest rates; adverse developments in the banking industry, which issues or guarantees many money market instruments; adverse economic, political or other developments affecting issuers of money market instruments; changes in the credit quality of issuers; and default by a counterparty.

Derivatives Risk. The Fund’s exposure to derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other investments. The use of derivatives can lead to losses because of adverse movements in the price or value of the security, instrument, index, currency, commodity, economic indicator or event underlying a derivative (“reference instrument”), due to failure of a counterparty or due to tax or regulatory constraints. Derivatives may create leverage in the Fund, which represents a non-cash exposure to the underlying reference instrument. Leverage can increase both the risk and return potential of the Fund. Derivatives risk may be more significant when derivatives are used to enhance return or as a substitute for a cash investment position, rather than solely to hedge the risk of a position held by the Fund. Use of derivatives involves the exercise of specialized skill and judgment, and a transaction may be unsuccessful in whole or in part because of market behavior or unexpected events. Changes in the value of a derivative (including one used for hedging) may not correlate perfectly with the underlying reference instrument. Derivative instruments traded in over-the-counter markets may be difficult to value, may be illiquid, and may be subject to wide swings in valuation caused by changes in the value of the underlying reference instrument. If a derivative’s counterparty is unable to honor its commitments, the value of Fund shares may decline and the Fund could experience delays in (or be unable to achieve) the return of collateral or other assets held by the counterparty. The loss on derivative transactions may substantially exceed the initial investment. A derivative investment also involves the risks relating to the reference instrument underlying the investment.

ETF Risk. ETFs are subject to the risks of investing in the underlying securities or other investments. ETF shares may trade at a premium or discount to net asset value and are subject to secondary market trading risks. In addition, the Fund will bear a pro rata portion of the operating expenses of an ETF in which it invests.

Liquidity Risk. The Fund is exposed to liquidity risk when trading volume, lack of a market maker or trading partner, large position size, market conditions, or legal restrictions impair its ability to sell particular investments or to sell them at advantageous market prices. Consequently, the Fund may have to accept a lower price to sell an investment or continue to hold it or keep the position open, sell other investments to raise cash or abandon an investment opportunity, any of which could have a negative effect on the Fund’s performance. These effects may be exacerbated during times of financial or political stress.

Securities Lending Risk. Securities lending involves a possible delay in recovery of the loaned securities or a possible loss of rights in the collateral if the borrower fails financially. The Fund could also lose money if the value of the collateral decreases.

Calvert Allocation Funds14Prospectus dated February 1, 2023

Responsible Investing Risk. Investing primarily in responsible investments carries the risk that, under certain market conditions, the Fund may underperform funds that do not utilize a responsible investment strategy. The application of responsible investment criteria may affect the Fund’s exposure to certain sectors or types of investments, and may impact the Fund’s relative investment performance depending on whether such sectors or investments are in or out of favor in the market. An investment’s ESG performance or the investment adviser's assessment of such performance may change over time, which could cause the Fund to temporarily hold securities that do not comply with the Fund’s responsible investment criteria. In evaluating an investment, the investment adviser is dependent upon information and data that may be incomplete, inaccurate or unavailable, which could adversely affect the analysis of the ESG factors relevant to a particular investment. Successful application of the Fund’s responsible investment strategy will depend on the investment adviser's skill in properly identifying and analyzing material ESG issues.

General Fund Investing Risks.

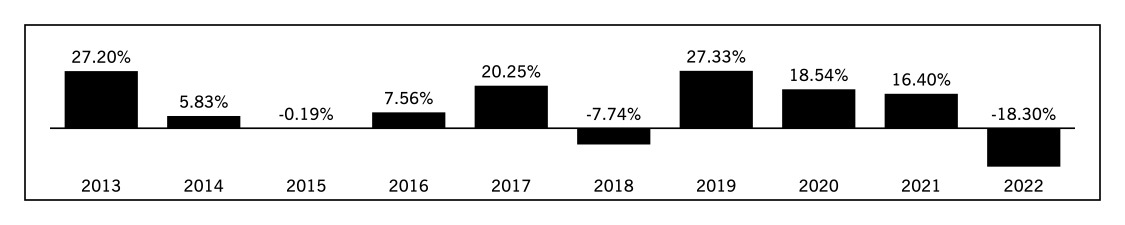

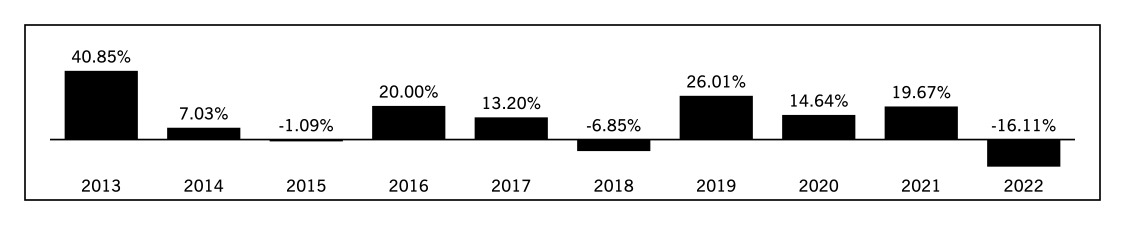

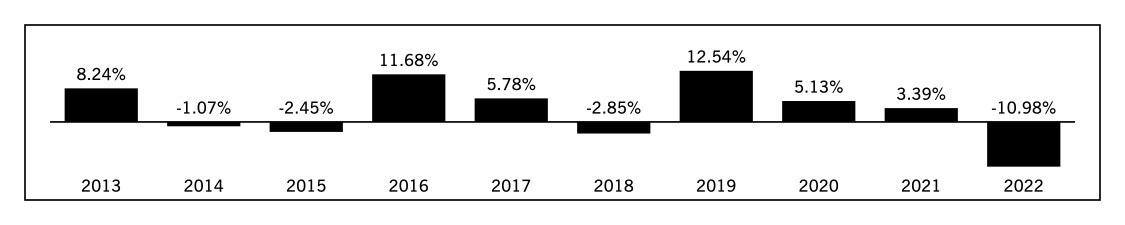

CRM became the investment adviser to the Fund on December 31, 2016. Performance reflected prior to such date is that of the Fund’s former investment adviser. The Fund’s performance for certain periods reflects the effects of expense reductions. Absent these reductions, performance for certain periods would have been lower. Updated Fund performance information can be obtained by visiting

Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

Year Total Return | - | - | - |

For the ten years ended December 31, 2022, the

Calvert Allocation Funds15Prospectus dated February 1, 2023

One Year | Five Years | Ten Years | |

Class A Return Before Taxes | - | ||

Class A Return After Taxes on Distributions | - | ||

Class A Return After Taxes on Distributions and Sale of Class A Shares | - | ||

Class C Return Before Taxes | - | ||

Class I Return Before Taxes | - | ||

Class R6 Return Before Taxes | - | ||

Russell 3000® Index | - | ||

Moderate Allocation Blended Benchmark* | - |

*

Management

Investment Adviser. Calvert Research and Management (“CRM” or the “Adviser”).

Portfolio Managers

Justin H. Bourgette, CFA, Vice President of CRM, has managed the Fund since December 31, 2016.

Schuyler Hooper, CFA, Vice President of CRM, has managed the Fund since November 12, 2021.

For important information about purchase and sale of shares, taxes and financial intermediary compensation, please turn to “Important Information Regarding Fund Shares” on page 24 of this Prospectus.

Calvert Allocation Funds16Prospectus dated February 1, 2023

Calvert Growth Allocation Fund

The Fund's investment objective is to seek long-term capital appreciation.

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. Investors may also pay commissions or other fees to their financial intermediary, which are not reflected below.

| Class A | Class C | Class I | Class R6 |

Maximum Sales Charge (load) Imposed on Purchases (as a percentage of offering price) | ||||

Maximum Deferred Sales Charge (load) (as a percentage of the lower of net asset value at purchase or redemption) |

(1)

| Class A | Class C | Class I | Class R6 |

Management Fees | ||||

Distribution and Service (12b-1) Fees | ||||

Other Expenses | ||||

Acquired Fund Fees and Expenses (1) | ||||

Total Annual Fund Operating Expenses | ||||

Expense Reimbursement(2) | ( | ( | ( | ( |

Total Annual Fund Operating Expenses after Expense Reimbursement |

(1)

(2)

| Expenses with Redemption | Expenses without Redemption | ||||||

1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | |

Class A shares | $ | $ | $ | $ | $ | $ | $ | $ |

Class C shares | $ | $ | $ | $ | $ | $ | $ | $ |

Class I shares | $ | $ | $ | $ | $ | $ | $ | $ |

Class R6 shares | $ | $ | $ | $ | $ | $ | $ | $ |

Calvert Allocation Funds17Prospectus dated February 1, 2023

Incidental to its main investment strategy, the Fund may also invest in (1) derivative instruments, including, but not limited to, futures, options and swaps; (2) exchange-traded funds (“ETFs”); and (3) U.S. Treasury securities, including Treasury-Inflation Protected Securities. The Fund will use these instruments to facilitate the periodic rebalancing of the Fund’s portfolio to maintain its target asset allocation, to make tactical asset allocations (including to gain or limit exposure to certain asset classes and/or sectors, and/or to manage duration) and to assist in managing cash. The Fund may also lend its securities.

The above asset allocation percentages are allocation targets. The Adviser has discretion to reallocate the Fund’s assets among underlying Calvert funds. The Adviser monitors the Fund’s allocation and may rebalance or reallocate the Fund’s assets (1) based on its view of economic and market factors and events or (2) to adjust for shifts in the style biases of the underlying funds. The Adviser also evaluates any necessary rebalancing to reflect different target asset class allocations based on changed economic and market conditions.

Responsible Investing. In accordance with its asset allocation strategy, the Fund will invest in Calvert income and equity funds that consider responsible investment criteria. The underlying fund portfolio manager(s) seek to invest in companies that manage environmental, social and governance (“ESG”) risk exposures adequately and that are not exposed to excessive ESG risk through their principal business activities. Companies are analyzed by the investment adviser’s ESG analysts utilizing The Calvert Principles for Responsible Investment (“Principles”), a framework for considering ESG factors (a copy of which is included as an appendix to the Fund’s Prospectus). Each company is evaluated relative to an appropriate peer group based on material ESG factors as determined by the investment adviser. The underlying funds generally invest in issuers that are believed by the investment adviser to operate in accordance with the Principles and may also invest in issuers that the investment adviser believes are likely to operate in accordance with the Principles pending the investment adviser’s engagement activity with such issuer.

Fund-of-Funds Structure. The Fund invests in other Calvert funds (“underlying funds”) in a fund-of-funds structure. The Fund’s asset allocation strategy and its selection of particular underlying funds may cause the Fund to underperform funds with similar investment objectives. The Fund’s performance is dependent upon the performance of the underlying funds and the Fund is subject to all of the risks of the underlying funds. The risks discussed below are the principal risks applicable to the Fund either directly or through its investment in the underlying funds and accordingly, references to the Fund below may be to the Fund or one or more underlying funds.

Market Risk. The value of investments held by the Fund may increase or decrease in response to social, economic, political, financial, public health crises or other disruptive events (whether real, expected or perceived) in the U.S. and global markets and include events such as war, natural disasters, epidemics and pandemics, terrorism, conflicts and social unrest. These events may negatively impact broad segments of businesses and populations and may exacerbate pre-existing risks to the Fund. The frequency and magnitude of resulting changes in the value of the Fund’s investments cannot be predicted. Certain securities and other investments held by the Fund may experience increased volatility, illiquidity, or other potentially adverse effects in reaction to changing market conditions. Monetary and/or fiscal actions taken by U.S. or foreign governments to stimulate or stabilize the global economy may not be effective and could lead to

Calvert Allocation Funds18Prospectus dated February 1, 2023

high market volatility. No active trading market may exist for certain investments held by the Fund, which may impair the ability of the Fund to sell or to realize the current valuation of such investments in the event of the need to liquidate such assets.

Equity Securities Risk. The value of equity securities and related instruments may decline in response to adverse changes in the economy or the economic outlook; deterioration in investor sentiment; interest rate, currency, and commodity price fluctuations; adverse geopolitical, social or environmental developments; issuer and sector-specific considerations; unexpected trading activity among retail investors; or other factors. Market conditions may affect certain types of stocks to a greater extent than other types of stocks. If the stock market declines in value, the value of the Fund’s equity securities will also likely decline. Although prices can rebound, there is no assurance that values will return to previous levels.

Large-Cap Growth and Value Risk. Because the Fund may invest in stocks of large-cap growth and/or value companies, it is subject to the risk of underperforming the overall stock market during periods in which stocks of such companies are out of favor and generate lower returns than the market as a whole.

Foreign Investment Risk. Foreign investments can be adversely affected by political, economic and market developments abroad, including the imposition of economic and other sanctions by the United States or another country against a particular country or countries, organizations, entities and/or individuals. There may be less publicly available information about foreign issuers because they may not be subject to reporting practices, requirements or regulations comparable to those to which United States companies are subject. Adverse changes in investment regulations, capital requirements or exchange controls could adversely affect the value of the Fund's investments. Foreign markets may be smaller, less liquid and more volatile than the major markets in the United States and, as a result, Fund share values may be more volatile. Trading in foreign markets typically involves higher expense than trading in the United States. The Fund may have difficulties enforcing its legal or contractual rights in a foreign country. Depositary receipts are subject to many of the risks associated with investing directly in foreign instruments.

Emerging Markets Investment Risk. Investment markets within emerging market countries are typically smaller, less liquid, less developed and more volatile than those in more developed markets like the United States, and may be focused in certain sectors. Emerging market securities often involve greater risks than developed market securities. The information available about an emerging market issuer may be less reliable than for comparable issuers in more developed capital markets.

Currency Risk. Exchange rates for currencies fluctuate daily. The value of foreign investments may be affected favorably or unfavorably by changes in currency exchange rates in relation to the U.S. dollar. Currency markets generally are not as regulated as securities markets and currency transactions are subject to settlement, custodial and other operational risks.

Smaller and Mid-Sized Company Risk. The stocks of smaller and mid-sized companies are generally subject to greater price fluctuations, limited liquidity, higher transaction costs and higher investment risk than the stocks of larger, more established companies. Such companies may have limited product lines, markets or financial resources, may be dependent on a limited management group, and may lack substantial capital reserves or an established performance record. There may be generally less publicly available information about such companies than for larger, more established companies. Stocks of these companies frequently have lower trading volumes making them more volatile and potentially less liquid and more difficult to value.

Interest Rate Risk. In general, the value of income securities will fluctuate based on changes in interest rates. The value of these securities is likely to increase when interest rates fall and decline when interest rates rise. Duration measures the time-weighted expected cash flows of a fixed-income security, while maturity refers to the amount of time until a fixed-income security matures. Generally, securities with longer durations or maturities are more sensitive to changes in interest rates than securities with shorter durations or maturities, causing them to be more volatile. Conversely, fixed-income securities with shorter durations or maturities will be less volatile but may provide lower returns than fixed-income securities with longer durations or maturities. In a rising interest rate environment, the duration of income securities that have the ability to be prepaid or called by the issuer may be extended. In a declining interest rate environment, the proceeds from prepaid or maturing instruments may have to be reinvested at a lower interest rate. Certain instruments held by the Fund pay an interest rate based on the London Interbank Offered Rate (“LIBOR”), which is the average offered rate for various maturities of short-term loans between certain major international banks. LIBOR is used throughout global banking and financial industries to determine interest rates for a variety of financial instruments (such as debt instruments and derivatives) and borrowing arrangements. The ICE Benchmark Administration Limited, the administrator of LIBOR, ceased publishing certain LIBOR settings on December 31, 2021, and is expected to cease publishing the remaining LIBOR settings on June 30, 2023. Although the transition process away from LIBOR has become increasingly well defined, the impact on certain debt securities, derivatives and other financial instruments that

Calvert Allocation Funds19Prospectus dated February 1, 2023

utilize LIBOR remains uncertain. The phase-out of LIBOR may result in, among other things, increased volatility or illiquidity in markets for instruments based on LIBOR and changes in the value of such instruments.

Credit Risk. Investments in fixed income and other debt obligations, including loans, (referred to below as “debt instruments”) are subject to the risk of non-payment of scheduled principal and interest. Changes in economic conditions or other circumstances may reduce the capacity of the party obligated to make principal and interest payments on such instruments and may lead to defaults. Such non-payments and defaults may reduce the value of Fund shares and income distributions. The value of debt instruments also may decline because of concerns about the issuer’s ability to make principal and interest payments. In addition, the credit ratings of debt instruments may be lowered if the financial condition of the party obligated to make payments with respect to such instruments deteriorates. In the event of bankruptcy of the issuer of a debt instrument, the Fund could experience delays or limitations with respect to its ability to realize the benefits of any collateral securing the instrument. In order to enforce its rights in the event of a default, bankruptcy or similar situation, the Fund may be required to retain legal or similar counsel, which may increase the Fund’s operating expenses and adversely affect net asset value.

Mortgage- and Asset-Backed Securities Risk. Mortgage- and asset-backed securities represent interests in “pools” of commercial or residential mortgages or other assets, including consumer loans or receivables. Movements in interest rates (both increases and decreases) may quickly and significantly reduce the value of certain types of mortgage- and asset-backed securities. Although certain mortgage- and asset-backed securities are guaranteed as to timely payment of interest and principal by a government entity, the market price for such securities is not guaranteed and will fluctuate. The purchase of mortgage- and asset-backed securities issued by non-government entities may entail greater risk than such securities that are issued or guaranteed by a government entity. Mortgage- and asset-backed securities issued by non-government entities may offer higher yields than those issued by government entities, but may also be subject to greater volatility than government issues and can also be subject to greater credit risk and the risk of default on the underlying mortgages or other assets. Investments in mortgage- and asset-backed securities are subject to both extension risk, where borrowers pay off their debt obligations more slowly in times of rising interest rates, and prepayment risk, where borrowers pay off their debt obligations sooner than expected in times of declining interest rates.

U.S. Government Securities Risk. Although certain U.S. Government-sponsored agencies (such as the Federal Home Loan Mortgage Corporation and the Federal National Mortgage Association) may be chartered or sponsored by acts of Congress, their securities are neither issued nor guaranteed by the U.S. Treasury. U.S. Treasury securities generally have a lower return than other obligations because of their higher credit quality and market liquidity.

Money Market Instrument Risk. Money market instruments may be adversely affected by market and economic events, such as a sharp rise in prevailing short-term interest rates; adverse developments in the banking industry, which issues or guarantees many money market instruments; adverse economic, political or other developments affecting issuers of money market instruments; changes in the credit quality of issuers; and default by a counterparty.

Derivatives Risk. The Fund’s exposure to derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other investments. The use of derivatives can lead to losses because of adverse movements in the price or value of the security, instrument, index, currency, commodity, economic indicator or event underlying a derivative (“reference instrument”), due to failure of a counterparty or due to tax or regulatory constraints. Derivatives may create leverage in the Fund, which represents a non-cash exposure to the underlying reference instrument. Leverage can increase both the risk and return potential of the Fund. Derivatives risk may be more significant when derivatives are used to enhance return or as a substitute for a cash investment position, rather than solely to hedge the risk of a position held by the Fund. Use of derivatives involves the exercise of specialized skill and judgment, and a transaction may be unsuccessful in whole or in part because of market behavior or unexpected events. Changes in the value of a derivative (including one used for hedging) may not correlate perfectly with the underlying reference instrument. Derivative instruments traded in over-the-counter markets may be difficult to value, may be illiquid, and may be subject to wide swings in valuation caused by changes in the value of the underlying reference instrument. If a derivative’s counterparty is unable to honor its commitments, the value of Fund shares may decline and the Fund could experience delays in (or be unable to achieve) the return of collateral or other assets held by the counterparty. The loss on derivative transactions may substantially exceed the initial investment. A derivative investment also involves the risks relating to the reference instrument underlying the investment.

ETF Risk. ETFs are subject to the risks of investing in the underlying securities or other investments. ETF shares may trade at a premium or discount to net asset value and are subject to secondary market trading risks. In addition, the Fund will bear a pro rata portion of the operating expenses of an ETF in which it invests.

Calvert Allocation Funds20Prospectus dated February 1, 2023

Liquidity Risk. The Fund is exposed to liquidity risk when trading volume, lack of a market maker or trading partner, large position size, market conditions, or legal restrictions impair its ability to sell particular investments or to sell them at advantageous market prices. Consequently, the Fund may have to accept a lower price to sell an investment or continue to hold it or keep the position open, sell other investments to raise cash or abandon an investment opportunity, any of which could have a negative effect on the Fund’s performance. These effects may be exacerbated during times of financial or political stress.

Securities Lending Risk. Securities lending involves a possible delay in recovery of the loaned securities or a possible loss of rights in the collateral if the borrower fails financially. The Fund could also lose money if the value of the collateral decreases.

Responsible Investing Risk. Investing primarily in responsible investments carries the risk that, under certain market conditions, the Fund may underperform funds that do not utilize a responsible investment strategy. The application of responsible investment criteria may affect the Fund’s exposure to certain sectors or types of investments, and may impact the Fund’s relative investment performance depending on whether such sectors or investments are in or out of favor in the market. An investment’s ESG performance or the investment adviser's assessment of such performance may change over time, which could cause the Fund to temporarily hold securities that do not comply with the Fund’s responsible investment criteria. In evaluating an investment, the investment adviser is dependent upon information and data that may be incomplete, inaccurate or unavailable, which could adversely affect the analysis of the ESG factors relevant to a particular investment. Successful application of the Fund’s responsible investment strategy will depend on the investment adviser's skill in properly identifying and analyzing material ESG issues.

General Fund Investing Risks.

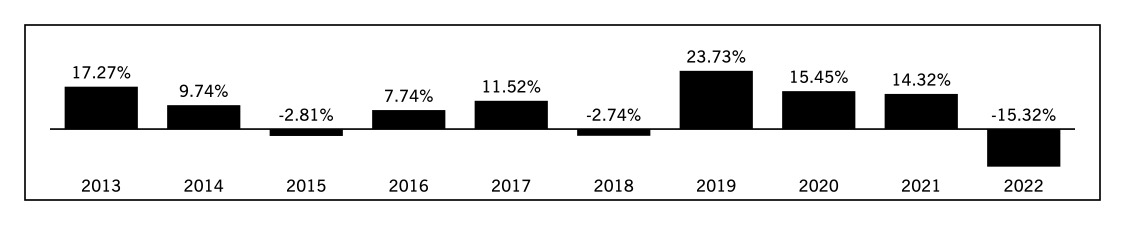

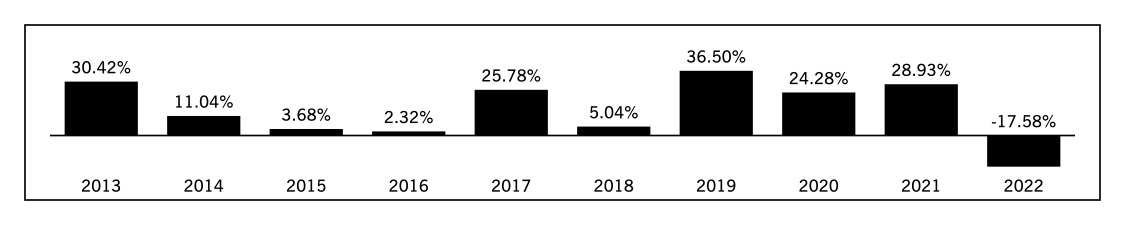

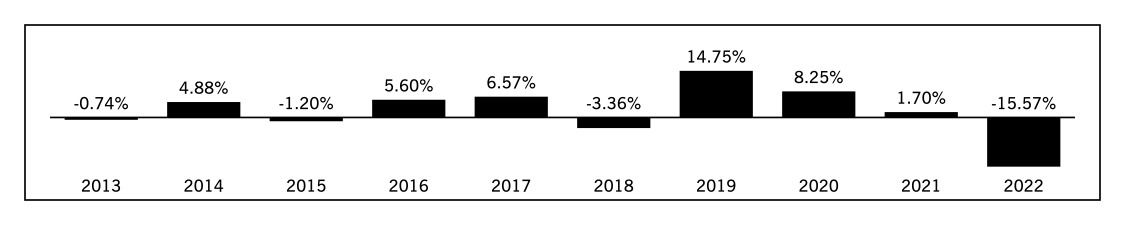

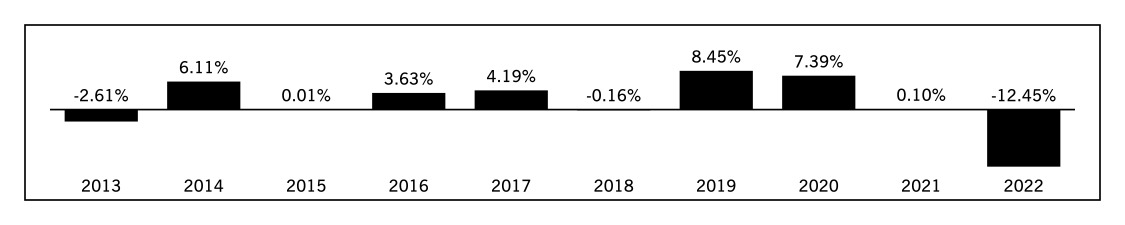

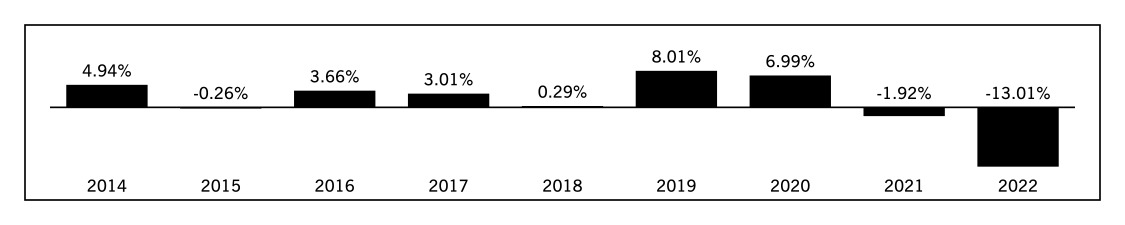

CRM became the investment adviser to the Fund on December 31, 2016. Performance reflected prior to such date is that of the Fund’s former investment adviser. The Fund’s performance reflects the effects of expense reductions. Absent these reductions, performance would have been lower. Updated Fund performance information can be obtained by visiting

Calvert Allocation Funds21Prospectus dated February 1, 2023

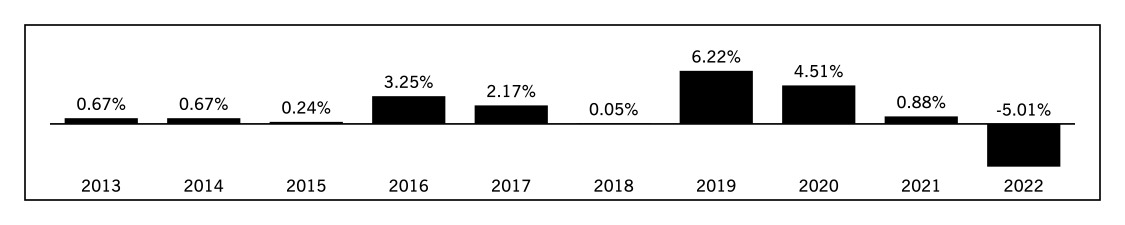

Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

Year Total Return | - | - | - |

For the ten years ended December 31, 2022, the

| One Year | Five Years | Ten Years |

Class A Return Before Taxes | - | ||

Class A Return After Taxes on Distributions | - | ||

Class A Return After Taxes on Distributions and Sale of Class A Shares | - | ||

Class C Return Before Taxes | - | ||

Class I Return Before Taxes | - | ||

Class R6 Return Before Taxes | - | ||

Russell 3000® Index | - | ||

Growth Allocation Blended Benchmark* | - |

*

Management

Investment Adviser. Calvert Research and Management (“CRM” or the “Adviser”).

Portfolio Managers

Justin H. Bourgette, CFA, Vice President of CRM, has managed the Fund since December 31, 2016.

Schuyler Hooper, CFA, Vice President of CRM, has managed the Fund since November 12, 2021.

For important information about purchase and sale of shares, taxes and financial intermediary compensation, please turn to “Important Information Regarding Fund Shares” on page 24 of this Prospectus.

Calvert Allocation Funds22Prospectus dated February 1, 2023

Important Information Regarding Fund Shares

Purchase and Sale of Fund Shares

You may purchase, redeem or exchange Fund shares on any business day, which is any day the New York Stock Exchange is open for business. You may purchase, redeem or exchange Fund shares either through your financial intermediary or (except for purchases of Class C shares by accounts with no specified financial intermediary) directly from a Fund either by writing to the Fund, P.O. Box 219544, Kansas City, MO 64121-9544, or by calling 1-800-368-2745. The minimum initial purchase or exchange into a Fund is $1,000 for Class A and Class C, $1,000,000 for Class I and $5,000,000 for Class R6 (waived in certain circumstances). There is no minimum for subsequent investments.

Tax Information

If your shares are held in a taxable account, each Fund’s distributions will be taxed to you as ordinary income and/or capital gains, unless you are exempt from taxation. If your shares are held in a tax-advantaged account, you will generally be taxed only upon withdrawals from the account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase a Fund’s shares through a broker-dealer or other financial intermediary (such as a bank) (collectively, “financial intermediaries”), the Fund, its principal underwriter and its affiliates may pay the financial intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the financial intermediary and your salesperson to recommend a Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

Calvert Allocation Funds23Prospectus dated February 1, 2023

Investment Objectives & Principal Policies and Risks

The investment objective(s) and principal investment policies and risks of each Fund are described in its Fund Summary. Set forth below is additional information about such policies and risks, as well as information about other types of investments and practices in which each Fund may engage in from time to time, unless otherwise noted. Each Fund seeks its investment objective(s) by allocating its assets to other registered investment companies managed by CRM that invest in various asset classes (collectively, the “Underlying Funds”). References to the Fund below are to each Fund and/or one or more of the Underlying Funds in which it may invest. A listing of the Underlying Funds and their prospectuses may be found on the Calvert website (www.calvert.com). Each Fund posts information about the allocation of its assets to the Calvert website periodically. See also “Strategies and Risks” in the Statement of Additional Information (“SAI”).

Definitions. As used herein, the following terms have the indicated meaning: “1940 Act” means the Investment Company Act of 1940, as amended; “1933 Act” means the Securities Act of 1933, as amended; “Code” means the Internal Revenue Code of 1986, as amended; “ERISA” means the Employee Retirement Income Security Act of 1974, as amended; and “investment adviser” means the Fund’s investment adviser but if the Fund is sub-advised, it refers to the sub-adviser(s) providing day-to-day management with respect to the investments or strategies discussed.

Use of Fund-of-Funds Structure. The Fund invests in other Calvert funds (“underlying funds”) in a fund-of-funds structure. Use of this structure enables the Fund to pool its assets with other investors in underlying funds, resulting in efficiencies in management and administration that can lower Fund costs and enhance shareholder returns. Contribution and withdrawal activities by other underlying fund investors may impact the management of an underlying fund and its ability to achieve its investment objective. A large withdrawal by an underlying fund investor could have an adverse effect on other underlying fund investors. The Fund’s investment adviser also serves as investment adviser to each underlying fund. Therefore, conflicts may arise as the investment adviser fulfills its fiduciary responsibilities to the Fund and each underlying fund.

As an investor in an underlying fund, the Fund may be asked to vote on certain underlying fund matters (such as changes in certain investment restrictions). When necessary, the Fund will hold a meeting of its shareholders to consider underlying fund matters and then vote its interest in an underlying fund in proportion to the votes cast by its shareholders. Alternatively, a Fund may vote its shares of an underlying fund in the same proportion as other investors voting on the matter. A Fund can withdraw its underlying fund investment at any time without shareholder approval.