UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-4

|

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

File No. 333-177316

|

|

Pre-Effective Amendment No.

|

o

|

|

Post-Effective Amendment No. 1

|

þ

|

and

|

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940

|

File No. 811-03330

|

|

Amendment No. 425

|

þ

|

(Check appropriate box or boxes.)

NATIONWIDE VARIABLE ACCOUNT – II

(Exact Name of Registrant)

NATIONWIDE LIFE INSURANCE COMPANY

(Name of Depositor)

One Nationwide Plaza, Columbus, Ohio 43215

(Address of Depositor's Principal Executive Offices) (Zip Code)

|

Depositor's Telephone Number, including Area Code

|

(614) 249-7111

|

Robert W. Horner, III, Vice President Corporate Governance and Secretary, One Nationwide Plaza, Columbus, Ohio 43215

(Name and Address of Agent for Service)

|

Approximate Date of Proposed Public Offering

|

November 5, 2012

|

It is proposed that this filing will become effective (check appropriate box)

o immediately upon filing pursuant to paragraph (b)

þ on November 5, 2012 pursuant to paragraph (b)

o 60 days after filing pursuant to paragraph (a)(1)

o on (date) pursuant to paragraph (a)(1)

If appropriate, check the following box:

o this post-effective amendment designates a new effective date for a previously filed post-effective amendment.

|

Title of Securities Being Registered

|

Individual Flexible Premium Deferred Variable Annuity Contract

|

|

Nationwide Life Insurance Company

· Nationwide Variable Account-II

|

Prospectus supplement dated November 5, 2012 to

Nationwide Destination B 2.0, Nationwide Destination B NY 2.0, Nationwide Destination EV 2.0,

Nationwide Destination EV NY 2.0, Nationwide Destination L 2.0, Nationwide Destination L NY 2.0, Nationwide Destination All American Gold 2.0, and Nationwide Destination All American Gold NY 2.0 prospectus dated April 20, 2012

This supplement updates certain information contained in your prospectus. Please read it and keep it with your prospectus for future reference.

Effective November 5, 2012, the following funds are available as investment options under the contract:

|

·

|

American Funds Insurance Series® - Protected Asset Allocation Fund: Class P2

|

|

·

|

Northern Lights Variable Trust - TOPS Protected Balanced ETF Portfolio: Class 4

|

|

·

|

Northern Lights Variable Trust - TOPS Protected Growth ETF Portfolio: Class 4

|

|

·

|

Northern Lights Variable Trust - TOPS Protected Moderate Growth ETF Portfolio: Class 4

|

In addition, effective November 5, 2012, the following funds are available as investment options under the 7% Lifetime Income Option:

|

·

|

American Funds Insurance Series® - Protected Asset Allocation Fund: Class P2

|

|

·

|

Nationwide Variable Insurance Trust - NVIT CardinalSM Moderate Fund: Class II

|

|

·

|

Nationwide Variable Insurance Trust - NVIT Investor Destinations Moderate Fund: Class II

|

Accordingly, the following changes apply to your prospectus:

|

1.

|

The bulleted list on page 1 is amended to add the following:

|

|

·

|

American Funds Insurance Series®

|

|

·

|

Northern Lights Variable Trust

|

|

2.

|

The "Income Benefit Investment Options" section is amended to add the following funds:

|

|

·

|

American Funds Insurance Series® - Protected Asset Allocation Fund: Class P2

|

|

·

|

Nationwide Variable Insurance Trust - NVIT CardinalSM Moderate Fund: Class II

|

|

·

|

Nationwide Variable Insurance Trust - NVIT Investor Destinations Moderate Fund: Class II

|

|

3.

|

The “Appendix A: Underlying Mutual Funds” is amended to add the following:

|

American Funds Insurance Series® - Protected Asset Allocation Fund: Class P2

|

Investment Advisor:

Sub-advisor:

Investment Objective:

|

Capital Research and Management Company

Milliman Financial Risk Management LLC

To provide high total return (including income and capital gains) consistent with preservation of capital over the long term while seeking to manage volatility.

|

Northern Lights Variable Trust - TOPS Protected Balanced ETF Portfolio: Class 4

|

Investment Advisor:

Sub-advisor:

Investment Objective:

Designation: FF

|

ValMark Advisers, Inc.

Milliman, Inc.

Seeks capital appreciation with less volatility than the equity markets.

|

Northern Lights Variable Trust - TOPS Protected Growth ETF Portfolio: Class 4

|

Investment Advisor:

Sub-advisor:

Investment Objective:

Designation: FF

|

ValMark Advisers, Inc.

Milliman, Inc.

Seeks capital appreciation with less volatility than the equity markets.

|

Northern Lights Variable Trust - TOPS Protected Moderate Growth ETF Portfolio: Class 4

|

Investment Advisor:

Sub-advisor:

Investment Objective:

Designation: FF

|

ValMark Advisers, Inc.

Milliman, Inc.

Seeks capital appreciation with less volatility than the equity markets.

|

|

4.

|

The “Legal Proceedings” section of your prospectus is replaced with the following:

|

Nationwide Financial Services, Inc. (NFS, or collectively with its subsidiaries, "the Company") was formed in November 1996. NFS is the holding company for Nationwide Life Insurance Company (NLIC), Nationwide Life and Annuity Insurance Company (NLAIC) and other companies that comprise the life insurance and retirement savings operations of the Nationwide group of companies (Nationwide). This group includes Nationwide Financial Network (NFN), an affiliated distribution network that markets directly to its customer base. NFS is incorporated in Delaware and maintains its principal executive offices in Columbus, Ohio.

The Company is subject to legal and regulatory proceedings in the ordinary course of its business. The Company’s legal and regulatory matters include proceedings specific to the Company and other proceedings generally applicable to business practices in the industries in which the Company operates. These matters are subject to many uncertainties, and given their complexity and scope, their outcomes cannot be predicted. Regulatory proceedings could also affect the outcome of one or more of the Company’s litigation matters. Furthermore, it is often not possible to determine the ultimate outcomes of the pending regulatory investigations and legal proceedings or to provide reasonable ranges of potential losses with any degree of certainty. Some matters, including certain of those referred to below, are in very preliminary stages, and the Company does not have sufficient information to make an assessment of the plaintiffs’ claims for liability or damages. In some of the cases seeking to be certified as class actions, the court has not yet decided whether a class will be certified or (in the event of certification) the size of the class and class period. In many of the cases, the plaintiffs are seeking undefined amounts of damages or other relief, including punitive damages and equitable remedies, which are difficult to quantify and cannot be defined based on the information currently available. The Company believes, however, that based on currently known information, the ultimate outcome of all pending legal and regulatory matters is not likely to have a material adverse effect on the Company’s condensed consolidated financial position. Nonetheless, given the large or indeterminate amounts sought in certain of these matters and the inherent unpredictability of litigation, it is possible that such outcomes could materially affect the Company’s condensed consolidated financial position or results of operations in a particular quarter or annual period.

The various businesses conducted by the Company are subject to oversight by numerous federal and state regulatory entities, including but not limited to the Securities and Exchange Commission, the Financial Industry Regulatory Authority, the Department of Labor, the Internal Revenue Service ("IRS"), and state insurance authorities. Such regulatory entities may, in the normal course, be engaged in general or targeted inquiries, examinations and investigations of the Company and/or its affiliates. The financial services industry has been the subject of increasing scrutiny in connection with a broad spectrum of regulatory issues; with respect to all such scrutiny directed at the Company and/or its affiliates, the Company is cooperating with regulators. The Company will cooperate with Nationwide Mutual Insurance Company (NMIC) insofar as any inquiry, examination or investigation encompasses NMIC's operations.

In October 2012, NLIC and NLAIC entered into a Regulatory Settlement Agreement with the Florida Office of Insurance Regulation and 21 other state Departments of Insurance to resolve a multi-state market conduct exam regarding claim settlement practices. The Regulatory Settlement Agreement applies prospectively and requires NLIC and NLAIC to adopt and implement additional procedures relating to the use of to the Social Security Death Master File and identifying and locating beneficiaries once deaths are identified. In October 2012, NLIC and NLAIC also entered into a Global Resolution Agreement to resolve the related unclaimed property audit.

Other jurisdictions may pursue similar investigations, examinations or inquires. The results of these investigations, examinations or inquiries could result in the payment or escheatment of unclaimed death benefits, and/or changes in the Company’s practices and procedures to its claims handling and escheat processes, all of which could impact claim payments and reserves and/or result in payment of investigation costs, fines or penalties.

On November 20, 2007, Nationwide Retirement Solutions, Inc. ("NRS") and NLIC were named in a lawsuit filed in the Circuit Court of Jefferson County, Alabama entitled Ruth A. Gwin and Sandra H. Turner, and a class of similarly situated individuals v Nationwide Life Insurance Company, Nationwide Retirement Solutions, Inc., Alabama State Employees Association, PEBCO, Inc. and Fictitious Defendants A to Z. On March 12, 2010, NRS and NLIC were named in a Second Amended Class Action Complaint filed in the Circuit Court of Jefferson County, Alabama entitled Steven E. Coker, Sandra H. Turner, David N. Lichtenstein and a class of similarly situated individuals v. Nationwide Life Insurance Company, Nationwide Retirement Solutions, Inc, Alabama State Employees Association, Inc., PEBCO, Inc. and Fictitious Defendants A to Z claiming to represent a class of all participants in the Alabama State Employees Association, Inc. ("ASEA") Plan, excluding members of the Deferred Compensation Committee, ASEA's directors, officers and board members, and PEBCO's directors, officers and board members. On October 22, 2010, the parties to this action executed a court approved stipulation of settlement that agreed to certify a class for settlement purposes only,

that provided for payments to the settlement class, and that provided for releases, certain bar orders, and dismissal of the case. The settlement fund has been paid out. On December 6, 2011 the Court entered an Order that NRS owes indemnification to ASEA and PEBCO for only the Coker (Gwin) class action, and dismissed NLIC. The Company has resolved the indemnification claims of ASEA. On June 19 and 20, 2012, the Court held an evidentiary hearing on the amount of indemnification owed to PEBCO. The Court has taken the matter under advisement. NRS continues to defend this case vigorously.

On August 15, 2001, NFS and NLIC were named in a lawsuit filed in the U.S. District Court for the District of Connecticut entitled Lou Haddock, as trustee of the Flyte Tool & Die, Incorporated Deferred Compensation Plan, et al v. Nationwide Financial Services, Inc. and Nationwide Life Insurance Company. In the plaintiffs' sixth amended complaint, filed November 18, 2009, they amended the list of named plaintiffs and claim to represent a class of qualified retirement plan trustees under Employee Retirement Income Security Act of 1974 ("ERISA") that purchased variable annuities from NLIC. The plaintiffs allege that they invested ERISA plan assets in their variable annuity contracts and that NLIC and NFS breached ERISA fiduciary duties by allegedly accepting service payments from certain mutual funds. The complaint seeks disgorgement of some or all of the payments allegedly received by NFS and NLIC, other unspecified relief for restitution, declaratory and injunctive relief, and attorneys' fees. On November 6, 2009, the Court granted the plaintiff's motion for class certification and certified a class of "All trustees of all employee pension benefit plans covered by ERISA which had variable annuity contracts with NFS and NLIC or whose participants had individual variable annuity contracts with NFS and NLIC at any time from January 1, 1996, or the first date NFS and NLIC began receiving payments from mutual funds based on a percentage of assets invested in the funds by NFS and NLIC, whichever came first, to the date of November 6, 2009". On October 21, 2010, the District Court dismissed NFS from the lawsuit. On February 6, 2012, the Second Circuit Court of Appeals vacated the November 6, 2009 order granting class certification and remanded the case back to the District Court for further consideration. The plaintiffs have renewed their motion for class certification. The case is fully briefed. NLIC continues to defend this lawsuit vigorously.

On June 8, 2011, NMIC and NLIC were named in a lawsuit filed in Court of Common Pleas, Cuyahoga County, Ohio entitled Stanley Andrews and Donald Clark, on their behalf and on behalf of the class defined herein v. Nationwide Mutual Insurance Company and Nationwide Life Insurance Company. The complaint alleges that NMIC and NLIC have an obligation to review the Social Security Administration Death Master File database for all life insurance policyholders who have at least a 70% probability of being deceased according to actuarial tables. The complaint further alleges that NMIC and NLIC are not conducting such a review. The complaint seeks injunctive relief and declaratory judgment requiring NMIC and NLIC to conduct such a review, and alleges NMIC and NLIC have violated the covenant of good faith and fair dealing and have been unjustly enriched by not having conducted such reviews. The complaint seeks certification as a class action. Including Andrews, there are four similar class actions in Ohio: two against Western & Southern; one against Cincinnati Life. NMIC and NLIC filed a motion to dismiss. By order dated January 18, 2012, the State Court issued an order dismissing the lawsuit. The court issued its opinion on January 23, 2012. On January 30, 2012, plaintiffs filed their appeal. Plaintiffs filed their appellate brief on April 12, 2012. The Association of Ohio Life Insurance Companies filed an amicus brief in support of NMIC and NLIC's position on May 24, 2012. NMIC and NLIC's filed its brief in opposition on May 25, 2012. Plaintiffs filed their reply brief on June 7, 2012. Oral argument on plaintiff’s appeal was held on October 1, 2012. NMIC and NLIC continue to defend their lawsuit vigorously.

The general distributor, NISC, is not engaged in any litigation of any material nature.

INCORPORATION BY REFERENCE

The prospectus and statement of additional information that were effective April 20, 2012, previously filed with the Commission under SEC file No. 333-177316, are hereby incorporated by reference and made a part of this registration statement.

PART C. OTHER INFORMATION

|

Item 24.

|

Financial Statements and Exhibits

|

|

|

(a)

|

Financial Statements

|

|

|

Nationwide Variable Account-II:

|

Report of Independent Registered Public Accounting Firm

Statement of Assets, Liabilities and Contract

Owners’ Equity as of December 31, 2011.

Statement of Operations for the year ended December 31, 2011.

Statements of Changes in Contract Owners’ Equity for the years

ended December 31, 2011 and 2010.

Notes to Financial Statements.

|

|

Nationwide Life Insurance Company and subsidiaries:

|

Report of Independent Registered Public Accounting Firm

Consolidated Statements of Operations for the

years ended December 31, 2011, 2010 and

2009.

Consolidated Balance Sheets as of December

31, 2011 and 2010.

Consolidated Statements of Changes in

Equity as of December 31, 2011, 2010 and 2009.

Consolidated Statements of Cash Flows for

the years ended December 31, 2011, 2010

and 2009.

Notes to Consolidated Financial Statements.

Financial Statement Schedules.

|

Item 24.

|

(b) Exhibits

|

|

|

(1)

|

Resolution of the Depositor’s Board of Directors authorizing the establishment of the Registrant - Filed with Post-Effective Amendment No. 16 on April 30, 2007 (File No. 333-103093) as Exhibit (1) and hereby incorporated by reference.

|

|

|

(2)

|

Not Applicable.

|

|

|

(3)

|

Underwriting or Distribution of Contracts between the Depositor and NISC as Principal Underwriter - Filed with Post-Effective Amendment No. 16 on April 19, 2007 (File No. 333-103093) as Exhibit (3) and hereby incorporated by reference.

|

|

|

(4)

|

The form of the variable annuity contract - Filed previously on March 15, 2012 with Pre-Effective Amendment No. 2 to the registration statement (File No. 333-177316) and hereby incorporated by reference .

|

|

|

(5)

|

Variable Annuity Application - Filed previously on March 15, 2012 with Pre-Effective Amendment No. 2 to the registration statement (File No. 333-177316) and hereby incorporated by reference.

|

|

|

(6)

|

Depositor’s Certificate of Incorporation and By-Laws.

|

|

|

(a)

|

Amended Articles of Incorporation for Nationwide Life Insurance Company. Filed previously with initial registration statement (333-164125) on January 4, 2010 as document "exhibit6a.htm" and hereby incorporated by reference.

|

|

|

(b)

|

Amended and Restated Code of Regulations of Nationwide Life Insurance Company. Filed previously with initial registration statement (333-164125) on January 4, 2010 as document "exhibit6b.htm" and hereby incorporated by reference.

|

|

|

(c)

|

Articles of Merger of Nationwide Life Insurance Company of America with and into Nationwide Life Insurance Company, effective December 31, 2009. Filed previously with initial registration statement (333-164125) on January 4, 2010 as document "exhibit6c.htm" and hereby incorporated by reference.

|

|

|

(7)

|

Not Applicable.

|

|

|

(8)

|

Form of Participation Agreements -

|

The following Fund Participation Agreements were previously filed on July 17, 2007 with Pre-Effective Amendment No. 1 to the registration statement associated with 1933 Act File No. 333-140608 under Exhibit 26(h), and are hereby incorporated by reference.

|

|

(1)

|

Amended and Restated Fund Participation and Shareholder Services Agreement with American Century Investment Services, Inc. dated September 15, 2004, as amended, under document "amcentfpa99h2."

|

|

|

(2)

|

Restated and Amended Fund Participation Agreement with The Dreyfus Corporation dated January 27, 2000, as amended, under document "dreyfusfpa99h3.htm."

|

|

|

(3)

|

Fund Participation Agreement with Fidelity Variable Insurance Products Fund dated May 1, 1988, as amended, including Fidelity Variable Insurance Products Fund IV and Fidelity Variable Insurance Products Fund V, under document "fidifpa99h5.htm."

|

|

|

(4)

|

Amended and Restated Fund Participation with Franklin Templeton Variable Insurance Products Trust and Franklin/Templeton Distributors, Inc., as amended, dated May 1, 2003, as document "frankfpa99h8.htm. "

|

|

|

(5)

|

Fund Participation Agreement, Service and Institutional Shares, with Janus Aspen Series, dated December 31, 1999, under document "janusfpa99h9a.htm."

|

|

|

(6)

|

Amended and Restated Fund Participation Agreement with MFS Variable Insurance Trust and Massachusetts Financial Services Company dated February 1, 2003, as amended, under document "mfsfpa99h11.htm."

|

|

|

(7)

|

Fund Participation Agreement with Nationwide Variable Insurance Trust (formerly, Gartmore Variable Insurance Trust) dated February 1, 2003, as amended, under document "nwfpa99h12a.htm."

|

|

|

(8)

|

Fund Participation Agreement with Nationwide Variable Insurance Trust (formerly, Gartmore Variable Insurance Trust), American Funds Insurance Series, and Capital Research and Management Company dated May 1, 2006, under document "nwfpa99h12b.htm."

|

|

|

(9)

|

Fund Participation Agreement with Neuberger Berman Advisers Management Trust / Lehman Brothers Advisers Management Trust (formerly, Neuberger Berman Advisers Management Trust) dated January 1, 2006, under document "neuberfpa99h13.htm."

|

|

|

(10)

|

Fund Participation Agreement with Oppenheimer Variable Account Funds and Oppenheimer Funds, Inc. dated April 13, 2007, under document "oppenfpa99h14.htm."

|

|

|

(11)

|

Fund Participation Agreement with T. Rowe Price Equity Series, Inc., T. Rowe Price International Series, Inc., T. Rowe Price Fixed Income Series, Inc., and T. Rowe Price Investment Services, Inc. dated October 1, 2002, as amended, under document "trowefpa99h15.htm."

|

The following Fund Participation Agreements were previously filed on September 27, 2007 with Pre-Effective Amendment No. 3 to the registration statement associated with 1933 Act File No. 333-137202 under Exhibit 26(h), and are hereby incorporated by reference.

|

|

(12)

|

Fund Participation Agreement (Amended and Restated) with Alliance Capital Management L.P. and Alliance-Bernstein Investment Research and Management, Inc. dated June 1, 2003, as document "alliancebernsteinfpa.htm."

|

|

|

(13)

|

Fund Participation Agreement with BlackRock (formerly FAM Distributors, Inc. and FAM Variable Series Funds, Inc.), as amended, dated April 13, 2004, as document " blackrockfpa.htm."

|

|

|

(14)

|

Fund Participation Agreement with PIMCO Variable Insurance Trust and PIMCO Fund Distributors, LLC, as amended, dated March 28, 2002, as document " pimcofpa.htm."

|

|

|

(15)

|

Fund Participation Agreement with Waddell & Reed Services Company, Waddell & Reed, Inc., and W&R Target Funds, Inc., as amended, dated December 1, 2000, as document "waddellreedfpa.htm."

|

|

|

(16)

|

Fund Participation Agreement with Wells Fargo Management, LLC, Stephens, Inc., as amended, dated November 15, 2004 as document "wellsfargofpa.htm."

|

|

|

(17)

|

Fund Participation Agreement with Van Eck Investment Trust, Van Eck Associates Corporation, Van Eck Securities Corporation, as amended, dated September 1, 1989, as document “vaneckfpa.htm”.

|

The following Fund Participation Agreement was previously filed on May 13, 2010 with Pre-Effective Amendment No. 1 to the registration statement associated with 1933 Act File No. 333-164886 under Exhibit 26(h), and is hereby incorporated by reference.

|

|

(18)

|

Fund Participation Agreement with INVESCO Funds Group, Inc., and INVESCO Distributors, Inc., as amended, dated August 1, 2001, as document "ex818.htm."

|

The following Fund Participation Agreement was previously filed on October 26, 2010 with Post-Effective Amendment No. 2 to the registration statement associated with 1933 Act File No. 333-164886 under Exhibit 26(h), and is hereby incorporated by reference.

|

|

(19)

|

Fund Participation Agreement with Unified Financial Securities and Huntington Asset Advisers, Inc., dated August 13, 2010, as document "huntingtonfpa.htm."

|

The following Fund Participation Agreement was previously filed on June 11, 2012, with Post-Effective Amendment No. 28 to the registration statement associated with 1933 Act File No. 333-62692 under Exhibit 24(b), and is hereby incorporated by reference.

|

|

(20)

|

Fund Participation Agreement with Northern Lights Variable Trust, dated February 8, 2012, as document "northernlightsfpa.htm."

|

For information regarding payments Nationwide receives from underlying mutual funds, please see the "Information on Underlying Mutual Fund Payments" section of the prospectus and/or the underlying mutual fund prospectuses.

|

|

(9)

|

Opinion of Counsel - Filed previously with initial registration statement (File No. 333-177316) and hereby incorporated by reference.

|

|

|

(10)

|

Consent of Independent Registered Public Accounting Firm - Attached hereto.

|

|

|

(11)

|

Not Applicable.

|

|

|

(12)

|

Not Applicable.

|

|

|

(99)

|

Power of Attorney - Attached hereto.

|

|

Item 25.

|

Directors and Officers of the Depositor

|

|

President and Chief Operating Officer and Director

|

Kirt A. Walker

|

|

Executive Vice President-Chief Legal and Governance Officer

|

Patricia R. Hatler

|

|

Executive Vice President

|

Terri L. Hill

|

|

Executive Vice President-Finance

|

Lawrence A. Hilsheimer

|

|

Executive Vice President-Chief Marketing & Strategy Officer

|

Matthew Jauchius

|

|

Executive Vice President-Chief Information Officer

|

Michael C. Keller

|

|

Executive Vice President-Chief Human Resources Officer

|

Gale V. King

|

|

Executive Vice President

|

Mark A. Pizzi

|

|

Executive Vice President and Director

|

Mark R. Thresher

|

|

Senior Vice President

|

Steven M. English

|

|

Senior Vice President

|

Harry H. Hallowell

|

|

Senior Vice President and Treasurer

|

David LaPaul

|

|

Senior Vice President-Business Transformation Office

|

Robert P. McIsaac

|

|

Senior Vice President-Chief Claims Officer

|

David A. Bano

|

|

Senior Vice President-Chief Compliance Officer

|

Sandra L. Rich

|

|

Senior Vice President-Chief Financial Officer and Director

|

Timothy G. Frommeyer

|

|

Senior Vice President-Chief Financial Officer-Property and Casualty

|

Michael P. Leach

|

|

Senior Vice President-Chief Risk Officer

|

Michael W. Mahaffey

|

|

Senior Vice President-CIO ACS

|

Daniel G. Greteman

|

|

Senior Vice President-CIO Enterprise Applications

|

Mark A. Gaetano

|

|

Senior Vice President-CIO IT Infrastructure

|

Gregory S. Moran

|

|

Senior Vice President-CIO NF Systems

|

Susan J. Gueli

|

|

Senior Vice President-Controller

|

James D. Benson

|

|

Senior Vice President-Corporate Marketing

|

Gordon E. Hecker

|

|

Senior Vice President-Corporate Strategy

|

Katherine M. Liebel

|

|

Senior Vice President-Deputy General Counsel

|

Thomas W. Dietrich

|

|

Senior Vice President-Deputy General Counsel

|

Sandra L. Neely

|

|

Senior Vice President-Distribution and Sales

|

John L. Carter

|

|

Senior Vice President-Enterprise Chief Technology Officer

|

Guruprasad C. Vasudeva

|

|

Senior Vice President-Field Operations EC

|

Amy T. Shore

|

|

Senior Vice President-Field Operations IC

|

Jeff M. Rommel

|

|

Senior Vice President-Head of Taxation

|

Pamela A. Biesecker

|

|

Senior Vice President-Individual Products & Solutions and Director

|

Eric S. Henderson

|

|

Senior Vice President-Internal Audit

|

Kai V. Monahan

|

|

Senior Vice President-Investment Management Group

|

Michael S. Spangler

|

|

Senior Vice President-IT Strategic Initiatives

|

Robert J. Dickson

|

|

Senior Vice President-Nationwide Financial

|

Steven C. Power

|

|

Senior Vice President-Nationwide Financial Network

|

Peter A. Golato

|

|

Senior Vice President-NF Brand Marketing

|

William J. Burke

|

|

Senior Vice President-NI Brand Marketing

|

Jennifer M. Hanley

|

|

Senior Vice President-NW Retirement Plans

|

Anne L. Arvia

|

|

Senior Vice President-PCIO Sales Support

|

Melissa D. Gutierrez

|

|

Senior Vice President-President-Nationwide Bank

|

J. Lynn Greenstein

|

|

Senior Vice President-Property and Casualty Commercial/Farm Product Pricing

|

W. Kim Austen

|

|

Vice President-Corporate Governance and Secretary

|

Robert W. Horner, III

|

|

Director

|

Stephen S. Rasmussen

|

|

The business address of the Directors and Officers of the Depositor is:

|

One Nationwide Plaza, Columbus, Ohio 43215

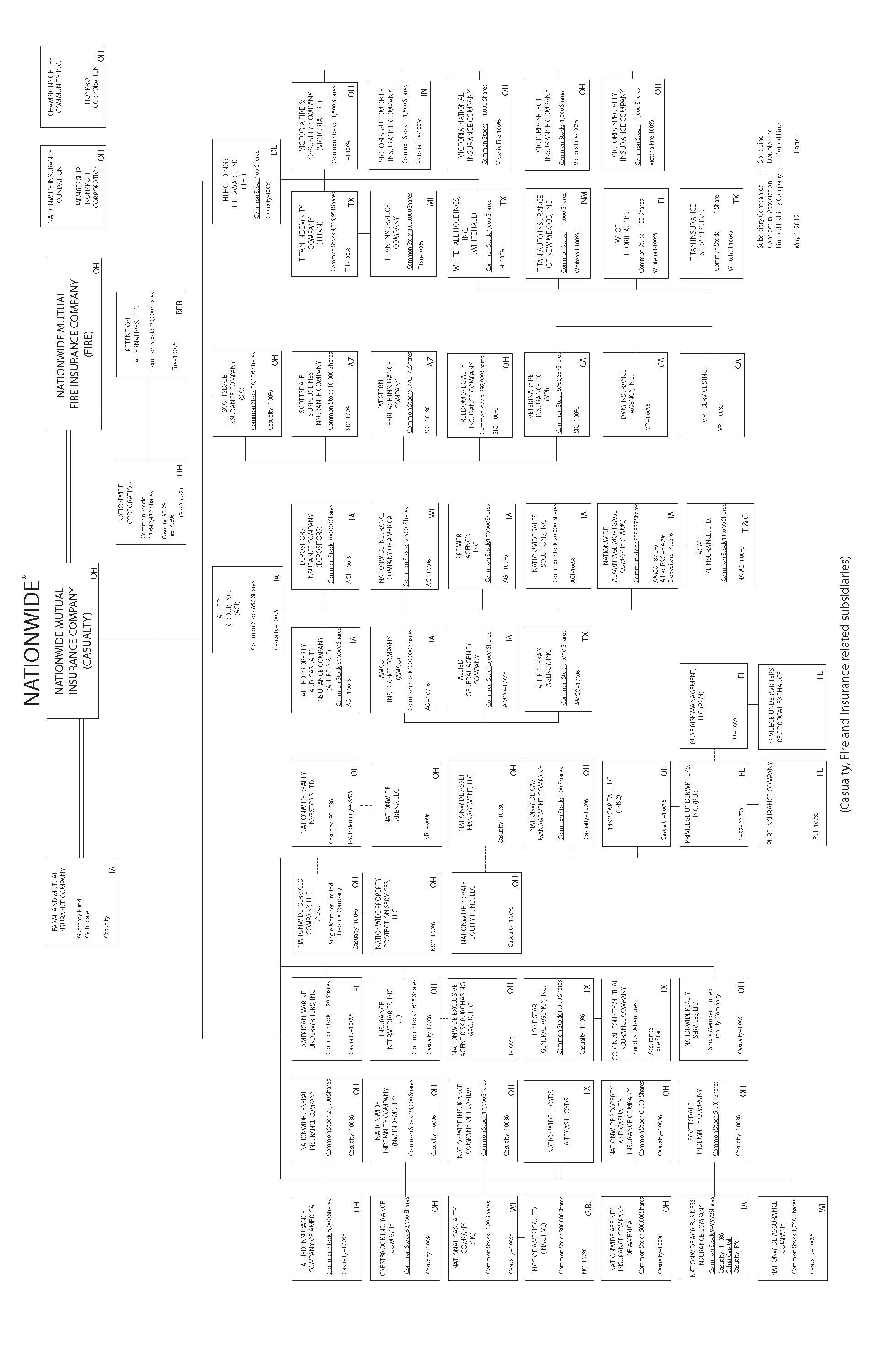

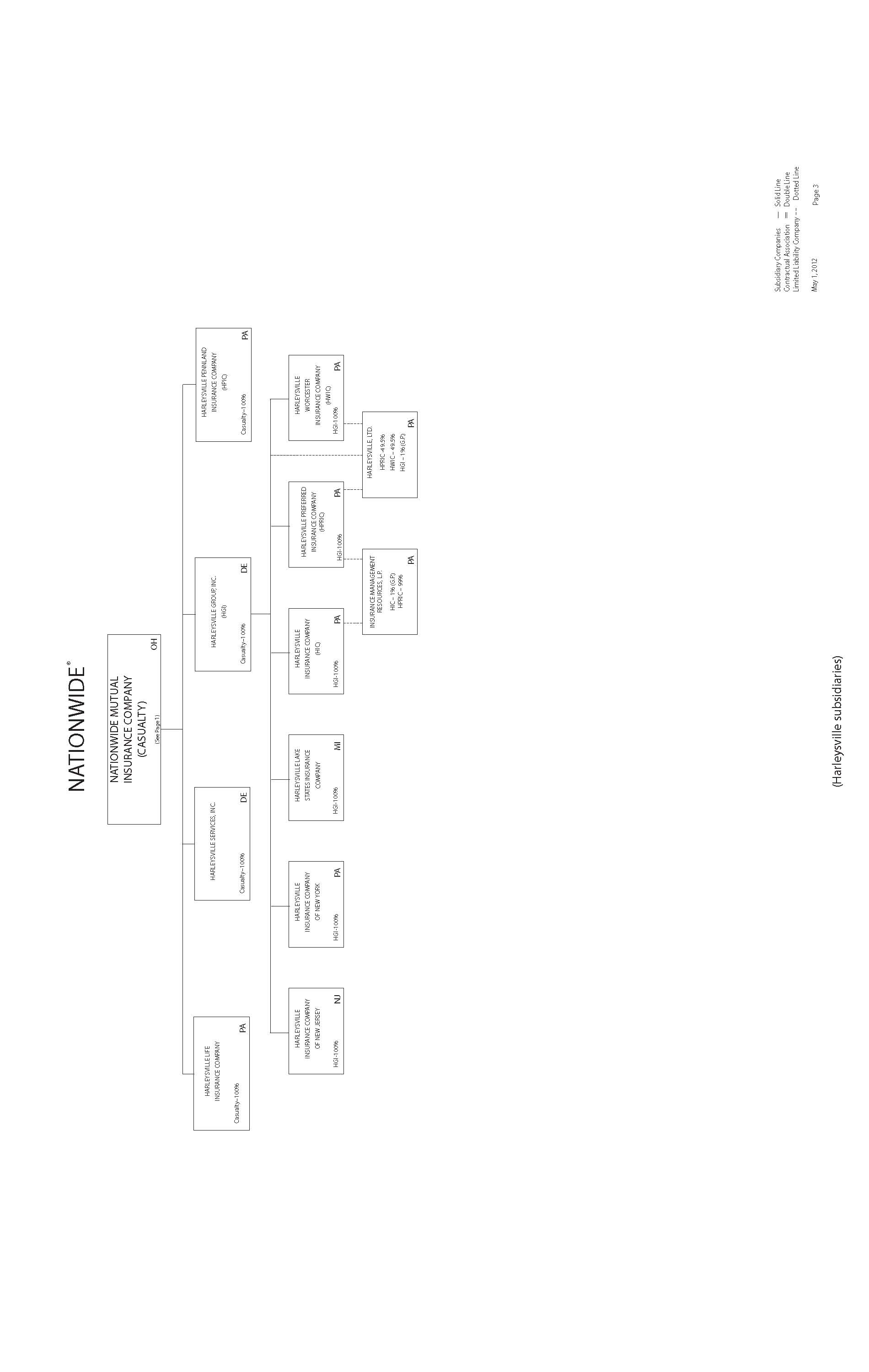

Item 26. Persons Controlled by or Under Common Control with the Depositor or Registrant.

|

*

|

Subsidiaries for which separate financial statements are filed

|

|||

|

**

|

Subsidiaries included in the respective consolidated financial statements

|

|||

|

***

|

Subsidiaries included in the respective group financial statements filed for unconsolidated subsidiaries

|

|||

|

****

|

Other subsidiaries

|

|||

|

COMPANY

|

STATE/COUNTRY OF ORGANIZATION

|

PRINCIPAL BUSINESS

|

||

|

1492 Capital, LLC

|

Ohio

|

The company acts as an investment holding company.

|

||

|

AGMC Reinsurance, Ltd.

|

Turks & Caicos Islands

|

The company is in the business of reinsurance of mortgage guaranty risks.

|

||

|

ALLIED General Agency Company

|

Iowa

|

The company acts as a managing general agent and surplus lines broker for property and casualty insurance products.

|

||

|

ALLIED Group, Inc.

|

Iowa

|

The company is a property and casualty insurance holding company.

|

||

|

ALLIED Insurance Company of America

|

Ohio

|

The company is organized to write commercial lines insurance business.

|

||

|

ALLIED Property and Casualty Insurance Company

|

Iowa

|

The company underwrites general property and casualty insurance.

|

||

|

ALLIED Texas Agency, Inc.

|

Texas

|

The company acts as a managing general agent to place personal and commercial automobile insurance with Colonial County Mutual Insurance Company.

|

||

|

AMCO Insurance Company

|

Iowa

|

The company underwrites general property and casualty insurance.

|

||

|

American Marine Underwriters, Inc.

|

Florida

|

The company is an underwriting manager for ocean cargo and hull insurance.

|

||

|

Champions of the Community, Inc.

|

Ohio

|

The company raises money to enable it to make gifts and grants to charitable organizations.

|

||

|

Colonial County Mutual Insurance Company*

|

Texas

|

The company underwrites non-standard automobile and motorcycle insurance and other commercial liability coverages in Texas.

|

||

|

Crestbrook Insurance Company

|

Ohio

|

The company is a multi-line insurance corporation that is authorized to write personal, automobile, homeowners and commercial insurance.

|

||

|

Depositors Insurance Company

|

Iowa

|

The company underwrites general property and casualty insurance.

|

||

|

DVM Insurance Agency, Inc.

|

California

|

The company places non-California pet insurance business not written by Veterinary Pet Insurance Company.

|

||

|

Farmland Mutual Insurance Company

|

Iowa

|

The company provides property and casualty insurance primarily to agricultural businesses.

|

||

|

Freedom Specialty Insurance Company

|

Ohio

|

The company operates as a multi-line insurance company.

|

||

|

Gates McDonald of Ohio, LLC

|

Ohio

|

The company provided services to employers for managing workers’ and unemployment compensation matters and employee benefit costs. The company is currently winding down to permit its eventual dissolution.

|

||

|

Gates, McDonald & Company of New York, Inc.

|

New York

|

The company provides workers’ compensation and self-insured claims administration services to employers with exposure in New York.

|

||

|

GatesMcDonald Health Plus, LLC

|

Ohio

|

The company provided medical management and cost containment services to employers. The company is currently winding down to permit its eventual dissolution.

|

||

|

Insurance Intermediaries, Inc.

|

Ohio

|

The company is an insurance agency and provides commercial property and casualty brokerage services.

|

||

|

Life Reo Holdings, LLC

|

Ohio

|

The company is an investment holding company.

|

||

|

Lone Star General Agency, Inc.

|

Texas

|

The company acts as general agent to market nonstandard automobile and motorcycle insurance for Colonial County Mutual Insurance Company.

|

|

National Casualty Company

|

Wisconsin

|

The company underwrites various property and casualty coverage, as well as some individual and group accident and health insurance.

|

|

National Casualty Company of America, Ltd.

|

England

|

This is a limited liability company organized for the purpose of carrying on the business of insurance, reinsurance, indemnity, and guarantee of various kinds. The company is currently inactive.

|

|

Nationwide Advantage Mortgage Company*

|

Iowa

|

The company makes residential mortgage loans.

|

|

Nationwide Affinity Insurance Company of America

|

Ohio

|

The company is a property and casualty insurer that writes personal lines business.

|

|

Nationwide Agribusiness Insurance Company

|

Iowa

|

The company provides property and casualty insurance primarily to agricultural businesses.

|

|

Nationwide Arena, LLC*

|

Ohio

|

The purpose of the company is to develop Nationwide Arena and to engage in related development activity.

|

|

Nationwide Asset Management, LLC

|

Ohio

|

The company provides investment advisory services as a registered investment advisor to affiliated and non-affiliated clients.

|

|

Nationwide Assurance Company

|

Wisconsin

|

The company underwrites non-standard automobile and motorcycle insurance.

|

|

Nationwide Bank*

|

United States

|

This is a federally chartered savings bank supervised by the Office of the Comptroller of the Currency to exercise deposit, lending, agency, custody and fiduciary powers and to engage in activities permissible for federal savings banks under the Home Owners’ Loan Act of 1933.

|

|

Nationwide Better Health (Ohio), LLC

|

Ohio

|

The company provided employee population health management. The company is currently winding down to permit its eventual dissolution.

|

|

Nationwide Better Health Holding Company, LLC

|

Ohio

|

The company is a holding company. The company is currently winding down to permit its eventual dissolution.

|

|

Nationwide Cash Management Company

|

Ohio

|

The company buys and sells investment securities of a short-term nature as the agent for other corporations, foundations and insurance company separate accounts.

|

|

Nationwide Community Development Corporation, LLC

|

Ohio

|

The company holds investments in low-income housing funds.

|

|

Nationwide Corporation

|

Ohio

|

The company acts as a holding company.

|

|

Nationwide Emerging Managers, LLC

|

Delaware

|

The company acts as a holding company.

|

|

Nationwide Exclusive Agent Risk Purchasing Group, LLC

|

Ohio

|

The company’s purpose is to provide a mechanism for the purchase of group liability insurance for insurance agents operating nationwide.

|

|

Nationwide Financial Assignment Company

|

Ohio

|

The company is an administrator of structured settlements.

|

|

Nationwide Financial General Agency, Inc. (fka 1717 Brokerage Services, Inc.)

|

Pennsylvania

|

The company is a multi-state licensed insurance agency.

|

|

Nationwide Financial Institution Distributors Agency, Inc.

|

Delaware

|

The company is an insurance agency.

|

|

Nationwide Financial Services Capital Trust

|

Delaware

|

The trust’s sole purpose is to issue and sell certain securities representing individual beneficial interests in the assets of the trust.

|

|

Nationwide Financial Services, Inc.*

|

Delaware

|

The company acts primarily as a holding company for companies within the Nationwide organization that offer or distribute life insurance, long-term savings and retirement products.

|

|

Nationwide Financial Structured Products, LLC

|

Ohio

|

The company captures and reports the results of the structured products business unit.

|

|

Nationwide Fund Advisors (fka Gartmore Mutual Fund Capital Trust)

|

Delaware

|

The trust acts as a registered investment advisor.

|

|

Nationwide Fund Distributors LLC (successor to Gartmore Distribution Services, Inc.)

|

Delaware

|

The company is a limited purpose broker-dealer.

|

|

Nationwide Fund Management LLC (successor to Gartmore Investors Services, Inc.)

|

Delaware

|

The company provides administration, transfer and dividend disbursing agent services to various mutual fund entities.

|

|

Nationwide General Insurance Company

|

Ohio

|

The company transacts a general insurance business, except life insurance, and primarily provides automobile and fire insurance to select customers.

|

|

Nationwide Global Holdings, Inc.

|

Ohio

|

The company acts as a holding company.

|

|

Nationwide Global Ventures, Inc.

|

Delaware

|

The company acts as a holding company.

|

|

Nationwide Indemnity Company*

|

Ohio

|

The company is involved in the reinsurance business and assumes business from Nationwide Mutual Insurance Company and other insurers within the Nationwide insurance organization.

|

|

Nationwide Insurance Company of America

|

Wisconsin

|

The company is an independent agency personal lines underwriter of property and casualty insurance.

|

|

Nationwide Insurance Company of Florida*

|

Ohio

|

The company transacts general insurance business, except life insurance.

|

|

Nationwide Insurance Foundation*

|

Ohio

|

The company contributes to non-profit activities and projects.

|

|

Nationwide Investment Advisors, LLC

|

Ohio

|

The company provides investment advisory services.

|

|

Nationwide Investment Services Corporation**

|

Oklahoma

|

This is a limited purpose broker-dealer and distributor of variable annuities and variable life products for Nationwide Life Insurance Company and Nationwide Life and Annuity Insurance Company. The company also provides educational services to retirement plan sponsors and its participants.

|

|

Nationwide Life and Annuity Insurance Company*

|

Ohio

|

The company engages in underwriting life insurance and granting, purchasing and disposing of annuities.

|

|

Nationwide Life Insurance Company*

|

Ohio

|

The company provides individual life insurance, group life and health insurance, fixed and variable annuity products and other life insurance products.

|

|

Nationwide Lloyds

|

Texas

|

The company markets commercial and property insurance in Texas.

|

|

Nationwide Mutual Fire Insurance Company

|

Ohio

|

The company engages in a general insurance and reinsurance business, except life insurance.

|

|

Nationwide Mutual Insurance Company*

|

Ohio

|

The company engages in a general insurance and reinsurance business, except life insurance.

|

|

Nationwide Private Equity Fund, LLC

|

Ohio

|

The company invests in private equity funds.

|

|

Nationwide Property and Casualty Insurance Company

|

Ohio

|

The company engages in a general insurance business, except life insurance.

|

|

Nationwide Property Protection Services, LLC

|

Ohio

|

The company provides alarm systems and security guard services.

|

|

Nationwide Realty Investors, Ltd.*

|

Ohio

|

The company is engaged in the business of developing, owning and operating real estate and real estate investment.

|

|

Nationwide Realty Services, Ltd.

|

Ohio

|

The company provides relocation services to Nationwide associates.

|

|

Nationwide Retirement Solutions, Inc.*

|

Delaware

|

The company markets and administers deferred compensation plans for public employees.

|

|

Nationwide Retirement Solutions, Inc. of Arizona

|

Arizona

|

The company markets and administers deferred compensation plans for public employees.

|

|

Nationwide Retirement Solutions, Inc. of Ohio

|

Ohio

|

The company provides retirement products, marketing and education and administration to public employees.

|

|

Nationwide Retirement Solutions, Inc. of Texas

|

Texas

|

The company markets and administers deferred compensation plans for public employees.

|

|

Nationwide Retirement Solutions Insurance Agency, Inc.

|

Massachusetts

|

The company markets and administers deferred compensation plans for public employees.

|

|

Nationwide SA Capital Trust

|

Delaware

|

The trust acts as a holding company.

|

|

Nationwide Sales Solutions, Inc.

|

Iowa

|

The company engages in the direct marketing of property and casualty insurance products.

|

|

Nationwide Securities, LLC

|

Delaware

|

The company is a registered broker-dealer.

|

|

Nationwide Services Company, LLC

|

Ohio

|

The company performs shared services functions for the Nationwide organization.

|

|

Newhouse Capital Partners, LLC

|

Delaware

|

The company is an investment holding company.

|

|

Newhouse Capital Partners II, LLC

|

Delaware

|

The company is an investment holding company.

|

|

NFS Distributors, Inc.

|

Delaware

|

The company acts primarily as a holding company for Nationwide Financial Services, Inc. companies.

|

|

NWD Asset Management Holdings, Inc.

|

Delaware

|

The company acts as a holding company.

|

|

NWD Investment Management, Inc.

|

Delaware

|

The company acts as a holding company and provides other business services for the NWD Investments Management group of companies.

|

|

NWD Management & Research Trust

|

Delaware

|

The company acts as a holding company for the NWD Investments Management group.

|

|

Olentangy Reinsurance, LLC

|

Vermont

|

The company is a captive life reinsurance company.

|

|

Pension Associates, Inc.

|

Wisconsin

|

The company provides pension plan administration and recordkeeping services, and pension plan and compensation consulting.

|

|

Premier Agency, Inc.

|

Iowa

|

The company is an insurance agency.

|

|

Privilege Underwriters, Inc.

|

Delaware

|

The company acts as a holding company for the PURE Group of insurance companies.

|

|

Privilege Underwriters, Reciprocal Exchange

|

Florida

|

The company acts as a reciprocal insurance company.

|

|

Pure Insurance Company

|

Florida

|

The company acts as a captive reinsurance company.

|

|

Pure Risk Management, LLC

|

Florida

|

The company acts as an attorney-in-fact for Privilege Underwriters Reciprocal Exchange.

|

|

Registered Investment Advisors Services, Inc.

|

Texas

|

The company is a technology company that facilitates third-party money management services for registered investment advisors.

|

|

Retention Alternatives, Ltd.*

|

Bermuda

|

The company is a captive insurer and writes first dollar insurance policies in workers’ compensation, general liability and automobile liability for its affiliates in the United States.

|

|

Riverview International Group, Inc.

|

Delaware

|

The company is an inactive shell company.

|

|

Scottsdale Indemnity Company

|

Ohio

|

The company is engaged in a general insurance business, except life insurance.

|

|

Scottsdale Insurance Company

|

Ohio

|

The company primarily provides excess and surplus lines of property and casualty insurance.

|

|

Scottsdale Surplus Lines Insurance Company

|

Arizona

|

The company provides excess and surplus lines coverage on a non-admitted basis.

|

|

THI Holdings (Delaware), Inc.

|

Delaware

|

The company acts as a holding company.

|

|

Titan Auto Insurance of New Mexico, Inc.

|

New Mexico

|

The company is an insurance agency that operates employee agent storefronts.

|

|

Titan Indemnity Company

|

Texas

|

The company is a multi-line insurance company that operates primarily as a property and casualty insurance company.

|

|

Titan Insurance Company

|

Michigan

|

The company is a property and casualty insurance company.

|

|

Titan Insurance Services, Inc.

|

Texas

|

The company is a Texas grandfathered managing general agency.

|

|

Veterinary Pet Insurance Company*

|

California

|

The company provides pet insurance.

|

|

Victoria Automobile Insurance Company

|

Indiana

|

The company is a property and casualty insurance company.

|

|

Victoria Fire & Casualty Company

|

Ohio

|

The company is a property and casualty insurance company.

|

|

Victoria National Insurance Company

|

Ohio

|

The company is a property and casualty insurance company.

|

|

Victoria Select Insurance Company

|

Ohio

|

The company is a property and casualty insurance company.

|

|

Victoria Specialty Insurance Company

|

Ohio

|

The company is a property and casualty insurance company.

|

|

VPI Services, Inc.

|

California

|

The company operates as a nationwide pet registry service for holders of Veterinary Pet Insurance Company policies, including pet indemnification and a lost pet recovery program.

|

|

Western Heritage Insurance Company

|

Arizona

|

The company underwrites excess and surplus lines of property and casualty insurance.

|

|

Whitehall Holdings, Inc.

|

Texas

|

The company acts as a holding company for the Titan group.

|

|

W.I. of Florida (d.b.a. Titan Auto Insurance)

|

Florida

|

The company is an insurance agency.

|

|

MFS Variable Account*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide Multi-Flex Variable Account*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide VA Separate Account-A*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide VA Separate Account-B*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide VA Separate Account-C*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide VA Separate Account-D*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide Variable Account*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide Variable Account-II*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide Variable Account-3*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide Variable Account-4*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide Variable Account-5*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide Variable Account-6*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide Variable Account-7*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide Variable Account-8*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide Variable Account-9*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide Variable Account-10*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide Variable Account-11*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide Variable Account-12*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide Variable Account-13*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide Variable Account-14*

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide Variable Account-15

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide Variable Account-16

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide Variable Account-17

|

Ohio

|

Issuer of variable annuity contracts.

|

|

Nationwide Provident VA Separate Account 1*

|

Pennsylvania

|

Issuer of variable annuity contracts.

|

|

Nationwide Provident VA Separate Account A*

|

Delaware

|

Issuer of variable annuity contracts.

|

|

Nationwide VL Separate Account-A

|

Ohio

|

Issuer of variable life insurance policies.

|

|

Nationwide VL Separate Account-B

|

Ohio

|

Issuer of variable life insurance policies.

|

|

Nationwide VL Separate Account-C*

|

Ohio

|

Issuer of variable life insurance policies.

|

|

Nationwide VL Separate Account-D*

|

Ohio

|

Issuer of variable life insurance policies.

|

|

Nationwide VL Separate Account-G*

|

Ohio

|

Issuer of variable life insurance policies.

|

|

Nationwide VLI Separate Account*

|

Ohio

|

Issuer of variable life insurance policies.

|

|

Nationwide VLI Separate Account-2*

|

Ohio

|

Issuer of variable life insurance policies.

|

|

Nationwide VLI Separate Account-3*

|

Ohio

|

Issuer of variable life insurance policies.

|

|

Nationwide VLI Separate Account-4*

|

Ohio

|

Issuer of variable life insurance policies.

|

|

Nationwide VLI Separate Account-5*

|

Ohio

|

Issuer of variable life insurance policies.

|

|

Nationwide VLI Separate Account-6*

|

Ohio

|

Issuer of variable life insurance policies.

|

|

Nationwide VLI Separate Account-7*

|

Ohio

|

Issuer of variable life insurance policies.

|

|

Nationwide Provident VLI Separate Account 1*

|

Pennsylvania

|

Issuer of variable life insurance policies.

|

|

Nationwide Provident VLI Separate Account A*

|

Delaware

|

Issuer of variable life insurance policies.

|

The ownership and control of each of the companies/entities listed above (including the percentage of voting securities owned or other basis of control) is shown in the following organizational chart.

|

Item 27.

|

Number of Contract Owners

|

N/A

|

Item 28.

|

Indemnification

|

Provision is made in Nationwide's Amended and Restated Code of Regulations and expressly authorized by the General Corporation Law of the State of Ohio, for indemnification by Nationwide of any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative by reason of the fact that such person is or was a director, officer or employee of Nationwide, against expenses, including attorneys fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding, to the extent and under the circumstances permitted by the General Corporation Law of the State of Ohio.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 ("Act") may be permitted to directors, officers or persons controlling Nationwide pursuant to the foregoing provisions, Nationwide has been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

|

Item 29.

|

Principal Underwriter

|

|

(a)

|

Nationwide Investment Services Corporation ("NISC") serves as principal underwriter and general distributor for the following separate investment accounts of Nationwide or its affiliates:

|

|

MFS Variable Account

|

Nationwide VA Separate Account-D

|

|

Multi-Flex Variable Account

|

Nationwide VLI Separate Account

|

|

Nationwide Variable Account

|

Nationwide VLI Separate Account-2

|

|

Nationwide Variable Account-II

|

Nationwide VLI Separate Account-3

|

|

Nationwide Variable Account-3

|

Nationwide VLI Separate Account-4

|

|

Nationwide Variable Account-4

|

Nationwide VLI Separate Account-5

|

|

Nationwide Variable Account-5

|

Nationwide VLI Separate Account-6

|

|

Nationwide Variable Account-6

|

Nationwide VLI Separate Account-7

|

|

Nationwide Variable Account-7

|

Nationwide VL Separate Account-A

|

|

Nationwide Variable Account-8

|

Nationwide VL Separate Account-C

|

|

Nationwide Variable Account-9

|

Nationwide VL Separate Account-D

|

|

Nationwide Variable Account-10

|

Nationwide VL Separate Account-G

|

|

Nationwide Variable Account-11

|

Nationwide Provident VA Separate Account 1

|

|

Nationwide Variable Account-12

|

Nationwide Provident VA Separate Account A

|

|

Nationwide Variable Account-13

|

Nationwide Provident VLI Separate Account 1

|

|

Nationwide Variable Account-14

|

Nationwide Provident VLI Separate Account A

|

|

Nationwide VA Separate Account-A

|

|

|

Nationwide VA Separate Account-B

|

|

|

Nationwide VA Separate Account-C

|

|

(b)

|

Directors and Officers of NISC:

|

|

President

|

Robert O. Cline

|

|

Vice President, Treasurer and Director

|

Keith L. Sheridan

|

|

Vice President-Chief Compliance Officer

|

James J. Rabenstine

|

|

Associate Vice President and Secretary

|

Kathy R. Richards

|

|

Associate Vice President-Finance Operations and Assistant Treasurer

|

Terry C. Smetzer

|

|

Associate Vice President

|

John J. Humphries, Jr.

|

|

Assistant Treasurer

|

J. Morgan Elliott

|

|

Assistant Treasurer

|

Jerry L. Greene

|

|

Director

|

John L. Carter

|

|

Director

|

Eric S. Henderson

|

The business address of the Directors and Officers of Nationwide Investment Services Corporation is:

One Nationwide Plaza, Columbus, Ohio 43215

(c)

|

Name of Principal Underwriter

|

Net Underwriting Discounts and Commissions

|

Compensation on Redemption or Annuitization

|

Brokerage Commissions

|

Compensation

|

|

Nationwide Investment Services Corporation

|

N/A

|

N/A

|

N/A

|

N/A

|

|

Item 30.

|

Location of Accounts and Records

|

Timothy G. Frommeyer

Nationwide Life Insurance Company

One Nationwide Plaza

Columbus, OH 43215

|

Item 31.

|

Management Services

|

Not Applicable

|

Item 32.

|

Undertakings

|

The Registrant hereby undertakes to:

|

|

(a)

|

file a post-effective amendment to this registration statement as frequently as is necessary to ensure that the audited financial statements in the registration statement are never more than 16 months old for so long as payments under the variable annuity contracts may be accepted;

|

|

|

(b)

|

include either (1) as part of any application to purchase a contract offered by the prospectus, a space that an applicant can check to request a Statement of Additional Information, or (2) a post card or similar written communication affixed to or included in the prospectus that the applicant can remove to send for a Statement of Additional Information; and

|

|

|

(c)

|

deliver any Statement of Additional Information and any financial statements required to be made available under this form promptly upon written or oral request.

|

Nationwide Life Insurance Company represents that the fees and charges deducted under the contract in the aggregate are reasonable in relation to the services rendered, the expenses expected to be incurred and risks assumed by Nationwide Life Insurance Company.

SIGNATURES

As required by the Securities Act of 1933, and the Investment Company Act of 1940, the Registrant, NATIONWIDE VARIABLE ACCOUNT-II, has caused this Registration Statement to be signed on its behalf in the City of Columbus, and State of Ohio, on this 19 th day of October , 2012.

|

NATIONWIDE VARIABLE ACCOUNT-II

|

(Registrant)

|

NATIONWIDE LIFE INSURANCE COMPANY

|

(Depositor)

|

By /s/ TIMOTHY D. CRAWFORD

|

Timothy D. Crawford

As required by the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities indicated on the 19 th day of October , 2012.

|

KIRT A. WALKER

|

|

|

Kirt A. Walker, President and Chief Operating Officer, and Director

|

|

|

MARK R. THRESHER

|

|

|

Mark R. Thresher, Executive Vice President and Director

|

|

|

TIMOTHY G. FROMMEYER

|

|

|

Timothy G. Frommeyer, Senior Vice President-Chief Financial Officer and Director

|

|

|

ERIC S. HENDERSON

|

|

|

Eric S. Henderson , Senior Vice President- Individual Products & Solutions and Director

|

|

|

STEPHEN S. RASMUSSEN

|

|

|

Stephen S. Rasmussen, Director

|

|

|

By /s/ TIMOTHY D. CRAWFORD

|

|

|

Timothy D. Crawford

|

|

|

Attorney-in-Fact

|