New Jersey Resources Corporation Exhibit 99.1

Part I

ITEM 1. BUSINESS

ORGANIZATIONAL STRUCTURE

New Jersey Resources Corporation is a New Jersey corporation formed in 1981 pursuant to a corporate reorganization. We are a diversified energy services holding company whose principal business is the distribution of natural gas through a regulated utility, providing other retail and wholesale energy services to customers and investing in clean energy projects and natural gas storage and transportation assets. We are an exempt holding company under section 1263 of the Energy Policy Act of 2005.

Our primary subsidiaries include:

New Jersey Natural Gas Company provides regulated retail natural gas utility service to approximately 558,000 residential and commercial customers throughout Monmouth, Ocean, Morris, Middlesex and Burlington counties in New Jersey and participates in the off-system sales and capacity release markets. NJNG, a local natural gas distribution company, is regulated by the BPU and comprises the Company’s Natural Gas Distribution segment and is referred to herein as NJNG or Natural Gas Distribution.

NJR Clean Energy Ventures Corporation includes the results of operations and assets related to the Company’s unregulated capital investments in clean energy projects, including commercial and residential solar projects. NJRCEV comprises the Company’s Clean Energy Ventures segment and is referred to herein as Clean Energy Ventures.

NJR Energy Services Company maintains and transacts around a portfolio of physical assets consisting of natural gas transportation and storage contracts in the U.S. and Canada. NJRES also provides unregulated wholesale energy management services to other energy companies and natural gas producers. NJRES comprises our Energy Services segment and is referred to herein as Energy Services.

NJR Midstream Holdings Corporation, which comprises the Storage and Transportation segment, formerly known as the Midstream segment, invests in energy-related ventures through its subsidiaries. Investments include NJR Steckman Ridge Storage Company, which holds our 50 percent combined ownership interest in Steckman Ridge, located in Pennsylvania, and NJR Midstream Company, formerly NJR Pipeline Company, which includes our 20 percent ownership interest in PennEast, our wholly-owned subsidiaries of Leaf River, located in southeastern Mississippi, and Adelphia Gateway, located in eastern Pennsylvania, and are subject to FERC regulation. See Note 7. Investments in Equity Investees for more information on Steckman Ridge and PennEast.

NJR Home Services Company provides heating, ventilation and cooling service, sales and installation of appliances to approximately 107,000 service contract customers, as well as solar installation projects, and is the primary contributor to Home Services and Other operations.

Page 1

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS Continued)

REPORTING SEGMENTS

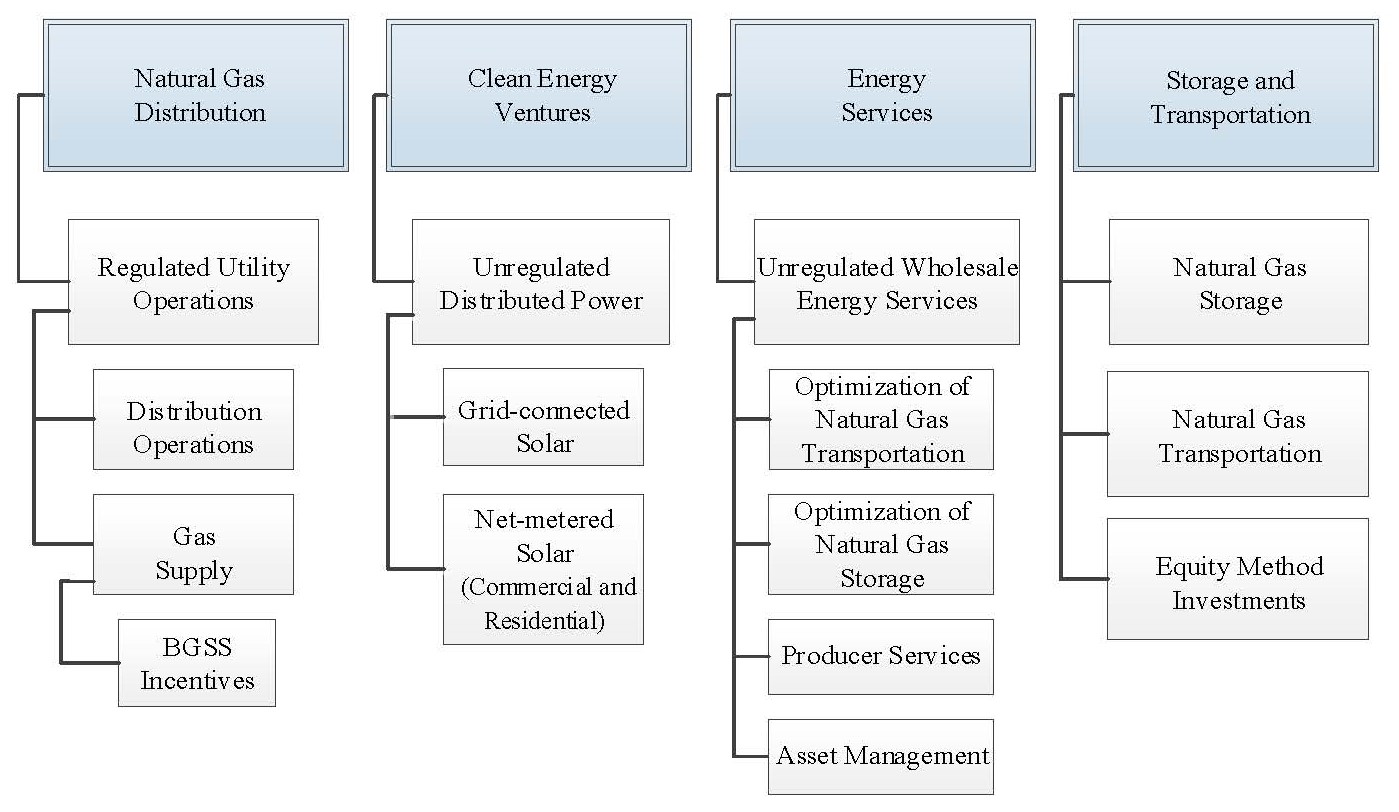

We operate within four reporting segments: Natural Gas Distribution, Clean Energy Ventures, Energy Services and Storage and Transportation, formerly known as Midstream.

The Natural Gas Distribution segment consists of regulated natural gas services, off-system sales, capacity and storage management operations. The Energy Services segment consists of unregulated wholesale and retail energy operations, as well as energy management services. The Clean Energy Ventures segment consists of capital investments in clean energy projects. The Storage and Transportation segment consists of investments in the natural gas storage and transportation market, such as natural gas storage and transportation facilities.

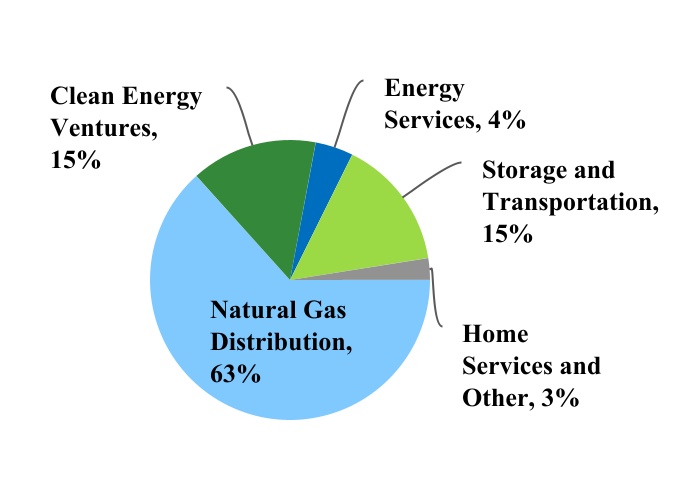

Net income by reporting segment and other business operations for the fiscal years ended September 30, are as follows:

Energy Services incurred a net loss of $11 million and $1.3 million in fiscal 2020 and 2019, respectively, which is not shown clearly in the above graph.

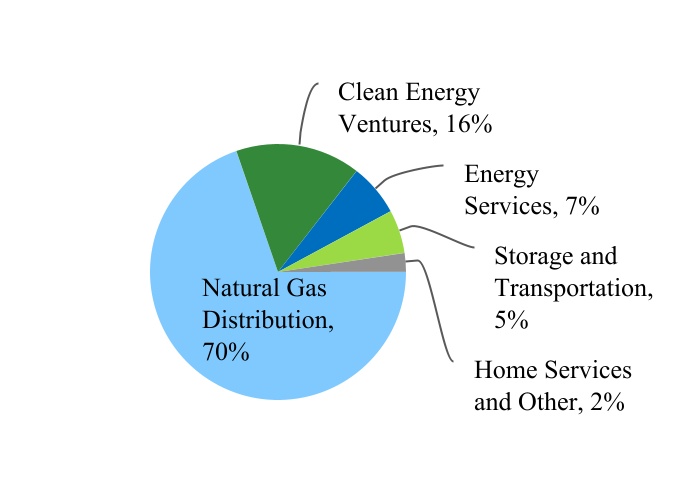

Assets composition by reporting segment and other business operations at September 30, are as follows:

| 2020 | 2019 | ||||

Page 2

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS Continued)

Management uses NFE, a non-GAAP financial measure, when evaluating our operating results. NFE is a measure of the earnings based on eliminating timing differences surrounding the recognition of certain gains or losses to effectively match the earnings effects of the economic hedges with the physical sale of natural gas and, therefore, eliminates the impact of volatility to GAAP earnings associated with the derivative instruments. Energy Services economically hedges its natural gas inventory with financial derivative instruments and calculates the related tax effect based on the statutory rate.

Non-GAAP financial measures are not in accordance with, or an alternative to, GAAP, and should be considered in addition to, and not as a substitute for, the comparable GAAP measure. The following is a reconciliation of consolidated net income, the most directly comparable GAAP measure, to NFE for the fiscal years ended September 30:

| (Thousands) | 2020 | 2019 | 2018 | ||||||||

| Net income | $ | 163,007 | $ | 123,935 | $ | 231,013 | |||||

| Add: | |||||||||||

| Unrealized (gain) loss on derivative instruments and related transactions | (9,644) | 2,881 | 26,770 | ||||||||

| Tax effect | 2,296 | (711) | (4,512) | ||||||||

| Effects of economic hedging related to natural gas inventory | 12,690 | 4,309 | (22,570) | ||||||||

| Tax effect | (3,016) | (1,024) | 7,362 | ||||||||

NFE (1) | $ | 165,333 | $ | 129,390 | $ | 238,063 | |||||

| Basic earnings per share | $ | 1.72 | $ | 1.39 | $ | 2.63 | |||||

| Add: | |||||||||||

| Unrealized (gain) loss on derivative instruments and related transactions | (0.10) | 0.03 | 0.31 | ||||||||

| Tax effect | 0.02 | (0.01) | (0.05) | ||||||||

| Effects of economic hedging related to natural gas inventory | 0.13 | 0.05 | (0.26) | ||||||||

| Tax effect | (0.03) | (0.01) | 0.08 | ||||||||

| Basic NFE per share | $ | 1.74 | $ | 1.45 | $ | 2.71 | |||||

(1) NFE during fiscal 2018 was $59.6 million, or $0.68 per share, higher due to the revaluation of deferred taxes resulting from the reduction in the federal corporate tax rate related to the Tax Act.

NFE by reporting segment and other business operations for the fiscal years ended September 30, are as follows:

NFE at Energy Services had a loss of $7.9 million in fiscal 2020 and income of $2.9 million in fiscal 2019, which is not shown clearly in the above graph.

Page 3

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS Continued)

Natural Gas Distribution

General

Our Natural Gas Distribution segment consists of regulated utility operations that provide natural gas service to approximately 558,000 customers. NJNG’s service territory includes Monmouth, Ocean, Morris, Middlesex and Burlington counties in New Jersey. It encompasses 1,516 square miles, covering 105 municipalities with an estimated population of 1.5 million people. It is primarily suburban, highlighted by approximately 100 miles of New Jersey coastline. It is in close proximity to New York City, Philadelphia and the metropolitan areas of northern New Jersey and is accessible through a network of major roadways and mass transportation.

NJNG’s business is subject to various risks, such as those associated with adverse economic conditions, which can negatively impact customer growth and operating and financing costs; fluctuations in commodity prices, which can impact customer usage; customer conservation efforts; certain regulatory actions; and environmental remediation. It is often difficult to predict the impact of trends associated with these risks. NJNG employs strategies to manage the challenges it faces, including pursuing customer conversions from other fuel sources and monitoring new construction markets through contact with developers, utilizing incentive programs through BPU-approved mechanisms to reduce natural gas costs, pursuing rate and other regulatory strategies designed to stabilize and decouple gross margin, and working actively with consultants and the NJDEP to manage expectations related to its obligations associated with its former MGP sites.

Operating Revenues/Throughput

For the fiscal years ended September 30, operating revenues and throughput by customer class for our Natural Gas Distribution segment are as follows:

| 2020 | 2019 | 2018 | ||||||||||||||||||||||||

| ($ in thousands) | Operating Revenue (2) | Bcf | Operating Revenue (2) | Bcf | Operating Revenue | Bcf | ||||||||||||||||||||

| Residential | $ | 500,271 | 44.6 | $ | 450,515 | 46.0 | $ | 441,486 | 45.5 | |||||||||||||||||

| Commercial and other | 98,463 | 8.2 | 104,372 | 9.7 | 95,351 | 8.9 | ||||||||||||||||||||

| Firm transportation | 66,871 | 13.3 | 57,513 | 13.7 | 65,256 | 15.5 | ||||||||||||||||||||

| Total residential and commercial | 665,605 | 66.1 | 612,400 | 69.4 | 602,093 | 69.9 | ||||||||||||||||||||

| Interruptible | 6,322 | 30.9 | 6,637 | 39.0 | 7,522 | 46.2 | ||||||||||||||||||||

| Total system | 671,927 | 97.0 | 619,037 | 108.4 | 609,615 | 116.1 | ||||||||||||||||||||

BGSS incentive programs (1) | 57,996 | 118.4 | 91,756 | 37.8 | 122,250 | 42.8 | ||||||||||||||||||||

| Total | $ | 729,923 | 215.4 | $ | 710,793 | 146.2 | $ | 731,865 | 158.9 | |||||||||||||||||

(1)Does not include 86.3, 86 and 107.4 Bcf for the capacity release program and related amounts of $3.1 million, $4.1 million and $5.7 million, which are recorded as a reduction of natural gas purchases on the Consolidated Statements of Operations for the fiscal years ended September 30, 2020, 2019 and 2018, respectively.

(2)Operating revenue presents sales tax, net during fiscal 2020 and 2019, due to the adoption of ASC 606, Revenue from Contracts with Customers. During fiscal 2018, operating revenue only included sales tax on operating revenues excluding tax-exempt sales.

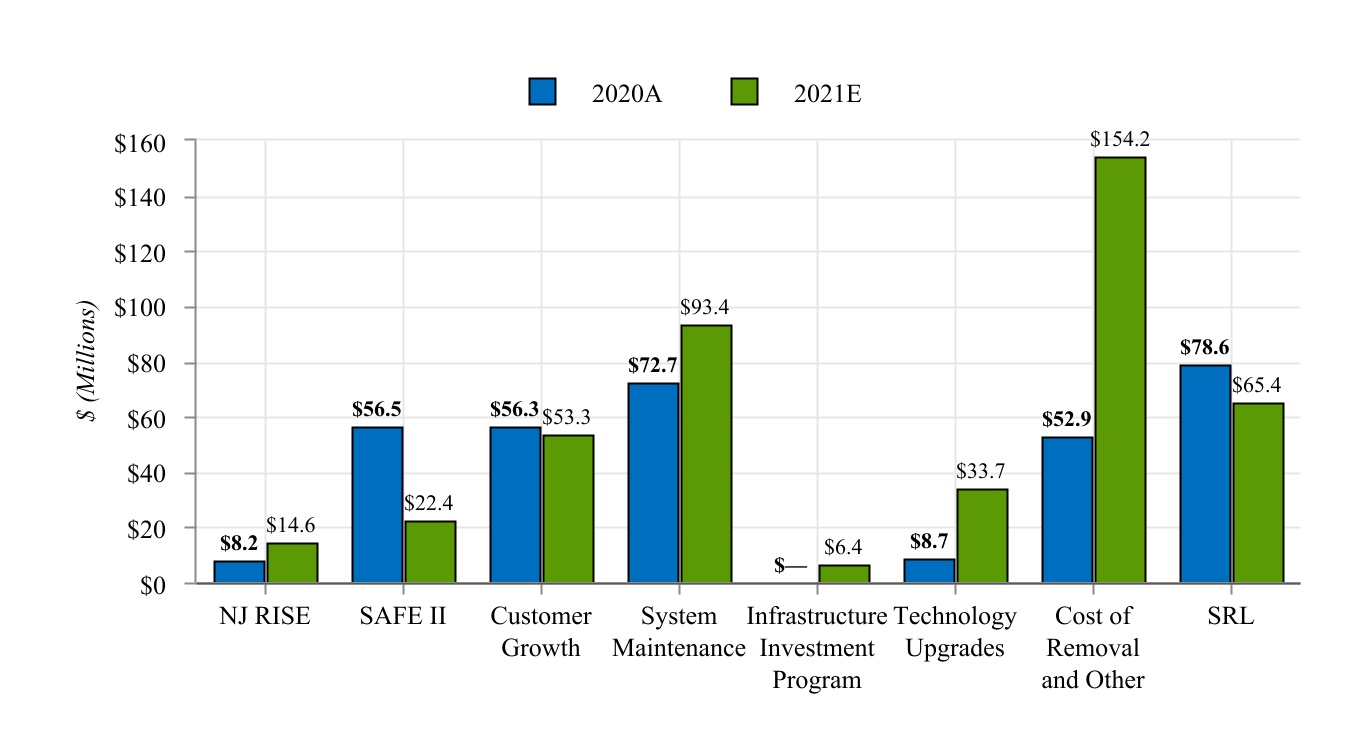

NJNG added 8,349 and 9,711 new customers and added natural gas heat and other services to another 260 and 218 existing customers in fiscal 2020 and 2019, respectively. NJNG expects its new customer annual growth rate to continue to be approximately 1.7 percent with projected additions in the range of approximately 28,000 to 30,000 new customers over the next three fiscal years. This anticipated customer growth represents approximately $6.3 million in new annual utility gross margin, a non-GAAP financial measure, as calculated under NJNG’s current CIP tariff. For a definition of utility gross margin see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Natural Gas Distribution Segment.

In fiscal 2020, no single customer represented more than 10 percent of consolidated operating revenues.

Seasonality of Natural Gas Revenues

Therm sales are significantly affected by weather conditions, with customer demand being greatest during the winter months when natural gas is used for heating purposes. The relative measurement of the impact of weather is in degree-days. Degree-day data is used to estimate amounts of energy required to maintain comfortable indoor temperature levels based on each day’s average temperature. A degree-day is the measure of the variation in the weather based on the extent to which the average daily temperature falls below 65 degrees Fahrenheit. Each degree of temperature below 65 degrees Fahrenheit is counted as one heating degree-day. Normal heating degree-days are based on a 20-year average, calculated based on three reference areas representative of NJNG’s service territory.

Page 4

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS Continued)

The CIP, a mechanism authorized by the BPU, stabilizes NJNG’s utility gross margin, regardless of variations in weather. In addition, the CIP decouples the link between utility gross margin and customer usage, allowing NJNG to promote energy conservation measures. Recovery of utility gross margin is subject to additional conditions, including an earnings test, a revenue test and an evaluation of BGSS-related savings achieved over a 12-month period. In May 2014, the BPU approved the continuation of the CIP program.

Concurrent with its annual BGSS filing, NJNG files for an annual review of its CIP, during which time it can request rate changes, as appropriate. For additional information regarding the CIP, including rate actions and impact to margin, see Note 4. Regulation in the accompanying Consolidated Financial Statements and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Natural Gas Distribution Segment.

Natural Gas Supply

Firm Natural Gas Supplies

In fiscal 2020, NJNG purchased natural gas from approximately 65 suppliers under contracts ranging from one day to one year and purchased over 10 percent of its natural gas from one supplier. NJNG believes the loss of this supplier would not have a material adverse impact on its results of operations, financial position or cash flows, as an adequate number of alternative suppliers exist. NJNG believes that its supply strategy should adequately meet its expected firm load for the upcoming winter season.

Firm Transportation and Storage Capacity

NJNG maintains agreements for firm transportation and storage capacity with several interstate pipeline companies to take delivery of firm natural gas supplies, which ensures the ability to reliably service its customers. NJNG receives natural gas at 10 citygate stations located in Middlesex, Morris and Passaic counties in New Jersey.

The pipeline companies that provide firm transportation service to NJNG’s citygate stations, the maximum daily deliverability of that capacity and the contract expiration dates are as follows:

| Pipeline | Dths(1) | Expiration | |||||||||

| Texas Eastern Transmission, L.P. | 300,738 | Various dates between 2021 and 2025 | |||||||||

| Columbia Gas Transmission Corp. | 50,000 | Various dates between 2024 and 2030 | |||||||||

| Tennessee Gas Pipeline Co. | 55,166 | Various dates between 2021 and 2024 | |||||||||

| Transcontinental Gas Pipe Line Corp. | 210,606 | Various dates between 2021 and 2033 | |||||||||

| Algonquin Gas Transmission | 12,000 | 2022 | |||||||||

| Total | 628,510 | ||||||||||

(1) Numbers are shown net of any capacity release contracted amounts.

Eastern Gas Transmission and Storage, Inc., formerly known as Dominion Energy Transmission, Inc. provides NJNG firm contract transportation service and supplies the pipelines included in the table above.

In addition, NJNG has storage contracts that provide an additional 102,941 Dths of maximum daily deliverability to NJNG’s citygate stations from storage fields in its Northeast market area. The storage suppliers, the maximum daily deliverability of that storage capacity and the contract expiration dates are as follows:

| Pipeline | Dths | Expiration | |||||||||

| Texas Eastern Transmission, L.P. | 94,557 | 2022 | |||||||||

| Transcontinental Gas Pipe Line Corp. | 8,384 | 2028 | |||||||||

| Total | 102,941 | ||||||||||

NJNG also has upstream storage contracts. The maximum daily deliverability and contract expiration dates are as follows:

| Company | Dths | Expiration | |||||||||

| Eastern Gas Transmission and Storage, Inc. | 251,829 | Various dates between 2023 and 2026 | |||||||||

| Steckman Ridge, L.P. | 38,000 | 2025 | |||||||||

| Central New York Oil & Gas | 25,337 | 2023 | |||||||||

| Total | 315,166 | ||||||||||

Page 5

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS Continued)

NJNG utilizes its transportation contracts to transport natural gas to NJNG’s citygates from the Eastern Gas Transmission and Storage, Inc., Steckman Ridge and Stagecoach Pipeline & Storage Company LLC storage fields. NJNG has sufficient firm transportation, storage and supply capacity to fully meet its firm sales contract obligations.

Citygate Supplies from Energy Services

NJNG has several citygate supply agreements with Energy Services. NJNG and Energy Services have an agreement where NJNG releases 10,000 Dths/day of TETCO capacity, 2,200 Dths/day of Eastern Gas Transmission and Storage, Inc. capacity, 10,728 Dths/day of Tennessee Gas Pipeline capacity and 1.6 million Dths of Stagecoach Pipeline & Storage Company LLC storage capacity to Energy Services for the period of April 1, 2019 to March 31, 2021. NJNG can call upon a supply of up to 20,000 Dths/day delivered to NJNG’s TETCO citygate. Energy Services manages the storage inventory and NJNG can call on that storage supply as needed at NJNG’s Tennessee citygate or storage point.

NJNG also has agreements where it releases 160,000 Dths/day of its TETCO capacity to Energy Services for the period of April 1, 2018 to October 31, 2021. Under these agreements, NJNG can call upon a supply of up to 160,000 Dths/day delivered to its TETCO citygate as needed. See Note 18. Related Party Transactions in the accompanying Consolidated Financial Statements for additional information regarding these transactions.

Peaking Supply

To manage its winter peak day demand, NJNG maintains two LNG facilities with a combined deliverability of approximately 170,000 Dths/day, which represents approximately 18 percent of its estimated peak day sendout. NJNG’s liquefaction facility allows NJNG to convert natural gas into LNG to fill NJNG’s existing LNG storage tanks. See Item 2. Properties - Natural Gas Distribution for additional information regarding the LNG storage facilities.

Basic Gas Supply Service

BGSS is a BPU-approved clause designed to allow for the recovery of natural gas commodity costs on an annual basis. The clause requires all New Jersey natural gas utilities to make an annual filing by each June 1 for review of BGSS rates and to request a potential rate change effective the following October 1. The BGSS also allows each natural gas utility to provisionally increase residential and small commercial customer BGSS rates on December 1 and February 1 for up to a five percent increase to the average residential heat customer’s bill on a self-implementing basis with proper notice. Such increases are subject to subsequent BPU review and final approval.

In addition to making periodic rate adjustments to reflect changes in commodity prices, NJNG is also permitted to refund or credit back a portion of the commodity costs to customers when the natural gas commodity costs decrease in comparison to amounts projected or to amounts previously collected from customers. Decreases in the BGSS rate and BGSS refunds can be implemented with five days’ notice to the BPU. Rate changes, as well as other regulatory actions related to BGSS, are discussed further in Note 4. Regulation in the accompanying Consolidated Financial Statements.

Wholesale natural gas prices are, by their nature, volatile. NJNG mitigates the impact of volatile price changes on customers through the use of financial derivative instruments, which are part of its storage incentive program and its BGSS clause.

Future Natural Gas Supplies

NJNG expects to meet the natural gas requirements for existing and projected firm customers. If NJNG’s long-term natural gas requirements change, NJNG expects to renegotiate and restructure its contract portfolio to better match the changing needs of its customers and changing natural gas supply landscape.

Regulation and Rates

State

NJNG is subject to the jurisdiction of the BPU with respect to a wide range of matters such as base rates and regulatory rider rates, the issuance of securities, the safety and adequacy of service, the manner of keeping its accounts and records, the sufficiency of natural gas supply, pipeline safety, environmental issues, compliance with affiliate standards and the sale or encumbrance of its properties. See Note 4. Regulation in the accompanying Consolidated Financial Statements for additional information regarding NJNG’s rate proceedings.

Page 6

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS Continued)

Federal

FERC regulates rates charged by interstate pipeline companies for the transportation and storage of natural gas. This affects NJNG’s agreements with several interstate pipeline companies for the purchase of such services. Costs associated with these services are currently recoverable through the BGSS.

Competition

Although its franchises are nonexclusive, NJNG is not currently subject to competition from other natural gas distribution utilities with regard to the transportation of natural gas in its service territory. Due to significant distances between NJNG’s current large industrial customers and the nearest interstate natural gas pipelines, as well as the availability of its transportation tariff, NJNG currently does not believe it has significant exposure to the risk that its distribution system will be bypassed. Competition does exist from suppliers of oil, electricity and propane. At the present time, however, natural gas is used in over 95 percent of new construction due to its efficiency, reliability and price advantage. Natural gas prices are a function of market supply and demand. Although NJNG believes natural gas will remain competitive with alternate fuels, no assurance can be given in this regard.

The BPU, within the framework of the EDECA, fully opened NJNG’s residential markets to competition, including third-party suppliers, and restructured rates to segregate its BGSS and delivery (i.e., transportation) prices. New Jersey’s natural gas utilities must provide BGSS in the absence of a third-party supplier. On September 30, 2020, NJNG had 22,420 residential and 9,184 commercial and industrial customers utilizing the transportation service.

Clean Energy Ventures

Our Clean Energy Ventures segment invests in, owns and operates clean energy projects, including commercial and residential solar installations located in New Jersey, Connecticut and Rhode Island.

As of September 30, 2020, Clean Energy Ventures has constructed a total of 357.4 MW of solar capacity in New Jersey that has qualified for ITCs, including a combination of residential and commercial net-metered and grid-connected solar systems. As part of its solar investment program, Clean Energy Ventures operates a residential solar program, The Sunlight Advantage®, which provides qualifying homeowners with the opportunity to have a solar system installed at their home with no installation or maintenance expenses. Clean Energy Ventures owns, operates and maintains the system over the life of the lease in exchange for monthly lease payments. The program is operated by Clean Energy Ventures using qualified contracting partners in addition to strategic suppliers for material standardization and sourcing. The residential solar lease and PPA market is highly competitive, with a large number of companies operating in New Jersey. Clean Energy Ventures competes on price, quality and brand reputation, leveraging its partner network and customer referrals.

Clean Energy Ventures’ commercial solar projects are sourced through various channels and include both net-metered and grid-connected systems. Net-metered projects involve the sale of energy to a host and grid-connected systems into the wholesale energy markets. Project construction is competitively sourced through third parties. New Jersey has the sixth largest solar market in the U.S., according to the Solar Energy Industries Association®, with a large number of firms competing in all facets of the market including development, financing and construction.

Our solar systems are registered and certified with the BPU’s Office of Clean Energy and qualified to produce RECs. One REC is created for every MWh of electricity produced by a solar generator. Clean Energy Ventures sells SRECs generated to a variety of counterparties, including electric load-serving entities that serve electric customers in New Jersey and are required to comply with the solar carve-out of the Renewable Portfolio Standard, a regulation that requires the increased production of energy from renewable energy sources. Solar projects are also currently eligible for federal ITCs in the year that they are placed into service. In December 2019, the BPU established the TREC as the interim program successor to the SREC program. TRECs provide a fixed compensation base multiplied by an assigned project factor in order to determine their value. The project factor is determined by the type and location of the project, as defined. All TRECs generated are required to be purchased monthly by a TREC program administrator as appointed by the BPU.

Clean Energy Ventures is subject to various risks including those associated with adverse federal and state legislation and regulatory policies, construction delays that can impact the timing or eligibility of tax incentives, technological changes and the future market of SRECs and TRECs. See Item 1A. Risk Factors for additional information regarding these risks.

Page 7

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS Continued)

Energy Services

Our Energy Services segment consists of unregulated wholesale and retail natural gas operations and provides producer and asset management services to a diverse customer base across North America. Energy Services has acquired contractual rights to natural gas transportation and storage assets it utilizes to implement its strategic and opportunistic market strategies. The rights to these assets were acquired in anticipation of delivering natural gas, performing asset management services for customers or identifying strategic opportunities that exist in or between the market areas that it serves. These opportunities are driven by price differentials between market locations and/or time periods. Energy Services’ activities are conducted in the market areas in which it has strong expertise, including the U.S. and Canada. Energy Services differentiates itself in the marketplace based on price, reliability and quality of service. Its competitors include wholesale marketing and trading companies, utilities, natural gas producers and financial institutions. Energy Services’ portfolio of customers includes regulated natural gas distribution companies, industrial companies, electric generators, natural gas/liquids processors, retail aggregators, wholesale marketers and natural gas producers.

While focusing on maintaining a low-risk operating and counterparty credit profile, Energy Services’ activities specifically consist of the following elements:

•Providing natural gas portfolio management services to nonaffiliated and our affiliated natural gas utility, electric generation facilities and natural gas producers;

•Managing strategies for new and existing natural gas transportation and storage assets to capture value from changes in price due to location or timing differences as a means to generate financial margin (as defined below);

•Managing transactional logistics to minimize the cost of natural gas delivery to customers while maintaining security of supply. Transactions utilize the most optimal and advantageous natural gas supply transportation routing available within its contractual asset portfolio and various market areas; and

•Managing economic hedging programs that are designed to mitigate the impact of changes in market prices on financial margin generated on its natural gas transportation and storage commitments.

In fiscal 2020, Energy Services did not purchase over 10 percent of its natural gas from any one supplier.

Transportation and Natural Gas Storage Transactions

Energy Services focuses on creating value from the use of its physical assets, which are typically amassed through contractual rights to natural gas transportation and storage capacity. These assets become more valuable when favorable price changes occur that impact the value between or within market areas and across time periods. On a forward basis, Energy Services may hedge these price differentials through the use of financial instruments. In addition, Energy Services may seek to optimize these assets on a daily basis, as market conditions warrant, by evaluating natural gas supply and transportation availability within its portfolio. This enables Energy Services to capture geographic pricing differences across various regions, as delivered natural gas prices may change favorably as a result of market conditions. Energy Services may, for example, initiate positions when intrinsic financial margin is present, and then enhance that financial margin as prices change across regions or time periods.

Energy Services also engages in park-and-loan transactions with storage and pipeline operators, where Energy Services will either borrow (receive a loan of) natural gas with an obligation to repay the storage or pipeline operator at a later date or “park” natural gas with an obligation to withdraw at a later date. In these cases, Energy Services evaluates the economics of the transaction to determine if it can capture pricing differentials in the marketplace and generate financial margin. Energy Services evaluates deal attributes such as fixed fees, calendar spread value from deal inception until volumes are scheduled to be returned and/or repaid, as well as the time value of money. If this evaluation demonstrates that financial margin exists, Energy Services may enter into the transaction and hedge with natural gas futures contracts, thereby locking in financial margin.

Energy Services maintains inventory balances to satisfy existing or anticipated sales of natural gas to its counterparties and/or to create additional value, as described above. During fiscal 2020 and 2019, Energy Services managed and sold 526.7 Bcf and 584.9 Bcf of natural gas, respectively. In addition, as of September 30, 2020 and 2019, Energy Services had 34.3 Bcf or $57.4 million of natural gas in storage and 25.6 Bcf or $52.4 million of natural gas in storage, respectively.

Page 8

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS Continued)

Weather/Seasonality

Energy Services activities are typically seasonal in nature as a result of changes in the supply and demand for natural gas. Demand for natural gas is generally higher during the winter months when there may also be supply constraints; however, during periods of milder temperatures, demand can decrease. In addition, demand for natural gas can also be high during periods of extreme heat in the summer months, resulting from the need for additional natural gas supply for natural gas-fired electric generation facilities. Accordingly, Energy Services can be subject to variations in earnings and working capital throughout the year as a result of changes in weather.

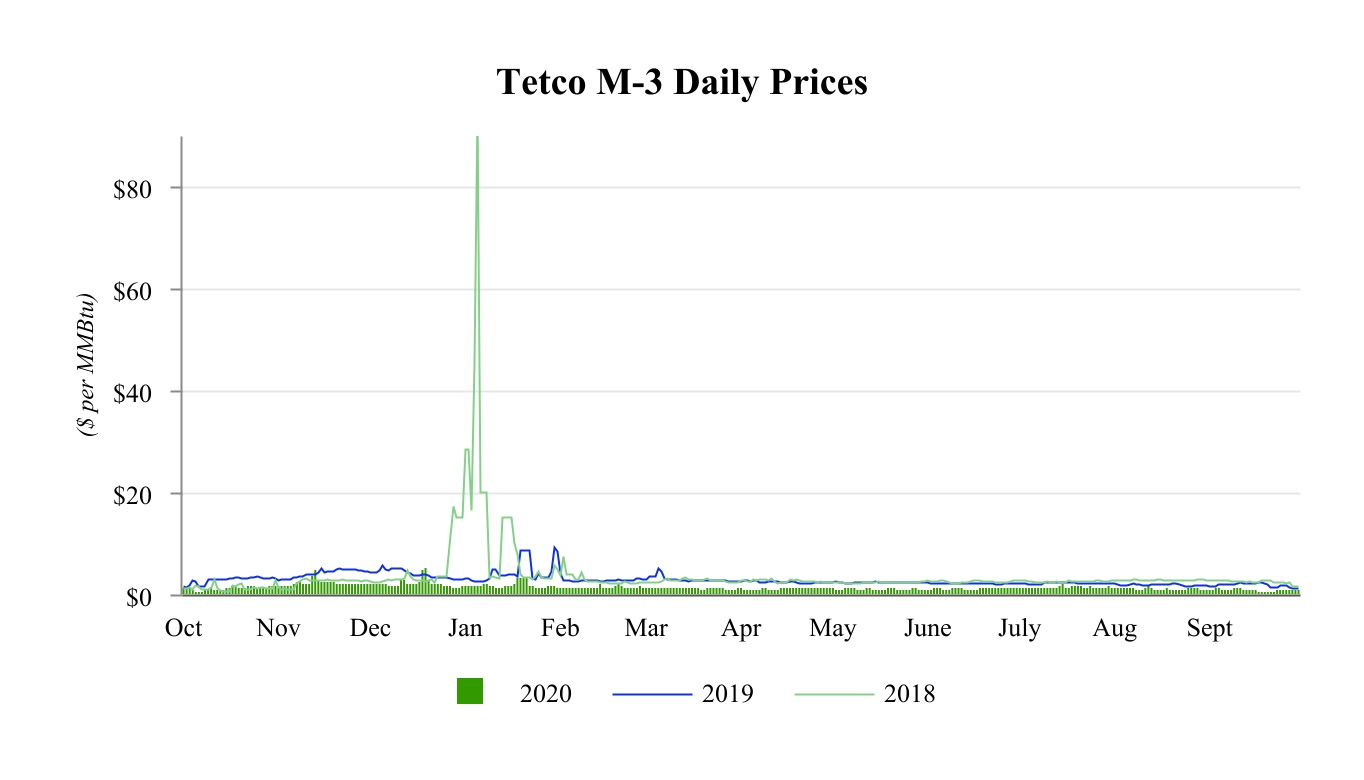

Volatility

Energy Services’ activities are also subject to price volatility or supply/demand dynamics within its North American wholesale markets, including in the Northeastern, Appalachian, Mid-Continent and Southeast regions. Changes in natural gas supply can affect capacity values and Energy Services’ financial margin, which, as described below, is generated from the optimization of transportation and storage assets. With its focus on risk management, Energy Services continues to diversify its revenue stream by identifying new growth opportunities in producer and asset management services. Energy Services monitors changing market dynamics and strategically adjusts its portfolio of transportation and storage assets, which currently includes an average of approximately 35bcf of firm storage and 1.4bcf/d of firm transportation capacity.

Financial Margin

To economically hedge the commodity price risk associated with its existing and anticipated commitments for the purchase and sale of natural gas, Energy Services enters into a variety of derivative instruments including, but not limited to, futures contracts, physical forward contracts, financial swaps and options. These derivative instruments are accounted for at fair value with changes in fair value recognized in earnings as they occur. Energy Services views “financial margin” as a key internal financial metric. Energy Services’ financial margin, which is a non-GAAP financial measure, represents revenues earned from the sale of natural gas less costs of natural gas sold including any transportation and storage costs, and excluding any accounting impact from changes in the fair value of certain derivative instruments. For additional information regarding financial margin, see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Energy Services Segment.

Risk Management

In conducting its business, Energy Services mitigates risk by following formal risk management guidelines, including transaction limits, segregation of duties and formal contract and credit review approval processes. Energy Services continuously monitors and seeks to reduce the risk associated with its counterparty credit exposures. Our Risk Management Committee oversees compliance with these established guidelines.

Storage and Transportation

Our Storage and Transportation segment, formerly known as our Midstream segment, includes investments in FERC-regulated interstate natural gas storage and transportation assets and is comprised of the following subsidiaries:

•NJR Steckman Ridge Storage Company, which holds our 50 percent equity investment in Steckman Ridge. Steckman Ridge is a Delaware limited partnership, jointly owned and controlled by our subsidiaries and subsidiaries of Enbridge Inc., which built, owns and operates a natural gas storage facility with up to 12 Bcf of working natural gas capacity in Bedford County, Pennsylvania. The facility has direct access to the TETCO and Eastern Gas Transmission and Storage, Inc. pipelines and has access to the Northeast and Mid-Atlantic markets; and

•NJR Midstream Company, formerly NJR Pipeline Company, which includes our 20 percent equity investment in PennEast, which is expected to construct a 120-mile, FERC-regulated interstate natural gas pipeline system that will extend from northern Pennsylvania to western New Jersey; Leaf River Energy Center LLC, which owns and operates a 32.2 million Dth salt dome natural gas facility, located in southeastern Mississippi; and FERC-regulated Adelphia Gateway, an indirect wholly-owned subsidiary of NJR, which acquired all of Talen’s membership interests in IEC, an existing 84-mile pipeline in southeastern Pennsylvania. See Note 19. Acquisitions and Dispositions for more information.

Page 9

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS Continued)

OTHER BUSINESS OPERATIONS

Home Services and Other

Home Services and Other operations consist primarily of the following unregulated affiliates:

•NJRHS, which provides heating, ventilation and cooling service, sales and installation of appliances to approximately 107,000 service contract customers, as well as installation of solar equipment;

•NJR Plumbing Services, Inc., which provides plumbing repair and installation services;

•New Jersey Resources Corporation, a diversified energy services holding company;

•CR&R, which holds commercial real estate; and

•NJR Service Corporation, which provides shared administrative and financial services to the Company and all of its subsidiaries and affiliates.

ENVIRONMENT

We, along with our subsidiaries, are subject to legislation and regulation by federal, state and local authorities with respect to environmental matters. We believe that we are, in all material respects, in compliance with all applicable environmental laws and regulations.

NJNG is responsible for the environmental remediation of identified former MGP sites, which contain contaminated residues from former gas manufacturing operations that ceased at these sites by the mid-1950s and, in some cases, had been discontinued many years earlier. NJNG periodically, and at least annually, performs an environmental review of the former MGP sites, including a review of potential estimated liabilities related to the investigation and remedial action on these sites. Based on this review, NJNG has estimated that the total future expenditures to remediate and monitor the former MGP sites for which it is responsible will range from approximately $143.1 million to $181.7 million.

NJNG’s estimate of these liabilities is based upon known and measurable facts, existing technology and enacted laws and regulations in place when the review was completed in fiscal 2020. Where it is probable that costs will be incurred, and the information is sufficient to establish a range of possible liability, NJNG accrues the most likely amount in the range. If no point within the range is more likely than the other, it is NJNG’s policy to accrue the lower end of the range. As of September 30, 2020, NJNG recorded an MGP remediation liability and a corresponding regulatory asset of $150.6 million on the Consolidated Balance Sheets, based on the most likely amount; however, actual costs may differ from these estimates.

HUMAN CAPITAL RESOURCES

Employee Overview

NJR fundamentally believes that its employees make the Company a unique, successful organization – in creativity, commitment, ingenuity, hard work and innovation. NJR employees fulfill the responsibilities that enable the Company to deliver natural gas service to its customers; to be a leader in clean energy investments; to grow its storage and transportation energy business; and, to earn the loyalty of its retail home services customers. NJR also is committed to provide every appropriate resource to ensure its employees’ safety. Through initiatives that start at the top, NJR has invested time, energy and manpower to foster a culture where safety is top-of-mind at all times, and where achieving safety goals is a shared priority for every NJR employee.

As of September 30, 2020, the Company and our subsidiaries employed 1,156 employees compared with 1,108 employees as of September 30, 2019. Of the total number of employees, NJNG had 469 and 460 and NJRHS had 101 and 101 Union or Represented employees as of September 30, 2020 and 2019, respectively. NJNG and NJRHS have collective bargaining agreements with the Union, which is affiliated with the American Federation of Labor and Congress of Industrial Organizations, that expire on December 7, 2021 and April 2, 2023, respectively. The labor agreements cover wage increases and other benefits, including the defined benefit pension (which was closed to all employees hired on or after January 1, 2012, with the exception of certain rehires who are eligible to resume active participation), the postemployment benefit plan (which was closed to all employees hired on or after January 1, 2012) and the enhanced 401(k) retirement savings plan. We consider our relationship with employees, including those covered by collective bargaining agreements, to be in good standing.

Page 10

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS Continued)

The Company depends on its key personnel to successfully operate its businesses, including its executive officers, senior corporate management and management at its operating units. NJR seeks to attract and retain its employees by offering competitive compensation packages including base and incentive compensation (and in certain instances share-based compensation and retention incentives), attractive benefits and opportunities for advancement and rewarding careers. NJR periodically reviews and adjusts, if needed, its employees’ total compensation (including salaries, annual cash incentive compensation, other cash and equity incentives, and benefits) to ensure that it is competitive within the industry and is consistent with our level of performance. NJR has also implemented enterprise-wide talent development and succession planning programs designed to identify future and/or replacement candidates for key positions. In addition to compensation, NJR promotes numerous charitable, philanthropic, and social awareness programs that not only support the communities served, but also provide experiences for employees to promote a collaborative and rewarding work environment.

Further, in order to take advantage of available opportunities and successfully implement our long-term strategy, NJR must be able to employ, train and retain the necessary skilled personnel. As a result, NJR supports and utilizes various training and educational programs and has developed additional company-wide and project-specific employee training and educational programs. NJR continues key programs focused on employee safety, leadership development, work-life balance, talent management, health and wellness, diversity and inclusion as well as employee engagement. Moreover, diversity, inclusion and employee engagement are integral to NJR’s vision, strategy and business success. NJR prides itself on a culture that respects co-workers and values concern for others. Fostering an environment that values diversity, inclusion and ethics helps create an inclusive organization that is able to embrace, leverage and respect the differences of employees, customers and the communities where we live, work and serve.

NJR regularly evaluates employees and their productivity against future demand expectations and historical trends. NJR employees continue to maintain high levels of engagement, satisfaction and retention according to NJR’s annual employee survey. From time to time, NJR may reduce or add resources in certain areas in an effort to align with changing demands.

NJR’s Board of Directors’ Role in Human Capital Resource Management

NJR’s Board of Directors believes that human capital management is an important component of the Company’s continued growth and success, and is essential for our ability to attract, retain and develop talented and skilled employees. We pride ourselves on a culture that respects co-workers and values concern for others.

Management regularly reports to the LDCC of the Board of Directors on human capital management topics, including corporate culture, diversity and inclusion, employee development and compensation and benefits. The LDCC has oversight of talent retention and development and succession planning, and the Board of Director’s provides input on important decisions in each of these areas.

Each year, NJR conducts an employee feedback survey designed to help the Company measure overall employee engagement. The feedback employees provide during the survey helps NJR evaluate employee programs and benefits and monitor its current practices for potential areas of improvement. The LDCC maintains oversight of matters related to human capital management and in that capacity reviews the results of the employee feedback survey.

Employee Benefits

The LDCC believes employee benefits are an essential component of the Company’s competitive total compensation package. These benefits are designed to attract and retain our employees and include medical, health and dental insurance, long-term disability insurance, accidental death and disability insurance, travel and accident insurance, and our 401(k) Plan. As part of the 401(k) Plan, NJR generally matches 80 percent of the first 6 percent of compensation contributed by the employee into the 401(k) Plan, subject to the Internal Revenue Code and NJR’s 401(k) Plan limits. The matching contribution is limited to 70 percent for represented employees of NJRHS. Additionally, for employees who are not eligible to participate in the defined benefit plans, NJR contributes between 3.5 percent and 4.5 percent of base compensation, depending upon years of service, into the 401(k) Plan on their behalf.

AVAILABLE INFORMATION AND CORPORATE GOVERNANCE DOCUMENTS

The following reports and any amendments to those reports are available free of charge on our website at https://investor.njresources.com/financials/sec-filings/default.aspx as soon as reasonably possible after filing or furnishing them with the SEC:

•Annual reports on Form 10-K;

•Quarterly reports on Form 10-Q; and

•Current reports on Form 8-K.

Page 11

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS Continued)

The following documents are available free of charge on our website (https://investor.njresources.com/governance/governance-documents/default.aspx):

•Amended and Restated Bylaws;

•Corporate Governance Guidelines;

•Wholesale Trading Code of Conduct;

•NJR Code of Conduct;

•Charters of the following Board of Directors Committees: Audit, Leadership Development and Compensation and Nominating/Corporate Governance;

•Audit Complaint Procedure;

•Communicating with Non-Management Directors Procedure; and

•Statement of Policy with Respect to Related Person Transactions.

In Part III of this Form 10-K, we incorporate certain information by reference from our Proxy Statement for our 2021 Annual Meeting of Shareowners. We expect to file that Proxy Statement with the SEC on or about December 11, 2020. We will make it available on our website as soon as reasonably possible following that filing date. Please refer to the Proxy Statement when it is available.

A printed copy of each document is available free of charge to any shareowner who requests it by contacting the Corporate Secretary at New Jersey Resources Corporation, 1415 Wyckoff Road, Wall, New Jersey 07719.

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

The Company’s Executive Officers and their age, position and business experience during the past five years are below.

| Name | Age | Officer since | Business experience during last five years | ||||||||

| Stephen D. Westhoven | 52 | 2004 | President and Chief Executive Officer (October 2019 - present) President and Chief Operating Officer (October 2018 - September 2019) Executive Vice President and Chief Operating Officer (November 2017 - September 2018) Senior Vice President and Chief Operating Officer, NJRES and NJRCEV (October 2016 - October 2017) Senior Vice President, NJRES (May 2010 - September 2016) | ||||||||

| Patrick J. Migliaccio | 46 | 2013 | Senior Vice President and Chief Financial Officer (January 2016 - present) Vice President, Finance and Accounting (November 2014 - December 2015) | ||||||||

| Amanda E. Mullan | 54 | 2015 | Senior Vice President and Chief Human Resources Officer (January 2017 - present) Vice President and Chief Human Resources Officer (April 2015 - December 2016) | ||||||||

| Amy Cradic | 49 | 2018 | Senior Vice President and Chief Operating Officer of Non-Utility Businesses, Strategy and External Affairs (March 2020 - present) Vice President, Corporate Strategy and External Affairs (January 2020 – February 2020) Vice President, Government Affairs and Policy (January 2018 – December 2019) Chief of Staff, Office of New Jersey Governor Chris Christie (April 2016 – January 2018) Chief Policy Advisor, Office of New Jersey Governor Chris Christie (December 2013 – March 2016) | ||||||||

| Nancy A. Washington | 56 | 2017 | Senior Vice President and General Counsel (March 2017 - present) Senior Vice President and Chief Litigation Counsel, CIT Group Inc., a Livingston, NJ-based financial services firm (September 2010 - March 2017) | ||||||||

Page 12

New Jersey Resources Corporation

Part II

ITEM 6. SELECTED FINANCIAL DATA

CONSOLIDATED FINANCIAL STATISTICS

| (Thousands, except per share data) | |||||||||||||||||

| Fiscal Years Ended September 30, | 2020 (1) | 2019 (1) | 2018 (1) | 2017 | 2016 | ||||||||||||

| SELECTED FINANCIAL DATA | |||||||||||||||||

| Operating revenues | $ | 1,953,668 | $ | 2,592,045 | $ | 2,915,109 | $ | 2,268,617 | $ | 1,880,905 | |||||||

| Natural gas purchases | $ | 1,304,719 | $ | 2,044,302 | $ | 2,275,342 | $ | 1,703,767 | $ | 1,352,686 | |||||||

| Net income | $ | 163,007 | $ | 123,935 | $ | 231,013 | $ | 132,065 | $ | 131,672 | |||||||

| Total assets | $ | 5,316,477 | $ | 4,157,942 | $ | 3,986,305 | $ | 3,928,507 | $ | 3,718,570 | |||||||

| Common stock equity | $ | 1,643,896 | $ | 1,381,833 | $ | 1,294,664 | $ | 1,114,752 | $ | 1,166,591 | |||||||

Long-term debt (2) (3) | $ | 2,259,466 | $ | 1,537,177 | $ | 1,180,619 | $ | 997,080 | $ | 1,055,038 | |||||||

| COMMON STOCK DATA | |||||||||||||||||

| Earnings per share-basic | $1.72 | $1.39 | $2.63 | $1.53 | $1.53 | ||||||||||||

| Earnings per share-diluted | $1.71 | $1.38 | $2.62 | $1.52 | $1.52 | ||||||||||||

| Dividends declared per share | $1.27 | $1.19 | $1.11 | $1.038 | $0.975 | ||||||||||||

| NON-GAAP RECONCILIATION | |||||||||||||||||

| Net income | $ | 163,007 | $ | 123,935 | $ | 231,013 | $ | 132,065 | $ | 131,672 | |||||||

| Add: | |||||||||||||||||

| Unrealized loss (gain) on derivative instruments and related transactions | (9,644) | 2,881 | 26,770 | (11,241) | 46,883 | ||||||||||||

| Tax effect | 2,296 | (711) | (4,512) | 4,062 | (17,018) | ||||||||||||

| Effects of economic hedging related to natural gas inventory | 12,690 | 4,309 | (22,570) | 38,470 | (36,816) | ||||||||||||

| Tax effect | (3,016) | (1,024) | 7,362 | (13,964) | 13,364 | ||||||||||||

Net financial earnings (4) | $ | 165,333 | $ | 129,390 | $ | 238,063 | $ | 149,392 | $ | 138,085 | |||||||

| Basic earnings per share | $1.72 | $1.39 | $2.63 | $1.53 | $1.53 | ||||||||||||

| Add: | |||||||||||||||||

| Unrealized loss (gain) on derivative instruments and related transactions | (0.10) | 0.03 | 0.31 | (0.13) | 0.55 | ||||||||||||

| Tax effect | 0.02 | (0.01) | (0.05) | 0.05 | (0.20) | ||||||||||||

| Effects of economic hedging related to natural gas inventory | 0.13 | 0.05 | (0.26) | 0.45 | (0.43) | ||||||||||||

| Tax effect | (0.03) | (0.01) | 0.08 | (0.17) | 0.16 | ||||||||||||

Net financial earnings per share-basic (4) | $1.74 | $1.45 | $2.71 | $1.73 | $1.61 | ||||||||||||

| Diluted earnings per share | $1.71 | $1.38 | $2.62 | $1.52 | $1.52 | ||||||||||||

| Add: | |||||||||||||||||

| Unrealized loss (gain) on derivative instruments and related transactions | (0.10) | 0.03 | 0.30 | (0.13) | 0.54 | ||||||||||||

| Tax effect | 0.03 | (0.01) | (0.05) | 0.05 | (0.20) | ||||||||||||

| Effects of economic hedging related to natural gas inventory | 0.13 | 0.05 | (0.25) | 0.44 | (0.42) | ||||||||||||

| Tax effect | (0.03) | (0.01) | 0.08 | (0.17) | 0.15 | ||||||||||||

Net financial earnings per share-diluted (4) | $1.74 | $1.44 | $2.70 | $1.71 | $1.59 | ||||||||||||

(1)Certain amounts have been revised to reflect the retrospective application of the Company's accounting policy change regarding its method of accounting for ITCs. Please see Item 8. Note 2. Summary of Significant Accounting Policies for additional details regarding this accounting policy change.

(2)Includes long-term financial leases of $63.7 million, $25 million, $26.4 million, $28.9 million and $30.7 million, respectively.

(3)Includes long-term solar asset financing obligation of $105.5 million, $80.4 million, $89.8 million, $28.2 million and $0, respectively.

(4)NFE is a non-GAAP financial measure that eliminates the timing differences surrounding the recognition of certain derivative gains or losses, to effectively match the earnings effects of economic hedges associated with the physical sale or purchase of natural gas and, therefore, eliminate the impact of volatility to GAAP earnings associated with the related derivative instruments. For further discussion of this financial measure, see the Energy Services segment discussion in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Page 13

New Jersey Resources Corporation

Part II

ITEM 6. SELECTED FINANCIAL DATA (Continued)

NJNG OPERATING STATISTICS

| Fiscal Years Ended September 30, | 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||

Operating revenues ($ in thousands) | |||||||||||||||||

| Residential | $ | 500,271 | $ | 450,515 | $ | 441,486 | $ | 395,315 | $ | 345,597 | |||||||

| Commercial, industrial and other | 98,463 | 104,372 | 95,351 | 98,777 | 80,994 | ||||||||||||

| Firm transportation | 66,871 | 57,513 | 65,256 | 73,206 | 69,696 | ||||||||||||

| Total residential and commercial | 665,605 | 612,400 | 602,093 | 567,298 | 496,287 | ||||||||||||

| Interruptible | 6,322 | 6,637 | 7,522 | 7,970 | 8,867 | ||||||||||||

| Total system | 671,927 | 619,037 | 609,615 | 575,268 | 505,154 | ||||||||||||

| BGSS incentive programs | 57,996 | 91,756 | 122,250 | 120,369 | 89,192 | ||||||||||||

| Total operating revenues | $ | 729,923 | $ | 710,793 | $ | 731,865 | $ | 695,637 | $ | 594,346 | |||||||

| Throughput (Bcf) | |||||||||||||||||

| Residential | 44.6 | 46.0 | 45.5 | 40.7 | 36.9 | ||||||||||||

| Commercial, industrial and other | 8.2 | 9.7 | 8.9 | 8.7 | 7.3 | ||||||||||||

| Firm transportation | 13.3 | 13.7 | 15.5 | 14.4 | 14.1 | ||||||||||||

| Total residential and commercial | 66.1 | 69.4 | 69.9 | 63.8 | 58.3 | ||||||||||||

| Interruptible | 30.9 | 39.0 | 46.2 | 55.0 | 61.5 | ||||||||||||

| Total system | 97.0 | 108.4 | 116.1 | 118.8 | 119.8 | ||||||||||||

| BGSS incentive programs | 118.4 | 123.8 | 150.2 | 178.4 | 216.7 | ||||||||||||

| Total throughput | 215.4 | 232.2 | 266.3 | 297.2 | 336.5 | ||||||||||||

| Customers at year-end | |||||||||||||||||

| Residential | 497,779 | 486,474 | 474,495 | 460,013 | 448,273 | ||||||||||||

| Commercial, industrial and other | 28,735 | 28,992 | 28,037 | 26,947 | 26,218 | ||||||||||||

| Firm transportation | 31,604 | 32,107 | 36,126 | 42,790 | 46,608 | ||||||||||||

| Total residential and commercial | 558,118 | 547,573 | 538,658 | 529,750 | 521,099 | ||||||||||||

| Interruptible | 29 | 32 | 31 | 33 | 34 | ||||||||||||

| BGSS incentive programs | 19 | 21 | 28 | 27 | 30 | ||||||||||||

| Total customers at year-end | 558,166 | 547,626 | 538,717 | 529,810 | 521,163 | ||||||||||||

Interest coverage ratio (1) | 8.29 | 6.57 | 6.35 | 7.96 | 8.97 | ||||||||||||

| Average therm use per customer | |||||||||||||||||

| Residential | 895 | 945 | 959 | 885 | 824 | ||||||||||||

| Commercial, industrial and other | 8,683 | 10,198 | 10,992 | 11,183 | 11,378 | ||||||||||||

| Degree days | 4,254 | 4,506 | 4,537 | 4,129 | 3,867 | ||||||||||||

Weather as a percent of normal (2) | 92.8 | % | 99.0 | % | 99.5 | % | 90.0 | % | 82.5 | % | |||||||

| Number of employees | 721 | 709 | 686 | 680 | 670 | ||||||||||||

(1)NJNG’s income from operations divided by interest expense.

(2)Normal heating degree days are based on a 20-year average, calculated based upon three reference areas representative of NJNG’s service territory.

(3)Operating revenue presents sales tax, net during fiscal 2020 and 2019, due to the adoption of ASC 606, Revenue from Contracts with Customers. Prior to fiscal 2019, operating revenue only included sales tax on operating revenues excluding tax-exempt sales.

Page 14

New Jersey Resources Corporation

Part II

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

Critical Accounting Policies

We prepare our financial statements in accordance with GAAP. Application of these accounting principles requires the use of estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosures of contingencies during the reporting period. We regularly evaluate our estimates, including those related to the calculation of the fair value of derivative instruments, regulatory assets, income taxes, pension and postemployment benefits other than pensions and contingencies related to environmental matters and litigation. We base our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. In the normal course of business, estimated amounts are subsequently adjusted to actual results that may differ from estimates.

Regulatory Accounting

NJNG maintains its accounts in accordance with the FERC Uniform System of Accounts as prescribed by the BPU and recognizes the impact of regulatory decisions on its financial statements. As a result of the ratemaking process, NJNG is required to apply the accounting principles in ASC 980, Regulated Operations, which differ in certain respects from those applied by unregulated businesses. Specifically, NJNG records regulatory assets when it is probable that certain operating costs will be recoverable from customers in future periods and records regulatory liabilities associated with probable future obligations to customers.

Regulatory decisions can have an impact on the recovery of costs, the rate of return earned on investment, and the timing and amount of assets to be recovered by rates. The BPU’s regulation of rates is premised on the full recovery of prudently incurred costs and a reasonable rate of return on invested capital. Decisions to be made by the BPU in the future will impact the accounting for regulated operations, including decisions about the amount of allowable costs and return on invested capital included in rates and any refunds that may be required. If the BPU indicates that recovery of all or a portion of a regulatory asset is not probable or does not allow for recovery of and a reasonable return on investments in property plant and equipment, a charge to income would be made in the period of such determination.

Environmental Costs

At the end of each fiscal year, NJNG, with the assistance of an independent consulting firm, updates the environmental review of its MGP sites, including its potential liability for investigation and remedial action. From this review, NJNG estimates expenditures necessary to remediate and monitor these MGP sites. NJNG’s estimate of these liabilities is developed from then-currently available facts, existing technology and current laws and regulations.

In accordance with accounting standards for contingencies, NJNG’s policy is to record a liability when it is probable that the cost will be incurred and can be reasonably estimated. NJNG will determine a range of liabilities and will record the most likely amount. If no point within the range is more likely than any other, NJNG will accrue the lower end of the range. Since we believe that recovery of these expenditures, as well as related litigation costs, is possible through the regulatory process, we have recorded a regulatory asset corresponding to the related accrued liability. Accordingly, NJNG recorded an MGP remediation liability and a corresponding regulatory asset on the Consolidated Balance Sheets, which is based on the most likely amount.

The actual costs to be incurred by NJNG are dependent upon several factors, including final determination of remedial action, changing technologies and governmental regulations and the ultimate ability of other responsible parties to pay, as well as the potential impact of any litigation and any insurance recoveries. Previously incurred remediation costs, net of recoveries from customers and insurance proceeds received are included in regulatory assets on the Consolidated Balance Sheets.

If there are changes in the regulatory position surrounding these costs, or should actual expenditures vary significantly from estimates in that these costs are disallowed for recovery by the BPU, such costs would be charged to income in the period of such determination. See the Legal Proceedings section in Note 15. Commitments and Contingent Liabilities for more details.

Page 15

New Jersey Resources Corporation

Part II

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS (Continued)

Postemployment Employee Benefits

Our costs of providing postemployment employee benefits are dependent upon numerous factors, including actual plan experience and assumptions of future experience. Postemployment employee benefit costs are affected by actual employee demographics including age, compensation levels and employment periods, the level of contributions made to the plans, changes in long-term interest rates and the return on plan assets. Changes made to the provisions of the plans or healthcare legislation may also impact current and future postemployment employee benefit costs. Postemployment employee benefit costs may also be significantly affected by changes in key actuarial assumptions, including anticipated rates of return on plan assets, changes in mortality tables, health care cost trends and discount rates used in determining the PBO. In determining the PBO and cost amounts, assumptions can change from period to period and could result in material changes to net postemployment employee benefit periodic costs and the related liability recognized by us.

The remeasurement of plan assets and obligations for a significant event should occur as of the date of the significant event. We may use a practical expedient to remeasure the plan assets and obligations as of the nearest calendar month-end date. When performing interim remeasurements, we obtain new asset values, roll forward the obligation to reflect population changes and review the appropriateness of all assumptions, regardless of the reason for performing the interim remeasurement.

Our postemployment employee benefit plan assets consist primarily of U.S. equity securities, international equity securities, fixed-income investments and other assets, with a targeted allocation of 34 percent, 17 percent, 38 percent and 11 percent, respectively. Fluctuations in actual market returns, as well as changes in interest rates, may result in increased or decreased postemployment employee benefit costs in future periods. Postemployment employee benefit expenses are included in O&M and other income, net on the Consolidated Statements of Operations.

The following is a summary of a sensitivity analysis for each actuarial assumption:

| Pension Plans | ||||||||||||||||||||||||||

| Actuarial Assumptions | Increase/ (Decrease) | Estimated Increase/(Decrease) on PBO (Thousands) | Estimated Increase/(Decrease) to Expense (Thousands) | |||||||||||||||||||||||

| Discount rate | 1.00 | % | $(49,896) | $(4,671) | ||||||||||||||||||||||

| Discount rate | (1.00) | % | $62,361 | $5,643 | ||||||||||||||||||||||

| Rate of return on plan assets | 1.00 | % | n/a | $(2,840) | ||||||||||||||||||||||

| Rate of return on plan assets | (1.00) | % | n/a | $2,839 | ||||||||||||||||||||||

| Other Postemployment Benefits | ||||||||||||||||||||||||||

| Actuarial Assumptions | Increase/ (Decrease) | Estimated Increase/(Decrease) on PBO (Thousands) | Estimated Increase/(Decrease) to Expense (Thousands) | |||||||||||||||||||||||

| Discount rate | 1.00 | % | $ | (36,740) | $ | (3,608) | ||||||||||||||||||||

| Discount rate | (1.00) | % | $ | 47,260 | $ | 4,486 | ||||||||||||||||||||

| Rate of return on plan assets | 1.00 | % | n/a | $ | (898) | |||||||||||||||||||||

| Rate of return on plan assets | (1.00) | % | n/a | $ | 898 | |||||||||||||||||||||

| Actuarial Assumptions | Increase/ (Decrease) | Estimated Increase/(Decrease) on PBO (Thousands) | Estimated Increase/(Decrease) to Expense (Thousands) | |||||||||||||||||||||||

| Health care cost trend rate | 1.00 | % | $ | 49,106 | $ | 6,861 | ||||||||||||||||||||

| Health care cost trend rate | (1.00) | % | $ | (38,844) | $ | (5,383) | ||||||||||||||||||||

Acquisitions

The Company follows the guidance in ASC 805, Business Combinations, for determining the appropriate accounting treatment for acquisitions. ASU No. 2017-01, Clarifying the Definition of a Business, provides an initial fair value screen to determine if substantially all of the fair value of the assets acquired is concentrated in a single asset or group of similar assets. If the initial screening test is not met, the set is considered a business based on whether there are inputs and substantive processes in place. Based on the results of this analysis and conclusion on an acquisition’s classification of a business combination or an asset acquisition, the accounting treatment is derived.

Page 16

New Jersey Resources Corporation

Part II

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS (Continued)

If the acquisition is deemed to be a business, the acquisition method of accounting is applied. Identifiable assets acquired and liabilities assumed at the acquisition date are recorded at fair value. If the transaction is deemed to be an asset purchase, the cost accumulation and allocation model is used whereby the assets and liabilities are recorded based on the purchase price and allocated to the individual assets and liabilities based on relative fair values.

The determination and allocation of fair values to the identifiable assets acquired and liabilities assumed are based on various assumptions and valuation methodologies requiring considerable management judgment. The most significant variables in these valuations are discount rates and the number of years on which to base the cash flow projections, as well as other assumptions and estimates used to determine the cash inflows and outflows. Management determines discount rates based on the risk inherent in the acquired assets and related cash flows. The valuation of an acquired business is based on available information at the acquisition date and assumptions that are believed to be reasonable. However, a change in facts and circumstances as of the acquisition date can result in subsequent adjustments during the measurement period, but no later than one year from the acquisition date.

Investments in Equity Investees

The Company accounts for its investments in Steckman Ridge and PennEast, using the equity method of accounting where it is not the primary beneficiary, as defined under ASC 810, Consolidation, in that its respective ownership interests are 50 percent or less and/or it has significant influence over operating and management decisions. The Company’s share of earnings is recognized as equity in earnings of affiliates on the Consolidated Statements of Operations.

Equity method investments are reviewed for impairment when changes in facts and circumstances indicate that the current fair value may be less than the asset’s carrying amount. Factors that the Company analyzes in determining whether an impairment in its equity investments exists include reviewing the financial condition and near-term prospects of the investees, including economic conditions and trends in the general market, significant delays in or failure to complete significant projects, unfavorable regulatory or legal actions expected to substantially impact future earnings potential and lower than expected cash distributions from investees. If the Company determines the decline in the value of its equity method investment is other than temporary, an impairment charge is recorded in an amount equal to the excess of the carrying value of the asset over its fair value.

On September 10, 2019, the Third Circuit issued an order overturning the U.S. District Court for the District of New Jersey’s order granting PennEast condemnation and immediate access in accordance with the Natural Gas Act to certain properties in which New Jersey holds an interest. The Petition for Panel Rehearing or Rehearing En Banc filed with the Third Circuit was denied on November 5, 2019.

On October 8, 2019, the NJDEP issued a letter indicating that it deemed PennEast’s freshwater wetlands permit application to be administratively incomplete and closed the matter without prejudice. On October 11, 2019, PennEast submitted a letter to the NJDEP objecting to its position that the freshwater wetlands permit application is administratively incomplete.

On November 14, 2019, PennEast announced that it will ask the Supreme Court of the U.S. to review the September 2019 decision by the Third Circuit.

As a result of the adverse court rulings, the Company evaluated its investment in PennEast for impairment and determined an impairment charge was not necessary. The Company estimated the fair value of its investment using probability-weighted scenarios of discounted future cash flows. Management made significant estimates and assumptions related to development options and legal outcomes, construction costs, timing of capital investments and in-service dates, revenues and discount rates. The discounted cash flow scenarios contemplate the impact of key assumptions of potential future court decisions and potential future management decisions and require management to make significant estimates regarding the likelihood of various scenarios and assumptions. It is reasonably possible that future unfavorable developments, such as a reduced likelihood of success from development options and legal outcomes, estimated increases in construction costs, increases in the discount rate or further significant delays, could result in an impairment of our equity method investment. Also, the use of alternate judgments and assumptions could result in a different calculation of fair value, which could ultimately result in the recognition of an impairment charge in the Consolidated Financial Statements. Higher probabilities were assumed related to those scenarios where the project is completed.

Page 17

New Jersey Resources Corporation

Part II

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS (Continued)

Due to the anticipated expiration of a customer contract for Steckman Ridge, the Company evaluated its investment in Steckman Ridge for other-than-temporary impairment and determined an impairment charge was not necessary.

The fair value of the Company’s investment in Steckman Ridge was determined using a discounted cash flow method and utilized management’s best estimates and assumptions related to expected future results, including the price and capacity of firm natural gas storage contracting, operations and maintenance costs, the nature and timing of major maintenance and capital investment, and discount rates. Fair value determinations require considerable judgment and are sensitive to changes in underlying assumptions and other factors. As a result, it is reasonably possible that unfavorable developments, such as the failure to execute storage contracts and other services for available capacity at anticipated price levels could result in an other-than temporary impairment charge in the Consolidated Financial Statements.

For further information on these investments, see Note 7. Investments in Equity Investees.

Impairment of Long-lived assets

Property, plant and equipment and finite-lived intangible assets are reviewed periodically for impairment when changes in facts and circumstances indicate that the carrying amount of an asset may not be fully recoverable in accordance with the appropriate accounting guidance. Factors that the Company analyzes in determining whether an impairment in its long-lived assets exists include determining if a significant decrease in the market price of a long-lived asset is present; a significant adverse change in the extent in which a long-lived asset is being used in its physical condition; legal proceedings or factors; significant business climate changes, accumulations of costs in significant excess of the amounts expected; a current-period operating or cash flow loss coupled with historical negative cash flows or expected future negative cash flows; and current expectations that more likely than not, a long-lived asset will be sold or otherwise disposed of significantly before the end of its estimated useful life. When an impairment indicator is present, the Company determines if the carrying value of the asset is recoverable by comparing it to its expected undiscounted future cash flows. If the carrying value of the asset is greater than the expected undiscounted future cash flows, an impairment charge is recorded in an amount equal to the excess of the carrying value of the asset over its fair value.

Derivative Instruments

We record our derivative instruments held as assets and liabilities at fair value on the Consolidated Balance Sheets. In addition, since we choose not to designate any of our physical and financial natural gas commodity derivatives as accounting hedges, changes in the fair value of Energy Services’ commodity derivatives are recognized in earnings, as they occur, as a component of operating revenues or natural gas purchases on the Consolidated Statements of Operations. Changes in the fair value of foreign exchange contracts are recognized in natural gas purchases on the Consolidated Statements of Operations.

The fair value of derivative instruments is determined by reference to quoted market prices of listed exchange-traded contracts, published price quotations, pipeline tariff information or a combination of those items. Energy Services’ portfolio is valued using the most current and reasonable market information. If the price underlying a physical commodity transaction does not represent a visible and liquid market, Energy Services may utilize additional published pipeline tariff information and/or other services to determine an equivalent market price. As of September 30, 2020, the fair value of its derivative assets and liabilities reported on the Consolidated Balance Sheets that is based on such pricing is considered immaterial.

Should there be a significant change in the underlying market prices or pricing assumptions, Energy Services may experience a significant impact on its financial position, results of operations and cash flows. Refer to Item 7A. Quantitative and Qualitative Disclosures About Market Risks for a sensitivity analysis related to the impact to derivative fair values resulting from changes in commodity prices. The valuation methods we use to determine fair values remained consistent for fiscal 2020, 2019 and 2018. We apply a discount to our derivative assets to factor in an adjustment associated with the credit risk of its physical natural gas counterparties and to our derivative liabilities to factor in an adjustment associated with its own credit risk. We determine this amount by using historical default probabilities corresponding to the appropriate S&P issuer ratings. Since the majority of our counterparties are rated investment grade, this results in an immaterial credit risk adjustment.

Gains and losses associated with derivatives utilized by NJNG to manage the price risk inherent in its natural gas purchasing activities are recoverable through its BGSS, subject to BPU approval. Accordingly, the offset to the change in fair value of these derivatives is recorded as either a regulatory asset or liability on the Consolidated Balance Sheets.

Page 18

New Jersey Resources Corporation

Part II

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS (Continued)

Clean Energy Ventures hedges certain of its expected production of SRECs through forward and futures contracts. Clean Energy Ventures intends to physically deliver all SRECs it sells and recognizes SREC revenue as operating revenue on the Consolidated Statements of Operations upon delivery of the underlying SREC.

We have not designated any derivatives as fair value or cash flow hedges as of September 30, 2020 and 2019.

Income Taxes

The determination of our provision for income taxes requires the use of estimates and the interpretation and application of tax laws. Judgment is required in assessing the deductibility and recoverability of certain tax benefits. We use the asset and liability method to determine and record deferred tax assets and liabilities, representing future tax benefits and taxes payable, which result from the differences in basis recorded in GAAP financial statements and amounts recorded in the income tax returns. The deferred tax assets and liabilities are recorded utilizing the statutorily enacted tax rates expected to be in effect at the time the assets are realized, and/or the liabilities settled. An offsetting valuation allowance is recorded when it is more likely than not that some or all of the deferred income tax assets won’t be realized. Any significant changes to the estimates and judgments with respect to the interpretations, timing or deductibility could result in a material change to earnings and cash flows. For a more detailed description of Income Taxes see Note 13. Income Taxes in the accompanying Consolidated Financial Statements.

For state income tax and other taxes, estimates and judgments are required with respect to the apportionment among the various jurisdictions. In addition, we operate within multiple tax jurisdictions and are subject to audits in these jurisdictions. These audits can involve complex issues, which may require an extended period of time to resolve. We maintain a liability for the estimate of potential income tax exposure and, in our opinion, adequate provisions for income taxes have been made for all years reported. Any significant changes to the estimates and judgments with respect to the apportionment factor could result in a material change to earnings and cash flows.