GNTX 12.31.2014 - 10K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| |

(x) | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the fiscal year ended December 31, 2014 or |

|

| |

( ) | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to _________

Commission File No.: 0-10235

GENTEX CORPORATION

(Exact name of registrant as specified in its charter)

|

| | |

Michigan | | 38-2030505 |

State or other jurisdiction of Incorporation of organization | | (I.R.S. Employer Identification No.) |

| | |

600 N. Centennial Street, Zeeland, Michigan | | 49464 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (616) 772-1800

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each Class | | Name of each exchange on which registered |

Common Stock, par value $.06 per share | | Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes: þ No: o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes: o No: þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes: þ No: o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes: þ No: o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ( )

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | |

Large accelerated filer | ü | | Accelerated filer | |

Non-accelerated filer | | (Do not check if a smaller reporting company) | Smaller reporting company | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes: o No: þ

As of June 30, 2014 (the last business day of the registrant’s most recently completed second fiscal quarter), 292,514,134 shares of the registrant’s common stock, par value $.06 per share, reflecting the two-for-one stock split effected in the form a 100% stock dividend on December 31, 2014, were outstanding. The aggregate market value of the common stock held by non-affiliates of the registrant (i.e., excluding shares held by executive officers, directors, and control persons as defined in Rule 405 (17 CFR 203.405) on that date was $4,135,375,784 computed at the closing price on that date.

As of February 2, 2015, 295,281,110 shares of the registrant’s common stock, par value $.06 per share, were outstanding,

Portions of the Company’s Proxy Statement for its 2015 Annual Meeting of Shareholders are incorporated by reference into Part III.

GENTEX CORPORATION AND SUBSIDIARIES

For the Year Ended December 31, 2014

FORM 10-K

Index

|

| | |

Part I - Financial Information | Page |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Part II | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Part III | | |

| | |

| | |

| | |

| | |

| | |

| | |

Part IV | | |

| | |

| | |

| | |

Part I

Item 1. Business.

| |

(a) | General Development of Business. |

Gentex Corporation (the Company) designs and manufactures automatic-dimming rearview mirrors and electronics for the automotive industry, dimmable aircraft windows for the aviation industry, and commercial smoke alarms and signaling devices for the fire protection industry. The Company’s largest business segment involves designing, developing, manufacturing and marketing interior and exterior auto-dimming automotive rearview mirrors that utilize proprietary electrochromic technology to dim in proportion to the amount of headlight glare from trailing vehicle headlamps. Within this business segment, the Company also designs, develops and manufactures various electronics features that are additive to the interior and exterior automotive rearview mirrors as well as interior visors and overhead consoles. The Company ships its product to all of the major automotive producing regions worldwide, which it supports with numerous sales, engineering and distribution locations worldwide.

The Company was organized as a Michigan corporation in 1974 to manufacture smoke detectors, a product line that has since evolved to include include a variety of fire protection products. In 1982, the Company introduced an interior electro-mechanical automatic-dimming rearview mirror as an alternative to the manual day/night rearview mirrors for automotive applications. In 1987, the Company introduced an interior electrochromic automatic-dimming rearview mirror for automotive applications. In 1991, the Company introduced an exterior electrochromic automatic-dimming rearview mirror for automotive applications. In 1997, the Company began making volume shipments of three new exterior mirror sub-assembly products: thin glass flat, convex and aspheric. In 2005, the Company began making volume shipments of its new bezel-free exterior auto-dimming mirror. In 2005, the Company announced, and in 2010 began delivering electrochromic dimmable aircraft windows for the aviation industry. In 2013, the Company acquired HomeLink®, a wireless vehicle/home communications product that enables drivers to remotely activate garage door openers, entry door locks, home lighting, security systems, entry gates and other radio frequency convenience products for automotive applications, wherein the Company had previously been a licensee of HomeLink® and had been, since 2003, integrating HomeLink® into its interior auto-dimming rearview mirrors. Automotive revenues represent approximately 97% of the Company's total revenue, consisting of interior and exterior electrochromic automatic-dimming rearview mirrors and automotive electronics.

| |

(b) | Financial Information About Segments. |

| |

(c) | Narrative Description of Business. |

The Company is a supplier of automatic-dimming rearview mirrors and electronics to the automotive industry, dimmable aircraft windows for aviation markets, and fire protection products to the fire protection market.

Automotive Products

Automotive Rearview Mirrors and Electronics

Automotive applications are the largest business segment for the Company, consisting of interior and exterior electrochromic automatic-dimming rearview mirrors and automotive electronics. The Company manufactures interior electrochromic automatic-dimming rearview mirrors that darken to reduce glare and improve visibility for the driver. These electronic interior mirrors can also include additional electronic features such as compass, microphones, HomeLink®, lighting assist and driver assist forward safety camera systems, video cameras for rearward vision, various lighting systems, various telematics systems, and a wide variety of displays. The Company also ships interior non-automatic-dimming rearview mirrors with features.

The Company’s interior electrochromic automatic-dimming rearview mirrors also power the application of the Company’s exterior electrochromic automatic-dimming rearview mirrors that darken to reduce glare and improve visibility for the driver. These electronic exterior mirrors typically range in size and shape per automaker specification, but also include additional features such as turn signal indicators, side blind zone indicators, and courtesy lighting.

The Company also ships exterior non-automatic-dimming rearview mirrors with similar electronic features available in its auto-dimming applications.

The Company manufactures other automotive electronics products both inside and outside of the rearview mirror through HomeLink® applications in the vehicle including the rearview mirror, interior visor or overhead console.

The Company produces rearview mirrors and electronics for automotive passenger cars, light trucks, pick-up trucks, sport utility vehicles, and vans for original equipment manufacturers (OEMs) worldwide, tier one automotive mirror manufacturers worldwide, and various aftermarket and accessory customers. Automotive rearview mirrors and electronics accounted for 97% of the Company’s consolidated net sales in 2014.

The Company is the leading manufacturer of electrochromic automatic-dimming rearview mirrors in the world, and is the dominant supplier to the automotive industry. Competitors for automotive rearview mirrors include Magna International, Samvardhana Motherson Reflective, Murakami Kaimeido Company, Ichikoh Industries, Tokai Rika Company, and Grupo Ficosa International. The Company also supplies electrochromic automatic-dimming rearview mirrors to certain of these rearview mirror competitors.

Automotive Rearview Mirrors and Electronics Product Development. The Company continually seeks to develop new products and is currently working to introduce additional advanced-feature automatic dimming mirrors. Advanced-feature automatic dimming mirrors currently being offered by the Company include, SmartBeam® and driver-assist features, HomeLink® , LED map lamps, compass and temperature displays, telematics, hands free communication, as well as Rear Camera Display (RCD) and Full Display (FDM) interior mirrors, CMOS imager based video cameras for rear vision with high dynamic range, proprietary exterior turn signals, side blind zone indicators and various other exterior mirror features that improve safety and field of view.

Automotive Rearview Mirrors and Electronics Markets and Marketing

In North America, Europe and Asia, the Company markets its products primarily through a direct sales force through its sales and engineering offices located in, Germany, UK, Sweden, France, Japan, Korea and China, as well as its headquarters in Michigan. The Company generally supplies auto-dimming mirrors and mirrors with advanced electronic features to its customers worldwide under annual blanket purchase orders with certain customers, as well as under long-term agreements with certain customers, entered into in the ordinary course of the Company's business.

The Company is currently supplying mirrors and electronics modules for Audi, BMW, Daimler, FCA Group, Ford, General Motors, Honda, Hyundai/Kia, Infiniti, Jaguar/Land Rover, Lexus, Mazda, Mitsubishi, Nissan, Opel, PSA Group, Renault, Rolls Royce, SAIC, Samsung, SEAT, Skoda, Tesla, Toyota, Volkswagen and Volvo.

The Company’s auto-dimming mirror unit shipment mix by region has significantly changed over the past ten years. The following is a breakdown of unit shipment mix by region in 2014 vs. 2004 calendar years:

|

| | | | | |

| 2014 | | 2004 |

Domestic | 21 | % | | 42 | % |

Transplants(1) | 16 | % | | 9 | % |

North America | 37 | % | | 51 | % |

Europe | 44 | % | | 34 | % |

Asia-Pacific | 19 | % | | 15 | % |

Total | 100 | % | | 100 | % |

(1) European and Asian based automakers with automotive production plants in North America.

Revenues by major geographic area are disclosed in Note 7 to the Consolidated Financial Statements. Historically, new safety and comfort and convenience options have entered the original equipment automotive market at relatively low rates on “top of the line” or luxury model automobiles. As the selection rates for the options on the luxury models increase, they generally become available on more models throughout the product line. The ongoing trend of domestic and foreign automakers is to offer several options as a package. The Company believes that its automatic dimming mirrors will be offered, in higher option rate packages, and on more small and mid-size vehicle models as consumer awareness of the safety and comfort and convenience features continues to grow, and as the

Company continues its efforts to make automakers aware of the Company's technology available on competitive vehicle platforms.

Automotive Rearview Mirrors and Electronics Competition. The Company continues to be the leading producer of automatic dimming rearview mirrors in the world and currently is the dominant supplier to the automotive industry with an approximate 90% market share worldwide in 2014 and and an approximate 88% market share in 2013. While the Company believes it will retain a dominant position in automatic dimming rearview mirrors for some time, another U.S. manufacturer Magna Mirrors, a wholly-owned subsidiary of Magna International, is competing for sales to domestic and foreign vehicle manufacturers and is supplying a number of domestic and foreign vehicle models with its versions of electrochromic mirrors and may have considerably more resources available to it. As such Magna Mirrors may present a formidable competitive threat. The Company also continues to sell automatic dimming exterior mirror sub-assemblies to Magna Mirrors. In addition, a Japanese manufacturer (Tokai Rika) is currently supplying a few vehicle models in Japan with solid-state electrochromic mirrors. There are also a small number of Chinese domestic mirror suppliers that are marketing and selling auto-dimming rearview mirrors, in low volume, within the domestic China automotive market. However, the Company believes that these Chinese domestic mirror suppliers do not currently meet global automotive grade specifications.

On September 27, 2013, the Company completed its acquisition of HomeLink®. Currently, the Company is the dominant supplier of wireless in-vehicle communication devices to the automotive industry. HomeLink® business has and, it appears, will continue to be awarded to the Company either through its auto-dimming rearview mirrors, or through HomeLink® electronic modules which are integrated into other areas of the automobile (i.e. visors and overhead consoles). Prior to the Company's acquisition of HomeLink® , a competitor offered a product similar to the HomeLink® product, but has since exited the market, thereby providing additional opportunities for the Company. The Company believes it is awarded virtually all business in this area.

The Company believes its electrochromic automatic dimming mirrors and mirrors with advanced electronic features offer significant performance advantages over competing products.

There are numerous other companies in the world conducting research on various technologies, including eletrochromics, for controlling light transmission and reflection. The Company currently believes that the electrochromic materials and manufacturing process it uses for automotive mirrors remains the most efficient and cost-effective way to produce such products. While automatic dimming mirrors using other technologies may eliminate glare, the Company currently believes that each of these technologies have inherent cost or performance limitations as compared to the Company's technologies.

As the Company continues to expand its automatic dimming mirror products with additional advanced electronic features and expands the capabilities of its CMOS imager technology for additional features (i.e. driver-assist features, rear video camera, etc.), the Company recognizes that it is competing with considerably larger and more geographically diverse electronics companies that could present a formidable competitive threat in the future as new products/features are brought to market.

Fire Protection Products

The Company manufactures photoelectric smoke detectors and alarms, photoelectric smoke detectors and visual signaling alarms, photoelectric smoke detectors and electrochemical carbon monoxide alarms, electrochemical carbon monoxide detectors and alarms, audible and visual signaling alarms, and bells and speakers for use in fire detection systems in office buildings, hotels, and other commercial establishments, as well as residential applications.

Markets and Marketing. The Company’s fire protection products are sold directly to fire protection and security product distributors under the Company’s brand name, to electrical wholesale houses, and to original equipment manufacturers of fire protection systems under both the Company’s brand name and private labels. The Company markets its fire protection products primarily in North America, but also globally through regional sales managers and manufacturer representative organizations.

Competition. The fire protection products industry is highly competitive in terms of both the smoke detectors and signaling appliance markets. The Company estimates that it competes principally with eight manufacturers of smoke detection products for commercial use and approximately four manufacturers within the residential market, three of which produce photoelectric smoke detectors. In the signaling appliance markets, the Company estimates it competes with approximately seven manufacturers. While the Company faces significant competition in the sale of smoke detectors and signaling appliances, it believes that the introduction of new products, improvements to its existing

products, its diversified product line, and the availability of special features will permit the Company to maintain its competitive position.

Dimmable Aircraft Windows

The Company previously announced that it would provide variably dimmable windows for the passenger compartment on the Boeing 787 Dreamliner Series of Aircraft. The Company continues to ship parts for the Boeing 787 Dreamliner Series of Aircraft.

Markets and Marketing. The Company markets its products to aircraft manufacturers globally.

Competition. The Company’s variable dimmable aircraft windows are the first commercialized product of its type for original equipment installation in the aircraft industry. Other manufacturers are working to develop and sell competing products utilizing other technology in the aircraft industry for aftermarket or original equipment installation.

The Company’s success with electrochromic technology provides potential opportunities for other commercial applications, which the Company expects to explore in the future when and as the Company feels it is in its best interests to do so.

Trademarks and Patents

The Company owns 26 U.S. Registered Trademarks and 495 U.S. Patents, of which 20 Registered Trademarks and 480 patents relate to electrochromic technology, automotive rearview mirrors, microphones, displays, cameras, sensor technology, and/or HomeLink® products. These patents expire at various times between 2015 and 2033. The Company believes that these patents provide the Company a competitive advantage in its markets, although no single patent is necessarily required for the success of the Company's products.

The Company also owns 128 foreign Registered Trademarks and 556 foreign Patents, of which 124 Registered Trademarks and 546 Patents relate to electrochromic technology, automotive rearview mirrors, microphones, displays, cameras, sensor technology, and/or HomeLink® products. These patents expire at various times between 2015 and 2039. The Company believes that the competitive advantage derived in the relevant foreign markets for these patents is comparable to that experienced in the U.S. market.

The Company owns 6 U.S. Registered Trademarks, 15 U.S. Patents, 4 foreign Registered Trademarks, and 10 foreign Patents that relate to the Company’s fire protection products. The US Patents expire between 2017 and 2032, while the foreign patents expire between 2020 and 2027. The Company believes that the competitive advantage provided by these patents is relatively small.

The Company’s owns 15 U.S. Patents and 6 foreign Patents that relate specifically to the Company’s variable dimmable windows. The U.S. Patents expire between 2016 and 2032, while the foreign patents expire between 2021 and 2027.

The Company also has in process 146 U.S. Patent Applications, 70 foreign Patent Applications, and 14 Trademark Applications. The Company continuously seeks to improve its core technologies and apply those technologies to new and existing products. As those efforts produce patentable inventions, the Company expects to file appropriate patent applications.

In addition, the Company periodically obtains intellectual property rights, in the ordinary course of the Company's business, to strengthen its intellectual property portfolio and minimize potential risks of infringement.

Miscellaneous

The Company considers itself to be engaged in the manufacture and sale of automatic-dimming rearview mirrors, non- automatic-dimming rearview mirrors and electronics for the automotive industry, fire protection products for the fire protection industry and variable dimmable windows for the aircraft industry. The Company has several important customers within the automotive industry, four of which each account for 10% or more of the Company’s annual sales (including direct sales to OEM customers and sales through their Tier 1 suppliers): Volkswagen/Audi, Toyota Motor Company, FCA (Fiat Chrysler Automobiles) Group and Daimler AG. The loss of any of these customers could have a material adverse effect on the Company. The Company’s backlog of unshipped orders was $368.2 million and $322.3 million at February 1, 2015, and 2014, respectively.

At February 1, 2015, the Company had 4,196 full-time employees. None of the Company’s employees are represented by a labor union or other collective bargaining representative. The Company believes that its relations with its employees are in good standing.

| |

(d) | Financial Information About Geographic Areas. |

See “Markets and Marketing” in Narrative Description of Business (Item 1(c)) and Note 7 of the Consolidated Financial Statements for certain information regarding geographic areas.

| |

(e) | Available Information. |

The Company’s Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports, will be made available, free of charge, through the Investor Information section of the Company’s Internet website (http://www.gentex.com) as soon as practicable after such materials are electronically filed with or furnished to the Securities and Exchange Commission (SEC). The SEC maintains an Internet website (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issues that a company files electronically with the SEC.

Item 1A. Risk Factors.

Safe Harbor for Forward-Looking Statements. This Annual Report on Form 10-K contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The statements contained in this communication that are not purely historical are forward-looking statements. Forward-looking statements give the Company’s current expectations or forecasts of future events. These forward-looking statements generally can be identified by the use of words such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “forecast”, “goal”, “hope”, “may”, “plan”, “project”, “will”, and variations of such words and similar expressions. Such statements are subject to risks and uncertainties that are often difficult to predict and beyond the Company’s control, and could cause the Company’s results to differ materially from those described. These risks and uncertainties include, without limitation, changes in general industry or regional market conditions; changes in consumer and customer preferences for our products; our ability to be awarded new business; continued uncertainty in pricing negotiations with customers; loss of business from increased competition; customer bankruptcies or divestiture of customer brands; fluctuation in vehicle production schedules; changes in product mix; raw material shortages; higher raw material, fuel, energy and other costs; unfavorable fluctuations in currencies or interest rates in the regions in which we operate; costs or difficulties related to the integration of any new or acquired technologies and businesses; changes in regulatory conditions; warranty and recall claims and other litigation and customer reactions thereto; possible adverse results of pending or future litigation or infringement claims; negative impact of any governmental investigations and associated litigations including securities litigations relating to the conduct of our business; integration of the newly acquired HomeLink business operations; retention of the newly acquired customers of the HomeLink business; and expansion of product offerings including those incorporating HomeLink technology. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law or the rules of the NASDAQ Global Select Market.

The following risk factors, together with all other information provided in this Annual Report on Form 10-K should be carefully considered.

Automotive Industry. 97% of our net sales are to customers within the automotive industry. The automotive industry has always been cyclical and highly impacted by levels of economic activity. The current economic environment, while improving, continues to be uncertain (especially in Europe and the Japan and Korean markets, which collectively are larger for us than North America as shipping destinations) and continues to cause increased financial and production stresses evidenced by volatile production levels, volatility with customer orders, supplier part shortages, automotive plant shutdowns, customer and supplier financial issues/bankruptcies, commodity material cost increases, consumer preference shift to smaller vehicles, where we have a lower penetration rate and lower content per vehicle, and supply chain stresses. If automotive customers (including their Tier 1 suppliers) and suppliers experience bankruptcies, work stoppages, strikes, part shortages, etc., it could disrupt our shipments to these customers, which could adversely affect our business, financial condition, and/or results of operations.

Automakers continue to experience volatility and uncertainty in executing planned new programs which result in delays or cancellations of new vehicle platforms, package configurations, and inaccurate volume forecasts. This challenge makes it difficult for us to forecast future sales and manage costs, inventory, capital, engineering, research and development, and human resource investments.

Key Customers. We have a number of large customers, including four automotive customers which each account for 10% or more of our annual net sales in 2014 (including direct sales to OEM customers and sales through their Tier 1 suppliers): Volkswagen Group, Toyota Motor Company, FCA (Fiat Chrysler Automobiles) Group and Daimler AG. The loss of all or a substantial portion of the sales to, or decreases in production by, any of these customers (or certain other significant customers) could have a material adverse effect on our business, financial condition, and/or results of operations.

Pricing Pressures. We continue to experience on-going pricing pressures from our automotive customers and competitors, which have affected, and which will continue to affect our profit margins to the extent that we are unable to offset the price reductions with engineering and purchasing cost reductions, productivity improvements, and increases in unit sales volume, each of which pose an ongoing challenge, which could adversely impact our business, financial condition, and/or results of operations.

Competition. We recognize that Magna Mirrors, our main competitor and wholly-owned subsidiary of Magna International, may have considerably more resources available to it, and may present a formidable competitive threat.

On March 31, 2014, the National Highway Traffic Safety Administration issued a final rule requiring rearview video systems in U.S. light vehicles by May 1, 2018, with a phase-in schedule requirement of 10% of vehicles after May 2016, 40% of vehicles after May 2017, and 100% of vehicles after May 2018. In this release, NHTSA estimated that 57% of model year 2014 vehicles already have a rear video system, and that even without a final rule, 73% of the vehicles sold into North America would have already included a rearview video system by 2018. This NHTSA ruling, as is indicated from the percentage of U.S. vehicles already having a rearview video solution, does not currently indicate an immediate opportunity for new Rear Camera Display (RCD) mirror applications for the Company. Customer opportunities may exist by the time the 100% requirement is in place, but there is no certainty in this regard. The Company’s rear camera display mirror application meets all the technical requirements of the NHTSA ruling when installed in a vehicle and appropriately paired with an OEM specified camera. The NHTSA ruling that rearview video systems are required has increased competition for systems capable of rear video in a variety of locations in the vehicle. Our Rear Camera Display (RCD) mirror application has and will continue to be affected by this increased competition.

Our SmartBeam® product is a driver-assist feature for headlamp lighting control that competes with other multiple-function driver-assist features that include headlamp lighting control as one of the multiple functions. While we believe SmartBeam® is a low cost solution for a safety feature that makes nighttime driving safer by maximizing a vehicle's high-beam usage, competition from multiple-function driver-assist products could impact the long-term success of SmartBeam®. As we continue to expand the capabilities of our CMOS imager technology for additional driver-assist features, we recognize that we are competing against multiple-function driver-assist technologies that have presented and will continue to present a competitive threat for SmartBeam®.

Our CMOS imager technology when used as a rearward facing automotive video camera is a video camera that that competes with other commercially available automotive video cameras. While we believe our video camera, when combined with our display mirror products produces a higher dynamic range than other commercially available automotive video cameras, we recognize other technologies are highly competitive and these features are price sensitive. Our ability to market and sell our products may be affected by the high level of competition in this market.

On March 31, 2014 the Alliance of Automobile Manufacturers petitioned the National Highway Traffic Safety Administration to allow automakers to use cameras as an option to replace conventional rearview mirrors. Rearview mirrors provide a robust and simple means to view the surrounding areas of a vehicle and are the primary safety function for rear vision today. Cameras when used as the primary rear vision delivery mechanism have some inherent limitations. Examples of these limitations include: electrical failure; cameras being blocked or obstructed; depth perception challenges; and viewing angle of the camera. Nonetheless, the Company continues designing and manufacturing not only rearview mirrors, but CMOS imager cameras and video displays as well. The Company believes that combining video displays with mirrors may well provide a safer overall product by addressing all driving conditions in a single solution that can be controlled by the driver. The Company also continues to develop in the areas of camera imager performance, camera dynamic range, lens optics design, image processing from the camera to the display and camera lens cleaning. The Company acknowledges that as such technology evolves over time, there could be increased competition.

Business Combinations. We anticipate that acquisitions of businesses and assets may play a role in our future growth. We cannot be certain that we will be able to identify attractive acquisition targets, obtain financing for acquisitions on satisfactory terms, successfully acquire identified targets or manage timing of acquisitions with capital obligations across our businesses. Additionally, we may not be successful in integrating acquired businesses into our existing operations and achieving projected synergies. Competition for acquisition opportunities in the various industries in which we operate exists and may increase, thereby potentially increasing our costs of making acquisitions or causing us to refrain from making further acquisitions. We are also subject to applicable antitrust laws and must avoid anticompetitive behavior. These and other acquisition-related factors may negatively and adversely impact our growth, profitability and results of operations.

Intellectual Property. We believe that our patents and trade secrets provide us with a competitive advantage in automotive rearview mirrors and electronics, although no single patent is necessarily required for the success of our products. The loss of any significant combination of patents and trade secrets regarding our products could adversely affect our business, financial condition, and/or results of operations. Lack of intellectual property protection in a number of countries, including China possess risk for the Company. This trend represents an increasing risk to technology companies in the United States, including the Company.

New Technology and Product Development. We continue to invest a significant portion of our annual sales in engineering, research and development projects as set forth in our Consolidated Statements of Income of our Consolidated Financial Statements filed with this report. Should these efforts ultimately prove unsuccessful, our business, financial condition, and/or results of operations could be adversely affected. Intellectual Property Litigation and Infringement Claims. A successful claim of patent or other intellectual property infringement and damages against us could affect our profitability and future growth. If someone claims that our products infringed their intellectual property rights, any resulting litigation could be costly and time consuming and would divert the attention of management and key personnel from other business issues. The complexity of the technology involved in our business and the uncertainty of intellectual property litigation significantly increases these risks and makes such risk part of our on-going business. To that end, we periodically obtain intellectual property rights, in the ordinary course of business, to strengthen our intellectual property portfolio and minimize potential risks of infringement. The increasing tendency of patents granted to others on combinations of known technology is a potential threat to our Company. Any of these adverse consequences could potentially have an effect on our business, financial condition and/or results of operations.

Credit Risk. In light of the continuing financial stresses within the certain regions within the worldwide automotive industry, certain automakers and Tier 1 customers are considering the sale of certain business segments or may be considering bankruptcy. Should one or more of our larger customers (including sales through their Tier 1 suppliers) declare bankruptcy or sell their business, it could adversely affect the collection of receivables, our business, financial condition, and/or results of operations. The current economic environment continues to cause increased financial pressures and production stresses on our customers, which could impact timely customer payments and ultimately the collectability of receivables.

Our overall allowance for doubtful accounts primarily relates to financially distressed automotive mirror and electronics customers. We continue to work with these financially distressed customers in collecting past due balances. Refer to Note 1 of the Consolidated Financial Statements for additional details regarding our allowance for doubtful accounts. Supply Chain Disruptions. Due to the just-in-time supply chains within the automotive industry, a disruption in a supply chain caused by one or more of our suppliers and/or an unrelated tier one supplier due to part shortages, natural disasters, work stoppages, strikes, bankruptcy, etc. could disrupt our shipments to one or more automakers or Tier 1 customers, which could adversely affect our business, financial condition, and/or results of operations.

Business Disruptions. Manufacturing of our proprietary products employing electro-optic technology is performed at our manufacturing facilities in Zeeland and Holland, Michigan. One of our manufacturing facilities is located in Holland, Michigan, which is approximately three miles from our other manufacturing facilities in Zeeland, Michigan. Should a catastrophic event occur, our ability to manufacture product, complete existing orders and provide other services could be severely impacted for an undetermined period of time. We have purchased business interruption insurance to address some of these potential costs. Our inability to conduct normal business operations for a period of time may have an adverse impact on our business, financial condition, and/or results of operations.

IT Infrastructure. A failure of our information technology (IT) infrastructure could adversely impact our business, financial condition, and/or results of operations. We rely upon the capacity, reliability and security of our information technology infrastructure and our ability to expand and continually update this infrastructure in response to the changing needs of our business. For example, we have implemented enterprise resource planning and other IT systems in certain aspects of our businesses over a period of several years and continue to update and further implement new systems going forward. These systems may not perform as expected. We also face the challenge of supporting our older systems and implementing necessary upgrades. If we experience a problem with the functioning of an important IT system or a security breach of our IT systems, the resulting disruptions could have an adverse effect on our business, financial condition, and/or results of operations. We and certain of our third-party vendors receive and store personal information in connection with our human resources operations and other aspects of our business. Despite our implementation of security measures, our IT systems, like all IT systems, are vulnerable to damages from computer viruses, natural disasters, unauthorized access, cyber-attack and other similar disruptions. Any system failure, accident or security breach could result in disruptions to our operations. A material network breach in the security of our IT systems could include the theft of our intellectual property, trade secrets or customer information. To the extent that any disruptions or security breach results in a loss or damage to our data, or an inappropriate disclosure of confidential or customer information, it could cause significant damage to our reputation, affect our relationships with our customers, lead to claims against the Company and ultimately harm our business. In addition, we may be required to incur significant costs to protect against damage caused by these disruptions or security breaches in the future.

Employees. Our business success depends on attracting and retaining qualified personnel. Our ability to sustain and grow our business requires us to hire, retain and develop a highly skilled and diverse management team and workforce. Failure to ensure that we have the leadership capacity with the necessary skill set and experience could impede our ability to deliver our growth objectives and execute our strategic plan. Organizational and reporting changes within management could result in increased turnover. In addition, any unplanned turnover or inability to attract and retain key employees, including managers, could have a negative effect on our business, financial condition and/or results of operations.

Government Regulations. The Dodd-Frank Wall Street Reform and Consumer Protection Act contains provisions to improve transparency and accountability concerning the supply of certain minerals, known as conflict minerals, originating from the Democratic Republic of Congo (DRC) and adjoining countries. As a result, in August 2012 the SEC adopted annual disclosure and reporting requirements for those companies who use conflict minerals mined from the DRC and adjoining countries in their products. These new requirements required due diligence efforts in 2013 and 2014, and the Company disclosed its findings to the SEC on Form SD on May 30, 2014. As there may be only a limited number of suppliers offering "conflict free" minerals, the Company cannot be sure that we will be able to obtain necessary conflict minerals from such suppliers in sufficient quantities or at competitive prices. Also, the Company may face reputational challenges if we determine that certain of our products contain minerals not determined to be conflict free or if the Company is unable to sufficiently verify the origins for all conflict minerals used in the Company's products through the procedures the Company may implement.

The European New Car Assessment Program (Euro NCAP) provides an incentive for automobiles sold in Europe to apply safety technologies that include driver assist features such as lane detection, vehicle detection, and pedestrian detection as standard equipment. Euro NCAP compliant driver assist systems are also capable of including high beam assist as a function. The increased application of Euro NCAP on European vehicles could potentially replace the Company's SmartBeam application on these vehicles.

Interest Rate Risk. The Company is exposed to interest rate changes primarily as a result of interest expense on borrowings used to finance an acquisition and working capital requirements. The Company's total variable-rate debt was $265.6 million as of December 31, 2014. As of December 31, 2014, the Company held one interest rate swap agreement denominated in U.S. dollars that effectively converts $150 million of its variable-rate debt to fixed-rate debt with an effective date of July 31, 2015 and lasting through the term of the Company's loan agreement related thereto which is September 27, 2018. The interest rate swap derivative instrument is held and used by the Company as a tool for managing interest rate risk. The counterparty to the swap instrument is a large financial institution that the Company believes is of high-quality creditworthiness. While the Company may be exposed to potential losses due to the credit risk of non-performance by this counterparty, such losses are not anticipated. The fair value of the interest rate swap was recorded within other accrued liabilities in the amount of $1.5 million at December 31, 2014. As of December 31, 2014, the weighted-average interest rate on the Company's variable-rate debt was approximately 1.17%. Based on loan balances as of December 31, 2014 and the effective date of July 31, 2015 of the interest rate swap, a one percent increase in the Company's borrowing rate would increase net interest expense paid by the Company on its borrowings by approximately $2.5 million dollars on an annual basis. The Company does not enter into contracts for speculative or trading purposes, nor is it a party to any leveraged derivative instruments.

Other. Other issues and uncertainties which could adversely impact our business, financial condition, and/or results of operations include:

| |

• | Volatility in commodity prices may adversely affect our business, financial condition and/or results of operations. If commodity prices rise, and if we are not able to recover these cost increases from our customers, such increases could have an adverse effect on our business, financial condition and/or results of operations. |

| |

• | Uncertain equity markets may negatively impact our financial performance due to an increase in realized losses on the sale of equity investments and/or recognized losses due to an Other-Than-Temporary Impairment adjustment on available-for-sale securities. |

| |

• | General economic conditions continue to be of concern in many of the regions in which we do business, given that our primary industry is greatly impacted by overall, general economic conditions. Any continued adverse worldwide economic conditions, currency exchange rates, war or significant terrorist acts, could each affect worldwide automotive sales and production levels. |

| |

• | Manufacturing yield issues may negatively impact our business, financial condition and/or results of operations. |

| |

• | Obligations and costs associated with addressing quality issues or warranty claims may adversely affect our business, financial condition and/or results of operations. |

Antitakeover Provisions. Our articles of incorporation, bylaws, and the laws of the state of Michigan include provisions that may provide our board of directors with adequate time to consider whether a hostile takeover offer is in our best interest and the best interests of our shareholders. These provisions, however, could discourage potential acquisition proposals and could delay or prevent a change in control.

Fluctuations in Market Price. The market price for our common stock has fluctuated, ranging from a low of $13.17 to a high of $19.06 during 2014 as adjusted for a stock split effected in the form of a 100% stock dividend issued on December 31, 2014. The overall market and the price of our common stock may continue to fluctuate. There may be a significant impact on the market price for our common stock relating to the issues discussed above or due to any of the following:

| |

• | variations in our anticipated or actual operating results or the results of our competitors; |

| |

• | changes in investors’ or analysts’ perceptions of the risks and conditions of our business and in particular our primary industry; |

| |

• | intellectual property litigation and infringement claims; |

| |

• | the size of the public float of our common stock; |

| |

• | market conditions, including the industry in which we operate; and |

| |

• | general macroeconomic conditions. |

Item 1B. Unresolved Staff Comments.

None

Item 2. Properties.

As of December 31, 2014 the Company operates primarily out of facilities in Zeeland and Holland, Michigan, which consist of manufacturing and office space. The Company also operates a chemistry lab facility to support production in Zeeland, Michigan. In addition, the Company operates overseas offices in Europe and Asia as further discussed below. The office and production facility for the Fire Protection Products Group is a 25,000 square-foot, one-story building leased by the Company since 1978 from related parties (see Part III, Item 13, of this report).

North America

The corporate office and production facility for the Company’s Automotive Products Group is a modern, two-story, 150,000 square-foot building of steel and masonry construction situated on a 40-acre site in a well-kept industrial park. A second 128,000 square-foot office/manufacturing facility was completed on this site in 1996. The Company expanded its automotive production facilities by constructing a third 170,000 square-foot facility on its current site which opened in 2000.

In 2002, the Company expanded its manufacturing operations in Zeeland, Michigan, with the construction of a 150,000 square-foot automotive mirror manufacturing facility. In 2003, the Company also announced plans for a new 200,000 square-foot technical office facility linking the fourth manufacturing facility with its existing corporate office and production facility. The Company completed the construction of this facility and the new technical center in 2006 at a total cost of approximately $38 million, which was funded from its cash and cash equivalents on hand.

In 2008, the Company expanded its automotive exterior mirror manufacturing facility in Zeeland, Michigan, with the construction of a 60,000 square-foot building addition, which was completed at a cost of approximately $6 million, which was funded from cash and cash equivalents on hand.

In 2010, the Company purchased, with cash and cash equivalents on hand, an existing 108,000-square-foot electronics manufacturing facility in Holland, Michigan, which is located approximately three miles from its other manufacturing facilities in Zeeland, Michigan. The facility was operational in the first quarter of 2011 and at full capacity in the third quarter of 2011. The total cost to purchase the facility and building improvements was approximately $5 million. In 2012, the Company expanded this electronics assembly facility with the construction of a 125,000 square-foot

expansion. The total cost of the facility expansion was approximately $25 million and was funded from cash and cash equivalents on hand.

In 2012, the Company expanded its automotive exterior mirror manufacturing facility in Zeeland, Michigan, with the construction of a 32,000 square-foot building addition, which was completed at a cost of approximately $4 million. The Company also in 2012 constructed a 60,000 square-foot chemistry lab facility in Zeeland, Michigan, which was completed as a cost of approximately $11.5 million. These expansion projects in 2012 were funded from cash and cash equivalents on hand.

In 2013, the Company completed a 120,000 square-foot expansion project connecting two of its manufacturing facilities in Zeeland, Michigan, with a total approximate cost of $25 million. Also in 2013, the Company completed a 10,000 square-foot facility to centralize the production and distribution of chilled water that is used in production, chemistry labs, as well as air conditioning. This was completed for a total cost of approximately $11 million. The above projects were funded from cash and cash equivalents on hand.

In 2014, the Company began construction of a 250,000 square-foot manufacturing and distribution facility located in Zeeland, Michigan. The total cost of the project is expected to be approximately $30 - $35 million and will be completed in 2016. This project will be funded from cash and cash equivalents on hand.

Europe

The Company also has sales and engineering offices throughout Europe to support its sales and engineering efforts. In 1993, the Company established a sales and engineering office in Germany and the following year, the Company formed a German limited liability company, Gentex GmbH, to expand its sales and engineering support activities in Europe. In 2003, the Company constructed a 40,000 square-foot office and distribution facility in Erlenbach, Germany, at a cost of approximately $5 million, which was funded from cash and cash equivalents on hand. In 2014, the Company began design plans for a 50,000 square-foot expansion of this facility. This project is expected to cost approximately $7 million, is expected to be completed in 2016, and is to be funded from cash and cash equivalents on hand.

The Company also operates satellite sales and engineering offices in Pfaffenhoffen, Sindlelfingen and Cologne, Germany.

The Company currently also operates sales and engineering offices out of the United Kingdom, France, Sweden and Sofia, Bulgaria.

Asia

In 1998, the Company established Gentex Japan, Inc., as a sales and engineering office in Nagoya, Japan, to expand its sales and engineering support in Japan. In 2004, the Company established a satellite office in Yokohama, Japan. In 2011, the Company established a satellite office in Tochigi, Japan.

In 2002, the Company established Gentex Technologies Korea Co., Ltd. as a sales and engineering office in Seoul, Korea.

In 2005, the Company opened a sales and engineering office near Shanghai, China. In 2006, the Company purchased a 25,000 square-foot office and distribution facility near Shanghai, China, at a cost of approximately $750,000, which was funded from cash and cash equivalents on hand.

Capacity

The Company believes its existing and planned facilities are currently suitable, adequate, and have the capacity required for current and near-term planned business. Nevertheless, the Company continues to evaluate longer term facilities needs. As a result, in 2014, the Company began construction of a 250,000 square-foot manufacturing and distribution facility located at a 140 acre site where the Company previously performed master planning and completed land infrastructure improvements, located in Zeeland, Michigan. The total cost of the building project is expected to be approximately $30 - $35 million and will be completed in 2016 and will be funded with cash and cash equivalents on hand. Once operational, the Company expects that it will add capacity to produce an additional 5 - 7 million mirrors annually, depending on product mix.

The Company estimates that it currently has building capacity to manufacture approximately 24 - 27 million interior mirror units annually, based on current product mix. The Company evaluates equipment capacity on an ongoing basis basis and adds equipment as needed. In 2014, the Company shipped 21.2 million interior auto-dimming mirrors.

The Company’s automotive exterior mirror manufacturing facility has an estimated building capacity to manufacture approximately 10 - 12 million units annually, based on the current product mix. The Company evaluates equipment capacity on an ongoing basis and adds equipment as needed. In 2014, the Company shipped approximately 7.8 million exterior auto-dimming mirrors.

Item 3. Legal Proceedings.

The Company is periodically involved in legal proceedings, legal actions and claims arising in the normal course of business, including proceedings relating to product liability, intellectual property, safety and health, employment and other matters. Such matters are subject to many uncertainties, and outcomes are not predictable. The Company does not believe however, that at the current time any of these matters constitute material pending legal proceedings that will have a material adverse effect on the financial position or future results of operations of the Company.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The Company’s common stock trades on The Nasdaq Global Select Market®. As of February 2, 2015, there were 2,286 record-holders of the Company’s common stock. Ranges of high and low sale prices of the Company’s common stock reported through The Nasdaq Global Select Market for the past two fiscal years appear in the following table. (Adjusted for 2-for-1 stock split effected in the form of a 100% stock dividend issued December 31, 2014).

|

| | | | | | | | | | | |

| Common Stock Price Range | | Dividends Declared Per Share |

Quarter | 2014 | | 2013 | | 2014 | | 2013 |

First Quarter | $14.80 - 17.21 | | $9.06 - 10.16 | | $ | 0.07 |

| | $ | 0.07 |

|

Second Quarter | $13.90 - 15.89 | | $9.51 - 12.70 | | 0.08 |

| | 0.07 |

|

Third Quarter | $13.33 - 15.16 | | $10.65 - 13.13 | | 0.08 |

| | 0.07 |

|

Fourth Quarter | $13.17 - 19.06 | | $12.32 - 17.08 | | 0.08 |

| | 0.07 |

|

Year | $13.17 - 19.06 | | $9.06 - 17.08 | | $ | 0.31 |

| | $ | 0.28 |

|

See Item 12 of Part III with respect to “Equity Compensation Plan Summary,” which is incorporated herein.

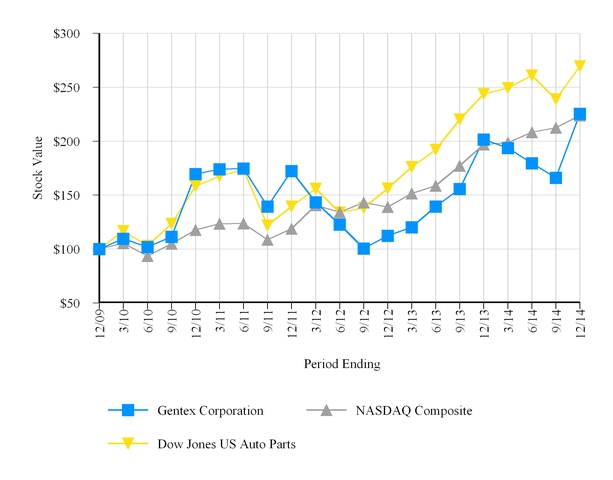

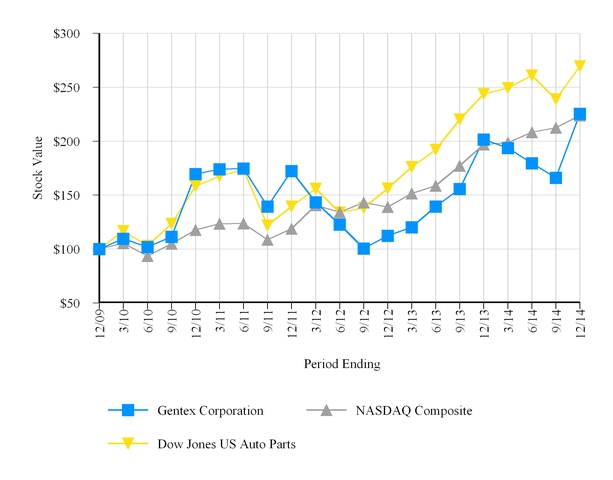

Stock Performance Graph: The following graph depicts the cumulative total return on the Company’s common stock compared to the cumulative total return on the Nasdaq Composite Index (all U.S. companies) and the Dow Jones U.S. Auto Parts Index (excluding tire and rubber makers). The graph assumes an investment of $100 on the last trading day of 2009, and reinvestment of dividends in all cases.

In August 2008, the Company’s Board of Directors approved a continuing resolution to pay a quarterly dividend at an increased rate of $0.055 per share until the Board takes other action with respect to the payment of dividends. In February 2011, the Company’s Board of Directors approved a continuing resolution to pay a quarterly dividend at an increased rate of $0.06 per share until the Board takes other action with respect to the payment of dividends. In February 2012, the Company’s Board of Directors approved a continuing resolution to pay a quarterly dividend at an increased rate of $0.065 per share until the Board takes other action with respect to the payment of dividends. In February 2013, The Company's Board of Directors approved a continuing resolution to pay a quarterly dividend at an increased rate of $0.07 per share until the Board takes other action with respect to the payment of dividends. In May 2014, the Company's Board of Directors approved a continuing resolution to pay a quarterly dividend at an increased rate of $0.08 per share until the Board takes other action with respect to the payment of dividends. Based on current U.S. income tax laws, the Company intends to continue to pay a quarterly cash dividend and will consider future dividend rate adjustments based on the Company’s financial condition, profitability, cash flow, liquidity and other relevant business factors. (All per share amounts have been adjusted to reflect the 2-for-1 stock split effected in the form of a 100% stock dividend issued December 31, 2014)

(b) Not applicable.

(c) On October 8, 2002, the Company announced a share repurchase plan, under which it may purchase up to 16,000,000 shares (post-split) based on a number of factors. On July 20, 2005, the Company announced that it had raised the price at which the Company may repurchase shares under the existing plan. On May 16, 2006, the Company announced that the Company's Board of Directors had authorized the repurchase of an additional 16,000,000 shares (post-split) under the plan. On August 14, 2006, the Company announced that the Company's Board of Directors had authorized the repurchase of an additional 16,000,000 shares (post -split) under the plan. On February 26, 2008, the Company announced that the Company's Board of Directors had authorized the repurchase of an additional 8,000,000 shares (post-split) under the plan. On October 23, 2012, the Company announced that the Company's Board of Directors had authorized the repurchase of an additional 8,000,000 shares (post - split) under the plan. The Company may purchase authorized shares of its common stock under the plan based on a number of factors, including market, economic, and industry conditions; the market price of the Company's common stock; anti-dilutive effect on earnings; available cash; and other factors that the Company deems appropriate. The plan does not have an expiration date, but the Board of Directors reviews such plan periodically.

The following is a summary of share repurchase activity during 2014:

|

| | | | | | | | | |

Issuer Purchase of Equity Securities |

Period | Total Number of Shares Purchased | Average Price Paid Per Share | Total Number of Shares Purchased As Part of a Publicly Announced Plan* | Maximum Number of Shares That May Yet Be Purchased Under the Plan* |

January 2014 | — |

| — |

| — |

| 8,000,000 |

|

February 2014 | — |

| — |

| — |

| 8,000,000 |

|

March 2013 | — |

| — |

| — |

| 8,000,000 |

|

April 2014 | — |

| — |

| — |

| 8,000,000 |

|

May 2014 | — |

| — |

| — |

| 8,000,000 |

|

June 2014 | — |

| — |

| — |

| 8,000,000 |

|

July 2014 | 345,000 |

| $ | 14.49 |

| 345,000 |

| 7,655,000 |

|

August 2014 | — |

| $ | — |

| — |

| 7,655,000 |

|

September 2014 | 358,130 |

| $ | 13.96 |

| 358,130 |

| 7,296,870 |

|

October 2014 | — |

| — |

| — |

| 7,296,870 |

|

November 2014 | — |

| — |

| — |

| 7,296,870 |

|

December 2014 | 1,094,350 |

| 18.29 |

| 1,094,350 |

| 6,202,520 |

|

Total | 1,797,480 |

| | 1,797,480 |

| |

* See above paragraph for data on which plan was announced, the total number of shares approved for

repurchase under the plan, and the expiration date (if any) of the plan.

As of December 31, 2014, the Company has repurchased 57,797,480 shares at a total cost of $444,628,061 under the plan. The following is a summary of quarterly share repurchase activity under the plan to date (adjusted for 2 for 1 stock splits each effected in the form of a 100% stock dividend issued effective May 6, 2005 and December 31, 2014, respectively):

|

| | | | | | |

Quarter Ended | Total Number of Shares Purchased (Post-Split) | | Cost of Shares Purchased |

March 31, 2003 | 1,660,000 |

| | $ | 10,246,810 |

|

September 30, 2005 | 2,992,118 |

| | 25,214,573 |

|

March 31, 2006 | 5,607,096 |

| | 47,145,310 |

|

June 30, 2006 | 14,402,162 |

| | 104,604,414 |

|

September 30, 2006 | 7,936,342 |

| | 55,614,102 |

|

December 31, 2006 | 2,465,768 |

| | 19,487,427 |

|

March 31, 2007 | 895,420 |

| | 7,328,015 |

|

March 31, 2008 | 4,401,504 |

| | 34,619,490 |

|

June 30, 2008 | 2,407,120 |

| | 19,043,775 |

|

September 30, 2008 | 5,038,306 |

| | 39,689,410 |

|

December 31, 2008 | 4,250,506 |

| | 17,907,128 |

|

September 30, 2012 | 3,943,658 |

| | 33,716,725 |

|

September 30, 2014 | 703,130 |

| | 9,999,957 |

|

December 31, 2014 | 1,094,350 |

| | 20,010,925 |

|

Total | 57,797,480 |

| | $ | 444,628,061 |

|

On December 5, 2014, the Company announced that its Board of Directors approved a two-for-one split of our outstanding shares of common stock to be effected in the form of a 100% stock dividend. On December 31, 2014, shareholders of record at the close of business on December 17, 2014, were issued one additional share of common stock for each share owned by such shareholder. The stock split increased the number of shares of common stock outstanding from approximately 147.6 million to approximately 295.2 million. Share and per-share amounts (including stock options and restricted stock) shown in the consolidated financial statements and related notes reflect the split. The total number of authorized common shares and the par value thereof was not changed by the split.

| |

Item 6. | Selected Financial Data. |

|

| | | | | | | | | | | | | | | | | | | |

(in thousands, except per share data) |

| 2014 | | 2013 | | 2012 | | 2011 | | 2010 |

Net Sales | $ | 1,375,501 |

| | $1,171,864 | | $1,099,560 | | $ | 1,023,762 |

| | $ | 816,263 |

|

Net Income | 288,605 |

| | 222,930 |

| | 168,587 |

| | 164,668 |

| | 137,734 |

|

Earnings Per Share (Fully Diluted) | $ | 0.98 |

| | $ | 0.77 |

| | $ | 0.59 |

| | $ | 0.57 |

| | $ | 0.49 |

|

Gross Profit Margin | 39.2 | % | | 36.8 | % | | 33.9 | % | | 35.3 | % | | 36.2 | % |

Cash Dividends per Common Share | $ | 0.31 |

| | $ | 0.28 |

| | $ | 0.26 |

| | $ | 0.24 |

| | $ | 0.22 |

|

Total Assets | $ | 2,022,540 |

| | $ | 1,764,088 |

| | $ | 1,265,691 |

| | $ | 1,176,027 |

| | $ | 1,022,691 |

|

Long-Term Debt Outstanding at Year End | $ | 258,125 |

| | $ | 265,625 |

| | $ | — |

| | $ | — |

| | $ | — |

|

| |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

Results of Operations.

The following table sets forth for the periods indicated certain items from the Company’s Consolidated Statements of Income expressed as a percentage of net sales and the percentage change in the dollar amount of each such item from that in the indicated previous year.

|

| | | | | | | | | | | | | | |

| Percentage of Net Sales | | Percentage Change |

| | | | | | | 2014 | | 2013 |

| Year Ended December 31, | | Vs | | Vs |

| 2014 | | 2013 | | 2012 | | 2013 | | 2012 |

Net Sales | 100.0 | % | | 100.0 | % | | 100.0 | % | | 17.4 | % | | 6.6 | % |

Cost of Goods Sold | 60.8 |

| | 63.2 |

| | 66.1 |

| | 12.9 |

| | 2.0 |

|

Gross Profit | 39.2 |

| | 36.8 |

| | 33.9 |

| | 25.1 |

| | 15.5 |

|

Operating Expenses: | | | | | | | | | |

Engineering, Research and Development | 6.1 |

| | 6.5 |

| | 7.7 |

| | 10.0 |

| | (10.0 | ) |

Selling, General and Administrative | 4.1 |

| | 4.2 |

| | 4.4 |

| | 12.9 |

| | 2.3 |

|

Litigation Settlement | — |

| | — |

| | 0.5 |

| | N/A | | (100.0) |

Total Operating Expenses: | 10.2 |

| | 10.8 |

| | 12.6 |

| | 11.2 |

| | (8.9 | ) |

Operating Income | 29.0 |

| | 26.0 |

| | 21.3 |

| | 30.9 |

| | 30.0 |

|

Other Income/(Expense) | 1.2 |

| | 2.0 |

| | 1.4 |

| | (29.3 | ) | | 53.7 |

|

Income Before Provision for Income Taxes | 30.2 |

| | 28.0 |

| | 22.7 |

| | 26.6 |

| | 31.4 |

|

Provision for Income Taxes | 9.2 |

| | 9.0 |

| | 7.4 |

| | 20.5 |

| | 29.7 |

|

Net Income | 21.0 | % | | 19.0 | % | | 15.3 | % | | 29.5 | % | | 32.2 | % |

Results of Operations: 2014 to 2013

Net Sales. Company net sales increased by $203.6 million, or 17% compared to the prior year. Automotive net sales increased due to the acquisition of HomeLink® and an 11% increase in auto-dimming mirror shipments, from 26.2 million units in 2013 to 29.0 million units in 2014, primarily reflecting increased overall penetration of auto-dimming mirrors. North American automotive mirror unit shipments increased 6% in 2014 compared with the prior year, primarily due to a 12% increase in shipments of the Company's exterior auto-dimming mirrors. International automotive mirror unit shipments increased 14% in 2014 when compared with the prior year, primarily due to increased penetration of both interior and exterior auto-dimming mirrors to certain European and Japanese automakers.

Other net sales increased 27% to $35.4 million compared to the prior year, as dimmable aircraft window sales increased 54% year over year and fire protection sales increased 4% year over year.

Cost of Goods Sold. As a percentage of net sales, cost of goods sold decreased from 63.2% in 2013 to 60.8% in 2014, primarily reflecting improvements in product mix , purchasing cost reductions, and the impact of the HomeLink® acquisition, partially offset by annual automotive customer price reductions. Each of the positive factors is estimated to have impacted cost of goods sold independently as a percentage of net sales by approximately 125 - 150 basis points.

Operating Expenses. Engineering, research and development expenses increased by $7.7 million from 2013 to 2014, and was 6% of net sales down from 7% of sales in the prior year. E, R & D expenses in 2014 increased 10% year over year, compared to calendar year 2013 primarily due to increased staffing levels which continue to support growth and the development of new business.

Selling, general and administrative expenses increased by $6.4 million or 13% from 2013 to 2014, and remained at 4% of net sales. The primary reason for the increase from 2013 to 2014 was increased amortization expense related to the HomeLink acquisition.

Total Other Income/(Expense). Investment income decreased $0.7 million in 2014 versus 2013, primarily due to lower year-end mutual fund distribution income. Other income – net decreased $6.1 million in 2014 versus 2013, primarily due to decreased realized gains on the sale of equity investments, and increased interest expense associated with the Company's debt financing.

Taxes. The effective tax rate was 30.5% for year ended December 31, 2014 compared to 32.0% the prior year. The effective tax rate differed from the statutory federal income tax rate, primarily due to the domestic manufacturing deduction, provisions for state and local income taxes, and permanent tax differences. The decrease in the effective tax rate from the prior year is primarily due to incremental research and development tax credits related to amended tax return filings for calendar years 2010 through 2012 of $5.5 million, as well as incremental benefits realized as part of original 2013 tax return of approximately $1.8 million plus the $3 million in estimated benefit for 2014 for a total of $10.3 million in decreased taxes, all realized during 2014.

Net Income. Net income increased by $65.7 million, or 29% year over year, primarily due to increased sales and gross profit.

Results of Operations: 2013 to 2012

Net Sales. Company net sales increased by $72.3 million, or 7% compared to the prior year. Automotive net sales increased by 6% on a 10% increase in auto-dimming mirror shipments, from 23.8 million units in 2012 to 26.2 million units, primarily reflecting increased overall penetration of auto-dimming mirrors. North American automotive mirror unit shipments increased 6% in 2013 compared with the prior year, primarily due to increased penetration of the Company's exterior auto-dimming mirrors, as well as a 5% year over year increase in North American light vehicle production. International automotive mirror unit shipments increased 13% in 2013 when compared with the prior year, primarily due to increased penetration of both interior and exterior auto-dimming mirrors to certain European and Japanese automakers, in spite of flat vehicle production in Europe and a 4% decline in vehicle production in the Japanese/Korean markets on a year over year basis.

Other net sales increased 23% to $27.9 million, as dimmable aircraft window sales increased 62% year over year and fire protection sales increased 3% year over year.

Cost of Goods Sold. As a percentage of net sales, cost of goods sold decreased from 66.1% in 2012 to 63.2% in 2013, primarily reflecting improvements in product mix and purchasing cost reductions, partially offset by annual automotive customer price reductions. Each positive factor is estimated to have impacted cost of goods sold as a percentage of net sales by approximately 1-2 percentage points.

Operating Expenses. Engineering, research and development expenses decreased by $8.5 million from 2012 to 2013, and was 7% of net sales down from 8% of sales in the prior year. E, R & D expenses decreased 10% year over year, compared to calendar year 2012 primarily due to planned reduced costs associated with temporary outside contract engineering and development services, partially offset by increased permanent staffing levels.

Selling, general and administrative expenses increased by $1.1 million or 2% from 2012 to 2013, and remained at 4% of net sales due in part to expenses related to the HomeLink® acquisition.

Total Other Income/(Expense). Investment income increased $1.4 million in 2013 versus 2012, primarily due to increased year-end mutual fund distribution income. Other income – net increased $6.7 million in 2013 versus 2012, primarily due to increased realized gains on the sale of equity investments, partially offset by increased interest expense associated with the Company's debt financing.

Taxes. The provision for federal income taxes varied from the statutory rate in 2013 primarily due to the domestic manufacturing deduction.

Net Income. Net income increased by $54.3 million, or 32% year over year, primarily due to increased sales and gross profit.

Liquidity and Capital Resources

The Company’s financial condition throughout the periods presented has remained very strong, in spite of the general economic environment and conditions in our primary industry of automotive which, even though improving in certain regions, has not necessarily fully recovered.

The Company's cash and cash equivalents were $497.4 million, $309.6 million and $389.7 million as of December 31, 2014, 2013 and 2012, respectively. The Company's cash and cash equivalents include amounts held by foreign subsidiaries of $10.1 million, $8.1 million and $6.6 million as of December 31, 2014, 2013 and 2012, respectively. The funds held by foreign subsidiaries are considered indefinitely reinvested to be used to support operations outside the United States. The Company does not intend to repatriate any foreign cash or cash equivalents in the foreseeable future. These amounts would be subject to possible U.S. taxation only if remitted as dividends.

The Company's current ratio increased from 5.0 as of December 31, 2013, to 6.4 as of December 31, 2014, primarily due to an increase in cash and cash equivalents as a result of increased operating cash flows. The Company's current ratio decreased from 8.5 as of December 31, 2012, to 5.0 as of December 31, 2013, primarily as a result of a decrease in cash and cash equivalents and an increase in accounts payable, partially offset by a decrease in inventory.

Cash flow from operating activities was $327.2 million, $317.3 million and $257.8 million for the years ended December 31, 2014, 2013, and 2012, respectively. Cash flow from operating activities increased $9.9 million for the year ended December 31, 2014 compared to the prior year, primarily due to increased net income. Cash flow from operating activities increased $59.4 million for the year ended December 31, 2013, compared the same period in 2012, primarily due to increases in net income and reductions in inventory.

Cash flow used for investing activities for the year ended December 31, 2014 decreased by $553.5 million to $79.7 million, compared with $633.3 million, during 2013, primarily due to the HomeLink® acquisition in 2013. Cash flow used for investing activities for the year ended December 31, 2013 increased $501.2 million to $633.3 million, compared to the year ended December 31, 2012, primarily due to the HomeLink® acquisition in 2013. Capital expenditures for the year ended December 31, 2014, were $72.5 million, compared with $55.4 million for the prior year year, primarily due to an increase in production equipment purchases and building related costs. Capital expenditures for the year ended December 31, 2013 were $55.4 million, compared with $117.5 million the prior year, primarily due to reductions in building related costs and reduced production equipment purchases.

Cash flow used for financing activities for the year ended December 31, 2014, increased $295.5 million to $59.7 million, compared to the prior year, primarily due to dividends paid and common stock repurchases. Cash flow from financing activities for the year ended December 31, 2013, increased $329.9 million to $235.8 million compared to the prior year, primarily due to proceeds from borrowings on the Company's long-term debt financing, discussed further in Note 2 to the Consolidated Financial Statements. Cash and cash equivalents as of December 31, 2014 increased $187.8 million compared to December 31, 2013, primarily due to cash flow from operating activities, partially offset by dividends paid and capital expenditures.

Accounts receivable as of December 31, 2014 increased $25.0 million compared to December 31, 2013, primarily due to the higher sequential sales level.

Inventories as of December 31, 2014, increased $21.7 million compared to December 31, 2013, primarily due to increases in raw materials inventory.

Long-term investments as of December 31, 2014, increased $7.6 million compared to December 31, 2013, primarily due to realized gains on sales of equity investments that were re-invested.

Intangible Assets, net as of December 31, 2014 decreased $19.3 million due to the amortization expenses of definitive lived intangible assets and patents, discussed further in in Note 11 to the Consolidated Financial Statements. Accounts payable as of December 31, 2014, increased $14.9 million compared to December 31, 2013, primarily due the timing of certain payments.

Long term debt as of December 31, 2014 decreased $7.5 million, due to principal repayments on the Company's long term debt financing. Additionally, the Company entered into an interest rate swap transaction on October 1, 2014 as discussed further in Note 2 of the Consolidated Financial Statements. Management considers the Company’s current working capital and long-term investments, as well as its existing debt financing arrangement (notwithstanding covenants prohibiting additional indebtedness), discussed further in Note 2