Fifth Third Bancorp 3Q18 Earnings Presentation October 23, 2018 Refer to earnings release dated October 23, 2018 for further information. Filed by Fifth Third Bancorp pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: MB Financial, Inc. SEC File No.: 001-36599 Filer’s SEC File No.: 001-33653 Date: October 23, 2018

FORWARD-LOOKING STATEMENTS This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, Fifth Third Bancorp’s and MB Financial, Inc.’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible” or “potential,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made and we assume no duty to update forward-looking statements. Actual results may differ materially from current projections. In addition to factors previously disclosed in Fifth Third Bancorp’s and MB Financial, Inc.’s reports filed with or furnished to the SEC and those identified elsewhere in this communication, the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: the ability to obtain regulatory approvals and meet other closing conditions to the merger, including approval of the merger by MB Financial, Inc.’s stockholders on the expected terms and schedule, including the risk that regulatory approvals required for the merger are not obtained or are obtained subject to conditions that are not anticipated; delay in closing the merger; difficulties and delays in integrating the businesses of MB Financial, Inc. or fully realizing cost savings and other benefits; business disruption following the merger; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of Fifth Third Bancorp’s products and services; customer borrowing, repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions and divestitures; economic conditions; and the impact, extent and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. In this presentation, we may sometimes use non-GAAP financial information. Please note that although non-GAAP financial measures provide useful insight to analysts, investors and regulators, they should not be considered in isolation or relied upon as a substitute for analysis using GAAP measures. If applicable, we provide GAAP reconciliations for non-GAAP financial measures in a later slide in this presentation, which is also available in the investor relations section of our website, www.53.com. Management does not provide a reconciliation for forward-looking non-GAAP financial measures where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the occurrence and the financial impact of various items that have not yet occurred, are out of the Bancorp's control or cannot be reasonably predicted. For the same reasons, the Bancorp's management is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures. We provide a discussion of non-GAAP measures and reconciliations to the most directly comparable GAAP measures in later slides in this presentation, as well as on pages 25 through 27 of our 3Q18 earnings release. IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the proposed merger, Fifth Third Bancorp has filed with the SEC a Registration Statement on Form S-4 that includes the Proxy Statement of MB Financial, Inc. and a Prospectus of Fifth Third Bancorp, as well as other relevant documents concerning the proposed transaction. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. INVESTORS AND STOCKHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about Fifth Third Bancorp and MB Financial, Inc., may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Fifth Third Bancorp at ir.53.com or from MB Financial, Inc. by accessing MB Financial, Inc.’s website at investor.mbfinancial.com. Copies of the Proxy Statement/Prospectus can also be obtained, free of charge, by directing a request to Fifth Third Investor Relations at Fifth Third Investor Relations, MD 1090QC, 38 Fountain Square Plaza, Cincinnati, OH 45263, by calling (866) 670-0468, or by sending an e-mail to ir@53.com or to MB Financial, Attention: Corporate Secretary, at 6111 North River Road, Rosemont, Illinois 60018, by calling (847) 653-1992 or by sending an e-mail to dkoros@mbfinancial.com. Fifth Third Bancorp and MB Financial, Inc. and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of MB Financial, Inc. in respect of the transaction described in the Proxy Statement/Prospectus. Information regarding Fifth Third Bancorp’s directors and executive officers is contained in Fifth Third Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2017 and its Proxy Statement on Schedule 14A, dated March 6, 2018, which are filed with the SEC. Information regarding MB Financial, Inc.’s directors and executive officers is contained in its Proxy Statement on Schedule 14A filed with the SEC on April 3, 2018. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger. Free copies of this document may be obtained as described in the preceding paragraph.

Strategic priorities for the company 1 3 Implement remaining NorthStar initiatives and achieve standalone financial targets Continue to position company to pursue profitable organic growth opportunities 2 Successfully integrate MB Financial and realize expected financial benefits

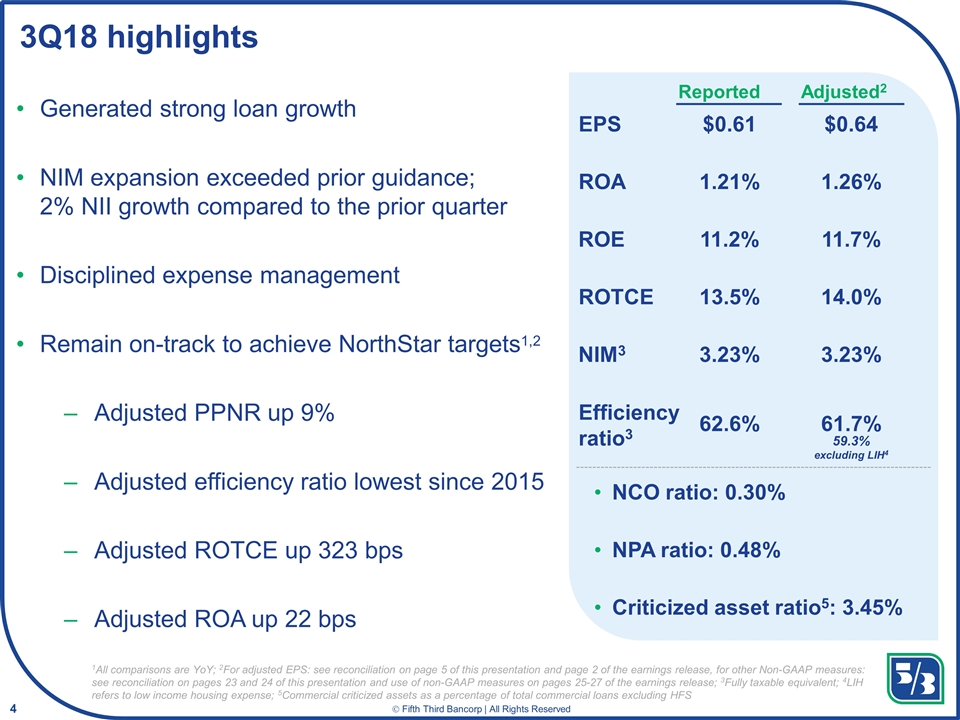

3Q18 highlights Generated strong loan growth NIM expansion exceeded prior guidance; 2% NII growth compared to the prior quarter Disciplined expense management Remain on-track to achieve NorthStar targets1,2 Adjusted PPNR up 9% Adjusted efficiency ratio lowest since 2015 Adjusted ROTCE up 323 bps Adjusted ROA up 22 bps Reported 1All comparisons are YoY; 2For adjusted EPS: see reconciliation on page 5 of this presentation and page 2 of the earnings release, for other Non-GAAP measures: see reconciliation on pages 23 and 24 of this presentation and use of non-GAAP measures on pages 25-27 of the earnings release; 3Fully taxable equivalent; 4LIH refers to low income housing expense; 5Commercial criticized assets as a percentage of total commercial loans excluding HFS Adjusted2 EPS ROA Efficiency ratio3 ROTCE $0.61 $0.64 1.26% NCO ratio: 0.30% NPA ratio: 0.48% Criticized asset ratio5: 3.45% 14.0% NIM3 3.23% 3.23% 1.21% 13.5% 61.7% 62.6% 59.3% excluding LIH4 ROE 11.7% 11.2%

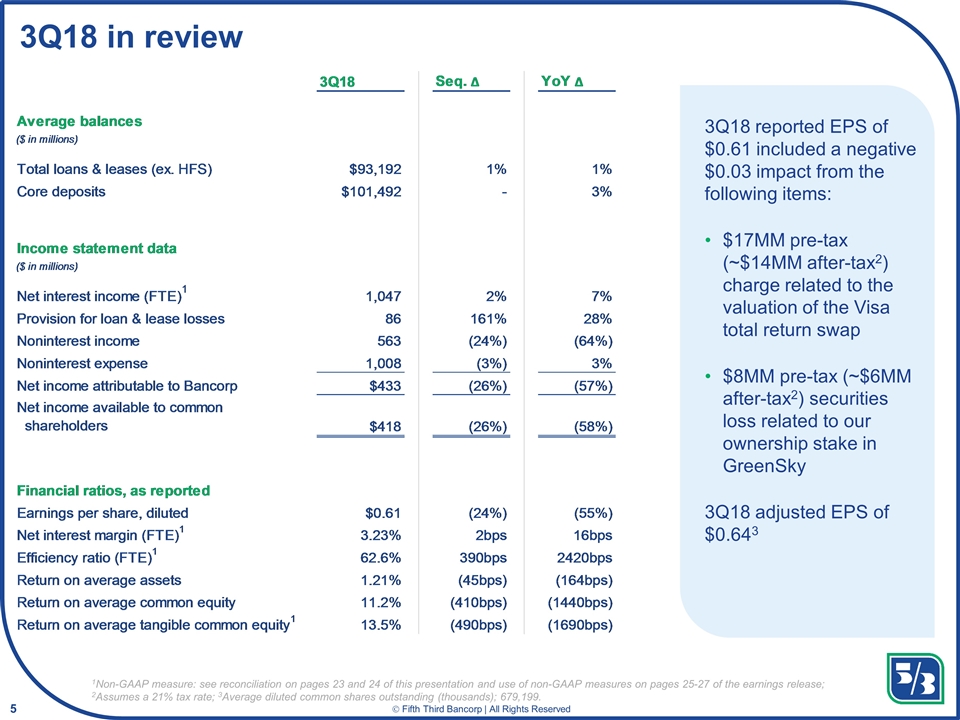

3Q18 in review 3Q18 reported EPS of $0.61 included a negative $0.03 impact from the following items: $17MM pre-tax (~$14MM after-tax2) charge related to the valuation of the Visa total return swap $8MM pre-tax (~$6MM after-tax2) securities loss related to our ownership stake in GreenSky 3Q18 adjusted EPS of $0.643 1Non-GAAP measure: see reconciliation on pages 23 and 24 of this presentation and use of non-GAAP measures on pages 25-27 of the earnings release; 2Assumes a 21% tax rate; 3Average diluted common shares outstanding (thousands); 679,199.

Commercial Balance sheet Securities1 and short-term investments Loan & lease balances Core deposit balances Securities1 Short-term investments Commercial Consumer Total IB core deposit rate 1Available-for-sale debt and other securities at amortized cost; previous disclosures included available-for-sale equity securities which are now disclosed separately in the financial results See forward looking statements on page 2 Consumer Total loan yield Taxable securities yield Total average balance; $ billions Commercial loans & leases: up modestly from 3Q18 Consumer loans: flat from 3Q18 Current 4Q18 outlook (end of period, incl. HFS) Loan & lease balances exclude HFS

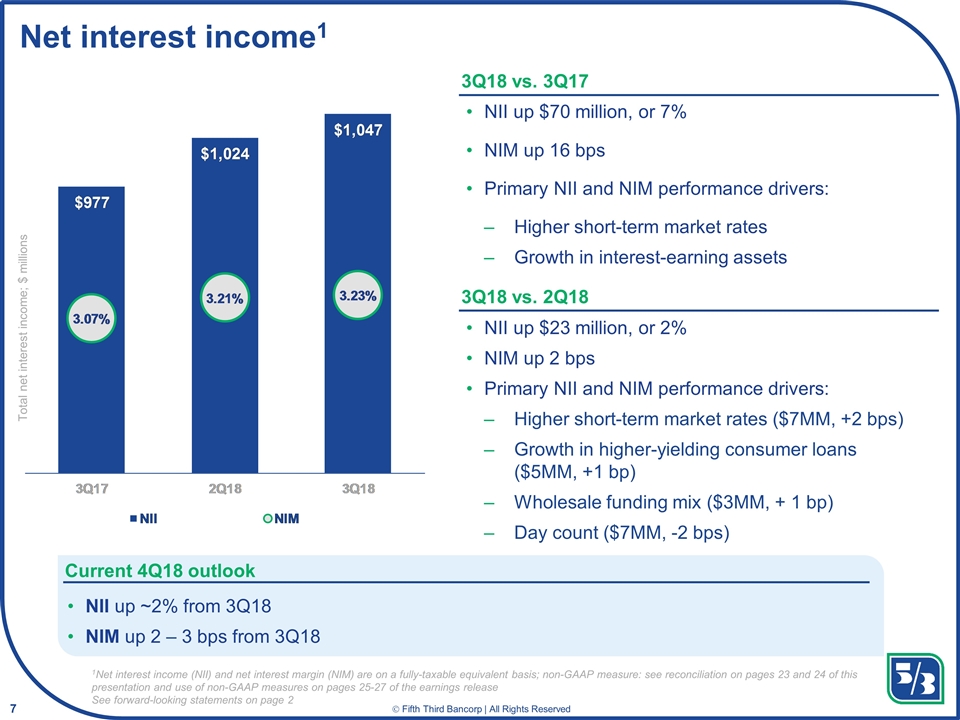

Net interest income1 3Q18 vs. 3Q17 Current 4Q18 outlook 3Q18 vs. 2Q18 NII up $70 million, or 7% NIM up 16 bps Primary NII and NIM performance drivers: Higher short-term market rates Growth in interest-earning assets NII up $23 million, or 2% NIM up 2 bps Primary NII and NIM performance drivers: Higher short-term market rates ($7MM, +2 bps) Growth in higher-yielding consumer loans ($5MM, +1 bp) Wholesale funding mix ($3MM, + 1 bp) Day count ($7MM, -2 bps) 1Net interest income (NII) and net interest margin (NIM) are on a fully-taxable equivalent basis; non-GAAP measure: see reconciliation on pages 23 and 24 of this presentation and use of non-GAAP measures on pages 25-27 of the earnings release See forward-looking statements on page 2 NII up ~2% from 3Q18 NIM up 2 – 3 bps from 3Q18 Total net interest income; $ millions

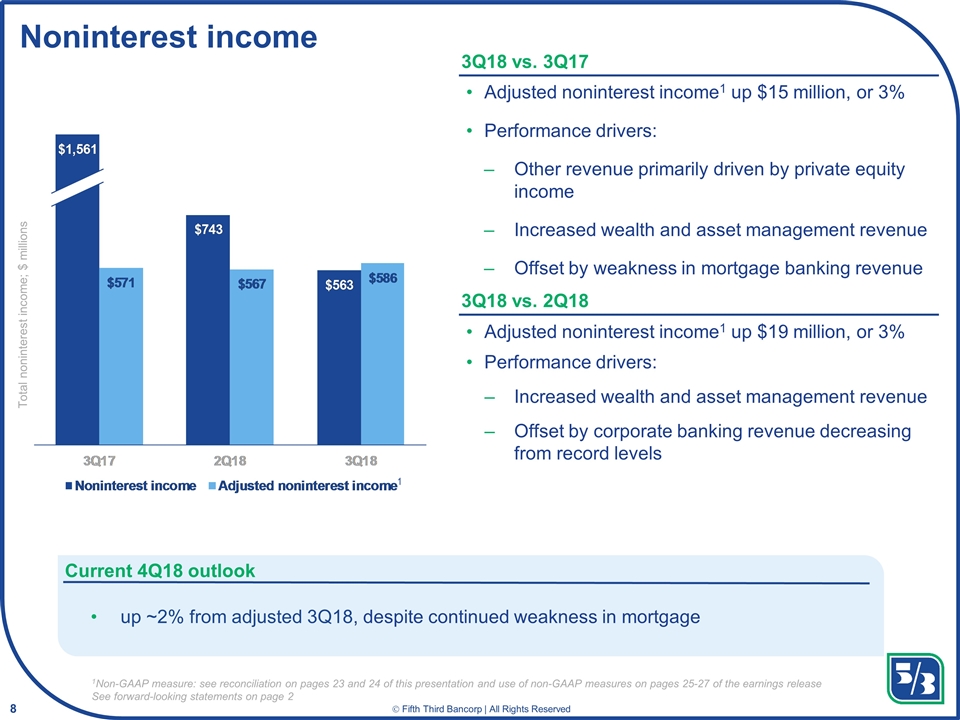

Noninterest income 3Q18 vs. 3Q17 Current 4Q18 outlook 3Q18 vs. 2Q18 Adjusted noninterest income1 up $15 million, or 3% Performance drivers: Other revenue primarily driven by private equity income Increased wealth and asset management revenue Offset by weakness in mortgage banking revenue Adjusted noninterest income1 up $19 million, or 3% Performance drivers: Increased wealth and asset management revenue Offset by corporate banking revenue decreasing from record levels 1Non-GAAP measure: see reconciliation on pages 23 and 24 of this presentation and use of non-GAAP measures on pages 25-27 of the earnings release See forward-looking statements on page 2 Total noninterest income; $ millions up ~2% from adjusted 3Q18, despite continued weakness in mortgage

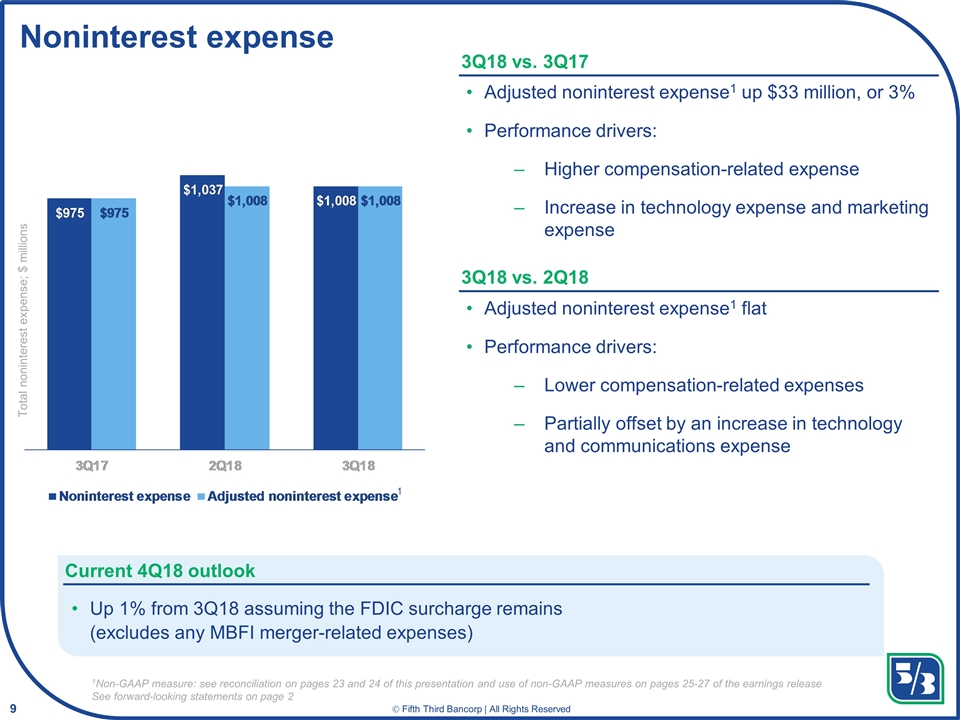

Noninterest expense 3Q18 vs. 3Q17 Current 4Q18 outlook 3Q18 vs. 2Q18 Adjusted noninterest expense1 up $33 million, or 3% Performance drivers: Higher compensation-related expense Increase in technology expense and marketing expense Adjusted noninterest expense1 flat Performance drivers: Lower compensation-related expenses Partially offset by an increase in technology and communications expense 1Non-GAAP measure: see reconciliation on pages 23 and 24 of this presentation and use of non-GAAP measures on pages 25-27 of the earnings release See forward-looking statements on page 2 Up 1% from 3Q18 assuming the FDIC surcharge remains (excludes any MBFI merger-related expenses) Total noninterest expense; $ millions

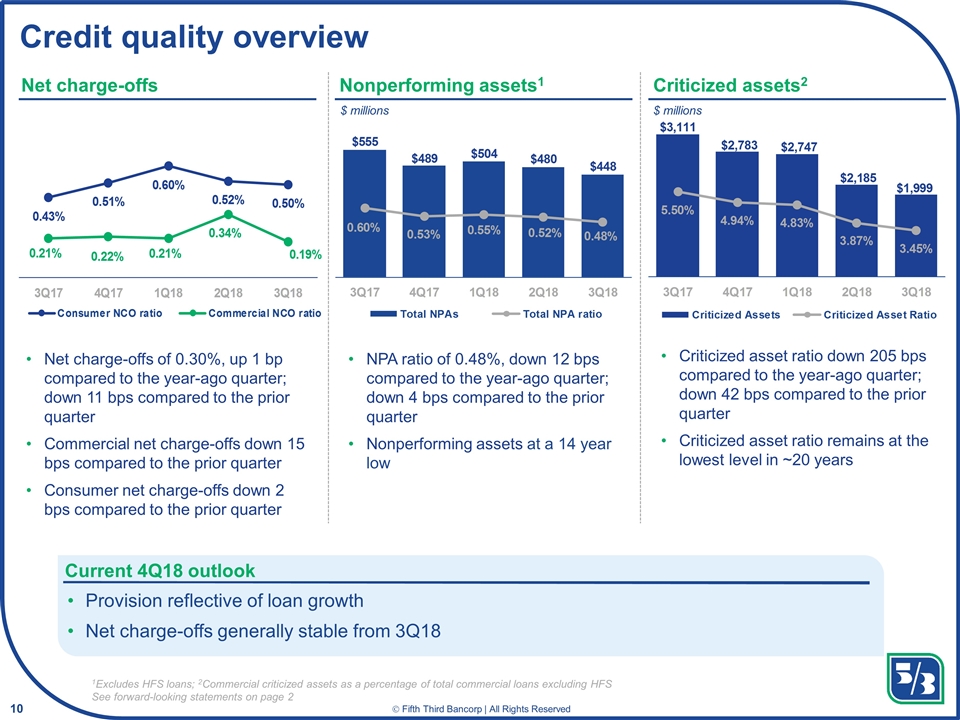

Credit quality overview 1Excludes HFS loans; 2Commercial criticized assets as a percentage of total commercial loans excluding HFS See forward-looking statements on page 2 Net charge-offs of 0.30%, up 1 bp compared to the year-ago quarter; down 11 bps compared to the prior quarter Commercial net charge-offs down 15 bps compared to the prior quarter Consumer net charge-offs down 2 bps compared to the prior quarter NPA ratio of 0.48%, down 12 bps compared to the year-ago quarter; down 4 bps compared to the prior quarter Nonperforming assets at a 14 year low Criticized asset ratio down 205 bps compared to the year-ago quarter; down 42 bps compared to the prior quarter Criticized asset ratio remains at the lowest level in ~20 years Nonperforming assets1 Net charge-offs Criticized assets2 $ millions $ millions Current 4Q18 outlook Provision reflective of loan growth Net charge-offs generally stable from 3Q18

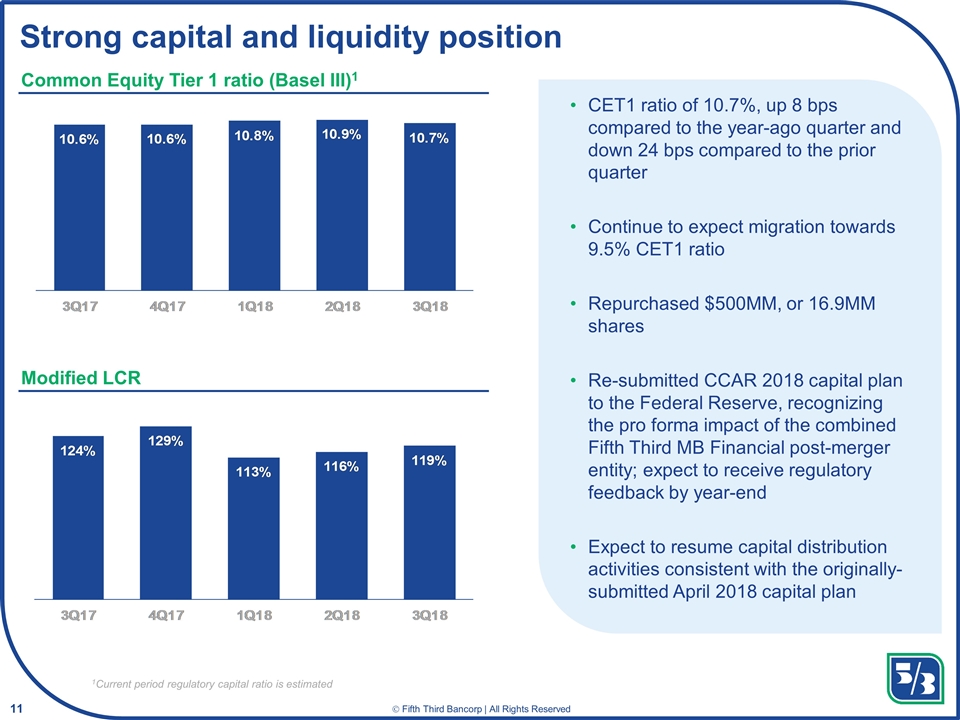

Strong capital and liquidity position 1Current period regulatory capital ratio is estimated Common Equity Tier 1 ratio (Basel III)1 Modified LCR CET1 ratio of 10.7%, up 8 bps compared to the year-ago quarter and down 24 bps compared to the prior quarter Continue to expect migration towards 9.5% CET1 ratio Repurchased $500MM, or 16.9MM shares Re-submitted CCAR 2018 capital plan to the Federal Reserve, recognizing the pro forma impact of the combined Fifth Third MB Financial post-merger entity; expect to receive regulatory feedback by year-end Expect to resume capital distribution activities consistent with the originally-submitted April 2018 capital plan

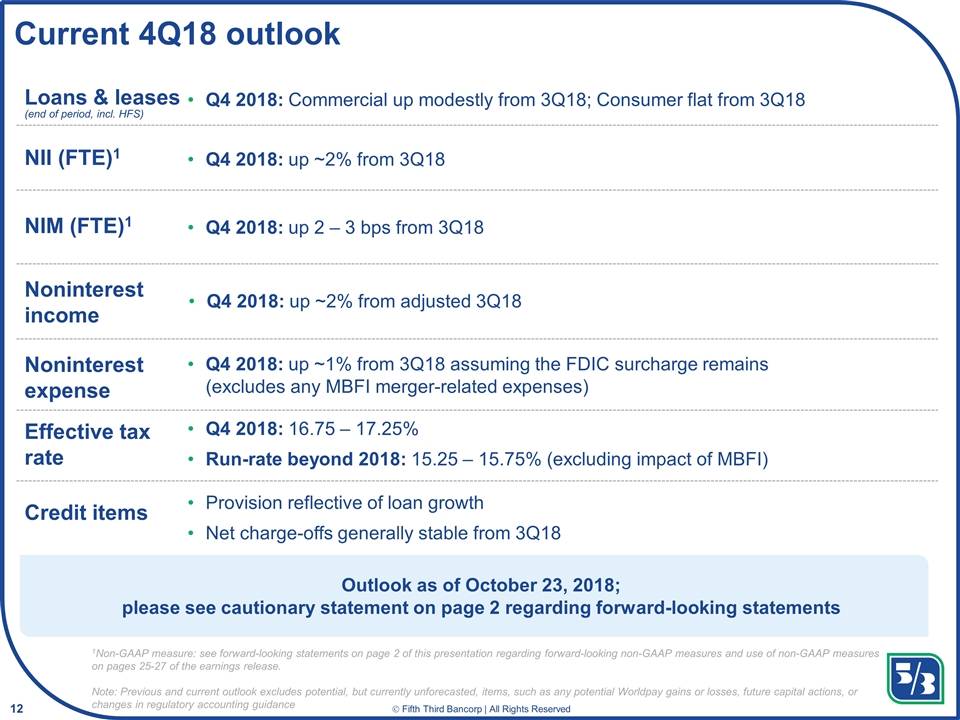

Current 4Q18 outlook Loans & leases Noninterest expense Effective tax rate Noninterest income NII (FTE)1 NIM (FTE)1 Credit items 1Non-GAAP measure: see forward-looking statements on page 2 of this presentation regarding forward-looking non-GAAP measures and use of non-GAAP measures on pages 25-27 of the earnings release. Note: Previous and current outlook excludes potential, but currently unforecasted, items, such as any potential Worldpay gains or losses, future capital actions, or changes in regulatory accounting guidance (end of period, incl. HFS) Q4 2018: up ~2% from 3Q18 Q4 2018: up 2 – 3 bps from 3Q18 Q4 2018: 16.75 – 17.25% Run-rate beyond 2018: 15.25 – 15.75% (excluding impact of MBFI) Provision reflective of loan growth Net charge-offs generally stable from 3Q18 Outlook as of October 23, 2018; please see cautionary statement on page 2 regarding forward-looking statements Q4 2018: Commercial up modestly from 3Q18; Consumer flat from 3Q18 Q4 2018: up ~1% from 3Q18 assuming the FDIC surcharge remains (excludes any MBFI merger-related expenses) Q4 2018: up ~2% from adjusted 3Q18

MB Financial integration and financial update Integration update All regulatory applications filed and up to date Received ODFI conditional approval pending FRB approval MB common shareholder approval received on 9/18 Highly successful talent and client retention to date; focused on maintaining positive momentum post-closing Detailed plans for seamless integration Expect to close and convert majority of systems applications in 1Q19 Financial update Expect pre-tax expense synergies of ~$255MM (50% year 1; 100% year 2) $60 - 75MM revenue synergies identified (pre-tax, net of expenses) by year 3 Continue to expect revenue streams consistent with original deal model Resubmitted CCAR plan; expect regulatory feedback by the end of 2018

Strategic priorities for the company 1 2 3 Implement remaining NorthStar initiatives and achieve standalone financial targets Successfully integrate MB Financial and realize expected financial benefits Continue to position company to pursue profitable organic growth opportunities Focused on top quartile through-the-cycle performance to create long term shareholder value

Appendix

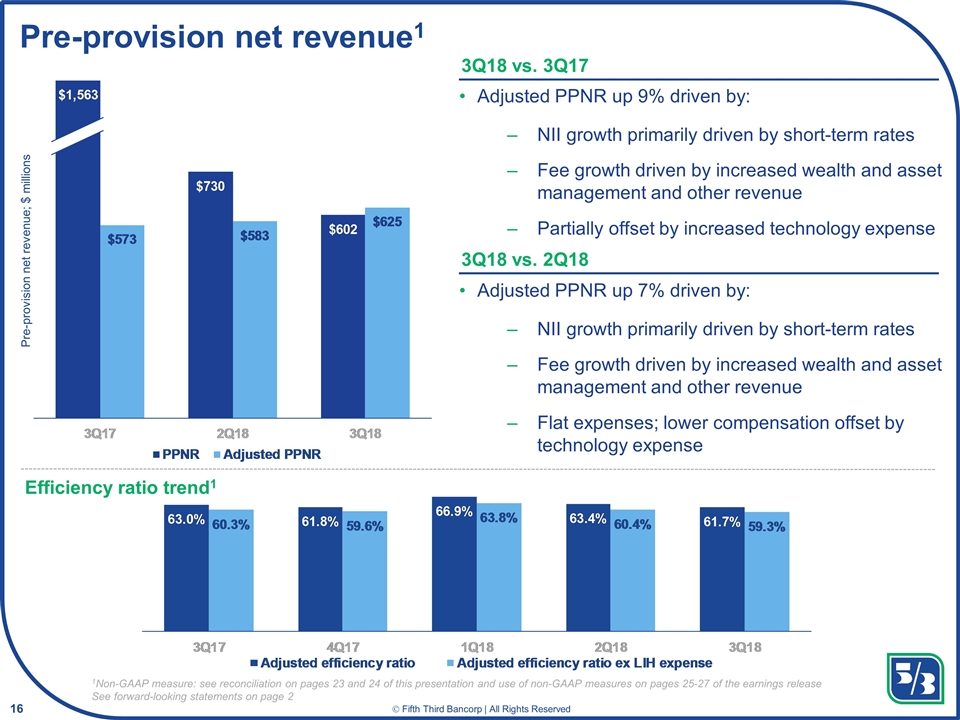

Efficiency ratio trend1 Pre-provision net revenue1 3Q18 vs. 3Q17 3Q18 vs. 2Q18 Adjusted PPNR up 9% driven by: NII growth primarily driven by short-term rates Fee growth driven by increased wealth and asset management and other revenue Partially offset by increased technology expense Adjusted PPNR up 7% driven by: NII growth primarily driven by short-term rates Fee growth driven by increased wealth and asset management and other revenue Flat expenses; lower compensation offset by technology expense 1Non-GAAP measure: see reconciliation on pages 23 and 24 of this presentation and use of non-GAAP measures on pages 25-27 of the earnings release See forward-looking statements on page 2 Pre-provision net revenue; $ millions

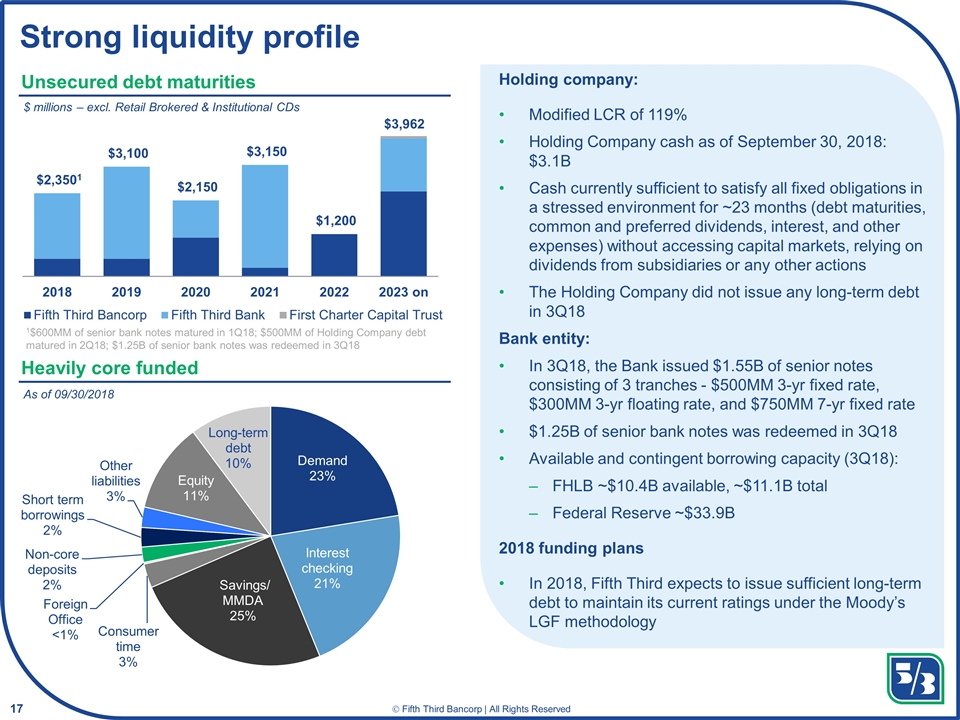

Strong liquidity profile $ millions – excl. Retail Brokered & Institutional CDs Unsecured debt maturities Heavily core funded Holding company: Modified LCR of 119% Holding Company cash as of September 30, 2018: $3.1B Cash currently sufficient to satisfy all fixed obligations in a stressed environment for ~23 months (debt maturities, common and preferred dividends, interest, and other expenses) without accessing capital markets, relying on dividends from subsidiaries or any other actions The Holding Company did not issue any long-term debt in 3Q18 Bank entity: In 3Q18, the Bank issued $1.55B of senior notes consisting of 3 tranches - $500MM 3-yr fixed rate, $300MM 3-yr floating rate, and $750MM 7-yr fixed rate $1.25B of senior bank notes was redeemed in 3Q18 Available and contingent borrowing capacity (3Q18): FHLB ~$10.4B available, ~$11.1B total Federal Reserve ~$33.9B 2018 funding plans In 2018, Fifth Third expects to issue sufficient long-term debt to maintain its current ratings under the Moody’s LGF methodology As of 09/30/2018 1$600MM of senior bank notes matured in 1Q18; $500MM of Holding Company debt matured in 2Q18; $1.25B of senior bank notes was redeemed in 3Q18 $3,962

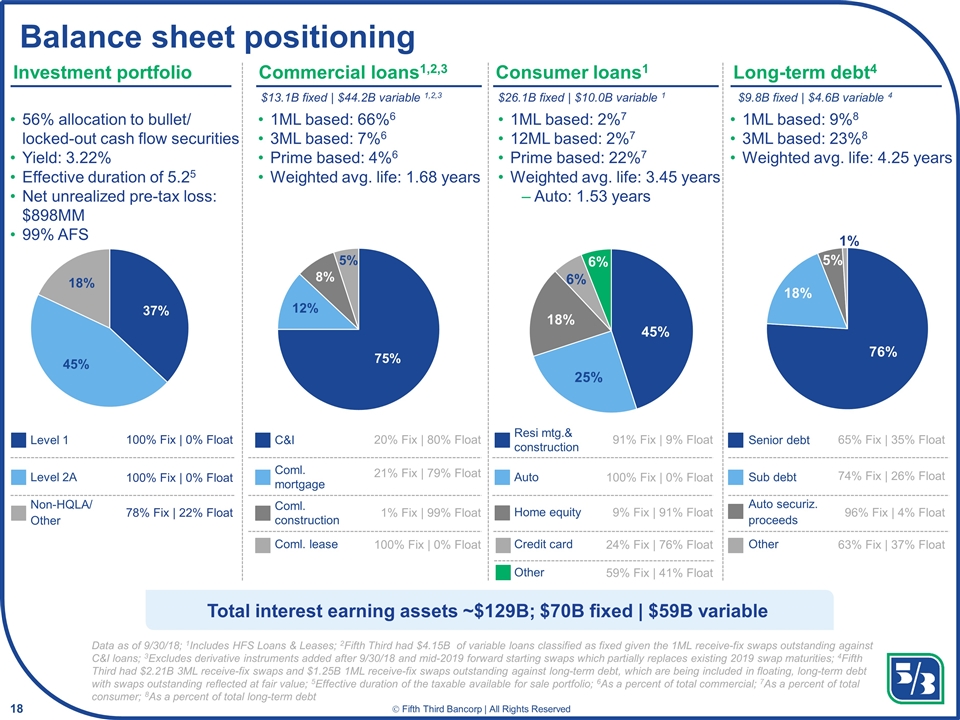

Balance sheet positioning Investment portfolio $13.1B fixed | $44.2B variable 1,2,3 Commercial loans1,2,3 Consumer loans1 Long-term debt4 $26.1B fixed | $10.0B variable 1 $9.8B fixed | $4.6B variable 4 56% allocation to bullet/ locked-out cash flow securities Yield: 3.22% Effective duration of 5.25 Net unrealized pre-tax loss: $898MM 99% AFS 1ML based: 66%6 3ML based: 7%6 Prime based: 4%6 Weighted avg. life: 1.68 years 1ML based: 2%7 12ML based: 2%7 Prime based: 22%7 Weighted avg. life: 3.45 years Auto: 1.53 years Data as of 9/30/18; 1Includes HFS Loans & Leases; 2Fifth Third had $4.15B of variable loans classified as fixed given the 1ML receive-fix swaps outstanding against C&I loans; 3Excludes derivative instruments added after 9/30/18 and mid-2019 forward starting swaps which partially replaces existing 2019 swap maturities; 4Fifth Third had $2.21B 3ML receive-fix swaps and $1.25B 1ML receive-fix swaps outstanding against long-term debt, which are being included in floating, long-term debt with swaps outstanding reflected at fair value; 5Effective duration of the taxable available for sale portfolio; 6As a percent of total commercial; 7As a percent of total consumer; 8As a percent of total long-term debt 1ML based: 9%8 3ML based: 23%8 Weighted avg. life: 4.25 years Level 1 100% Fix | 0% Float Level 2A 100% Fix | 0% Float Non-HQLA/ Other 78% Fix | 22% Float C&I 20% Fix | 80% Float Coml. mortgage 21% Fix | 79% Float Coml. lease 100% Fix | 0% Float Resi mtg.& construction 91% Fix | 9% Float Auto 100% Fix | 0% Float Home equity 9% Fix | 91% Float Senior debt 65% Fix | 35% Float Sub debt 74% Fix | 26% Float Auto securiz. proceeds 96% Fix | 4% Float Coml. construction 1% Fix | 99% Float Credit card 24% Fix | 76% Float Other 59% Fix | 41% Float Other 63% Fix | 37% Float Total interest earning assets ~$129B; $70B fixed | $59B variable

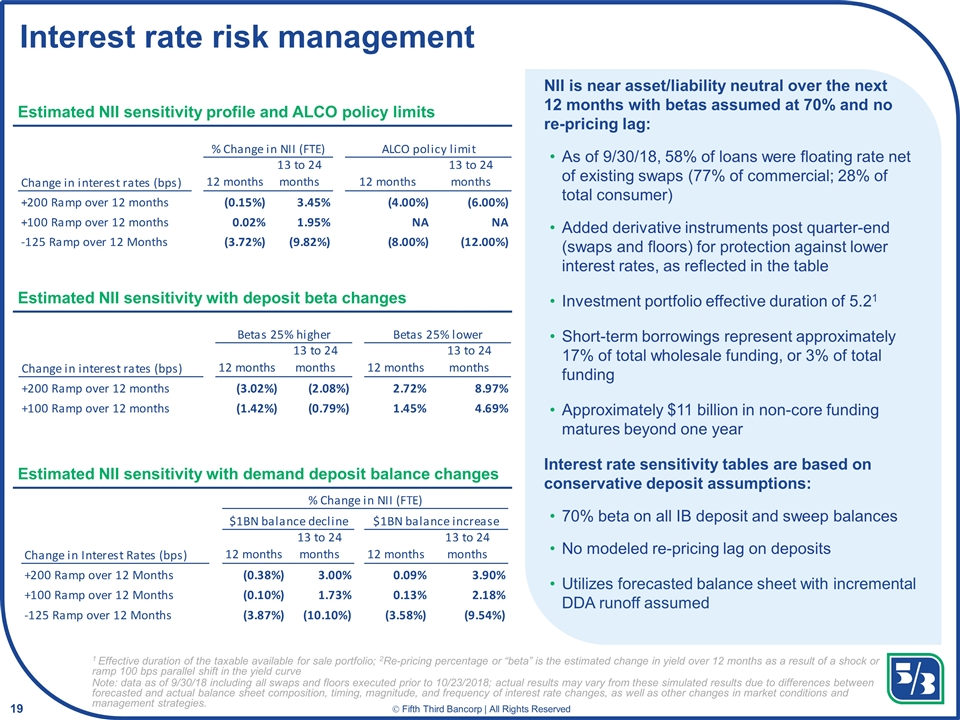

Interest rate risk management Estimated NII sensitivity profile and ALCO policy limits Estimated NII sensitivity with deposit beta changes Estimated NII sensitivity with demand deposit balance changes NII is near asset/liability neutral over the next 12 months with betas assumed at 70% and no re-pricing lag: As of 9/30/18, 58% of loans were floating rate net of existing swaps (77% of commercial; 28% of total consumer) Added derivative instruments post quarter-end (swaps and floors) for protection against lower interest rates, as reflected in the table Investment portfolio effective duration of 5.21 Short-term borrowings represent approximately 17% of total wholesale funding, or 3% of total funding Approximately $11 billion in non-core funding matures beyond one year Interest rate sensitivity tables are based on conservative deposit assumptions: 70% beta on all IB deposit and sweep balances No modeled re-pricing lag on deposits Utilizes forecasted balance sheet with incremental DDA runoff assumed 1 Effective duration of the taxable available for sale portfolio; 2Re-pricing percentage or “beta” is the estimated change in yield over 12 months as a result of a shock or ramp 100 bps parallel shift in the yield curve Note: data as of 9/30/18 including all swaps and floors executed prior to 10/23/2018; actual results may vary from these simulated results due to differences between forecasted and actual balance sheet composition, timing, magnitude, and frequency of interest rate changes, as well as other changes in market conditions and management strategies.

Mortgage banking results $ millions Mortgage banking net revenue $ billions Mortgage originations and gain-on-sale margin1 1Gain-on-sale margin represents gains on all loans originated for sale $1.9B in originations, down 12% compared to the year-ago quarter and prior quarter; 76% purchase volume 3Q18 mortgage banking drivers: Origination fees and gain on sale revenue down $3MM sequentially Gain on sale margin down 3 bps sequentially $1MM securities loss compared to $4MM loss in the prior quarter (not included in mortgage banking) Acquired $3BN servicing portfolio in 3Q18 to be on-boarded in 4Q18 (~$17BN UPB added since 2Q17) Originations HFS Originations HFI Margin Origination fees and gains on loan sale Gross servicing fees Net MSR valuation

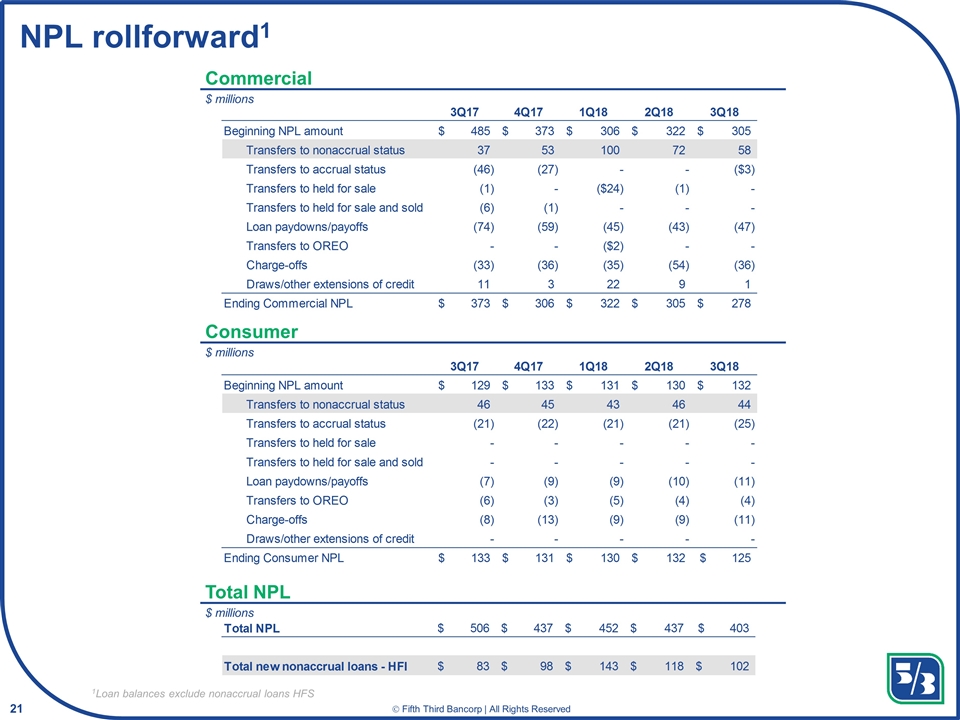

NPL rollforward1 1Loan balances exclude nonaccrual loans HFS Commercial $ millions Consumer $ millions Total NPL $ millions

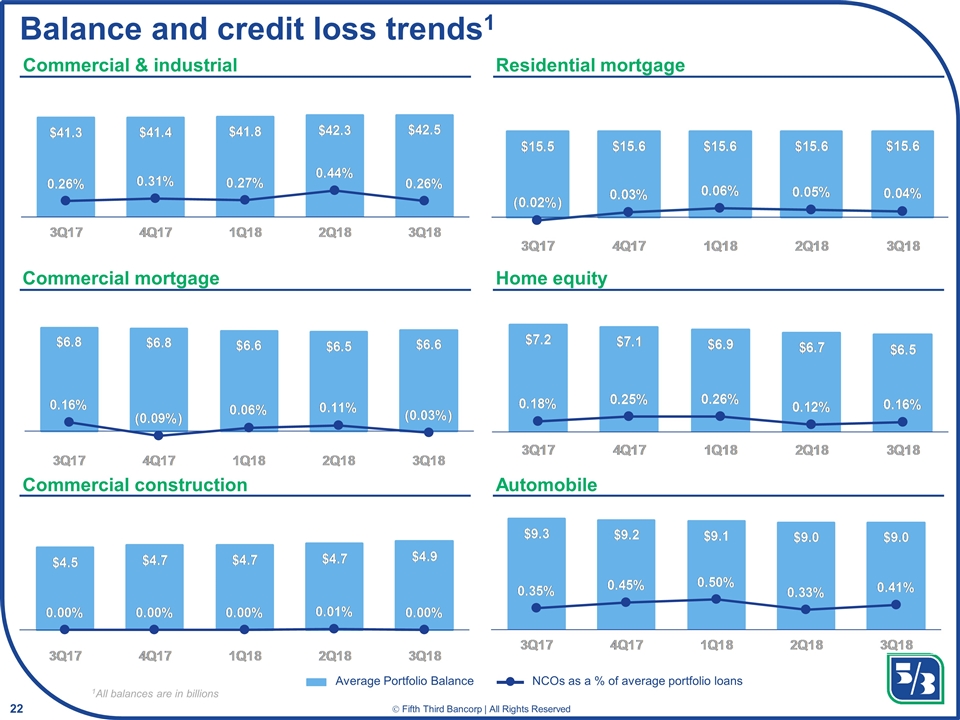

Balance and credit loss trends1 Commercial & industrial Residential mortgage Commercial mortgage Commercial construction Home equity Automobile Average Portfolio Balance NCOs as a % of average portfolio loans 1All balances are in billions

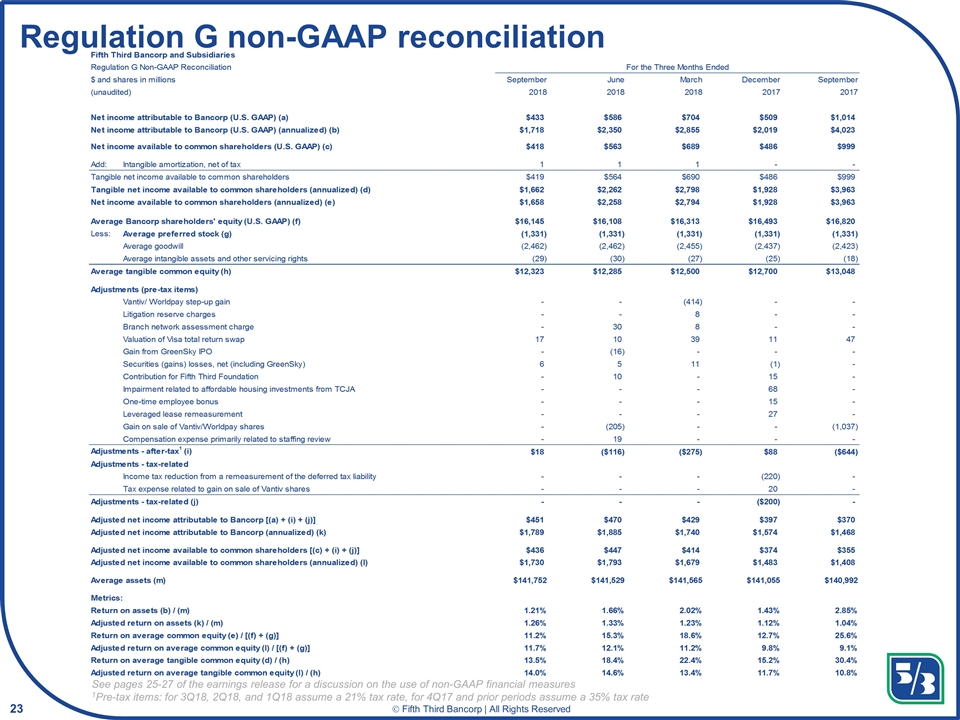

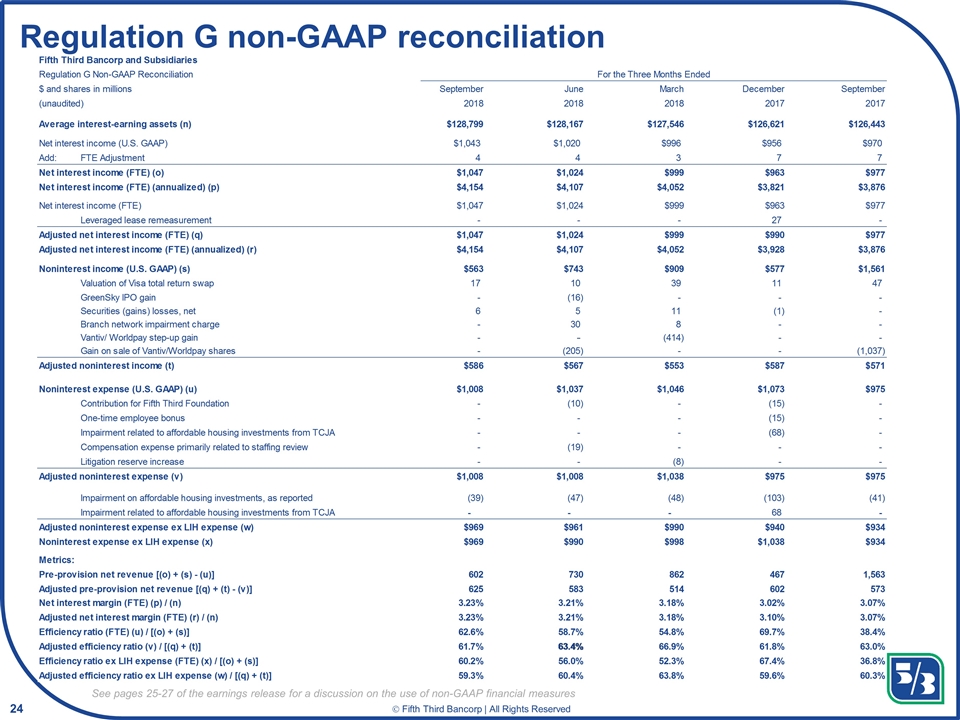

Regulation G non-GAAP reconciliation See pages 25-27 of the earnings release for a discussion on the use of non-GAAP financial measures 1Pre-tax items: for 3Q18, 2Q18, and 1Q18 assume a 21% tax rate, for 4Q17 and prior periods assume a 35% tax rate

Regulation G non-GAAP reconciliation See pages 25-27 of the earnings release for a discussion on the use of non-GAAP financial measures