Fifth Third Bancorp Investor Day December 7, 2017 Exhibit 99.1

Firm Overview Greg D. Carmichael President & Chief Executive Officer 1

Cautionary statement This presentation contains statements that we believe are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder. These statements relate to our financial condition, results of operations, plans, objectives, future performance or business. They usually can be identified by the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “is anticipated,” “potential,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or similar verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K, as updated by our Quarterly Reports on Form 10-Q. When considering these forward-looking statements, you should keep in mind these risks and uncertainties, as well as any cautionary statements we may make. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to us. We undertake no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this document. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) general economic or real estate market conditions, either nationally or in the states in which Fifth Third, one or more acquired entities and/or the combined company do business, weaken or are less favorable than expected; (2) deteriorating credit quality; (3) political developments, wars or other hostilities may disrupt or increase volatility in securities markets or other economic conditions; (4) changes in the interest rate environment reduce interest margins; (5) prepayment speeds, loan origination and sale volumes, charge-offs and loan loss provisions; (6) Fifth Third’s ability to maintain required capital levels and adequate sources of funding and liquidity; (7) maintaining capital requirements and adequate sources of funding and liquidity may limit Fifth Third’s operations and potential growth; (8) changes and trends in capital markets; (9) problems encountered by larger or similar financial institutions may adversely affect the banking industry and/or Fifth Third; (10) competitive pressures among depository institutions increase significantly; (11) changes in customer preferences or information technology systems; (12) effects of critical accounting policies and judgments; (13) changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board (FASB) or other regulatory agencies; (14) legislative or regulatory changes or actions, or significant litigation, adversely affect Fifth Third, one or more acquired entities and/or the combined company or the businesses in which Fifth Third, one or more acquired entities and/or the combined company are engaged, including the Dodd-Frank Wall Street Reform and Consumer Protection Act; (15) ability to maintain favorable ratings from rating agencies; (16) failure of models or risk management systems or controls; (17) fluctuation of Fifth Third’s stock price; (18) ability to attract and retain key personnel; (19) ability to receive dividends from its subsidiaries; (20) potentially dilutive effect of future acquisitions on current shareholders’ ownership of Fifth Third; (21) declines in the value of Fifth Third’s goodwill or other intangible assets; (22) effects of accounting or financial results of one or more acquired entities; (23) difficulties from Fifth Third’s investment in, relationship with, and nature of the operations of Vantiv Holding, LLC; (24) loss of income from any sale or potential sale of businesses; (25) difficulties in separating the operations of any branches or other assets divested; (26) losses or adverse impacts on the carrying values of branches and long-lived assets in connection with their sales or anticipated sales; (27) inability to achieve expected benefits from branch consolidations and planned sales within desired timeframes, if at all; (28) ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks; (29) the negotiation and (if any) implementation by Vantiv, Inc. and/or Worldpay Group plc of the potential acquisition of Worldpay Group plc by Vantiv, Inc. and such other actions as Vantiv, Inc. and Worldpay Group plc may take in furtherance thereof; and (30) the impact of reputational risk created by these developments on such matters as business generation and retention, funding and liquidity. You should refer to our periodic and current reports filed with the Securities and Exchange Commission, or “SEC,” for further information on other factors, which could cause actual results to be significantly different from those expressed or implied by these forward-looking statements. In this presentation, we may sometimes provide non-GAAP financial information. Please note that although non-GAAP financial measures provide useful insight to analysts, investors and regulators, they should not be considered in isolation or relied upon as a substitute for analysis using GAAP measures. If applicable, we provide GAAP reconciliations for non-GAAP measures in a later slide in this presentation which is also available in the investor relations section of our website, www.53.com. 2

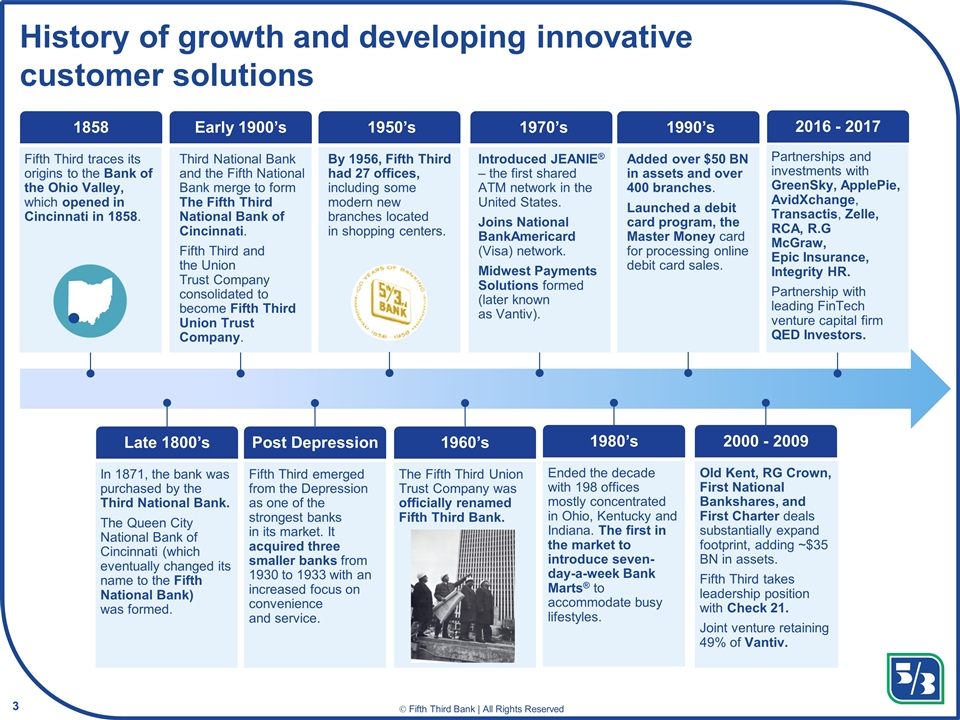

History of growth and developing innovative customer solutions 3 Fifth Third traces its origins to the Bank of the Ohio Valley, which opened in Cincinnati in 1858. 1858 In 1871, the bank was purchased by the Third National Bank. The Queen City National Bank of Cincinnati (which eventually changed its name to the Fifth National Bank) was formed. Late 1800’s Third National Bank and the Fifth National Bank merge to form The Fifth Third National Bank of Cincinnati. Fifth Third and the Union Trust Company consolidated to become Fifth Third Union Trust Company. Early 1900’s Fifth Third emerged from the Depression as one of the strongest banks in its market. It acquired three smaller banks from 1930 to 1933 with an increased focus on convenience and service. Post Depression By 1956, Fifth Third had 27 offices, including some modern new branches located in shopping centers. 1950’s The Fifth Third Union Trust Company was officially renamed Fifth Third Bank. 1960’s Partnerships and investments with GreenSky, ApplePie, AvidXchange, Transactis, Zelle, RCA, R.G McGraw, Epic Insurance, Integrity HR. Partnership with leading FinTech venture capital firm QED Investors. 2016 - 2017 Old Kent, RG Crown, First National Bankshares, and First Charter deals substantially expand footprint, adding ~$35 BN in assets. Fifth Third takes leadership position with Check 21. Joint venture retaining 49% of Vantiv. 2000 - 2009 Added over $50 BN in assets and over 400 branches. Launched a debit card program, the Master Money card for processing online debit card sales. 1990’s Ended the decade with 198 offices mostly concentrated in Ohio, Kentucky and Indiana. The first in the market to introduce seven-day-a-week Bank Marts® to accommodate busy lifestyles. 1980’s Introduced JEANIE® – the first shared ATM network in the United States. Joins National BankAmericard (Visa) network. Midwest Payments Solutions formed (later known as Vantiv). 1970’s

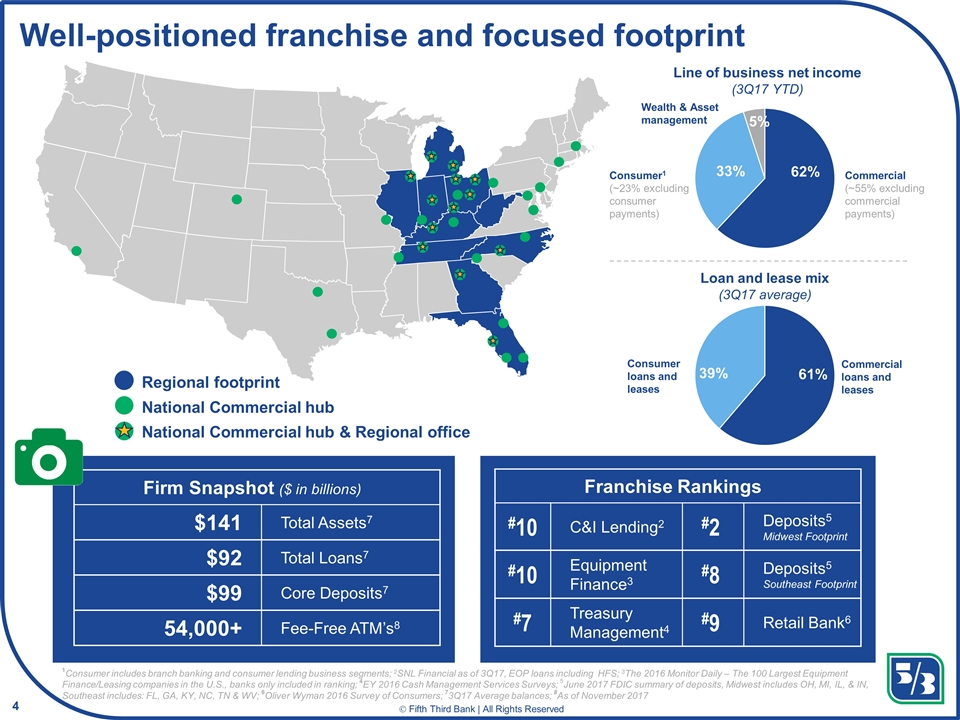

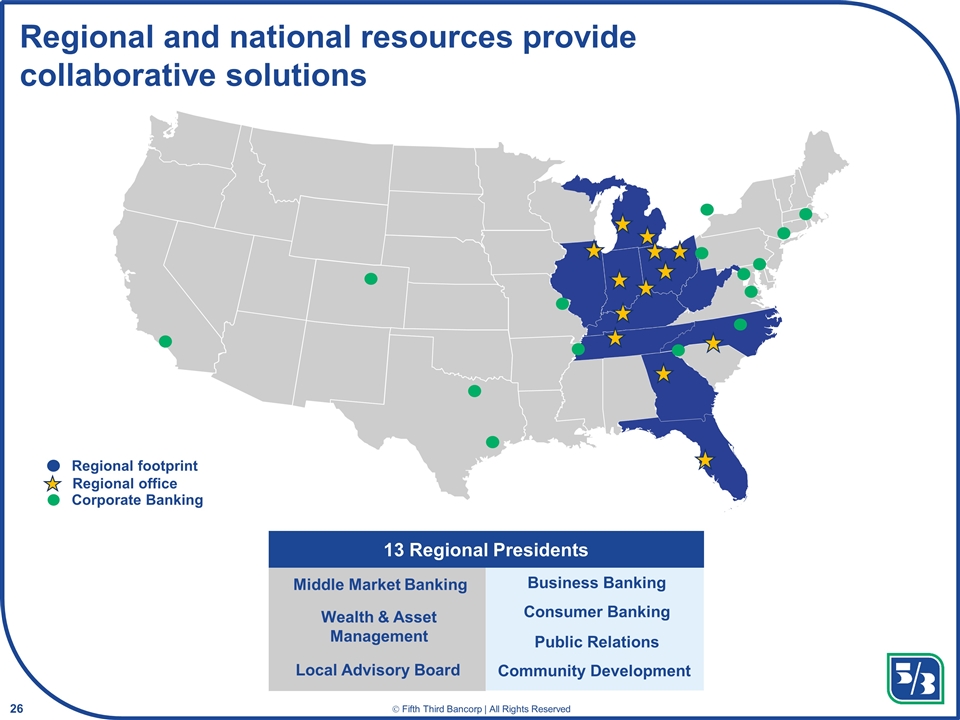

Well-positioned franchise and focused footprint 1Consumer includes branch banking and consumer lending business segments; 2SNL Financial as of 3Q17, EOP loans including HFS; 3The 2016 Monitor Daily – The 100 Largest Equipment Finance/Leasing companies in the U.S., banks only included in ranking; 4EY 2016 Cash Management Services Surveys; 5June 2017 FDIC summary of deposits, Midwest includes OH, MI, IL, & IN, Southeast includes: FL, GA, KY, NC, TN & WV; 6Oliver Wyman 2016 Survey of Consumers; 73Q17 Average balances; 8As of November 2017 4 Firm Snapshot ($ in billions) $141 Total Assets7 $92 Total Loans7 $99 Core Deposits7 54,000+ Fee-Free ATM’s8 Franchise Rankings #10 C&I Lending2 #2 Deposits5 Midwest Footprint #10 Equipment Finance3 #8 Deposits5 Southeast Footprint #7 Treasury Management4 #9 Retail Bank6 Regional footprint National Commercial hub Commercial loans and leases Consumer loans and leases Commercial (~55% excluding commercial payments) Consumer1 (~23% excluding consumer payments) Wealth & Asset management Line of business net income (3Q17 YTD) Loan and lease mix (3Q17 average) National Commercial hub & Regional office

Transparency of key objectives and expectations Highlight our ability to execute Opportunity to meet the broader Fifth Third management team Inaugural investor day – why now? 5

Building a franchise that will allow us to perform well through business cycles Assembled a team of experienced leaders that deliver results, think strategically, and operate at an accelerated “pace of play” Leveraging data, technology, strategic partnerships, and agile methodology to deliver solutions that increase revenue and drive efficiencies What is different about Fifth Third today? 6

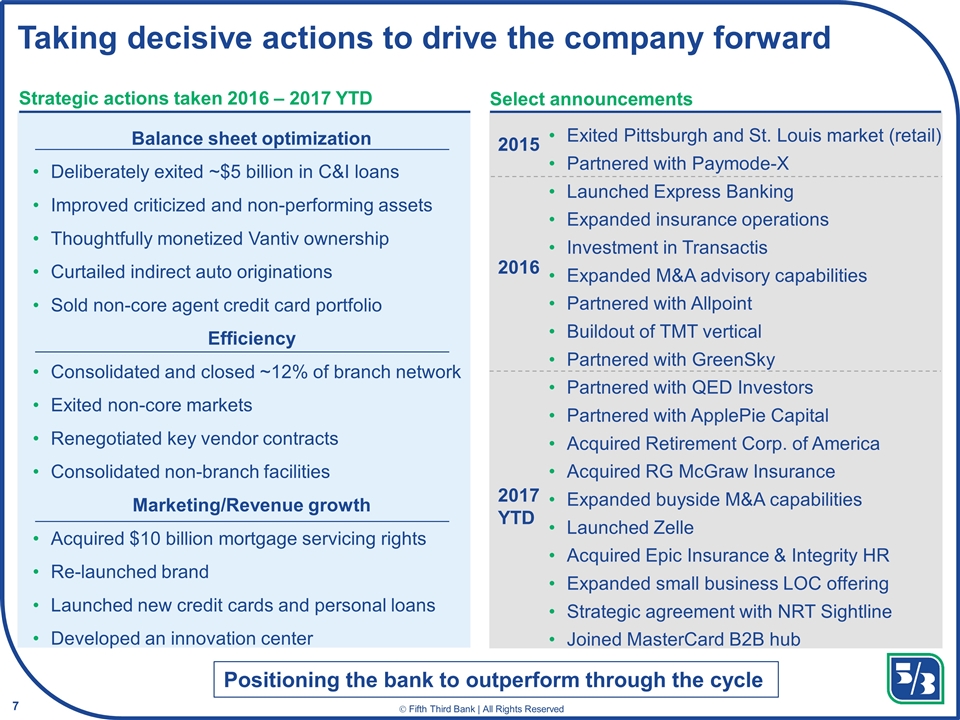

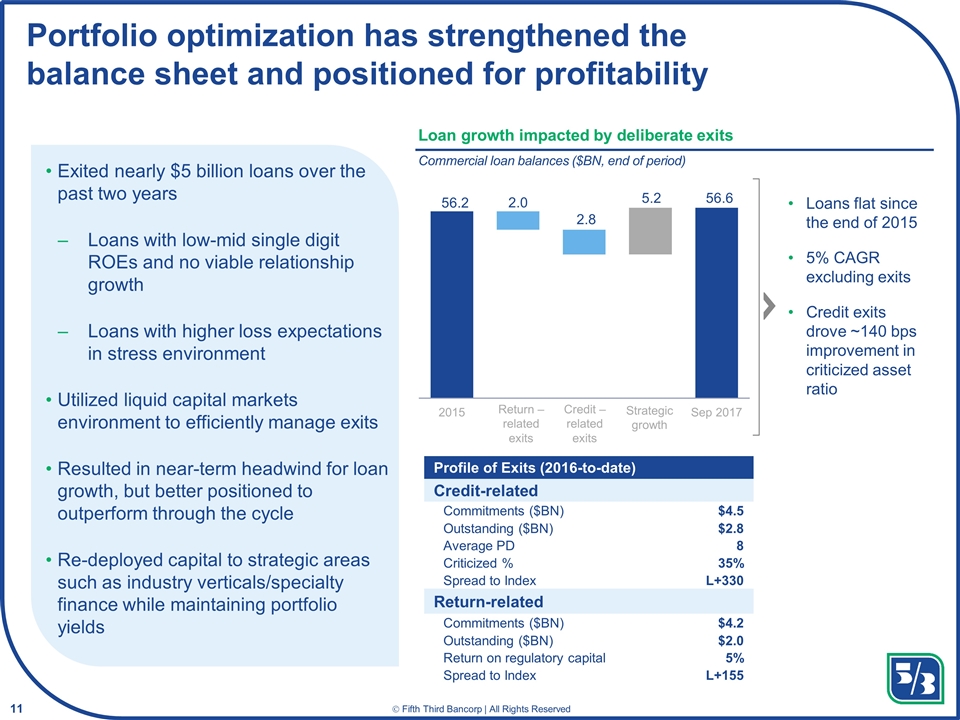

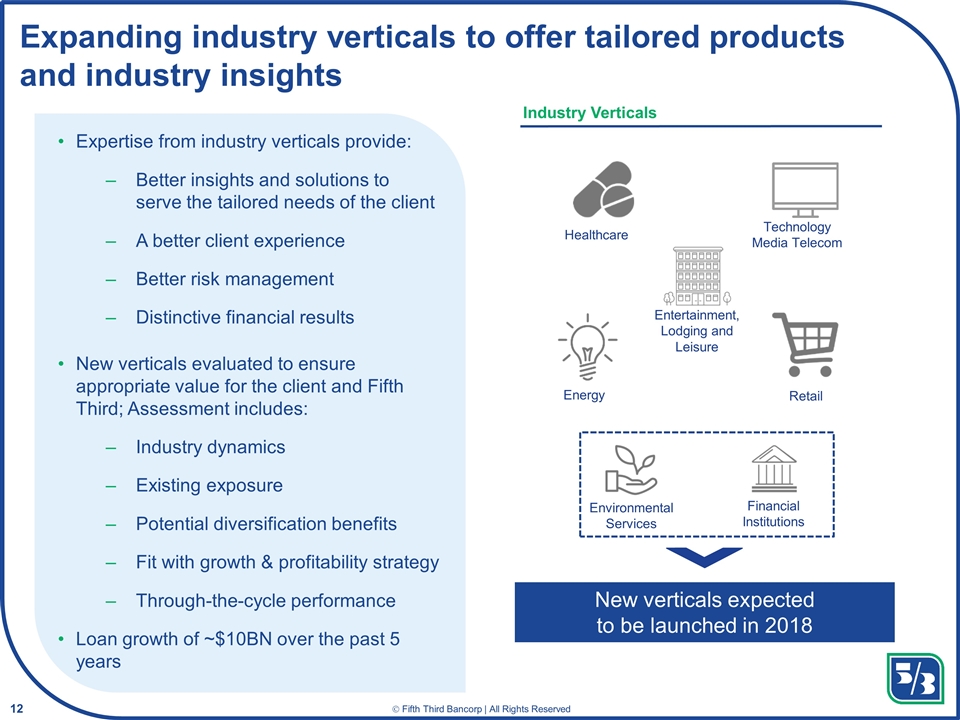

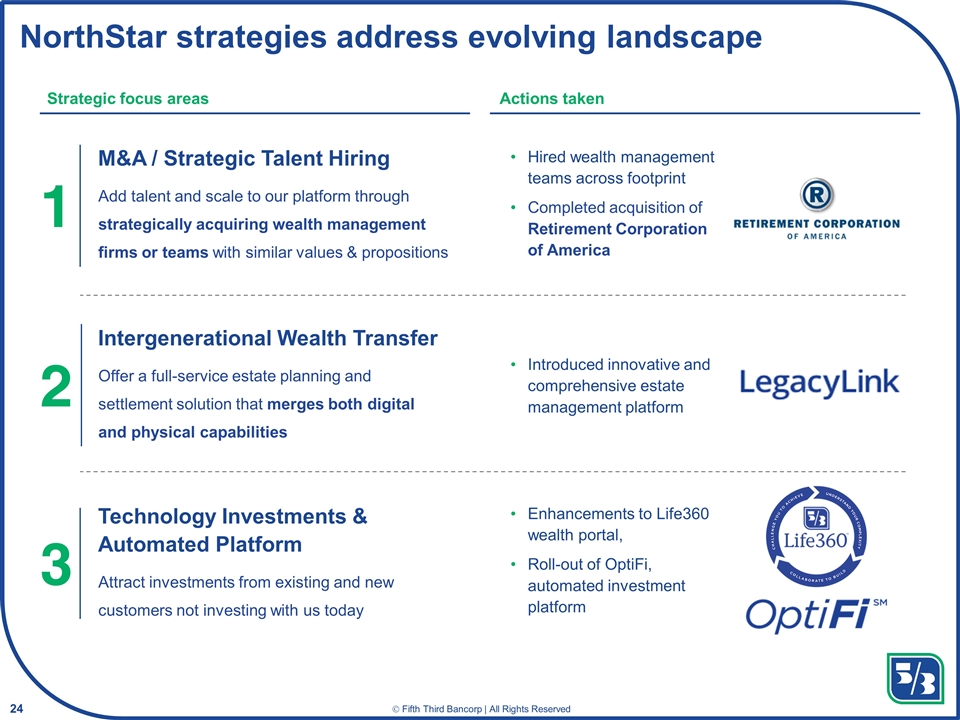

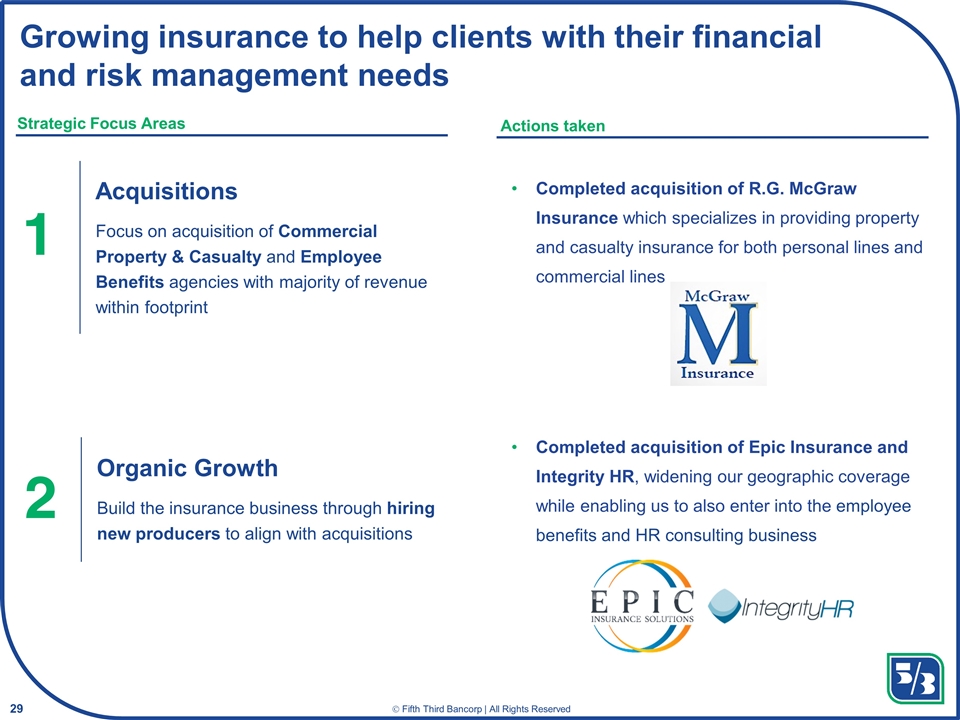

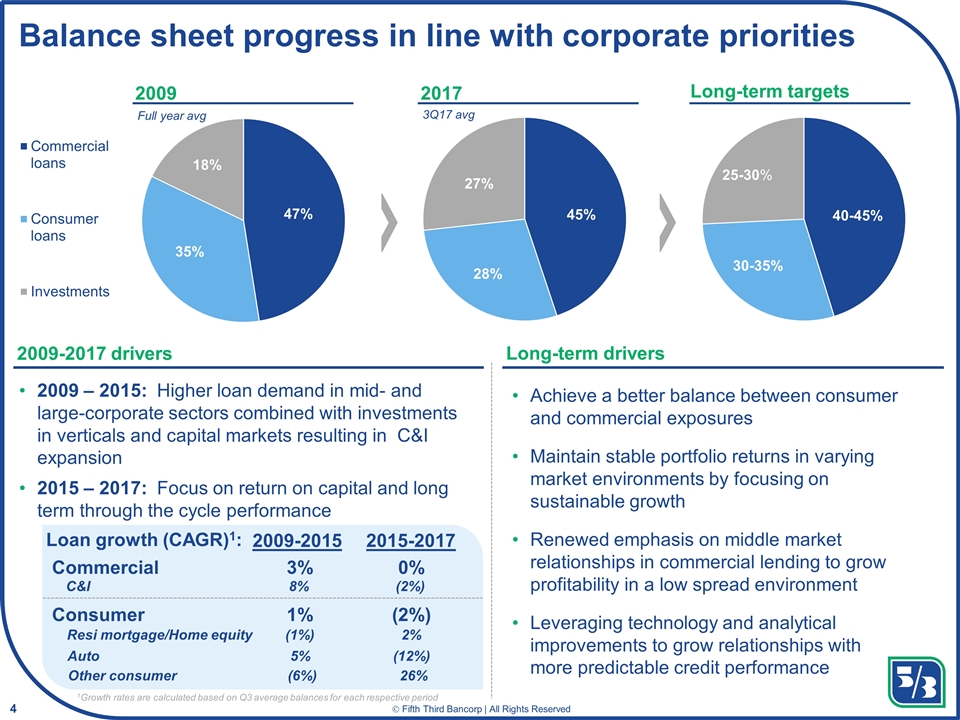

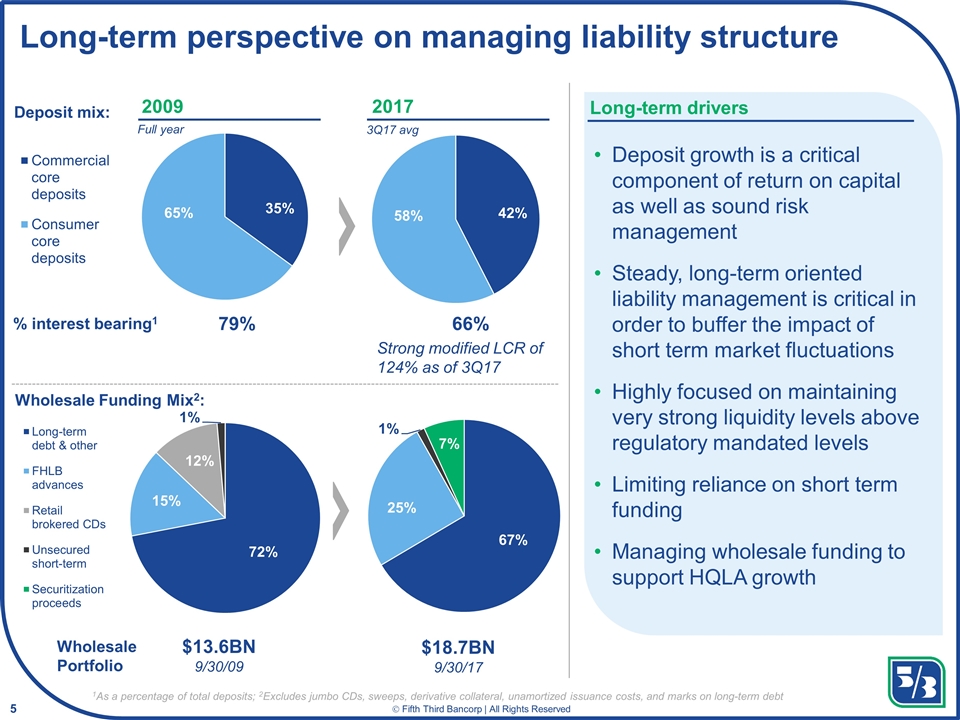

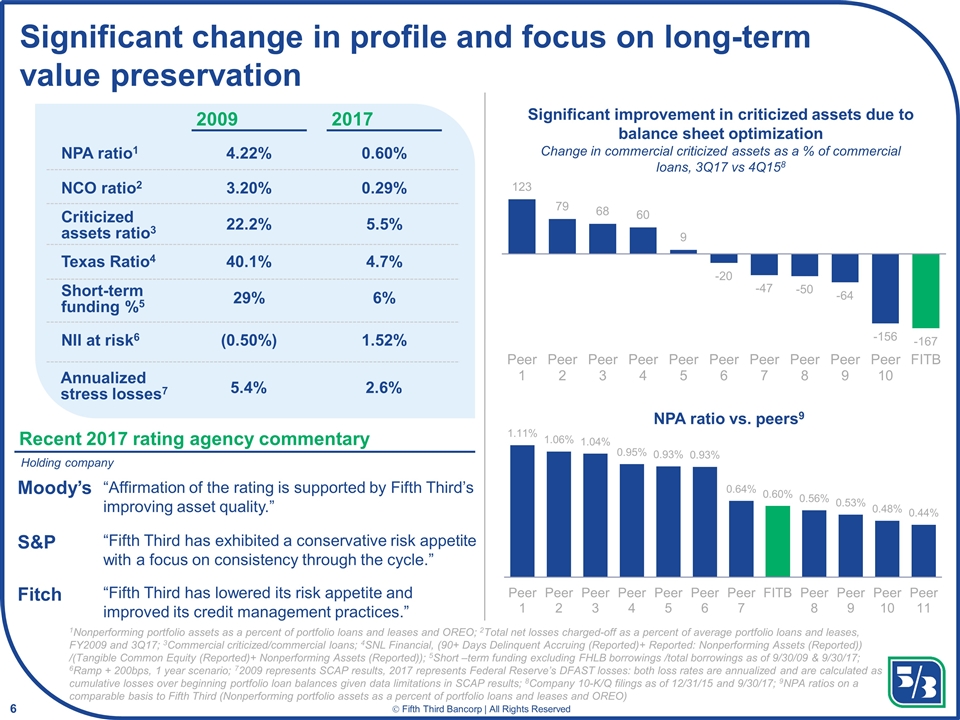

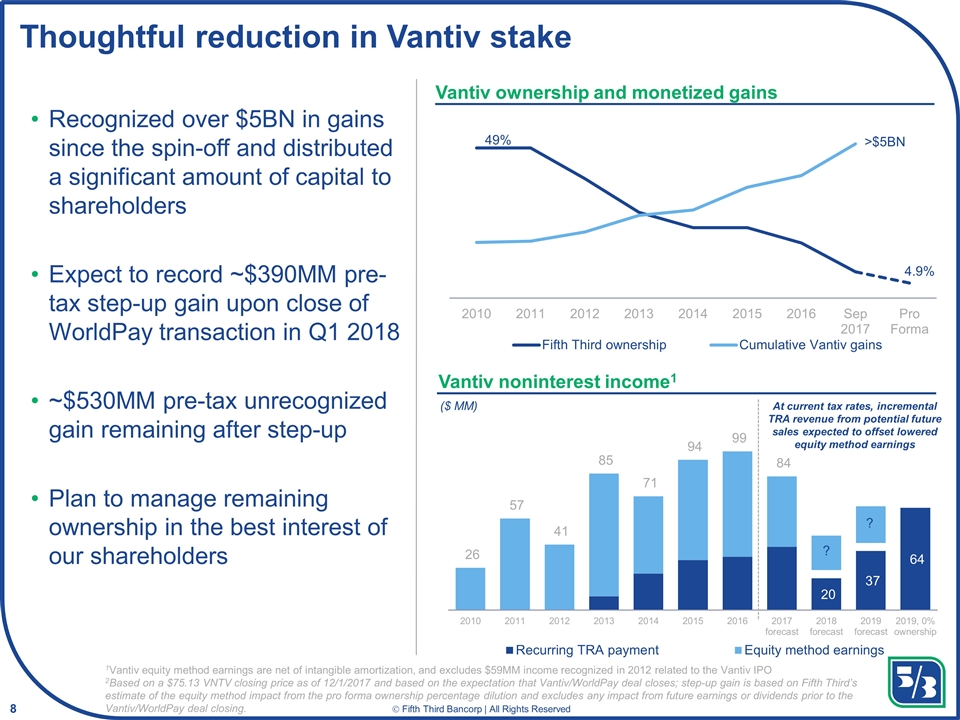

Taking decisive actions to drive the company forward Balance sheet optimization Deliberately exited ~$5 billion in C&I loans Improved criticized and non-performing assets Thoughtfully monetized Vantiv ownership Curtailed indirect auto originations Sold non-core agent credit card portfolio Efficiency Consolidated and closed ~12% of branch network Exited non-core markets Renegotiated key vendor contracts Consolidated non-branch facilities Marketing/Revenue growth Acquired $10 billion mortgage servicing rights Re-launched brand Launched new credit cards and personal loans Developed an innovation center Select announcements 2015 Strategic actions taken 2016 – 2017 YTD Exited Pittsburgh and St. Louis market (retail) Partnered with Paymode-X Launched Express Banking Expanded insurance operations Investment in Transactis Expanded M&A advisory capabilities Partnered with Allpoint Buildout of TMT vertical Partnered with GreenSky Partnered with QED Investors Partnered with ApplePie Capital Acquired Retirement Corp. of America Acquired RG McGraw Insurance Expanded buyside M&A capabilities Launched Zelle Acquired Epic Insurance & Integrity HR Expanded small business LOC offering Strategic agreement with NRT Sightline Joined MasterCard B2B hub 2016 2017 YTD Positioning the bank to outperform through the cycle 7

Strategic priorities for the company 1 2 3 Growing profitable and enduring relationships Continuously improving the customer experience 4 Leveraging analytics and technology Prudent capital management Focused on creating long term shareholder value 8

Growing profitable and enduring relationships Partnering with commercial clients Maintaining disciplined underwriting standards Growing credit cards and personal loans Generating household growth 1 $ 9

Improving the customer experience Our customer solutions aim to be seamless, convenient, fast and flexible Tailored and needs-based We want our customers to see us as a strategic partner 2 4+ #3 Retail Banking 12017 Greenwich Associates National Best Brand Awards for Middle Market Banking (companies $10-500MM in revenues), consideration for use for a range of products among customers and prospects; 22017 study from a widely used survey institution Largest partner in our fee-free ATM network Unique app aimed at tackling student debt Innovative solutions designed to prepare clients for retirement One of the first banks to implement Simplified offering with more customer-friendly rewards and benefits Select proof points and initiatives American Customer Satisfaction Index award Customer Satisfaction Survey2 Consistently rated 4+ stars since insourcing apps in 2015 Customer Service & Money Movement 2017 Best Brand in Commercial Banking, Middle Market 1 Our efforts have been recognized 10

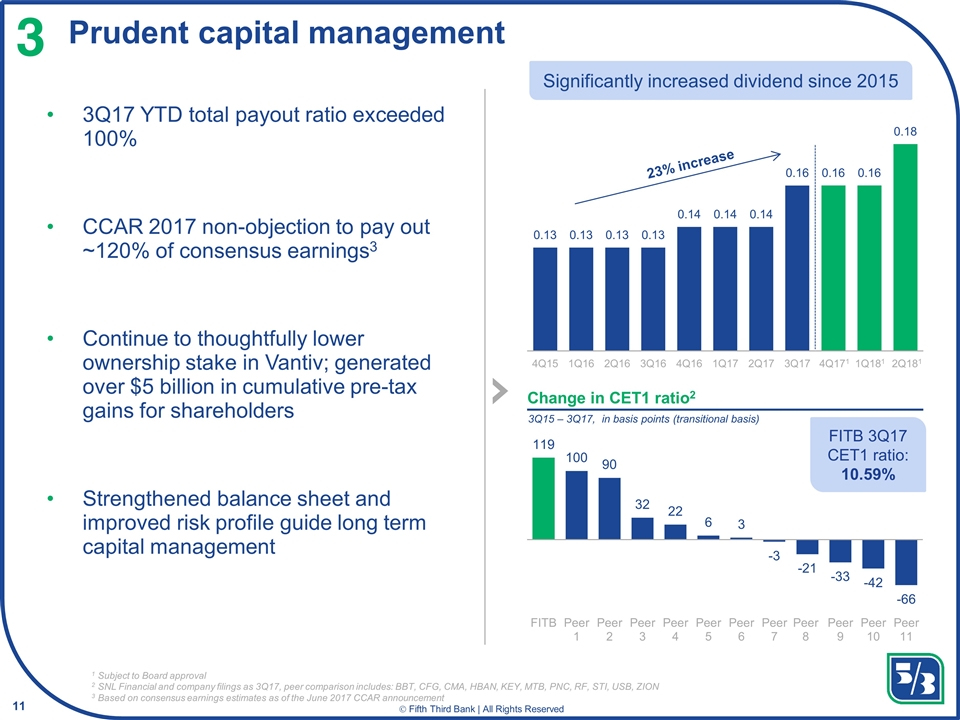

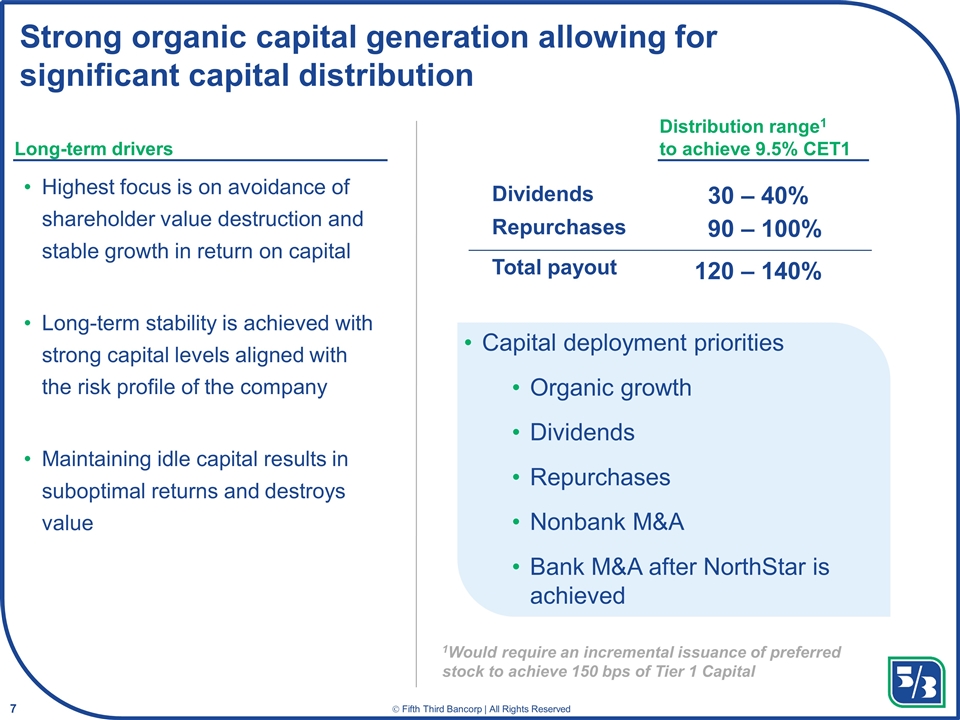

Prudent capital management 3 3Q17 YTD total payout ratio exceeded 100% CCAR 2017 non-objection to pay out ~120% of consensus earnings3 Continue to thoughtfully lower ownership stake in Vantiv; generated over $5 billion in cumulative pre-tax gains for shareholders Strengthened balance sheet and improved risk profile guide long term capital management Significantly increased dividend since 2015 1 Subject to Board approval 2 SNL Financial and company filings as 3Q17, peer comparison includes: BBT, CFG, CMA, HBAN, KEY, MTB, PNC, RF, STI, USB, ZION 3 Based on consensus earnings estimates as of the June 2017 CCAR announcement Change in CET1 ratio2 3Q15 – 3Q17, in basis points (transitional basis) 4Q171 1Q181 2Q181 FITB 3Q17 CET1 ratio: 10.59% 11

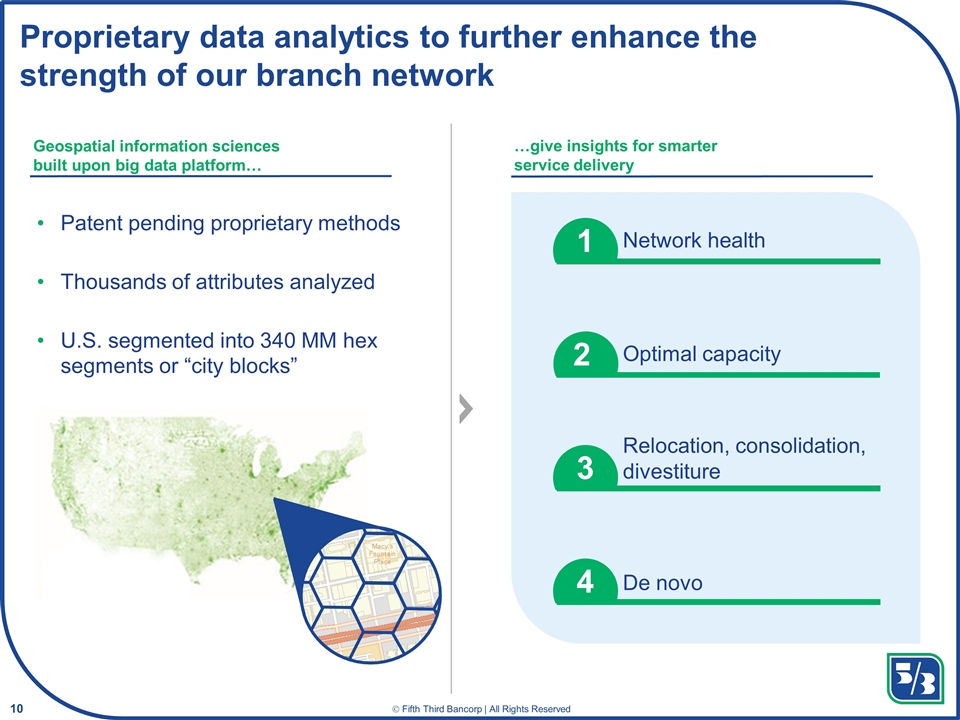

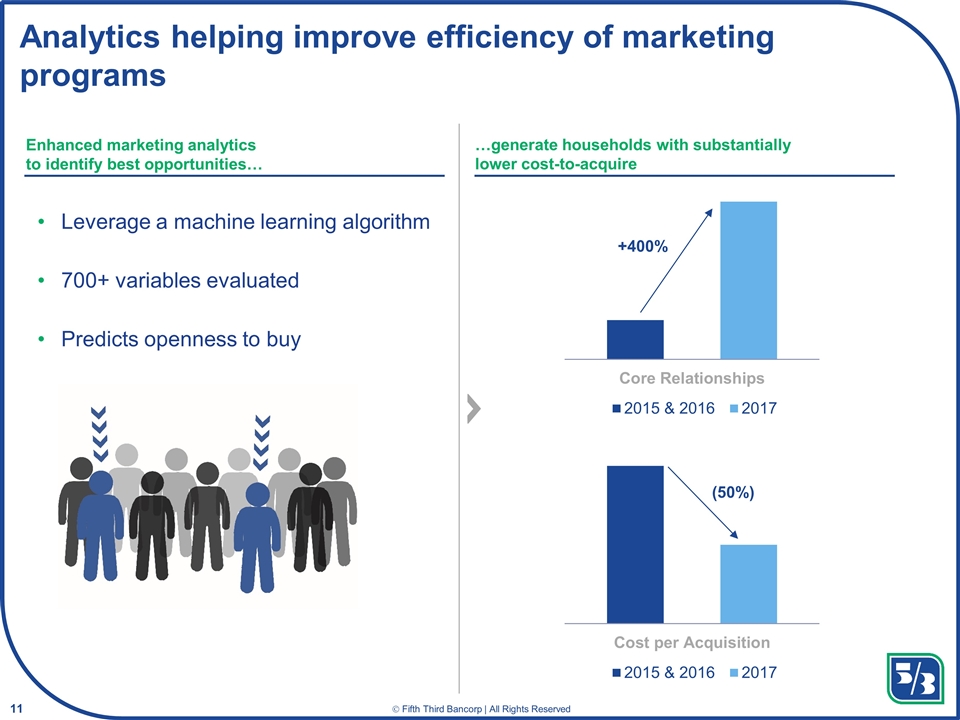

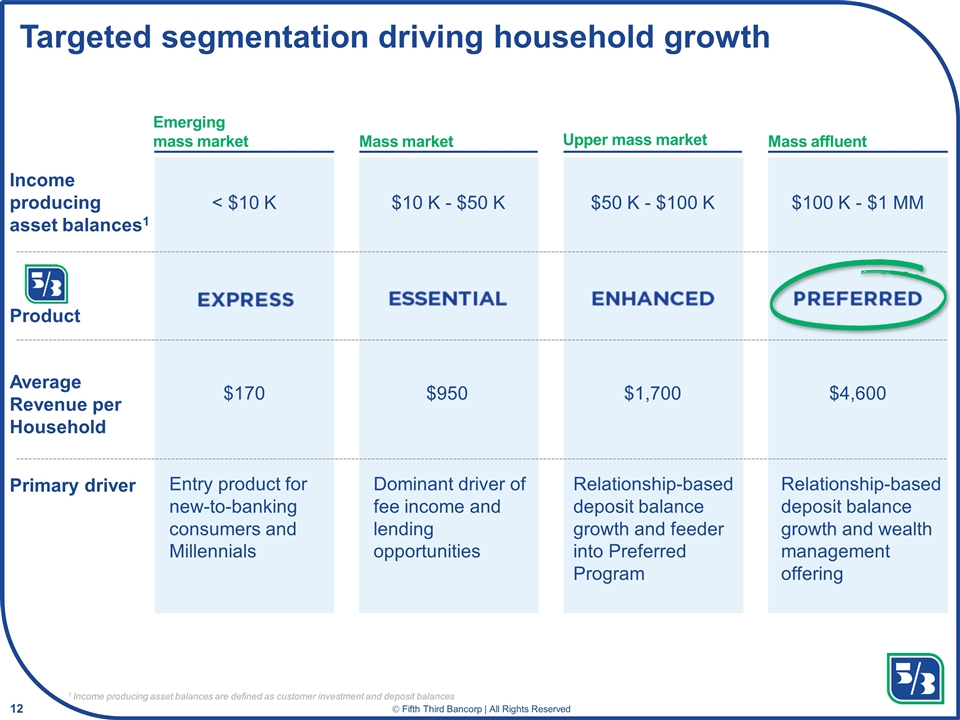

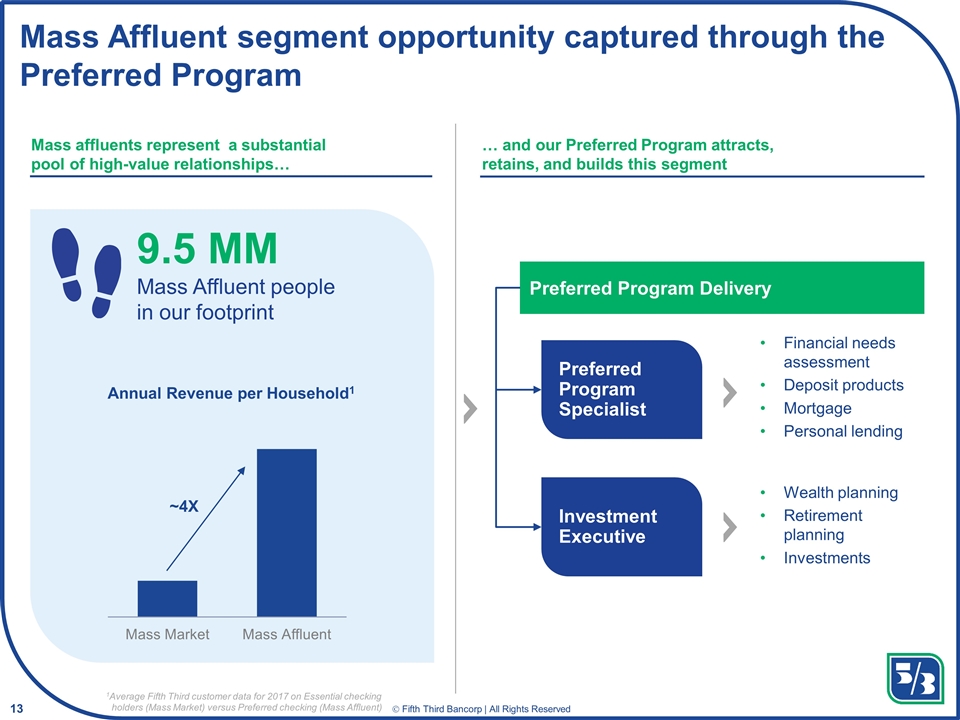

Leveraging analytics, technology, and innovation Return and risk-focused technology investments 4 Growth through improved analytics, data-driven solutions, and agile methodology Branch analytics Marketing analytics Agile methodology Partnerships and growth incubators Innovation center Information-driven approach to improve relationship growth 12

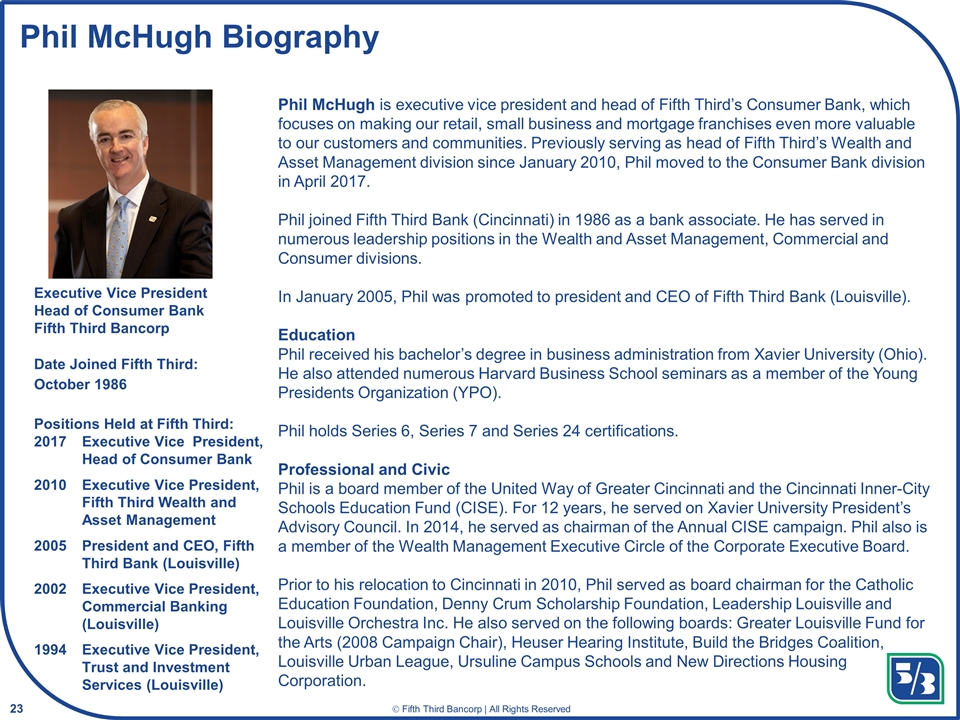

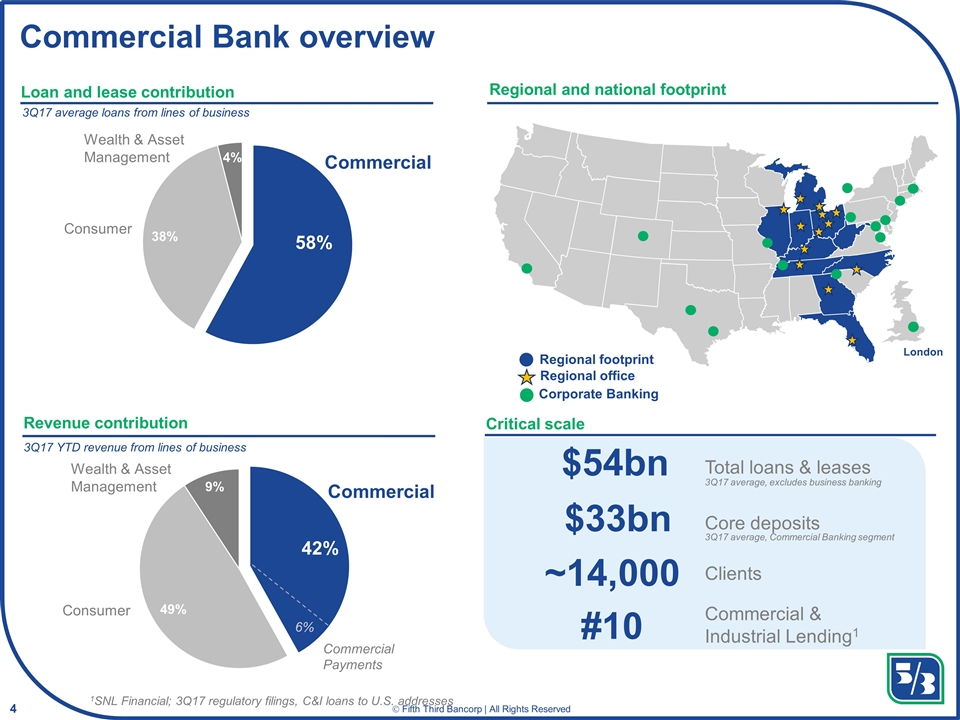

Led by an experienced & energized management team Management team is listed by alphabetical order of last name Name Title Industry Experience Greg Carmichael President & CEO 14 years Lars Anderson Chief Operating Officer 33 years Frank Forrest Chief Risk Officer 41 years Aravind Immaneni Chief Operations & Technology Officer 15 years Phil McHugh Head of the Consumer Bank 31 years Jelena McWilliams Chief Legal Officer 15 years Mike Michael Head of Wealth & Asset Management 42 years Bob Shaffer Chief Human Resources Officer 26 years Tim Spence Chief Strategy Officer 11 years Richard Stein Head of the Commercial Bank 21 years Brian Lamb Chief Corporate Responsibility & Reputation Officer 11 years Teresa Tanner Chief Administrative Officer 14 years Tayfun Tuzun Chief Financial Officer 24 years ~23 years average industry experience Jed Scala 19 years Head of Payments and Commerce Solutions 13

Governed by an accomplished and diverse Board Name Title Retired CFO, Orbitz Worldwide, Inc. Chairman, President and CEO, American Electric Power Company Partner, McGuire-Woods LLP Retired CEO, North America Accenture Executive Vice President, Cincinnati Bengals, Inc. Retired President and COO, M&T Bank Retired President and CEO, Associated Materials Group, Inc. President and CEO, Fifth Third Bancorp President, CEO, and Chairman, Marathon Petroleum Corporation Retired Senior Official, Comptroller Of the Currency Retired Chairman and CEO, Humana Inc. Retired CFO, Nationwide Property & Casualty Segment Marsha Williams Nicholas Akins B. Evan Bayh III Jorge Benitez Katherine Blackburn Emerson Brumback Jerry Burris Greg Carmichael Gary Heminger Jewell Hoover Eileen Mallesch Michael McCallister Chair of the Board Experienced Board of Directors with a track record of success Including our Board chair, Marsha Williams, four of Fifth Third’s twelve directors are women, representing 33% of our Board of Directors Women and people of color represent 46% of our Board Recognized by the Women’s Forum of New York for having at least 25% female representation on our Board of Directors 14

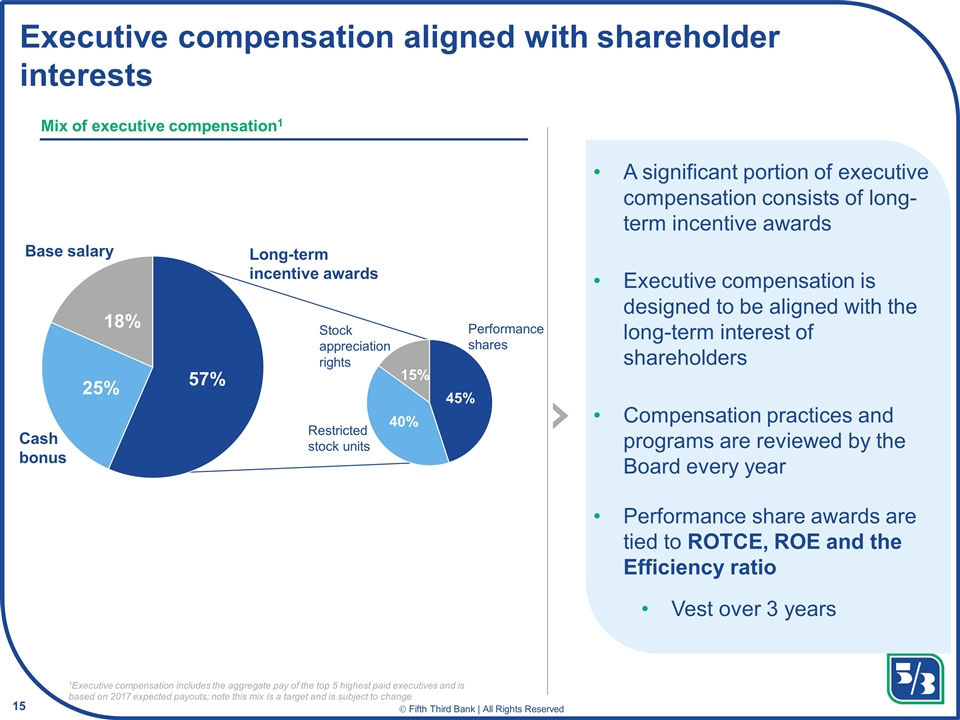

Stock appreciation rights Restricted stock units Executive compensation aligned with shareholder interests A significant portion of executive compensation consists of long-term incentive awards Executive compensation is designed to be aligned with the long-term interest of shareholders Compensation practices and programs are reviewed by the Board every year Performance share awards are tied to ROTCE, ROE and the Efficiency ratio Vest over 3 years Mix of executive compensation1 Long-term incentive awards 1Executive compensation includes the aggregate pay of the top 5 highest paid executives and is based on 2017 expected payouts; note this mix is a target and is subject to change Cash bonus Base salary Performance shares 15

Ensuring Fifth Third remains a great place to work New workspace design Focus on healthy living Maternity concierge Dedicated employees driving the execution of strategic priorities Recent Accolades Engaged employees have the single biggest impact on customer satisfaction 4x Recipient Attract and retain great employees Great employees treat customers right Customer at the center Long-term success 16

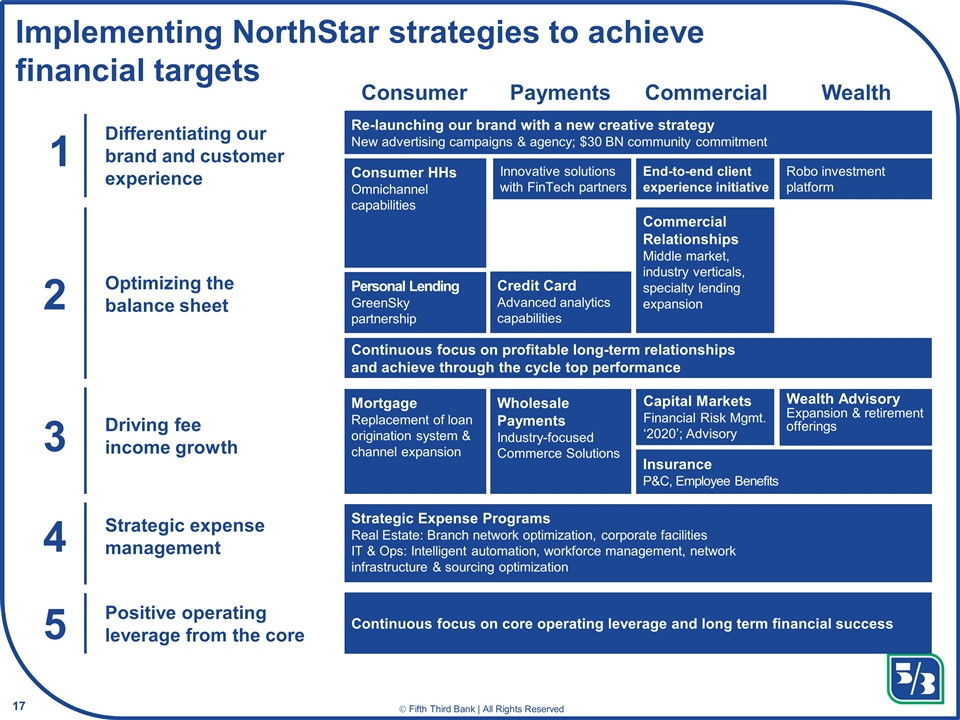

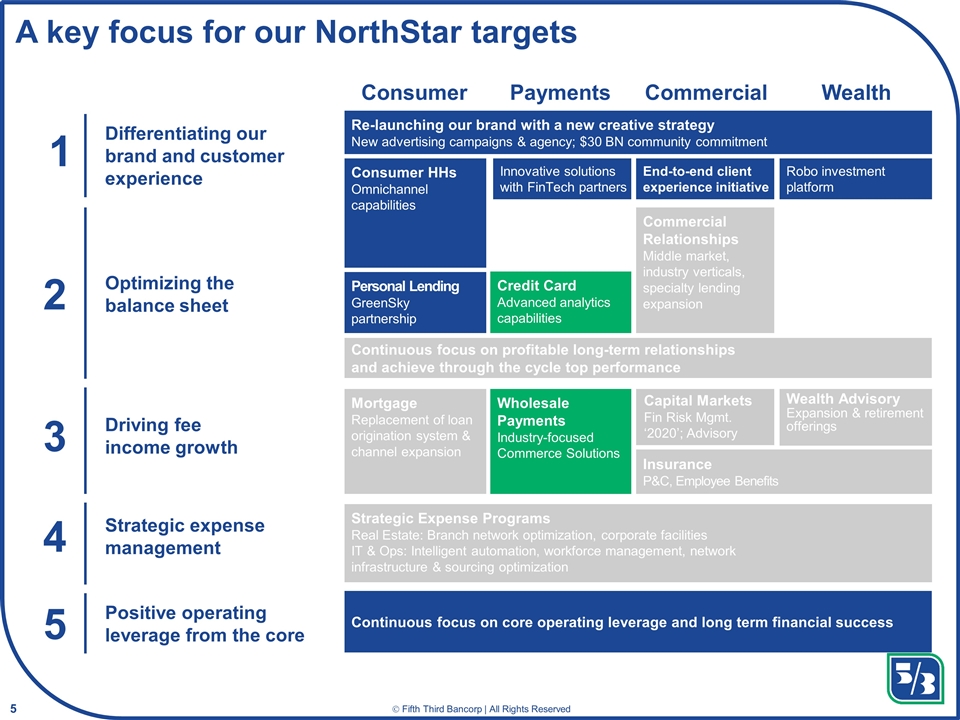

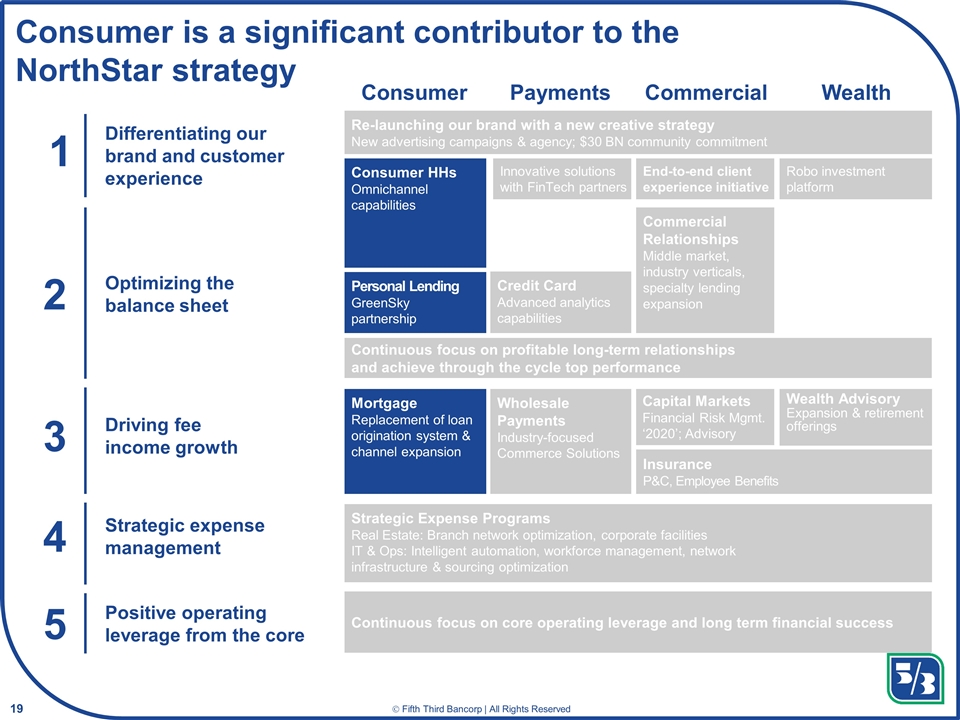

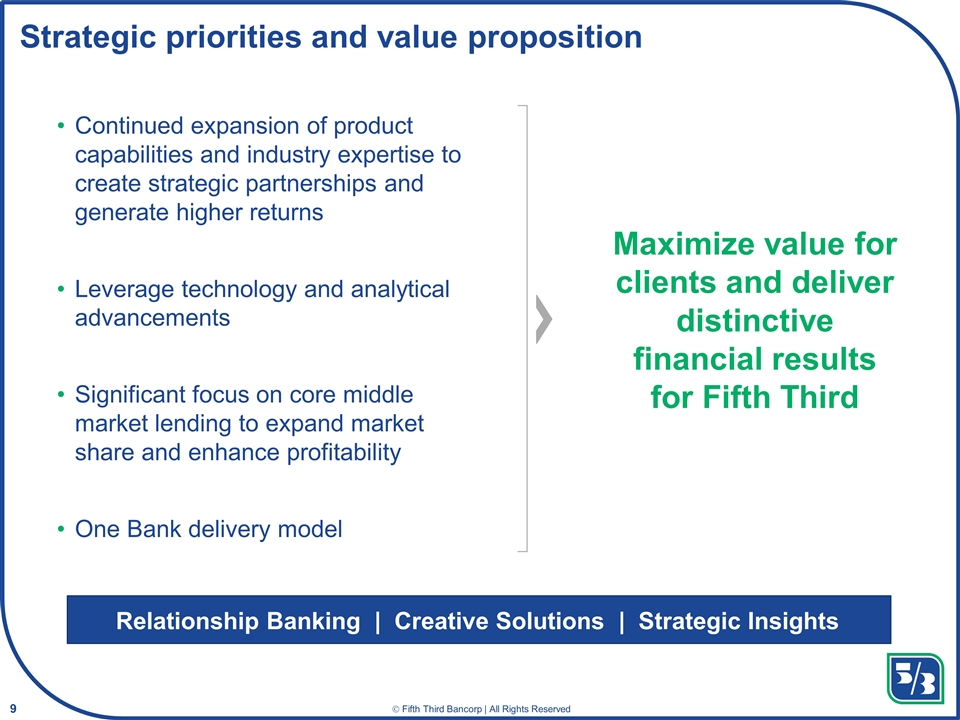

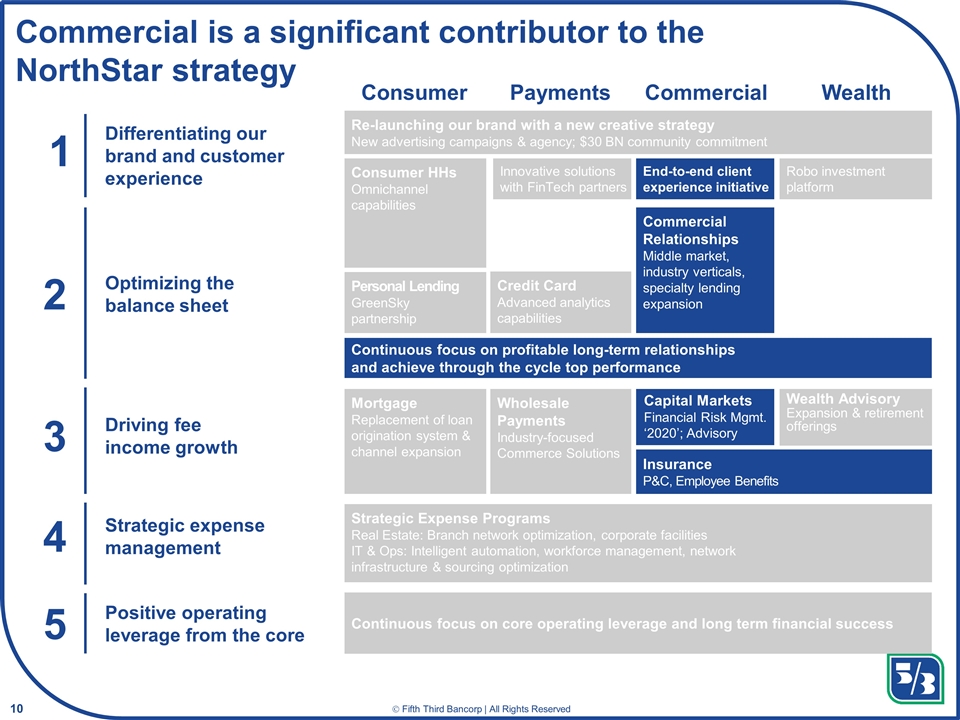

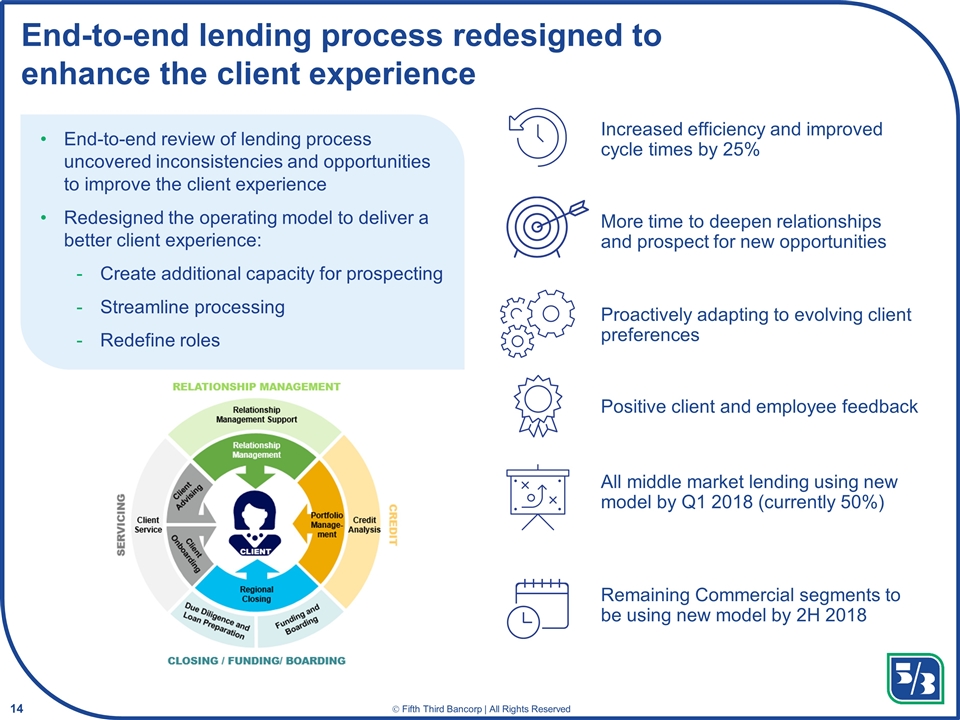

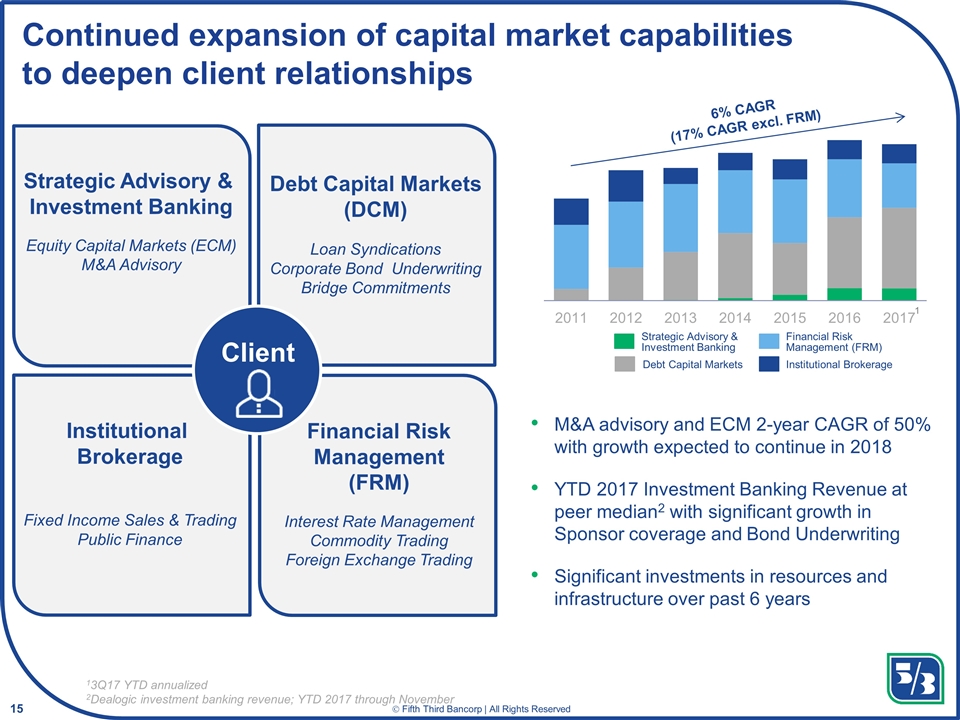

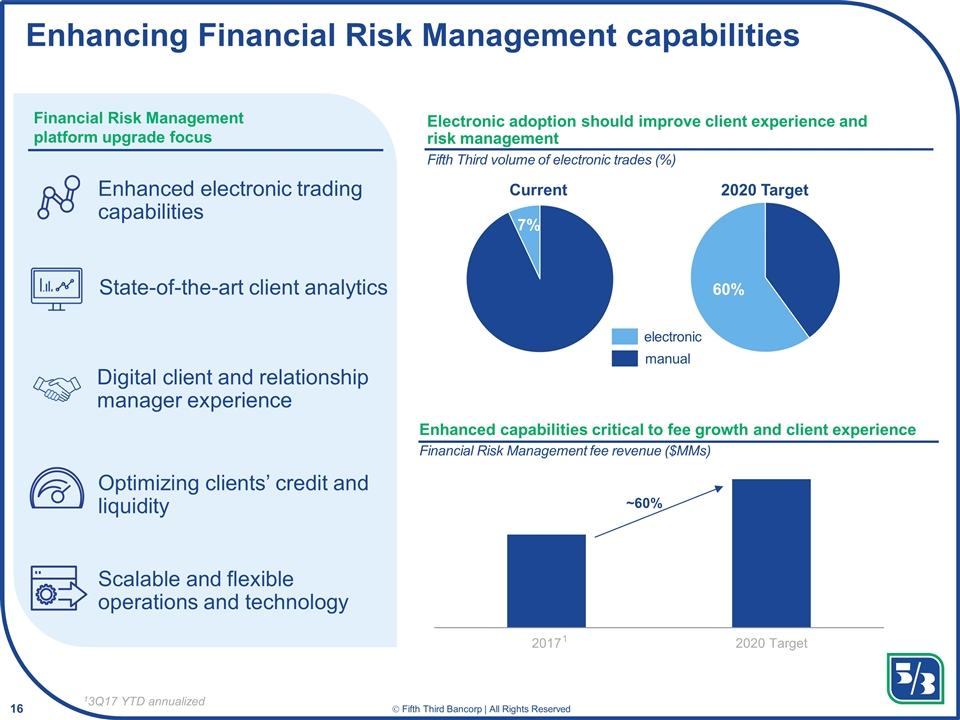

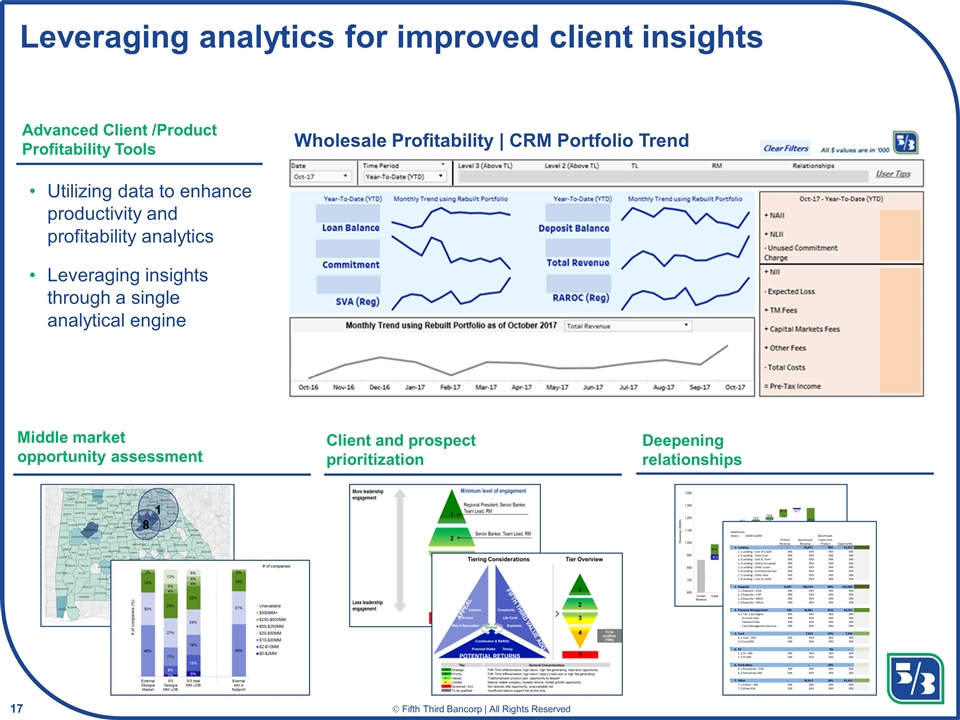

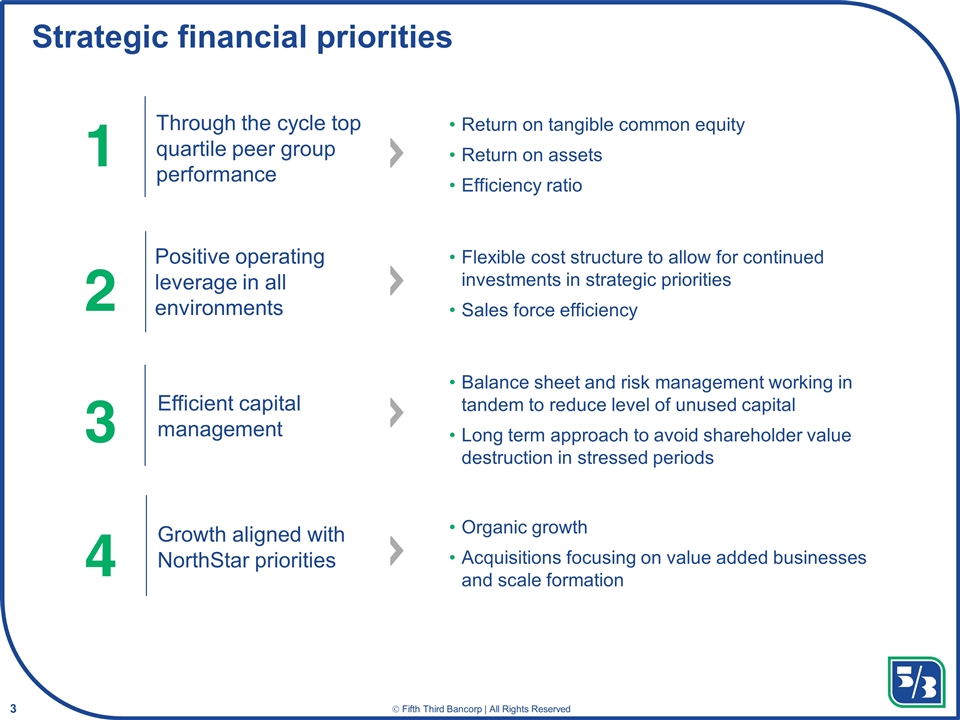

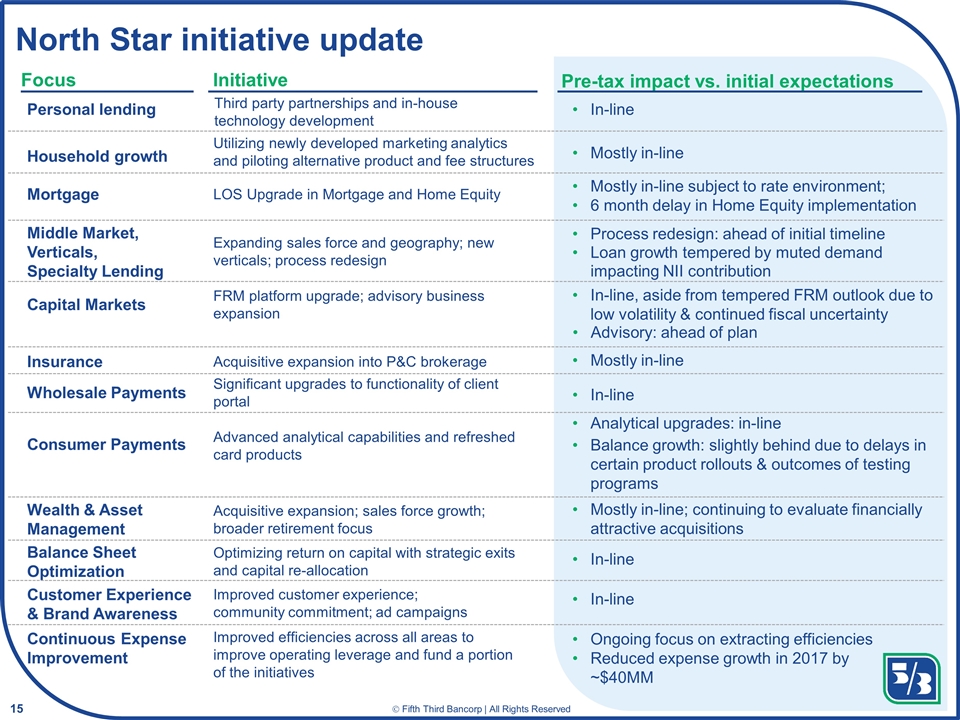

Capital Markets Financial Risk Mgmt. ‘2020’; Advisory Implementing NorthStar strategies to achieve financial targets 1 Differentiating our brand and customer experience 2 Optimizing the balance sheet Driving fee income growth 3 4 Strategic expense management Consumer Payments Commercial Wealth 5 Positive operating leverage from the core Personal Lending GreenSky partnership Credit Card Advanced analytics capabilities Wholesale Payments Industry-focused Commerce Solutions Insurance P&C, Employee Benefits Commercial Relationships Middle market, industry verticals, specialty lending expansion Wealth Advisory Expansion & retirement offerings Strategic Expense Programs Real Estate: Branch network optimization, corporate facilities IT & Ops: Intelligent automation, workforce management, network infrastructure & sourcing optimization Re-launching our brand with a new creative strategy New advertising campaigns & agency; $30 BN community commitment Consumer HHs Omnichannel capabilities Continuous focus on core operating leverage and long term financial success Mortgage Replacement of loan origination system & channel expansion Continuous focus on profitable long-term relationships and achieve through the cycle top performance End-to-end client experience initiative Robo investment platform Innovative solutions with FinTech partners 17

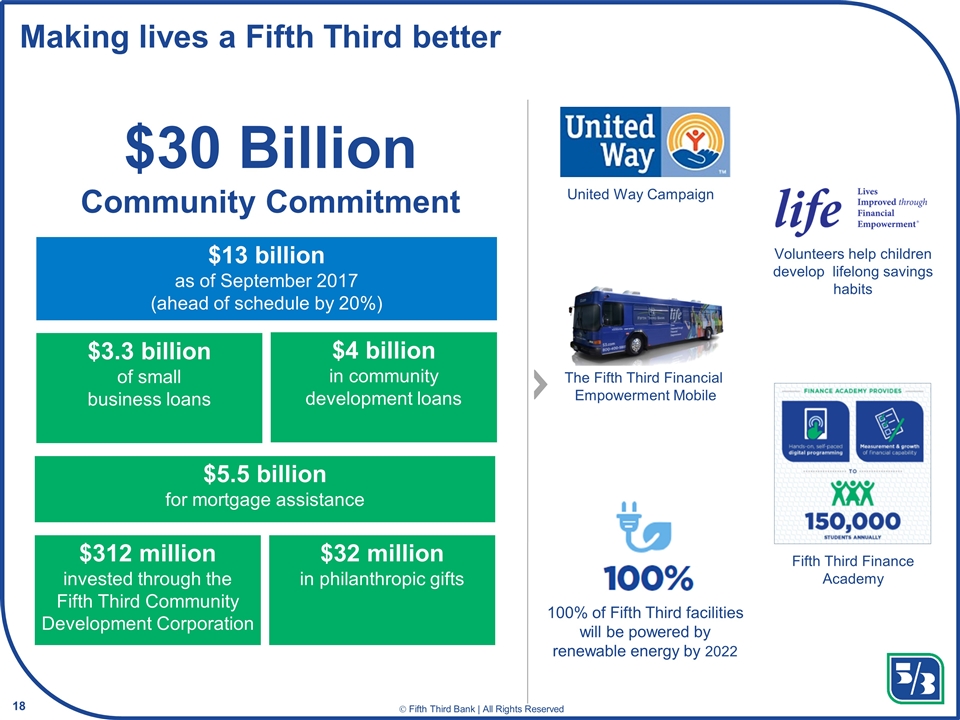

Making lives a Fifth Third better $30 Billion Community Commitment $312 million invested through the Fifth Third Community Development Corporation $13 billion as of September 2017 (ahead of schedule by 20%) $3.3 billion of small business loans $4 billion in community development loans $32 million in philanthropic gifts Volunteers help children develop lifelong savings habits United Way Campaign The Fifth Third Financial Empowerment Mobile $5.5 billion for mortgage assistance Fifth Third Finance Academy 100% of Fifth Third facilities will be powered by renewable energy by 2022 18

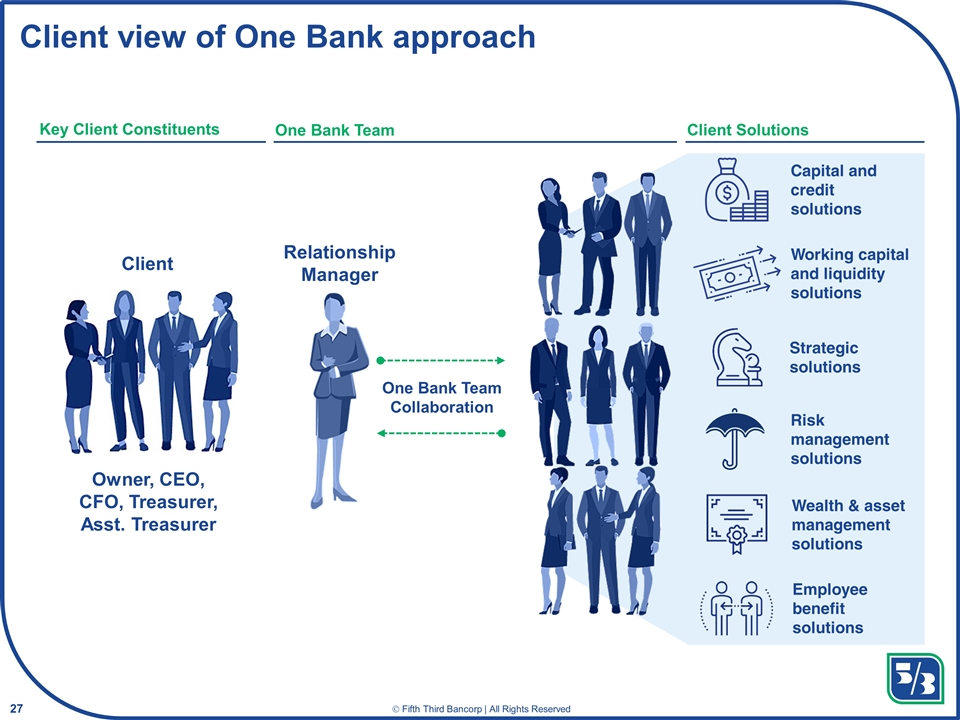

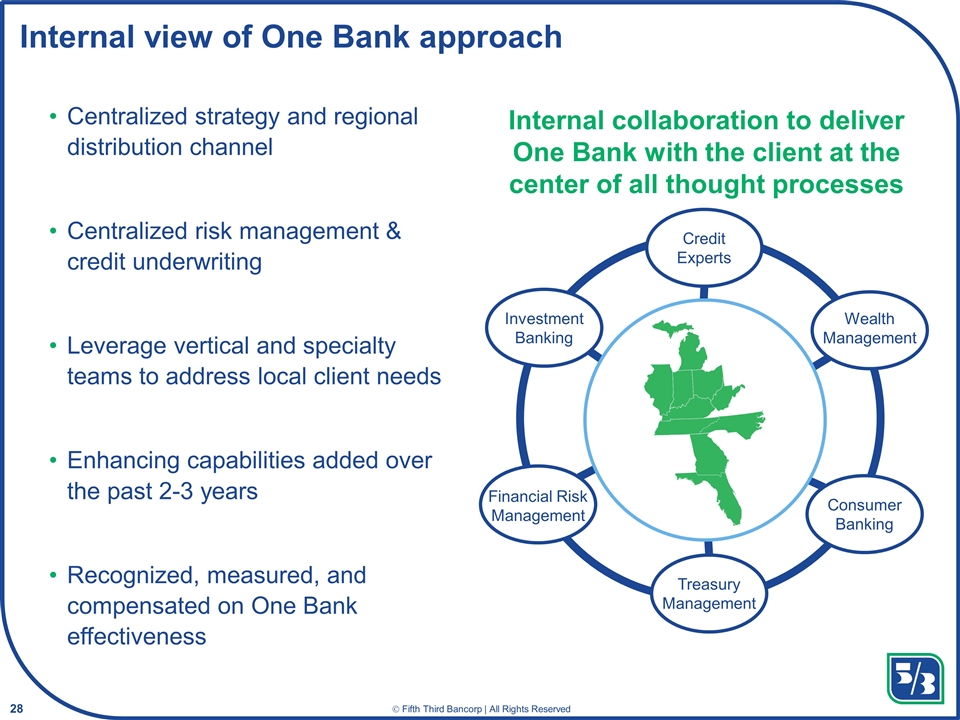

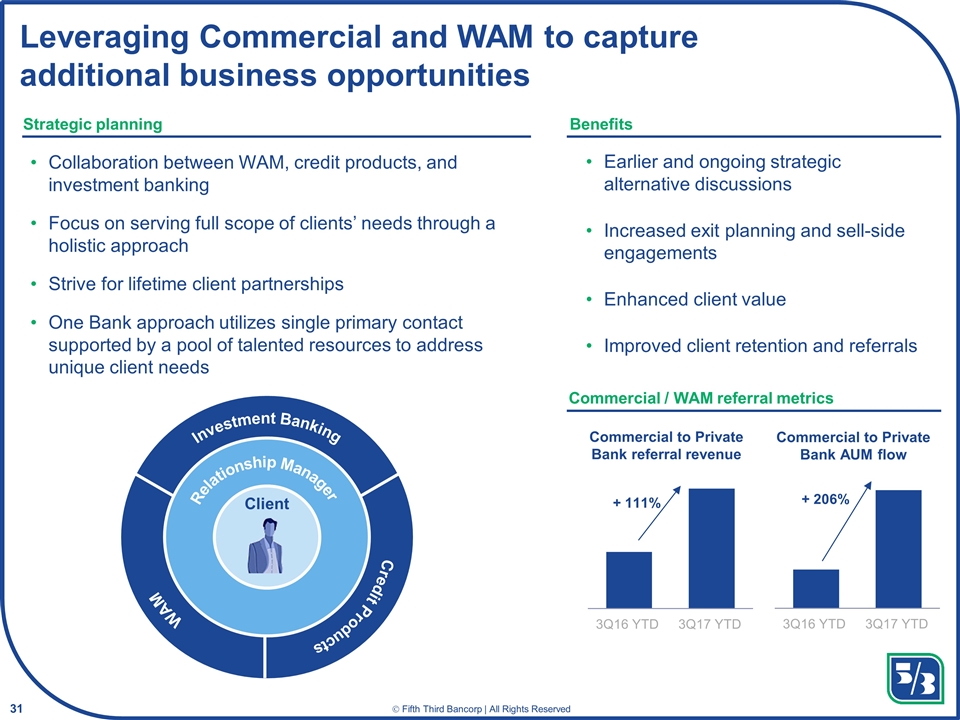

Guided by the vision to be the One Bank people most value and trust One Bank We have organized our bank around collaborating together and providing holistic solutions for our customers People Including current and prospective customers, employees, shareholders, regulators and the communities we serve Most Actively engaged, we aim to put forth 166.7% effort to be the best at everything we do Value Focused on providing excellent value to customers, being the employer of choice, and creating shareholder value Trust Earning customers’ trust every day by providing insights and advice, while also safeguarding data from external threats Fifth Third Compass 19

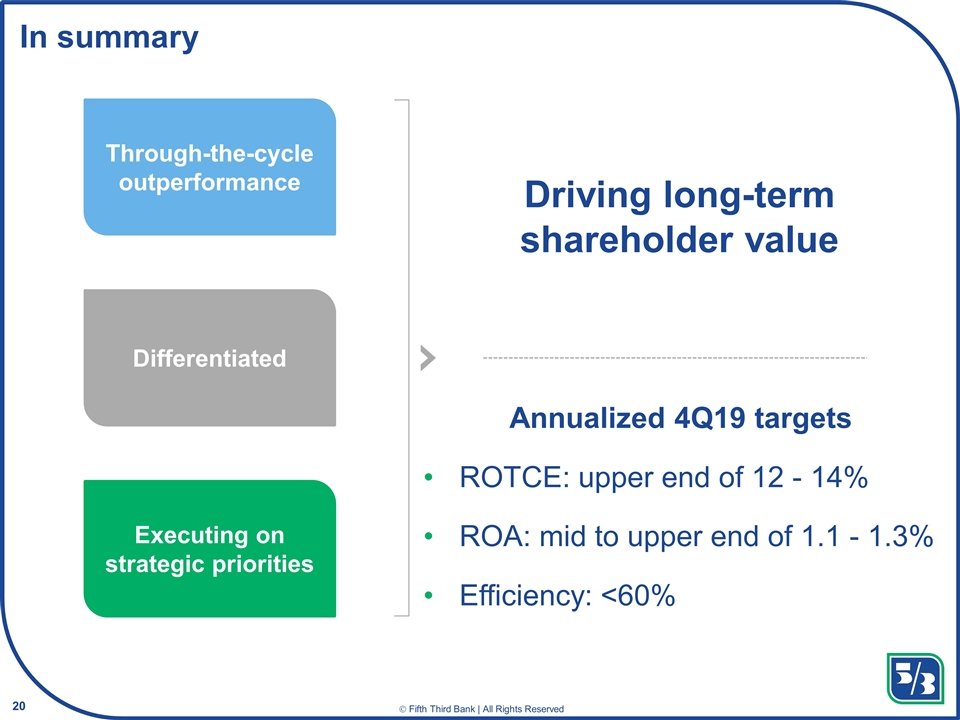

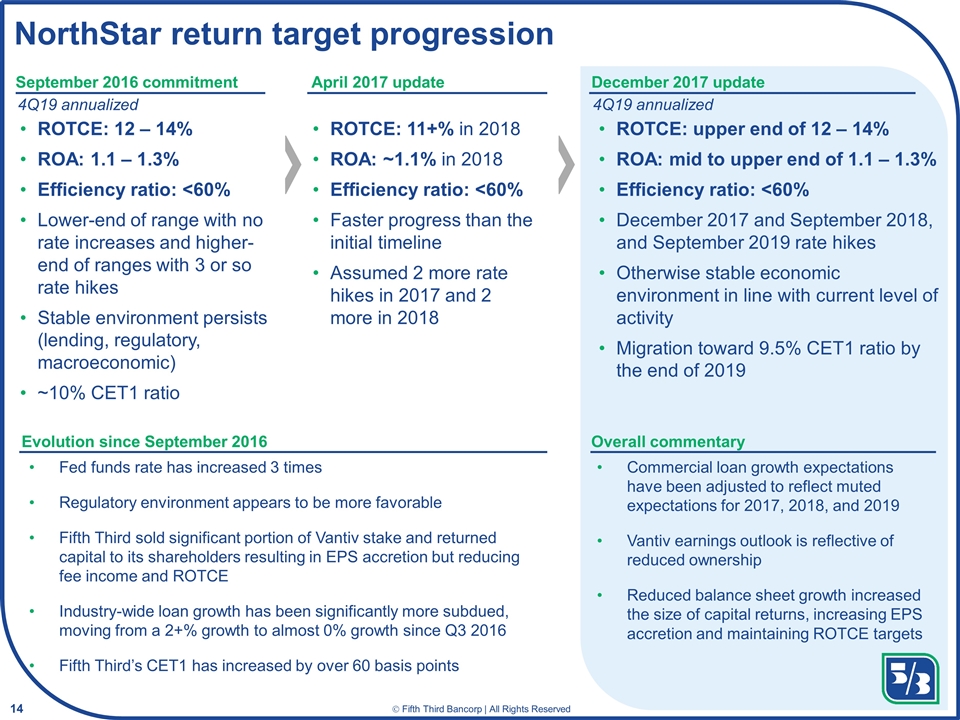

In summary Annualized 4Q19 targets ROTCE: upper end of 12 - 14% ROA: mid to upper end of 1.1 - 1.3% Efficiency: <60% Through-the-cycle outperformance Executing on strategic priorities Differentiated Driving long-term shareholder value 20

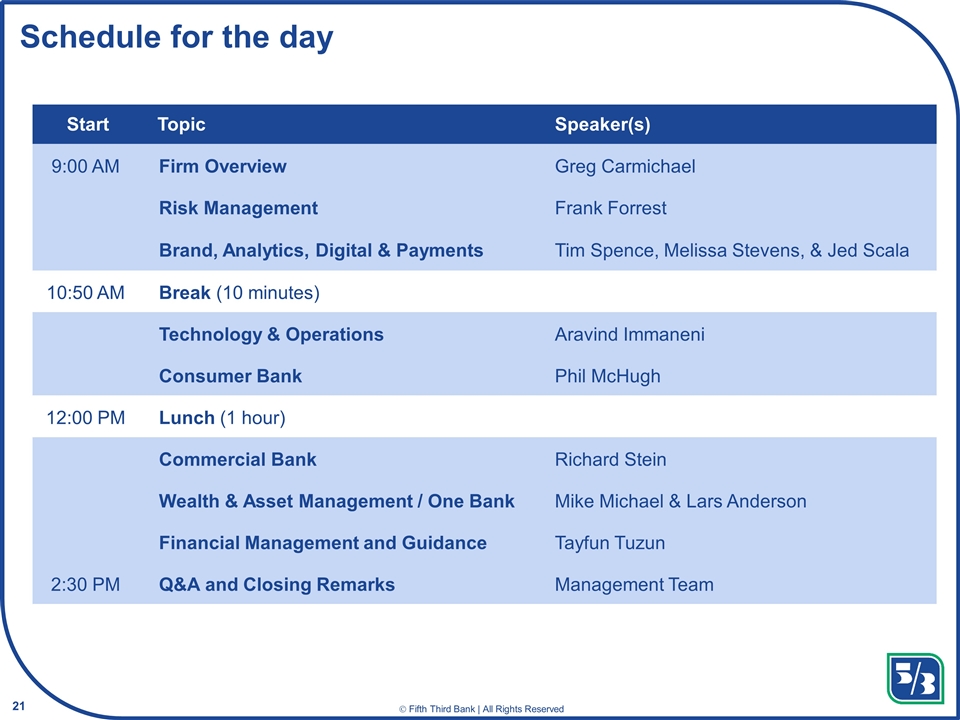

Schedule for the day Start Topic Speaker(s) 9:00 AM Firm Overview Greg Carmichael Risk Management Frank Forrest Brand, Analytics, Digital & Payments Tim Spence, Melissa Stevens, & Jed Scala 10:50 AM Break (10 minutes) Technology & Operations Aravind Immaneni Consumer Bank Phil McHugh 12:00 PM Lunch (1 hour) Commercial Bank Richard Stein Wealth & Asset Management / One Bank Mike Michael & Lars Anderson Financial Management and Guidance Tayfun Tuzun 2:30 PM Q&A and Closing Remarks Management Team 21

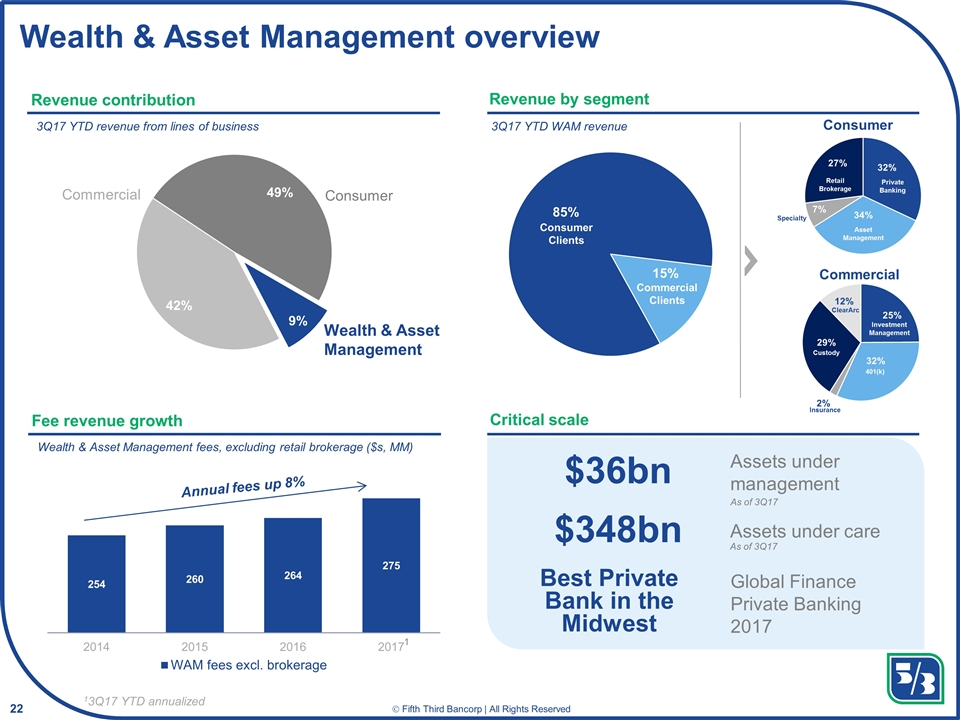

22

Risk Management Frank Forrest Executive Vice President Chief Risk Officer

Cautionary statement This presentation contains statements that we believe are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder. These statements relate to our financial condition, results of operations, plans, objectives, future performance or business. They usually can be identified by the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “is anticipated,” “potential,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or similar verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K, as updated by our Quarterly Reports on Form 10-Q. When considering these forward-looking statements, you should keep in mind these risks and uncertainties, as well as any cautionary statements we may make. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to us. We undertake no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this document. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) general economic or real estate market conditions, either nationally or in the states in which Fifth Third, one or more acquired entities and/or the combined company do business, weaken or are less favorable than expected; (2) deteriorating credit quality; (3) political developments, wars or other hostilities may disrupt or increase volatility in securities markets or other economic conditions; (4) changes in the interest rate environment reduce interest margins; (5) prepayment speeds, loan origination and sale volumes, charge-offs and loan loss provisions; (6) Fifth Third’s ability to maintain required capital levels and adequate sources of funding and liquidity; (7) maintaining capital requirements and adequate sources of funding and liquidity may limit Fifth Third’s operations and potential growth; (8) changes and trends in capital markets; (9) problems encountered by larger or similar financial institutions may adversely affect the banking industry and/or Fifth Third; (10) competitive pressures among depository institutions increase significantly; (11) changes in customer preferences or information technology systems; (12) effects of critical accounting policies and judgments; (13) changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board (FASB) or other regulatory agencies; (14) legislative or regulatory changes or actions, or significant litigation, adversely affect Fifth Third, one or more acquired entities and/or the combined company or the businesses in which Fifth Third, one or more acquired entities and/or the combined company are engaged, including the Dodd-Frank Wall Street Reform and Consumer Protection Act; (15) ability to maintain favorable ratings from rating agencies; (16) failure of models or risk management systems or controls; (17) fluctuation of Fifth Third’s stock price; (18) ability to attract and retain key personnel; (19) ability to receive dividends from its subsidiaries; (20) potentially dilutive effect of future acquisitions on current shareholders’ ownership of Fifth Third; (21) declines in the value of Fifth Third’s goodwill or other intangible assets; (22) effects of accounting or financial results of one or more acquired entities; (23) difficulties from Fifth Third’s investment in, relationship with, and nature of the operations of Vantiv Holding, LLC; (24) loss of income from any sale or potential sale of businesses; (25) difficulties in separating the operations of any branches or other assets divested; (26) losses or adverse impacts on the carrying values of branches and long-lived assets in connection with their sales or anticipated sales; (27) inability to achieve expected benefits from branch consolidations and planned sales within desired timeframes, if at all; (28) ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks; (29) the negotiation and (if any) implementation by Vantiv, Inc. and/or Worldpay Group plc of the potential acquisition of Worldpay Group plc by Vantiv, Inc. and such other actions as Vantiv, Inc. and Worldpay Group plc may take in furtherance thereof; and (30) the impact of reputational risk created by these developments on such matters as business generation and retention, funding and liquidity. You should refer to our periodic and current reports filed with the Securities and Exchange Commission, or “SEC,” for further information on other factors, which could cause actual results to be significantly different from those expressed or implied by these forward-looking statements. In this presentation, we may sometimes provide non-GAAP financial information. Please note that although non-GAAP financial measures provide useful insight to analysts, investors and regulators, they should not be considered in isolation or relied upon as a substitute for analysis using GAAP measures. If applicable, we provide GAAP reconciliations for non-GAAP measures in a later slide in this presentation which is also available in the investor relations section of our website, www.53.com.

Risk Management mission To ensure enterprise risks are managed within our risk appetite and in alignment with our strategic and financial plans. We manage risk through disciplined programs and practices designed to: Drive consistent performance through the cycle Ensure regulatory compliance Enable proactive client solutions Optimize the use of capital 1 2 3 4

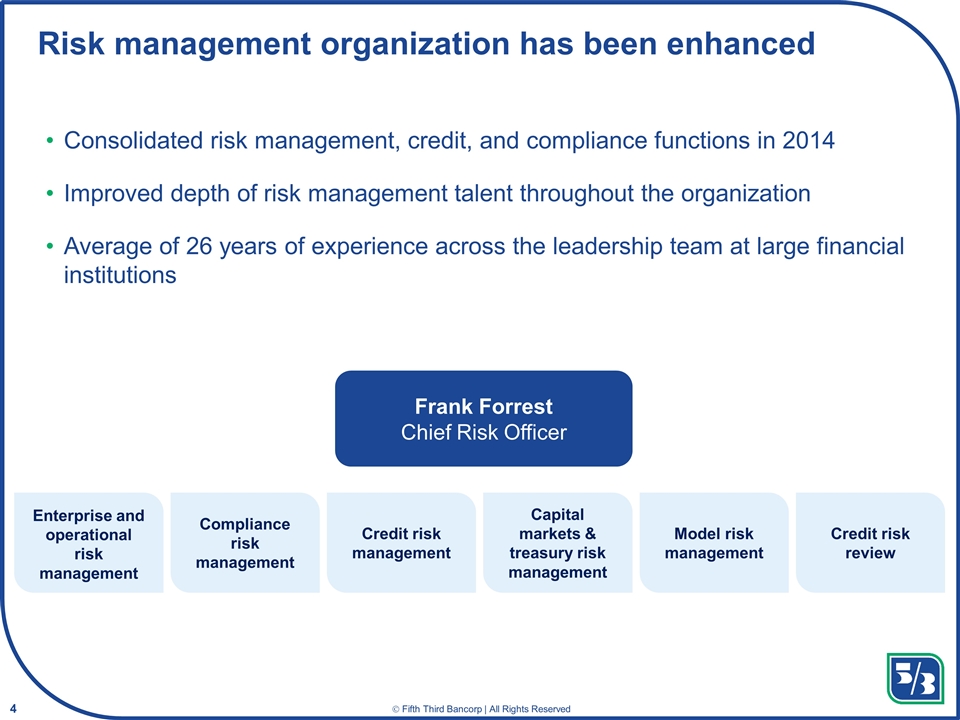

Frank Forrest Chief Risk Officer Risk management organization has been enhanced Consolidated risk management, credit, and compliance functions in 2014 Improved depth of risk management talent throughout the organization Average of 26 years of experience across the leadership team at large financial institutions Enterprise and operational risk management Compliance risk management Credit risk management Capital markets & treasury risk management Model risk management Credit risk review

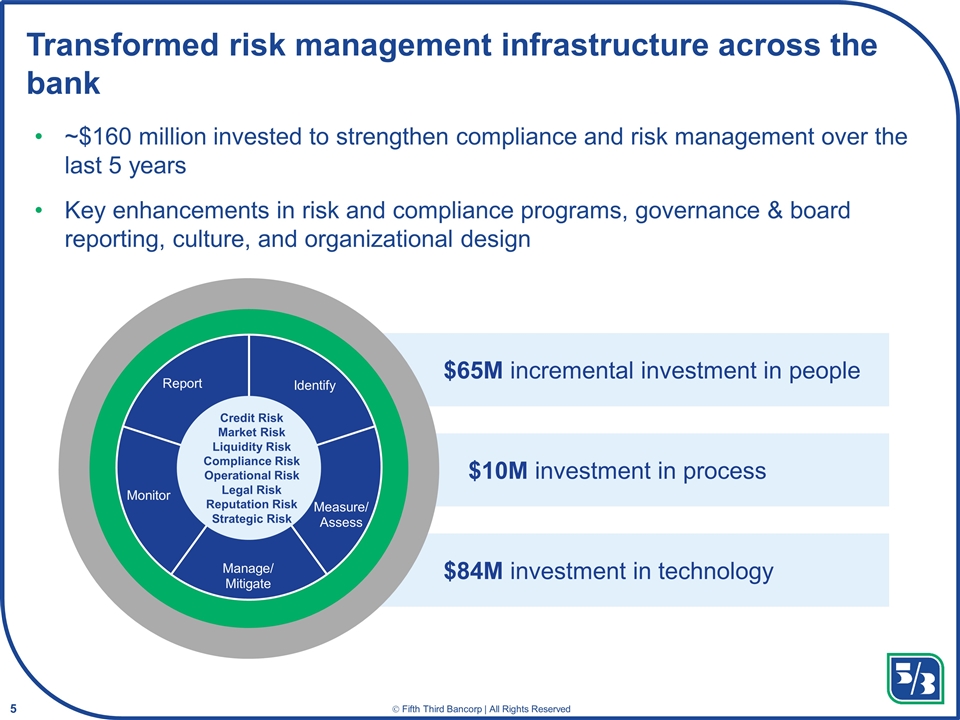

$65M incremental investment in people $10M investment in process $84M investment in technology Transformed risk management infrastructure across the bank ~$160 million invested to strengthen compliance and risk management over the last 5 years Key enhancements in risk and compliance programs, governance & board reporting, culture, and organizational design Credit Risk Market Risk Liquidity Risk Compliance Risk Operational Risk Legal Risk Reputation Risk Strategic Risk

Targeted areas of focus Compliance risk Operational risk Compliance risk management Financial crimes compliance Regulatory change management Operational risk management Vendor risk management Fraud risk management Cyber risk management Improved identification, monitoring and reporting of financial crimes, vendor risk, fraud risk, and cyber risk Increased focus and oversight of high risk processes and timely response to regulatory changes Strengthened execution of compliance and operational risk programs and overall control environment Improved management of compliance and operational risk has substantially improved our risk profile

Conduct Risk is well managed across the organization in alignment with our core values Our Corporate Responsibility and Reputation Office focuses on five key areas: Corporate responsibility and ethics community & economic development diversity & social responsibility corporate communications reputation Oversight and governance of conduct risk includes: Code of business conduct & ethics Culture and conduct risk dashboard Annual risk assessment of incentive plans Corporate Responsibility & Reputation Committee Fifth Third Compass

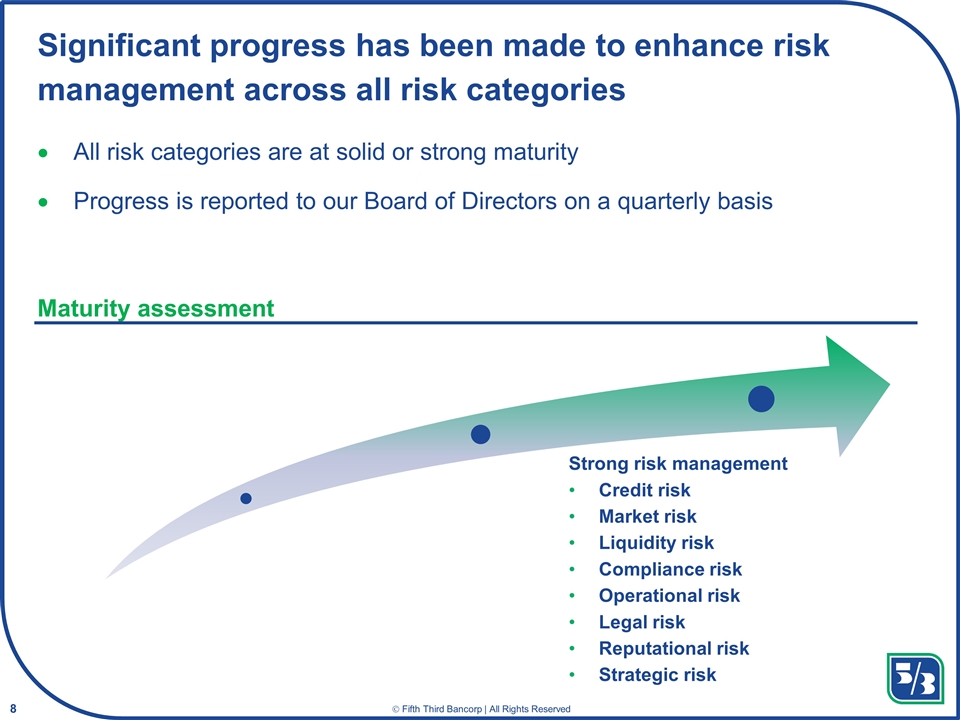

Significant progress has been made to enhance risk management across all risk categories All risk categories are at solid or strong maturity Progress is reported to our Board of Directors on a quarterly basis Strong risk management Credit risk Market risk Liquidity risk Compliance risk Operational risk Legal risk Reputational risk Strategic risk Maturity assessment

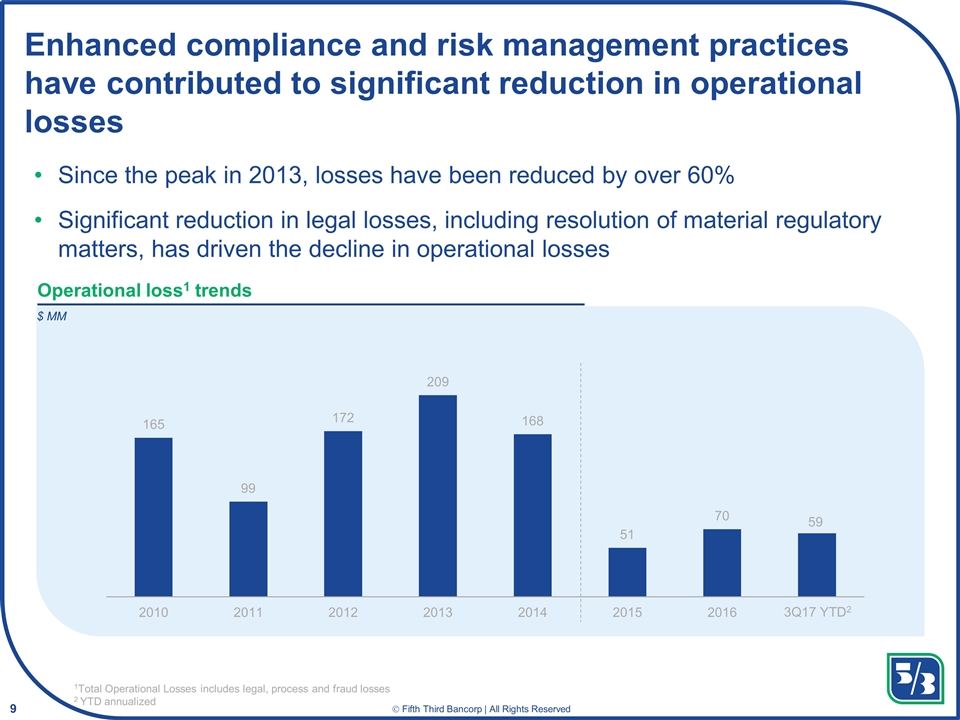

Enhanced compliance and risk management practices have contributed to significant reduction in operational losses Since the peak in 2013, losses have been reduced by over 60% Significant reduction in legal losses, including resolution of material regulatory matters, has driven the decline in operational losses 1Total Operational Losses includes legal, process and fraud losses 2 YTD annualized Operational loss1 trends 59 $ MM 3Q17 YTD2

Credit Risk Management

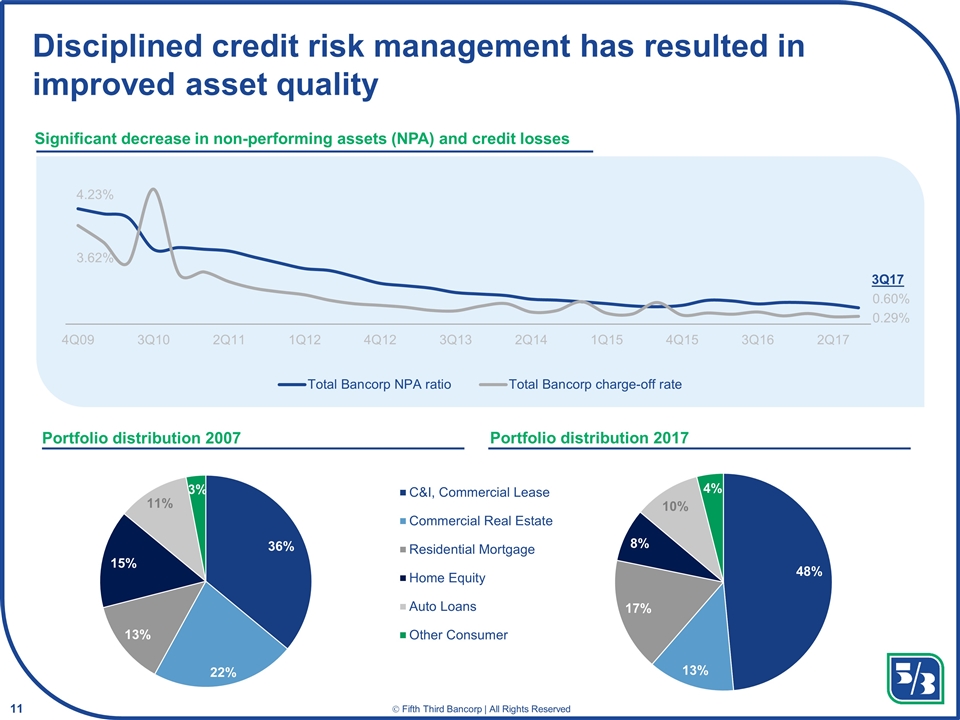

Disciplined credit risk management has resulted in improved asset quality Significant decrease in non-performing assets (NPA) and credit losses Portfolio distribution 2007 Portfolio distribution 2017 3Q17

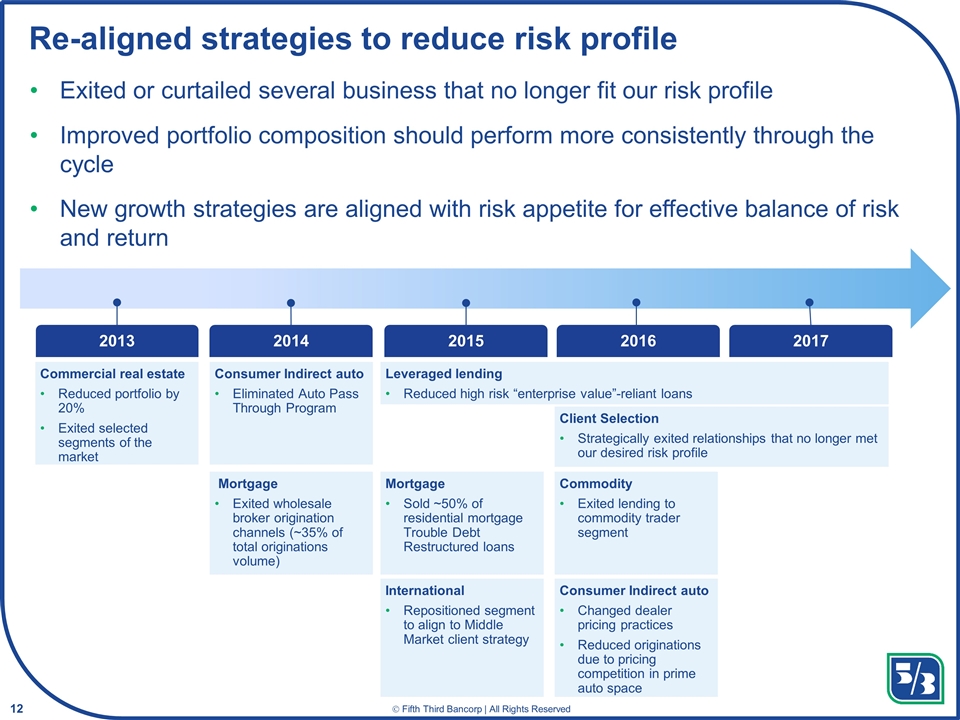

Re-aligned strategies to reduce risk profile Exited or curtailed several business that no longer fit our risk profile Improved portfolio composition should perform more consistently through the cycle New growth strategies are aligned with risk appetite for effective balance of risk and return Commercial real estate Reduced portfolio by 20% Exited selected segments of the market 2013 2014 Leveraged lending Reduced high risk “enterprise value”-reliant loans 2015 2017 2016 Consumer Indirect auto Eliminated Auto Pass Through Program Mortgage Exited wholesale broker origination channels (~35% of total originations volume) Mortgage Sold ~50% of residential mortgage Trouble Debt Restructured loans Client Selection Strategically exited relationships that no longer met our desired risk profile International Repositioned segment to align to Middle Market client strategy Consumer Indirect auto Changed dealer pricing practices Reduced originations due to pricing competition in prime auto space Commodity Exited lending to commodity trader segment

Consumer Credit

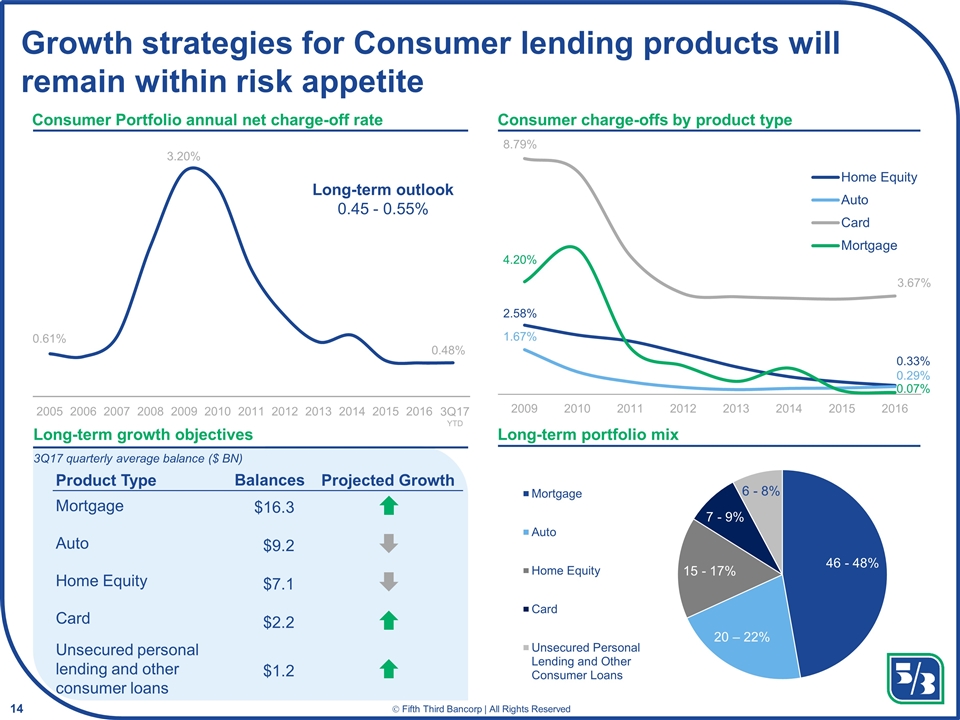

Growth strategies for Consumer lending products will remain within risk appetite Consumer Portfolio annual net charge-off rate Long-term portfolio mix Consumer charge-offs by product type Long-term outlook 0.45 - 0.55% Long-term growth objectives Mortgage Product Type Balances Projected Growth Auto Home Equity Card Unsecured personal lending and other consumer loans $16.3 $9.2 $7.1 $2.2 $1.2 3Q17 quarterly average balance ($ BN) 0.61% 3.20% 0.48% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 3Q17 YTD

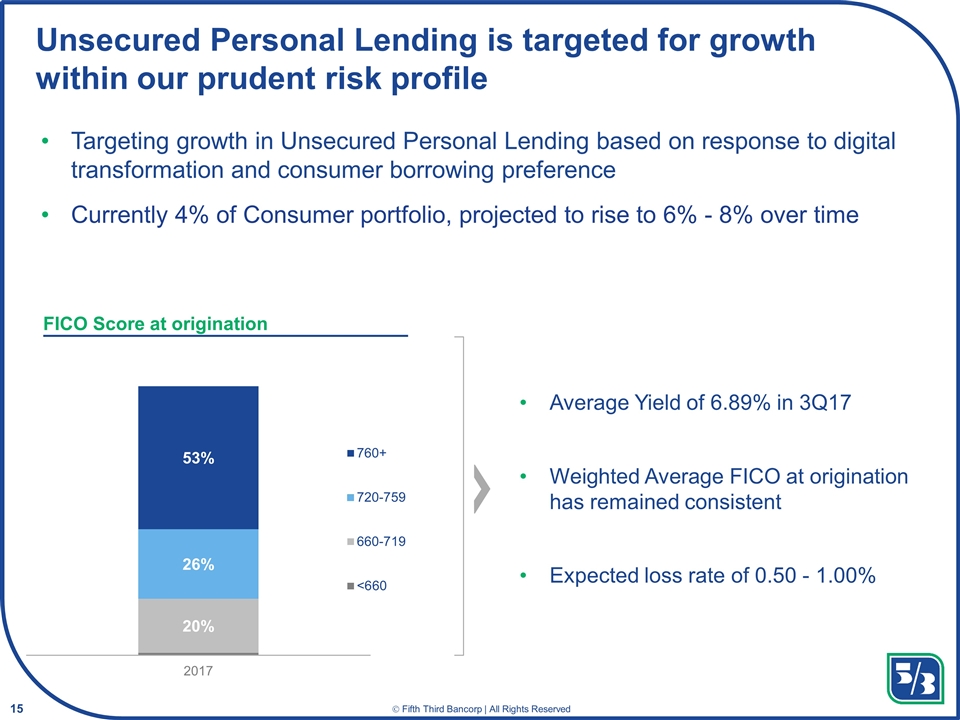

Unsecured Personal Lending is targeted for growth within our prudent risk profile Targeting growth in Unsecured Personal Lending based on response to digital transformation and consumer borrowing preference Currently 4% of Consumer portfolio, projected to rise to 6% - 8% over time Average Yield of 6.89% in 3Q17 Weighted Average FICO at origination has remained consistent Expected loss rate of 0.50 - 1.00% FICO Score at origination

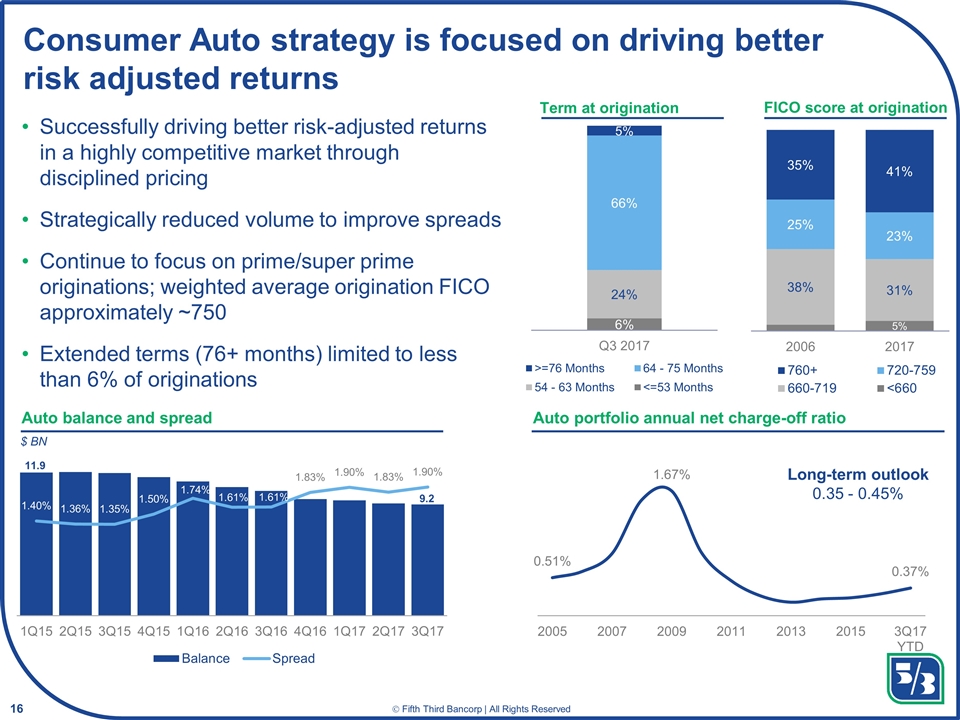

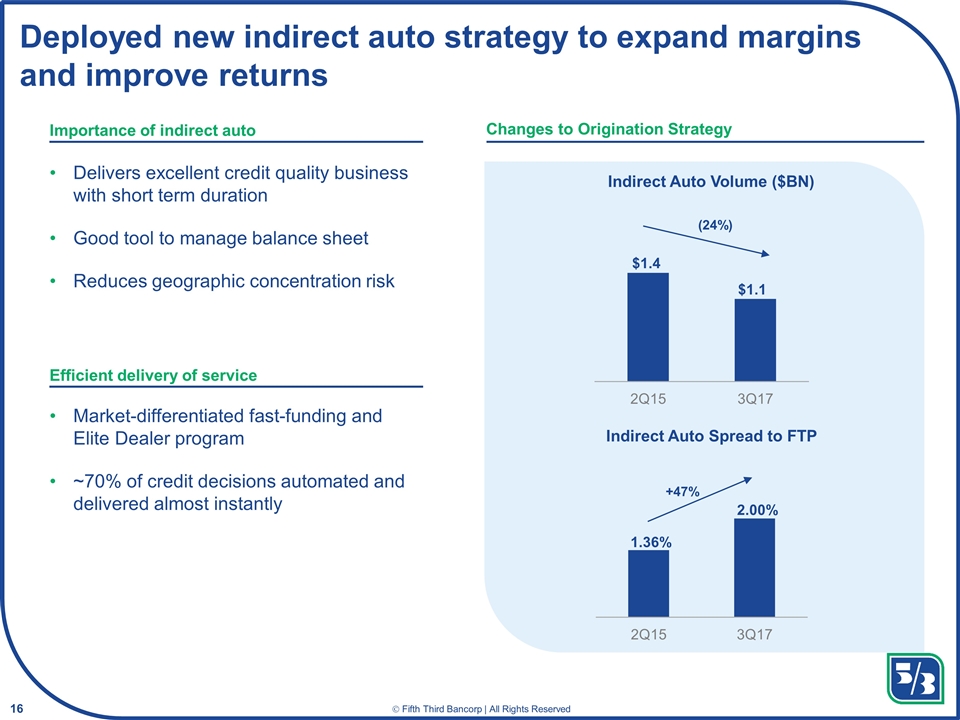

Term at origination Consumer Auto strategy is focused on driving better risk adjusted returns Auto balance and spread Auto portfolio annual net charge-off ratio Long-term outlook 0.35 - 0.45% FICO score at origination Successfully driving better risk-adjusted returns in a highly competitive market through disciplined pricing Strategically reduced volume to improve spreads Continue to focus on prime/super prime originations; weighted average origination FICO approximately ~750 Extended terms (76+ months) limited to less than 6% of originations 11.9 9.2 $ BN

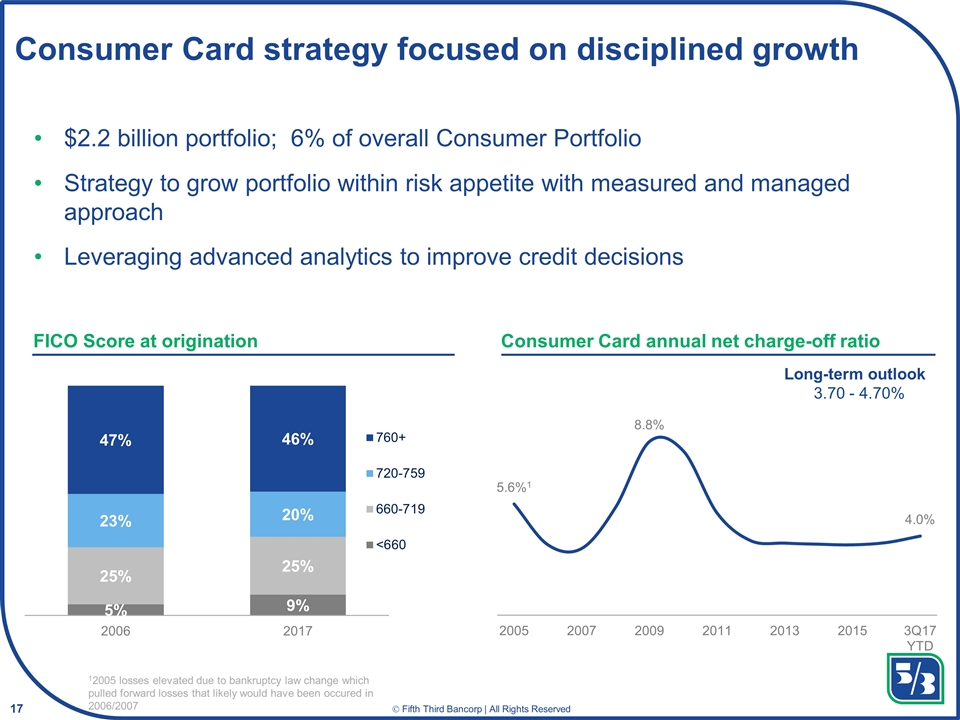

Consumer Card strategy focused on disciplined growth 12005 losses elevated due to bankruptcy law change which pulled forward losses that likely would have been occured in 2006/2007 FICO Score at origination $2.2 billion portfolio; 6% of overall Consumer Portfolio Strategy to grow portfolio within risk appetite with measured and managed approach Leveraging advanced analytics to improve credit decisions Consumer Card annual net charge-off ratio Long-term outlook 3.70 - 4.70%

Commercial Credit

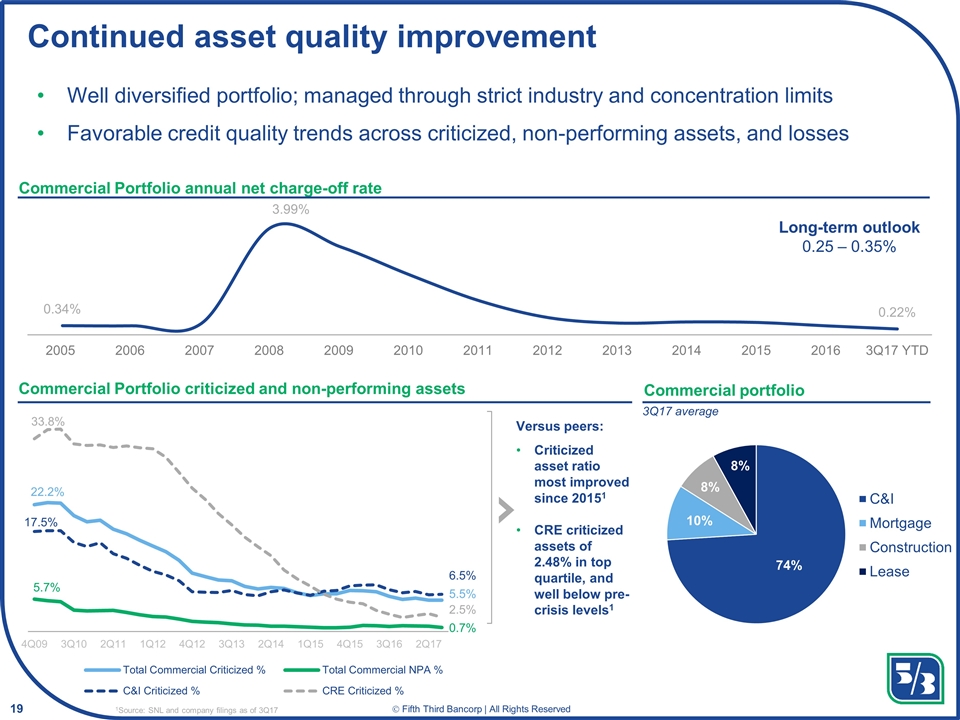

Continued asset quality improvement Well diversified portfolio; managed through strict industry and concentration limits Favorable credit quality trends across criticized, non-performing assets, and losses Commercial Portfolio annual net charge-off rate Commercial portfolio Commercial Portfolio criticized and non-performing assets Versus peers: Criticized asset ratio most improved since 20151 CRE criticized assets of 2.48% in top quartile, and well below pre-crisis levels1 Long-term outlook 0.25 – 0.35% 1Source: SNL and company filings as of 3Q17 3Q17 average

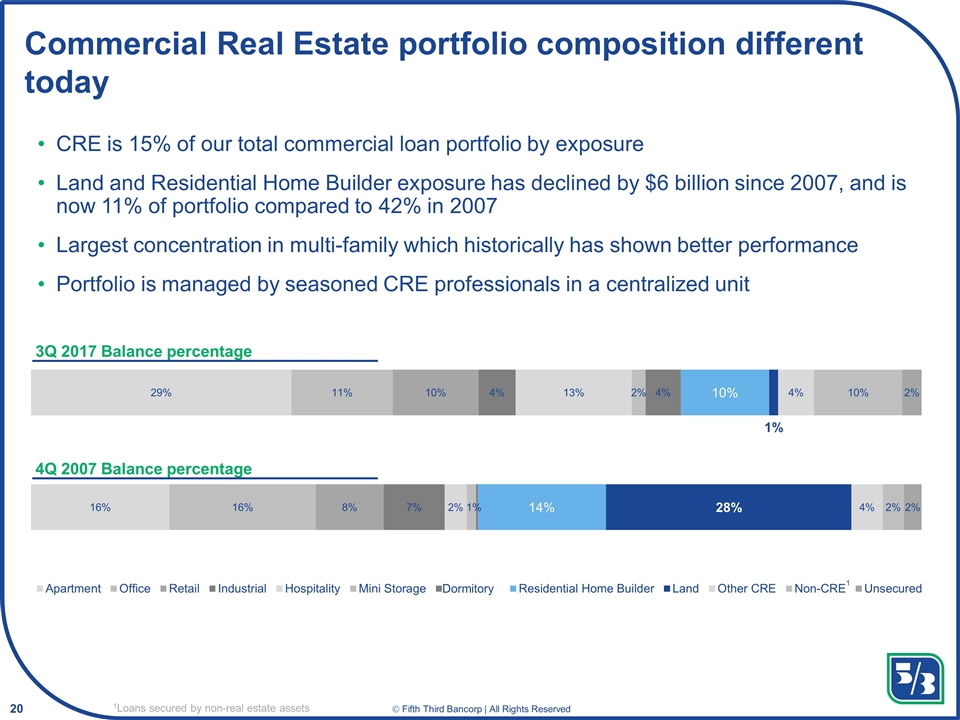

CRE is 15% of our total commercial loan portfolio by exposure Land and Residential Home Builder exposure has declined by $6 billion since 2007, and is now 11% of portfolio compared to 42% in 2007 Largest concentration in multi-family which historically has shown better performance Portfolio is managed by seasoned CRE professionals in a centralized unit Commercial Real Estate portfolio composition different today 1Loans secured by non-real estate assets 4Q 2007 Balance percentage 3Q 2017 Balance percentage 1

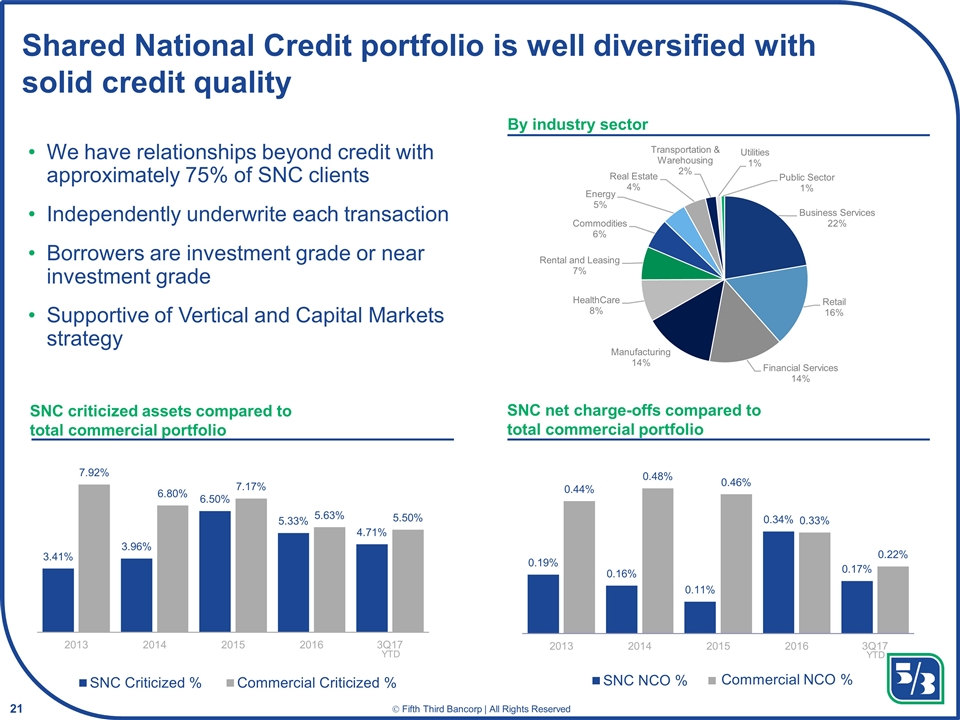

Shared National Credit portfolio is well diversified with solid credit quality By industry sector We have relationships beyond credit with approximately 75% of SNC clients Independently underwrite each transaction Borrowers are investment grade or near investment grade Supportive of Vertical and Capital Markets strategy SNC criticized assets compared to total commercial portfolio SNC net charge-offs compared to total commercial portfolio YTD YTD

Strengthened risk leadership, programs, and governance Enhanced risk culture and accountability Significantly improved asset quality Substantially reduced operational losses Well positioned with our regulators These outcomes have positioned us to perform well through all cycles In summary, we have transformed risk management and are achieving sustainable outcomes

Frank Forrest Bio Executive Vice President Chief Risk Officer Date Joined Fifth Third: September 2013 Positions Held at Fifth Third: 2013Chief Risk Officer Frank Forrest, executive vice president and chief risk officer, assumed his current role in September 2013. He is responsible for all risk management and governance functions, including relationships with key regulatory agencies. His team leads enterprise programs and initiatives for managing risk and sustaining a strong risk culture across the enterprise. Responsibilities include development and implementation of Fifth Third’s risk management framework, risk appetite, and risk management and mitigation strategies. These teams manage credit, compliance, operational, market, strategic, liquidity, and model risk to support balanced, profitable growth. Previously, Frank held numerous positions in credit and risk management at Bank of America Merrill Lynch, including Managing Director - Quality Control for Mortgage Banking, Global Debt Products executive and Commercial Banking Risk Management executive. Prior to joining Bank of America, Frank worked for eight years at the U.S. Department of Treasury, Office of the Comptroller of the Currency as a national bank examiner. Education Frank graduated from Florida State University with Bachelor of Science degrees in accounting and finance. Professional and Civic Frank recently served on the Wake Forest University College Board of Visitors (2010-14). For more than 10 years, he served Providence Day School, Charlotte, NC on the board of advisors, board of trustees and finally chairman of the board of trustees.

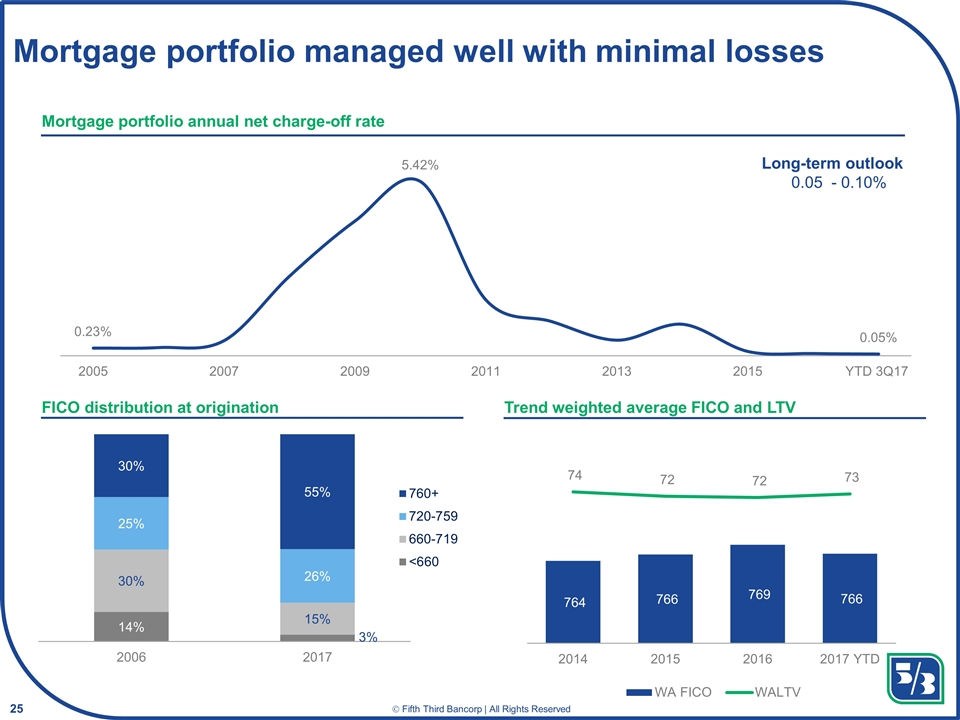

Mortgage portfolio managed well with minimal losses FICO distribution at origination Mortgage portfolio annual net charge-off rate Trend weighted average FICO and LTV Long-term outlook 0.05 - 0.10%

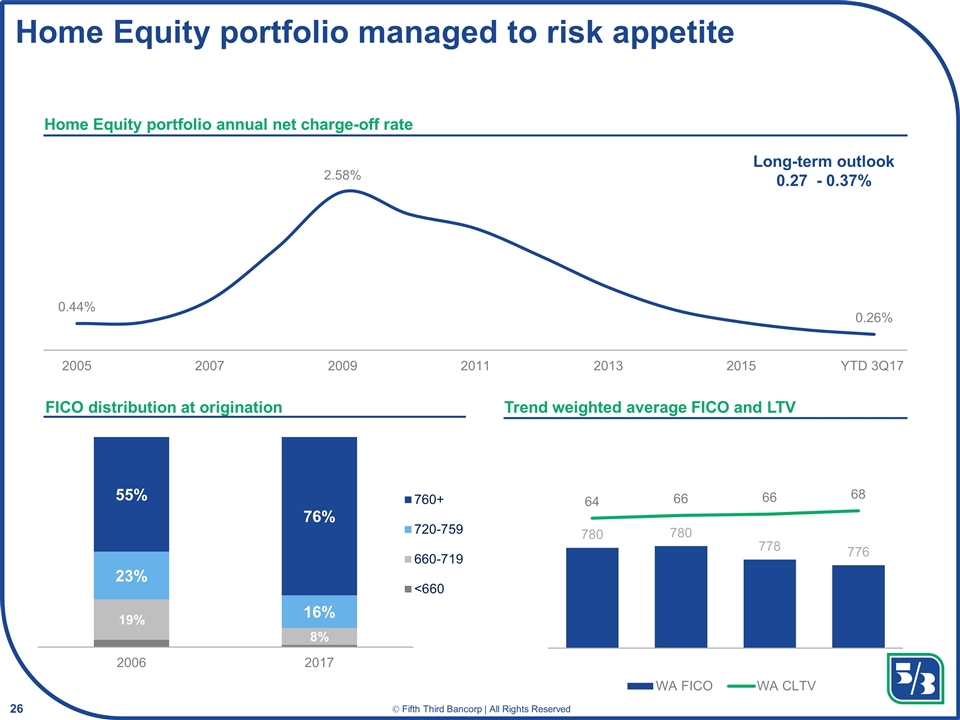

Home Equity portfolio managed to risk appetite Home Equity portfolio annual net charge-off rate FICO distribution at origination Trend weighted average FICO and LTV Long-term outlook 0.27 - 0.37%

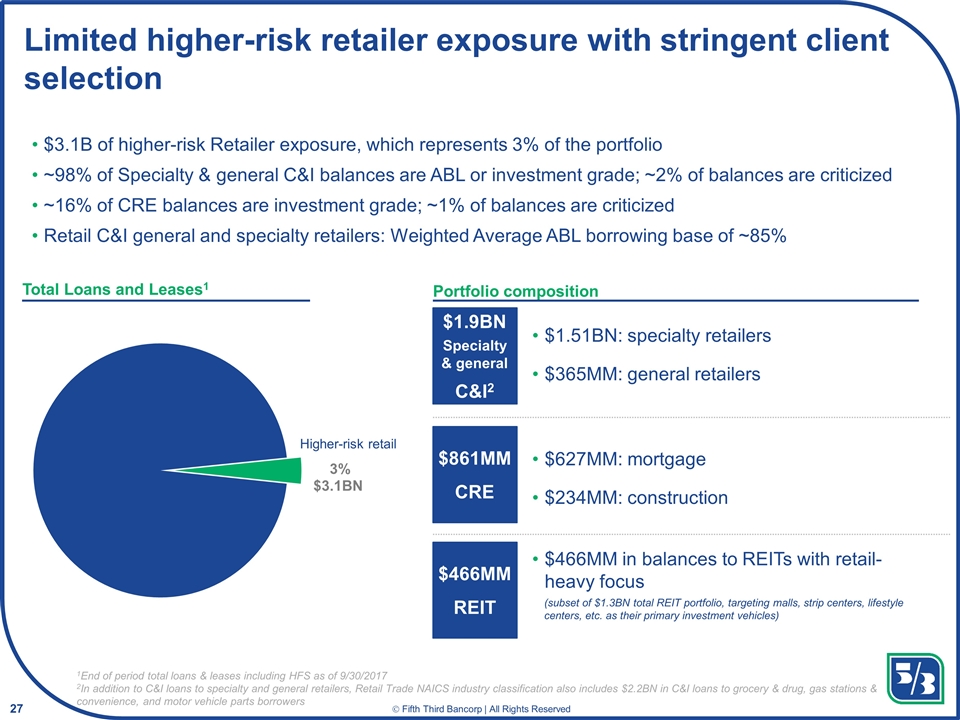

Limited higher-risk retailer exposure with stringent client selection $3.1B of higher-risk Retailer exposure, which represents 3% of the portfolio ~98% of Specialty & general C&I balances are ABL or investment grade; ~2% of balances are criticized ~16% of CRE balances are investment grade; ~1% of balances are criticized Retail C&I general and specialty retailers: Weighted Average ABL borrowing base of ~85% $861MM CRE $1.9BN Specialty & general C&I2 $1.51BN: specialty retailers $365MM: general retailers $466MM REIT $627MM: mortgage $234MM: construction $466MM in balances to REITs with retail-heavy focus (subset of $1.3BN total REIT portfolio, targeting malls, strip centers, lifestyle centers, etc. as their primary investment vehicles) 1End of period total loans & leases including HFS as of 9/30/2017 2In addition to C&I loans to specialty and general retailers, Retail Trade NAICS industry classification also includes $2.2BN in C&I loans to grocery & drug, gas stations & convenience, and motor vehicle parts borrowers Higher-risk retail Total Loans and Leases1 Portfolio composition

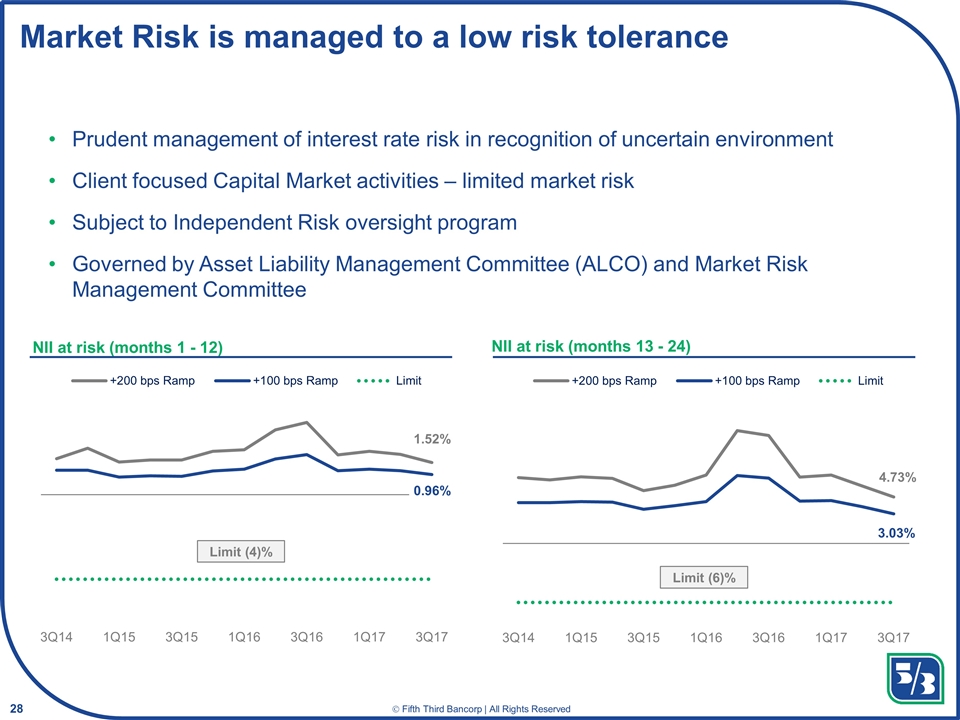

Market Risk is managed to a low risk tolerance Prudent management of interest rate risk in recognition of uncertain environment Client focused Capital Market activities – limited market risk Subject to Independent Risk oversight program Governed by Asset Liability Management Committee (ALCO) and Market Risk Management Committee NII at risk (months 1 - 12) NII at risk (months 13 - 24)

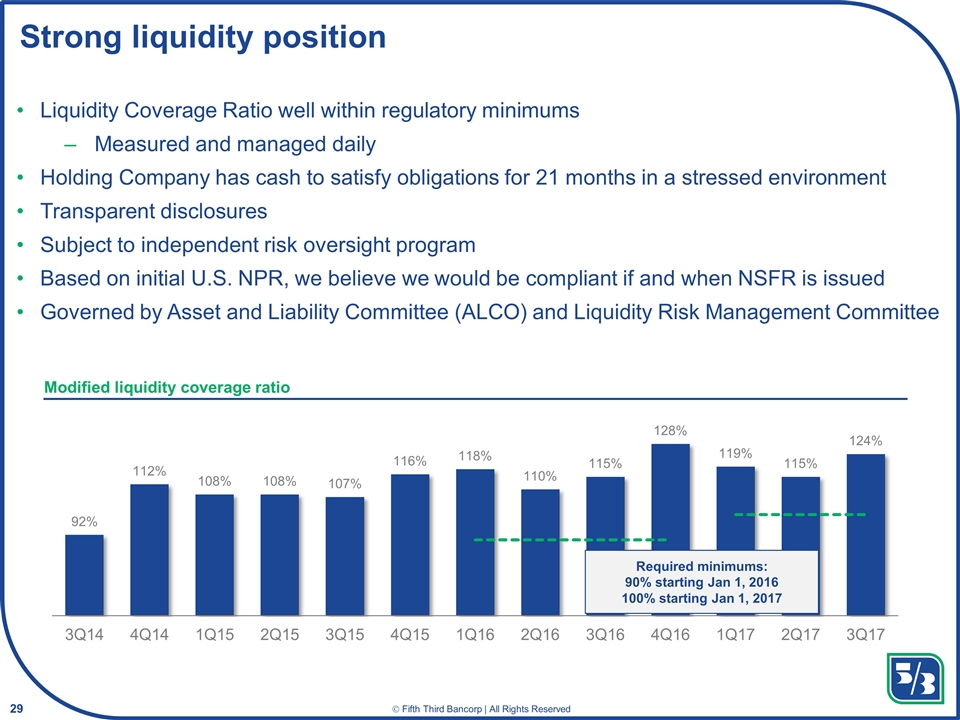

Liquidity Coverage Ratio well within regulatory minimums Measured and managed daily Holding Company has cash to satisfy obligations for 21 months in a stressed environment Transparent disclosures Subject to independent risk oversight program Based on initial U.S. NPR, we believe we would be compliant if and when NSFR is issued Governed by Asset and Liability Committee (ALCO) and Liquidity Risk Management Committee Strong liquidity position Modified liquidity coverage ratio

Strategic Differentiators: Brand, Analytics, Digital & Payments Tim Spence Executive Vice President Chief Strategy Officer Melissa Stevens Senior Vice President Chief Digital Officer Jed Scala Executive Vice President Head of Payments reprint

Cautionary statement This presentation contains statements that we believe are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder. These statements relate to our financial condition, results of operations, plans, objectives, future performance or business. They usually can be identified by the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “is anticipated,” “potential,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or similar verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K, as updated by our Quarterly Reports on Form 10-Q. When considering these forward-looking statements, you should keep in mind these risks and uncertainties, as well as any cautionary statements we may make. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to us. We undertake no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this document. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) general economic or real estate market conditions, either nationally or in the states in which Fifth Third, one or more acquired entities and/or the combined company do business, weaken or are less favorable than expected; (2) deteriorating credit quality; (3) political developments, wars or other hostilities may disrupt or increase volatility in securities markets or other economic conditions; (4) changes in the interest rate environment reduce interest margins; (5) prepayment speeds, loan origination and sale volumes, charge-offs and loan loss provisions; (6) Fifth Third’s ability to maintain required capital levels and adequate sources of funding and liquidity; (7) maintaining capital requirements and adequate sources of funding and liquidity may limit Fifth Third’s operations and potential growth; (8) changes and trends in capital markets; (9) problems encountered by larger or similar financial institutions may adversely affect the banking industry and/or Fifth Third; (10) competitive pressures among depository institutions increase significantly; (11) changes in customer preferences or information technology systems; (12) effects of critical accounting policies and judgments; (13) changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board (FASB) or other regulatory agencies; (14) legislative or regulatory changes or actions, or significant litigation, adversely affect Fifth Third, one or more acquired entities and/or the combined company or the businesses in which Fifth Third, one or more acquired entities and/or the combined company are engaged, including the Dodd-Frank Wall Street Reform and Consumer Protection Act; (15) ability to maintain favorable ratings from rating agencies; (16) failure of models or risk management systems or controls; (17) fluctuation of Fifth Third’s stock price; (18) ability to attract and retain key personnel; (19) ability to receive dividends from its subsidiaries; (20) potentially dilutive effect of future acquisitions on current shareholders’ ownership of Fifth Third; (21) declines in the value of Fifth Third’s goodwill or other intangible assets; (22) effects of accounting or financial results of one or more acquired entities; (23) difficulties from Fifth Third’s investment in, relationship with, and nature of the operations of Vantiv Holding, LLC; (24) loss of income from any sale or potential sale of businesses; (25) difficulties in separating the operations of any branches or other assets divested; (26) losses or adverse impacts on the carrying values of branches and long-lived assets in connection with their sales or anticipated sales; (27) inability to achieve expected benefits from branch consolidations and planned sales within desired timeframes, if at all; (28) ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks; (29) the negotiation and (if any) implementation by Vantiv, Inc. and/or Worldpay Group plc of the potential acquisition of Worldpay Group plc by Vantiv, Inc. and such other actions as Vantiv, Inc. and Worldpay Group plc may take in furtherance thereof; and (30) the impact of reputational risk created by these developments on such matters as business generation and retention, funding and liquidity. You should refer to our periodic and current reports filed with the Securities and Exchange Commission, or “SEC,” for further information on other factors, which could cause actual results to be significantly different from those expressed or implied by these forward-looking statements. In this presentation, we may sometimes provide non-GAAP financial information. Please note that although non-GAAP financial measures provide useful insight to analysts, investors and regulators, they should not be considered in isolation or relied upon as a substitute for analysis using GAAP measures. If applicable, we provide GAAP reconciliations for non-GAAP measures in a later slide in this presentation which is also available in the investor relations section of our website, www.53.com.

Forces reshaping banking market dynamics Expectations are evolving, driven by the customer’s ‘last best experience’ Technology is transforming when and how we interact The pace and volume of data growth is exponential Competition is increasing driven by macro economics and new entrants

Key differentiators that will accelerate achieving our goals for the company 1 Growing profitable and enduring relationships 2 Continuously improving the customer experience 4 Leveraging analytics and technology 3 Prudent capital management Leveraging advanced analytics to deliver a highly personalized relationship banking experience Establishing a compelling brand platform that resonates with our core audiences Delivering innovation and a seamless experience through digital transformation and FinTech partnerships Winning the war for our customers’ Payments wallet

Capital Markets Fin Risk Mgmt. ‘2020’; Advisory A key focus for our NorthStar targets 1 Differentiating our brand and customer experience 2 Optimizing the balance sheet Driving fee income growth 3 4 Strategic expense management Consumer Payments Commercial Wealth 5 Positive operating leverage from the core Personal Lending GreenSky partnership Credit Card Advanced analytics capabilities Wholesale Payments Industry-focused Commerce Solutions Insurance P&C, Employee Benefits Commercial Relationships Middle market, industry verticals, specialty lending expansion Wealth Advisory Expansion & retirement offerings Strategic Expense Programs Real Estate: Branch network optimization, corporate facilities IT & Ops: Intelligent automation, workforce management, network infrastructure & sourcing optimization Re-launching our brand with a new creative strategy New advertising campaigns & agency; $30 BN community commitment Consumer HHs Omnichannel capabilities Continuous focus on core operating leverage and long term financial success Mortgage Replacement of loan origination system & channel expansion Continuous focus on profitable long-term relationships and achieve through the cycle top performance End-to-end client experience initiative Robo investment platform Innovative solutions with FinTech partners Reprint Complete Need to remerge

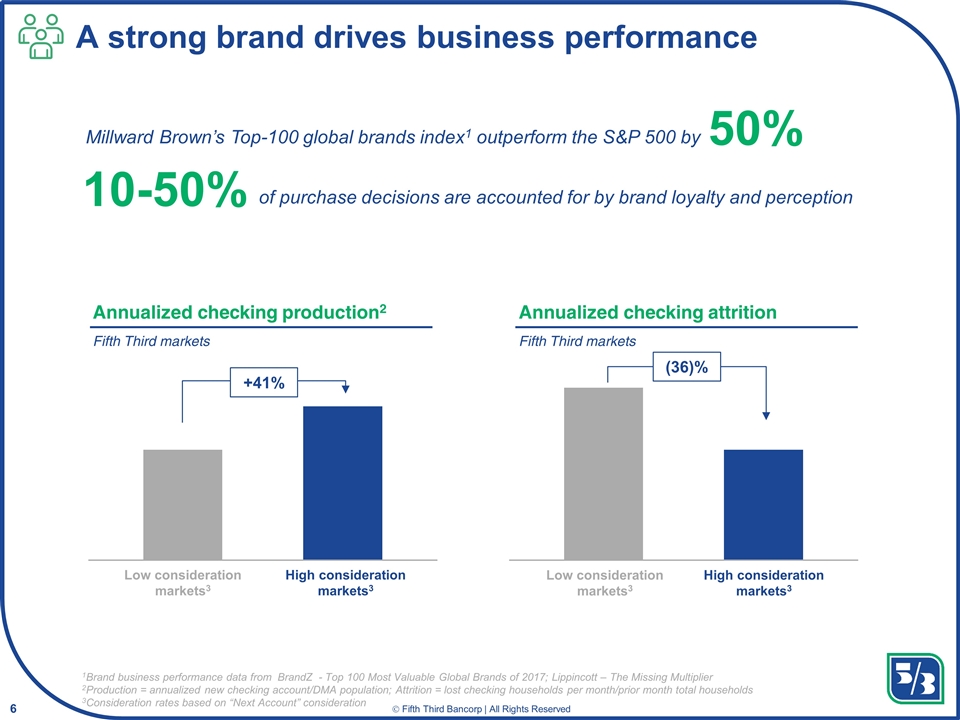

A strong brand drives business performance Low consideration markets3 High consideration markets3 Low consideration markets3 High consideration markets3 50% Millward Brown’s Top-100 global brands index1 outperform the S&P 500 by 10-50% of purchase decisions are accounted for by brand loyalty and perception +41% (36)% Annualized checking production2 Fifth Third markets Annualized checking attrition Fifth Third markets 1Brand business performance data from BrandZ - Top 100 Most Valuable Global Brands of 2017; Lippincott – The Missing Multiplier 2Production = annualized new checking account/DMA population; Attrition = lost checking households per month/prior month total households 3Consideration rates based on “Next Account” consideration

What do customers want? A better kind of bank Simplicity, speed, and security Access Value-added advice and solutions “Be different” 1Fifth Third’s collective wisdom community survey – customer panel of 5,000 participants surveyed twice per month 91% of Millennials prefer simple, streamlined solutions to manage their finances1 75% of customers desire ID alerts on their accounts1 72% of Millennial customers expect their bank to provide advice when it comes to making good financial decisions1

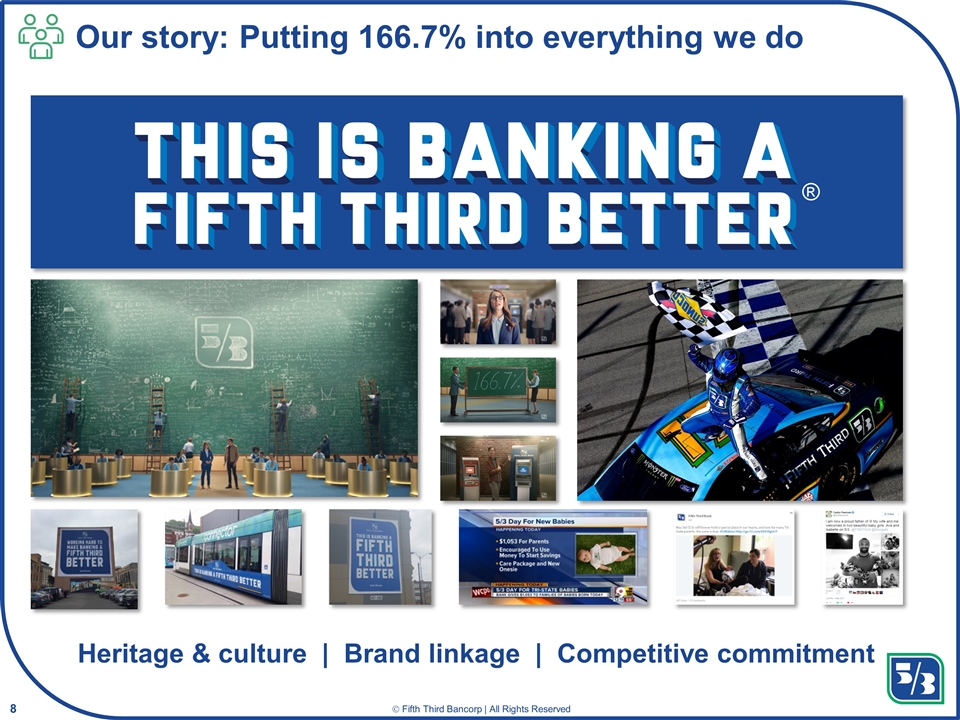

Our story: Putting 166.7% into everything we do Heritage & culture | Brand linkage | Competitive commitment ®

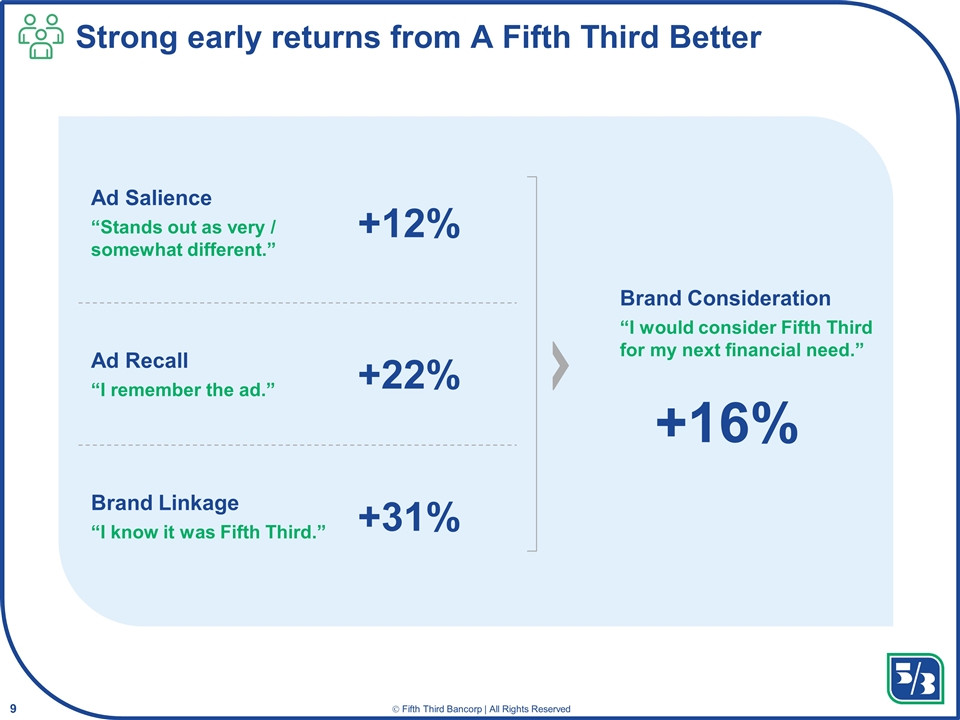

Strong early returns from A Fifth Third Better Ad Salience “Stands out as very / somewhat different.” +12% Ad Recall “I remember the ad.” +22% Brand Linkage “I know it was Fifth Third.” +31% Brand Consideration “I would consider Fifth Third for my next financial need.” +16%

Sustaining momentum with new campaign creative reprint

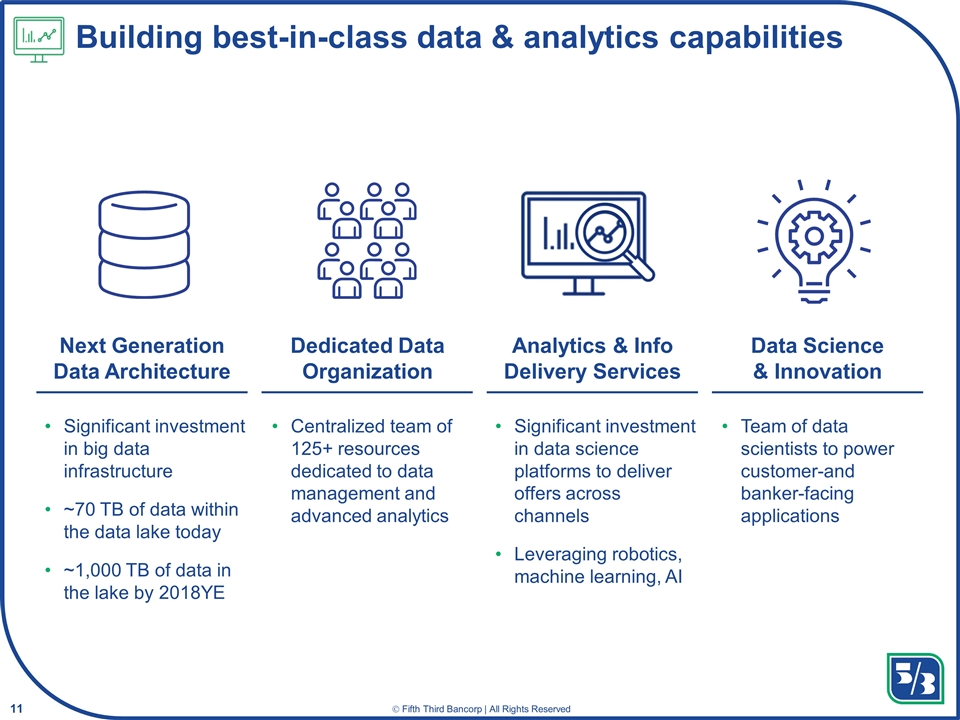

Next Generation Data Architecture Dedicated Data Organization Analytics & Info Delivery Services Data Science & Innovation Building best-in-class data & analytics capabilities Significant investment in big data infrastructure ~70 TB of data within the data lake today ~1,000 TB of data in the lake by 2018YE Centralized team of 125+ resources dedicated to data management and advanced analytics Significant investment in data science platforms to deliver offers across channels Leveraging robotics, machine learning, AI Team of data scientists to power customer-and banker-facing applications

Distribution Optimization Intelligent Automation Product Innovation Marketing Strategic focus on applications that drive improved revenue and efficiency Direct marketing optimization Retail network optimization Back-office process automation Real-time fraud monitoring and alerts Personalized financial advice and education Electronic FX trading platform Managed payables and receivables solutions Sales and service intelligence Direct marketing optimization Commercial banker coverage Card offers customized by channel Back-office process automation Dynamic, behavior based, automated card strategies Sample applications Consumer Commercial Payments

Customer Focused Innovation The Amplify Program Emerging Technologies & Monetizing Investments Collaborative Ecosystem Development FinTech@53 Delivering innovative solutions to our clients with a “Buy-Partner-Build” philosophy

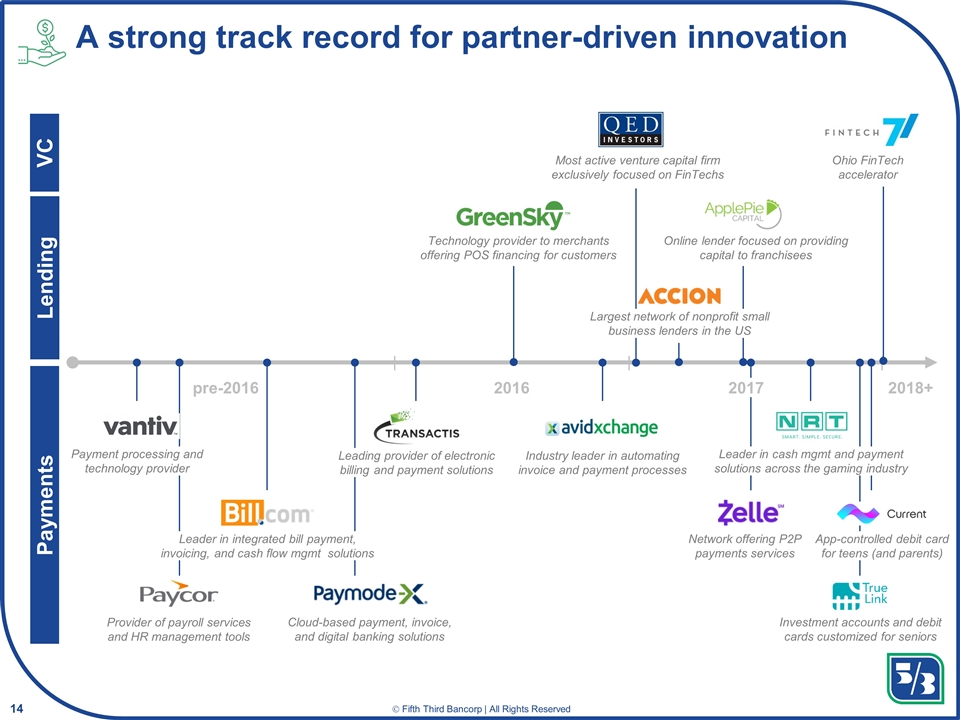

2018+ pre-2016 Technology provider to merchants offering POS financing for customers Leading provider of electronic billing and payment solutions Industry leader in automating invoice and payment processes Leader in cash mgmt and payment solutions across the gaming industry Provider of payroll services and HR management tools Leader in integrated bill payment, invoicing, and cash flow mgmt solutions Cloud-based payment, invoice, and digital banking solutions Payment processing and technology provider Largest network of nonprofit small business lenders in the US Online lender focused on providing capital to franchisees Network offering P2P payments services A strong track record for partner-driven innovation Most active venture capital firm exclusively focused on FinTechs 2017 Lending Payments 2016 Ohio FinTech accelerator VC Investment accounts and debit cards customized for seniors App-controlled debit card for teens (and parents) reprint

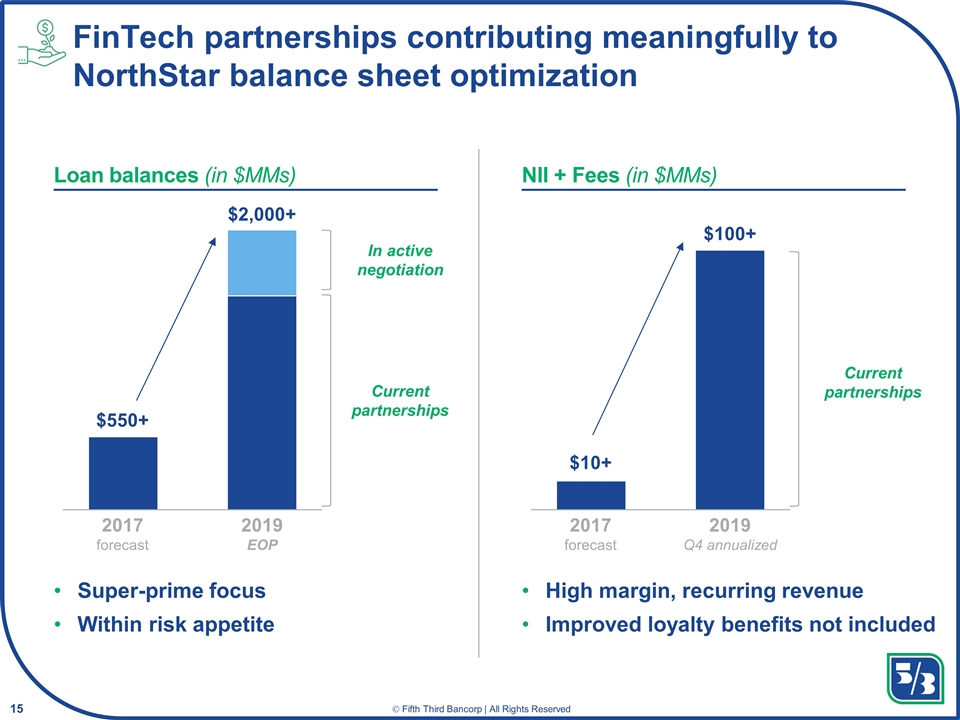

Super-prime focus Within risk appetite $550+ 2017 forecast 2019 EOP Current partnerships In active negotiation High margin, recurring revenue Improved loyalty benefits not included $10+ $100+ 2017 forecast 2019 Q4 annualized Current partnerships Loan balances (in $MMs) NII + Fees (in $MMs) $2,000+ FinTech partnerships contributing meaningfully to NorthStar balance sheet optimization

Digital Strategies Melissa Stevens Senior Vice President Chief Digital Officer

Technology is changing customer expectations and behavior Customers desire a simple, seamless experience Customers want to be met at their point of need Customers require immediacy Customers seek extreme personalization

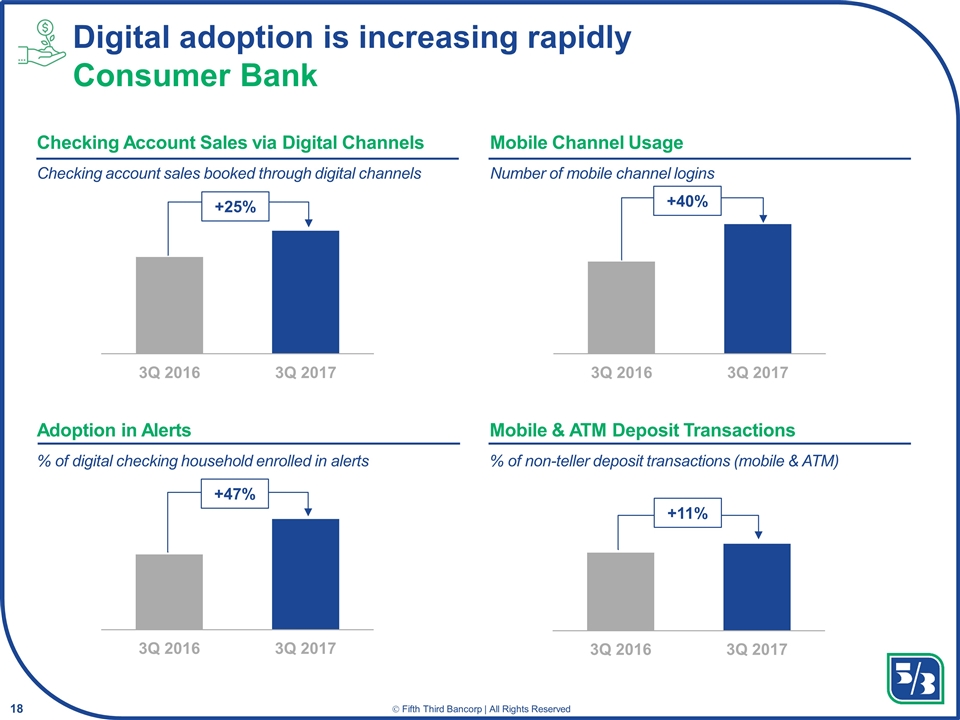

Digital adoption is increasing rapidly Consumer Bank Mobile Channel Usage Number of mobile channel logins Adoption in Alerts % of digital checking household enrolled in alerts Mobile & ATM Deposit Transactions % of non-teller deposit transactions (mobile & ATM) +40% Checking Account Sales via Digital Channels Checking account sales booked through digital channels +25% +47% +11%

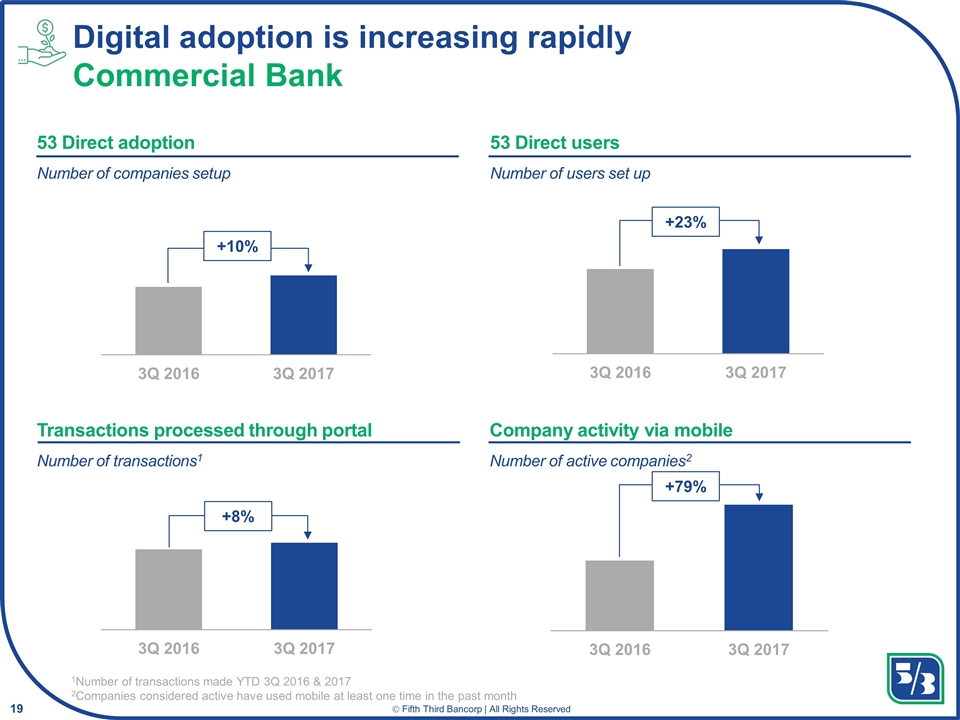

Digital adoption is increasing rapidly Commercial Bank 1Number of transactions made YTD 3Q 2016 & 2017 2Companies considered active have used mobile at least one time in the past month 53 Direct adoption Number of companies setup 53 Direct users Number of users set up Transactions processed through portal Number of transactions1 Company activity via mobile Number of active companies2 +10% +23% +8% +79%

Ratings and reviews reflect the strength of our core digital channels A top rated mobile app Leader in online banking capabilities Top quartile digital performance Leader in business intelligence implementation Named a Leader in Money Movement and Customer Service for online banking categories Top quartile in retail banking customer satisfaction across all digital channels by top industry benchmarking association Consistently rated 4+ stars since insourcing apps in 2015 4+ Early leader in implementing business intelligence platforms to help transform the quality and consistency of advice delivered to commercial clients

Customer insights drive omnichannel experience design and innovation opportunities

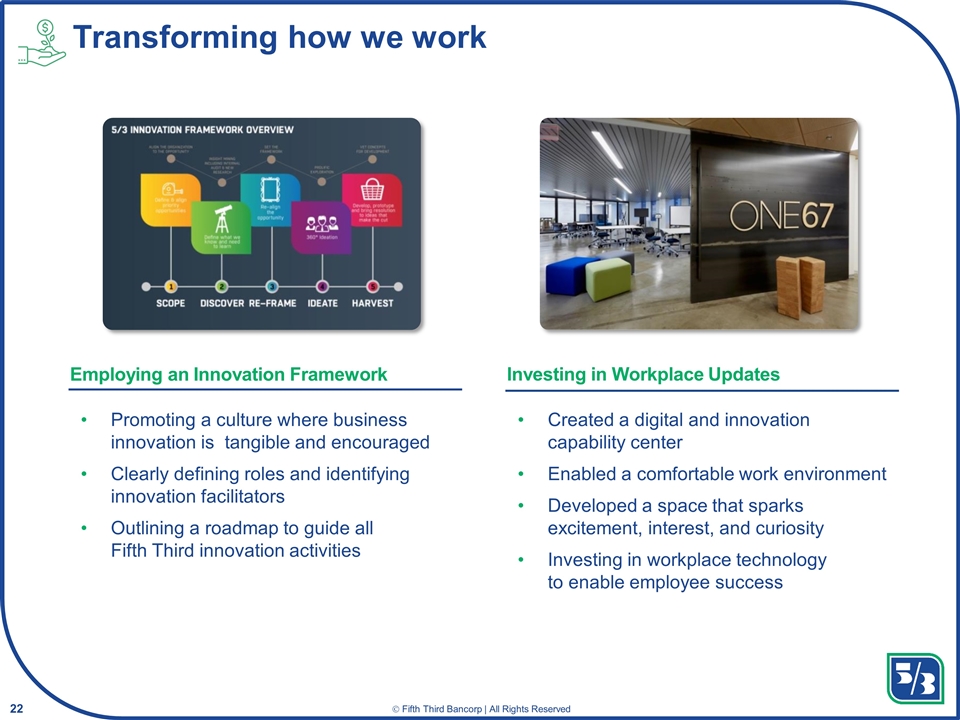

Transforming how we work Promoting a culture where business innovation is tangible and encouraged Clearly defining roles and identifying innovation facilitators Outlining a roadmap to guide all Fifth Third innovation activities Created a digital and innovation capability center Enabled a comfortable work environment Developed a space that sparks excitement, interest, and curiosity Investing in workplace technology to enable employee success Employing an Innovation Framework Investing in Workplace Updates

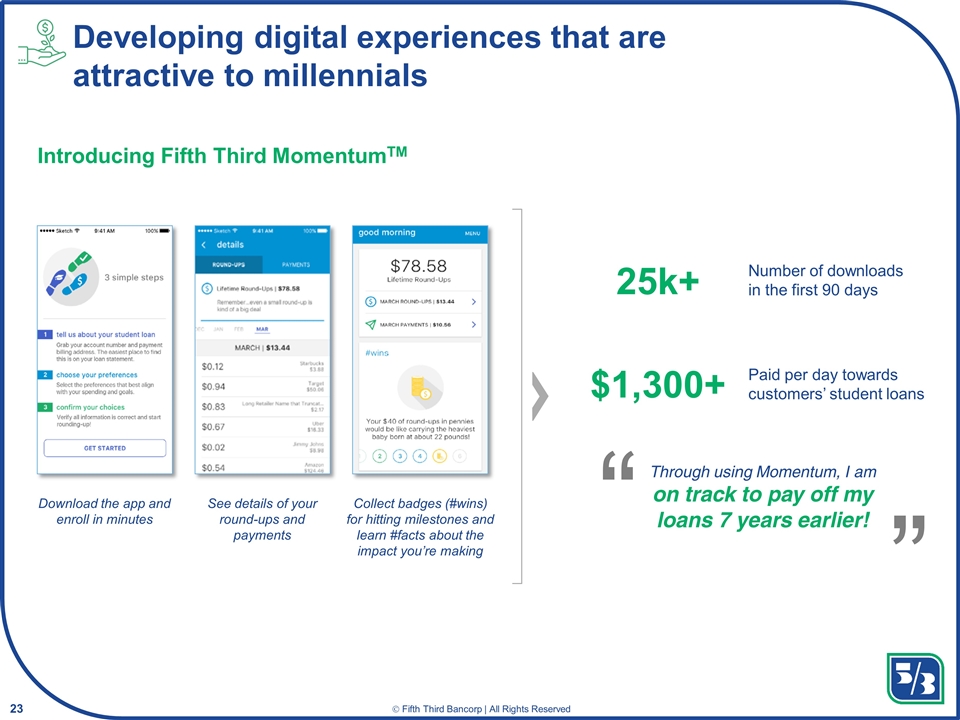

Developing digital experiences that are attractive to millennials Introducing Fifth Third MomentumTM Number of downloads in the first 90 days Paid per day towards customers’ student loans 25k+ $1,300+ Through using Momentum, I am on track to pay off my loans 7 years earlier! Download the app and enroll in minutes See details of your round-ups and payments Collect badges (#wins) for hitting milestones and learn #facts about the impact you’re making

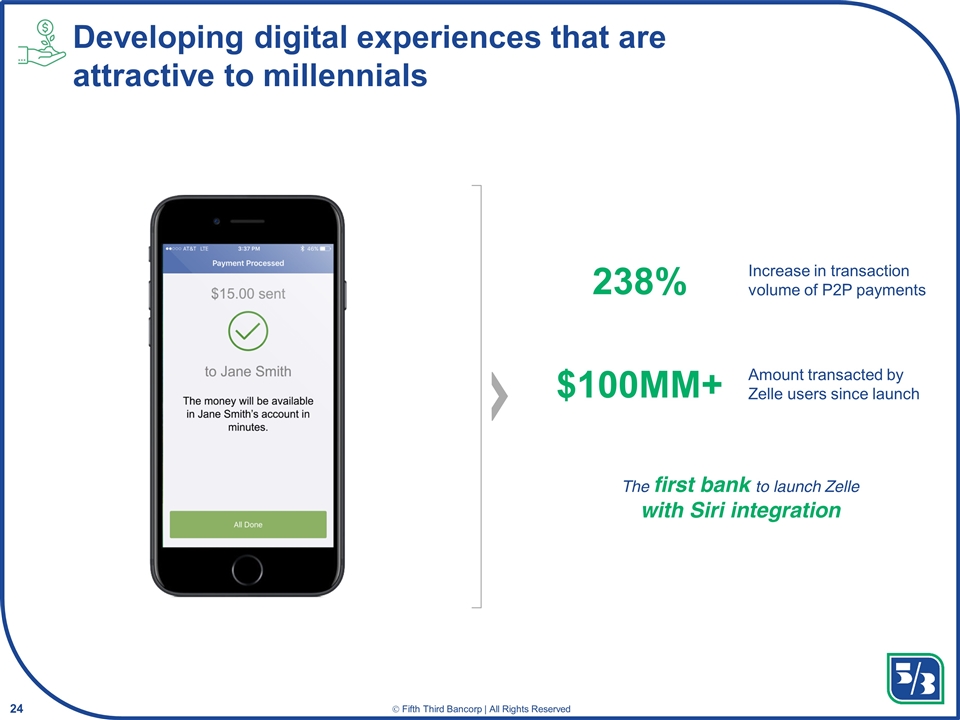

Developing digital experiences that are attractive to millennials Increase in transaction volume of P2P payments Amount transacted by Zelle users since launch 238% $100MM+ The first bank to launch Zelle with Siri integration

Enhancing digital capabilities within the commercial experience Enhancing online and mobile capabilities to improve our client and their team’s experience Iris (RM Portal): Improving banker digital / analytic capabilities

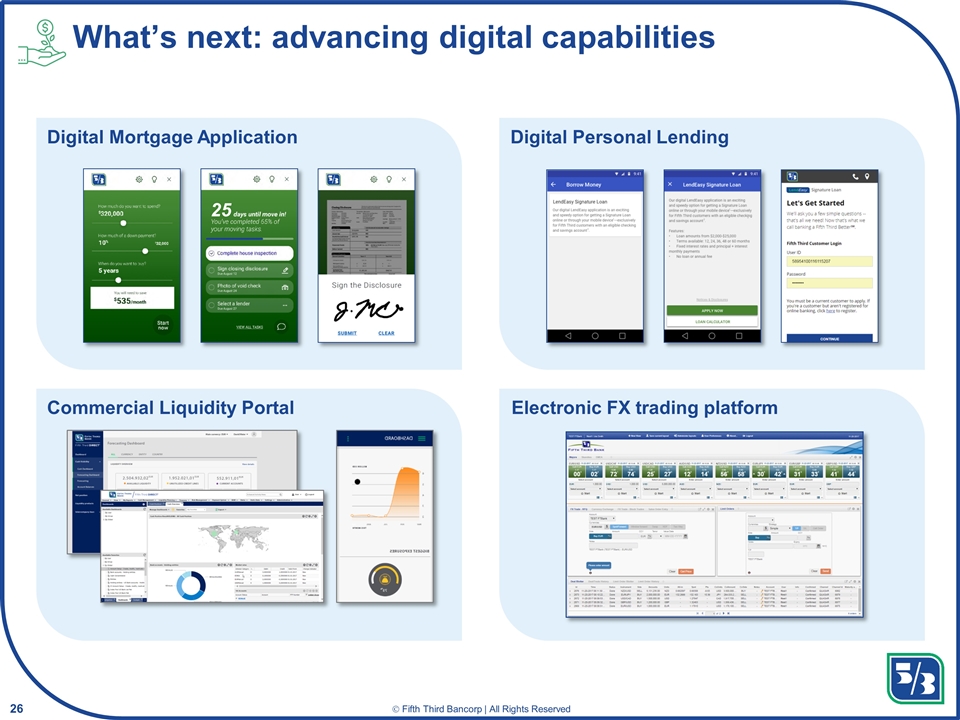

What’s next: advancing digital capabilities Digital Mortgage Application Digital Personal Lending Commercial Liquidity Portal Electronic FX trading platform 25

Payments & Commerce Solutions Jed Scala Executive Vice President Head of Payments Print to the end

Large, growing, attractive market New entrants present opportunities Increased expectations Relationship cornerstone Higher return business Provides diversification & resiliency Key contributor to NorthStar strategy Growing payments is strategically important Market Dynamics Customer Imperative Financial Objectives

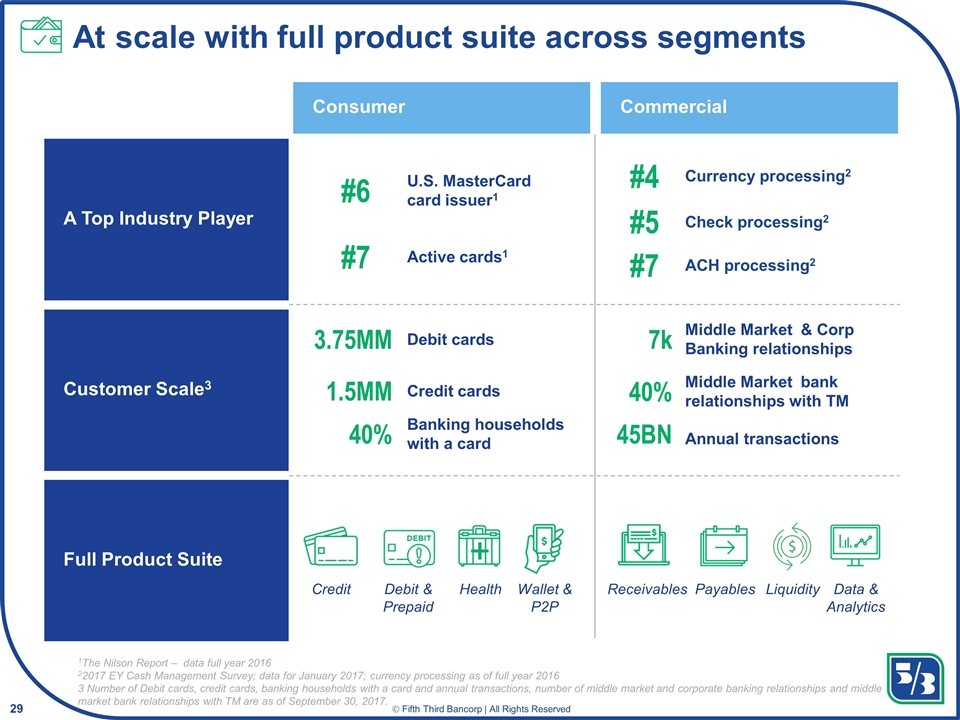

1The Nilson Report – data full year 2016 22017 EY Cash Management Survey; data for January 2017; currency processing as of full year 2016 3 Number of Debit cards, credit cards, banking households with a card and annual transactions, number of middle market and corporate banking relationships and middle market bank relationships with TM are as of September 30, 2017. A Top Industry Player Customer Scale3 Full Product Suite Consumer Commercial Active cards1 U.S. MasterCard card issuer1 #7 #6 3.75MM 1.5MM 40% Debit cards Credit cards Banking households with a card Credit Debit & Prepaid Health Wallet & P2P Check processing2 Currency processing2 #5 #4 ACH processing2 #7 7k 40% 45BN Middle Market & Corp Banking relationships Middle Market bank relationships with TM Annual transactions Receivables Payables Liquidity Data & Analytics At scale with full product suite across segments

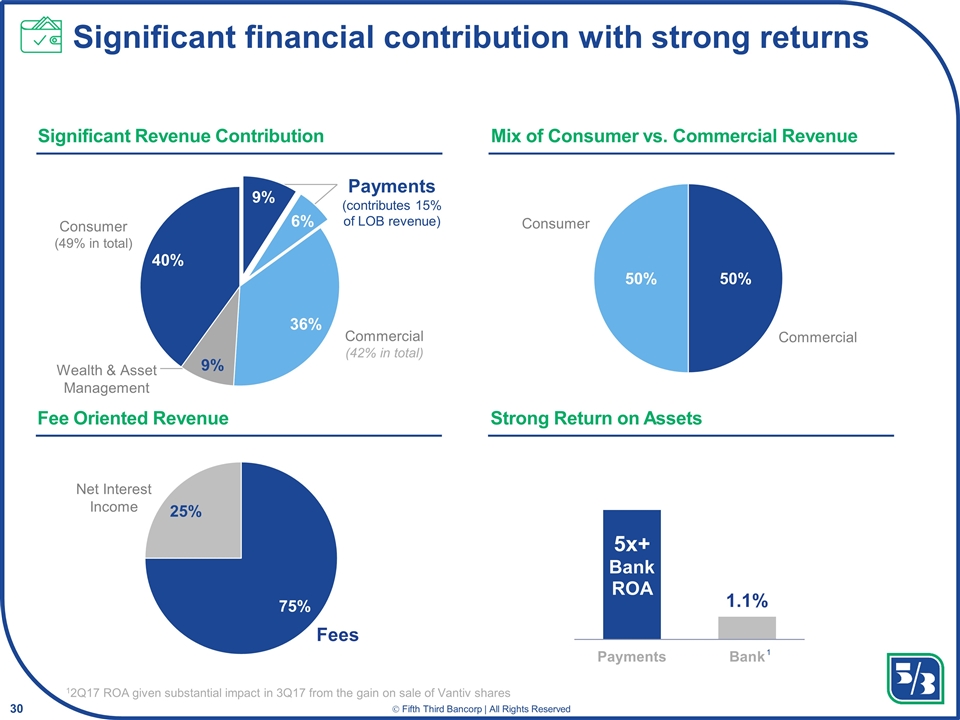

12Q17 ROA given substantial impact in 3Q17 from the gain on sale of Vantiv shares 1 Mix of Consumer vs. Commercial Revenue Fee Oriented Revenue Strong Return on Assets Significant Revenue Contribution Significant financial contribution with strong returns

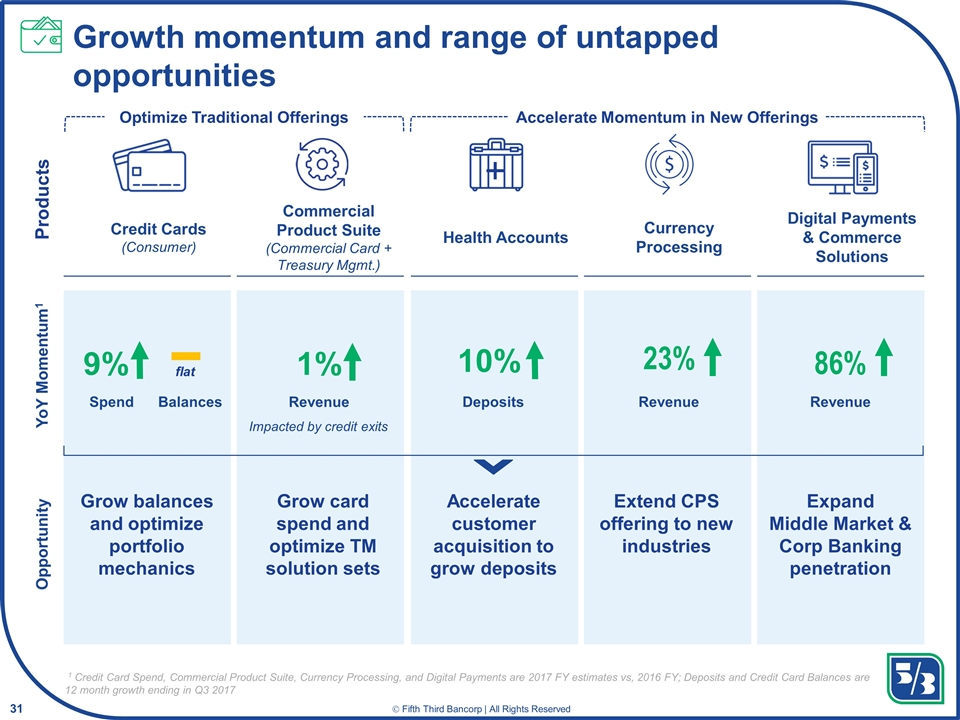

YoY Momentum1 Opportunity Products Optimize Traditional Offerings Accelerate Momentum in New Offerings Credit Cards (Consumer) Commercial Product Suite (Commercial Card + Treasury Mgmt.) Health Accounts Currency Processing Digital Payments & Commerce Solutions Deposits Revenue Revenue Revenue Spend 9% 10% 23% 86% 1% Balances flat Grow balances and optimize portfolio mechanics Grow card spend and optimize TM solution sets Accelerate customer acquisition to grow deposits Extend CPS offering to new industries Expand Middle Market & Corp Banking penetration 1 Credit Card Spend, Commercial Product Suite, Currency Processing, and Digital Payments are 2017 FY estimates vs, 2016 FY; Deposits and Credit Card Balances are 12 month growth ending in Q3 2017 -Changed “AR” to “Balances” under Credit Card column -Changed Revenue from “1%” to “4%” and added “excluding strategic exits -Need to validate that 4% is the correct number -Jamie asked if the last column was included in column 2 and if we pull it out, what would be the impact on the growth -Added “& Corp Banking” under opportunity under Digital Payments Column Impacted by credit exits Growth momentum and range of untapped opportunities

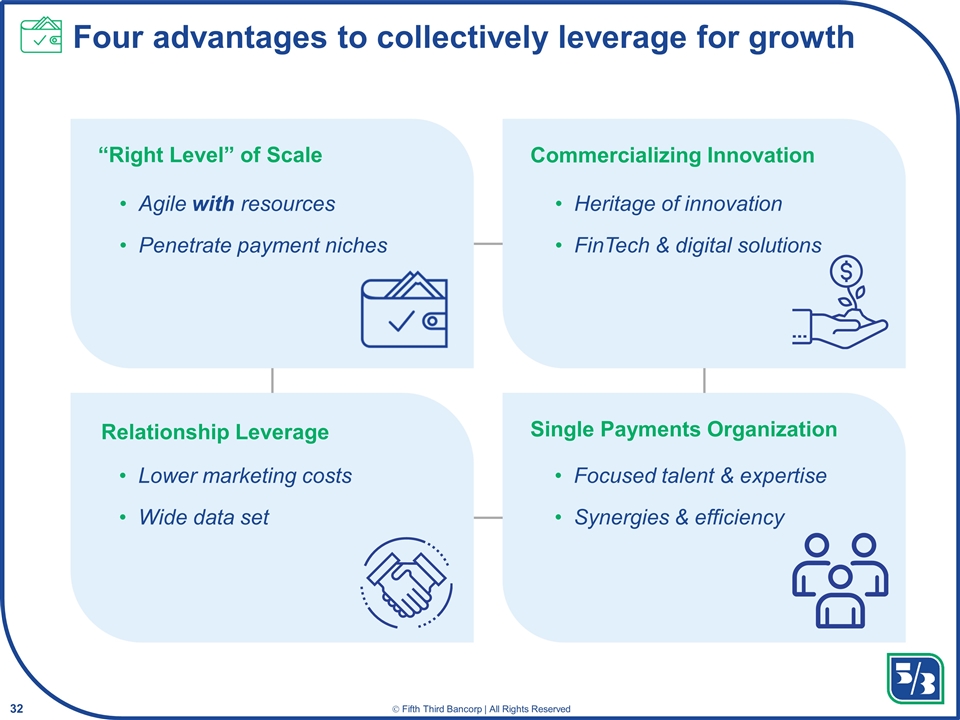

“Right Level” of Scale Commercializing Innovation Relationship Leverage Single Payments Organization Agile with resources Penetrate payment niches Heritage of innovation FinTech & digital solutions Lower marketing costs Wide data set Focused talent & expertise Synergies & efficiency Four advantages to collectively leverage for growth

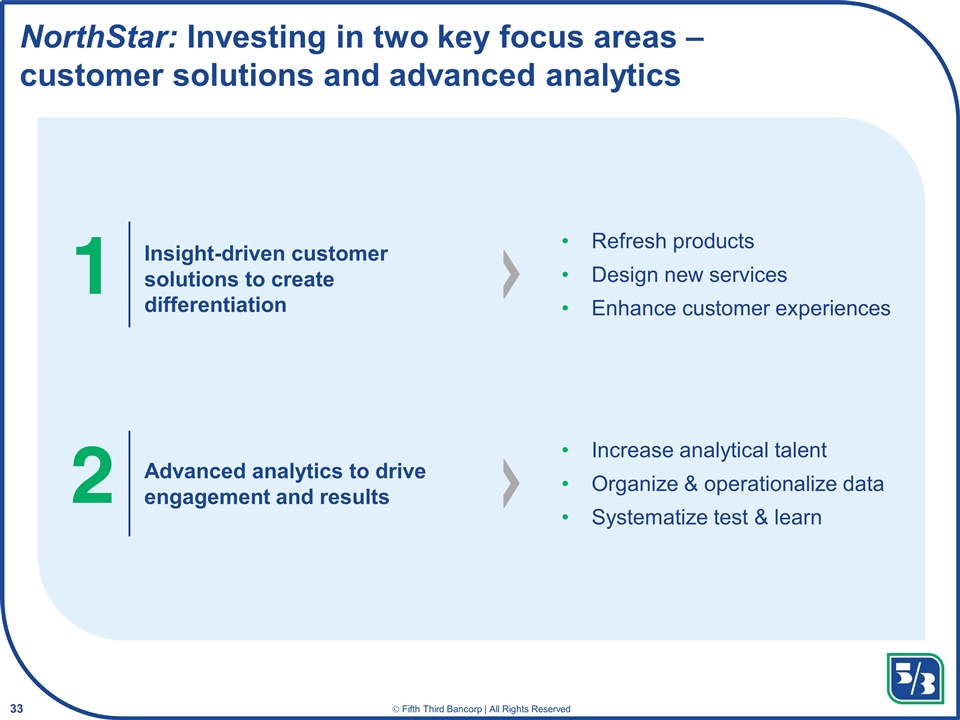

NorthStar: Investing in two key focus areas – customer solutions and advanced analytics 1 Insight-driven customer solutions to create differentiation Refresh products Design new services Enhance customer experiences 2 Advanced analytics to drive engagement and results Increase analytical talent Organize & operationalize data Systematize test & learn

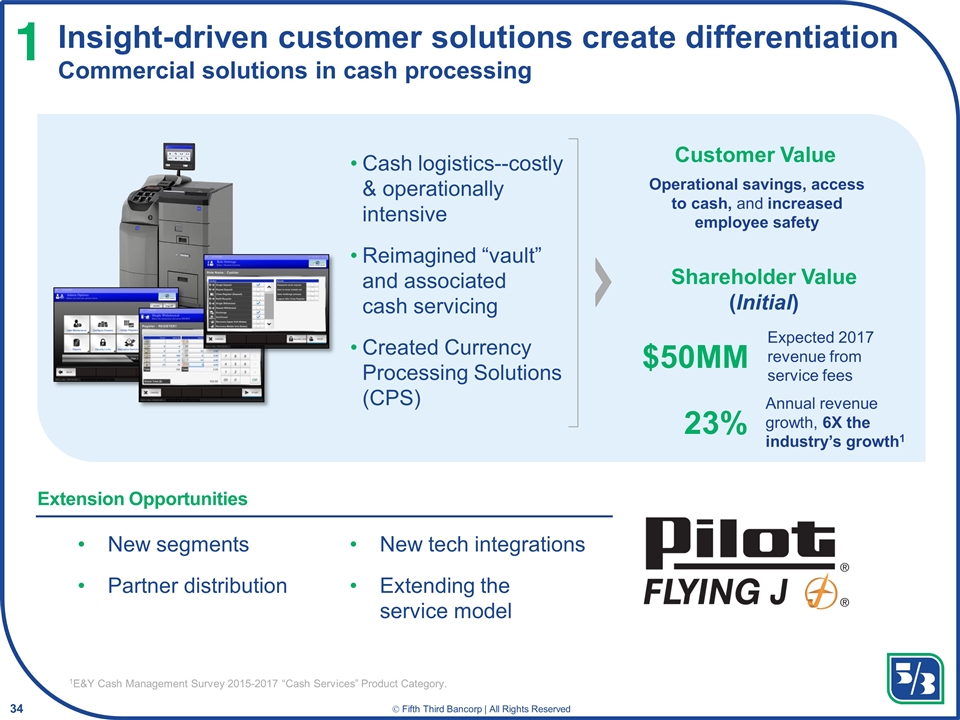

Insight-driven customer solutions create differentiation Commercial solutions in cash processing 1 Cash logistics--costly & operationally intensive Reimagined “vault” and associated cash servicing Created Currency Processing Solutions (CPS) Expected 2017 revenue from service fees Annual revenue growth, 6X the industry’s growth1 $50MM 23% Operational savings, access to cash, and increased employee safety -Removed Delaware North logo -researching amount of cash payments Added footnote 1E&Y Cash Management Survey 2015-2017 “Cash Services” Product Category. Customer Value Shareholder Value (Initial) New segments Partner distribution New tech integrations Extending the service model Extension Opportunities

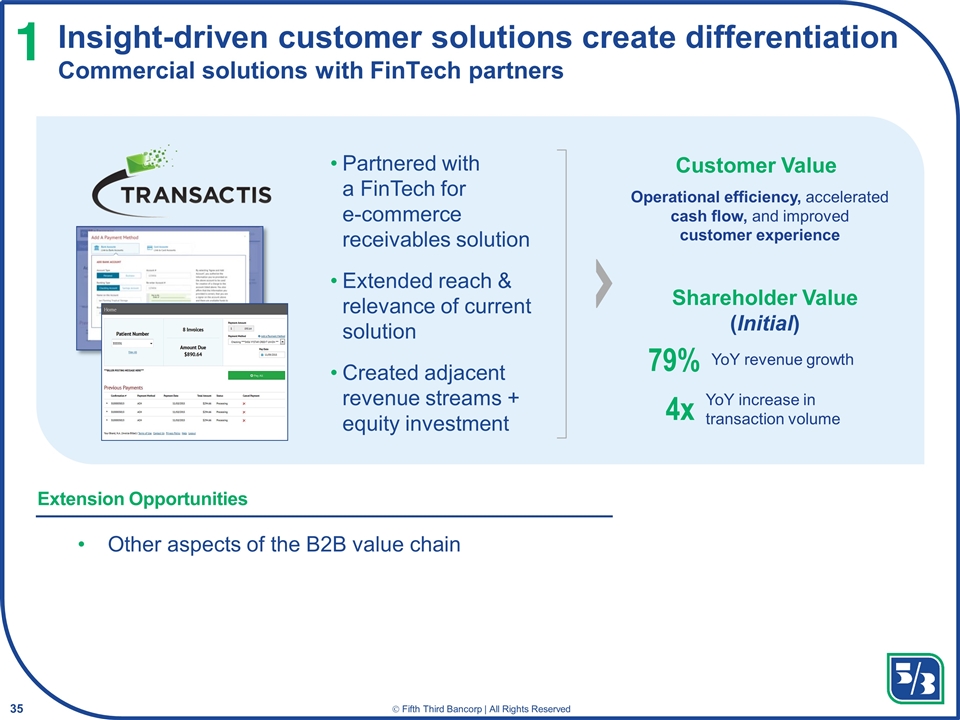

Insight-driven customer solutions create differentiation Commercial solutions with FinTech partners 1 Partnered with a FinTech for e-commerce receivables solution Extended reach & relevance of current solution Created adjacent revenue streams + equity investment YoY revenue growth YoY increase in transaction volume 79% 4x Operational efficiency, accelerated cash flow, and improved customer experience Customer Value Shareholder Value (Initial) Other aspects of the B2B value chain Extension Opportunities

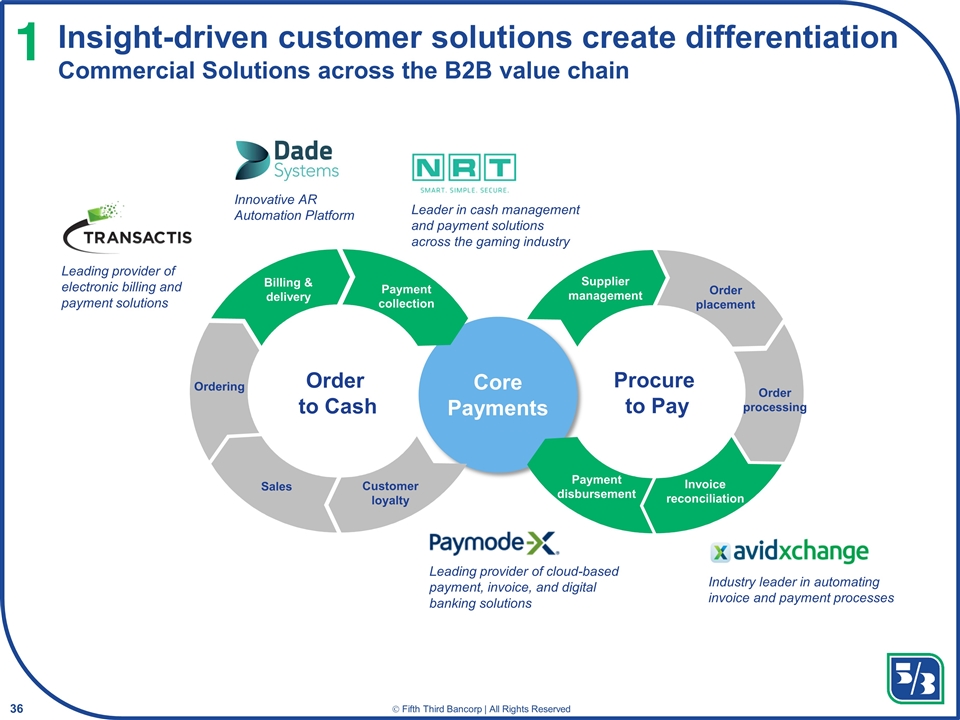

Insight-driven customer solutions create differentiation Commercial Solutions across the B2B value chain 1 Changed Supplier Management to Green per discussion with Bridgit Billing & delivery Payment collection Customer loyalty Sales Ordering Payment disbursement Invoice reconciliation Order processing Order placement Supplier management Order to Cash Procure to Pay Leading provider of electronic billing and payment solutions Leader in cash management and payment solutions across the gaming industry Core Payments Leading provider of cloud-based payment, invoice, and digital banking solutions Industry leader in automating invoice and payment processes Innovative AR Automation Platform

Insight-driven customer solutions create differentiation Consumer solutions in credit cards 1 Increase in spend active cards in the portfolio1 +6.4% More relevant rewards & revolver value propositions for customers and prospects Upgrading our value proposition to attract high potential customers Fifth Third current customers Prospects 1Increase in number of active cards in portfolio from Q3 2016 vs. Q3 2017 Customer Value Shareholder Value (Initial) Targeted migrations Secured card Graduation strategies Additional products Extension Opportunities

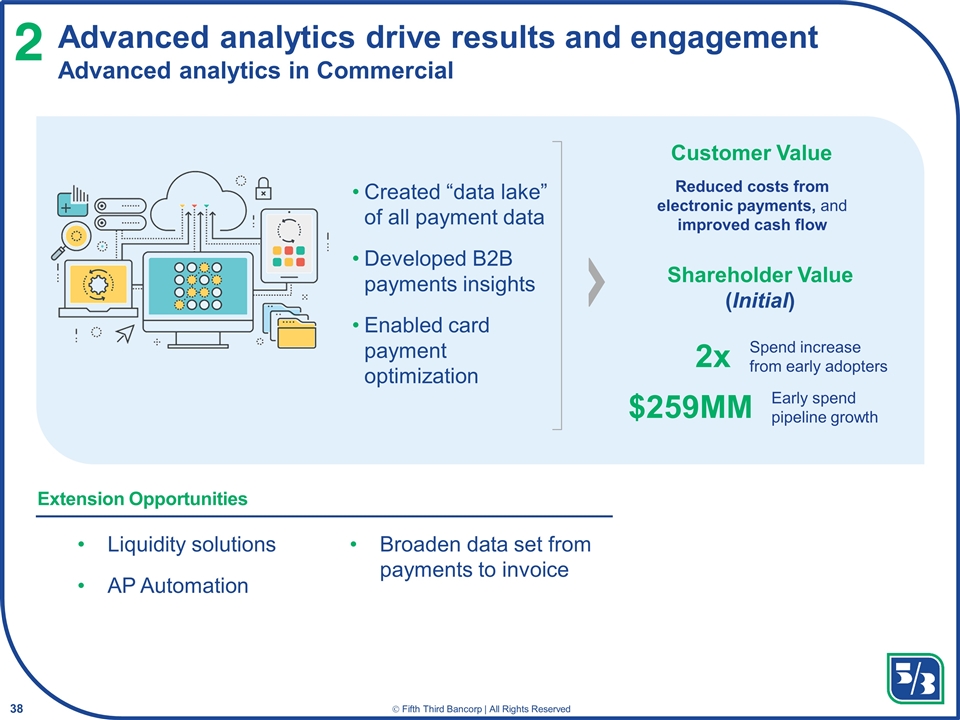

Advanced analytics drive results and engagement Advanced analytics in Commercial 2 Created “data lake” of all payment data Developed B2B payments insights Enabled card payment optimization Spend increase from early adopters Early spend pipeline growth 2x $259MM Reduced costs from electronic payments, and improved cash flow Customer Value Shareholder Value (Initial) Liquidity solutions AP Automation Broaden data set from payments to invoice Extension Opportunities

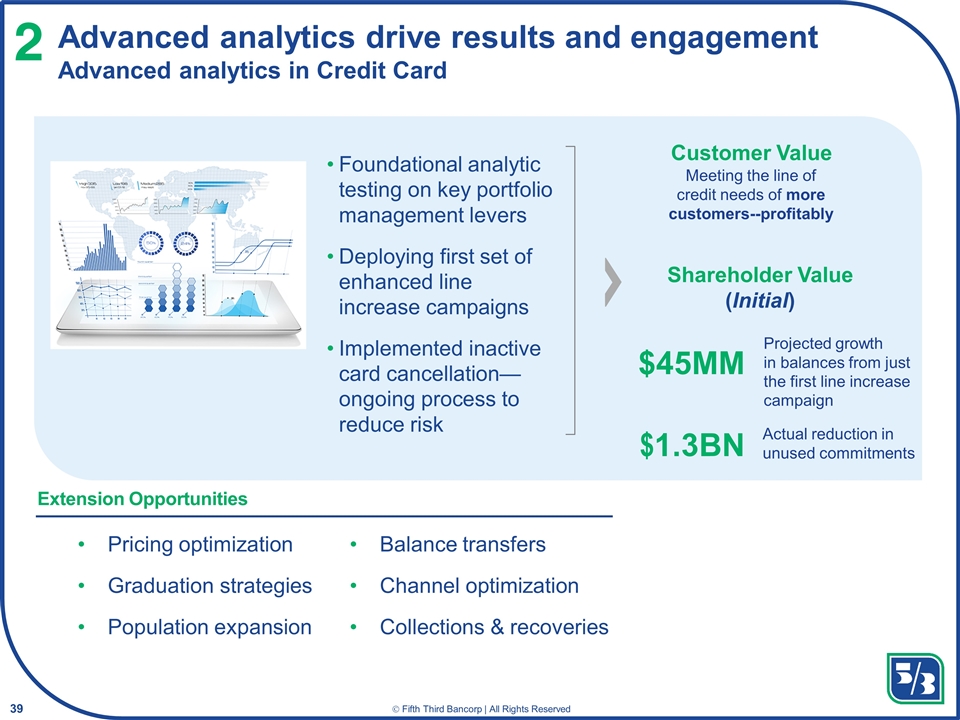

Advanced analytics drive results and engagement Advanced analytics in Credit Card 2 Foundational analytic testing on key portfolio management levers Deploying first set of enhanced line increase campaigns Implemented inactive card cancellation— ongoing process to reduce risk Projected growth in balances from just the first line increase campaign $45MM Meeting the line of credit needs of more customers--profitably Actual reduction in unused commitments $1.3BN Pricing optimization Graduation strategies Population expansion Balance transfers Channel optimization Collections & recoveries Extension Opportunities Customer Value Shareholder Value (Initial)

Payments & Commerce Solutions summary Existing large scale business with attractive returns Extending advantages by investing in customer solutions & analytics Executing at pace against a range of growth opportunities Targeting profitable growth and consistent performance

Market dynamics are creating the opportunity and imperative to reimagine the business model Brand, Analytics, Digital, and Payments summary Fifth Third is investing in key areas of differentiation to deliver a superior client experience and our NorthStar targets Strategies in each area are already bearing fruit and the signs of success are positive

Tim Spence Biography Tim Spence is executive vice president and chief strategy officer. He is responsible for Fifth Third’s corporate strategy, innovation, marketing, decision analytics, corporate development and FinTech partnerships teams, as well as the bank’s Payments & Commerce Solutions line of business. Tim joined Fifth Third from Oliver Wyman, where he was a senior partner in the Financial Services practice group, advising executives at the world’s largest financial institutions on strategy, innovation and performance improvement. He also served as the firm’s U.S. Midwest region leader. Prior to joining Oliver Wyman, Tim held a variety of management positions at two early-stage technology firms. Education Tim earned a bachelor’s degree in English with a minor in Economics from Colgate University, graduating with High Honors. Professional and Civic Tim is active in the industry, having served for several years as chairman of the American Banker’s Marketing and Innovation Symposium. He has written extensively on the evolving financial services landscape. He also serves on the executive committee of the board of directors at Cintrifuse, a public-private partnership that exists to build a sustainable tech-based economy for the Greater Cincinnati region. Executive Vice President Chief Strategy Officer Date Joined Fifth Third: September 2015

Melissa Stevens Biography Melissa Stevens serves as senior vice president, chief digital officer and head of omnichannel banking, design and innovation. She is charged with ensuring a client-centric, digital-first approach to all areas of the Bank, including Consumer Banking, Commercial Banking, and Wealth & Asset Management. Melissa joined Fifth Third in May 2016. She is responsible for architecting a cross-organizational strategic plan for an integrated and seamless customer experience. She is leading an “omni” approach to banking, focusing across the full customer journey, including how customers shop, buy and obtain services; integrating experiences across channels from banking online or through a mobile device to utilizing ATMs and visiting branches. At the same time, she’s focused on changing the way the bank works to meet today’s challenges – she aims to propel the bank forward by operating differently; bringing the “outside-in”; and, accelerating adjacent and disruptive opportunities. Previously, Melissa held several senior management positions at Citigroup, including Chief Operating Officer for Citi FinTech, a new consumer unit charged with creating a smartphone-centric business model. She was also head of Citi’s Consumer Innovation Labs. Prior to that she was the Global Digital head for Citi’s consumer banking business, where she oversaw the organization’s growing online and mobile banking services for clients in more than 700 cities globally. Earlier in her career, Melissa held general consumer banking positions across various Citi businesses and functions, including mortgage, retail banking and credit cards; across geographies including Brazil, Spain and the United States. In 2014, she was named to Crain’s New York “40 under 40” and in both 2015 and 2016, she was named to Bank Innovation’s “Innovators to Watch.” Education Melissa graduated from Kalamazoo College, holds a Master’s Degree from Michigan State University’s School of Labor & Industrial Relations; and, received her M.B.A. in Finance and Operations from New York University’s Stern School of Business. Senior Vice President Chief Digital Officer and Head of Omnichannel, Design and Innovation Date Joined Fifth Third: May 2016

Jed Scala Biography Executive Vice President, Head of Payments & Commerce Solutions Date Joined Fifth Third: October 2017 Positions Held at Fifth Third: 2017Head of Payments & Commerce Solutions Jed Scala serves as Executive Vice President and Head of Payments & Commerce Solutions for Fifth Third Bancorp. He assumed this role in October 2017 and is responsible for leading the growth objectives for this recently formed division. Jed brings two decades of experience leading and growing payment, loyalty and lending businesses across both the consumer and small business segments at American Express. During his tenure at the company, Jed consistently demonstrated the ability to create compelling customer value, successfully launch new ventures and deliver business outcomes at scale across a wide range of business lines. As the SVP & GM of U.S. Consumer Lending at American Express, he accelerated the growth trajectory of the Consumer proprietary Credit Card portfolio during a critical period for the company. Jed also brings broad knowledge of small business credit cards, financing and B2B payments having worked in OPEN, American Express’ small business division, for almost a decade. Fostering innovation, cultivating mission driven cultures, differentiating on customer experience and digital products have been common threads throughout Jed’s career as most recently evidenced by his leadership on American Express Personal Loans, a successful rival to FinTech offerings, Pay It & Plan It a newly launched lending feature, and Plenti, the first loyalty coalition in the United States. Education Jed holds an MBA from Columbia Business School, and a BA from Williams College. Professional and Civic Jed has a long history of community involvement including having served on the board of Count-me-in for Women’s Economic Independence in New York City, Co-Chair of the Berkshire School Advisory Board in Sheffield, Massachusetts and as a Philanthropic Advisor for the Each Foundation in San Francisco.

Technology & Operations Aravind Immaneni Executive Vice President Chief Operations & Technology Officer

Cautionary statement This presentation contains statements that we believe are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder. These statements relate to our financial condition, results of operations, plans, objectives, future performance or business. They usually can be identified by the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “is anticipated,” “potential,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or similar verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K, as updated by our Quarterly Reports on Form 10-Q. When considering these forward-looking statements, you should keep in mind these risks and uncertainties, as well as any cautionary statements we may make. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to us. We undertake no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this document. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) general economic or real estate market conditions, either nationally or in the states in which Fifth Third, one or more acquired entities and/or the combined company do business, weaken or are less favorable than expected; (2) deteriorating credit quality; (3) political developments, wars or other hostilities may disrupt or increase volatility in securities markets or other economic conditions; (4) changes in the interest rate environment reduce interest margins; (5) prepayment speeds, loan origination and sale volumes, charge-offs and loan loss provisions; (6) Fifth Third’s ability to maintain required capital levels and adequate sources of funding and liquidity; (7) maintaining capital requirements and adequate sources of funding and liquidity may limit Fifth Third’s operations and potential growth; (8) changes and trends in capital markets; (9) problems encountered by larger or similar financial institutions may adversely affect the banking industry and/or Fifth Third; (10) competitive pressures among depository institutions increase significantly; (11) changes in customer preferences or information technology systems; (12) effects of critical accounting policies and judgments; (13) changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board (FASB) or other regulatory agencies; (14) legislative or regulatory changes or actions, or significant litigation, adversely affect Fifth Third, one or more acquired entities and/or the combined company or the businesses in which Fifth Third, one or more acquired entities and/or the combined company are engaged, including the Dodd-Frank Wall Street Reform and Consumer Protection Act; (15) ability to maintain favorable ratings from rating agencies; (16) failure of models or risk management systems or controls; (17) fluctuation of Fifth Third’s stock price; (18) ability to attract and retain key personnel; (19) ability to receive dividends from its subsidiaries; (20) potentially dilutive effect of future acquisitions on current shareholders’ ownership of Fifth Third; (21) declines in the value of Fifth Third’s goodwill or other intangible assets; (22) effects of accounting or financial results of one or more acquired entities; (23) difficulties from Fifth Third’s investment in, relationship with, and nature of the operations of Vantiv Holding, LLC; (24) loss of income from any sale or potential sale of businesses; (25) difficulties in separating the operations of any branches or other assets divested; (26) losses or adverse impacts on the carrying values of branches and long-lived assets in connection with their sales or anticipated sales; (27) inability to achieve expected benefits from branch consolidations and planned sales within desired timeframes, if at all; (28) ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks; (29) the negotiation and (if any) implementation by Vantiv, Inc. and/or Worldpay Group plc of the potential acquisition of Worldpay Group plc by Vantiv, Inc. and such other actions as Vantiv, Inc. and Worldpay Group plc may take in furtherance thereof; and (30) the impact of reputational risk created by these developments on such matters as business generation and retention, funding and liquidity. You should refer to our periodic and current reports filed with the Securities and Exchange Commission, or “SEC,” for further information on other factors, which could cause actual results to be significantly different from those expressed or implied by these forward-looking statements. In this presentation, we may sometimes provide non-GAAP financial information. Please note that although non-GAAP financial measures provide useful insight to analysts, investors and regulators, they should not be considered in isolation or relied upon as a substitute for analysis using GAAP measures. If applicable, we provide GAAP reconciliations for non-GAAP measures in a later slide in this presentation which is also available in the investor relations section of our website, www.53.com.

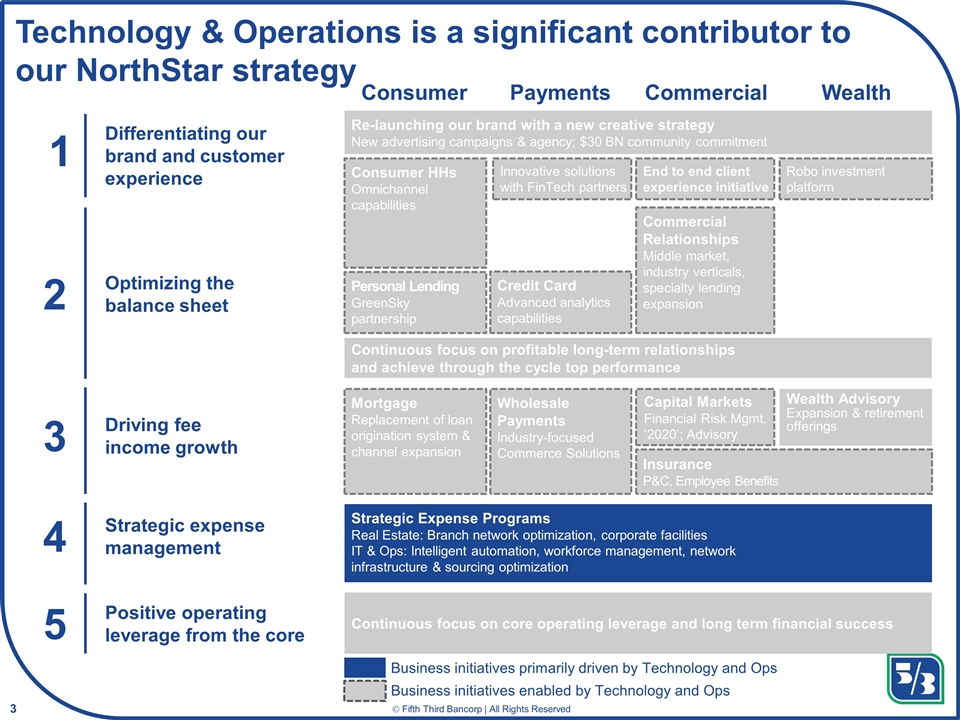

Capital Markets Financial Risk Mgmt. ‘2020’; Advisory Technology & Operations is a significant contributor to our NorthStar strategy 1 Differentiating our brand and customer experience 2 Optimizing the balance sheet Driving fee income growth 3 4 Strategic expense management Consumer Payments Commercial Wealth 5 Positive operating leverage from the core Personal Lending GreenSky partnership Credit Card Advanced analytics capabilities Wholesale Payments Industry-focused Commerce Solutions Insurance P&C, Employee Benefits Commercial Relationships Middle market, industry verticals, specialty lending expansion Wealth Advisory Expansion & retirement offerings Strategic Expense Programs Real Estate: Branch network optimization, corporate facilities IT & Ops: Intelligent automation, workforce management, network infrastructure & sourcing optimization Re-launching our brand with a new creative strategy New advertising campaigns & agency; $30 BN community commitment Consumer HHs Omnichannel capabilities Continuous focus on core operating leverage and long term financial success Mortgage Replacement of loan origination system & channel expansion Continuous focus on profitable long-term relationships and achieve through the cycle top performance End to end client experience initiative Robo investment platform Innovative solutions with FinTech partners Business initiatives enabled by Technology and Ops Business initiatives primarily driven by Technology and Ops

The evolution of technology is changing banking Digitization, Automation & Big Data are Enabling Transformation An opportunity exists to differentiate against our peers, deliver against our objectives, and continue to provide a great customer experience Mobile is Changing the Way the Experiences are Consumed

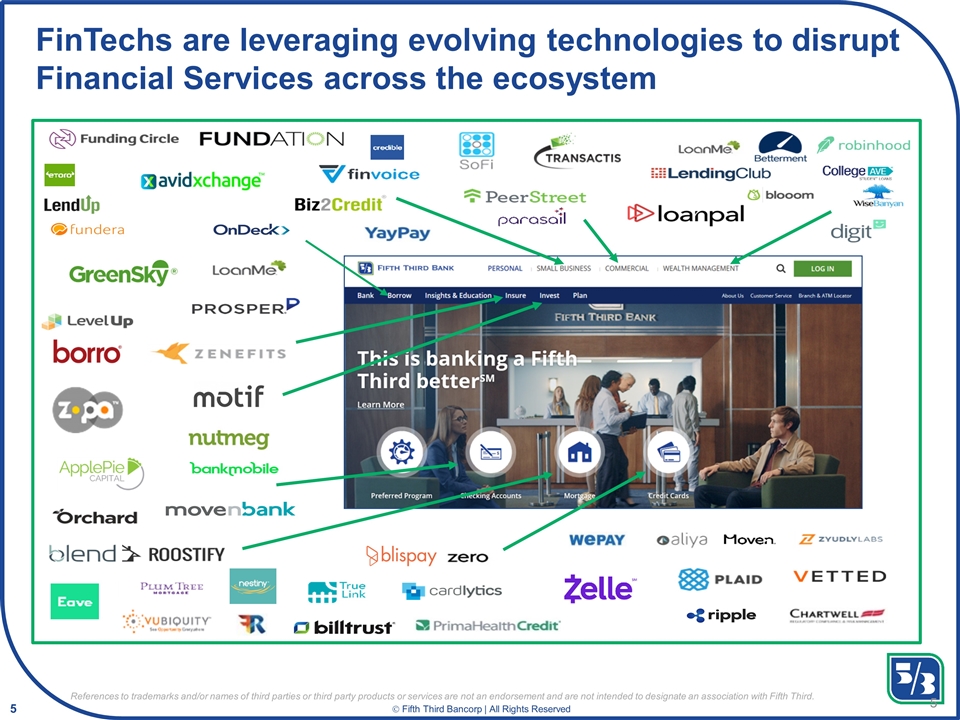

FinTechs are leveraging evolving technologies to disrupt Financial Services across the ecosystem References to trademarks and/or names of third parties or third party products or services are not an endorsement and are not intended to designate an association with Fifth Third.

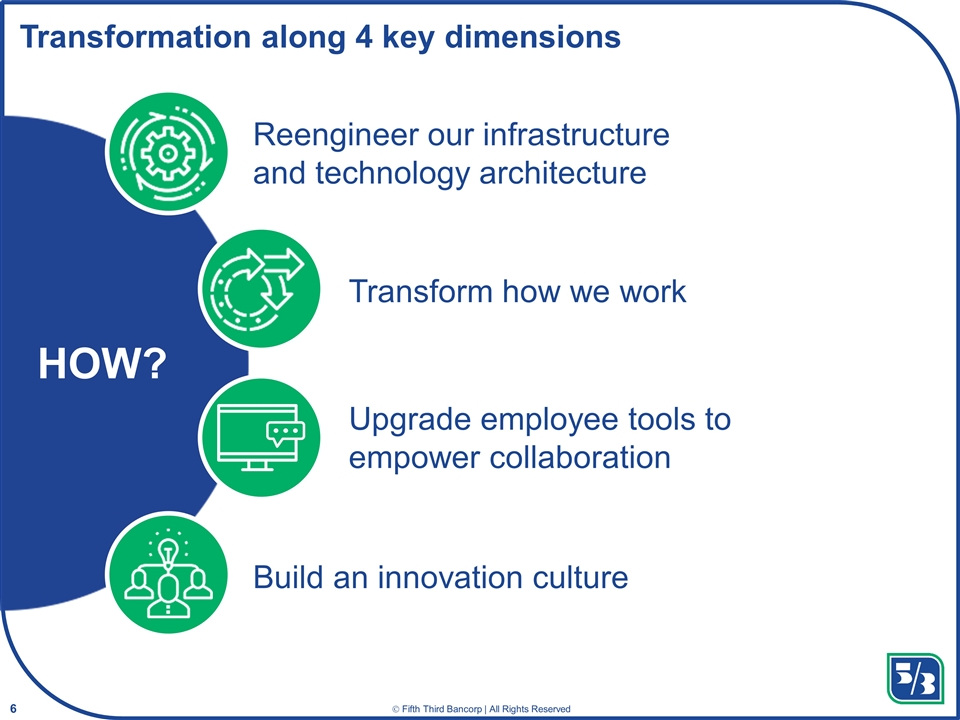

Build an innovation culture Transform how we work Upgrade employee tools to empower collaboration Reengineer our infrastructure and technology architecture HOW? Transformation along 4 key dimensions

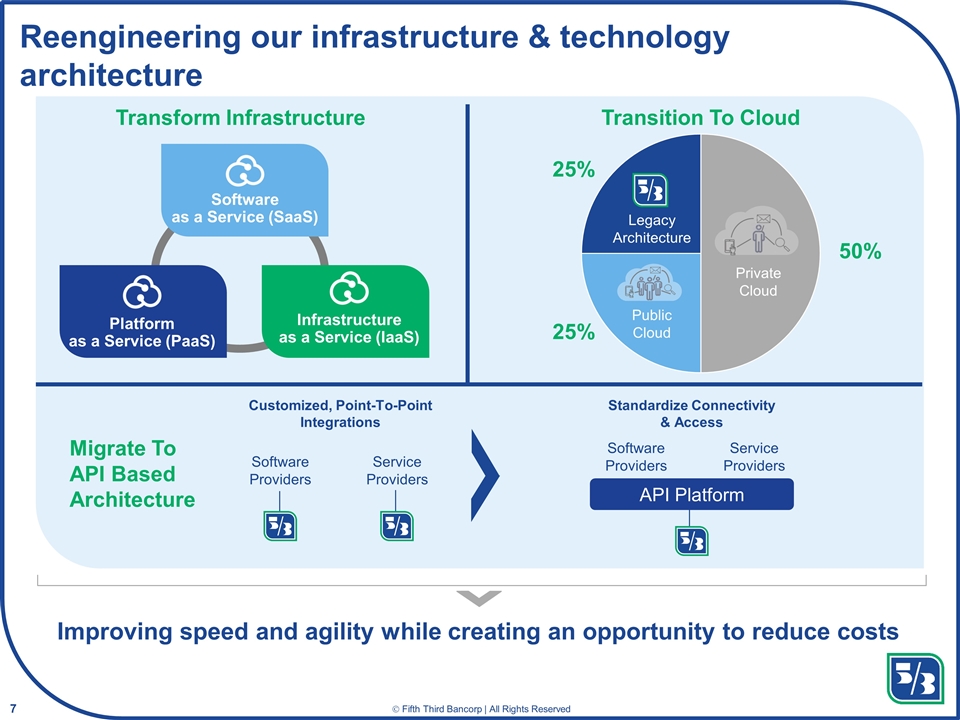

Reengineering our infrastructure & technology architecture Transform Infrastructure Transition To Cloud Migrate To API Based Architecture Platform as a Service (PaaS) Private Cloud Public Cloud Legacy Architecture Standardize Connectivity & Access Software Providers Service Providers Customized, Point-To-Point Integrations Software Providers Service Providers API Platform Improving speed and agility while creating an opportunity to reduce costs 25% 25% 50% Infrastructure as a Service (IaaS) Software as a Service (SaaS)

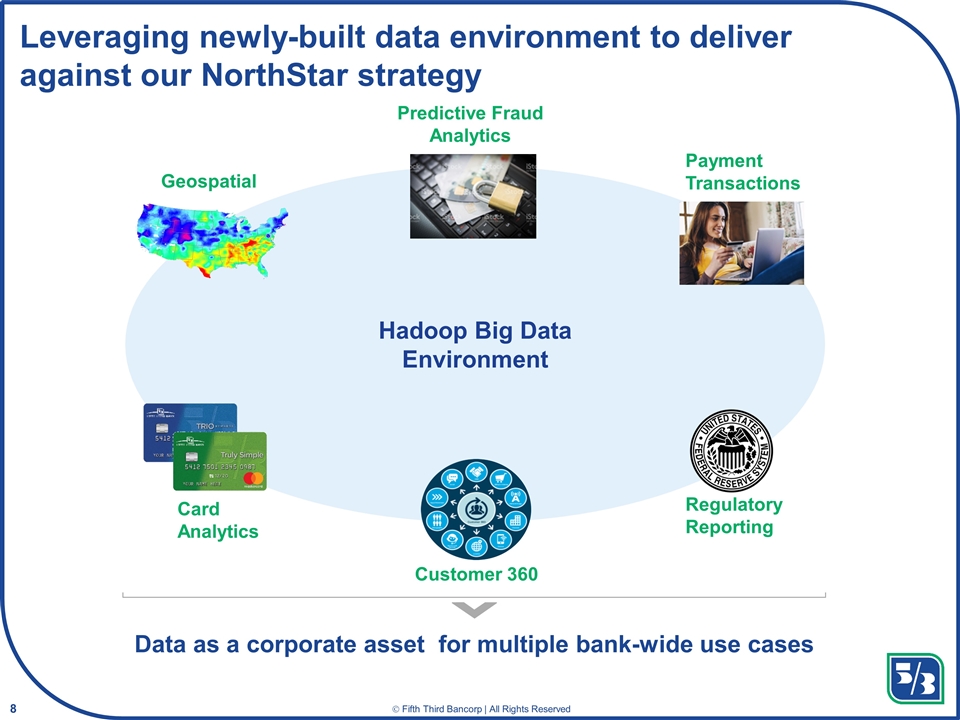

Leveraging newly-built data environment to deliver against our NorthStar strategy Data as a corporate asset for multiple bank-wide use cases Hadoop Big Data Environment Payment Transactions Card Analytics Regulatory Reporting Predictive Fraud Analytics Geospatial Customer 360

Enhancing information security capabilities Being mindful of potential cyber security risks as we transform our infrastructure and evolve our capabilities Investing in a state-of-the-art cyber fusion center Anomaly detection capabilities NSA/DHS accredited workforce Continuous cyber resiliency testing Dark web threat intelligence Utilizing white hat hackers

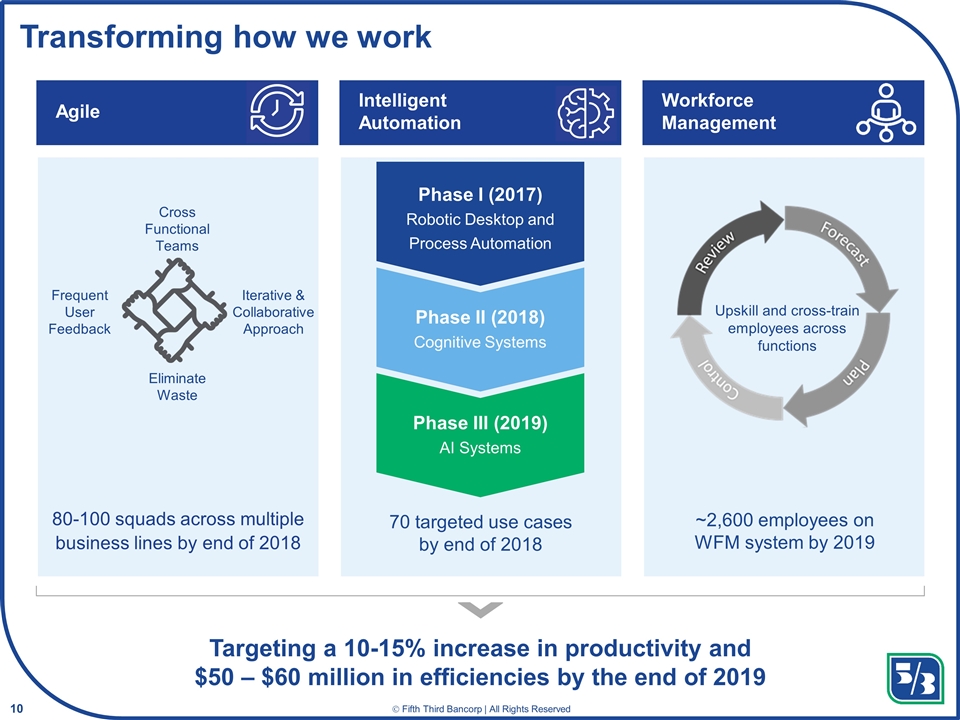

Transforming how we work Agile Intelligent Automation Workforce Management Cross Functional Teams Eliminate Waste Iterative & Collaborative Approach Frequent User Feedback 80-100 squads across multiple business lines by end of 2018 70 targeted use cases by end of 2018 ~2,600 employees on WFM system by 2019 Upskill and cross-train employees across functions Targeting a 10-15% increase in productivity and $50 – $60 million in efficiencies by the end of 2019 Phase I (2017) Robotic Desktop and Process Automation Phase II (2018) Cognitive Systems Phase III (2019) AI Systems

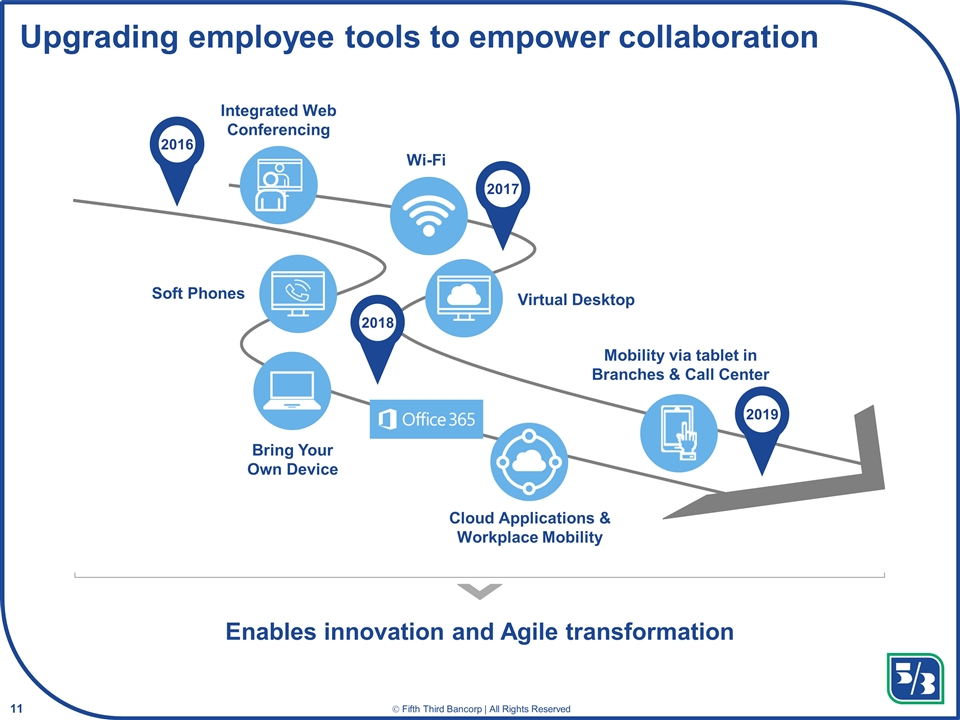

Upgrading employee tools to empower collaboration Soft Phones Bring Your Own Device Virtual Desktop Cloud Applications & Workplace Mobility Integrated Web Conferencing Wi-Fi Mobility via tablet in Branches & Call Center 2016 2017 2018 2019 Enables innovation and Agile transformation

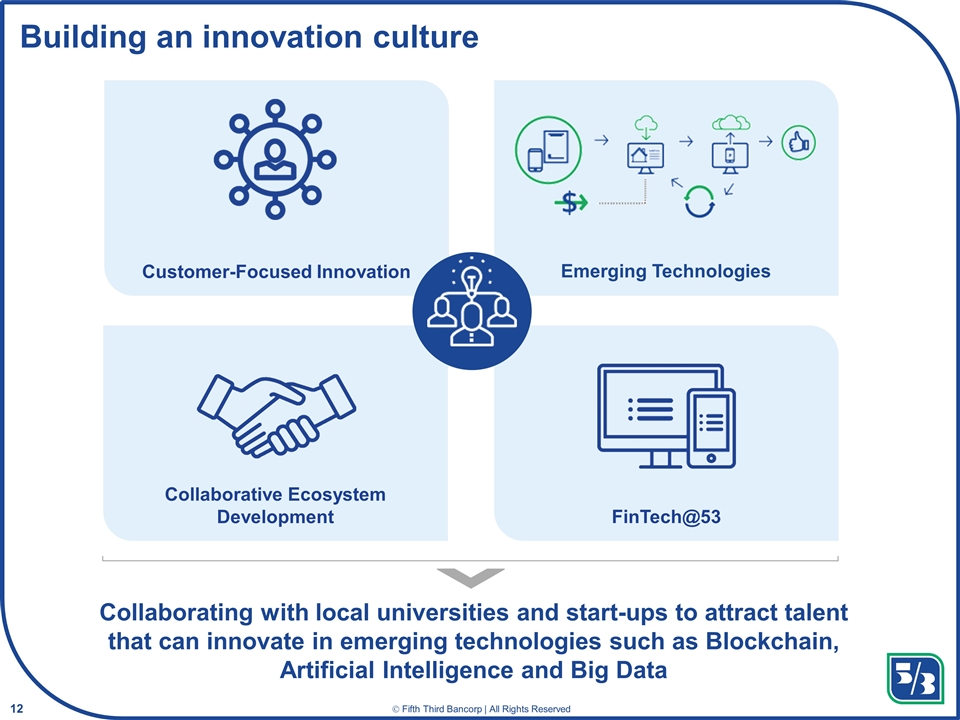

Building an innovation culture Collaborating with local universities and start-ups to attract talent that can innovate in emerging technologies such as Blockchain, Artificial Intelligence and Big Data Customer-Focused Innovation Collaborative Ecosystem Development FinTech@53 Emerging Technologies

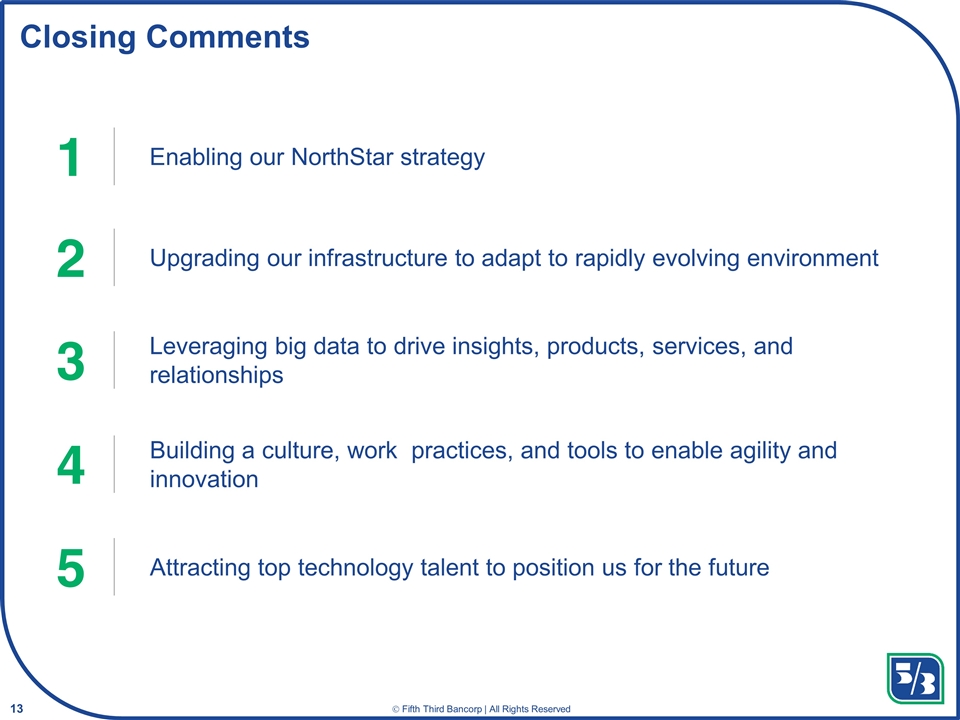

Closing Comments 1 Enabling our NorthStar strategy 2 Upgrading our infrastructure to adapt to rapidly evolving environment 3 Leveraging big data to drive insights, products, services, and relationships 4 Building a culture, work practices, and tools to enable agility and innovation 5 Attracting top technology talent to position us for the future