UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03221

Fidelity Charles Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | September 30 |

Date of reporting period: | March 31, 2022 |

Item 1.

Reports to Stockholders

Fidelity Asset Manager® Funds - 20%, 30%, 40%, 50%, 60%, 70%, 85%

Semi-Annual Report

March 31, 2022

Includes Fidelity and Fidelity Advisor share classes

Contents

|

Fidelity Asset Manager® 20% | |

|

Fidelity Asset Manager® 30% | |

|

Fidelity Asset Manager® 40% | |

|

Fidelity Asset Manager® 50% | |

|

Fidelity Asset Manager® 60% | |

|

Fidelity Asset Manager® 70% | |

|

Fidelity Asset Manager® 85% | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 if you’re an individual investing directly with Fidelity, call 1-800-835-5092 if you’re a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you’re an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2022 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of COVID-19 emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and corporate earnings. On March 11, 2020, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread. The pandemic prompted a number of measures to limit the spread of COVID-19, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. To help stem the turmoil, the U.S. government took unprecedented action – in concert with the U.S. Federal Reserve and central banks around the world – to help support consumers, businesses, and the broader economy, and to limit disruption to the financial system.

In general, the overall impact of the pandemic lessened in 2021, amid a resilient economy and widespread distribution of three COVID-19 vaccines granted emergency use authorization from the U.S. Food and Drug Administration (FDA) early in the year. Still, the situation remains dynamic, and the extent and duration of its influence on financial markets and the economy is highly uncertain, due in part to a recent spike in cases based on highly contagious variants of the coronavirus.

Extreme events such as the COVID-19 crisis are exogenous shocks that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets. Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we continue to take extra steps to be responsive to customer needs. We encourage you to visit us online, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Fidelity Asset Manager® 20%

Investment Summary (Unaudited)

The information in the following tables is based on the combined investments of the Fund and its pro-rata share of the investments of Fidelity's Central Funds, other than the Commodity Strategy and Money Market Central Funds.Top Five Bond Issuers as of March 31, 2022

| (with maturities greater than one year) | % of fund's net assets |

| U.S. Treasury Obligations | 15.3 |

| Freddie Mac | 2.9 |

| Fannie Mae | 2.5 |

| Ginnie Mae | 1.7 |

| Uniform Mortgage Backed Securities | 1.7 |

| 24.1 |

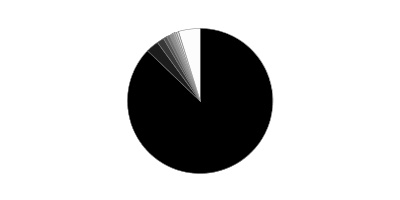

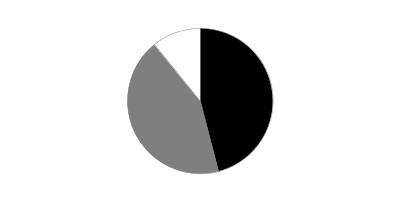

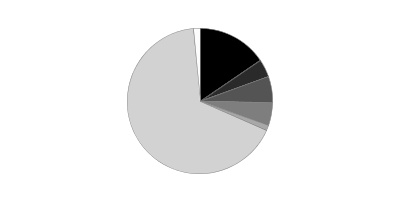

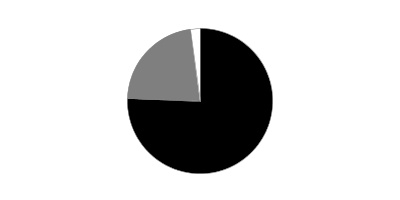

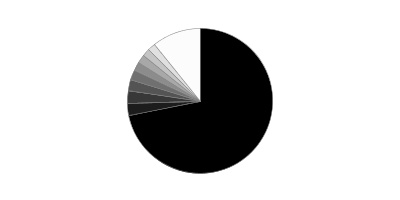

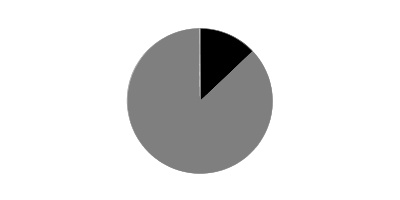

Quality Diversification (% of fund's net assets)

| As of March 31, 2022 | ||

| U.S. Government and U.S. Government Agency Obligations | 24.8% | |

| AAA,AA,A | 6.9% | |

| BBB | 9.8% | |

| BB and Below | 5.8% | |

| Not Rated | 1.7% | |

| Equities* | 26.9% | |

| Short-Term Investments and Net Other Assets | 24.1% | |

* Includes investment in Fidelity® Commodity Strategy Central Fund of 0.9%

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

Top Ten Stocks as of March 31, 2022

| % of fund's net assets | |

| Apple, Inc. | 1.2 |

| Microsoft Corp. | 1.2 |

| Alphabet, Inc. Class A | 0.8 |

| Amazon.com, Inc. | 0.6 |

| Meta Platforms, Inc. Class A | 0.3 |

| Prologis (REIT), Inc. | 0.3 |

| UnitedHealth Group, Inc. | 0.3 |

| Tesla, Inc. | 0.3 |

| Exxon Mobil Corp. | 0.2 |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 0.2 |

| 5.4 |

Market Sectors as of March 31, 2022

| % of fund's net assets | |

| Financials | 30.4 |

| Information Technology | 6.9 |

| Consumer Discretionary | 4.1 |

| Health Care | 3.5 |

| Communication Services | 3.5 |

| Industrials | 4.3 |

| Real Estate | 3.3 |

| Energy | 2.9 |

| Consumer Staples | 2.3 |

| Utilities | 1.1 |

| Materials | 0.9 |

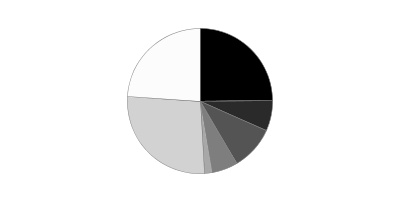

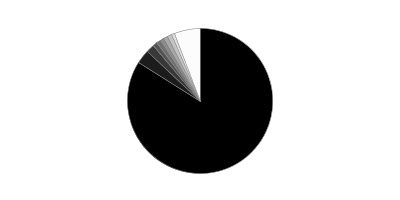

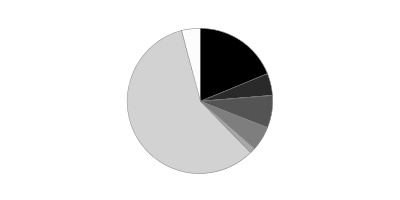

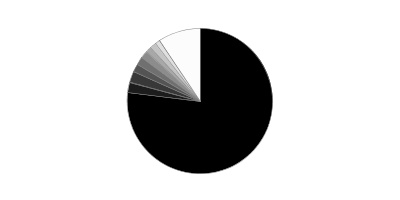

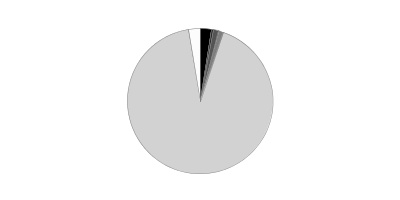

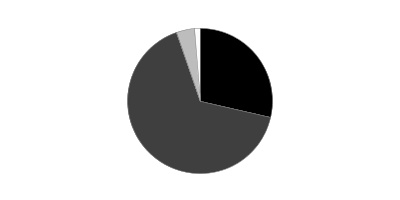

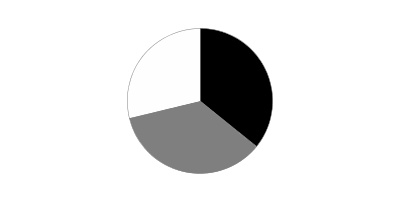

Asset Allocation (% of fund's net assets)

| As of March 31, 2022 | ||

| Stocks and Equity Futures* | 25.2% | |

| Bond Class | 48.7% | |

| Short-Term Class | 26.1% | |

* Includes investment in Fidelity® Commodity Strategy Central Fund of 0.9%

Asset allocations in the pie charts reflect the categorization of assets as defined in the Fund's prospectus in effect as of the time periods indicated above. Percentages are adjusted for the effect of future contracts and swap contracts, if applicable.

Geographic Diversification (% of fund's net assets)

| As of March 31, 2022 | ||

| United States of America | 87.1% | |

| Cayman Islands | 2.9% | |

| United Kingdom | 1.6% | |

| France | 0.8% | |

| Canada | 0.7% | |

| Switzerland | 0.7% | |

| Netherlands | 0.5% | |

| Ireland | 0.5% | |

| Japan | 0.5% | |

| Other | 4.7% | |

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable.

At period end, foreign investments including the Fund's pro-rata share of the underlying Central Funds, other than the Commodity Strategy Central and Money Market Funds, was 12.9% of net assets.

Percentages in the above tables are adjusted for the effect of TBA Sale Commitments.

An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of any securities and other investments held indirectly through its investment in underlying Fidelity Central Funds, other than the Commodity Strategy and Money Market Central Funds, is available at fidelity.com and/or institutional.fidelity.com, as applicable.

Fidelity Asset Manager® 20%

Schedule of Investments March 31, 2022 (Unaudited)

Showing Percentage of Net Assets

| Equity Central Funds - 25.6% | |||

| Shares | Value | ||

| Fidelity Commodity Strategy Central Fund (a)(b) | 8,500,482 | $52,447,975 | |

| Fidelity Emerging Markets Equity Central Fund (b) | 639,833 | 137,979,924 | |

| Fidelity International Equity Central Fund (b) | 2,487,791 | 237,285,513 | |

| Fidelity Real Estate Equity Central Fund (b) | 555,648 | 84,619,579 | |

| Fidelity U.S. Equity Central Fund (b) | 9,380,093 | 1,161,724,517 | |

| TOTAL EQUITY CENTRAL FUNDS | |||

| (Cost $1,054,878,613) | 1,674,057,508 | ||

| Fixed-Income Central Funds - 47.8% | |||

| High Yield Fixed-Income Funds - 4.6% | |||

| Fidelity Emerging Markets Debt Central Fund (b) | 1,770,824 | 14,680,129 | |

| Fidelity Emerging Markets Debt Local Currency Central Fund (b) | 143,948 | 12,713,459 | |

| Fidelity Floating Rate Central Fund (b) | 2,243,237 | 223,762,934 | |

| Fidelity High Income Central Fund (b) | 458,150 | 50,698,878 | |

| TOTAL HIGH YIELD FIXED-INCOME FUNDS | 301,855,400 | ||

| Investment Grade Fixed-Income Funds - 43.2% | |||

| Fidelity Inflation-Protected Bond Index Central Fund (b) | 777,163 | 81,003,671 | |

| Fidelity International Credit Central Fund (b) | 698,482 | 65,824,937 | |

| Fidelity Investment Grade Bond Central Fund (b) | 25,019,156 | 2,679,301,447 | |

| TOTAL INVESTMENT GRADE FIXED-INCOME FUNDS | 2,826,130,055 | ||

| TOTAL FIXED-INCOME CENTRAL FUNDS | |||

| (Cost $3,050,657,538) | 3,127,985,455 | ||

| Money Market Central Funds - 25.3% | |||

| Fidelity Cash Central Fund 0.31% (c) | 370,670,334 | 370,744,468 | |

| Fidelity Money Market Central Fund 0.45% (c) | 1,256,422,226 | 1,256,170,941 | |

| Fidelity Securities Lending Cash Central Fund 0.31% (c)(d) | 27,583,192 | 27,585,950 | |

| TOTAL MONEY MARKET CENTRAL FUNDS | |||

| (Cost $1,654,738,958) | 1,654,501,359 | ||

| Principal Amount | Value | ||

| U.S. Treasury Obligations - 0.2% | |||

| U.S. Treasury Bills, yield at date of purchase 0.11% to 0.5% 4/14/22 to 6/30/22 (e) | |||

| (Cost $15,658,201) | 15,670,000 | 15,658,187 | |

| Shares | Value | ||

| Investment Companies - 1.5% | |||

| iShares 20+ Year Treasury Bond ETF (f) | |||

| (Cost $108,730,703) | 736,520 | 97,279,561 | |

| TOTAL INVESTMENT IN SECURITIES - 100.4% | |||

| (Cost $5,884,664,013) | 6,569,482,070 | ||

| NET OTHER ASSETS (LIABILITIES) - (0.4)% | (23,280,139) | ||

| NET ASSETS - 100% | $6,546,201,931 |

| Futures Contracts | |||||

| Number of contracts | Expiration Date | Notional Amount | Value | Unrealized Appreciation/(Depreciation) | |

| Purchased | |||||

| Equity Index Contracts | |||||

| ICE E-mini MSCI Emerging Markets Index Contracts (United States) | 117 | June 2022 | $6,584,175 | $502,382 | $502,382 |

| TOTAL PURCHASED FUTURES | 502,382 | ||||

| Sold | |||||

| Equity Index Contracts | |||||

| CME Micro E-mini S&P 500 Index Contracts (United States) | 719 | June 2022 | 162,880,463 | (9,278,029) | (9,278,029) |

| ICE E-mini MSCI EAFE Index Contracts (United States) | 1,729 | June 2022 | 185,383,380 | (10,751,075) | (10,751,075) |

| TOTAL SOLD FUTURES | (20,029,104) | ||||

| TOTAL FUTURES CONTRACTS | $(19,526,722) |

The notional amount of futures purchased as a percentage of Net Assets is 0.1%

The notional amount of futures sold as a percentage of Net Assets is 5.3%

For the period, the average monthly notional amount at value for futures contracts in the aggregate was $401,750,472.

Security Type Abbreviations

ETF – Exchange-Traded Fund

Legend

(a) Non-income producing

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. A complete unaudited schedule of portfolio holdings for each Fidelity Central Fund is filed with the SEC for the first and third quarters of each fiscal year on Form N-PORT and is available upon request or at the SEC's website at www.sec.gov. An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, other than the Commodity Strategy Central Fund, is available at fidelity.com and/or institutional.fidelity.com, as applicable. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(c) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(d) Investment made with cash collateral received from securities on loan.

(e) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $15,658,187.

(f) Security or a portion of the security is on loan at period end.

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Fund | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Realized Gain (loss) | Change in Unrealized appreciation (depreciation) | Value, end of period | % ownership, end of period |

| Fidelity Cash Central Fund 0.31% | $426,692,704 | $434,435,072 | $490,383,308 | $151,654 | $-- | $-- | $370,744,468 | 0.7 |

| Fidelity Commodity Strategy Central Fund | 92,939,665 | 12,224,454 | 71,797,458 | -- | 9,716,271 | 9,365,043 | 52,447,975 | 9 |

| Fidelity Emerging Markets Debt Central Fund | 14,087,986 | 4,062,494 | 1,971,559 | 340,763 | (84,594) | (1,414,198) | 14,680,129 | 0.6 |

| Fidelity Emerging Markets Debt Local Currency Central Fund | 13,637,451 | 747,450 | -- | 747,450 | -- | (1,671,442) | 12,713,459 | 14.1 |

| Fidelity Emerging Markets Equity Central Fund | 166,846,598 | 14,431,599 | 4,550,791 | 13,873,562 | 7,108,249 | (45,855,731) | 137,979,924 | 7.6 |

| Fidelity Floating Rate Central Fund | 146,201,187 | 92,106,951 | 12,120,342 | 4,115,122 | 302,300 | (2,727,162) | 223,762,934 | 7 |

| Fidelity High Income Central Fund | 82,065,669 | 6,701,619 | 35,833,360 | 1,567,801 | 1,476,947 | (3,711,997) | 50,698,878 | 2.4 |

| Fidelity Inflation-Protected Bond Index Central Fund | 168,009,085 | 28,469,486 | 103,888,802 | 12,313,144 | 4,225,276 | (15,811,374) | 81,003,671 | 12.4 |

| Fidelity International Credit Central Fund | 84,468,784 | 10,638,011 | 22,881,734 | 1,402,123 | (1,242,359) | (5,157,765) | 65,824,937 | 12.8 |

| Fidelity International Equity Central Fund | 236,560,300 | 35,926,856 | 6,970,288 | 15,580,988 | (457,862) | (27,773,493) | 237,285,513 | 6.2 |

| Fidelity Investment Grade Bond Central Fund | 2,530,110,915 | 492,693,924 | 160,075,643 | 29,892,324 | (3,566,663) | (179,861,086) | 2,679,301,447 | 7.8 |

| Fidelity Money Market Central Fund 0.45% | 1,059,257,144 | 268,787,253 | 71,627,368 | 1,303,246 | (8,222) | (237,866) | 1,256,170,941 | 74.4 |

| Fidelity Real Estate Equity Central Fund | 92,883,360 | 27,109,878 | 40,521,662 | 1,091,766 | 789,193 | 4,358,810 | 84,619,579 | 5 |

| Fidelity Securities Lending Cash Central Fund 0.31% | -- | 31,057,550 | 3,471,600 | 3,165 | -- | -- | 27,585,950 | 0.1 |

| Fidelity U.S. Equity Central Fund | 1,083,698,613 | 221,100,857 | 58,754,824 | 95,512,640 | (5,456,644) | (78,863,485) | 1,161,724,517 | 5.3 |

| $6,197,459,461 | $1,680,493,454 | $1,084,848,739 | $177,895,748 | $12,801,892 | $(349,361,746) | $6,456,544,322 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Investment Valuation

The following is a summary of the inputs used, as of March 31, 2022, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Equity Central Funds | $1,674,057,508 | $1,674,057,508 | $-- | $-- |

| Fixed-Income Central Funds | 3,127,985,455 | 3,127,985,455 | -- | -- |

| Money Market Central Funds | 1,654,501,359 | 1,654,501,359 | -- | -- |

| U.S. Treasury Obligations | 15,658,187 | -- | 15,658,187 | -- |

| Investment Companies | 97,279,561 | 97,279,561 | -- | -- |

| Total Investments in Securities: | $6,569,482,070 | $6,553,823,883 | $15,658,187 | $-- |

| Derivative Instruments: | ||||

| Assets | ||||

| Futures Contracts | $502,382 | $502,382 | $-- | $-- |

| Total Assets | $502,382 | $502,382 | $-- | $-- |

| Liabilities | ||||

| Futures Contracts | $(20,029,104) | $(20,029,104) | $-- | $-- |

| Total Liabilities | $(20,029,104) | $(20,029,104) | $-- | $-- |

| Total Derivative Instruments: | $(19,526,722) | $(19,526,722) | $-- | $-- |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of March 31, 2022. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk Exposure / Derivative Type | Value | |

| Asset | Liability | |

| Equity Risk | ||

| Futures Contracts(a) | $502,382 | $(20,029,104) |

| Total Equity Risk | 502,382 | (20,029,104) |

| Total Value of Derivatives | $502,382 | $(20,029,104) |

(a) Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in Total accumulated earnings (loss).

See accompanying notes which are an integral part of the financial statements.

Fidelity Asset Manager® 20%

Financial Statements

Statement of Assets and Liabilities

| March 31, 2022 (Unaudited) | ||

| Assets | ||

| Investment in securities, at value (including securities loaned of $27,089,608) — See accompanying schedule: Unaffiliated issuers (cost $124,388,904) | $112,937,748 | |

| Fidelity Central Funds (cost $5,760,275,109) | 6,456,544,322 | |

| Total Investment in Securities (cost $5,884,664,013) | $6,569,482,070 | |

| Receivable for investments sold | 4,306,302 | |

| Receivable for fund shares sold | 1,137,396 | |

| Distributions receivable from Fidelity Central Funds | 67,788 | |

| Receivable for daily variation margin on futures contracts | 5,416,930 | |

| Prepaid expenses | 3,070 | |

| Total assets | 6,580,413,556 | |

| Liabilities | ||

| Payable for investments purchased | $5,503 | |

| Payable for fund shares redeemed | 3,826,418 | |

| Accrued management fee | 2,169,714 | |

| Distribution and service plan fees payable | 48,736 | |

| Other affiliated payables | 509,003 | |

| Other payables and accrued expenses | 66,301 | |

| Collateral on securities loaned | 27,585,950 | |

| Total liabilities | 34,211,625 | |

| Net Assets | $6,546,201,931 | |

| Net Assets consist of: | ||

| Paid in capital | $6,013,180,733 | |

| Total accumulated earnings (loss) | 533,021,198 | |

| Net Assets | $6,546,201,931 | |

| Net Asset Value and Maximum Offering Price | ||

| Class A: | ||

| Net Asset Value and redemption price per share ($64,588,488 ÷ 4,547,515 shares)(a) | $14.20 | |

| Maximum offering price per share (100/94.25 of $14.20) | $15.07 | |

| Class M: | ||

| Net Asset Value and redemption price per share ($30,771,548 ÷ 2,172,096 shares)(a) | $14.17 | |

| Maximum offering price per share (100/96.50 of $14.17) | $14.68 | |

| Class C: | ||

| Net Asset Value and offering price per share ($29,334,274 ÷ 2,086,716 shares)(a) | $14.06 | |

| Asset Manager 20%: | ||

| Net Asset Value, offering price and redemption price per share ($4,485,428,708 ÷ 315,233,718 shares) | $14.23 | |

| Class I: | ||

| Net Asset Value, offering price and redemption price per share ($33,192,418 ÷ 2,332,503 shares) | $14.23 | |

| Class Z: | ||

| Net Asset Value, offering price and redemption price per share ($1,902,886,495 ÷ 133,796,397 shares) | $14.22 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Six months ended March 31, 2022 (Unaudited) | ||

| Investment Income | ||

| Dividends | $1,050,141 | |

| Interest | 5,836 | |

| Income from Fidelity Central Funds (including $3,165 from security lending) | 60,550,787 | |

| Total income | 61,606,764 | |

| Expenses | ||

| Management fee | $13,136,073 | |

| Transfer agent fees | 2,395,452 | |

| Distribution and service plan fees | 291,431 | |

| Accounting fees | 619,304 | |

| Custodian fees and expenses | 17,733 | |

| Independent trustees' fees and expenses | 11,106 | |

| Registration fees | 106,985 | |

| Audit | 16,579 | |

| Legal | 7,160 | |

| Miscellaneous | 14,307 | |

| Total expenses before reductions | 16,616,130 | |

| Expense reductions | (53,847) | |

| Total expenses after reductions | 16,562,283 | |

| Net investment income (loss) | 45,044,481 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | (4,453,555) | |

| Fidelity Central Funds | 12,801,892 | |

| Futures contracts | 41,363,246 | |

| Capital gain distributions from Fidelity Central Funds | 117,344,961 | |

| Total net realized gain (loss) | 167,056,544 | |

| Change in net unrealized appreciation (depreciation) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | (5,648,365) | |

| Fidelity Central Funds | (349,361,746) | |

| Futures contracts | (38,799,853) | |

| Total change in net unrealized appreciation (depreciation) | (393,809,964) | |

| Net gain (loss) | (226,753,420) | |

| Net increase (decrease) in net assets resulting from operations | $(181,708,939) |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Six months ended March 31, 2022 (Unaudited) | Year ended September 30, 2021 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $45,044,481 | $77,567,982 |

| Net realized gain (loss) | 167,056,544 | 40,784,860 |

| Change in net unrealized appreciation (depreciation) | (393,809,964) | 290,401,122 |

| Net increase (decrease) in net assets resulting from operations | (181,708,939) | 408,753,964 |

| Distributions to shareholders | (77,324,062) | (110,397,850) |

| Share transactions - net increase (decrease) | 444,099,673 | 531,844,334 |

| Total increase (decrease) in net assets | 185,066,672 | 830,200,448 |

| Net Assets | ||

| Beginning of period | 6,361,135,259 | 5,530,934,811 |

| End of period | $6,546,201,931 | $6,361,135,259 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Asset Manager 20% Class A

| Six months ended (Unaudited) March 31, | Years endedSeptember 30, | |||||

| 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $14.74 | $14.00 | $13.51 | $13.40 | $13.55 | $13.24 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A,B | .08 | .14 | .18 | .26 | .20 | .16 |

| Net realized and unrealized gain (loss) | (.47) | .82 | .62 | .36 | .11 | .37 |

| Total from investment operations | (.39) | .96 | .80 | .62 | .31 | .53 |

| Distributions from net investment income | (.11) | (.11) | (.19) | (.26) | (.19) | (.16) |

| Distributions from net realized gain | (.03) | (.12) | (.13) | (.24) | (.27) | (.07) |

| Total distributions | (.15)C | (.22)C | (.31)C | (.51)C | (.46) | (.22)C |

| Net asset value, end of period | $14.20 | $14.74 | $14.00 | $13.51 | $13.40 | $13.55 |

| Total ReturnD,E,F | (2.70)% | 6.91% | 6.04% | 4.85% | 2.36% | 4.08% |

| Ratios to Average Net AssetsB,G,H | ||||||

| Expenses before reductions | .81%I | .81% | .82% | .83% | .84% | .84% |

| Expenses net of fee waivers, if any | .81%I | .81% | .82% | .83% | .84% | .84% |

| Expenses net of all reductions | .81%I | .81% | .82% | .83% | .84% | .83% |

| Net investment income (loss) | 1.05%I | .97% | 1.34% | 1.97% | 1.49% | 1.21% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $64,588 | $62,957 | $50,633 | $45,153 | $39,089 | $39,787 |

| Portfolio turnover rateJ | 22%I | 25% | 25% | 41% | 24% | 22% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Total distributions per share do not sum due to rounding.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the sales charges.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Annualized

J Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Asset Manager 20% Class M

| Six months ended (Unaudited) March 31, | Years endedSeptember 30, | |||||

| 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $14.70 | $13.97 | $13.48 | $13.37 | $13.52 | $13.21 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A,B | .06 | .10 | .15 | .23 | .16 | .13 |

| Net realized and unrealized gain (loss) | (.46) | .82 | .62 | .35 | .12 | .37 |

| Total from investment operations | (.40) | .92 | .77 | .58 | .28 | .50 |

| Distributions from net investment income | (.10) | (.07) | (.15) | (.23) | (.16) | (.12) |

| Distributions from net realized gain | (.03) | (.12) | (.13) | (.24) | (.27) | (.07) |

| Total distributions | (.13) | (.19) | (.28) | (.47) | (.43) | (.19) |

| Net asset value, end of period | $14.17 | $14.70 | $13.97 | $13.48 | $13.37 | $13.52 |

| Total ReturnC,D,E | (2.75)% | 6.60% | 5.79% | 4.58% | 2.10% | 3.81% |

| Ratios to Average Net AssetsB,F,G | ||||||

| Expenses before reductions | 1.06%H | 1.07% | 1.08% | 1.08% | 1.10% | 1.10% |

| Expenses net of fee waivers, if any | 1.06%H | 1.07% | 1.07% | 1.08% | 1.10% | 1.10% |

| Expenses net of all reductions | 1.06%H | 1.07% | 1.07% | 1.08% | 1.10% | 1.10% |

| Net investment income (loss) | .80%H | .72% | 1.09% | 1.72% | 1.23% | .95% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $30,772 | $31,762 | $27,366 | $25,696 | $22,133 | $22,474 |

| Portfolio turnover rateI | 22%H | 25% | 25% | 41% | 24% | 22% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the sales charges.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Asset Manager 20% Class C

| Six months ended (Unaudited) March 31, | Years endedSeptember 30, | |||||

| 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $14.61 | $13.91 | $13.43 | $13.32 | $13.47 | $13.17 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A,B | .02 | .03 | .08 | .16 | .10 | .06 |

| Net realized and unrealized gain (loss) | (.46) | .82 | .61 | .36 | .11 | .36 |

| Total from investment operations | (.44) | .85 | .69 | .52 | .21 | .42 |

| Distributions from net investment income | (.08) | (.03) | (.09) | (.16) | (.09) | (.06) |

| Distributions from net realized gain | (.03) | (.12) | (.13) | (.24) | (.27) | (.07) |

| Total distributions | (.11) | (.15) | (.21)C | (.41)C | (.36) | (.12)C |

| Net asset value, end of period | $14.06 | $14.61 | $13.91 | $13.43 | $13.32 | $13.47 |

| Total ReturnD,E,F | (3.03)% | 6.10% | 5.22% | 4.06% | 1.59% | 3.25% |

| Ratios to Average Net AssetsB,G,H | ||||||

| Expenses before reductions | 1.56%I | 1.57% | 1.58% | 1.59% | 1.59% | 1.59% |

| Expenses net of fee waivers, if any | 1.56%I | 1.57% | 1.58% | 1.59% | 1.59% | 1.59% |

| Expenses net of all reductions | 1.56%I | 1.57% | 1.58% | 1.59% | 1.59% | 1.59% |

| Net investment income (loss) | .30%I | .22% | .59% | 1.21% | .74% | .45% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $29,334 | $25,804 | $24,940 | $21,588 | $26,000 | $28,217 |

| Portfolio turnover rateJ | 22%I | 25% | 25% | 41% | 24% | 22% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Total distributions per share do not sum due to rounding.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the contingent deferred sales charge.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Annualized

J Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Asset Manager 20%

| Six months ended (Unaudited) March 31, | Years endedSeptember 30, | |||||

| 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $14.76 | $14.02 | $13.54 | $13.42 | $13.57 | $13.26 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A,B | .10 | .19 | .23 | .30 | .24 | .20 |

| Net realized and unrealized gain (loss) | (.46) | .82 | .61 | .37 | .12 | .37 |

| Total from investment operations | (.36) | 1.01 | .84 | .67 | .36 | .57 |

| Distributions from net investment income | (.14) | (.15) | (.23) | (.31) | (.24) | (.20) |

| Distributions from net realized gain | (.03) | (.12) | (.13) | (.24) | (.27) | (.07) |

| Total distributions | (.17) | (.27) | (.36) | (.55) | (.51) | (.26)C |

| Net asset value, end of period | $14.23 | $14.76 | $14.02 | $13.54 | $13.42 | $13.57 |

| Total ReturnD,E | (2.48)% | 7.24% | 6.29% | 5.24% | 2.68% | 4.40% |

| Ratios to Average Net AssetsB,F,G | ||||||

| Expenses before reductions | .50%H | .50% | .51% | .51% | .52% | .52% |

| Expenses net of fee waivers, if any | .50%H | .50% | .50% | .51% | .52% | .52% |

| Expenses net of all reductions | .50%H | .50% | .50% | .51% | .51% | .52% |

| Net investment income (loss) | 1.36%H | 1.29% | 1.66% | 2.29% | 1.81% | 1.52% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $4,485,429 | $4,723,410 | $5,377,374 | $4,990,188 | $4,819,671 | $4,880,833 |

| Portfolio turnover rateI | 22%H | 25% | 25% | 41% | 24% | 22% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Total distributions per share do not sum due to rounding.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Asset Manager 20% Class I

| Six months ended (Unaudited) March 31, | Years endedSeptember 30, | |||||

| 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $14.76 | $14.02 | $13.53 | $13.41 | $13.57 | $13.26 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A,B | .10 | .18 | .22 | .30 | .24 | .20 |

| Net realized and unrealized gain (loss) | (.46) | .82 | .61 | .36 | .10 | .37 |

| Total from investment operations | (.36) | 1.00 | .83 | .66 | .34 | .57 |

| Distributions from net investment income | (.13) | (.14) | (.22) | (.30) | (.23) | (.19) |

| Distributions from net realized gain | (.03) | (.12) | (.13) | (.24) | (.27) | (.07) |

| Total distributions | (.17)C | (.26) | (.34)C | (.54) | (.50) | (.26) |

| Net asset value, end of period | $14.23 | $14.76 | $14.02 | $13.53 | $13.41 | $13.57 |

| Total ReturnD,E | (2.51)% | 7.17% | 6.27% | 5.18% | 2.57% | 4.35% |

| Ratios to Average Net AssetsB,F,G | ||||||

| Expenses before reductions | .55%H | .55% | .58% | .56% | .55% | .56% |

| Expenses net of fee waivers, if any | .55%H | .55% | .57% | .56% | .55% | .56% |

| Expenses net of all reductions | .55%H | .55% | .57% | .56% | .55% | .56% |

| Net investment income (loss) | 1.32%H | 1.24% | 1.59% | 2.24% | 1.78% | 1.48% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $33,192 | $31,374 | $32,445 | $25,577 | $48,713 | $50,272 |

| Portfolio turnover rateI | 22%H | 25% | 25% | 41% | 24% | 22% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Total distributions per share do not sum due to rounding.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Asset Manager 20% Class Z

| Six months ended (Unaudited) March 31, | Years endedSeptember 30, | |||

| 2022 | 2021 | 2020 | 2019 A | |

| Selected Per–Share Data | ||||

| Net asset value, beginning of period | $14.76 | $14.02 | $13.53 | $13.41 |

| Income from Investment Operations | ||||

| Net investment income (loss)B,C | .10 | .19 | .23 | .30 |

| Net realized and unrealized gain (loss) | (.47) | .82 | .62 | .37 |

| Total from investment operations | (.37) | 1.01 | .85 | .67 |

| Distributions from net investment income | (.14) | (.16) | (.24) | (.31) |

| Distributions from net realized gain | (.03) | (.12) | (.13) | (.24) |

| Total distributions | (.17) | (.27)D | (.36)D | (.55) |

| Net asset value, end of period | $14.22 | $14.76 | $14.02 | $13.53 |

| Total ReturnE,F | (2.53)% | 7.27% | 6.41% | 5.27% |

| Ratios to Average Net AssetsC,G,H | ||||

| Expenses before reductions | .47%I | .47% | .48% | .48%I |

| Expenses net of fee waivers, if any | .47%I | .47% | .48% | .48%I |

| Expenses net of all reductions | .47%I | .47% | .48% | .48%I |

| Net investment income (loss) | 1.39%I | 1.31% | 1.69% | 2.32%I |

| Supplemental Data | ||||

| Net assets, end of period (000 omitted) | $1,902,886 | $1,485,829 | $18,177 | $14,613 |

| Portfolio turnover rateJ | 22%I | 25% | 25% | 41% |

A For the period October 2, 2018 (commencement of sale of shares) through September 30, 2019.

B Calculated based on average shares outstanding during the period.

C Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

D Total distributions per share do not sum due to rounding.

E Total returns for periods of less than one year are not annualized.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Annualized

J Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Asset Manager® 30%

Investment Summary (Unaudited)

The information in the following tables is based on the combined investments of the Fund and its pro-rata share of the investments of Fidelity's Central Funds, other than the Commodity Strategy and Money Market Central Funds.Top Five Bond Issuers as of March 31, 2022

| (with maturities greater than one year) | % of fund's net assets |

| U.S. Treasury Obligations | 15.4 |

| Freddie Mac | 2.8 |

| Fannie Mae | 2.5 |

| Ginnie Mae | 1.6 |

| Uniform Mortgage Backed Securities | 1.5 |

| 23.8 |

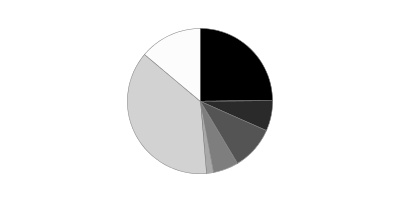

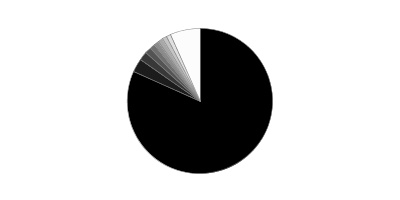

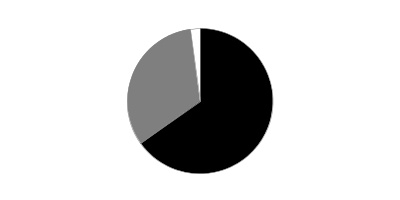

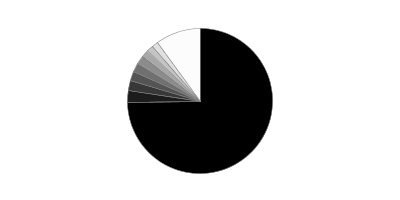

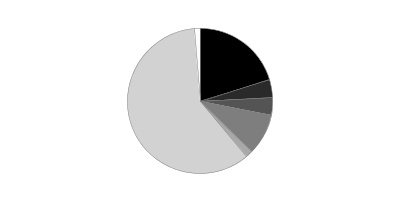

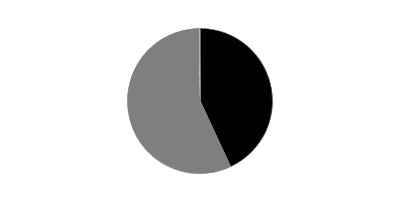

Quality Diversification (% of fund's net assets)

| As of March 31, 2022 | ||

| U.S. Government and U.S. Government Agency Obligations | 24.8% | |

| AAA,AA,A | 6.9% | |

| BBB | 9.7% | |

| BB and Below | 5.6% | |

| Not Rated | 1.6% | |

| Equities* | 37.5% | |

| Short-Term Investments and Net Other Assets | 13.9% | |

* Includes investment in Fidelity® Commodity Strategy Central Fund of 0.9%

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

Top Ten Stocks as of March 31, 2022

| % of fund's net assets | |

| Apple, Inc. | 1.7 |

| Microsoft Corp. | 1.6 |

| Alphabet, Inc. Class A | 1.1 |

| Amazon.com, Inc. | 0.9 |

| Meta Platforms, Inc. Class A | 0.4 |

| UnitedHealth Group, Inc. | 0.4 |

| Tesla, Inc. | 0.4 |

| Prologis (REIT), Inc. | 0.3 |

| Exxon Mobil Corp. | 0.3 |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 0.3 |

| 7.4 |

Market Sectors as of March 31, 2022

| % of fund's net assets | |

| Financials | 23.6 |

| Information Technology | 9.5 |

| Consumer Discretionary | 5.2 |

| Health Care | 5.0 |

| Industrials | 4.5 |

| Communication Services | 4.0 |

| Real Estate | 3.9 |

| Energy | 3.0 |

| Consumer Staples | 3.0 |

| Materials | 1.7 |

| Utilities | 1.6 |

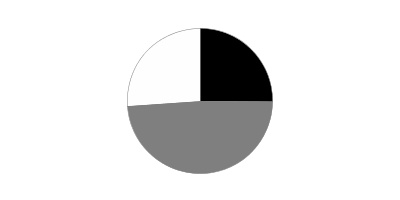

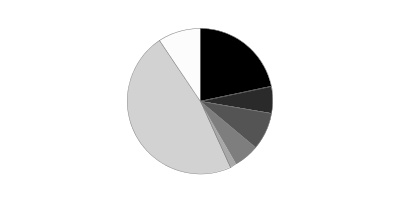

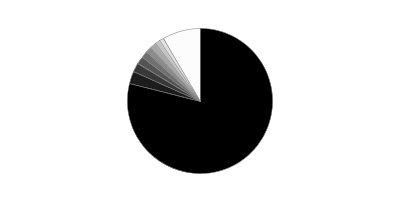

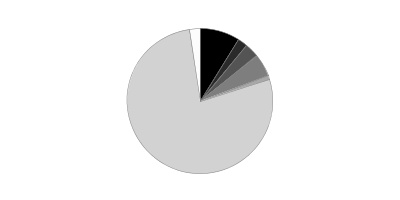

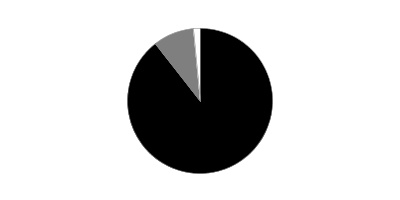

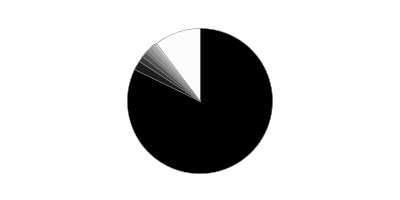

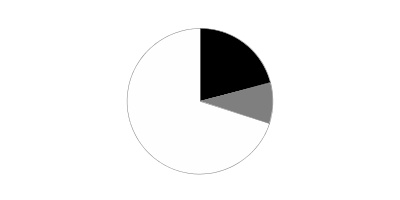

Asset Allocation (% of fund's net assets)

| As of March 31, 2022 | ||

| Stocks and Equity Futures* | 35.7% | |

| Bond Class | 48.4% | |

| Short-Term Class | 15.9% | |

* Includes investment in Fidelity® Commodity Strategy Central Fund of 0.9%

Asset allocations in the pie charts reflect the categorization of assets as defined in the Fund's prospectus in effect as of the time periods indicated above. Percentages are adjusted for the effect of future contracts and swap contracts, if applicable.

Geographic Diversification (% of fund's net assets)

| As of March 31, 2022 | ||

| United States of America | 83.9% | |

| Cayman Islands | 3.1% | |

| United Kingdom | 1.8% | |

| France | 1.1% | |

| Canada | 0.9% | |

| Switzerland | 0.9% | |

| Japan | 0.9% | |

| Netherlands | 0.9% | |

| Germany | 0.7% | |

| Other | 5.8% | |

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable.

At period end, foreign investments including the Fund's pro-rata share of the underlying Central Funds, other than the Commodity Strategy Central and Money Market Funds, was 16.1% of net assets.

Percentages in the above tables are adjusted for the effect of TBA Sale Commitments.

An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of any securities and other investments held indirectly through its investment in underlying Fidelity Central Funds, other than the Commodity Strategy and Money Market Central Funds, is available at fidelity.com and/or institutional.fidelity.com, as applicable.

Fidelity Asset Manager® 30%

Schedule of Investments March 31, 2022 (Unaudited)

Showing Percentage of Net Assets

| Equity Central Funds - 36.1% | |||

| Shares | Value | ||

| Fidelity Commodity Strategy Central Fund (a)(b) | 3,584,110 | $22,113,959 | |

| Fidelity Emerging Markets Equity Central Fund (b) | 383,307 | 82,660,053 | |

| Fidelity International Equity Central Fund (b) | 1,645,927 | 156,988,527 | |

| Fidelity Real Estate Equity Central Fund (b) | 282,332 | 42,996,309 | |

| Fidelity U.S. Equity Central Fund (b) | 5,576,779 | 690,684,058 | |

| TOTAL EQUITY CENTRAL FUNDS | |||

| (Cost $711,233,950) | 995,442,906 | ||

| Fixed-Income Central Funds - 47.2% | |||

| High Yield Fixed-Income Funds - 4.6% | |||

| Fidelity Emerging Markets Debt Central Fund (b) | 757,419 | 6,279,006 | |

| Fidelity Emerging Markets Debt Local Currency Central Fund (b) | 66,130 | 5,840,564 | |

| Fidelity Floating Rate Central Fund (b) | 948,804 | 94,643,222 | |

| Fidelity High Income Central Fund (b) | 194,288 | 21,499,916 | |

| TOTAL HIGH YIELD FIXED-INCOME FUNDS | 128,262,708 | ||

| Investment Grade Fixed-Income Funds - 42.6% | |||

| Fidelity Inflation-Protected Bond Index Central Fund (b) | 392,267 | 40,886,010 | |

| Fidelity International Credit Central Fund (b) | 288,444 | 27,183,002 | |

| Fidelity Investment Grade Bond Central Fund (b) | 10,332,499 | 1,106,507,304 | |

| TOTAL INVESTMENT GRADE FIXED-INCOME FUNDS | 1,174,576,316 | ||

| TOTAL FIXED-INCOME CENTRAL FUNDS | |||

| (Cost $1,323,944,224) | 1,302,839,024 | ||

| Money Market Central Funds - 14.9% | |||

| Fidelity Cash Central Fund 0.31% (c) | 108,426,701 | 108,448,386 | |

| Fidelity Money Market Central Fund 0.45% (c) | 294,405,461 | 294,346,580 | |

| Fidelity Securities Lending Cash Central Fund 0.31% (c)(d) | 7,073,993 | 7,074,700 | |

| TOTAL MONEY MARKET CENTRAL FUNDS | |||

| (Cost $409,925,126) | 409,869,666 | ||

| Principal Amount | Value | ||

| U.S. Treasury Obligations - 0.3% | |||

| U.S. Treasury Bills, yield at date of purchase 0.17% to 0.5% 4/21/22 to 6/30/22 (e) | |||

| (Cost $7,413,904) | 7,420,000 | 7,413,891 | |

| Shares | Value | ||

| Investment Companies - 1.7% | |||

| iShares 20+ Year Treasury Bond ETF (f) | |||

| (Cost $54,319,385) | 360,948 | 47,674,011 | |

| TOTAL INVESTMENT IN SECURITIES - 100.2% | |||

| (Cost $2,506,836,589) | 2,763,239,498 | ||

| NET OTHER ASSETS (LIABILITIES) - (0.2)% | (5,375,195) | ||

| NET ASSETS - 100% | $2,757,864,303 |

| Futures Contracts | |||||

| Number of contracts | Expiration Date | Notional Amount | Value | Unrealized Appreciation/(Depreciation) | |

| Purchased | |||||

| Equity Index Contracts | |||||

| ICE E-mini MSCI Emerging Markets Index Contracts (United States) | 36 | June 2022 | $2,025,900 | $154,851 | $154,851 |

| TOTAL PURCHASED FUTURES | 154,851 | ||||

| Sold | |||||

| Equity Index Contracts | |||||

| CME Micro E-mini S&P 500 Index Contracts (United States) | 312 | June 2022 | 70,679,700 | (4,066,981) | (4,066,981) |

| ICE E-mini MSCI EAFE Index Contracts (United States) | 721 | June 2022 | 77,305,620 | (4,483,242) | (4,483,242) |

| TOTAL SOLD FUTURES | (8,550,223) | ||||

| TOTAL FUTURES CONTRACTS | $(8,395,372) |

The notional amount of futures purchased as a percentage of Net Assets is 0.1%

The notional amount of futures sold as a percentage of Net Assets is 5.4%

For the period, the average monthly notional amount at value for futures contracts in the aggregate was $175,982,913.

Security Type Abbreviations

ETF – Exchange-Traded Fund

Legend

(a) Non-income producing

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. A complete unaudited schedule of portfolio holdings for each Fidelity Central Fund is filed with the SEC for the first and third quarters of each fiscal year on Form N-PORT and is available upon request or at the SEC's website at www.sec.gov. An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, other than the Commodity Strategy Central Fund, is available at fidelity.com and/or institutional.fidelity.com, as applicable. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(c) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(d) Investment made with cash collateral received from securities on loan.

(e) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $7,413,891.

(f) Security or a portion of the security is on loan at period end.

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Fund | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Realized Gain (loss) | Change in Unrealized appreciation (depreciation) | Value, end of period | % ownership, end of period |

| Fidelity Cash Central Fund 0.31% | $196,597,498 | $141,602,728 | $229,751,840 | $53,050 | $-- | $-- | $108,448,386 | 0.2 |

| Fidelity Commodity Strategy Central Fund | 48,804,189 | 1,965,907 | 36,879,319 | -- | 3,214,168 | 5,009,014 | 22,113,959 | 3.8 |

| Fidelity Emerging Markets Debt Central Fund | 7,059,584 | 754,901 | 877,364 | 157,850 | (38,968) | (619,147) | 6,279,006 | 0.2 |

| Fidelity Emerging Markets Debt Local Currency Central Fund | 6,265,046 | 343,379 | -- | 343,379 | -- | (767,861) | 5,840,564 | 6.5 |

| Fidelity Emerging Markets Equity Central Fund | 99,679,753 | 9,557,416 | 3,354,919 | 8,311,519 | 4,068,615 | (27,290,812) | 82,660,053 | 4.6 |

| Fidelity Floating Rate Central Fund | 66,339,199 | 34,934,118 | 5,588,078 | 1,795,721 | 31,171 | (1,073,188) | 94,643,222 | 3 |

| Fidelity High Income Central Fund | 37,058,284 | 1,649,010 | 16,254,188 | 690,936 | 484,538 | (1,437,728) | 21,499,916 | 1 |

| Fidelity Inflation-Protected Bond Index Central Fund | 79,607,934 | 8,569,475 | 41,852,225 | 5,812,595 | 1,906,752 | (7,345,926) | 40,886,010 | 6.3 |

| Fidelity International Credit Central Fund | 36,888,078 | 2,040,350 | 9,098,873 | 597,916 | (529,879) | (2,116,674) | 27,183,002 | 5.3 |

| Fidelity International Equity Central Fund | 166,241,962 | 16,478,684 | 6,853,713 | 10,855,278 | (507,192) | (18,371,214) | 156,988,527 | 4.1 |

| Fidelity Investment Grade Bond Central Fund | 1,124,283,159 | 126,594,812 | 68,319,248 | 12,755,245 | (1,498,288) | (74,553,131) | 1,106,507,304 | 3.2 |

| Fidelity Money Market Central Fund 0.45% | 211,270,733 | 98,588,635 | 15,455,786 | 297,958 | (3,157) | (53,845) | 294,346,580 | 17.4 |

| Fidelity Real Estate Equity Central Fund | 42,196,369 | 15,506,284 | 17,232,003 | 556,652 | (576,613) | 3,102,272 | 42,996,309 | 2.6 |

| Fidelity Securities Lending Cash Central Fund 0.31% | 59,003,075 | 86,627,953 | 138,556,328 | 4,052 | -- | -- | 7,074,700 | -- |

| Fidelity U.S. Equity Central Fund | 686,091,383 | 92,663,479 | 38,444,307 | 59,634,731 | (2,773,992) | (46,852,505) | 690,684,058 | 3.2 |

| $2,867,386,246 | $637,877,131 | $628,518,191 | $101,866,882 | $3,777,155 | $(172,370,745) | $2,708,151,596 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Investment Valuation

The following is a summary of the inputs used, as of March 31, 2022, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Equity Central Funds | $995,442,906 | $995,442,906 | $-- | $-- |

| Fixed-Income Central Funds | 1,302,839,024 | 1,302,839,024 | -- | -- |

| Money Market Central Funds | 409,869,666 | 409,869,666 | -- | -- |

| U.S. Treasury Obligations | 7,413,891 | -- | 7,413,891 | -- |

| Investment Companies | 47,674,011 | 47,674,011 | -- | -- |

| Total Investments in Securities: | $2,763,239,498 | $2,755,825,607 | $7,413,891 | $-- |

| Derivative Instruments: | ||||

| Assets | ||||

| Futures Contracts | $154,851 | $154,851 | $-- | $-- |

| Total Assets | $154,851 | $154,851 | $-- | $-- |

| Liabilities | ||||

| Futures Contracts | $(8,550,223) | $(8,550,223) | $-- | $-- |

| Total Liabilities | $(8,550,223) | $(8,550,223) | $-- | $-- |

| Total Derivative Instruments: | $(8,395,372) | $(8,395,372) | $-- | $-- |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of March 31, 2022. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk Exposure / Derivative Type | Value | |

| Asset | Liability | |

| Equity Risk | ||

| Futures Contracts(a) | $154,851 | $(8,550,223) |

| Total Equity Risk | 154,851 | (8,550,223) |

| Total Value of Derivatives | $154,851 | $(8,550,223) |

(a) Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in Total accumulated earnings (loss).

See accompanying notes which are an integral part of the financial statements.

Fidelity Asset Manager® 30%

Financial Statements

Statement of Assets and Liabilities

| March 31, 2022 (Unaudited) | ||

| Assets | ||

| Investment in securities, at value (including securities loaned of $6,947,408) — See accompanying schedule: Unaffiliated issuers (cost $61,733,289) | $55,087,902 | |

| Fidelity Central Funds (cost $2,445,103,300) | 2,708,151,596 | |

| Total Investment in Securities (cost $2,506,836,589) | $2,763,239,498 | |

| Receivable for investments sold | 2,121,269 | |

| Receivable for fund shares sold | 542,516 | |

| Distributions receivable from Fidelity Central Funds | 21,939 | |

| Receivable for daily variation margin on futures contracts | 2,309,760 | |

| Prepaid expenses | 1,348 | |

| Total assets | 2,768,236,330 | |

| Liabilities | ||

| Payable for investments purchased | $4,194 | |

| Payable for fund shares redeemed | 2,017,898 | |

| Accrued management fee | 914,544 | |

| Distribution and service plan fees payable | 53,219 | |

| Other affiliated payables | 255,723 | |

| Other payables and accrued expenses | 51,749 | |

| Collateral on securities loaned | 7,074,700 | |

| Total liabilities | 10,372,027 | |

| Net Assets | $2,757,864,303 | |

| Net Assets consist of: | ||

| Paid in capital | $2,494,535,917 | |

| Total accumulated earnings (loss) | 263,328,386 | |

| Net Assets | $2,757,864,303 | |

| Net Asset Value and Maximum Offering Price | ||

| Class A: | ||

| Net Asset Value and redemption price per share ($81,955,794 ÷ 6,676,575 shares)(a) | $12.28 | |

| Maximum offering price per share (100/94.25 of $12.28) | $13.03 | |

| Class M: | ||

| Net Asset Value and redemption price per share ($26,642,318 ÷ 2,175,502 shares)(a) | $12.25 | |

| Maximum offering price per share (100/96.50 of $12.25) | $12.69 | |

| Class C: | ||

| Net Asset Value and offering price per share ($30,416,831 ÷ 2,507,561 shares)(a) | $12.13 | |

| Asset Manager 30%: | ||

| Net Asset Value, offering price and redemption price per share ($2,050,926,587 ÷ 167,163,078 shares) | $12.27 | |

| Class I: | ||

| Net Asset Value, offering price and redemption price per share ($71,175,158 ÷ 5,802,193 shares) | $12.27 | |

| Class Z: | ||

| Net Asset Value, offering price and redemption price per share ($496,747,615 ÷ 40,494,855 shares) | $12.27 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Six months ended March 31, 2022 (Unaudited) | ||

| Investment Income | ||

| Dividends | $467,529 | |

| Interest | 2,787 | |

| Income from Fidelity Central Funds (including $4,052 from security lending) | 28,447,518 | |

| Total income | 28,917,834 | |

| Expenses | ||

| Management fee | $5,748,653 | |

| Transfer agent fees | 1,104,731 | |

| Distribution and service plan fees | 333,841 | |

| Accounting fees | 464,819 | |

| Custodian fees and expenses | 18,211 | |

| Independent trustees' fees and expenses | 4,881 | |

| Registration fees | 85,140 | |

| Audit | 16,579 | |

| Legal | 3,264 | |

| Miscellaneous | 6,416 | |

| Total expenses before reductions | 7,786,535 | |

| Expense reductions | (24,187) | |

| Total expenses after reductions | 7,762,348 | |

| Net investment income (loss) | 21,155,486 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | (1,279,577) | |

| Fidelity Central Funds | 3,777,155 | |

| Futures contracts | 19,107,747 | |

| Capital gain distributions from Fidelity Central Funds | 73,419,364 | |

| Total net realized gain (loss) | 95,024,689 | |

| Change in net unrealized appreciation (depreciation) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | (3,433,395) | |

| Fidelity Central Funds | (172,370,745) | |

| Futures contracts | (16,736,303) | |

| Total change in net unrealized appreciation (depreciation) | (192,540,443) | |

| Net gain (loss) | (97,515,754) | |

| Net increase (decrease) in net assets resulting from operations | $(76,360,268) |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Six months ended March 31, 2022 (Unaudited) | Year ended September 30, 2021 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $21,155,486 | $34,840,431 |

| Net realized gain (loss) | 95,024,689 | 8,098,367 |

| Change in net unrealized appreciation (depreciation) | (192,540,443) | 187,987,524 |

| Net increase (decrease) in net assets resulting from operations | (76,360,268) | 230,926,322 |

| Distributions to shareholders | (40,662,108) | (45,916,472) |

| Share transactions - net increase (decrease) | (7,599,046) | 634,239,450 |

| Total increase (decrease) in net assets | (124,621,422) | 819,249,300 |

| Net Assets | ||

| Beginning of period | 2,882,485,725 | 2,063,236,425 |

| End of period | $2,757,864,303 | $2,882,485,725 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Asset Manager 30% Class A

| Six months ended (Unaudited) March 31, | Years endedSeptember 30, | |||||

| 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $12.77 | $11.80 | $11.24 | $11.15 | $11.11 | $10.62 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A,B | .07 | .14 | .16 | .21 | .16 | .13 |

| Net realized and unrealized gain (loss) | (.40) | 1.03 | .71 | .27 | .21 | .51 |

| Total from investment operations | (.33) | 1.17 | .87 | .48 | .37 | .64 |

| Distributions from net investment income | (.11) | (.09) | (.17) | (.21) | (.15) | (.13) |

| Distributions from net realized gain | (.04) | (.11) | (.14) | (.18) | (.18) | (.02) |

| Total distributions | (.16)C | (.20) | (.31) | (.39) | (.33) | (.15) |

| Net asset value, end of period | $12.28 | $12.77 | $11.80 | $11.24 | $11.15 | $11.11 |

| Total ReturnD,E,F | (2.65)% | 9.98% | 7.83% | 4.54% | 3.40% | 6.06% |

| Ratios to Average Net AssetsB,G,H | ||||||

| Expenses before reductions | .82%I | .82% | .82% | .82% | .84% | .85% |

| Expenses net of fee waivers, if any | .82%I | .82% | .82% | .82% | .84% | .85% |

| Expenses net of all reductions | .82%I | .82% | .82% | .82% | .84% | .85% |

| Net investment income (loss) | 1.18%I | 1.10% | 1.43% | 1.91% | 1.47% | 1.24% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $81,956 | $77,502 | $50,625 | $36,978 | $28,713 | $22,457 |

| Portfolio turnover rateJ | 20%I | 18% | 23% | 34% | 18% | 24% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Total distributions per share do not sum due to rounding.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the sales charges.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Annualized

J Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Asset Manager 30% Class M

| Six months ended (Unaudited) March 31, | Years endedSeptember 30, | |||||

| 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $12.75 | $11.77 | $11.22 | $11.13 | $11.10 | $10.61 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A,B | .06 | .11 | .13 | .18 | .13 | .11 |

| Net realized and unrealized gain (loss) | (.42) | 1.04 | .70 | .27 | .21 | .50 |

| Total from investment operations | (.36) | 1.15 | .83 | .45 | .34 | .61 |

| Distributions from net investment income | (.10) | (.07) | (.14) | (.18) | (.13) | (.10) |

| Distributions from net realized gain | (.04) | (.11) | (.14) | (.18) | (.18) | (.02) |

| Total distributions | (.14) | (.17)C | (.28) | (.36) | (.31) | (.12) |

| Net asset value, end of period | $12.25 | $12.75 | $11.77 | $11.22 | $11.13 | $11.10 |

| Total ReturnD,E,F | (2.84)% | 9.84% | 7.49% | 4.28% | 3.08% | 5.81% |

| Ratios to Average Net AssetsB,G,H | ||||||

| Expenses before reductions | 1.07%I | 1.08% | 1.08% | 1.09% | 1.10% | 1.11% |

| Expenses net of fee waivers, if any | 1.07%I | 1.08% | 1.08% | 1.09% | 1.09% | 1.11% |

| Expenses net of all reductions | 1.07%I | 1.08% | 1.08% | 1.09% | 1.09% | 1.11% |

| Net investment income (loss) | .92%I | .84% | 1.17% | 1.64% | 1.21% | .98% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $26,642 | $26,218 | $20,329 | $16,252 | $14,473 | $13,023 |

| Portfolio turnover rateJ | 20%I | 18% | 23% | 34% | 18% | 24% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Total distributions per share do not sum due to rounding.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the sales charges.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Annualized

J Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Asset Manager 30% Class C

| Six months ended (Unaudited) March 31, | Years endedSeptember 30, | |||||

| 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $12.64 | $11.71 | $11.16 | $11.07 | $11.04 | $10.57 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A,B | .03 | .04 | .07 | .12 | .08 | .05 |

| Net realized and unrealized gain (loss) | (.41) | 1.03 | .70 | .28 | .20 | .49 |

| Total from investment operations | (.38) | 1.07 | .77 | .40 | .28 | .54 |

| Distributions from net investment income | (.08) | (.03) | (.08) | (.12) | (.07) | (.05) |

| Distributions from net realized gain | (.04) | (.11) | (.14) | (.18) | (.18) | (.02) |

| Total distributions | (.13)C | (.14) | (.22) | (.31)C | (.25) | (.07) |

| Net asset value, end of period | $12.13 | $12.64 | $11.71 | $11.16 | $11.07 | $11.04 |

| Total ReturnD,E,F | (3.07)% | 9.17% | 7.00% | 3.77% | 2.59% | 5.16% |

| Ratios to Average Net AssetsB,G,H | ||||||

| Expenses before reductions | 1.58%I | 1.59% | 1.59% | 1.60% | 1.61% | 1.61% |

| Expenses net of fee waivers, if any | 1.58%I | 1.59% | 1.59% | 1.60% | 1.61% | 1.61% |

| Expenses net of all reductions | 1.58%I | 1.59% | 1.59% | 1.60% | 1.61% | 1.61% |

| Net investment income (loss) | .41%I | .33% | .66% | 1.13% | .70% | .47% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $30,417 | $31,949 | $27,496 | $24,224 | $24,911 | $20,979 |

| Portfolio turnover rateJ | 20%I | 18% | 23% | 34% | 18% | 24% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Total distributions per share do not sum due to rounding.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the contingent deferred sales charge.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Annualized

J Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Asset Manager 30%

| Six months ended (Unaudited) March 31, | Years endedSeptember 30, | |||||

| 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $12.77 | $11.79 | $11.24 | $11.15 | $11.11 | $10.63 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A,B | .09 | .18 | .20 | .24 | .20 | .17 |

| Net realized and unrealized gain (loss) | (.41) | 1.04 | .69 | .27 | .21 | .49 |

| Total from investment operations | (.32) | 1.22 | .89 | .51 | .41 | .66 |

| Distributions from net investment income | (.13) | (.14) | (.20) | (.24) | (.19) | (.16) |

| Distributions from net realized gain | (.04) | (.11) | (.14) | (.18) | (.18) | (.02) |

| Total distributions | (.18)C | (.24)C | (.34) | (.42) | (.37) | (.18) |

| Net asset value, end of period | $12.27 | $12.77 | $11.79 | $11.24 | $11.15 | $11.11 |

| Total ReturnD,E | (2.58)% | 10.43% | 8.05% | 4.87% | 3.75% | 6.32% |

| Ratios to Average Net AssetsB,F,G | ||||||

| Expenses before reductions | .52%H | .52% | .52% | .53% | .53% | .54% |

| Expenses net of fee waivers, if any | .51%H | .52% | .52% | .52% | .53% | .54% |

| Expenses net of all reductions | .51%H | .52% | .52% | .52% | .53% | .53% |

| Net investment income (loss) | 1.48%H | 1.40% | 1.74% | 2.21% | 1.78% | 1.55% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $2,050,927 | $2,196,582 | $1,935,863 | $1,661,192 | $1,480,983 | $1,139,197 |

| Portfolio turnover rateI | 20%H | 18% | 23% | 34% | 18% | 24% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Total distributions per share do not sum due to rounding.