UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3221

Fidelity Charles Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

|

Date of fiscal year end: |

October 31 |

|

|

|

|

Date of reporting period: |

April 30, 2015 |

Item 1. Reports to Stockholders

Fidelity®

Global Balanced

Fund

Semiannual Report

April 30, 2015

(Fidelity Cover Art)

Contents

|

Shareholder Expense Example |

An example of shareholder expenses. |

|

|

Investment Changes |

A summary of major shifts in the fund's investments over the past six months. |

|

|

Investments |

A complete list of the fund's investments with their market values. |

|

|

Financial Statements |

Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

|

|

Notes |

Notes to financial statements. |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2015 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2014 to April 30, 2015).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Semiannual Report

Shareholder Expense Example - continued

|

|

Annualized |

Beginning |

Ending |

Expenses Paid |

|

Class A |

1.29% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,015.30 |

$ 6.45 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,018.40 |

$ 6.46 |

|

Class T |

1.57% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,013.90 |

$ 7.84 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,017.01 |

$ 7.85 |

|

Class B |

2.07% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,010.90 |

$ 10.32 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,014.53 |

$ 10.34 |

|

Class C |

2.10% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,010.70 |

$ 10.47 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,014.38 |

$ 10.49 |

|

Global Balanced |

1.01% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,016.70 |

$ 5.05 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,019.79 |

$ 5.06 |

|

Institutional Class |

1.03% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,016.60 |

$ 5.15 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,019.69 |

$ 5.16 |

A 5% return per year before expenses

B Annualized expense ratio reflects expenses net of applicable fee waivers.

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The fees and expenses of the underlying Fidelity Central Funds in which the Fund invests are not included in each Class' annualized expense ratio.

In addition to the expenses noted above, the Fund also indirectly bears its proportional share of the expenses of the underlying Fidelity Central Funds. Annualized expenses of the underlying non-money market Fidelity Central Funds as of their most recent fiscal half year ranged from less than .01% to .01%.

Semiannual Report

Investment Changes (Unaudited)

|

The information in the following tables is based on the combined investments of the Fund and its pro-rata share of the investments of Fidelity's Fixed Income Central Funds. |

|

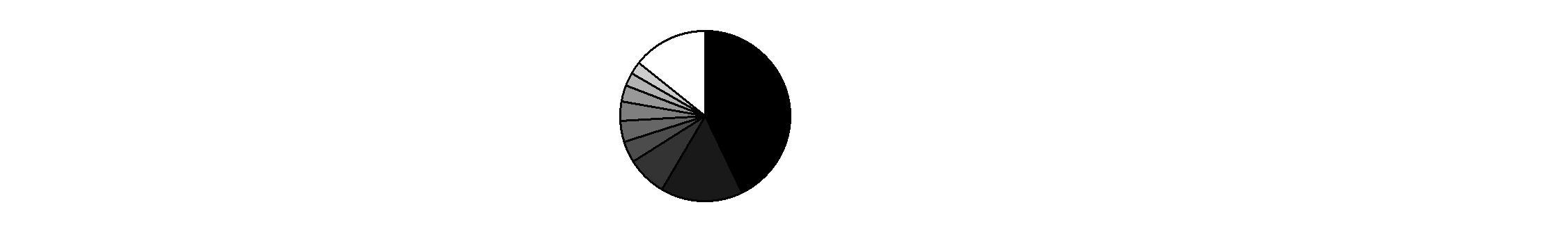

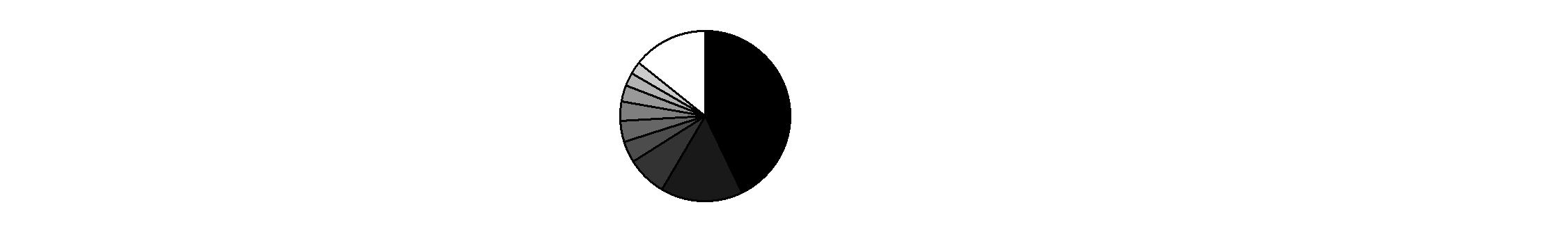

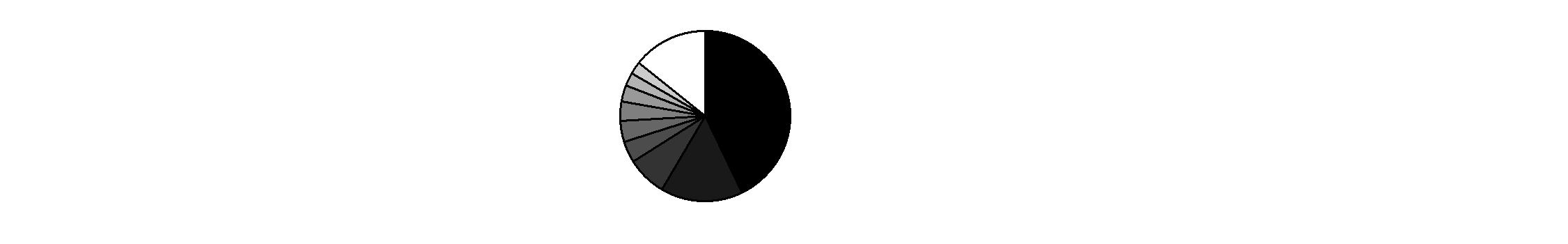

Geographic Diversification (% of fund's net assets) |

|||

|

As of April 30, 2015 |

|||

|

United States of America* 42.9% |

|

|

|

Japan 15.6% |

|

|

|

United Kingdom 7.6% |

|

|

|

France 4.0% |

|

|

|

Italy 3.9% |

|

|

|

Germany 3.7% |

|

|

|

Ireland 3.1% |

|

|

|

Netherlands 2.5% |

|

|

|

Spain 2.3% |

|

|

|

Other 14.4% |

|

|

|

* Includes Short-Term Investments and Net Other Assets (Liabilities) |

|

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable. |

|

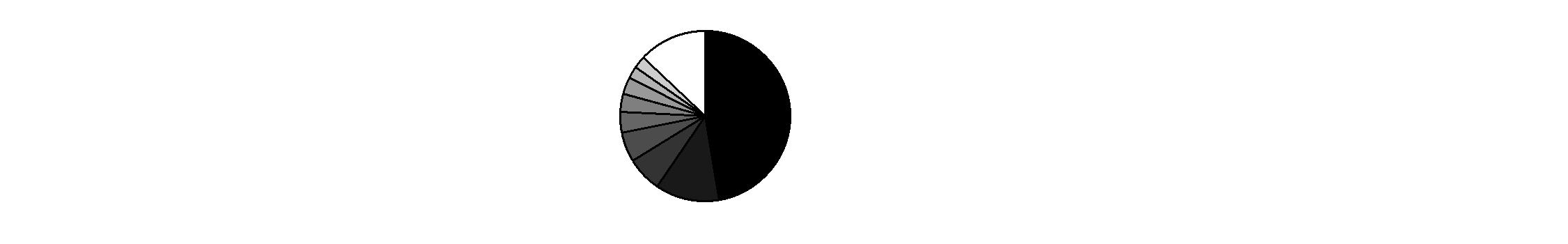

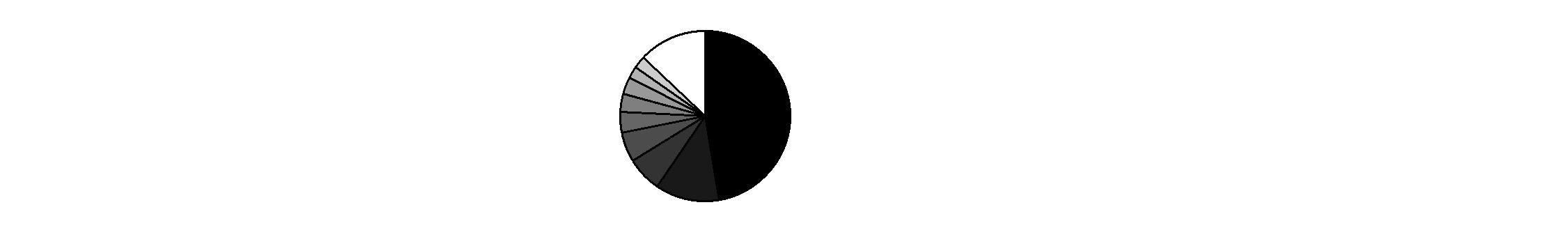

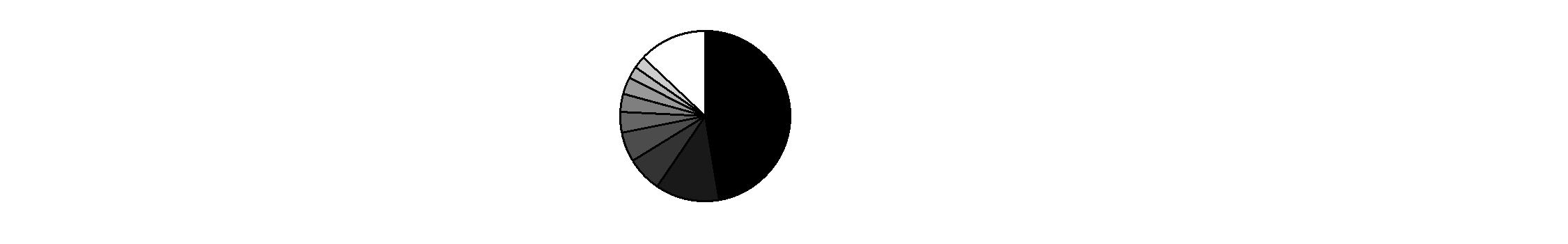

As of October 31, 2014 |

|||

|

United States of America* 47.4% |

|

|

|

Japan 12.2% |

|

|

|

United Kingdom 6.6% |

|

|

|

Germany 5.7% |

|

|

|

Italy 3.9% |

|

|

|

France 3.5% |

|

|

|

Canada 3.2% |

|

|

|

Switzerland 2.2% |

|

|

|

Spain 2.2% |

|

|

|

Other 13.1% |

|

|

|

* Includes Short-Term Investments and Net Other Assets (Liabilities) |

|

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable. |

|

Asset Allocation as of April 30, 2015 |

||

|

|

% of fund's |

% of fund's net assets |

|

Stocks |

58.8 |

57.5 |

|

Bonds |

31.9 |

36.3 |

|

Convertible Securities |

0.5 |

0.0 |

|

Other Investments |

1.8 |

0.6 |

|

Short-Term Investments and Net Other Assets (Liabilities) |

7.0 |

5.6 |

|

Top Five Stocks as of April 30, 2015 |

||

|

|

% of fund's |

% of fund's net assets |

|

McGraw Hill Financial, Inc. (United States of America) |

2.0 |

2.0 |

|

Adobe Systems, Inc. (United States of America) |

1.6 |

1.8 |

|

CVS Health Corp. (United States of America) |

1.4 |

1.3 |

|

Ameriprise Financial, Inc. (United States of America) |

1.1 |

1.8 |

|

Zebra Technologies Corp. Class A (United States of America) |

1.1 |

0.6 |

|

|

7.2 |

|

|

Top Five Bond Issuers as of April 30, 2015 |

||

|

(with maturities greater than one year) |

% of fund's |

% of fund's net assets |

|

Japan Government |

5.4 |

8.3 |

|

Buoni del Tesoro Poliennali |

2.8 |

2.5 |

|

Spanish Kingdom |

1.8 |

1.7 |

|

French Government |

1.6 |

1.3 |

|

German Federal Republic |

1.2 |

3.2 |

|

|

12.8 |

|

|

Market Sectors as of April 30, 2015 |

||

|

|

% of fund's |

% of fund's net assets |

|

Financials |

18.8 |

19.1 |

|

Health Care |

11.8 |

9.4 |

|

Information Technology |

9.6 |

9.5 |

|

Consumer Discretionary |

8.7 |

7.2 |

|

Industrials |

7.3 |

8.2 |

|

Consumer Staples |

6.0 |

5.1 |

|

Energy |

3.8 |

5.4 |

|

Materials |

2.0 |

3.0 |

|

Utilities |

1.3 |

1.6 |

|

Telecommunication Services |

1.2 |

1.1 |

|

An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of any securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, is available at fidelity.com and/or advisor.fidelity.com, as applicable. |

Semiannual Report

Investments April 30, 2015 (Unaudited)

Showing Percentage of Net Assets

|

Common Stocks - 58.5% |

|||

|

Shares |

Value |

||

|

Australia - 1.7% |

|||

|

AMP Ltd. |

108,504 |

$ 552,968 |

|

|

Ardent Leisure Group unit |

74,204 |

116,562 |

|

|

Asciano Ltd. |

50,184 |

262,504 |

|

|

Australia & New Zealand Banking Group Ltd. |

19,730 |

530,697 |

|

|

BHP Billiton Ltd. |

27,213 |

694,921 |

|

|

Cabcharge Australia Ltd. |

63,766 |

228,589 |

|

|

Carsales.com Ltd. |

18,338 |

136,991 |

|

|

Cimic Group Ltd. |

13,810 |

230,483 |

|

|

Coca-Cola Amatil Ltd. |

25,263 |

205,317 |

|

|

Commonwealth Bank of Australia |

19,811 |

1,393,254 |

|

|

Computershare Ltd. |

46,507 |

453,049 |

|

|

CSL Ltd. |

9,901 |

712,843 |

|

|

John Fairfax Holdings Ltd. |

344,134 |

284,585 |

|

|

Lend Lease Group unit |

37,128 |

471,569 |

|

|

Lovisa Holdings Ltd. |

29,466 |

72,519 |

|

|

Macquarie CountryWide Trust |

10,120 |

34,516 |

|

|

Macquarie Group Ltd. |

8,920 |

550,378 |

|

|

Mount Gibson Iron Ltd. |

449,069 |

72,851 |

|

|

Myer Holdings Ltd. |

184,783 |

201,795 |

|

|

Pact Group Holdings Ltd. |

63,653 |

207,532 |

|

|

Paladin Energy Ltd. (Australia) (a) |

398,082 |

110,258 |

|

|

QBE Insurance Group Ltd. |

48,836 |

529,455 |

|

|

Sims Metal Management Ltd. |

49,453 |

422,263 |

|

|

Slater & Gordon Ltd. |

21,236 |

106,544 |

|

|

Suncorp Group Ltd. |

37,419 |

388,355 |

|

|

Sunland Group Ltd. |

118,290 |

175,985 |

|

|

Super Cheap Auto Group Ltd. |

24,958 |

195,135 |

|

|

Sydney Airport unit |

133,563 |

569,696 |

|

|

Transpacific Industries Group Ltd. |

202,645 |

122,678 |

|

|

TOTAL AUSTRALIA |

10,034,292 |

||

|

Austria - 0.2% |

|||

|

Andritz AG |

19,300 |

1,129,952 |

|

|

Bailiwick of Jersey - 0.6% |

|||

|

Randgold Resources Ltd. |

300 |

22,830 |

|

|

Shire PLC |

31,200 |

2,535,425 |

|

|

Wolseley PLC |

18,202 |

1,076,547 |

|

|

TOTAL BAILIWICK OF JERSEY |

3,634,802 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

Belgium - 0.5% |

|||

|

Anheuser-Busch InBev SA NV ADR |

15,300 |

$ 1,836,612 |

|

|

KBC Groep NV |

21,102 |

1,388,370 |

|

|

TOTAL BELGIUM |

3,224,982 |

||

|

Bermuda - 0.2% |

|||

|

China Everbright Water Ltd. (a) |

202,400 |

171,318 |

|

|

DVN Holdings Ltd. (a) |

1,043,000 |

174,942 |

|

|

Signet Jewelers Ltd. |

2,000 |

268,260 |

|

|

Travelport Worldwide Ltd. |

17,000 |

269,110 |

|

|

Vostok Nafta Investment Ltd. SDR (a) |

47,500 |

313,862 |

|

|

TOTAL BERMUDA |

1,197,492 |

||

|

Canada - 0.6% |

|||

|

AG Growth International, Inc. |

100 |

4,334 |

|

|

Agnico Eagle Mines Ltd. (Canada) |

900 |

27,242 |

|

|

Agrium, Inc. |

350 |

36,262 |

|

|

Alimentation Couche-Tard, Inc. Class B (sub. vtg.) |

1,800 |

68,897 |

|

|

Allied Properties (REIT) |

840 |

27,849 |

|

|

ARC Resources Ltd. |

2,450 |

50,137 |

|

|

AutoCanada, Inc. |

280 |

9,271 |

|

|

Avigilon Corp. (a) |

1,100 |

18,982 |

|

|

Bank of Nova Scotia |

1,020 |

56,246 |

|

|

Barrick Gold Corp. |

700 |

9,097 |

|

|

Canadian National Railway Co. |

2,890 |

186,598 |

|

|

Canadian Natural Resources Ltd. |

1,180 |

39,209 |

|

|

CCL Industries, Inc. Class B |

320 |

36,790 |

|

|

CGI Group, Inc. Class A (sub. vtg.) (a) |

1,270 |

53,453 |

|

|

Constellation Software, Inc. |

110 |

43,125 |

|

|

Constellation Software, Inc. rights 9/15/15 (a) |

110 |

33 |

|

|

Eldorado Gold Corp. |

4,120 |

20,523 |

|

|

Enbridge, Inc. |

3,150 |

164,641 |

|

|

Fairfax Financial Holdings Ltd. (sub. vtg.) |

90 |

49,159 |

|

|

George Weston Ltd. |

630 |

52,040 |

|

|

Gildan Activewear, Inc. |

1,270 |

40,253 |

|

|

Gluskin Sheff + Associates, Inc. |

630 |

14,840 |

|

|

H&R REIT/H&R Finance Trust |

1,510 |

28,973 |

|

|

IMAX Corp. (a) |

7,000 |

261,520 |

|

|

Imperial Oil Ltd. |

2,210 |

97,412 |

|

|

Intact Financial Corp. |

1,050 |

80,876 |

|

|

Jean Coutu Group, Inc. Class A (sub. vtg.) |

2,260 |

43,982 |

|

|

Keyera Corp. |

1,646 |

57,941 |

|

|

Labrador Iron Ore Royalty Corp. |

740 |

8,832 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

Canada - continued |

|||

|

Lundin Mining Corp. (a) |

5,340 |

$ 26,556 |

|

|

Manulife Financial Corp. |

1,050 |

19,111 |

|

|

MDC Partners, Inc. Class A (sub. vtg.) |

300 |

6,282 |

|

|

Metro, Inc. Class A (sub. vtg.) |

1,100 |

31,801 |

|

|

National Bank of Canada |

1,570 |

63,438 |

|

|

North West Co., Inc. |

1,060 |

21,754 |

|

|

Novadaq Technologies, Inc. (a) |

280 |

3,027 |

|

|

Open Text Corp. |

680 |

34,358 |

|

|

Painted Pony Petroleum Ltd. (a) |

1,900 |

11,764 |

|

|

Paramount Resources Ltd. Class A (a) |

350 |

10,354 |

|

|

Parkland Fuel Corp. |

900 |

19,649 |

|

|

Pason Systems, Inc. |

1,200 |

21,603 |

|

|

Peyto Exploration & Development Corp. |

880 |

25,579 |

|

|

Pizza Pizza Royalty Corp. |

140 |

1,654 |

|

|

Potash Corp. of Saskatchewan, Inc. |

870 |

28,411 |

|

|

Power Corp. of Canada (sub. vtg.) |

2,590 |

71,163 |

|

|

PrairieSky Royalty Ltd. |

620 |

17,025 |

|

|

Quebecor, Inc. Class B (sub. vtg.) |

680 |

18,701 |

|

|

Raging River Exploration, Inc. (a) |

1,300 |

10,182 |

|

|

Rogers Communications, Inc. Class B (non-vtg.) (e) |

2,520 |

90,022 |

|

|

Romarco Minerals, Inc. (a) |

13,818 |

5,211 |

|

|

RONA, Inc. |

2,290 |

30,141 |

|

|

Royal Bank of Canada |

4,350 |

288,834 |

|

|

Silver Wheaton Corp. |

1,470 |

28,998 |

|

|

Spartan Energy Corp. (a) |

6,660 |

18,824 |

|

|

Stantec, Inc. |

850 |

22,960 |

|

|

Stella-Jones, Inc. |

460 |

16,581 |

|

|

Sun Life Financial, Inc. |

3,020 |

96,645 |

|

|

Suncor Energy, Inc. |

5,512 |

179,500 |

|

|

Tahoe Resources, Inc. |

810 |

11,447 |

|

|

TELUS Corp. |

2,990 |

103,417 |

|

|

The Toronto-Dominion Bank |

5,790 |

267,305 |

|

|

Torex Gold Resources, Inc. (a) |

10,180 |

9,450 |

|

|

TransForce, Inc. |

1,060 |

23,941 |

|

|

Valeant Pharmaceuticals International (Canada) (a) |

660 |

143,121 |

|

|

Vermilion Energy, Inc. |

450 |

21,663 |

|

|

West Fraser Timber Co. Ltd. |

600 |

30,873 |

|

|

WestJet Airlines Ltd. |

840 |

18,986 |

|

|

Whistler Blackcomb Holdings, Inc. |

320 |

4,838 |

|

|

Whitecap Resources, Inc. |

2,360 |

29,243 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

Canada - continued |

|||

|

Winpak Ltd. |

390 |

$ 12,675 |

|

|

ZCL Composites, Inc. |

3,020 |

19,249 |

|

|

TOTAL CANADA |

3,504,853 |

||

|

Cayman Islands - 0.4% |

|||

|

21Vianet Group, Inc. ADR (a) |

5,033 |

103,529 |

|

|

CK Hutchison Holdings Ltd. |

23,500 |

510,899 |

|

|

New Oriental Education & Technology Group, Inc. sponsored ADR (a) |

6,200 |

158,658 |

|

|

Tencent Holdings Ltd. |

16,100 |

332,286 |

|

|

Uni-President China Holdings Ltd. |

358,000 |

289,613 |

|

|

Vipshop Holdings Ltd. ADR (a) |

28,000 |

792,120 |

|

|

TOTAL CAYMAN ISLANDS |

2,187,105 |

||

|

China - 0.1% |

|||

|

Ping An Insurance (Group) Co. of China Ltd. (H Shares) |

32,000 |

459,942 |

|

|

Denmark - 0.6% |

|||

|

Carlsberg A/S Series B |

13,300 |

1,212,542 |

|

|

DSV de Sammensluttede Vognmaend A/S |

33,900 |

1,175,980 |

|

|

Novo Nordisk A/S Series B |

5,000 |

280,703 |

|

|

William Demant Holding A/S (a) |

12,900 |

1,055,895 |

|

|

TOTAL DENMARK |

3,725,120 |

||

|

Finland - 1.0% |

|||

|

Amer Group PLC (A Shares) |

45,500 |

1,138,683 |

|

|

Cargotec Corp. (B Shares) |

58,300 |

2,350,404 |

|

|

Huhtamaki Oyj |

32,300 |

1,032,559 |

|

|

Kesko Oyj |

15,400 |

629,226 |

|

|

Valmet Corp. |

79,700 |

923,673 |

|

|

TOTAL FINLAND |

6,074,545 |

||

|

France - 1.8% |

|||

|

bioMerieux SA |

12,500 |

1,348,519 |

|

|

Bollore Group |

207,800 |

1,187,587 |

|

|

Christian Dior SA |

7,605 |

1,486,786 |

|

|

Havas SA |

135,700 |

1,131,840 |

|

|

Ipsen SA |

21,900 |

1,257,674 |

|

|

Publicis Groupe SA |

16,124 |

1,352,329 |

|

|

Rexel SA |

78,300 |

1,475,693 |

|

|

Total SA sponsored ADR |

13,000 |

703,300 |

|

|

Wendel SA |

8,400 |

1,031,714 |

|

|

TOTAL FRANCE |

10,975,442 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

Germany - 1.6% |

|||

|

adidas AG |

14,600 |

$ 1,196,265 |

|

|

Bayer AG |

14,900 |

2,144,596 |

|

|

Brenntag AG |

18,300 |

1,098,012 |

|

|

CompuGroup Medical AG |

20,100 |

574,534 |

|

|

Continental AG (e) |

5,800 |

1,359,258 |

|

|

Deutsche Annington Immobilien SE |

13,085 |

439,200 |

|

|

Fresenius SE & Co. KGaA |

25,200 |

1,499,222 |

|

|

GEA Group AG |

23,596 |

1,133,220 |

|

|

MLP AG |

25,383 |

108,500 |

|

|

TOTAL GERMANY |

9,552,807 |

||

|

Hong Kong - 0.6% |

|||

|

AIA Group Ltd. |

242,800 |

1,622,729 |

|

|

Lenovo Group Ltd. |

216,000 |

373,444 |

|

|

Power Assets Holdings Ltd. |

28,500 |

288,473 |

|

|

SJM Holdings Ltd. |

297,000 |

378,217 |

|

|

Techtronic Industries Co. Ltd. |

115,500 |

410,555 |

|

|

Wharf Holdings Ltd. |

45,000 |

325,429 |

|

|

TOTAL HONG KONG |

3,398,847 |

||

|

Ireland - 2.7% |

|||

|

Actavis PLC (a) |

23,850 |

6,746,211 |

|

|

Alkermes PLC (a) |

44,400 |

2,458,428 |

|

|

DCC PLC (United Kingdom) |

13,000 |

826,977 |

|

|

Endo Health Solutions, Inc. (a) |

9,000 |

756,585 |

|

|

Greencore Group PLC |

111,821 |

606,806 |

|

|

James Hardie Industries PLC CDI |

33,849 |

391,349 |

|

|

Medtronic PLC |

33,000 |

2,456,850 |

|

|

Prothena Corp. PLC (a) |

3,000 |

97,230 |

|

|

Ryanair Holdings PLC sponsored ADR |

10,000 |

648,500 |

|

|

United Drug PLC (United Kingdom) |

164,090 |

1,334,545 |

|

|

TOTAL IRELAND |

16,323,481 |

||

|

Isle of Man - 0.5% |

|||

|

Optimal Payments PLC (a) |

194,600 |

884,327 |

|

|

Optimal Payments PLC rights 5/1/15 (a) |

324,333 |

688,553 |

|

|

Playtech Ltd. |

126,880 |

1,593,966 |

|

|

TOTAL ISLE OF MAN |

3,166,846 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

Israel - 0.2% |

|||

|

Sarine Technologies Ltd. |

268,100 |

$ 415,360 |

|

|

Teva Pharmaceutical Industries Ltd. sponsored ADR |

9,000 |

543,780 |

|

|

TOTAL ISRAEL |

959,140 |

||

|

Italy - 0.2% |

|||

|

Amplifon SpA |

153,000 |

1,191,717 |

|

|

Japan - 6.3% |

|||

|

AEON Financial Service Co. Ltd. |

41,000 |

1,045,195 |

|

|

Asahi Group Holdings |

33,800 |

1,086,908 |

|

|

Asahi Kasei Corp. |

33,000 |

310,749 |

|

|

Bridgestone Corp. |

36,800 |

1,541,320 |

|

|

Dai-ichi Mutual Life Insurance Co. |

50,300 |

826,726 |

|

|

Daikin Industries Ltd. |

15,300 |

1,030,746 |

|

|

Fanuc Corp. |

600 |

131,978 |

|

|

Fuji Heavy Industries Ltd. |

30,700 |

1,026,609 |

|

|

Furukawa Electric Co. Ltd. |

250,000 |

458,224 |

|

|

Hitachi Metals Ltd. |

85,000 |

1,329,335 |

|

|

Hoya Corp. |

35,900 |

1,383,618 |

|

|

KDDI Corp. |

34,200 |

809,252 |

|

|

Kubota Corp. |

65,000 |

1,017,316 |

|

|

Kyocera Corp. |

2,000 |

104,403 |

|

|

LIXIL Group Corp. |

47,900 |

998,406 |

|

|

Mitsubishi Electric Corp. |

22,000 |

287,314 |

|

|

Mitsubishi Heavy Industries Ltd. |

211,000 |

1,169,093 |

|

|

NEC Corp. |

460,000 |

1,530,425 |

|

|

Nihon Kohden Corp. |

31,300 |

822,454 |

|

|

Nihon Parkerizing Co. Ltd. |

36,800 |

418,372 |

|

|

Nintendo Co. Ltd. |

5,000 |

839,500 |

|

|

Nippon Ceramic Co. Ltd. |

25,900 |

369,126 |

|

|

Nippon Shinyaku Co. Ltd. |

12,000 |

401,203 |

|

|

Nissan Motor Co. Ltd. |

36,400 |

377,857 |

|

|

OMRON Corp. |

3,000 |

137,754 |

|

|

ORIX Corp. |

122,400 |

1,882,316 |

|

|

Panasonic Corp. |

114,100 |

1,634,354 |

|

|

Rakuten, Inc. |

27,700 |

483,931 |

|

|

ROHM Co. Ltd. |

15,600 |

1,082,091 |

|

|

Seiko Epson Corp. |

31,600 |

552,190 |

|

|

SoftBank Corp. |

26,500 |

1,656,524 |

|

|

Stanley Electric Co. Ltd. |

43,000 |

964,818 |

|

|

Sumitomo Mitsui Financial Group, Inc. |

39,700 |

1,733,485 |

|

|

Sumitomo Mitsui Trust Holdings, Inc. |

261,000 |

1,148,906 |

|

|

T&D Holdings, Inc. |

53,900 |

777,766 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

Japan - continued |

|||

|

Temp Holdings Co., Ltd. |

28,100 |

$ 890,015 |

|

|

Tokyo Electron Ltd. |

6,400 |

350,799 |

|

|

Tokyo Tatemono Co. Ltd. |

77,000 |

558,301 |

|

|

Toray Industries, Inc. |

97,000 |

843,187 |

|

|

Tosoh Corp. |

173,000 |

927,499 |

|

|

Toyota Motor Corp. |

22,500 |

1,566,206 |

|

|

Yahoo! Japan Corp. |

159,400 |

651,186 |

|

|

Yamaha Motor Co. Ltd. |

46,400 |

1,091,893 |

|

|

TOTAL JAPAN |

38,249,350 |

||

|

Korea (South) - 0.0% |

|||

|

Samsung Electronics Co. Ltd. |

100 |

130,906 |

|

|

Luxembourg - 0.0% |

|||

|

Samsonite International SA |

72,900 |

266,654 |

|

|

Netherlands - 0.9% |

|||

|

ING Groep NV (Certificaten Van Aandelen) |

114,900 |

1,762,745 |

|

|

LyondellBasell Industries NV Class A |

50 |

5,176 |

|

|

NXP Semiconductors NV (a) |

21,000 |

2,018,520 |

|

|

Reed Elsevier NV |

46,633 |

1,124,668 |

|

|

Unilever NV (NY Reg.) |

6,000 |

260,880 |

|

|

TOTAL NETHERLANDS |

5,171,989 |

||

|

Norway - 0.2% |

|||

|

TGS Nopec Geophysical Co. ASA |

51,200 |

1,302,989 |

|

|

Singapore - 0.0% |

|||

|

Rex International Holdings Ltd. (a) |

967,400 |

230,299 |

|

|

Spain - 0.4% |

|||

|

Amadeus IT Holding SA Class A |

32,000 |

1,458,623 |

|

|

Red Electrica Corporacion SA |

13,300 |

1,116,201 |

|

|

TOTAL SPAIN |

2,574,824 |

||

|

Sweden - 2.1% |

|||

|

Elekta AB (B Shares) |

94,698 |

886,110 |

|

|

Getinge AB (B Shares) |

117,400 |

2,853,395 |

|

|

Hemfosa Fastigheter AB (a) |

45,500 |

1,051,276 |

|

|

Indutrade AB |

24,000 |

1,172,446 |

|

|

Kungsleden AB |

138,395 |

1,007,361 |

|

|

Lundbergfoeretagen AB |

21,600 |

1,014,536 |

|

|

Nordea Bank AB |

78,400 |

996,084 |

|

|

SKF AB (B Shares) |

48,900 |

1,194,385 |

|

|

Svenska Cellulosa AB (SCA) (B Shares) |

49,600 |

1,254,631 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

Sweden - continued |

|||

|

Svenska Handelsbanken AB (A Shares) |

19,200 |

$ 886,252 |

|

|

Volvo AB (B Shares) |

13,000 |

179,598 |

|

|

TOTAL SWEDEN |

12,496,074 |

||

|

Switzerland - 1.2% |

|||

|

Julius Baer Group Ltd. |

23,500 |

1,230,008 |

|

|

Roche Holding AG (participation certificate) |

12,917 |

3,696,265 |

|

|

Sonova Holding AG Class B |

7,986 |

1,103,303 |

|

|

TE Connectivity Ltd. |

19,200 |

1,277,760 |

|

|

TOTAL SWITZERLAND |

7,307,336 |

||

|

United Kingdom - 5.2% |

|||

|

Aberdeen Asset Management PLC |

136,143 |

988,599 |

|

|

Babcock International Group PLC |

109,930 |

1,695,772 |

|

|

British American Tobacco PLC (United Kingdom) |

43,300 |

2,379,060 |

|

|

British Land Co. PLC |

90,300 |

1,150,091 |

|

|

Bunzl PLC |

39,469 |

1,109,761 |

|

|

Compass Group PLC |

58,535 |

1,034,766 |

|

|

Dechra Pharmaceuticals PLC |

46,600 |

728,103 |

|

|

Diageo PLC |

62,749 |

1,742,061 |

|

|

Diploma PLC |

81,000 |

993,558 |

|

|

Essentra PLC |

70,200 |

1,030,488 |

|

|

HSBC Holdings PLC (United Kingdom) |

223,500 |

2,232,654 |

|

|

ITV PLC |

249,800 |

969,853 |

|

|

JUST EAT Ltd. (a) |

5,000 |

35,062 |

|

|

Land Securities Group PLC |

62,612 |

1,198,177 |

|

|

Lloyds Banking Group PLC |

1,448,300 |

1,715,190 |

|

|

London Stock Exchange Group PLC |

28,245 |

1,099,448 |

|

|

Micro Focus International PLC |

400 |

7,699 |

|

|

Prudential PLC |

69,511 |

1,730,653 |

|

|

Rolls-Royce Group PLC |

98,827 |

1,575,590 |

|

|

Royal & Sun Alliance Insurance Group PLC |

190,585 |

1,246,761 |

|

|

Schroders PLC |

13,600 |

674,538 |

|

|

Shawbrook Group Ltd. |

47,900 |

226,061 |

|

|

St. James's Place Capital PLC |

39,600 |

540,172 |

|

|

Standard Chartered PLC: |

|

|

|

|

(Hong Kong) |

21,400 |

353,420 |

|

|

(United Kingdom) |

149,650 |

2,450,101 |

|

|

Unite Group PLC |

118,300 |

1,082,288 |

|

|

William Hill PLC |

215,600 |

1,191,217 |

|

|

TOTAL UNITED KINGDOM |

31,181,143 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

United States of America - 28.7% |

|||

|

AbbVie, Inc. |

13,000 |

$ 840,580 |

|

|

Adobe Systems, Inc. (a) |

125,200 |

9,522,712 |

|

|

Agios Pharmaceuticals, Inc. (a) |

3,000 |

277,020 |

|

|

Alaska Air Group, Inc. |

30,000 |

1,921,800 |

|

|

Alnylam Pharmaceuticals, Inc. (a) |

1,726 |

175,828 |

|

|

AMAG Pharmaceuticals, Inc. (a) |

2,000 |

101,940 |

|

|

Amazon.com, Inc. (a) |

6,700 |

2,825,926 |

|

|

American Airlines Group, Inc. |

41,400 |

1,998,999 |

|

|

Ameriprise Financial, Inc. |

54,700 |

6,852,816 |

|

|

Amgen, Inc. |

6,000 |

947,460 |

|

|

Amphenol Corp. Class A |

3,700 |

204,869 |

|

|

AutoZone, Inc. (a) |

2,500 |

1,681,650 |

|

|

Avalanche Biotechnologies, Inc. (a) |

1,500 |

47,790 |

|

|

Babcock & Wilcox Co. |

10,000 |

323,200 |

|

|

Biogen, Inc. (a) |

11,200 |

4,188,016 |

|

|

BioMarin Pharmaceutical, Inc. (a) |

9,000 |

1,008,450 |

|

|

BlackRock, Inc. Class A |

1,700 |

618,698 |

|

|

bluebird bio, Inc. (a) |

3,100 |

412,889 |

|

|

Booz Allen Hamilton Holding Corp. Class A |

25,000 |

687,500 |

|

|

Cabot Oil & Gas Corp. |

62,000 |

2,096,840 |

|

|

California Resources Corp. |

11,000 |

102,300 |

|

|

CDW Corp. |

1,000 |

38,320 |

|

|

Celgene Corp. (a) |

12,000 |

1,296,720 |

|

|

Celldex Therapeutics, Inc. (a) |

2,300 |

55,200 |

|

|

Charles Schwab Corp. |

10,000 |

305,000 |

|

|

Chimerix, Inc. (a) |

1,600 |

54,400 |

|

|

Church & Dwight Co., Inc. |

4,000 |

324,680 |

|

|

Cidara Therapeutics, Inc. |

5,564 |

81,346 |

|

|

Cigna Corp. |

8,300 |

1,034,512 |

|

|

Cognizant Technology Solutions Corp. Class A (a) |

15,000 |

878,100 |

|

|

CommScope Holding Co., Inc. (a) |

13,000 |

383,630 |

|

|

Constellation Brands, Inc. Class A (sub. vtg.) (a) |

21,000 |

2,434,740 |

|

|

CVS Health Corp. |

84,500 |

8,390,005 |

|

|

Denbury Resources, Inc. (e) |

326,000 |

2,872,060 |

|

|

Diamondback Energy, Inc. (a) |

8,000 |

660,560 |

|

|

Diplomat Pharmacy, Inc. (e) |

15,000 |

537,300 |

|

|

Domino's Pizza, Inc. |

3,000 |

323,550 |

|

|

Dyax Corp. (a) |

4,000 |

95,640 |

|

|

Dynegy, Inc. (a) |

72,900 |

2,425,383 |

|

|

E*TRADE Financial Corp. (a) |

5,000 |

143,950 |

|

|

Ecolab, Inc. |

7,100 |

795,058 |

|

|

Electronic Arts, Inc. (a) |

8,000 |

464,720 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

United States of America - continued |

|||

|

Energizer Holdings, Inc. |

20 |

$ 2,732 |

|

|

EQT Corp. |

25,000 |

2,248,500 |

|

|

Estee Lauder Companies, Inc. Class A |

19,200 |

1,560,768 |

|

|

Etsy, Inc. |

2,100 |

46,704 |

|

|

Facebook, Inc. Class A (a) |

63,800 |

5,025,526 |

|

|

FedEx Corp. |

2,900 |

491,753 |

|

|

Ford Motor Co. |

40,000 |

632,000 |

|

|

Freeport-McMoRan, Inc. |

790 |

18,383 |

|

|

Gilead Sciences, Inc. (a) |

64,000 |

6,432,640 |

|

|

Google, Inc. Class A (a) |

4,700 |

2,579,219 |

|

|

HD Supply Holdings, Inc. (a) |

13,000 |

429,000 |

|

|

Home Depot, Inc. |

22,000 |

2,353,560 |

|

|

Huntington Ingalls Industries, Inc. |

2,000 |

263,180 |

|

|

Illumina, Inc. (a) |

100 |

18,425 |

|

|

inContact, Inc. (a) |

85,000 |

879,750 |

|

|

Interactive Intelligence Group, Inc. (a) |

2,000 |

87,960 |

|

|

Intercept Pharmaceuticals, Inc. (a) |

10,600 |

2,679,786 |

|

|

Intrexon Corp. (a) |

15,000 |

582,450 |

|

|

Intuit, Inc. |

31,200 |

3,130,296 |

|

|

Isis Pharmaceuticals, Inc. (a) |

3,700 |

209,864 |

|

|

J.B. Hunt Transport Services, Inc. |

10,000 |

872,000 |

|

|

Level 3 Communications, Inc. (a) |

33,000 |

1,846,020 |

|

|

LinkedIn Corp. Class A (a) |

1,000 |

252,130 |

|

|

Lithia Motors, Inc. Class A (sub. vtg.) |

3,900 |

388,947 |

|

|

Lowe's Companies, Inc. |

3,300 |

227,238 |

|

|

lululemon athletica, Inc. (a) |

12,000 |

763,680 |

|

|

Marathon Petroleum Corp. |

25,500 |

2,513,535 |

|

|

MarketAxess Holdings, Inc. |

1,200 |

103,020 |

|

|

MasterCard, Inc. Class A |

43,800 |

3,951,198 |

|

|

McGraw Hill Financial, Inc. |

114,000 |

11,890,200 |

|

|

Mead Johnson Nutrition Co. Class A |

10,150 |

973,588 |

|

|

Microsoft Corp. |

27,000 |

1,313,280 |

|

|

Moody's Corp. |

24,000 |

2,580,480 |

|

|

Neurocrine Biosciences, Inc. (a) |

19,000 |

647,710 |

|

|

Newfield Exploration Co. (a) |

67,000 |

2,629,080 |

|

|

NiSource, Inc. |

56,500 |

2,453,230 |

|

|

Novavax, Inc. (a) |

7,000 |

54,110 |

|

|

Nu Skin Enterprises, Inc. Class A |

3,700 |

209,235 |

|

|

NVIDIA Corp. |

6,000 |

133,170 |

|

|

O'Reilly Automotive, Inc. (a) |

2,800 |

609,924 |

|

|

PACCAR, Inc. |

3,000 |

196,050 |

|

|

Palo Alto Networks, Inc. (a) |

1,200 |

177,264 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

United States of America - continued |

|||

|

Papa John's International, Inc. |

6,000 |

$ 368,220 |

|

|

Party City Holdco, Inc. |

2,500 |

51,975 |

|

|

PDC Energy, Inc. (a) |

3,000 |

170,220 |

|

|

Philip Morris International, Inc. |

16,000 |

1,335,520 |

|

|

Pinnacle Foods, Inc. |

18,000 |

729,900 |

|

|

Post Holdings, Inc. (a) |

6,000 |

281,640 |

|

|

Prestige Brands Holdings, Inc. (a) |

85,000 |

3,336,250 |

|

|

Priceline Group, Inc. (a) |

500 |

618,905 |

|

|

Range Resources Corp. |

26,000 |

1,652,560 |

|

|

Red Hat, Inc. (a) |

3,300 |

248,358 |

|

|

Rock-Tenn Co. Class A |

10,000 |

629,800 |

|

|

Ross Stores, Inc. |

5,000 |

494,400 |

|

|

Royal Gold, Inc. |

300 |

19,359 |

|

|

Sage Therapeutics, Inc. |

1,300 |

68,900 |

|

|

Salesforce.com, Inc. (a) |

4,300 |

313,126 |

|

|

ServiceMaster Global Holdings, Inc. |

29,000 |

1,002,240 |

|

|

Skyworks Solutions, Inc. |

11,000 |

1,014,750 |

|

|

SolarWinds, Inc. (a) |

2,000 |

97,560 |

|

|

Spark Therapeutics, Inc. |

1,000 |

57,270 |

|

|

Spirit Airlines, Inc. (a) |

31,300 |

2,143,111 |

|

|

Sprouts Farmers Market LLC (a) |

21,000 |

671,685 |

|

|

SVB Financial Group (a) |

15,900 |

2,110,884 |

|

|

Teleflex, Inc. |

2,000 |

245,920 |

|

|

TESARO, Inc. (a) |

2,000 |

108,940 |

|

|

Tetraphase Pharmaceuticals, Inc. (a) |

3,000 |

105,840 |

|

|

The Blackstone Group LP |

9,000 |

368,640 |

|

|

The Coca-Cola Co. |

6,000 |

243,360 |

|

|

The Cooper Companies, Inc. |

10,400 |

1,851,928 |

|

|

The Hain Celestial Group, Inc. (a) |

14,000 |

843,360 |

|

|

The J.M. Smucker Co. |

4,000 |

463,680 |

|

|

The Walt Disney Co. |

25,400 |

2,761,488 |

|

|

Twitter, Inc. (a) |

42,000 |

1,636,320 |

|

|

Ulta Salon, Cosmetics & Fragrance, Inc. (a) |

5,000 |

755,450 |

|

|

Ultragenyx Pharmaceutical, Inc. (a) |

4,100 |

231,363 |

|

|

UnitedHealth Group, Inc. |

23,000 |

2,562,200 |

|

|

Visa, Inc. Class A |

50,000 |

3,302,500 |

|

|

Walgreens Boots Alliance, Inc. |

14,700 |

1,219,071 |

|

|

Wells Fargo & Co. |

76,000 |

4,187,600 |

|

|

Whirlpool Corp. |

11,300 |

1,984,280 |

|

|

WPX Energy, Inc. (a) |

81,000 |

1,113,750 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

United States of America - continued |

|||

|

Zebra Technologies Corp. Class A (a) |

74,000 |

$ 6,813,920 |

|

|

Zendesk, Inc. |

5,000 |

115,300 |

|

|

TOTAL UNITED STATES OF AMERICA |

173,221,285 |

||

|

TOTAL COMMON STOCKS (Cost $305,600,794) |

|

||

|

Preferred Stocks - 0.8% |

|||

|

|

|

|

|

|

Convertible Preferred Stocks - 0.5% |

|||

|

United States of America - 0.5% |

|||

|

Actavis PLC 5.50% |

1,700 |

1,701,122 |

|

|

American Tower Corp. 5.50% (a) |

12,900 |

1,323,540 |

|

|

Dynegy, Inc. 5.375% (a) |

2,500 |

283,775 |

|

|

TOTAL UNITED STATES OF AMERICA |

3,308,437 |

||

|

Nonconvertible Preferred Stocks - 0.3% |

|||

|

Germany - 0.3% |

|||

|

Volkswagen AG |

6,000 |

1,544,675 |

|

|

United Kingdom - 0.0% |

|||

|

Rolls-Royce Group PLC |

13,934,607 |

21,390 |

|

|

Rolls-Royce Group PLC (C Shares) (a) |

30,690,583 |

47,110 |

|

|

TOTAL UNITED KINGDOM |

68,500 |

||

|

TOTAL NONCONVERTIBLE PREFERRED STOCKS |

1,613,175 |

||

|

TOTAL PREFERRED STOCKS (Cost $4,272,256) |

|

||

|

Investment Companies - 1.2% |

|||

|

|

|

|

|

|

United States of America - 1.2% |

|||

|

iShares Barclays 20+ Year Treasury Bond ETF (e) |

55,300 |

|

|

|

Nonconvertible Bonds - 10.6% |

||||

|

|

Principal Amount (d) |

Value |

||

|

Australia - 0.1% |

||||

|

Aurizon Network Pty Ltd. 2% 9/18/24 (Reg. S) (d) |

EUR |

450,000 |

$ 517,874 |

|

|

Rio Tinto Finance (U.S.A.) Ltd. 9% 5/1/19 |

|

250,000 |

314,460 |

|

|

TOTAL AUSTRALIA |

832,334 |

|||

|

Bailiwick of Jersey - 0.3% |

||||

|

AA Bond Co. Ltd.: |

|

|

|

|

|

3.781% 7/31/43 (Reg S.) |

GBP |

500,000 |

796,358 |

|

|

4.7201% 7/31/18 (Reg. S) |

GBP |

600,000 |

984,346 |

|

|

TOTAL BAILIWICK OF JERSEY |

1,780,704 |

|||

|

British Virgin Islands - 0.1% |

||||

|

CNOOC Finance 2011 Ltd. 4.25% 1/26/21 |

|

400,000 |

428,460 |

|

|

Canada - 0.2% |

||||

|

Methanex Corp. 4.25% 12/1/24 |

|

1,250,000 |

1,275,050 |

|

|

The Toronto Dominion Bank 2.375% 10/19/16 |

|

250,000 |

255,901 |

|

|

TOTAL CANADA |

1,530,951 |

|||

|

Cayman Islands - 0.2% |

||||

|

Bishopgate Asset Finance Ltd. 4.808% 8/14/44 |

GBP |

177,771 |

280,363 |

|

|

IPIC GMTN Ltd.: |

|

|

|

|

|

5.875% 3/14/21 (Reg. S) |

EUR |

175,000 |

252,010 |

|

|

6.875% 3/14/26 |

GBP |

150,000 |

309,686 |

|

|

Yorkshire Water Services Finance Ltd. 6.375% 8/19/39 |

GBP |

100,000 |

217,017 |

|

|

TOTAL CAYMAN ISLANDS |

1,059,076 |

|||

|

France - 0.5% |

||||

|

Arkema SA 3.85% 4/30/20 |

EUR |

300,000 |

386,868 |

|

|

Banque Federative du Credit Mutuel SA 2.5% 10/29/18 (f) |

|

350,000 |

358,370 |

|

|

Bureau Veritas SA 3.125% 1/21/21 (Reg. S) |

EUR |

500,000 |

615,998 |

|

|

EDF SA 4.625% 9/11/24 |

EUR |

150,000 |

219,586 |

|

|

HSBC SFH France SA 2% 10/16/23 |

EUR |

800,000 |

1,012,481 |

|

|

Iliad SA 4.875% 6/1/16 |

EUR |

500,000 |

585,467 |

|

|

TOTAL FRANCE |

3,178,770 |

|||

|

Germany - 0.6% |

||||

|

Deutsche Bank AG 1.25% 9/8/21 |

EUR |

1,400,000 |

1,594,201 |

|

|

Deutsche Bank AG London Branch 1.875% 2/13/18 |

|

400,000 |

401,635 |

|

|

Infineon Technologies AG 1.5% 3/10/22 (Reg. S) |

EUR |

800,000 |

894,567 |

|

|

Nonconvertible Bonds - continued |

||||

|

|

Principal Amount (d) |

Value |

||

|

Germany - continued |

||||

|

ProSiebenSat.1 Media AG 2.625% 4/15/21 (Reg S.) |

EUR |

550,000 |

$ 652,777 |

|

|

Vier Gas Transport GmbH 2.875% 6/12/25 (Reg. S) |

EUR |

200,000 |

258,296 |

|

|

TOTAL GERMANY |

3,801,476 |

|||

|

Hong Kong - 0.1% |

||||

|

Wharf Finance Ltd. 4.625% 2/8/17 |

|

400,000 |

417,911 |

|

|

Ireland - 0.4% |

||||

|

Aquarius & Investments PLC 4.25% 10/2/43 (h) |

EUR |

150,000 |

195,738 |

|

|

GE Capital UK Funding 4.375% 7/31/19 |

GBP |

450,000 |

760,973 |

|

|

Medtronic, Inc.: |

|

|

|

|

|

3.5% 3/15/25 (f) |

|

700,000 |

724,186 |

|

|

4.375% 3/15/35 (f) |

|

450,000 |

475,308 |

|

|

4.625% 3/15/45 (f) |

|

450,000 |

484,524 |

|

|

TOTAL IRELAND |

2,640,729 |

|||

|

Italy - 0.2% |

||||

|

Banco Popolare Societa Cooperativa 3.5% 3/14/19 |

EUR |

600,000 |

707,403 |

|

|

Intesa Sanpaolo SpA 4.875% 7/10/15 |

EUR |

300,000 |

339,627 |

|

|

TOTAL ITALY |

1,047,030 |

|||

|

Japan - 0.1% |

||||

|

Sumitomo Life Insurance Co. 6.5% 9/20/73 (Reg. S) (h) |

|

400,000 |

473,600 |

|

|

Korea (South) - 0.2% |

||||

|

Export-Import Bank of Korea 5% 4/11/22 |

|

200,000 |

229,713 |

|

|

Korea Resources Corp. 2.125% 5/2/18 (Reg. S) |

|

200,000 |

200,771 |

|

|

National Agricultural Cooperative Federation 4.25% 1/28/16 (Reg. S) |

|

450,000 |

459,815 |

|

|

Nonghyup Bank 2.625% 11/1/18 (Reg. S) |

|

200,000 |

204,144 |

|

|

TOTAL KOREA (SOUTH) |

1,094,443 |

|||

|

Luxembourg - 0.2% |

||||

|

Actavis Funding SCS: |

|

|

|

|

|

3% 3/12/20 |

|

250,000 |

254,332 |

|

|

3.45% 3/15/22 |

|

250,000 |

254,128 |

|

|

3.8% 3/15/25 |

|

350,000 |

353,922 |

|

|

4.55% 3/15/35 |

|

200,000 |

200,682 |

|

|

4.75% 3/15/45 |

|

150,000 |

151,228 |

|

|

TOTAL LUXEMBOURG |

1,214,292 |

|||

|

Netherlands - 0.7% |

||||

|

Achmea BV 2.5% 11/19/20 |

EUR |

500,000 |

606,177 |

|

|

Coca Cola HBC Finance BV 2.375% 6/18/20 |

EUR |

400,000 |

475,431 |

|

|

Nonconvertible Bonds - continued |

||||

|

|

Principal Amount (d) |

Value |

||

|

Netherlands - continued |

||||

|

Deutsche Annington Finance BV: |

|

|

|

|

|

3.2% 10/2/17 (f) |

|

$ 350,000 |

$ 359,008 |

|

|

5% 10/2/23 (f) |

|

450,000 |

489,356 |

|

|

Heineken NV 1.4% 10/1/17 (f) |

|

550,000 |

552,187 |

|

|

LYB International Finance BV: |

|

|

|

|

|

4% 7/15/23 |

|

500,000 |

529,334 |

|

|

4.875% 3/15/44 |

|

500,000 |

528,187 |

|

|

Volkswagen International Finance NV 2.375% 3/22/17 (f) |

|

400,000 |

408,590 |

|

|

Wuerth Finance International BV 1.75% 5/21/20 |

EUR |

150,000 |

178,023 |

|

|

TOTAL NETHERLANDS |

4,126,293 |

|||

|

Norway - 0.1% |

||||

|

DNB Boligkreditt A/S 1.45% 3/21/19 (f) |

|

400,000 |

399,638 |

|

|

Singapore - 0.1% |

||||

|

CMT MTN Pte. Ltd. 3.731% 3/21/18 (Reg. S) |

|

400,000 |

418,526 |

|

|

PSA International Pte Ltd. 4.625% 9/11/19 (Reg. S) |

|

250,000 |

276,730 |

|

|

TOTAL SINGAPORE |

695,256 |

|||

|

Spain - 0.1% |

||||

|

BBVA U.S. Senior SA 4.664% 10/9/15 |

|

500,000 |

508,057 |

|

|

Sweden - 0.1% |

||||

|

Svenska Handelsbanken AB 2.656% 1/15/24 (h) |

EUR |

441,000 |

519,319 |

|

|

Switzerland - 0.1% |

||||

|

Credit Suisse Group 5.75% 9/18/25 (Reg. S) (h) |

EUR |

300,000 |

389,168 |

|

|

United Arab Emirates - 0.0% |

||||

|

Abu Dhabi National Energy Co. 3.625% 1/12/23 |

|

300,000 |

306,750 |

|

|

United Kingdom - 1.2% |

||||

|

Barclays Bank PLC: |

|

|

|

|

|

4.25% 1/12/22 |

GBP |

350,000 |

611,713 |

|

|

6.75% 1/16/23 (h) |

GBP |

300,000 |

506,561 |

|

|

BAT International Finance PLC 3.25% 6/7/22 (f) |

|

200,000 |

204,506 |

|

|

Channel Link Enterprises Finance PLC 3.426% 6/30/50 (h) |

EUR |

950,000 |

1,063,008 |

|

|

Direct Line Insurance Group PLC 9.25% 4/27/42 (h) |

GBP |

100,000 |

195,650 |

|

|

Eastern Power Networks PLC 6.25% 11/12/36 |

GBP |

160,000 |

336,951 |

|

|

Eversholt Funding PLC 6.697% 2/22/35 |

GBP |

100,000 |

204,420 |

|

|

Experian Finance PLC 2.375% 6/15/17 (f) |

|

425,000 |

429,260 |

|

|

First Hydro Finance PLC 9% 7/31/21 |

GBP |

320,000 |

663,493 |

|

|

Great Rolling Stock Co. Ltd. 6.25% 7/27/20 |

GBP |

350,000 |

628,634 |

|

|

Nonconvertible Bonds - continued |

||||

|

|

Principal Amount (d) |

Value |

||

|

United Kingdom - continued |

||||

|

Intu Properties PLC 3.875% 3/17/23 |

GBP |

300,000 |

$ 481,794 |

|

|

Mondi Finance PLC 3.375% 9/28/20 |

EUR |

350,000 |

437,828 |

|

|

Sky PLC 2.5% 9/15/26 (Reg. S) |

EUR |

700,000 |

855,209 |

|

|

Tesco PLC 5.875% 9/12/16 |

EUR |

100,000 |

119,824 |

|

|

Unite (USAF) II PLC 3.374% 6/30/28 |

GBP |

150,000 |

237,261 |

|

|

Wales & West Utilities Finance PLC 6.75% 12/17/36 (h) |

GBP |

150,000 |

263,691 |

|

|

Western Power Distribution PLC 5.75% 3/23/40 |

GBP |

150,000 |

299,995 |

|

|

TOTAL UNITED KINGDOM |

7,539,798 |

|||

|

United States of America - 5.0% |

||||

|

AbbVie, Inc. 1.75% 11/6/17 |

|

400,000 |

402,235 |

|

|

Altria Group, Inc.: |

|

|

|

|

|

2.85% 8/9/22 |

|

500,000 |

497,695 |

|

|

9.25% 8/6/19 |

|

134,000 |

170,916 |

|

|

American Express Co. 1.55% 5/22/18 |

|

550,000 |

549,787 |

|

|

American International Group, Inc. 5% 4/26/23 |

GBP |

200,000 |

353,519 |

|

|

Anadarko Petroleum Corp. 3.45% 7/15/24 |

|

900,000 |

913,830 |

|

|

AutoZone, Inc. 3.125% 7/15/23 |

|

400,000 |

399,542 |

|

|

Bank of America Corp. 4.2% 8/26/24 |

|

950,000 |

960,137 |

|

|

Bayer U.S. Finance LLC 3.375% 10/8/24 (f) |

|

550,000 |

567,247 |

|

|

Burlington Northern Santa Fe LLC: |

|

|

|

|

|

3.4% 9/1/24 |

|

550,000 |

567,555 |

|

|

4.15% 4/1/45 |

|

150,000 |

151,188 |

|

|

Chevron Corp.: |

|

|

|

|

|

2.427% 6/24/20 |

|

200,000 |

206,706 |

|

|

3.191% 6/24/23 |

|

300,000 |

310,497 |

|

|

Citigroup, Inc.: |

|

|

|

|

|

2.125% 9/10/26 (Reg. S) |

EUR |

950,000 |

1,120,625 |

|

|

2.375% 5/22/24 (Reg. S) |

EUR |

1,100,000 |

1,332,459 |

|

|

4.5% 1/14/22 |

|

150,000 |

163,908 |

|

|

CME Group, Inc. 3% 3/15/25 |

|

300,000 |

301,607 |

|

|

Comcast Corp.: |

|

|

|

|

|

3.6% 3/1/24 |

|

350,000 |

373,140 |

|

|

4.75% 3/1/44 |

|

350,000 |

383,350 |

|

|

Frontier Oil Corp. 6.875% 11/15/18 |

|

250,000 |

259,063 |

|

|

General Electric Capital Corp. 4.65% 10/17/21 |

|

250,000 |

284,008 |

|

|

General Electric Co.: |

|

|

|

|

|

4.5% 3/11/44 |

|

650,000 |

709,662 |

|

|

5.25% 12/6/17 |

|

550,000 |

606,228 |

|

|

Glencore Funding LLC 3.125% 4/29/19 (f) |

|

250,000 |

254,675 |

|

|

Goldman Sachs Group, Inc. 3.85% 7/8/24 |

|

650,000 |

671,311 |

|

|

Illinois Tool Works, Inc. 3% 5/19/34 |

EUR |

600,000 |

820,455 |

|

|

Nonconvertible Bonds - continued |

||||

|

|

Principal Amount (d) |

Value |

||

|

United States of America - continued |

||||

|

Jefferies Group, Inc. 2.375% 5/20/20 (Reg. S) |

EUR |

1,150,000 |

$ 1,296,701 |

|

|

Marsh & McLennan Companies, Inc.: |

|

|

|

|

|

2.35% 9/10/19 |

|

900,000 |

910,007 |

|

|

3.5% 3/10/25 |

|

950,000 |

973,741 |

|

|

Metropolitan Life Global Funding I 3% 1/10/23 (f) |

|

350,000 |

354,060 |

|

|

Morgan Stanley: |

|

|

|

|

|

2.375% 7/23/19 |

|

4,200,000 |

4,214,868 |

|

|

4.35% 9/8/26 |

|

950,000 |

968,251 |

|

|

NBCUniversal, Inc. 4.375% 4/1/21 |

|

500,000 |

555,050 |

|

|

Philip Morris International, Inc. 2.875% 5/30/24 |

EUR |

150,000 |

192,774 |

|

|

Plains All American Pipeline LP/PAA Finance Corp.: |

|

|

|

|

|

3.6% 11/1/24 |

|

550,000 |

551,280 |

|

|

8.75% 5/1/19 |

|

100,000 |

124,135 |

|

|

Prologis LP: |

|

|

|

|

|

3% 1/18/22 |

EUR |

300,000 |

370,881 |

|

|

3% 6/2/26 |

EUR |

250,000 |

312,369 |

|

|

3.375% 2/20/24 |

EUR |

450,000 |

573,364 |

|

|

Qwest Corp. 6.75% 12/1/21 |

|

650,000 |

745,875 |

|

|

Reynolds American, Inc.: |

|

|

|

|

|

1.05% 10/30/15 |

|

200,000 |

200,012 |

|

|

3.25% 11/1/22 |

|

200,000 |

197,893 |

|

|

Roche Holdings, Inc. 6% 3/1/19 (f) |

|

69,000 |

79,566 |

|

|

SABMiller Holdings, Inc.: |

|

|

|

|

|

2.2% 8/1/18 (f) |

|

450,000 |

454,669 |

|

|

2.45% 1/15/17 (f) |

|

400,000 |

408,280 |

|

|

3.75% 1/15/22 (f) |

|

200,000 |

210,887 |

|

|

Verizon Communications, Inc. 5.15% 9/15/23 |

|

350,000 |

395,173 |

|

|

Viacom, Inc. 4.25% 9/1/23 |

|

250,000 |

260,750 |

|

|

Wal-Mart Stores, Inc. 5.625% 4/15/41 |

|

500,000 |

629,195 |

|

|

Walt Disney Co.: |

|

|

|

|

|

0.45% 12/1/15 |

|

350,000 |

350,183 |

|

|

2.35% 12/1/22 |

|

150,000 |

148,856 |

|

|

WEA Finance LLC/Westfield UK & Europe Finance PLC 2.7% 9/17/19 (f) |

|

600,000 |

607,991 |

|

|

Wells Fargo & Co. 3.676% 6/15/16 |

|

450,000 |

464,738 |

|

|

William Wrigley Jr. Co. 2.9% 10/21/19 (f) |

|

150,000 |

154,724 |

|

|

TOTAL UNITED STATES OF AMERICA |

30,037,618 |

|||

|

TOTAL NONCONVERTIBLE BONDS (Cost $63,939,112) |

|

|||

|

Government Obligations - 21.1% |

||||

|

|

Principal |

Value |

||

|

Bahrain - 0.1% |

||||

|

Bahrain Kingdom 6% 9/19/44 (Reg. S) |

|

$ 400,000 |

$ 391,000 |

|

|

Canada - 0.8% |

||||

|

Canadian Government 1.5% 6/1/23 |

CAD |

6,000,000 |

5,004,244 |

|

|

Denmark - 0.4% |

||||

|

Danish Kingdom Indexed Link CPI, 0.1% 11/15/23 |

DKK |

15,567,450 |

2,538,215 |

|

|

France - 1.6% |

||||

|

French Government 0.5% 5/25/25 |

EUR |

8,650,000 |

9,581,804 |

|

|

Germany - 1.2% |

||||

|

German Federal Republic: |

|

|

|

|

|

0.5% 2/15/25 |

EUR |

1,050,000 |

1,194,095 |

|

|

2% 1/4/22 |

EUR |

1,400,000 |

1,767,577 |

|

|

2.5% 7/4/44 |

EUR |

2,650,000 |

4,250,696 |

|

|

TOTAL GERMANY |

7,212,368 |

|||

|

Italy - 3.5% |

||||

|

Buoni del Tesoro Poliennali: |

|

|

|

|

|

Indexed-Linked Bond, 2.35% 9/15/24 (f) |

EUR |

1,000,000 |

1,330,866 |

|

|

4.5% 3/1/24 |

EUR |

5,450,000 |

7,686,072 |

|

|

5.5% 11/1/22 |

EUR |

5,250,000 |

7,715,598 |

|

|

Italian Republic Inflation-Indexed Bond 2.25% 4/22/17 |

EUR |

4,003,000 |

4,666,705 |

|

|

TOTAL ITALY |

21,399,241 |

|||

|

Japan - 9.1% |

||||

|

Japan Government: |

|

|

|

|

|

Inflation-Indexed Bond, 0.1% 9/10/24 |

JPY |

471,960,000 |

4,170,890 |

|

|

0.1% 2/15/16 |

JPY |

1,680,000,000 |

14,081,465 |

|

|

0.3% 6/20/15 |

JPY |

835,000,000 |

6,996,062 |

|

|

0.5% 3/20/16 |

JPY |

150,000,000 |

1,261,805 |

|

|

1.3% 3/20/20 |

JPY |

100,000,000 |

887,235 |

|

|

1.3% 6/20/20 |

JPY |

331,000,000 |

2,943,954 |

|

|

1.3% 3/20/21 |

JPY |

802,750,000 |

7,194,240 |

|

|

1.7% 9/20/32 |

JPY |

1,014,450,000 |

9,567,589 |

|

|

2% 9/20/40 |

JPY |

781,000,000 |

7,562,186 |

|

|

TOTAL JAPAN |

54,665,426 |

|||

|

Netherlands - 0.9% |

||||

|

Dutch Government 2.75% 1/15/47 |

EUR |

3,150,000 |

5,213,897 |

|

|

Government Obligations - continued |

||||

|

|

Principal Amount (d) |

Value |

||

|

Spain - 1.8% |

||||

|

Spanish Kingdom: |

|

|

|

|

|

Inflation-Indexed Bond, 1.8% 11/30/24 (f) |

EUR |

600,000 |

$ 768,599 |

|

|

3.8% 4/30/24 (Reg.S) |

EUR |

6,000,000 |

8,096,835 |

|

|

5.5% 4/30/21 |

EUR |

1,400,000 |

1,995,855 |

|

|

TOTAL SPAIN |

10,861,289 |

|||

|

United Arab Emirates - 0.1% |

||||

|

Sharjah Government 3.764% 9/17/24 (Reg. S) |

|

800,000 |

849,296 |

|

|

United Kingdom - 1.1% |

||||

|

United Kingdom, Great Britain and Northern Ireland: |

|

|

|

|

|

3.25% 1/22/44 |

GBP |

1,150,000 |

2,017,596 |

|

|

4% 3/7/22 |

GBP |

1,250,000 |

2,229,413 |

|

|

5% 3/7/25 |

GBP |

1,075,000 |

2,122,221 |

|

|

TOTAL UNITED KINGDOM |

6,369,230 |

|||

|

United States of America - 0.5% |

||||

|

U.S. Treasury Bonds: |

|

|

|

|

|

2.75% 8/15/42 |

|

200,000 |

199,984 |

|

|

2.75% 11/15/42 |

|

300,000 |

299,789 |

|

|

3% 11/15/44 |

|

200,000 |

210,359 |

|

|

3.625% 2/15/44 |

|

150,000 |

176,625 |

|

|

U.S. Treasury Notes: |

|

|

|

|

|

1.75% 5/15/23 |

|

1,050,000 |

1,036,957 |

|

|

2.75% 11/15/23 |

|

850,000 |

904,453 |

|

|

TOTAL UNITED STATES OF AMERICA |

2,828,167 |

|||

|

TOTAL GOVERNMENT OBLIGATIONS (Cost $137,060,303) |

|

|||

|

Asset-Backed Securities - 0.0% |

||||

|

|

||||

|

Bavarian Sky SA 0.208% 6/20/20 (h) |

EUR |

150,271 |

|

|

|

Collateralized Mortgage Obligations - 0.0% |

||||

|

|

||||

|

Private Sponsor - 0.0% |

||||

|

Granite Master Issuer PLC Series 2005-1 Class A5, 0.148% 12/20/54 (h) |

EUR |

83,215 |

|

|

|

Commercial Mortgage Securities - 0.0% |

||||

|

|

Principal Amount (d) |

Value |

||

|

United Kingdom - 0.0% |

||||

|

Eddystone Finance PLC Series 2006-1 Class A2, 1.0938% 4/19/21 (h) |

GBP |

109,693 |

$ 165,011 |

|

|

Supranational Obligations - 0.2% |

||||

|

|

||||

|

European Investment Bank 1.75% 3/15/17 |

|

1,000,000 |

|

|

|

Preferred Securities - 0.6% |

||||

|

|

||||

|

Cayman Islands - 0.1% |

||||

|

SMFG Preferred Capital GBP 2 Ltd. 10.231% (Reg. S) (g)(h) |

GBP |

250,000 |

613,274 |

|

|

France - 0.1% |

||||

|

Credit Agricole SA 8.125% 9/19/33 (Reg. S) (h) |

|

350,000 |

398,385 |

|

|

Japan - 0.1% |

||||

|

Fukoku Mutual Life Insurance Co. 6.5% (Reg. S) (h) |

|

550,000 |

643,200 |

|

|

Switzerland - 0.2% |

||||

|

UBS AG 4.75% 2/12/26 (Reg. S) (h) |

EUR |

800,000 |

1,003,248 |

|

|

United Kingdom - 0.1% |

||||

|

Lloyds Banking Group PLC 7% (Reg. S) (g)(h) |

GBP |

500,000 |

790,903 |

|

|

TOTAL PREFERRED SECURITIES (Cost $3,516,578) |

|

|||

|

Money Market Funds - 7.8% |

|||

|

Shares |

|

||

|

Fidelity Cash Central Fund, 0.15% (b) |

40,745,726 |

40,745,726 |

|

|

Fidelity Securities Lending Cash Central Fund, 0.17% (b)(c) |

6,403,356 |

6,403,356 |

|

|

TOTAL MONEY MARKET FUNDS (Cost $47,149,082) |

|

||

|

TOTAL INVESTMENT PORTFOLIO - 100.8% (Cost $570,375,816) |

607,741,553 |

||

|

NET OTHER ASSETS (LIABILITIES) - (0.8)% |

(4,859,664) |

||

|

NET ASSETS - 100% |

$ 602,881,889 |

||

|

Security Type Abbreviations |

||

|

ETF |

- |

Exchange-Traded Fund |

|

Currency Abbreviations |

||

|

CAD |

- |

Canadian dollar |

|

DKK |

- |

Danish krone |

|

EUR |

- |

European Monetary Unit |

|

GBP |

- |

British pound |

|

JPY |

- |

Japanese yen |

|

Legend |

|

(a) Non-income producing |

|

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

|

(c) Investment made with cash collateral received from securities on loan. |

|

(d) Amount is stated in United States dollars unless otherwise noted. |

|

(e) Security or a portion of the security is on loan at period end. |

|

(f) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $10,076,497 or 1.7% of net assets. |

|

(g) Security is perpetual in nature with no stated maturity date. |

|

(h) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

|

Affiliated Central Funds |

|

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

|

Fund |

Income earned |

|

Fidelity Cash Central Fund |

$ 26,361 |

|

Fidelity Emerging Markets Debt Central Fund |

57,478 |

|

Fidelity High Income Central Fund 1 |

49,034 |

|

Fidelity Securities Lending Cash Central Fund |

23,580 |

|

Total |

$ 156,453 |

|