Fidelity Asset Manager® 20%

Class/Ticker

Fidelity Advisor Asset Manager® 20%

A/FTAWX T/FTDWX B/FTBWX C/FTCWX

Summary Prospectus

November 28, 2015

Before you invest, you may want to review the fund's prospectus, which contains more information about the fund and its risks. You can find the fund's prospectus and other information about the fund (including the fund's SAI) online at advisor.fidelity.com/fafunddocuments. You can also get this information at no cost by calling 1-866-997-1254 or by sending an e-mail request to funddocuments@fmr.com. The fund's prospectus and SAI dated November 28, 2015 are incorporated herein by reference.

245 Summer Street, Boston, MA 02210

Fund Summary

Fund/Class:

Fidelity Asset Manager® 20%/Fidelity Advisor Asset Manager® 20% A, T, B, C

Investment Objective

The fund seeks a high level of current income by allocating its assets among stocks, bonds, short-term instruments and other investments. The fund also considers the potential for capital appreciation.

Fee Table

The following table describes the fees and expenses that may be incurred when you buy and hold shares of the fund.

You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the fund or certain other Fidelity® funds. More information about these and other discounts is available from your investment professional and in the Fund Distribution section of the prospectus.

Shareholder fees

(fees paid directly from your investment)

| Class A | Class T | Class B | Class C | |

| Maximum sales charge (load) on purchases (as a % of offering price) | 5.75% | 3.50% | None | None |

| Maximum contingent deferred sales charge (as a % of the lesser of original purchase price or redemption proceeds) | None(a) | None(a) | 5.00%(b) | 1.00%(c) |

(a) Class A and Class T purchases of $1 million or more will not be subject to a front-end sales charge. Such Class A and Class T purchases may be subject, upon redemption, to a contingent deferred sales charge (CDSC) of 1.00% or 0.25%, respectively.

(b) Declines over 6 years from 5.00% to 0%.

(c) On Class C shares redeemed less than one year after purchase.

Annual Operating Expenses

(expenses that you pay each year as a % of the value of your investment)

| Class A | Class T | Class B | Class C | |

| Management fee | 0.41% | 0.41% | 0.41% | 0.41% |

| Distribution and/or Service (12b-1) fees | 0.25% | 0.50% | 1.00% | 1.00% |

| Other expenses | 0.18% | 0.19% | 0.17% | 0.19% |

| Total annual operating expenses | 0.84%(a) | 1.10% | 1.58% | 1.60% |

(a) Differs from the ratios of expenses to average net assets in the Financial Highlights section of the prospectus because of acquired fund fees and expenses.

This example helps compare the cost of investing in the fund with the cost of investing in other funds.

Let's say, hypothetically, that the annual return for shares of the fund is 5% and that your shareholder fees and the annual operating expenses for shares of the fund are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you sell all of your shares at the end of each time period indicated and if you hold your shares:

| Class A | Class T | Class B | Class C | |||||

| Sell All Shares |

Hold Shares |

Sell All Shares |

Hold Shares |

Sell All Shares |

Hold Shares |

Sell All Shares |

Hold Shares |

|

| 1 year | $656 | $656 | $458 | $458 | $661 | $161 | $263 | $163 |

| 3 years | $828 | $828 | $687 | $687 | $799 | $499 | $505 | $505 |

| 5 years | $1,014 | $1,014 | $935 | $935 | $1,060 | $860 | $871 | $871 |

| 10 years | $1,553 | $1,553 | $1,643 | $1,643 | $1,586 | $1,586 | $1,900 | $1,900 |

Portfolio Turnover

The fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual operating expenses or in the example, affect the fund's performance. During the most recent fiscal year, the fund's portfolio turnover rate was 20% of the average value of its portfolio.

Principal Investment Strategies

- Allocating the fund's assets among three main asset classes: the stock class (equity securities of all types), the bond class (fixed-income securities of all types maturing in more than one year, including lower-quality debt securities which are sometimes referred to as high yield debt securities or junk bonds), and the short-term/money market class (fixed-income securities of all types maturing in one year or less).

- Maintaining a neutral mix over time of 20% of assets in stocks, 50% of assets in bonds, and 30% of assets in short-term and money market instruments.

- Adjusting allocation among asset classes gradually within the following ranges: stock class (10%-30%), bond class (40%-60%), and short-term/money market class (10%-50%).

- Investing in domestic and foreign issuers.

- Investing in Fidelity's central funds (specialized investment vehicles used by Fidelity® funds to invest in particular security types or investment disciplines).

Principal Investment Risks

- Stock Market Volatility. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Different parts of the market, including different market sectors, and different types of securities can react differently to these developments.

- Interest Rate Changes. Interest rate increases can cause the price of a debt security to decrease.

- Foreign Exposure. Foreign markets, particularly emerging markets, can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market, or economic developments and can perform differently from the U.S. market. Emerging markets can be subject to greater social, economic, regulatory, and political uncertainties and can be extremely volatile. Foreign exchange rates also can be extremely volatile.

- Prepayment. The ability of an issuer of a debt security to repay principal prior to a security's maturity can cause greater price volatility if interest rates change.

- Issuer-Specific Changes. The value of an individual security or particular type of security can be more volatile than, and can perform differently from, the market as a whole. A decline in the credit quality of an issuer or a provider of credit support or a maturity-shortening structure for a security can cause the price of a security to decrease. Lower-quality debt securities (those of less than investment-grade quality, also referred to as high yield debt securities or junk bonds) and certain types of other securities involve greater risk of default or price changes due to changes in the credit quality of the issuer. The value of lower-quality debt securities and certain types of other securities can be more volatile due to increased sensitivity to adverse issuer, political, regulatory, market, or economic developments.

An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. You could lose money by investing in the fund.

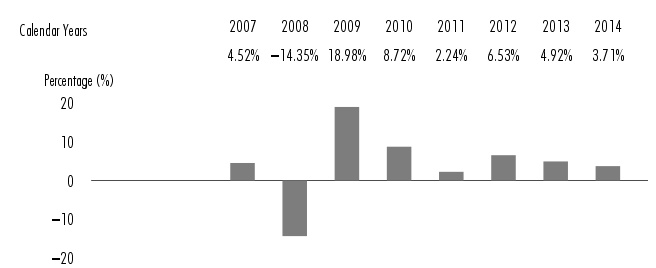

Performance

The following information is intended to help you understand the risks of investing in the fund. The information illustrates the changes in the performance of the fund's shares from year to year and compares the performance of the fund's shares to the performance of a securities market index and a hypothetical composite of market indexes over various periods of time. The indexes have characteristics relevant to the fund's investment strategies. Index descriptions appear in the Additional Index Information section of the prospectus. Past performance (before and after taxes) is not an indication of future performance.

Visit www.advisor.fidelity.com for updated return information.

Year-by-Year Returns

The returns in the bar chart do not reflect any applicable sales charges; if sales charges were reflected, returns would be lower than those shown.

| During the periods shown in the chart for Class A: | Returns | Quarter ended |

| Highest Quarter Return | 8.73% | June 30, 2009 |

| Lowest Quarter Return | (7.79)% | December 31, 2008 |

| Year-to-Date Return | (1.31)% | September 30, 2015 |

Average Annual Returns

Unlike the returns in the bar chart, the returns in the table reflect the maximum applicable sales charges. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, but do not reflect the impact of state or local taxes. After-tax returns for Class A are shown in the table below and after-tax returns for other classes will vary. Actual after-tax returns may differ depending on your individual circumstances. The after-tax returns shown are not relevant if you hold your shares in a retirement account or in another tax-deferred arrangement. Return After Taxes on Distributions and Sale of Fund Shares may be higher than other returns for the same period due to a tax benefit of realizing a capital loss upon the sale of fund shares.

| For the periods ended December 31, 2014 | Past 1 year | Past 5 years | Life of class(a) |

| Class A - Return Before Taxes | (2.25)% | 3.96% | 3.46% |

| Return After Taxes on Distributions | (3.55)% | 3.10% | 2.31% |

| Return After Taxes on Distributions and Sale of Fund Shares | (0.78)% | 2.92% | 2.41% |

| Class T - Return Before Taxes | (0.17)% | 4.17% | 3.49% |

| Class B - Return Before Taxes | (2.02)% | 4.04% | 3.49% |

| Class C - Return Before Taxes | 1.97% | 4.40% | 3.41% |

| Barclays® U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) |

5.97% | 4.45% | 5.03% |

| Fidelity Asset Manager 20% Composite Index℠ (reflects no deduction for fees or expenses) |

4.43% | 4.88% | 4.31% |

(a) From October 2, 2006

Investment Adviser

Fidelity Management & Research Company (FMR) (the Adviser) is the fund's manager. Fidelity Investments Money Management, Inc. (FIMM), FMR Co., Inc. (FMRC), and other investment advisers serve as sub-advisers for the fund.

Portfolio Manager(s)

Geoff Stein (portfolio manager) has managed the fund since June 2009.

Purchase and Sale of Shares

You may buy or sell shares through a retirement account or through an investment professional. You may buy or sell shares in various ways:

Internet

www.advisor.fidelity.com

Phone

To reach a Fidelity representative 1-877-208-0098

| Fidelity Investments P.O. Box 770002 Cincinnati, OH 45277-0081 |

Overnight Express: Fidelity Investments 100 Crosby Parkway Covington, KY 41015 |

Subject to certain limited exceptions described in the Additional Information about the Purchase and Sale of Shares section of the prospectus, the fund no longer accepts investments in Class B shares. Any purchase order for Class B shares (other than from an existing Class B shareholder pursuant to an exchange or the reinvestment of dividends and capital gain distributions paid on Class B shares) will be deemed to be a purchase order for Class A shares of the fund and will be subject to any applicable Class A front-end sales charge.

The price to buy one share of Class A or Class T is its offering price, if you pay a front-end sales charge, or its net asset value per share (NAV), if you qualify for a front-end sales charge waiver. The price to buy one share of Class B or Class C is its NAV. Shares will be bought at the offering price or NAV, as applicable, next calculated after an order is received in proper form.

The price to sell one share of Class A, Class T, Class B, or Class C is its NAV, minus any applicable contingent deferred sales charge (CDSC). Shares will be sold at the NAV next calculated after an order is received in proper form, minus any applicable CDSC.

The fund is open for business each day the New York Stock Exchange (NYSE) is open.

| Initial Purchase Minimum | $2,500 |

| For Fidelity Advisor® Traditional IRA, Roth IRA, Rollover IRA, Simplified Employee Pension-IRA, and Keogh accounts | $500 |

| Through a regular investment plan established at the time the fund position is opened | $100 |

The fund may waive or lower purchase minimums in other circumstances.

After a maximum of seven years from the initial purchase date, Class B shares convert automatically to Class A shares of the fund at NAV.

Tax Information

Distributions you receive from the fund are subject to federal income tax and generally will be taxed as ordinary income or capital gains, and may also be subject to state or local taxes, unless you are investing through a tax-advantaged retirement account (in which case you may be taxed later, upon withdrawal of your investment from such account).

Payments to Broker-Dealers and Other Financial Intermediaries

The fund, the Adviser, Fidelity Distributors Corporation (FDC), and/or their affiliates may pay intermediaries, which may include banks, broker-dealers, retirement plan sponsors, administrators, or service-providers (who may be affiliated with the Adviser or FDC), for the sale of fund shares and related services. These payments may create a conflict of interest by influencing your intermediary and your investment professional to recommend the fund over another investment. Ask your investment professional or visit your intermediary's web site for more information.

Current regulations allow Fidelity to send a single copy of shareholder documents for Fidelity® funds, such as prospectuses, annual and semiannual reports, and proxy materials, to certain mutual fund customers whom we believe are members of the same family who share the same address. We will not send multiple copies of these documents to you and members of your family who share the same address. Instead, we will send only a single copy of these documents. This will continue for as long as you are a shareholder, unless you notify us otherwise. If at any time you choose to receive individual copies of any documents, please call 1-877-208-0098. We will begin sending individual copies to you within 30 days of receiving your call.

FDC is a member of the Securities Investor Protection Corporation (SIPC). You may obtain information about SIPC, including the SIPC brochure, by visiting www.sipc.org or calling SIPC at 202-371-8300.

Fidelity Asset Manager, Fidelity Advisor Asset Manager, Fidelity Investments & Pyramid Design, Fidelity, and Fidelity Advisor are registered service marks of FMR LLC. © 2015 FMR LLC. All rights reserved.

Fidelity Asset Manager 20% Composite Index is a service mark of FMR LLC.

The third-party marks appearing above are the marks of their respective owners.

| 1.920232.107 | AAM-20-SUM-1115 |

Fidelity Asset Manager® 20%

Class/Ticker

Fidelity Advisor Asset Manager® 20%

I/FTIWX

Summary Prospectus

November 28, 2015

Before you invest, you may want to review the fund's prospectus, which contains more information about the fund and its risks. You can find the fund's prospectus and other information about the fund (including the fund's SAI) online at advisor.fidelity.com/fafunddocuments. You can also get this information at no cost by calling 1-866-997-1254 or by sending an e-mail request to funddocuments@fmr.com. The fund's prospectus and SAI dated November 28, 2015 are incorporated herein by reference.

245 Summer Street, Boston, MA 02210

Fund Summary

Fund/Class:

Fidelity Asset Manager® 20%/Fidelity Advisor Asset Manager® 20% I

Investment Objective

The fund seeks a high level of current income by allocating its assets among stocks, bonds, short-term instruments and other investments. The fund also considers the potential for capital appreciation.

Fee Table

The following table describes the fees and expenses that may be incurred when you buy and hold shares of the fund.

Shareholder fees

| (fees paid directly from your investment) | None |

Annual Operating Expenses

(expenses that you pay each year as a % of the value of your investment)

| Management fee | 0.41% | |

| Distribution and/or Service (12b-1) fees | None | |

| Other expenses | 0.17% | |

| Total annual operating expenses(a) | 0.58% |

(a) Differs from the ratios of expenses to average net assets in the Financial Highlights section of the prospectus because of acquired fund fees and expenses.

This example helps compare the cost of investing in the fund with the cost of investing in other funds.

Let's say, hypothetically, that the annual return for shares of the fund is 5% and that your shareholder fees and the annual operating expenses for shares of the fund are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you sell all of your shares at the end of each time period indicated:

| 1 year | $59 |

| 3 years | $186 |

| 5 years | $324 |

| 10 years | $726 |

Portfolio Turnover

The fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual operating expenses or in the example, affect the fund's performance. During the most recent fiscal year, the fund's portfolio turnover rate was 20% of the average value of its portfolio.

Principal Investment Strategies

- Allocating the fund's assets among three main asset classes: the stock class (equity securities of all types), the bond class (fixed-income securities of all types maturing in more than one year, including lower-quality debt securities which are sometimes referred to as high yield debt securities or junk bonds), and the short-term/money market class (fixed-income securities of all types maturing in one year or less).

- Maintaining a neutral mix over time of 20% of assets in stocks, 50% of assets in bonds, and 30% of assets in short-term and money market instruments.

- Adjusting allocation among asset classes gradually within the following ranges: stock class (10%-30%), bond class (40%-60%), and short-term/money market class (10%-50%).

- Investing in domestic and foreign issuers.

- Investing in Fidelity's central funds (specialized investment vehicles used by Fidelity® funds to invest in particular security types or investment disciplines).

Principal Investment Risks

- Stock Market Volatility. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Different parts of the market, including different market sectors, and different types of securities can react differently to these developments.

- Interest Rate Changes. Interest rate increases can cause the price of a debt security to decrease.

- Foreign Exposure. Foreign markets, particularly emerging markets, can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market, or economic developments and can perform differently from the U.S. market. Emerging markets can be subject to greater social, economic, regulatory, and political uncertainties and can be extremely volatile. Foreign exchange rates also can be extremely volatile.

- Prepayment. The ability of an issuer of a debt security to repay principal prior to a security's maturity can cause greater price volatility if interest rates change.

- Issuer-Specific Changes. The value of an individual security or particular type of security can be more volatile than, and can perform differently from, the market as a whole. A decline in the credit quality of an issuer or a provider of credit support or a maturity-shortening structure for a security can cause the price of a security to decrease. Lower-quality debt securities (those of less than investment-grade quality, also referred to as high yield debt securities or junk bonds) and certain types of other securities involve greater risk of default or price changes due to changes in the credit quality of the issuer. The value of lower-quality debt securities and certain types of other securities can be more volatile due to increased sensitivity to adverse issuer, political, regulatory, market, or economic developments.

An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. You could lose money by investing in the fund.

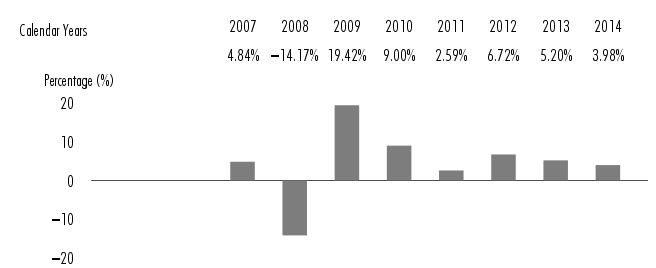

Performance

The following information is intended to help you understand the risks of investing in the fund. The information illustrates the changes in the performance of the fund's shares from year to year and compares the performance of the fund's shares to the performance of a securities market index and a hypothetical composite of market indexes over various periods of time. The indexes have characteristics relevant to the fund's investment strategies. Index descriptions appear in the Additional Index Information section of the prospectus. Past performance (before and after taxes) is not an indication of future performance.

Visit www.advisor.fidelity.com for updated return information.

Year-by-Year Returns

| During the periods shown in the chart: | Returns | Quarter ended |

| Highest Quarter Return | 8.81% | June 30, 2009 |

| Lowest Quarter Return | (7.70)% | December 31, 2008 |

| Year-to-Date Return | (1.15)% | September 30, 2015 |

Average Annual Returns

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, but do not reflect the impact of state or local taxes. Actual after-tax returns may differ depending on your individual circumstances. The after-tax returns shown are not relevant if you hold your shares in a retirement account or in another tax-deferred arrangement. Return After Taxes on Distributions and Sale of Fund Shares may be higher than other returns for the same period due to a tax benefit of realizing a capital loss upon the sale of fund shares.

| For the periods ended December 31, 2014 | Past 1 year | Past 5 years | Life of class(a) |

| Class I | |||

| Return Before Taxes | 3.98% | 5.48% | 4.49% |

| Return After Taxes on Distributions | 2.49% | 4.52% | 3.25% |

| Return After Taxes on Distributions and Sale of Fund Shares | 2.78% | 4.09% | 3.20% |

| Barclays® U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) |

5.97% | 4.45% | 5.03% |

| Fidelity Asset Manager 20% Composite Index℠ (reflects no deduction for fees or expenses) |

4.43% | 4.88% | 4.31% |

(a) From October 2, 2006

Investment Adviser

Fidelity Management & Research Company (FMR) (the Adviser) is the fund's manager. Fidelity Investments Money Management, Inc. (FIMM), FMR Co., Inc. (FMRC), and other investment advisers serve as sub-advisers for the fund.

Portfolio Manager(s)

Geoff Stein (portfolio manager) has managed the fund since June 2009.

Purchase and Sale of Shares

Class I eligibility requirements are listed in the Additional Information about the Purchase and Sale of Shares section of the prospectus.

You may buy or sell shares through a retirement account or through an investment professional. You may buy or sell shares in various ways:

Internet

www.advisor.fidelity.com

Phone

To reach a Fidelity representative 1-877-208-0098

| Fidelity Investments P.O. Box 770002 Cincinnati, OH 45277-0081 |

Overnight Express: Fidelity Investments 100 Crosby Parkway Covington, KY 41015 |

The price to buy one share is its net asset value per share (NAV). Shares will be bought at the NAV next calculated after an order is received in proper form.

The price to sell one share is its NAV. Shares will be sold at the NAV next calculated after an order is received in proper form.

The fund is open for business each day the New York Stock Exchange (NYSE) is open.

| Initial Purchase Minimum | $2,500 |

| For Fidelity Advisor® Traditional IRA, Roth IRA, Rollover IRA, Simplified Employee Pension-IRA, and Keogh accounts | $500 |

| Through a regular investment plan established at the time the fund position is opened | $100 |

The fund may waive or lower purchase minimums in other circumstances.

Tax Information

Distributions you receive from the fund are subject to federal income tax and generally will be taxed as ordinary income or capital gains, and may also be subject to state or local taxes, unless you are investing through a tax-advantaged retirement account (in which case you may be taxed later, upon withdrawal of your investment from such account).

Payments to Broker-Dealers and Other Financial Intermediaries

The fund, the Adviser, Fidelity Distributors Corporation (FDC), and/or their affiliates may pay intermediaries, which may include banks, broker-dealers, retirement plan sponsors, administrators, or service-providers (who may be affiliated with the Adviser or FDC), for the sale of fund shares and related services. These payments may create a conflict of interest by influencing your intermediary and your investment professional to recommend the fund over another investment. Ask your investment professional or visit your intermediary's web site for more information.

Current regulations allow Fidelity to send a single copy of shareholder documents for Fidelity® funds, such as prospectuses, annual and semiannual reports, and proxy materials, to certain mutual fund customers whom we believe are members of the same family who share the same address. We will not send multiple copies of these documents to you and members of your family who share the same address. Instead, we will send only a single copy of these documents. This will continue for as long as you are a shareholder, unless you notify us otherwise. If at any time you choose to receive individual copies of any documents, please call 1-877-208-0098. We will begin sending individual copies to you within 30 days of receiving your call.

FDC is a member of the Securities Investor Protection Corporation (SIPC). You may obtain information about SIPC, including the SIPC brochure, by visiting www.sipc.org or calling SIPC at 202-371-8300.

Fidelity Asset Manager, Fidelity Advisor Asset Manager, Fidelity Investments & Pyramid Design, Fidelity, and Fidelity Advisor are registered service marks of FMR LLC. © 2015 FMR LLC. All rights reserved.

Fidelity Asset Manager 20% Composite Index is a service mark of FMR LLC.

The third-party marks appearing above are the marks of their respective owners.

| 1.920233.108 | AAM-20I-SUM-1115 |

Fidelity Asset Manager® 20%

Class/Ticker

Fidelity Asset Manager® 20%/FASIX

In this summary prospectus, the term "shares" (as it relates to the fund) means the class of shares offered through this summary prospectus.

Summary Prospectus

November 28, 2015

Before you invest, you may want to review the fund's prospectus, which contains more information about the fund and its risks. You can find the fund's prospectus and other information about the fund (including the fund's SAI) online at www.fidelity.com/funddocuments. You can also get this information at no cost by calling 1-800-FIDELITY or by sending an e-mail request to fidfunddocuments@fidelity.com. The fund's prospectus and SAI dated November 28, 2015 are incorporated herein by reference.

245 Summer Street, Boston, MA 02210

Fund Summary

Fund/Class:

Fidelity Asset Manager® 20%/Fidelity Asset Manager® 20%

Investment Objective

The fund seeks a high level of current income by allocating its assets among stocks, bonds, short-term instruments and other investments. The fund also considers the potential for capital appreciation.

Fee Table

The following table describes the fees and expenses that may be incurred when you buy and hold shares of the fund.

Shareholder fees

| (fees paid directly from your investment) | None |

Annual Operating Expenses

(expenses that you pay each year as a % of the value of your investment)

| Management fee | 0.41% | |

| Distribution and/or Service (12b-1) fees | None | |

| Other expenses | 0.12% | |

| Total annual operating expenses | 0.53% |

This example helps compare the cost of investing in the fund with the cost of investing in other funds.

Let's say, hypothetically, that the annual return for shares of the fund is 5% and that your shareholder fees and the annual operating expenses for shares of the fund are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you sell all of your shares at the end of each time period indicated:

| 1 year | $54 |

| 3 years | $170 |

| 5 years | $296 |

| 10 years | $665 |

Portfolio Turnover

The fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual operating expenses or in the example, affect the fund's performance. During the most recent fiscal year, the fund's portfolio turnover rate was 20% of the average value of its portfolio.

Principal Investment Strategies

- Allocating the fund's assets among three main asset classes: the stock class (equity securities of all types), the bond class (fixed-income securities of all types maturing in more than one year, including lower-quality debt securities which are sometimes referred to as high yield debt securities or junk bonds), and the short-term/money market class (fixed-income securities of all types maturing in one year or less).

- Maintaining a neutral mix over time of 20% of assets in stocks, 50% of assets in bonds, and 30% of assets in short-term and money market instruments.

- Adjusting allocation among asset classes gradually within the following ranges: stock class (10%-30%), bond class (40%-60%), and short-term/money market class (10%-50%).

- Investing in domestic and foreign issuers.

- Investing in Fidelity's central funds (specialized investment vehicles used by Fidelity® funds to invest in particular security types or investment disciplines).

Principal Investment Risks

- Stock Market Volatility. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Different parts of the market, including different market sectors, and different types of securities can react differently to these developments.

- Interest Rate Changes. Interest rate increases can cause the price of a debt security to decrease.

- Foreign Exposure. Foreign markets, particularly emerging markets, can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market, or economic developments and can perform differently from the U.S. market. Emerging markets can be subject to greater social, economic, regulatory, and political uncertainties and can be extremely volatile. Foreign exchange rates also can be extremely volatile.

- Prepayment. The ability of an issuer of a debt security to repay principal prior to a security's maturity can cause greater price volatility if interest rates change.

- Issuer-Specific Changes. The value of an individual security or particular type of security can be more volatile than, and can perform differently from, the market as a whole. A decline in the credit quality of an issuer or a provider of credit support or a maturity-shortening structure for a security can cause the price of a security to decrease. Lower-quality debt securities (those of less than investment-grade quality, also referred to as high yield debt securities or junk bonds) and certain types of other securities involve greater risk of default or price changes due to changes in the credit quality of the issuer. The value of lower-quality debt securities and certain types of other securities can be more volatile due to increased sensitivity to adverse issuer, political, regulatory, market, or economic developments.

An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. You could lose money by investing in the fund.

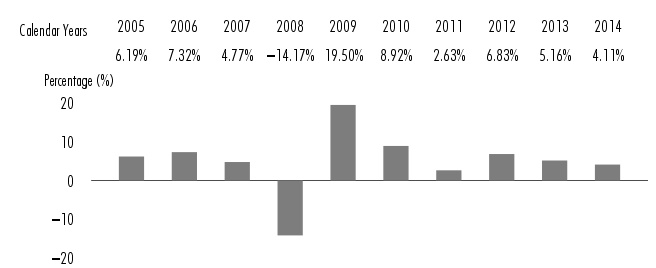

Performance

The following information is intended to help you understand the risks of investing in the fund. The information illustrates the changes in the performance of the fund's shares from year to year and compares the performance of the fund's shares to the performance of a securities market index and a hypothetical composite of market indexes over various periods of time. The indexes have characteristics relevant to the fund's investment strategies. Index descriptions appear in the Additional Index Information section of the prospectus. Past performance (before and after taxes) is not an indication of future performance.

Visit www.fidelity.com for updated return information.

Year-by-Year Returns

| During the periods shown in the chart: | Returns | Quarter ended |

| Highest Quarter Return | 8.80% | June 30, 2009 |

| Lowest Quarter Return | (7.78)% | December 31, 2008 |

| Year-to-Date Return | (1.19)% | September 30, 2015 |

Average Annual Returns

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, but do not reflect the impact of state or local taxes. Actual after-tax returns may differ depending on your individual circumstances. The after-tax returns shown are not relevant if you hold your shares in a retirement account or in another tax-deferred arrangement. Return After Taxes on Distributions and Sale of Fund Shares may be higher than other returns for the same period due to a tax benefit of realizing a capital loss upon the sale of fund shares.

| For the periods ended December 31, 2014 | Past 1 year | Past 5 years | Past 10 years |

| Fidelity Asset Manager® 20% | |||

| Return Before Taxes | 4.11% | 5.51% | 4.82% |

| Return After Taxes on Distributions | 2.59% | 4.54% | 3.56% |

| Return After Taxes on Distributions and Sale of Fund Shares | 2.85% | 4.11% | 3.45% |

| Barclays® U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) |

5.97% | 4.45% | 4.71% |

| Fidelity Asset Manager 20% Composite Index℠ (reflects no deduction for fees or expenses) |

4.43% | 4.88% | 4.28% |

Investment Adviser

Fidelity Management & Research Company (FMR) (the Adviser) is the fund's manager. Fidelity Investments Money Management, Inc. (FIMM), FMR Co., Inc. (FMRC), and other investment advisers serve as sub-advisers for the fund.

Portfolio Manager(s)

Geoff Stein (portfolio manager) has managed the fund since June 2009.

Purchase and Sale of Shares

You may buy or sell shares through a Fidelity® brokerage or mutual fund account, through a retirement account, or through an investment professional. You may buy or sell shares in various ways:

Internet

www.fidelity.com

Phone

Fidelity Automated Service Telephone (FAST®) 1-800-544-5555

To reach a Fidelity representative 1-800-544-6666

|

Additional purchases: Fidelity Investments |

Redemptions: Fidelity Investments |

TDD- Service for the Deaf and Hearing Impaired

1-800-544-0118

The price to buy one share is its net asset value per share (NAV). Shares will be bought at the NAV next calculated after your investment is received in proper form.

The price to sell one share is its NAV. Shares will be sold at the NAV next calculated after an order is received in proper form.

The fund is open for business each day the New York Stock Exchange (NYSE) is open.

| Initial Purchase Minimum | $2,500 |

| For Fidelity® Simplified Employee Pension-IRA, Keogh, Investment Only Retirement accounts, and effective January 1, 2016, Health Savings Accounts recordkept by Fidelity | $500 |

| Through regular investment plans in Fidelity® Traditional IRAs, Roth IRAs, and Rollover IRAs (requires monthly purchases of $200 until fund balance is $2,500) | $200 |

The fund may waive or lower purchase minimums in other circumstances.

Tax Information

Distributions you receive from the fund are subject to federal income tax and generally will be taxed as ordinary income or capital gains, and may also be subject to state or local taxes, unless you are investing through a tax-advantaged retirement account (in which case you may be taxed later, upon withdrawal of your investment from such account).

Payments to Broker-Dealers and Other Financial Intermediaries

The fund, the Adviser, Fidelity Distributors Corporation (FDC), and/or their affiliates may pay intermediaries, which may include banks, broker-dealers, retirement plan sponsors, administrators, or service-providers (who may be affiliated with the Adviser or FDC), for the sale of fund shares and related services. These payments may create a conflict of interest by influencing your intermediary and your investment professional to recommend the fund over another investment. Ask your investment professional or visit your intermediary's web site for more information.

Current regulations allow Fidelity to send a single copy of shareholder documents for Fidelity® funds, such as prospectuses, annual and semiannual reports, and proxy materials, to certain mutual fund customers whom we believe are members of the same family who share the same address. We will not send multiple copies of these documents to you and members of your family who share the same address. Instead, we will send only a single copy of these documents. This will continue for as long as you are a shareholder, unless you notify us otherwise. If at any time you choose to receive individual copies of any documents, please call 1-800-544-8544. We will begin sending individual copies to you within 30 days of receiving your call.

FDC is a member of the Securities Investor Protection Corporation (SIPC). You may obtain information about SIPC, including the SIPC brochure, by visiting www.sipc.org or calling SIPC at 202-371-8300.

Fidelity Asset Manager, Fidelity Investments & Pyramid Design, Fidelity, and FAST are registered service marks of FMR LLC. © 2015 FMR LLC. All rights reserved.

Fidelity Asset Manager 20% Composite Index is a service mark of FMR LLC.

The third-party marks appearing above are the marks of their respective owners.

| 1.920234.108 | AMI-SUM-1115 |