UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02628

Fidelity Municipal Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

|

Date of fiscal year end: |

December 31 |

|

|

|

|

Date of reporting period: |

June 30, 2011 |

Item 1. Reports to Stockholders

Fidelity®

Michigan Municipal

Income Fund

and

Fidelity

Michigan Municipal Money Market Fund

Semiannual Report

June 30, 2011

(2_fidelity_logos) (Registered_Trademark)

Contents

|

Chairman's Message |

The Chairman's message to shareholders |

|

|

Shareholder Expense Example |

An example of shareholder expenses. |

|

|

Fidelity Michigan Municipal Income Fund |

||

|

Investment Changes |

A summary of major shifts in the fund's investments over the past six months. |

|

|

Investments |

A complete list of the fund's investments with their market values. |

|

|

Financial Statements |

Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

|

|

Fidelity Michigan Municipal Money Market Fund |

||

|

Investment Changes |

A summary of major shifts in the fund's investments over the past six months. |

|

|

Investments |

A complete list of the fund's investments. |

|

|

Financial Statements |

Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

|

|

Notes |

Notes to the Financial Statements |

|

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Semiannual Report

Chairman's Message

(photo_of_Abigail_P_Johnson)

Dear Shareholder:

Despite bouts of short-term volatility, U.S. equities gained ground in the first half of 2011, buoyed by solid corporate earnings and modest improvement in employment. A strong start had the market up more than 100% off its March 2009 low, but investors were unnerved by this past March's natural disaster in Japan, while weaker economic data and new concern about Greek debt hurt performance during May and June. The longer-term outlook remains clouded by the impact of inflationary pressure and persistently high unemployment. Financial markets are always unpredictable, of course, but there are several time-tested investment principles that can help put the odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There can be tax advantages and cost benefits to consider as well. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best-performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or by phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

(The chairman's signature appears here.)

Abigail P. Johnson

Semiannual Report

Shareholder Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2011 to June 30, 2011).

Actual Expenses

The first line of the accompanying table for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each fund provides information about hypothetical account values and hypothetical expenses based on a fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Semiannual Report

Shareholder Expense Example - continued

|

|

Annualized |

Beginning |

Ending |

Expenses Paid |

|

Fidelity Michigan Municipal Income Fund |

.49% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,033.70 |

$ 2.47 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,022.36 |

$ 2.46 |

|

Fidelity Michigan Municipal Money Market Fund |

.27% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,000.05 |

$ 1.34** |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,023.46 |

$ 1.35** |

A 5% return per year before expenses

* Expenses are equal to each Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

** If certain fees were not voluntarily waived by FMR or its affiliates during the period, the annualized expense ratio for Michigan Municipal Money Market Fund would have been .55% and the expenses paid in the actual and hypothetical examples above would have been $2.73 and $2.76, respectively.

Semiannual Report

Fidelity Michigan Municipal Income Fund

Investment Changes (Unaudited)

|

Top Five Sectors as of June 30, 2011 |

||

|

|

% of fund's |

% of fund's net assets |

|

General Obligations |

45.8 |

44.5 |

|

Water & Sewer |

20.7 |

20.5 |

|

Health Care |

15.8 |

13.6 |

|

Special Tax |

6.0 |

6.3 |

|

Education |

5.0 |

6.0 |

|

Weighted Average Maturity as of June 30, 2011 |

||

|

|

|

6 months ago |

|

Years |

6.3 |

7.7 |

|

This is a weighted average of all the maturities of the securities held in a fund. Weighted Average Maturity (WAM) can be used as a measure of sensitivity to interest rate changes and markets changes. Generally, the longer the maturity, the greater the sensitivity to such changes. WAM is based on the dollar-weighted average length of time until principal payments must be paid. Depending on the types of securities held in a fund, certain maturity shortening devices (e.g., demand features, interest rate resets, and call options) may be taken into account when calculating the WAM. |

|

Duration as of June 30, 2011 |

||

|

|

|

6 months ago |

|

Years |

6.9 |

6.9 |

|

Duration estimates how much a bond fund's price will change with a change in comparable interest rates. If rates rise 1%, for example, a fund with a 5-year duration is likely to lose about 5% of its value. Other factors also can influence a bond fund's performance and share price. Accordingly, a bond fund's actual performance may differ from this example. Duration takes into account any call or put option embedded in the bonds. |

|

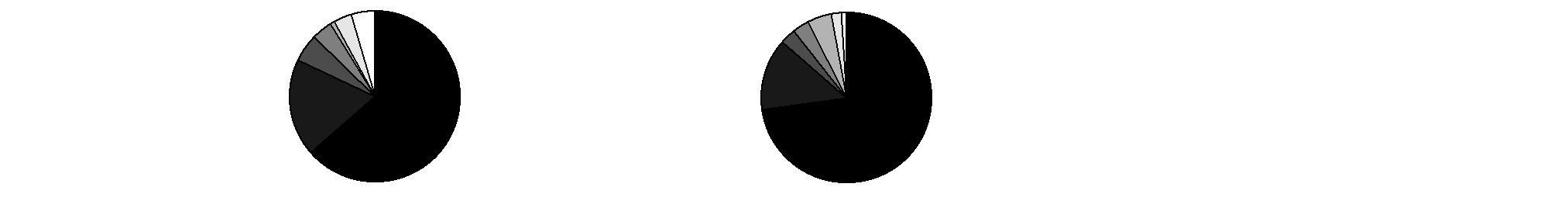

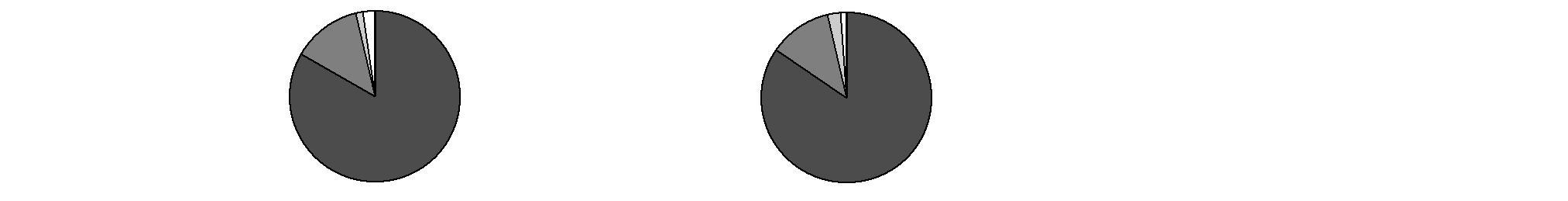

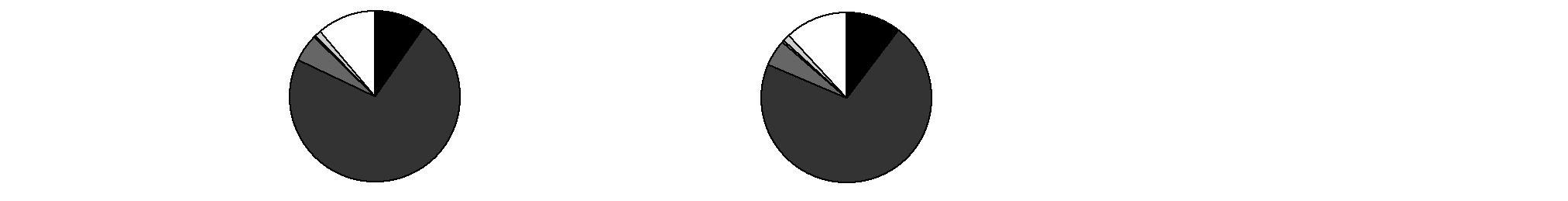

Quality Diversification (% of fund's net assets) |

|||||||

|

As of June 30, 2011 |

As of December 31, 2010 |

||||||

|

AAA 7.7% |

|

|

AAA 9.2% |

|

||

|

AA,A 85.8% |

|

|

AA,A 83.4% |

|

||

|

BBB 2.7% |

|

|

BBB 3.0% |

|

||

|

BB and Below 1.3% |

|

|

BB and Below 1.9% |

|

||

|

Not Rated 1.7% |

|

|

Not Rated 1.5% |

|

||

|

Short-Term |

|

|

Short-Term |

|

||

|

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

Semiannual Report

Fidelity Michigan Municipal Income Fund

Investments June 30, 2011 (Unaudited)

Showing Percentage of Net Assets

|

Municipal Bonds - 99.2% |

||||

|

|

Principal Amount |

Value |

||

|

Guam - 0.3% |

||||

|

Guam Ed. Fing. Foundation Ctfs. of Prtn.: |

|

|

|

|

|

(Guam Pub. School Facilities Proj.) Series 2006 A, 5% 10/1/16 |

|

$ 1,045,000 |

$ 1,084,856 |

|

|

Series 2006 A, 5% 10/1/23 |

|

1,000,000 |

952,390 |

|

|

|

2,037,246 |

|||

|

Michigan - 96.4% |

||||

|

Algonac Cmnty. Schools Series 2008, 5.25% 5/1/28 (FSA Insured) |

|

1,575,000 |

1,645,481 |

|

|

Allegan Pub. School District Series 2008: |

|

|

|

|

|

5% 5/1/14 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,570,000 |

1,729,810 |

|

|

5% 5/1/16 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,545,000 |

1,767,604 |

|

|

Ann Arbor Bldg. Auth. Series 2005 A: |

|

|

|

|

|

5% 3/1/17 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,405,000 |

1,550,642 |

|

|

5% 3/1/18 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,440,000 |

1,581,797 |

|

|

Ann Arbor Econ. Dev. Corp. Ltd. Oblig. Rev. (Glacier Hills, Inc. Proj.) 8.375% 1/15/19 (Escrowed to Maturity) (c) |

|

2,220,000 |

2,763,878 |

|

|

Bay City Gen. Oblig. Series 1991, 0% 6/1/15 (AMBAC Insured) |

|

1,725,000 |

1,530,437 |

|

|

Brighton Area School District Livingston County Series II, 0% 5/1/15 (AMBAC Insured) |

|

10,000,000 |

8,938,400 |

|

|

Caledonia Cmnty. Schools Counties of Kent, Allegan and Barry Series 2003: |

|

|

|

|

|

5.25% 5/1/17 |

|

1,370,000 |

1,452,419 |

|

|

5.25% 5/1/18 |

|

1,100,000 |

1,162,106 |

|

|

Carman-Ainsworth Cmnty. School District Series 2005: |

|

|

|

|

|

5% 5/1/16 (FSA Insured) |

|

1,000,000 |

1,108,200 |

|

|

5% 5/1/17 (FSA Insured) |

|

2,065,000 |

2,252,667 |

|

|

Carrier Creek Drainage District #326 Series 2005: |

|

|

|

|

|

5% 6/1/16 (AMBAC Insured) |

|

1,620,000 |

1,809,313 |

|

|

5% 6/1/25 (AMBAC Insured) |

|

1,775,000 |

1,869,288 |

|

|

Charles Stewart Mott Cmnty. College Series 2005, 5% 5/1/17 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,675,000 |

1,829,134 |

|

|

Charter Township of Commerce Gen. Oblig. Series 2009 B, 5.125% 12/1/38 |

|

970,000 |

986,985 |

|

|

Chelsea School District Series 2008: |

|

|

|

|

|

5% 5/1/15 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,720,000 |

1,916,166 |

|

|

5% 5/1/18 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,675,000 |

1,890,053 |

|

|

Clarkston Cmnty. Schools Series 2008: |

|

|

|

|

|

5% 5/1/15 (FSA Insured) |

|

1,905,000 |

2,084,680 |

|

|

5% 5/1/16 (FSA Insured) |

|

1,855,000 |

2,051,834 |

|

|

Municipal Bonds - continued |

||||

|

|

Principal Amount |

Value |

||

|

Michigan - continued |

||||

|

Comstock Park Pub. Schools Series 2005, 5% 5/1/16 (FSA Insured) |

|

$ 1,000,000 |

$ 1,099,310 |

|

|

Constantine Pub. Schools Series 2002, 5% 5/1/25 |

|

1,130,000 |

1,171,042 |

|

|

Detroit City School District: |

|

|

|

|

|

(School Bldg. & Site Impt. Proj.) Series 2003, 5% 5/1/33 |

|

1,800,000 |

1,677,726 |

|

|

Series 2003 B, 5% 5/1/24 (FGIC Insured) |

|

5,000,000 |

5,011,700 |

|

|

Series 2003, 5.25% 5/1/15 (FGIC Insured) |

|

3,085,000 |

3,173,694 |

|

|

Series 2005 A, 5.25% 5/1/30 |

|

5,000,000 |

4,820,150 |

|

|

Detroit Convention Facilities Rev. (Cobo Hall Expansion Proj.) Series 2003: |

|

|

|

|

|

5% 9/30/11 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

3,000,000 |

3,022,650 |

|

|

5% 9/30/12 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

4,765,000 |

4,922,769 |

|

|

Detroit Gen. Oblig.: |

|

|

|

|

|

Series 2004 B1, 5% 4/1/13 (AMBAC Insured) |

|

2,000,000 |

1,958,540 |

|

|

Series 2004, 5% 4/1/15 (AMBAC Insured) |

|

3,800,000 |

3,583,210 |

|

|

Series 2005 B, 5% 4/1/13 (FSA Insured) |

|

1,830,000 |

1,875,128 |

|

|

Series 2005 C, 5% 4/1/13 (FSA Insured) |

|

1,995,000 |

2,044,197 |

|

|

Detroit Swr. Disp. Rev.: |

|

|

|

|

|

Series 1998, 5.5% 7/1/17 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

3,050,000 |

3,345,789 |

|

|

Series 2001 E, 5.75% 7/1/31 (Berkshire Hathaway Assurance Corp. Insured) (FGIC Insured) |

|

2,700,000 |

2,798,820 |

|

|

Series 2003 B, 7.5% 7/1/33 (FSA Insured) |

|

2,600,000 |

2,994,082 |

|

|

Series 2003, 5% 7/1/32 (FSA Insured) |

|

535,000 |

501,220 |

|

|

Series 2006: |

|

|

|

|

|

5% 7/1/15 (FGIC Insured) |

|

1,085,000 |

1,161,319 |

|

|

5% 7/1/36 |

|

7,800,000 |

6,769,542 |

|

|

Series A, 0% 7/1/14 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

6,730,000 |

6,060,500 |

|

|

Detroit Wtr. Supply Sys. Rev.: |

|

|

|

|

|

Series 1993, 6.5% 7/1/15 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

6,340,000 |

7,085,838 |

|

|

Series 2003 A, 5% 7/1/34 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

5,000,000 |

4,626,900 |

|

|

Series 2004: |

|

|

|

|

|

5% 7/1/20 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

5,000,000 |

5,191,900 |

|

|

5.25% 7/1/16 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,000,000 |

1,068,100 |

|

|

Municipal Bonds - continued |

||||

|

|

Principal Amount |

Value |

||

|

Michigan - continued |

||||

|

Detroit Wtr. Supply Sys. Rev.: - continued |

|

|

|

|

|

Series 2004: |

|

|

|

|

|

5.25% 7/1/17 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

$ 2,000,000 |

$ 2,098,160 |

|

|

5.25% 7/1/21 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

6,035,000 |

6,140,733 |

|

|

Series 2005 B, 5.5% 7/1/35 (Berkshire Hathaway Assurance Corp. Insured) (FGIC Insured) |

|

2,800,000 |

2,819,320 |

|

|

Series 2006 B, 7% 7/1/36 (FSA Insured) |

|

2,700,000 |

3,012,444 |

|

|

Series 2006, 5% 7/1/33 (FSA Insured) |

|

5,000,000 |

4,512,250 |

|

|

DeWitt Pub. Schools Gen. Oblig. Series 2008: |

|

|

|

|

|

5% 5/1/15 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,475,000 |

1,653,077 |

|

|

5% 5/1/17 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,550,000 |

1,763,110 |

|

|

Dexter Cmnty. Schools: |

|

|

|

|

|

(School Bldg. and Site Proj.) Series 1998, 5.1% 5/1/18 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,000,000 |

1,095,000 |

|

|

Series 2003, 5% 5/1/18 (Liquidity Facility Sumitomo Bank Lease Fin., Inc. (SBLF)) |

|

1,955,000 |

2,068,253 |

|

|

Durand Area Schools Gen. Oblig. Series 2006: |

|

|

|

|

|

5% 5/1/27 (FSA Insured) |

|

1,225,000 |

1,286,360 |

|

|

5% 5/1/28 (FSA Insured) |

|

1,250,000 |

1,307,013 |

|

|

5% 5/1/29 (FSA Insured) |

|

1,275,000 |

1,326,344 |

|

|

East Grand Rapids Pub. School District Gen. Oblig. Series 2004: |

|

|

|

|

|

5% 5/1/16 (FSA Insured) |

|

1,425,000 |

1,547,308 |

|

|

5% 5/1/17 (FSA Insured) |

|

1,985,000 |

2,133,260 |

|

|

East Lansing School District Gen. Oblig. Series 2005, 5% 5/1/30 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

3,530,000 |

3,592,305 |

|

|

Farmington Pub. School District Gen. Oblig. Series 2005, 5% 5/1/18 (FSA Insured) |

|

4,500,000 |

4,908,960 |

|

|

Fenton Area Pub. Schools Gen. Oblig. Series 2005, 5% 5/1/14 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,775,000 |

1,937,590 |

|

|

Ferris State Univ. Rev. Series 2005: |

|

|

|

|

|

5% 10/1/16 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,255,000 |

1,351,911 |

|

|

5% 10/1/17 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,320,000 |

1,399,530 |

|

|

Fraser Pub. School District Series 2005: |

|

|

|

|

|

5% 5/1/16 (FSA Insured) |

|

1,055,000 |

1,165,469 |

|

|

5% 5/1/17 (FSA Insured) |

|

1,615,000 |

1,761,158 |

|

|

Garden City School District: |

|

|

|

|

|

Series 2005: |

|

|

|

|

|

5% 5/1/14 (FSA Insured) |

|

1,210,000 |

1,325,059 |

|

|

5% 5/1/17 (FSA Insured) |

|

1,390,000 |

1,504,175 |

|

|

Municipal Bonds - continued |

||||

|

|

Principal Amount |

Value |

||

|

Michigan - continued |

||||

|

Garden City School District: - continued |

|

|

|

|

|

Series 2006, 5% 5/1/19 (FSA Insured) |

|

$ 1,205,000 |

$ 1,288,880 |

|

|

Genesee County Gen. Oblig. Series 2005: |

|

|

|

|

|

5% 5/1/17 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,355,000 |

1,470,405 |

|

|

5% 5/1/18 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,505,000 |

1,616,174 |

|

|

Gibraltar School District Series 2005: |

|

|

|

|

|

5% 5/1/16 (FSA Insured) |

|

1,230,000 |

1,338,498 |

|

|

5% 5/1/17 (FSA Insured) |

|

1,230,000 |

1,319,483 |

|

|

Grand Ledge Pub. Schools District (School Bldg. & Site Proj.) Series 2007: |

|

|

|

|

|

5% 5/1/23 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,175,000 |

1,231,670 |

|

|

5% 5/1/24 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,300,000 |

1,353,807 |

|

|

5% 5/1/28 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

4,300,000 |

4,380,066 |

|

|

Grand Rapids Cmnty. College Series 2008: |

|

|

|

|

|

5% 5/1/17 (FSA Insured) |

|

1,315,000 |

1,489,685 |

|

|

5% 5/1/19 (FSA Insured) |

|

1,315,000 |

1,471,748 |

|

|

Grand Rapids San. Swr. Sys. Rev.: |

|

|

|

|

|

Series 2004, 5% 1/1/28 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

2,500,000 |

2,566,150 |

|

|

Series 2005: |

|

|

|

|

|

5% 1/1/34 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

3,000,000 |

3,039,960 |

|

|

5.125% 1/1/25 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

2,000,000 |

2,139,900 |

|

|

Series 2008, 5% 1/1/38 |

|

3,320,000 |

3,369,534 |

|

|

Series 2010, 5% 1/1/28 |

|

3,000,000 |

3,283,440 |

|

|

Grand Rapids Wtr. Supply Sys. Series 2005, 5% 1/1/35 (FGIC Insured) |

|

5,000,000 |

5,062,000 |

|

|

Grand Valley Michigan State Univ. Rev.: |

|

|

|

|

|

Series 2007, 5% 12/1/19 (AMBAC Insured) |

|

500,000 |

548,080 |

|

|

Series 2008, 5% 12/1/33 (FSA Insured) |

|

5,000,000 |

5,028,750 |

|

|

Series 2009, 5.625% 12/1/29 |

|

2,400,000 |

2,535,168 |

|

|

Grosse Ile Township School District Unltd. Tax Gen. Oblig. Series 2006: |

|

|

|

|

|

5% 5/1/29 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,950,000 |

2,015,598 |

|

|

5% 5/1/32 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,950,000 |

1,992,549 |

|

|

Harper Creek Cmnty. School District (School Bldg. & Site Proj.) Series 2008: |

|

|

|

|

|

4.75% 5/1/27 (FSA Insured) |

|

500,000 |

515,535 |

|

|

5.25% 5/1/21 (FSA Insured) |

|

2,000,000 |

2,236,320 |

|

|

5.25% 5/1/24 (FSA Insured) |

|

2,100,000 |

2,279,991 |

|

|

Municipal Bonds - continued |

||||

|

|

Principal Amount |

Value |

||

|

Michigan - continued |

||||

|

Haslett Pub. Schools Series 2005, 5% 5/1/16 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

$ 1,100,000 |

$ 1,219,020 |

|

|

Hudsonville Pub. Schools: |

|

|

|

|

|

Series 2005, 5% 5/1/16 (FSA Insured) |

|

1,000,000 |

1,111,710 |

|

|

5.25% 5/1/41 |

|

1,750,000 |

1,756,528 |

|

|

Huron Valley School District: |

|

|

|

|

|

Series 2003, 5.25% 5/1/16 |

|

2,450,000 |

2,613,317 |

|

|

0% 5/1/12 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,420,000 |

1,402,719 |

|

|

Jackson County Hosp. Fin. Auth. Hosp. Rev. (Allegiance Health Proj.) Series 2010 A, 5% 6/1/37 (FSA Insured) |

|

2,250,000 |

2,140,178 |

|

|

Kalamazoo Hosp. Fin. Auth. Hosp. Facilities Rev. (Bronson Methodist Hosp. Proj.): |

|

|

|

|

|

Series 2003 A, 5% 5/15/13 (FSA Insured) |

|

2,125,000 |

2,241,471 |

|

|

Series 2003 B: |

|

|

|

|

|

4% 5/15/12 (FSA Insured) |

|

2,125,000 |

2,165,524 |

|

|

5% 5/15/13 (FSA Insured) |

|

2,125,000 |

2,241,471 |

|

|

5.25% 5/15/14 (FSA Insured) |

|

1,200,000 |

1,298,736 |

|

|

Kalamazoo Pub. Schools Series 2006: |

|

|

|

|

|

5% 5/1/17 (FSA Insured) |

|

3,165,000 |

3,511,409 |

|

|

5.25% 5/1/16 (FSA Insured) |

|

1,500,000 |

1,718,415 |

|

|

Kent County Arpt. Rev. (Gerald R. Ford Int'l. Arpt. Proj.) Series 2007, 5% 1/1/37 |

|

4,180,000 |

4,229,909 |

|

|

Kent Hosp. Fin. Auth. Hosp. Facilities Rev.: |

|

|

|

|

|

(Butterworth Hosp. Proj.) Series A, 7.25% 1/15/13 (Escrowed to Maturity) (c) |

|

1,080,000 |

1,135,069 |

|

|

(Spectrum Health Sys. Proj.): |

|

|

|

|

|

Series 1998 A, 5.375% 1/15/12 |

|

2,505,000 |

2,513,742 |

|

|

Series 2011 A, 5.5% 11/15/25 |

|

5,000,000 |

5,333,200 |

|

|

Bonds (Spectrum Health Sys. Proj.) Series 2008 A, 5.5%, tender 1/15/15 (a) |

|

3,525,000 |

3,931,433 |

|

|

L'Anse Creuse Pub. Schools Series 2005, 5% 5/1/24 (FSA Insured) |

|

1,350,000 |

1,423,724 |

|

|

Lansing Board Wtr. & Lt. Rev. 5.5% 7/1/41 |

|

5,000,000 |

5,238,650 |

|

|

Lansing Bldg. Auth. Rev. Series 2009, 0% 6/1/12 (AMBAC Insured) |

|

2,170,000 |

2,147,649 |

|

|

Lapeer Cmnty. Schools Series 2007: |

|

|

|

|

|

5% 5/1/19 (FSA Insured) |

|

1,350,000 |

1,459,080 |

|

|

5% 5/1/20 (FSA Insured) |

|

1,425,000 |

1,528,569 |

|

|

5% 5/1/22 (FSA Insured) |

|

1,395,000 |

1,484,322 |

|

|

Lenawee Co. Hosp. Fin. Auth. Hosp. Rev. (ProMedica Heathcare Oblig. Group Proj.) Series 2011 B, 6% 11/15/35 |

|

3,000,000 |

3,197,550 |

|

|

Municipal Bonds - continued |

||||

|

|

Principal Amount |

Value |

||

|

Michigan - continued |

||||

|

Lincoln Consolidated School District Series 2008: |

|

|

|

|

|

5% 5/1/14 (FSA Insured) |

|

$ 1,460,000 |

$ 1,592,480 |

|

|

5% 5/1/16 (FSA Insured) |

|

1,425,000 |

1,605,077 |

|

|

Michigan Bldg. Auth. Rev.: |

|

|

|

|

|

(Facilities Prog.) Series 2008 I, 6% 10/15/38 |

|

5,000,000 |

5,348,500 |

|

|

Series 1, 5.25% 10/15/16 (FSA Insured) |

|

5,000,000 |

5,400,150 |

|

|

Series 2009 I, 5.25% 10/15/25 (Assured Guaranty Corp. Insured) |

|

2,000,000 |

2,118,120 |

|

|

Michigan Fin. Auth. Rev. (Trinity Health Sys. Proj.) Series 2010 A, 5% 12/1/27 |

|

1,100,000 |

1,098,724 |

|

|

Michigan Gen. Oblig.: |

|

|

|

|

|

(Envir. Protection Prog.) Series 1992, 6.25% 11/1/12 |

|

2,840,000 |

2,880,811 |

|

|

Series 2007, 5.25% 9/15/21 (FSA Insured) |

|

5,000,000 |

5,462,650 |

|

|

Michigan Hosp. Fin. Auth. Rev.: |

|

|

|

|

|

(Ascension Health Sr. Cr. Group Proj.) Series 2010 F, 5% 11/15/23 |

|

7,500,000 |

7,967,775 |

|

|

(Crittenton Hosp. Proj.) Series 2002: |

|

|

|

|

|

5.5% 3/1/13 |

|

455,000 |

466,320 |

|

|

5.5% 3/1/14 |

|

1,300,000 |

1,329,536 |

|

|

5.5% 3/1/15 |

|

1,985,000 |

2,028,928 |

|

|

(Genesys Reg'l. Med. Hosp. Proj.) Series 1998, 5.3% 10/1/11 (Escrowed to Maturity) (c) |

|

350,000 |

351,183 |

|

|

(Henry Ford Health Sys. Proj.): |

|

|

|

|

|

Series 2006 A: |

|

|

|

|

|

5% 11/15/12 |

|

1,485,000 |

1,546,405 |

|

|

5% 11/15/14 |

|

1,000,000 |

1,068,690 |

|

|

5% 11/15/17 |

|

1,000,000 |

1,066,620 |

|

|

Series 2009, 5.25% 11/15/24 |

|

3,000,000 |

3,007,830 |

|

|

(McLaren Health Care Corp. Proj.) Series 2008 A: |

|

|

|

|

|

5.25% 5/15/15 |

|

1,615,000 |

1,807,653 |

|

|

5.75% 5/15/38 |

|

6,880,000 |

6,980,517 |

|

|

(Mercy Health Svcs. Proj.): |

|

|

|

|

|

Series 1996 R, 5.375% 8/15/26 (Escrowed to Maturity) (c) |

|

2,500,000 |

2,504,850 |

|

|

Series 1996: |

|

|

|

|

|

5.375% 8/15/16 (Escrowed to Maturity) (c) |

|

2,500,000 |

2,507,200 |

|

|

5.375% 8/15/26 (Escrowed to Maturity) (c) |

|

2,450,000 |

2,454,753 |

|

|

(MidMichigan Obligated Group Proj.): |

|

|

|

|

|

Series 2002 A, 5.5% 4/15/18 (AMBAC Insured) |

|

2,000,000 |

2,023,300 |

|

|

Series 2009 A, 6.125% 6/1/39 |

|

3,740,000 |

3,832,602 |

|

|

(Oakwood Hosp. Proj.) Series 2007, 5% 7/15/17 |

|

1,000,000 |

1,064,070 |

|

|

Municipal Bonds - continued |

||||

|

|

Principal Amount |

Value |

||

|

Michigan - continued |

||||

|

Michigan Hosp. Fin. Auth. Rev.: - continued |

|

|

|

|

|

(Oakwood Obligated Group Proj.) Series 2003, 5.5% 11/1/11 |

|

$ 3,000,000 |

$ 3,038,310 |

|

|

(Sisters of Mercy Health Corp. Proj.) Series 1993, 5.375% 8/15/14 (Escrowed to Maturity) (c) |

|

260,000 |

276,047 |

|

|

(Sparrow Hosp. Obligated Group Proj.) Series 2007: |

|

|

|

|

|

5% 11/15/17 |

|

535,000 |

580,368 |

|

|

5% 11/15/18 |

|

725,000 |

765,731 |

|

|

5% 11/15/19 |

|

1,000,000 |

1,038,530 |

|

|

5% 11/15/20 |

|

2,000,000 |

2,053,540 |

|

|

5% 11/15/31 |

|

5,000,000 |

4,630,650 |

|

|

(Trinity Health Sys. Proj.): |

|

|

|

|

|

Series 2002 C, 5.375% 12/1/30 |

|

1,095,000 |

1,097,059 |

|

|

Series 2006 A, 5% 12/1/26 |

|

4,555,000 |

4,569,758 |

|

|

Series 2008 A, 6.5% 12/1/33 |

|

5,000,000 |

5,382,150 |

|

|

Michigan Muni. Bond Auth. Rev.: |

|

|

|

|

|

(Clean Wtr. Pooled Proj.) Series 2010, 5% 10/1/30 |

|

4,850,000 |

5,106,226 |

|

|

(Clean Wtr. Proj.) Series 2004, 5% 10/1/26 |

|

4,925,000 |

5,136,627 |

|

|

(Detroit School District Proj.) Series B, 5% 6/1/12 (FSA Insured) |

|

7,300,000 |

7,525,497 |

|

|

(Local Govt. Ln. Prog.): |

|

|

|

|

|

Series 2007, 5% 12/1/21 (AMBAC Insured) |

|

1,155,000 |

1,084,557 |

|

|

Series G, 0% 5/1/19 (AMBAC Insured) |

|

1,865,000 |

1,281,180 |

|

|

(State Clean Wtr. Revolving Fund Proj.) Series 2006, 5% 10/1/27 |

|

4,225,000 |

4,440,898 |

|

|

Series 2001, 5% 10/1/23 |

|

5,000,000 |

5,044,300 |

|

|

Series 2002, 5.375% 10/1/19 |

|

2,005,000 |

2,115,014 |

|

|

Series 2005, 5% 10/1/23 |

|

385,000 |

428,324 |

|

|

Series 2009, 5% 10/1/26 |

|

5,000,000 |

5,409,600 |

|

|

Series C, 0% 6/15/15 (FSA Insured) |

|

3,000,000 |

2,768,250 |

|

|

Michigan Strategic Fund Ltd. Oblig. Rev.: |

|

|

|

|

|

(Cadillac Place Office Bldg. Proj.) Series 2011, 5.25% 10/15/26 |

|

3,585,000 |

3,627,303 |

|

|

(Detroit Edison Co. Proj.): |

|

|

|

|

|

Series 1999 A, 5.55% 9/1/29 (Nat'l. Pub. Fin. Guarantee Corp. Insured) (b) |

|

1,000,000 |

998,790 |

|

|

Series BB, 7% 5/1/21 (AMBAC Insured) |

|

8,520,000 |

9,951,353 |

|

|

Michigan Technological Univ. Series 2008, 5.25% 10/1/17 (Assured Guaranty Corp. Insured) |

|

1,875,000 |

2,180,363 |

|

|

Michigan Tobacco Settlement Fin. Auth. Tobacco Settlement Asset Rev. Series 2007, 6% 6/1/34 |

|

3,000,000 |

2,374,140 |

|

|

Municipal Bonds - continued |

||||

|

|

Principal Amount |

Value |

||

|

Michigan - continued |

||||

|

Michigan Trunk Line Fund Rev.: |

|

|

|

|

|

Series 1998 A, 5.5% 11/1/16 |

|

$ 3,000,000 |

$ 3,538,890 |

|

|

Series 2002 B, 5.25% 10/1/16 (FSA Insured) |

|

3,000,000 |

3,149,340 |

|

|

Series 2005, 5.5% 11/1/20 (FSA Insured) |

|

2,500,000 |

2,940,225 |

|

|

Series 2006, 5.25% 11/1/15 (FGIC Insured) |

|

5,000,000 |

5,760,900 |

|

|

Montague Pub. School District Series 2001: |

|

|

|

|

|

5.5% 5/1/16 |

|

430,000 |

434,696 |

|

|

5.5% 5/1/17 |

|

430,000 |

434,193 |

|

|

5.5% 5/1/19 |

|

430,000 |

433,169 |

|

|

North Kent Swr. Auth. Wtr. & Swr. Rev. Series 2006: |

|

|

|

|

|

5% 11/1/19 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

420,000 |

458,837 |

|

|

5% 11/1/20 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

490,000 |

532,307 |

|

|

5% 11/1/22 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,645,000 |

1,762,914 |

|

|

5% 11/1/23 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,290,000 |

1,372,805 |

|

|

Northview Pub. Schools District Series 2008, 5% 5/1/21 (FSA Insured) |

|

1,070,000 |

1,159,816 |

|

|

Northville Pub. Schools Series 2005: |

|

|

|

|

|

5% 5/1/15 (FSA Insured) |

|

1,525,000 |

1,723,601 |

|

|

5% 5/1/16 (FSA Insured) |

|

1,475,000 |

1,636,321 |

|

|

5% 5/1/17 (FSA Insured) |

|

3,675,000 |

3,992,704 |

|

|

Okemos Pub. School District Series 1993: |

|

|

|

|

|

0% 5/1/12 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

2,500,000 |

2,468,975 |

|

|

0% 5/1/13 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,700,000 |

1,643,101 |

|

|

Olivet Cmnty. School District (School Bldg. & Site Proj.) Series 2008: |

|

|

|

|

|

5.25% 5/1/23 (FSA Insured) |

|

1,010,000 |

1,104,172 |

|

|

5.25% 5/1/27 (FSA Insured) |

|

1,135,000 |

1,211,896 |

|

|

Ottawa County Wtr. Supply Sys. Rev. Series 2010: |

|

|

|

|

|

4.5% 5/1/33 |

|

2,680,000 |

2,712,964 |

|

|

5% 5/1/37 |

|

1,100,000 |

1,133,946 |

|

|

Petoskey Pub. School District Series 2005: |

|

|

|

|

|

5% 5/1/14 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,430,000 |

1,563,891 |

|

|

5% 5/1/16 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,175,000 |

1,306,259 |

|

|

Plainwell Cmnty. School District: |

|

|

|

|

|

(School Bldg. & Site Proj.): |

|

|

|

|

|

Series 2002, 5.5% 5/1/14 |

|

1,000,000 |

1,062,240 |

|

|

Series 2008: |

|

|

|

|

|

5% 5/1/23 (Assured Guaranty Corp. Insured) |

|

1,885,000 |

2,022,002 |

|

|

Municipal Bonds - continued |

||||

|

|

Principal |

Value |

||

|

Michigan - continued |

||||

|

Plainwell Cmnty. School District: - continued |

|

|

|

|

|

(School Bldg. & Site Proj.): |

|

|

|

|

|

Series 2008: |

|

|

|

|

|

5% 5/1/28 (Assured Guaranty Corp. Insured) |

|

$ 1,000,000 |

$ 1,045,750 |

|

|

Series 2005: |

|

|

|

|

|

5% 5/1/15 (FSA Insured) |

|

1,030,000 |

1,150,706 |

|

|

5% 5/1/16 (FSA Insured) |

|

1,025,000 |

1,117,363 |

|

|

Plymouth-Canton Cmnty. School District Series 2008, 5% 5/1/20 (FSA Insured) |

|

5,000,000 |

5,400,850 |

|

|

Portage Pub. Schools Series 2008, 5% 5/1/22 (FSA Insured) |

|

4,300,000 |

4,585,907 |

|

|

Ravenna Pub. Schools Gen. Oblig. (2008 School Bldg. and Site Proj.) Series 2008: |

|

|

|

|

|

5% 5/1/31 (FSA Insured) |

|

2,080,000 |

2,126,862 |

|

|

5% 5/1/38 (FSA Insured) |

|

1,000,000 |

1,000,500 |

|

|

Riverview Cmnty. School District Series 2004: |

|

|

|

|

|

5% 5/1/14 |

|

630,000 |

688,987 |

|

|

5% 5/1/15 |

|

955,000 |

1,045,524 |

|

|

5% 5/1/17 |

|

1,000,000 |

1,081,240 |

|

|

5% 5/1/18 |

|

1,000,000 |

1,074,970 |

|

|

Rochester Cmnty. School District 5% 5/1/19 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,475,000 |

1,617,736 |

|

|

Rockford Pub. Schools Gen. Oblig. (2008 School Bldg. and Site Proj.) 5% 5/1/30 (FSA Insured) |

|

3,975,000 |

4,078,628 |

|

|

Royal Oak Hosp. Fin. Auth. Hosp. Rev. (William Beaumont Hosp. Proj.) Series 2009 V: |

|

|

|

|

|

8% 9/1/29 |

|

1,750,000 |

2,019,063 |

|

|

8.25% 9/1/39 |

|

3,100,000 |

3,562,613 |

|

|

Saginaw Hosp. Fin. Auth. Hosp. Rev. (Covenant Med. Ctr., Inc.) Series 2010 H, 5% 7/1/30 |

|

5,000,000 |

4,579,100 |

|

|

Saint Clair County Gen. Oblig. Series 2004: |

|

|

|

|

|

5% 4/1/17 (AMBAC Insured) |

|

1,380,000 |

1,495,810 |

|

|

5% 4/1/19 (AMBAC Insured) |

|

1,475,000 |

1,577,940 |

|

|

Shepherd Pub. Schools Series 2008, 5% 5/1/17 (FSA Insured) |

|

1,025,000 |

1,165,927 |

|

|

South Haven Gen. Oblig. Series 2009: |

|

|

|

|

|

4.875% 12/1/28 (Assured Guaranty Corp. Insured) |

|

2,500,000 |

2,636,450 |

|

|

5.125% 12/1/33 (Assured Guaranty Corp. Insured) |

|

1,000,000 |

1,043,290 |

|

|

South Redford School District Series 2005, 5% 5/1/16 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,125,000 |

1,251,551 |

|

|

Taylor City Bldg. Auth. County of Wayne Bldg. Auth. Pub. Facilities Series 2003, 5% 10/1/21 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,635,000 |

1,514,680 |

|

|

Three Rivers Cmnty. Schools Series 2008: |

|

|

|

|

|

5% 5/1/14 (FSA Insured) |

|

1,765,000 |

1,930,257 |

|

|

Municipal Bonds - continued |

||||

|

|

Principal Amount |

Value |

||

|

Michigan - continued |

||||

|

Three Rivers Cmnty. Schools Series 2008: - continued |

|

|

|

|

|

5% 5/1/16 (FSA Insured) |

|

$ 1,750,000 |

$ 1,974,560 |

|

|

Troy School District: |

|

|

|

|

|

Series 2006: |

|

|

|

|

|

5% 5/1/15 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,000,000 |

1,123,880 |

|

|

5% 5/1/16 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,000,000 |

1,140,120 |

|

|

5% 5/1/15 |

|

2,135,000 |

2,328,111 |

|

|

Univ. of Michigan Univ. Rev. Series 2010 C, 5% 4/1/26 |

|

6,085,000 |

6,684,859 |

|

|

Utica Cmnty. Schools: |

|

|

|

|

|

Series 2004, 5% 5/1/17 |

|

3,000,000 |

3,233,400 |

|

|

Series 2007: |

|

|

|

|

|

5% 5/1/15 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,000,000 |

1,131,020 |

|

|

5% 5/1/16 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

2,000,000 |

2,278,260 |

|

|

Waverly Cmnty. School District Series 2005, 5% 5/1/17 (FSA Insured) |

|

3,090,000 |

3,452,117 |

|

|

Wayne Charter County Gen. Oblig. Series 2001 A, 5.5% 12/1/17 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,000,000 |

1,014,730 |

|

|

Western Michigan Univ. Rev.: |

|

|

|

|

|

Series 2005, 5% 11/15/35 (FGIC Insured) |

|

5,435,000 |

5,234,612 |

|

|

Series 2008, 5% 11/15/20 (FSA Insured) |

|

5,280,000 |

5,603,453 |

|

|

Williamston Cmnty. Schools Gen. Oblig. Series 2005, 5% 5/1/18 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,000,000 |

1,089,350 |

|

|

Willow Run Cmnty. Schools County of Washtenaw Series 2005, 5% 5/1/17 (FSA Insured) |

|

1,875,000 |

2,033,269 |

|

|

Wyoming Sewage Disp. Sys. Rev. Series 2005, 5% 6/1/30 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

4,000,000 |

4,063,520 |

|

|

Zeeland Pub. Schools: |

|

|

|

|

|

Series 2004, 5.25% 5/1/16 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

1,050,000 |

1,143,975 |

|

|

Series 2005: |

|

|

|

|

|

5% 5/1/16 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

2,035,000 |

2,238,663 |

|

|

5% 5/1/17 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

365,000 |

398,033 |

|

|

|

571,147,704 |

|||

|

Municipal Bonds - continued |

||||

|

|

Principal Amount |

Value |

||

|

Puerto Rico - 2.0% |

||||

|

Puerto Rico Commonwealth Hwy. & Trans. Auth. Hwy. Rev. Series 1996 Z, 6.25% 7/1/15 (Nat'l. Pub. Fin. Guarantee Corp. Insured) |

|

$ 1,280,000 |

$ 1,410,394 |

|

|

Puerto Rico Elec. Pwr. Auth. Pwr. Rev. Series QQ, 5.5% 7/1/18 (XL Cap. Assurance, Inc. Insured) |

|

1,000,000 |

1,102,160 |

|

|

Puerto Rico Pub. Bldg. Auth. Rev. Bonds Series M2, 5.75%, tender 7/1/17 (a) |

|

2,000,000 |

2,146,160 |

|

|

Puerto Rico Sales Tax Fing. Corp. Sales Tax Rev.: |

|

|

|

|

|

Series 2007 A: |

|

|

|

|

|

0% 8/1/41 (FGIC Insured) |

|

12,000,000 |

1,649,280 |

|

|

0% 8/1/47 (AMBAC Insured) |

|

1,000,000 |

90,270 |

|

|

Series 2009 A: |

|

|

|

|

|

6% 8/1/42 |

|

4,000,000 |

4,134,000 |

|

|

6.5% 8/1/44 |

|

1,500,000 |

1,592,610 |

|

|

|

12,124,874 |

|||

|

Virgin Islands - 0.5% |

||||

|

Virgin Islands Pub. Fin. Auth.: |

|

|

|

|

|

(Cruzan Proj.) Series 2009 A, 6% 10/1/39 |

|

1,500,000 |

1,505,625 |

|

|

Series 2009 B, 5% 10/1/25 |

|

1,200,000 |

1,196,280 |

|

|

|

2,701,905 |

|||

|

TOTAL INVESTMENT PORTFOLIO - 99.2% (Cost $574,898,052) |

588,011,729 |

|||

|

NET OTHER ASSETS (LIABILITIES) - 0.8% |

4,609,548 |

|||

|

NET ASSETS - 100% |

$ 592,621,277 |

|||

|

Legend |

|

(a) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

|

(b) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals. |

|

(c) Security collateralized by an amount sufficient to pay interest and principal. |

|

Other Information |

|

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

|

The distribution of municipal securities by revenue source, as a percentage of total net assets, is as follows (Unaudited): |

|

General Obligations |

45.8% |

|

Water & Sewer |

20.7% |

|

Health Care |

15.8% |

|

Special Tax |

6.0% |

|

Education |

5.0% |

|

Others* (Individually Less Than 5%) |

6.7% |

|

|

100.0% |

|

* Includes net other assets |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements

Statement of Assets and Liabilities

|

|

June 30, 2011 (Unaudited) |

|

|

|

|

|

|

Assets |

|

|

|

Investment in securities, at value - See accompanying schedule: Unaffiliated issuers (cost $574,898,052) |

|

$ 588,011,729 |

|

Receivable for investments sold |

|

50,718 |

|

Receivable for fund shares sold |

|

72,245 |

|

Interest receivable |

|

6,561,292 |

|

Other receivables |

|

768 |

|

Total assets |

|

594,696,752 |

|

|

|

|

|

Liabilities |

|

|

|

Payable to custodian bank |

$ 971,355 |

|

|

Payable for fund shares redeemed |

96,253 |

|

|

Distributions payable |

700,841 |

|

|

Accrued management fee |

180,321 |

|

|

Other affiliated payables |

104,109 |

|

|

Other payables and accrued expenses |

22,596 |

|

|

Total liabilities |

|

2,075,475 |

|

|

|

|

|

Net Assets |

|

$ 592,621,277 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 580,437,113 |

|

Undistributed net investment income |

|

81,673 |

|

Accumulated undistributed net realized gain (loss) on investments |

|

(1,011,186) |

|

Net unrealized appreciation (depreciation) on investments |

|

13,113,677 |

|

Net Assets, for 50,167,567 shares outstanding |

|

$ 592,621,277 |

|

Net Asset Value, offering price and redemption price per share ($592,621,277 ÷ 50,167,567 shares) |

|

$ 11.81 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Operations

|

Six months ended June 30, 2011 (Unaudited) |

||

|

|

|

|

|

Investment Income |

|

|

|

Interest |

|

$ 13,068,810 |

|

|

|

|

|

Expenses |

|

|

|

Management fee |

$ 1,068,925 |

|

|

Transfer agent fees |

236,319 |

|

|

Accounting fees and expenses |

71,472 |

|

|

Custodian fees and expenses |

3,513 |

|

|

Independent trustees' compensation |

1,110 |

|

|

Registration fees |

15,657 |

|

|

Audit |

22,597 |

|

|

Legal |

5,704 |

|

|

Miscellaneous |

3,928 |

|

|

Total expenses before reductions |

1,429,225 |

|

|

Expense reductions |

(1,169) |

1,428,056 |

|

Net investment income (loss) |

|

11,640,754 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: |

|

|

|

Investment securities: |

|

|

|

Unaffiliated issuers |

|

(872,771) |

|

Change in net unrealized appreciation (depreciation) on investment securities |

|

8,185,357 |

|

Net gain (loss) |

|

7,312,586 |

|

Net increase (decrease) in net assets resulting from operations |

|

$ 18,953,340 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Changes in Net Assets

|

|

Six months ended |

Year ended |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

|

|

|

Net investment income (loss) |

$ 11,640,754 |

$ 25,546,192 |

|

Net realized gain (loss) |

(872,771) |

814,536 |

|

Change in net unrealized appreciation (depreciation) |

8,185,357 |

(11,101,701) |

|

Net increase (decrease) in net assets resulting |

18,953,340 |

15,259,027 |

|

Distributions to shareholders from net investment income |

(11,630,535) |

(25,524,718) |

|

Distributions to shareholders from net realized gain |

(352,543) |

(378,580) |

|

Total distributions |

(11,983,078) |

(25,903,298) |

|

Share transactions |

39,197,544 |

98,472,500 |

|

Reinvestment of distributions |

7,494,802 |

16,035,129 |

|

Cost of shares redeemed |

(87,796,175) |

(122,308,020) |

|

Net increase (decrease) in net assets resulting from share transactions |

(41,103,829) |

(7,800,391) |

|

Redemption fees |

2,582 |

2,123 |

|

Total increase (decrease) in net assets |

(34,130,985) |

(18,442,539) |

|

|

|

|

|

Net Assets |

|

|

|

Beginning of period |

626,752,262 |

645,194,801 |

|

End of period (including undistributed net investment income of $81,673 and undistributed net investment income of $71,454, respectively) |

$ 592,621,277 |

$ 626,752,262 |

|

Other Information Shares |

|

|

|

Sold |

3,353,706 |

8,226,552 |

|

Issued in reinvestment of distributions |

640,995 |

1,340,660 |

|

Redeemed |

(7,568,742) |

(10,280,828) |

|

Net increase (decrease) |

(3,574,041) |

(713,616) |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights

|

|

Six months ended |

Years ended December 31, |

||||

|

|

(Unaudited) |

2010 |

2009 |

2008 |

2007 |

2006 |

|

Selected Per-Share Data |

|

|

|

|

|

|

|

Net asset value, beginning of period |

$ 11.66 |

$ 11.85 |

$ 11.29 |

$ 11.76 |

$ 11.82 |

$ 11.84 |

|

Income from Investment Operations |

|

|

|

|

|

|

|

Net investment income (loss) D |

.232 |

.462 |

.460 |

.457 |

.461 |

.469 |

|

Net realized and unrealized gain (loss) |

.157 |

(.184) |

.575 |

(.465) |

(.031) |

.041 |

|

Total from investment operations |

.389 |

.278 |

1.035 |

(.008) |

.430 |

.510 |

|

Distributions from net investment income |

(.232) |

(.461) |

(.460) |

(.457) |

(.462) |

(.470) |

|

Distributions from net realized gain |

(.007) |

(.007) |

(.015) |

(.005) |

(.028) |

(.060) |

|

Total distributions |

(.239) |

(.468) |

(.475) |

(.462) |

(.490) |

(.530) |

|

Redemption fees added to paid in capital D,F |

- |

- |

- |

- |

- |

- |

|

Net asset value, end of period |

$ 11.81 |

$ 11.66 |

$ 11.85 |

$ 11.29 |

$ 11.76 |

$ 11.82 |

|

Total Return B,C |

3.37% |

2.32% |

9.30% |

(.06)% |

3.73% |

4.41% |

|

Ratios to Average Net Assets E |

|

|

|

|

|

|

|

Expenses before reductions |

.49% A |

.49% |

.50% |

.49% |

.49% |

.49% |

|

Expenses net of fee waivers, if any |

.49% A |

.49% |

.50% |

.49% |

.49% |

.49% |

|

Expenses net of all reductions |

.49% A |

.49% |

.50% |

.47% |

.44% |

.44% |

|

Net investment income (loss) |

4.00% A |

3.86% |

3.94% |

3.96% |

3.94% |

3.98% |

|

Supplemental Data |

|

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 592,621 |

$ 626,752 |

$ 645,195 |

$ 568,852 |

$ 592,633 |

$ 571,869 |

|

Portfolio turnover rate |

8% A |

7% |

6% |

19% |

15% |

17% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Calculated based on average shares outstanding during the period.

E Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

F Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Fidelity Michigan Municipal Money Market Fund

Investment Changes (Unaudited)

|

Effective Maturity Diversification |

|||

|

Days |

% of fund's |

% of fund's |

% of fund's |

|

0 - 30 |

79.2 |

83.2 |

83.4 |

|

31 - 90 |

10.4 |

7.6 |

10.9 |

|

91 - 180 |

4.5 |

2.0 |

2.1 |

|

181 - 397 |

5.9 |

7.2 |

3.6 |

|

Effective maturity is determined in accordance with the requirements of Rule 2a-7 under the Investment Company Act of 1940. |

|

Weighted Average Maturity |

|||

|

|

6/30/11 |

12/31/10 |

6/30/10 |

|

Fidelity Michigan Municipal Money Market Fund |

29 Days |

28 Days |

21 Days |

|

All Tax-Free Money Market Funds Average* |

26 Days |

31 Days |

26 Days |

|

This is a weighted average of all the maturities of the securities held in a fund. Weighted Average Maturity (WAM) can be used as a measure of sensitivity to interest rate changes and markets changes. Generally, the longer the maturity, the greater the sensitivity to such changes. WAM is based on the dollar-weighted average length of time until principal payments must be paid. Depending on the types of securities held in a fund, certain maturity shortening devices (e.g., demand features, interest rate resets, and call options) may be taken into account when calculating the WAM. |

|

Weighted Average Life |

|||

|

|

6/30/11 |

12/31/10 |

6/30/10 |

|

Fidelity Michigan Municipal Money Market Fund |

29 Days |

28 Days |

21 Days |

|

Weighted Average Life (WAL) is the weighted average of the life of the securities held in a fund or portfolio and can be used as a measure of sensitivity to changes in liquidity and/or credit risk. Generally, the higher the value, the greater the sensitivity. WAL is based on the dollar-weighted average length of time until principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets. The difference between WAM and WAL is that WAM takes into account interest rate resets and WAL does not. WAL for money market funds is not the same as WAL of a mortgage- or asset-backed security. |

|

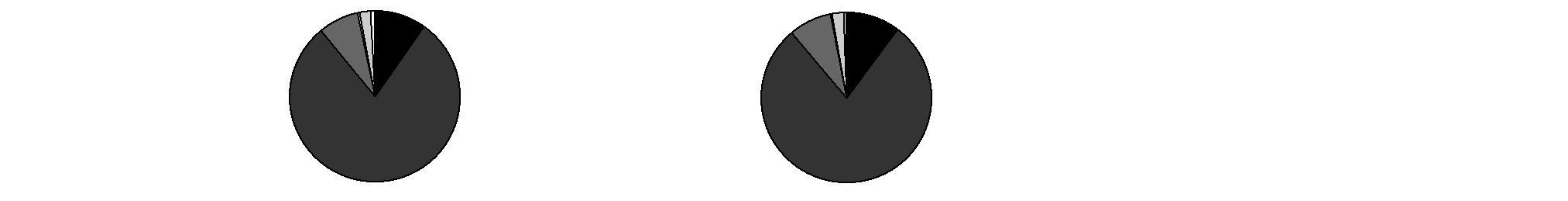

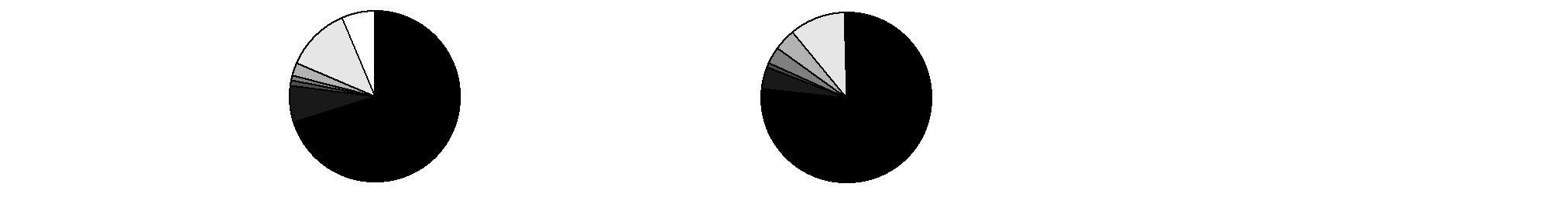

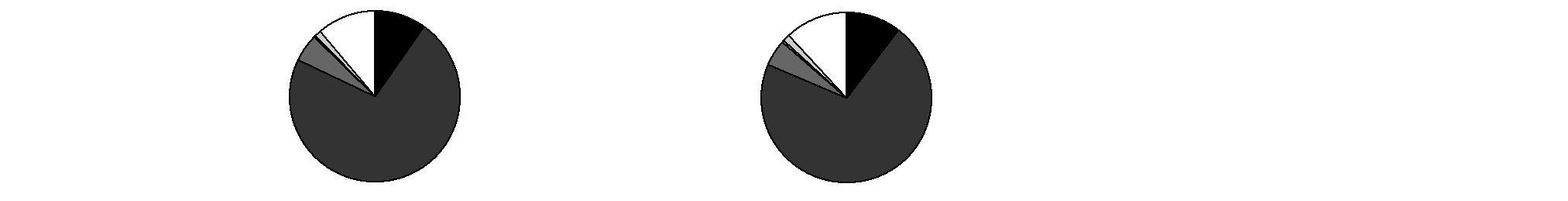

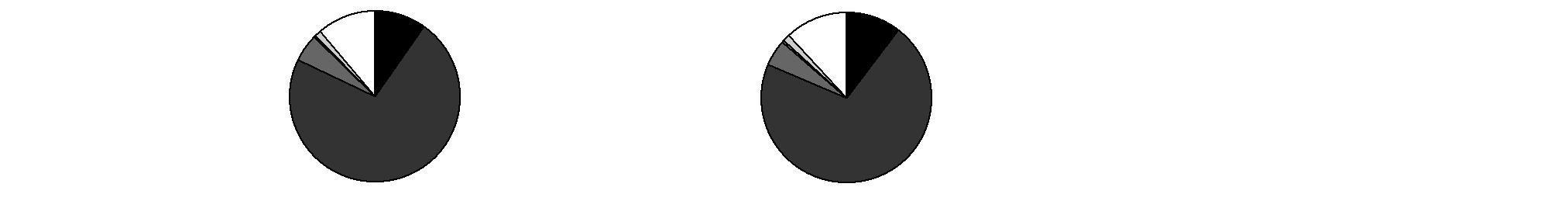

Asset Allocation (% of fund's net assets) |

|||||||

|

As of June 30, 2011 |

As of December 31, 2010 |

||||||

|

Variable Rate Demand Notes (VRDNs) 63.7% |

|

|

Variable Rate Demand Notes (VRDNs) 72.8% |

|

||

|

Commercial |

|

|

Commercial |

|

||

|

Tender Bonds 5.3% |

|

|

Tender Bonds 2.8% |

|

||

|

Municipal Notes 4.0% |

|

|

Municipal Notes 3.1% |

|

||

|

Fidelity Municipal |

|

|

Fidelity Municipal |

|

||

|

Other Investments 3.6% |

|

|

Other Investments 1.9% |

|

||

|

Net Other Assets 4.4% |

|

|

Net Other Assets 1.0% |

|

||

|

* Source: iMoneyNet, Inc. |

Semiannual Report

Fidelity Michigan Municipal Money Market Fund

Investments June 30, 2011 (Unaudited)

Showing Percentage of Net Assets

|

Municipal Securities - 95.6% |

|||

|

Principal Amount |

Value |

||

|

Arizona - 0.2% |

|||

|

Phoenix Indl. Dev. Auth. Multi-family Hsg. Rev. (Paradise Lakes Apt. Proj.) Series 2007 A, 0.07% 7/7/11, LOC Wells Fargo Bank NA, VRDN (a) |

$ 1,500,000 |

$ 1,500,000 |

|

|

Colorado - 0.1% |

|||

|

Colorado Hsg. & Fin. Auth. Series 2003 A2, 0.12% 7/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (a) |

1,000,000 |

1,000,000 |

|

|

Delaware - 0.3% |

|||

|

Delaware Econ. Dev. Auth. Rev. (Delmarva Pwr. & Lt. Co. Proj.) Series 1987, 0.37% 7/1/11, VRDN (a)(d) |

2,300,000 |

2,300,000 |

|

|

District Of Columbia - 0.5% |

|||

|

District of Columbia Univ. Rev. (American Univ. Proj.) Series 2006 A, 0.05% 7/7/11, LOC Bank of America NA, VRDN (a) |

4,300,000 |

4,300,000 |

|

|

Georgia - 0.2% |

|||

|

Athens-Clarke County Unified Govt. Dev. Auth. Rev. (Univ. of Georgia Athletic Assoc. Proj.) Series 2005 B, 0.08% 7/1/11, LOC Bank of America NA, VRDN (a) |

1,460,000 |

1,460,000 |

|

|

Idaho - 0.1% |

|||

|

Idaho Hsg. & Fin. Assoc. Single Family Mtg. Series C, 0.08% 7/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (a) |

945,000 |

945,000 |

|

|

Indiana - 0.1% |

|||

|

Indiana Fin. Auth. Health Sys. Rev. (Sisters of Saint Francis Health Svcs., Inc. Obligated Group Proj.) Series 2008 H, 0.08% 7/7/11, LOC JPMorgan Chase Bank, VRDN (a) |

700,000 |

700,000 |

|

|

Kentucky - 0.1% |

|||

|

Trimble County Poll. Cont. Rev. Bonds (Louisville Gas & Elec. Co. Proj.) Series A2, 0.9% tender 7/21/11, CP mode (d) |

1,200,000 |

1,200,000 |

|

|

Louisiana - 0.9% |

|||

|

Louisiana Pub. Facilities Auth. Rev. (Air Products & Chemicals, Inc. Proj.): |

|

|

|

|

Series 2002, 0.12% 7/7/11, VRDN (a)(d) |

3,300,000 |

3,300,000 |

|

|

Series 2010, 0.06% 7/7/11, VRDN (a) |

1,700,000 |

1,700,000 |

|

|

0.12% 7/7/11, VRDN (a)(d) |

3,000,000 |

3,000,000 |

|

|

|

8,000,000 |

||

|

Massachusetts - 0.2% |

|||

|

Massachusetts Indl. Fin. Agcy. Poll. Cont. Rev. Bonds (New England Pwr. Co. Proj.) Series 1993 B, 0.75% tender 7/1/11, CP mode |

2,000,000 |

2,000,000 |

|

|

Municipal Securities - continued |

|||

|

Principal Amount |

Value |

||

|

Michigan - 90.3% |

|||

|

Central Michigan Univ. Rev. Series 2008 A, 0.05% 7/7/11, LOC JPMorgan Chase Bank, VRDN (a) |

$ 2,405,000 |

$ 2,405,000 |

|

|

Detroit City School District Participating VRDN Series Solar 06 01, 0.08% 7/7/11 (Liquidity Facility U.S. Bank NA, Minnesota) (a)(f) |

14,835,000 |

14,835,000 |

|

|

Detroit Econ. Dev. Corp. Rev. (Michigan Opera Theatre Proj.) Series 1999, 0.2% 7/7/11, LOC JPMorgan Chase Bank, VRDN (a) |

2,100,000 |

2,100,000 |

|

|

Eastern Michigan Univ. Revs.: |

|

|

|

|

Series 2009 A, 0.1% 7/1/11, LOC JPMorgan Chase Bank, VRDN (a) |

5,225,000 |

5,225,000 |

|

|

Series 2009 B, 0.1% 7/1/11, LOC JPMorgan Chase Bank, VRDN (a) |

1,800,000 |

1,800,000 |

|

|

Grand Rapids Econ. Dev. Corp. (Cornerstone Univ. Proj.) 0.1% 7/7/11, LOC PNC Bank NA, VRDN (a) |

6,785,000 |

6,785,000 |

|

|

Grand Valley Michigan State Univ. Rev.: |

|

|

|

|

Series 2005, 0.08% 7/7/11, LOC PNC Bank NA, VRDN (a) |

21,300,000 |

21,300,000 |

|

|

Series 2008 B, 0.05% 7/7/11, LOC U.S. Bank NA, Minnesota, VRDN (a) |

13,940,000 |

13,940,000 |

|

|

Kent Hosp. Fin. Auth. Hosp. Facilities Rev.: |

|

|

|

|

(Spectrum Health Sys. Proj.): |

|

|

|

|

Series 2008 B3, 0.07% 7/7/11 (Liquidity Facility Wells Fargo Bank NA), VRDN (a) |

11,900,000 |

11,900,000 |

|

|

Series 2008 C, 0.07% 7/7/11, LOC Bank of New York, New York, VRDN (a) |

30,200,000 |

30,200,000 |

|

|

Bonds: |

|

|

|

|

(Spectrum Health Proj.) Series 2005 B, 5% 7/15/11 |

8,995,000 |

9,010,696 |

|

|

Series 2011 A, 1% 11/15/11 |

2,000,000 |

2,004,898 |

|

|

Michigan Bldg. Auth. Rev.: |

|

|

|

|

Bonds Series I, 5.5% 10/15/11 |

3,175,000 |

3,223,295 |

|

|

Participating VRDN Series Solar 06 21, 0.08% 7/7/11 (Liquidity Facility U.S. Bank NA, Minnesota) (a)(f) |

3,800,000 |

3,800,000 |

|

|

Series 6, 0.12% 8/4/11, LOC State Street Bank & Trust Co., Boston, LOC U.S. Bank NA, Minnesota, CP |

63,480,000 |

63,480,000 |

|

|

Michigan Fin. Auth. Rev. RAN: |

|

|

|

|

Series 2010 D2, 2% 8/22/11, LOC JPMorgan Chase Bank |

9,695,000 |

9,717,052 |

|

|

Series 2010 D3, 2% 8/22/11, LOC Bank of Nova Scotia New York Branch |

10,900,000 |

10,924,948 |

|

|

Michigan Gen. Oblig. TRAN Series A, 2% 9/30/11 |

13,300,000 |

13,352,151 |

|

|

Michigan Higher Ed. Rev. (Thomas M. Cooley Law School Proj.) Series 2008 A, 0.06% 7/7/11, LOC Wells Fargo Bank NA, VRDN (a) |

5,700,000 |

5,700,000 |

|

|

Municipal Securities - continued |

|||

|

Principal Amount |

Value |

||

|

Michigan - continued |

|||

|

Michigan Hosp. Fin. Auth. Rev.: |

|

|

|

|

(Henry Ford Health Sys. Proj.) Series 2007, 0.08% 7/7/11, LOC JPMorgan Chase Bank, VRDN (a) |

$ 7,270,000 |

$ 7,270,000 |

|

|

(Hosp. Equip. Ln. Prog.) Series B, 0.09% 7/6/11, LOC Bank of America NA, VRDN (a) |

4,100,000 |

4,100,000 |

|

|

(McLaren Health Care Corp. Proj.): |

|

|

|

|

Series 2008 B1, 0.08% 7/7/11, LOC JPMorgan Chase Bank, VRDN (a) |

8,210,000 |

8,210,000 |

|

|

Series 2008 B2, 0.08% 7/7/11, LOC JPMorgan Chase Bank, VRDN (a) |

13,285,000 |

13,285,000 |

|

|

Bonds: |

|

|

|

|

(Ascension Health Cr. Group Proj.): |

|

|

|

|

Series 1999 B, 3.75%, tender 3/15/12 (a) |

8,700,000 |

8,903,026 |

|

|

Series 2010 F1, 1.5%, tender 6/1/12 (a) |

5,000,000 |

5,053,499 |

|

|

Series 2010 F5, 0.45%, tender 3/15/12 (a) |

8,000,000 |

8,000,000 |

|

|

(Ascension Health Sr. Cr. Group Proj.) Series 2010 F: |

|

|

|

|

0.18%, tender 1/26/12 (a) |

8,800,000 |

8,800,000 |

|

|

0.18%, tender 1/26/12 (a) |

8,800,000 |

8,800,000 |

|

|

0.18%, tender 1/26/12 (a) |

7,100,000 |

7,100,000 |

|

|

(Sparrow Hosp. Obligated Group Proj.) Series 2001, 5.625% 11/15/11 (Pre-Refunded to 11/15/11 @ 101) (e) |

4,500,000 |

4,631,032 |

|

|

(Trinity Health Sys. Proj.): |

|

|

|

|

Series 2008 C: |

|

|

|

|

0.15% tender 7/6/11, CP mode |

20,000,000 |

20,000,000 |

|

|

0.15% tender 7/11/11, CP mode |

24,000,000 |

24,000,000 |

|

|

0.3% tender 7/8/11, CP mode |

16,000,000 |

16,000,000 |

|

|

Series B, 0.15% tender 7/11/11, CP mode |

3,000,000 |

3,000,000 |

|

|

Series C: |

|

|

|

|

0.27% tender 7/21/11, CP mode |

17,000,000 |

17,000,000 |

|

|

0.31% tender 10/4/11, CP mode |

5,000,000 |

5,000,000 |

|

|

Michigan Hsg. Dev. Auth. Ltd.: |

|

|

|

|

(Sand Creek Apts., Phase I Proj.) Series 2007 A, 0.11% 7/7/11, LOC Citibank NA, VRDN (a)(d) |

3,700,000 |

3,700,000 |

|

|

(Sand Creek II Apts. Proj.) Series 2007 A, 0.11% 7/7/11, LOC Citibank NA, VRDN (a)(d) |

5,495,000 |

5,495,000 |

|

|

(Teal Run I Apts. Proj.) Series 2007 A, 0.11% 7/7/11, LOC Citibank NA, VRDN (a)(d) |

6,350,000 |

6,350,000 |

|

|

Michigan Hsg. Dev. Auth. Multi-family Hsg. Rev.: |

|

|

|

|

(Canton Club East Apts. Proj.) Series 1998 A, 0.09% 7/7/11, LOC Fannie Mae, VRDN (a)(d) |

1,075,000 |

1,075,000 |

|

|

(Hunt Club Apts. Proj.) 0.13% 7/7/11, LOC Fannie Mae, VRDN (a)(d) |

6,795,000 |

6,795,000 |

|

|

Municipal Securities - continued |

|||

|

Principal Amount |

Value |

||

|

Michigan - continued |

|||

|

Michigan Hsg. Dev. Auth. Single Family Mtg. Rev.: |

|

|

|

|

Series 2007 B, 0.08% 7/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (a)(d) |

$ 65,000,000 |

$ 65,000,000 |

|

|

Series 2009 D, 0.08% 7/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (a) |

34,500,000 |

34,500,000 |

|

|

Michigan Hsg. Dev. Ltd. Oblig. Rev. (JAS Non-Profit Hsg. Corp. VI Proj.) Series 2000, 0.1% 7/7/11, LOC JPMorgan Chase Bank, VRDN (a) |

6,300,000 |

6,300,000 |

|

|

Michigan Muni. Bond Auth. Rev. Bonds: |

|

|

|

|

Series 2002, 5.25% 10/1/11 |

2,310,000 |

2,338,394 |

|

|

Series 2003 A, 5.25% 6/1/12 |

2,000,000 |

2,088,160 |

|

|

Michigan State Univ. Revs. Participating VRDN Series WF 11 33 C, 0.1% 7/7/11 (Liquidity Facility Wells Fargo Bank NA) (a)(f) |