| Label |

Element |

Value |

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Registrant Name |

dei_EntityRegistrantName |

FIDELITY HASTINGS STREET TRUST

|

|

| Prospectus Date |

rr_ProspectusDate |

Mar. 01, 2017

|

|

| 12.31 Fidelity Series Emerging Markets Debt Fund Series PRO-02 | Fidelity® Series Emerging Markets Debt Fund |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

Fund Summary Fund/Class:

Fidelity® Series Emerging Markets Debt Fund/Fidelity® Series Emerging Markets Debt Fund

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

Investment Objective

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The fund seeks high total return.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

Fee Table

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

The following table describes the fees and expenses that may be incurred when you buy and hold shares of the fund.

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder fees

|

|

| (fees paid directly from your investment) |

rr_ShareholderFeeOther |

none

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual Operating Expenses (expenses that you pay each year as a % of the value of your investment)

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio Turnover

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual operating expenses or in the example, affect the fund's performance. During the most recent fiscal year, the fund's portfolio turnover rate was 47% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

47.00%

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This example helps compare the cost of investing in the fund with the cost of investing in other funds. Let's say, hypothetically, that the annual return for shares of the fund is 5% and that your shareholder fees and the annual operating expenses for shares of the fund are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you sell all of your shares at the end of each time period indicated:

|

|

| Expense Example by, Year, Caption [Text] |

rr_ExpenseExampleByYearCaption |

Sell All Shares

|

|

| Strategy [Heading] |

rr_StrategyHeading |

Principal Investment Strategies

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

- Normally investing at least 80% of assets in debt securities of issuers in emerging markets (countries that have an emerging stock market as defined by MSCI, countries or markets with low- to middle-income economies as classified by the World Bank, and other countries or markets with similar emerging characteristics) and other debt investments that are tied economically to emerging markets.

- Potentially investing in other types of securities, including debt securities of non-emerging market foreign issuers and lower-quality debt securities (those of less than investment-grade quality, also referred to as high yield debt securities or junk bonds) of U.S. issuers.

- Allocating investments across different emerging market countries.

- Analyzing a security's structural features and current pricing, trading opportunities, and the credit, currency, and economic risks of the security and its issuer to select investments.

|

|

| Risk [Heading] |

rr_RiskHeading |

Principal Investment Risks

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

- Interest Rate Changes. Interest rate increases can cause the price of a debt security to decrease.

- Foreign and Emerging Market Risk. Foreign markets, particularly emerging markets, can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market, or economic developments and can perform differently from the U.S. market. Emerging markets can be subject to greater social, economic, regulatory, and political uncertainties and can be extremely volatile. Foreign exchange rates also can be extremely volatile.

- Issuer-Specific Changes. The value of an individual security or particular type of security can be more volatile than, and can perform differently from, the market as a whole. Lower-quality debt securities (those of less than investment-grade quality, also referred to as high yield debt securities or junk bonds) and certain types of other securities involve greater risk of default or price changes due to changes in the credit quality of the issuer. The value of lower-quality debt securities and certain types of other securities can be more volatile due to increased sensitivity to adverse issuer, political, regulatory, market, or economic developments and can be difficult to resell.

In addition, the fund is considered non-diversified and can invest a greater portion of assets in securities of a smaller number of individual issuers than a diversified fund. As a result, changes in the market value of a single investment could cause greater fluctuations in share price than would occur in a more diversified fund. An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. You could lose money by investing in the fund.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

You could lose money by investing in the fund.

|

|

| Risk Nondiversified Status [Text] |

rr_RiskNondiversifiedStatus |

In addition, the fund is considered non-diversified and can invest a greater portion of assets in securities of a smaller number of individual issuers than a diversified fund. As a result, changes in the market value of a single investment could cause greater fluctuations in share price than would occur in a more diversified fund.

|

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Performance

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The following information is intended to help you understand the risks of investing in the fund. The information illustrates the changes in the performance of the fund's shares from year to year and compares the performance of the fund's shares to the performance of a securities market index over various periods of time. The index description appears in the Additional Index Information section of the prospectus. Past performance (before and after taxes) is not an indication of future performance. Visit www.fidelity.com for more recent performance information.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The information illustrates the changes in the performance of the fund's shares from year to year and compares the performance of the fund's shares to the performance of a securities market index over various periods of time.

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

www.fidelity.com

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

Past performance (before and after taxes) is not an indication of future performance.

|

|

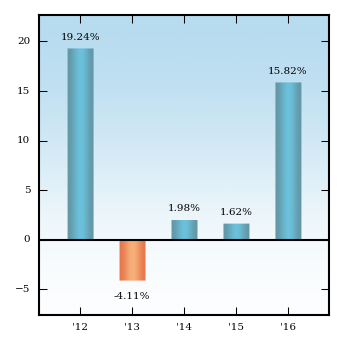

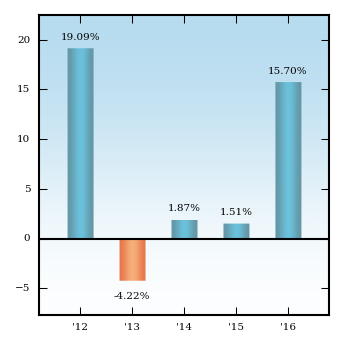

| Bar Chart [Heading] |

rr_BarChartHeading |

Year-by-Year Returns Calendar Years

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

| During the periods shown in the chart: | Returns | Quarter ended | | Highest Quarter Return | 7.75% | September 30, 2012 | | Lowest Quarter Return | -5.21% | June 30, 2013 |

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

Average Annual Returns

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, but do not reflect the impact of state or local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

The after-tax returns shown are not relevant if you hold your shares in a retirement account or in another tax-deferred arrangement, such as an employee benefit plan (profit sharing, 401(k), or 403(b) plan).

|

|

| Performance Table Explanation after Tax Higher |

rr_PerformanceTableExplanationAfterTaxHigher |

Return After Taxes on Distributions and Sale of Fund Shares may be higher than other returns for the same period due to a tax benefit of realizing a capital loss upon the sale of fund shares.

|

|

| Performance Table Narrative |

rr_PerformanceTableNarrativeTextBlock |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, but do not reflect the impact of state or local taxes. Actual after-tax returns may differ depending on your individual circumstances. The after-tax returns shown are not relevant if you hold your shares in a retirement account or in another tax-deferred arrangement, such as an employee benefit plan (profit sharing, 401(k), or 403(b) plan). Return After Taxes on Distributions and Sale of Fund Shares may be higher than other returns for the same period due to a tax benefit of realizing a capital loss upon the sale of fund shares. For the periods ended December 31, 2016

|

|

| 12.31 Fidelity Series Emerging Markets Debt Fund Series PRO-02 | Fidelity® Series Emerging Markets Debt Fund | Fidelity Series Emerging Markets Debt Fund-Series Class |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Management fee |

rr_ManagementFeesOverAssets |

0.66%

|

|

| Distribution and/or Service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.16%

|

|

| Total annual operating expenses |

rr_ExpensesOverAssets |

0.82%

|

|

| 1 year |

rr_ExpenseExampleYear01 |

$ 84

|

|

| 3 years |

rr_ExpenseExampleYear03 |

262

|

|

| 5 years |

rr_ExpenseExampleYear05 |

455

|

|

| 10 years |

rr_ExpenseExampleYear10 |

$ 1,014

|

|

| 2012 |

rr_AnnualReturn2012 |

19.09%

|

|

| 2013 |

rr_AnnualReturn2013 |

(4.22%)

|

|

| 2014 |

rr_AnnualReturn2014 |

1.87%

|

|

| 2015 |

rr_AnnualReturn2015 |

1.51%

|

|

| 2016 |

rr_AnnualReturn2016 |

15.70%

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Highest Quarter Return

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Sep. 30, 2012

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

7.75%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Lowest Quarter Return

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Jun. 30, 2013

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(5.21%)

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Mar. 17, 2011

|

|

| 12.31 Fidelity Series Emerging Markets Debt Fund Series PRO-02 | Fidelity® Series Emerging Markets Debt Fund | Return Before Taxes | Fidelity Series Emerging Markets Debt Fund-Series Class |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Column |

rr_AverageAnnualReturnColumnName |

Fidelity® Series Emerging Markets Debt Fund

|

|

| Label |

rr_AverageAnnualReturnLabel |

Return Before Taxes

|

|

| Past 1 year |

rr_AverageAnnualReturnYear01 |

15.70%

|

|

| Past 5 years |

rr_AverageAnnualReturnYear05 |

6.42%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

6.05%

|

[1] |

| 12.31 Fidelity Series Emerging Markets Debt Fund Series PRO-02 | Fidelity® Series Emerging Markets Debt Fund | After Taxes on Distributions | Fidelity Series Emerging Markets Debt Fund-Series Class |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Column |

rr_AverageAnnualReturnColumnName |

Fidelity® Series Emerging Markets Debt Fund

|

|

| Label |

rr_AverageAnnualReturnLabel |

Return After Taxes on Distributions

|

|

| Past 1 year |

rr_AverageAnnualReturnYear01 |

12.63%

|

|

| Past 5 years |

rr_AverageAnnualReturnYear05 |

3.76%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

3.52%

|

[1] |

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Mar. 17, 2011

|

|

| 12.31 Fidelity Series Emerging Markets Debt Fund Series PRO-02 | Fidelity® Series Emerging Markets Debt Fund | After Taxes on Distributions and Sales | Fidelity Series Emerging Markets Debt Fund-Series Class |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Column |

rr_AverageAnnualReturnColumnName |

Fidelity® Series Emerging Markets Debt Fund

|

|

| Label |

rr_AverageAnnualReturnLabel |

Return After Taxes on Distributions and Sale of Fund Shares

|

|

| Past 1 year |

rr_AverageAnnualReturnYear01 |

8.82%

|

|

| Past 5 years |

rr_AverageAnnualReturnYear05 |

3.75%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

3.55%

|

[1] |

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Mar. 17, 2011

|

|

| 12.31 Fidelity Series Emerging Markets Debt Fund Series PRO-02 | Fidelity® Series Emerging Markets Debt Fund | J.P. Morgan Emerging Markets Bond Index Global(reflects no deduction for fees, expenses, or taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Past 1 year |

rr_AverageAnnualReturnYear01 |

10.19%

|

|

| Past 5 years |

rr_AverageAnnualReturnYear05 |

5.44%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

6.06%

|

[1] |

|

|