Table of Contents

Commission File Nos. 2-72671

811-3199

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-4

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | ☐ | |

| Pre-Effective Amendment No. |

☐ | |

| Post-Effective Amendment No. 56 |

☒ | |

| and |

||

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 | ☐ | |

| Amendment No. 138 |

☒ |

ZALICO Variable Annuity Separate Account

(Exact Name of Registrant)

Zurich American Life Insurance Company

(Name of Insurance Company)

| 1299 Zurich Way, Schaumburg, Illinois | 60196 | |

| (Address of Insurance Company’s Principal Executive Offices) | (Zip Code) |

Insurance Company’s Telephone Number, including Area Code: (877) 301-5376

Juanita M. Thomas, Esq.

Zurich American Life Insurance Company

4962 Cross Pointe Drive

Oldsmar, FL 34677

(Name and Address of Agent for Service)

Approximate Date of Proposed Public Offering: Continuous

It is proposed that this filing will become effective (check appropriate box)

| ☐ | immediately upon filing pursuant to paragraph (b) of Rule 485 |

| ☒ | on May 1, 2020 pursuant to paragraph (b) of Rule 485 |

| ☐ | 60 days after filing pursuant to paragraph (a) of Rule 485 |

| ☐ | on pursuant to paragraph (a) of Rule 485 |

If appropriate, check the following box:

| ☐ | This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

Title of Securities being Registered:

Units of interest in Separate Account under the Contracts

No filing fee is due because an indefinite number of shares is deemed to have been registered in reliance on Section 24(f) of the Investment Company Act of 1940.

Table of Contents

PROSPECTUS FOR

ZURICH AMERICAN LIFE INSURANCE COMPANY

PERIODIC PAYMENT VARIABLE

ANNUITY CONTRACTS

ZURICH ADVANTAGE III

Issued By

ZALICO VARIABLE ANNUITY SEPARATE ACCOUNT

(formerly KILICO Variable Annuity Separate Account)

of

ZURICH AMERICAN LIFE INSURANCE COMPANY

(formerly Kemper Investors Life Insurance Company)

This Prospectus describes Periodic Payment Deferred Variable Annuity Contracts (the “Contract”) offered by Zurich American Life Insurance Company (formerly known as Kemper Investors Life Insurance Company) (“we” or “ZALICO”). These Contracts are designed to provide annuity benefits for retirement which may or may not qualify for certain federal tax advantages. The Contract is no longer issued, however, you may make additional purchase payments as permitted under your Contract.

You may allocate purchase payments to the General Account or to one or more of the variable options. The Contract currently offers 50 variable investment options, each being a Subaccount of the ZALICO Variable Annuity Separate Account. All Subaccount options are not available to all Contract Owners (See “7. Death Benefit” page 77.) Currently, Subaccounts that invest in the following Portfolios or Funds (certain funds may not be available in all States) are offered under the Contract:

| • | AIM Variable Insurance Funds (Invesco Variable Insurance Funds) (Series I Shares) |

| • | Invesco V.I. Diversified Dividend Fund |

| • | Invesco V.I. Health Care Fund |

| • | Invesco V.I. Global Real Estate Fund |

| • | Invesco V.I. Managed Volatility Fund |

| • | AIM Variable Insurance Funds (Invesco Variable Insurance Funds) (Series II) |

| • | Invesco Oppenheimer V.I. Capital Appreciation Fund(1) |

| • | Invesco Oppenheimer V.I. Global Fund(2) |

| • | Invesco Oppenheimer V.I. Global Strategic Income Fund(3) |

| • | Invesco Oppenheimer V.I. Main Street Fund(4) |

| • | Invesco Oppenheimer V.I. Main Street Small Cap Fund(5) |

| • | Invesco Oppenheimer V.I. Discovery Mid Cap Growth Fund(6) |

| • | The Alger Portfolios (Class I-2 Shares) |

| • | Alger Large Cap Growth Portfolio |

| • | Alger Mid Cap Growth Portfolio |

| • | Alger Small Cap Growth Portfolio |

| • | American Century Variable Portfolios, Inc. (“VP”) (Class I Shares) |

| • | American Century VP Income & Growth Fund |

| • | American Century VP Value Fund |

| • | BNY Mellon Investment Portfolios (“Dreyfus IP”) (Service Shares)(7) |

| • | BNY Mellon Investment Portfolios MidCap Stock Portfolio(8) |

| • | BNY Mellon Sustainable U.S. Equity Portfolio, Inc. (Initial Share Class)(9) |

| • | BNY Mellon Sustainable U.S. Equity Portfolio, Inc.(9) |

| • | Deutsche DWS Variable Series I (Class A Shares) |

| • | DWS Bond VIP |

| • | DWS Capital Growth VIP |

| • | DWS Core Equity VIP |

| • | DWS CROCI® International VIP |

| • | Deutsche DWS Variable Series II (Class A Shares) |

| • | DWS Global Income Builder VIP |

| • | DWS Global Equity VIP |

| • | DWS Small Mid Cap Value VIP |

| • | DWS High Income VIP |

| • | DWS CROCI® U.S. VIP |

| • | DWS Government Money Market VIP(10) |

| • | DWS Small Mid Cap Growth VIP |

| • | Fidelity Variable Insurance Products Funds (“VIP”) (Initial Class Shares) |

| • | Fidelity VIP Asset ManagerSM Portfolio |

| • | Fidelity VIP Contrafund® Portfolio |

| • | Fidelity VIP Equity-Income Portfolio |

| • | Fidelity VIP Growth Portfolio |

| • | Fidelity VIP Index 500 Portfolio |

| • | Franklin Templeton Variable Insurance Products Trust (Class 2 Shares) |

| • | Franklin Rising Dividends VIP Fund |

| • | Franklin Small Cap Value VIP Fund |

| • | Franklin Strategic Income VIP Fund |

| • | Franklin U.S. Government Securities VIP Fund |

| • | Franklin Mutual Global Discovery VIP Fund |

| • | Franklin Mutual Shares VIP Fund |

| • | Templeton Developing Markets VIP Fund |

| • | JPMorgan Insurance Trust (Class I) |

| • | JPMorgan Insurance Trust Mid Cap Value Portfolio |

| • | JPMorgan Insurance Trust Small Cap Core Portfolio |

| • | JPMorgan Insurance Trust U.S. Equity Portfolio |

| • | Janus Aspen Series (Institutional Shares) |

| • | Janus Henderson Balanced Portfolio |

| • | Janus Henderson Enterprise Portfolio |

Table of Contents

| • | Janus Henderson Research Portfolio |

| • | Janus Henderson Global Research Portfolio |

| • | Janus Aspen Series (Service Shares) |

| • | Janus Henderson Mid Cap Value Portfolio |

| • | Voya Investors Trust (Institutional Class) |

| • | VY® JPMorgan Emerging Markets Equity Portfolio |

| • | Voya Variable Portfolios, Inc. (Class S) |

| • | Voya Global High Dividend Low Volatility Portfolio(11) |

| (1) | Name change effective May 25, 2019. Formerly known as Oppenheimer Capital Appreciation Fund/VA. |

| (2) | Name change effective May 25, 2019. Formerly known as Oppenheimer Discovery Mid Cap Growth Fund/VA. |

| (3) | Name change effective May 25, 2019. Formerly known as Oppenheimer Global Fund/VA. |

| (4) | Name change effective May 25, 2019. Formerly known as Oppenheimer Global Strategic Income Fund/VA . |

| (5) | Name change effective May 25, 2019. Formerly known as Oppenheimer Main Street Fund/VA. |

| (6) | Name change effective May 25, 2019. Formerly known as Oppenheimer Main Street Small Cap Fund/VA. |

| (7) | Formerly known as Dreyfus Investment Portfolios. |

| (8) | Formerly known as Dreyfus MidCap Stock Portfolio. |

| (9) | Formerly known as The Dreyfus Sustainable U.S. Equity Portfolio, Inc. |

| (10) | Effective February 28, 2020, assets of the DWS Government & Agency Securities VIP-A were liquidated and invested in the DWS Government Money Market VIP. |

| (11) | Name change effective April 30, 2020. Formerly known as Voya Global Equity Portfolio. |

The Contracts are not insured by the FDIC. They are obligations of the issuing insurance company and not a deposit of, or guaranteed by, any bank or savings institution and are subject to risks, including possible loss of principal.

This Prospectus contains important information about the Contracts that you should know before investing. You should read it before investing and keep it for reference. We have filed a Statement of Additional Information (“SAI”) with the Securities and Exchange Commission. The current SAI has the same date as this Prospectus and is incorporated by reference. You may obtain a free copy by writing us or calling (888) 477-9700. A table of contents for the SAI appears on page 102. You may also find this Prospectus and other required information about the Separate Account at the SEC’s web site at http://www.sec.gov.

The Securities and Exchange Commission has not approved or disapproved these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is May 1, 2020.

Table of Contents

| Page | ||||

| 4 | ||||

| 6 | ||||

| 8 | ||||

| 11 | ||||

| 65 | ||||

| 70 | ||||

| 72 | ||||

| 81 | ||||

| 84 | ||||

| 88 | ||||

| 100 | ||||

| 100 | ||||

| 100 | ||||

| 101 | ||||

| 101 | ||||

| 101 | ||||

| 102 | ||||

| 102 | ||||

| 102 | ||||

| 103 | ||||

| 103 | ||||

| 106 | ||||

3

Table of Contents

The following terms as used in this Prospectus have the indicated meanings:

Accumulation Period—The period between the Date of Issue of a Contract and the Annuity Date.

Accumulation Unit—A unit of measurement used to determine the value of each Subaccount during the Accumulation Period.

Annuitant—The person during whose lifetime the annuity is to be paid.

Annuity Date—The date on which annuity payments are to commence.

Annuity Option—One of several forms in which annuity payments can be made.

Annuity Period—The period starting on the Annuity Date.

Annuity Unit—A unit of measurement used to determine the amount of Variable Annuity payments.

Beneficiary—The person designated to receive any benefits under a Contract upon your death or upon the Annuitant’s death prior to the Annuity Period.

Company (“we”, “us”, “our”, “ZALICO”)—Zurich American Life Insurance Company. Our home office is at 1299 Zurich Way, Schaumburg, Illinois 60196. For Insurance Services, please write us at P.O. Box 758557, Topeka, KS 66675-8557.

Contract—A Variable Annuity Contract offered by this Prospectus.

Contract Value—The sum of the values of your interest in the Subaccount(s) of the Separate Account and the General Account.

Contract Year—The period between anniversaries of the Date of Issue of a Contract.

Contract Quarter—The periods between quarterly anniversaries of the Date of Issue of a Contract.

Contribution Year—Each Contract Year in which a Purchase Payment is made and each later year measured from the start of the Contract Year when the Purchase Payment was made. For example, if you make an initial payment of $15,000 and then make a later payment of $10,000 during the fourth Contract Year, the fifth Contract Year will be the fifth Contribution Year for the purpose of Accumulation Units attributable to the initial payment and the second Contribution Year with respect to Accumulation Units attributable to the later $10,000 payment.

Date of Issue—The date on which the first Contract Year commences.

Debt—The principal of any outstanding loan from the General Account Contract Value, plus any accrued interest.

Fixed Account—The General Account of ZALICO to which you may allocate all or a portion of Purchase Payments or Contract Value.

Fixed Annuity—An annuity under which we guarantee the amount of each annuity payment; it does not vary with the investment experience of a Subaccount.

Fund or Funds—AIM Variable Insurance Funds (Invesco Variable Insurance Funds), The Alger Portfolios, American Century Variable Portfolios, Inc., BNY Mellon Investment Portfolios, BNY Mellon Sustainable U.S. Equity Portfolio, Inc., Deutsche DWS Variable Series I, Deutsche DWS Variable Series II, Fidelity Variable Insurance Products Funds (which includes Variable Insurance Products Fund and Variable Insurance Products Fund II), Franklin Templeton Variable Insurance Products Trust, JPMorgan Insurance Trust, Janus Aspen Series, Voya Investors Trust, and Voya Variable Portfolios, Inc.

4

Table of Contents

General Account—All our assets other than those allocated to any legally segregated separate account. We guarantee a minimum rate of interest on Purchase Payments allocated to the General Account under the Fixed Account Option.

General Account Contract Value—The value of your interest in the General Account.

Non-Qualified Contract—A Contract which does not receive favorable tax treatment under Section 401, 403, 408, 408A or 457 of the Internal Revenue Code.

Owner (“you”, “your”, “yours”)—The person designated in the Contract as having the privileges of ownership.

Portfolio—A series of a Fund with its own objective and policies, which represents shares of beneficial interest in a separate portfolio of securities and other assets. Portfolio is sometimes referred to as a Fund.

Purchase Payments—The dollar amount we receive in U.S. currency to buy the benefits this Contract provides.

Qualified Contract—A Contract issued in connection with a retirement plan which receives favorable tax treatment under Section 401, 403, 408, 408A or 457 of the Internal Revenue Code.

Separate Account—The ZALICO Variable Annuity Separate Account.

Separate Account Contract Value—The sum of your interests in the Subaccount(s).

Subaccounts—The subdivisions of the Separate Account, the assets of which consist solely of shares of the corresponding Fund or Portfolio of a Fund.

Subaccount Value—The value of your interest in each Subaccount.

Unitholder—The person holding the voting rights with respect to an Accumulation or Annuity Unit.

Valuation Date—Each day when the New York Stock Exchange is open for trading, as well as each day otherwise required.

Valuation Period—The interval of time between two consecutive Valuation Dates.

Variable Annuity—An annuity with payments varying in amount in accordance with the investment experience of the Subaccount(s) in which you have an interest.

Withdrawal Charge—The “contingent deferred sales charge” assessed against certain withdrawals of Accumulation Units in their first six Contribution Years or against certain annuitizations of Accumulation Units in their first six Contribution Years.

Withdrawal Value—Contract Value minus Debt, any premium tax payable, and any Withdrawal Charge.

5

Table of Contents

The summary does not contain all information that may be important. Read the entire Prospectus and the Contract before deciding to invest.

The Contract provides for tax-deferred investments and annuity benefits. Both Qualified Contracts and Non-Qualified Contracts are described in this Prospectus. The Contract is no longer offered for sale, although we continue to accept additional Purchase Payments under the Contract.

The minimum initial Purchase Payment for a Non-Qualified Contract was $2,500 and the minimum subsequent Purchase Payment is $500. The minimum Purchase Payment for a Qualified Contract is $50. However, if annualized contribution amounts from a payroll or salary deduction are equal to or greater than $600, we accept a periodic payment for a Qualified Contract under $50. For a Non-Qualified Contract, a minimum of $100 in Contract Value must be allocated to an investment option before another investment option can be selected. For a Qualified Contract, as long as contribution amounts to a new investment option from a payroll or salary reduction plan are equal to or greater than $50 per month, you may select another such investment option. The maximum Purchase Payment for a Qualified Contract is the maximum permitted under the qualified plan’s terms. You may make Purchase Payments to Non-Qualified Contracts and Contracts issued as Individual Retirement Annuities (“IRAs”) by authorizing us to draw on your account via check or electronic debit (“Pre-Authorized Checking [PAC] Agreement”). (See “The Contracts.”)

We provide for variable accumulations and benefits by crediting Purchase Payments to one or more Subaccounts of the Separate Account selected by you. Each Subaccount invests in a corresponding Fund or Portfolio of one of the Funds. (See “The Funds,” page 66.) The Contract Values allocated to the Separate Account will vary with the investment performance of the Portfolios and Funds you select. Not all Subaccount options are available to all Contract Owners (See “7. Death Benefit.”)

We also provide for fixed accumulations and benefits in the Fixed Account Option of the General Account. Any portion of the Purchase Payment allocated to the Fixed Account Option is credited with interest daily at a rate periodically declared by us at our discretion, but not less than the minimum guaranteed rate. (See “Fixed Account Option.”)

The investment risk under the Contract is borne by you, except to the extent that Contract Values are allocated to the Fixed Account Option and are guaranteed to earn at least the minimum guaranteed rate.

Transfers between Subaccounts are permitted before and after the Annuity Date, if allowed by the qualified plan and subject to limitations. Restrictions apply to transfers out of the Fixed Account Option. (See “Transfers During the Accumulation Period” and “Transfers During the Annuity Period,” respectively.)

No sales charge is deducted from any Purchase Payment. You may withdraw up to 10% of the Contract Value less Debt in any Contract Year without assessment of any charge. If you withdraw an amount in excess of 10% of the Contract Value less Debt in any Contract Year, the amount withdrawn in excess of 10% is subject to a contingent deferred sales charge (“Withdrawal Charge”). The Withdrawal Charge starts at 6% in the first Contribution Year and reduces by 1% each Contribution Year so that there is no charge in the seventh and later Contribution Years. (See “Withdrawal Charge.”) The Withdrawal Charge also applies at the annuitization of Accumulation Units in their sixth Contribution Year or earlier, except as set forth under “Withdrawal Charge.” However, the aggregate Withdrawal Charges assessed against a Contract will never exceed 7.25% of the aggregate Purchase Payments made under the Contract. Withdrawals will have tax consequences, which may include the amount of the withdrawal being subject to income tax and in some circumstances an additional 10% penalty tax. Withdrawals are permitted from Contracts issued in connection with Section 403(b) qualified plans only under limited circumstances. (See “Federal Tax Matters.”)

We charge for mortality and expense risk and administrative expenses, for records maintenance, and for any applicable premium taxes. (See “Asset-Based Charges Against the Separate Account.”) We also charge for optional death benefits (See “Guaranteed Minimum Death Benefit Rider” and “Earnings Based Death Benefit Rider.”). The Funds will incur certain management fees and other expenses. (See “Summary of Expenses”, “Investment Management Fees and Other Expenses” and the Funds’ prospectuses.)

6

Table of Contents

The Contracts were previously available to be purchased in connection with retirement plans qualifying either under Section 401 or 403(b) of the Internal Revenue Code (the “Code”) or as individual retirement annuities including Roth IRAs. The Contracts were also available in connection with state and municipal deferred compensation plans and non-qualified deferred compensation plans. A Contract purchased as a Qualified Contract does not provide any additional tax deferred treatment of earnings beyond the treatment that is already provided by the qualified plan itself. (See “Taxation of Annuities in General” and “Qualified Plans.”)

You have the right within the “free look” period (generally ten days, subject to state variation) after receiving the Contract to cancel the Contract by delivering or mailing it to us. If you decide to return your Contact for a refund during the “free look” period, please also include a letter of instruction. Upon receipt by us, the Contract will be cancelled and amounts refunded. The amount of the refund depends on the state where issued; however, generally the refund is at least the Contract Value. (See “The Contracts.”) In addition, a special “free look” period applies in some circumstances to Contracts issued as Individual Retirement Annuities or as Roth IRAs.

7

Table of Contents

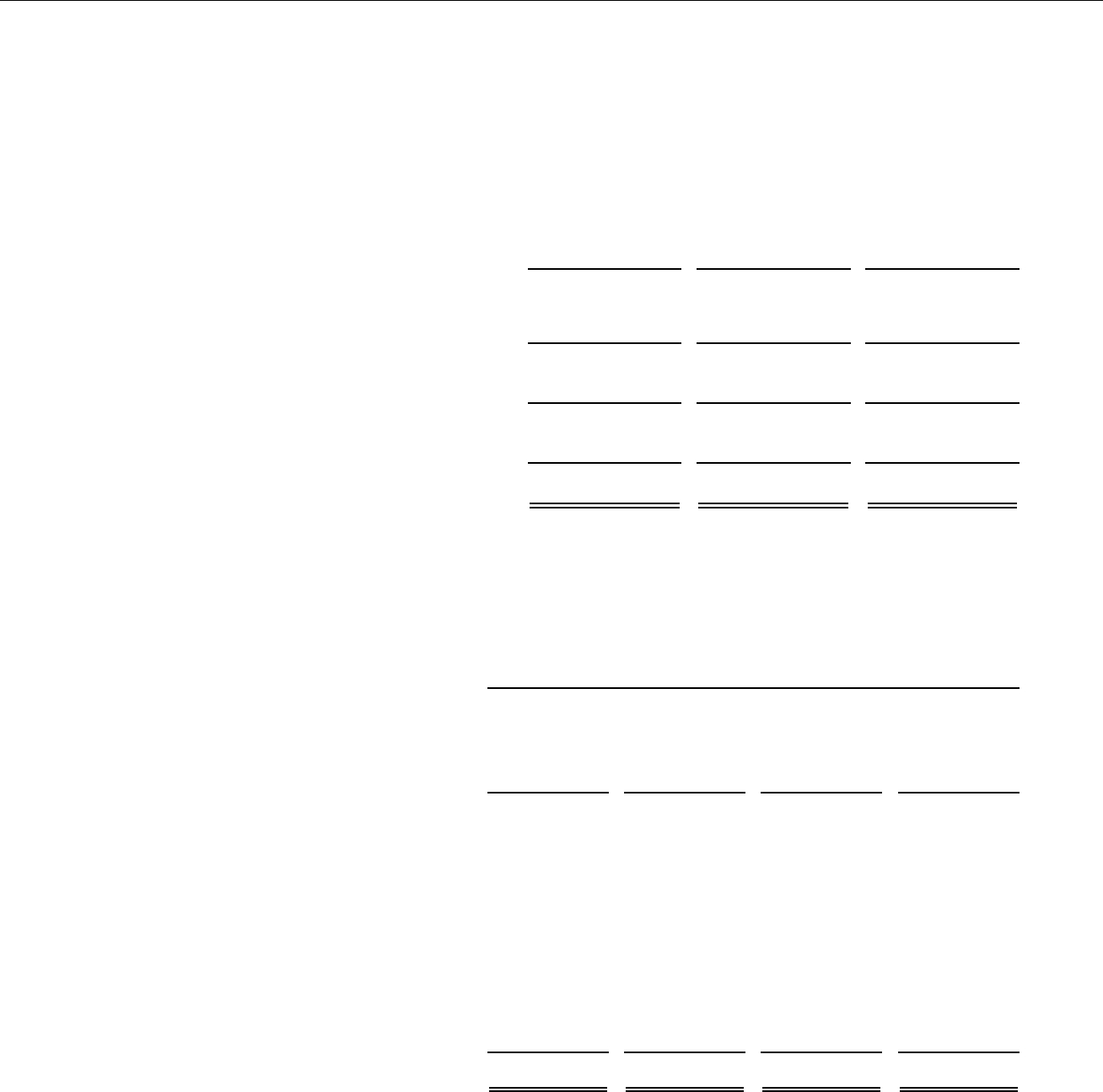

The following tables describe the fees and expenses that you will pay when buying, owning, and surrendering the Contract. The first table describes the fees and expenses that you will pay at the time that you buy the Contract, surrender the Contract, or transfer cash value between investment options. State premium taxes may also be deducted.

| Contract Owner Transaction Expenses |

||||

| Sales Load Imposed on Purchases (as a percentage of Purchase Payments) |

None | |||

| Maximum Withdrawal Charge(1) (as a percentage of amount surrendered): |

6% | |||

| Contribution Year |

Withdrawal Charge |

|||

| First year |

6.00% | |||

| Second year |

5.00% | |||

| Third year |

4.00% | |||

| Fourth year |

3.00% | |||

| Fifth year |

2.00% | |||

| Sixth year |

1.00% | |||

| Seventh year and following |

0.00% | |||

| Maximum Transfer Fee: |

None | |||

| (1) | Each Contract Year, a Contract Owner may withdraw up to 10% of Contract Value less debt without incurring a Withdrawal Charge. In certain circumstances we may reduce or waive the Withdrawal Charge. (See “Withdrawal Charge.”) |

The next table describes the fees and expenses that you will pay periodically during the time that you own the Contract, not including Fund fees and expenses.

| Quarterly Records Maintenance Charge | $ | 7.50 | (2) | |

| Separate Account Annual Expenses (as a percentage of average Separate Account Contract Value) |

||||

| Mortality and Expense Risk Charge: |

1.00% | |||

| Administration Charge: |

0.30% | |||

|

|

|

|||

| Total Separate Account Annual Expenses: |

1.30% | |||

|

|

|

|||

| Optional Benefits: |

||||

| Guaranteed Minimum Death Benefit Charge |

0.15% | |||

| Earnings Based Death Benefit Charge |

0.20% | |||

|

|

|

|||

| Total Separate Account Annual Expenses including |

1.65% | |||

|

|

|

|||

Qualified Plan Loan Interest Rates(3)

| Loans not subject to ERISA |

— | 5.50% | ||

| Loans subject to ERISA |

— | Moody’s Corporate Bond Yield Average—Monthly |

| (2) | The records maintenance charge is reduced to $3.75 for Contracts with Contract Value between $25,000 and $50,000 on the date of assessment. There is no charge for Contracts with Contract Value of $50,000 or more. In certain circumstances we may reduce or waive the quarterly records maintenance charge. (See “Records Maintenance Charge.”) |

| (3) | Loans are only available under certain qualified plans. Interest rate depends on whether plan is subject to the Employee Retirement Income Security Act of 1974 (“ERISA”). The value securing the loan will earn interest at the loan interest rate reduced by not more than 2.5%. (See “Loans”.) |

8

Table of Contents

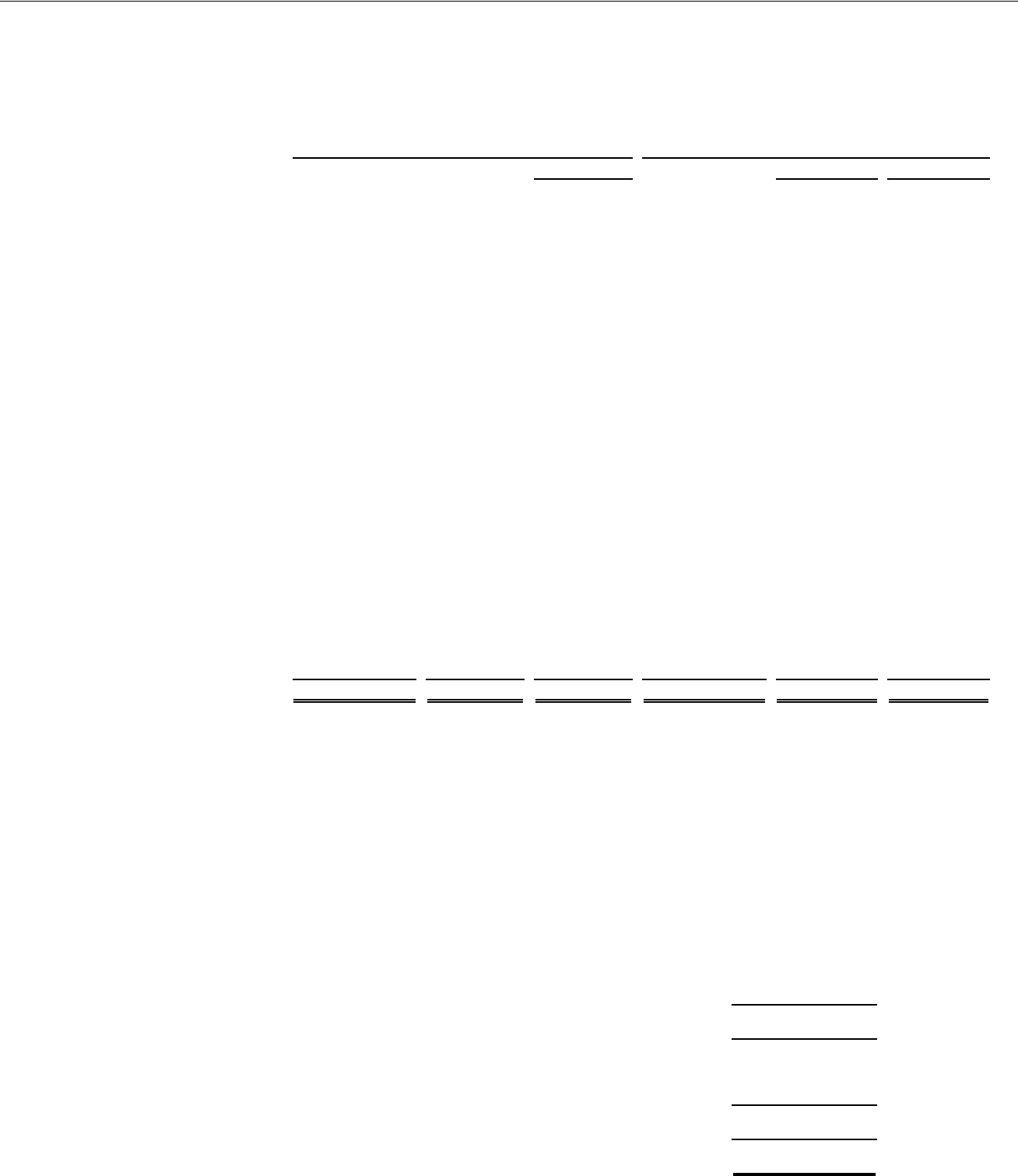

The next table shows the minimum and maximum total operating expenses charged by the Funds that you may pay periodically during the time that you own the Contract. More detail concerning each Fund’s fees and expenses is contained in the prospectus for each Fund.

| Minimum | — | Maximum | ||||||||||

| Total Annual Fund Operating Expenses(4) (expenses that are deducted from Fund assets, including management fees, distribution and/or service (12b-1) fees, and other expenses, prior to any fee waivers or expense reimbursements) | 0.10% | — | 1.41% | |||||||||

| (4) | The expenses shown are for the year ended December 31, 2019, and do not reflect any fee waivers or expense reimbursements. |

The advisers and/or other service providers of certain Funds have agreed to reduce their fees and/or reimburse the Funds’ expenses in order to keep the Funds’ expenses below specified limits. Other Funds have voluntary fee reduction and/or expense reimbursement arrangements that may be terminated at any time. The minimum and maximum Total Annual Fund Operating Expenses for all Funds after all fee reductions and expense reimbursements if any, are 0.10% and 1.41%, respectively. Each fee reduction and/or expense reimbursement arrangement is described in the relevant Fund’s prospectus.

THE FUND’S INVESTMENT MANAGER OR ADVISER PROVIDED THE ABOVE EXPENSES FOR THE FUNDS. WE HAVE NOT INDEPENDENTLY VERIFIED THE ACCURACY OF THE INFORMATION.

9

Table of Contents

EXAMPLE

This Example is intended to help you compare the cost of investing in the Contract with the cost of investing in other variable annuity contracts. These costs include Contract Owner transaction expenses, Contract fees, Separate Account annual expenses, and Fund fees and expenses.

The Example assumes that you invest $10,000 in the Contract for the time periods indicated and that your Contract includes the Guaranteed Minimum Death Benefit and the Earnings Based Death Benefit. If these features were not elected, the expense figures shown below would be lower. The Example also assumes that your investment has a 5% return each year and assumes the maximum fees and expenses of any of the Funds prior to any fee waivers or expense reimbursements. In addition, this Example assumes no transfers were made and no premium taxes were deducted. If these arrangements were considered, the expenses shown would be higher. This Example also does not take into consideration any fee waiver or expense reimbursement arrangements of the Funds. If these arrangements were taken into consideration, the expenses shown would be lower.

Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| (1) | If you surrender your Contract at the end of the applicable time period: |

| 1 year |

3 years |

5 years |

10 years | |||

| $967 | $1,647 | $2,334 | $4,378 |

| (2) | a. If you annuitize your Contract at the end of the applicable time period under Annuity Option 2, 3, 4, or under Annuity Option 1 for a period of 5 years or more(5): |

| 1 year |

3 years |

5 years |

10 years | |||

| $423 | $1,278 | $2,147 | $4,378 |

b. If you annuitize your Contract at the end of the applicable time period under Annuity Option 1 for a period of less then 5 years:(5)

| 1 year |

3 years |

5 years |

10 years | |||

| $967 | $1,647 | $2,334 | $4,378 |

| (3) | If you do not surrender your Contract at the end of the applicable time period: |

| 1 year |

3 years |

5 years |

10 years | |||

| $423 | $1,278 | $2,147 | $4,378 |

| (5) | Withdrawal Charges do not apply if the Contract is annuitized under Annuity Option 2, 3, or 4, or under Annuity Option 1 for a period of five years or more. |

The fee table and Example should not be considered a representation of past or future expenses and charges of the Subaccounts. Your actual expenses may be greater or less than those shown. The Example does not include the deduction of state premium taxes, which may be assessed before or upon annuitization or any taxes or penalties you may be required to pay if you surrender the Contract. Similarly, the 5% annual rate of return assumed in the Example is not intended to be representative of past or future performance of any Subaccount.

REDEMPTION FEES

A Fund or Portfolio may assess a redemption fee of up to 2% on Subaccount assets that are redeemed out of the Fund or Portfolio in connection with a withdrawal or transfer. Each Fund or Portfolio determines the amount of the redemption fee and when the fee is imposed. The redemption fee will reduce your Contract Value. For more information, see the Fund or Portfolio prospectus.

10

Table of Contents

CONDENSED FINANCIAL INFORMATION

The following tables list the Condensed Financial Information (the Accumulation Unit values for Accumulation Units outstanding) for Contracts without optional benefits yielding the lowest Separate Account charges possible under the Contract (1.30%) and Contracts with optional benefits yielding the highest Separate Account charges possible under the Contract (2.05%) as of December 31, 2019. In the table(s) below, no number is shown when there were no Accumulation Units outstanding at the end of the period. A zero (0) is shown when there were fewer than 1,000 Accumulation Units outstanding at the end of the period. Should the Separate Account charges applicable to your Contract fall between the maximum and minimum charges, and you wish to see a copy of the Condensed Financial Information applicable to your Contract, such information can be obtained in the Statement of Additional Information free of charge.

No Additional Contract Options Elected

(Separate Account Charges of 1.30% of the Daily Net Assets of the Separate Account)

Tax Qualified (1.00%)

| Flexible Payment Contracts | ||||||||||||||||||||||||||||||||||||||||

| Subaccount |

2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||||||||||||

| Alger Large Cap Growth Subaccount (formerly Alger American Growth Subaccount) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 116.312 | $ | 114.945 | $ | 90.368 | $ | 92.031 | $ | 91.383 | $ | 83.160 | $ | 62.179 | $ | 57.163 | $ | 57.935 | $ | 51.606 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 146.750 | $ | 116.312 | $ | 114.945 | $ | 90.368 | $ | 92.031 | $ | 91.383 | $ | 83.160 | $ | 62.179 | $ | 57.163 | $ | 57.935 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

4 | 4 | 4 | 4 | 4 | 4 | — | — | — | — | ||||||||||||||||||||||||||||||

| Alger MidCap Growth Subaccount (formerly Alger American MidCap Growth Subaccount) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 63.133 | $ | 68.898 | $ | 53.613 | $ | 53.625 | $ | 55.022 | $ | 51.451 | $ | 38.254 | $ | 33.249 | $ | 36.610 | $ | 30.973 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 81.421 | $ | 63.133 | $ | 68.898 | $ | 53.613 | $ | 53.625 | $ | 55.022 | $ | 51.451 | $ | 38.254 | $ | 33.249 | $ | 36.610 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 2 | 2 | ||||||||||||||||||||||||||||||

| Alger Small Cap Growth Subaccount (formerly Alger American Small Capitalization Subaccount) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 102.733 | $ | 102.297 | $ | 80.258 | $ | 76.298 | $ | 79.706 | $ | 80.153 | $ | 60.296 | $ | 54.134 | $ | 56.472 | $ | 45.522 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 131.555 | $ | 102.733 | $ | 102.297 | $ | 80.258 | $ | 76.298 | $ | 79.706 | $ | 80.153 | $ | 60.296 | $ | 54.134 | $ | 56.472 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

1 | 1 | 1 | 1 | 1 | 1 | — | — | — | — | ||||||||||||||||||||||||||||||

| American Century VP Income & Growth Subaccount |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 14.896 | $ | 16.155 | $ | 13.542 | $ | 12.052 | $ | 12.897 | $ | 11.578 | $ | 8.610 | $ | 7.579 | $ | 7.423 | $ | 6.568 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 18.280 | $ | 14.896 | $ | 16.155 | $ | 13.542 | $ | 12.052 | $ | 12.897 | $ | 11.578 | $ | 8.610 | $ | 7.579 | $ | 7.423 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

1 | 1 | 1 | 1 | 2 | 2 | 2 | 1 | 1 | 2 | ||||||||||||||||||||||||||||||

| American Century VP Value Subaccount |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 19.502 | $ | 21.682 | $ | 20.137 | $ | 16.881 | $ | 17.738 | $ | 15.843 | $ | 12.148 | $ | 10.709 | $ | 10.707 | $ | 9.534 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 24.529 | $ | 19.502 | $ | 21.682 | $ | 20.137 | $ | 16.881 | $ | 17.738 | $ | 15.843 | $ | 12.148 | $ | 10.709 | $ | 10.707 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 4 | 4 | ||||||||||||||||||||||||||||||

11

Table of Contents

| Flexible Payment Contracts | ||||||||||||||||||||||||||||||||||||||||

| Subaccount |

2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||||||||||||

| BNY Mellon I.P. Mid Cap Stock Subaccount, name change as of 6/3/19 (formerly Dreyfus I.P. Mid Cap Stock Subaccount) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 29.668 | $ | 35.541 | $ | 31.203 | $ | 27.356 | $ | 28.342 | $ | 25.613 | $ | 19.205 | $ | 16.254 | $ | 16.384 | $ | 13.035 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 35.207 | $ | 29.668 | $ | 35.541 | $ | 31.203 | $ | 27.356 | $ | 28.342 | $ | 25.613 | $ | 19.205 | $ | 16.254 | $ | 16.384 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | 1 | 1 | 1 | 1 | — | ||||||||||||||||||||||||||||||

| BNY Mellon Sustainable U.S Equity Portfolio, name change as of 6/3/19 (formerly Dreyfus Sustainable U.S. Equity Portfolio), name change as of 5/1/17 (formerly Dreyfus Socially Responsible Growth Subaccount) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 54.253 | $ | 57.321 | $ | 50.196 | $ | 45.932 | $ | 47.922 | $ | 42.662 | $ | 32.073 | $ | 28.930 | $ | 28.958 | $ | 25.473 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 72.171 | $ | 54.253 | $ | 57.321 | $ | 50.196 | $ | 45.932 | $ | 47.922 | $ | 42.662 | $ | 32.073 | $ | 28.930 | $ | 28.958 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| DWS Bond VIP Subaccount (formerly Deutsche Bond VIP Subaccount, name change as of 7/2/18 (formerly DWS Bond VIP Subaccount, name change as of 8/11/14 (formerly Scudder Bond Subaccount))) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 10.435 | $ | 10.827 | $ | 10.332 | $ | 9.851 | $ | 9.979 | $ | 9.452 | $ | 9.845 | $ | 9.226 | $ | 8.817 | $ | 8.339 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 11.429 | $ | 10.435 | $ | 10.827 | $ | 10.332 | $ | 9.851 | $ | 9.979 | $ | 9.452 | $ | 9.845 | $ | 9.226 | $ | 8.817 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| DWS Capital Growth VIP Subaccount (formerly Deutsche Capital Growth VIP Subaccount, name change as of 7/2/18 (formerly DWS Capital Growth VIP Subaccount, name change as of 8/11/14 (formerly Scudder Capital Growth Subaccount))) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 52.942 | $ | 54.342 | $ | 43.455 | $ | 42.101 | $ | 39.148 | $ | 35.000 | $ | 26.254 | $ | 22.849 | $ | 24.158 | $ | 20.906 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 71.884 | $ | 52.942 | $ | 54.342 | $ | 43.455 | $ | 42.101 | $ | 39.148 | $ | 35.000 | $ | 26.254 | $ | 22.849 | $ | 24.158 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

2 | 2 | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| DWS Core Equity VIP Subaccount (formerly Deutsche Core Equity VIP Subaccount, name change as of 7/2/18 (formerly DWS Core Equity VIP Subaccount, name change as of 8/11/14 (formerly DWS Growth & Income Subaccount))) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 25.202 | $ | 26.990 | $ | 22.525 | $ | 20.591 | $ | 19.760 | $ | 17.847 | $ | 13.126 | $ | 11.447 | $ | 11.578 | $ | 10.223 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 32.513 | $ | 25.202 | $ | 26.990 | $ | 22.525 | $ | 20.591 | $ | 19.760 | $ | 17.847 | $ | 13.126 | $ | 11.447 | $ | 11.578 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

12

Table of Contents

| Flexible Payment Contracts | ||||||||||||||||||||||||||||||||||||||||

| Subaccount |

2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||||||||||||

| DWS CROCI® International VIP Subaccount (formerly Deutsche CROCI® International VIP Subaccount, name change as of 7/2/18 (formerly Deutsche International VIP Subaccount, name change as of 5/1/15 (formerly DWS International VIP Subaccount, name change as of 8/11/14 (formerly Scudder International Subaccount)))) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 13.739 | $ | 16.210 | $ | 13.424 | $ | 13.458 | $ | 14.381 | $ | 16.462 | $ | 13.829 | $ | 11.577 | $ | 14.032 | $ | 13.946 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 16.564 | $ | 13.739 | $ | 16.210 | $ | 13.424 | $ | 13.458 | $ | 14.381 | $ | 16.462 | $ | 13.829 | $ | 11.577 | $ | 14.032 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| DWS CROCI® U.S. VIP Subaccount, name change as of 5/1/17 (formerly Deutsche CROCI® U.S. VIP Subaccount, name change as of 7/2/18 (formerly Deutsche Large Cap Value VIP Subaccount (formerly DWS Large Cap Value VIP Subaccount, name change as of 8/11/14 ))) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 3.515 | $ | 3.967 | $ | 3.260 | $ | 3.444 | $ | 3.735 | $ | 3.407 | $ | 2.629 | $ | 2.419 | $ | 2.444 | $ | 2.229 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 4.627 | $ | 3.515 | $ | 3.967 | $ | 3.260 | $ | 3.444 | $ | 3.735 | $ | 3.407 | $ | 2.629 | $ | 2.419 | $ | 2.444 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

1 | 1 | 2 | 2 | 2 | 4 | 8 | 10 | 20 | 21 | ||||||||||||||||||||||||||||||

| DWS Global Equity VIP Subaccount (formerly Deutsche Global Equity VIP Subaccount, name change as of 7/2/18 (formerly DWS Global Equity VIP Subaccount, name change as of 8/11/14 (formerly DWS International Select Equity VIP Subaccount)) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 3.156 | $ | 3.587 | $ | 2.920 | $ | 2.779 | $ | 2.857 | $ | 2.853 | $ | 2.415 | $ | 2.079 | $ | 2.388 | $ | 2.174 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 4.258 | $ | 3.156 | $ | 3.587 | $ | 2.920 | $ | 2.779 | $ | 2.857 | $ | 2.853 | $ | 2.415 | $ | 2.079 | $ | 2.388 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

1 | 1 | 1 | 1 | 2 | 3 | 3 | 3 | 4 | 5 | ||||||||||||||||||||||||||||||

| DWS Global Income Builder VIP Subaccount (formerly Deutsche Global Income Builder VIP Subaccount, name change as of 7/2/18 (formerly DWS Global Income Builder VIP Subaccount, name change as of 8/11/14 (formerly DWS Balanced VIP Subaccount)) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 12.516 | $ | 13.691 | $ | 11.865 | $ | 11.219 | $ | 11.497 | $ | 11.184 | $ | 9.685 | $ | 8.659 | $ | 8.871 | $ | 8.056 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 14.891 | $ | 12.516 | $ | 13.691 | $ | 11.865 | $ | 11.219 | $ | 11.497 | $ | 11.184 | $ | 9.685 | $ | 8.659 | $ | 8.871 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

20 | 23 | 65 | 85 | 95 | 110 | 127 | 150 | 175 | 182 | ||||||||||||||||||||||||||||||

13

Table of Contents

| Flexible Payment Contracts | ||||||||||||||||||||||||||||||||||||||||

| Subaccount |

2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||||||||||||

| DWS Government & Agency Securities VIP Subaccount (formerly Deutsche Government & Agency Securities VIP Subaccount, name change as of 7/2/18 (formerly DWS Government & Agency Securities VIP Subaccount, name change as of 8/11/14 (formerly Scudder Government & Agency Securities Subaccount)) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 3.295 | $ | 3.310 | $ | 3.288 | $ | 3.283 | $ | 3.316 | $ | 3.181 | $ | 3.314 | $ | 3.252 | $ | 3.056 | $ | 2.895 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 3.472 | $ | 3.295 | $ | 3.310 | $ | 3.288 | $ | 3.283 | $ | 3.316 | $ | 3.181 | $ | 3.314 | $ | 3.252 | $ | 3.056 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

8 | 10 | 15 | 15 | 17 | 15 | 20 | 21 | 21 | 23 | ||||||||||||||||||||||||||||||

| DWS Government Money Market VIP Subaccount (formerly Deutsche Government Money Market VIP Subaccount, name change as of 7/2/18 (formerly DWS Money Market VIP Subaccount, name change as of 8/11/14 (formerly Scudder Money Market Subaccount)) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 2.881 | $ | 2.870 | $ | 2.886 | $ | 2.913 | $ | 2.942 | $ | 2.971 | $ | 3.000 | $ | 3.030 | $ | 3.060 | $ | 3.090 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 2.903 | $ | 2.881 | $ | 2.870 | $ | 2.886 | $ | 2.913 | $ | 2.942 | $ | 2.971 | $ | 3.000 | $ | 3.030 | $ | 3.060 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

7 | 10 | 15 | 10 | 15 | 25 | 20 | 30 | 45 | 111 | ||||||||||||||||||||||||||||||

| DWS High Income VIP Subaccount (formerly Deutsche High Income VIP Subaccount, name change as of 7/2/18 (formerly DWS High Income VIP Subaccount, name change as of 8/11/14 (formerly Scudder High Income Subaccount)) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 14.498 | $ | 15.021 | $ | 14.112 | $ | 12.628 | $ | 13.346 | $ | 13.283 | $ | 12.433 | $ | 10.928 | $ | 10.629 | $ | 9.417 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 16.606 | $ | 14.498 | $ | 15.021 | $ | 14.112 | $ | 12.628 | $ | 13.346 | $ | 13.283 | $ | 12.433 | $ | 10.928 | $ | 10.629 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

5 | 6 | 17 | 18 | 20 | 23 | 26 | 30 | 36 | 48 | ||||||||||||||||||||||||||||||

| DWS Small Mid Cap Growth VIP Subaccount (formerly Deutsche Small Cap Growth VIP Subaccount, name change as of 7/2/18 (formerly DWS Small Cap Growth VIP Subaccount, name change as of 8/11/14 (formerly Scudder Small Cap Growth Subaccount)) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 3.761 | $ | 4.396 | $ | 3.636 | $ | 3.367 | $ | 3.431 | $ | 3.278 | $ | 2.319 | $ | 2.048 | $ | 2.153 | $ | 1.680 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 4.588 | $ | 3.761 | $ | 4.396 | $ | 3.636 | $ | 3.367 | $ | 3.431 | $ | 3.278 | $ | 2.319 | $ | 2.048 | $ | 2.153 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

4 | 4 | 4 | 9 | 9 | 9 | 9 | 10 | 10 | 11 | ||||||||||||||||||||||||||||||

14

Table of Contents

| Flexible Payment Contracts | ||||||||||||||||||||||||||||||||||||||||

| Subaccount |

2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||||||||||||

| DWS Small Mid Cap Value VIP Subaccount (formerly Deutsche Small Mid Cap Value VIP Subaccount, name change as of 7/2/18 (formerly DWS Small Mid Cap Value Subaccount, name change as of 8/11/14 (formerly DWS Dreman Small Mid Cap Value VIP, formerly DWS Dreman Small Cap Value VIP Subaccount), name change as of 5/1/13) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 4.298 | $ | 5.169 | $ | 4.724 | $ | 4.082 | $ | 4.203 | $ | 4.023 | $ | 3.004 | $ | 2.667 | $ | 2.868 | $ | 2.354 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 5.171 | $ | 4.298 | $ | 5.169 | $ | 4.724 | $ | 4.082 | $ | 4.203 | $ | 4.023 | $ | 3.004 | $ | 2.667 | $ | 2.868 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

5 | 5 | 1 | 4 | 4 | 8 | 16 | 20 | 35 | 40 | ||||||||||||||||||||||||||||||

| Fidelity VIP Asset Manager Subaccount |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 44.239 | $ | 47.209 | $ | 41.786 | $ | 40.946 | $ | 41.297 | $ | 39.411 | $ | 34.401 | $ | 30.890 | $ | 32.019 | $ | 28.301 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 51.794 | $ | 44.239 | $ | 47.209 | $ | 41.786 | $ | 40.946 | $ | 41.297 | $ | 39.411 | $ | 34.401 | $ | 30.890 | $ | 32.019 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Fidelity VIP Contrafund® Subaccount |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 84.867 | $ | 91.559 | $ | 75.873 | $ | 70.950 | $ | 71.182 | $ | 64.223 | $ | 49.407 | $ | 42.865 | $ | 44.415 | $ | 38.270 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 110.561 | $ | 84.867 | $ | 91.559 | $ | 75.873 | $ | 70.950 | $ | 71.182 | $ | 64.223 | $ | 49.407 | $ | 42.865 | $ | 44.415 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

1 | 1 | 1 | 3 | 2 | 3 | 3 | 4 | 4 | 5 | ||||||||||||||||||||||||||||||

| Fidelity VIP Equity Income Subaccount |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 68.281 | $ | 75.204 | $ | 67.279 | $ | 57.576 | $ | 60.552 | $ | 56.253 | $ | 44.336 | $ | 38.173 | $ | 38.183 | $ | 33.491 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 86.158 | $ | 68.281 | $ | 75.204 | $ | 67.279 | $ | 57.576 | $ | 60.552 | $ | 56.253 | $ | 44.336 | $ | 38.173 | $ | 38.183 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | ||||||||||||||||||||||||||||||

| Fidelity VIP Growth Subaccount |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 127.092 | $ | 128.587 | $ | 96.104 | $ | 96.291 | $ | 90.743 | $ | 82.347 | $ | 61.004 | $ | 53.724 | $ | 54.150 | $ | 44.044 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 169.012 | $ | 127.092 | $ | 128.587 | $ | 96.104 | $ | 96.291 | $ | 90.743 | $ | 82.347 | $ | 61.004 | $ | 53.724 | $ | 54.150 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||

15

Table of Contents

| Flexible Payment Contracts | ||||||||||||||||||||||||||||||||||||||||

| Subaccount |

2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||||||||||||

| Fidelity VIP Index 500 Subaccount |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 353.012 | $ | 373.330 | $ | 309.787 | $ | 279.705 | $ | 278.782 | $ | 247.924 | $ | 189.349 | $ | 164.989 | $ | 163.306 | $ | 143.395 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 459.093 | $ | 353.012 | $ | 373.330 | $ | 309.787 | $ | 279.705 | $ | 278.782 | $ | 247.924 | $ | 189.349 | $ | 164.989 | $ | 163.306 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||

| Franklin Mutual Global Discovery VIP Subaccount (formerly Mutual Global Discovery Securities Subaccount), name change as of 5/1/14 |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 30.847 | $ | 35.094 | $ | 32.638 | $ | 29.386 | $ | 30.804 | $ | 29.431 | $ | 23.293 | $ | 20.754 | $ | 21.601 | $ | 19.486 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 37.984 | $ | 30.847 | $ | 35.094 | $ | 32.638 | $ | 29.386 | $ | 30.804 | $ | 29.431 | $ | 23.293 | $ | 20.754 | $ | 21.601 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 3 | 4 | ||||||||||||||||||||||||||||||

| Franklin Mutual Shares VIP Subaccount (formerly Mutual Shares Securities Subaccount), name change as of 5/1/14 |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 23.508 | $ | 26.112 | $ | 24.340 | $ | 21.182 | $ | 22.504 | $ | 21.218 | $ | 16.708 | $ | 14.772 | $ | 15.076 | $ | 13.694 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 28.529 | $ | 23.508 | $ | 26.112 | $ | 24.340 | $ | 21.182 | $ | 22.504 | $ | 21.218 | $ | 16.708 | $ | 14.772 | $ | 15.076 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Franklin Rising Dividends VIP Subaccount (formerly Franklin Rising Dividends Securities Subaccount), name change as of 5/1/14 |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 30.392 | $ | 32.339 | $ | 27.092 | $ | 23.579 | $ | 24.717 | $ | 22.961 | $ | 17.882 | $ | 16.131 | $ | 15.370 | $ | 12.867 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 38.888 | $ | 30.392 | $ | 32.339 | $ | 27.092 | $ | 23.579 | $ | 24.717 | $ | 22.961 | $ | 17.882 | $ | 16.131 | $ | 15.370 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

2 | 2 | 2 | 2 | 1 | 1 | 1 | — | 1 | 1 | ||||||||||||||||||||||||||||||

| Franklin Small Cap Value VIP Subaccount (formerly Franklin Small Cap Value Securities Subaccount), name change as of 5/1/14 |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 35.306 | $ | 40.932 | $ | 37.360 | $ | 28.984 | $ | 31.608 | $ | 31.743 | $ | 23.532 | $ | 20.077 | $ | 21.069 | $ | 16.596 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 44.167 | $ | 35.306 | $ | 40.932 | $ | 37.360 | $ | 28.984 | $ | 31.608 | $ | 31.743 | $ | 23.532 | $ | 20.077 | $ | 21.069 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | 1 | 1 | 1 | 1 | 2 | 2 | ||||||||||||||||||||||||||||||

16

Table of Contents

| Flexible Payment Contracts | ||||||||||||||||||||||||||||||||||||||||

| Subaccount |

2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||||||||||||

| Franklin Strategic Income VIP Subaccount (formerly Franklin Strategic Income Securities Subaccount), name change as of 5/1/14 |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 19.222 | $ | 19.839 | $ | 19.163 | $ | 17.930 | $ | 18.839 | $ | 18.679 | $ | 18.261 | $ | 16.358 | $ | 16.106 | $ | 14.666 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 20.564 | $ | 19.222 | $ | 19.839 | $ | 19.163 | $ | 17.930 | $ | 18.839 | $ | 18.679 | $ | 18.261 | $ | 16.358 | $ | 16.106 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

1 | 1 | 1 | 1 | 2 | 2 | 1 | 1 | — | 1 | ||||||||||||||||||||||||||||||

| Franklin U.S. Government Securities VIP Subaccount (formerly Franklin U.S. Government Subaccount), name change as of 5/1/14 |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 13.254 | $ | 13.342 | $ | 13.297 | $ | 13.341 | $ | 13.411 | $ | 13.102 | $ | 13.536 | $ | 13.418 | $ | 12.824 | $ | 12.302 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 13.809 | $ | 13.254 | $ | 13.342 | $ | 13.297 | $ | 13.341 | $ | 13.411 | $ | 13.102 | $ | 13.536 | $ | 13.418 | $ | 12.824 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Templeton Developing Markets VIP Subaccount (formerly Templeton Developing Markets Securities Subaccount), name change as of 5/1/14 |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 30.353 | $ | 36.409 | $ | 26.189 | $ | 22.522 | $ | 28.294 | $ | 31.194 | $ | 31.800 | $ | 28.383 | $ | 34.068 | $ | 29.262 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 38.075 | $ | 30.353 | $ | 36.409 | $ | 26.189 | $ | 22.522 | $ | 28.294 | $ | 31.194 | $ | 31.800 | $ | 28.383 | $ | 34.068 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | 1 | 1 | 1 | 1 | 2 | 3 | 3 | ||||||||||||||||||||||||||||||

| Invesco Oppenheimer V.I. Capital Appreciation Subaccount (formerly Oppenheimer Capital Appreciation Subaccount), name changed as of 5/27/19 |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 24.987 | $ | 26.836 | $ | 21.425 | $ | 22.178 | $ | 21.691 | $ | 19.029 | $ | 14.849 | $ | 13.179 | $ | 13.496 | $ | 12.489 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 33.608 | $ | 24.987 | $ | 26.836 | $ | 21.425 | $ | 22.178 | $ | 21.691 | $ | 19.029 | $ | 14.849 | $ | 13.179 | $ | 13.496 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | — | — | — | — | 0 | ||||||||||||||||||||||||||||||

| Invesco Oppenheimer V.I. Discovery Mid Cap Growth Subaccount (formerly Oppeheimer Discovery Mid Cap Growth Subaccount ), name changed as of 5/27/19 |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 28.258 | $ | 30.462 | $ | 23.951 | $ | 23.697 | $ | 22.506 | $ | 21.541 | $ | 16.041 | $ | N/A | $ | N/A | $ | N/A | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 38.892 | $ | 28.258 | $ | 30.462 | $ | 23.951 | $ | 23.697 | $ | 22.506 | $ | 21.541 | $ | 16.041 | $ | N/A | $ | N/A | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | — | — | — | N/A | N/A | ||||||||||||||||||||||||||||||

| Invesco Oppenheimer V.I. Global Strategic Income Subaccount (formerly Oppenheimer Global Strategic Income Subaccount), name changed as of 5/27/19 |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 17.281 | $ | 18.285 | $ | 17.416 | $ | 16.553 | $ | 17.146 | $ | 16.896 | $ | 17.128 | $ | 15.289 | $ | 15.342 | $ | 13.501 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 18.925 | $ | 17.281 | $ | 18.285 | $ | 17.416 | $ | 16.553 | $ | 17.146 | $ | 16.896 | $ | 17.128 | $ | 15.289 | $ | 15.342 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

17

Table of Contents

| Flexible Payment Contracts | ||||||||||||||||||||||||||||||||||||||||

| Subaccount |

2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||||||||||||

| Invesco Oppenheimer V.I. Global Subaccount (formerly Oppenheimer Global Subaccount), name changed as of 5/27/19, (formerly Oppenheimer Global Securities Subaccount), name change as of 4/30/13 |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 34.771 | $ | 40.552 | $ | 30.044 | $ | 30.392 | $ | 29.608 | $ | 29.302 | $ | 23.304 | $ | 19.461 | $ | 21.487 | $ | 18.757 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 45.255 | $ | 34.771 | $ | 40.552 | $ | 30.044 | $ | 30.392 | $ | 29.608 | $ | 29.302 | $ | 23.304 | $ | 19.461 | $ | 21.487 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||

| Invesco Oppenheimer V.I. Main Street Subaccount (formerly Oppenheimer Main Street Subaccount), name changed as of 5/27/19 |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 27.211 | $ | 29.907 | $ | 25.897 | $ | 23.500 | $ | 23.020 | $ | 21.060 | $ | 16.183 | $ | 14.017 | $ | 14.201 | $ | 12.383 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 35.493 | $ | 27.211 | $ | 29.907 | $ | 25.897 | $ | 23.500 | $ | 23.020 | $ | 21.060 | $ | 16.183 | $ | 14.017 | $ | 14.201 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Invesco Oppenheimer V.I. Main Street Small Cap Subaccount (formerly Oppenheimer Main Street Small Cap Subaccount), name changed as of 5/27/19, (formerly Oppenheimer Main Street Small & Mid Cap Subaccount), name change as of 4/30/13 |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 37.137 | $ | 41.929 | $ | 37.176 | $ | 31.908 | $ | 34.319 | $ | 31.044 | $ | 22.296 | $ | 19.138 | $ | 19.801 | $ | 16.252 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 46.379 | $ | 37.137 | $ | 41.929 | $ | 37.176 | $ | 31.908 | $ | 34.319 | $ | 31.044 | $ | 22.296 | $ | 19.138 | $ | 19.801 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Invesco V.I. Diversified Dividend Subaccount (formerly Invesco Dividend Growth Subaccount) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 12.677 | $ | 13.853 | $ | 12.887 | $ | 11.336 | $ | 11.218 | $ | 10.042 | $ | 7.740 | $ | 6.584 | $ | N/A | $ | N/A | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 15.701 | $ | 12.677 | $ | 13.853 | $ | 12.887 | $ | 11.336 | $ | 11.218 | $ | 10.042 | $ | 7.740 | $ | 6.584 | $ | N/A | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 6 | N/A | ||||||||||||||||||||||||||||||

| Invesco V.I. Health Care Fund (formerly Invesco V.I. Global Health Care Subaccount, name changed as of 4/30/18 (formerly AIM V.I. Global Health Care Subaccount ) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 30.322 | $ | 30.352 | $ | 26.466 | $ | 30.190 | $ | 29.557 | $ | 24.946 | $ | 17.927 | $ | 14.977 | $ | 14.552 | $ | 13.958 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 39.780 | $ | 30.322 | $ | 30.352 | $ | 26.466 | $ | 30.190 | $ | 29.557 | $ | 24.946 | $ | 17.927 | $ | 14.977 | $ | 14.552 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Invesco V.I. Global Real Estate Subaccount (formerly AIM V.I. Real Estate Subaccount) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 30.550 | $ | 32.880 | $ | 29.374 | $ | 29.074 | $ | 29.806 | $ | 26.264 | $ | 25.826 | $ | 20.360 | $ | 21.995 | $ | 18.904 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 37.204 | $ | 30.550 | $ | 32.880 | $ | 29.374 | $ | 29.074 | $ | 29.806 | $ | 26.264 | $ | 25.826 | $ | 20.360 | $ | 21.995 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

18

Table of Contents

| Flexible Payment Contracts | ||||||||||||||||||||||||||||||||||||||||

| Subaccount |

2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||||||||||||

| Invesco V.I. Managed Volatility Subaccount (formerly Invesco V.I. Utilities Subaccount) name change as of 4/30/14 |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 31.309 | $ | 35.533 | $ | 32.460 | $ | 29.638 | $ | 30.592 | $ | 25.627 | $ | 23.369 | $ | 22.782 | $ | 19.759 | $ | 18.774 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 36.759 | $ | 31.309 | $ | 35.533 | $ | 32.460 | $ | 29.638 | $ | 30.592 | $ | 25.627 | $ | 23.369 | $ | 22.782 | $ | 19.759 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Janus Henderson Balanced Subaccount, name change as of 6/5/17 (formerly Janus Aspen Balanced Subaccount) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 77.762 | $ | 78.012 | $ | 66.529 | $ | 64.236 | $ | 64.478 | $ | 60.016 | $ | 50.448 | $ | 44.846 | $ | 44.563 | $ | 41.526 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 94.384 | $ | 77.762 | $ | 78.012 | $ | 66.529 | $ | 64.236 | $ | 64.478 | $ | 60.016 | $ | 50.448 | $ | 44.846 | $ | 44.563 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

2 | 2 | 2 | 2 | 3 | 3 | 3 | 4 | 4 | 6 | ||||||||||||||||||||||||||||||

| Janus Henderson Enterprise Subaccount, name change as of 6/5/17 (formerly Janus Aspen Enterprise Subaccount) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 99.303 | $ | 100.720 | $ | 79.833 | $ | 71.759 | $ | 69.669 | $ | 62.534 | $ | 47.711 | $ | 41.086 | $ | 42.093 | $ | 33.782 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 133.209 | $ | 99.303 | $ | 100.720 | $ | 79.833 | $ | 71.759 | $ | 69.669 | $ | 62.534 | $ | 47.711 | $ | 41.086 | $ | 42.093 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||

| Janus Henderson Global Research Subaccount, name change as of 6/5/17 (formerly Janus Aspen Global Research Subaccount) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 52.620 | $ | 57.068 | $ | 45.373 | $ | 44.899 | $ | 46.409 | $ | 43.625 | $ | 34.309 | $ | 28.858 | $ | 33.789 | $ | 29.461 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 67.231 | $ | 52.620 | $ | 57.068 | $ | 45.373 | $ | 44.899 | $ | 46.409 | $ | 43.625 | $ | 34.309 | $ | 28.858 | $ | 33.789 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

1 | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | ||||||||||||||||||||||||||||||

| Janus Henderson Mid Cap Value Subaccount, name changed 6/5/2017 (Janus Aspen Perkins Mid Cap Value Subaccount) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 33.535 | $ | 39.304 | $ | 34.934 | $ | 29.709 | $ | 31.155 | $ | 29.018 | $ | 23.296 | $ | 21.237 | $ | 22.108 | $ | 19.356 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 43.180 | $ | 33.535 | $ | 39.304 | $ | 34.934 | $ | 29.709 | $ | 31.155 | $ | 29.018 | $ | 23.296 | $ | 21.237 | $ | 22.108 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Janus Henderson Research Subaccount, name change as of 6/5/17 (formerly Janus Aspen Janus Subaccount) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 55.120 | $ | 57.147 | $ | 45.133 | $ | 45.356 | $ | 43.485 | $ | 38.869 | $ | 30.120 | $ | 25.654 | $ | 27.360 | $ | 24.130 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 73.960 | $ | 55.120 | $ | 57.147 | $ | 45.133 | $ | 45.356 | $ | 43.485 | $ | 38.869 | $ | 30.120 | $ | 25.654 | $ | 27.360 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 2 | ||||||||||||||||||||||||||||||

19

Table of Contents

| Flexible Payment Contracts | ||||||||||||||||||||||||||||||||||||||||

| Subaccount |

2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||||||||||||

| JPMorgan Insurance Trust MidCap Value Subaccount (formerly JPMorgan Investment Trust MidCap Value) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 27.826 | $ | 31.879 | $ | 28.302 | $ | 24.922 | $ | 25.858 | $ | 22.688 | $ | 17.320 | $ | 14.533 | $ | 14.367 | $ | 11.754 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 34.924 | $ | 27.826 | $ | 31.879 | $ | 28.302 | $ | 24.922 | $ | 25.858 | $ | 22.688 | $ | 17.320 | $ | 14.533 | $ | 14.367 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| JPMorgan Insurance Trust Small Cap Core Subaccount |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 37.964 | $ | 43.540 | $ | 38.163 | $ | 32.062 | $ | 34.188 | $ | 31.507 | $ | 22.363 | $ | 18.866 | $ | 20.009 | $ | 15.897 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 46.826 | $ | 37.964 | $ | 43.540 | $ | 38.163 | $ | 32.062 | $ | 34.188 | $ | 31.507 | $ | 22.363 | $ | 18.866 | $ | 20.009 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| JPMorgan Insurance Trust US Equity Subaccount |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 28.152 | $ | 30.304 | $ | 25.019 | $ | 22.777 | $ | 22.808 | $ | 20.224 | $ | 14.995 | $ | 12.874 | $ | 13.250 | $ | 11.783 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 36.725 | $ | 28.152 | $ | 30.304 | $ | 25.019 | $ | 22.777 | $ | 22.808 | $ | 20.224 | $ | 14.995 | $ | 12.874 | $ | 13.250 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Voya Global Equity Subaccount (formerly Voya Global Value Advantage), name change as of 5/1/16 |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 12.215 | $ | 13.575 | $ | 11.107 | $ | 10.606 | $ | 11.335 | $ | N/A | $ | N/A | $ | N/A | $ | N/A | $ | N/A | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 14.683 | $ | 12.215 | $ | 13.575 | $ | 11.107 | $ | 10.606 | $ | N/A | $ | N/A | $ | N/A | $ | N/A | $ | N/A | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

— | — | — | — | — | N/A | N/A | N/A | N/A | N/A | ||||||||||||||||||||||||||||||

| VY JPMorgan Emerging Markets Equity (formerly ING JPMorgan Emerging Markets Equity Subaccount), name change as of 5/1/14 |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 26.375 | $ | 31.937 | $ | 22.500 | $ | 20.064 | $ | 23.999 | $ | 23.970 | $ | 25.616 | $ | 21.682 | $ | 26.722 | $ | 22.373 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 34.501 | $ | 26.375 | $ | 31.937 | $ | 22.500 | $ | 20.064 | $ | 23.999 | $ | 23.970 | $ | 25.616 | $ | 21.682 | $ | 26.722 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||

No Additional Contract Options Elected

(Separate Account Charges of 1.30% of the Daily Net Assets of the Separate Account)

Tax Qualified (1.30%)

| Qualified Payment Contracts | ||||||||||||||||||||||||||||||||||||||||

| Subaccount |

2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||||||||||||

| Alger Large Cap Growth Subaccount (formerly Alger American Growth Subaccount) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 109.718 | $ | 108.752 | $ | 85.752 | $ | 87.590 | $ | 87.231 | $ | 79.618 | $ | 59.707 | $ | 55.054 | $ | 55.963 | $ | 49.997 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 138.020 | $ | 109.718 | $ | 108.752 | $ | 85.752 | $ | 87.590 | $ | 87.231 | $ | 79.618 | $ | 59.707 | $ | 55.054 | $ | 55.963 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

68 | 77 | 78 | 87 | 104 | 112 | 120 | 133 | 158 | 175 | ||||||||||||||||||||||||||||||

20

Table of Contents

| Qualified Payment Contracts | ||||||||||||||||||||||||||||||||||||||||

| Subaccount |

2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||||||||||||

| Alger MidCap Growth Subaccount (formerly Alger American MidCap Growth Subaccount) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 59.851 | $ | 65.511 | $ | 51.129 | $ | 51.292 | $ | 52.785 | $ | 49.505 | $ | 36.917 | $ | 32.182 | $ | 35.540 | $ | 30.157 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 76.959 | $ | 59.851 | $ | 65.511 | $ | 51.129 | $ | 51.292 | $ | 52.785 | $ | 49.505 | $ | 36.917 | $ | 32.182 | $ | 35.540 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

98 | 113 | 124 | 127 | 146 | 165 | 182 | 197 | 250 | 293 | ||||||||||||||||||||||||||||||

| Alger Small Cap Growth Subaccount (formerly Alger American Small Capitalization Subaccount) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 96.907 | $ | 96.785 | $ | 76.158 | $ | 72.615 | $ | 76.084 | $ | 76.738 | $ | 57.899 | $ | 52.136 | $ | 54.549 | $ | 44.102 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 123.728 | $ | 96.907 | $ | 96.785 | $ | 76.158 | $ | 72.615 | $ | 76.084 | $ | 76.738 | $ | 57.899 | $ | 52.136 | $ | 54.549 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

49 | 54 | 52 | 60 | 72 | 78 | 86 | 105 | 122 | 125 | ||||||||||||||||||||||||||||||

| American Century VP Income & Growth Subaccount |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 14.051 | $ | 15.285 | $ | 12.850 | $ | 11.470 | $ | 12.311 | $ | 11.085 | $ | 8.268 | $ | 7.299 | $ | 7.171 | $ | 6.364 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 17.193 | $ | 14.051 | $ | 15.285 | $ | 12.850 | $ | 11.470 | $ | 12.311 | $ | 11.085 | $ | 8.268 | $ | 7.299 | $ | 7.171 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

496 | 528 | 567 | 632 | 654 | 688 | 758 | 829 | 961 | 1,129 | ||||||||||||||||||||||||||||||

| American Century VP Value Subaccount |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 18.396 | $ | 20.514 | $ | 19.109 | $ | 16.066 | $ | 16.933 | $ | 15.169 | $ | 11.665 | $ | 10.314 | $ | 10.342 | $ | 9.237 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 23.070 | $ | 18.396 | $ | 20.514 | $ | 19.109 | $ | 16.066 | $ | 16.933 | $ | 15.169 | $ | 11.665 | $ | 10.314 | $ | 10.342 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

405 | 474 | 552 | 628 | 697 | 745 | 806 | 916 | 1,598 | 1,635 | ||||||||||||||||||||||||||||||

| BNY Mellon I.P. Mid Cap Stock Subaccount, name change as of 6/3/19 (formerly Dreyfus I.P. Mid Cap Stock Subaccount) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 28.321 | $ | 34.028 | $ | 29.963 | $ | 26.346 | $ | 27.378 | $ | 24.815 | $ | 18.662 | $ | 15.842 | $ | 16.015 | $ | 12.780 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 33.508 | $ | 28.321 | $ | 34.028 | $ | 29.963 | $ | 26.346 | $ | 27.378 | $ | 24.815 | $ | 18.662 | $ | 15.842 | $ | 16.015 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

93 | 110 | 120 | 120 | 121 | 120 | 108 | 60 | 72 | 80 | ||||||||||||||||||||||||||||||

| BNY Mellon Sustainable U.S Equity Portfolio, name change as of 6/3/19 (formerly Dreyfus Sustainable U.S. Equity Portfolio), name change as of 5/1/17 (formerly Dreyfus Socially Responsible Growth Subaccount) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 51.177 | $ | 54.233 | $ | 47.632 | $ | 43.715 | $ | 45.745 | $ | 40.845 | $ | 30.798 | $ | 27.863 | $ | 27.972 | $ | 24.679 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 67.878 | $ | 51.177 | $ | 54.233 | $ | 47.632 | $ | 43.715 | $ | 45.745 | $ | 40.845 | $ | 30.798 | $ | 27.863 | $ | 27.972 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

36 | 40 | 42 | 49 | 55 | 65 | 71 | 74 | 74 | 75 | ||||||||||||||||||||||||||||||

21

Table of Contents

| Qualified Payment Contracts | ||||||||||||||||||||||||||||||||||||||||

| Subaccount |

2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||||||||||||

| DWS Bond VIP Subaccount (formerly Deutsche Bond VIP Subaccount, name change as of 7/2/18 (formerly DWS Bond VIP Subaccount, name change as of 8/11/14 (formerly Scudder Bond Subaccount))) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 9.843 | $ | 10.244 | $ | 9.805 | $ | 9.376 | $ | 9.526 | $ | 9.050 | $ | 9.454 | $ | 8.886 | $ | 8.517 | $ | 8.079 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 10.749 | $ | 9.843 | $ | 10.244 | $ | 9.805 | $ | 9.376 | $ | 9.526 | $ | 9.050 | $ | 9.454 | $ | 8.886 | $ | 8.517 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |

516 | 540 | 658 | 748 | 813 | 916 | 1,022 | 1,307 | 670 | 801 | ||||||||||||||||||||||||||||||

| DWS Capital Growth VIP Subaccount (formerly Deutsche Capital Growth VIP Subaccount, name change as of 7/2/18 (formerly DWS Capital Growth VIP Subaccount, name change as of 8/11/14 (formerly Scudder Capital Growth Subaccount))) |

||||||||||||||||||||||||||||||||||||||||

| Accumulation unit value at beginning of period |

$ | 49.941 | $ | 51.415 | $ | 41.236 | $ | 40.070 | $ | 37.370 | $ | 33.509 | $ | 25.210 | $ | 22.006 | $ | 23.335 | $ | 20.254 | ||||||||||||||||||||

| Accumulation unit value at end of period |

$ | 67.608 | $ | 49.941 | $ | 51.415 | $ | 41.236 | $ | 40.070 | $ | 37.370 | $ | 33.509 | $ | 25.210 | $ | 22.006 | $ | 23.335 | ||||||||||||||||||||

| Number of accumulation units outstanding at end of period (000’s omitted) |