UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02105

Fidelity Salem Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

|

Date of fiscal year end: |

December 31 |

|

|

|

|

Date of reporting period: |

June 30, 2022 |

Item 1.

Reports to Stockholders

Contents

|

Top Five States (% of Fund's net assets)

|

|

|

Illinois

|

13.5

|

|

New York

|

8.4

|

|

Pennsylvania

|

7.5

|

|

Other

|

7.4

|

|

Georgia

|

6.4

|

|

Revenue Sources (% of Fund's net assets)

|

||

|

The distribution of municipal securities by revenue source, as a percentage of total net assets, is as follows (Unaudited):

|

||

|

Transportation

|

24.4%

|

|

|

General Obligations

|

22.8%

|

|

|

Health Care

|

15.5%

|

|

|

Education

|

10.7%

|

|

|

Special Tax

|

5.0%

|

|

|

Water & Sewer

|

5.0%

|

|

|

Others* (Individually Less Than 5%)

|

16.6%

|

|

|

100.0%

|

||

|

*Includes net other assets

|

||

|

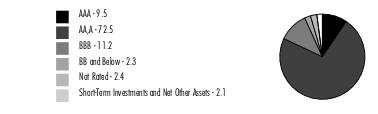

Quality Diversification (% of Fund's net assets)

|

|

|

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

|

|

Municipal Bonds - 98.0%

|

|||

|

Principal

Amount (a)

|

Value ($)

|

||

|

Alabama - 0.5%

|

|||

|

Auburn Univ. Gen. Fee Rev. Series 2018 A, 5% 6/1/43

|

155,000

|

167,975

|

|

|

Jefferson County Gen. Oblig. Series 2018 A:

|

|||

|

5% 4/1/25

|

155,000

|

166,703

|

|

|

5% 4/1/26

|

145,000

|

159,157

|

|

|

Lower Alabama Gas District Bonds (No. 2 Proj.) Series 2020, 4%, tender 12/1/25 (b)

|

2,080,000

|

2,110,716

|

|

|

Montgomery Med. Clinic Facilities Series 2015:

|

|||

|

5% 3/1/33

|

255,000

|

263,435

|

|

|

5% 3/1/36

|

460,000

|

473,660

|

|

|

TOTAL ALABAMA

|

3,341,646

|

||

|

Alaska - 0.3%

|

|||

|

Alaska Hsg. Fin. Corp. Series 2021 A:

|

|||

|

4% 6/1/26

|

175,000

|

184,511

|

|

|

4% 12/1/29

|

290,000

|

308,447

|

|

|

5% 12/1/28

|

400,000

|

450,115

|

|

|

5% 6/1/29

|

300,000

|

337,365

|

|

|

Alaska Hsg. Fin. Corp. Mtg. Rev. Series 2022 A, 3% 6/1/51

|

255,000

|

248,151

|

|

|

Alaska Int'l. Arpts. Revs. Series 2016 B, 5% 10/1/35

|

675,000

|

704,982

|

|

|

TOTAL ALASKA

|

2,233,571

|

||

|

Arizona - 1.0%

|

|||

|

Arizona Health Facilities Auth. Rev.:

|

|||

|

(Banner Health Sys. Proj.) Series 2007 B, 3 month U.S. LIBOR + 0.810% 1.458%, tender 1/1/37 (b)(c)

|

150,000

|

141,048

|

|

|

(Scottsdale Lincoln Hospitals Proj.) Series 2014 A, 5% 12/1/39

|

230,000

|

236,022

|

|

|

Arizona Indl. Dev. Auth. Hosp. Rev. Series 2021 A, 5% 2/1/29

|

410,000

|

459,335

|

|

|

Arizona Indl. Dev. Auth. Rev. (Provident Group-Eastern Michigan Univ. Parking Proj.) Series 2018:

|

|||

|

5% 5/1/48

|

55,000

|

44,386

|

|

|

5% 5/1/51

|

55,000

|

43,734

|

|

|

Arizona State Univ. Revs. Series 2021 C:

|

|||

|

5% 7/1/37

|

340,000

|

383,613

|

|

|

5% 7/1/38

|

550,000

|

619,000

|

|

|

Chandler Indl. Dev. Auth. Indl. Dev. Rev. Bonds (Intel Corp. Proj.) Series 2007, 2.7%, tender 8/14/23 (b)(d)

|

370,000

|

372,217

|

|

|

Glendale Gen. Oblig. Series 2017:

|

|||

|

5% 7/1/30

|

130,000

|

144,466

|

|

|

5% 7/1/31

|

190,000

|

210,767

|

|

|

Glendale Indl. Dev. Auth. (Terraces of Phoenix Proj.) Series 2018 A:

|

|||

|

5% 7/1/38

|

15,000

|

13,760

|

|

|

5% 7/1/48

|

20,000

|

17,290

|

|

|

Maricopa County Indl. Dev. Auth.:

|

|||

|

(Creighton Univ. Proj.) Series 2020, 5% 7/1/47

|

175,000

|

185,431

|

|

|

Series 2021 A, 4% 9/1/51

|

295,000

|

274,481

|

|

|

Maricopa County Indl. Dev. Auth. Sr. Living Facilities Series 2016:

|

|||

|

5.75% 1/1/36 (e)

|

250,000

|

199,006

|

|

|

6% 1/1/48 (e)

|

395,000

|

292,416

|

|

|

Maricopa County Rev. Series 2016 A, 5% 1/1/33

|

305,000

|

324,670

|

|

|

Phoenix Civic Impt. Board Arpt. Rev.:

|

|||

|

Series 2013, 5% 7/1/22 (d)

|

50,000

|

50,000

|

|

|

Series 2017 A:

|

|||

|

5% 7/1/33 (d)

|

55,000

|

58,449

|

|

|

5% 7/1/36 (d)

|

90,000

|

94,643

|

|

|

5% 7/1/37 (d)

|

65,000

|

68,254

|

|

|

Series 2017 B:

|

|||

|

5% 7/1/29

|

125,000

|

137,432

|

|

|

5% 7/1/33

|

175,000

|

189,714

|

|

|

5% 7/1/36

|

205,000

|

220,486

|

|

|

5% 7/1/37

|

125,000

|

134,246

|

|

|

Series 2019 B, 5% 7/1/35 (d)

|

720,000

|

764,487

|

|

|

Phoenix Civic Impt. Corp. Wtr. Sys. Rev. Series 2021 A, 5% 7/1/45

|

410,000

|

454,785

|

|

|

Salt Verde Finl. Corp. Sr. Gas Rev. Series 2007, 5.5% 12/1/29

|

450,000

|

500,367

|

|

|

TOTAL ARIZONA

|

6,634,505

|

||

|

California - 4.8%

|

|||

|

ABC Unified School District Series 1997 C, 0% 8/1/28 (Nat'l. Pub. Fin. Guarantee Corp. Insured)

|

200,000

|

165,756

|

|

|

California Gen. Oblig.:

|

|||

|

Series 2004, 5.25% 12/1/33

|

10,000

|

10,023

|

|

|

Series 2016, 5% 9/1/29

|

110,000

|

120,732

|

|

|

Series 2017:

|

|||

|

5% 11/1/27

|

585,000

|

661,662

|

|

|

5% 8/1/30

|

725,000

|

807,479

|

|

|

Series 2020, 4% 11/1/37

|

575,000

|

579,579

|

|

|

Series 2022, 5% 4/1/47

|

3,050,000

|

3,401,024

|

|

|

California Hsg. Fin. Agcy. Series 2021 1, 3.5% 11/20/35

|

212,094

|

197,901

|

|

|

California Pub. Fin. Auth. Univ. Hsg. Rev.:

|

|||

|

(Claremont Colleges Proj.) Series 2017 A, 5% 7/1/27 (e)

|

100,000

|

86,445

|

|

|

(NCCD - Claremont Properties LLC - Claremont Colleges Proj.) Series 2017 A, 5% 7/1/47 (e)

|

100,000

|

76,759

|

|

|

California Pub. Works Board Lease Rev. (Various Cap. Projs.):

|

|||

|

Series 2021 B, 4% 5/1/46

|

1,685,000

|

1,643,096

|

|

|

Series 2022 C:

|

|||

|

5% 8/1/31 (f)(g)

|

190,000

|

218,035

|

|

|

5% 8/1/34 (f)(g)

|

350,000

|

396,979

|

|

|

California Statewide Cmntys. Dev. Auth. Rev. Series 2015, 5% 2/1/45

|

195,000

|

181,078

|

|

|

Folsom Cordova Union School District No. 4 Series A, 0% 10/1/31 (Nat'l. Pub. Fin. Guarantee Corp. Insured)

|

90,000

|

63,800

|

|

|

Kern Cmnty. College District Gen. Oblig. Series 2006:

|

|||

|

0% 11/1/28 (Assured Guaranty Muni. Corp. Insured)

|

250,000

|

203,538

|

|

|

0% 11/1/30 (Assured Guaranty Muni. Corp. Insured)

|

255,000

|

190,904

|

|

|

Long Beach Unified School District Series 2009, 5.5% 8/1/29

|

10,000

|

10,029

|

|

|

Los Angeles Dept. of Wtr. & Pwr. Rev.:

|

|||

|

Series 2021 B, 5% 7/1/51

|

1,995,000

|

2,182,948

|

|

|

Series B, 5% 7/1/50

|

1,435,000

|

1,566,624

|

|

|

Los Angeles Dept. of Wtr. & Pwr. Wtrwks. Rev. Series 2020 A, 5% 7/1/40

|

30,000

|

33,580

|

|

|

Los Angeles Hbr. Dept. Rev. Series 2019 A, 5% 8/1/25 (d)

|

255,000

|

273,827

|

|

|

Monrovia Unified School District Series B, 0% 8/1/29 (Nat'l. Pub. Fin. Guarantee Corp. Insured)

|

230,000

|

181,528

|

|

|

Mount Diablo Unified School District Series 2022 B:

|

|||

|

4% 8/1/31

|

285,000

|

307,018

|

|

|

4% 8/1/32

|

400,000

|

426,178

|

|

|

Oakland Unified School District Alameda County Series 2015 A, 5% 8/1/29

|

90,000

|

95,885

|

|

|

Poway Unified School District:

|

|||

|

(District #2007-1 School Facilities Proj.) Series 2008 A, 0% 8/1/32

|

300,000

|

211,219

|

|

|

Series 2011, 0% 8/1/46

|

60,000

|

20,356

|

|

|

Series B:

|

|||

|

0% 8/1/37

|

395,000

|

221,125

|

|

|

0% 8/1/39

|

1,200,000

|

607,395

|

|

|

0% 8/1/41

|

200,000

|

91,281

|

|

|

Poway Unified School District Pub. Fing. Series 2015 A:

|

|||

|

5% 9/1/24

|

50,000

|

52,298

|

|

|

5% 9/1/26

|

65,000

|

68,780

|

|

|

5% 9/1/29

|

135,000

|

140,740

|

|

|

5% 9/1/31

|

60,000

|

62,075

|

|

|

Sacramento City Fing. Auth. Rev. Series A, 0% 12/1/26 (Nat'l. Pub. Fin. Guarantee Corp. Insured)

|

255,000

|

221,516

|

|

|

San Diego County Wtr. Auth. Fing. Agcy. Wtr. Rev. Series 2022 A:

|

|||

|

5% 5/1/47

|

685,000

|

778,991

|

|

|

5% 5/1/52

|

1,160,000

|

1,312,865

|

|

|

San Diego Unified School District:

|

|||

|

Series 2008 C, 0% 7/1/34

|

180,000

|

111,064

|

|

|

Series 2008 E, 0% 7/1/47 (h)

|

440,000

|

314,872

|

|

|

San Francisco City & County Arpts. Commission Int'l. Arpt. Rev.:

|

|||

|

Series 2019 A:

|

|||

|

5% 1/1/35 (d)

|

360,000

|

382,224

|

|

|

5% 5/1/49 (d)

|

3,960,000

|

4,114,474

|

|

|

Series 2019 B, 5% 5/1/49

|

275,000

|

289,879

|

|

|

Series 2019 E, 5% 5/1/50 (d)

|

395,000

|

410,108

|

|

|

Series 2022 A:

|

|||

|

5% 5/1/26 (d)

|

920,000

|

992,148

|

|

|

5% 5/1/27 (d)

|

930,000

|

1,012,737

|

|

|

5% 5/1/28 (d)

|

1,245,000

|

1,363,413

|

|

|

5% 5/1/29 (d)

|

835,000

|

918,761

|

|

|

Series 2022 B, 5% 5/1/52

|

2,525,000

|

2,698,794

|

|

|

San Jose Fing. Auth. Lease Rev. (Civic Ctr. Proj.) Series 2013 A:

|

|||

|

5% 6/1/27 (Pre-Refunded to 6/1/23 @ 100)

|

235,000

|

242,046

|

|

|

5% 6/1/31 (Pre-Refunded to 6/1/23 @ 100)

|

290,000

|

298,695

|

|

|

San Marcos Unified School District Series 2010 B, 0% 8/1/47

|

1,075,000

|

350,645

|

|

|

San Mateo County Cmnty. College District Series A, 0% 9/1/26 (Nat'l. Pub. Fin. Guarantee Corp. Insured)

|

275,000

|

247,299

|

|

|

Washington Township Health Care District Gen. Oblig.:

|

|||

|

Series 2013 A, 5.5% 8/1/38

|

230,000

|

240,093

|

|

|

Series 2013 B, 5.5% 8/1/38

|

50,000

|

52,194

|

|

|

West Contra Costa Unified School District Series 2012, 5% 8/1/26 (Pre-Refunded to 8/1/22 @ 100)

|

100,000

|

100,273

|

|

|

TOTAL CALIFORNIA

|

32,010,767

|

||

|

Colorado - 3.2%

|

|||

|

Arkansas River Pwr. Auth. Rev. Series 2018 A:

|

|||

|

5% 10/1/38

|

125,000

|

130,427

|

|

|

5% 10/1/43

|

160,000

|

164,108

|

|

|

Colorado Health Facilities Auth.:

|

|||

|

(Parkview Med. Ctr., Inc. Proj.) Series 2016:

|

|||

|

4% 9/1/35

|

85,000

|

81,713

|

|

|

4% 9/1/36

|

65,000

|

62,166

|

|

|

5% 9/1/46

|

370,000

|

378,957

|

|

|

Series 2019 A:

|

|||

|

5% 11/1/25

|

540,000

|

578,561

|

|

|

5% 11/15/39

|

700,000

|

751,218

|

|

|

Series 2019 A1, 4% 8/1/44

|

1,170,000

|

1,076,847

|

|

|

Series 2019 A2:

|

|||

|

4% 8/1/49

|

725,000

|

649,502

|

|

|

5% 8/1/44

|

4,585,000

|

4,683,771

|

|

|

Colorado Hsg. & Fin. Auth.:

|

|||

|

Series 2019 F, 4.25% 11/1/49

|

165,000

|

168,602

|

|

|

Series 2019 H, 4.25% 11/1/49

|

290,000

|

296,416

|

|

|

Colorado Reg'l. Trans. District Sales Tax Rev. (Fastracks Proj.) Series 2021 B, 5% 11/1/28

|

1,030,000

|

1,177,175

|

|

|

Denver City & County Arpt. Rev.:

|

|||

|

Series 2017 A:

|

|||

|

5% 11/15/26 (d)

|

175,000

|

190,939

|

|

|

5% 11/15/27 (d)

|

150,000

|

165,371

|

|

|

Series 2018 A:

|

|||

|

5% 12/1/30 (d)

|

390,000

|

431,827

|

|

|

5% 12/1/34 (d)

|

260,000

|

288,967

|

|

|

5% 12/1/36 (d)

|

255,000

|

269,759

|

|

|

5% 12/1/37 (d)

|

505,000

|

532,206

|

|

|

Denver City & County Board Wtr. Rev.:

|

|||

|

Series 2020 A:

|

|||

|

5% 9/15/45

|

1,550,000

|

1,728,495

|

|

|

5% 9/15/46

|

2,375,000

|

2,645,516

|

|

|

Series 2020 B:

|

|||

|

5% 9/15/28

|

770,000

|

880,861

|

|

|

5% 9/15/29

|

1,430,000

|

1,657,310

|

|

|

E-470 Pub. Hwy. Auth. Rev. Series 2020 A:

|

|||

|

5% 9/1/36

|

705,000

|

786,909

|

|

|

5% 9/1/40

|

820,000

|

855,929

|

|

|

Univ. of Colorado Enterprise Sys. Rev. Bonds:

|

|||

|

Series 2021 C3A, 2%, tender 10/15/25 (b)

|

305,000

|

297,864

|

|

|

Series 2021 C3B, 2%, tender 10/15/26 (b)

|

260,000

|

250,634

|

|

|

Vauxmont Metropolitan District:

|

|||

|

Series 2019, 5% 12/15/32 (Assured Guaranty Muni. Corp. Insured)

|

47,000

|

50,797

|

|

|

Series 2020, 5% 12/1/33 (Assured Guaranty Muni. Corp. Insured)

|

75,000

|

83,948

|

|

|

TOTAL COLORADO

|

21,316,795

|

||

|

Connecticut - 2.1%

|

|||

|

Connecticut Gen. Oblig.:

|

|||

|

Series 2015 B, 5% 6/15/32

|

145,000

|

153,712

|

|

|

Series 2016 B, 5% 5/15/26

|

365,000

|

401,278

|

|

|

Series 2018 F:

|

|||

|

5% 9/15/23

|

130,000

|

134,896

|

|

|

5% 9/15/24

|

165,000

|

175,269

|

|

|

5% 9/15/25

|

165,000

|

179,108

|

|

|

Series 2021 D:

|

|||

|

5% 7/15/24

|

335,000

|

354,186

|

|

|

5% 7/15/25

|

555,000

|

600,385

|

|

|

5% 7/15/26

|

555,000

|

612,069

|

|

|

5% 7/15/27

|

735,000

|

824,163

|

|

|

5% 7/15/28

|

850,000

|

962,467

|

|

|

Series 2022 D, 5% 9/15/28

|

295,000

|

334,753

|

|

|

Connecticut Health & Edl. Facilities Auth. Rev.:

|

|||

|

(Sacred Heart Univ., CT. Proj.) Series 2017 I-1:

|

|||

|

5% 7/1/26

|

25,000

|

26,985

|

|

|

5% 7/1/27

|

20,000

|

21,882

|

|

|

5% 7/1/28

|

30,000

|

32,617

|

|

|

5% 7/1/29

|

20,000

|

21,660

|

|

|

Series 2016 K, 4% 7/1/46

|

445,000

|

381,059

|

|

|

Series 2019 A:

|

|||

|

5% 7/1/26 (e)

|

350,000

|

347,899

|

|

|

5% 7/1/27 (e)

|

205,000

|

202,803

|

|

|

5% 7/1/49 (e)

|

420,000

|

355,686

|

|

|

Series 2019 Q-1:

|

|||

|

5% 11/1/22

|

240,000

|

242,765

|

|

|

5% 11/1/26

|

255,000

|

281,567

|

|

|

Series 2020 A, 4% 7/1/40

|

390,000

|

379,786

|

|

|

Series 2021 G:

|

|||

|

4% 3/1/46

|

305,000

|

298,346

|

|

|

4% 3/1/51

|

490,000

|

473,200

|

|

|

Series 2022 M, 4% 7/1/39

|

585,000

|

527,199

|

|

|

Series K1:

|

|||

|

5% 7/1/27

|

25,000

|

26,205

|

|

|

5% 7/1/29

|

65,000

|

67,773

|

|

|

5% 7/1/30

|

50,000

|

51,815

|

|

|

5% 7/1/31

|

410,000

|

422,710

|

|

|

5% 7/1/33

|

80,000

|

81,975

|

|

|

5% 7/1/34

|

580,000

|

592,987

|

|

|

Series K3, 5% 7/1/43

|

605,000

|

608,670

|

|

|

Connecticut Hsg. Fin. Auth.:

|

|||

|

Series 2021 B1, 3% 11/15/49

|

430,000

|

420,183

|

|

|

Series C:

|

|||

|

5% 5/15/23 (d)

|

75,000

|

76,889

|

|

|

5% 11/15/23 (d)

|

350,000

|

363,067

|

|

|

5% 5/15/24 (d)

|

630,000

|

659,207

|

|

|

5% 11/15/24 (d)

|

295,000

|

311,624

|

|

|

5% 11/15/25 (d)

|

260,000

|

278,650

|

|

|

Connecticut State Revolving Fund Gen. Rev. Series 2017 A, 5% 5/1/35

|

190,000

|

208,424

|

|

|

Hbr. Point Infrastructure Impt. District Series 2017:

|

|||

|

5% 4/1/30 (e)

|

230,000

|

239,523

|

|

|

5% 4/1/39 (e)

|

295,000

|

303,745

|

|

|

New Britain Gen. Oblig. Series 2017 C, 5% 3/1/29 (Assured Guaranty Muni. Corp. Insured)

|

55,000

|

59,824

|

|

|

Stratford Gen. Oblig. Series 2019, 5% 1/1/23

|

520,000

|

528,703

|

|

|

Univ. of Connecticut Gen. Oblig. Series 2019 A, 5% 11/1/25

|

260,000

|

282,360

|

|

|

TOTAL CONNECTICUT

|

13,910,074

|

||

|

Delaware - 0.1%

|

|||

|

Delaware Gen. Oblig.:

|

|||

|

Series 2019, 5% 2/1/30

|

294,000

|

336,009

|

|

|

Series 2020 A, 5% 1/1/31

|

294,000

|

339,774

|

|

|

TOTAL DELAWARE

|

675,783

|

||

|

District Of Columbia - 1.6%

|

|||

|

District of Columbia Gen. Oblig.:

|

|||

|

Series 2021 D:

|

|||

|

4% 2/1/27

|

380,000

|

407,299

|

|

|

5% 2/1/28

|

380,000

|

430,810

|

|

|

5% 2/1/29

|

505,000

|

579,070

|

|

|

Series 2021 E:

|

|||

|

5% 2/1/27

|

1,285,000

|

1,433,322

|

|

|

5% 2/1/28

|

835,000

|

946,648

|

|

|

5% 2/1/29

|

1,070,000

|

1,226,939

|

|

|

District of Columbia Rev. Series 2018, 5% 10/1/48

|

2,100,000

|

2,173,659

|

|

|

Metropolitan Washington Arpts. Auth. Dulles Toll Road Rev. (Dulles Metrorail and Cap. Impt. Projs.) Series 2019 A:

|

|||

|

5% 10/1/31

|

210,000

|

234,754

|

|

|

5% 10/1/32

|

265,000

|

295,364

|

|

|

Metropolitan Washington DC Arpts. Auth. Sys. Rev.:

|

|||

|

Series 2017 A:

|

|||

|

5% 10/1/28 (d)

|

335,000

|

365,859

|

|

|

5% 10/1/30 (d)

|

415,000

|

447,772

|

|

|

5% 10/1/31 (d)

|

75,000

|

80,640

|

|

|

5% 10/1/32 (d)

|

115,000

|

123,053

|

|

|

5% 10/1/33 (d)

|

55,000

|

58,581

|

|

|

5% 10/1/35 (d)

|

125,000

|

132,151

|

|

|

5% 10/1/42 (d)

|

255,000

|

266,462

|

|

|

Series 2019 A, 5% 10/1/25 (d)

|

180,000

|

193,176

|

|

|

Series 2020 A:

|

|||

|

5% 10/1/26 (d)

|

650,000

|

707,899

|

|

|

5% 10/1/27 (d)

|

225,000

|

247,773

|

|

|

5% 10/1/28 (d)

|

115,000

|

127,430

|

|

|

TOTAL DISTRICT OF COLUMBIA

|

10,478,661

|

||

|

Florida - 4.6%

|

|||

|

Brevard County School Board Ctfs. of Prtn. Series 2015 C, 5% 7/1/28

|

90,000

|

95,456

|

|

|

Broward County Arpt. Sys. Rev.:

|

|||

|

Series 2012 P-1, 5% 10/1/22 (d)

|

50,000

|

50,379

|

|

|

Series 2012 Q1, 5% 10/1/25

|

265,000

|

266,805

|

|

|

Series 2015 C, 5% 10/1/24 (d)

|

130,000

|

136,947

|

|

|

Series 2017:

|

|||

|

5% 10/1/25 (d)

|

15,000

|

16,084

|

|

|

5% 10/1/26 (d)

|

50,000

|

54,141

|

|

|

5% 10/1/27 (d)

|

50,000

|

54,679

|

|

|

5% 10/1/29 (d)

|

135,000

|

145,485

|

|

|

5% 10/1/30 (d)

|

35,000

|

37,486

|

|

|

5% 10/1/32 (d)

|

175,000

|

185,962

|

|

|

5% 10/1/33 (d)

|

65,000

|

68,755

|

|

|

5% 10/1/34 (d)

|

65,000

|

68,494

|

|

|

5% 10/1/35 (d)

|

75,000

|

78,745

|

|

|

5% 10/1/36 (d)

|

100,000

|

104,863

|

|

|

5% 10/1/37 (d)

|

115,000

|

120,178

|

|

|

5% 10/1/42 (d)

|

655,000

|

679,741

|

|

|

5% 10/1/47 (d)

|

305,000

|

314,776

|

|

|

Series 2019 A, 5% 10/1/49 (d)

|

705,000

|

733,933

|

|

|

Series A:

|

|||

|

5% 10/1/28 (d)

|

150,000

|

158,088

|

|

|

5% 10/1/30 (d)

|

175,000

|

182,945

|

|

|

5% 10/1/31 (d)

|

150,000

|

156,503

|

|

|

5% 10/1/32 (d)

|

140,000

|

145,702

|

|

|

Broward County School Board Ctfs. of Prtn.:

|

|||

|

(Broward County School District Proj.) Series 2016 A, 5% 7/1/28

|

35,000

|

38,041

|

|

|

Series 2012 A, 5% 7/1/27

|

290,000

|

290,000

|

|

|

Series 2015 A, 5% 7/1/27

|

50,000

|

53,565

|

|

|

Series 2015 B, 5% 7/1/24

|

140,000

|

147,462

|

|

|

Series 2016, 5% 7/1/32

|

110,000

|

119,210

|

|

|

Cap. Projs. Fin. Auth. Student Hsg. Rev. (Cap. Projs. Ln. Prog. - Florida Univs.) Series 2020 A, 5% 10/1/30

|

220,000

|

228,409

|

|

|

Duval County School Board Ctfs. of Prtn.:

|

|||

|

Series 2015 B:

|

|||

|

5% 7/1/28

|

105,000

|

112,831

|

|

|

5% 7/1/32

|

620,000

|

664,018

|

|

|

Series 2016 A, 5% 7/1/33

|

70,000

|

76,027

|

|

|

Escambia County Health Facilities Auth. Health Facilities Rev. Series 2020 A, 4% 8/15/45

|

215,000

|

193,109

|

|

|

Florida Keys Aqueduct Auth. Wtr. Rev. Series 2021 B, 5% 9/1/25

|

430,000

|

464,895

|

|

|

Florida Mid-Bay Bridge Auth. Rev.:

|

|||

|

Series 2015 A, 5% 10/1/35

|

325,000

|

334,515

|

|

|

Series 2015 C:

|

|||

|

5% 10/1/30

|

165,000

|

170,396

|

|

|

5% 10/1/40

|

100,000

|

101,880

|

|

|

Florida Muni. Pwr. Agcy. Rev.:

|

|||

|

(Requirements Pwr. Supply Proj.) Series 2016 A:

|

|||

|

5% 10/1/30

|

110,000

|

119,385

|

|

|

5% 10/1/31

|

120,000

|

129,939

|

|

|

Series 2015 B:

|

|||

|

5% 10/1/28

|

50,000

|

53,660

|

|

|

5% 10/1/30

|

90,000

|

96,125

|

|

|

Greater Orlando Aviation Auth. Arpt. Facilities Rev.:

|

|||

|

Series 2016 A, 5% 10/1/46 (d)

|

50,000

|

51,643

|

|

|

Series 2016:

|

|||

|

5% 10/1/22 (d)

|

50,000

|

50,385

|

|

|

5% 10/1/24 (d)

|

150,000

|

158,016

|

|

|

5% 10/1/26 (d)

|

85,000

|

92,040

|

|

|

5% 10/1/27 (d)

|

50,000

|

54,679

|

|

|

Series 2017 A:

|

|||

|

5% 10/1/25 (d)

|

15,000

|

16,059

|

|

|

5% 10/1/25 (Escrowed to Maturity) (d)

|

35,000

|

37,777

|

|

|

5% 10/1/27 (d)

|

25,000

|

27,276

|

|

|

5% 10/1/27 (Escrowed to Maturity) (d)

|

80,000

|

89,167

|

|

|

5% 10/1/29 (Pre-Refunded to 10/1/27 @ 100) (d)

|

150,000

|

167,578

|

|

|

5% 10/1/30 (Pre-Refunded to 10/1/27 @ 100) (d)

|

165,000

|

184,336

|

|

|

5% 10/1/31 (d)

|

435,000

|

464,484

|

|

|

5% 10/1/32 (d)

|

340,000

|

361,299

|

|

|

5% 10/1/34 (d)

|

305,000

|

321,393

|

|

|

5% 10/1/35 (d)

|

400,000

|

420,165

|

|

|

5% 10/1/36 (d)

|

380,000

|

398,662

|

|

|

5% 10/1/37 (d)

|

315,000

|

330,094

|

|

|

Series 2019 A, 5% 10/1/54 (d)

|

2,460,000

|

2,562,986

|

|

|

Halifax Hosp. Med. Ctr. Rev. Series 2015:

|

|||

|

4% 6/1/27 (Pre-Refunded to 6/1/25 @ 100)

|

70,000

|

73,490

|

|

|

5% 6/1/24

|

15,000

|

15,674

|

|

|

Hillsborough County Port District Series 2018 B, 5% 6/1/38 (d)

|

155,000

|

164,494

|

|

|

Lake County School Board Ctfs. of Prtn. Series 2014 A:

|

|||

|

5% 6/1/27 (Pre-Refunded to 6/1/24 @ 100)

|

50,000

|

52,743

|

|

|

5% 6/1/28 (Pre-Refunded to 6/1/24 @ 100)

|

50,000

|

52,743

|

|

|

Miami-Dade County Aviation Rev.:

|

|||

|

Series 2012 A:

|

|||

|

5% 10/1/22 (d)

|

50,000

|

50,379

|

|

|

5% 10/1/23 (d)

|

390,000

|

392,834

|

|

|

5% 10/1/24 (d)

|

460,000

|

463,154

|

|

|

Series 2014 A:

|

|||

|

5% 10/1/28 (d)

|

255,000

|

264,596

|

|

|

5% 10/1/33 (d)

|

425,000

|

439,304

|

|

|

5% 10/1/36 (d)

|

800,000

|

821,902

|

|

|

Series 2015 A:

|

|||

|

5% 10/1/29 (d)

|

80,000

|

83,343

|

|

|

5% 10/1/31 (d)

|

70,000

|

72,428

|

|

|

5% 10/1/35 (d)

|

275,000

|

282,690

|

|

|

5% 10/1/38 (d)

|

95,000

|

97,561

|

|

|

Series 2016 A:

|

|||

|

5% 10/1/29

|

75,000

|

80,249

|

|

|

5% 10/1/31

|

90,000

|

95,566

|

|

|

Series 2017 B, 5% 10/1/40 (d)

|

875,000

|

909,266

|

|

|

Series 2020 A, 4% 10/1/39

|

490,000

|

475,206

|

|

|

Miami-Dade County Cap. Asset Acquisition Series 2012 A, 5% 10/1/26 (Pre-Refunded to 10/1/22 @ 100)

|

190,000

|

191,682

|

|

|

Miami-Dade County Expressway Auth.:

|

|||

|

Series 2014 A, 5% 7/1/44

|

175,000

|

180,870

|

|

|

Series 2014 B:

|

|||

|

5% 7/1/26

|

125,000

|

131,613

|

|

|

5% 7/1/27

|

90,000

|

94,707

|

|

|

5% 7/1/28

|

50,000

|

52,635

|

|

|

Series 2016 A:

|

|||

|

5% 7/1/32

|

215,000

|

228,156

|

|

|

5% 7/1/33

|

185,000

|

195,966

|

|

|

Miami-Dade County School Board Ctfs. of Prtn.:

|

|||

|

Series 2015 A:

|

|||

|

5% 5/1/27 (Assured Guaranty Muni. Corp. Insured)

|

40,000

|

42,983

|

|

|

5% 5/1/29

|

205,000

|

216,824

|

|

|

Series 2016 A:

|

|||

|

5% 5/1/30

|

380,000

|

405,534

|

|

|

5% 5/1/32

|

505,000

|

536,499

|

|

|

Miami-Dade County Wtr. & Swr. Rev. Series 2021, 5% 10/1/32

|

205,000

|

234,045

|

|

|

Orange County Health Facilities Auth. Series 2016 A, 5% 10/1/44

|

115,000

|

119,125

|

|

|

Palm Beach County Arpt. Sys. Rev. Series 2016:

|

|||

|

5% 10/1/24 (d)

|

70,000

|

73,741

|

|

|

5% 10/1/27 (d)

|

50,000

|

53,842

|

|

|

5% 10/1/29 (d)

|

55,000

|

58,512

|

|

|

5% 10/1/30 (d)

|

95,000

|

100,551

|

|

|

5% 10/1/31 (d)

|

65,000

|

68,626

|

|

|

5% 10/1/32 (d)

|

100,000

|

105,238

|

|

|

5% 10/1/33 (d)

|

215,000

|

225,834

|

|

|

5% 10/1/34 (d)

|

230,000

|

241,564

|

|

|

5% 10/1/35 (d)

|

240,000

|

251,790

|

|

|

Palm Beach County Health Facilities Auth. Hosp. Rev.:

|

|||

|

(Jupiter Med. Ctr. Proj.) Series 2022:

|

|||

|

5% 11/1/31 (f)

|

200,000

|

216,656

|

|

|

5% 11/1/33 (f)

|

350,000

|

370,642

|

|

|

5% 11/1/36 (f)

|

370,000

|

386,216

|

|

|

5% 11/1/38 (f)

|

400,000

|

415,648

|

|

|

5% 11/1/40 (f)

|

400,000

|

412,369

|

|

|

5% 11/1/42 (f)

|

500,000

|

512,607

|

|

|

Series 2014, 5% 12/1/22 (Escrowed to Maturity)

|

35,000

|

35,502

|

|

|

Palm Beach County School Board Ctfs. of Prtn. Series 2015 D:

|

|||

|

5% 8/1/28

|

240,000

|

255,375

|

|

|

5% 8/1/29

|

300,000

|

318,401

|

|

|

Pinellas County Hsg. Fin. Auth. Bonds Series 2021 B, 0.65%, tender 7/1/24 (b)

|

430,000

|

411,075

|

|

|

South Florida Wtr. Mgmt. District Ctfs. of Prtn. Series 2015:

|

|||

|

5% 10/1/29

|

255,000

|

277,506

|

|

|

5% 10/1/32

|

315,000

|

341,862

|

|

|

South Miami Health Facilities Auth. Hosp. Rev. (Baptist Med. Ctr., FL. Proj.) Series 2017:

|

|||

|

4% 8/15/33

|

125,000

|

124,232

|

|

|

5% 8/15/26

|

170,000

|

184,851

|

|

|

5% 8/15/27

|

115,000

|

126,654

|

|

|

5% 8/15/28

|

75,000

|

83,294

|

|

|

5% 8/15/30

|

165,000

|

180,980

|

|

|

5% 8/15/31

|

160,000

|

174,167

|

|

|

5% 8/15/32

|

115,000

|

123,806

|

|

|

5% 8/15/34

|

325,000

|

346,807

|

|

|

5% 8/15/35

|

215,000

|

228,604

|

|

|

5% 8/15/42

|

335,000

|

350,836

|

|

|

5% 8/15/47

|

495,000

|

515,598

|

|

|

Tallahassee Health Facilities Rev.:

|

|||

|

(Tallahassee Memorial Healthcare, Inc. Proj.) Series 2016 A, 5% 12/1/41

|

55,000

|

56,336

|

|

|

Series 2015 A, 5% 12/1/40

|

110,000

|

112,382

|

|

|

Tampa Hosp. Rev. (H. Lee Moffitt Cancer Ctr. Proj.) Series 2020 B, 5% 7/1/50

|

1,320,000

|

1,376,009

|

|

|

Tampa Tax Allocation (H. Lee Moffitt Cancer Ctr. Proj.):

|

|||

|

Series 2012 A, 5% 9/1/25

|

70,000

|

70,404

|

|

|

Series 2020 A:

|

|||

|

0% 9/1/37

|

235,000

|

120,128

|

|

|

0% 9/1/49

|

765,000

|

201,031

|

|

|

Volusia County Edl. Facilities Auth. Rev. (Embry-Riddle Aeronautical Univ., Inc. Proj.) Series 2020 A:

|

|||

|

5% 10/15/44

|

65,000

|

69,029

|

|

|

5% 10/15/49

|

125,000

|

132,071

|

|

|

Volusia County School Board Ctfs. of Prtn.:

|

|||

|

(Florida Master Lease Prog.) Series 2016 A:

|

|||

|

5% 8/1/29 (Build America Mutual Assurance Insured)

|

50,000

|

54,240

|

|

|

5% 8/1/32 (Build America Mutual Assurance Insured)

|

255,000

|

275,628

|

|

|

(Master Lease Prog.) Series 2014 B:

|

|||

|

5% 8/1/25

|

90,000

|

95,197

|

|

|

5% 8/1/26

|

20,000

|

21,142

|

|

|

TOTAL FLORIDA

|

30,712,897

|

||

|

Georgia - 6.4%

|

|||

|

Atlanta Arpt. Rev.:

|

|||

|

Series 2014 C, 5% 1/1/29 (d)

|

170,000

|

174,906

|

|

|

Series 2019 B, 5% 7/1/25 (d)

|

140,000

|

149,606

|

|

|

Atlanta Wtr. & Wastewtr. Rev.:

|

|||

|

Series 2015, 5% 11/1/27

|

50,000

|

53,434

|

|

|

Series 2018 B, 5% 11/1/47

|

480,000

|

513,254

|

|

|

Burke County Indl. Dev. Auth. Poll. Cont. Rev. Bonds (Georgia Pwr. Co. Plant Vogtle Proj.):

|

|||

|

Series 1994, 2.25%, tender 5/25/23 (b)

|

825,000

|

819,941

|

|

|

Series 2013 1st, 2.925%, tender 3/12/24 (b)

|

1,555,000

|

1,550,257

|

|

|

Columbus Med. Ctr. Hosp. Auth. Bonds (Piedmont Healthcare, Inc. Proj.) Series 2019 B, 5%, tender 7/1/29 (b)

|

500,000

|

551,637

|

|

|

Coweta County Dev. Auth. Rev. (Piedmont Healthcare, Inc. Proj.) Series 2019 A, 5% 7/1/44

|

1,470,000

|

1,555,302

|

|

|

DeKalb County Wtr. & Swr. Rev. Series 2011 A, 5.25% 10/1/36

|

150,000

|

150,246

|

|

|

Fayette County Hosp. Auth. Rev. Bonds (Piedmont Healthcare, Inc. Proj.) Series 2019 A, 5%, tender 7/1/24 (b)

|

265,000

|

275,144

|

|

|

Fulton County Dev. Auth. Rev. Series 2019, 4% 6/15/49

|

110,000

|

106,947

|

|

|

Georgia Gen. Oblig. Series 2022 A:

|

|||

|

5% 7/1/33 (f)

|

1,025,000

|

1,222,699

|

|

|

5% 7/1/34 (f)

|

2,140,000

|

2,543,807

|

|

|

5% 7/1/35 (f)

|

3,610,000

|

4,280,747

|

|

|

Georgia Muni. Elec. Auth. Pwr. Rev. Series 2021 A:

|

|||

|

4% 1/1/35 (Assured Guaranty Muni. Corp. Insured)

|

325,000

|

326,810

|

|

|

4% 1/1/37 (Assured Guaranty Muni. Corp. Insured)

|

190,000

|

191,144

|

|

|

4% 1/1/39 (Assured Guaranty Muni. Corp. Insured)

|

295,000

|

295,978

|

|

|

4% 1/1/39 (Assured Guaranty Muni. Corp. Insured)

|

180,000

|

180,597

|

|

|

4% 1/1/40 (Assured Guaranty Muni. Corp. Insured)

|

210,000

|

210,282

|

|

|

4% 1/1/41 (Assured Guaranty Muni. Corp. Insured)

|

150,000

|

149,897

|

|

|

5% 1/1/31 (Assured Guaranty Muni. Corp. Insured)

|

155,000

|

171,593

|

|

|

5% 1/1/33 (Assured Guaranty Muni. Corp. Insured)

|

295,000

|

320,543

|

|

|

5% 1/1/33 (Assured Guaranty Muni. Corp. Insured)

|

175,000

|

190,153

|

|

|

5% 1/1/34 (Assured Guaranty Muni. Corp. Insured)

|

260,000

|

281,022

|

|

|

5% 1/1/34 (Assured Guaranty Muni. Corp. Insured)

|

180,000

|

194,553

|

|

|

Georgia Muni. Gas Auth. Rev. (Gas Portfolio III Proj.) Series S, 5% 10/1/22

|

175,000

|

176,451

|

|

|

Georgia Road & Thruway Auth. Rev. Series 2020:

|

|||

|

5% 6/1/31

|

585,000

|

667,247

|

|

|

5% 6/1/32

|

880,000

|

1,000,037

|

|

|

Glynn-Brunswick Memorial Hosp. Auth. Rev. (Southeast Georgia Health Sys. Proj.) Series 2017:

|

|||

|

4% 8/1/43

|

115,000

|

102,936

|

|

|

5% 8/1/39

|

105,000

|

107,035

|

|

|

5% 8/1/43

|

140,000

|

141,670

|

|

|

Hosp. Auth. of Savannah Auth. Rev. Series 2019 A:

|

|||

|

4% 7/1/36

|

415,000

|

409,596

|

|

|

4% 7/1/43

|

435,000

|

406,111

|

|

|

Main Street Natural Gas, Inc. Bonds:

|

|||

|

Series 2018 C, 4%, tender 12/1/23 (b)

|

1,295,000

|

1,321,127

|

|

|

Series 2021 A, 4%, tender 9/1/27 (b)

|

14,680,000

|

15,051,331

|

|

|

Series 2022 E, 4%, tender 12/1/29 (b)

|

3,880,000

|

3,850,590

|

|

|

Private Colleges & Univs. Auth. Rev.:

|

|||

|

(Savannah College Art & Design, Inc. Proj.) Series 2014, 5% 4/1/24 (Escrowed to Maturity)

|

255,000

|

268,242

|

|

|

(The Savannah College of Art & Design Projs.) Series 2021:

|

|||

|

4% 4/1/37

|

295,000

|

288,980

|

|

|

5% 4/1/30

|

160,000

|

178,393

|

|

|

5% 4/1/36

|

165,000

|

181,696

|

|

|

Series 2020 B:

|

|||

|

4% 9/1/37

|

395,000

|

396,446

|

|

|

4% 9/1/38

|

515,000

|

515,670

|

|

|

5% 9/1/25

|

365,000

|

395,664

|

|

|

5% 9/1/32

|

370,000

|

418,344

|

|

|

TOTAL GEORGIA

|

42,338,065

|

||

|

Hawaii - 1.3%

|

|||

|

Hawaii Arpts. Sys. Rev.:

|

|||

|

Series 2015 A, 5% 7/1/41 (d)

|

380,000

|

391,627

|

|

|

Series 2018 A:

|

|||

|

5% 7/1/29 (d)

|

65,000

|

70,786

|

|

|

5% 7/1/30 (d)

|

75,000

|

81,091

|

|

|

5% 7/1/31 (d)

|

75,000

|

80,756

|

|

|

5% 7/1/32 (d)

|

75,000

|

80,321

|

|

|

5% 7/1/33 (d)

|

75,000

|

79,926

|

|

|

5% 7/1/48 (d)

|

4,170,000

|

4,331,419

|

|

|

Hawaii Gen. Oblig. Series 2020 A, 4% 7/1/36 (d)

|

60,000

|

60,600

|

|

|

Honolulu City & County Gen. Oblig.:

|

|||

|

(Honolulu Rail Transit Proj.) Series 2020 B, 5% 3/1/29

|

1,880,000

|

2,158,021

|

|

|

Series 2022 A:

|

|||

|

5% 11/1/24 (f)(g)

|

250,000

|

265,564

|

|

|

5% 11/1/25 (f)(g)

|

110,000

|

119,347

|

|

|

5% 11/1/27 (f)(g)

|

450,000

|

505,768

|

|

|

State of Hawaii Dept. of Trans. Series 2013:

|

|||

|

5% 8/1/22 (d)

|

80,000

|

80,180

|

|

|

5.25% 8/1/24 (d)

|

100,000

|

102,830

|

|

|

5.25% 8/1/25 (d)

|

125,000

|

128,360

|

|

|

TOTAL HAWAII

|

8,536,596

|

||

|

Idaho - 0.0%

|

|||

|

Idaho Hsg. & Fin. Assoc. Single Family Mtg. Series 2019 A, 4% 1/1/50

|

45,000

|

45,652

|

|

|

Illinois - 13.5%

|

|||

|

Chicago Board of Ed.:

|

|||

|

Series 2012 A, 5% 12/1/42

|

465,000

|

465,014

|

|

|

Series 2015 C, 5.25% 12/1/39

|

85,000

|

86,696

|

|

|

Series 2016 B, 6.5% 12/1/46

|

100,000

|

107,990

|

|

|

Series 2017 A, 7% 12/1/46 (e)

|

140,000

|

155,699

|

|

|

Series 2017 C:

|

|||

|

5% 12/1/24

|

290,000

|

298,727

|

|

|

5% 12/1/25

|

165,000

|

171,226

|

|

|

5% 12/1/26

|

100,000

|

104,372

|

|

|

5% 12/1/30

|

130,000

|

134,216

|

|

|

Series 2017 D:

|

|||

|

5% 12/1/23

|

150,000

|

153,180

|

|

|

5% 12/1/24

|

100,000

|

103,009

|

|

|

5% 12/1/31

|

150,000

|

154,795

|

|

|

Series 2018 A:

|

|||

|

5% 12/1/25

|

100,000

|

103,773

|

|

|

5% 12/1/26

|

100,000

|

104,372

|

|

|

5% 12/1/28

|

240,000

|

251,807

|

|

|

5% 12/1/30

|

350,000

|

362,935

|

|

|

5% 12/1/32

|

100,000

|

103,038

|

|

|

5% 12/1/35

|

100,000

|

102,452

|

|

|

Series 2018 C, 5% 12/1/46

|

1,585,000

|

1,606,594

|

|

|

Series 2019 A:

|

|||

|

5% 12/1/28

|

165,000

|

173,118

|

|

|

5% 12/1/30

|

340,000

|

353,632

|

|

|

5% 12/1/31

|

190,000

|

196,859

|

|

|

5% 12/1/33

|

455,000

|

468,704

|

|

|

Series 2022 A, 5% 12/1/47

|

780,000

|

786,361

|

|

|

Series 2022 B:

|

|||

|

4% 12/1/35

|

585,000

|

551,856

|

|

|

4% 12/1/36

|

1,005,000

|

942,061

|

|

|

Chicago Gen. Oblig.:

|

|||

|

Series 2017 A, 6% 1/1/38

|

295,000

|

316,683

|

|

|

Series 2020 A:

|

|||

|

5% 1/1/29

|

870,000

|

922,674

|

|

|

5% 1/1/30

|

1,500,000

|

1,583,235

|

|

|

Series 2021 A, 5% 1/1/32

|

1,530,000

|

1,601,532

|

|

|

Chicago Midway Arpt. Rev.:

|

|||

|

Series 2013 A:

|

|||

|

5.375% 1/1/33 (d)

|

1,320,000

|

1,332,606

|

|

|

5.5% 1/1/29 (d)

|

235,000

|

237,538

|

|

|

Series 2014 A:

|

|||

|

5% 1/1/27 (d)

|

525,000

|

539,964

|

|

|

5% 1/1/28 (d)

|

970,000

|

996,066

|

|

|

5% 1/1/33 (d)

|

270,000

|

276,270

|

|

|

5% 1/1/34 (d)

|

130,000

|

132,745

|

|

|

Series 2016 A:

|

|||

|

4% 1/1/33 (d)

|

375,000

|

368,775

|

|

|

5% 1/1/28 (d)

|

100,000

|

105,261

|

|

|

Series 2016 B:

|

|||

|

4% 1/1/35

|

80,000

|

79,120

|

|

|

5% 1/1/36

|

100,000

|

104,248

|

|

|

5% 1/1/37

|

135,000

|

140,531

|

|

|

5% 1/1/46

|

360,000

|

367,552

|

|

|

Chicago O'Hare Int'l. Arpt. Rev.:

|

|||

|

Series 2013 B, 5% 1/1/27

|

315,000

|

319,067

|

|

|

Series 2013 D, 5% 1/1/27

|

160,000

|

162,066

|

|

|

Series 2015 A:

|

|||

|

5% 1/1/31 (d)

|

305,000

|

314,926

|

|

|

5% 1/1/32 (d)

|

615,000

|

634,100

|

|

|

Series 2015 C, 5% 1/1/46 (d)

|

120,000

|

121,975

|

|

|

Series 2016 B, 5% 1/1/34

|

310,000

|

325,859

|

|

|

Series 2016 C:

|

|||

|

5% 1/1/33

|

140,000

|

147,465

|

|

|

5% 1/1/34

|

160,000

|

168,185

|

|

|

Series 2016 G:

|

|||

|

5% 1/1/37 (d)

|

100,000

|

103,920

|

|

|

5% 1/1/42 (d)

|

100,000

|

103,291

|

|

|

5.25% 1/1/29 (d)

|

20,000

|

21,569

|

|

|

5.25% 1/1/31 (d)

|

20,000

|

21,339

|

|

|

Series 2017 A, 5% 1/1/31

|

180,000

|

193,677

|

|

|

Series 2017 B:

|

|||

|

5% 1/1/35

|

105,000

|

111,295

|

|

|

5% 1/1/37

|

430,000

|

453,170

|

|

|

Series 2017 C:

|

|||

|

5% 1/1/30

|

30,000

|

32,448

|

|

|

5% 1/1/31

|

30,000

|

32,279

|

|

|

5% 1/1/32

|

30,000

|

32,147

|

|

|

Series 2017 D:

|

|||

|

5% 1/1/28 (d)

|

150,000

|

161,282

|

|

|

5% 1/1/29 (d)

|

125,000

|

133,511

|

|

|

5% 1/1/32 (d)

|

135,000

|

142,012

|

|

|

5% 1/1/34 (d)

|

205,000

|

213,933

|

|

|

5% 1/1/35 (d)

|

150,000

|

156,336

|

|

|

5% 1/1/36 (d)

|

190,000

|

197,807

|

|

|

5% 1/1/37 (d)

|

100,000

|

103,920

|

|

|

Series 2018 A:

|

|||

|

5% 1/1/37 (d)

|

1,030,000

|

1,086,156

|

|

|

5% 1/1/39 (d)

|

1,005,000

|

1,056,168

|

|

|

5% 1/1/48 (d)

|

165,000

|

171,282

|

|

|

5% 1/1/53 (d)

|

285,000

|

295,060

|

|

|

Chicago O'Hare Int'l. Arpt. Spl. Facilities Rev. Series 2018:

|

|||

|

5% 7/1/38 (d)

|

135,000

|

139,148

|

|

|

5% 7/1/48 (d)

|

1,140,000

|

1,157,621

|

|

|

Chicago Transit Auth.:

|

|||

|

Series 2014, 5.25% 12/1/49

|

910,000

|

936,388

|

|

|

Series 2017, 5% 12/1/46

|

205,000

|

212,985

|

|

|

Chicago Transit Auth. Cap. Grant Receipts Rev. Series 2017:

|

|||

|

5% 6/1/23

|

90,000

|

92,410

|

|

|

5% 6/1/24

|

15,000

|

15,734

|

|

|

5% 6/1/25

|

15,000

|

15,989

|

|

|

5% 6/1/26

|

10,000

|

10,820

|

|

|

Cook County Forest Preservation District Series 2012 A, 5% 11/15/22

|

100,000

|

101,295

|

|

|

Cook County Gen. Oblig.:

|

|||

|

Series 2012 C, 5% 11/15/24

|

560,000

|

566,066

|

|

|

Series 2016 A:

|

|||

|

5% 11/15/26

|

290,000

|

317,163

|

|

|

5% 11/15/27

|

140,000

|

152,631

|

|

|

5% 11/15/28

|

185,000

|

200,741

|

|

|

5% 11/15/29

|

230,000

|

248,785

|

|

|

5% 11/15/30

|

255,000

|

274,961

|

|

|

Series 2021 A, 5% 11/15/33

|

550,000

|

605,675

|

|

|

Series 2021 B:

|

|||

|

4% 11/15/25

|

215,000

|

225,117

|

|

|

4% 11/15/26

|

110,000

|

115,947

|

|

|

4% 11/15/27

|

110,000

|

116,636

|

|

|

4% 11/15/28

|

55,000

|

58,449

|

|

|

Illinois Fin. Auth.:

|

|||

|

Series 2020 A, 4% 5/15/50

|

1,760,000

|

1,595,540

|

|

|

Series 2022 A:

|

|||

|

5% 10/1/35 (f)

|

330,000

|

327,935

|

|

|

5.5% 10/1/39 (f)

|

750,000

|

769,487

|

|

|

Illinois Fin. Auth. Rev.:

|

|||

|

(Bradley Univ. Proj.) Series 2017 C:

|

|||

|

5% 8/1/29

|

60,000

|

62,799

|

|

|

5% 8/1/30

|

45,000

|

46,854

|

|

|

5% 8/1/32

|

60,000

|

61,965

|

|

|

(Depaul Univ. Proj.) Series 2016 A:

|

|||

|

4% 10/1/34

|

50,000

|

49,730

|

|

|

5% 10/1/29

|

50,000

|

53,295

|

|

|

5% 10/1/30

|

50,000

|

53,043

|

|

|

5% 10/1/35

|

100,000

|

104,872

|

|

|

(OSF Healthcare Sys.) Series 2018 A:

|

|||

|

4.125% 5/15/47

|

1,585,000

|

1,492,326

|

|

|

5% 5/15/43

|

2,105,000

|

2,163,502

|

|

|

(Presence Health Proj.) Series 2016 C:

|

|||

|

3.625% 2/15/32

|

60,000

|

58,831

|

|

|

4% 2/15/33

|

15,000

|

15,097

|

|

|

5% 2/15/29

|

310,000

|

339,799

|

|

|

5% 2/15/36

|

70,000

|

74,390

|

|

|

(Rosalind Franklin Univ. Research Bldg. Proj.) Series 2017 C, 5% 8/1/46

|

50,000

|

50,995

|

|

|

(Rush Univ. Med. Ctr. Proj.) Series 2015 A, 5% 11/15/34

|

25,000

|

25,744

|

|

|

Series 2012:

|

|||

|

4% 9/1/32 (Pre-Refunded to 9/1/22 @ 100)

|

445,000

|

446,829

|

|

|

5% 9/1/32 (Pre-Refunded to 9/1/22 @ 100)

|

95,000

|

95,540

|

|

|

5% 11/15/43 (Pre-Refunded to 11/15/22 @ 100)

|

265,000

|

268,316

|

|

|

Series 2013:

|

|||

|

5% 11/15/24

|

25,000

|

25,303

|

|

|

5% 11/15/27

|

5,000

|

5,059

|

|

|

5% 11/15/28

|

145,000

|

146,640

|

|

|

5% 11/15/29

|

70,000

|

70,804

|

|

|

Series 2015 A:

|

|||

|

5% 10/1/35

|

885,000

|

942,123

|

|

|

5% 11/15/45

|

165,000

|

168,473

|

|

|

Series 2015 B, 5% 11/15/27

|

160,000

|

168,299

|

|

|

Series 2015 C:

|

|||

|

4.125% 8/15/37

|

45,000

|

43,951

|

|

|

5% 8/15/35

|

375,000

|

386,832

|

|

|

5% 8/15/44

|

1,845,000

|

1,888,701

|

|

|

Series 2016 A:

|

|||

|

5% 8/15/22 (Escrowed to Maturity)

|

50,000

|

50,203

|

|

|

5% 8/15/25 (Escrowed to Maturity)

|

120,000

|

129,791

|

|

|

5% 7/1/28 (Pre-Refunded to 7/1/26 @ 100)

|

60,000

|

65,737

|

|

|

5% 2/15/29

|

260,000

|

279,836

|

|

|

5% 2/15/30

|

275,000

|

294,628

|

|

|

5% 7/1/30 (Pre-Refunded to 7/1/26 @ 100)

|

35,000

|

38,346

|

|

|

5% 2/15/31

|

220,000

|

234,328

|

|

|

5% 7/1/31 (Pre-Refunded to 7/1/26 @ 100)

|

65,000

|

71,215

|

|

|

5% 2/15/32

|

215,000

|

227,119

|

|

|

5% 7/1/33 (Pre-Refunded to 7/1/26 @ 100)

|

30,000

|

32,868

|

|

|

5% 7/1/34 (Pre-Refunded to 7/1/26 @ 100)

|

255,000

|

279,381

|

|

|

5% 8/15/34 (Pre-Refunded to 8/15/26 @ 100)

|

30,000

|

33,067

|

|

|

5% 8/15/35 (Pre-Refunded to 8/15/26 @ 100)

|

25,000

|

27,556

|

|

|

5% 7/1/36 (Pre-Refunded to 7/1/26 @ 100)

|

130,000

|

142,429

|

|

|

5% 8/15/36 (Pre-Refunded to 8/15/26 @ 100)

|

105,000

|

115,733

|

|

|

5.25% 8/15/31 (Pre-Refunded to 8/15/26 @ 100)

|

30,000

|

33,359

|

|

|

Series 2016 B:

|

|||

|

5% 8/15/31

|

375,000

|

400,691

|

|

|

5% 8/15/32

|

305,000

|

323,828

|

|

|

5% 8/15/34

|

380,000

|

400,059

|

|

|

5% 8/15/36

|

530,000

|

556,706

|

|

|

Series 2016 C:

|

|||

|

3.75% 2/15/34

|

75,000

|

73,572

|

|

|

4% 2/15/36

|

315,000

|

315,462

|

|

|

4% 2/15/41

|

1,855,000

|

1,832,082

|

|

|

4% 2/15/41 (Pre-Refunded to 2/15/27 @ 100)

|

40,000

|

42,518

|

|

|

5% 2/15/24

|

5,000

|

5,230

|

|

|

5% 2/15/30

|

390,000

|

425,049

|

|

|

5% 2/15/31

|

1,415,000

|

1,527,784

|

|

|

5% 2/15/32

|

225,000

|

240,938

|

|

|

5% 2/15/34

|

180,000

|

191,906

|

|

|

5% 2/15/41

|

350,000

|

367,972

|

|

|

Series 2016 D, 4% 2/15/46

|

2,315,000

|

2,158,922

|

|

|

Series 2016:

|

|||

|

4% 2/15/41 (Pre-Refunded to 2/15/27 @ 100)

|

5,000

|

5,315

|

|

|

5% 5/15/29

|

65,000

|

68,837

|

|

|

5% 12/1/29

|

85,000

|

90,688

|

|

|

5% 5/15/30

|

135,000

|

142,275

|

|

|

5% 12/1/33

|

115,000

|

121,635

|

|

|

5% 12/1/46

|

1,300,000

|

1,344,374

|

|

|

Series 2017 A, 5% 8/1/42

|

45,000

|

46,136

|

|

|

Series 2017:

|

|||

|

5% 1/1/29

|

170,000

|

186,852

|

|

|

5% 7/1/34

|

285,000

|

307,922

|

|

|

5% 7/1/35

|

240,000

|

258,882

|

|

|

Series 2019, 4% 9/1/35

|

145,000

|

135,488

|

|

|

Illinois Gen. Oblig.:

|

|||

|

Series 2013:

|

|||

|

5.5% 7/1/24

|

50,000

|

51,397

|

|

|

5.5% 7/1/25

|

265,000

|

271,741

|

|

|

Series 2014:

|

|||

|

5% 2/1/25

|

185,000

|

190,743

|

|

|

5% 2/1/26

|

140,000

|

144,439

|

|

|

5% 4/1/28

|

115,000

|

118,472

|

|

|

5% 5/1/28

|

110,000

|

113,452

|

|

|

5% 2/1/39

|

865,000

|

874,082

|

|

|

5.25% 2/1/31

|

20,000

|

20,494

|

|

|

Series 2016:

|

|||

|

5% 6/1/26

|

60,000

|

63,965

|

|

|

5% 2/1/27

|

340,000

|

365,023

|

|

|

Series 2017 C, 5% 11/1/29

|

425,000

|

452,418

|

|

|

Series 2017 D, 5% 11/1/27

|

1,050,000

|

1,132,197

|

|

|

Series 2021 A:

|

|||

|

5% 3/1/34

|

1,035,000

|

1,099,917

|

|

|

5% 3/1/46

|

2,165,000

|

2,223,017

|

|

|

Series 2022 A:

|

|||

|

5% 3/1/29

|

645,000

|

699,251

|

|

|

5% 3/1/31

|

705,000

|

762,916

|

|

|

5% 3/1/36

|

1,820,000

|

1,925,605

|

|

|

Illinois Hsg. Dev. Auth. Series 2021, 3% 4/1/51

|

990,000

|

966,686

|

|

|

Illinois Hsg. Dev. Auth. Multi-family Hsg. Rev. Series 2019, 2.9% 7/1/35

|

438,763

|

396,137

|

|

|

Illinois Hsg. Dev. Auth. Rev. Series D, 3.75% 4/1/50

|

100,000

|

100,729

|

|

|

Illinois Muni. Elec. Agcy. Pwr. Supply Series 2015 A, 5% 2/1/31

|

205,000

|

220,199

|

|

|

Illinois Toll Hwy. Auth. Toll Hwy. Rev.:

|

|||

|

Series 2016 A:

|

|||

|

5% 12/1/31

|

355,000

|

378,619

|

|

|

5% 12/1/32

|

520,000

|

552,917

|

|

|

Series 2019 A, 5% 1/1/44

|

140,000

|

150,061

|

|

|

Series A:

|

|||

|

5% 1/1/40

|

335,000

|

365,400

|

|

|

5% 1/1/41

|

880,000

|

954,085

|

|

|

5% 1/1/45

|

2,975,000

|

3,205,386

|

|

|

Kendall, Kane & Will Counties Cmnty. Unit School District #308 Series 2016:

|

|||

|

5% 2/1/34

|

355,000

|

383,465

|

|

|

5% 2/1/35

|

255,000

|

275,356

|

|

|

5% 2/1/36

|

435,000

|

468,955

|

|

|

McHenry & Kane Counties Cmnty. Consolidated School District #158 Series 2004, 0% 1/1/24 (Assured Guaranty Muni. Corp. Insured)

|

260,000

|

251,008

|

|

|

Metropolitan Pier & Exposition:

|

|||

|

(McCormick Place Expansion Proj.):

|

|||

|

Series 1996 A, 0% 6/15/23 (Nat'l. Pub. Fin. Guarantee Corp. Insured)

|

320,000

|

312,157

|

|

|

Series 2010 B1:

|

|||

|

0% 6/15/43 (Assured Guaranty Muni. Corp. Insured)

|

3,150,000

|

1,173,164

|

|

|

0% 6/15/45 (Assured Guaranty Muni. Corp. Insured)

|

1,540,000

|

516,472

|

|

|

0% 6/15/47 (Assured Guaranty Muni. Corp. Insured)

|

185,000

|

55,863

|

|

|

Series 2012 B, 0% 12/15/51

|

660,000

|

146,130

|

|

|

Series A, 0% 12/15/24 (Nat'l. Pub. Fin. Guarantee Corp. Insured)

|

175,000

|

162,104

|

|

|

Series 1994, 0% 6/15/28 (Nat'l. Pub. Fin. Guarantee Corp. Insured)

|

335,000

|

269,028

|

|

|

Series 1996 A, 0% 6/15/24

|

155,000

|

146,164

|

|

|

Series 2002 A, 0% 6/15/35 (Nat'l. Pub. Fin. Guarantee Corp. Insured)

|

260,000

|

148,252

|

|

|

Series 2002, 0% 12/15/36 (Nat'l. Pub. Fin. Guarantee Corp. Insured)

|

2,445,000

|

1,282,269

|

|

|

Series 2017 B:

|

|||

|

5% 12/15/25

|

50,000

|

52,545

|

|

|

5% 12/15/26

|

165,000

|

175,012

|

|

|

5% 12/15/27

|

20,000

|

21,371

|

|

|

5% 12/15/31

|

35,000

|

36,449

|

|

|

5% 12/15/34

|

20,000

|

20,604

|

|

|

Series 2020 A, 5% 6/15/50

|

560,000

|

565,097

|

|

|

Series 2020 B, 5% 6/15/42

|

675,000

|

690,764

|

|

|

Series 2022 A:

|

|||

|

0% 12/15/36

|

65,000

|

33,611

|

|

|

0% 12/15/39

|

515,000

|

223,293

|

|

|

0% 12/15/40

|

430,000

|

175,788

|

|

|

0% 12/15/41

|

1,225,000

|

472,917

|

|

|

4% 6/15/52

|

5,875,000

|

5,057,243

|

|

|

Northern Illinois Univ. Revs. Series 2020 B, 5% 4/1/34 (Build America Mutual Assurance Insured)

|

395,000

|

435,409

|

|

|

Railsplitter Tobacco Settlement Auth. Rev. Series 2017:

|

|||

|

5% 6/1/27

|

1,215,000

|

1,306,212

|

|

|

5% 6/1/28

|

140,000

|

149,722

|

|

|

Univ. of Illinois Rev.:

|

|||

|

Series 2013:

|

|||

|

6% 10/1/42

|

275,000

|

285,292

|

|

|

6.25% 10/1/38

|

275,000

|

286,388

|

|

|

Series 2018 A, 5% 4/1/30

|

210,000

|

230,083

|

|

|

Will County Cmnty. Unit School District #365-U Series 2007 B, 0% 11/1/26 (Assured Guaranty Muni. Corp. Insured)

|

310,000

|

274,492

|

|

|

Will County Illinois Series 2016:

|

|||

|

5% 11/15/32 (Pre-Refunded to 11/15/25 @ 100)