|

Share Class | Ticker |

A | FMTAX |

A2 | FMTHX |

Institutional | FSHIX |

Service | FSHSX |

Federated Hermes Short-Intermediate Municipal Fund

A Portfolio of Federated Hermes Short-Intermediate Duration Municipal Trust

|

|

A |

A2 |

IS |

SS |

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

|

|

|

|

Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

|

|

|

|

|

Maximum Sales Charge (Load) Imposed on Reinvested Dividends (and other Distributions) (as a percentage of

offering price) |

|

|

|

|

|

Redemption Fee (as a percentage of amount redeemed, if applicable) |

|

|

|

|

|

Exchange Fee |

|

|

|

|

|

|

A |

A2 |

IS |

SS |

|

Management Fee1 |

|

|

|

|

|

Distribution (12b-1) Fee |

|

|

|

|

|

Other Expenses |

|

|

|

|

|

Total Annual Fund Operating Expenses1 |

|

|

|

|

|

Fee Waivers and/or Expense Reimbursements1,4 |

( |

( |

( |

( |

|

Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements |

|

|

|

|

|

Share Class |

1 Year |

3 Years |

5 Years |

10 Years |

|

A |

$ |

$ |

$ |

$ |

|

A2 |

$ |

$ |

$ |

$ |

|

IS |

$ |

$ |

$ |

$ |

|

SS |

$ |

$ |

$ |

$ |

|

|

1 Year |

5 Year |

10 Year |

|

A: |

|

|

|

|

Return Before Taxes |

( |

( |

|

|

A2: |

|

|

|

|

Return Before Taxes |

( |

( |

|

|

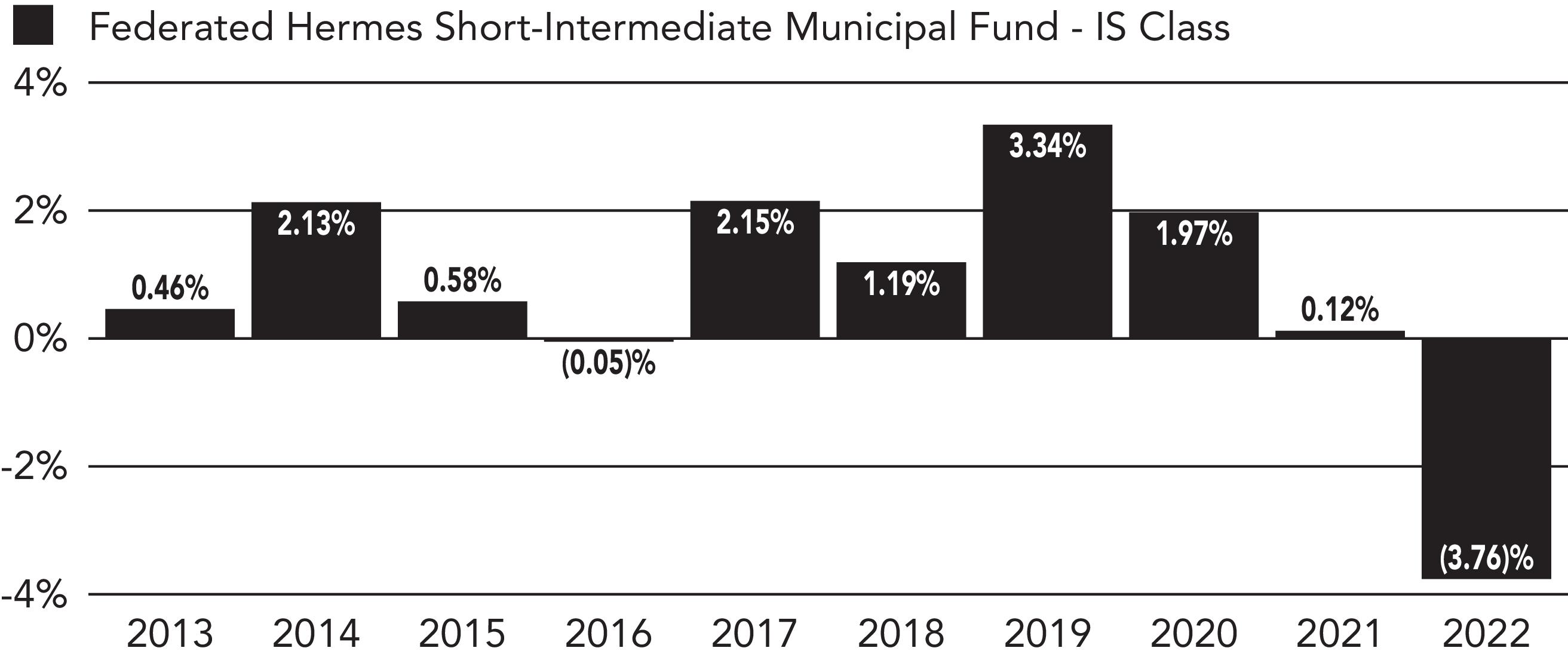

IS: |

|

|

|

|

Return Before Taxes |

( |

|

|

|

Return After Taxes on Distributions |

( |

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

( |

|

|

|

SS: |

|

|

|

|

Return Before Taxes |

( |

|

|

|

S&P Municipal Bond Short Index1

(reflects no deduction for fees, expenses or taxes) |

( |

|

|

|

S&P Municipal Bond 1-5 Years Investment

Grade 5% Pre-Refunded Index2

(reflects no deduction for fees, expenses or taxes) |

( |

|

|

|

Morningstar U.S. Fund Muni National Short Funds Average3 |

( |

|

|

|

|

|

|

|

The following sections until “How is the Fund Sold?” relate to sales charge information in connection with the purchase of the A & A2 classes. | ||

|

|

Minimum

Initial/Subsequent

Investment

Amounts1 |

Maximum Sales Charges | |

|

Shares Offered |

Front-End

Sales Charge2 |

Contingent

Deferred

Sales Charge3 | |

|

A |

$1,500/$100 |

1.00% |

None |

|

A2 |

$1,500/$100 |

1.50% |

0.00% |

|

A Class: | ||

|

Purchase Amount |

Sales Charge

as a Percentage

of Public

Offering Price |

Sales Charge

as a Percentage

of NAV |

|

Less than $100,000 |

1.00% |

1.01% |

|

$100,000 or greater |

0.00% |

0.00% |

|

A2 Class: |

|

|

|

Purchase Amount |

Sales Charge

as a Percentage

of Public

Offering Price |

Sales Charge

as a Percentage

of NAV |

|

Less than $100,000 |

1.50% |

1.52% |

|

$100,000 but less than $250,000 |

1.25% |

1.27% |

|

$250,000 but less than $500,000 |

1.00% |

1.01% |

|

$500,000 and Over1

|

0.00% |

0.00% |

|

A2: |

|

|

|

If you make a purchase of the A2 class in the amount of $500,000 or more and your financial intermediary received an advance commission on the sale, you will

pay a 0.50% CDSC on any such Shares redeemed within 18 months of the purchase. | ||

|

A Class: |

|

|

Purchase Amount |

Dealer Reallowance

as a Percentage of

Public Offering Price |

|

Less than $100,000 |

1.00% |

|

$100,000 or greater |

0.00% |

|

A2 (for purchases over $500,000): |

|

|

Purchase Amount |

Advance Commission

as a Percentage of

Public Offering Price |

|

First $500,000 - $20 million |

0.50% |

|

Over $20 million |

0.25% |

Boston, MA

Dollar Amount of Wire

ABA Number 011000028

BNF: 23026552

Attention: Federated Hermes EDGEWIRE

Wire Order Number, Dealer Number or Group Number

Nominee/Institution Name

Fund Name and Number and Account Number

P.O. Box 219318

Kansas City, MO 64121-9318

430 W 7th Street

Suite 219318

Kansas City, MO 64105-1407

P.O. Box 219318

Kansas City, MO 64121-9318

430 W 7th Street

Suite 219318

Kansas City, MO 64105-1407

|

Year Ended June 30 |

2023 |

2022 |

2021 |

2020 |

2019 |

|

Net Asset Value, Beginning of Period |

$9.82 |

$10.37 |

$10.25 |

$10.30 |

$10.22 |

|

Income From Investment Operations: |

|

|

|

|

|

|

Net investment income |

0.17 |

0.07 |

0.08 |

0.13 |

0.14 |

|

Net realized and unrealized gain (loss) |

0.00 |

(0.55) |

0.12 |

(0.05) |

0.08 |

|

TOTAL FROM INVESTMENT OPERATIONS |

0.17 |

(0.48) |

0.20 |

0.08 |

0.22 |

|

Less Distributions: |

|

|

|

|

|

|

Distributions from net investment income |

(0.17) |

(0.07) |

(0.08) |

(0.13) |

(0.14) |

|

Net Asset Value, End of Period |

$9.82 |

$9.82 |

$10.37 |

$10.25 |

$10.30 |

|

Total Return1 |

1.76% |

(4.67)% |

1.98% |

0.81% |

2.20% |

|

Ratios to Average Net Assets: |

|

|

|

|

|

|

Net expenses2 |

0.72%3 |

0.71% |

0.71% |

0.81%3 |

0.96%3 |

|

Net investment income |

1.68% |

0.64% |

0.78% |

1.30% |

1.41% |

|

Expense waiver/reimbursement4 |

0.11% |

0.10% |

0.10% |

0.11% |

0.10% |

|

Supplemental Data: |

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

$156,679 |

$294,033 |

$509,643 |

$250,177 |

$178,706 |

|

Portfolio turnover5 |

27% |

23% |

11% |

49% |

39% |

|

|

Year

Ended

6/30/2023 |

Period

Ended

6/30/20221 |

|

Net Asset Value, Beginning of Period |

$9.82 |

$10.31 |

|

Income From Investment Operations: |

|

|

|

Net investment income |

0.17 |

0.04 |

|

Net realized and unrealized gain (loss) |

(0.02) |

(0.49) |

|

TOTAL FROM INVESTMENT OPERATIONS |

0.15 |

(0.45) |

|

Less Distributions: |

|

|

|

Distributions from net investment income |

(0.17) |

(0.04) |

|

Net Asset Value, End of Period |

$9.80 |

$9.82 |

|

Total Return2 |

1.56% |

(4.33)% |

|

Ratios to Average Net Assets: |

|

|

|

Net expenses3 |

0.70%4 |

0.71%5 |

|

Net investment income |

2.16% |

0.22%5 |

|

Expense waiver/reimbursement6 |

0.09% |

—%5 |

|

Supplemental Data: |

|

|

|

Net assets, end of period (000 omitted) |

$7,001 |

$07 |

|

Portfolio turnover8 |

27% |

23%9 |

|

Year Ended June 30 |

2023 |

2022 |

2021 |

2020 |

2019 |

|

Net Asset Value, Beginning of Period |

$9.83 |

$10.37 |

$10.24 |

$10.30 |

$10.21 |

|

Income From Investment Operations: |

|

|

|

|

|

|

Net investment income |

0.20 |

0.09 |

0.11 |

0.17 |

0.19 |

|

Net realized and unrealized gain (loss) |

(0.01) |

(0.54) |

0.13 |

(0.06) |

0.09 |

|

TOTAL FROM INVESTMENT OPERATIONS |

0.19 |

(0.45) |

0.24 |

0.11 |

0.28 |

|

Less Distributions: |

|

|

|

|

|

|

Distributions from net investment income |

(0.20) |

(0.09) |

(0.11) |

(0.17) |

(0.19) |

|

Net Asset Value, End of Period |

$9.82 |

$9.83 |

$10.37 |

$10.24 |

$10.30 |

|

Total Return1 |

1.91% |

(4.33)% |

2.34% |

1.07% |

2.81% |

|

Ratios to Average Net Assets: |

|

|

|

|

|

|

Net expenses2 |

0.47%3 |

0.46% |

0.46% |

0.46%3 |

0.46%3 |

|

Net investment income |

1.95% |

0.91% |

1.05% |

1.66% |

1.91% |

|

Expense waiver/reimbursement4 |

0.18% |

0.17% |

0.17% |

0.18% |

0.21% |

|

Supplemental Data: |

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

$307,564 |

$461,550 |

$624,552 |

$561,612 |

$575,676 |

|

Portfolio turnover5 |

27% |

23% |

11% |

49% |

39% |

|

Year Ended June 30 |

2023 |

2022 |

2021 |

2020 |

2019 |

|

Net Asset Value, Beginning of Period |

$9.83 |

$10.37 |

$10.25 |

$10.30 |

$10.22 |

|

Income From Investment Operations: |

|

|

|

|

|

|

Net investment income |

0.17 |

0.07 |

0.08 |

0.14 |

0.17 |

|

Net realized and unrealized gain (loss) |

(0.01) |

(0.54) |

0.12 |

(0.05) |

0.08 |

|

TOTAL FROM INVESTMENT OPERATIONS |

0.16 |

(0.47) |

0.20 |

0.09 |

0.25 |

|

Less Distributions: |

|

|

|

|

|

|

Distributions from net investment income |

(0.17) |

(0.07) |

(0.08) |

(0.14) |

(0.17) |

|

Net Asset Value, End of Period |

$9.82 |

$9.83 |

$10.37 |

$10.25 |

$10.30 |

|

Total Return1 |

1.67% |

(4.56)% |

2.00% |

0.93% |

2.46% |

|

Ratios to Average Net Assets: |

|

|

|

|

|

|

Net expenses2 |

0.70%3 |

0.70% |

0.70% |

0.70%3 |

0.70%3 |

|

Net investment income |

1.75% |

0.67% |

0.82% |

1.42% |

1.67% |

|

Expense waiver/reimbursement4 |

0.11% |

0.10% |

0.10% |

0.21% |

0.35% |

|

Supplemental Data: |

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

$7,098 |

$7,697 |

$10,101 |

$11,431 |

$11,663 |

|

Portfolio turnover5 |

27% |

23% |

11% |

49% |

39% |

|

FEDERATED HERMES SHORT-INTERMEDIATE MUNICIPAL FUND–A CLASS | |||||

|

ANNUAL EXPENSE RATIO: 0.82% | |||||

|

MAXIMUM FRONT-END SALES CHARGE: 1.00% | |||||

|

Year |

Hypothetical

Beginning

Investment |

Hypothetical

Performance

Earnings |

Investment

After

Returns |

Hypothetical

Expenses |

Hypothetical

Ending

Investment |

|

1 |

$10,000.00 |

$495.00 |

$10,395.00 |

$182.88 |

$10,313.82 |

|

2 |

$10,313.82 |

$515.69 |

$10,829.51 |

$86.34 |

$10,744.94 |

|

3 |

$10,744.94 |

$537.25 |

$11,282.19 |

$89.95 |

$11,194.08 |

|

4 |

$11,194.08 |

$559.70 |

$11,753.78 |

$93.71 |

$11,661.99 |

|

5 |

$11,661.99 |

$583.10 |

$12,245.09 |

$97.63 |

$12,149.46 |

|

6 |

$12,149.46 |

$607.47 |

$12,756.93 |

$101.71 |

$12,657.31 |

|

7 |

$12,657.31 |

$632.87 |

$13,290.18 |

$105.96 |

$13,186.39 |

|

8 |

$13,186.39 |

$659.32 |

$13,845.71 |

$110.39 |

$13,737.58 |

|

9 |

$13,737.58 |

$686.88 |

$14,424.46 |

$115.00 |

$14,311.81 |

|

10 |

$14,311.81 |

$715.59 |

$15,027.40 |

$119.81 |

$14,910.04 |

|

Cumulative |

|

$5,992.87 |

|

$1,103.38 |

|

|

FEDERATED HERMES SHORT-INTERMEDIATE MUNICIPAL FUND–A2 CLASS | |||||

|

ANNUAL EXPENSE RATIO: 0.78% | |||||

|

MAXIMUM FRONT-END SALES CHARGE: 1.50% | |||||

|

Year |

Hypothetical

Beginning

Investment |

Hypothetical

Performance

Earnings |

Investment

After

Returns |

Hypothetical

Expenses |

Hypothetical

Ending

Investment |

|

1 |

$10,000.00 |

$492.50 |

$10,342.50 |

$228.45 |

$10,265.67 |

|

2 |

$10,265.67 |

$513.28 |

$10,778.95 |

$81.76 |

$10,698.88 |

|

3 |

$10,698.88 |

$534.94 |

$11,233.82 |

$85.21 |

$11,150.37 |

|

4 |

$11,150.37 |

$557.52 |

$11,707.89 |

$88.81 |

$11,620.92 |

|

5 |

$11,620.92 |

$581.05 |

$12,201.97 |

$92.56 |

$12,111.32 |

|

6 |

$12,111.32 |

$605.57 |

$12,716.89 |

$96.46 |

$12,622.42 |

|

7 |

$12,622.42 |

$631.12 |

$13,253.54 |

$100.53 |

$13,155.09 |

|

8 |

$13,155.09 |

$657.75 |

$13,812.84 |

$104.77 |

$13,710.23 |

|

9 |

$13,710.23 |

$685.51 |

$14,395.74 |

$109.20 |

$14,288.80 |

|

10 |

$14,288.80 |

$714.44 |

$15,003.24 |

$113.80 |

$14,891.79 |

|

Cumulative |

|

$5,973.68 |

|

$1,101.55 |

|

|

FEDERATED HERMES SHORT-INTERMEDIATE MUNICIPAL FUND–IS CLASS | |||||

|

ANNUAL EXPENSE RATIO: 0.82% | |||||

|

MAXIMUM FRONT-END SALES CHARGE: NONE | |||||

|

Year |

Hypothetical

Beginning

Investment |

Hypothetical

Performance

Earnings |

Investment

After

Returns |

Hypothetical

Expenses |

Hypothetical

Ending

Investment |

|

1 |

$10,000.00 |

$500.00 |

$10,500.00 |

$83.71 |

$10,418.00 |

|

2 |

$10,418.00 |

$520.90 |

$10,938.90 |

$87.21 |

$10,853.47 |

|

3 |

$10,853.47 |

$542.67 |

$11,396.14 |

$90.86 |

$11,307.15 |

|

4 |

$11,307.15 |

$565.36 |

$11,872.51 |

$94.66 |

$11,779.79 |

|

5 |

$11,779.79 |

$588.99 |

$12,368.78 |

$98.61 |

$12,272.19 |

|

6 |

$12,272.19 |

$613.61 |

$12,885.80 |

$102.74 |

$12,785.17 |

|

7 |

$12,785.17 |

$639.26 |

$13,424.43 |

$107.03 |

$13,319.59 |

|

8 |

$13,319.59 |

$665.98 |

$13,985.57 |

$111.50 |

$13,876.35 |

|

9 |

$13,876.35 |

$693.82 |

$14,570.17 |

$116.16 |

$14,456.38 |

|

10 |

$14,456.38 |

$722.82 |

$15,179.20 |

$121.02 |

$15,060.66 |

|

Cumulative |

|

$6,053.41 |

|

$1,013.50 |

|

|

FEDERATED HERMES SHORT-INTERMEDIATE MUNICIPAL FUND–SS CLASS | |||||

|

ANNUAL EXPENSE RATIO: 0.82% | |||||

|

MAXIMUM FRONT-END SALES CHARGE: NONE | |||||

|

Year |

Hypothetical

Beginning

Investment |

Hypothetical

Performance

Earnings |

Investment

After

Returns |

Hypothetical

Expenses |

Hypothetical

Ending

Investment |

|

1 |

$10,000.00 |

$500.00 |

$10,500.00 |

$83.71 |

$10,418.00 |

|

2 |

$10,418.00 |

$520.90 |

$10,938.90 |

$87.21 |

$10,853.47 |

|

3 |

$10,853.47 |

$542.67 |

$11,396.14 |

$90.86 |

$11,307.15 |

|

4 |

$11,307.15 |

$565.36 |

$11,872.51 |

$94.66 |

$11,779.79 |

|

5 |

$11,779.79 |

$588.99 |

$12,368.78 |

$98.61 |

$12,272.19 |

|

6 |

$12,272.19 |

$613.61 |

$12,885.80 |

$102.74 |

$12,785.17 |

|

7 |

$12,785.17 |

$639.26 |

$13,424.43 |

$107.03 |

$13,319.59 |

|

8 |

$13,319.59 |

$665.98 |

$13,985.57 |

$111.50 |

$13,876.35 |

|

9 |

$13,876.35 |

$693.82 |

$14,570.17 |

$116.16 |

$14,456.38 |

|

10 |

$14,456.38 |

$722.82 |

$15,179.20 |

$121.02 |

$15,060.66 |

|

Cumulative |

|

$6,053.41 |

|

$1,013.50 |

|

Breakpoints, Rights of Accumulation & Letters of Intent

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, PA 15086-7561

or call 1-800-341-7400.

CUSIP 31423H106

CUSIP 313907107

CUSIP 313907206