Filed Pursuant to Rule 424(b)(2)

Registration Number 333-249829

(To Prospectus dated November 3, 2020,

Prospectus Supplement dated November 3, 2020

and Prospectus Addendum dated February 26, 2021)

US$1,250,000,000

AKTIEBOLAGET

SVENSK EXPORTKREDIT (PUBL)

(Swedish Export Credit Corporation)

4.000% Fixed Rate Notes

Due July 15, 2025

Issue Price: 99.767%

These notes are issued by Aktiebolaget Svensk Exportkredit (publ) (Swedish Export Credit Corporation or “SEK”). The notes will mature on July 15, 2025. The notes will not be redeemable before maturity except for tax reasons and will not be entitled to the benefit of any sinking fund.

Interest on the notes will be payable in arrears on each January 15 and July 15, commencing on July 15, 2023, where there will be a short first coupon, up to and including the maturity date.

Application will be made to the Irish Stock Exchange plc (trading as Euronext Dublin) (“Euronext Dublin”) for the notes to be admitted to the official list (the “Official List”) and trading on its regulated market. There can be no assurance that such listing will be granted or maintained.

See “Risk Factors” beginning on page P-4 to read about factors you should consider before buying the notes.

By acquiring the notes, you acknowledge, agree to be bound by, and consent to the exercise of any Bail-in Power by the Swedish resolution authority and the Debt Office. All payments are subject to the exercise of any Bail-in Power by the relevant Swedish resolution authority. See “Description of the Notes—Consent to Bail-in Power.”

THE NOTES ARE OBLIGATIONS OF SEK, AND NOT THE KINGDOM OF SWEDEN.

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any other US regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this pricing supplement or the prospectus and the prospectus supplement to which it relates. Any representation to the contrary is a criminal offense.

| Per Note | Total | ||||||

| Initial public offering price | 99.767 | % | US$ | 1,247,087,500 | |||

| Underwriting discount | 0.075 | % | US$ | 937,500 | |||

| Proceeds to SEK | 99.692 | % | US$ | 1,246,150,000 | |||

The Managers (as defined below) expect to deliver the notes to investors through the facilities of The Depository Trust Company (“DTC”), Clearstream Banking, S.A. (“Clearstream Luxembourg”) and Euroclear Bank SA/NV (“Euroclear”) on or about May 3, 2023.

Joint Lead Managers

| BofA Securities | Deutsche Bank | Nomura | TD Securities |

The date of this pricing supplement is April 26, 2023.

This pricing supplement is a supplement to:

| · | the accompanying prospectus addendum dated February 26, 2021; |

| · | the accompanying prospectus supplement dated November 3, 2020 relating to our medium-term notes, series G, due nine months or more from date of issue; and |

| · | the accompanying prospectus dated November 3, 2020 relating to our debt securities. |

If the information in this pricing supplement differs from the information contained in the prospectus addendum, the prospectus supplement or the prospectus, you should rely on the information in this pricing supplement.

You should read this pricing supplement along with the accompanying, prospectus addendum, prospectus supplement and prospectus. All four documents contain information you should consider when making your investment decision. We are responsible for the information contained and incorporated by reference in this pricing supplement, the prospectus addendum, the prospectus supplement, the prospectus and in any related free-writing prospectus we prepare or authorize. We have not authorized anyone else to provide you with different information, and we take no responsibility for any other information that others may give you. We and the Managers are offering to sell the notes and seeking offers to buy the notes only in jurisdictions where it is lawful to do so. The information contained in this pricing supplement and the accompanying prospectus supplement and prospectus is current only as of its date.

This pricing supplement does not constitute an offer to sell, or a solicitation of an offer to buy, any of the securities offered hereby to any person in any jurisdiction in which it is unlawful for such person to receive or make such an offer. The offer or sale of notes may be restricted by law in certain jurisdictions, and you should inform yourself about, and observe, any such restrictions.

MiFID II product governance / Professional investors and ECPs only target market—Solely for the purposes of each manufacturer’s product approval process, the target market assessment in respect of the notes has led to the conclusion that: (i) the target market for the notes is eligible counterparties and professional clients only, each as defined in Directive 2014/65/EU (as amended, “MiFID II”); and (ii) all channels for distribution of the notes to eligible counterparties and professional clients are appropriate. Any person subsequently offering, selling or recommending the notes (a “distributor”) should take into consideration the manufacturers’ target market assessment; however, a distributor subject to MiFID II is responsible for undertaking its own target market assessment in respect of the notes (by either adopting or refining the manufacturers’ target market assessment) and determining appropriate distribution channels.

PRIIPs/ Important - EEA Retail Investors—The notes are not intended to be offered, sold or otherwise made available to, and should not be offered, sold or otherwise made available to, any retail investor in the European Economic Area (the “EEA”). For these purposes, a “retail investor” means a person who is one (or more) of: (a) a retail client, as defined in point (11) of Article 4(1) of MiFID II or (b) a customer within the meaning of the Insurance Distribution Directive (EU) 2016/97, as amended, where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (c) not a qualified investor as defined in Regulation (EU) 2017/1129 (the “Prospectus Regulation”). Consequently, no key information document required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for offering or selling the notes or otherwise making them available to retail investors in the EEA has been prepared, and therefore, offering or selling the notes or otherwise making them available to any retail investor in the EEA may be unlawful under the PRIIPs Regulation.

PRIIPs/ Important - UK Retail Investors—The notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the United Kingdom (“UK”). For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client, as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (“EUWA”); (ii) a customer within the meaning of the provisions of the Financial Services and Markets Act, 2000 (“FSMA”) and any rules or regulations made under the FSMA to implement Directive (EU) 2016/97, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law by virtue of the EUWA; or (iii) not a qualified investor as defined in Article 2 of Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the EUWA. Consequently no key information document required by Regulation (EU) No 1286/2014 as it forms part of domestic law by virtue of the EUWA (the “UK PRIIPs Regulation”) for offering or selling the notes or otherwise making them available to retail investors in the UK has been prepared and therefore offering or selling the notes or otherwise making them available to any retail investor in the UK may be unlawful under the UK PRIIPs Regulation.

| P-1 |

This document is only being distributed to and is only directed at (i) persons who are outside the UK or (ii) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (iii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). The notes are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such notes will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.

In connection with the issue of the notes, the Managers (if any) named as the Stabilizing Manager (or persons acting on behalf of any Stabilizing Manager) may over-allot notes or effect transactions with a view to supporting the market price of the notes at a level higher than that which might otherwise prevail. However, stabilization may not necessarily occur. Any stabilization action may begin on or after the date on which adequate disclosure of the terms of the offer of the notes is made and, if begun, may cease at any time, but it must end no later than the earlier of 30 days after the issue date of the notes and 60 days after the date of the allotment of the notes. Any stabilization action or over-allotment must be conducted by the Stabilizing Manager (or person(s) acting on behalf of any Stabilizing Manager) in accordance with all applicable laws and rules.

| P-2 |

INCORPORATION OF INFORMATION WE FILE WITH THE SEC

The SEC allows us to incorporate by reference the information we file with them. This means:

| · | incorporated documents are considered part of this pricing supplement; |

| · | we can disclose important information to you by referring you to those documents; |

| · | information in this pricing supplement automatically updates and supersedes information in earlier documents that are incorporated by reference in the prospectus; and |

| · | information that we file with the SEC that we incorporate by reference in this pricing supplement will automatically update and supersede this pricing supplement. |

We incorporate by reference the documents listed below which we have filed with the SEC under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”):

| · | our annual report on Form 20-F for the fiscal year ended December 31, 2022, which we filed with the SEC on February 28, 2023. |

| · | our reports on Form 6-K furnished to the SEC on February 1, 2023, February 14, 2023 and April 24, 2023 (except to the extent such documents specify that certain parts thereof are not incorporated by reference in our Registration Statement No. 333-249829); for the avoidance of doubt, such parts shall not be incorporated by reference herein. |

We also incorporate by reference each of the following documents that we may file with the SEC after the date of this pricing supplement but before the end of the notes offering:

| · | any report on Form 6-K filed by us pursuant to the Exchange Act that indicates on its cover or inside cover page that we will incorporate it by reference in the registration statement of which this pricing supplement forms a part (except to the extent that such documents specify that certain parts thereof are not so incorporated by reference); and |

| · | reports filed under Sections 13(a), 13(c) or 15(d) of the Exchange Act. |

You may request a copy of any filings referred to above (excluding exhibits), at no cost, by contacting us at the following address:

Aktiebolaget Svensk Exportkredit

(Swedish Export Credit Corporation)

Fleminggatan 20

SE-112 26 Stockholm, Sweden

Tel: +46-8-613-8300

The exchange rate for converting U.S. dollars into Swedish kronor was 10.3110 Skr per U.S. dollar on April 21, 2023, based on the Federal Reserve Statistical Release publication of Foreign Exchange Rates (Weekly) (the latest date for which such data is available).

| P-3 |

Prospective investors should read the entire pricing supplement along with the accompanying prospectus addendum, prospectus supplement and prospectus. Investing in the notes involves certain risks and is suitable only for investors who have the knowledge and experience in financial and business matters necessary to enable them to evaluate the risks and the merits of such an investment. Prospective investors should make such inquiries as they deem necessary without relying on us or any of the Managers and should consult with their financial, tax, legal, accounting and other advisers, prior to deciding to make an investment in the notes. Prospective investors should consider, among other things, “Risks Associated with the Notes” beginning on page S-6 of the accompanying prospectus supplement, as well as discussions of risk factors and other information contained or incorporated by reference in this pricing supplement or the accompanying prospectus addendum, prospectus supplement or prospectus and the following:

Risks Relating to the Notes

The notes lack a developed public market.

There can be no assurance regarding the future development of a market for the notes or the ability of the holders of the notes to sell their notes or the price at which such holders may be able to sell their notes. If such a market were to develop, the notes may trade at a discount to their initial offering price, depending upon prevailing interest rates, the market for similar securities, general economic conditions and our financial condition. Although application will be made for the notes to be admitted to trading on Euronext Dublin, there is no assurance that such application will be accepted or that an active trading market will develop. Accordingly, there is no assurance as to the development or liquidity of any trading market for the notes and, therefore, any prospective purchaser should be prepared to hold the notes indefinitely or until the maturity or final redemption of such notes.

The notes may be redeemed prior to maturity.

If, due to the imposition by Sweden or one of its political subdivisions or taxing authorities of any tax, assessment or governmental charge subsequent to the issue date, we become obligated to pay additional amounts, we may at our option redeem all, but not less than all, the notes by giving notice specifying a redemption date at least 30 days, but not more than 60 days, after the date of the notice. In such a circumstance, the notes could be redeemed at a time when prevailing interest rates may not enable an investor to reinvest the redemption proceeds in a comparable security at an effective interest rate as high as that of the notes.

| P-4 |

You should read the following description of the particular terms of the notes in conjunction with the description of the general terms and provisions of the notes set forth in the accompanying prospectus supplement, as amended and supplemented by the accompanying prospectus addendum, and of the Debt Securities (as defined below) set forth in the accompanying prospectus. If this summary differs in any way from the descriptions in the accompanying prospectus addendum, prospectus supplement or prospectus, you should rely on this summary.

We will issue the notes under the indenture, dated as of August 15, 1991, between us and the predecessor in interest to The Bank of New York Mellon Trust Company, N.A. (directly or as the successor in interest to another party), as supplemented by supplemental indentures dated as of June 2, 2004, January 30, 2006, October 23, 2008, March 8, 2010 and November 3, 2020 (together, the “Indenture”). The information contained in this section and in the accompanying prospectus addendum, prospectus supplement or prospectus summarizes some of the terms of the notes and the indenture. This summary does not contain all of the information that may be important to you as a potential investor in the notes. You should read the Indenture before making your investment decision. We have filed copies of these documents with the SEC and we have filed or will file copies of these documents at the offices of the trustee and the paying agents.

For the purposes hereof, the term “Debt Securities” used in the prospectus, and the term “notes” used in the prospectus supplement, as amended and supplemented by the accompanying prospectus addendum, include the notes we are offering in this pricing supplement.

| Principal Amount: | US$1,250,000,000 |

| Issue Price: | 99.767% of the Principal Amount |

| Pricing Date: | April 26, 2023 |

| Issue Date: | May 3, 2023 (T+4) |

| Maturity Date: | July 15, 2025 |

| Redemption Price: | 100.000% of Principal Amount |

| Specified Currency: | U.S. dollars (US$) |

| Interest Rate: | 4.000% per annum, calculated on the basis of a 360 day year of twelve 30 day months. |

| Spread to Benchmark Treasury: | +49.6 basis points |

| Benchmark Treasury: | UST 3.750% due April 15, 2026 |

| Re-Offer Yield: | 4.114% (semi annual) |

| Interest Payment Dates: | Semi-annually every January 15 and July 15, commencing July 15, 2023, where there will be a short first coupon, up to and including the Maturity Date. |

| Regular Record Dates: | Fifteen calendar days immediately preceding each Interest Payment Date. |

| Business Day Convention: | Following, unadjusted for each Interest Period. If any scheduled Interest Payment Date, other than the Maturity Date or a date for earlier redemption would fall on a day that is not a Business Day, the Interest Payment Date will be postponed to the next succeeding Business Day, with no adjustments to the amount due. If the Maturity Date or a date for earlier redemption is not a Business Day, the payment of interest and principal and/or any amount payable upon redemption will be made on the next succeeding Business Day, but interest on that payment will not accrue during the period from and after the Maturity Date or such redemption date. |

| P-5 |

| Day Count Fraction: | 30/360 |

| Business Day: | Any day, other than a Saturday or Sunday, that is a day on which commercial banks are generally open for business in New York and London. |

| Optional Redemption: | We cannot redeem the notes prior to maturity unless, due to the imposition by Sweden or one of its political subdivisions or taxing authorities of any tax, assessment or governmental charge subsequent to the issue date, we would become obligated to pay additional amounts. If such an imposition occurs, we may at our option redeem all, but not less than all, the notes by giving notice specifying a redemption date at least 30 days, but not more than 60 days, after the date of the notice. The redemption price will be 100.000% of the principal amount thereof, together with accrued and unpaid interest to the redemption date. |

| Form: | The notes will be represented by one or more global securities, registered in the name of The Depository Trust Company or its nominee. Except as described herein, notes in definitive form will not be issued. |

| Denomination: | The notes will be issued in denominations of US$200,000 and integral multiples of US$1,000 in excess thereof. |

| Status / Ranking: | The notes will constitute our direct, unconditional, unsecured and unsubordinated obligations and will rank pari passu amongst themselves. The rights of holders of the notes in respect of or arising from the notes (including any damages awarded for breach of any obligations under the indenture, if any are payable) shall, in the event of our voluntary or involuntary liquidation (Sw. likvidation) or bankruptcy (Sw. konkurs), rank: (A) (subject to mandatory exceptions as are from time to time applicable under Swedish law) at least pari passu with all other unsecured and unsubordinated indebtedness from time to time outstanding; and (B) senior to any senior non-preferred liabilities (as defined under “Description of the Notes—MREL Senior Non-Preferred Notes” in the accompanying prospectus supplement, as amended and supplemented by the accompanying prospectus addendum) and to any subordinated liabilities.

The notes will not be obligations of, or guaranteed by, the Kingdom of Sweden or any internal division or agency thereof, and will be subject entirely and exclusively, to our credit risk.

|

| Joint Lead Managers: | BofA Securities Europe SA Deutsche Bank Aktiengesellschaft Nomura Financial Products Europe GmbH TD Global Finance unlimited company

|

| Method of Payment: | Immediately available funds |

| P-6 |

| Listing: | We will apply to Euronext Dublin for the notes to be admitted to listing on the Official List and trading on its regulated market. |

| Securities Codes: | |

| CUSIP: | 87031CAK9 |

| ISIN: | US87031CAK99 |

Trustee: |

The Bank of New York Mellon Trust Company, N.A. (directly or as the successor in interest to another party). |

| Further Issues: | We may from time to time, without the consent of existing holders, create and issue further notes having the same terms and conditions as the notes being offered hereby in all respects, except for the issue date, issue price and, if applicable, the first payment of interest thereon. Additional notes issued in this manner will be consolidated with, and will form a single series with, the previously outstanding notes. Any additional notes issued in this manner shall be issued under a separate CUSIP or ISIN number unless the additional notes are issued pursuant to a “qualified reopening” of the original series, are otherwise treated as part of the same “issue” of debt instruments as the original series or are issued with no more than a de minimis amount of original discount, in each case for U.S. federal income tax purposes. |

| Payment

of Principal and Interest: |

Under the laws of New York, claims relating to payment of principal and interest on the notes will be prescribed according to the applicable statute of limitations. |

| Governing Law: | The notes will be governed by, and construed in accordance with, New York law, except that provisions that govern the ranking of the notes, that exclude (or otherwise govern) rights of set-off and matters relating to the authorization and execution of the notes by us will be governed by the law of Sweden. Furthermore, if the notes are at any time secured by property or assets in Sweden, matters relating to the enforcement of such security will be governed by the law of Sweden See “Description of the Notes—Agreement with Respect to the Exercise of Bail-in Power”. |

| Consent to Bail-in Power: | By investing in this offering, you acknowledge, agree to be bound by, and consent to the exercise of any Bail-in Power (as defined under “Description of the Notes—Agreement with Respect to the Exercise of Bail-in Power” in the accompanying prospectus supplement) by the Swedish National Debt Office (the “Debt Office”), the Swedish resolution authority. All payments are subject to the exercise of any Bail-in Power by the relevant Swedish resolution authority.

Under the Resolution Act (as defined under “Description of the Notes—Recovery and Resolution Matters” in the accompanying prospectus supplement), the Debt Office may exercise a Bail-in Power under certain conditions which include that authority determining that: (i) a relevant entity (such as SEK) is failing or is likely to fail; (ii) it is not reasonably likely that any action will be taken to avoid the entity’s failure (other than pursuant to the other stabilization powers under the Resolution Act); (iii) the exercise of the stabilization powers are necessary, taking into account certain public interest considerations such as the stability of the Swedish financial system, public confidence in the Swedish banking and resolution systems and the protection of depositors (also regulated by the Swedish Financial Supervisory Authority; and (iv) the objectives of the resolution measures would not be met to the same extent by the winding up of the entity. Notwithstanding these conditions, there remains uncertainty regarding how the Debt Office would assess these conditions in deciding whether to exercise any Bail-in Power. |

| P-7 |

The Bail-in Power includes any statutory write-down and conversion power, which allows for the cancellation of all, or a portion, of any amounts payable on the notes, including any repayment of principal and/or the conversion of all, or a portion, of any amounts payable on the notes, including principal, into shares or other securities or other obligations of ours or another person, including by means of a variation to the terms of the notes. Accordingly, if any Bail-in Power is exercised, you may lose all or a part of the value of your investment in the notes or receive a different security, which may be worth significantly less than the notes and which may have significantly fewer protections than those typically afforded to debt securities. Moreover, the Debt Office may exercise its authority to implement the Bail-in Power without providing any advance notice to the holders of the notes. By your acquisition of the notes, you acknowledge, agree to be bound by, and consent to the exercise of any Bail-in Power by the relevant resolution authority. The exercise of any Bail-in Power with respect to the notes will not be a default or an Event of Default (as each term is defined in the indenture relating to the notes). The Bank of New York Mellon Trust Company, N.A. (the “trustee”) will not be liable for any action that the trustee takes, or abstains from taking, in accordance with the exercise of the Bail-in Power with respect to the notes. Your rights as a holder of the notes are subject to, and will be varied, if necessary, so as to give effect to the exercise of any Bail-in Power by the Debt Office.

This is only a summary. For more information, see “Description of the Notes—Recovery and Resolution Matters” and “Description of the Notes—Agreement with Respect to the Exercise of Bail-in Power,” beginning on pages S-43 and S-44 of the accompanying prospectus supplement, respectively. | |

| Further Information: | See “General Information”. |

| Advertisement: | The prospectus for purposes of the Prospectus Regulation, when published, will be available at https://live.euronext.com/. |

| P-8 |

CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

Book/Tax Conformity

The first paragraph under the section headed “United States Federal Income Tax Considerations” on page S-46 of the accompanying prospectus supplement is hereby amended by adding the following after the text “net investment income”: “, or consequences arising under special timing rules prescribed under section 451(b) of the U.S. Internal Revenue Code,”.

The subheading and corresponding text under “United States Federal Income Tax Considerations—Book/Tax Conformity” on page S-46 in the Prospectus Supplement shall be deleted in its entirety.

We expect that the net proceeds from the issuance of notes will be US$1,246,150,000. We will use the net proceeds for general corporate purposes.

Subject to the terms and conditions set forth in an Agency Agreement dated November 3, 2020 and a Terms Agreement dated April 26, 2023 (the “Agreements”), we have agreed to sell to the Managers, listed below (the “Managers”), as purchasers, and each of the Managers has agreed to purchase, the principal amount of notes set forth opposite the Manager’s name below at 99.767% of the aggregate principal amount thereof (prior to deduction of the aforementioned underwriting commissions).

| Managers | Principal Amount of Notes | |||

| BofA Securities Europe SA | US$ | 312,500,000 | ||

| Deutsche Bank Aktiengesellschaft | 312,500,000 | |||

| Nomura Financial Products Europe GmbH | 312,500,000 | |||

| TD Global Finance unlimited company | 312,500,000 | |||

| Total | US$ | 1,250,000,000 | ||

Under the terms and conditions of the Agreements, the Managers are committed to take and pay for all of the notes, if any are taken.

The Managers have advised us that they intend to make a market in the notes but are not obligated to do so and may discontinue market making at any time without notice. We cannot give any assurance as to the liquidity of the trading market for the notes.

In connection with the issue of the notes, the Managers (if any) named as the Stabilizing Manager (or persons acting on behalf of any Stabilizing Manager) may over-allot notes or effect transactions with a view to supporting the market price of the notes at a level higher than that which might otherwise prevail. However, stabilization may not necessarily occur. Any stabilization action may begin on or after the date on which adequate disclosure of the terms of the offer of the notes is made and, if begun, may cease at any time, but it must end no later than the earlier of 30 days after the issue date of the notes and 60 days after the date of the allotment of the notes. Any stabilization action or over-allotment must be conducted by the Stabilizing Manager (or person(s) acting on behalf of any Stabilizing Manager) in accordance with all applicable laws and rules.

Some of the Managers and their affiliates have engaged in, and may in the future engage in, investment banking and other commercial dealings in the ordinary course of business with us or our affiliates. They have received, or may in the future receive, customary fees and commissions for these transactions.

P-9

In addition, in the ordinary course of their business activities, the Managers and their affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers. Such investments and securities activities may involve securities and/or instruments of ours or our affiliates. Certain of the Managers or their affiliates that have a lending relationship with us routinely hedge their credit exposure to us consistent with their customary risk management policies. Typically, such Managers and their affiliates would hedge such exposure by entering into transactions which consist of either the purchase of credit default swaps or the creation of short positions in our securities, including potentially the notes offered hereby. Any such short positions could adversely affect future trading prices of the notes offered hereby. The Managers and their affiliates may also make investment recommendations and/or publish or express independent research views in respect of such securities or financial instruments and may hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

Any Manager that is not a broker-dealer registered with the SEC will only make sales of notes in the United States through one or more SEC registered broker-dealers in compliance with applicable securities laws and the rules of the Financial Industry Regulatory Authority, Inc.

Delivery of the notes will be made against payment on or about the fourth business day following the date of this pricing supplement. Trades of securities in the United States secondary market generally are required to settle in two business days, referred to as T+2, unless the parties to a trade agree otherwise. Accordingly, by virtue of the fact that the initial delivery of the notes will not be made on a T+2 basis, investors who wish to trade the notes before a final settlement will be required to specify an alternative settlement cycle at the time of any such trade to prevent a failed settlement.

We have agreed to indemnify the Managers against, or to make contributions relating to, certain liabilities, including liabilities under the Securities Act.

From time to time the Managers and their affiliates have, and in the future may, engage in transactions with and perform services for us for which they have been, and may be, paid customary fees. In particular, one or more of the Managers or an affiliate of one or more of the Managers may enter into swap transactions with us associated with this offering of notes.

The Managers have agreed to pay the out-of-pocket expenses (other than our internal costs and expenses) of the issue of the notes.

We will apply for the notes to be admitted to listing on the Official List and trading on the regulated market of Euronext Dublin. The Managers reserve the right to withdraw, cancel or modify any offer and to reject orders in whole or in part.

European Economic Area

The notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in any Member State of the EEA. For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of MiFID II; or (ii) a customer within the meaning of Directive 2016/97/EU (as amended), where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MIFID II; or (iii) not a qualified investor as defined in the Prospectus Regulation. The expression “offer” includes the communication in any form and by any means of sufficient information on the terms of the offer and the notes to be offered so as to enable an investor to decide to purchase or subscribe for the notes.

Consequently no key information document required by the PRIIPs Regulation for offering or selling the notes or otherwise making them available to retail investors in a Relevant State has been prepared and therefore offering or selling the notes or otherwise making them available to any retail investor in a Relevant State may be unlawful under the PRIIPs Regulation. This pricing supplement has been prepared on the basis that any offer of notes in any Relevant State will be made pursuant to an exemption under the Prospectus Regulation from the requirement to publish a prospectus for offers of notes. This pricing supplement is not a prospectus for the purposes of the Prospectus Regulation.

P-10

This EEA selling restriction is in addition to any other selling restrictions set out in this pricing supplement.

Each Manager has represented and agreed that it has not offered, sold or otherwise made available and will not offer, sell or otherwise make available any notes to any retail investor in the European Economic Area. For the purposes of this provision;

(a) the expression “retail investor” means a person who is one (or more) of the following:

(i) a retail client as defined in point (11) of Article 4(1) of MiFID II;

(ii) a customer within the meaning of the Insurance Distribution Directive, where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or

(iii) not a qualified investor as defined in the Prospectus Regulation; and

(b) the expression “offer” includes the communication in any form and by means of sufficient information on the terms of the offer and the notes to be offered so as to enable an investor to decide to purchase or subscribe to the notes.

United Kingdom

The notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the UK. For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law by virtue of the EUWA; or (ii) a customer within the meaning of the provisions of the FSMA and any rules or regulations made under the FSMA to implement Directive (EU) 2016/97, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law by virtue of the EUWA; or (iii) not a qualified investor as defined in Article 2 of Regulation (EU) No 2017/1129 as if forms part of domestic law by virtue of the EUWA.

Consequently no key information document required by the UK PRIIPs Regulation for offering or selling the notes or otherwise making them available to retail investors in the UK has been prepared and therefore offering or selling the notes or otherwise making them available to any retail investor in the UK may be unlawful under the UK PRIIPs Regulation. This pricing supplement has been prepared on the basis that any offer of notes in the UK will be made pursuant to an exemption under Regulation (EU) No 2017/1129 as it forms part of domestic law by virtue of the EUWA from the requirement to publish a prospectus for offers of notes. This pricing supplement is not a prospectus for the purposes of Regulation (EU) No 2017/1129 as it forms part of domestic law by virtue of the EUWA.

This UK selling restriction is in addition to any other selling restrictions set out in this pricing supplement.

Each Manager has represented and agreed that it has not offered, sold or otherwise made available and will not offer, sell or otherwise make available any notes to any retail investor in the UK. For the purposes of this provision:

(a) the expression “retail investor” means a person who is one (or more) of the following:

(i) a retail client as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law by virtue of the EUWA;

P-11

(ii) a customer within the meaning of the provisions of the FSMA and any rules or regulations made under the FSMA to implement Directive (EU) 2016/97, where that customer would not qualify as a professional client as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law by virtue of the EUWA; or

(iii) not a qualified investor as defined in Article 2 of Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the EUWA; and

(b) the expression “offer” includes the communication in any form and by any means of sufficient information on the terms of the offer and the notes to be offered so as to enable an investor to decide to purchase or subscribe to the notes.

Each of the Managers has or will have represented and agreed that:

(a) it has only communicated or caused to be communicated and will only communicate or cause to be communicated an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the FSMA received by it in connection with the issue or sale of the notes in circumstances in which Section 21(1) of the FSMA does not apply to SEK; and

(b) it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to the notes in, from or otherwise involving the UK.

We have obtained all necessary consents, approvals and authorizations in connection with the issuance and performance of the notes.

Application will be made to Euronext Dublin for the notes to be admitted to the Official List and to trading on its regulated market.

We are not involved in any litigation or arbitration proceedings relating to claims or amounts which are material in the context of the issuance of the notes nor, so far as we are aware, is any such litigation or arbitration pending or threatened. Except as disclosed in the prospectus, the prospectus supplement, the prospectus addendum and the documents considered part of them, there has been no material adverse change in our prospects since March 31, 2023, nor has there been any significant change in our financial or trading position which has occurred since March 31, 2023.

We have consented to the non-exclusive jurisdiction of the courts of the State of New York and the U.S. courts located in the City of New York with respect to any action that may be brought in connection with the notes.

Under the Indenture, we have irrevocably appointed Business Sweden as our authorized agent for service of process in any action based on the notes or the Indenture brought against us in any U.S. state or federal court in The City of New York. The contact information for Business Sweden is as follows:

Business Sweden

295 Madison Ave Suite 4000

New York, New York 10017

Tel. No.: +1-212-507-9001

The Indenture provides that any money deposited with the trustee or any paying agent, or then held by us, in trust for the payment of any principal of or interest on the notes that is unclaimed for two years after such principal or interest has become due and payable will be paid to us, or if then held by us, will be discharged from such trust.

We accept responsibility for the information contained in the prospectus, the prospectus supplement, the prospectus addendum and this pricing supplement. We will also accept responsibility for any information contained in the application that will made to Euronext Dublin for the notes to be admitted to the Official List and to trading on its regulated market. We have taken all reasonable care to ensure that the information contained in the prospectus, the prospectus supplement, the prospectus addendum and this pricing supplement is in accordance with the facts and does not omit anything likely to affect the import of such information.

P-12

This document is an advertisement for the purposes of applicable measures implementing the Prospectus Regulation. A prospectus prepared pursuant to the Prospectus Regulation is intended to be published, which, when published, can be obtained from the offices of SEK.

We are furnishing this pricing supplement and the accompanying prospectus, prospectus supplement and prospectus addendum solely for use by prospective investors in connection with their consideration of a purchase of the notes. We confirm that:

| · | the information contained in this pricing supplement, the accompanying prospectus, prospectus supplement and prospectus addendum is true and correct in all material respects and is not misleading; |

| · | we have not omitted other facts, the omission of which makes this pricing supplement, the accompanying prospectus, prospectus supplement and prospectus addendum as a whole misleading; and |

| · | we accept responsibility for the information we have provided in this pricing supplement, the accompanying prospectus, prospectus supplement and prospectus addendum. |

P-13

CLEARANCE THROUGH DTC, EUROCLEAR AND CLEARSTREAM, LUXEMBOURG

The notes have been accepted for clearance through DTC under CUSIP 87031CAK9. The notes have also been accepted for clearing through Euroclear and Clearstream, Luxembourg under ISIN US87031CAK99.

We will issue the notes as global notes registered in the name of Cede & Co., as nominee for DTC. You may hold book-entry interests in a global note through organizations that participate, directly or indirectly, in the DTC, Clearstream, Luxembourg and Euroclear systems, as applicable. Book-entry interests in and all transfers relating to the notes will be reflected in the book-entry records of DTC or its nominee and, where applicable, the book-entry records of Euroclear and Clearstream, Luxembourg.

For further information concerning clearance and settlement procedures, see “Description of the Notes—Form of the Notes” and “—Global Clearance and Settlement Procedures” in the accompanying prospectus supplement.

P-14

Filed Pursuant to Rule 424(b)(5)

Registration Number 333-249829

(To Prospectus

dated November 3, 2020 and

Prospectus

Supplement dated November 3, 2020)

AKTIEBOLAGET SVENSK EXPORTKREDIT (PUBL)

(Swedish Export Credit Corporation)

(incorporated in Sweden with limited liability)

Medium-Term Notes, Series G

Due Nine Months or More From Date of Issue

As further described in the accompanying prospectus supplement and prospectus, each dated November 3, 2020, we, Aktiebolaget Svensk Exportkredit (Publ) (Swedish Export Credit Corporation) (“SEK”, “our”, “we”, “us” or the “Issuer”), may from time to time offer and sell certain debt securities as part of our Medium-Term Notes, Series G program (the “notes”). This prospectus addendum contains information on a particular type of notes, MREL Senior Preferred Notes (as described herein), that we may issue after the date hereof, and supplements the accompanying prospectus supplement and prospectus as concerns such MREL Senior Preferred Notes.

If the information in this prospectus addendum concerning the MREL Senior Preferred Notes differs from the information contained in the accompanying prospectus, you should rely on the information in this prospectus addendum. We may also vary the terms of any MREL Senior Preferred Notes that we issue from those described in this prospectus addendum and will provide the final terms for each offering of MREL Senior Preferred Notes in a pricing supplement. Accordingly, if the information in the pricing supplement for a particular tranche of MREL Senior Preferred Notes differs from the information contained in this prospectus addendum, or in the accompanying prospectus supplement or prospectus, you should rely on the information contained in the pricing supplement.

In addition, pursuant to this prospectus addendum, the section entitled “Description of the Notes—Interest Rates—Base Rates—SOFR—SOFR average” in the accompanying prospectus supplement is hereby replaced in its entirety with the section entitled “Compounded SOFR using SOFR Index” in this prospectus addendum, and all other references in the accompanying prospectus supplement to “SOFR average” are also replaced (and should henceforth be read and construed) as references to “Compounded SOFR using SOFR Index.” These changes represent a change in nomenclature only. Except as otherwise specified in the applicable pricing supplement, the methodology to determine “Compounded SOFR using SOFR Index” described in this prospectus addendum is identical to that described in the accompanying prospectus in relation to “SOFR average.”

Neither the U.S. Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined that this prospectus addendum or the accompanying prospectus supplement and prospectus to which it relates is truthful or complete. Any representation to the contrary is a criminal offense.

SEK

This prospectus addendum is dated February 26,

2021

The following information concerning the MREL Senior Preferred Notes supplements the information contained in the accompanying prospectus supplement and prospectus as concerns the MREL Senior Preferred Notes, including the descriptions of the general terms and provisions of the notes and the debt securities set out therein, as well as the discussions of risk factors contained or incorporated by reference into the accompanying prospectus supplement or prospectus.

The “MREL Senior Preferred Notes” are a type of notes that are intended to constitute “MREL eligible liabilities” (as defined in “Description of the Notes—MREL Senior Non-Preferred Notes” in the accompanying prospectus supplement) but which, in contrast to the MREL Senior Non-Preferred Notes described in the accompanying prospectus supplement (and certain other instruments that we may issue that are similarly intended to constitute MREL eligible liabilities), are not intended to constitute “senior non-preferred liabilities” (as defined under “Description of the Notes—MREL Senior Non-Preferred Notes” in the accompanying prospectus supplement).

Instead, as with the notes generally, the MREL Senior Preferred Notes will constitute our direct, unconditional, unsecured and unsubordinated obligations and will rank pari passu amongst themselves. The rights of holders of the MREL Senior Preferred Notes in respect of or arising from the MREL Senior Preferred Notes (including any damages awarded for breach of any obligations under the indenture, if any are payable) shall, in the event of our voluntary or involuntary liquidation (Sw. likvidation) or bankruptcy (Sw. konkurs), rank: (A) (subject to such mandatory exceptions as are from time to time applicable under Swedish law) at least pari passu with all our other unsecured and unsubordinated indebtedness from time to time outstanding; and (B) senior to any senior non-preferred liabilities (as defined under “Description of the Notes—MREL Senior Non-Preferred Notes” in the accompanying prospectus supplement) and to any subordinated liabilities. As with the notes generally, the MREL Senior Preferred Notes will not be obligations of, or guaranteed by, the Kingdom of Sweden or any internal division or agency thereof, and will be subject, entirely and exclusively, to our credit risk.

Except as described above (or as otherwise specified in the applicable pricing supplement), however, the general terms and provisions of the MREL Senior Preferred Notes will be identical to the general terms and provisions of the MREL Senior Non-Preferred Notes described in the accompanying prospectus supplement if references therein to the “MREL Senior Non-Preferred Notes” are instead read as references to the “MREL Senior Preferred Notes”, including as concerns:

| · | MREL Senior Preferred Notes having maturities of at least one year from their issue dates, as described in “Description of the Notes—General Terms of the Notes” in relation to the MREL Senior Non-Preferred Notes; |

| · | our rights to purchase MREL Senior Preferred Notes at any time in the open market or otherwise at any price, subject to certain limitations, as described in “Description of the Notes—MREL Senior Non-Preferred Notes” in relation to the MREL Senior Non-Preferred Notes; |

| · | our ability to redeem MREL Senior Preferred Notes upon the occurrence of a “MREL disqualification event”, subject to certain limitations, as described in “Description of the Notes—MREL Senior Non-Preferred Notes—MREL Senior Non-Preferred Notes Redemption upon occurrence of a MREL disqualification event” in relation to the MREL Senior Non-Preferred Notes; |

| · | our ability to substitute the MREL Senior Preferred Notes for, or vary the terms of the MREL Senior Preferred Notes so that they remain or, as appropriate, become, MREL qualifying securities at any time that a MREL disqualification event occurs and is continuing, subject to certain limitations, as described in “Description of the Notes—MREL Senior Non-Preferred Notes— Substitution or Variation of MREL Senior Non-Preferred Notes” in relation to the MREL Senior Non-Preferred Notes; |

PA-1

| · | more limited events of default and remedies than those applicable to our notes generally, as further described in “Description of the Notes—MREL Senior Non-Preferred Notes—Events of Default for MREL Senior Non-Preferred Notes” in relation to the MREL Senior Non-Preferred Notes; |

| · | the duties and entitlements of the trustee if an event of default in relation to the MREL Senior Preferred Notes has occurred and is continuing, as described in “Description of the Notes—MREL Senior Non-Preferred Notes—Entitlement of Trustee” in relation to the MREL Senior Non-Preferred Notes; |

| · | the inability of holders of MREL Senior Preferred Notes to exercise any right of set-off or counterclaim against moneys owed by us in respect of the MREL Senior Preferred Notes, as described in “Description of the Notes—MREL Senior Non-Preferred Notes—Waiver of set-off” in relation to the MREL Senior Non-Preferred Notes; |

| · | the non-application of the negative pledge provisions of the indenture to the MREL Senior Preferred Notes, as described in “Description of the Notes—MREL Senior Non-Preferred Notes—No negative pledge” in relation to the MREL Senior Non-Preferred Notes; and |

| · | the provisions described under “Description of Debt Securities—Additional Amounts” in the accompanying prospectus applying only in respect of interest payments, and not payments of principal or any other amount, on the MREL Senior Preferred Notes, as described in “Description of the Notes—MREL Senior Non-Preferred Notes—Additional Amounts in respect of MREL Senior Non-Preferred Notes” in relation to the MREL Senior Non-Preferred Notes. |

For the avoidance of doubt, if references therein to the “MREL Senior Non-Preferred Notes” are instead read as references to the “MREL Senior Preferred Notes,” the risks described in the accompanying prospectus supplement under the heading “Risk Factors—Risks Associated with the MREL Senior Non-Preferred Notes” in relation to the MREL Senior Non-Preferred Notes (other than the risk factor titled “The MREL Senior Non-Preferred Notes rank junior to claims of our other unsubordinated creditors”) will be applicable to the MREL Senior Preferred Notes.

PA-2

Compounded SOFR using SOFR Index

The section entitled “Description of the Notes—Interest Rates—Base Rates—SOFR—SOFR average” in the accompanying prospectus supplement is hereby replaced in its entirety with the section below entitled “Compounded SOFR using SOFR Index.” All other references in the accompanying prospectus supplement to “SOFR average” are also replaced (and should henceforth be read and construed) as references to “Compounded SOFR using SOFR Index.” These changes represent a change in nomenclature only. Except as otherwise specified in the applicable pricing supplement, the methodology to determine “Compounded SOFR using SOFR Index” described below is identical to that described in the accompanying prospectus in relation to “SOFR average.”

Compounded SOFR using SOFR Index

If the base rate is specified in the applicable pricing supplement as being Compounded SOFR using SOFR Index, the rate of interest for each interest period will, subject as provided below, be Compounded SOFR using SOFR Index calculated as defined below plus or minus (as indicated in the applicable pricing supplement) the margin.

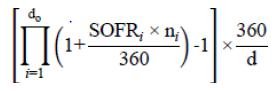

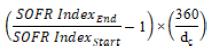

“Compounded SOFR using SOFR Index” means, in respect of an interest period, the rate calculated by the calculation agent, on the relevant interest determination date as follows, and the resulting percentage will be rounded, if necessary, to the fifth decimal place of a percentage point, with 0.000005 being rounded upwards:

where:

“SOFR indexStart” means the SOFR index value on the day which is “p” U.S. government securities business days preceding the first date of the relevant interest period (an “SOFR index determination start date”);

“SOFR indexEnd” means the SOFR index value on the day which is “p” U.S. government securities business days preceding the interest payment date relating to such interest period (or in the final interest period, the maturity date) (a “SOFR index determination end date”);

“dc” means the number of calendar days from (and including) SOFR indexStart to (but excluding) SOFR indexEnd; and

“SOFR index date” means an SOFR index determination start date or an SOFR index Determination End Date, as the case may be.

The “SOFR index” in relation to any U.S. government securities business day shall be the value as published by the SOFR administrator at the SOFR determination time.

Subject to the provisions described below under the following heading “—Benchmark transition events applicable to LIBOR and SOFR linked notes,” if the SOFR index is not published on any relevant SOFR index date, and a benchmark transition event and related benchmark replacement date have not occurred, “Compounded SOFR using SOFR Index” means, for an interest determination date with respect to an interest period, USD-SOFR-COMPOUND, i.e., the daily compound interest investment (it being understood that the reference rate for the calculation of such interest is the SOFR), calculated in accordance with only the formula and definitions required for such formula set forth in USD-SOFR-COMPOUND of Supplement number 57 (for the avoidance of doubt, without applying all fallbacks included therein) to the ISDA definitions (and for the purposes of such provisions, references to “calculation period” shall mean, the period from and including the date which is “p” U.S. government securities business days preceding the first date of the relevant interest period to, but excluding, the date which is “p” U.S. government securities business days preceding the interest payment date relating to such interest period (or in the final interest period, the maturity date) (or if the notes become due and payable in accordance with the events of default), the date on which the notes become due and payable (or, if such date is not a U.S. government securities business day, the U.S. government securities business day immediately preceding such date) and references to “SOFR index cessation event” shall mean benchmark transition event (as defined below)).

PA-3

PROSPECTUS SUPPLEMENT

(To Prospectus dated November 3, 2020)

AKTIEBOLAGET

SVENSK EXPORTKREDIT (PUBL)

(Swedish Export Credit Corporation)

(incorporated in Sweden with limited liability)

Medium-Term

Notes, Series G

Due Nine Months Or More From Date Of Issue

We may offer an unlimited principal amount of notes. The following terms may apply to the notes, which we may sell from time to time. We may vary these terms and will provide the final terms for each offering of notes in a pricing supplement. If the information in a pricing supplement differs from the information contained in this prospectus supplement or the prospectus, you should rely on the information contained in the pricing supplement.

| · | The notes may bear interest at fixed or floating interest rates. Floating interest rate formulae may be based on: |

· LIBOR;

· SOFR;

· Commercial Paper Rate;

· the Treasury Rate;

· the Federal Funds Rate; or

· any other rate specified in the relevant pricing supplement.

· We may sell the notes as indexed notes or discount notes.

· The notes may be subject to redemption at our option or repurchase at our option.

· The notes will be in registered form and may be in book-entry or certificated form.

· The notes will be denominated in U.S. dollars or other currencies.

· Unless otherwise specified, U.S. dollar-denominated notes will be issued in denominations of U.S.$1,000 and integral multiples of U.S.$1,000.

· The notes will not be listed on any securities exchange, unless otherwise indicated in the applicable pricing supplement.

· Subject to certain exceptions, we will make interest payments on the notes without deducting withholding or similar taxes imposed by Sweden.

· If the applicable pricing supplement so indicates, the notes may be MREL Senior Non-Preferred Notes (as described herein).

See “Risks Associated With the Notes” beginning on page “S-6” to read about certain risks you should consider before investing in the notes.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus supplement or the related prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Barclays | BofA Securities | Citigroup |

| Deutsche Bank | Goldman Sachs & Co. LLC | Incapital LLC |

| J.P. Morgan | Morgan Stanley | Wells Fargo Securities |

This prospectus supplement is dated November 3, 2020.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement supplements the accompanying prospectus dated November 3, 2020 relating to our debt securities. If the information in this prospectus supplement differs from the information contained in the accompanying prospectus, you should rely on the information in this prospectus supplement.

You should read this prospectus supplement along with the accompanying prospectus (and any relevant pricing supplement). Each document contains information you should consider when making your investment decision. You should rely only on the information provided or incorporated by reference in this prospectus supplement and the accompanying prospectus (or such pricing supplement). We have not authorized anyone else to provide you with different information. We and the agents are offering to sell the notes and seeking offers to buy the notes only in jurisdictions where it is lawful to do so. The information contained in this prospectus supplement and the accompanying prospectus is current only as of the date hereof.

Solely for the purposes of each manufacturer’s product approval process, the target market assessment in respect of the notes has led to the conclusion that: (i) the target market for the notes is eligible counterparties and professional clients only, each as defined in Directive 2014/65/EU (as amended, “MiFID II”); and (ii) all channels for distribution of the notes to eligible counterparties and professional clients are appropriate. Any person subsequently offering, selling or recommending the notes (a “distributor”) should take into consideration the manufacturers’ target market assessment; however, a distributor subject to MiFID II is responsible for undertaking its own target market assessment in respect of the notes (by either adopting or refining the manufacturers’ target market assessment) and determining appropriate distribution channels.

The notes are not intended to be offered, sold or otherwise made available to, and should not be offered, sold or otherwise made available to, any retail investor in the European Economic Area (the “EEA”) or the United Kingdom. For these purposes, a “retail investor” means a person who is one (or more) of: (a) a retail client, as defined in point (11) of Article 4(1) of MiFID II or (b) a customer within the meaning of the Insurance Distribution Directive (EU) 2016/97, as amended, where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in Regulation (EU) 2017/1129 (the “Prospectus Regulation”). Consequently, no key information document required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for offering or selling the notes or otherwise making them available to retail investors in the EEA or the United Kingdom has been prepared, and therefore, offering or selling the notes or otherwise making them available to any retail investor in the EEA or the United Kingdom may be unlawful under the PRIIPs Regulation.

This document is only being distributed to and is only directed at (i) persons who are outside the United Kingdom or (ii) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000, as amended (“FSMA”) Order 2005 (the “Order”) or (iii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49 (2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). Any notes will only be available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such notes will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.

THE NOTES OFFERED HEREBY MAY BE OFFERED FROM TIME TO TIME IN THE EUROPEAN UNION (THE “EU”) PURSUANT TO A BASE PROSPECTUS DIFFERENT FROM, BUT NOT INCONSISTENT WITH, THIS PROSPECTUS SUPPLEMENT AND THE PROSPECTUS TO WHICH IT REFERS.

S-1

SUMMARY DESCRIPTION OF THE NOTES

This summary highlights information contained elsewhere in this prospectus supplement and in the prospectus. It does not contain all the information that you should consider before investing in the notes. You should carefully read the pricing supplement relating to the terms and conditions of a particular issue of notes along with this entire prospectus supplement and the prospectus.

Swedish Export Credit Corporation

Swedish Export Credit Corporation (“SEK”, “our,” “us,” or “we”) is a “public limited liability company” within the meaning of the Swedish Companies Act (2005:551). We are wholly owned by the Swedish state through the Ministry of Enterprise and Innovation (“Sweden” or the “State”).

Our principal executive office is located at Klarabergsviadukten 61-63, SE-111 64 Stockholm, Sweden; and our telephone number is +46-8-613-83 00.

The Notes

| Issuer: | Swedish Export Credit Corporation |

| Agents: | Barclays Capital Inc. BofA Securities, Inc. Deutsche Bank Aktiengesellschaft Wells Fargo Securities, LLC

|

| Trustee: | The Bank of New York Mellon Trust Company, N.A. |

| Paying Agent: | The Bank of New York Mellon Trust Company, N.A., unless otherwise specified in the applicable pricing supplement. |

| Amount: | We may offer an unlimited amount of notes. |

| Issue Price: | We may issue the notes at par, or at a premium over, or discount to, par and either on a fully paid or partly paid basis. |

| Maturities: | The notes will mature at least nine months or, in respect of MREL Senior Non-Preferred Notes, at least one year, from their date of issue. |

| Fixed Rate Notes: | Fixed rate notes will bear interest at a fixed rate. |

| Floating Rate Notes: | Floating rate notes will bear interest at a rate determined periodically by reference to one or more interest base rates plus a spread or multiplied by a spread multiplier. |

| Indexed Notes: | Payments of principal and/or interest on indexed notes will be calculated by reference to a specific measure or index. |

| Discount Notes: | Discount notes are notes that are offered or sold at a price less than their principal amount and called discount notes in the applicable pricing supplement. They may or may not bear interest. |

S-2

| Redemption and Repayment: | If the notes are redeemable at our option (other than on the occurrence of the tax events described under “Description of Debt Securities—Optional Redemption Due to Change in Swedish Tax Treatment” in the accompanying prospectus, or upon the occurrence of an MREL disqualification event described under “Description of the Notes—MREL Senior Non-Preferred Notes”) or repayable at the option of the holder before maturity, the pricing supplement will specify, as applicable:

· the repayment date or dates on which we may elect repayment of the notes;

· the repayment date or dates on which the holders may elect repayment of the notes;

· the redemption or repayment price or how this will be calculated; and

· the required prior notice to the holders or to us.

|

| Status: | Except in the case of MREL Senior Non-Preferred Notes or if otherwise specified in the applicable pricing supplement, the notes will constitute our direct, unconditional, unsecured and unsubordinated obligations and will rank pari passu amongst themselves. The rights of holders of the notes in respect of or arising from the notes (including any damages awarded for breach of any obligations under the indenture, if any are payable) shall, in the event of our voluntary or involuntary liquidation (Sw. likvidation) or bankruptcy (Sw. konkurs), rank: (A) (subject to such mandatory exceptions as are from time to time applicable under Swedish law) at least pari passu with all our other unsecured and unsubordinated indebtedness from time to time outstanding; and (B) senior to any senior non-preferred liabilities (as defined under “Description of the Notes—MREL Senior Non-Preferred Notes”) and to any subordinated liabilities.

If the applicable pricing supplement so indicates, the notes may be intended to constitute MREL eligible liabilities (as defined under “Description of the Notes—MREL Senior Non-Preferred Notes”) and senior non-preferred liabilities (as defined under “Description of the Notes—MREL Senior Non-Preferred Notes”) (such notes, “MREL Senior Non-Preferred Notes”). Any MREL Senior Non-Preferred Notes will constitute our unsecured obligations and rank pari passu without any preference amongst themselves. The rights of holders of any MREL Senior Non-Preferred Notes in respect of or arising from the MREL Senior Non-Preferred Notes (including any damages awarded for breach of any obligations under the indenture, if any are payable) shall, in the event of our voluntary or involuntary liquidation (Sw. likvidation) or bankruptcy (Sw. konkurs), have senior non-preferred ranking (as defined under “Description of the Notes—MREL Senior Non-Preferred Notes”). The MREL Senior Non-Preferred Notes will also have certain differences in terms from the notes described in the immediately preceding paragraph and more generally in this summary (including limited events of default, no rights of set-off, limitations in our obligations to pay additional amounts to compensate holders against any deduction or withholding of taxes and our rights upon the occurrence of an MREL disqualification event), as more fully described in “Description of the Notes—MREL Senior Non-Preferred Notes” and in the applicable pricing supplement.

The notes issued by us (including any MREL Senior Non-Preferred Notes) will not be obligations of, or guaranteed by, the Kingdom of Sweden or any internal division or agency thereof, and will be subject, entirely and exclusively, to our credit risk.

|

S-3

| Taxes: | Subject to certain exceptions, we will make all payments on the notes (or, in the case of the MREL Senior Non-Preferred Notes, all interest payments but not payments of principal or any other amount) without withholding or deducting any taxes imposed by Sweden. For further information, see “Description of Debt Securities—Additional Amounts” beginning on page 11 of the accompanying prospectus. |

| Further Issues: | The notes are issued as part of a single series which will comprise one or more tranches (each a “tranche”) of notes. Each tranche is the subject of a pricing supplement which supplements, amends and/or replaces the terms described in this prospectus supplement and the accompanying prospectus.

We may from time to time, without the consent of existing holders, create and issue notes having the same terms and conditions in all respects as any other outstanding notes offered pursuant to a pricing supplement, except for the issue date and, if applicable, the issue price and the first payment of interest thereon. Additional notes issued in this manner will be consolidated with, and will form a single series with, any such other outstanding notes. Any additional notes issued in this manner shall be issued under a separate CUSIP or ISIN number unless the additional notes are issued pursuant to a “qualified reopening” of the original tranche, are otherwise treated as part of the same “issue” of debt instruments as the original tranche or are issued with no more than a de minimis amount of original discount, in each case for U.S. federal income tax purposes.

|

| Listing: | We have not applied to list the notes on any securities exchange. However, we may apply to list any particular issue of notes on a securities exchange, as provided in the applicable pricing supplement. We are under no obligation to list any issued notes and may in fact not list any. |

| Stabilization: | In connection with issues of notes, a stabilizing manager or any person acting for the stabilizing manager may over-allot or effect transactions with a view to supporting the market price of the notes at a level higher than that which might otherwise prevail for a limited period after the issue date. However, there may be no obligation of the stabilizing manager or any agent of the stabilizing manager to do this. Stabilization may begin on or after the date on which adequate public disclosure of the terms of the offer of the notes under the issue is made. Any such stabilizing, if commenced, may be discontinued at any time, and must be brought to an end after a limited period, in any case no later than the earlier of 30 days after the issue date of the notes and 60 days after the date of the allotment of the issue of notes. Such stabilizing or over-allotment shall be conducted in compliance with all applicable laws, regulations and rules. |

| Governing Law: | The notes will be governed by, and construed in accordance with, New York law, except that provisions that govern the ranking of the notes, that exclude (or otherwise govern) rights of set-off and matters relating to the authorization and execution of the notes by us will be governed by the law of Sweden. Furthermore, if the notes are at any time secured by property or assets in Sweden, matters relating to the enforcement of such security will be governed by the law of Sweden. See “Description of the Notes—Agreement with Respect to the Exercise of Bail-in Power.” |

| Purchase Currency: | You must pay for notes by wire transfer in the specified currency. You may ask an agent to arrange for, at its discretion, the conversion of U.S. dollars or another currency into the specified currency to enable you to pay for the notes. You must make this request on or before the fifth business day preceding the issue date, or by a later date if the agent allows. The agent will set the terms for each conversion and you will be responsible for all currency exchange costs. |

S-4

| Consent to Bail-in Power: | By investing in the notes, you acknowledge, agree to be bound by, and consent to the exercise of any Bail-in Power (as defined under “Description of the Notes—Agreement with Respect to the Exercise of Bail-in Power”) by the Swedish National Debt Office (the “Debt Office”), the Swedish resolution authority. All payments are subject to the exercise of any Bail-in Power by the relevant Swedish resolution authority.

Under the Resolution Act (as defined under “Description of the Notes—Recovery and Resolution Matters”), the Debt Office may exercise a Bail-in Power under certain conditions which include that authority determining that: (i) a relevant entity (such as SEK) is failing or is likely to fail; (ii) it is not reasonably likely that any action will be taken to avoid the entity’s failure (other than pursuant to the other stabilization powers under the Resolution Act); (iii) the exercise of the stabilization powers are necessary, taking into account certain public interest considerations such as the stability of the Swedish financial system, public confidence in the Swedish banking and resolution systems and the protection of depositors (also regulated by the Swedish Financial Supervisory Authority (the “SFSA”)); and (iv) the objectives of the resolution measures would not be met to the same extent by the winding up of the entity. Notwithstanding these conditions, there remains uncertainty regarding how the Debt Office would assess these conditions in deciding whether to exercise any Bail-in Power.

The Bail-in Power includes any statutory write-down and conversion power, which allows for the cancellation of all, or a portion, of any amounts payable on the notes, including any repayment of principal and/or the conversion of all, or a portion, of any amounts payable on the notes, including principal, into shares or other securities or other obligations of ours or another person, including by means of a variation to the terms of the notes. Accordingly, if any Bail-in Power is exercised, you may lose all or a part of the value of your investment in the notes or receive a different security, which may be worth significantly less than the notes and which may have significantly fewer protections than those typically afforded to debt securities. Moreover, the Debt Office may exercise its authority to implement the Bail-in Power without providing any advance notice to the holders of the notes. By your acquisition of the notes, you acknowledge, agree to be bound by, and consent to the exercise of any Bail-in Power by the relevant resolution authority. The exercise of any Bail-in Power with respect to the notes will not be a default or an Event of Default (as each term is defined in the indenture relating to the notes). The trustee will not be liable for any action that the trustee takes, or abstains from taking, in accordance with the exercise of the Bail-in Power with respect to the notes. Your rights as a holder of the notes are subject to, and will be varied, if necessary, so as to give effect to the exercise of any Bail-in Power by the Debt Office.

This is only a summary. For more information, see “Description of the Notes—Recovery and Resolution Matters” and “Description of the Notes—Agreement with Respect to the Exercise of Bail-in Power,” beginning on pages S-43 and S-44, respectively.

|

| Certain Risk Factors: | For information about risks you should consider before investing in the notes, see “Risks Associated with the Notes” beginning on page “S-6”. |

S-5

RISKS ASSOCIATED WITH THE NOTES

RISKS ASSOCIATED WITH THE NOTES

Your investment in the notes will involve certain risks. You should consider carefully the following risk factors together with the risk information contained in the prospectus supplement, the applicable product supplement, if any, the applicable index supplement, if any, the relevant pricing supplement and our most recent annual report on Form 20-F before you decide that an investment in the notes is suitable for you.

Regulatory action in the event we are failing or likely to fail could materially adversely affect the value of the notes.

The BRRD (as defined under “Description of the Notes—Recovery and Resolution Matters”), also known as the European Bank Recovery and Resolution Directive (as amended, supplemented or replaced from time to time), provides an EU-wide framework for the recovery and resolution of credit institutions and investment firms, their subsidiaries and certain holding companies. In Sweden, the requirements of the BRRD are implemented into national law, inter alia, by the Resolution Act 2016 (as amended, the “Resolution Act”). The Resolution Act confers substantial powers on the Debt Office and the SFSA to enable it to take a range of actions in relation to Swedish financial institutions that are considered to be at risk of failing. The resolution powers are designed to be triggered prior to insolvency of an issuer.