all-20220330POS AMFALSEEverlake Life Insurance Company0000352736Non-accelerated FilerFALSEFALSEPOS AMEverlake Life Insurance Company0000352736Non-accelerated FilerFALSEFALSEFALSE00003527362021-01-012021-12-31iso4217:USD00003527362020-01-012020-12-3100003527362019-01-012019-12-3100003527362021-12-3100003527362020-12-310000352736all:NonAffiliatesMember2021-12-310000352736all:NonAffiliatesMember2020-12-310000352736srt:AffiliatedEntityMember2021-12-310000352736srt:AffiliatedEntityMember2020-12-310000352736us-gaap:SeriesAPreferredStockMember2020-12-31iso4217:USDxbrli:shares0000352736us-gaap:SeriesAPreferredStockMember2021-12-31xbrli:shares0000352736us-gaap:SeriesBPreferredStockMember2020-12-310000352736us-gaap:SeriesBPreferredStockMember2021-12-310000352736us-gaap:CommonStockMember2021-12-310000352736us-gaap:CommonStockMember2020-12-310000352736us-gaap:CommonStockMember2019-12-310000352736us-gaap:AdditionalPaidInCapitalMember2020-12-310000352736us-gaap:AdditionalPaidInCapitalMember2019-12-310000352736us-gaap:AdditionalPaidInCapitalMember2018-12-310000352736us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000352736us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310000352736us-gaap:AdditionalPaidInCapitalMember2021-12-310000352736us-gaap:RetainedEarningsMember2020-12-310000352736us-gaap:RetainedEarningsMember2019-12-310000352736us-gaap:RetainedEarningsMember2018-12-310000352736us-gaap:RetainedEarningsMember2021-01-012021-12-310000352736us-gaap:RetainedEarningsMember2020-01-012020-12-310000352736us-gaap:RetainedEarningsMember2019-01-012019-12-310000352736us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310000352736us-gaap:RetainedEarningsMember2021-12-310000352736us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000352736us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310000352736us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310000352736us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310000352736us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310000352736us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310000352736us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-3100003527362019-12-3100003527362018-12-310000352736all:TraditionalLifeInsuranceMember2021-01-012021-12-310000352736all:TraditionalLifeInsuranceMember2020-01-012020-12-310000352736all:TraditionalLifeInsuranceMember2019-01-012019-12-310000352736us-gaap:AccidentAndHealthInsuranceSegmentMember2021-01-012021-12-310000352736us-gaap:AccidentAndHealthInsuranceSegmentMember2020-01-012020-12-310000352736us-gaap:AccidentAndHealthInsuranceSegmentMember2019-01-012019-12-310000352736all:InterestSensitiveLifeInsuranceMember2021-01-012021-12-310000352736all:InterestSensitiveLifeInsuranceMember2020-01-012020-12-310000352736all:InterestSensitiveLifeInsuranceMember2019-01-012019-12-310000352736all:FixedAnnuitiesMember2021-01-012021-12-310000352736all:FixedAnnuitiesMember2020-01-012020-12-310000352736all:FixedAnnuitiesMember2019-01-012019-12-31all:statexbrli:pure0000352736all:PrivateEquityOrDebtFundsAndRealEstateFundsAndTaxCreditFundsMember2021-01-012021-12-310000352736srt:MaximumMember2021-01-012021-12-310000352736srt:MinimumMember2021-01-012021-12-310000352736srt:MinimumMemberall:InterestSensitiveLifeInsuranceMember2021-01-012021-12-310000352736srt:MaximumMemberall:InterestSensitiveLifeInsuranceMember2021-01-012021-12-310000352736srt:MinimumMemberall:FixedAnnuitiesMember2021-01-012021-12-310000352736all:FixedAnnuitiesMembersrt:MaximumMember2021-01-012021-12-310000352736all:AmericanHeritageLifeInsuranceCompanyMember2021-12-310000352736us-gaap:FixedIncomeSecuritiesMember2021-12-310000352736us-gaap:FixedIncomeSecuritiesMember2020-12-310000352736us-gaap:MortgagesMember2021-12-310000352736us-gaap:MortgagesMember2020-12-310000352736all:DirectlyOriginatedCorporateLoansMember2021-12-310000352736all:DirectlyOriginatedCorporateLoansMember2020-12-310000352736all:AviationLoansMember2021-12-310000352736all:AviationLoansMember2020-12-310000352736all:BankLoansMember2021-12-310000352736all:BankLoansMember2020-12-310000352736all:AgentLoansMember2021-12-310000352736all:AgentLoansMember2020-12-310000352736all:AllstateLifeInsuranceCompanyOfNewYorkMemberall:AllstateInsuranceHoldingsLLCMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberus-gaap:CommonStockMemberall:AllstateLifeInsuranceCompanyOfNewYorkMember2021-09-302021-09-300000352736us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberall:AllstateLifeInsuranceCompanyOfNewYorkAndIntramericaLifeInsuranceCompanyMemberall:WiltonReassuranceCompanyMemberall:AllstateLifeInsuranceCompanyOfNewYorkMember2021-09-302021-09-300000352736us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberall:AllstateLifeInsuranceCompanyOfNewYorkAndIntramericaLifeInsuranceCompanyMemberall:WiltonReassuranceCompanyMemberall:AllstateLifeInsuranceCompanyOfNewYorkMember2021-09-300000352736us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberall:AllstateLifeInsuranceCompanyOfNewYorkMember2021-09-302021-09-300000352736us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberall:AllstateLifeInsuranceCompanyOfNewYorkMember2021-01-012021-12-310000352736us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberall:AllstateLifeInsuranceCompanyOfNewYorkMember2021-01-012021-09-300000352736us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberall:AllstateLifeInsuranceCompanyOfNewYorkMember2020-01-012020-12-310000352736us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberall:AllstateLifeInsuranceCompanyOfNewYorkMember2019-01-012019-12-310000352736us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberall:AllstateLifeInsuranceCompanyOfNewYorkMember2021-10-010000352736us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberall:AllstateLifeInsuranceCompanyOfNewYorkMember2020-12-310000352736all:AllstateFinancialServicesLLCMember2021-04-012021-04-010000352736all:AllstateFinancialServicesLLCMember2021-05-012021-05-0100003527362021-11-012021-11-010000352736us-gaap:CollateralizedLoanObligationsMember2016-12-220000352736us-gaap:CollateralizedLoanObligationsMember2019-12-160000352736all:NotesDueMarch102037Membersrt:AffiliatedEntityMemberus-gaap:CollateralizedLoanObligationsMemberall:AllstateNewJerseyInsuranceCompanyMemberall:ClassANotesMember2021-12-310000352736all:AmericanHeritageLifeInsuranceCompanyMemberall:NotesDueMarch102037Membersrt:AffiliatedEntityMemberus-gaap:CollateralizedLoanObligationsMemberall:ClassANotesMember2021-12-310000352736all:NotesDueMarch102037Memberall:FirstColonialInsuranceCompanyMembersrt:AffiliatedEntityMemberus-gaap:CollateralizedLoanObligationsMemberall:ClassANotesMember2021-12-310000352736all:NotesDueMarch102037Membersrt:AffiliatedEntityMemberus-gaap:CollateralizedLoanObligationsMemberall:ClassANotesMemberall:AllstateFireCasualtyInsuranceCompanyMember2021-12-310000352736all:NotesDueMarch102037Membersrt:AffiliatedEntityMemberus-gaap:CollateralizedLoanObligationsMemberall:ClassANotesMemberall:AllstatePropertyandCasualtyInsuranceCompanyMember2021-12-310000352736all:NotesDueMarch102037Membersrt:AffiliatedEntityMemberus-gaap:CollateralizedLoanObligationsMemberall:AllstateIndemnityCompanyMemberall:ClassANotesMember2021-12-310000352736all:EsuranceInsuranceCompanyMemberall:NotesDueMarch102037Membersrt:AffiliatedEntityMemberus-gaap:CollateralizedLoanObligationsMemberall:ClassANotesMember2021-12-310000352736all:NotesDueMarch102037Memberall:NorthLightSpecialtyInsuranceCompanyMembersrt:AffiliatedEntityMemberus-gaap:CollateralizedLoanObligationsMemberall:ClassANotesMember2021-12-310000352736all:NotesDueMarch102037Memberall:AllstateVehicleandPropertyInsuranceCompanyMembersrt:AffiliatedEntityMemberus-gaap:CollateralizedLoanObligationsMemberall:ClassANotesMember2021-12-310000352736all:NotesDueMarch102037Membersrt:AffiliatedEntityMemberus-gaap:CollateralizedLoanObligationsMemberall:AllstateNewJerseyPropertyandCasualtyInsuranceCompanyMemberall:ClassANotesMember2021-12-310000352736all:NotesDueMarch102037Memberall:EsurancePropertyandCasualtyInsuranceCompanyMembersrt:AffiliatedEntityMemberus-gaap:CollateralizedLoanObligationsMemberall:ClassANotesMember2021-12-310000352736all:NotesDueMarch102037Membersrt:AffiliatedEntityMemberus-gaap:CollateralizedLoanObligationsMemberall:ClassANotesMember2021-12-310000352736srt:AffiliatedEntityMemberall:EverlakeLifeInsuranceCompanyMemberus-gaap:CollateralizedLoanObligationsMemberall:ClassBDeferrableNotesMember2021-12-310000352736all:ClassCDeferrableNotesMembersrt:AffiliatedEntityMemberall:EverlakeLifeInsuranceCompanyMemberus-gaap:CollateralizedLoanObligationsMember2021-12-310000352736all:SubordinatedNotesMembersrt:AffiliatedEntityMemberall:EverlakeLifeInsuranceCompanyMemberus-gaap:CollateralizedLoanObligationsMember2021-12-310000352736srt:AffiliatedEntityMemberus-gaap:CollateralizedLoanObligationsMember2021-12-310000352736all:NotesDueMarch102037Membersrt:AffiliatedEntityMemberus-gaap:CollateralizedLoanObligationsMember2021-12-310000352736all:NotesDueMarch102037Membersrt:AffiliatedEntityMemberus-gaap:CollateralizedLoanObligationsMember2020-12-310000352736all:AllstateFinanceCompanyAgencyLoansLLCMemberus-gaap:BeneficialOwnerMember2021-12-310000352736us-gaap:RetainedEarningsMember2021-11-012021-11-010000352736all:AllstateAssuranceCompanyMember2020-12-010000352736all:AllstateAssuranceCompanyMember2020-12-012020-12-010000352736srt:AffiliatedEntityMember2021-01-012021-12-310000352736srt:AffiliatedEntityMember2020-01-012020-12-310000352736srt:AffiliatedEntityMember2019-01-012019-12-310000352736srt:ParentCompanyMemberall:StructuredSettlementAnnuitiesMember2021-12-310000352736srt:ParentCompanyMemberall:StructuredSettlementAnnuitiesMember2020-12-310000352736all:AllstateAssuranceCompanyMemberus-gaap:SubsidiaryOfCommonParentMember2016-12-022016-12-020000352736all:AllstateAssuranceCompanyMemberus-gaap:SubsidiaryOfCommonParentMember2016-12-020000352736all:AllstateAssuranceCompanyMemberus-gaap:SubsidiaryOfCommonParentMember2020-01-012020-12-310000352736all:AllstateAssuranceCompanyMemberus-gaap:SubsidiaryOfCommonParentMember2019-01-012019-12-310000352736srt:MaximumMemberall:LiquidityAgreementMember2021-01-012021-12-310000352736all:LiquidityAgreementMember2020-12-310000352736all:LiquidityAgreementMember2021-12-310000352736all:IntercompanyLoanAgreementMembersrt:MaximumMember2021-01-012021-12-310000352736all:IntercompanyLoanAgreementMember2020-12-310000352736all:IntercompanyLoanAgreementMember2021-12-310000352736all:RevolvingLoanCreditAgreementMember2020-12-310000352736all:RevolvingLoanCreditAgreementMember2021-12-310000352736srt:MinimumMemberus-gaap:CapitalSupportAgreementMember2021-01-012021-12-310000352736srt:MaximumMemberus-gaap:CapitalSupportAgreementMember2021-01-012021-12-310000352736us-gaap:CapitalSupportAgreementMember2021-01-012021-12-310000352736us-gaap:CapitalSupportAgreementMember2021-12-310000352736us-gaap:CapitalSupportAgreementMember2020-12-310000352736all:ALICReinsuranceCompanyMemberus-gaap:HybridInstrumentMemberus-gaap:SubsidiaryOfCommonParentMember2021-12-310000352736all:AllstateFinancialServicesLLCMember2021-04-012021-06-300000352736all:AllstateFinancialServicesLLCMember2021-06-302021-06-300000352736all:AllstateFinancialServicesLLCMember2021-11-012021-11-010000352736all:AllstateFinancialServicesLLCMember2020-01-012020-12-310000352736all:AllstateFinancialServicesLLCMember2019-01-012019-12-310000352736srt:AffiliatedEntityMemberall:EverlakeServicesCompanyMember2021-01-012021-12-310000352736all:EverlakeReinsuranceLimitedERLMember2021-11-010000352736srt:AffiliatedEntityMemberall:EverlakeReinsuranceLimitedERLMember2021-11-010000352736all:BlackstoneISG1AdvisorsLLCMember2021-01-012021-12-310000352736all:BlackstoneTreasuryHoldingsIILLCMember2021-11-082021-11-080000352736all:BlackstoneManagedDirectLendingSecuritizationStructureAzulMember2021-10-012021-12-310000352736all:BlackstoneManagedDirectLendingSecuritizationStructureAzulMember2021-12-310000352736all:BlackstoneManagedAviationLoanSecuritizationStructureMaybayMember2021-12-310000352736all:EverlakeUSHoldingsCompanyMember2021-11-012021-11-010000352736us-gaap:USTreasuryAndGovernmentMember2021-12-310000352736us-gaap:USStatesAndPoliticalSubdivisionsMember2021-12-310000352736us-gaap:CorporateDebtSecuritiesMember2021-12-310000352736us-gaap:ForeignGovernmentDebtSecuritiesMember2021-12-310000352736us-gaap:AssetBackedSecuritiesMember2021-12-310000352736us-gaap:MortgageBackedSecuritiesMember2021-12-310000352736us-gaap:USTreasuryAndGovernmentMember2020-12-310000352736us-gaap:USStatesAndPoliticalSubdivisionsMember2020-12-310000352736us-gaap:CorporateDebtSecuritiesMember2020-12-310000352736us-gaap:ForeignGovernmentDebtSecuritiesMember2020-12-310000352736us-gaap:AssetBackedSecuritiesMember2020-12-310000352736us-gaap:MortgageBackedSecuritiesMember2020-12-310000352736us-gaap:FixedIncomeSecuritiesMember2021-01-012021-12-310000352736us-gaap:FixedIncomeSecuritiesMember2020-01-012020-12-310000352736us-gaap:FixedIncomeSecuritiesMember2019-01-012019-12-310000352736us-gaap:MortgagesMember2021-01-012021-12-310000352736us-gaap:MortgagesMember2020-01-012020-12-310000352736us-gaap:MortgagesMember2019-01-012019-12-310000352736us-gaap:EquitySecuritiesMember2021-01-012021-12-310000352736us-gaap:EquitySecuritiesMember2020-01-012020-12-310000352736us-gaap:EquitySecuritiesMember2019-01-012019-12-310000352736srt:PartnershipInterestMember2021-01-012021-12-310000352736srt:PartnershipInterestMember2020-01-012020-12-310000352736srt:PartnershipInterestMember2019-01-012019-12-310000352736us-gaap:ShortTermInvestmentsMember2021-01-012021-12-310000352736us-gaap:ShortTermInvestmentsMember2020-01-012020-12-310000352736us-gaap:ShortTermInvestmentsMember2019-01-012019-12-310000352736us-gaap:PolicyLoansMember2021-01-012021-12-310000352736us-gaap:PolicyLoansMember2020-01-012020-12-310000352736us-gaap:PolicyLoansMember2019-01-012019-12-310000352736us-gaap:OtherThanSecuritiesInvestmentMember2021-01-012021-12-310000352736us-gaap:OtherThanSecuritiesInvestmentMember2020-01-012020-12-310000352736us-gaap:OtherThanSecuritiesInvestmentMember2019-01-012019-12-310000352736all:DirectlyOriginatedCorporateLoansMember2021-01-012021-12-310000352736all:DirectlyOriginatedCorporateLoansMember2020-01-012020-12-310000352736all:DirectlyOriginatedCorporateLoansMember2019-01-012019-12-310000352736all:AviationLoansMember2021-01-012021-12-310000352736all:AviationLoansMember2020-01-012020-12-310000352736all:AviationLoansMember2019-01-012019-12-310000352736us-gaap:DerivativeMember2021-01-012021-12-310000352736us-gaap:DerivativeMember2020-01-012020-12-310000352736us-gaap:DerivativeMember2019-01-012019-12-310000352736us-gaap:CorporateDebtSecuritiesMember2021-01-012021-12-310000352736us-gaap:CorporateDebtSecuritiesMember2020-01-012020-12-310000352736us-gaap:CorporateDebtSecuritiesMember2019-01-012019-12-310000352736us-gaap:AssetBackedSecuritiesMember2021-01-012021-12-310000352736us-gaap:AssetBackedSecuritiesMember2020-01-012020-12-310000352736us-gaap:AssetBackedSecuritiesMember2019-01-012019-12-310000352736us-gaap:MortgageBackedSecuritiesMember2021-01-012021-12-310000352736us-gaap:MortgageBackedSecuritiesMember2020-01-012020-12-310000352736us-gaap:MortgageBackedSecuritiesMember2019-01-012019-12-310000352736all:MortgageLoansMember2021-01-012021-12-310000352736all:MortgageLoansMember2020-01-012020-12-310000352736all:MortgageLoansMember2019-01-012019-12-310000352736all:BankLoansMember2021-01-012021-12-310000352736all:BankLoansMember2020-01-012020-12-310000352736all:BankLoansMember2019-01-012019-12-310000352736all:AgentLoansMember2021-01-012021-12-310000352736all:AgentLoansMember2020-01-012020-12-310000352736all:AgentLoansMember2019-01-012019-12-310000352736us-gaap:EquityMethodInvestmentsMember2021-01-012021-12-310000352736us-gaap:EquityMethodInvestmentsMember2020-01-012020-12-310000352736us-gaap:EquityMethodInvestmentsMember2019-01-012019-12-310000352736all:CommercialMortgageMember2021-12-310000352736all:CommercialMortgageMember2020-12-310000352736us-gaap:ResidentialMortgageMember2021-12-310000352736stpr:TX2021-12-310000352736stpr:TX2020-12-310000352736stpr:CA2021-12-310000352736stpr:CA2020-12-310000352736stpr:FL2021-12-310000352736stpr:FL2020-12-310000352736stpr:NC2021-12-310000352736stpr:NC2020-12-310000352736stpr:IL2021-12-310000352736stpr:IL2020-12-310000352736srt:ApartmentBuildingMember2021-12-310000352736srt:ApartmentBuildingMember2020-12-310000352736srt:OfficeBuildingMember2021-12-310000352736srt:OfficeBuildingMember2020-12-310000352736srt:SingleFamilyMember2021-12-310000352736srt:SingleFamilyMember2020-12-310000352736srt:RetailSiteMember2021-12-310000352736srt:RetailSiteMember2020-12-310000352736srt:WarehouseMember2021-12-310000352736srt:WarehouseMember2020-12-310000352736srt:OtherPropertyMember2021-12-310000352736srt:OtherPropertyMember2020-12-310000352736us-gaap:MortgagesMemberall:MortgageLoansOnRealEstateMaturingInYearOneMember2021-12-31all:loan0000352736us-gaap:MortgagesMemberall:MortgageLoansOnRealEstateMaturingInYearTwoMember2021-12-310000352736us-gaap:MortgagesMemberall:MortgageLoansOnRealEstateMaturingInYearThreeMember2021-12-310000352736us-gaap:MortgagesMemberall:MortgageLoansOnRealEstateMaturingInYearFourMember2021-12-310000352736us-gaap:MortgagesMemberall:MortgageLoansOnRealEstateMaturingAfterYearFourMember2021-12-310000352736all:PrivateEquityMemberus-gaap:EquityMethodInvestmentsMember2021-12-310000352736srt:PartnershipInterestMemberall:PrivateEquityMember2021-12-310000352736all:PrivateEquityMember2021-12-310000352736all:PrivateEquityMemberus-gaap:EquityMethodInvestmentsMember2020-12-310000352736srt:PartnershipInterestMemberall:PrivateEquityMember2020-12-310000352736all:PrivateEquityMember2020-12-310000352736us-gaap:RealEstateLoanMemberus-gaap:EquityMethodInvestmentsMember2021-12-310000352736srt:PartnershipInterestMemberus-gaap:RealEstateLoanMember2021-12-310000352736us-gaap:RealEstateLoanMember2021-12-310000352736us-gaap:RealEstateLoanMemberus-gaap:EquityMethodInvestmentsMember2020-12-310000352736srt:PartnershipInterestMemberus-gaap:RealEstateLoanMember2020-12-310000352736us-gaap:RealEstateLoanMember2020-12-310000352736us-gaap:OtherInvestmentsMemberus-gaap:EquityMethodInvestmentsMember2021-12-310000352736us-gaap:OtherInvestmentsMembersrt:PartnershipInterestMember2021-12-310000352736us-gaap:OtherInvestmentsMember2021-12-310000352736us-gaap:OtherInvestmentsMemberus-gaap:EquityMethodInvestmentsMember2020-12-310000352736us-gaap:OtherInvestmentsMembersrt:PartnershipInterestMember2020-12-310000352736us-gaap:OtherInvestmentsMember2020-12-310000352736us-gaap:EquityMethodInvestmentsMember2021-12-310000352736srt:PartnershipInterestMember2021-12-310000352736us-gaap:EquityMethodInvestmentsMember2020-12-310000352736srt:PartnershipInterestMember2020-12-310000352736stpr:OR2021-12-310000352736stpr:OR2020-12-310000352736stpr:NJ2021-12-310000352736stpr:NJ2020-12-310000352736stpr:NY2021-12-310000352736stpr:NY2020-12-310000352736stpr:HI2021-12-310000352736stpr:HI2020-12-310000352736stpr:AZ2021-12-310000352736stpr:AZ2020-12-310000352736all:DirectlyOriginatedCorporateLoansMember2021-12-310000352736all:DirectlyOriginatedCorporateLoansMember2020-12-310000352736all:AviationLoansMember2021-12-310000352736all:AviationLoansMember2020-12-310000352736all:AgentLoansMember2021-12-310000352736all:AgentLoansMember2020-12-310000352736all:BankLoansMember2021-12-310000352736all:BankLoansMember2020-12-310000352736all:DerivativesAndOtherMember2021-12-310000352736all:DerivativesAndOtherMember2020-12-310000352736us-gaap:FixedIncomeSecuritiesMember2019-12-31all:security0000352736all:InvestmentGradeFixedIncomeSecuritiesMember2021-12-310000352736all:BelowInvestmentGradeFixedIncomeSecuritiesMember2021-12-310000352736all:InvestmentGradeFixedIncomeSecuritiesMember2020-12-310000352736all:BelowInvestmentGradeFixedIncomeSecuritiesMember2020-12-310000352736us-gaap:MortgagesMemberall:Acquisition2015AndPriorMemberall:DebtServiceCoverageRatioBelow1Member2021-12-310000352736us-gaap:MortgagesMemberall:Acquisition2016Memberall:DebtServiceCoverageRatioBelow1Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioBelow1Memberall:Acquisition2017Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioBelow1Memberall:Acquisition2018Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioBelow1Memberall:Acquisition2019Member2021-12-310000352736all:AcquisitionCurrentMemberus-gaap:MortgagesMemberall:DebtServiceCoverageRatioBelow1Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioBelow1Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioBelow1Member2020-12-310000352736us-gaap:MortgagesMemberall:Acquisition2015AndPriorMemberall:DebtServiceCoverageRatioBelow1To1.25Member2021-12-310000352736us-gaap:MortgagesMemberall:Acquisition2016Memberall:DebtServiceCoverageRatioBelow1To1.25Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioBelow1To1.25Memberall:Acquisition2017Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioBelow1To1.25Memberall:Acquisition2018Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioBelow1To1.25Memberall:Acquisition2019Member2021-12-310000352736all:AcquisitionCurrentMemberus-gaap:MortgagesMemberall:DebtServiceCoverageRatioBelow1To1.25Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioBelow1To1.25Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioBelow1To1.25Member2020-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioBelow1.26To1.5Memberall:Acquisition2015AndPriorMember2021-12-310000352736us-gaap:MortgagesMemberall:Acquisition2016Memberall:DebtServiceCoverageRatioBelow1.26To1.5Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioBelow1.26To1.5Memberall:Acquisition2017Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioBelow1.26To1.5Memberall:Acquisition2018Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioBelow1.26To1.5Memberall:Acquisition2019Member2021-12-310000352736all:AcquisitionCurrentMemberus-gaap:MortgagesMemberall:DebtServiceCoverageRatioBelow1.26To1.5Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioBelow1.26To1.5Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioBelow1.26To1.5Member2020-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioabove1.5Memberall:Acquisition2015AndPriorMember2021-12-310000352736us-gaap:MortgagesMemberall:Acquisition2016Memberall:DebtServiceCoverageRatioabove1.5Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioabove1.5Memberall:Acquisition2017Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioabove1.5Memberall:Acquisition2018Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioabove1.5Memberall:Acquisition2019Member2021-12-310000352736all:AcquisitionCurrentMemberus-gaap:MortgagesMemberall:DebtServiceCoverageRatioabove1.5Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioabove1.5Member2021-12-310000352736us-gaap:MortgagesMemberall:DebtServiceCoverageRatioabove1.5Member2020-12-310000352736us-gaap:MortgagesMemberall:Acquisition2015AndPriorMember2021-12-310000352736all:Acquisition2016Memberus-gaap:MortgagesMember2021-12-310000352736us-gaap:MortgagesMemberall:Acquisition2017Member2021-12-310000352736us-gaap:MortgagesMemberall:Acquisition2018Member2021-12-310000352736us-gaap:MortgagesMemberall:Acquisition2019Member2021-12-310000352736all:AcquisitionCurrentMemberus-gaap:MortgagesMember2021-12-310000352736us-gaap:MortgagesMember2021-12-310000352736us-gaap:MortgagesMember2020-12-310000352736us-gaap:MortgagesMember2020-10-012020-12-3100003527362020-10-012020-12-310000352736us-gaap:MortgagesMember2019-12-310000352736us-gaap:AccountingStandardsUpdate201613Memberus-gaap:MortgagesMemberus-gaap:MortgagesMember2020-12-310000352736us-gaap:AccountingStandardsUpdate201613Memberus-gaap:MortgagesMemberus-gaap:MortgagesMember2019-12-310000352736all:DirectlyOriginatedCorporateLoansMembersrt:WeightedAverageMember2021-12-310000352736all:AviationLoansMembersrt:WeightedAverageMember2021-12-310000352736srt:StandardPoorsBBBRatingMemberall:BankLoansMemberall:Acquisition2015AndPriorMember2021-12-310000352736srt:StandardPoorsBBBRatingMemberall:BankLoansMemberall:Acquisition2016Member2021-12-310000352736all:Acquisition2017Membersrt:StandardPoorsBBBRatingMemberall:BankLoansMember2021-12-310000352736all:Acquisition2018Membersrt:StandardPoorsBBBRatingMemberall:BankLoansMember2021-12-310000352736all:Acquisition2019Membersrt:StandardPoorsBBBRatingMemberall:BankLoansMember2021-12-310000352736all:AcquisitionCurrentMembersrt:StandardPoorsBBBRatingMemberall:BankLoansMember2021-12-310000352736srt:StandardPoorsBBBRatingMemberall:BankLoansMember2021-12-310000352736srt:StandardPoorsBBRatingMemberall:BankLoansMemberall:Acquisition2015AndPriorMember2021-12-310000352736srt:StandardPoorsBBRatingMemberall:BankLoansMemberall:Acquisition2016Member2021-12-310000352736srt:StandardPoorsBBRatingMemberall:Acquisition2017Memberall:BankLoansMember2021-12-310000352736srt:StandardPoorsBBRatingMemberall:Acquisition2018Memberall:BankLoansMember2021-12-310000352736srt:StandardPoorsBBRatingMemberall:Acquisition2019Memberall:BankLoansMember2021-12-310000352736all:AcquisitionCurrentMembersrt:StandardPoorsBBRatingMemberall:BankLoansMember2021-12-310000352736srt:StandardPoorsBBRatingMemberall:BankLoansMember2021-12-310000352736srt:StandardPoorsBRatingMemberall:BankLoansMemberall:Acquisition2015AndPriorMember2021-12-310000352736srt:StandardPoorsBRatingMemberall:BankLoansMemberall:Acquisition2016Member2021-12-310000352736srt:StandardPoorsBRatingMemberall:Acquisition2017Memberall:BankLoansMember2021-12-310000352736srt:StandardPoorsBRatingMemberall:Acquisition2018Memberall:BankLoansMember2021-12-310000352736srt:StandardPoorsBRatingMemberall:Acquisition2019Memberall:BankLoansMember2021-12-310000352736all:AcquisitionCurrentMembersrt:StandardPoorsBRatingMemberall:BankLoansMember2021-12-310000352736srt:StandardPoorsBRatingMemberall:BankLoansMember2021-12-310000352736all:StandardPoorsCCCRatingAndBelowMemberall:BankLoansMemberall:Acquisition2015AndPriorMember2021-12-310000352736all:StandardPoorsCCCRatingAndBelowMemberall:BankLoansMemberall:Acquisition2016Member2021-12-310000352736all:Acquisition2017Memberall:StandardPoorsCCCRatingAndBelowMemberall:BankLoansMember2021-12-310000352736all:Acquisition2018Memberall:StandardPoorsCCCRatingAndBelowMemberall:BankLoansMember2021-12-310000352736all:Acquisition2019Memberall:StandardPoorsCCCRatingAndBelowMemberall:BankLoansMember2021-12-310000352736all:AcquisitionCurrentMemberall:StandardPoorsCCCRatingAndBelowMemberall:BankLoansMember2021-12-310000352736all:StandardPoorsCCCRatingAndBelowMemberall:BankLoansMember2021-12-310000352736all:Acquisition2015AndPriorMemberall:BankLoansMember2021-12-310000352736all:BankLoansMemberall:Acquisition2016Member2021-12-310000352736all:Acquisition2017Memberall:BankLoansMember2021-12-310000352736all:Acquisition2018Memberall:BankLoansMember2021-12-310000352736all:Acquisition2019Memberall:BankLoansMember2021-12-310000352736all:AcquisitionCurrentMemberall:BankLoansMember2021-12-310000352736srt:StandardPoorsBBBRatingMemberall:BankLoansMemberall:Acquisition2015AndPriorMember2020-12-310000352736srt:StandardPoorsBBBRatingMemberall:BankLoansMemberall:Acquisition2016Member2020-12-310000352736all:Acquisition2017Membersrt:StandardPoorsBBBRatingMemberall:BankLoansMember2020-12-310000352736all:Acquisition2018Membersrt:StandardPoorsBBBRatingMemberall:BankLoansMember2020-12-310000352736all:Acquisition2019Membersrt:StandardPoorsBBBRatingMemberall:BankLoansMember2020-12-310000352736all:AcquisitionCurrentMembersrt:StandardPoorsBBBRatingMemberall:BankLoansMember2020-12-310000352736srt:StandardPoorsBBBRatingMemberall:BankLoansMember2020-12-310000352736srt:StandardPoorsBBRatingMemberall:BankLoansMemberall:Acquisition2015AndPriorMember2020-12-310000352736srt:StandardPoorsBBRatingMemberall:BankLoansMemberall:Acquisition2016Member2020-12-310000352736srt:StandardPoorsBBRatingMemberall:Acquisition2017Memberall:BankLoansMember2020-12-310000352736srt:StandardPoorsBBRatingMemberall:Acquisition2018Memberall:BankLoansMember2020-12-310000352736srt:StandardPoorsBBRatingMemberall:Acquisition2019Memberall:BankLoansMember2020-12-310000352736all:AcquisitionCurrentMembersrt:StandardPoorsBBRatingMemberall:BankLoansMember2020-12-310000352736srt:StandardPoorsBBRatingMemberall:BankLoansMember2020-12-310000352736srt:StandardPoorsBRatingMemberall:BankLoansMemberall:Acquisition2015AndPriorMember2020-12-310000352736srt:StandardPoorsBRatingMemberall:BankLoansMemberall:Acquisition2016Member2020-12-310000352736srt:StandardPoorsBRatingMemberall:Acquisition2017Memberall:BankLoansMember2020-12-310000352736srt:StandardPoorsBRatingMemberall:Acquisition2018Memberall:BankLoansMember2020-12-310000352736srt:StandardPoorsBRatingMemberall:Acquisition2019Memberall:BankLoansMember2020-12-310000352736all:AcquisitionCurrentMembersrt:StandardPoorsBRatingMemberall:BankLoansMember2020-12-310000352736srt:StandardPoorsBRatingMemberall:BankLoansMember2020-12-310000352736all:StandardPoorsCCCRatingAndBelowMemberall:BankLoansMemberall:Acquisition2015AndPriorMember2020-12-310000352736all:StandardPoorsCCCRatingAndBelowMemberall:BankLoansMemberall:Acquisition2016Member2020-12-310000352736all:Acquisition2017Memberall:StandardPoorsCCCRatingAndBelowMemberall:BankLoansMember2020-12-310000352736all:Acquisition2018Memberall:StandardPoorsCCCRatingAndBelowMemberall:BankLoansMember2020-12-310000352736all:Acquisition2019Memberall:StandardPoorsCCCRatingAndBelowMemberall:BankLoansMember2020-12-310000352736all:AcquisitionCurrentMemberall:StandardPoorsCCCRatingAndBelowMemberall:BankLoansMember2020-12-310000352736all:StandardPoorsCCCRatingAndBelowMemberall:BankLoansMember2020-12-310000352736all:Acquisition2015AndPriorMemberall:BankLoansMember2020-12-310000352736all:BankLoansMemberall:Acquisition2016Member2020-12-310000352736all:Acquisition2017Memberall:BankLoansMember2020-12-310000352736all:Acquisition2018Memberall:BankLoansMember2020-12-310000352736all:Acquisition2019Memberall:BankLoansMember2020-12-310000352736all:AcquisitionCurrentMemberall:BankLoansMember2020-12-310000352736all:BankLoansMember2019-12-310000352736us-gaap:AccountingStandardsUpdate201613Memberall:BankLoansMember2020-12-310000352736us-gaap:AccountingStandardsUpdate201613Memberall:BankLoansMember2019-12-310000352736all:BankLoansMember2021-01-012021-12-310000352736all:BankLoansMember2020-01-012020-12-310000352736srt:PartnershipInterestMembersrt:MinimumMember2021-01-012021-12-310000352736srt:PartnershipInterestMembersrt:MaximumMember2021-01-012021-12-310000352736us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryAndGovernmentMember2021-12-310000352736us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2021-12-310000352736us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMember2021-12-310000352736us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USTreasuryAndGovernmentMember2021-12-310000352736us-gaap:FairValueInputsLevel1Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2021-12-310000352736us-gaap:FairValueInputsLevel2Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2021-12-310000352736us-gaap:FairValueInputsLevel3Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2021-12-310000352736us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310000352736us-gaap:FairValueInputsLevel1Memberall:CorporateDebtSecuritiesPublicMember2021-12-310000352736us-gaap:FairValueInputsLevel2Memberall:CorporateDebtSecuritiesPublicMember2021-12-310000352736us-gaap:FairValueInputsLevel3Memberall:CorporateDebtSecuritiesPublicMember2021-12-310000352736us-gaap:EstimateOfFairValueFairValueDisclosureMemberall:CorporateDebtSecuritiesPublicMember2021-12-310000352736us-gaap:FairValueInputsLevel1Memberall:CorporateDebtSecuritiesPrivatePlacementMember2021-12-310000352736us-gaap:FairValueInputsLevel2Memberall:CorporateDebtSecuritiesPrivatePlacementMember2021-12-310000352736us-gaap:FairValueInputsLevel3Memberall:CorporateDebtSecuritiesPrivatePlacementMember2021-12-310000352736all:CorporateDebtSecuritiesPrivatePlacementMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310000352736us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2021-12-310000352736us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2021-12-310000352736us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2021-12-310000352736us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2021-12-310000352736us-gaap:FairValueInputsLevel1Memberus-gaap:AssetBackedSecuritiesMember2021-12-310000352736us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2021-12-310000352736us-gaap:FairValueInputsLevel3Memberus-gaap:AssetBackedSecuritiesMember2021-12-310000352736us-gaap:AssetBackedSecuritiesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310000352736us-gaap:FairValueInputsLevel1Memberus-gaap:MortgageBackedSecuritiesMember2021-12-310000352736us-gaap:FairValueInputsLevel2Memberus-gaap:MortgageBackedSecuritiesMember2021-12-310000352736us-gaap:FairValueInputsLevel3Memberus-gaap:MortgageBackedSecuritiesMember2021-12-310000352736us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:MortgageBackedSecuritiesMember2021-12-310000352736us-gaap:FairValueInputsLevel1Member2021-12-310000352736us-gaap:FairValueInputsLevel2Member2021-12-310000352736us-gaap:FairValueInputsLevel3Member2021-12-310000352736us-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310000352736us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2021-12-310000352736us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryAndGovernmentMember2020-12-310000352736us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2020-12-310000352736us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMember2020-12-310000352736us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USTreasuryAndGovernmentMember2020-12-310000352736us-gaap:FairValueInputsLevel1Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2020-12-310000352736us-gaap:FairValueInputsLevel2Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2020-12-310000352736us-gaap:FairValueInputsLevel3Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2020-12-310000352736us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000352736us-gaap:FairValueInputsLevel1Memberall:CorporateDebtSecuritiesPublicMember2020-12-310000352736us-gaap:FairValueInputsLevel2Memberall:CorporateDebtSecuritiesPublicMember2020-12-310000352736us-gaap:FairValueInputsLevel3Memberall:CorporateDebtSecuritiesPublicMember2020-12-310000352736us-gaap:EstimateOfFairValueFairValueDisclosureMemberall:CorporateDebtSecuritiesPublicMember2020-12-310000352736us-gaap:FairValueInputsLevel1Memberall:CorporateDebtSecuritiesPrivatePlacementMember2020-12-310000352736us-gaap:FairValueInputsLevel2Memberall:CorporateDebtSecuritiesPrivatePlacementMember2020-12-310000352736us-gaap:FairValueInputsLevel3Memberall:CorporateDebtSecuritiesPrivatePlacementMember2020-12-310000352736all:CorporateDebtSecuritiesPrivatePlacementMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000352736us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2020-12-310000352736us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2020-12-310000352736us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2020-12-310000352736us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2020-12-310000352736us-gaap:FairValueInputsLevel1Memberus-gaap:AssetBackedSecuritiesMember2020-12-310000352736us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2020-12-310000352736us-gaap:FairValueInputsLevel3Memberus-gaap:AssetBackedSecuritiesMember2020-12-310000352736us-gaap:AssetBackedSecuritiesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000352736us-gaap:FairValueInputsLevel1Memberus-gaap:MortgageBackedSecuritiesMember2020-12-310000352736us-gaap:FairValueInputsLevel2Memberus-gaap:MortgageBackedSecuritiesMember2020-12-310000352736us-gaap:FairValueInputsLevel3Memberus-gaap:MortgageBackedSecuritiesMember2020-12-310000352736us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:MortgageBackedSecuritiesMember2020-12-310000352736us-gaap:FairValueInputsLevel1Member2020-12-310000352736us-gaap:FairValueInputsLevel2Member2020-12-310000352736us-gaap:FairValueInputsLevel3Member2020-12-310000352736us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000352736us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2020-12-310000352736us-gaap:FairValueInputsLevel3Memberall:EmbeddedDerivativeEquityIndexedAndForwardStartingOptionsInLifeAndAnnuityProductContractMember2021-12-310000352736us-gaap:FairValueInputsLevel3Membersrt:MinimumMemberall:EmbeddedDerivativeEquityIndexedAndForwardStartingOptionsInLifeAndAnnuityProductContractMemberus-gaap:MeasurementInputExercisePriceMember2021-12-310000352736us-gaap:FairValueInputsLevel3Memberall:EmbeddedDerivativeEquityIndexedAndForwardStartingOptionsInLifeAndAnnuityProductContractMemberus-gaap:MeasurementInputExercisePriceMembersrt:MaximumMember2021-12-310000352736us-gaap:FairValueInputsLevel3Memberall:EmbeddedDerivativeEquityIndexedAndForwardStartingOptionsInLifeAndAnnuityProductContractMemberus-gaap:MeasurementInputExercisePriceMembersrt:WeightedAverageMember2021-12-310000352736us-gaap:FairValueInputsLevel3Memberall:EmbeddedDerivativeEquityIndexedAndForwardStartingOptionsInLifeAndAnnuityProductContractMember2020-12-310000352736us-gaap:FairValueInputsLevel3Membersrt:MinimumMemberall:EmbeddedDerivativeEquityIndexedAndForwardStartingOptionsInLifeAndAnnuityProductContractMemberus-gaap:MeasurementInputExercisePriceMember2020-12-310000352736us-gaap:FairValueInputsLevel3Memberall:EmbeddedDerivativeEquityIndexedAndForwardStartingOptionsInLifeAndAnnuityProductContractMemberus-gaap:MeasurementInputExercisePriceMembersrt:MaximumMember2020-12-310000352736us-gaap:FairValueInputsLevel3Memberall:EmbeddedDerivativeEquityIndexedAndForwardStartingOptionsInLifeAndAnnuityProductContractMemberus-gaap:MeasurementInputExercisePriceMembersrt:WeightedAverageMember2020-12-310000352736all:FixedIncomeSecuritiesValuedBasedOnNonbindingBrokerQuotesMemberus-gaap:FairValueInputsLevel3Member2020-12-310000352736us-gaap:USStatesAndPoliticalSubdivisionsMember2021-01-012021-12-310000352736all:CorporateDebtSecuritiesPublicMember2020-12-310000352736all:CorporateDebtSecuritiesPublicMember2021-01-012021-12-310000352736all:CorporateDebtSecuritiesPublicMember2021-12-310000352736all:CorporateDebtSecuritiesPrivatePlacementMember2020-12-310000352736all:CorporateDebtSecuritiesPrivatePlacementMember2021-01-012021-12-310000352736all:CorporateDebtSecuritiesPrivatePlacementMember2021-12-310000352736us-gaap:EquitySecuritiesMember2020-12-310000352736us-gaap:EquitySecuritiesMember2021-12-310000352736all:FreeStandingDerivativesNetMember2020-12-310000352736all:FreeStandingDerivativesNetMember2021-01-012021-12-310000352736all:FreeStandingDerivativesNetMember2021-12-310000352736all:DerivativesEmbeddedInAnnuityContractsMember2020-12-310000352736all:DerivativesEmbeddedInAnnuityContractsMember2021-01-012021-12-310000352736all:DerivativesEmbeddedInAnnuityContractsMember2021-12-310000352736all:NetInvestmentIncomeMember2021-01-012021-12-310000352736all:RealizedCapitalGainsAndLossesMember2021-01-012021-12-310000352736all:ContractBenefitsMember2021-01-012021-12-310000352736all:InterestCreditedToContractholderFundsMember2021-01-012021-12-310000352736us-gaap:USStatesAndPoliticalSubdivisionsMember2019-12-310000352736us-gaap:USStatesAndPoliticalSubdivisionsMember2020-01-012020-12-310000352736all:CorporateDebtSecuritiesPublicMember2019-12-310000352736all:CorporateDebtSecuritiesPublicMember2020-01-012020-12-310000352736all:CorporateDebtSecuritiesPrivatePlacementMember2019-12-310000352736all:CorporateDebtSecuritiesPrivatePlacementMember2020-01-012020-12-310000352736us-gaap:AssetBackedSecuritiesMember2019-12-310000352736us-gaap:MortgageBackedSecuritiesMember2019-12-310000352736us-gaap:EquitySecuritiesMember2019-12-310000352736all:FreeStandingDerivativesNetMember2019-12-310000352736all:FreeStandingDerivativesNetMember2020-01-012020-12-310000352736all:DerivativesEmbeddedInAnnuityContractsMember2019-12-310000352736all:DerivativesEmbeddedInAnnuityContractsMember2020-01-012020-12-310000352736all:NetInvestmentIncomeMember2020-01-012020-12-310000352736all:RealizedCapitalGainsAndLossesMember2020-01-012020-12-310000352736all:ContractBenefitsMember2020-01-012020-12-310000352736all:InterestCreditedToContractholderFundsMember2020-01-012020-12-310000352736us-gaap:USStatesAndPoliticalSubdivisionsMember2018-12-310000352736us-gaap:USStatesAndPoliticalSubdivisionsMember2019-01-012019-12-310000352736all:CorporateDebtSecuritiesPublicMember2018-12-310000352736all:CorporateDebtSecuritiesPublicMember2019-01-012019-12-310000352736all:CorporateDebtSecuritiesPrivatePlacementMember2018-12-310000352736all:CorporateDebtSecuritiesPrivatePlacementMember2019-01-012019-12-310000352736us-gaap:AssetBackedSecuritiesMember2018-12-310000352736us-gaap:MortgageBackedSecuritiesMember2018-12-310000352736us-gaap:FixedIncomeSecuritiesMember2018-12-310000352736us-gaap:EquitySecuritiesMember2018-12-310000352736all:FreeStandingDerivativesNetMember2018-12-310000352736all:FreeStandingDerivativesNetMember2019-01-012019-12-310000352736all:DerivativesEmbeddedInAnnuityContractsMember2018-12-310000352736all:DerivativesEmbeddedInAnnuityContractsMember2019-01-012019-12-310000352736all:NetInvestmentIncomeMember2019-01-012019-12-310000352736all:RealizedCapitalGainsAndLossesMember2019-01-012019-12-310000352736all:ContractBenefitsMember2019-01-012019-12-310000352736all:InterestCreditedToContractholderFundsMember2019-01-012019-12-310000352736us-gaap:FairValueInputsLevel3Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310000352736us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310000352736us-gaap:FairValueInputsLevel3Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310000352736us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000352736us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310000352736us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310000352736us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310000352736us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000352736us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueHedgingMember2020-12-31all:contract0000352736us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueHedgingMember2021-12-310000352736us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueHedgingMember2019-12-310000352736us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2021-12-310000352736us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2020-12-310000352736us-gaap:OtherContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherAssetsMember2021-12-310000352736us-gaap:NondesignatedMemberus-gaap:InterestRateCapMemberus-gaap:OtherInvestmentsMember2021-12-310000352736all:InterestRateFinancialFuturesContractsMemberus-gaap:NondesignatedMemberus-gaap:OtherAssetsMember2021-12-310000352736all:EquityAndIndexContractsOptionsAndWarrantsMemberus-gaap:NondesignatedMemberus-gaap:OtherInvestmentsMember2021-12-310000352736us-gaap:NondesignatedMemberall:EquityAndIndexContractsFinancialFuturesContractsMemberus-gaap:OtherAssetsMember2021-12-310000352736us-gaap:NondesignatedMemberall:TotalReturnSwapEquityMemberus-gaap:OtherInvestmentsMember2021-12-310000352736us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMemberus-gaap:OtherInvestmentsMember2021-12-310000352736us-gaap:NondesignatedMemberus-gaap:OtherInvestmentsMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-12-310000352736us-gaap:CreditDefaultSwapBuyingProtectionMemberus-gaap:NondesignatedMemberus-gaap:OtherInvestmentsMember2021-12-310000352736us-gaap:NondesignatedMemberus-gaap:CreditDefaultSwapSellingProtectionMemberus-gaap:OtherInvestmentsMember2021-12-310000352736us-gaap:NondesignatedMember2021-12-310000352736us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:InterestRateCapMember2021-12-310000352736all:InterestRateFinancialFuturesContractsMemberus-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2021-12-310000352736all:EquityAndIndexContractsOptionsAndWarrantsMemberus-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2021-12-310000352736us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMemberall:EquityAndIndexContractsFinancialFuturesContractsMember2021-12-310000352736us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2021-12-310000352736us-gaap:GuaranteedMinimumAccumulationBenefitMemberus-gaap:NondesignatedMemberus-gaap:ContractHolderFundsMember2021-12-310000352736us-gaap:GuaranteedMinimumWithdrawalBenefitMemberus-gaap:NondesignatedMemberus-gaap:ContractHolderFundsMember2021-12-310000352736us-gaap:NondesignatedMemberus-gaap:ContractHolderFundsMemberall:EmbeddedDerivativeEquityIndexedAndForwardStartingOptionsInLifeAndAnnuityProductContractMember2021-12-310000352736all:EmbeddedDerivativeFundsWithheldReinsuranceAgreementWithAffiliateMemberall:FundsHeldUnderReinsuranceAgreementsLiabilityMemberus-gaap:NondesignatedMember2021-12-310000352736us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:CreditDefaultSwapSellingProtectionMember2021-12-310000352736us-gaap:OtherContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherAssetsMember2020-12-310000352736us-gaap:NondesignatedMemberus-gaap:InterestRateCapMemberus-gaap:OtherInvestmentsMember2020-12-310000352736all:InterestRateFinancialFuturesContractsMemberus-gaap:NondesignatedMemberus-gaap:OtherAssetsMember2020-12-310000352736all:EquityAndIndexContractsOptionsAndWarrantsMemberus-gaap:NondesignatedMemberus-gaap:OtherInvestmentsMember2020-12-310000352736us-gaap:NondesignatedMemberall:EquityAndIndexContractsFinancialFuturesContractsMemberus-gaap:OtherAssetsMember2020-12-310000352736us-gaap:NondesignatedMemberall:TotalReturnSwapEquityMemberus-gaap:OtherInvestmentsMember2020-12-310000352736us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMemberus-gaap:OtherInvestmentsMember2020-12-310000352736us-gaap:NondesignatedMemberus-gaap:OtherInvestmentsMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2020-12-310000352736us-gaap:CreditDefaultSwapBuyingProtectionMemberus-gaap:NondesignatedMemberus-gaap:OtherInvestmentsMember2020-12-310000352736us-gaap:NondesignatedMemberus-gaap:CreditDefaultSwapSellingProtectionMemberus-gaap:OtherInvestmentsMember2020-12-310000352736us-gaap:NondesignatedMember2020-12-310000352736us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:InterestRateCapMember2020-12-310000352736all:InterestRateFinancialFuturesContractsMemberus-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2020-12-310000352736all:EquityAndIndexContractsOptionsAndWarrantsMemberus-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2020-12-310000352736us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2020-12-310000352736us-gaap:GuaranteedMinimumAccumulationBenefitMemberus-gaap:NondesignatedMemberus-gaap:ContractHolderFundsMember2020-12-310000352736us-gaap:GuaranteedMinimumWithdrawalBenefitMemberus-gaap:NondesignatedMemberus-gaap:ContractHolderFundsMember2020-12-310000352736us-gaap:NondesignatedMemberus-gaap:ContractHolderFundsMemberall:EmbeddedDerivativeEquityIndexedAndForwardStartingOptionsInLifeAndAnnuityProductContractMember2020-12-310000352736us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:CreditDefaultSwapSellingProtectionMember2020-12-310000352736us-gaap:OverTheCounterMember2020-12-310000352736us-gaap:InterestRateContractMemberall:RealizedCapitalGainsAndLossesMember2021-01-012021-12-310000352736all:ContractBenefitsMemberus-gaap:InterestRateContractMember2021-01-012021-12-310000352736us-gaap:InterestRateContractMemberall:InterestCreditedToContractholderFundsMember2021-01-012021-12-310000352736us-gaap:InterestRateContractMember2021-01-012021-12-310000352736all:RealizedCapitalGainsAndLossesMemberall:EquityAndIndexContractMember2021-01-012021-12-310000352736all:ContractBenefitsMemberall:EquityAndIndexContractMember2021-01-012021-12-310000352736all:InterestCreditedToContractholderFundsMemberall:EquityAndIndexContractMember2021-01-012021-12-310000352736all:EquityAndIndexContractMember2021-01-012021-12-310000352736all:RealizedCapitalGainsAndLossesMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-01-012021-12-310000352736all:ContractBenefitsMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-01-012021-12-310000352736all:InterestCreditedToContractholderFundsMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-01-012021-12-310000352736us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-01-012021-12-310000352736all:RealizedCapitalGainsAndLossesMemberus-gaap:ForeignExchangeContractMember2021-01-012021-12-310000352736all:ContractBenefitsMemberus-gaap:ForeignExchangeContractMember2021-01-012021-12-310000352736all:InterestCreditedToContractholderFundsMemberus-gaap:ForeignExchangeContractMember2021-01-012021-12-310000352736us-gaap:ForeignExchangeContractMember2021-01-012021-12-310000352736all:RealizedCapitalGainsAndLossesMemberus-gaap:CreditDefaultSwapMember2021-01-012021-12-310000352736all:ContractBenefitsMemberus-gaap:CreditDefaultSwapMember2021-01-012021-12-310000352736all:InterestCreditedToContractholderFundsMemberus-gaap:CreditDefaultSwapMember2021-01-012021-12-310000352736us-gaap:CreditDefaultSwapMember2021-01-012021-12-310000352736us-gaap:InterestRateContractMemberall:RealizedCapitalGainsAndLossesMember2020-01-012020-12-310000352736all:ContractBenefitsMemberus-gaap:InterestRateContractMember2020-01-012020-12-310000352736us-gaap:InterestRateContractMemberall:InterestCreditedToContractholderFundsMember2020-01-012020-12-310000352736us-gaap:InterestRateContractMember2020-01-012020-12-310000352736all:RealizedCapitalGainsAndLossesMemberall:EquityAndIndexContractMember2020-01-012020-12-310000352736all:ContractBenefitsMemberall:EquityAndIndexContractMember2020-01-012020-12-310000352736all:InterestCreditedToContractholderFundsMemberall:EquityAndIndexContractMember2020-01-012020-12-310000352736all:EquityAndIndexContractMember2020-01-012020-12-310000352736all:RealizedCapitalGainsAndLossesMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2020-01-012020-12-310000352736all:ContractBenefitsMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2020-01-012020-12-310000352736all:InterestCreditedToContractholderFundsMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2020-01-012020-12-310000352736us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2020-01-012020-12-310000352736all:RealizedCapitalGainsAndLossesMemberus-gaap:ForeignExchangeContractMember2020-01-012020-12-310000352736all:ContractBenefitsMemberus-gaap:ForeignExchangeContractMember2020-01-012020-12-310000352736all:InterestCreditedToContractholderFundsMemberus-gaap:ForeignExchangeContractMember2020-01-012020-12-310000352736us-gaap:ForeignExchangeContractMember2020-01-012020-12-310000352736all:RealizedCapitalGainsAndLossesMemberus-gaap:CreditDefaultSwapMember2020-01-012020-12-310000352736all:ContractBenefitsMemberus-gaap:CreditDefaultSwapMember2020-01-012020-12-310000352736all:InterestCreditedToContractholderFundsMemberus-gaap:CreditDefaultSwapMember2020-01-012020-12-310000352736us-gaap:CreditDefaultSwapMember2020-01-012020-12-310000352736all:TotalReturnSwapEquityMemberall:RealizedCapitalGainsAndLossesMember2020-01-012020-12-310000352736all:ContractBenefitsMemberall:TotalReturnSwapEquityMember2020-01-012020-12-310000352736all:InterestCreditedToContractholderFundsMemberall:TotalReturnSwapEquityMember2020-01-012020-12-310000352736all:TotalReturnSwapEquityMember2020-01-012020-12-310000352736all:RealizedCapitalGainsAndLossesMemberall:EquityAndIndexContractMember2019-01-012019-12-310000352736all:ContractBenefitsMemberall:EquityAndIndexContractMember2019-01-012019-12-310000352736all:InterestCreditedToContractholderFundsMemberall:EquityAndIndexContractMember2019-01-012019-12-310000352736all:EquityAndIndexContractMember2019-01-012019-12-310000352736all:RealizedCapitalGainsAndLossesMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2019-01-012019-12-310000352736all:ContractBenefitsMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2019-01-012019-12-310000352736all:InterestCreditedToContractholderFundsMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2019-01-012019-12-310000352736us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2019-01-012019-12-310000352736all:RealizedCapitalGainsAndLossesMemberus-gaap:ForeignExchangeContractMember2019-01-012019-12-310000352736all:ContractBenefitsMemberus-gaap:ForeignExchangeContractMember2019-01-012019-12-310000352736all:InterestCreditedToContractholderFundsMemberus-gaap:ForeignExchangeContractMember2019-01-012019-12-310000352736us-gaap:ForeignExchangeContractMember2019-01-012019-12-310000352736all:RealizedCapitalGainsAndLossesMemberus-gaap:CreditDefaultSwapMember2019-01-012019-12-310000352736all:ContractBenefitsMemberus-gaap:CreditDefaultSwapMember2019-01-012019-12-310000352736all:InterestCreditedToContractholderFundsMemberus-gaap:CreditDefaultSwapMember2019-01-012019-12-310000352736us-gaap:CreditDefaultSwapMember2019-01-012019-12-310000352736all:TotalReturnSwapFixedIncomeMemberall:RealizedCapitalGainsAndLossesMember2019-01-012019-12-310000352736all:ContractBenefitsMemberall:TotalReturnSwapFixedIncomeMember2019-01-012019-12-310000352736all:InterestCreditedToContractholderFundsMemberall:TotalReturnSwapFixedIncomeMember2019-01-012019-12-310000352736all:TotalReturnSwapFixedIncomeMember2019-01-012019-12-310000352736all:TotalReturnSwapEquityMemberall:RealizedCapitalGainsAndLossesMember2019-01-012019-12-310000352736all:ContractBenefitsMemberall:TotalReturnSwapEquityMember2019-01-012019-12-310000352736all:InterestCreditedToContractholderFundsMemberall:TotalReturnSwapEquityMember2019-01-012019-12-310000352736all:TotalReturnSwapEquityMember2019-01-012019-12-310000352736srt:StandardPoorsAPlusRatingMember2020-12-31all:counter-party0000352736srt:StandardPoorsAARatingMemberall:SingleNameMemberus-gaap:CreditDefaultSwapMember2020-12-310000352736srt:StandardPoorsARatingMemberall:SingleNameMemberus-gaap:CreditDefaultSwapMember2020-12-310000352736srt:StandardPoorsBBBRatingMemberall:SingleNameMemberus-gaap:CreditDefaultSwapMember2020-12-310000352736all:StandardPoorsBBAndLowerRatingMemberall:SingleNameMemberus-gaap:CreditDefaultSwapMember2020-12-310000352736all:SingleNameMemberus-gaap:CreditDefaultSwapMember2020-12-310000352736srt:StandardPoorsAARatingMemberus-gaap:CreditDefaultSwapMember2020-12-310000352736srt:StandardPoorsARatingMemberus-gaap:CreditDefaultSwapMember2020-12-310000352736srt:StandardPoorsBBBRatingMemberus-gaap:CreditDefaultSwapMember2020-12-310000352736all:StandardPoorsBBAndLowerRatingMemberus-gaap:CreditDefaultSwapMember2020-12-310000352736us-gaap:CreditDefaultSwapMember2020-12-31all:entity0000352736all:StructuredSettlementLifeContingenciesAnnuitiesMember2021-12-310000352736all:StructuredSettlementLifeContingenciesAnnuitiesMember2020-12-310000352736all:OtherImmediateFixedAnnuitiesMember2021-12-310000352736all:OtherImmediateFixedAnnuitiesMember2020-12-310000352736all:TraditionalLifeInsuranceMember2021-12-310000352736all:TraditionalLifeInsuranceMember2020-12-310000352736all:AccidentAndHealthInsuranceMember2021-12-310000352736all:AccidentAndHealthInsuranceMember2020-12-310000352736all:OtherLifeContingentProductsMember2021-12-310000352736all:OtherLifeContingentProductsMember2020-12-310000352736srt:MinimumMemberall:StructuredSettlementLifeContingenciesAnnuitiesMember2021-01-012021-12-310000352736srt:MinimumMemberall:OtherImmediateFixedAnnuitiesMember2021-01-012021-12-310000352736all:TraditionalLifeInsuranceMembersrt:MinimumMember2021-01-012021-12-310000352736all:TraditionalLifeInsuranceMembersrt:MaximumMember2021-01-012021-12-310000352736srt:MinimumMemberall:AccidentAndHealthInsuranceMember2021-01-012021-12-310000352736srt:MinimumMemberall:OtherLifeContingentProductsMember2021-01-012021-12-310000352736all:OtherLifeContingentProductsMembersrt:MaximumMember2021-01-012021-12-310000352736all:AllstateAnnuitiesMemberus-gaap:LifeAndAnnuityInsuranceProductLineMember2021-10-012021-12-310000352736all:AllstateAnnuitiesMemberus-gaap:LifeAndAnnuityInsuranceProductLineMember2020-07-012020-09-300000352736all:InterestSensitiveLifeInsuranceMember2021-12-310000352736all:InterestSensitiveLifeInsuranceMember2020-12-310000352736all:FixedAnnuitiesMember2021-12-310000352736all:FixedAnnuitiesMember2020-12-310000352736all:OtherInvestmentContractsMember2021-12-310000352736all:OtherInvestmentContractsMember2020-12-310000352736all:EquityIndexedLifeInsuranceMembersrt:MinimumMember2021-01-012021-12-310000352736all:EquityIndexedLifeInsuranceMembersrt:MaximumMember2021-01-012021-12-310000352736srt:MinimumMemberall:OtherLifeInsuranceMember2021-01-012021-12-310000352736srt:MaximumMemberall:OtherLifeInsuranceMember2021-01-012021-12-310000352736all:EquityIndexedFixedAnnuitiesMember2021-01-012021-12-310000352736srt:MinimumMemberall:ImmediateFixedAnnuitiesMember2021-01-012021-12-310000352736all:ImmediateFixedAnnuitiesMembersrt:MaximumMember2021-01-012021-12-310000352736srt:MinimumMemberall:EquityIndexedFixedAnnuitiesMember2021-01-012021-12-310000352736all:EquityIndexedFixedAnnuitiesMembersrt:MaximumMember2021-01-012021-12-310000352736all:OtherFixedAnnuitiesMembersrt:MinimumMember2021-01-012021-12-310000352736all:OtherFixedAnnuitiesMembersrt:MaximumMember2021-01-012021-12-310000352736srt:MinimumMemberall:OtherInvestmentContractsMember2021-01-012021-12-310000352736all:OtherInvestmentContractsMembersrt:MaximumMember2021-01-012021-12-310000352736all:VariableAnnuitiesMember2021-12-310000352736all:VariableAnnuitiesMember2020-12-310000352736all:VariableAnnuitiesMemberus-gaap:GuaranteedMinimumDeathBenefitMember2021-12-310000352736all:VariableAnnuitiesMemberus-gaap:GuaranteedMinimumDeathBenefitMember2020-12-310000352736all:VariableAnnuitiesMemberus-gaap:GuaranteedMinimumDeathBenefitMember2021-01-012021-12-310000352736all:VariableAnnuitiesMemberus-gaap:GuaranteedMinimumDeathBenefitMember2020-01-012020-12-310000352736us-gaap:GuaranteedMinimumIncomeBenefitMemberall:VariableAnnuitiesMember2021-12-310000352736us-gaap:GuaranteedMinimumIncomeBenefitMemberall:VariableAnnuitiesMember2020-12-310000352736all:VariableAnnuitiesMemberus-gaap:GuaranteedLifetimeWithdrawalBenefitMember2021-12-310000352736all:VariableAnnuitiesMemberus-gaap:GuaranteedLifetimeWithdrawalBenefitMember2020-12-310000352736us-gaap:GuaranteedMinimumAccumulationBenefitMemberall:VariableAnnuitiesMember2021-12-310000352736us-gaap:GuaranteedMinimumAccumulationBenefitMemberall:VariableAnnuitiesMember2020-12-310000352736us-gaap:GuaranteedMinimumAccumulationBenefitMemberall:VariableAnnuitiesMember2021-01-012021-12-310000352736us-gaap:GuaranteedMinimumAccumulationBenefitMemberall:VariableAnnuitiesMember2020-01-012020-12-310000352736all:GuaranteedMinimumDeathBenefitAndInterestSensitiveLifeInsuranceGuaranteesMember2020-12-310000352736us-gaap:GuaranteedMinimumIncomeBenefitMember2020-12-310000352736all:GuaranteedAccumulationAndWithdrawalBenefitsMember2020-12-310000352736all:GuaranteedMinimumDeathBenefitAndInterestSensitiveLifeInsuranceGuaranteesMember2021-01-012021-12-310000352736us-gaap:GuaranteedMinimumIncomeBenefitMember2021-01-012021-12-310000352736all:GuaranteedAccumulationAndWithdrawalBenefitsMember2021-01-012021-12-310000352736all:EverlakeReinsuranceLimitedERLMemberall:GuaranteedMinimumDeathBenefitAndInterestSensitiveLifeInsuranceGuaranteesMember2021-01-012021-12-310000352736us-gaap:GuaranteedMinimumIncomeBenefitMemberall:EverlakeReinsuranceLimitedERLMember2021-01-012021-12-310000352736all:GuaranteedAccumulationAndWithdrawalBenefitsMemberall:EverlakeReinsuranceLimitedERLMember2021-01-012021-12-310000352736all:EverlakeReinsuranceLimitedERLMember2021-01-012021-12-310000352736all:GuaranteedMinimumDeathBenefitAndInterestSensitiveLifeInsuranceGuaranteesMember2021-12-310000352736us-gaap:GuaranteedMinimumIncomeBenefitMember2021-12-310000352736all:GuaranteedAccumulationAndWithdrawalBenefitsMember2021-12-310000352736all:GuaranteedMinimumDeathBenefitAndInterestSensitiveLifeInsuranceGuaranteesMember2019-12-310000352736us-gaap:GuaranteedMinimumIncomeBenefitMember2019-12-310000352736all:GuaranteedAccumulationAndWithdrawalBenefitsMember2019-12-310000352736all:GuaranteedMinimumDeathBenefitAndInterestSensitiveLifeInsuranceGuaranteesMember2020-01-012020-12-310000352736us-gaap:GuaranteedMinimumIncomeBenefitMember2020-01-012020-12-310000352736all:GuaranteedAccumulationAndWithdrawalBenefitsMember2020-01-012020-12-310000352736us-gaap:GuaranteedMinimumDeathBenefitMemberall:VariableAnnuitiesMember2021-12-310000352736us-gaap:GuaranteedMinimumDeathBenefitMemberall:VariableAnnuitiesMember2020-12-310000352736us-gaap:GuaranteedMinimumDeathBenefitMemberall:VariableAnnuitiesMember2019-12-310000352736us-gaap:GuaranteedMinimumIncomeBenefitMemberall:VariableAnnuitiesMember2021-12-310000352736us-gaap:GuaranteedMinimumIncomeBenefitMemberall:VariableAnnuitiesMember2020-12-310000352736us-gaap:GuaranteedMinimumIncomeBenefitMemberall:VariableAnnuitiesMember2019-12-310000352736us-gaap:GuaranteedMinimumAccumulationBenefitMemberall:VariableAnnuitiesMember2021-12-310000352736us-gaap:GuaranteedMinimumAccumulationBenefitMemberall:VariableAnnuitiesMember2020-12-310000352736us-gaap:GuaranteedMinimumAccumulationBenefitMemberall:VariableAnnuitiesMember2019-12-310000352736all:VariableAnnuitiesMemberus-gaap:GuaranteedLifetimeWithdrawalBenefitMember2021-12-310000352736all:VariableAnnuitiesMemberus-gaap:GuaranteedLifetimeWithdrawalBenefitMember2020-12-310000352736all:VariableAnnuitiesMemberus-gaap:GuaranteedLifetimeWithdrawalBenefitMember2019-12-310000352736all:OtherGuaranteesMemberall:VariableAnnuitiesMember2021-12-310000352736all:OtherGuaranteesMemberall:VariableAnnuitiesMember2020-12-310000352736all:OtherGuaranteesMemberall:VariableAnnuitiesMember2019-12-310000352736all:VariableAnnuitiesMember2019-12-31all:item0000352736all:SingleLifeInsuranceMember2015-04-012017-12-310000352736all:SingleLifeInsuranceMember2011-04-012015-03-310000352736all:JointLifeInsuranceMember2011-04-012015-03-3100003527362007-07-012011-03-3100003527361998-09-012007-06-3000003527361998-08-011998-08-310000352736all:PrudentialMember2021-12-310000352736all:PrudentialMember2020-12-310000352736all:PrudentialMember2021-01-012021-12-310000352736all:PrudentialMember2020-01-012020-12-310000352736all:PrudentialMember2019-01-012019-12-310000352736all:CitigroupAndScottishReMember2021-12-310000352736all:CitigroupAndScottishReMember2020-12-310000352736all:ScottishReMember2021-12-310000352736all:ScottishReMember2020-12-310000352736all:LincolnBenefitLifeCompanyMember2021-12-310000352736all:NonAffiliatesMember2021-12-310000352736srt:AffiliatedEntityMember2021-01-012021-12-310000352736srt:AffiliatedEntityMember2020-01-012020-12-310000352736srt:AffiliatedEntityMember2019-01-012019-12-310000352736all:NonAffiliatesMember2021-01-012021-12-310000352736all:NonAffiliatesMember2020-01-012020-12-310000352736all:NonAffiliatesMember2019-01-012019-12-310000352736us-gaap:InvestmentsSegmentMember2021-12-310000352736us-gaap:InvestmentsSegmentMember2020-12-310000352736us-gaap:LifeInsuranceSegmentMember2021-12-310000352736us-gaap:LifeInsuranceSegmentMember2020-12-310000352736us-gaap:OtherInsuranceProductLineMember2021-12-310000352736us-gaap:OtherInsuranceProductLineMember2020-12-310000352736us-gaap:ReinsuranceRecoverableMemberus-gaap:ReinsurerConcentrationRiskMemberall:AllstateFinancialMembersrt:StandardPoorsAMinusRatingMemberall:EverlakeReinsuranceLimitedMember2021-01-012021-12-310000352736us-gaap:ReinsuranceRecoverableMemberus-gaap:ReinsurerConcentrationRiskMemberall:AllstateFinancialMembersrt:StandardPoorsAMinusRatingMember2021-01-012021-12-310000352736us-gaap:ReinsuranceRecoverableMemberus-gaap:ReinsurerConcentrationRiskMemberall:AllstateFinancialMembersrt:StandardPoorsAMinusRatingMember2020-01-012020-12-310000352736srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2019-12-310000352736all:GuarantyFundsMember2021-01-012021-12-310000352736all:GuarantyFundsMember2020-01-012020-12-310000352736all:GuarantyFundsMember2021-12-310000352736all:GuarantyFundsMember2020-12-310000352736all:WiltonReassuranceLifeCompanyOfNewYorkMember2021-12-310000352736all:WiltonReassuranceLifeCompanyOfNewYorkMember2020-12-310000352736us-gaap:DomesticCountryMember2021-12-3100003527362021-11-012021-12-3100003527362021-01-012021-10-310000352736all:LimitedPartnershipMember2020-12-310000352736srt:SubsidiariesMember2021-01-012021-12-310000352736srt:SubsidiariesMember2020-01-012020-12-310000352736us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310000352736us-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310000352736us-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310000352736us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2021-01-012021-12-310000352736us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-12-310000352736us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-12-310000352736us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2021-01-012021-12-310000352736us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-12-310000352736us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-12-310000352736srt:FederalHomeLoanBankOfChicagoMemberus-gaap:SubsequentEventMember2022-02-250000352736us-gaap:USTreasuryAndGovernmentMember2021-12-310000352736us-gaap:USStatesAndPoliticalSubdivisionsMember2021-12-310000352736us-gaap:ForeignGovernmentDebtSecuritiesMember2021-12-310000352736us-gaap:PublicUtilityBondsMember2021-12-310000352736us-gaap:AllOtherCorporateBondsMember2021-12-310000352736us-gaap:AssetBackedSecuritiesMember2021-12-310000352736us-gaap:MortgageBackedSecuritiesMember2021-12-310000352736us-gaap:FixedIncomeSecuritiesMember2021-12-310000352736us-gaap:IndustrialMiscellaneousAndAllOthersMember2021-12-310000352736us-gaap:EquitySecuritiesMember2021-12-310000352736us-gaap:MortgagesMember2021-12-310000352736us-gaap:PolicyLoansMember2021-12-310000352736us-gaap:DerivativeMember2021-12-310000352736all:DirectlyOriginatedCorporateLoansMember2021-12-310000352736all:AviationLoansMember2021-12-310000352736us-gaap:OtherLongTermInvestmentsMember2021-12-310000352736us-gaap:ShortTermInvestmentsMember2021-12-310000352736us-gaap:LifeInsuranceSegmentMember2021-01-012021-12-310000352736us-gaap:LifeInsuranceSegmentMember2020-01-012020-12-310000352736us-gaap:LifeInsuranceSegmentMember2019-01-012019-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossFixedIncomeSecuritiesMember2020-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossFixedIncomeSecuritiesMember2021-01-012021-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossFixedIncomeSecuritiesMember2021-12-310000352736us-gaap:AllowanceForLoanAndLeaseLossesRealEstateMember2020-12-310000352736us-gaap:AllowanceForLoanAndLeaseLossesRealEstateMember2021-01-012021-12-310000352736us-gaap:AllowanceForLoanAndLeaseLossesRealEstateMember2021-12-310000352736all:SECSchedule1209AllowanceLoanLeaseLossDirectlyOriginatedCorporateLoansMember2020-12-310000352736all:SECSchedule1209AllowanceLoanLeaseLossDirectlyOriginatedCorporateLoansMember2021-01-012021-12-310000352736all:SECSchedule1209AllowanceLoanLeaseLossDirectlyOriginatedCorporateLoansMember2021-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossAviationLoansMember2020-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossAviationLoansMember2021-01-012021-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossAviationLoansMember2021-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossBankLoansMember2020-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossBankLoansMember2021-01-012021-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossBankLoansMember2021-12-310000352736all:SECSchedule1209AllowanceLoanandLeaseLossAgentLoansMember2020-12-310000352736all:SECSchedule1209AllowanceLoanandLeaseLossAgentLoansMember2021-01-012021-12-310000352736all:SECSchedule1209AllowanceLoanandLeaseLossAgentLoansMember2021-12-310000352736us-gaap:AllowanceForReinsuranceRecoverableMember2020-12-310000352736us-gaap:AllowanceForReinsuranceRecoverableMember2021-01-012021-12-310000352736us-gaap:AllowanceForReinsuranceRecoverableMember2021-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossOtherAssetsMember2020-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossOtherAssetsMember2021-01-012021-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossOtherAssetsMember2021-12-310000352736us-gaap:AllowanceForCreditLossMember2020-12-310000352736us-gaap:AllowanceForCreditLossMember2021-01-012021-12-310000352736us-gaap:AllowanceForCreditLossMember2021-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossFixedIncomeSecuritiesMember2019-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossFixedIncomeSecuritiesMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossFixedIncomeSecuritiesMember2020-01-012020-12-310000352736us-gaap:AllowanceForLoanAndLeaseLossesRealEstateMember2019-12-310000352736us-gaap:AllowanceForLoanAndLeaseLossesRealEstateMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310000352736us-gaap:AllowanceForLoanAndLeaseLossesRealEstateMember2020-01-012020-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossBankLoansMember2019-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossBankLoansMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossBankLoansMember2020-01-012020-12-310000352736all:SECSchedule1209AllowanceLoanandLeaseLossAgentLoansMember2019-12-310000352736all:SECSchedule1209AllowanceLoanandLeaseLossAgentLoansMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310000352736all:SECSchedule1209AllowanceLoanandLeaseLossAgentLoansMember2020-01-012020-12-310000352736us-gaap:AllowanceForReinsuranceRecoverableMember2019-12-310000352736us-gaap:AllowanceForReinsuranceRecoverableMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310000352736us-gaap:AllowanceForReinsuranceRecoverableMember2020-01-012020-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossOtherAssetsMember2019-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossOtherAssetsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310000352736all:SECSchedule1209AllowanceLoanAndLeaseLossOtherAssetsMember2020-01-012020-12-310000352736us-gaap:AllowanceForCreditLossMember2019-12-310000352736us-gaap:AllowanceForCreditLossMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310000352736us-gaap:AllowanceForCreditLossMember2020-01-012020-12-310000352736us-gaap:AllowanceForReinsuranceRecoverableMember2018-12-310000352736us-gaap:AllowanceForReinsuranceRecoverableMember2019-01-012019-12-310000352736us-gaap:AllowanceForLoanAndLeaseLossesRealEstateMember2018-12-310000352736us-gaap:AllowanceForLoanAndLeaseLossesRealEstateMember2019-01-012019-12-310000352736all:SECSchedule1209AllowanceLoanandLeaseLossAgentLoansMember2018-12-310000352736all:SECSchedule1209AllowanceLoanandLeaseLossAgentLoansMember2019-01-012019-12-310000352736us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberall:AllstateLifeInsuranceCompanyOfNewYorkMemberus-gaap:AllowanceForLoanAndLeaseLossesRealEstateMember2021-12-310000352736us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberus-gaap:AllowanceForReinsuranceRecoverableMemberall:AllstateLifeInsuranceCompanyOfNewYorkMember2021-12-31

As filed with the Securities and Exchange Commission on March 30, 2022

FILE NO. 333-237710

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________

FORM S-1

POST-EFFECTIVE AMENDMENT NO. 2

TO

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

____________________________________

EVERLAKE LIFE INSURANCE COMPANY

(Exact name of registrant as specified in its charter)

________________________________________________

ILLINOIS 36-2554642

(State or other jurisdiction (I.R.S. Employer

of incorporation or organization) Identification Number)

6311

(Primary Standard Industrial Classification Code Number)

3100 SANDERS ROAD

NORTHBROOK, ILLINOIS 60062

847-665-9930

(Address, including zip code, and telephone number, including area code, of principal executive offices)

___________________________________________________

CT Corporation

208 South LaSalle Street

Suite 814

Chicago, IL 60604

312-345-4320

(Name, address, including zip code, and telephone number, including area code, of agent for service)

______________________________________________________

COPIES TO:

ANGELA FONTANA

EVERLAKE LIFE INSURANCE COMPANY

3100 SANDERS ROAD SUITE 303

NORTHBROOK, IL 60062

_____________________________________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. /X/

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Large accelerated filer | | / / | | Accelerated filer | | / / |

| | | |

| Non-accelerated filer | | /X/ | | Smaller reporting company | | / / |

| | | |

| Emerging growth company | | / / | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. / /

This Registration Statement contains a combined prospectus under Rule 429 under the Securities Act of 1933 which relates to the Form S-1 Registration Statement (File No. 333-237710), filed on April 16, 2020, by Everlake Life Insurance Company. Upon effectiveness, this Registration Statement will also act as a post-effective amendment to such earlier Registration Statements.

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

Custom Plus Annuity

Everlake Life Insurance Company

P.O. Box 660191

Dallas, TX 75266-0191

Telephone Number: 1-800-632-3492

Fax Number: 1-877-525-2689 Prospectus dated April 29, 2022 Everlake Life Insurance Company (“Everlake Life”) has issued the Custom Plus Annuity, a group and individual flexible premium deferred annuity contract (“Contract”). This prospectus contains information about the Contract. Please keep it for future reference.

The Contract is no longer being offered for sale. If you have already purchased a Contract you may continue to add to it. Each additional payment must be at least $1,000.

The Contracts were available through Morgan Stanley & Co. Inc., the principal underwriter for the Contracts.

Discussion of Risk Factors begins on page 5 of this prospectus.

The registrant’s obligations under the contract are subject to the financial strength and claims paying ability of the registrant.

| | | | | |

IMPORTANT

NOTICES | Neither the Securities and Exchange Commission ("SEC") nor any State securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense. |

| Investment in the Contracts involves serious investment risks, including possible loss of principal. |

| | | | | |

| Page |

| Overview | |

| Important Terms | |

| The Contract at a Glance | |

| How the Contract Works | |

| Contract Features | |

| The Contract | |

| Contract Owner | |

| Annuitant | |

| Beneficiary | |

| Modification of the Contract | |

| Assignment | |

| Written Requests and Forms in Good Order | |

| Purchases and Contract Value | |

| Minimum Purchase Payments | |

| Automatic Additions Program | |

| Allocation of Purchase Payments | |

| Contract Value | |

| Guarantee Periods | |

| Interest Rates | |

| How We Credit Interest | |

| Renewals | |

| Market Value Adjustment | |

| Expenses | |

| Withdrawal Charge | |

| Premium Taxes | |

| Access to Your Money | |

| Systematic Withdrawal Program | |

| Postponement of Payments | |

| Return of Purchase Payment Guarantee | |

| Minimum Contract Value | |

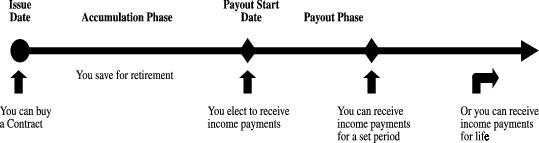

| Payout Phase | |

| | | | | |

| Page |

| Payout Start Date | |