As filed with the Securities and Exchange Commission on March 30, 2021

FILE NO. 333- 236809

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________

FORM S-1

POST-EFFECTIVE AMENDMENT NO. 1

TO

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

____________________________________

ALLSTATE LIFE INSURANCE COMPANY

(Exact name of registrant as specified in its charter)

________________________________________________

ILLINOIS 36-2554642

(State or other jurisdiction (I.R.S. Employer

of incorporation or organization) Identification Number)

6311

(Primary Standard Industrial Classification Code Number)

3075 SANDERS ROAD

NORTHBROOK, ILLINOIS 60062

847-402-5000

(Address, including zip code, and telephone number, including area code, of principal executive offices)

___________________________________________________

CT Corporation

208 South LaSalle Street

Suite 814

Chicago, IL 60604

312-345-4320

(Name, address, including zip code, and telephone number, including area code, of agent for service)

______________________________________________________

COPIES TO:

ANGELA K. FONTANA

ALLSTATE LIFE INSURANCE COMPANY

2775 SANDERS ROAD SUITE A2E

NORTHBROOK, IL 60062

_____________________________________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. /X/

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | / / | Accelerated filer | / / | |||||||||||||||||

| Non-accelerated filer | /X/ | Smaller reporting company | / / | |||||||||||||||||

| Emerging growth company | / / | |||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. / /

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Amount to be registered | Proposed maximum offering price per unit(1) | Proposed maximum aggregate offering price | Amount of registration fee(2) | ||||||||||||||||||||||

| Index Linked Annuity Contract | $N/A | $1 | $N/A | $N/A | ||||||||||||||||||||||

| (1) | Interests in the index linked annuity contract are sold on a dollar basis, not on the basis of a price per share or unit. | |||||||||||||||||||||||||

| (2) | By filing dated April 16, 2020, Allstate Life Insurance Company carried over $178,309,816 of unsold securities from an existing Form S-3 Registration Statement of the same issuer (File No. 333-220581) filed on September 22, 2017. Because a filing fee previously was paid with respect to those securities, there is no filing fee under this Registration Statement. Registrant continues that offering in this Post-Effective Amendment to that Registration Statement. | |||||||||||||||||||||||||

This Registration Statement contains a combined prospectus under Rule 429 under the Securities Act of 1933 which relates to the Form S-1/A Registration Statement (File No. 333-236809), filed on April 16, 2020, by Allstate Life Insurance Company. Upon effectiveness, this Registration Statement will also act as a post-effective amendment to such earlier Registration Statements.

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

Allstate RightFit® Annuity

Allstate Life Insurance Company

P.O. Box 660191

Dallas, TX 75266-0191

Telephone Number: 1-800-632-3492

Fax Number: 1-877-525-2689 Prospectus dated April 30, 2021

P.O. Box 660191

Dallas, TX 75266-0191

Telephone Number: 1-800-632-3492

Fax Number: 1-877-525-2689 Prospectus dated April 30, 2021

Allstate Life Insurance Company (“Allstate Life”) has issued the Allstate RightFit®, a group and individual single premium deferred indexed linked annuity contract ("Contract"). The Contract is no longer being offered for sale. This prospectus contains information about the Contract. Please keep it for future reference.

This prospectus is not your Contract, although this prospectus provides a description of all of your Contract's material features, benefits, rights and obligations. The description of the Contract's material provisions in this prospectus is current as of the date of this prospectus. If certain material provisions under the Contract are changed after the date of this prospectus in accordance with the Contract, those changes will be described in a supplement to this prospectus and the supplement will become a part of this prospectus. You should carefully read this prospectus in conjunction with any applicable supplements before taking any action under your Contract.

The Contract is no longer being offered for sale.

The principal underwriter for all of the Contracts is Allstate Distributors, L.L.C. (ADLLC), a wholly-owned subsidiary of Allstate Life. ADLLC is a registered broker dealer under the Securities Exchange Act of 1934, as amended (the Exchange Act), and a member of the Financial Industry Regulatory Authority. Allstate Distributors, L.L.C., is not required to sell any specific number or dollar amount of securities but will use its best efforts to sell the securities offered.

Discussion of Risk Factors begins on page 8 of this prospectus.

Index-linked annuity contracts are complex insurance and investment vehicles. Investors should speak with a financial

professional about the contract’s features, benefits, risks, and fees, and whether the contract is appropriate for the investor based upon his or her financial situation and objectives.

The registrant’s obligations under the contract are subject to the financial strength and claims paying ability of the registrant.

There is a risk of loss of principal under the contract and that loss can become greater if there is an early withdrawal because it may be subject to charges and adjustments. Please also note the possibility of losses on amounts withdrawn from the contract even if the S&P 500 has risen in value since the issue date.

IMPORTANT NOTICES | Investment in the Contracts involves serious investment risks, including possible loss of principal. This prospectus does not constitute an offering in any jurisdiction in which such offering may not lawfully be made. We do not authorize anyone to provide any information or representations regarding the offering described in this prospectus other than as contained in this prospectus. Neither the Securities and Exchange Commission ("SEC") nor any State securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense. | ||||

| The Contracts are not FDIC insured. | |||||

| The Contracts may not be available in all states. | |||||

1 PROSPECTUS

| Table of Contents | ||

| Page | |||||

| Overview | |||||

| Important Terms | |||||

| What is the Allstate RightFit® annuity? | |||||

| The Contract at a Glance | |||||

| How the Contract Works | |||||

| Contract Features | |||||

| The Contract | |||||

| Contract Owner | |||||

| Annuitant | |||||

| Beneficiary | |||||

| Assignment | |||||

| Written Requests and Forms in Good Order | |||||

| Modification of the Contract | |||||

| Purchasing the Contract | |||||

| Purchase Payment | |||||

| Issue Date | |||||

| Allocation of the Purchase Payment | |||||

| Trial Examination Period | |||||

| Contract Values | |||||

| Maturity Value | |||||

| Investment Option Maturity Value | |||||

| Interim Value | |||||

| Investment Option Interim Value | |||||

| Access Account Value | |||||

| Accumulation Phase | |||||

| Investment Option Period | |||||

| Investment Options | |||||

| Access Account Period | |||||

| Performance | |||||

| Index | |||||

| How We Apply Performance | |||||

| Transfers | |||||

| Bailout Provision | |||||

| Access to Your Money | |||||

| Preferred Withdrawal Amount | |||||

| Withdrawal Amounts in Excess of the Preferred Withdrawal Amount | |||||

| Withdrawals during the Access Account Period | |||||

| Net or Gross Withdrawals | |||||

| Systematic Withdrawal Program | |||||

| Required Minimum Distributions | |||||

| Postponement of Payments | |||||

| Minimum Value | |||||

| Expenses | |||||

| Page | |||||

| Withdrawal Charge | |||||

| Withdrawal Charge Waiver | |||||

| Premium Taxes | |||||

| Payout Phase | |||||

| Payout Phase | |||||

| Payout Start Date | |||||

| Amount Applied to Your Income Plan | |||||

| Income Plans | |||||

| Income Payments | |||||

| Certain Employee Benefit Plans | |||||

| Payments Upon Death | |||||

| Death of Owner | |||||

| Death of Annuitant | |||||

| Death Proceeds | |||||

| Other Information | |||||

| More Information | |||||

| Allstate Life | |||||

| The Contract | |||||

| Annuities Held within a Qualified Plan | |||||

| Legal Matters | |||||

| Experts | |||||

| Taxes | |||||

| Taxation of Allstate Life Insurance Company | |||||

| Taxation of Fixed Annuities in General | |||||

| Income Tax Withholding | |||||

| Tax Qualified Contracts | |||||

| Additional Considerations | |||||

| Annual Reports and Other Documents | |||||

| Annual Statements | |||||

| Disclosure of Commission Position on Indemnification for Securities Act Liabilities | |||||

| Reliance on Rule 12h-7 | |||||

| Appendix A – Determination of Interim Value Including Calculation of Fair Value Index | |||||

| Appendix B – Determination of Values with Withdrawals | |||||

| Appendix C – Information with Respect to the Registrant | |||||

| Risk Factors | |||||

2 PROSPECTUS

| Important Terms | ||

This prospectus uses a number of important terms with which you may not be familiar. The index below identifies the page that defines each term. Each term will appear in bold italics on the page on which it is first defined.

| Page | |||||

| Access Account Anniversary | |||||

| Access Account Period | |||||

| Access Account Value | |||||

| Access Account Year | |||||

| Accumulation Phase | |||||

| Adjustment for the change in the Fair Value Index | |||||

| Allstate Life | |||||

| Annuitant | |||||

| Bailout Provision | |||||

| Beneficiary | |||||

| Contract Anniversary | |||||

| Contract | |||||

| Contract Maturity Date | |||||

| Contract Owner ("You") | |||||

| Contract Year | |||||

| Death Proceeds | |||||

| Due Proof of Death | |||||

| Fair Value Index | |||||

| Income Plan | |||||

| Index | |||||

| Interim Value | |||||

| Page | |||||

| Investment Option Interim Value | |||||

| Investment Option Maturity Value | |||||

| Investment Option Period | |||||

| Investment Options | |||||

| Issue Date | |||||

| Maturity Value | |||||

| Maximum Access Account Performance Rate | |||||

| Minimum Access Account Performance Rate | |||||

| Payout Phase | |||||

| Payout Start Date | |||||

| Performance | |||||

| Preferred Withdrawal Amount | |||||

| Purchase Payment | |||||

| Right to Cancel | |||||

| SEC | |||||

| Systematic Withdrawal Program | |||||

| Tax Qualified Contracts | |||||

| The Maximum Investment Performance Rate | |||||

| The Minimum Investment Performance Rate | |||||

| Trial Examination Period | |||||

| Withdrawal Request Amount | |||||

3 PROSPECTUS

What is the Allstate RightFit® annuity? | ||

Allstate RightFit® is a single premium deferred indexed linked annuity contract (Contract) issued by Allstate Life Insurance Company. It provides investment options allowing you to balance a level of protection and growth potential, up to a ceiling, in your investment portfolio.

During the Investment Option Period you allocate the single Purchase Payment into one or more Investment Options with differing levels of risk/return profiles. Withdrawals made during the Investment Option Period are subject to Withdrawal Charges or Adjustments for the change in the Fair Value Index. The Performance for each Investment Option is applied to your Contract daily based on the amount of increase or decrease in the Standard & Poor’s 500 Composite Stock Price Index, commonly known as the S&P 500 Index (“S&P 500 Index”) subject to the minimum performance rates and maximum performance rates. Your Performance may be positive, zero or negative, it is possible for you to lose a portion of the Purchase Payment invested in the Contract.

At the end of the Investment Option Period, the values in your Investment Options are transferred to a single account, which allows you to withdraw some or all of your money at any time without incurring any Withdrawal Charges or Adjustments for the change in the Fair Value Index. You may remain in the Access Account until the Contract Maturity Date.

4 PROSPECTUS

The Contract at a Glance | ||

Preliminary Note Regarding Terms Used in the Prospectus

Here are some important terms you should understand before you go any further:

•The "Contract" is the Allstate RightFit® annuity contract described in this prospectus.

•"We," "Us," "Our," and "Allstate Life" mean Allstate Life Insurance Company.

•"You," "Your," "Owner," and "Contract Owner" mean the person(s) who purchased the Allstate RightFit® annuity contract.

The following is a snapshot of the Contract. It is intended to provide a basic overview of how the Contract functions. To fully understand the Contract you should read the entire prospectus.

Contract Type Single Premium Deferred Indexed Linked Annuity contract offering 5, 7 and 10 year Investment Option Period

Purchase Payment The amount you pay to purchase your Contract. The minimum Purchase Payment is $10,000.

Right to Cancel You may cancel your Contract within 10 days of receipt or any longer period as the state in which your Contract is issued may require. Upon cancellation, we will return your Interim Value or other value as the state in which your Contract is issued may require less any withdrawals. See Purchasing the Contract - Trial Examination Period for the full definition of Right to Cancel.

Phases of the Contract The Contract has two Phases:

•The Accumulation Phase, during which Performance is applied to your Contract based on the amount of increase or decrease in the S&P 500 Index, subject to the minimum performance rates and maximum performance rates. The Accumulation Phase includes the Investment Option Period, and the Access Account Period; and

Performance Each Investment Option and the Access Account will have an individual rate of Performance based on the amount of increase or decrease in the S&P 500 Index subject to the specified minimum performance rates and a maximum performance rates.

The Minimum Investment Performance Rate (“Floor”) and the Minimum Access Account Performance Rate (“Floor”) are the lowest rates of Performance for an Investment Option and the Access Account that can be applied to your Contract in a Contract Year.

The Maximum Investment Performance Rate (“Ceiling”) and the Maximum Access Account Performance Rate (“Ceiling”) are the highest rates of Performance for an Investment Option and the Access Account that can be applied to your Contract in a Contract Year.

Investment Option Period The first period of the Accumulation Phase may be 5, 7, or 10 years in length, based on the Investment Option Period you select as shown on your Annuity Data Page. After the Issue Date, you can not change the length of the Investment Option Period.

5 PROSPECTUS

During the Investment Option Period:

•you participate in the performance of the S&P 500 Index through the Investment Options you choose.

•your Performance may be positive, negative or zero

•you may withdraw 10% of your Maturity Value each Contract Year without incurring a Withdrawal Charge

•you may reallocate your money among the Investment Options

•Withdrawals in excess of the Preferred Withdrawal Amount may incur Withdrawal Charges and an Adjustment for the Change in the Fair Value Index.

•If the Index is discontinued or the calculation materially changes, we may substitute it for another Index. For the Contract Year in which the Index is substituted, the performance will be calculated using the Index at the beginning of the Contract Year for the portion of the year it was effective and the substituted Index for the remainder of the Contract Year.

Investment Options We currently offer three Investment Options; each Investment Option is linked to the performance of the S&P 500 Index and has a specified Ceiling and Floor.

•ConservativeFit – Offers the lowest Ceiling and the Floor will always be 0.00%.

•ModerateFit – Offers a higher Ceiling and will have a negative Floor, currently - 4.00%; You have the risk of losing money.

•AggressiveFit – Offers highest Ceiling and the lowest Floor, currently -8.00%; You have the greatest risk of losing money.

The Floor may range between -15.00% and 0.00%.

The Ceiling may range between 0.00% and 25.00%.

You may contact your financial representative for current Floors and Ceilings.

The Ceiling for each Investment Option may increase or decrease on each Contract Anniversary, see Overview - How the Contract Works for more information. We intend to set the Ceilings for each Investment Option such that the Ceiling is higher based on risk level, but there is a not a minimum Ceiling for each Investment Options that would ensure that the higher risk investment options have a higher Ceiling. The Floor for each Investment Option may change on each Contract Anniversary and will never be less than the rate shown on your Annuity Data Page.

On each Contract Anniversary during the Investment Option Period you may choose to reallocate your money from one or more Investment Options to any available Investment Option within your Investment Option Period. Requests to transfer must be received no later than 5 days before the Contract Anniversary and will be effective on the Contract Anniversary. If you transfer from an Investment Option with a 0.0% Floor to an Investment Option with a negative Floor there is more potential your account value could decline if the Index declines during the next Contract Year.

Bailout Provision If the Ceiling for an Investment Option is set below the Bailout Rate shown on your Annuity Data Page, the Bailout Provision allows you to withdraw some or all of your Maturity Value from that Investment Option, during the 30 day period following the Contract Anniversary, without a Withdrawal Charge or Adjustment for the change in the Fair Value Index. See the Accumulation Phase - Bailout Provision for the full definition.

6 PROSPECTUS

Transfers On each Contract Anniversary during the Investment Option Period, you may transfer value from any Investment Option into other available Investment Options. This allows you to adjust the weight each Investment Option bears in your overall investment strategy for your Contract. We must receive notification of your election to transfer no later than 5 days before the Contract Anniversary.

Access Account Period The second period in the Accumulation Phase that runs from the expiration of the Investment Option Period until the Payout Start Date.

During the Access Account Period;

•you participate in the performance of the S&P 500 Index through your Access Account

•your Performance may be positive or zero

•your Floor will always be 0.00%

•you Ceiling will range between 0.00% and 15.00%

•you may withdraw some or all of your money without incurring any Withdrawal Charges or Adjustments for the Changes in the Fair Value Index.

You may contact your financial representative for the current Ceiling.

Access Account The Access Account is a liquid Account; you may withdraw some or all of your Access Account Value at any time without incurring a Withdrawal Charge or an Adjustment for the Change in the Fair Value Index.

The Ceiling for the Access Account may increase or decrease on each Contract Anniversary.

Preferred Withdrawal Amount During each Contract Year during the Investment Option Period, you may withdraw up to 10% of your Maturity Value without incurring any Withdrawal Charges or Adjustments for the change in the Fair Value Index.

Withdrawals You may withdraw some or all of your money at any time prior to your Payout Start Date. For a withdrawal taken during the Investment Option Period in excess of the Preferred Withdrawal Amount, a Withdrawal Charge and an Adjustment for the change in the Fair Value Index may apply.

Withdrawal Charge A percentage charge applied to withdrawals in excess of the Preferred Withdrawal Amount during the Investment Option Period. The maximum Withdrawal Charge is 12.00% for Contracts with applications signed before May 2, 2011 and 10.00% for Contract with applications signed on or after May 2, 2011. The maximum Withdrawal Charge is set at issue and decreases each Contract Year as outlined on your Annuity Data Page. See “Expenses – Withdrawal Charge”.

7 PROSPECTUS

Withdrawal Charge Waivers Withdrawal Charges will be waived for:

•withdrawals taken to satisfy IRS required minimum distribution rules;

•withdrawals that qualify for a waiver included in an endorsement to your Contract, such as:

•Inability to perform Activities of Daily Living;

•Confinement in Long Term Care Facility or Hospital;

•Terminal Illness;

•Unemployment.

Income Plan Currently, we offer a Life Income with Guaranteed Payment Period Income Plan. Your Guaranteed Payment Period may range from 0 to 240 months. If the Annuitant is age 90 or older on the Payout Start Date, the Guaranteed Period may range from 60 to 240 months.

Death Proceeds If you, or the Annuitant (if the Contract Owner is a non-natural person), die before the Payout Start Date, we will pay the Death Proceeds equal to the greatest of :

•Maturity Value, less taxes; or

•Interim Value, less Withdrawal Charges and taxes; or

•Purchase Payment, adjusted in the same proportion as the Interim Value is reduced upon a partial withdrawal, less any taxes.

* In certain states, a Contract is available only as a group Contract. In these states, we issued you a certificate that represents your ownership and summarizes the provisions of the group Contract. References to “Contract” in this prospectus include certificates unless the context requires otherwise.

How the Contract Works | ||

The Contract works in three ways.

First, the Contract can help you (we assume you are the Contract Owner) save for retirement because you can invest in the Contract and generally pay no federal income taxes on any earnings until you withdraw them. You do this during what we call the “Accumulation Phase” of the Contract. The Accumulation Phase begins on the date we issue your Contract (“Issue Date”) and continues until the “Payout Start Date,” which is the date we apply your money to an Income Plan. The Accumulation Phase includes two periods, the Investment Option Period and the Access Account Period.

During the Investment Option Period, Performance is applied to your Contract based on the amount of increase or decrease in the S&P 500 Index, subject to the Floor and Ceiling of the Investment Options you choose. The Ceiling may increase or decrease on each Contract Anniversary. Every year on the Contract Anniversary you have the opportunity to reallocate your money among the Investment Options. At the end of the Investment Option Period, the values in your Investment Options are transferred to establish the Access Account. If the publication of the S&P 500 Index is discontinued, or the calculation of that Index is materially changed, we will substitute another Index at our discretion and notify you of the change. For the Contract Year in which an Index is substituted, the performance will be calculated using the applicable Index at the beginning of the Contract Year for the portion of the year it was effective and the substituted Index for the remainder of the Contract Year. We will not recalculate Index performance from the beginning of an Investment Option Period if a new Index is introduced in the middle of the period.

The Access Account is a liquid account linked to the performance of the S&P 500 Index which allows you to withdraw some or all of your money at any time without incurring any Withdrawal Charges or Adjustments for changes in the Fair Value Index. The Access Account has a specified Floor and Ceiling. The Floor for the Access Account will always be 0.00%. The Ceiling for the Access Account may increase or decrease on each Contract Anniversary. The Access Account does not allow you to allocate money to the Investment Options. You may remain in the Access Account until the Contract Maturity Date.

8 PROSPECTUS

The gain or loss experienced each Contract Year by the Investment Options and the Access Account is defined by the applicable Floor and the applicable Ceiling. It is important to understand that we may increase or decrease the Ceiling each Contract Year.

Second, the Contract helps you balance a level of protection and growth potential up to a ceiling in your portfolio. You can choose from one or more of the broad categories of risk protection and growth potential offered.

Third, the Contract can help you plan for retirement because you can use it to receive retirement income for life and/ or for a pre-set number of years by applying the Contract's value to an income plan, described at "Payout Phase - Income Plans." You receive income payments during what we call the “Payout Phase” of the Contract, which begins on the Payout Start Date and continues until we make the last income payment required by the Income Plan you select. During the Payout Phase, we guarantee the amount of your payments, which will remain fixed. The amount of money you accumulate under your Contract during the Accumulation Phase and apply to an Income Plan will determine the amount of your income payments during the Payout Phase.

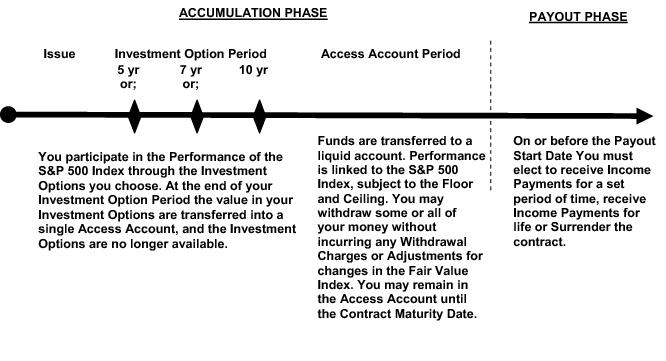

The timeline below illustrates how you might use your Contract.

As the Contract Owner, you exercise all of the rights and privileges provided by the Contract. If you die, any surviving Contract Owner or, if none, the Vested Beneficiary will exercise the rights and privileges provided by the Contract. See "The Contract." In addition, if you die before the Payout Start Date we will pay Death Proceeds to your Beneficiary. (See "Payments Upon Death.")

Please call us at 1-800-203-0068 if you have any questions about how the Contract works.

9 PROSPECTUS

The Contract | ||

CONTRACT OWNER

The Allstate RightFit® annuity is a contract between you and Allstate Life, a life insurance company. As Contract Owner, you may exercise all of the rights and privileges provided to you by the Contract. That means it is up to you to select or change (to the extent permitted):

•the amount and timing of your withdrawals,

•the programs you want to use to withdraw money,

•the income payment plan you want to use to receive retirement income,

•the Annuitant (either yourself or someone else) on whose life the income payments will be based,

•the Beneficiary or Beneficiaries who will receive the benefits that the Contract provides when the sole Contract Owner dies, and

•any other rights that the Contract provides.

You may not change the Owner, unless the state in which your Contract was issued requires otherwise.

Any request to exercise ownership rights must be signed by all Owners.

If you die, any surviving Contract Owner or, if none, the Vested Beneficiary may exercise the rights and privileges provided to them by the Contract.

The Contract cannot be jointly owned by both a non-natural person and a natural person. No Contract Owner may be older than 80 on the Issue Date.

The Contract can also be purchased as an IRA. The endorsements required to qualify these annuities under the Internal Revenue Code of 1986, as amended, ("Code") may limit or modify your rights and privileges under the Contract. We use the term "Qualified Contract" to refer to a Contract issued as an IRA, or with a qualified plan.

ANNUITANT

The Annuitant is the individual whose life determines the amount and duration of income payments (other than under Income Plans with guaranteed payments for a specified period). The Contract requires that there be an Annuitant at all times during the Accumulation Phase and on the Payout Start Date. The Annuitant must be a natural person. The Annuitant may not be older than 80 on the Issue Date.

You initially designate an Annuitant in your application. If you do not name an Annuitant, you (or the youngest Contract Owner, if there is more than one Contract Owner) will be the Annuitant. If the Contract Owner is a natural person, you may request, in a form satisfactory to us, to change the Annuitant at any time prior to the Payout Start Date.

Once we accept your change request, any change will be effective on the date you sign the written request. We are not liable for any payment we make or other action we take before accepting any written request from you.

BENEFICIARY

A Beneficiary is the person(s) you designate to receive certain benefits under the Contract. You may name one or more primary and contingent Beneficiaries when you apply for a Contract. The primary Beneficiary is the person who may, in accordance with the terms of the Contract, first become the Vested Beneficiary if the sole Contract Owner dies before the Payout Start Date. If the sole Contract Owner dies on or after the Payout Start Date, the primary Beneficiary will receive any guaranteed income payments scheduled to continue. A contingent Beneficiary is the person selected by the Contract Owner who will exercise the rights of the primary Beneficiary if all named primary Beneficiaries die before the death of the sole Contract Owner.

Upon the death of the sole Contract Owner, a Beneficiary becomes a Vested Beneficiary and obtains certain rights in all or a share of the Death Proceeds.

You may change or add Beneficiaries at any time. We will provide a change of Beneficiary request form to be signed by you and filed with us. Until we receive your written request to change a Beneficiary, we are entitled to rely on the most recent Beneficiary information in our files. Once we accept your change request, any change will be effective on the date you signed the written request. We are not liable for any payment we make or other action we take before accepting any written

request from you. Accordingly, if you wish to change your Beneficiary, you should deliver your written request to us promptly.

If you did not name a Beneficiary, or if no named Beneficiary is living when the sole Contract Owner dies (unless otherwise provided in the Beneficiary designation), the new Beneficiary will be:

•your spouse (or person of equivalent legal status), or if he or she is no longer alive,

•your surviving children equally, or if you have no surviving children,

•your estate.

Children, as used in this prospectus, are natural and legally adopted children only, either minor or adult.

If more than one Beneficiary survives you, we will divide the Death Proceeds among the surviving Beneficiaries according to your most recent written instructions that we have accepted. If you have not given us written instructions in a form satisfactory to us, we will pay the Death Proceeds in equal amounts to the surviving Beneficiaries. If there is more than one Beneficiary in a class (e.g., more than one primary Beneficiary) and one of the Beneficiaries predeceases the Contract Owner, the remaining Beneficiaries in that class will divide the deceased Beneficiary's share in proportion to the original share of the remaining Beneficiaries.

For purposes of the Contract, in determining whether a natural person, including a Contract Owner, primary Beneficiary, contingent Beneficiary, or Annuitant (“Natural Person A”) has survived another natural person, including a Contract Owner, primary Beneficiary, contingent Beneficiary, or Annuitant (“Natural Person B”), Natural Person A must survive Natural Person B by at least 24 hours. Otherwise, Natural Person A will be conclusively deemed to have predeceased Natural Person B.

ASSIGNMENT

No Contract Owner has a right to assign any interest in a Contract as collateral or security for a loan, and we will not honor an assignment of an interest in a Contract as collateral or security for a loan. However, you may otherwise assign periodic income payments under the Contract prior to the Payout Start Date. No Beneficiary may assign benefits under the Contract until they are due. We will not be bound by any assignment until you sign and file it with us. We are not responsible for the validity of any assignment. Federal law prohibits or restricts the assignment of benefits under many types of retirement plans and the terms of such plans may themselves contain restrictions on assignments. An assignment may also result in taxes or tax penalties. You should consult with an attorney before trying to assign your Contract.

WRITTEN REQUESTS AND FORMS IN GOOD ORDER

Written requests must include sufficient information and/ or documentation, and be sufficiently clear, to enable us to complete your request without the need to exercise discretion on our part to carry it out. You may contact our Customer Service Center to learn what information we require for your particular request to be in "good order." Additionally, we may require that you submit your request on our form. We reserve the right to determine whether any particular request is in good order, and to change or waive any good order requirements at any time.

Any financial request (i.e., a withdrawal request or a transfer request) that is received in good order and accepted by us by 3:00 PM Central Time on a business day will be processed on the same day we accept the request. If your financial request is accepted by us after 3:00 PM on a business day, we will process your request on the next business day.

A "business day" is each Monday through Friday that the New York Stock Exchange is open for business.

MODIFICATION OF THE CONTRACT

Only an officer of Allstate Life may approve a change in or waive any provision of the Contract. Any change or waiver must be in writing. None of our agents has the authority to change or waive the provisions of the Contract. We may not change the terms of the Contract without your consent, except to conform the Contract to applicable law or changes in the law or except as otherwise permitted in the Contract. If a provision of the Contract is inconsistent with state law, we will follow state law.

11 PROSPECTUS

Purchasing the Contract | ||

PURCHASE PAYMENT

The Purchase Payment is the amount you pay to purchase your Contract. The Allstate RightFit® is a single premium annuity that allows for only one Purchase Payment. Your Purchase Payment must be at least $10,000. Also, the total of all contracts and certificates you own that are issued by Allstate Life or any of our affiliates may not exceed $1 million, without our prior written approval. We reserve the right to reject any application or waive this limitation in our sole discretion.

Your Purchase Payment becomes part of our general account, which supports our insurance and annuity obligations. The general account consists of our general assets other than those in segregated asset accounts. We have sole discretion to invest the assets of the general account, subject to applicable law. You do not share in the investment experience of the general account.

ISSUE DATE

We will issue your Contract on the first Wednesday following the day we receive the last portion of the Purchase Payment. If we receive that payment on a Wednesday, we will issue your Contract on the following Wednesday. If the relevant market is closed due to a scheduled market closure on the Wednesday when we would have issued the Contract, we will issue the Contract on the last day that the market is open preceding that scheduled market closure. If the relevant market is closed due to a disruption in the markets on the Wednesday when we would have issued the Contract, we will issue the Contract on the first Wednesday following the first day that the relevant market is open.

If you pay for the Contract by transferring or exchanging value from one or more sources (including transfers or exchanges from other annuities), we will not issue your Contract until after we have received the last transfer or exchange payment.

If you notify us, in a form satisfactory to us, that we will not receive a transfer or exchange from one or more sources, and your Purchase Payment is still at least $10,000, then we will issue your Contract on the first Wednesday following the date we receive notification of the change.

You will receive no ownership interest in the Contract or benefits under the Contract and no Purchase Payment will be applied to any Investment Option, until after we have received the last transfer or exchange payment and you have completed all other purchase requirements.

ALLOCATION OF THE PURCHASE PAYMENT

On the application for the Contract, you select an Investment Option Period, and choose how to allocate your Purchase Payment to one or more Investment Options. On your Issue Date, your Purchase Payment is allocated to the Investment Option Period and the Investment Options as you specified on the application, unless we receive notification, in a form satisfactory to us, of any changes you would like to make before we have issued your Contract.

All allocations must be in whole percentages that total 100% or in whole dollars. If the allocation to any Investment Option is less than the Investment Option Minimum Allocation Requirement, as shown on the Annuity Data Page, we will re-allocate your Purchase Payment proportionately from the other Investment Options to meet the Investment Option Minimum Allocation Requirement.

TRIAL EXAMINATION PERIOD

You may cancel your Contract by providing us with written notice within the Trial Examination Period, which is the 10 day period after you receive the Contract or such longer period as the state in which your Contract was issued may require. If you exercise this “Right to Cancel”, the Contract terminates and we will pay your Interim Value (or other value as the state in which your Contract is issued may require), less the amount of any withdrawals. If your Contract is an IRA under Code Section 408(b), we will refund the greater of the Interim Value or your Purchase Payment, each less the amount of any withdrawals.

12 PROSPECTUS

Contract Values | ||

Some more important terms that will help you understand the following sections of this prospectus. “Contract Anniversary” is the anniversary of the Issue Date of the Contract.

•“Contract Year” is a 365-day period (366 days for a leap year) beginning on the Issue Date and on each Contract Anniversary during the Investment Option Period.

•“Access Account Anniversary” is the anniversary of the date the Access Account is established.

•“Access Account Year” is a 365-day period (366 days for a leap year) beginning on the date the Access Account is established and on each Access Account Anniversary.

Several different values are calculated for the Contract. The timing and purpose of the various calculations are described below.

INVESTMENT OPTION MATURITY VALUE

The Investment Option Maturity Value is an amount that is used in certain withdrawal and Death Proceed calculations. The value reflects a starting amount and increases or decreases with Investment Option Performance over time. This may adversely affect the amount that can be withdrawn. The value is calculated daily during the Investment Option Period. The value is calculated in the same manner for all Investment Options by the following formula prior to any withdrawals on that date:

Investment Option Maturity Value = A × (1+ B), where

A = On the Issue Date, this amount equals the portion of the Purchase Payment allocated to that particular Investment Option.

Thereafter, this amount equals the Investment Option Maturity Value as of the later of the Issue Date, the last day on which a withdrawal was taken, or the beginning of the current Contract Year.

If the valuation date is a Contract Anniversary, this amount equals the Investment Option Maturity Value as of the previous Contract Anniversary.

B = Investment Option Performance (as described in the "Performance" section)

MATURITY VALUE

The Maturity Value is the total amount of Investment Option Maturity Values among the various Investment Options. The value is calculated by adding up the Investment Option Maturity Values. The Maturity Value is calculated during the Investment Option Period.

The Maturity Value is used as a basis for calculating certain features of the Contract, including, but not limited to:

•the Preferred Withdrawal Amount;

•the Interim Value;

•the RMD Withdrawal Amount, and;

•certain Death Proceeds amounts.

The Maturity Value is available as a cash value only at the end of the Investment Option Period.

INVESTMENT OPTION INTERIM VALUE

The Investment Option Interim Value is similar to the Investment Option Maturity Value, but it also has consideration for a Fair Value Index. The value is used in certain withdrawal, Income Plan, and Death Proceed calculations. Both the Investment Option Performance and Fair Value Index can adversely affect the amount that can be withdrawn. The value is calculated daily during the Investment Option Period. The value is calculated in the same manner for all Investment Options by multiplying the Investment Option Maturity Value by the Adjustment for changes in the Fair Value Index using the following formula prior to any withdrawals on that date.

13 PROSPECTUS

Investment Option Interim Value = A × (1+B) × C, where

A = On the Issue Date, this amount equals the portion of the Purchase Payment allocated to that particular Investment Option.

Thereafter this amount equals the Investment Option Maturity Value as of the later of the Issue Date, the last day on which a withdrawal was taken, or the beginning of the current Contract Year.

If the valuation date is a Contract Anniversary, this amount equals the Investment Option Maturity Value as of the previous Contract Anniversary.

B = Investment Option Performance, as described in the "Performance" section.

C = The Adjustment for changes in the Fair Value Index, calculated as ((1+D)/(1+E))^F, where

D = The Fair Value Index, computed as of the Issue Date, based upon the U.S. Constant Maturity Treasury rate of a length corresponding to the applicable Investment Option Period you selected plus the Option Adjusted Spread of the Barclays Capital U.S. Corporate Investment Grade Index.

E = The Fair Value Index, computed as of the current date, based upon the U.S. Constant Maturity Treasury rate of a length corresponding to the applicable Investment Option Period you selected plus the Option Adjusted Spread of the Barclays Capital U.S. Corporate Investment Grade Index.

F = Number of whole and partial years from the current date until the end of the applicable Investment Option Period you selected. If E does not correspond to the length of an observed financial instrument as defined in the Fair Value Index, we will linearly interpolate based on the values of observed financial instruments, of maturities closest to F, to determine D and E above.

The Investment Option Maturity Value has limits on how much the value can change up or down. This is achieved through the Ceiling and Floor, and it is described in the Performance section of the Prospectus. The Investment Option Interim Value only has a limit on how much the value can increase. There is no corresponding limit to how much the value can decrease. The Investment Option Interim Value will not be greater than the Investment Option Maturity Value at the beginning of the Contract Year multiplied by (1 + the Ceiling); however, the Investment Option Interim Value may be less than the Investment Option Maturity Value at the beginning of the Contract Year multiplied by (1 + the Floor). In other words, a change in the Fair Value Index cannot increase your Investment Option Interim Value higher than the Investment Option Maturity Value would be increased by a Performance Rate equal to the Ceiling. However, a change in the Fair Value Index may decrease your Investment Option Interim Value lower than the Investment Option Maturity Value would be affected by a Performance Rate equal to the Floor.

The Investment Option Interim Value is applicable only during the Investment Option Period.

INTERIM VALUE

The Interim Value is the sum of the Investment Option Interim Values. The Interim Value is calculated during the Investment Option Period.

The Interim Value is used to calculate certain features of the Contract, including, but not limited to:

•the amount available for withdrawals in excess of the Preferred Withdrawal Amount;

•the amount applied to an Income Plan; and

•certain Death Proceeds amounts.

Fair Value Index. The Fair Value Index is used to estimate the current value of Allstate’s obligations. A change in the Fair Value Index will adjust the amount of your Investment Option Interim Value; this is referred to as the Adjustment for the change in the Fair Value Index. It may increase or decrease the amount available to apply to an Income Plan, as Death Proceeds, or upon surrender. The Fair Value Index and the Adjustment for the change in the Fair Value Index are used only during the Investment Option Period. As explained below, whether you have a positive or negative Adjustment for the change in the Fair Value Index depends in significant part on bond market conditions at the time of the Adjustment for the change in the Fair Value Index compared to bond market conditions at the time of the beginning of the Investment Option Period.

All withdrawals are subject to Adjustments for the change in the Fair Value Index, unless expressly exempted. The following withdrawals are exempt from a change in the Fair Value Index:

•withdrawals you make to satisfy IRS minimum distribution rules for the Contract;

•withdrawals made within the Preferred Withdrawal Amount, described under "Expenses";

14 PROSPECTUS

•withdrawals made under the Bailout Option;

We calculate the Fair Value Index using the U.S. Constant Maturity Treasury rate with a length corresponding to the applicable Investment Option Period you selected plus the Option Adjusted Spread of the Barclays Capital U.S. Corporate Investment Grade Index. The Option Adjusted Spread is the yield spread that when added to the risk-free rate (U.S. Treasury rates) represents the price of a bond in the market. In other words, it is the difference between the yield of a security that pays fixed interest payments (a corporate bond for example) and the current U.S. Treasury rates, which represents the rate of return on a risk-free investment. The formula for calculating the Fair Value Index and the Adjustment for the change in the Fair Value Index is set forth in the Contract Value section.

The Adjustment for the change in the Fair Value Index may be positive or negative, depending on changes in the Fair Value Index from the Issue Date to the date we calculate the Investment Option Interim Value (see Appendix A). Generally, if the Fair Value Index on the Issue Date is lower than the current Fair Value Index on the date we calculate the Investment Option Interim Value, then the amount payable to you will decrease. Conversely, if the Fair Value Index on the Issue Date is higher than the current Fair Value Index on the date we calculate the Investment Option Interim Value, then the amount payable to you will increase.

For example, assume that you purchase a Contract and the Fair Value Index on the day you purchase the Contract is 4.50%. Assume that at the end of 3 years, you make a partial withdrawal in excess of the Preferred Withdrawal Amount. If, at that later time, the Fair Value Index is 4.00%, then the Adjustment for the change in the Fair Value Index will be positive, which will increase the amount payable to you. However, if the Fair Value Index is 5.00%, then the Adjustment for the change in the Fair Value Index will be negative, which will decrease the amount payable to you. The hypothetical Fair Value Index is for illustrative purposes only and is not intended to predict future Fair Value Index rates under the Contract. The actual Fair Value Index may be more or less than shown above, and in recent years it generally has been lower in a generally low interest rate environment.

The Adjustment for the change in the Fair Value Index also depends upon the amount of time remaining prior to the end of the current Investment Option Period. The formula for calculating the Fair Value Index and the Adjustment for the change in the Fair Value Index is set forth in the Contract Values section, and Appendix A to this prospectus contains additional examples showing how the Adjustment for the change in the Fair Value Index is applied to your Contract.

Once your Contract is issued, the same indices will be used for the duration of your Contract. However, if the publication of any index is discontinued, or the calculation of the index is materially changed, we will substitute a suitable index which will be used for the entire then-current Contact Year and notify you of the change.

We may offer additional indices at our discretion.

The Allstate RightFit® annuity is not sponsored, endorsed, sold or promoted by Barclays Capital. Barclays Capital makes no representation or warranty, express or implied, to the owners of Allstate RightFit® annuity or any member of the public regarding the advisability of investing in securities generally or in Allstate RightFit® annuity particularly or ability of the Barclays Capital Indices, including without limitation, the Barclay’s Capital U.S. Corporate Investment Grade Index, to track general bond market performance. Barclays Capital’s only relationship to Allstate Life Insurance Company is the licensing of the Barclay’s Capital U.S. Corporate Investment Grade Index which is determined, composed and calculated by Barclays Capital without regard to Allstate Life Insurance Company or the Allstate RightFit® annuity. Barclays Capital has no obligation to take the needs of Allstate Life Insurance Company or the owners of the Allstate RightFit® annuity into consideration in determining, composing or calculating the Barclay’s Capital U.S. Corporate Investment Grade Index. Barclays Capital is not responsible for and has not participated in the determination of the timing of, prices at, or quantities of the Allstate RightFit® annuity to be issued or in the determination or calculation of the equation by which the Allstate RightFit® annuity is to be converted into cash. Barclays Capital has no obligation or liability in connection with the administration, marketing or trading of the Allstate RightFit® annuity.

BARCLAYS CAPITAL DOES NOT GUARANTEE THE QUALITY, ACCURACY AND/OR THE COMPLETENESS OF THE BARCLAYS CAPITAL INDICES, OR ANY DATA INCLUDED THEREIN, OR OTHERWISE OBTAINED BY ALLSTATE LIFE INSURANCE COMPANY, OWNERS OF THE ALLSTATE RIGHTFIT® ANNUITY OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE BARCLAYS CAPITAL INDICES, INCLUDING WITHOUT LIMITATION, THE BARCLAY’S CAPITAL U.S. CORPORATE INVESTMENT GRADE INDEX, IN CONNECTION WITH THE RIGHTS LICENSED HEREUNDER OR FOR ANY OTHER USE. BARCLAYS CAPITAL MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE INDICES, INCLUDING WITHOUT LIMITATION, THE BARCLAY’S CAPITAL U.S. CORPORATE INVESTMENT GRADE INDEX, OR ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL BARCLAYS CAPITAL HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR

15 PROSPECTUS

CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

ACCESS ACCOUNT VALUE

The Access Account Value is calculated daily during the Access Account Period. It is used as a basis for calculating all features of the Contract during the Access Account Period.

The Access Account Value is calculated by the following formula prior to any withdrawals on that date:

Access Account Value = A × (1+B), where

A = At establishment:

•The Maturity Value, if the establishment of the Access Account Period occurs at the expiration of the Investment Option Period.

•The Death Proceeds, if the establishment of the Access Account Period occurs pursuant to the selection of a Death Proceeds payment option (see Death Proceeds).

Thereafter, this amount equals the Access Account Value as of the later of the last day on which a withdrawal was taken or the beginning of the current Access Account Year.

If the valuation date is an Access Account Anniversary, this amount equals the Access Account Value as of the previous Access Account Anniversary.

B = Access Account Performance, as described in the "Performance" section.

| Accumulation Phase | ||

The Accumulation Phase is the first of the two phases of your Contract. The Accumulation Phase starts on the Issue Date and continues until the Payout Start Date. During the Accumulation Phase, you will participate in the performance of one or more specified index(es).

The Accumulation Phase is composed of two periods, the first is the Investment Option Period and the second is the Access Account Period.

INVESTMENT OPTION PERIOD

We currently offer 5, 7, and 10 year Investment Option Periods. You may select one Investment Option Period for your Contract. The length of Investment Option Period you select will be shown on your Annuity Data Page. You may not change the Investment Option Period after the Issue Date.

The Investment Option Period begins on the Issue Date and ends on the earlier of the expiration of the length of the Investment Option Period that you selected or the Payout Start Date.

During the Investment Option Period:

•your money is allocated to one or more Investment Option(s) you select;

•Performance is linked to the S&P 500 Index and subject to the specified Floor and Ceiling for the Investment Options you choose;

•you may reallocate your money on each Contract Anniversary from one or more Investment Options to any available Investment Option. Requests to transfer must be received no later than 5 days before the Contract Anniversary and will be effective on the Contract Anniversary (see Transfers);

•you may withdraw up to 10% of your Maturity Value without incurring any Withdrawal Charges or Adjustments for changes in the Fair Value Index (see Preferred Withdrawal Amount);

•withdrawals in excess of your Preferred Withdrawal Amount may incur Withdrawal Charges and Adjustments for changes in the Fair Value Index (See Expenses and Fair Value Index);

INVESTMENT OPTIONS

The Investment Options are designed to provide a combination of a level of protection against market declines and growth potential up to a ceiling. Each Investment Option has a risk and potential reward profile associated with it. The greater the risk, the higher the potential reward.

16 PROSPECTUS

We currently offer three Investment Options; each Investment Option is linked to the performance of the S&P 500 Index and has a specified Floor and Ceiling.

•Conservative Fit – Offers the lowest Ceiling and a Floor that will always be 0.00%.

•Moderate Fit – Offers a higher Ceiling and a Floor that may be negative, currently -4.00%. You have the risk of losing money.

•Aggressive Fit – Offers the highest Ceiling and the lowest Floor, currently -8.0%. You have the greatest risk of losing money.

The Ceiling for each Investment Option may increase or decrease on each Contract Anniversary. For the Moderate Fit and Aggressive Fit options, the Floor may range from -15.00% to 0.00%. For all Options, the Ceiling will range from 0.00% to 25.00%. We intend to set the Ceilings for each Investment Option such that the Ceiling is higher based on risk level, but there is a not a minimum Ceiling for each Investment Options that would ensure that the higher risk investment options have a higher Ceiling. All Ceiling and Floor rates are set on an annual basis.

You may contact your financial representative for current Floors and Ceilings.

On each Contract Anniversary during the Investment Option Period you may choose to reallocate your money from one or more Investment Options to any available Investment Option. Requests to transfer must be received no later than 5 days before the Contract Anniversary and will be effective on the Contract Anniversary. We will send you a notice 30 days before the Contract Anniversary indicating the Contract Anniversary is coming up and you should contact your financial representative for a review. The notice will provide deadlines for certain account activities.

Amounts you allocate to the various Investment Options may grow in value, decline in value or grow less than you expect, depending on the performance of the Index and applicable floor and ceiling rates of the new Investment Options. Future performance will reflect the new allocation of funds to the various Investment Options and the respective floor and ceiling rates as of the Contract Anniversary. Withdrawals are taken in the proportion that each Investment Option bears to the total.

For example, if you transfer from the Conservative Fit with a 0.0% Floor to the Aggressive Fit with a -8.0% Floor your Access Account Value would become subject to a decline if the Index declines during the next Contract Year. Conversely, if you transfer from the Aggressive Fit with a -8.0% Floor to the Moderate Fit with a -4.0% Floor the level of potential loss is reduced due to the difference in the Floor.

We reserve the right in our sole discretion to add or to restrict transfers into any Investment Option.

The Investment Options are available only during the Investment Option Period.

At the expiration of the length of the Investment Option Period your Maturity Value will be transferred to establish the Access Account. Once the Access Account is established, you may:

•Remain in the Access Account until your Payout Start Date; or

•Apply the Maturity Value to an Income Plan; or

• Surrender your Contract.

You must notify us of your election no later than 30 days prior to the expiration of the Investment Option Period, in a form acceptable to us, of your election. If we do not receive such notification, you will be deemed to have elected to transfer your Maturity Value to the Access Account.

ACCESS ACCOUNT PERIOD

The Access Account Period begins at the end of the Investment Option Period and ends on the Payout Start Date.

The Access Account Period is established when:

•You elect, or are deemed to have elected, to transfer the Maturity Value to establish the Access Account; or

•Option A or Option B is selected upon the death of the Contract Owner, or Option A is selected upon the death of the Annuitant.

During the Access Account Period:

•your money is allocated to the Access Account;

•Performance is linked to the S&P 500 Index and subject to the Floor and Ceiling of the Access Account;

•The Floor will always be 0.00%;

17 PROSPECTUS

•You may withdraw some or all of your money prior to your Payout Start Date without incurring any Withdrawal Charges or Adjustments for changes in the Fair Value Index.

You may contact your financial representative for current Floor and Ceiling.

At the expiration of the Access Account Period, you must elect to do one of the following:

•Apply the Access Account Value to an Income Plan; or

•Surrender the Contract.

You must notify us of your election no later than 30 days prior to the expiration of the Access Account Period, in a form acceptable to us. If we do not receive such notification, you will be deemed to have elected to apply your Access Account Value to Income Plan 1, life income with guaranteed payments for 120 months, and we will make payments in accordance with that Income Plan.

PERFORMANCE

The Performance is the percentage your Investment Option Maturity Values and Access Account Value will increase or decrease each Contract Year or Access Account Year.

Currently, the Investment Option Performance and the Access Account Performance are calculated in the same manner, and are collectively referred to as “Performance”.

The Performance is calculated and applied daily by the following formula where both A and B are subject to the Maximum and Minimum Index Values described below:

Performance = A / B -1, where

A = Index value as of that date.

B = Index value as of the later of the Issue Date, the last date on which a withdrawal was taken, or the beginning of the current Contract Year or Access Account Year, as applicable.

Minimum = Index value at the beginning of the current Contract

Index Year or Access Account Year, as applicable X (1+ the

Value Floor).

If the valuation date is a Contract Anniversary or Access Account Anniversary, the index value equals the index value as of the previous Contract Anniversary or Access Account Anniversary.

Maximum = Index value at the beginning of the current Contract

Index Year or Access Account Year, as applicable, X (1+ the

Value Ceiling).

If the valuation date is a Contract Anniversary or Access Account Anniversary, the index value equals the index value as of the previous Contract Anniversary or Access Account Anniversary.

For purposes of the calculation above, if either A or B is less than the Minimum Index Value, then that value(s) will be replaced by the Minimum Index Value in the calculation.

If either A or B is greater than the Maximum Index Value, then that value(s) will be replaced by the Maximum Index Value in the calculation.

Example: Assume the Index value at the beginning of the current contract year is 1000, and the Index value as of the calculation date is 1200. The Floor is -5.00% and the Ceiling is 8.00%. The Minimum Index Value is 1000 x -5.00% = 950. The Maximum Index Value is 1000 x 8.00% = 1080. Since 1200 is greater than the Maximum Index Value, we will use the Maximum Index Value for (A) in the Performance calculation. Performance = 1080 / 1000 - 1 = 8.00%.

INDEX

The Contract uses the movement of an Index as a basis to calculate the performance for the Contract. The Index for your Contract will be shown on your Annuity Data Page. The Index value for a particular day is the value published at the end of that day, computed to the nearest 1/100th of a point. If the Index is not published that day due to scheduled market closure, the first preceding published Index value will apply. If the Index is not published on a particular day due to a disruption in the markets, the Index value for that day will be the value of the Index at the end of the first business day that the Index value is published after said disruption.

Once your Contract is issued, the same Index will be used for the duration of your Contract. However, if the publication of that Index is discontinued, or the calculation of that Index is materially changed, we will substitute a suitable index that will be used to the entire then-current Contact Year and notify you of the change.

18 PROSPECTUS

We currently offer the following Index:

The Standard and Poor’s 500 Composite Stock Price Index, commonly known as the S&P 500 Index (“S&P 500 Index”)

We may use additional indices for new Contracts at our discretion.

The Allstate RightFit® annuity is not sponsored, endorsed, sold or promoted by Standard & Poor’s ( S&P ) or its third party licensors. Neither S&P nor its third party licensors makes any representation or warranty, express or implied, to the owners of the Allstate RightFit® annuity or any member of the public regarding the advisability of investing in securities generally or in the Allstate RightFit® annuity particularly or the ability of the S&P 500 Index (the Index ) to track general stock market performance. S&P’s and its third party licensors’ only relationship to Allstate Life Insurance Company is the licensing of the Index and certain trademarks and trade names of S&P and the third party licensors. The Index is determined, composed, and calculated by S&P or its third party licensors without regard to Allstate Life or Allstate RightFit® annuity. S&P and its third party licensors have no obligation to take the needs of Allstate Life or the owners of the Allstate RightFit® annuity into consideration in determining, composing, or calculating the Index. Neither S&P nor its third party licensors are responsible for and has not participated in the determination of the prices and amount of the Allstate RightFit® annuity or the timing of the issuance or sale of the Allstate RightFit® annuity or in the determination or calculation of the equation by which the Allstate RightFit® annuity is to be converted into cash. S&P has no obligation or liability in connection with the administration, marketing or trading of the Allstate RightFit® annuity.

NEITHER S&P, ITS AFFILIATES NOR THEIR THIRD PARTY LICENSORS GUARANTEE THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDEX OR ANY DATA INCLUDED THEREIN OR ANY COMMUNICATIONS, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNICATIONS (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P, ITS AFFILIATES AND THEIR THIRD PARTY LICENSORS SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS OR DELAYS THEREIN. S&P MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE MARKS, THE INDEX OR ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P, ITS AFFILIATES OR THEIR THIRD PARTY LICENSORS BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE OR CONSEQUENTIAL DAMAGES, INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY OR OTHERWISE.

“Standard & Poor’s®”, S&P® and S&P 500® , “Standard & Poor’s 500” and “500” are trademarks of Standard & Poor’s and have been licensed for use by Allstate Life.

19 PROSPECTUS

HOW WE APPLY PERFORMANCE

We will apply the Performance to your Contract daily. Performance will depend on the Ceiling and Floor of the Investment Options you choose or of the Access Account. The Performance will be calculated as shown in the Performance section above.

If the Performance for any Investment Option or the Access Account is equal to or greater than the Ceiling for that Investment Option or Access Account, your Performance will equal the Ceiling for that Investment Option or Access Account.

If the Performance for any Investment Option or the Access Account is less than the Ceiling for that Investment Option or the Access Account and greater than the Floor for that Investment Option or the Access Account, your Performance for that Investment Option or Access Account will equal the Performance.

If the Performance for any Investment Option or Access Account is equal to or less than the Floor for that Investment Option or the Access Account, your Performance will equal the Floor for that Investment Option or the Access Account.

Resetting of Ceiling and Floor. On each Contract Anniversary or Access Account Anniversary, as applicable, we may increase or decrease the Ceiling for each Investment Option or the Access Account. We may also increase or decrease the Floor for each Investment Option or the Access Account on each Contract Anniversary or Access Account Anniversary, but we will never reset the Floor below the minimum performance rates shown on your Annuity Data Page.

During the Investment Option Period, if we reset the Ceiling on any Investment Option less than the Bailout Rate shown on your Annuity Data Page, you may exercise the Bailout Provision. Prior to your Contract Anniversary, we will send you a statement containing information on your Ceilings and Floors for the next Contract Year.

EXAMPLES

The following examples illustrate how a Purchase Payment could perform over a five-year period, given fluctuating Index values:

| Example 1 | |||||||||||||||||

| Purchase Payment: $10,000 Initial Index Value: 800 | |||||||||||||||||

| 1 | 2 | 3 | 4 | 5 | |||||||||||||

| Index at the Beginning of the Contract Year | 800 | 950 | 1,000 | 875 | 1,300 | ||||||||||||

| Index at the End of the Contract Year | 950 | 1,000 | 875 | 1,300 | 1,400 | ||||||||||||

| Index Growth as Percentage | 18.75 | % | 5.26 | % | -12.50 | % | 48.57 | % | 7.69 | % | |||||||

| Ceiling | 20.00 | % | 20.00 | % | 20.00 | % | 20.00 | % | 20.00 | % | |||||||

| Floor | -10.00 | % | -10.00 | % | -10.00 | % | -10.00 | % | -10.00 | % | |||||||

| Maturity Value at Beginning of Contract Year | $ | 10,000.00 | $ | 11,875.00 | $ | 12,500.00 | $ | 11,250.00 | $ | 13,500.00 | |||||||

| Credited Rate | 18.75 | % | 5.26 | % | -10.00 | % | 20.00 | % | 7.69 | % | |||||||

| Credited Performance | $ | 1,875.00 | $ | 625.00 | $ | -1,250.00 | $ | 2,250.00 | $ | 1,038.46 | |||||||

| Maturity Value at End of Contract Year | $ | 11,875.00 | $ | 12,500.00 | $ | 11,250.00 | $ | 13,500.00 | $ | 14,538.46 | |||||||

| Example 2 | |||||||||||||||||

| Purchase Payment: $10,000 Initial Index Value: 800 | |||||||||||||||||

| 1 | 2 | 3 | 4 | 5 | |||||||||||||

| Index at the Beginning of the Contract Year | 800 | 850 | 650 | 550 | 600 | ||||||||||||

| Index at the End of the Contract Year | 850 | 650 | 550 | 600 | 625 | ||||||||||||

| Index Growth as Percentage | 6.25 | % | -23.53 | % | -15.38 | % | 9.09 | % | 4.17 | % | |||||||

| Ceiling | 20.00 | % | 20.00 | % | 20.00 | % | 20.00 | % | 20.00 | % | |||||||

| Floor | -10.00 | % | -10.00 | % | -10.00 | % | -10.00 | % | -10.00 | % | |||||||

| Maturity Value at Beginning of Contract Year | $ | 10,000.00 | $ | 10,625.00 | $ | 9,562.50 | $ | 8,606.25 | $ | 9,388.64 | |||||||

| Credited Rate | 6.25 | % | -10.00 | % | -10.00 | % | 9.09 | % | 4.17 | % | |||||||

| Credited Performance | $ | 625.00 | $-1,062.50 | $-956.25 | $ | 782.39 | $ | 391.19 | |||||||||

| Maturity Value at End of Contract Year | $ | 10,625.00 | $ | 9,562.50 | $ | 8,606.25 | $ | 9,388.64 | $ | 9,779.83 | |||||||

These examples assume no withdrawals during the entire 5-year example period. If you were to make a partial withdrawal during your Investment Option Period, a Withdrawal Charge and an Adjustment based on the change in the Fair Value Index may apply. The hypothetical Ceilings are for illustrative purposes only and are not intended to predict future performance rates to be declared under the Contract. Actual investment performance rates declared may be more or less than those shown

20 PROSPECTUS

above.

TRANSFERS

On any Contract Anniversary during the Investment Option Period, you may elect to transfer all or part of the Maturity Value from one or more Investment Options into other Investment Option(s), subject to the following conditions:

•All Investment Options into which you elect to transfer the Maturity Value must be eligible to receive transfers of Maturity Value according to the terms and conditions in effect on the transfer date; and

•We must receive notification of your election to transfer, in a form satisfactory to us, no later than 5 days before the Contract Anniversary on which the transfer will take place.

If you transfer any Maturity Value into an Investment Option that was available on the Issue Date of your Contract, the Floor for that Investment Option as shown on your Annuity Data Page will be applicable. At any time while the Ceiling for an Investment Option is less than the Bailout Rate shown on your Annuity Data Page for that Investment Option, we reserve the right to restrict any transfers into such Investment Options. If you transfer all or part of your Maturity Value on a Contract Anniversary, the amount transferred will not be subject to a Withdrawal Charge or Adjustment.

Amounts you allocate to the various Investment Options may grow in value, decline in value or grow less than you expect, depending on the performance of the Index and applicable floor and ceiling rates of the new Investment Options. Future performance will reflect the new allocation of funds to the various Investment Options and the respective floor and ceiling rates as of the Contract Anniversary. Withdrawals are taken in the proportion that each Investment Option bears to the total.

For additional discussion of transfers, see "Investment Options" in the Accumulation Phase section of this prospectus.

BAILOUT PROVISION

We will set a Bailout Rate for each Investment Option. The Bailout Rates will be shown on your Annuity Data Page and will not change for the life of your Contract.

A Bailout Provision allows you to withdraw some or all of your Maturity Value from an Investment Option, without incurring any Withdrawal Charges or Adjustments for the change in the Fair Value Index during the 30-day period following the Contract Anniversary. The Bailout Provision may be exercised if the Ceiling for that Investment Option is set below the Bailout Rate shown on your Annuity Data Page for that Investment Option.

We must receive your request, in a form satisfactory to us, during the 30-day period following the Contract Anniversary.

Upon withdrawal, the Investment Option Interim Value will be reduced by the same proportion as the Investment Option Maturity Value.

Withdrawals taken under the Bailout Provision are generally considered to come from the earnings in the Contract first. If the contract is tax-qualified, generally all withdrawals are treated as distributions of earnings.

Withdrawals of earnings are taxed as ordinary income and, if taken prior to age 59½, may be subject to an additional 10% federal tax penalty.

Access to Your Money | ||

You can withdraw some or all of your money at any time prior to the Payout Start Date. You may not make any withdrawals or surrender your Contract once the Payout Phase has begun. Withdrawals in each Contract Year always come from your Preferred Withdrawal Amount first. During the Investment Option Period, the minimum amount you may withdraw must reduce your Interim Value by $250. During the Access Account Period, the minimum amount you must withdraw is $250.

Withdrawals taken any time prior to the Payout Phase are generally considered to come from the earnings in the Contract first. If you have a Tax Qualified Contract, generally all withdrawals are treated as distributions of earnings. Withdrawals of earnings are taxed as ordinary income and, if taken prior to age 59½, may be subject to an additional 10% federal tax penalty. You should consult your tax advisor for further information.

21 PROSPECTUS

PREFERRED WITHDRAWAL AMOUNT

The Preferred Withdrawal Amount is the amount you may withdraw each Contract Year during the Investment Option Period without incurring a Withdrawal Charge or an Adjustment for the change in the Fair Value Index. The Preferred Withdrawal Amount equals 10% of your Maturity Value at the beginning of the Contract Year.

Upon taking a portion or all of your Preferred Withdrawal Amount, your Interim Value will be reduced by the same proportion as your Maturity Value (see Appendix B).