0000352541DEF 14Afalse00003525412023-01-012023-12-31iso4217:USDxbrli:pure00003525412022-01-012022-12-3100003525412021-01-012021-12-3100003525412020-01-012020-12-310000352541lnt:EquityAwardsAdjustmentsMemberecd:PeoMember2023-01-012023-12-310000352541lnt:EquityAwardsAdjustmentsMemberecd:NonPeoNeoMember2023-01-012023-12-310000352541ecd:PeoMemberlnt:ChangeInPensionValueMember2023-01-012023-12-310000352541lnt:ChangeInPensionValueMemberecd:NonPeoNeoMember2023-01-012023-12-310000352541ecd:PeoMemberlnt:PensionAdjustmentsServiceCostMember2023-01-012023-12-310000352541lnt:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2023-01-012023-12-310000352541lnt:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2023-01-012023-12-310000352541lnt:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000352541ecd:PeoMemberlnt:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310000352541lnt:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000352541ecd:PeoMemberlnt:EquityAwardsGrantedDuringTheYearUnvestedMember2023-01-012023-12-310000352541lnt:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-31000035254112023-01-012023-12-31000035254122023-01-012023-12-31000035254132023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under § 240.14a-12

ALLIANT ENERGY CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

x No fee required

¨ Fee paid previously with preliminary materials

¨ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

NOTICE OF 2024 ANNUAL MEETING OF SHAREOWNERS OF ALLIANT ENERGY CORPORATION

| | | | | |

| DATE: | May 17, 2024 |

| TIME: | 9:00 a.m. CDT |

www.virtualshareholdermeeting.com/LNT2024

VIRTUAL MEETING ONLY — NO PHYSICAL LOCATION

The virtual Annual Meeting may be accessed at www.virtualshareholdermeeting.com/LNT2024, where you will be able to listen to the meeting live, submit questions and vote online.

AGENDA:

1. Elect six directors nominated by our Board of Directors to serve on our Board of Directors, one for a term expiring at the 2025 Annual Meeting of Shareowners, one for a term expiring at the 2026 Annual Meeting of Shareowners and four for terms expiring at the 2027 Annual Meeting of Shareowners

2. Approve, on an advisory, non-binding basis, the compensation of our named executive officers

3. Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2024

4. Attend to any other business properly presented at this meeting

RECORD DATE: March 18, 2024

Shareowners of record of our common stock as of the close of business on March 18, 2024 will be entitled to notice of, and to vote at, the Annual Meeting.

PROXY VOTING: YOUR VOTE IS IMPORTANT. Whether or not you plan to participate in the Annual Meeting, please vote promptly.

You may vote your shares by telephone or online. Instructions for voting are on the enclosed proxy card. If you prefer, you may sign and date the enclosed proxy card and return it in the postage-paid envelope.

PARTICIPATING IN THE ANNUAL MEETING:

The 2024 Annual Meeting of Shareowners will be held exclusively online via live webcast. An audio broadcast of the Annual Meeting will also be available by telephone toll-free at (877) 346-6110. Shareowners of record as of the close of business on March 18, 2024, are entitled to participate in and submit questions in writing before and during the Annual Meeting by visiting www.virtualshareholdermeeting.com/LNT2024. To participate in the online Annual Meeting, you will need the 16-digit control number included on your proxy card. The Annual Meeting will begin promptly at 9:00 a.m. CDT. Online check-in will begin at 8:45 a.m. CDT. Please allow ample time for the online check-in procedures.

ANNUAL REPORT:

A copy of our Annual Report for the fiscal year ended December 31, 2023 was included with these proxy materials.

Important Notice Regarding the Availability of Proxy Materials for the Shareowner Meeting to be held on May 17, 2024. The Alliant Energy Corporation Proxy Statement for the 2024 Annual Meeting of Shareowners and the Annual Report for the fiscal year ended December 31, 2023, are available at www.alliantenergy.com/eproxy.

By Order of the Board of Directors

John O. Larsen

Executive Chairman

Chairman of the Board

Dated, mailed and made available online on or before April 2, 2024.

In accordance with Securities and Exchange Commission rules, a notice containing instructions on how to access this proxy statement and our annual report online was mailed, starting on or about April 2, 2024, and we provided access to our materials online before that date to certain holders of our common stock on the close of business on the record date.

| | | | | |

Proxy Summary | |

| |

Proposal One — Election of Directors | |

| |

Corporate Governance | |

| |

Meetings and Committees of the Board of Directors | |

| |

2023 Director Compensation | |

| |

Ownership of Voting Securities | |

| |

Compensation Discussion and Analysis | |

| |

Compensation and Personnel Committee Report | |

| |

Summary Compensation Table | |

| |

2023 Grants of Plan-Based Awards | |

| |

2023 Outstanding Equity Awards at Fiscal Year-End | |

| |

2023 Option Exercises and Stock Vested | |

| |

2023 Pension Benefits | |

| |

2023 Non-qualified Deferred Compensation | |

| |

2023 Potential Payments Upon Termination or Change in Control | |

| |

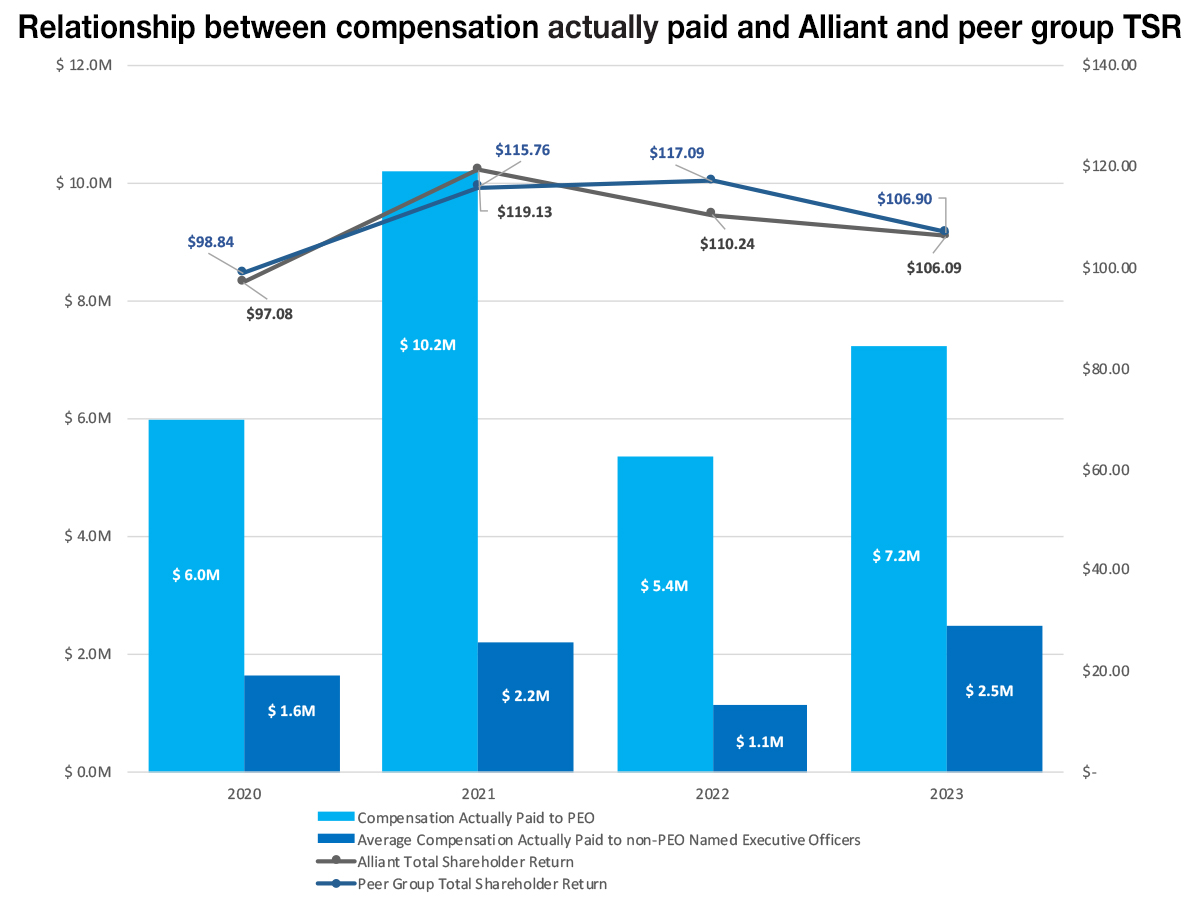

| Pay for Performance | |

| |

Proposal Two — Advisory Vote to Approve the Compensation of Our Named Executive Officers | |

| |

Report of the Audit Committee | |

| |

Fees Paid to Independent Registered Public Accounting Firm | |

| |

Proposal Three — Ratification of the Appointment of Deloitte & Touche LLP as the Company’s Independent Registered Public Accounting Firm for 2024 | |

| |

Information About the Annual Meeting and Voting | |

| |

This summary highlights information contained in this Proxy Statement. It is only a summary. Please read the entire Proxy Statement and 2023 Annual Report before you vote.

2024 Annual Meeting of Shareowners

Date and Time: May 17, 2024 at 9:00 a.m. CDT

Record Date: March 18, 2024

Place: www.virtualshareholdermeeting.com/LNT2024

| | | | | | | | | | | |

| Voting Matters | Board Recommendation | Page |

| 1. | Election of Six Director Nominees | FOR all Director Nominees | |

| 2. | Advisory Vote to Approve Executive Compensation | FOR | |

| 3. | Ratification of Appointment of Deloitte & Touche LLP as Independent Registered Public Accountants for 2024 | FOR | |

Vote your proxy today in one of the following methods:

| | | | | | | | | | | | | | |

| | | | |

| |

www.proxyvote.com | | (800) 690-6903 | | Mark, sign and date your proxy card and return it in the postage-paid envelope provided. Your proxy card must be received by May 16, 2024. 401(k) participants’ cards must be received by May 13, 2024.

|

Vote your proxy online until 10:59 p.m. CDT on May 16, 2024. 401(k) participants’ votes must be received by May 13, 2024. | | Vote your proxy using a touch-tone telephone until 10:59 p.m. CDT on May 16, 2024. 401(k) participants’ votes must be received by May 13, 2024. | |

If you vote your proxy online or by telephone, you do NOT need to mail back your proxy card.

See pages 65-69 for directions on voting your proxy and to see how your votes are counted.

ALLIANT ENERGY | 2024 Proxy Statement | 1

| | |

Proposal One—ELECTION OF DIRECTORS |

At our annual meeting of shareowners (Annual Meeting), six directors will be elected. The nominees are:

| | | | | |

| Lisa M. Barton | Roger K. Newport |

| Ignacio A. Cortina | Christie Raymond |

| Stephanie L. Cox | Carol P. Sanders |

Each nominee currently serves on our Board of Directors. If elected as directors, each of Ms. Barton, Ms. Cox, Mr. Newport and Ms. Sanders will serve until our Annual Meeting of Shareowners in 2027 or until his or her successor has been duly qualified and elected. Mr. Cortina, Ms. Raymond and Ms. Barton were added to the Board of Directors to fill vacancies since our 2023 Annual Meeting of Shareowners. In accordance with our Bylaws and Wisconsin law, when a director is appointed to fill a vacancy, his or her initial term expires at the next annual meeting of shareowners, regardless of the class to which the director is elected. If elected as a director, Ms. Raymond will serve until our Annual Meeting of Shareowners in 2025, Mr. Cortina will serve until our Annual Meeting of Shareowners in 2026, and, as stated above, Ms. Barton will serve until our Annual Meeting of Shareowners in 2027, or until their successors have been duly qualified and elected.

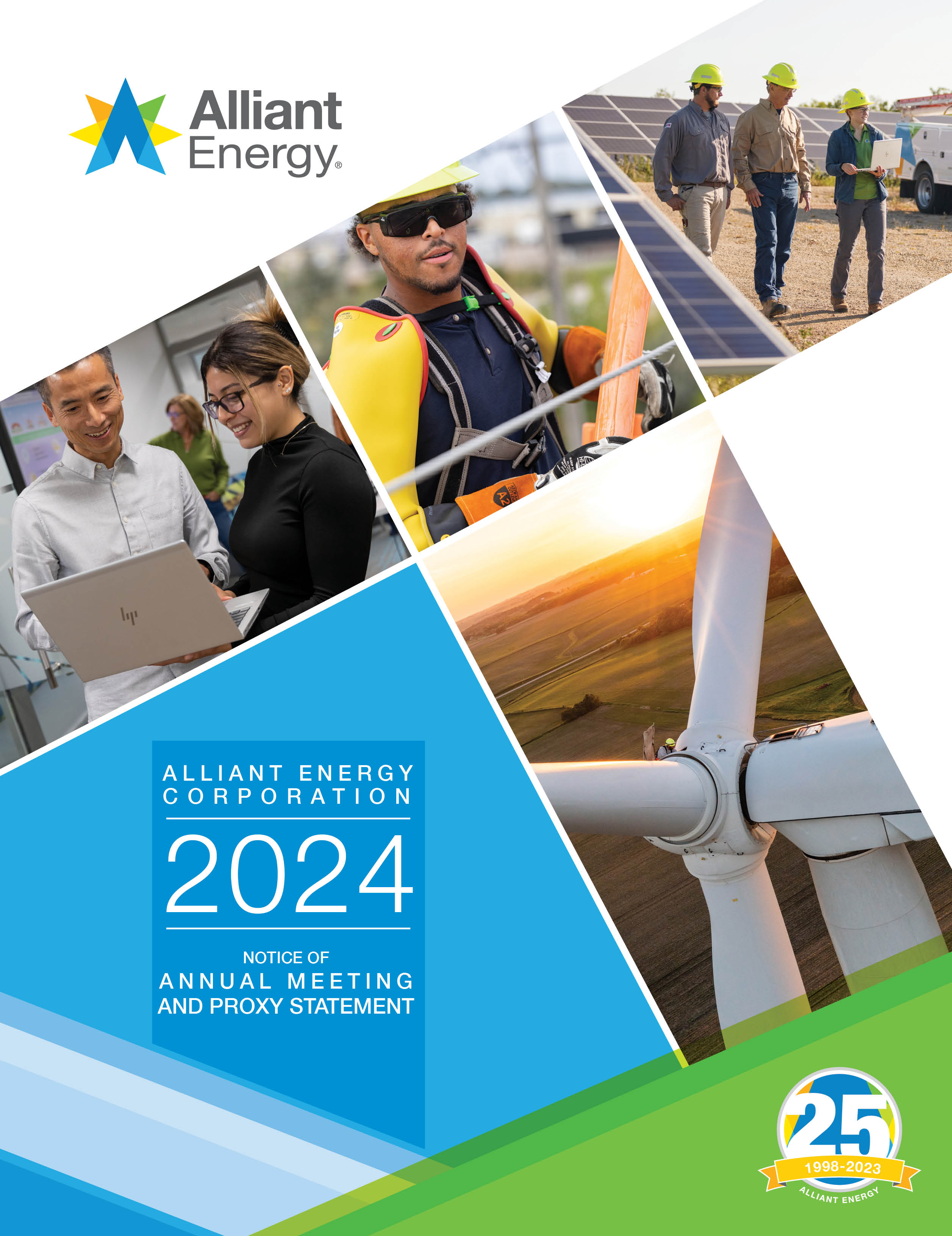

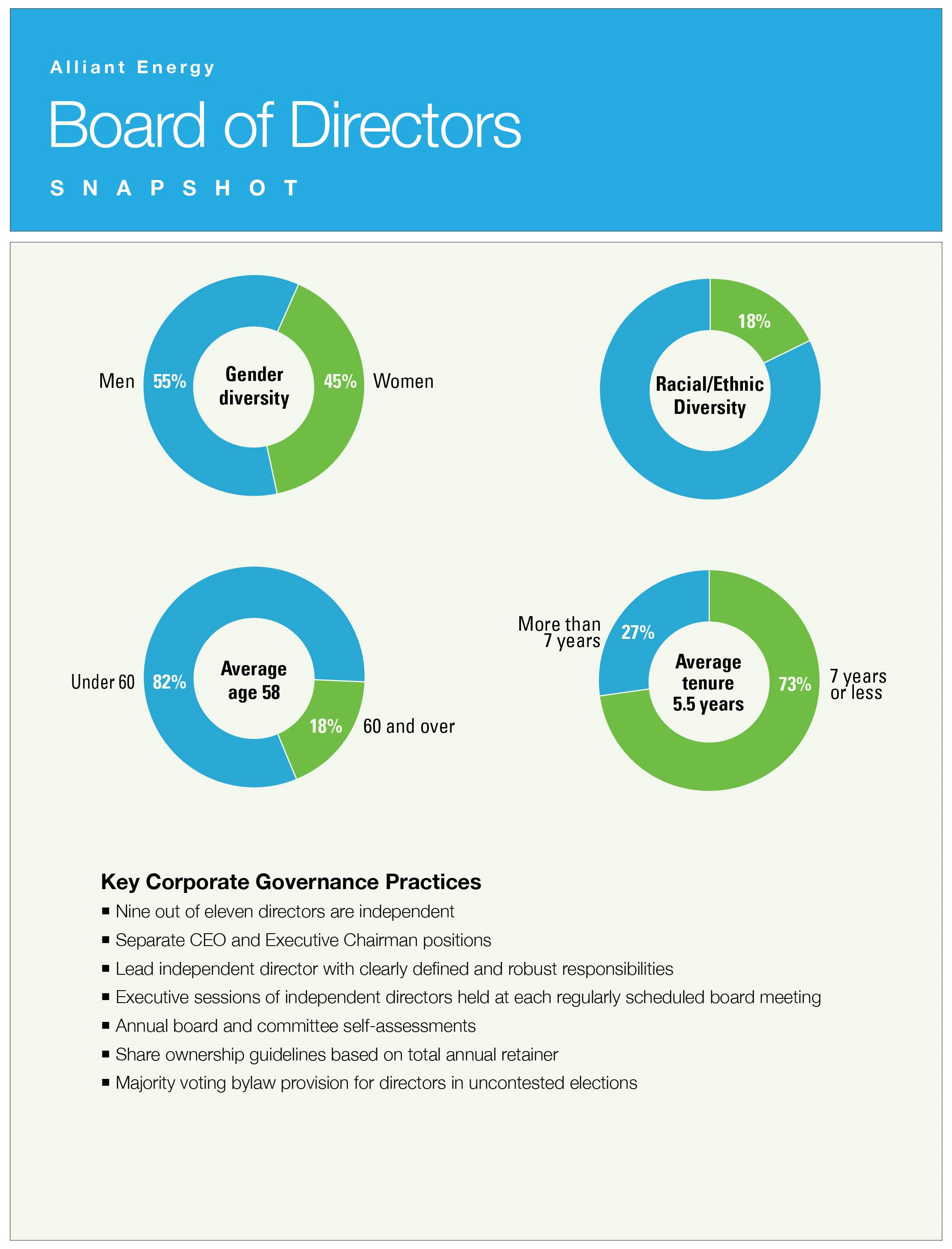

The nominees were selected by the Board of Directors on the recommendation of the Nominating and Governance Committee. The Nominating and Governance Committee is responsible for evaluating nominees for director and director candidates. The committee has criteria to ensure that the specific skills, qualifications and experiences necessary for the effectiveness of the Board of Directors are fully represented on the Board. In addition, the Nominating and Governance Committee strives to create a diverse Board of Directors as measured by the criteria of age, gender, ethnicity, race, tenure, skills, qualifications and experience. The following charts reflect the skills and qualifications and demographic information that the Board views as important when evaluating director nominees. Each director nominee also contributes other important skills, expertise, experience and personal attributes to the Board that are not reflected in the chart below.

ALLIANT ENERGY | 2024 Proxy Statement | 2

The table below provides a summary of our Board diversity as of April 2, 2024.

| | | | | | | | |

| Total Number of Directors | 11 |

| Female | Male |

| Part I: Gender Identity |

| Directors | 5 | 6 |

| Part II: Demographic Background |

| Hispanic or Latin-x | 0 | 2 |

| White | 5 | 4 |

The balance of tenure of our directors promotes experience and stability while also allowing for a broader understanding of the issues that can affect our business. Over the last five years, we have added five new independent directors to our Board. Our more tenured directors provide deep historical perspective of our Company and our industry and provide leadership to the Board. Our newer directors provide fresh perspectives and benefit from the knowledge and experience of our more tenured directors. This optimal combination of experience, subject matter expertise and fresh perspectives ensures that our Board is able to provide oversight and guidance that is innovative, balanced and aligned with the Company’s purpose and strategy.

Our Bylaws set a mandatory retirement age for directors to encourage Board refreshment, providing that a Director may not stand for election at an Annual Meeting of Shareowners after reaching age 70. The Bylaws do not provide any exceptions nor the ability to waive the mandatory retirement age.

ALLIANT ENERGY | 2024 Proxy Statement | 3

In fulfilling its responsibility to identify qualified candidates for membership on the Board of Directors, the Nominating and Governance Committee considers, among other factors, the following attributes of all nominees:

• Highest personal and professional ethics, integrity and values

• Highly accomplished in his or her respective field, with superior credentials and recognition and broad experience at the administrative and/or policy-making level in business, government, education, technology or public interest

• Ability to exercise sound business judgment

• Independence from any particular constituency and/or ability to represent all of our shareowners and commitment to enhance long-term shareowner value

• Relevant expertise and experience and the ability to offer advice and guidance to our Chief Executive Officer based on that expertise and experience

• Sufficient time available to devote to activities of the Board of Directors and to enhance his or her knowledge of our business

The Nominating and Governance Committee regularly evaluates the composition of the Board in light of the Company’s strategy and the types of risks and opportunities associated with the strategy. The committee seeks to nominate directors that provide a mix of experience, knowledge and abilities in aggregate that enable the Board to fulfill its responsibilities.

Biographies of the director nominees and continuing directors follow. The biographies list the key qualifications, skills and experience of each director nominee and continuing director that led to the Board’s conclusion that the person should serve. Each nominee and continuing director’s age is as of April 2, 2024.

Directors will be elected by a majority of the votes cast at the meeting assuming a quorum is present. Any shares not voted at the meeting, including abstentions and broker non-votes, will not be counted as votes cast. The proxies solicited may be voted for a substitute nominee or nominees if any of the nominees is unable to serve, or for good reason will not serve, a contingency the Board of Directors does not currently anticipate.

Alliant Energy Corporation (Alliant Energy) is a public utility holding company whose wholly-owned regulated utility subsidiaries are Interstate Power and Light Company (IPL) and Wisconsin Power and Light Company (WPL). The members of our Board of Directors are identical to the members of the Boards of Directors of IPL and WPL. References to Company throughout this Proxy Statement refer to all three companies unless otherwise indicated.

Additional information regarding the selection process for members of the Board of Directors can be found starting on page 16.

| | | | | |

| þ | The Board of Directors recommends a vote FOR the nominees for director. |

ALLIANT ENERGY | 2024 Proxy Statement | 4

NOMINEES FOR DIRECTOR

| | | | | |

|

| Summary: Ms. Barton brings extensive knowledge of the utility industry to the Board. Ms. Barton has served as President and Chief Executive Officer of Alliant Energy since January 2024. She has served as Chief Executive Officer of IPL and WPL since February 2023. She previously was President and Chief Operating Officer of Alliant Energy from February 2023 to January 2024. Prior to joining Alliant Energy, Ms. Barton served as Executive Vice President and Chief Operating Officer of American Electric Power Company, Inc. (AEP) from January 2021 to November 2022, Executive Vice President — Utilities of AEP from January 2020 to December 2020, and Executive Vice President — Transmission of AEP from 2011 to 2019. Ms. Barton has served on the Board of Directors of Commercial Metals Company, a manufacturer, recycler and marketer of steel and metal products, since 2020. She has been a Director of IPL and WPL since 2024.

Skills and Qualifications: strategic leadership; financial acumen/literacy; operations; customer perspective; public policy and regulatory; human capital management; risk management; technology systems; environmental and safety.

|

Lisa M. Barton Age: 58 Director since: 2024 Nominated for a term expiring in: 2027 Committee memberships: • Equity Awards

|

| | | | | |

|

| Summary: Mr. Cortina brings to the Board extensive experience in public policy, compliance, corporate governance, environmental and legal matters. Mr. Cortina has been Executive Vice President, Chief Legal Officer and Secretary of Oshkosh Corporation, a leading innovator of mission-critical vehicles and essential equipment, since February 2023. Mr. Cortina previously served as Executive Vice President, General Counsel and Secretary from 2016 to 2023. He has held various roles of increasing responsibility since joining Oshkosh Corporation in 2003. He has been a Director of IPL and WPL since 2023.

Skills and Qualifications: strategic leadership; financial acumen/literacy; public policy and regulatory; human capital management; risk management; environmental and safety.

|

Ignacio A. Cortina Age: 52 Director since: 2023 Nominated for a term expiring in: 2026 Committee memberships: • Compensation and Personnel •Operations

|

| | | | | |

|

| Summary: Ms. Cox brings to our Board more than 30 years of experience in the energy sector leading strategic planning, P&L management, human resources, manufacturing, supply chain and other functional roles for global organizations. Ms. Cox served as Executive President of Operations at John Wood Group PLC (Wood), a global leader in consulting and engineering in energy and materials markets, from October 2020 through July 2022. She also served as Wood’s Chief Executive Officer of Asset Solutions for the Americas from October 2019 to October 2020. Prior to joining Wood, Ms. Cox held multiple executive leadership roles with Schlumberger Limited (SLB), a global technology company that drives energy innovation for a balanced planet, spanning a 28-year career, including President, North America Land Drilling from 2018-2019; Vice President, Human Resources from 2017-2018 and from 2009-2014; President, North America from 2016-2017; President, Asia from 2014-2016; and leadership positions overseeing IT, Human Resources, Manufacturing and Supply Chain. Ms. Cox has served on the Board of Directors of Technip Energies, N.V., an engineering and technology company for the energy transition with shares listed on Euronext Paris, since 2023. She has served as a Director of IPL and WPL since 2023.

Skills and Qualifications: strategic leadership; financial acumen/literacy; operations; customer perspective; human capital management; risk management; technology systems; environmental and safety.

|

Stephanie L. Cox Age: 55 Director since: 2023 Nominated for a term expiring in: 2027 Committee memberships: • Compensation and Personnel • Operations |

ALLIANT ENERGY | 2024 Proxy Statement | 5

| | | | | |

|

| Summary: Mr. Newport brings to our Board broad experience and leadership in finance and operations of a manufacturing company. He served as Chief Executive Officer and a Director of AK Steel Holding Corporation from January 2016 until March 2020, when he retired in connection with the acquisition of AK Steel by Cleveland-Cliffs Inc. Prior to that, Mr. Newport served at AK Steel Holding Corporation as Executive Vice President, Finance and Chief Financial Officer since May 2015, as Senior Vice President, Finance and Chief Financial Officer since May 2014, and as Vice President, Finance and Chief Financial Officer since May 2012. Prior to that, Mr. Newport served in a variety of other leadership positions since joining AK Steel in 1985, including Vice President-Business Planning and Development, Controller and Chief Accounting Officer, Assistant Treasurer, Investor Relations, Manager-Financial Planning and Analysis and Product Manager. Mr. Newport has served on the Board of American Financial Group, Inc., an insurance holding company, since 2024. He has been a Director of IPL and WPL since 2018.

Skills and Qualifications: strategic leadership; financial acumen/literacy; operations; customer perspective; public policy and regulatory; human capital management; risk management; technology systems; environmental and safety.

|

Roger K. Newport Age: 59 Director since: 2018 Nominated for a term expiring in: 2027 Committee memberships: • Audit • Nominating and Governance |

| | | | | |

|

| Summary: Ms. Raymond brings extensive customer-focused marketing experience to our Board. Ms. Raymond has served as Senior Executive Vice President and Chief Marketing Officer at Kohl’s, a leading retailer, since August 2022. In her current role, she is responsible for Kohl’s marketing and customer service organizations, including the overall marketing strategy, brand and creative, media and personalization, credit and loyalty, customer insights and analytics, corporate communications, and philanthropic efforts. Prior to her current role, she was Executive Vice President Customer Engagement, Analytics & Insights from June 2020 to August 2022 and Senior Vice President, Media and Personalization from October 2017 to June 2020 at Kohl’s. Prior to joining Kohl’s, Ms. Raymond served in marketing, new business, and strategic planning leadership roles at The Walt Disney Company, where she had extensive experience with customer analytics and digital marketing, and Aspen Club Technologies. She has been a director of IPL and WPL since 2024.

Skills and Qualifications: strategic leadership; financial acumen/literacy; customer perspective; risk management; technology systems. |

Christie Raymond Age: 54 Director since: 2024 Nominated for a term expiring in: 2025 Committee memberships: • Audit • Compensation and Personnel |

| | | | | |

|

| Summary: Ms. Sanders is our Lead Independent Director and brings valuable leadership and insights as an experienced leader of our Board. Ms. Sanders has been the President of Carol P. Sanders Consulting LLC since 2015, a business consulting firm serving insurance and technology clients. She served as the Executive Vice President, Chief Financial Officer and Treasurer of Sentry Insurance, a Mutual Company, located in Stevens Point, Wisconsin from 2013 to 2015. Previously, she served as the Executive Vice President and Chief Operating Officer of Jewelers Mutual Insurance Company from 2012 until 2013, where she also served as Senior Vice President, Chief Financial Officer and Treasurer from 2011 until 2012 and as Chief Financial Officer from 2004 until 2011. Before that, Ms. Sanders served as Controller and Assistant Treasurer of Sentry Insurance from 2001 to 2004. She has served on the Boards of Directors of RenaissanceRE Holdings Ltd., a global provider of reinsurance and insurance since 2016, and First Business Financial Services, Inc., a Wisconsin-based bank holding company since 2016. She has served as a Director of IPL and WPL since 2005.

Skills and Qualifications: strategic leadership; financial acumen/literacy; operations; public policy and regulatory; human capital management; risk management; technology systems. |

Carol P. Sanders Age: 57 Director since: 2005 Nominated for a term expiring in: 2027 Lead Independent Director Committee memberships: • Audit • Executive • Nominating and Governance (Chair) |

ALLIANT ENERGY | 2024 Proxy Statement | 6

CONTINUING DIRECTORS | | | | | |

|

| Summary: Mr. Allen brings to our Board extensive experience in financial leadership. Mr. Allen served as Chief Financial Officer at Collins Aerospace since 2018 prior to retiring in 2020. He served as Senior Vice President and Chief Financial Officer at Rockwell Collins, Inc. in Cedar Rapids, Iowa, leading the company’s finance activities, including financial planning, accounting, treasury, audit, and tax from 2005 to 2018. Mr. Allen previously served in various financial officer positions at Rockwell Collins and its subsidiaries since 2001. Before joining Rockwell Collins, he served in various roles at Rockwell International, including Vice President and Treasurer, Vice President of Financial Planning, and Assistant Controller. Prior to that, he worked as an auditor at Deloitte & Touche and has passed the certified public accountancy examination. Mr. Allen has served on the Board of Triumph Group, Inc., an aerospace company, since 2023. Mr. Allen has been a Director of IPL and WPL since 2011.

Skills and Qualifications: strategic leadership; financial acumen/literacy; public policy and regulatory; human capital management; risk management; technology systems; environmental and safety.

|

Patrick E. Allen Age: 59 Director since: 2011 Term expires in: 2026 Committee memberships: • Compensation and Personnel (Chair) • Executive • Nominating and Governance

|

| | | | | |

|

| Summary: Ms. Falotico brings to our Board more than 33 years’ experience across a diverse set of areas including business leadership, corporate governance, strategic planning, regulatory banking, marketing and sales, enterprise risk management, global operations and business transformations. Ms. Falotico served as President of Lincoln Motor Company from March 2018 until she retired in December 2022. She also served as Ford Motor Company’s Chief Marketing Officer from March 2018 until January 2021 and was a Group Vice President of Ford Motor Company since 2016. Ms. Falotico was named an Executive Vice President of Ford Motor Credit Company, a leading global automotive financial services provider, in 2012. In 2016 she was named Chief Operating Officer and moved rapidly into the role of Chair and CEO, serving as CEO until 2018 and Chair until 2019. She served as a Director of Ford Motor Credit Company until 2022. She has been a Director of IPL and WPL since 2021.

Skills and Qualifications: strategic leadership; financial acumen/literacy; operations; customer perspective; public policy and regulatory; human capital management; risk management; technology systems; environmental and safety.

|

N. Joy Falotico Age: 56 Director since: 2021 Term expires in: 2025 Committee memberships: • Audit (Chair) • Executive • Operations |

| | | | | |

|

| Summary: Mr. Garcia brings to our Board extensive operational leadership in heavy industrial industries. Mr. Garcia has been the Chief Executive Officer with Algoma Steel Group Inc., since June 2022. Mr. Garcia was President of the Pulp and Paper Division of Domtar Corporation from April 2014 to January 2021. Prior to joining Domtar, Mr. Garcia was the Chief Executive Officer at EVRAZ Highveld Steel & Vanadium Co., in South Africa. Mr. Garcia has more than 25 years of international management experience in paper, steel, and aluminum manufacturing and marketing. Mr. Garcia has served on the Board of Directors of Algoma Steel Group Inc., since June 2022. He has been a Director of IPL and WPL since 2020.

Skills and Qualifications: strategic leadership; financial acumen/literacy; operations; customer perspective; public policy and regulatory; human capital management; risk management; technology systems; environmental and safety. |

Michael D. Garcia Age: 59 Director since: 2020 Term expires in: 2026 Committee memberships: • Compensation and Personnel • Executive • Operations (Chair) |

ALLIANT ENERGY | 2024 Proxy Statement | 7

| | | | | |

|

| Summary: Mr. Larsen brings to our Board an extensive knowledge of the utility business and his tenure with the Company in strategic leadership positions. He currently serves as Executive Chairman and Chairman of the Board of Alliant Energy, IPL and WPL. He served as Chairman and Chief Executive Officer of Alliant Energy from February 2023 to January 2024 and Chairman, President and Chief Executive Officer from July 2019 to February 2023. He served as Chairman of the Board of IPL and WPL from February 2023 to January 2024 and as Chief Executive Officer of IPL and WPL from January 2019 to February 2023. Mr. Larsen previously served as President and Chief Operating Officer of Alliant Energy since January 2019, President of Alliant Energy since January 2018, Senior Vice President of Alliant Energy from 2014 to 2017, Senior Vice President of IPL from 2014 to 2018, and as Senior Vice President-Generation of Alliant Energy and IPL from 2010 to 2014. He served as President of WPL from 2010 to 2018. Mr. Larsen joined Alliant Energy in 1988 as an engineer and held engineering, energy delivery and generation roles of increasing importance with the Company. He has been a Director of IPL and WPL since 2019.

Skills and Qualifications: strategic leadership; financial acumen/literacy; operations; customer perspective; public policy and regulatory; human capital management; risk management; technology systems; environmental and safety.

|

John O. Larsen Age: 60 Director since: 2019 Term expires in: 2025 Executive Chairman Chairman of the Board Committee memberships: • Executive (non-voting Chair) |

| | | | | |

|

| Summary: Mr. O’Toole brings to our Board his strong experience in revenue strategy, customer strategy, data-driven business and digital commerce. Since 2023, Mr. O’Toole has been Associate Dean, Executive Programs and Clinical Professor of Marketing at the Kellogg School of Management of Northwestern University. From 2020 to 2023, Mr. O'Toole was Associate Dean, Executive Education and Clinical Professor of Marketing at Kellogg. From 2018 to 2020, Mr. O’Toole was the Executive Director of the Program for Data Analytics and Clinical Professor of Marketing at Kellogg. From 2016 to 2018, he was Senior Fellow and Clinical Professor of Marketing at Kellogg. He is the principal of O’Toole Associates, LLC, through which he serves as a Senior Advisor with McKinsey & Co., a global management consulting firm. Until his retirement in late 2016, Mr. O’Toole was Chief Marketing Officer and Senior Vice President of United Airlines and President, MileagePlus of United Continental Holdings, Inc., a global air carrier. He joined United in 2010 as Chief Marketing Officer and Senior Vice President and held positions with United as Senior Vice President, Marketing and Loyalty and President, MileagePlus from 2012 to 2014, Chief Operating Officer, MileagePlus from 2010 to 2012, and Chief Marketing Officer in 2010. Before joining United, Mr. O’Toole held leadership roles for over 13 years with Hyatt Hotels Corporation, including as Chief Marketing Officer and Chief Information Officer. He served on the Boards of Directors of LSC Communications, Inc., a print, print-related services and office products company, from 2016 to 2021, and Extended Stay America Inc., a hotel owner and operator, from 2017 to 2021. He has served as a Director of IPL and WPL since 2015.

Skills and Qualifications: strategic leadership; financial acumen/literacy; operations; customer perspective; technology systems.

|

Thomas F. O’Toole Age: 66 Director since: 2015 Term expires in: 2025 Committee memberships: • Nominating and Governance • Operations |

ALLIANT ENERGY | 2024 Proxy Statement | 8

CORPORATE GOVERNANCE

Corporate Purpose and Values

Our purpose at Alliant Energy is to serve customers and build strong communities. Our purpose, supported by our values, is the foundation of our culture, guides our actions, and describes how we accomplish our strategy.

Ethical and Legal Compliance Policy

Our Board of Directors has adopted a Code of Conduct that serves as our code of ethics. We created our Code of Conduct to define our standards for workplace behavior and to provide guidance on what to do in difficult situations and gray areas. These guidelines apply to all employees, at every level, including our Chief Executive Officer (CEO), Chief Financial Officer (CFO), and Chief Accounting Officer, as well as the members of our Board of Directors. The expectations laid out in the Code of Conduct are quite simple: make good choices and live our values. Our Code of Conduct is posted at www.alliantenergy.com/investors under the Corporate Governance link. To comply with the disclosure requirements under Item 5.05 of Form 8-K, we will post any new amendments, other than technical, administrative, or other non-substantive amendments, to, or waivers from our Code of Conduct granted to our CEO, CFO, or Chief Accounting Officer on that website throughout the year.

Corporate Governance Guidelines

Our Board of Directors has adopted Corporate Governance Guidelines that outline how directors can represent investor interests and oversee how the Company fulfills its purpose. The Corporate Governance Guidelines, in conjunction with the Board committee charters, establish processes and procedures to help ensure effective and responsive governance by the Board. Our Corporate Governance Guidelines are posted at www.alliantenergy.com/investors under the Corporate Governance link.

Director Independence

Our Corporate Governance Guidelines provide that at least 75% of the members of the Board of Directors must be independent directors under the applicable rules of The Nasdaq Stock Market LLC (Nasdaq). The Audit, Compensation and Personnel, and Nominating and Governance Committees must be composed only of independent directors.

The Board of Directors evaluates directors’ independence under the applicable Nasdaq rules, including the categorical standards of independence provided by Nasdaq rules. The Board of Directors also considers certain other factors to determine a director’s independence.

The Board of Directors adopted resolutions that affirm that each of Mr. Allen, Mr. Cortina, Ms. Cox, Ms. Falotico, Mr. Garcia, Mr. Newport, Mr. O’Toole, Ms. Raymond, Ms. Sanders, and Mr. Oestreich, Ms. McAllister and Ms. Whiting while they were members of the Board of Directors, has no material relationship with the Company that would impair his or her independent judgment as a director and, therefore, is independent in accordance with Nasdaq rules.

Majority Voting in Uncontested Director Elections

Under our Bylaws, if a director nominee in an uncontested election (i.e., an election where the number of nominees is not greater than the number of directors to be elected) receives more AGAINST votes than FOR votes, the director nominee is required to offer his or her resignation to the Chair of the Board of Directors following certification of the shareowner vote. The Nominating and Governance Committee will consider such resignation and make a recommendation to the Board whether to accept or reject the tendered resignation, or whether other action should be taken. The Board will act on the tendered resignation, taking into account the Nominating and Governance Committee’s recommendation and all other factors deemed relevant, and publicly disclose (by a press release, a filing

ALLIANT ENERGY | 2024 Proxy Statement | 9

with the SEC or other broadly disseminated means of communication) its decision regarding the tendered resignation within 90 days from the date of final certification of the shareowner vote. The director who has tendered a resignation pursuant to this provision will not participate in the Nominating and Governance Committee’s or the Board’s deliberations or decision with respect to the tendered resignation.

Attendance and Performance Evaluations

Our Board of Directors held eight joint (Alliant Energy, IPL and WPL) Board meetings in 2023. Each director attended at least 75% of the aggregate number of meetings of the Board of Directors and Board committees on which he or she served during his or her tenure on the Board.

The Board of Directors and each Board committee conduct performance evaluations annually to determine their effectiveness and suggest improvements. In addition, the Compensation and Personnel Committee evaluates the performance of the CEO on an annual basis.

Members of our Board of Directors are expected to attend our Annual Meeting of Shareowners. All members of our Board of Directors at the time of the 2023 Annual Meeting were present for the 2023 Annual Meeting.

Related-Person Transactions

We have adopted a written policy regarding related-person transactions. The policy provides that we will annually disclose information regarding related-person transactions as required by regulations of the SEC to be disclosed, or incorporated by reference, in our Annual Report on Form 10-K. For purposes of the policy “related-person” means any of our directors or executive officers, nominees for director and any member of the immediate family of such person.

A related-person transaction is generally a transaction in which: (1) we are a participant; (2) the amount involved exceeds $120,000; and (3) a related-person has a direct or indirect material interest. A related-person transaction does not include:

• The payment of compensation by us to our executive officers, directors or nominees for director

• A transaction in which the interest of the related-person arises solely from the ownership of our shares and all shareowners receive the same benefit on a pro-rata basis

• A transaction in which the rates or charges involved are determined by competitive bids, or that involves the rendering of services as a common or contract carrier or public utility at rates or charges fixed and in conformity with law or governmental authority

• A transaction that involves services as a bank, transfer agent, registrar, trustee under a trust indenture, or similar services

Furthermore, a related-person is not deemed to have a material interest in a transaction if the person’s interest arises only:

•From the person’s position as a director of another party to the transaction

•From the ownership by such person and all other related-persons, in the aggregate, of less than a 10% equity interest in another entity (other than a partnership) that is a party to the transaction

•From such person’s position as a limited partner in a partnership in which such person and other related-persons have an interest of less than 10%, and the person is not a general partner of, and does not hold another position in, the partnership

•From both such director position and ownership interest

Pursuant to the policy, each of our executive officers, directors and nominees for director is required to disclose to the Nominating and Governance Committee certain information regarding related-person transactions for review, approval or ratification by the committee. If possible, they should disclose the related-person transaction to the committee before the related-person transaction occurs. In any event, they must disclose the transaction as soon as practicable after the transaction is effected or they become aware of it.

The Nominating and Governance Committee will decide whether to approve or ratify the related-person transaction based on whether the transaction is contrary to the best interests of the Company. The committee may take into account the effect of a director’s related-person transaction on such person’s status as an independent member of our Board of Directors and eligibility to serve on Board committees under Securities and Exchange Commission (SEC) and Nasdaq rules.

We had no related-person transactions since the beginning of 2023, and no related-person transactions are currently proposed.

Risk Oversight

Our Corporate Governance Guidelines provide that the Board of Directors is responsible for overseeing and understanding our purpose, vision and mission, strategic plans, overall corporate risk profile, risk parameters, annual operating plans and annual budgets, and for monitoring whether these plans are being implemented effectively. We utilize an enterprise risk management (ERM) program, which is designed to identify, assess, communicate and manage material risks in a structured framework. Under the ERM program, management periodically reviews an extensive risk inventory and assigns values and rankings to identify key risks, and identifies mitigation strategies for key risks. The Audit Committee oversees the ERM program. Risks identified under the ERM program are overseen by the Board or a designated Board committee and certain members of management, and internal audit assessments of such risks are periodically completed as needed. In addition, the Executive Review and Risk Committee, composed of senior executives, reviews business, financial, reputational, and operational risks that may be material to the Company, as well as processes to control, mitigate and monitor the risks, including risks identified through the ERM program.

ALLIANT ENERGY | 2024 Proxy Statement | 10

The process assigns oversight of certain risks to the Board of Directors or certain Board committees. Significant operational risks are the subject of regularly scheduled reports to the full Board of Directors or the appropriate Board committee. Certain risks covered in 2023 are as follows.

| | | | | | | | | | | | | | | | | |

Board of Directors

Cybersecurity Regulatory

| Nominating and Governance Committee

Corporate Governance Corporate Environmental and Social Responsibility | Compensation and Personnel Committee

Compensation Workforce Corporate Culture |

Audit Committee

Financial Performance and Reporting Compliance Liquidity

| Operations Committee

Safety Environmental Compliance Customer Satisfaction Large Construction Operations Physical Security Price and Volume of Commodities, Materials and Supplies Catastrophic Events |

The Compensation and Personnel Committee conducted an assessment of our compensation policies and practices in 2023. The result of this assessment is described in further detail under “Compensation and Personnel Committee Risk Assessment” in the Compensation Discussion and Analysis.

Corporate Sustainability, Environmental and Social Responsibility Oversight

We recognize the importance that sustainability, environmental and social responsibility have on our operations. These matters are represented by our Company purpose and values. The Nominating and Governance Committee is responsible for general oversight of these issues, including review and approval of our annual Corporate Responsibility Report. The committee oversees the Company’s progress on important sustainability topics, which include a broad range of issues handled by various committees. The Board of Directors and Board committees covered sustainability responsibilities in 2023 as follows.

| | | | | | | | | | | | | | | | | |

Board of Directors

Purpose, Mission and Strategy Cyber and Physical Security Public Policy Engagement | Nominating and Governance Committee

ESG Oversight Board and Management Quality Board Structure Ownership and Shareowner Rights Corporate Responsibility Report Political Engagement | Compensation and Personnel Committee

Remuneration and ESG Performance Metrics Diversity, Equity and Inclusion Workforce Environment Corporate Culture Workforce Development |

Audit Committee

Audit and Financial Reporting Enterprise Risk Management Code of Conduct Conflict of Interest Business Ethics

| Operations Committee

Climate Change Risks Greenhouse Gas Emissions Water Management Energy Portfolio Diversity Emissions and Waste Community Relations Customer Engagement Safety and Health Supply Chain Energy Reliability and Resiliency

|

Shareowner Outreach

In 2023, we reached out to holders of approximately 55% of our outstanding shares, and held discussions with those who agreed to meet. Our outreach meetings generally included discussions about governance, executive compensation, sustainability, our clean energy vision, human capital management and diversity, equity and inclusion matters, and board risk oversight. The Executive Chairman, Lead Independent Director, CEO, Treasurer, and members of the Environmental Services & Corporate Sustainability, Corporate Secretary, Legal and Investor Relations departments participated in these discussions. Shareowner feedback and suggestions that we received were reported to the Board of Directors or relevant Board committee for consideration.

In addition, our top managers, including the Executive Chairman, CEO and CFO, regularly participate in investor and industry conferences throughout the year to discuss performance and share perspectives on Company and industry developments. We also offer channels for shareowners to contact the Board of Directors with any inquiry or issue.

ALLIANT ENERGY | 2024 Proxy Statement | 11

Communication with Directors

Shareowners and other interested parties may communicate with the full Board of Directors, non-employee directors as a group, or individual directors (including the Lead Independent Director) by writing to our Corporate Secretary, who will post such communication directly to our Board of Directors’ confidential web portal.

Board of Directors Leadership Structure

Our Bylaws and our Corporate Governance Guidelines provide that the Board of Directors is responsible for selecting a Chair of the Board of Directors and a CEO. The Board regularly reviews the leadership structure. As part of the Company’s recent CEO succession planning process, the Board determined that having Mr. Larsen serve as Executive Chairman and Chairman of the Board and Ms. Barton serve as President and CEO provides the optimal leadership structure at this time. This structure leverages Mr. Larsen’s company and industry knowledge and strong stakeholder relationships to support a successful transition.

Mr. Larsen is well-suited to lead the Board due to his extensive company and industry expertise and experience, and his strong relationships with external stakeholders. This experience is valuable to the Board in its oversight, advisory and risk management roles. Mr. Larsen also provides support to the CEO on strategic matters, external stakeholder relationships, and general support and counsel during the transition. Separating the CEO role allows Ms. Barton to focus on leading all aspects of the Company’s strategy development and execution, including operational, financial, regulatory, workforce, and public policy matters.

The Board continues to have a strong Lead Independent Director. As the Chair of the Nominating and Governance Committee, Ms. Sanders is currently designated as the Lead Independent Director. The Lead Independent Director is recognized by management and the Board of Directors as a key position of leadership within the Board of Directors. Our Corporate Governance Guidelines provide that the Lead Independent Director will preside at regular executive sessions of the Board of Directors, without management participation, though our Corporate Governance Guidelines do not grant the Lead Independent Director any special authority over management. Our Lead Independent Director’s role also encompasses additional Board governance responsibilities.

| | | | | | | | | | | | | | |

Lead Independent Director Roles |

• Communicating applicable information from executive session deliberations to the Executive Chairman and CEO |

• Reviewing with the Executive Chairman and CEO items of importance for consideration by the Board of Directors |

• Acting as principal liaison between the independent directors and management on sensitive issues |

• Discussing with the Executive Chairman and CEO important issues to assess and evaluate views of the Board of Directors |

• Consulting with any or all of our independent directors at the discretion of either party and with or without the attendance of the Executive Chairman and CEO |

• In conjunction with the Nominating and Governance Committee, recommending to the Executive Chairman the membership of the various Board committees and selection of the Board committee chairs |

• In conjunction with the Nominating and Governance Committee, interviewing all director candidates and making recommendations to the Board of Directors on director nominees |

• Mentoring and counseling new members of the Board of Directors to assist them in becoming active and effective directors |

• In conjunction with the Nominating and Governance Committee, reviewing and approving the philosophy of, and program for, compensation of the independent directors |

• Meeting with the CEO to discuss the CEO performance evaluation |

We believe that the use of a Lead Independent Director has been effective for us and has greatly facilitated communication of important issues between the independent members of the Board of Directors and the Executive Chairman and CEO.

The Board of Directors regularly reviews the leadership structure considering a variety of factors to implement a leadership structure it believes is in the best interests of the Company, its customers and and its shareowners. The Board of Directors recognizes that, depending on the specific characteristics and circumstances of the Company, other Board leadership structures might also be appropriate.

Other Board Service

Our Corporate Governance Guidelines provide that a director who is expected to be elected or appointed to an additional board of directors of a public company shall provide notice to the Board Chair and Lead Independent Director prior to accepting such additional directorship. This requirement allows the Board Chair and Lead Independent Director to evaluate for any potential conflicts, whether the directors will continue to have sufficient time available to devote to the activities of the Board of Directors, and any other considerations related to fulfilling their responsibilities to our shareowners.

Executive Sessions

The independent directors meet in executive session with no member of our management present at every regular meeting of the Board of Directors.

ALLIANT ENERGY | 2024 Proxy Statement | 12

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Board of Directors has five standing committees: (1) Audit; (2) Compensation and Personnel; (3) Nominating and Governance; (4) Operations; and (5) Executive. The Board of Directors has adopted formal written charters for each of the standing committees, which are posted at www.alliantenergy.com/investors under the Corporate Governance link. The Board of Directors also has established an Equity Awards Committee, which has the authority to approve certain limited equity issuances to employees other than executive officers. Directors serve on the following standing committees:

| | | | | | | | | | | | | | | | | |

| Audit | Compensation

and Personnel | Nominating

and

Governance |

Operations | Executive |

Patrick E. Allen | | C | ü | | ü |

| Lisa M. Barton | | | | | |

| Ignacio A. Cortina | | ü | | ü | |

| Stephanie L. Cox | | ü | | ü | |

| N. Joy Falotico | C | | | ü | ü |

| Michael D. Garcia | | ü | | C | ü |

| John O. Larsen | | | | | C* |

| Roger K. Newport | ü | | ü | | |

| Thomas F. O’Toole | | | ü | ü | |

| Christie Raymond | ü | ü | | | |

| Carol P. Sanders | ü | | C | | ü |

C = Committee Chair C* = Non-Voting Committee Chair ü= Member

Each committee is described below. The committees of our Board of Directors, including the composition and independence of the committees, are identical to the committees of the Board of Directors of IPL and WPL. The term “joint meetings” in the following descriptions refers to meetings of the Company, IPL and WPL. Except as otherwise noted, all meetings were held jointly.

ALLIANT ENERGY | 2024 Proxy Statement | 13

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

| | | | | | | | |

| Audit Committee |

| Members | N. Joy Falotico, Chair Roger K. Newport Christie Raymond (effective April 1, 2024) Carol P. Sanders

|

| Independence and Financial Expertise | All members are independent as required by applicable SEC and Nasdaq rules. The Board of Directors has determined that Ms. Falotico, Mr. Newport and Ms. Sanders are audit committee financial experts and all committee members are financially sophisticated within the meaning of Nasdaq rules. |

| Meetings | The committee held six meetings in 2023. |

| Charter | The committee charter is posted at www.alliantenergy.com/investors under the Corporate Governance link. |

| Responsibilities | The primary responsibilities of the Audit Committee are: |

| • | Engaging and overseeing the Company’s independent auditors (taking into account the vote on shareowner ratification), considering the qualifications, performance and independence of the independent auditors, periodically reviewing and evaluating the lead audit partner of the independent auditors and periodically considering whether to rotate the independent auditors |

| • | Pre-approving all audit engagement services and permitted non-audit services to be performed by the independent auditors |

| • | Reporting to the Board of Directors on the quality and integrity of the Company’s financial statements and its related internal controls over financial reporting, and reviewing with management and the independent auditors: (1) the Company’s annual and quarterly financial statements and other financial disclosures, including earnings press releases and earnings guidance; and (2) major issues as to the adequacy of the Company’s internal control over financial reporting |

| • | Reviewing with the independent auditors and the Company’s internal auditors the overall scope and plans for their respective audits |

| • | Preparing the Report of the Audit Committee for inclusion in the Company’s proxy statement |

| • | Reviewing and assessing the guidelines and policies governing the Company’s risk management processes, the Company’s major financial risk exposures and actions taken to monitor and control such risk exposures |

| • | Overseeing compliance and ethical standards adopted by the Company |

| • | Reviewing the status of the Company’s compliance with laws, regulations and internal procedures, and monitoring contingent liabilities and risks that may be material to the Company |

| • | Establishing procedures for the Company to receive, retain and respond to the confidential, anonymous submission of concerns regarding accounting and auditing matters or other federal securities law matters |

| Additional information on oversight roles and responsibilities of the Audit Committee is provided on page 11. |

ALLIANT ENERGY | 2024 Proxy Statement | 14

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

| | | | | | | | |

Compensation and Personnel Committee |

| Members | Patrick E. Allen, Chair Ignacio A. Cortina Stephanie L. Cox Michael D. Garcia Christie Raymond (effective April 1, 2024) |

| Independence | All members are independent as required by applicable SEC and Nasdaq rules. |

| Meetings | The committee held seven meetings in 2023. |

| Charter | The committee charter is posted at www.alliantenergy.com/investors under the Corporate Governance link. |

| Responsibilities | The primary responsibilities of the Compensation and Personnel Committee are: |

| • | Overseeing compensation philosophy and policies relating to compensation of the Company’s executive officers |

| • | Setting corporate goals and objectives relevant to CEO and executive compensation and evaluating the CEO’s performance compared to those goals |

| • | Determining and approving the CEO’s compensation and benefits based on the CEO’s performance |

| • | Reviewing and approving the compensation of the other executive officers |

| • | Reviewing and approving stock ownership guidelines |

| • | Overseeing the general health of the Company’s working environment and how the Company is addressing any related trends |

| • | Reviewing the Compensation Discussion and Analysis and producing a Compensation and Personnel Committee Report for inclusion in the Company’s proxy statement |

| • | Evaluating its relationship with any compensation consultant for any conflicts of interest and assessing the independence of any of its legal, compensation or other external advisors |

| Additional information on the roles and responsibilities of the Compensation and Personnel Committee is provided on page 11 and in the Compensation Discussion and Analysis beginning on page 22. |

Compensation Advisor

The Compensation and Personnel Committee has engaged Pay Governance LLC as its independent external advisor to analyze the competitive level of executive compensation and provide information regarding executive compensation trends. The committee reviewed its relationship with Pay Governance and considered Pay Governance’s independence and the existence of potential conflicts of interest. The committee determined that the engagement of Pay Governance did not raise any conflict of interest or other issues that would adversely impact Pay Governance’s independence. In reaching this conclusion, the committee considered various factors, including:

•Whether Pay Governance and its advisors provide other services to us

•The amount of fees we pay to Pay Governance as a percentage of Pay Governance’s total revenues

•The policies and procedures that Pay Governance has implemented to prevent conflicts of interest

•Any business or personal relationship of an individual Pay Governance advisor working with us or with a member of the committee

•Any of our stock owned by the individual Pay Governance advisor working with us

•Any business or personal relationships between our executive officers and Pay Governance or the Pay Governance advisor working with us

Delegation

The Board of Directors has delegated to the Equity Awards Committee the authority to approve certain limited equity issuances to employees other than executive officers. Ms. Barton is the sole member of this committee.

Compensation and Personnel Committee Interlocks and Insider Participation

No person who served as a member of the Compensation and Personnel Committee during 2023: (a) served as one of our officers or employees or (b) has any relationship requiring disclosure as a related-person transaction under Item 404 of the SEC Regulation S-K. None of our executive officers serves as a member of the Board of Directors or compensation committee of any other company that has an executive officer serving as a member of our Board of Directors or our Compensation and Personnel Committee.

ALLIANT ENERGY | 2024 Proxy Statement | 15

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

| | | | | | | | |

Nominating and Governance Committee |

| Members | Carol P. Sanders, Chair Patrick E. Allen Roger K. Newport Thomas F. O’Toole |

| Independence | All members are independent as required by applicable SEC and Nasdaq rules. |

| Meetings | The committee held eight meetings in 2023. |

| Charter | The committee charter is posted at www.alliantenergy.com/investors under the Corporate Governance link. |

| Responsibilities | The primary responsibilities of the Nominating and Governance Committee are: |

| • | Developing criteria and qualifications, including independence standards, for selecting director candidates and identifying qualified candidates for membership on the Board of Directors and Board committees |

| • | Making recommendations to the Board of Directors concerning the composition, size, structure and activities of the Board of Directors and Board committees |

| • | Assessing and reporting to the Board of Directors on the performance and effectiveness of the Board of Directors and Board committees |

| • | Ensuring that directors receive continuing director education |

| • | Reviewing and determining whether to approve or ratify any related-person transactions |

| • | Reviewing and making recommendations to the Board of Directors with respect to director compensation and benefits |

| • | Developing and recommending to the Board of Directors updates to our Corporate Governance Guidelines and other corporate governance policies and practices |

| • | Overseeing sustainability, environmental and social responsibility initiatives, including approving the Corporate Responsibility Report |

| • | Overseeing the political engagement activity of the Company |

| • | Reviewing and making recommendations to the Board regarding shareowner proposals, working with other committees as appropriate |

| • | Reviewing and recommending to the Board of Directors succession plans for the Company’s CEO |

| Additional information on oversight roles and responsibilities of the Nominating and Governance Committee is provided on page 11. |

The Nominating and Governance Committee is responsible for evaluating nominees for director and director candidates. The considerations used by the committee to identify qualified candidates for membership on the Board are described starting on page 2.

In addition, the Nominating and Governance Committee maintains a file of potential director nominees, which is reviewed when we search for a new director. The committee has also engaged a national consulting firm to perform searches for director candidates who meet the current needs of the Board. We pay a fee to consulting firms that assist in our search. In recruiting Mr. Cortina and Ms. Raymond, the Nominating and Governance Committee retained a search firm to help identify director prospects, perform candidate outreach, assist in reference checks and provide other related services.

The Nominating and Governance Committee will consider recommendations for director nominees made by shareowners and evaluate them using the same criteria as for other candidates. Recommendations received from shareowners are reviewed by the Chair of the committee to determine whether each candidate meets the minimum membership criteria set forth in the Corporate Governance Guidelines and, if so, whether the recommended candidate’s expertise and particular set of skills and background fit the current needs of the Board of Directors. Any shareowner recommendation must be sent to the Corporate Secretary of Alliant Energy at 4902 North Biltmore Lane, Madison, Wisconsin 53718 and must include biographical information. Shareowners wishing to nominate director candidates directly for consideration by shareowners must write to our Corporate Secretary in a timely manner as specified in our Bylaws.

Board of Directors Diversity

We strive to create a workplace in which people of diverse backgrounds, talents and perspectives support our purpose. The Nominating and Governance Committee seeks a Board of Directors with diverse opinions, perspectives and backgrounds. We believe we have been effective in assembling a diverse body of individuals as measured by the criteria of age, gender, ethnicity, race, tenure, skills, qualifications and experience specified in our Corporate Governance Guidelines as shown in the charts on page 3. Approximately 64% of our directors are women or ethnically or racially diverse individuals.

ALLIANT ENERGY | 2024 Proxy Statement | 16

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

| | | | | | | | |

Operations Committee |

| Members | Michael D. Garcia, Chair

Ignacio A. Cortina

Stephanie L. Cox

N. Joy Falotico

Thomas F. O’Toole

|

| Independence | All members are independent as defined by the Nasdaq rules. |

| Meetings | The committee held seven meetings in 2023. |

| Charter | The committee charter is posted at www.alliantenergy.com/investors under the Corporate Governance link. |

| Responsibilities | The primary responsibilities of the Operations Committee are: |

| • | Reviewing and overseeing environmental policy and planning issues |

| • | Reviewing and overseeing safety issues and policies |

| • | Reviewing and monitoring issues of strategic importance related to the Company’s operations such as reliability, quality of service, customer care and customer satisfaction |

| • | Reviewing and assessing risk in relation to the Company’s operations |

| • | Reviewing and monitoring issues with significant impact on the utility capital budgets and energy resource adequacy |

| Additional information on oversight roles and responsibilities of the Operations Committee is provided on page 11. |

| | | | | |

Executive Committee |

| Members | John O. Larsen, Chair (non-voting)

Patrick E. Allen

N. Joy Falotico

Michael D. Garcia

Carol P. Sanders |

| Independence | All members except Mr. Larsen are independent as defined by the Nasdaq rules. |

| Meetings | The committee generally does not meet and did not meet in 2023. |

| Charter | The committee charter is posted at www.alliantenergy.com/investors under the Corporate Governance link. |

| Responsibilities | The Executive Committee possesses all the power and authority of the Board of Directors when the Board is not in session. |

ALLIANT ENERGY | 2024 Proxy Statement | 17

2023 DIRECTOR COMPENSATION

The following table summarizes the compensation paid to or earned by our non-employee directors during 2023.

| | | | | | | | | | | | | | |

Name(1) | Fees Earned

or Paid in

Cash ($)(2) | Change in Pension Value and Non-qualified Deferred Compensation Earnings ($)(3) | All Other

Compensation

($)(4) | Total ($) |

| Patrick E. Allen | $290,000 | $0 | $0 | $290,000 |

| Ignacio A. Cortina | $135,000 | $0 | $0 | $135,000 |

| Stephanie L. Cox | $270,000 | $0 | $0 | $270,000 |

| N. Joy Falotico | $282,500 | $0 | $0 | $282,500 |

| Michael D. Garcia | $277,500 | $0 | $0 | $277,500 |

| Singleton B McAllister | $135,000 | $363 | $3,500 | $138,863 |

| Roger K. Newport | $282,500 | $0 | $3,500 | $286,000 |

| Dean C. Oestreich | $67,500 | $6,609 | $0 | $74,109 |

| Thomas F. O'Toole | $277,500 | $1,297 | $0 | $278,797 |

| Carol P. Sanders | $320,000 | $5,877 | $0 | $325,877 |

| Susan D. Whiting | $206,250 | $0 | $3,500 | $209,750 |

(1) Mr. Larsen is also an employee of the Company and received no additional compensation for his service on our Board of Directors and therefore is not included in this table. Ms. Barton is also an employee of the Company but did not serve on the Board in 2023 and is therefore not included in this table. Compensation received by Mr. Larsen and Ms. Barton for 2023 is shown in the Summary Compensation Table. Mr. Oestreich served on the Board until February 2023, Ms. McAllister served on the Board until May 2023 and Ms. Whiting served on the Board until July 2023. Mr. Cortina was appointed to the Board in July 2023. Ms. Raymond did not serve on the Board in 2023 and is therefore not included in this table.

(2) The amounts shown in this column include the following aggregate dollar amounts deferred and the corresponding number of shares of common stock credited in our Alliant Energy Deferred Compensation Plan Company Stock Account by each of the following directors:

| | | | | | | | |

| Name | Aggregate Dollar

Amounts Deferred | Number of Shares

of Common

Stock Credited |

| Stephanie L. Cox | $270,000 | 5,083 |

| N. Joy Falotico | $240,125 | 4,518 |

| Michael D. Garcia | $194,250 | 3,655 |

| Roger K. Newport | $211,875 | 3,979 |

| Thomas F. O'Toole | $138,750 | 2,605 |

| Susan D. Whiting | $203,250 | 3,732 |

(3) The amounts shown in this column represent above-market interest on non-qualified deferred compensation.

(4) The amounts in this column include payments made to charities through the Alliant Energy matching gift program. Infrequently, spouses and guests of directors accompany the directors on a corporate aircraft when the aircraft is already going to a specific destination for a business purpose at no aggregate incremental cost to the Company. No such travel occurred in 2023.

Retainer Fees

In 2023, all non-employee directors, each of whom served on the Boards of Directors of Alliant Energy, IPL and WPL, received an annual cash retainer for service on all Boards, payable quarterly in advance. The following table describes the annual cash retainer received for service in 2023 and the annual retainer that will be received for service in 2024, as well as other fees for director services. Fees for 2023 and 2024 were based on a review of market-based compensation for non-employee directors presented by the Compensation and Personnel Committee’s independent consultant.

| | | | | | | | | | | | | | | | | | | | | | | |

| Year | Annual

Retainer for

Service on All

Boards | Lead

Independent

Director | Chair of

the Audit

Committee | Chair of the

Compensation

and Personnel

Committee | Chair of

the Nominating

and

Governance

Committee | Chair of

the Operations

Committee | Other Audit

Committee

Members |

| 2023 | $270,000 | $30,000 | $20,000 | $20,000 | $15,000 | $15,000 | $5,000 |

| 2024 | $280,000 | $35,000 | $25,000 | $20,000 | $17,500 | $17,500 | $5,000 |

ALLIANT ENERGY | 2024 Proxy Statement | 18

Meeting Fees

In 2023, directors did not receive any additional compensation for attendance at Board or committee meetings. The same applies for 2024.

Expense Reimbursements

Pursuant to our directors’ expense reimbursement policy, we reimburse all directors for travel and other necessary business expenses incurred in the performance of their responsibilities for us, including certain continuing education expenses. Committees are provided the opportunity to retain outside independent advisors, as needed. We also extend coverage to directors under our Directors’ and Officers’ Indemnity Insurance Policies.

Receipt of Fees in Stock

For fees paid in 2023 and 2024, directors were encouraged to use 55% of their cash retainer to purchase shares of our common stock through the Shareowner Direct Plan or the Alliant Energy Deferred Compensation Plan. A non-employee director may elect to receive, or the Nominating and Governance Committee may require that a non-employee director be paid, all or any portion of his or her annual cash retainer payment or other cash fees in the form of shares of common stock issued under our 2020 Omnibus Incentive Plan or a successor plan thereto.

Share Ownership Guidelines

Directors are required to be shareowners. The target share ownership level for non-employee directors is the number of shares equal to the value of two times the full annual retainer (equivalent to $540,000 in 2023). Directors have five years after joining the Board of Directors to attain the ownership guideline. Shares held by directors in the Shareowner Direct Plan and the Alliant Energy Deferred Compensation Plan are included in the target goal. As of December 31, 2023, all of our current non-employee directors who have been board members for five years have met the share ownership guidelines. The directors who have joined the board in the last five years are on track to achieve the above ownership goals within the required timeline. We continue to monitor the status of the target ownership levels and review them with the Board of Directors.

Alliant Energy Deferred Compensation Plan

Under the Alliant Energy Deferred Compensation Plan, directors may elect to defer all or part of their retainer fee to an Interest Account, Equity Account, Company Stock Account or Mutual Fund Account. Deferrals credited to the Interest Account receive an annual return based on the 10-year Treasury Bond Rate plus 1.50%. Deferrals credited to the Equity Account are treated as invested in an S&P 500 index fund. Deferrals credited to the Mutual Fund Account are treated as invested in a mutual fund or other investment vehicle offered under our Alliant Energy Corporation 401(k) Savings Plan as selected by the director. Deferrals credited to the Company Stock Account are treated as though invested in our common stock and are credited with dividend equivalents, which are treated as if reinvested in our common stock. Payments from our Alliant Energy Deferred Compensation Plan by reason of death or retirement may be made in a lump sum or in annual installments for up to 10 years at the election of the director. Payments from our Alliant Energy Deferred Compensation Plan for any reason other than death or retirement are made in a lump sum.

Directors’ Charitable Award Program

We maintain a legacy Directors’ Charitable Award Program in which only Ms. McAllister participated in 2023; this program was terminated for all directors who joined the Board after January 1, 2005. The purpose of the program was to recognize our directors’ interest in supporting worthy charitable institutions. Under the program, when a director dies, we will donate a total of $500,000 to up to five qualified charitable organizations selected by the individual director. The individual director derives no financial benefit from the program. We take all deductions for charitable contributions and fund the donations through life insurance policies on the director. Over the life of the program, all costs of donations and premiums on the life insurance policies, including a return of our cost of funds, will be recovered through life insurance proceeds on the director. In 2023, Ms. McAllister received no additional compensation for this program.

Alliant Energy Matching Gift Program

Directors are eligible to participate in the Alliant Energy Foundation, Inc. matching gift program, which is generally available to all employees and retirees. Under this program, the foundation matches 100% of charitable donations over $50 to eligible charities. In 2023, the amount of matching contributions was capped at $3,500 per year for each director.

ALLIANT ENERGY | 2024 Proxy Statement | 19

OWNERSHIP OF VOTING SECURITIES

OWNERSHIP OF VOTING SECURITIES

Listed below are the number of shares of our common stock beneficially owned, except as otherwise indicated, as of March 8, 2024 by: (1) the named executive officers listed in the Summary Compensation Table; (2) all of our director nominees and directors; and (3) all director nominees, directors and executive officers as a group. No individual director or executive officer owned more than 1% of the outstanding shares of common stock on that date. The directors and executive officers as a group owned less than 1% of the outstanding shares of common stock on that date. No director or executive officer owns any other equity of Alliant Energy Corporation or any of its subsidiaries. None of the shares held by the executive officers and directors are pledged.

| | | | | | | | | | | |

| Name of Beneficial Owner | Shares

Beneficially

Owned(1) | Restricted Stock Units(2) | Total |

| NAMED EXECUTIVE OFFICERS | | | |

John O. Larsen | 247,581 | 62,825 | 310,406 |

| Lisa M. Barton | 1,100 | 35,344 | 36,444 |

| Robert J. Durian | 107,889 | 20,296 | 128,185 |

| Raja Sundararajan | 500 | 10,056 | 10,556 |

| Terry L. Kouba | 48,034 | 6,463 | 54,497 |

| David A. de Leon | 31,933 | 6,463 | 38,396 |

| DIRECTOR NOMINEES | | | |

| Ignacio A. Cortina | 1,503 | | 1,503 |

| Stephanie L. Cox | 7,139 | | 7,139 |

| Roger K. Newport | 22,591 | | 22,591 |

| Christie Raymond | | | |

| Carol P. Sanders | 66,761 | | 66,761 |

| DIRECTORS | | | |

| Patrick E. Allen | 43,783 | | 43,783 |

| N. Joy Falotico | 11,172 | | 11,172 |

| Michael D. Garcia | 15,203 | | 15,203 |

| Thomas F. O’Toole | 35,828 | | 35,828 |

| All Executive Officers and Directors as a Group (16 people) | 656,375 | 144,553 | 800,928 |

| | | |

(1) Ms. Barton’s share ownership is shown in the named executive officer section. She is also a director nominee. Mr. Larsen’s share ownership is shown in the named executive officer section. He is also a director. Total shares of Alliant Energy common stock outstanding as of March 8, 2024 were 256,376,510. Named executive officers and directors own fractional shares of common stock. Fractional shares have been rounded to the nearest whole share in this table and in this footnote. Included in the beneficially owned shares shown are the following number of shares of common stock held in deferred compensation plans: Mr. Allen — 39,555; Mr. Cortina — 1,403; Ms. Cox — 6,639; Ms. Falotico — 9,962; Mr. Garcia — 15,203; Mr. Kouba — 868; Mr. Larsen — 20,158; Mr. Newport — 21,591; Mr. O’Toole — 35,628; Ms. Sanders — 66,761; (all executive officers and directors as a group — 217,767).

(2) Unvested Restricted Stock Units do not have investment or voting power and are not considered “beneficially owned” under SEC rules.

The following table sets forth information regarding beneficial ownership by the only owners known to us to own more than 5% of Alliant Energy’s common stock. The beneficial ownership set forth below has been reported on Schedule 13G filings with the SEC by the beneficial owners, as of the respective date provided below.

ALLIANT ENERGY | 2024 Proxy Statement | 20

OWNERSHIP OF VOTING SECURITIES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Amount and Nature of Beneficial Ownership |

| Voting Power | Investment Power | | | |

Name and Address of

Beneficial Owner | Sole | Shared | | Sole | Shared | | Aggregate | | Percent

of Class |

The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 (dated as of February 13, 2024) | 0 | 434,877 | | 30,889,968 | 1,204,244 | | 32,094,212 | | 12.58% |

BlackRock Inc. 50 Hudson Yards New York, NY 10001 (dated as of January 24, 2024) | 21,913,481 | 0 | | 23,143,382 | 0 | | 23,143,382 | | 9.10% |

State Street Corporation 1 Congress Street, Suite 1 Boston, MA 02114-2016 (dated as of January 30, 2024) | 0 | 8,541,602 | | 0 | 13,358,335 | | 13,410,618 | | 5.31% |

Alliant Energy owns all of the outstanding common stock of IPL and WPL.

ALLIANT ENERGY | 2024 Proxy Statement | 21

COMPENSATION DISCUSSION AND ANALYSIS

ALLIANT ENERGY | 2024 Proxy Statement | 22

COMPENSATION DISCUSSION AND ANALYSIS

COMPENSATION DISCUSSION AND ANALYSIS

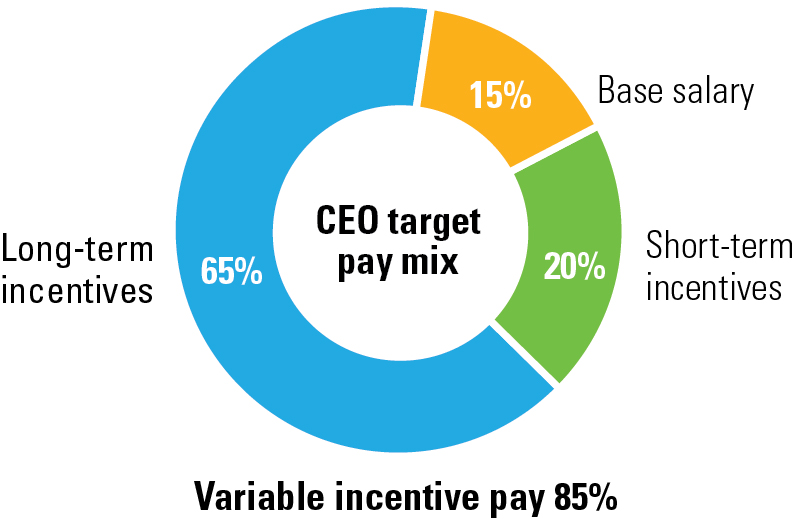

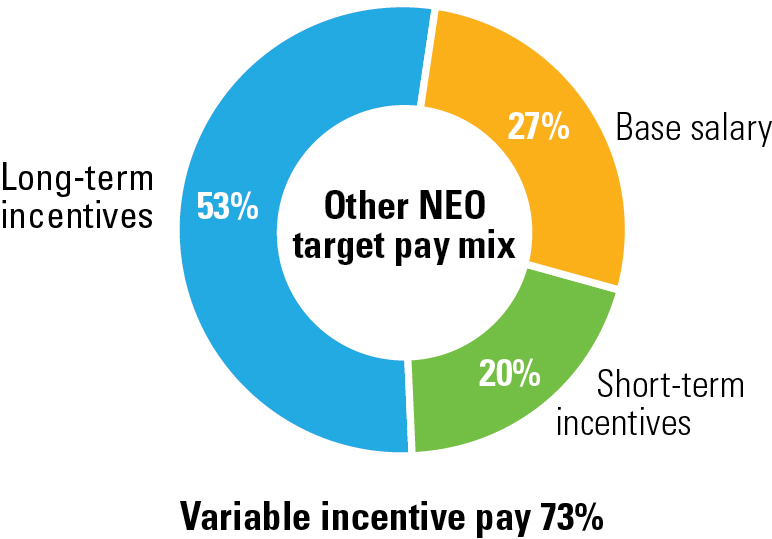

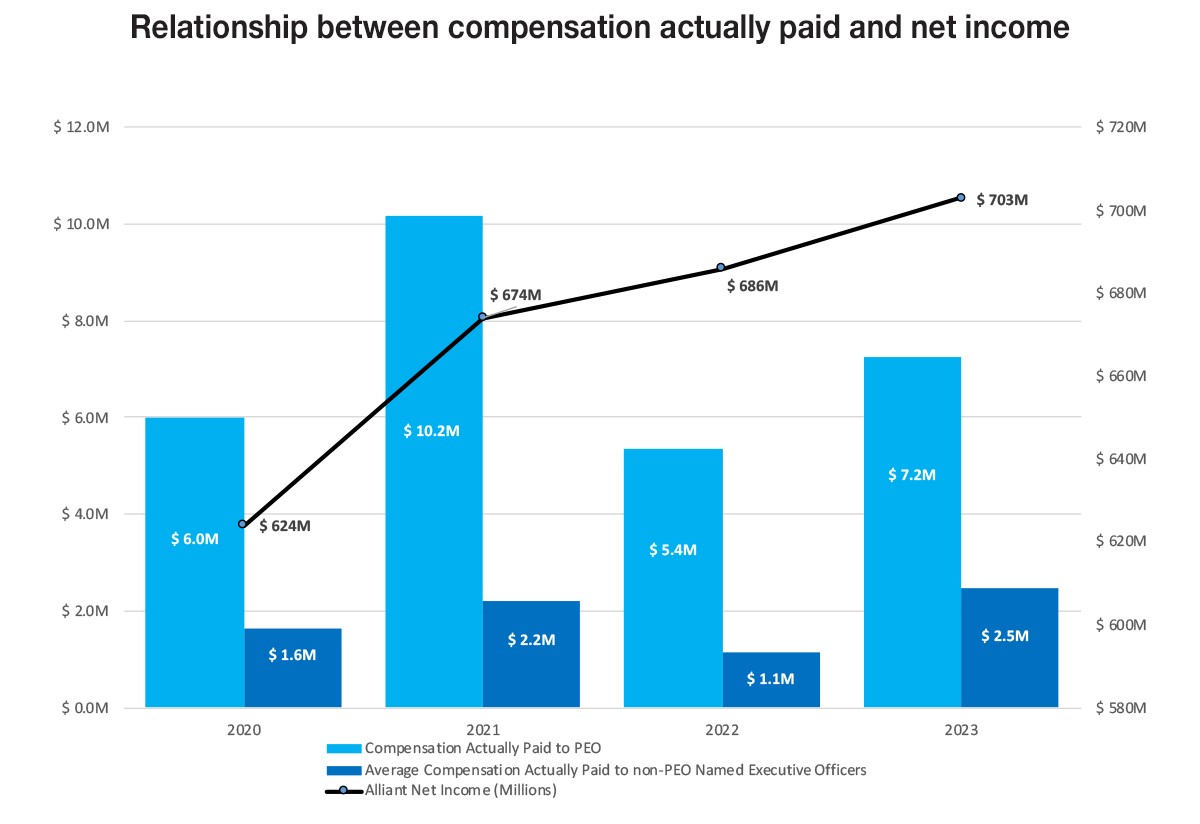

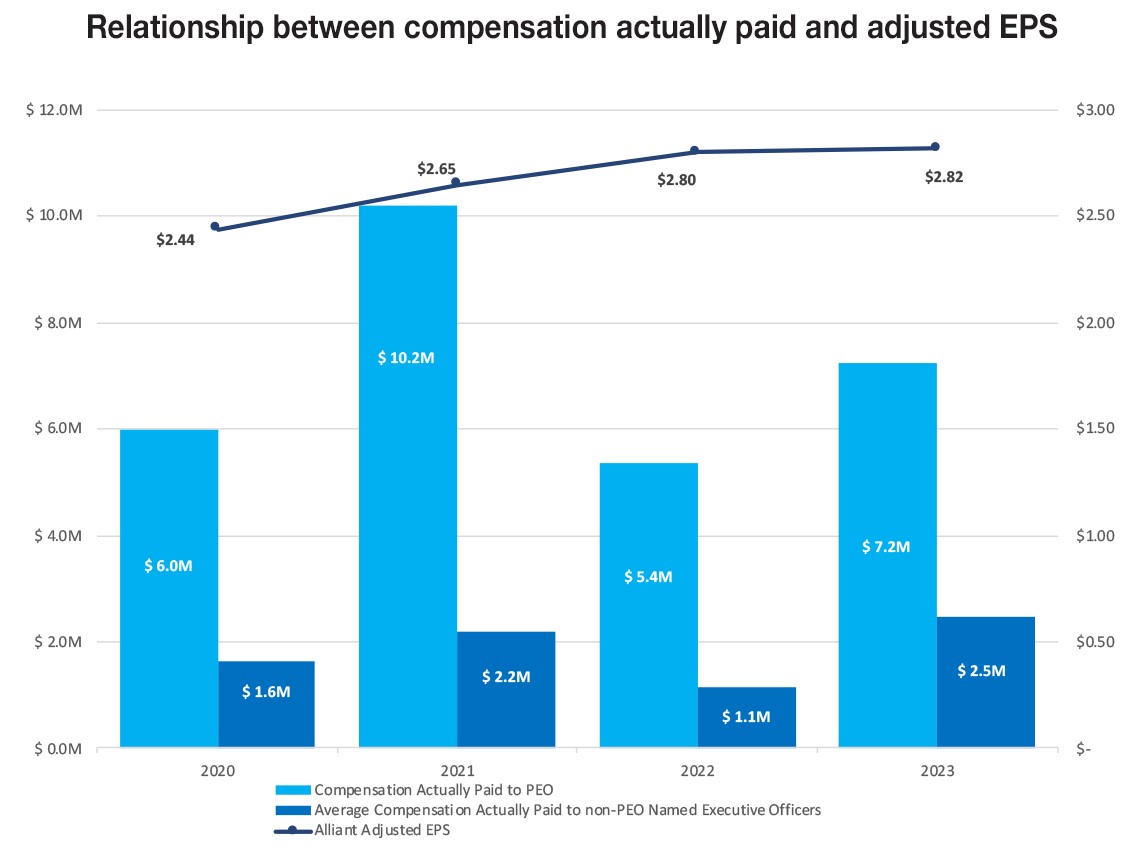

INTRODUCTION