Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under Rule 14a-12 |

EPOCH HOLDING CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

EPOCH HOLDING CORPORATION

640 Fifth Avenue

New York, New York 10019

(212) 303-7200

October 18, 2012

Dear Stockholders:

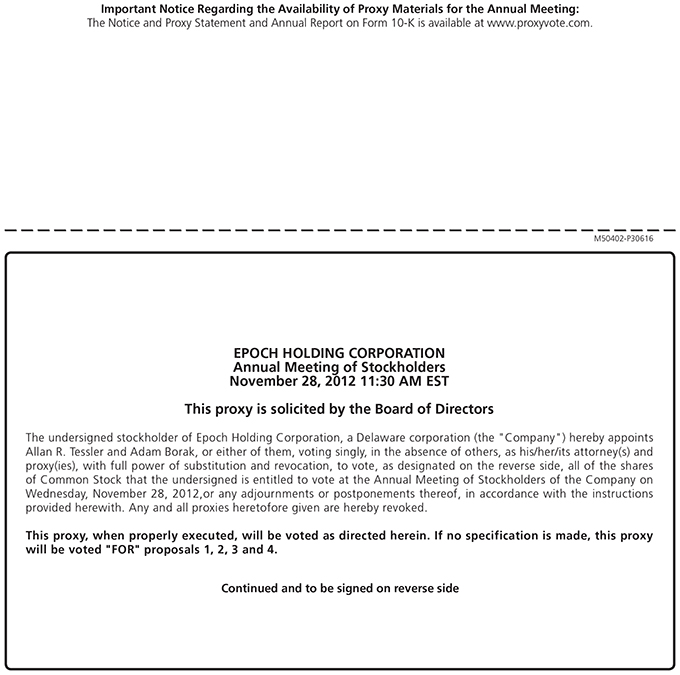

On behalf of the Board of Directors and Management of Epoch Holding Corporation (“Epoch” or the “Company”), I cordially invite you to attend our Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Wednesday, November 28, 2012, at 11:30 a.m. Eastern Standard Time. This year’s Annual Meeting will be a completely “virtual meeting” of stockholders; that is, stockholders will be able to attend and participate at the Annual Meeting, vote electronically, and submit questions during the meeting via live audio webcast by visiting www.virtualshareholdermeeting.com/ephc2012.

The matters to be acted upon at the meeting are fully described in the attached Notice of Annual Meeting of Stockholders and the Proxy Statement. In addition, our directors and executive officers, as well as a representative from CF & Co., L.L.P., our independent auditor, will be present to respond to any questions that you may have.

The Company is pleased to continue to take advantage of the U.S. Securities and Exchange Commission rules that allow issuers to furnish proxy materials to their stockholders via the Internet. The Notice of Availability of Proxy Materials (“Notice”) contains instructions on how to access the 2012 Proxy Statement and Annual Report on Form 10-K and how to vote your shares. This electronic process expedites stockholders’ receipt of proxy materials, while reducing the environmental impact and lowering the costs of printing and distributing our proxy materials. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions included in the Notice for requesting such materials.

Only stockholders of record as of the close of business on October 4, 2012 are entitled to receive notice of, to attend, and to vote at, the Annual Meeting.

You may vote your shares by mail, by telephone, or via the Internet. Instructions for using these convenient services are enclosed. Whether or not you plan to attend the Annual Meeting, please read the Proxy Statement for detailed information on each of the proposals. It is important that your shares be represented and voted at the Annual Meeting. Your vote is important to us. Accordingly, I encourage you to vote your shares promptly.

Thank you for your continued interest and support.

Sincerely,

Allan R. Tessler

Chairman

Table of Contents

EPOCH HOLDING CORPORATION

Annual Definitive Proxy Statement

For the 2012 Annual Meeting of Stockholders

| Page No. |

||||

| 1 | ||||

| 2 | ||||

| Questions and Answers About the Proxy Materials and the Annual Meeting |

2 | |||

| 8 | ||||

| 8 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| Proposal 2—Advisory Vote on the Company’s Named Executive Officer Compensation |

35 | |||

| Proposal 3—Approval of the Epoch Holding Corporation 2012 Long-Term Incentive Compensation Plan |

36 | |||

| 45 | ||||

| Proposal 4—Ratification of Appointment of Independent Registered Public Accounting Firm |

47 | |||

| 47 | ||||

| 47 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

48 | |||

| 49 | ||||

| 50 | ||||

| 50 | ||||

| 50 | ||||

| 50 | ||||

| 51 | ||||

| 51 | ||||

| 51 | ||||

| Exhibit A—Epoch Holding Corporation 2012 Long-Term Incentive Compensation Plan |

A-1 | |||

i

Table of Contents

EPOCH HOLDING CORPORATION

640 Fifth Avenue

New York, New York 10019

(212) 303-7200

Notice of 2012 Annual Meeting of Stockholders

NOTICE IS HEREBY GIVEN that the 2012 Annual Meeting of Stockholders of Epoch Holding Corporation will be held on Wednesday, November 28, 2012, at 11:30 a.m. Eastern Standard Time, via live audio webcast, for the following purposes:

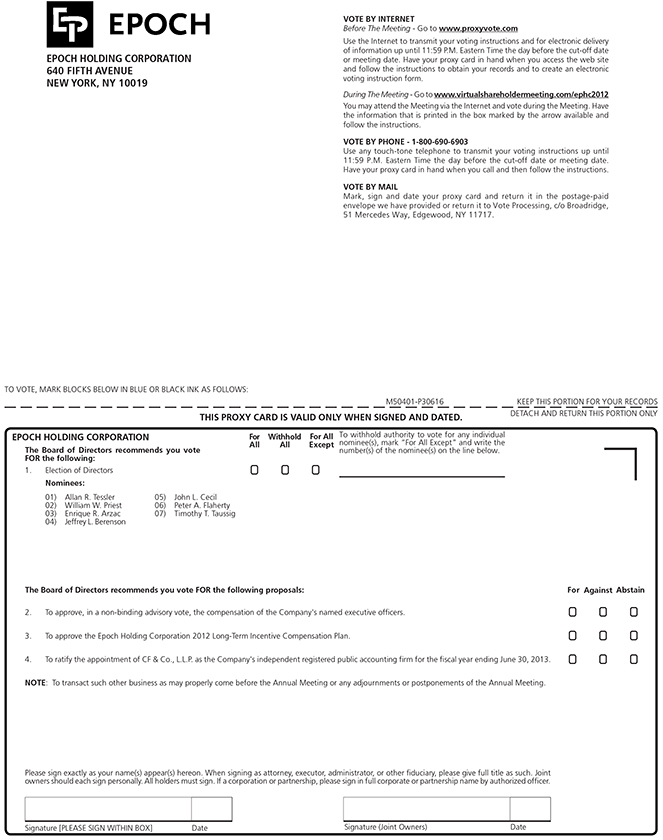

| 1. | To elect the seven nominees named in this Proxy Statement to our Board of Directors for a one year term; |

| 2. | To approve, in a nonbinding advisory vote, the compensation of the Company’s named executive officers; |

| 3. | To approve the Company’s 2012 Long-Term Incentive Compensation Plan; |

| 4. | To ratify the appointment of CF & Co., L.L.P. as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2013; and |

| 5. | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

Only stockholders of record as of the close of business on October 4, 2012 are entitled to receive notice of, to attend, and to vote at the Annual Meeting and any adjournment or postponement thereof.

Attend the Annual Meeting via live audio webcast by visiting www.virtualshareholdermeeting.com/ephc2012. Use your 12-Digit Control Number, found on your proxy card, to access the Annual Meeting.

Whether or not you plan to attend the Annual Meeting, we encourage you to promptly vote your shares by telephone, via the Internet, or if this Proxy Statement was mailed to you, by completing, signing and dating the enclosed proxy card and returning by mail.

| By Order of the Board of Directors,

Adam Borak Corporate Secretary | ||

| October 18, 2012 |

1

Table of Contents

EPOCH HOLDING CORPORATION

640 Fifth Avenue

New York, New York 10019

(212) 303-7200

We are providing these proxy materials in connection with Epoch Holding Corporation’s 2012 Annual Meeting. This Proxy Statement, the accompanying proxy card and our 2012 Annual Report on Form 10-K are being mailed, or made available via the Internet as described below, to our stockholders on or about October 18, 2012. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read the Proxy Statement carefully.

The Company is furnishing proxy materials to stockholders via the Internet. If you received a Notice of Internet Availability of Proxy Materials (“Notice”) by mail, you will not receive a printed copy of the proxy materials unless you specifically request one. The Notice instructs you on how to access and review all of the important information contained in the Proxy Statement and Annual Report as well as how to submit your proxy over the Internet. Internet distribution of proxy materials is designed to expedite stockholders’ receipt of proxy materials, while reducing the environmental impact and lowering the costs of printing and distributing our proxy materials. We plan to mail the Notice to stockholders on or about October 18, 2012. We will also continue to mail a printed copy of this Proxy Statement and form of proxy to certain stockholders who have requested such, and we expect that mailing to also begin on or about October 18, 2012. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions included in the Notice for requesting such materials.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND

THE ANNUAL MEETING

Who is soliciting my vote?

The Board of Directors of Epoch Holding Corporation is soliciting your vote at the 2012 Annual Meeting of Stockholders.

What is the purpose of the Annual Meeting?

You will be voting:

| • | on the election of the seven nominees named in this Proxy Statement to serve on our Board of Directors until the next Annual Meeting and until their successors are duly elected and qualified; |

| • | to approve, in a nonbinding advisory vote, the compensation of the Company’s named executive officers; |

| • | to approve the Company’s 2012 Long-Term Incentive Compensation Plan; |

| • | on the ratification of the appointment of CF & Co., L.L.P. as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2013; and |

| • | with respect to such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

2

Table of Contents

What are the Board of Directors’ recommendations?

The Board of Directors recommends a vote:

| • | FOR the election of each of the seven named nominees. |

| • | FOR the approval of the compensation of our named executive officers, as disclosed in this Proxy Statement. |

| • | FOR the approval of our 2012 Long-Term Incentive Compensation Plan. |

| • | FOR the ratification of the appointment of CF & Co., L.L.P. as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2013. |

Who is entitled to vote?

Our Board of Directors has set October 4, 2012 as the record date for the Annual Meeting (the “Record Date”). Only Stockholders of Record at the close of business on October 4, 2012 will be entitled to notice of, and to vote at, the Annual Meeting. As of the Record Date, we had 23,683,835 shares of Common Stock outstanding. Shares of our Common Stock are the only securities entitled to vote at our Annual Meeting and each share of Common Stock outstanding as of the Record Date will be entitled to one vote.

How many votes do I have?

You will have one vote for each share of our Common Stock that you owned at the close of business on the Record Date, provided those shares are either held directly in your name as the stockholder of record or were held for you as the beneficial owner through a broker, bank or other nominee.

Is my vote confidential?

Our By-Laws provide that your vote is confidential and will not be disclosed, except in certain limited circumstances, such as when you request or consent to disclosure or as otherwise required by law. Only the proxy solicitor, the proxy tabulator, and the inspector of election have access to the ballots, proxy forms, and voting instructions.

What is the difference between holding shares as a stockholder of record and a beneficial owner?

Most of our stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Co., you are considered the stockholder of record with respect to those shares, and these proxy materials are being sent directly to you by us. As the stockholder of record, you have the right to grant your voting proxy directly to us or to vote at the Annual Meeting. We have enclosed a proxy card for you to use.

Beneficial Owner. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you together with a voting instruction card by your broker, bank or other nominee who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote your shares and are also invited to attend the Annual Meeting.

Because a beneficial owner is not the stockholder of record, you may not vote these shares at the Annual Meeting, unless you obtain a “legal proxy” from the broker, bank or other nominee that holds your shares giving you the right to vote the shares at the Annual Meeting. You should allow yourself enough time prior to the Annual Meeting to obtain this proxy from the stockholder of record.

3

Table of Contents

How can I vote my shares?

Your vote is important. You may vote by telephone, via the Internet, by mail or by attending the Annual Meeting and voting by ballot, all as described below. The Internet and telephone voting procedures are designed to authenticate stockholders by use of a control number and to allow you to confirm that your instructions have been properly recorded. If you vote by telephone or via the Internet, you do not need to return your proxy card.

Voting Methods:

| • | Via Internet—Prior to the Annual Meeting, the website for Internet voting is www.proxyvote.com. As with telephone voting, you can confirm that your instructions have been properly recorded. If you vote via the Internet, you also can request electronic delivery of future proxy materials. If you vote via the Internet, please note that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, for which you will be responsible. |

| • | Via Telephone—You can vote by calling the toll-free telephone number on your proxy card. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded. |

| • | Via Mail—If you choose to vote by mail, simply mark your proxy card, date and sign it, and return it in the postage-paid envelope provided. If the envelope is missing, please mail your completed proxy card to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717. |

| • | At the Annual Meeting—Stockholders of record can vote at the Annual Meeting via live audio webcast by visiting www.virtualshareholdermeeting.com/ephc2012. However, if your shares are held in the name of a bank, broker or other nominee, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote at the Annual Meeting. You should allow yourself enough time prior to the Annual Meeting to obtain this proxy from the holder of record. The shares represented by the proxy cards received, properly marked, dated, signed and not revoked, will be voted at the Annual Meeting. |

Can I change or revoke my vote after I return my proxy card?

Yes. Even if you sign the proxy card or voting instruction card in the form accompanying this Proxy Statement, vote by telephone or vote via the Internet, you retain the power to revoke your proxy or change your vote. You can revoke your proxy or change your vote at any time before it is exercised by giving written notice to our Corporate Secretary at Epoch Holding Corporation, 640 Fifth Avenue, 18th Floor, New York, New York 10019, Attn: Corporate Secretary, specifying such revocation. You may also change your vote by timely delivery of a valid, later-dated proxy or a later-dated vote by telephone or via the Internet, or by voting electronically at the Annual Meeting during the live audio webcast.

What does it mean if I receive more than one proxy or voting instruction card?

It generally means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive.

Who can attend the Annual Meeting?

All stockholders as of the Record Date, or their duly appointed proxies, may attend.

What information do I need to attend the Annual Meeting?

The Company will host the Annual Meeting via live audio webcast. A summary of the information you need to attend the Annual Meeting online is provided below:

| • | Any stockholder can attend the Annual Meeting live via the Internet at www.virtualshareholdermeeting.com/ephc2012. |

4

Table of Contents

| • | Webcast will start at 11:30 a.m. (Eastern Standard Time), but access to the Annual Meeting will be available 15 minutes prior to such time and we encourage you to log in during that period. |

| • | Stockholders may vote and submit questions while attending the Annual Meeting on the Internet. |

| • | Please have available your 12-Digit Control Number, found on your proxy card, to enter the Annual Meeting. |

| • | Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/ephc2012. |

| • | Webcast replay of the Annual Meeting will be available until December 15, 2012 at www.virtualshareholdermeeting.com/ephc2012. |

How many votes can be cast by all stockholders?

Each share of our Common Stock is entitled to one vote. There is no cumulative voting whereby votes may be concentrated for a single candidate. We had 23,683,835 shares of Common Stock outstanding and entitled to vote on the Record Date.

How many shares must be present to hold the Annual Meeting?

A majority of our outstanding shares of Common Stock as of the Record Date must be present at the Annual Meeting in order to hold the Annual Meeting and transact business. This is called a “quorum.” Shares are counted as present at the Annual Meeting if you are present and vote via the live audio webcast, or a proxy has been properly voted by you or on your behalf. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum.

Who counts the votes cast at the Annual Meeting?

All votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Abstentions and broker non-votes will be counted as present in determining whether the quorum requirement is satisfied. Broker non-votes are not counted for any purpose in determining whether a matter has been approved. A broker non-vote occurs when a bank or broker holding shares of a beneficial stockholder does not vote on a particular proposal because it has not received instructions from the beneficial stockholder and the bank or broker does not have discretionary voting power for that particular item.

How many votes are required to approve the proposals?

| • | Proposal 1: Delaware law and our By-Laws require that each of the seven nominees for director be elected by a plurality of the votes cast. This means that the seven individuals nominated for election to the Board of Directors who receive the most “FOR” votes (among votes properly cast at the Annual Meeting or by proxy) will be elected; nominees do not need to receive a majority to be elected. As the election of directors is a non-routine matter under applicable rules, your bank, broker or other nominee cannot vote without instructions from you. Therefore, although there may be broker non-votes on this proposal, only “FOR” votes are counted in determining whether a plurality has been cast in favor of a director. Broker non-votes and “WITHHOLD” votes will not affect the outcome on the election of directors. |

| • | Proposal 2: The nonbinding advisory vote on Epoch’s executive compensation requires the affirmative “FOR” vote of a majority of the votes (among votes properly cast at the Annual Meeting or by proxy). While our Board of Directors intends to carefully consider the stockholder vote resulting from the proposal, the vote is not binding on us and is advisory in nature. As the advisory vote on Epoch’s executive compensation is a non-routine matter under applicable rules, your bank, broker or other nominee cannot vote without instructions from you. Broker non-votes and abstentions will have no effect on the outcome of this proposal. |

5

Table of Contents

| • | Proposal 3: The vote on our 2012 Long-Term Incentive Compensation Plan requires the affirmative “FOR” vote of a majority of the votes (among votes properly cast at the Annual Meeting or by proxy). As the vote for the compensation plan is a non-routine matter under applicable rules, your bank, broker or other nominee cannot vote without instructions from you. Broker non-votes and abstentions will have no effect on the outcome of this proposal. |

| • | Proposal 4: Although not required to be submitted for stockholder approval, the Board has conditioned its appointment of its independent registered public accounting firm upon receiving the affirmative vote of a majority of the shares voted (among votes properly cast at the Annual Meeting or by proxy). In the event the stockholders do not approve the selection of CF & Co., L.L.P., the appointment of independent registered public accounting firm will be reconsidered by the Board. |

What if I don’t vote for some of the items listed on my proxy card or voting instruction card?

If you return your signed proxy card or voting instruction card in the enclosed envelope but do not mark selections, it will be voted in accordance with the recommendations of the Board of Directors. If you indicate a choice with respect to any matter to be acted upon on your proxy card or voting instruction card, the shares will be voted in accordance with your instructions.

If you are a beneficial owner and hold your shares in street name through a broker and do not return the voting instruction card, the broker or other nominee will determine if it has the discretionary authority to vote on the particular matter. Under applicable rules, brokers have the discretion to vote on routine matters, such as the ratification of the appointment of CF & Co., L.L.P. as the Company’s independent registered public accounting firm. The election of directors, the proposal on executive officer compensation, and the proposal on the compensation plan are not considered routine, and brokers, banks and other nominees cannot vote on those proposals without your instructions. Therefore, it is important that you cast your vote or instruct your broker, bank or nominee on how you wish to vote your shares.

Who pays for the proxy solicitation and how will Epoch solicit votes?

The Company will bear the expense of printing and mailing proxy materials. In addition to this solicitation of proxies by mail, our directors, officers and other employees may solicit proxies by personal interview, telephone, facsimile or email. They will not be paid any additional compensation for such solicitation. We will request brokers and nominees who hold shares of our Common Stock in their names to furnish proxy material to beneficial owners of the shares. We will reimburse such brokers and nominees for their reasonable expenses incurred in forwarding solicitation materials to such beneficial owners.

How can I access the proxy materials and Annual Report electronically?

Prior to the Annual Meeting, stockholders will be able to vote and access these documents, at www.proxyvote.com. At the Annual Meeting, stockholders will be able to attend, vote, access these documents and submit questions by visiting www.virtualshareholdermeeting.com/ephc2012.

The Company also maintains a website which contains current information on operations and other corporate governance matters. The website address is www.eipny.com. Through the “Investor Relations” section of our website, we make available, free of charge, our Annual Report on Form 10-K and our Proxy, as well as Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission (the “SEC”).

Where can I find the voting results of the Annual Meeting?

We will publish the voting results of the Annual Meeting in a Current Report on Form 8-K within four business days after the Annual Meeting.

6

Table of Contents

Is a list of stockholders available?

The names of stockholders of record entitled to vote at the Annual Meeting will be available to stockholders entitled to vote at this Meeting for ten days prior to the Meeting for any purpose relevant to the Meeting. This list can be viewed between the hours of 9:00 a.m. and 5:00 p.m. at our principal executive offices at 640 Fifth Avenue, 18th Floor, New York, New York 10019. Please contact our Corporate Secretary to make arrangements.

What if I have questions about lost stock certificates or I need to change my mailing address?

To get more information about these matters, stockholders of record may call Continental Stock Transfer & Trust Co. at (212) 509-4000 or write to Continental Stock Transfer & Trust Co., 17 Battery Place, 8th Floor, New York, New York 10004:

For lost stock certificates—Attention: Lost Securities Department

For mailing address changes—Attention: FISO Department

7

Table of Contents

PROPOSAL 1—ELECTION OF DIRECTORS

Our Board of Directors currently has seven directors, each elected to the Board at our last Annual Meeting. Directors serve for a one-year term and until his or her successor has been elected and qualified or until the director’s resignation or removal. Our present Board of Directors consists of the following individuals:

| Name |

Position with the Company |

Audit Committee |

Compensation Committee |

Nominating/ Corporate Governance Committee | ||||

| Allan R. Tessler |

Chairman of the Board | X | X | |||||

| William W. Priest |

Chief Executive Officer, Director | |||||||

| Enrique R. Arzac |

Director | X* | ||||||

| Jeffrey L. Berenson |

Director | X | X* | X | ||||

| John L. Cecil |

Director | |||||||

| Peter A. Flaherty |

Director | X | X | X* | ||||

| Timothy T. Taussig |

President and Chief Operating Officer, Director |

|||||||

X = Member

* = Committee Chairman

The Board, upon the recommendation of the Nominating/Corporate Governance Committee, has nominated Messrs. Tessler, Priest, Arzac, Berenson, Cecil, Flaherty and Taussig for election as directors for the Company for a term ending at the 2013 Annual Meeting. Each nominee presently serves as a director. Each nominee has consented to being named in this Proxy Statement and indicated to the Company that he would serve if elected.

At our Annual Meeting, directors are to be elected, each to hold office (subject to our By-Laws) until the next Annual Meeting of Stockholders and until a respective successor has been elected and qualified. If any nominee should become unavailable for any reason, which we do not anticipate, the proxies will be voted for any substitute nominee or nominees who may be selected by our Nominating/Corporate Governance Committee prior to, or at, the Annual Meeting, or, if no substitute is selected, for a motion to reduce the membership of our Board to the number of nominees available. The information concerning the nominees and their security holdings has been furnished to us by them.

| ALLAN R. TESSLER |

Director since 2004 | Age: 76 |

Chairman. Mr. Tessler has served as Chairman of the Board since Epoch’s inception in June 2004. He has been the Chairman and Chief Executive Officer of International Financial Group, Inc., an international merchant banking firm, since 1987. Mr. Tessler was the Chief Executive Officer and Chairman of the Board of J Net Enterprises from 2000 to 2004. He was Co-Chairman and Co-Chief Executive Officer of Interactive Data Corporation (formerly Data Broadcasting Corporation), a securities market data supplier, from June 1992 through February 2000. Mr. Tessler was co-founder and Chairman of the Board of Enhance Financial Services, Inc., a public insurance holding company, from 1986 through 2001, and was Chairman of the Board of Great Dane Holdings Inc., a private diversified holding company, from 1987 through December 1996. He presently is a director of Limited Brands, Inc. (since 1987), Steel Partners Holding GP, Inc. (since 2010), and TD Ameritrade Holding Corporation (since 2006). Mr. Tessler serves as Chairman of the Board of both Teton Financial Services (since 2012) and Rocky Mountain Bank (since 2012). He serves as Chairman of the Board of Trustees of the Hudson Institute and is a member of the Board of Governors of the Boys & Girls Clubs of America. Mr. Tessler received his undergraduate degree from Cornell University and L.L.B. from Cornell University Law School.

8

Table of Contents

Mr. Tessler’s qualifications to serve on our Board include: extensive business and executive management experience; financial and legal expertise; experience in corporate oversight as a member of several boards of directors and committees; and involvement in various public policy issues.

| WILLIAM W. PRIEST |

Director since 2004 | Age: 71 |

Chief Executive Officer. Mr. Priest has been our Chief Executive Officer and a member of our Board of Directors since Epoch’s inception in June 2004. He currently also serves as Co-Chief Investment Officer and Portfolio Manager of our Company. From 2001 to 2004, Mr. Priest was Co-Managing Partner and Portfolio Manager at Steinberg Priest & Sloane Capital Management, LLC. Prior to joining Steinberg Priest, he was a Member of the Global Executive Committee of Credit Suisse Asset Management, Chairman and CEO of Credit Suisse Asset Management-Americas and CEO and Portfolio Manager of its predecessor firm BEA Associates, which he joined in 1972. Mr. Priest is presently a director of Globe Wireless and InfraReDx, and a Member of the Council on Foreign Relations. He is the author of several published articles and papers on investing and finance, including the most recently published book in 2007, Free Cash Flow and Shareholder Yield: New Priorities for the Global Investor. Mr. Priest is a CFA Charterholder, a former CPA, and a graduate of Duke University and the University of Pennsylvania Wharton Graduate School of Business.

Mr. Priest’s qualifications to serve on our Board include: knowledge and leadership of our Company and extensive experience in the investment management industry; extensive experience related to portfolio management, investment performance, and evaluation of investment products; extensive knowledge of economics and finance; accounting and security analyst credentials; experience related to corporate governance; and general executive management experience.

| ENRIQUE R. ARZAC |

Director since 2006 | Age: 71 |

Dr. Arzac was appointed to our Board in August 2006. Dr. Arzac is a Senior Professor of Finance and Economics at the Columbia University Graduate School of Business. He is presently a director of The Adams Express Company (since 1983), Petroleum & Resources Corporation (since 1986), Credit Suisse Funds (since 1990), Aberdeen closed-end funds (since 2009), and Mirae Asset Discovery Funds (since 2010). He is the author of the book, Valuation for Mergers, Buyouts and Restructuring, and has published many articles in finance and economic journals. Dr. Arzac has served as a financial consultant to the United Nations Conference on Trade Development, the State of New Jersey and several U.S. and foreign corporations and financial institutions. Prior to joining Columbia in 1971, Dr. Arzac taught at the University of Buenos Aires. He holds a CPN from the University of Buenos Aires and an M.B.A., M.A., and Ph.D. from Columbia University.

Dr. Arzac’s qualifications to serve on our Board include: expertise in the fields of economics and finance; extensive research and practical experience in financial markets, corporate valuation and transaction structures; extensive international and academic experience; and extensive mutual fund and investment advisor oversight background. Our Board has determined that Dr. Arzac qualifies as an “audit committee financial expert” under the SEC’s rules and regulations.

| JEFFREY L. BERENSON |

Director since 2004 | Age: 62 |

Mr. Berenson was appointed to our Board in June 2004. Mr. Berenson is the Chief Executive Officer of Berenson & Company, Inc., a privately owned, independent investment banking firm headquartered in New York City that he co-founded in 1990. From 1978 until founding Berenson & Company, Mr. Berenson was employed by Merrill Lynch & Company, and served at various times as head of Merrill Lynch’s Mergers and Acquisitions Group and co-head of its Merchant Banking unit. Mr. Berenson is presently a director of Noble Energy, Inc. Mr. Berenson graduated with a B.A. from Princeton University.

Mr. Berenson’s qualifications to serve on our Board include: a strong financial and executive management background; experience with various investment products; extensive experience in investment banking, private equity, and capital management; and experience in corporate oversight as a member of other boards of directors

9

Table of Contents

and committees. Our Board has determined that Mr. Berenson qualifies as an “audit committee financial expert” under the SEC’s rules and regulations.

| JOHN L. CECIL |

Director since 2009 | Age: 58 |

Mr. Cecil was appointed to our Board in December 2009. Mr. Cecil is a private investor, and since 2005 has served as an advisor to a number of financial services institutions, including Lehman Brothers, the New York Stock Exchange, and Neuberger Berman. From 2001 to 2004, Mr. Cecil served as Chairman of CP Kelco, a privately-held specialty chemicals company. Prior to CP Kelco, Mr. Cecil was the Chief Financial and Administrative Officer of Lehman Brothers Holdings Inc. from 1994 until 2000 and was also a member of their operating and executive committees. Prior to that, Mr. Cecil was a Director in the New York City office of McKinsey & Company, Inc. Mr. Cecil joined McKinsey in 1980, was elected partner in 1986, and was a Director from 1991 through 1993. Mr. Cecil graduated with honors from Princeton University in 1976 with an A.B. in public and international affairs from the Woodrow Wilson School. He graduated from Harvard Law School with a J.D. Magna Cum Laude in 1980 and, the same year, received his M.B.A. from Harvard Business School, graduating as a Baker Scholar. Mr. Cecil is a Senior Vice Chairman of the Board of Directors of Graham-Windham Agency and is also on the Board of Directors of The Graham School (a New York Special Act Public School). He is a member of the Advisory Council of the Bendheim Center for Finance at Princeton University. Mr. Cecil also serves on the Wildlife Conservation Society’s Global Conservation Council.

Mr. Cecil’s qualifications to serve on our Board include: extensive experience with investment management and financial services institutions; academic background in finance and law; experience in corporate oversight as a member of several boards of directors and committees; and general executive management experience.

| PETER A. FLAHERTY |

Director since 2004 | Age: 68 |

Mr. Flaherty was appointed to our Board in July 2004. Mr. Flaherty has been Managing Director of Arcon Partners, LLC, a private investment firm since 2005, and is currently a Director Emeritus of McKinsey & Company, Inc., which he joined in 1975. At McKinsey, Mr. Flaherty worked predominantly with financial services institutions, as well as media and information companies. Mr. Flaherty is active in private investments and for many years served on, and led, McKinsey’s Investment Advisory Committee, which is responsible for pension and discretionary partner investments, with a particular focus on alternative investments. He serves on the Boards of The Rockefeller University, The Foreign Policy Association, The Kenyon Review, the New York City Leadership Academy, Educators for Excellence, and TechnoServe. He serves as Chairman of the Advisory Council of the Johns Hopkins School of Advanced International Studies and is a member of the Council on Foreign Relations. Mr. Flaherty is a graduate of Stanford University, the Johns Hopkins School of Advanced International Studies and the Harvard Business School.

Mr. Flaherty’s qualifications to serve on our Board include: extensive experiences with investment products and financial services institutions; academic background in finance and international studies; experience in corporate oversight as a member of several boards of directors and committees; general executive management experience; and involvement in various public policy issues. Our Board has determined that Mr. Flaherty qualifies as an “audit committee financial expert” under the SEC’s rules and regulations.

| TIMOTHY T. TAUSSIG |

Director since 2009 | Age: 55 |

President and Chief Operating Officer. Mr. Taussig was appointed to our Board in December 2009. Mr. Taussig has been our President and Chief Operating Officer since Epoch’s inception in June 2004. From 2003 to 2004, Mr. Taussig was Chief Operating Officer of Trident Investment Management, LLC, (“Trident”) a global hedge fund and a sub-advisor to a mutual fund for non-U.S. equity mandates. At Trident he was responsible for the firm’s business, operations, and marketing requirements. Prior to his employment with Trident, Mr. Taussig was a Managing Director and Co-Head of Global Marketing for Credit Suisse Asset Management-Americas and its predecessor firm, BEA Associates, which he joined in 1985. His responsibilities included marketing, client service and e-commerce strategies across all distribution channels. Mr. Taussig holds a B.A. from Dartmouth College.

10

Table of Contents

Mr. Taussig’s qualifications to serve on our Board include: knowledge and management of our Company; extensive experience related to investment management, investment performance, and evaluation of investment products; experience related to domestic and international distribution channels, marketing and client relations; experience related to operations and technology; experience related to corporate governance; and general executive management experience.

Our Nominating/Corporate Governance Committee has evaluated each individual in the context of our Board as a whole, with the objective of recommending a group of directors that can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment, using its diversity of experience.

The individuals set forth above will be placed in nomination for election to our Board. The Board recommends a vote “FOR” the election of each of the above nominees.

11

Table of Contents

The primary functions of our Board of Directors are to:

| • | provide oversight, counseling and direction to our management in the interest and for the benefit of our stockholders; |

| • | monitor senior management’s performance; |

| • | actively oversee risks that could affect our Company; and |

| • | oversee and promote the exercise of responsible corporate governance. |

Our Board has determined that, other than Messrs. Priest and Taussig, each of the nominees for director is “independent” under the applicable NASDAQ Stock Market (“NASDAQ”) and U.S. Securities and Exchange Commission (“SEC”) rules.

Since Epoch’s inception, the roles of Chairman of the Board and Chief Executive Officer have been held separately. Mr. Tessler, the Chairman of Epoch’s Board of Directors, is an independent director. Mr. Priest serves as the Company’s Chief Executive Officer. While the participation of the Chief Executive Officer on our Board helps foster, among other things, an appropriate level of continuity and fluid communication between the Board and management, we have chosen an independent director as Chairman in order to ensure that the Board maintains an independent thought process that is designed to benefit stockholders.

The Chairman of the Board, among other things, establishes the agenda for, and presides at, meetings of the Board. The Chairman also serves as the primary liaison between the independent directors and the Chief Executive Officer, and makes himself available for consultation and director communication.

During fiscal year 2012, the independent directors held executive sessions at each of the Board meetings without the Chief Executive Officer or any other member of management present. Mr. Tessler presided at each of these sessions.

Our Board believes its current leadership structure is appropriate because it effectively allocates authority, responsibility, and oversight between management and the independent members of our Board. It does this by giving primary responsibility for the operational leadership and strategic direction of the Company to our Chief Executive Officer, while enabling the Chairman to facilitate our Board’s independent oversight of management, promote communication between management and our Board, and support our Board’s consideration of key governance matters. The Board believes that its programs for overseeing risk, as described under “Board Role in Risk Oversight” which follows, would be effective under a variety of leadership frameworks and therefore do not materially affect its choice of structure.

Communications with our Board of Directors

Our Board provides a process for stockholders and interested parties to send communications to the Board. Stockholders and interested parties may communicate with our Board, any committee chairperson or our non-employee directors as a group by writing to the Board or committee chairperson in care of Epoch Holding Corporation, Attention: Adam Borak, Corporate Secretary, 640 Fifth Avenue, 18th Floor, New York, New York 10019. Each communication will be forwarded, depending on the subject matter, to the Board, the appropriate committee chairperson or all non-employee directors.

Committees of the Board and Meetings

The Board of Directors held seven meetings during the fiscal year ended June 30, 2012. Each incumbent director attended at least 75 percent of the aggregate of the meetings of the Board and the standing committees of

12

Table of Contents

which the director was a member. All of the directors were present at the Company’s 2011 Annual Meeting of Stockholders.

Our Board has an Audit Committee, a Compensation Committee and a Nominating/Corporate Governance Committee. The Board has determined that all members of the Audit, Compensation and Nominating/Corporate Governance Committees are “independent directors” under the applicable NASDAQ and SEC rules.

The Audit Committee, which presently consists of Messrs. Arzac, Berenson and Flaherty, held four meetings during fiscal year 2012. In the event a member was unable to participate in any given meeting, the Chairman of the Audit Committee briefed, in full, such absentee member as to the discussion at such meeting. Mr. Cecil served as a member and Chairman of the Audit Committee until April 2012 at which time he began providing consulting services to the Company. Thereafter, Mr. Berenson replaced Mr. Cecil on the Audit Committee and Dr. Arzac was appointed Chairman. Our Board has determined that Messrs. Arzac, Berenson and Flaherty each qualify as an “audit committee financial expert” under the applicable SEC rules and regulations. Each of our Audit Committee members is financially sophisticated, has accounting or related financial management expertise, and is able to read and understand our financial statements. The Audit Committee assesses the adequacy of the structure of our financial organization and the proper implementation of our financial reporting and accounting policies. Our Audit Committee’s responsibilities include, among other items, reviewing the audit plans and audit findings of our independent registered public accounting firm; reviewing the results of regulatory examinations; reviewing and discussing matters that may have a material impact on our financial statements; reviewing our financial statements, including significant accounting policies and changes in accounting policies, with our senior management and independent registered public accounting firm; reviewing our financial risk and control procedures, compliance programs and significant tax, legal and regulatory matters; overseeing the implementation and monitoring of our Whistleblower Policy; reviewing and approving any related party transactions; and appointing annually our independent registered public accountants, and evaluating their qualifications, independence and performance.

The Compensation Committee, which presently consists of Messrs. Berenson, Flaherty and Tessler, held two meetings during fiscal year 2012. Mr. Berenson serves as Chairman of the Compensation Committee. The Compensation Committee consists entirely of “independent directors” as defined under applicable NASDAQ and SEC rules, and “outside directors” as defined under Section 162(m) of the Internal Revenue Code. Our Compensation Committee’s responsibilities include, among other items, reviewing and approving the compensation of our executive officers; overseeing and administering, and making recommendations to our Board with respect to, our cash and equity incentive plans; and reviewing and making recommendations to the Board with respect to director compensation.

Our Nominating/Corporate Governance Committee, which presently consists of Messrs. Flaherty, Berenson and Tessler, held one meeting during the fiscal year 2012. Mr. Flaherty serves as Chairman of the Nominating/Corporate Governance Committee. Our Nominating and Corporate Governance Committee’s responsibilities include, among other items, making recommendations to the Board regarding the selection of director candidates, qualification and competency requirements for service on the Board and the suitability of proposed nominees as directors; advising the Board with respect to the corporate governance principles applicable to us; and overseeing the evaluation of the Board and management.

In evaluating the suitability of individuals for Board membership, our Nominating/Corporate Governance Committee takes into account many factors, including whether the individual meets requirements for independence; the individual’s general understanding of the various disciplines relevant to the success of a publicly-traded company; the individual’s understanding of our businesses and markets; the individual’s professional expertise and educational background; and other factors that promote diversity of views and experience. Our Nominating/Corporate Governance Committee evaluates each individual in the context of our Board as a whole, with the objective of recommending a group of directors that can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment, using its diversity of experience. In determining whether to recommend a director for re-election, our Nominating/Corporate Governance Committee considers a director’s past attendance at meetings and participation in, and contributions

13

Table of Contents

to, the activities of the Board. Our Nominating/Corporate Governance Committee has not established any specific minimum qualification standards for nominees to our Board, although from time to time our Board may identify certain skills or attributes (e.g., financial experience and investment advisory and sub-advisory management experience) as being particularly desirable to help meet specific Company needs that have arisen. Our Nominating/Corporate Governance Committee does not distinguish between nominees recommended by stockholders and other nominees.

Nominees must be approved for nomination in accordance with the criteria and procedures set forth by the Nominating/Corporate Governance Committee.

In identifying potential candidates for Board membership, the Nominating/Corporate Governance Committee relies on suggestions and recommendations from Board members, management and others. The Nominating/Corporate Governance Committee may also retain search firms to assist it in identifying potential candidates for director, gathering information about the background and experience of such candidates and acting as an intermediary with such candidates. Currently, no such firms have been retained.

Our Nominating/Corporate Governance Committee will consider timely written suggestions from our Stockholders. Stockholders wishing to suggest a candidate for director nomination for the 2013 Annual Meeting of Stockholders should follow the proposal process requirements as set forth in the “Submission of Stockholder Proposals” section of this Proxy. The manner in which director nominee candidates suggested in accordance with this policy are evaluated will not differ from the manner in which candidates recommended by other sources are evaluated.

Management is responsible for the day-to-day assessment and management of risk and the development and implementation of related mitigation procedures and processes. In exercising this responsibility, management regularly conducts risk assessments of our business and operations, including portfolio risk management.

Our Board is responsible for overseeing the effectiveness of management’s overall risk management programs and processes and focuses on our overall risk management strategies. In addition, our Board has delegated to its committees specific risk oversight responsibilities as summarized below. The chairs of the committees report regularly to the Board on the areas of risk they are responsible for overseeing. Further, each of our directors has full and free access to members of the Company’s management and may consult with the Company’s management committees at any time. The Board and its committees oversee risks associated with their respective principal areas of focus, summarized as follows:

| • | The Board as a whole has primary responsibility for overseeing strategic, financial and execution risks associated with the Company’s operations and operating environment, including: (i) significant changes in economic and market conditions worldwide that may pose significant risk to our overall business; (ii) major legal, regulatory and compliance matters that may present material risk to the Company’s operations, plans, prospects or competitive position; (iii) strategic and competitive developments; and (iv) senior management succession planning. The Board reviews information concerning these and other relevant matters that is provided by management, as well as each of the committees of the Board. |

| • | The Audit Committee has primary responsibility for addressing risks relating to financial matters, particularly financial reporting, accounting practices and policies, disclosure controls and procedures, internal control over financial reporting, and significant tax, legal and regulatory compliance matters. |

| • | The Compensation Committee has primary responsibility for risks and exposures associated with the Company’s compensation policies, plans and practices, regarding both executive compensation and the compensation structure generally, including whether it provides appropriate incentives and alignment of interests between our executives and our stockholders. |

| • | The Nominating/Corporate Governance Committee oversees risks associated with the independence of the Board and potential conflicts of interest. |

14

Table of Contents

We monitor regulatory developments and review our policies, processes and procedures in the area of corporate governance to respond to such developments. As part of those efforts, we review laws affecting corporate governance, as well as rules adopted by the SEC and NASDAQ. Additional corporate governance information, including copies of our Audit Committee Charter, Compensation Committee Charter and Nominating/Corporate Governance Committee Charter, can be found through the “Investor Relations” section of our website at www.eipny.com.

Code of Ethics and Business Conduct

The Board has adopted a Code of Ethics and Business Conduct (“Code of Ethics”) that applies to all of our employees, officers and directors. Our Code of Ethics constitutes our “code of ethics” within the meaning of Section 406 of the Sarbanes-Oxley Act and the “code of conduct” under the NASDAQ Marketplace Rules. A copy of the Code of Ethics is available through the “Investor Relations” section of the Company’s website, www.eipny.com. We intend to post amendments to, or waivers from, the Code of Ethics at this location on our website. In addition, we will provide a copy of our Code of Ethics and Business Conduct, free of charge, to any stockholder who calls or submits a request in writing to:

Epoch Holding Corporation

640 Fifth Avenue, 18th Floor

New York, New York 10019

Attention: Adam Borak, Corporate Secretary

(212) 303-7200

Our employees and directors are required to report any conduct that they believe could in any way be construed as a fraudulent or illegal act or otherwise in violation of the Code of Ethics. The Audit Committee has established procedures to receive, retain and address complaints regarding accounting, internal accounting controls or auditing matters and to allow for the confidential and anonymous submission by employees of related concerns.

The Board believes that a substantial portion of director compensation should be in the form of equity to help align directors’ interests with the interests of stockholders. The Compensation Committee annually reviews and recommends to our Board of Directors the compensation of our non-employee directors. For fiscal year 2012, directors who were not salaried employees of our Company received annual fees equal to $80,000, with a minimum of $60,000 payable in Common Stock, at the discretion of the director. Awards were granted at the beginning of the fiscal year, based on the volume weighted average price of our Common Stock for the five business days ended June 30, 2011, and vest on the one year anniversary of the grant date. Directors who receive compensation as officers or employees of the Company receive no additional compensation for their services on the Board. All directors of the Company are reimbursed for travel and related expenses incurred in attending meetings of the Board, committees and stockholders.

15

Table of Contents

The following table provides information about the compensation earned by our non-employee directors in fiscal year 2012.

| Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($)(2) | All Other Compensation ($) |

Total ($) | ||||||||||||

| Enrique R. Arzac |

— | 81,117 | — | 81,117 | ||||||||||||

| Jeffrey L. Berenson |

20,000 | (1) | 60,837 | — | 80,837 | |||||||||||

| John L. Cecil |

— | 81,117 | 100,000 | (3) | 181,117 | |||||||||||

| Peter A. Flaherty |

— | 81,117 | — | 81,117 | ||||||||||||

| Allan R. Tessler |

20,000 | (1) | 60,837 | — | 80,837 | |||||||||||

| (1) | Messrs. Berenson and Tessler elected $20,000 in cash and $60,000 in stock. All of the other non-employee directors elected stock. |

| (2) | All shares of restricted stock were awarded pursuant to the 2004 Omnibus Long-Term Incentive Compensation Plan. Represents the fair value of restricted stock awards granted during fiscal year 2012 as measured by the Company’s stock price on the date of grant, calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification (“FASB ASC”) Topic 718, Compensation—Stock Compensation. The grant date fair value was calculated by multiplying the number of shares granted by the closing price of the Company’s common shares on the date of grant. Restricted stock awards granted to our non-employee directors vest on the one year anniversary of the grant date. |

| (3) | In April 2012, the Company entered into a consulting agreement with Mr. Cecil. Mr. Cecil is providing assistance with the Company’s strategic planning initiatives, in conjunction with his services as a Board member. The Company incurred $100,000 of expense for these consulting services during the fiscal year ended June 30, 2012. |

As of June 30, 2012, our non-employee directors held the following unvested restricted shares:

| Name |

Unvested Restricted Shares (#)(1) |

|||

| Enrique R. Arzac |

4,552 | |||

| Jeffrey L. Berenson |

3,414 | (2) | ||

| John L. Cecil |

4,552 | |||

| Peter A. Flaherty |

4,552 | |||

| Allan R. Tessler |

3,414 | (2) | ||

| (1) | The awards of July 1, 2011 vested on July 1, 2012, one year from the date of grant. All awards are subject to continued service as a director through the vesting date. |

| (2) | For fiscal year 2012, Messrs. Berenson and Tessler elected to receive a portion of the director compensation as cash. |

For fiscal year 2013, directors who are not salaried employees of our Company will receive annual fees equal to $80,000, with a minimum of $60,000 payable in Common Stock, at the discretion of the director, based on the volume weighted average price of our Common Stock for the five business days ended June 30, 2012.

16

Table of Contents

EXECUTIVE OFFICERS OF THE COMPANY

Biographies of the current executive officers of the Company are set forth below, excluding Messrs. Priest’s and Taussig’s biographies, which are included in the “Election of Directors” section of this Proxy Statement. Each executive officer serves at the discretion of the Board of Directors. There are no family relationships among the directors, executive officers and other key employees of Epoch.

| ADAM BORAK |

Age: 45 |

Chief Financial Officer. Mr. Borak joined our Company in August 2005 as Chief Financial Officer. Mr. Borak was previously a Director of Finance at Credit Suisse Asset Management-Americas, and its predecessor firm BEA Associates. During his seven year tenure, he was responsible for the corporate finance function of the firm’s New York office. Prior to that, Mr. Borak was the Chief Financial Officer of Lehman Brothers Canada, Inc. and also worked for Lehman Brothers in New York. Mr. Borak is a CPA, and began his career with PriceWaterhouse. Mr. Borak received a B.S. in Economics from the Wharton School of the University of Pennsylvania.

| DAVID N. PEARL |

Age: 53 |

Executive Vice President. Mr. Pearl was named as an Executive Vice President of the Company in February 2006. Mr. Pearl has been a Managing Director and Head of U.S. Equities since June 2004, and Co-Chief Investment Officer since February 2009. From 2001 until June 2004, Mr. Pearl was a Managing Director and Portfolio Manager at Steinberg Priest & Sloane Capital Management, LLC where he was responsible for both institutional and private client assets. Prior to that, he held a similar portfolio management position at ING Furman Selz Asset Management and earlier was a Senior Portfolio Manager at Citibank Global Asset Management. Prior to Citibank, Mr. Pearl was an officer and Senior Analyst at BEA Associates, predecessor to Credit Suisse Asset Management-Americas. Mr. Pearl received an MBA from Stanford University Graduate School of Business and a B.S. in Mechanical Engineering from the University of Pennsylvania.

17

Table of Contents

Compensation Discussion and Analysis

Overview

The Compensation Committee (the “Committee”) consists entirely of “independent directors” as defined under applicable NASDAQ and SEC rules, and “outside directors” as defined under Section 162(m) of the Internal Revenue Code (“Section 162(m)”). The Committee authorizes and determines all salaries for our officers, administers our incentive compensation plan in accordance with the powers and authority granted in such plan, determines any incentive awards to be made to our officers, approves the performance-based compensation of individuals pursuant to Section 162(m), and administers other matters relating to compensation or benefits.

Additionally, the Compensation Committee engages an independent compensation consultant, Johnson Associates, Inc. (“Johnson Associates”) to advise on marketplace trends in executive compensation, management proposals for compensation programs, and executive officer compensation decisions. Johnson Associates also provides guidance on compensation for the next levels of senior management and equity compensation programs generally. To maintain the independence of their advice, Johnson Associates does not provide any other services to the Company.

The Committee annually reviews and approves our executive compensation strategy and principles to ascertain whether they are aligned with our business strategy and objectives, stockholder interests, desired behaviors and corporate culture. The Committee establishes the total compensation paid to the executive officers with the goal of being fair, reasonable and competitive. Generally, the types of compensation and benefits provided to executive officers are similar to those provided to other employees.

Throughout this Proxy Statement, the individuals who served as our Chief Executive Officer, Chief Operating Officer, Chief Financial Officer, and Executive Vice President during fiscal year 2012 are referred to as the “named executive officers.”

Compensation Philosophy and Objectives

The Committee acknowledges that the investment management and financial services industry is highly competitive and that experienced professionals have potential career mobility. The Company competes for executive talent with a large number of investment management and financial services companies, some of which are privately owned and others that have significantly larger market capitalizations than the Company. We are a smaller company in a highly competitive industry and our ability to attract, retain and reward our named executive officers and other key employees is essential to maintaining the Company’s competitive position. The Company’s comparatively smaller size within its industry provides unique challenges, and therefore, is a substantial factor in the design of the executive compensation program. The Committee’s goal is to maintain a compensation program that is competitive within the Company’s industry. Each year, the Committee reviews the executive compensation program with respect to the external competitiveness of the program, the linkage between executive compensation and the creation of stockholder value, and determines what changes, if any, are appropriate.

In determining the form and amount of compensation payable to the Company’s named executive officers, the Committee is guided by the following objectives and principles:

| • | Compensation levels should be sufficiently competitive to attract and retain key executives. The Company aims to ensure its executive compensation program attracts, motivates and retains high performance talent and rewards them for the Company’s achieving and maintaining a competitive position in its industry. Total compensation should increase with position, responsibility and contribution to the Company. |

| • | Compensation should relate directly to performance and incentive compensation should constitute a substantial portion of total compensation. The Company aims to foster a pay-for-performance culture, |

18

Table of Contents

| with a majority of total compensation being “at risk.” Accordingly, a substantial portion of total compensation should be tied to, and vary with, the Company’s financial, operational and strategic performance, as well as individual performance. Executives with greater roles and the ability to directly impact the Company’s strategic goals and long-term results should bear a greater proportion of the risk if these goals and results are not achieved. |

| • | Long-term incentive compensation should align executives’ interests with the Company’s stockholders. Awards of equity-based compensation encourage executives to focus on the Company’s long-term growth and prospects, and increase stockholder value over the long-term. Additionally, the equity-based awards incentivize executives to manage the Company from the perspective of owners with a meaningful stake in the Company, as well as to focus on long-term career objectives. |

| • | Benefits should comprise an element of executive compensation. The Company provides several benefits. The Committee believes that the Company’s benefits are competitive with its peers and provide additional incentive for strong performance. |

The Company’s executive compensation program is designed to reward the achievement of initiatives regarding growth and productivity, including:

| • | To set, implement and communicate strategies, goals and objectives that encourage growth in assets under management and earnings at rates that are competitive with or greater than our peers, create stockholder value, and focus employees on meaningful actions that position the Company for growth. |

| • | To recruit, motivate and exhibit leadership that aligns employees’ interests with that of our stockholders. |

| • | To develop and maintain a strong understanding of the competitive environment and position the Company as a competitive force within its industry. |

| • | To develop strategic opportunities which benefit the Company and our stockholders. |

| • | To sustain an investment culture focused on performance and high quality products that benefit clients. |

| • | To implement a culture of compliance and unwavering commitment to operate the Company’s business with the highest standards of professional conduct and compliance. |

Compensation Process

Based on the foregoing objectives, the Committee has structured our annual cash and long-term equity-based incentive compensation to motivate executives to achieve the business goals set by us and reward the executives for achieving such goals. In establishing total annual compensation for the named executive officers, the Committee reviews and considers the following:

| • | Management’s Role in the Compensation-Setting Process. The Company’s Chief Executive Officer, William W. Priest, provides evaluations of all senior executive officers, and provides recommendations to the Committee regarding base salary levels and the form and amount of the annual cash incentive and long-term equity-based incentive awards paid to all senior executive officers who report directly to Mr. Priest. Additionally, Mr. Priest and other officers of the Company attend portions of Committee meetings and, upon the Committee’s request, provide compensation and other information to the Committee, as well as historical breakdowns of primary compensation components for each executive officer. |

| • | Compensation Consultant. The Committee Charter provides the Committee sole authority to retain and terminate any compensation consulting firm or other adviser, independent from management and the Company, it deems appropriate. For fiscal years 2010, 2011 and 2012 the Committee engaged Johnson Associates, Inc. to review and assess total compensation and individual pay components and evaluate long-term incentive objectives for the named executive officers, and to provide various compensation analyses requested by the Committee. Specifically, the Committee directed Johnson Associates to provide (1) comparative compensation data with respect to the Company’s peer group, including both |

19

Table of Contents

| public and private asset management companies and (2) recommendations regarding the Company’s overall compensation program and executive officers’ pay levels. |

| • | Benchmarking Against Our Peer Group. With the assistance of Johnson Associates, the Committee benchmarked the Company’s executive compensation program in fiscal year 2012 against a group of companies in the asset management and financial services industry. The Company competes for market share, institutional clients, mutual fund shareholders, executive talent and employees within the investment advisory industry. The peer group includes several of the companies in the Investment Advisor Standard Industry Classification Code 6282, as well as several companies in the Dow Jones U.S. Asset Managers Total Stock Market Index, a composite of publicly traded asset management companies, that are both used for comparison purposes in the Company’s stock performance graph included in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2012. The companies comprising the compensation peer group are Boston Private Financial Holdings Inc.; Calamos Asset Management, Inc.; Cohen & Steers, Inc.; Cowen Group, Inc.; Diamond Hill Investment Group, Inc.; Edelman Financial Group Inc.; GAMCO Investors, Inc.; PrivateBancorp Inc.; Resource America, Inc.; Stifel Financial Corporation; U.S. Global Investors, Inc.; Waddell & Reed Financial, Inc.; and Westwood Holdings Group, Inc. |

Additionally, Johnson Associates also provides broad market perspectives for the Committee based on factors such as (1) publicly traded competitor information, (2) Johnson Associates’ proprietary data sources, (3) market competitive trends, and (4) the Company’s particular circumstances.

The Committee does not necessarily believe that it is appropriate to establish compensation levels based exclusively or primarily on benchmarking to the Company’s publicly traded peers. Although many of those companies may compete with the Company in certain lines of business, they are not fully comparable in terms of size, scope or operations. The Committee looks to external market data as one of several reference points in reviewing and establishing individual pay components and total compensation and ensuring that the Company’s executive compensation is competitive in the marketplace.

In addition to reviewing our market positioning against our public competitors, the Committee also reviews competitive compensation information obtained from McLagan Partners’ U.S. Investment Management Survey, a widely used source for compensation information within public and private investment firms. This survey provides detailed analysis of compensation for a greater range of investment management employees than are available for public companies and is specifically focused on the asset management industry. The McLagan survey includes approximately 125 investment management and advisory firms of various sizes and scope, several of which are included in the peer group above. The Company does not specifically set any compensation elements or pay levels versus the McLagan survey results; rather it uses the comparative survey data as part of its decision-making process relating to the base salary, annual cash incentive levels and long-term equity-based incentives for our executive team and our employees.

| • | Compensation Analysis Tools. In addition to the competitive compensation information provided by Johnson Associates, the McLagan surveys, and the historical breakdown of the total compensation components for each executive officer provided by management, the Committee also reviewed various Company compensation metrics such as total compensation as a percentage of revenue, cash compensation as a percentage of revenue, and equity share awards as a percentage of shares outstanding. The Committee intends to continue using and developing these materials and data points in the future as compensation practices are reviewed and evolve. |

| • | Determining Compensation Levels. The Committee annually determines total compensation level, as well as the individual pay components of the named executive officers. In making such determinations, the Committee reviews and considers (1) the Company’s current and historical operating performance, (2) compensation information for comparable public and private asset managers, (3) recommendations of the Company’s Chief Executive Officer, based on individual responsibilities and performance, (4) historical compensation levels for each named executive officer, (5) current industry and market conditions, (6) the Company’s future objectives and challenges, and (7) overall effectiveness of the executive compensation program. |

20

Table of Contents

There is no pre-established policy or target against peer companies for total compensation, or for the allocation between cash and long-term equity-based incentive compensation. Rather, the Committee considers information provided by the compensation consultant, compensation surveys and peer group analysis, as well as its own judgment, to determine the appropriate level and mix of each component of the compensation program in any given year. In general, as executives progress to higher levels of our company, their ability to directly impact our performance and shareholder value increases, and our need to retain these executives’ increases. As a result, they receive a larger allocation of their total compensation in the form of long-term equity-based incentive compensation compared to the average for all employees.

The Committee does not rely solely on predetermined formulas, weighted factors or a limited set of criteria in making compensation decisions. In determining incentive awards payable to named executive officers, the Committee considers, among other things, the Company’s financial, strategic and operating results, performance of the Company’s products, execution of the Company’s business plan, the Company’s total shareholder return, leadership and personal performance, analysis of the executive’s historical and current compensation, and competitiveness of the executive’s total compensation. Based upon information received from Johnson Associates, recommendations of the Chief Executive Officer, and its own judgment, the Committee approved the base salary, performance-based cash incentive award and performance-based restricted stock incentive award of each named executive officer in fiscal year 2012. The Committee believes these approved forms and levels of compensation are reasonable, appropriate, and in line with the Company’s compensation philosophy and principles.

The Committee intends to continue its strategy of compensating the Company’s named executive officers through programs that emphasize performance-based incentive compensation, fostering a pay-for-performance culture. To that end, a majority of executive compensation will continue to be tied to Company and individual performance, while maintaining an appropriate balance between cash and non-cash compensation.

The named executive officers are compensated on a calendar year basis, in synchronization with the determination and payment of annual performance-based incentive awards for all other Company employees.

The foregoing discussion primarily describes the compensation philosophies, principles and practices the Committee utilizes in setting executive compensation currently. In the future, as the Committee continues to review each element of the executive compensation program, these philosophies, principles and practices may change.

Risks Related to Compensation Policies and Practices

As part of its oversight of the Company’s executive and non-executive compensation programs, the Compensation Committee, in conjunction with Company management and the compensation consultant, considers how current compensation policies and practices, including the incentives created by compensation awards, affect the Company’s risk profile. The Compensation Committee evaluates the Company’s compensation policies to determine whether they are designed to (i) retain key personnel, and (ii) encourage an appropriate level of risk-taking and not create incentives that are reasonably likely to pose material risks to the Company.

The Company reviews industry comparative compensation data, permitting it to set compensation levels that it believes contribute to low rates of employee attrition. Additionally, equity-based awards are subject to vesting over a three year period. We believe both the levels of compensation and the structure of the deferral plan are appropriately designed to retain key personnel.

By design, our compensation program for executive officers and our employees is designed to minimize excessive risk taking. Our base salary component of compensation is structured to lessen risk taking because it is a fixed amount that is positioned to be fully market competitive. The current incentive awards have the following risk limiting characteristics:

| • | Awards are made based on a review of a variety of indicators of performance, thus diversifying the risk associated with any single indicator of performance; |

21

Table of Contents