Exhibit 99.1

News Release

For more information contact:

Dennis J. Zember Jr.

Executive Vice President, CFO & COO

(229) 890-1111

AMERIS BANCORP ANNOUNCES 20% INCREASE IN OPERATING RESULTS

FOR FIRST QUARTER 2017

MOULTRIE, Ga., April 21, 2017 – Ameris Bancorp (Nasdaq: ABCB) (the “Company”) today reported net income of $21.2 million, or $0.59 per diluted share, for the quarter ended March 31, 2017, compared with $12.3 million, or $0.37 per diluted share, for the quarter ended March 31, 2016. Commenting on the Company’s quarterly results, Edwin W. Hortman, Jr., the Company’s President and Chief Executive Officer, said, “We delivered another quarter of consistent financial results with very little noise. Generally, the first quarter is our most challenging quarter, but control of operating expenses and double digit growth in year-over-year revenue led us to solid results. Our pipelines are very strong and I expect reliable growth in earnings through the remainder of 2017.”

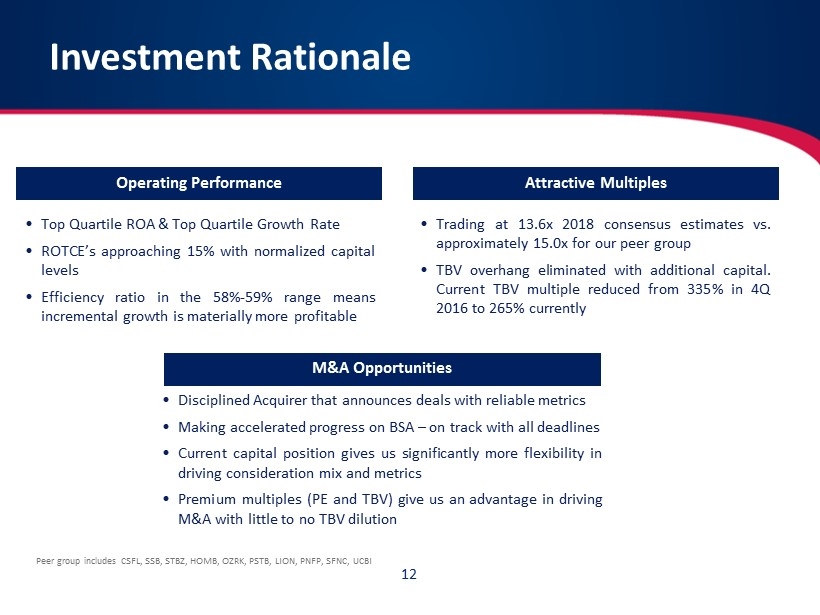

The Company reported operating net income of $21.6 million, or $0.60 per diluted share, for the quarter ended March 31, 2017, compared with $16.4 million, or $0.50 per diluted share, for the first quarter of 2016. Operating net income for the first quarter of 2017 and 2016 excludes certain after-tax costs associated with acquisitions and sales of premises, as seen below. Operating returns on average assets and average tangible common equity were 1.27% and 15.84%, respectively, for the first quarter of 2017, compared with 1.17% and 15.37%, respectively, for the same quarter of 2016.

Following is a summary of the adjustments between reported net income and adjusted operating net income:

| Three Months Ended | ||||||||

| Adjusted Operating Net Income Reconciliation | Mar 17 | Mar 16 | ||||||

| Net income available to common shareholders | $ | 21,153 | $ | 12,317 | ||||

| Merger and conversion charges | 402 | 6,359 | ||||||

| Losses (gains) on sale of premises | 295 | (77 | ) | |||||

| Tax effect of management-adjusted charges | (244 | ) | (2,199 | ) | ||||

| Plus: After tax management-adjusted charges | 453 | 4,083 | ||||||

| Adjusted Operating Net income | $ | 21,606 | $ | 16,400 | ||||

| Reported Return on average assets | 1.24 | % | 0.88 | % | ||||

| Adjusted Operating Return on average assets | 1.27 | % | 1.17 | % | ||||

Highlights of the Company’s performance and results for the first quarter of 2017 include the following:

| · | Operating return on average assets of 1.27% and return on average tangible equity of 15.84% |

| · | Increase in tangible book value per share to $16.57, compared with $14.42 per share at December 31, 2016 |

| · | Organic loan growth of $98.5 million for the quarter, reflecting an annualized growth rate of 8.5% |

| · | Growth in non-interest bearing demand deposits of $81.3 million for the quarter, reflecting an annualized growth rate of 21.0% |

| · | 15.5% increase in total revenue, to $86.3 million, in the first quarter of 2017, compared with total revenue of $74.7 million in the first quarter of 2016 |

| · | 12% improvement in the Company’s net overhead ratio from 1.79% in the first quarter of 2016 to 1.57% in the first quarter of 2017 |

| · | Improvement in operating efficiency ratio, on a tax-equivalent basis, to 59.67% in the first quarter of 2017, compared with 65.4% in the same quarter in 2016 |

| · | Improvement in net interest margin to 3.97% from 3.95% in the fourth quarter of 2016 |

| · | Successful public offering of 2,012,500 shares of the Company’s common stock to prepare for future growth |

| · | Completion of public offering of $75 million of fixed-to-floating rate subordinated notes |

Net Interest Income and Net Interest Margin

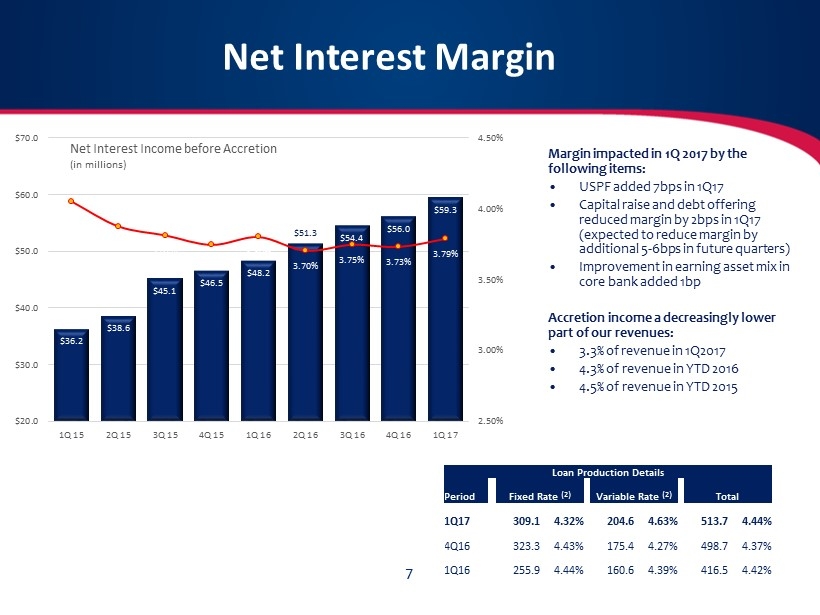

Net interest income on a tax-equivalent basis for the first quarter of 2017 totaled $62.1 million, compared with $51.2 million for the first quarter of 2016, an increase of $10.9 million, or 21.4%. The Company’s net interest margin increased during the quarter to 3.97%, compared with 3.95% during the fourth quarter of 2016, but declined from 4.03% for the first quarter of 2016. Accretion income for the first quarter of 2017 was $2.8 million, compared with $2.9 million in the first quarter of 2016. Excluding the effect of accretion on purchased assets, the Company’s net interest margin was 3.79% in the first quarter of 2017, compared with 3.73% in the fourth quarter of 2016 and 3.80% in the first quarter of 2016. During the first quarter of 2017, the Company experienced an increase in the margin of approximately 0.07% related to the activity in the premium finance division. The capital raise and the debt offering completed during the first quarter of the year negatively impacted the margin by approximately 0.02%. Lastly, the Company’s improved asset mix with more concentrations in loans outstanding improved the margin by approximately 0.01%

Yields on earning assets in the first quarter of 2017 were 4.38%, compared with 4.36% in the first quarter of 2016. Interest income on loans on a tax-equivalent basis increased during the first quarter of 2017 to $62.8 million, compared with $59.4 million in the fourth quarter of 2016 and $49.8 million in the first quarter of 2016. Yields on the funds invested in purchased mortgage pools were 2.84% during the first quarter of 2017, compared with 3.30% during the same period in 2016. Excluding accretion income, yields on all loans were 4.56% in the first quarter of 2017, an increase of 0.05% from the fourth quarter of 2016, reflecting success in the Company’s pricing efforts on new and renewed credits in the current interest rate environment.

Total interest expense for the first quarter of 2017 was $6.5 million, compared with $4.1 million for the same quarter of 2016. This increase in total interest expense was driven by increases in total deposits and other borrowings. Deposit costs increased slightly, from 0.23% in the first quarter of 2016 to 0.28% in the first quarter of 2017. Continued improvement in the Company’s mix of deposits, primarily toward non-interest bearing deposits, has allowed for more aggressive retention efforts on money market deposit accounts and CDs without negatively impacting overall deposit costs. Non-interest bearing deposits were 29.2% of the total average deposits during the first quarter of 2017, compared with 27.9% for the first quarter of 2016. During the first quarter of 2017, the average balance of Federal Home Loan Bank advances increased significantly as the Company used those proceeds to fund loans generated by the Company’s new premium finance division.

Non-interest Income

Non-interest income in the first quarter of 2017 was $25.7 million, an increase of $1.4 million, or 5.8%, compared with the same quarter in 2016. Service charges in the first quarter of 2017 were $10.6 million, an increase of $648,000, or 6.5%, compared with the same quarter in 2016. Growth in service charge-related revenues on commercial and consumer accounts was responsible for much of the increase in service charges, while NSF fee income was flat.

The Company’s mortgage divisions continued to make strides in revenues and net income. Revenue in the retail mortgage group totaled $13.5 million in the first quarter of 2017, an increase of 11.9% compared with the same quarter in 2016. Net income for the Company’s retail mortgage division increased 7.4% during the first quarter of 2017 to $2.8 million, compared with $2.6 million in the first quarter of 2016. Total production in the first quarter of 2017 for the retail mortgage group amounted to $311.8 million (85% retail and 15% wholesale), compared with $268.6 million in the same quarter of 2016 (also 85% retail and 15% wholesale). In addition to the strong results, the Company reported that its mortgage division received approval late in the quarter to become a GNMA issuer effective immediately. Production in the first quarter that was GNMA eligible totaled approximately $120 million and the division estimates that between 35% - 40% of 2017 production will be eligible for these programs.

Net income for the Company’s warehouse lending division increased 41.2% during the quarter, from $667,000 in the first quarter of 2016 to $942,000 in the first quarter of 2017. Loan production increased from $565.2 million in the first quarter of 2016 to approximately $647.4 million in the current quarter. Sales efforts now are focused on improving already strong penetration and capture rates among the customer base, as well as targeted sales towards mortgage companies focused more heavily on purchase transactions. Although the average balances and production were impressive against the linked quarter, the Company did experience a contraction in quarter-end balances of approximately $83 million that impacted overall loan growth. Management believes the decline was centered more heavily in unusually high balances at the end of the year and that growth rates and comparisons against the same quarter in 2016 are more indicative of where the division is with respect to profitability and growth.

Revenues from the Company’s SBA division increased 24.3% during the first quarter of 2017 to $2.7 million, compared with $2.2 million during the first quarter of 2016. Net income for the division increased 42.0%, from $833,000 for the first quarter of 2016 to $1.2 million for the first quarter of 2017. The SBA pipeline totaled $55.0 million at the end of the first quarter, up $5.6 million compared with the same time in 2016.

Non-interest Expense

During the first quarter of 2017 and 2016, the Company incurred pre-tax merger and conversion charges of $402,000 and $6.4 million, respectively, as well as losses on the sale of premises totaling $295,000 in 2017 and gains on the sale of premises totaling $77,000 in 2016. Excluding these charges, operating expenses increased approximately $3.1 million, to $52.4 million, from $49.3 million in the first quarter of 2016. The acquisition of JAXB in the first quarter of 2016, together with the additional operating expenses associated with the premium finance division, impacted operating expenses by approximately $4.0 million in the first quarter of 2017.

Efforts to improve operating efficiency and the net overhead ratio have been very successful. During the first quarter of 2017, the Company’s operating efficiency ratio declined to 59.67%, compared with 65.44% in the same quarter of 2016. The Company’s operating net overhead ratio also declined materially, to 1.57% in the first quarter of 2017, compared with 1.79% in the first quarter of 2016. Management attributes the improvement in efficiency-related ratios to expanded average portfolios of the Company’s commercial lenders, branches with higher deposit balances and the Company’s lending lines of business reaching a certain level of critical mass.

Salaries and benefits increased by $1.6 million to $27.8 million in the current quarter of 2017, compared with $26.2 million in the first quarter of 2016. Growth in salaries and benefits from the first quarter of 2016 to the first quarter of 2017 relating to the Company’s ongoing Bank Secrecy Act compliance efforts and the addition of the premium finance division was $565,000 and $996,000, respectively. Compared with the fourth quarter of 2016, salaries and benefits increased $2.7 million, primarily due to $996,000 of premium finance division salaries and benefits, $441,000 of Bank Secrecy Act compliance salaries and benefits and $1.0 million of payroll taxes that are typical for the first quarter of each year.

Data processing and telecommunications costs for the quarter were $6.6 million, an increase of $459,000 or 7.5% over the first quarter in 2016. Significant improvements to the Company’s infrastructure have been undertaken and are included in the current run rate, including data center relocation, upgrades in connectivity speeds, hardware upgrades, data management and reporting, and the development of an on-line deposit origination platform that should augment the Company’s approach to deposit gathering in its local markets in the near future. Repurposing of existing resources into new contracts and tools have allowed the Company to receive material improvements in the reliability of its systems with only moderate increase in costs.

Total credit costs (provision and non-provision credit resolution-related costs) totaled $2.8 million in the first quarter of 2017, compared with $2.5 million in the same quarter in 2016 and $2.8 million in the fourth quarter of 2016.

Balance Sheet Trends

Total assets at March 31, 2017 were $7.09 billion, compared with $6.89 billion at December 31, 2016. The growth in total assets was driven by the increase in interest bearing deposits held as a result of the Company’s capital raise and debt offering transactions.

Loans, including loans held for sale, totaled $5.43 billion at March 31, 2017, compared with $5.37 billion at December 31, 2016. During the quarter, growth in core loans (legacy and purchased non-covered loans) increased by $98.5 million, or 8.5% on an annualized basis.

Lending activities in the core bank in the first quarter of 2017 were notably stronger than normal for the first quarter. Commercial real estate lending grew $51.9 million during the quarter, or 15.0% on an annualized basis, while commercial and industrial lending (excluding operations of the new premium finance division) expanded $20.0 million, or 13.2% on an annualized basis. Pipelines for the bank at the end of the first quarter of 2017 were similar to those at the end of 2016.

Loan production and growth associated with the new premium finance division were very close to forecasted levels. Loans outstanding grew from $353.9 million at the end of 2016 to $425.9 million at the end of the first quarter of 2017. The Company believes it can sustain annualized growth rates in this division of 15% - 20% for the next few years, with steady credit and profitability levels.

The Company’s newest lending effort is in the equipment finance division, which provides financing for heavy equipment in the manufacturing, transportation and construction sectors. At the end of the first quarter of 2017, the division had booked approximately $2.3 million in loans and had an immediate pipeline of approximately $50.0 million that is expected to close during the second quarter. Activity and client calls have been brisk, and management remains confident in its full year forecast of $200 million of growth in this division.

Mortgage warehouse balances fell during the quarter from $189.3 million at the end of 2016 to $107.8 million at the end of the first quarter of 2017. Mortgage warehouse balances were unusually high at the end of 2016, as mortgage volume swelled in the month following the presidential election. While average balances were lower, the group’s loan production moved higher by 14.5% compared with the same quarter in 2016. This increase resulted from continued growth in customers and approved lines of credit. Management expects a rebound in the outstanding balances throughout the remainder of 2017 as mortgage volume picks up in the seasonally strong second and third quarters.

Investment securities at the end of the first quarter of 2017 were $866.7 million, or 13.3% of earning assets, compared with $852.2 million, or 13.5% of earning assets, at December 31, 2016.

Deposits increased $67.2 million during the first quarter of 2017 to end the quarter at $5.64 billion, despite the runoff of approximately $67.6 million in seasonal deposits that the Company holds for municipal clients at the end of each year. Excluding this runoff, the Company managed growth in deposits of $134.8 million during the first quarter, or 9.8% on an annualized basis.

At March 31, 2017, non-interest bearing deposit accounts were $1.65 billion, or 29.3% of total deposits, compared with $1.57 billion and 28.2%, respectively, at December 31, 2016. Non-rate sensitive deposits (including non-interest bearing, NOW and savings) totaled $3.09 billion at March 31, 2017, compared with $3.17 billion at the end of 2016. These funds represented 54.8% of the Company’s total deposits at March 31, 2017, compared with 56.9% at the end of 2016.

Shareholders’ equity at March 31, 2017 totaled $758.2 million, compared with $646.4 million at December 31, 2016. The increase in shareholders’ equity was the result of the issuance of shares of common stock in the Company’s public offering, plus earnings of $21.2 million during the quarter. Tangible book value per share at March 31, 2017 was $16.57, up 14.9% from $14.42 at the end of 2016. Tangible common equity as a percentage of tangible assets increased to 8.85% at the end of the first quarter of 2017, compared with 7.46% at the end of 2016.

Conference Call

The Company will host a teleconference at 10:00 a.m. EDT today (April 21, 2017) to discuss the Company's results and answer appropriate questions. The conference call can be accessed by dialing 1-877-504-1190 (or 1-855-669-9657 for participants in Canada and 1-412-902-6630 for other international participants). The conference ID name is Ameris Bancorp ABCB. A replay of the call will be available one hour after the end of the conference call until May 5, 2017. To listen to the replay, dial 1-877-344-7529 (or 1-855-669-9658 for participants in Canada and 1-412-317-0088 for other international participants). The conference replay access code is 10104743. The conference call replay and the financial information discussed will also be available on the Investor Relations page of the Ameris Bank website at www.amerisbank.com.

About Ameris Bancorp

Ameris Bancorp is a bank holding company headquartered in Moultrie, Georgia. The Company’s banking subsidiary, Ameris Bank, had 97 locations in Georgia, Alabama, northern Florida and South Carolina at the end of the most recent quarter.

This news release contains certain performance measures determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Management of Ameris Bancorp (the “Company”) uses these non-GAAP measures in its analysis of the Company’s performance. These measures are useful when evaluating the underlying performance and efficiency of the Company’s operations and balance sheet. The Company’s management believes that these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results with prior periods and demonstrate the effects of significant gains and charges in the current period. The Company’s management believes that investors may use these non-GAAP financial measures to evaluate the Company’s financial performance without the impact of unusual items that may obscure trends in the Company’s underlying performance. These disclosures should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

This news release contains statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words “believe”, “estimate”, “expect”, “intend”, “anticipate” and similar expressions and variations thereof identify certain of such forward-looking statements, which speak only as of the dates which they were made. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those indicated in the forward-looking statements as a result of various factors. Readers are cautioned not to place undue reliance on these forward-looking statements and are referred to the Company’s periodic filings with the Securities and Exchange Commission for a summary of certain factors that may impact the Company’s results of operations and financial condition.

AMERIS BANCORP

FINANCIAL HIGHLIGHTS

(unaudited)

(dollars in thousands except per share data and FTE headcount)

| Three Months Ended | ||||||||||||||||||||

| Mar. | Dec. | Sept. | Jun. | Mar. | ||||||||||||||||

| 2017 | 2016 | 2016 | 2016 | 2016 | ||||||||||||||||

| EARNINGS | ||||||||||||||||||||

| Net Income | $ | 21,153 | $ | 18,177 | $ | 21,557 | $ | 20,049 | $ | 12,317 | ||||||||||

| Adjusted Operating Net Income | $ | 21,606 | $ | 22,205 | $ | 21,712 | $ | 20,310 | $ | 16,400 | ||||||||||

| PER COMMON SHARE DATA | ||||||||||||||||||||

| Earnings per share available to common shareholders: | ||||||||||||||||||||

| Basic | $ | 0.59 | $ | 0.52 | $ | 0.62 | $ | 0.58 | $ | 0.38 | ||||||||||

| Diluted | $ | 0.59 | $ | 0.52 | $ | 0.61 | $ | 0.57 | $ | 0.37 | ||||||||||

| Cash Dividends per share | $ | 0.10 | $ | 0.10 | $ | 0.10 | $ | 0.05 | $ | 0.05 | ||||||||||

| Book value per share (period end) | $ | 20.42 | $ | 18.51 | $ | 18.42 | $ | 17.96 | $ | 17.25 | ||||||||||

| Tangible book value per share (period end) | $ | 16.57 | $ | 14.42 | $ | 14.38 | $ | 13.89 | $ | 13.13 | ||||||||||

| Weighted average number of shares: | ||||||||||||||||||||

| Basic | 35,664,420 | 34,915,459 | 34,869,747 | 34,832,621 | 32,752,063 | |||||||||||||||

| Diluted | 36,040,240 | 35,293,035 | 35,194,739 | 35,153,311 | 33,053,554 | |||||||||||||||

| Period-end number of shares | 37,128,714 | 34,921,474 | 34,891,304 | 34,847,311 | 34,837,454 | |||||||||||||||

| Market data: | ||||||||||||||||||||

| High intraday price | $ | 49.50 | $ | 47.70 | $ | 36.20 | $ | 32.76 | $ | 33.81 | ||||||||||

| Low intraday price | $ | 41.60 | $ | 34.61 | $ | 28.90 | $ | 27.73 | $ | 24.96 | ||||||||||

| Period end closing price | $ | 46.10 | $ | 43.60 | $ | 34.95 | $ | 29.70 | $ | 29.58 | ||||||||||

| Average daily volume | 242,982 | 191,894 | 166,841 | 215,409 | 253,779 | |||||||||||||||

| PERFORMANCE RATIOS | ||||||||||||||||||||

| Return on average assets | 1.24 | % | 1.10 | % | 1.35 | % | 1.31 | % | 0.88 | % | ||||||||||

| Return on average common equity | 12.33 | % | 11.06 | % | 13.39 | % | 13.08 | % | 9.14 | % | ||||||||||

| Earning asset yield (TE) | 4.38 | % | 4.34 | % | 4.35 | % | 4.35 | % | 4.36 | % | ||||||||||

| Total cost of funds | 0.42 | % | 0.38 | % | 0.36 | % | 0.35 | % | 0.33 | % | ||||||||||

| Net interest margin (TE) | 3.97 | % | 3.95 | % | 3.99 | % | 4.01 | % | 4.03 | % | ||||||||||

| Non-interest income excluding securities transactions, as a percent of total revenue (TE) | 27.27 | % | 27.32 | % | 31.36 | % | 32.01 | % | 30.40 | % | ||||||||||

| Efficiency ratio | 61.52 | % | 67.05 | % | 61.91 | % | 63.11 | % | 74.41 | % | ||||||||||

| CAPITAL ADEQUACY (period end) | ||||||||||||||||||||

| Stockholders' equity to assets | 10.69 | % | 9.38 | % | 9.90 | % | 10.06 | % | 9.85 | % | ||||||||||

| Tangible common equity to tangible assets | 8.85 | % | 7.46 | % | 7.90 | % | 7.96 | % | 7.68 | % | ||||||||||

| EQUITY TO ASSETS RECONCILIATION | ||||||||||||||||||||

| Tangible common equity to tangible assets | 8.85 | % | 7.46 | % | 7.90 | % | 7.96 | % | 7.68 | % | ||||||||||

| Effect of goodwill and other intangibles | 1.83 | % | 1.92 | % | 2.00 | % | 2.10 | % | 2.17 | % | ||||||||||

| Equity to assets (GAAP) | 10.69 | % | 9.38 | % | 9.90 | % | 10.06 | % | 9.85 | % | ||||||||||

| OTHER PERIOD-END DATA | ||||||||||||||||||||

| Banking Division FTE | 1,039 | 1,014 | 987 | 1,000 | 1,063 | |||||||||||||||

| Retail Mortgage Division FTE | 252 | 254 | 254 | 239 | 227 | |||||||||||||||

| Warehouse Lending Division FTE | 8 | 9 | 5 | 6 | 6 | |||||||||||||||

| SBA Division FTE | 20 | 21 | 24 | 23 | 22 | |||||||||||||||

| Premium Finance Division FTE | 50 | - | - | - | - | |||||||||||||||

| Total Ameris Bancorp FTE Headcount | 1,369 | 1,298 | 1,270 | 1,268 | 1,318 | |||||||||||||||

| Assets per Banking Division FTE | $ | 6,829 | $ | 6,797 | $ | 6,579 | $ | 6,221 | $ | 5,736 | ||||||||||

| Branch locations | 97 | 97 | 99 | 102 | 103 | |||||||||||||||

| Deposits per branch location | $ | 58,169 | $ | 57,476 | $ | 53,597 | $ | 50,780 | $ | 50,784 | ||||||||||

AMERIS BANCORP

FINANCIAL HIGHLIGHTS

(unaudited)

(dollars in thousands except per share data and FTE headcount)

| Three Months Ended | ||||||||||||||||||||

| Mar. | Dec. | Sept. | Jun. | Mar. | ||||||||||||||||

| 2017 | 2016 | 2016 | 2016 | 2016 | ||||||||||||||||

| INCOME STATEMENT | ||||||||||||||||||||

| Interest income | ||||||||||||||||||||

| Interest and fees on loans | $ | 61,521 | $ | 57,982 | $ | 57,322 | $ | 54,164 | $ | 49,191 | ||||||||||

| Interest on taxable securities | 4,800 | 4,348 | 4,336 | 4,554 | 4,586 | |||||||||||||||

| Interest on nontaxable securities | 416 | 425 | 397 | 454 | 446 | |||||||||||||||

| Interest on deposits in other banks | 313 | 193 | 147 | 159 | 328 | |||||||||||||||

| Interest on federal funds sold | - | 8 | 8 | 9 | 8 | |||||||||||||||

| Total interest income | 67,050 | 62,956 | 62,210 | 59,340 | 54,559 | |||||||||||||||

| Interest expense | ||||||||||||||||||||

| Interest on deposits | $ | 3,763 | $ | 3,680 | $ | 3,074 | $ | 2,915 | $ | 2,741 | ||||||||||

| Interest on other borrowings | 2,697 | 1,997 | 2,069 | 1,836 | 1,382 | |||||||||||||||

| Total interest expense | 6,460 | 5,677 | 5,143 | 4,751 | 4,123 | |||||||||||||||

| Net interest income | 60,590 | 57,279 | 57,067 | 54,589 | 50,436 | |||||||||||||||

| Provision for loan losses | 1,836 | 1,710 | 811 | 889 | 681 | |||||||||||||||

| Net interest income after provision for loan losses | $ | 58,754 | $ | 55,569 | $ | 56,256 | $ | 53,700 | $ | 49,755 | ||||||||||

| Noninterest income | ||||||||||||||||||||

| Service charges on deposit accounts | $ | 10,563 | $ | 11,036 | $ | 11,358 | $ | 10,436 | $ | 9,915 | ||||||||||

| Mortgage banking activity | 11,215 | 9,878 | 14,067 | 14,142 | 10,211 | |||||||||||||||

| Other service charges, commissions and fees | 709 | 706 | 791 | 967 | 1,111 | |||||||||||||||

| Gain(loss) on sale of securities | - | - | - | - | 94 | |||||||||||||||

| Other non-interest income | 3,219 | 2,652 | 2,648 | 2,834 | 2,955 | |||||||||||||||

| Total noninterest income | 25,706 | 24,272 | 28,864 | 28,379 | 24,286 | |||||||||||||||

| Noninterest expense | ||||||||||||||||||||

| Salaries and employee benefits | 27,794 | 25,137 | 27,982 | 27,531 | 26,187 | |||||||||||||||

| Occupancy and equipment expenses | 5,877 | 6,337 | 5,989 | 6,371 | 5,700 | |||||||||||||||

| Data processing and telecommunications expenses | 6,572 | 6,244 | 6,185 | 6,049 | 6,113 | |||||||||||||||

| Credit resolution related expenses (1) | 933 | 1,083 | 1,526 | 1,764 | 1,799 | |||||||||||||||

| Advertising and marketing expenses | 1,106 | 1,273 | 1,249 | 854 | 805 | |||||||||||||||

| Amortization of intangible assets | 1,036 | 1,044 | 993 | 1,319 | 1,020 | |||||||||||||||

| Merger and conversion charges | 402 | 17 | - | - | 6,359 | |||||||||||||||

| Other non-interest expenses | 9,373 | 13,542 | 9,275 | 8,471 | 7,617 | |||||||||||||||

| Total noninterest expense | 53,093 | 54,677 | 53,199 | 52,359 | 55,600 | |||||||||||||||

| Income before income taxes | $ | 31,367 | $ | 25,164 | $ | 31,921 | $ | 29,720 | $ | 18,441 | ||||||||||

| Income tax expense | 10,214 | 6,987 | 10,364 | 9,671 | 6,124 | |||||||||||||||

| Net income | $ | 21,153 | $ | 18,177 | $ | 21,557 | $ | 20,049 | $ | 12,317 | ||||||||||

| Diluted earnings available to common shareholders | 0.59 | 0.52 | 0.61 | 0.57 | 0.37 | |||||||||||||||

| (1) | Includes expenses associated with problem loans and OREO, as well as OREO losses and writedowns. |

AMERIS BANCORP

FINANCIAL HIGHLIGHTS

(unaudited)

(dollars in thousands except per share data and FTE headcount)

| Three Months Ended | ||||||||||||||||||||

| Mar. | Dec. | Sept. | Jun. | Mar. | ||||||||||||||||

| 2017 | 2016 | 2016 | 2016 | 2016 | ||||||||||||||||

| PERIOD-END BALANCE SHEET | ||||||||||||||||||||

| Assets | ||||||||||||||||||||

| Cash and due from banks | $ | 127,164 | $ | 127,164 | $ | 123,270 | $ | 116,255 | $ | 146,863 | ||||||||||

| Federal funds sold and interest bearing deposits in banks | 232,045 | 71,221 | 90,801 | 68,273 | 107,373 | |||||||||||||||

| Investment securities available for sale, at fair value | 830,765 | 822,735 | 838,124 | 843,646 | 837,103 | |||||||||||||||

| Other investments | 35,950 | 29,464 | 24,578 | 19,125 | 12,802 | |||||||||||||||

| Loans held for sale | 105,637 | 105,924 | 126,263 | 102,757 | 97,439 | |||||||||||||||

| Loans, net of unearned income | 3,785,480 | 3,626,821 | 3,091,039 | 2,819,071 | 2,528,007 | |||||||||||||||

| Purchased loans (excluding loan pools) | 1,006,935 | 1,069,191 | 1,129,381 | 1,193,635 | 1,260,198 | |||||||||||||||

| Purchased loan pools | 529,099 | 568,314 | 624,886 | 610,425 | 656,734 | |||||||||||||||

| Less allowance for loan losses | (25,250 | ) | (23,920 | ) | (22,963 | ) | (21,734 | ) | (21,482 | ) | ||||||||||

| Loans, net | 5,296,264 | 5,240,406 | 4,822,343 | 4,601,397 | 4,423,457 | |||||||||||||||

| Other real estate owned | 10,466 | 10,874 | 10,392 | 13,765 | 14,967 | |||||||||||||||

| Purchased other real estate owned | 11,668 | 12,540 | 15,126 | 16,670 | 18,812 | |||||||||||||||

| Total other real estate owned | 22,134 | 23,414 | 25,518 | 30,435 | 33,779 | |||||||||||||||

| Premises and equipment, net | 121,610 | 121,217 | 122,191 | 123,978 | 124,747 | |||||||||||||||

| Goodwill | 126,419 | 125,532 | 122,545 | 121,422 | 121,512 | |||||||||||||||

| Other intangibles, net | 16,391 | 17,428 | 18,472 | 20,574 | 21,892 | |||||||||||||||

| Deferred income taxes, net | 40,618 | 40,776 | 37,626 | 39,286 | 44,579 | |||||||||||||||

| Cash value of bank owned life insurance | 78,442 | 78,053 | 77,637 | 77,095 | 76,676 | |||||||||||||||

| Other assets | 61,417 | 88,697 | 64,127 | 57,051 | 49,549 | |||||||||||||||

| Total assets | $ | 7,094,856 | $ | 6,892,031 | $ | 6,493,495 | $ | 6,221,294 | $ | 6,097,771 | ||||||||||

| Liabilities | ||||||||||||||||||||

| Deposits: | ||||||||||||||||||||

| Noninterest-bearing | $ | 1,654,723 | $ | 1,573,389 | $ | 1,563,316 | $ | 1,553,972 | $ | 1,529,037 | ||||||||||

| Interest-bearing | 3,987,646 | 4,001,774 | 3,742,782 | 3,625,560 | 3,701,750 | |||||||||||||||

| Total deposits | 5,642,369 | 5,575,163 | 5,306,098 | 5,179,532 | 5,230,787 | |||||||||||||||

| Federal funds purchased & securities sold under | ||||||||||||||||||||

| agreements to repurchase | 40,415 | 53,505 | 42,647 | 37,139 | 43,741 | |||||||||||||||

| Other borrowings | 525,669 | 492,321 | 373,461 | 260,191 | 110,531 | |||||||||||||||

| Subordinated deferrable interest debentures | 84,559 | 84,228 | 83,898 | 83,570 | 83,237 | |||||||||||||||

| Other liabilities | 43,628 | 40,377 | 44,808 | 34,947 | 28,647 | |||||||||||||||

| Total liabilities | 6,336,640 | 6,245,594 | 5,850,912 | 5,595,379 | 5,496,943 | |||||||||||||||

| Shareholders' equity | ||||||||||||||||||||

| Preferred stock | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||

| Common stock | 38,603 | 36,378 | 36,348 | 36,303 | 36,272 | |||||||||||||||

| Capital surplus | 503,543 | 410,276 | 409,630 | 408,549 | 407,726 | |||||||||||||||

| Retained earnings | 231,894 | 214,454 | 199,769 | 181,701 | 163,395 | |||||||||||||||

| Accumulated other comprehensive income (loss) | (1,209 | ) | (1,058 | ) | 10,449 | 12,960 | 6,411 | |||||||||||||

| Less treasury stock | (14,615 | ) | (13,613 | ) | (13,613 | ) | (13,598 | ) | (12,976 | ) | ||||||||||

| Total shareholders' equity | 758,216 | 646,437 | 642,583 | 625,915 | 600,828 | |||||||||||||||

| Total liabilities and shareholders' equity | $ | 7,094,856 | $ | 6,892,031 | $ | 6,493,495 | $ | 6,221,294 | $ | 6,097,771 | ||||||||||

| Other Data | ||||||||||||||||||||

| Earning Assets | 6,525,911 | 6,293,670 | 5,925,072 | 5,656,932 | 5,499,656 | |||||||||||||||

| Intangible Assets | 142,810 | 142,960 | 141,017 | 141,996 | 143,404 | |||||||||||||||

| Interest Bearing Liabilities | 4,638,289 | 4,631,828 | 4,242,788 | 4,006,460 | 3,939,259 | |||||||||||||||

| Average Assets | 6,915,965 | 6,573,344 | 6,330,350 | 6,138,757 | 5,618,397 | |||||||||||||||

| Average Common Stockholders' Equity | 695,830 | 653,991 | 640,382 | 616,361 | 542,264 | |||||||||||||||

AMERIS BANCORP

FINANCIAL HIGHLIGHTS

(unaudited)

(dollars in thousands except per share data and FTE headcount)

| Three Months Ended | ||||||||||||||||||||

| Mar. | Dec. | Sept. | Jun. | Mar. | ||||||||||||||||

| 2017 | 2016 | 2016 | 2016 | 2016 | ||||||||||||||||

| ASSET QUALITY INFORMATION | ||||||||||||||||||||

| Allowance for loan losses | ||||||||||||||||||||

| Balance at beginning of period | $ | 23,920 | $ | 22,963 | $ | 21,734 | $ | 21,482 | $ | 21,062 | ||||||||||

| Provision for loan loss | 1,836 | 1,710 | 811 | 889 | 681 | |||||||||||||||

| Charge-offs | 1,102 | 1,686 | 1,451 | 1,376 | 1,814 | |||||||||||||||

| Recoveries | 596 | 933 | 1,869 | 739 | 1,553 | |||||||||||||||

| Net charge-offs (recoveries) | 506 | 753 | (418 | ) | 637 | 261 | ||||||||||||||

| Ending balance | $ | 25,250 | $ | 23,920 | $ | 22,963 | $ | 21,734 | $ | 21,482 | ||||||||||

| Net charge-off information | ||||||||||||||||||||

| Charge-offs | ||||||||||||||||||||

| Commercial, financial & agricultural | $ | 104 | $ | 726 | $ | 326 | $ | 541 | $ | 406 | ||||||||||

| Real estate - residential | 216 | 239 | 292 | 123 | 468 | |||||||||||||||

| Real estate - commercial & farmland | 9 | - | - | 361 | 347 | |||||||||||||||

| Real estate - construction & development | 53 | 264 | 60 | 109 | 155 | |||||||||||||||

| Consumer installment | 164 | 159 | 74 | 59 | 59 | |||||||||||||||

| Purchased loans (excluding loan pools) | 556 | 298 | 699 | 183 | 379 | |||||||||||||||

| Purchased loan pools | - | - | - | - | - | |||||||||||||||

| Total charge-offs | 1,102 | 1,686 | 1,451 | 1,376 | 1,814 | |||||||||||||||

| Recoveries | ||||||||||||||||||||

| Commercial, financial & agricultural | 69 | 121 | 119 | 87 | 73 | |||||||||||||||

| Real estate - residential | 61 | 23 | 40 | 14 | 314 | |||||||||||||||

| Real estate - commercial & farmland | 9 | 78 | 13 | 57 | 121 | |||||||||||||||

| Real estate - construction & development | 20 | 16 | 131 | 221 | 122 | |||||||||||||||

| Consumer installment | 17 | 8 | 78 | 16 | 25 | |||||||||||||||

| Purchased loans (excluding loan pools) | 420 | 687 | 1,488 | 344 | 898 | |||||||||||||||

| Purchased loan pools | - | - | - | - | - | |||||||||||||||

| Total recoveries | 596 | 933 | 1,869 | 739 | 1,553 | |||||||||||||||

| Net charge-offs (recoveries) | $ | 506 | $ | 753 | $ | (418 | ) | $ | 637 | $ | 261 | |||||||||

| Non-accrual loans (excluding purchased loans) | 18,281 | 18,114 | 16,379 | 16,003 | 15,700 | |||||||||||||||

| Non-accrual purchased loans | 23,606 | 22,966 | 23,827 | 26,736 | 32,518 | |||||||||||||||

| Non-accrual purchased loan pools | - | - | 864 | 864 | - | |||||||||||||||

| Foreclosed assets (excluding purchased assets) | 10,466 | 10,874 | 10,392 | 13,765 | 14,967 | |||||||||||||||

| Purchased other real estate owned | 11,668 | 12,540 | 15,126 | 16,670 | 18,812 | |||||||||||||||

| Accruing loans delinquent 90 days or more | 933 | - | - | - | - | |||||||||||||||

| Total non-performing assets | 64,954 | 64,494 | 66,588 | 74,038 | 81,997 | |||||||||||||||

| Non-performing assets as a percent of total assets | 0.92 | % | 0.94 | % | 1.03 | % | 1.19 | % | 1.34 | % | ||||||||||

| Net charge offs as a percent of average loans (annualized) | 0.04 | % | 0.06 | % | -0.04 | % | 0.06 | % | 0.03 | % | ||||||||||

| Net charge offs, excluding purchased loans as a percent | ||||||||||||||||||||

| of average loans (annualized) | 0.04 | % | 0.14 | % | 0.05 | % | 0.12 | % | 0.13 | % | ||||||||||

AMERIS BANCORP

FINANCIAL HIGHLIGHTS

(unaudited)

(dollars in thousands except per share data and FTE headcount)

| For the quarter ended: | ||||||||||||||||||||

| Mar. | Dec. | Sept. | Jun. | Mar. | ||||||||||||||||

| Loans by Type | 2017 | 2016 | 2016 | 2016 | 2016 | |||||||||||||||

| Commercial, financial & agricultural | $ | 1,061,599 | $ | 967,138 | $ | 625,947 | $ | 564,343 | $ | 434,073 | ||||||||||

| Real estate - construction & development | 415,029 | 363,045 | 328,308 | 274,717 | 264,820 | |||||||||||||||

| Real estate - commercial & farmland | 1,458,110 | 1,406,219 | 1,297,582 | 1,248,580 | 1,154,887 | |||||||||||||||

| Real estate - residential | 726,795 | 781,018 | 766,933 | 680,233 | 629,138 | |||||||||||||||

| Consumer installment | 115,919 | 96,915 | 68,305 | 33,245 | 31,901 | |||||||||||||||

| Other | 8,028 | 12,486 | 3,964 | 17,953 | 13,188 | |||||||||||||||

| Total Legacy (excluding purchased loans) | $ | 3,785,480 | $ | 3,626,821 | $ | 3,091,039 | $ | 2,819,071 | $ | 2,528,007 | ||||||||||

| Commercial, financial & agricultural | $ | 89,897 | $ | 96,537 | $ | 100,426 | $ | 103,407 | $ | 116,276 | ||||||||||

| Real estate - construction & development | 82,378 | 81,368 | 89,319 | 96,264 | 110,958 | |||||||||||||||

| Real estate - commercial & farmland | 538,046 | 576,355 | 604,076 | 639,921 | 665,990 | |||||||||||||||

| Real estate - residential | 292,911 | 310,277 | 330,626 | 348,353 | 360,946 | |||||||||||||||

| Consumer installment | 3,703 | 4,654 | 4,934 | 5,690 | 6,028 | |||||||||||||||

| Total Purchased loans (net of discounts) | $ | 1,006,935 | $ | 1,069,191 | $ | 1,129,381 | $ | 1,193,635 | $ | 1,260,198 | ||||||||||

| Commercial, financial & agricultural | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||

| Real estate - construction & development | - | - | - | - | - | |||||||||||||||

| Real estate - commercial & farmland | - | - | - | - | - | |||||||||||||||

| Real estate - residential | 529,099 | 568,314 | 624,886 | 610,425 | 656,734 | |||||||||||||||

| Consumer installment | - | - | - | - | - | |||||||||||||||

| Total Purchased loan pools | $ | 529,099 | $ | 568,314 | $ | 624,886 | $ | 610,425 | $ | 656,734 | ||||||||||

| Total Loan Portfolio: | ||||||||||||||||||||

| Commercial, financial & agricultural | $ | 1,151,496 | $ | 1,063,675 | $ | 726,373 | $ | 667,750 | $ | 550,349 | ||||||||||

| Real estate - construction & development | 497,407 | 444,413 | 417,627 | 370,981 | 375,778 | |||||||||||||||

| Real estate - commercial & farmland | 1,996,156 | 1,982,574 | 1,901,658 | 1,888,501 | 1,820,877 | |||||||||||||||

| Real estate - residential | 1,548,805 | 1,659,609 | 1,722,445 | 1,639,011 | 1,646,818 | |||||||||||||||

| Consumer installment | 119,622 | 101,569 | 73,239 | 38,935 | 37,929 | |||||||||||||||

| Other | 8,028 | 12,486 | 3,964 | 17,953 | 13,188 | |||||||||||||||

| Total Loans | $ | 5,321,514 | $ | 5,264,326 | $ | 4,845,306 | $ | 4,623,131 | $ | 4,444,939 | ||||||||||

Troubled Debt Restructurings, excluding purchased loans:

| Accruing loan types: | ||||||||||||||||||||

| Commercial, financial & agricultural | $ | 42 | $ | 47 | $ | 53 | $ | 275 | $ | 279 | ||||||||||

| Real estate - construction & development | 435 | 686 | 691 | 468 | 476 | |||||||||||||||

| Real estate - commercial & farmland | 3,944 | 4,119 | 5,535 | 5,802 | 5,945 | |||||||||||||||

| Real estate - residential | 9,220 | 9,340 | 7,713 | 8,226 | 7,648 | |||||||||||||||

| Consumer installment | 18 | 17 | 21 | 24 | 37 | |||||||||||||||

| Total Accruing TDRs | $ | 13,659 | $ | 14,209 | $ | 14,013 | $ | 14,795 | $ | 14,385 | ||||||||||

| Non-accruing loan types: | ||||||||||||||||||||

| Commercial, financial & agricultural | $ | 142 | $ | 114 | $ | 112 | $ | 86 | $ | 75 | ||||||||||

| Real estate - construction & development | 34 | 35 | 35 | 36 | 30 | |||||||||||||||

| Real estate - commercial & farmland | 1,617 | 2,970 | 2,015 | 1,832 | 1,871 | |||||||||||||||

| Real estate - residential | 998 | 738 | 849 | 899 | 1,040 | |||||||||||||||

| Consumer installment | 129 | 130 | 120 | 113 | 87 | |||||||||||||||

| Total Non-accrual TDRs | $ | 2,920 | $ | 3,987 | $ | 3,131 | $ | 2,966 | $ | 3,103 | ||||||||||

| Total Troubled Debt Restructurings | $ | 16,579 | $ | 18,196 | $ | 17,144 | $ | 17,761 | $ | 17,488 |

The following table presents the loan portfolio by risk grade, excluding purchased loans:

| Grade 10 - Prime credit | $ | 420,814 | $ | 414,564 | $ | 398,781 | $ | 349,725 | $ | 254,203 | ||||||||||

| Grade 15 - Good credit | 587,180 | 539,147 | 190,389 | 191,574 | 213,510 | |||||||||||||||

| Grade 20 - Satisfactory credit | 1,718,749 | 1,669,998 | 1,608,265 | 1,493,561 | 1,346,050 | |||||||||||||||

| Grade 23 - Performing, under-collateralized credit | 20,889 | 23,186 | 22,763 | 23,665 | 25,047 | |||||||||||||||

| Grade 25 - Minimum acceptable credit | 958,623 | 907,588 | 797,148 | 687,817 | 628,042 | |||||||||||||||

| Grade 30 - Other asset especially mentioned | 37,298 | 29,172 | 31,764 | 32,468 | 22,141 | |||||||||||||||

| Grade 40 - Substandard | 41,821 | 43,067 | 41,929 | 40,261 | 39,013 | |||||||||||||||

| Grade 50 - Doubtful | 106 | 99 | - | - | - | |||||||||||||||

| Grade 60 - Loss | - | - | - | - | 1 | |||||||||||||||

| Total | $ | 3,785,480 | $ | 3,626,821 | $ | 3,091,039 | $ | 2,819,071 | $ | 2,528,007 |

The following table presents the purchased loan portfolio by risk grade:

| Grade 10 - Prime credit | $ | 6,017 | $ | 6,536 | $ | 6,543 | $ | 6,899 | $ | 10,505 | ||||||||||

| Grade 15 - Good credit | 38,179 | 40,786 | 42,257 | 45,245 | 48,229 | |||||||||||||||

| Grade 20 - Satisfactory credit | 365,434 | 334,353 | 341,544 | 364,624 | 365,374 | |||||||||||||||

| Grade 23 - Performing, under-collateralized credit | 22,081 | 27,475 | 31,841 | 33,817 | 34,291 | |||||||||||||||

| Grade 25 - Minimum acceptable credit | 476,954 | 569,026 | 604,272 | 620,489 | 674,149 | |||||||||||||||

| Grade 30 - Other asset especially mentioned | 43,450 | 35,032 | 50,691 | 61,227 | 58,733 | |||||||||||||||

| Grade 40 - Substandard | 54,820 | 55,983 | 52,233 | 61,302 | 68,885 | |||||||||||||||

| Grade 50 - Doubtful | - | - | - | 30 | 30 | |||||||||||||||

| Grade 60 - Loss | - | - | - | 2 | 2 | |||||||||||||||

| Total | $ | 1,006,935 | $ | 1,069,191 | $ | 1,129,381 | $ | 1,193,635 | $ | 1,260,198 |

The following table presents the purchased loan pools by risk grade:

| Grade 20 - Satisfactory credit | $ | 528,181 | $ | 567,389 | $ | 624,022 | $ | 609,561 | $ | 656,734 | ||||||||||

| Grade 40 - Substandard | 918 | 925 | 864 | 864 | - | |||||||||||||||

| Total | $ | 529,099 | $ | 568,314 | $ | 624,886 | $ | 610,425 | $ | 656,734 |

AMERIS BANCORP

FINANCIAL HIGHLIGHTS

(unaudited)

(dollars in thousands except per share data and FTE headcount)

| Three Months Ended | ||||||||||||||||||||

| Mar. | Dec. | Sept. | Jun. | Mar. | ||||||||||||||||

| 2017 | 2016 | 2016 | 2016 | 2016 | ||||||||||||||||

| AVERAGE BALANCES | ||||||||||||||||||||

| Federal funds sold | $ | - | $ | 5,261 | $ | 5,500 | $ | 7,186 | $ | 6,200 | ||||||||||

| Interest bearing deposits in banks | 147,385 | 122,538 | 85,051 | 96,906 | 201,814 | |||||||||||||||

| Investment securities - taxable | 759,850 | 770,373 | 767,421 | 766,006 | 728,269 | |||||||||||||||

| Investment securities - nontaxable | 65,374 | 66,566 | 68,325 | 69,664 | 68,824 | |||||||||||||||

| Other investments | 37,392 | 19,732 | 21,687 | 14,765 | 9,606 | |||||||||||||||

| Loans held for sale | 77,617 | 102,926 | 105,859 | 96,998 | 82,803 | |||||||||||||||

| Loans | 3,678,149 | 3,145,714 | 2,897,771 | 2,653,171 | 2,410,747 | |||||||||||||||

| Purchased loans (excluding loan pools) | 1,034,983 | 1,101,907 | 1,199,175 | 1,239,409 | 970,570 | |||||||||||||||

| Purchased loan pools | 547,057 | 590,617 | 629,666 | 630,503 | 627,178 | |||||||||||||||

| Total Earning Assets | $ | 6,347,807 | $ | 5,925,634 | $ | 5,780,455 | $ | 5,574,608 | $ | 5,106,011 | ||||||||||

| Noninterest bearing deposits | $ | 1,604,495 | $ | 1,592,073 | $ | 1,546,211 | $ | 1,561,621 | $ | 1,362,007 | ||||||||||

| NOW accounts | 1,169,567 | 1,253,849 | 1,085,828 | 1,087,442 | 1,137,076 | |||||||||||||||

| MMDA | 1,486,972 | 1,435,958 | 1,435,151 | 1,413,503 | 1,278,199 | |||||||||||||||

| Savings accounts | 268,741 | 262,782 | 266,344 | 265,936 | 251,108 | |||||||||||||||

| Retail CDs < $100,000 | 444,195 | 445,132 | 431,570 | 437,899 | 438,122 | |||||||||||||||

| Retail CDs > $100,000 | 517,354 | 497,113 | 451,115 | 439,954 | 406,699 | |||||||||||||||

| Brokered CDs | - | 3,750 | 5,000 | 5,000 | 1,099 | |||||||||||||||

| Total Deposits | 5,491,324 | 5,490,657 | 5,221,219 | 5,211,355 | 4,874,310 | |||||||||||||||

| Federal funds purchased and securities sold | ||||||||||||||||||||

| under agreements to repurchase | 42,589 | 44,000 | 37,305 | 43,286 | 52,787 | |||||||||||||||

| FHLB advances | 525,583 | 222,426 | 265,202 | 104,195 | 9,648 | |||||||||||||||

| Other borrowings | 47,738 | 38,728 | 49,345 | 51,970 | 42,096 | |||||||||||||||

| Subordinated deferrable interest debentures | 84,379 | 84,050 | 83,719 | 83,386 | 72,589 | |||||||||||||||

| Total Non-Deposit Funding | 700,289 | 389,204 | 435,571 | 282,837 | 177,120 | |||||||||||||||

| Total Funding | $ | 6,191,613 | $ | 5,879,861 | $ | 5,656,790 | $ | 5,494,192 | $ | 5,051,430 | ||||||||||

AMERIS BANCORP

FINANCIAL HIGHLIGHTS

(unaudited)

(dollars in thousands except per share data and FTE headcount)

| Three Months Ended | ||||||||||||||||||||

| Mar. | Dec. | Sept. | Jun. | Mar. | ||||||||||||||||

| 2017 | 2016 | 2016 | 2016 | 2016 | ||||||||||||||||

| INTEREST INCOME/EXPENSE | ||||||||||||||||||||

| INTEREST INCOME | ||||||||||||||||||||

| Federal funds sold | $ | - | $ | 8 | $ | 8 | $ | 9 | $ | 8 | ||||||||||

| Interest bearing deposits in banks | 313 | 193 | 147 | 159 | 328 | |||||||||||||||

| Investment securities - taxable | 4,800 | 4,348 | 4,336 | 4,554 | 4,586 | |||||||||||||||

| Investment securities - nontaxable (TE) | 640 | 654 | 536 | 613 | 602 | |||||||||||||||

| Loans held for sale | 653 | 989 | 826 | 821 | 755 | |||||||||||||||

| Loans (TE) | 43,157 | 37,418 | 33,672 | 31,531 | 28,684 | |||||||||||||||

| Purchased loans (excluding loan pools) | 15,173 | 17,015 | 19,296 | 18,859 | 15,193 | |||||||||||||||

| Purchased loan pools | 3,832 | 3,950 | 4,346 | 3,730 | 5,144 | |||||||||||||||

| Total Earning Assets | $ | 68,568 | $ | 64,575 | $ | 63,167 | $ | 60,276 | $ | 55,300 | ||||||||||

| Accretion Income (included above) | 2,810 | 3,370 | 3,604 | 4,196 | 2,942 | |||||||||||||||

| INTEREST EXPENSE | ||||||||||||||||||||

| Non-interest bearing deposits | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||

| NOW accounts | 497 | 613 | 433 | 439 | 468 | |||||||||||||||

| MMDA | 1,538 | 1,405 | 1,241 | 1,168 | 1,040 | |||||||||||||||

| Savings accounts | 43 | 44 | 45 | 45 | 43 | |||||||||||||||

| Retail CDs < $100,000 | 562 | 553 | 493 | 476 | 512 | |||||||||||||||

| Retail CDs > $100,000 | 1,123 | 1,060 | 854 | 779 | 676 | |||||||||||||||

| Brokered CDs | - | 6 | 8 | 8 | 2 | |||||||||||||||

| Total Deposits | 3,763 | 3,681 | 3,074 | 2,915 | 2,741 | |||||||||||||||

| Federal funds purchased and securities sold | ||||||||||||||||||||

| under agreements to repurchase | 20 | 21 | 18 | 24 | 35 | |||||||||||||||

| FHLB advances | 907 | 328 | 393 | 155 | 23 | |||||||||||||||

| Other borrowings | 559 | 432 | 479 | 484 | 370 | |||||||||||||||

| Subordinated deferrable interest debentures | 1,211 | 1,216 | 1,179 | 1,173 | 954 | |||||||||||||||

| Total Non-Deposit Funding | 2,697 | 1,997 | 2,069 | 1,836 | 1,382 | |||||||||||||||

| Total Funding | $ | 6,460 | $ | 5,678 | $ | 5,143 | $ | 4,751 | $ | 4,123 | ||||||||||

| Net Interest Income (TE) | $ | 62,108 | $ | 58,897 | $ | 58,024 | $ | 55,525 | $ | 51,177 | ||||||||||

AMERIS BANCORP

FINANCIAL HIGHLIGHTS

(unaudited)

(dollars in thousands except per share data and FTE headcount)

| Three Months Ended | ||||||||||||||||||||

| Mar. | Dec. | Sept. | Jun. | Mar. | ||||||||||||||||

| 2017 | 2016 | 2016 | 2016 | 2016 | ||||||||||||||||

| YIELDS (1) | ||||||||||||||||||||

| Federal funds sold | 0.00 | % | 0.60 | % | 0.58 | % | 0.50 | % | 0.52 | % | ||||||||||

| Interest bearing deposits in banks | 0.86 | % | 0.63 | % | 0.69 | % | 0.66 | % | 0.65 | % | ||||||||||

| Investment securities - taxable | 2.56 | % | 2.25 | % | 2.25 | % | 2.39 | % | 2.53 | % | ||||||||||

| Investment securities - nontaxable | 3.97 | % | 3.91 | % | 3.12 | % | 3.54 | % | 3.52 | % | ||||||||||

| Loans held for sale | 3.41 | % | 3.82 | % | 3.10 | % | 3.40 | % | 3.67 | % | ||||||||||

| Loans | 4.76 | % | 4.73 | % | 4.62 | % | 4.78 | % | 4.79 | % | ||||||||||

| Purchased loans (excluding loan pools) | 5.95 | % | 6.14 | % | 6.40 | % | 6.12 | % | 6.30 | % | ||||||||||

| Purchased loan pools | 2.84 | % | 2.66 | % | 2.75 | % | 2.38 | % | 3.30 | % | ||||||||||

| Total Earning Assets | 4.38 | % | 4.34 | % | 4.35 | % | 4.35 | % | 4.36 | % | ||||||||||

| Noninterest bearing deposits | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | ||||||||||

| NOW accounts | 0.17 | % | 0.19 | % | 0.16 | % | 0.16 | % | 0.17 | % | ||||||||||

| MMDA | 0.42 | % | 0.39 | % | 0.34 | % | 0.33 | % | 0.33 | % | ||||||||||

| Savings accounts | 0.06 | % | 0.07 | % | 0.07 | % | 0.07 | % | 0.07 | % | ||||||||||

| Retail CDs < $100,000 | 0.51 | % | 0.49 | % | 0.45 | % | 0.44 | % | 0.47 | % | ||||||||||

| Retail CDs > $100,000 | 0.88 | % | 0.85 | % | 0.75 | % | 0.71 | % | 0.67 | % | ||||||||||

| Brokered CDs | 0.00 | % | 0.64 | % | 0.64 | % | 0.64 | % | 0.73 | % | ||||||||||

| Total Deposits | 0.28 | % | 0.27 | % | 0.23 | % | 0.22 | % | 0.23 | % | ||||||||||

| Federal funds purchased and securities sold | ||||||||||||||||||||

| under agreements to repurchase | 0.19 | % | 0.19 | % | 0.19 | % | 0.22 | % | 0.27 | % | ||||||||||

| FHLB advances | 0.70 | % | 0.59 | % | 0.59 | % | 0.60 | % | 0.96 | % | ||||||||||

| Other borrowings | 4.75 | % | 4.44 | % | 3.86 | % | 3.75 | % | 3.54 | % | ||||||||||

| Subordinated deferrable interest debentures | 5.82 | % | 5.76 | % | 5.60 | % | 5.66 | % | 5.29 | % | ||||||||||

| Total Non-Deposit Funding | 1.56 | % | 2.04 | % | 1.89 | % | 2.61 | % | 3.14 | % | ||||||||||

| Total funding (2) | 0.42 | % | 0.38 | % | 0.36 | % | 0.35 | % | 0.33 | % | ||||||||||

| Net interest spread | 3.96 | % | 3.95 | % | 3.99 | % | 4.00 | % | 4.03 | % | ||||||||||

| Net interest margin (3) | 3.97 | % | 3.95 | % | 3.99 | % | 4.01 | % | 4.03 | % | ||||||||||

(1) Interest and average rates are calculated on a tax-equivalent basis using an effective tax rate of 35%.

(2) Rate calculated based on total average funding including non-interest bearing deposits.

(3) Rate calculated based on average earning assets.

AMERIS BANCORP

FINANCIAL HIGHLIGHTS

(unaudited)

(dollars in thousands except per share data and FTE headcount)

| Three Months Ended | ||||||||||||||||||||

| Mar. | Dec. | Sept. | Jun. | Mar. | ||||||||||||||||

| Adjusted Operating Net Income Reconciliation | 2017 | 2016 | 2016 | 2016 | 2016 | |||||||||||||||

| Net income available to common shareholders | $ | 21,153 | $ | 18,177 | $ | 21,557 | $ | 20,049 | $ | 12,317 | ||||||||||

| Merger and conversion charges | 402 | 17 | - | - | 6,359 | |||||||||||||||

| Certain compliance resolution expenses | - | 5,750 | - | - | - | |||||||||||||||

| Losses (gains) on the sale of premises | 295 | 430 | 238 | 401 | (77 | ) | ||||||||||||||

| Tax effect of management-adjusted charges | (244 | ) | (2,169 | ) | (83 | ) | (140 | ) | (2,199 | ) | ||||||||||

| Plus: After tax management-adjusted charges | 453 | 4,028 | 155 | 261 | 4,083 | |||||||||||||||

| Adjusted Operating Net income | 21,606 | 22,205 | 21,712 | 20,310 | 16,400 | |||||||||||||||

| Adjusted operating net income per diluted share: | $ | 0.60 | $ | 0.63 | $ | 0.62 | $ | 0.58 | $ | 0.50 | ||||||||||

| Adjusted operating return on average assets | 1.27 | % | 1.34 | % | 1.36 | % | 1.33 | % | 1.17 | % | ||||||||||

| Adjusted operating return on average common | ||||||||||||||||||||

| tangible equity | 15.84 | % | 17.25 | % | 17.31 | % | 17.25 | % | 15.37 | % | ||||||||||

| Three Months Ended | ||||||||||||||||||||

| Mar. | Dec. | Sept. | Jun. | Mar. | ||||||||||||||||

| Net Interest Margin and Yields on Total Loans | 2017 | 2016 | 2016 | 2016 | 2016 | |||||||||||||||

| Excluding Accretion Reconciliation | ||||||||||||||||||||

| Total Interest Income (TE) | $ | 68,568 | $ | 64,575 | $ | 63,167 | $ | 60,276 | $ | 55,300 | ||||||||||

| Accretion Income | 2,810 | 3,370 | 3,604 | 4,196 | 2,942 | |||||||||||||||

| Total Interest Income (TE) Excluding Accretion | $ | 65,758 | $ | 61,205 | $ | 59,563 | $ | 56,080 | $ | 52,358 | ||||||||||

| Total Interest Expense | $ | 6,460 | $ | 5,677 | $ | 5,143 | $ | 4,751 | $ | 4,123 | ||||||||||

| Net Interest Income (TE) Excluding Accretion | $ | 59,298 | $ | 55,528 | $ | 54,420 | $ | 51,329 | $ | 48,235 | ||||||||||

| Yield on Total Loans (TE) Excluding Accretion | 4.56 | % | 4.51 | % | 4.49 | % | 4.42 | % | 4.60 | % | ||||||||||

| Net Interest Margin (TE) Excluding Accretion | 3.79 | % | 3.73 | % | 3.75 | % | 3.70 | % | 3.80 | % | ||||||||||

| Three Months Ended | ||||||||||||||||||||

| Mar. | Dec. | Sept. | Jun. | Mar. | ||||||||||||||||

| Management-Adjusted Operating Expenses | 2017 | 2016 | 2016 | 2016 | 2016 | |||||||||||||||

| Total operating expenses | 53,093 | 54,677 | 53,199 | 52,359 | 55,600 | |||||||||||||||

| Less: Management-adjusted charges | ||||||||||||||||||||

| Merger and conversion expenses | (402 | ) | (17 | ) | - | - | (6,359 | ) | ||||||||||||

| Certain compliance resolution expenses | - | (5,750 | ) | - | - | - | ||||||||||||||

| Gains/(Losses) on the sale of premises | (295 | ) | (430 | ) | (238 | ) | (401 | ) | 77 | |||||||||||

| Management-adjusted operating expenses | $ | 52,396 | $ | 48,480 | $ | 52,961 | $ | 51,958 | $ | 49,318 | ||||||||||

| Management-adjusted operating efficiency ratio (TE) | 59.67 | % | 58.29 | % | 60.95 | % | 61.93 | % | 65.44 | % | ||||||||||

AMERIS BANCORP

FINANCIAL HIGHLIGHTS

(unaudited)

(dollars in thousands except per share data and FTE headcount)

| Three Months Ended | ||||||||||||||||||||

| Mar. | Dec. | Sept. | Jun. | Mar. | ||||||||||||||||

| Segment Reporting | 2017 | 2016 | 2016 | 2016 | 2016 | |||||||||||||||

| Banking Division: | ||||||||||||||||||||

| Net interest income | $ | 50,126 | $ | 50,528 | $ | 51,653 | $ | 49,820 | $ | 46,483 | ||||||||||

| Provision for loan losses | 1,982 | 502 | 57 | 733 | 681 | |||||||||||||||

| Noninterest income | 13,013 | 13,466 | 13,949 | 13,018 | 12,735 | |||||||||||||||

| Noninterest expense: | ||||||||||||||||||||

| Salaries and employee benefits | 18,844 | 17,084 | 18,323 | 18,428 | 18,989 | |||||||||||||||

| Occupancy | 5,257 | 5,668 | 5,490 | 5,901 | 5,150 | |||||||||||||||

| Data Processing | 6,043 | 5,841 | 5,794 | 5,685 | 5,820 | |||||||||||||||

| Other expenses | 9,241 | 15,398 | 11,533 | 11,071 | 16,436 | |||||||||||||||

| Total noninterest expense | 39,385 | 43,991 | 41,140 | 41,085 | 46,395 | |||||||||||||||

| Income before income taxes | 21,772 | 19,501 | 24,405 | 21,020 | 12,142 | |||||||||||||||

| Income Tax | 6,856 | 5,005 | 7,733 | 6,626 | 3,919 | |||||||||||||||

| Net income | $ | 14,916 | $ | 14,496 | $ | 16,672 | $ | 14,394 | $ | 8,223 | ||||||||||

| Retail Mortgage Division: | ||||||||||||||||||||

| Net interest income | $ | 2,976 | $ | 3,032 | $ | 2,625 | $ | 2,554 | $ | 2,430 | ||||||||||

| Provision for loan losses | 8 | 33 | 447 | 93 | - | |||||||||||||||

| Noninterest income | 10,513 | 9,036 | 13,198 | 13,304 | 9,624 | |||||||||||||||

| Noninterest expense: | ||||||||||||||||||||

| Salaries and employee benefits | 7,216 | 7,098 | 8,940 | 8,304 | 6,347 | |||||||||||||||

| Occupancy | 519 | 602 | 433 | 405 | 488 | |||||||||||||||

| Data Processing | 317 | 326 | 364 | 338 | 272 | |||||||||||||||

| Other expenses | 1,141 | 1,093 | 1,303 | 1,133 | 956 | |||||||||||||||

| Total noninterest expense | 9,193 | 9,119 | 11,040 | 10,180 | 8,063 | |||||||||||||||

| Income before income taxes | 4,288 | 2,916 | 4,336 | 5,585 | 3,991 | |||||||||||||||

| Income Tax | 1,501 | 1,021 | 1,518 | 1,955 | 1,397 | |||||||||||||||

| Net income | $ | 2,787 | $ | 1,895 | $ | 2,818 | $ | 3,630 | $ | 2,594 | ||||||||||

| Warehouse Lending Division: | ||||||||||||||||||||

| Net interest income | $ | 1,105 | $ | 1,706 | $ | 1,848 | $ | 1,481 | $ | 927 | ||||||||||

| Provision for loan losses | (232 | ) | 496 | 94 | - | - | ||||||||||||||

| Noninterest income | 319 | 462 | 555 | 440 | 333 | |||||||||||||||

| Noninterest expense: | ||||||||||||||||||||

| Salaries and employee benefits | 147 | 220 | 103 | 108 | 188 | |||||||||||||||

| Occupancy | 1 | 1 | 1 | 1 | 1 | |||||||||||||||

| Data Processing | 27 | 32 | 26 | 25 | 20 | |||||||||||||||

| Other expenses | 32 | 29 | 26 | 26 | 25 | |||||||||||||||

| Total noninterest expense | 207 | 282 | 156 | 160 | 234 | |||||||||||||||

| Income before income taxes | 1,449 | 1,390 | 2,153 | 1,761 | 1,026 | |||||||||||||||

| Income Tax | 507 | 487 | 754 | 616 | 359 | |||||||||||||||

| Net income | $ | 942 | $ | 904 | $ | 1,399 | $ | 1,145 | $ | 667 | ||||||||||

| SBA Division: | ||||||||||||||||||||

| Net interest income | $ | 907 | $ | 949 | $ | 941 | $ | 734 | $ | 596 | ||||||||||

| Provision for loan losses | 48 | 571 | 213 | 63 | - | |||||||||||||||

| Noninterest income | 1,815 | 1,308 | 1,162 | 1,617 | 1,594 | |||||||||||||||

| Noninterest expense: | ||||||||||||||||||||

| Salaries and employee benefits | 591 | 735 | 616 | 691 | 663 | |||||||||||||||

| Occupancy | 51 | 64 | 65 | 64 | 61 | |||||||||||||||

| Data Processing | 1 | 1 | 1 | 1 | 1 | |||||||||||||||

| Other expenses | 211 | 170 | 181 | 178 | 183 | |||||||||||||||

| Total noninterest expense | 854 | 970 | 863 | 934 | 908 | |||||||||||||||

| Income before income taxes | 1,820 | 716 | 1,027 | 1,354 | 1,282 | |||||||||||||||

| Income Tax | 637 | 251 | 359 | 474 | 449 | |||||||||||||||

| Net income | $ | 1,183 | $ | 465 | $ | 668 | $ | 880 | $ | 833 | ||||||||||

| Premium Finance Division: | ||||||||||||||||||||

| Net interest income | $ | 5,476 | $ | 1,064 | $ | - | $ | - | $ | - | ||||||||||

| Provision for loan losses | 30 | 108 | - | - | - | |||||||||||||||

| Noninterest income | 46 | - | - | - | - | |||||||||||||||

| Noninterest expense: | ||||||||||||||||||||

| Salaries and employee benefits | 996 | - | - | - | - | |||||||||||||||

| Occupancy | 49 | 2 | - | - | - | |||||||||||||||

| Data Processing | 184 | 44 | - | - | - | |||||||||||||||

| Other expenses | 2,225 | 269 | - | - | - | |||||||||||||||

| Total noninterest expense | 3,454 | 315 | - | - | - | |||||||||||||||

| Income before income taxes | 2,038 | 641 | - | - | - | |||||||||||||||

| Income Tax | 713 | 224 | - | - | - | |||||||||||||||

| Net income | $ | 1,325 | $ | 417 | $ | - | $ | - | $ | - | ||||||||||

| Total Consolidated: | ||||||||||||||||||||

| Net interest income | $ | 60,590 | $ | 57,279 | $ | 57,067 | $ | 54,589 | $ | 50,436 | ||||||||||

| Provision for loan losses | 1,836 | 1,710 | 811 | 889 | 681 | |||||||||||||||

| Noninterest income | 25,706 | 24,272 | 28,864 | 28,379 | 24,286 | |||||||||||||||

| Noninterest expense: | ||||||||||||||||||||

| Salaries and employee benefits | 27,794 | 25,137 | 27,982 | 27,531 | 26,187 | |||||||||||||||

| Occupancy | 5,877 | 6,337 | 5,989 | 6,371 | 5,700 | |||||||||||||||

| Data Processing | 6,572 | 6,244 | 6,185 | 6,049 | 6,113 | |||||||||||||||

| Other expenses | 12,850 | 16,959 | 13,043 | 12,408 | 17,600 | |||||||||||||||

| Total noninterest expense | 53,093 | 54,677 | 53,199 | 52,359 | 55,600 | |||||||||||||||

| Income before income taxes | 31,367 | 25,164 | 31,921 | 29,720 | 18,441 | |||||||||||||||

| Income Tax | 10,214 | 6,987 | 10,364 | 9,671 | 6,124 | |||||||||||||||

| Net income | $ | 21,153 | $ | 18,177 | $ | 21,557 | $ | 20,049 | $ | 12,317 | ||||||||||