Exhibit 99.1

ASM International N.V.

ASM INTERNATIONAL REPORTS

FOURTH QUARTER 2010 AND FULL YEAR 2010 OPERATING RESULTS

ALMERE, THE NETHERLANDS, March 2, 2011—ASM International N.V. (NASDAQ: ASMI and Euronext Amsterdam: ASM) reports today its fourth quarter 2010 and full year 2010 (unaudited) operating results in accordance with US GAAP.

Highlights:

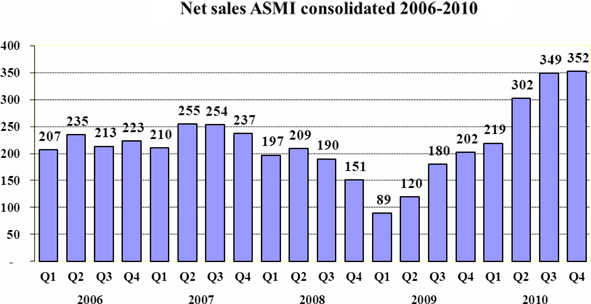

| • | Fourth quarter 2010 net sales of EUR 352 million up 1% quarter on quarter and up 74% year on year. |

| • | Gross Margin in Q4 stable at 46% compared to Q3 and up against a 40% gross margin in the fourth quarter of 2009. Front-end business gross margin increased from 39.8% in Q3 to 40.7% in Q4. |

| • | Result from operations increased from EUR 101 million in Q3 to EUR 103 million in Q4. The fourth quarter of 2009 showed a profit of EUR 32 million; |

| • | The Front-end segment increased to a profit of EUR 13 million which includes EUR 2 million restructuring charges. Q4 2009 showed a loss of EUR 13 million including EUR 5 million restructuring charges; |

| • | The Back-end segment profit decreased from EUR 97 million to EUR 90 million quarter on quarter mainly caused by currency translation differences while increasing EUR 45 million year on year. |

| • | In the fourth quarter of 2010 we have finalized our PERFORM! Front-end restructuring program, in a shorter time period and against substantially lower costs than earlier indicated. |

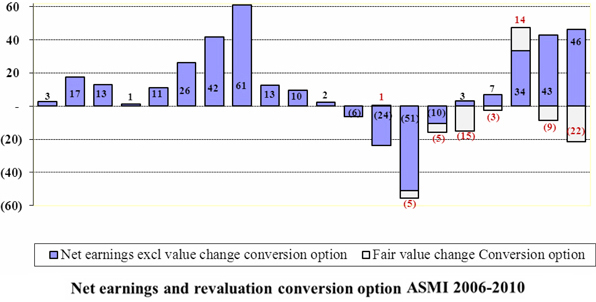

| • | Fourth quarter 2010 net earnings were EUR 25 million compared to net earnings of EUR 34 million for the third quarter of 2010 and a net loss of EUR 12 million for the fourth quarter of 2009. Both 2010 quarters were significantly impacted by the revaluation of the conversion option. Excluding this revaluation net earnings improved from EUR 43 million in the third quarter to EUR 46 million in the fourth quarter. |

| • | Book to bill in the fourth quarter was 0.7. In the Front-end segment the book to bill was 1.2, in the Back-end segment the book to bill was 0.5. The backlog decreased from EUR 587 million at the end of the third quarter, to EUR 500 million at the end of the fourth quarter. |

| • | The Board proposes to the Annual General Shareholders Meeting to declare a dividend of Euro 0.40 per share. |

Comment

Commenting on the results, Chuck del Prado, President and Chief Executive Officer of ASM International, said, “The fourth quarter showed further improvements in the Front-end operations,

1

where our results from operations (excluding restructuring) are now into the mid-tens. Moreover we saw, besides a sales increase of 35%, a further strengthening of our order book. The Back-end segment showed with a 36% result from operations as a percentage of sales again a solid performance.

As part of our financing policy we aim to pay a sustainable annual dividend. We will propose to the forthcoming AGM to declare a dividend of Euro 0.40 per share.

Outlook

Based upon the current backlog and our current visibility:

| • | For our Front-end operations we expect single digit sales growth in the first quarter of 2011 at constant FX-rates as compared to the fourth quarter of 2010. |

| • | For our Back-end operations (including SMT equipment, the former SEAS) we expect a double digit sales growth in the first quarter at constant FX-rates as compared to the fourth quarter of 2010. |

Unaudited Accounts

ASM International N.V. is currently finalizing the financial statements for the year ended December 31, 2010. We expect to be able to file our Form 20-F with the U.S. Securities and Exchange Commission within four weeks and to publish our Statutory Annual Accounts for the year 2010 in early April 2011. The consolidated balance sheets of ASM International N.V. as of December 31, 2010, the related statements of operations and cash flows for the year ended December 31, 2010 and all quarterly information as presented in this press release have not been audited by Deloitte Accountants B.V.

About ASM International

ASM International N.V., headquartered in Almere, the Netherlands, and its subsidiaries design and manufacture equipment and materials used to produce semiconductor devices. ASM International and its subsidiaries provide production solutions for wafer processing (Front-end segment) as well as assembly and packaging (Back-end segment) through facilities in the United States, Europe, Japan and Asia. ASM International’s common stock trades on NASDAQ (symbol ASMI) and the Euronext Amsterdam Stock Exchange (symbol ASM). For more information, visit ASMI’s website at www.asm.com.

Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: All matters discussed in this statement, except for any historical data, are forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. These include, but are not limited to, economic conditions and trends in the semiconductor industry generally and the timing of the industry cycles specifically, currency fluctuations, corporate transactions, financing and liquidity matters, the success of restructurings, the timing of significant orders, market acceptance of new products, competitive factors, litigation involving intellectual property, shareholder and other issues, commercial and economic disruption due to natural disasters, terrorist activity, armed conflict or political instability, epidemics and other risks indicated in the Company’s filings from time to time with the U.S. Securities and Exchange Commission, including, but not limited to, the Company’s reports on Form 20-F and Form 6-K. The Company assumes no obligation nor intends to update or revise any forward-looking statements to reflect future developments or circumstances.

2

ASM International will host an investor conference call and web cast on Thursday, March 3, 2011 at 15:00 Continental European Time (9:00 a.m. - US Eastern Time).

The teleconference dial-in numbers are as follows:

| • | United States: +1 718 247 0885 |

| • | International: + 44 (0)20 7806 1967 |

| • | Confirmation Code: 6311824 |

| • | A simultaneous audio web cast will be accessible at www.asm.com. |

The teleconference will be available for replay, beginning one hour after completion of the live broadcast, through April 1, 2011.

The replay dial-in numbers are:

| • | United States: +1 347 366 9565 |

| • | International: + 44 (0)20 7111 1244 |

| • | Access Code: 6311824# |

| Investor Contacts: | Media Contact: | |

| Erik Kamerbeek | Ian Bickerton | |

| +31 88100 8500 | +31 20 6855 955 | |

| Mary Jo Dieckhaus | +31 62501 8512 | |

| +1 212 986 2900 |

3

ANNEX 1

OPERATING AND FINANCIAL REVIEW

The following table shows the operating performance for the fourth quarter of 2010 as compared to the third quarter of 2010 and the fourth quarter of 2009:

| (EUR millions, except earnings per share) | ||||||||||||||||||||

| Q4 2009 | Q3 2010 | Q4 2010 | % Change Q3 2010 to Q4 2010 |

% Change Q4 2009 to Q4 2010 |

||||||||||||||||

| Net sales |

201.9 | 349.2 | 352.2 | 1 | % | 74 | % | |||||||||||||

| Gross profit before impairment of inventories |

81.7 | 161.8 | 161.3 | 0 | % | 97 | % | |||||||||||||

| Gross profit margin % |

40.4 | % | 46.3 | % | 45.8 | % | ||||||||||||||

| Impairment inventories |

2.3 | — | — | |||||||||||||||||

| Gross profit |

84.0 | 161.8 | 161.3 | 0 | % | 92 | % | |||||||||||||

| Selling, general and administrative expenses |

(28.8 | ) | (37.3 | ) | (34.6 | ) | (7 | %) | 20 | % | ||||||||||

| Research and development expenses |

(16.5 | ) | (20.8 | ) | (22.3 | ) | 7 | % | 35 | % | ||||||||||

| Restructuring expenses |

(6.9 | ) | (2.4 | ) | (1.8 | ) | ||||||||||||||

| Result from operations |

31.8 | 101.3 | 102.5 | 1 | % | 222 | % | |||||||||||||

| Net earnings (loss)1) |

(11.7 | ) | 34.3 | 24.7 | ||||||||||||||||

| Net earnings (loss) per share, diluted in euro1) |

(0.23 | ) | 0.62 | 0.47 | ||||||||||||||||

| 1) | allocated to the shareholders of the parent |

Net Sales. The following table shows net sales of our Front-end and Back-end segments for the fourth quarter of 2010 as compared to the third quarter of 2010 and the fourth quarter of 2009:

| (EUR millions) | Q4 2009 | Q3 2010 | Q4 2010 | % Change Q3 2010 to Q4 2010 |

% Change Q4 2009 to Q4 2010 |

|||||||||||||||

| Front-end |

49.2 | 73.8 | 99.6 | 35 | % | 102 | % | |||||||||||||

| Back-end |

152.7 | 275.4 | 252.7 | (8 | %) | 65 | % | |||||||||||||

| Total net sales |

201.9 | 349.2 | 352.2 | 1 | % | 74 | % | |||||||||||||

The fourth quarter 2010 sales increase in our Front-end segment, compared to the previous quarter, was driven by increased equipment sales in particular for our ALD and PECVD technologies. In our Back-end segment quarterly sales were strongly impacted by currency developments. On a comparable currency level sales came down with 2%.

The impact of currency changes quarter to quarter was a decrease of 5% and year to year an increase of 10%.

4

Gross Profit (Margin). The following table shows our gross profit and gross profit margin for our Front-end and Back-end segments for the fourth quarter of 2010 as compared to the third quarter of 2010 and the fourth quarter of 2009:

| (EUR millions) | Gross Q4 2009 |

Gross Q3 2010 |

Gross Q4 2010 |

Gross profit margin Q4 2009 |

Gross Q3 2010 |

Gross Q4 2010 |

Increase or (decrease) percentage points Q3 2010 to Q4 2010 |

Increase or percentage Q4 2009 to Q4 2010 |

||||||||||||||||||||||||

| Front-end |

13.7 | 29.3 | 40.6 | 27.7 | % | 39.8 | % | 40.7 | % | 1.0 | 13.0 | |||||||||||||||||||||

| Back-end |

68.0 | 132.4 | 120.7 | 44.5 | % | 48.1 | % | 47.8 | % | (0.3 | ) | 3.2 | ||||||||||||||||||||

| Total gross profit |

81.7 | 161.8 | 161.3 | 40.4 | % | 46.3 | % | 45.8 | % | (0.5 | ) | 5.3 | ||||||||||||||||||||

| 1) | before impairment inventories |

The gross profit margin of our Front-end segment continued to improve when compared to the third quarter of 2010 mainly driven by a better utilization combined with lower cost levels and manufacturing overhead as a result of the transfer of our manufacturing activities to our plant in Singapore. The Back-end gross profit margin stabilized in the quarter following a slightly lower activity level.

The impact of currency changes quarter to quarter was a decrease of 5% and year to year an increase of 11%.

Selling, General and Administrative Expenses. The following table shows selling, general and administrative expenses for our Front-end and Back-end segments for the fourth quarter of 2010 as compared to the third quarter of 2010 and the fourth quarter of 2009:

| (EUR millions) | Q4 2009 | Q3 2010 | Q4 2010 | % Change Q3 2010 to Q4 2010 |

% Change Q4 2009 to Q4 2010 |

|||||||||||||||

| Front-end |

13.3 | 12.8 | 15.1 | 18 | % | 14 | % | |||||||||||||

| Back-end |

15.5 | 24.4 | 19.5 | (20 | %) | 26 | % | |||||||||||||

| Total selling, general and administrative expenses |

28.8 | 37.3 | 34.6 | (7 | %) | 20 | % | |||||||||||||

| Total selling, general and administrative expenses as a percentage of net sales |

14 | % | 11 | % | 10 | % | ||||||||||||||

In the Front-end segment SG&A as a percentage of sales decreased from 17% for the third quarter to 15% for the fourth quarter of 2010. SG&A was 27% of net sales for the fourth quarter of 2009. The SG&A increase in monetary terms is the consequence of the higher activity level and certain one off-costs.

In the Back-end segment SG&A as a percentage of sales decreased from 9%, in the third quarter, to 8% in the fourth quarter of 2010.

The impact of currency changes quarter to quarter was a decrease of 4%, and year to year an increase of 7%.

5

Research and Development Expenses. The following table shows research and development expenses for our Front-end and Back-end segments for the fourth quarter of 2010 as compared to the third quarter of 2010 and the fourth quarter of 2009:

| (EUR millions) | Q4 2009 | Q3 2010 | Q4 2010 | % Change Q3 2010 to Q4 2010 |

% Change Q4 2009 to Q4 2010 |

|||||||||||||||

| Front-end |

8.8 | 9.2 | 11.2 | 21 | % | 27 | % | |||||||||||||

| Back-end |

7.7 | 11.6 | 11.1 | (4 | %) | 45 | % | |||||||||||||

| Total research and development expenses |

16.5 | 20.8 | 22.3 | 7 | % | 35 | % | |||||||||||||

| Total research and development expenses as a percentage of net sales |

8 | % | 6 | % | 6 | % | ||||||||||||||

R&D as a % of sales stabilized in Q4. In absolute amounts the increase in the Front-end segment is mainly attributable to the higher activity level, which requires more custom specific development activities.

The impact of currency changes quarter to quarter was a decrease of 4% and year to year an increase of 10%.

Restructuring expenses. In 2009 ASMI started the implementation of a major restructuring in the Front-end segment. Related to this EUR 1.8 million of expenses were incurred during the fourth quarter of 2010. These expenses were mainly costs for severance packages, retention costs and costs for the transfer of activities to Singapore. By the end of 2010 all costs, related to the PERFORM! program have been booked. Originally this program was expected to be finalized by mid-2011. Moreover we spent substantial less costs than earlier indicated. The total out of pocket expenses are EUR 42 million against an earlier guidance of EUR 50-60 million. Total impairment charges (including inventories) were EUR 29 million against a guidance of EUR 30-35 million.

Result from Operations. The following table shows results from operations for our Front-end and Back-end segments for the fourth quarter of 2010 as compared to the third quarter of 2010 and the fourth quarter of 2009:

| (EUR millions) | Q4 2009 | Q3 2010 | Q4 2010 | Change Q3 2010 to Q4 2010 |

Change Q4 2009 to Q4 2010 |

|||||||||||||||

| Front-end: |

||||||||||||||||||||

| -Excluding impairments and restructuring |

(8.5 | ) | 7.3 | 14.3 | 7.0 | 22.7 | ||||||||||||||

| -Impairments and restructuring |

(4.6 | ) | (2.4 | ) | (1.8 | ) | 0.6 | 2.8 | ||||||||||||

| -Including impairments and restructuring |

(13.1 | ) | 4.9 | 12.5 | 7.6 | 25.6 | ||||||||||||||

| Back-end |

44.9 | 96.5 | 90.0 | (6.5 | ) | 45.1 | ||||||||||||||

| Total result from operations |

31.8 | 101.3 | 102.5 | 1.2 | 70.7 | |||||||||||||||

| Total result from operations excluding impairments and restructuring as a percentage of net sales |

18 | % | 30 | % | 30 | % | ||||||||||||||

The impact of currency changes quarter to quarter was a decrease of 5% and year to year an increase of 12%.

6

Net Earnings (Loss) allocated to the shareholders of the parent. The following table shows net earnings (loss) for our Front-end and Back-end segments for the fourth quarter of 2010 as compared to the third quarter of 2010 and the fourth quarter of 2009:

| (EUR millions) | Q4 2009 | Q3 2010 | Q4 2010 | Change Q3 2010 to Q4 2010 |

Change Q4 2009 to Q4 2010 |

|||||||||||||||

| Front-end: |

||||||||||||||||||||

| -Excluding impairments, restructuring expenses, result on early extinguishment of debt and fair value changes conversion option |

(11.5 | ) | 0.8 | 5.9 | 5.1 | 17.5 | ||||||||||||||

| -Impairments and restructuring |

(4.6 | ) | (2.4 | ) | (1.8 | ) | 0.6 | 2.8 | ||||||||||||

| -Result on early extinguishment of debt |

(1.8 | ) | (0.9 | ) | (0.5 | ) | 0.4 | 1.3 | ||||||||||||

| -Fair value changes conversion options |

(14.9 | ) | (8.8 | ) | (21.7 | ) | (12.9 | ) | (6.8 | ) | ||||||||||

| -Including impairments, restructuring expenses, result on early extinguishment of debt and fair value changes conversion option |

(32.8 | ) | (11.2 | ) | (18.1 | ) | (6.9 | ) | 14.8 | |||||||||||

| Back-end |

21.1 | 45.5 | 42.7 | (2.8 | ) | 21.6 | ||||||||||||||

| Total net earnings (loss) allocated to the shareholders of the parent |

(11.7 | ) | 34.3 | 24.7 | (9.6 | ) | 36.4 | |||||||||||||

Although on December 31, 2010 we have initiated a full redemption for all of the outstanding principal balance of our 4.25% Convertible Subordinated notes due 2011, we still have to value the option part in the convertible at fair value until conversion (latest February 16, 2011).

Due to the strong increase of our share price in the course of the fourth quarter this has led to a negative non-cash result of EUR 21.7 million.

Net earnings for the Back-end segment reflect our 52.36% ownership of ASM Pacific Technology.

7

Full Year 2010

The following table shows the operating performance and the percentage change for the full year 2010 compared to the same period in 2009:

| (EUR millions, except earnings per share) | ||||||||||||

| 2009 | 2010 | % Change | ||||||||||

| Net sales |

590.7 | 1,222.9 | 107 | % | ||||||||

| Gross profit before impairment of inventories |

205.7 | 549.6 | 167 | % | ||||||||

| Gross profit margin % |

34.8 | % | 44.9 | % | ||||||||

| Impairment inventories |

(24.2 | ) | — | |||||||||

| Gross profit |

181.5 | 549.6 | 203 | % | ||||||||

| Selling, general and administrative expenses |

(108.2 | ) | (131.0 | ) | 21 | % | ||||||

| Research and development expenses |

(62.8 | ) | (78.8 | ) | 25 | % | ||||||

| Restructuring expenses |

(35.7 | ) | (11.2 | ) | (69 | %) | ||||||

| Result from operations |

(25.2 | ) | 328.6 | |||||||||

| Net earnings (loss)1) |

(106.6 | ) | 110.6 | |||||||||

| Net earnings (loss) per share, diluted in euro1) |

(2.06 | ) | 2.11 | |||||||||

| 1) | allocated to the shareholders of the parent |

Net Sales. The following table shows net sales of our Front-end and Back-end segments for the full year 2010 compared to the same period in 2009:

| (EUR millions) | ||||||||||||

| 2009 | 2010 | % Change | ||||||||||

| Front-end |

160.4 | 293.4 | 83 | % | ||||||||

| Back-end |

430.4 | 929.5 | 116 | % | ||||||||

| Total net sales |

590.7 | 1,222.9 | 107 | % | ||||||||

The increase of net sales for the full year of 2010 in our Front-end segment, compared to the same period last year, was driven by higher customer demand as well in all our equipment segments as in spares and service. In our Back-end segment record quarterly sales were realized both in the first quarter, the second quarter and in the third quarter of 2010 due to the high continued strong demand for our traditional products and increasing demand for our LED related products.

The impact of currency changes year to year was an increase of 5%.

8

Gross Profit Margin. The following table shows gross profit and gross profit margin for the Front-end and Back-end segments for the full year 2010 compared to the same period in 2009:

| (EUR millions) | ||||||||||||||||||||

| Gross profit | Gross profit margin | |||||||||||||||||||

| 20091) | 2010 | 2009 | 2010 | Increase or (decrease) percentage points |

||||||||||||||||

| Front-end |

32.9 | 114.6 | 20.5 | % | 39.1 | % | 18.6 | |||||||||||||

| Back-end |

172.8 | 435.0 | 40.1 | % | 46.8 | % | 6.6 | |||||||||||||

| Total gross profit |

205.7 | 549.6 | 34.8 | % | 44.9 | % | 10.1 | |||||||||||||

| 1) | before impairment inventories |

The gross profit margin of both our Front-end segment and our Back-end segment strongly improved when compared to the full year of 2009 driven by significantly higher activity levels. The Front-end margin further improved due to the execution of our PERFORM! Front-end restructuring program which, among others, resulted in a lower manufacturing overhead.

The impact of currency changes year to year was an increase of 6%.

Selling, General and Administrative Expenses. The following table shows selling, general and administrative expenses for our Front-end and Back-end segments for the full year 2010 compared to the same period in 2009:

| (EUR millions) | ||||||||||||

| 2009 | 2010 | % Change | ||||||||||

| Front-end |

58.9 | 51.0 | (13 | )% | ||||||||

| Back-end |

49.3 | 79.9 | 62 | % | ||||||||

| Total selling, general and administrative expenses |

108.2 | 131.0 | 21 | % | ||||||||

| Total selling, general and administrative expenses as a percentage of net sales |

18 | % | 11 | % | ||||||||

For the full year 2010 selling, general and administrative expenses as a percentage of net sales of our Front-end segment, were reduced to 17% compared with 37% for the same period of 2009, reflecting our focus to reduce the fixed cost base as part of our restructuring program PERFORM!. For the period under review the selling, general and administrative expenses in the Back-end segment as a percentage of net sales decreased from 12% in 2009 to 9% in 2010.

The impact of currency changes year to year was an increase of 5%.

9

Research and Development Expenses. The following table shows research and development expenses for our Front-end and Back-end segments for the full year 2010 compared to the same period in 2009:

| (EUR millions) | ||||||||||||

| 2009 | 2010 | % Change | ||||||||||

| Front-end |

34.4 | 36.5 | 6 | % | ||||||||

| Back-end |

28.4 | 42.3 | 49 | % | ||||||||

| Total research and development expenses |

62.8 | 78.8 | 25 | % | ||||||||

| Total research and development expenses as a percentage of net sales |

11 | % | 6 | % | ||||||||

The strong decrease as a % of sales, in both our Front-end and Back-end segment, is the result of a further prioritisation of research and development projects in combination with a substantial sales increase. In the course of 2010 we saw an increase in the absolute amount of development costs driven by those higher activity levels and some customer specific development activities related to that.

The impact of currency changes year to year was an increase of 6%.

Restructuring Expenses. In 2009 ASMI started the implementation of a major restructuring in the Front-end segment. During 2010 EUR 11.2 million of expenses were incurred related to these restructuring projects. These expenses were mainly costs for severance packages, retention costs, provisions for vacancy and other costs related to the transition of activities to Singapore. By the end of 2010 all costs, related to the PERFORM! front-end restructuring program have been booked. Originally this program was expected to be finalized by mid-2011. Moreover we spent substantial less costs than earlier indicated. The total out of pocket expenses are EUR 42 million against an earlier guidance of EUR 50-60 million. Total impairment charges (including inventories) were EUR 29 million against a guidance of EUR 30-35 million.

Result from Operations. The following table shows earnings (loss) from operations for our Front-end and Back-end segments for the full year 2010 compared to the same period in 2009:

| (EUR millions) | ||||||||||||

| 2009 | 2010 | Change | ||||||||||

| Front-end: |

||||||||||||

| Excluding impairments and restructuring charges |

(60.4 | ) | 27.1 | 87.5 | ||||||||

| Impairments and restructuring charges |

(59.9 | ) | (11.2 | ) | 48.7 | |||||||

| Including impairments and restructuring charges |

(120.3 | ) | 15.9 | 136.1 | ||||||||

| Back-end |

95.1 | 312.8 | 217.6 | |||||||||

| Total result from operations |

(25.2 | ) | 328.6 | 353.8 | ||||||||

The impact of currency changes year to year was an increase of 6%.

10

Net Earnings (Loss) allocated to the shareholders of the parent. The following table shows net earnings (loss) for our Front-end and Back-end segments for the full year 2010 compared to the same period in 2009:

| (EUR millions) | ||||||||||||

| 2009 | 2010 | Change | ||||||||||

| Front-end: |

||||||||||||

| Excluding impairments, restructuring charges, result on early extinguishment of debt and fair value change conversion option |

(65.5 | ) | (1.8 | ) | 63.7 | |||||||

| Impairments and restructuring charges |

(59.9 | ) | (11.2 | ) | 48.7 | |||||||

| Loss from early extinguishment of debt |

(1.8 | ) | (3.6 | ) | (1.9 | ) | ||||||

| Fair value change conversion options |

(24.4 | ) | (19.0 | ) | 5.3 | |||||||

| Special items |

(86.0 | ) | (33.8 | ) | 52.2 | |||||||

| Including impairments, restructuring charges result on early extinguishment of debt and fair value change conversion options |

(151.5 | ) | (35.7 | ) | 115.8 | |||||||

| Back-end |

44.0 | 146.3 | 102.3 | |||||||||

| Gain on dilution of investment in ASMPT (Back-end)1) |

1.0 | — | (1.0 | ) | ||||||||

| Total net earnings (loss) allocated to the shareholders of the parent |

(106.6 | ) | 110.6 | 217.4 | ||||||||

| 1) | Following accounting changes according to US GAAP this item is accounted directly in equity as per 2010 |

Net earnings for the Back-end segment reflect our 52.36% ownership of ASM Pacific Technology.

11

Bookings and backlog

The following table shows, for our Front-end and Back-end segments, the level of new orders for the fourth quarter of 2010 and the backlog at the end of the fourth quarter of 2010 as compared to the third quarter of 2010 and the fourth quarter of 2009:

| (EUR millions, except book-to-bill ratio) | ||||||||||||||||||||

| Q4 2009 | Q3 2010 | Q4 2010 | % Change Q3 2010 to Q4 2010 |

% Change Q4 2009 to Q4 2010 |

||||||||||||||||

| Front-end: |

||||||||||||||||||||

| Backlog at the beginning of the quarter |

42.1 | 82.1 | 139.4 | 70 | % | 231 | % | |||||||||||||

| - New orders for the quarter |

57.1 | 139.4 | 120.2 | (14 | )% | 111 | % | |||||||||||||

| - Net sales for the quarter |

(49.3 | ) | (73.7 | ) | (99.5 | ) | 35 | % | 102 | % | ||||||||||

| - FX-effect for the quarter |

0.4 | (8.4 | ) | 2.8 | ||||||||||||||||

| Backlog at the end of the quarter |

50.3 | 139.4 | 162.9 | 17 | % | 224 | % | |||||||||||||

| Book-to-bill ratio (new orders divided by net sales) |

1.2 | 1.9 | 1.2 | |||||||||||||||||

| Back-end: |

||||||||||||||||||||

| Backlog at the beginning of the quarter |

104.5 | 474.5 | 447.8 | (6 | )% | 329 | % | |||||||||||||

| - New orders for the quarter |

191.8 | 297.0 | 134.1 | (55 | )% | (30 | )% | |||||||||||||

| - Net sales for the quarter |

(152.7 | ) | (275.5 | ) | (252.7 | ) | (8 | )% | 65 | % | ||||||||||

| - FX-effect for the quarter |

2.9 | (48.2 | ) | 7.8 | ||||||||||||||||

| Backlog at the end of the quarter |

146.4 | 447.8 | 336.9 | (25 | )% | 130 | % | |||||||||||||

| Book-to-bill ratio (new orders divided by net sales) |

1.3 | 1.1 | 0.5 | |||||||||||||||||

| Total |

||||||||||||||||||||

| Backlog at the beginning of the quarter |

146.6 | 556.6 | 587.2 | 5 | % | 301 | % | |||||||||||||

| - New orders for the quarter |

248.9 | 436.4 | 254.3 | (42 | )% | 2 | % | |||||||||||||

| - Net sales for the quarter |

(202.0 | ) | (349.2 | ) | (352.2 | ) | 1 | % | 74 | % | ||||||||||

| - FX-effect for the quarter |

3.3 | (56.6 | ) | 10.6 | ||||||||||||||||

| Backlog at the end of the quarter |

196.7 | 587.2 | 499.8 | (15 | )% | 154 | % | |||||||||||||

| Book-to-bill ratio (new orders divided by net sales) |

1.2 | 1.2 | 0.7 | |||||||||||||||||

Our Front-end segment showed again strong order bookings in Q4 especially in ALD equipment. In our Back-end segment the demand for equipment to assemble both integrated circuits and LEDs reflects the fact that most capex budgets for the year have been consumed in the previous quarters.

Liquidity and capital resources

Net cash provided by operations was EUR 72.6 million for the fourth quarter of 2010 as compared to EUR 100.3 million for the third quarter of 2010 and EUR 31.2 million for the fourth quarter of 2009. For the twelve months ended December 31, 2010 net cash provided from operations was EUR 259.9 million compared to EUR 62.7 million for the same period in 2009. This increase results mainly from the improved net earnings, partly offset by investments in working capital resulting from the increased level of activity.

Net cash used in investing activities was EUR 38.1 million for the fourth quarter of 2010 as compared to EUR 32.4 million for the third quarter of 2010 and EUR 8.2 million for the fourth quarter of 2009. For the twelve months ended December 31, 2010 net cash used in investing activities of EUR 100.6 million compared to EUR 15.5 million for the comparable period in 2009. The increase results mainly from increased capital expenditures in our Back-end segment.

12

Net cash used in financing activities was EUR 10.3 million for the fourth quarter of 2010 as compared to net cash used in financing activities of EUR 42.0 million for the third quarter of 2010 and proceeds of EUR 120.6 million for the fourth quarter of 2009. For the twelve months ended December 31, 2010 net cash used in financing activities was EUR 123.0 million compared to proceeds of EUR 90.9 million for the same period in 2009. The increase mainly results from the increased payment of dividend to minority shareholders and the repurchase of convertible bonds during the first, third and the fourth quarter of 2010. In November 2009 we received the net proceeds of the issued convertible bonds (EUR 144.5 million) and we repurchased a part of the outstanding convertibles (EUR 26.8 million).

Net working capital, consisting of accounts receivable, inventories, other current assets, accounts payable, accrued expenses, advance payments from customers and deferred revenue, increased from EUR 244 million at September 30, 2010 to EUR 293 million at December 31, 2010. The number of outstanding days of working capital, measured based on quarterly sales, increased from 64 days at September 30, 2010 to 76 days at December 31, 2010. For the same period, our Front-end segment decreased from 100 days to 93 days and our Back-end segment increased from 55 days to 70 days.

Sources of liquidity. At December 31, 2010, the Company’s principal sources of liquidity consisted of EUR 340 million in cash and cash equivalents and EUR 119 million in undrawn bank lines. Approximately EUR 198 million of the cash and cash equivalents and EUR 22 million of the undrawn bank lines are restricted to use in the Company’s Back-end operations. EUR 16 million of the cash and cash equivalents and EUR 6 million in undrawn bank lines are restricted to use in the Company’s Front-end operations in Japan. The use of EUR 22 million of cash and cash equivalents is restricted in use for buy-back of outstanding convertible bonds due 2011.

13

Historical development sales and net earnings in EUR millions

14

ASM INTERNATIONAL N.V.

CONSOLIDATED STATEMENTS OF OPERATIONS

| (thousands, except earnings per share data) | In Euro | |||||||||||||||

| Three months ended December 31, | Full year | |||||||||||||||

| 2009 | 2010 | 2009 | 2010 | |||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| Net sales |

201,924 | 352,232 | 590,739 | 1,222,900 | ||||||||||||

| Cost of sales |

(117,955 | ) | (190,975 | ) | (409,224 | ) | (673,322 | ) | ||||||||

| Gross profit |

83,970 | 161,257 | 181,515 | 549,578 | ||||||||||||

| Operating expenses: |

||||||||||||||||

| Selling, general and administrative |

(28,774 | ) | (34,640 | ) | (108,178 | ) | (130,953 | ) | ||||||||

| Research and development |

(16,480 | ) | (22,301 | ) | (62,806 | ) | (78,785 | ) | ||||||||

| Restructuring expenses |

(6,925 | ) | (1,837 | ) | (35,687 | ) | (11,201 | ) | ||||||||

| Total operating expenses |

(52,180 | ) | (58,778 | ) | (206,671 | ) | (220,939 | ) | ||||||||

| Earnings (loss) from operations |

31,790 | 102,478 | (25,156 | ) | 328,640 | |||||||||||

| Net interest expense |

(3,050 | ) | (3,564 | ) | (7,538 | ) | (14,457 | ) | ||||||||

| Loss from early extinguishment of debt |

(1,759 | ) | (473 | ) | (1,759 | ) | (3,609 | ) | ||||||||

| Accretion of interest convertible |

(1,417 | ) | (1,353 | ) | (4,286 | ) | (6,010 | ) | ||||||||

| Revaluation conversion option |

(14,901 | ) | (21,659 | ) | (24,364 | ) | (19,037 | ) | ||||||||

| Foreign currency exchange gains (losses) |

(284 | ) | 987 | (1,384 | ) | (65 | ) | |||||||||

| Earnings (loss) before income taxes |

10,378 | 76,416 | (64,487 | ) | 285,462 | |||||||||||

| Income tax expense |

(4,273 | ) | (13,261 | ) | (3,786 | ) | (42,939 | ) | ||||||||

| Gain on dilution of investment in subsidiary |

956 | — | 956 | — | ||||||||||||

| Net earnings (loss) |

7,061 | 63,155 | (67,317 | ) | 242,523 | |||||||||||

| Allocation of net earnings (loss) |

||||||||||||||||

| Shareholders of the parent |

(11,741 | ) | 24,656 | (106,561 | ) | 110,639 | ||||||||||

| Minority interest |

18,802 | 38,499 | 39,244 | 131,884 | ||||||||||||

| Net earnings (loss) per share, allocated |

||||||||||||||||

| Basic net earnings (loss) |

(0.23 | ) | 0.47 | (2.06 | ) | 2.11 | ||||||||||

| Diluted net earnings (loss) (1) |

(0.23 | ) | 0.47 | (2.06 | ) | 2.11 | ||||||||||

| Weighted average number of shares used in computing per share amounts (in thousands): |

||||||||||||||||

| Basic |

51,778 | 52,848 | 51,627 | 52,435 | ||||||||||||

| Diluted (1) |

51,778 | 54,212 | 51,627 | 62,316 | ||||||||||||

| (1) | The calculation of diluted net earnings per share reflects the potential dilution that could occur if securities or other contracts to issue common stock were exercised or converted into common stock or resulted in the issuance of common stock that then shared in earnings of the Company. Only instruments that have a dilutive effect on net earnings are included in the calculation. The assumed conversion results in adjustment in the weighted average number of common shares and net earnings due to the related impact on interest expense. The calculation is done for each reporting period individually. For the three month ended December 2010, the effect of a potential conversion of convertible debt into 10,945,532 common shares was anti-dilutive and for the full year, 2010, the effect of a potential conversion of convertible debt into 2,630,113 common shares was anti-dilutive. |

Amounts are rounded to the nearest thousand euro; therefore amounts may not equal (sub) totals due to rounding.

ASM INTERNATIONAL N.V.

CONSOLIDATED BALANCE SHEETS

| (thousands, except share data) | In Euro | |||||||

| December 31, | December 31, | |||||||

| Assets | 2009 | 2010 | ||||||

| (unaudited) | ||||||||

| Cash and cash equivalents |

293,902 | 340,294 | ||||||

| Accounts receivable, net |

165,754 | 271,271 | ||||||

| Inventories, net |

150,645 | 254,557 | ||||||

| Income taxes receivable |

43 | 57 | ||||||

| Deferred tax assets |

6,893 | 8,567 | ||||||

| Other current assets |

31,129 | 59,405 | ||||||

| Total current assets |

648,367 | 934,149 | ||||||

| Debt issuance costs |

6,978 | 5,564 | ||||||

| Deferred tax assets |

8,545 | 5,807 | ||||||

| Other intangible assets |

8,936 | 6,804 | ||||||

| Goodwill, net |

47,223 | 50,815 | ||||||

| Investments |

50 | 50 | ||||||

| Assets held for sale |

5,508 | 6,347 | ||||||

| Evaluation tools at customers |

11,282 | 6,644 | ||||||

| Property, plant and equipment, net |

114,811 | 197,937 | ||||||

| Total Assets |

851,700 | 1,214,117 | ||||||

| Liabilities and Shareholders’ Equity |

||||||||

| Notes payable to banks |

17,008 | 8,297 | ||||||

| Accounts payable |

93,117 | 170,553 | ||||||

| Accrued expenses |

64,086 | 93,035 | ||||||

| Advance payments from customers |

16,371 | 28,272 | ||||||

| Deferred revenue |

3,254 | 4,367 | ||||||

| Income taxes payable |

17,658 | 47,493 | ||||||

| Current portion of long-term debt |

17,337 | 72,264 | ||||||

| Total current liabilities |

228,832 | 424,282 | ||||||

| Pension liabilities |

5,556 | 7,167 | ||||||

| Deferred tax liabilities |

314 | 321 | ||||||

| Long-term debt |

16,554 | 4,316 | ||||||

| Convertible subordinated debt |

192,350 | 130,804 | ||||||

| Conversion option |

22,181 | — | ||||||

| Total Liabilities |

465,787 | 566,890 | ||||||

| Shareholders’ Equity: |

||||||||

| Common shares |

||||||||

| Authorized 110,000,000 shares, par value € 0.04, issued and outstanding 51,745,140 |

2,070 | 2,117 | ||||||

| Financing preferred shares, issued none |

— | — | ||||||

| Preferred shares, issued and outstanding none |

— | — | ||||||

| Capital in excess of par value |

287,768 | 311,841 | ||||||

| Retained earnings |

16,145 | 131,741 | ||||||

| Accumulated other comprehensive loss |

(64,754 | ) | (34,239 | ) | ||||

| Total Shareholders’ Equity |

241,229 | 411,460 | ||||||

| Non-controlling interest |

144,684 | 235,767 | ||||||

| Total Equity |

385,913 | 647,227 | ||||||

| Total Liabilities and Equity |

851,700 | 1,214,117 | ||||||

Amounts are rounded to the nearest thousand euro; therefore amounts may not equal (sub) totals due to rounding.

ASM INTERNATIONAL N.V.

CONSOLIDATED STATEMENTS OF CASH FLOWS

| (thousands) | In Euro | |||||||||||||||

| Three months ended December 31, | Full year | |||||||||||||||

| 2009 | 2010 | 2009 | 2010 | |||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| Increase (decrease) in cash and cash equivalents: |

||||||||||||||||

| Cash flows from operating activities: |

||||||||||||||||

| Net earnings (loss) |

7,061 | 63,156 | (67,317 | ) | 242,523 | |||||||||||

| Adjustments to reconcile net earnings to net cash from operating activities: |

||||||||||||||||

| Depreciation of property, plant and equipment |

6,458 | 8,230 | 32,054 | 30,630 | ||||||||||||

| Depreciation evaluation tools |

- | 613 | - | 2,477 | ||||||||||||

| Amortization of other intangible assets |

1,171 | 689 | 2,335 | 2,735 | ||||||||||||

| Impairment of property, plant and equipment |

(62 | ) | - | 4,628 | - | |||||||||||

| Impairment of inventories |

(2,297 | ) | - | 24,188 | - | |||||||||||

| Addition provision restructuring expenses |

7,336 | (480 | ) | 26,657 | 1,863 | |||||||||||

| Amortization of debt issuance costs |

512 | 300 | 902 | 1,952 | ||||||||||||

| Loss resulting from early extinguishment of debt |

1,759 | 473 | 1,759 | 3,609 | ||||||||||||

| Compensation expense employee stock option plan |

416 | 609 | 2,127 | 2,526 | ||||||||||||

| Compensation expense employee share incentive scheme ASMPT |

879 | 2,756 | 3,685 | 11,375 | ||||||||||||

| Revaluation conversion option |

14,901 | 21,659 | 24,364 | 19,037 | ||||||||||||

| Additional non-cash interest convertible |

1,417 | 1,353 | 4,286 | 6,010 | ||||||||||||

| Income taxes |

(3,051 | ) | 8,296 | (8,586 | ) | 29,096 | ||||||||||

| Deferred income taxes |

(1,455 | ) | 3,798 | (9,081 | ) | 4,092 | ||||||||||

| Gain on dilution of investment in subsidiary |

(956 | ) | - | (956 | ) | - | ||||||||||

| Changes in other assets and liabilities: |

||||||||||||||||

| Accounts receivable |

(19,045 | ) | (26,534 | ) | 3,005 | (95,260 | ) | |||||||||

| Inventories |

(4,936 | ) | (27,356 | ) | 7,888 | (77,236 | ) | |||||||||

| Other current assets |

(3,408 | ) | 4,190 | (5,449 | ) | (31,478 | ) | |||||||||

| Accounts payable and accrued expenses |

28,425 | 17,726 | 23,171 | 104,095 | ||||||||||||

| Advance payments from customers |

4,480 | (6,238 | ) | 11,052 | 9,646 | |||||||||||

| Deferred revenue |

1,257 | 16 | (1,674 | ) | 1,100 | |||||||||||

| Pension liabilities |

22 | 527 | (280 | ) | 390 | |||||||||||

| Payments out of restructuring provision |

(9,715 | ) | (1,183 | ) | (16,105 | ) | (9,297 | ) | ||||||||

| Net cash provided by operating activities |

31,168 | 72,600 | 62,652 | 259,884 | ||||||||||||

| Cash flows from investing activities: |

||||||||||||||||

| Capital expenditures |

(8,057 | ) | (39,324 | ) | (12,718 | ) | (102,974 | ) | ||||||||

| Purchase of intangible assets |

(429 | ) | (302 | ) | (3,294 | ) | (624 | ) | ||||||||

| Acquisition of business |

(50 | ) | - | (50 | ) | - | ||||||||||

| Proceeds from sale of property, plant and equipment |

343 | 1,490 | 572 | 3,035 | ||||||||||||

| Net cash used in investing activities |

(8,194 | ) | (38,136 | ) | (15,490 | ) | (100,563 | ) | ||||||||

| Cash flows from financing activities: |

||||||||||||||||

| Notes payable to banks, net |

1,425 | (1,522 | ) | (109 | ) | (10,817 | ) | |||||||||

| Debt issuance costs paid |

- | - | - | (704 | ) | |||||||||||

| Net proceeds from long-term debt and subordinated debt |

144,516 | - | 144,516 | - | ||||||||||||

| Repayments of long-term debt and subordinated debt |

(26,796 | ) | (10,447 | ) | (32,246 | ) | (57,290 | ) | ||||||||

| Sale (Purchase) of treasury shares |

(35 | ) | - | - | - | |||||||||||

| Dividend tax paid on withdrawal of treasury shares |

- | - | (3,399 | ) | - | |||||||||||

| Proceeds from issuance (withdrawal) of preferred shares |

- | - | (220 | ) | - | |||||||||||

| Proceeds from issuance of common shares |

1,457 | 1,630 | 1,447 | 3,945 | ||||||||||||

| Dividend to minority shareholders |

- | - | (19,099 | ) | (58,162 | ) | ||||||||||

| Net cash provided (used) in financing activities |

120,567 | (10,339 | ) | 90,890 | (123,027 | ) | ||||||||||

| Exchange rate effects |

2,708 | 3,561 | (1,429 | ) | 10,096 | |||||||||||

| Net increase (decrease) in cash and cash equivalents |

146,249 | 27,686 | 136,624 | 46,391 | ||||||||||||

| Cash and cash equivalents at beginning of period |

147,653 | 312,608 | 157,279 | 293,902 | ||||||||||||

| Cash and cash equivalents at end of period |

293,902 | 340,294 | 293,902 | 340,294 | ||||||||||||

| Supplemental disclosures of cash flow information |

||||||||||||||||

| Cash paid during the period for: |

||||||||||||||||

| Interest, net |

2,569 | 3,822 | 5,918 | 14,786 | ||||||||||||

| Income taxes, net |

8,780 | 1,167 | 21,453 | 9,751 | ||||||||||||

| Non cash investing and financing activities: |

||||||||||||||||

| Subordinated debt converted into number of common shares |

- | - | - | 878,491 | ||||||||||||

| Subordinated debt converted |

- | - | - | 13,473 | ||||||||||||

Amounts are rounded to the nearest thousand euro; therefore amounts may not equal (sub) totals due to rounding.

ASM INTERNATIONAL N.V.

DISCLOSURE ABOUT SEGMENTS AND RELATED INFORMATION

The Company organizes its activities in two operating segments, Front-end and Back-end.

The Front-end segment manufactures and sells equipment used in wafer processing, encompassing the fabrication steps in which silicon wafers are layered with semiconductor devices. The segment is a product driven organizational unit comprised of manufacturing, service, and sales operations in Europe, the United States, Japan and Southeast Asia.

The Back-end segment manufactures and sells equipment and materials used in assembly and packaging, encompassing the processes in which silicon wafers are separated into individual circuits and subsequently assembled, packaged and tested. The segment is organized in ASM Pacific Technology Ltd., in which the Company holds a majority interest of 52.36% at December 31, 2010, whilst the remaining shares are listed on the Stock Exchange of Hong Kong. The segment’s main operations are located in Hong Kong, Singapore, the People’s Republic of China and Malaysia.

| (thousands) | In Euro | |||||||||||

| Front-end | Back-end | Total | ||||||||||

| Three months ended December 31, 2009 | (unaudited) | (unaudited) | (unaudited) | |||||||||

| Net sales to unaffiliated customers |

49,248 | 152,676 | 201,924 | |||||||||

| Gross profit |

15,955 | 68,015 | 83,970 | |||||||||

| Earnings (loss) from operations |

(13,082 | ) | 44,872 | 31,790 | ||||||||

| Net interest income (expense) |

(3,174 | ) | 124 | (3,050 | ) | |||||||

| Loss resulting from early extinguishment of debt |

(1,759 | ) | - | (1,759 | ) | |||||||

| Accretion of interest convertible |

(1,417 | ) | - | (1,417 | ) | |||||||

| Revaluation conversion option |

(14,901 | ) | - | (14,901 | ) | |||||||

| Foreign currency exchange losses |

(428 | ) | 144 | (284 | ) | |||||||

| Income tax benefit (expense) |

975 | (5,248 | ) | (4,273 | ) | |||||||

| Net earnings (loss) before dilution |

(33,787 | ) | 39,892 | 6,105 | ||||||||

| Gain on dilution of investment in subsidiary |

956 | |||||||||||

| Net earnings |

7,061 | |||||||||||

| Net earnings (loss) allocated to: |

||||||||||||

| Shareholders of the parent |

(11,741 | ) | ||||||||||

| Minority interest |

18,802 | |||||||||||

| Capital expenditures and purchase of intangible assets |

1,883 | 6,604 | 8,487 | |||||||||

| Depreciation and amortization |

2,877 | 4,753 | 7,629 | |||||||||

| Impairment of fixed assets

|

|

(62

|

)

|

|

-

|

|

|

(62

|

)

| |||

| Three months ended December 31, 2010 | (unaudited) | (unaudited) | (unaudited) | |||||||||

| Net sales to unaffiliated customers |

99,570 | 252,661 | 352,232 | |||||||||

| Gross profit |

40,560 | 120,697 | 161,257 | |||||||||

| Earnings from operations |

12,496 | 89,982 | 102,478 | |||||||||

| Net interest income (expense) |

(3,815 | ) | 251 | (3,564 | ) | |||||||

| Loss resulting from early extinguishment of debt |

(473 | ) | - | (473 | ) | |||||||

| Accretion of interest convertible |

(1,353 | ) | - | (1,353 | ) | |||||||

| Revaluation conversion option |

(21,659 | ) | - | (21,659 | ) | |||||||

| Foreign currency exchange gains (losses) |

1,285 | (298 | ) | 987 | ||||||||

| Income tax expense |

(4,537 | ) | (8,724 | ) | (13,261 | ) | ||||||

| Net earnings (loss) |

(18,056 | ) | 81,211 | 63,155 | ||||||||

| Net earnings allocated to: |

||||||||||||

| Shareholders of the parent |

24,656 | |||||||||||

| Minority interest |

38,499 | |||||||||||

| Capital expenditures and purchase of intangible assets |

7,675 | 31,952 | 39,626 | |||||||||

| Depreciation and amortization

|

|

3,577

|

|

|

5,955

|

|

|

9,532

|

| |||

Amounts are rounded to the nearest thousand euro; therefore amounts may not equal (sub) totals due to rounding.

ASM INTERNATIONAL N.V.

DISCLOSURE ABOUT SEGMENTS AND RELATED INFORMATION (2/2)

| (thousands, except headcount) | In Euro | |||||||||||

| Front-end | Back-end | Total | ||||||||||

| Full year 2009 | (unaudited) | (unaudited) | (unaudited) | |||||||||

| Net sales to unaffiliated customers |

160,378 | 430,361 | 590,739 | |||||||||

| Gross profit |

8,726 | 172,789 | 181,515 | |||||||||

| Earnings (loss) from operations |

(120,269 | ) | 95,113 | (25,156 | ) | |||||||

| Net interest income (expense) |

(8,014 | ) | 477 | (7,538 | ) | |||||||

| Loss resulting from early extinguishment of debt |

(1,759 | ) | - | (1,759 | ) | |||||||

| Accretion of interest convertible |

(4,286 | ) | - | (4,286 | ) | |||||||

| Revaluation conversion option |

(24,364 | ) | - | (24,364 | ) | |||||||

| Foreign currency exchange losses |

(733 | ) | (651 | ) | (1,384 | ) | ||||||

| Income tax benefit (expense) |

7,890 | (11,676 | ) | (3,786 | ) | |||||||

| Net earnings (loss) before dilution |

(151,535 | ) | 83,262 | (68,273 | ) | |||||||

| Gain on dilution of investment in subsidiary |

956 | |||||||||||

| Net loss |

(67,317 | ) | ||||||||||

| Net earnings (loss) allocated to: |

||||||||||||

| Shareholders of the parent |

(106,561 | ) | ||||||||||

| Minority interest |

39,244 | |||||||||||

| Capital expenditures and purchase of intangible assets |

6,201 | 9,811 | 16,012 | |||||||||

| Depreciation and amortization |

13,320 | 21,070 | 34,390 | |||||||||

| Impairment of fixed assets |

4,628 | - | 4,628 | |||||||||

| Cash and cash equivalents |

181,681 | 112,222 | 293,902 | |||||||||

| Capitalized goodwill |

10,395 | 36,828 | 47,223 | |||||||||

| Other intangible assets |

8,440 | 497 | 8,936 | |||||||||

| Other identifiable assets |

187,194 | 314,445 | 501,638 | |||||||||

| Total assets |

387,709 | 463,991 | 851,700 | |||||||||

| Total debt |

265,430 | - | 265,430 | |||||||||

| Headcount in full-time equivalents (1)

|

|

1,322

|

|

|

10,773

|

|

|

12,095

|

| |||

| Full year 2010 | (unaudited) | (unaudited) | (unaudited) | |||||||||

| Net sales to unaffiliated customers |

293,356 | 929,544 | 1,222,900 | |||||||||

| Gross profit |

114,624 | 434,954 | 549,578 | |||||||||

| Earnings from operations |

15,954 | 312,686 | 328,640 | |||||||||

| Net interest income (expense) |

(15,062 | ) | 605 | (14,457 | ) | |||||||

| Loss resulting of early extinguishment of debt |

(3,609 | ) | - | (3,609 | ) | |||||||

| Accretion of interest convertible |

(6,010 | ) | - | (6,010 | ) | |||||||

| Revaluation conversion option |

(19,037 | ) | - | (19,037 | ) | |||||||

| Foreign currency exchange gains (losses) |

(1,809 | ) | 1,744 | (65 | ) | |||||||

| Income tax expense |

(6,106 | ) | (36,833 | ) | (42,939 | ) | ||||||

| Net earnings (loss) |

(35,679 | ) | 278,202 | 242,523 | ||||||||

| Net earnings allocated to: |

||||||||||||

| Shareholders of the parent |

110,639 | |||||||||||

| Minority interest |

131,884 | |||||||||||

| Capital expenditures and purchase of intangible assets |

17,696 | 85,902 | 103,598 | |||||||||

| Depreciation and amortization |

13,745 | 22,097 | 35,842 | |||||||||

| Cash and cash equivalents |

142,420 | 197,874 | 340,294 | |||||||||

| Capitalized goodwill |

11,193 | 39,622 | 50,815 | |||||||||

| Other intangible assets |

6,089 | 715 | 6,804 | |||||||||

| Other identifiable assets |

281,076 | 535,129 | 816,204 | |||||||||

| Total assets |

440,777 | 773,340 | 1,214,117 | |||||||||

| Total debt |

215,681 | - | 215,681 | |||||||||

| Headcount in full-time equivalents (1) |

|

1,450

|

|

|

15,249

|

|

|

16,699

|

| |||

| (1) | Headcount includes those employees with a fixed contract, and is exclusive of temporary workers. |

Amounts are rounded to the nearest thousand euro; therefore amounts may not equal (sub) totals due to rounding.

ASM INTERNATIONAL N.V.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Basis of Presentation

ASM International N.V, (“ASMI”) follows accounting principles generally accepted in the United States of America (“US GAAP”). Amounts are rounded to the nearest thousand euro; therefore amounts may not equal (sub) totals due to rounding.

Principles of Consolidation

The Consolidated Financial Statements include the accounts of ASMI and its subsidiaries, where ASMI holds a controlling interest. The non-controlling interest of third parties is disclosed separately in the Consolidated Financial Statements. All intercompany profits, transactions and balances have been eliminated in consolidation.

Change in accounting policies

No significant changes in accounting policies incurred during the fourth quarter of 2010.

ASM INTERNATIONAL N.V.

RECONCILIATION US GAAP—IFRS

Accounting principles under IFRS

ASMI’s primary consolidated financial statements are and will continue to be prepared in accordance with US GAAP. However, ASMI is required under Dutch law to report its Consolidated Financial Statements in accordance with International Financial Reporting Standards (“IFRS”). As a result of the differences between IFRS and US GAAP that are applicable to ASMI, the Consolidated Statement of Operations and Consolidated Balance Sheet reported in accordance with IFRS differ from those reported in accordance with US GAAP. The most significant differences that affect ASMIconcern to the capitalization of certain product development costs, goodwill, the accounting of reversal of inventory write downs, option plans, pension plans and preferred shares.

The reconciliation between IFRS and US GAAP is as follows:

| Net earnings | Net earnings | |||||||||||||||||||

| Three months ended December 31, | Full year | |||||||||||||||||||

| (EUR thousands, except per share data) | 2009 | 2010 | 2009 | 2010 | ||||||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||||||

| US GAAP |

7,061 | 63,155 | (67,317 | ) | 242,523 | |||||||||||||||

| Adjustments for IFRS: |

||||||||||||||||||||

| Reversal inventory write downs |

- | (16 | ) | - | 3,608 | |||||||||||||||

| Development expenses |

(11,570 | ) | 1,874 | (10,784 | ) | 4,439 | ||||||||||||||

| Pensions |

||||||||||||||||||||

| Debt issuance fees |

(1,283 | ) | 125 | (1,283 | ) | 157 | ||||||||||||||

| Dividend preferred shares |

- | - | (5 | ) | - | |||||||||||||||

| Total adjustments |

(12,853 | ) | 1,983 | (12,072 | ) | 8,204 | ||||||||||||||

| IFRS |

(5,792 | ) | 65,138 | (79,389 | ) | 250,727 | ||||||||||||||

| IFRS allocation of net earnings (loss): |

||||||||||||||||||||

| Shareholders |

(24,594 | ) | 26,639 | (118,633 | ) | 118,843 | ||||||||||||||

| Minority interest |

18,802 | 38,499 | 39,244 | 131,884 | ||||||||||||||||

| Net earnings (loss) per share, allocated to the shareholders of the parent; |

||||||||||||||||||||

| Basic |

(0.48 | ) | 0.50 | (2.30 | ) | 2.27 | ||||||||||||||

| Diluted |

(0.48 | ) | 0.50 | (2.30 | ) | 2.25 | ||||||||||||||

| Total Equity | Total Equity | |||||||||||||||||||

| (euro thousands) | December 31, 2009 | December 31, 2010 | ||||||||||||||||||

| (unaudited | ) | (unaudited | ) | |||||||||||||||||

| US GAAP |

385,913 | 647,227 | ||||||||||||||||||

| Adjustments for IFRS: |

||||||||||||||||||||

| Goodwill |

(9,672 | ) | (10,333 | ) | ||||||||||||||||

| Debt issuance fees |

(1,283 | ) | (1,126 | ) | ||||||||||||||||

| Reversal inventory write downs |

- | 3,501 | ||||||||||||||||||

| Development expenses |

26,926 | 34,032 | ||||||||||||||||||

| Pension plans |

391 | 565 | ||||||||||||||||||

| Preferred shares |

- | - | ||||||||||||||||||

| Total adjustments |

16,362 | 26,639 | ||||||||||||||||||

| IFRS |

402,275 | 673,866 | ||||||||||||||||||

Amounts are rounded to the nearest thousand euro; therefore amounts may not equal (sub) totals due to rounding.