As filed with the Securities and Exchange Commission on May 14, 2013

Registration No. 333-188255

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

AMENDMENT NO. 1 TO

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

UNDER

THE SECURITIES ACT OF 1933

_________________

BIOMET, INC.

(Exact name of registrant as specified in its charter)

_________________

Indiana | 3842 | 35-1418342 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) | ||

(see table of additional registrants below)

56 East Bell Drive Warsaw, Indiana 46582 (574) 267-6639 (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) | |

Jody S. Gale Vice President and Associate General Counsel – M&A, Securities & Governance Biomet, Inc. 56 East Bell Drive Warsaw, Indiana 46582 (574) 267-6639 (Address, including zip code, and telephone number, including area code, of agent for service.) | Jeffrey D. Karpf James D. Small Cleary Gottlieb Steen & Hamilton LLP One Liberty Plaza New York, New York 10006 (212) 225-2000 (Copies of all communications, including communications sent to agent for service) |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | Accelerated filer | Non-accelerated filer x | Smaller reporting company |

(Do not check if a smaller reporting company)

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

________________

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | Amount to be registered | Proposed maximum offering price per unit | Proposed maximum aggregate offering price(1) | Amount of registration fee(2)(5) |

6.500% Senior Notes due 2020 | $1,825,000,000 | 100% | $1,825,000,000 | $248,930 |

Guarantees of 6.500% Senior Notes due 2020(3) | (4) | (4) | (4) | (4) |

6.500% Senior Subordinated Notes due 2020 | $800,000,000 | 100% | $800,000,000 | $109,120 |

Guarantees of 6.500% Senior Subordinated Notes due 2020(3) | (4) | (4) | (4) | (4) |

(1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(f) under the Securities Act of 1933, as amended. |

(2) | Calculated pursuant to Rule 457 under the Securities Act. |

(3) | Each of Biomet, Inc.’s current and future wholly-owned domestic restricted subsidiaries that is a guarantor of Biomet’s senior secured credit facilities jointly, severally and unconditionally guarantees, the 6.500% Senior Notes due 2020 on a senior unsecured basis, and the 6.500% Senior Subordinated Notes due 2020 on a senior subordinated unsecured basis. See inside facing page for table of additional registrant guarantors. |

(4) | Pursuant to Rule 457(n) under the Securities Act, no separate fee is payable for the registration of the Guarantees. |

(5) | Previously paid. |

_________________

The registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

TABLE OF ADDITIONAL REGISTRANT GUARANTORS

Exact Name of Registrant as Specified in its Charter | State or Other Jurisdiction of Incorporation or Organization | Primary Standard Industrial Classification Code Number | I.R.S. Employer Identification Number | Address, including Zip Code and Telephone Number, including Area Code, of Agent for Service, of Registrant’s Principal Executive Offices | ||||

Biolectron, Inc. | Delaware | 3842 | 13-2914413 | 399 Jefferson Road Parsippany, NJ 07054 (973) 299-9300 | ||||

Biomet 3i, LLC | Florida | 3842 | 59-2816882 | 4555 Riverside Drive Palm Beach Gardens, FL 33410 (561) 776-6700 | ||||

Biomet Biologics, LLC | Indiana | 3842 | 03-04079652 | 56 E. Bell Drive Warsaw, IN 46582 (574) 267-6639 | ||||

Biomet Europe Ltd. | Delaware | 3842 | 35-1603620 | 56 E. Bell Drive Warsaw, IN 46582 (574) 267-6639 | ||||

Biomet Fair Lawn, LLC | Indiana | 3842 | 31-1651311 | 20-01 Pollitt Drive Fairlawn, NJ 07410 (201) 797-7300 | ||||

Biomet International Ltd. | Delaware | 3842 | 35-2046422 | 56 E. Bell Drive Warsaw, IN 46582 (574) 267-6639 | ||||

Biomet Leasing, Inc. | Indiana | 3842 | 35-2076217 | 56 E. Bell Drive Warsaw, IN 46582 (574) 267-6639 | ||||

Biomet Manufacturing Corporation | Indiana | 3842 | 35-2074039 | 56 E. Bell Drive Warsaw, IN 46582 (574) 267-6639 | ||||

Biomet Microfixation, LLC | Florida | 3842 | 59-1692523 | 1520 Tradeport Drive Jacksonville, FL 32218-2482 (904) 741-4400 | ||||

Biomet Orthopedics, LLC | Indiana | 3842 | 35-2074037 | 56 E. Bell Drive Warsaw, IN 46582 (574) 267-6639 | ||||

Biomet Sports Medicine, LLC | Indiana | 3842 | 35-1803072 | 56 E. Bell Drive Warsaw, IN 46852 (574) 267-6639 | ||||

Cross Medical Products, LLC | Delaware | 3842 | 31-0992628 | 181 Technology Drive Irvine, CA 92618 (574) 267-6639 | ||||

EBI Holdings, LLC | Delaware | 3842 | 22-2407246 | 399 Jefferson Road Parsippany, NJ 07054 (973) 299-9300 | ||||

EBI, LLC | Indiana | 3842 | 31-1651314 | 399 Jefferson Road Parsippany, NJ 07054 (973) 299-9300 | ||||

EBI Medical Systems, LLC | Delaware | 3842 | 22-2406619 | 399 Jefferson Road Parsippany, NJ 07054 (973) 299-9300 | ||||

Exact Name of Registrant as Specified in its Charter | State or Other Jurisdiction of Incorporation or Organization | Primary Standard Industrial Classification Code Number | I.R.S. Employer Identification Number | Address, including Zip Code and Telephone Number, including Area Code, of Agent for Service, of Registrant’s Principal Executive Offices | ||||

Electro-Biology, LLC | Delaware | 3842 | 22-2278360 | #1 Electro-Biology Boulevard Los Frailes Industrial Park Guaynabo, Puerto Rico 00657 (787) 720-6855 | ||||

Biomet Florida Services, LLC | Florida | 3842 | 20-0388276 | 1520 Tradeport Drive Jacksonville, FL 32218 (904) 741-4400 | ||||

Implant Innovations Holdings, LLC | Indiana | 3842 | 35-2088040 | 56 E. Bell Drive Warsaw, IN 46852 (574) 267-6639 | ||||

Interpore Cross International, LLC | California | 3842 | 33-0818017 | 181 Technology Drive, Irvine, CA 92618 (949) 453-3200 | ||||

Interpore Spine Ltd. | Delaware | 3842 | 95-3043318 | 181 Technology Drive, Irvine, CA 92618 (949) 453-3200 | ||||

Kirschner Medical Corporation | Delaware | 3842 | 52-1319702 | 56 E. Bell Drive Warsaw, IN 46852 (574) 267-6639 | ||||

Biomet Trauma, LLC | Indiana | 3842 | 27-3309062 | 56 E. Bell Drive Warsaw, IN 46582 (574) 267-6639 | ||||

Biomet U.S. Reconstruction, LLC | Indiana | 3842 | 45-5118007 | 56 E. Bell Drive Warsaw, IN 46582 (574) 267-6639 | ||||

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell or a solicitation of an offer to purchase these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 14, 2013

PRELIMINARY PROSPECTUS

OFFERS TO EXCHANGE

$1,825,000,000, aggregate principal amount of our 6.500% Senior Notes due 2020 (the “exchange senior notes”) and $800,000,000 aggregate principal amount of our 6.500% Senior Subordinated Notes due 2020, (the “exchange senior subordinated notes” and together with the exchange senior notes, the “exchange notes”), the issuance of each of which has been registered under the Securities Act of 1933, as amended (the “Securities Act”),

for

$1,825,000,000 of our 6.500% Senior Notes due 2020, (the “original senior notes”, and together with the exchange senior notes, the “Senior Notes”) and $800,000,000 of our 6.500% Senior Subordinated Notes due 2020 (the “original senior subordinated notes” and together with the exchange senior subordinated notes, the “Subordinated Notes” and the original senior subordinated notes with the original senior notes, the “original notes”, and the original notes together with the exchange notes, the “notes”), respectively, that have not been registered under the Securities Act.

for

$1,825,000,000 of our 6.500% Senior Notes due 2020, (the “original senior notes”, and together with the exchange senior notes, the “Senior Notes”) and $800,000,000 of our 6.500% Senior Subordinated Notes due 2020 (the “original senior subordinated notes” and together with the exchange senior subordinated notes, the “Subordinated Notes” and the original senior subordinated notes with the original senior notes, the “original notes”, and the original notes together with the exchange notes, the “notes”), respectively, that have not been registered under the Securities Act.

_________________

THIS EXCHANGE OFFERS WILL EXPIRE AT 5:00 P.M., NEW YORK CITY TIME, ON , 2013 UNLESS EXTENDED BY US.

_________________

The Exchange Offers: • We will exchange all original notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes. • The exchange offers expire at 5:00 P.M., New York City time, on , 2013 (such date and time, the “Expiration Date,” unless we extend or terminate either or both exchange offers, in which case the “Expiration Date” will mean the latest date and time to which we extend such exchange offer or exchange offers). We do not currently intend to extend the Expiration Date with respect to either exchange offer. • You may withdraw tenders of original notes at any time prior to the Expiration Date. • The exchange of original notes for exchange notes in the exchange offers generally will not be a taxable event for U.S. federal income tax purposes. • We will not receive any proceeds from the exchange offers. | The Exchange Notes: • The exchange notes are being offered in order to satisfy certain of our obligations under the registration rights agreements entered into in connection with the private offerings of the original notes. • The terms of the exchange notes to be issued in the exchange offers are substantially the same as the terms of the original notes, except that the offer of the exchange notes is registered under the Securities Act, and the exchange notes have no transfer restrictions, rights to additional interest or registration rights. Resales of the Exchange Notes: • The exchange notes may be sold in the over-the-counter market, in negotiated transactions or through a combination of such methods. We do not plan to list the exchange notes on a securities exchange or automated quotation system. |

_________________

Investing in the exchange notes to be issued in the exchange offers involves certain risks. You should consider carefully the risk factors beginning on page 9 of this prospectus before participating in the exchange offers.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offers must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The letter of transmittal set forth in Annex A to this prospectus states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for original notes where such original notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 90 days after the Expiration Date (as defined herein), we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

We are not making an offer to exchange notes in any jurisdiction where the offer is not permitted.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

_________________

The date of this prospectus is , 2013.

You should rely only on the information contained in this prospectus. We have not authorized any person to provide you with any information or represent anything about us or this offering that is not contained in this prospectus. If given or made, any such other information or representation should not be relied upon as having been authorized by us. We are offering to exchange the original notes for the exchange notes only in places where the exchange offers are permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus.

_______________________________________________

TABLE OF CONTENTS | |

Page | |

_______________________________________________

i

WHERE YOU CAN FIND MORE INFORMATION

We and the guarantors have filed with the Securities and Exchange Commission (the “SEC”), a registration statement on Form S-4 under the Securities Act with respect to the notes being offered hereby. This prospectus, which forms a part of the registration statement, does not contain all of the information set forth in the registration statement. For further information with respect to us, the guarantors or the notes, we refer you to the registration statement. We also file annual, quarterly, and current reports and other information with the SEC. The registration statement, such reports and other information can be inspected and copied at the Public Reference Room of the SEC located at Room 1580, 100 F Street, N.E., Washington D.C. 20549. Copies of such materials, including copies of all or any portion of the registration statement, can be obtained from the Public Reference Room of the SEC at prescribed rates. You can call the SEC at 1-800-SEC-0330 to obtain information on the operation of the Public Reference Room. Such materials may also be accessed electronically by means of the SEC’s home page on the Internet (http://www.sec.gov).

Our Internet address is www.biomet.com. There we make available free of charge, on or through the “Investors” section of our Web site, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The information found on our Web site does not form a part of this prospectus.

Under the terms of the indentures relating to the notes, we have agreed that, whether or not we are required to do so by the rules and regulations of the SEC, for so long as any of the notes remain outstanding, we will furnish to the trustee and holders of the notes the information specified in the indentures. See “Description of Exchange Senior Notes” and “Description of Exchange Senior Subordinated Notes.”

FORWARD-LOOKING STATEMENTS

Some of the statements made under the headings “Summary” and elsewhere in this prospectus contain forward-looking statements within the meaning of U.S. federal securities laws, including Section 27A of the Securities Act and Section 21E of the Exchange Act. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. Forward-looking statements include statements generally preceded by, followed by or that include the words “believe,” “could,” “expect,” “forecast,” “intend,” “may,” “anticipate,” “plan,” “predict,” “possibly,” “project,” “potential,” “estimate,” “should,” “will,” or similar expressions. These statements include, but are not limited to, statements related to:

• | the timing and number of planned new product introductions; |

• | the effect of anticipated changes in the size, health and activities of the population or on the demand for our products; |

• | assumptions and estimates regarding the size and growth of certain market categories; |

• | our ability and intent to expand in key international markets; |

• | the timing and anticipated outcome of clinical studies; |

• | assumptions concerning anticipated product developments and emerging technologies; |

• | the future availability of raw materials; |

• | the anticipated adequacy of our capital resources to meet the needs of our business; |

• | our continued investment in new products and technologies; |

• | the ultimate marketability of products currently being developed; |

ii

• | our ability to successfully implement new technologies and transition certain manufacturing operations to China; |

• | our ability to manage working capital and generate adequate cash flows to service outstanding debt; |

• | our ability to sustain sales and earnings growth; |

• | our success in achieving timely approval or clearance of our products with domestic and foreign regulatory entities; |

• | our success in implementing our operational improvement programs; |

• | the stability of certain foreign economic markets; |

• | the impact of anticipated changes in the musculoskeletal industry and our ability to react to and capitalize on those changes; |

• | our ability to successfully implement desired organizational changes; |

• | our ability to successfully integrate the DePuy Trauma acquisition; |

• | the impact of our managerial changes; and |

• | our ability to take advantage of technological advancements. |

Forward-looking statements reflect our current expectations and are not guarantees of performance. These statements are based on our management’s beliefs and assumptions, which in turn are based on currently available information. Important assumptions relating to these forward-looking statements include, among others, assumptions regarding demand for our products, expected pricing levels, raw material costs, the timing and cost of planned capital expenditures, future regulatory reforms affecting the healthcare industry, expected outcomes of pending litigation and regulatory matters, the solvency of our insurers and the ultimate resolution of allocation and coverage issues with those insurers, competitive conditions and general economic conditions. Readers of this prospectus are cautioned that reliance on any forward-looking statement involves risks and uncertainties. Although we believe that the assumptions on which the forward-looking statements contained herein are based are reasonable, any of those assumptions could prove to be inaccurate given the inherent uncertainties as to the occurrence or nonoccurrence of future events. There can be no assurance that the forward-looking statements contained in this prospectus will prove to be accurate. The inclusion of a forward-looking statement in this prospectus should not be regarded as a representation by us that our objectives will be achieved. Forward-looking statements also involve risks and uncertainties, which could cause actual results to differ materially from those projected by any forward-looking statement. Many of these factors are beyond our ability to control or predict and could, among other things, cause actual results to differ from those contained in forward-looking statements made in this prospectus and presented elsewhere by management from time to time. Such factors, among others, may have a material adverse effect upon our business, financial condition, results of operations and cash flows and may include, but are not limited to, factors discussed under the heading “Risk Factors” and the following:

• | changes in general economic conditions and interest rates; |

• | changes in the availability of capital and financing sources; |

• | changes in competitive conditions and prices in our markets; |

• | changes to the regulatory environment for our products, including national health care reform; |

• | the effects of incurring or having incurred a substantial amount of indebtedness under the notes, our senior secured credit facilities and our existing notes; |

iii

• | the effects upon us of complying with the covenants contained in our senior secured credit facilities and the indentures and our existing notes; |

• | restrictions that the terms and conditions of the notes, our senior secured credit facilities and the existing notes may place on our ability to respond to changes in our business or take certain actions; |

• | changes in the relationship between supply of and demand for our products; |

• | fluctuations in costs of raw materials and labor; |

• | changes in other significant operating expenses; |

• | decreases in sales of our principal product lines; |

• | slowdowns or inefficiencies in our product research and development efforts; |

• | increases in expenditures related to increased government regulation of our business; |

• | developments adversely affecting our sales activities inside or outside the United States; |

• | decreases in reimbursement levels by our customers, including certain of our foreign government customers that are experiencing financial distress; |

• | difficulties in transitioning certain manufacturing operations to China and other locations; |

• | challenges in effectively implementing restructuring and cost saving initiatives; |

• | increases in cost-containment efforts from managed care organizations and other third-party payors; |

• | loss of our key management and other personnel or inability to attract such management and other personnel; |

• | increases in costs of retaining existing independent sales agents of our products; |

• | potential future goodwill and/or intangible impairment charges; |

• | unanticipated expenditures related to litigation; and |

• | failure to comply with the terms of the DPA (as defined elsewhere in this prospectus). |

There may be other factors of which we are currently unaware or that we deem immaterial that may cause our actual results to differ materially from the expectations we express in our forward-looking statements. Although we believe the assumptions underlying our forward-looking statements are reasonable, any of these assumptions, and, therefore, also the forward-looking statements based on these assumptions could themselves prove to be inaccurate.

Forward-looking statements are based on current plans, estimates, assumptions and projections, and therefore you should not place undue reliance on them. Forward-looking statements speak only as of the date they are made and we undertake no obligation to update them publicly in light of new information or future events.

You should carefully consider the “Risk Factors” and other information included in this prospectus before making any investment decision with respect to the exchange notes. If any of these trends, risks, assumptions or uncertainties actually occurs or continues, our business, financial condition or operating results could be materially adversely affected, the trading prices of the notes could decline and you could lose all or part of your investment. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

iv

MARKET AND INDUSTRY DATA

In this prospectus, we rely on and refer to information and statistics regarding our industry products and our market share based on revenues in the sectors in which we compete. Where possible, we obtained this information and statistics from third-party sources, such as independent industry publications, government publications or reports by market research firms, including, without limitation, Eurostat, Knowledge Enterprises, Inc., the U.S. Census Bureau, Wall Street research and from company research and trade interviews. In addition, we have supplemented third-party information where necessary with management estimates based on our review of internal surveys, information from our customers and vendors, trade and business organizations and other contacts in markets in which we operate, and our management’s knowledge and experience. However, these estimates are subject to change and are uncertain due to limits on the availability and reliability of primary sources of information and the voluntary nature of the data gathering process. Although we believe that these independent sources and our management’s estimates are reliable as of the date of this prospectus, the information contained in them has not been independently verified, and we cannot assure you as to the accuracy or completeness of such information. As a result, you should be aware that market share and industry data included in this prospectus, and estimates and beliefs based on that data, may not be reliable. We make no representation as to the accuracy or completeness of such information.

TERMS USED IN THIS PROSPECTUS

Unless otherwise noted or indicated by the context, in this prospectus:

The term “guarantors”, as of the date of this prospectus with respect to both the senior notes and the senior subordinated notes, means Biolectron, Inc., Biomet 3i, LLC, Biomet Biologics, LLC, Biomet Europe Ltd., Biomet Fair Lawn, LLC, Biomet Florida Services, LLC, Biomet International Ltd, Biomet Leasing, Inc., Biomet Manufacturing Corporation, Biomet Microfixation, LLC, Biomet Orthopedics, LLC, Biomet Sports Medicine, LLC, Biomet U.S. Reconstruction, LLC, Biomet Trauma, LLC, Cross Medical Products, LLC, EBI Holdings, LLC, EBI, LLC, EBI Medical Systems, LLC, Electro-Biology, LLC, Implant Innovations Holdings, LLC, Interpore Cross International, LLC, Interpore Spine Ltd., and Kirschner Medical Corporation. However, since each of our current and future wholly owned domestic restricted subsidiaries that is a guarantor of our senior secured credit facilities will fully and unconditionally guarantee the exchange senior notes on a senior unsecured basis and the exchange senior subordinated notes on a senior subordinated unsecured basis, the identities of the guarantors may change from time to time without notice. See “Description of Exchange Senior Notes—Guarantees” and “Description of Exchange Senior Subordinated Notes—Guarantees.”

The term “senior notes indenture” refers to the Senior Notes Indenture dated as of August 8, 2012 among Biomet, Inc., the Guarantors listed therein and Wells Fargo Bank, National Association and the First Supplemental Indenture, dated as of October 2, 2012 among Biomet, Inc., the Guarantors listed therein and Wells Fargo Bank, National Association, collectively.

The term “senior subordinated notes indenture” refers to the Senior Subordinated Notes Indenture dated as of October 2, 2012 among Biomet, Inc., the Guarantors listed therein and Wells Fargo Bank, National Association.

The term “indentures” refers to the senior notes indenture and senior subordinated notes indenture, collectively.

The term “senior notes registration rights agreements” refers to each of the registration rights agreements we entered into with the initial purchasers of the original senior notes concurrently with the sales of the original senior notes on August 8, 2012 and October 2, 2012, respectively.

The term “senior subordinated notes registration rights agreement” refers to registration rights agreement we entered into with the initial purchasers of the original senior subordinated notes concurrently with the sale of the original senior subordinated notes on October 2, 2012.

The term “registration rights agreements” refers to the senior notes registration rights agreements and the senior subordinated notes registration rights agreement, collectively.

References to our fiscal years through and including fiscal 2012 are to the twelve months ended on May 31 of such year.

v

SUMMARY

This summary highlights aspects of our business and the exchange offers. You should, however, carefully read the entire prospectus, including the information presented under the section entitled “Risk Factors” and our consolidated financial statements and the notes thereto included elsewhere in this prospectus before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from the results discussed in the forward-looking statements as a result of certain factors, including those set forth under “Risk Factors” and “Forward-Looking Statements.”

Unless the context otherwise requires or indicates, references to “Biomet,” “the Company,” “we,” “us” and “our” refer to Biomet, Inc. and its subsidiaries.

Our Company

General

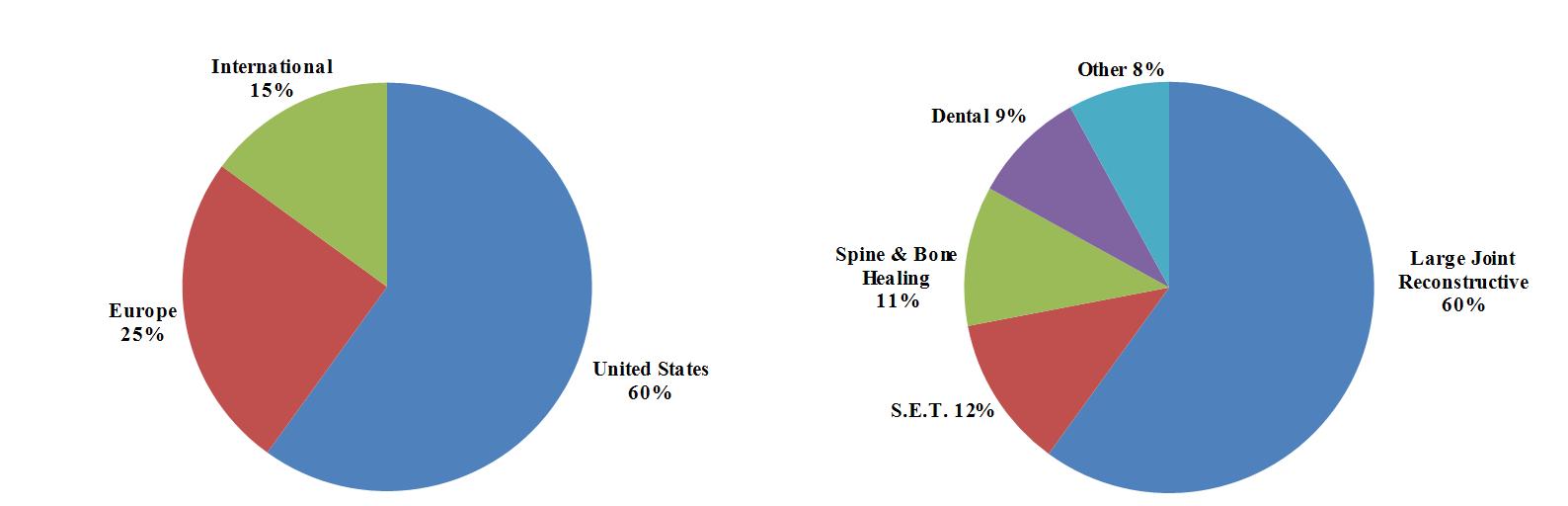

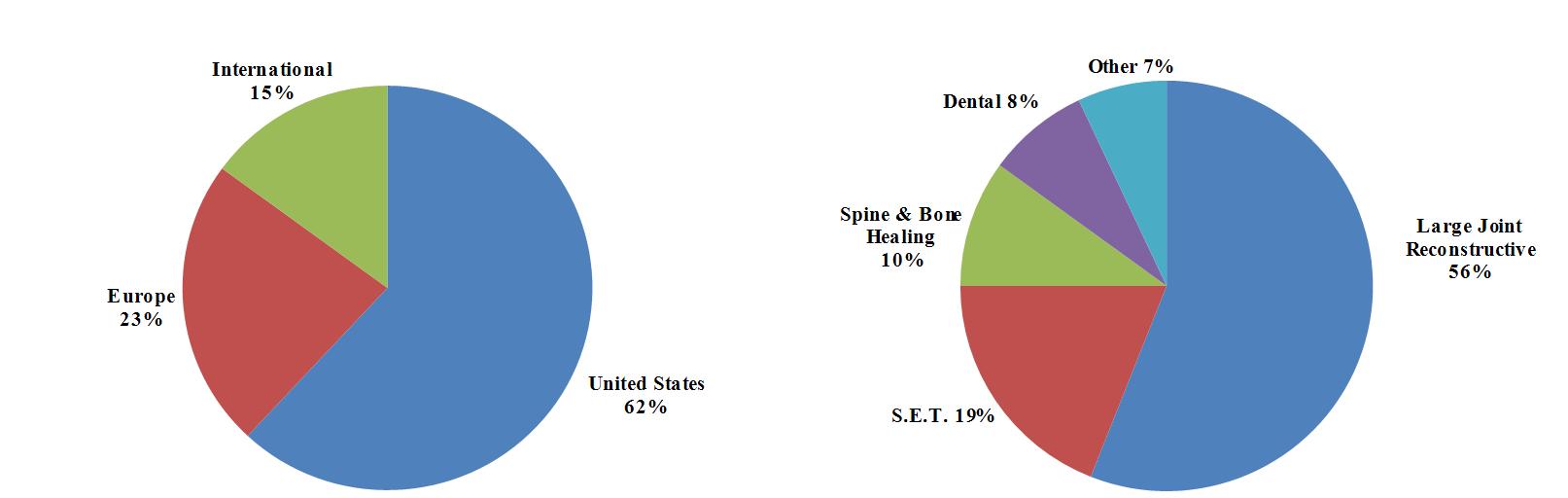

Biomet, Inc., an Indiana corporation incorporated in 1977, is one of the largest orthopedic medical device companies in the United States and worldwide with operations in more than 50 locations throughout the world and distribution in approximately 90 countries. Our principal subsidiaries include Biomet U.S. Reconstruction, LLC; Biomet Orthopedics, LLC; Biomet Manufacturing Corp.; Biomet Europe BV; EBI, LLC; Biomet 3i, LLC; Biomet International Ltd.; Biomet Microfixation, LLC; Biomet Sports Medicine, LLC; Biomet Trauma, LLC; and Biomet Biologics, LLC. We design, manufacture and market a comprehensive range of both surgical and non-surgical products used primarily by orthopedic surgeons and other musculoskeletal medical specialists. We operate in one reportable business segment, musculoskeletal products, which includes the design, manufacture and marketing of products in five major product categories: Large Joint Reconstructive; Sports, Extremities and Trauma (“S.E.T.”); Spine & Bone Healing; Dental; and Other Products. We have three geographic markets: United States, Europe and International.

Corporate Information

Biomet is incorporated in the State of Indiana. Our principal executive offices are located at 56 East Bell Drive, Warsaw, Indiana 46582. Our website address is www.biomet.com. The information on our website is not deemed to be part of this prospectus. For additional information, contact our Corporate Communications department at (574) 372-1514.

Ownership and Corporate Structures

LVB Acquisition, Inc., or “Parent,” owns all of our issued and outstanding capital stock. LVB Acquisition Holding, LLC (“Holding”) owns 97.0% of the issued and outstanding capital stock of Parent. Substantially all the equity interests in Holding are owned, directly or indirectly, by a consortium of private equity funds affiliated with The Blackstone Group, Goldman, Sachs & Co., Kohlberg Kravis Roberts & Co. and TPG Global, LLC (together with its affiliates, “TPG”), and their co-investors (jointly, the “Sponsors”).

1

The Exchange Offers

On August 8, 2012 and October 2, 2012, we completed private offerings of our original notes. We entered into registration rights agreements with the initial purchasers in the private offerings in which we agreed, among other things, to file the registration statement of which this prospectus is a part. The following is a summary of the exchange offers.

Original Notes | On August 8, 2012, we issued: • $1,000,000,000 aggregate principal amount of 6.500% Senior Notes due 2020. On October 2, 2012, we issued: • $825,000,000 aggregate principal amount of 6.500% Senior Notes due 2020; and • $800,000,000 aggregate principal amount of 6.500% Senior Subordinated Notes due 2020. The proceeds of these issuances were used to purchase or redeem all of our outstanding 10⅜%/11⅛% Senior PIK Toggle Notes due 2017; all of our outstanding 10% Senior Notes due 2017; and all of our outstanding 11⅝% Senior Subordinated Notes due 2017. |

Exchange Notes Offered in the Exchange Offer | |

Exchange Senior Notes | 6.500% Senior Notes due 2020. The terms of the exchange senior notes are substantially identical in all material respects to those terms of the original senior notes, except that the transfer restrictions, registration rights and provisions for additional interest relating to the original senior notes do not apply to the exchange senior notes. |

Exchange Senior Subordinated Notes | 6.500% Senior Subordinated Notes due 2020. The terms of the exchange senior subordinated notes are substantially identical in all material respects to those terms of the original senior subordinated notes, except that the transfer restrictions, registration rights and provisions for additional interest relating to the original senior subordinated notes do not apply to the exchange senior subordinated notes. The exchange notes are summarized in greater detail below under “The Exchange Notes.” |

Exchange Offers | We are offering to exchange: • up to $1,825 million principal amount of our exchange senior notes for an equal amount of our original senior notes; and • up to $800 million principal amount of our exchange senior subordinated notes for an equal amount of our original senior subordinated notes. We will not pay any accrued and unpaid interest on the original notes that we will acquire in the exchange offers. Instead, interest on the exchange senior notes will accrue from February 1, 2013, the most recent date on which interest has been paid. Interest on the exchange senior subordinated notes will accrue from October 2, 2012, the issue date of the senior subordinated notes, or from April 1, 2013 if the exchange offer in respect thereof is completed after, and interest is paid on, that date. |

Expiration Date | The exchange offers will expire at 5:00 P.M., New York City time, , 2013, unless we extend or terminate either or both exchange offers, in which case the “Expiration Date” will mean the latest date and time to which we extend such exchange offer or exchange offers. |

Settlement Date | The settlement date of the exchange offers will be as soon as practicable after the respective Expiration Date. |

2

Conditions to the Exchange Offers | The registration rights agreements do not require us to accept original notes for exchange if the exchange offers or the making of any exchange by a holder of the original notes would violate any applicable law or interpretation of the staff of the SEC or if any legal action has been instituted or threatened that would impair our ability to proceed with the exchange offers. A minimum aggregate principal amount of original notes being tendered is not a condition to the exchange offers. Please read “The Exchange Offers—Conditions to the Exchange Offers” for more information about the conditions to the exchange offers. |

Procedures for Tendering Original Notes | To participate in the exchange offers, you must follow the automatic tender offer program (“ATOP”) procedures established by The Depository Trust Company (“DTC”) for tendering original notes held in book-entry form. The ATOP procedures require that the exchange agent receive, prior to the Expiration Date, a computer-generated message known as an “agent’s message” that is transmitted through ATOP and that DTC confirms that: • DTC has received instructions to exchange your original notes; and • you agree to be bound by the terms of the letter of transmittal. |

In the alternative, you may properly complete and duly execute a letter of transmittal and transmit it, along with all other documents required by such letter of transmittal, to the exchange agent on or before the Expiration Date at the address provided on the cover page of the letter of transmittal. The form of the letter of transmittal is set forth in Annex A to this prospectus. For more details, please read “The Exchange Offers—Procedures for Tendering,” “The Exchange Offers—Book-Entry Transfer”. If you elect to have original notes exchanged pursuant to these exchange offers, you must properly tender your original notes prior to 5:00 p.m., New York City time, on the respective Expiration Date. All original notes validly tendered and not properly withdrawn will be accepted for exchange. Original notes may be exchanged only in minimum denominations of $1,000 and integral multiples of $1,000 in excess thereof. | |

Withdrawal of Tenders | You may withdraw your tender of original notes at any time prior to the Expiration Date. |

Fees and Expenses | We will bear all expenses related to the exchange offers. Please read “The Exchange Offers—Fees and Expenses.” |

Use of Proceeds | The issuance of the exchange notes will not provide us with any new proceeds. We are making the exchange offers solely to satisfy certain obligations under our registration rights agreements. |

Consequences of Failure to Exchange Original Notes | If we complete the exchange offers and you do not participate, then: • your original notes will continue to be subject to the existing restrictions upon their transfer; • we will have no further obligations to provide the registration under the Securities Act of those original notes except under certain limited circumstances; and • the liquidity of the market for your original notes could be adversely affected. |

U.S. Federal Income Tax Considerations | Neither the registration of the original notes pursuant to our obligations under the registration rights agreements nor the U.S. Holder’s receipt of exchange notes in exchange for original notes will constitute a taxable event for U.S. federal income tax purposes. Please read “Certain U.S. Federal Income Tax Considerations.” |

3

Exchange Agent | We have appointed Wells Fargo Bank, National Association as the exchange agent for the exchange offers. You should direct questions and requests for assistance and requests for additional copies of this prospectus (including the letter of transmittal) to the exchange agent at the following addresses: By Registered and Certified Mail: Wells Fargo Bank, National Association Corporate Trust Operations MAC N9303-121 P.O. Box 1517 Minneapolis, MN 55480 By Overnight Courier or Regular Mail: Wells Fargo Bank, National Association Corporate Trust Operations MAC N9303-121 6th & Marquette Avenue Minneapolis, MN 55479 By Hand Delivery: Wells Fargo Bank, National Association Corporate Trust Services 608 2nd Avenue South Northstar East Building—12th Floor Minneapolis, MN 55402 By Facsimile Transmission: (612) 667-6282 Confirm by Telephone: (800) 344-5128 |

Resales of the Exchange Notes | Based on interpretations of the staff of the SEC, we believe that you may offer for sale, resell or otherwise transfer the exchange notes that we issue in the exchange offers without complying with the registration and prospectus delivery requirements of the Securities Act if: • you are not a broker-dealer tendering original notes acquired directly from us; • you acquire the exchange notes in the ordinary course of your business; • you are not participating, do not intend to participate, and have no arrangement or undertaking with anyone to participate, in the distribution (within the meaning of the Exchange Act) of the exchange notes issued to you in the exchange offers; and • you are not an “affiliate” of our company, as that term is defined in Rule 405 of the Securities Act. |

If any of these conditions are not satisfied and you transfer any exchange notes issued to you in the exchange offers without delivering a proper prospectus or without qualifying for a registration exemption, you may incur liability under the Securities Act. We will not be responsible for, or indemnify you against, any liability you incur. Any broker-dealer that acquires exchange notes in the exchange offers for its own account in exchange for original notes which it acquired through market-making or other trading activities must acknowledge that it will deliver this prospectus when it resells or transfers any exchange notes issued in the exchange offers. See “Plan of Distribution” for a description of the prospectus delivery obligations of broker-dealers. | |

4

The Exchange Notes | |

Issuer | Biomet, Inc. |

Guarantors | Each of our current and future wholly owned domestic restricted subsidiaries that is a guarantor of our senior secured credit facilities will fully and unconditionally guarantee the exchange senior notes on a senior unsecured basis and the exchange senior subordinated notes on a senior subordinated unsecured basis. See “Description of Exchange Senior Notes—Guarantees” and “Description of Exchange Senior Subordinated Notes—Guarantees.” |

Notes Offered | |

Exchange Senior Notes | Up to $1,825 million in aggregate principal amount of 6.500% Senior Notes due 2020. The exchange senior notes and the original senior notes will be considered to be a single class for all purposes under the senior notes indenture, including waivers, amendments, redemptions and offers to purchase. |

Exchange Senior Subordinated Notes | Up to $800 million in aggregate principal amount of 6.500% Senior Subordinated Notes due 2020. The exchange senior subordinated notes and the original senior subordinated notes will be considered to be a single class for all purposes under the senior subordinated notes indenture, including waivers, amendments, redemptions and offers to purchase. |

Maturity Dates | The exchange senior notes will mature on August 1, 2020, and the exchange senior subordinated notes will mature on October 1, 2020. |

Interest Rates | Interest on the exchange senior notes and exchange senior subordinated notes will be payable in cash and will accrue at a rate of 6.500% per annum. |

Interest Payment Dates Exchange Senior Notes Exchange Senior Subordinated Notes | August 1 and February 1, commencing February 1, 2013. Interest will accrue from February 1, 2013. April 1 and October 1, commencing April 1, 2013. Interest will accrue from October 2, 2012, or from April 1, 2013 if the exchange offer in respect thereof is completed after, and interest is paid on, that date. |

5

Ranking | |

Exchange Senior Notes | The exchange senior notes will be our senior unsecured obligations and will: • rank pari passu in right of payment with all of our existing and future indebtedness that is not expressly subordinated in right of payment thereto; • be senior in right of payment to any future indebtedness that is expressly subordinated in right of payment thereto (including our existing senior subordinated notes); and • be effectively junior to our and our guarantors’ existing and future secured indebtedness (including the borrowings under our senior secured credit facilities), to the extent of the value of the collateral securing such indebtedness and to all existing and future liabilities of our non-guarantor subsidiaries. Similarly, the guarantees of the exchange senior notes will be the guarantors’ senior unsecured obligations and will: • rank pari passu in right of payment with all existing and future indebtedness of each guarantor that is not expressly subordinated thereto; • be senior in right of payment to any future indebtedness of each guarantor that is expressly subordinated in right of payment thereto; and • be effectively junior to all existing and future secured indebtedness of each guarantor to the extent of the value of the collateral securing such indebtedness. |

Exchange Senior Subordinated Notes…… | The exchange senior subordinated notes will be our senior subordinated unsecured obligations and will: • rank junior in right of payment with all of our existing and future indebtedness that is not expressly subordinated in right of payment thereto (including the senior notes); • rank pari passu in right of payment to any of our existing and future senior subordinated indebtedness (including the original senior subordinated notes) and other obligations; and • be senior in right of payment to any future subordinated indebtedness and effectively junior to our and our guarantors’ existing and future secured indebtedness (including the borrowings under our senior secured credit facilities), to the extent of the value of the collateral securing such indebtedness and to all existing and future liabilities of our non-guarantor subsidiaries. Similarly, the guarantees of the exchange senior subordinated notes will be the guarantors’ senior subordinated unsecured obligations and: • rank junior in right of payment with all existing and future indebtedness of each guarantor that is not expressly subordinated thereto; • rank pari passu in right of payment to any of our existing and future senior subordinated indebtedness and other obligations; and • be senior in right of payment to any future indebtedness of each guarantor that is expressly subordinated in right of payment thereto and effectively junior to all existing and future secured indebtedness of each guarantor to the extent of the value of the collateral securing such indebtedness. |

6

Optional Redemption | |

Exchange Senior Notes | At any time prior to August 1, 2015, we may redeem up to 35% of the aggregate principal amount of the senior notes (including both the original senior notes and the exchange senior notes) with the net proceeds of certain equity offerings at the redemption price set forth in this prospectus, plus accrued and unpaid interest, if any, to the redemption date. At any time prior to August 1, 2015, we may redeem the exchange senior notes, in whole or in part, at our option, at a redemption price equal to 100% of their principal amount plus a “make-whole premium” and accrued and unpaid interest, if any, to the date of redemption. On and after August 1, 2015, we may redeem some or all of the exchange senior notes at any time at the redemption prices set forth in this prospectus plus accrued and unpaid interest, if any, to the date of redemption. See “Description of Exchange Senior Notes—Optional Redemption.” |

Exchange Senior Subordinated Notes | At any time prior to October 1, 2015, we may redeem up to 40% of the aggregate principal amount of the senior subordinated notes (including both the original senior subordinated notes and the exchange senior subordinated notes) with the net proceeds of certain equity offerings at the redemption price set forth in this prospectus, plus accrued and unpaid interest, if any, to the redemption date. At any time prior to October 1, 2015, we may redeem the exchange senior subordinated notes, in whole or in part, at our option, at a redemption price equal to 100% of their principal amount plus a “make-whole premium” and accrued and unpaid interest, if any, to the date of redemption. On and after October 1, 2015, we may redeem some or all of the exchange senior subordinated notes at any time at the redemption prices set forth herein plus accrued and unpaid interest, if any, to the date of redemption. See “Description of Exchange Senior Subordinated Notes—Optional Redemption.” |

Change of Control | Upon certain change of control events, each holder of exchange notes may require us to purchase all or a portion of such holder’s notes at a purchase price equal to 101% of the principal amount thereof, plus accrued and unpaid interest, if any, to the purchase date. See “Description of Exchange Senior Notes” and “Description of Exchange Senior Subordinated Notes.” |

7

Certain Covenants | The senior notes indenture and the senior subordinated notes indenture contain covenants that, among other things, limit our ability and the ability of our restricted subsidiaries to: • pay dividends on, redeem or repurchase capital stock or make other restricted payments; • make investments; • incur indebtedness or issue certain equity; • create certain liens; • incur obligations that restrict the ability of our subsidiaries to make dividend or other payments to us; • enter into transactions with our affiliates; • create or designate unrestricted subsidiaries; and • consolidate, merge or transfer all or substantially all of our assets. These covenants are subject to important exceptions and qualifications, which are described under the headings “Description of Exchange Senior Notes” and “Description of Exchange Senior Subordinated Notes” in this prospectus. Certain of these covenants will be suspended if the notes are assigned an investment grade rating by Standard & Poor’s Rating Services (“Standard & Poor’s”) and Moody’s Investors Services, Inc. (“Moody’s”) and no default has occurred and is continuing. If either rating on the notes should subsequently decline to below investment grade or a default occurs and is continuing, the suspended covenants will be reinstated. |

Absence of a Public Market | The exchange notes are new securities for which there currently is no market and we cannot assure you that any public market for the exchange notes will develop or be sustained. |

Listing | We do not intend to list the notes on any securities exchange. |

Governing Law | The notes are governed by, and construed in accordance with, the laws of the State of New York. |

Trustee | Wells Fargo Bank, National Association |

Risk Factors | See “Risk Factors” and the other information in this prospectus for a discussion of some of the factors you should carefully consider before participating in the exchange offers. |

8

RISK FACTORS

Before tendering original notes in the exchange offers and investing in the exchange notes, you should consider carefully each of the following risk factors, as well as other information included in this prospectus. The risks described below are not the only ones facing our company. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business or results of operations in the future. Any of the following risks could materially adversely affect our business, financial condition or results of operations. We cannot assure you that any of the events discussed in or incorporated by reference into this prospectus will not occur. In such case, you may lose all or part of your original investment in the notes.

Risks Related to Our Business

Our future profitability depends on the success of our principal product lines.

Sales of our large joint reconstructive products accounted for approximately 56% of our net sales for the nine months ended February 28, 2013 and 60% of our net sales for each of the three fiscal years ended May 31, 2012, 2011 and 2010. We expect sales of reconstructive products to continue to account for a significant portion of our aggregate sales. Any event adversely affecting the sale of reconstructive products may, as a result, adversely affect our business, financial condition, results of operations and cash flows.

If we are unable to continue to develop and market new products and technologies in a timely manner, the demand for our products may decrease or our products could become obsolete, and our revenue and profitability may decline.

The market for our products is highly competitive and dominated by a small number of large companies. We are continually engaged in product development, research and improvement efforts. New products and line extensions of existing products represent a significant component of our growth rate. Our ability to continue to grow sales effectively depends on our capacity to keep up with existing or new products and technologies in the musculoskeletal products market. The process of obtaining regulatory approvals to market a medical device, particularly from the U.S. Food and Drug Administration (“FDA”) and certain foreign governmental authorities, can be costly and time consuming and approvals and clearances might not be granted for future products on a timely basis, if at all. On July 29, 2011, the Institute of Medicine (“IoM”) published a report of its review of the 510(k) clearance program to FDA. The IoM report recommended that the FDA pursue a legislative change from the current 510(k) process to an integrated premarket and post-market regulatory framework. It is uncertain if these recommendations will ultimately be pursued. If they are pursued, it is possible we will be required to submit additional clinical and manufacturing information with respect to premarket applications in the future, resulting in increased costs and increased delay in introducing products to the market. Other devices we develop and market fall into a class of products for which the FDA has implemented stringent clinical investigation and Premarket Approval (“PMA”) requirements. The PMA process requires us to provide clinical and laboratory data that establishes that the new medical device is safe and effective. The FDA will approve the new device for commercial distribution if it determines that the data and information in the PMA relating to design, materials, bench and animal testing and human clinical data constitute valid scientific evidence and that there is reasonable assurance that the device is safe and effective for its intended use. In addition, if our competitors’ new products and technologies reach the market before our products, they may gain a competitive advantage or render our products obsolete. The ultimate success of our product development efforts will depend on many factors, including, but not limited to, our ability to create innovative designs and materials, provide innovative surgical techniques, accurately anticipate and meet customers’ needs, commercialize new products in a timely manner, and manufacture and deliver products and instrumentation in sufficient volumes on time. Moreover, research and development efforts may require a substantial investment of time and resources before we are adequately able to determine the commercial viability of a new product, technology, material or other innovation. Even in the event that we are able to successfully develop innovations, they may not produce revenue in excess of the costs of development and may be quickly rendered obsolete as a result of changing customer preferences or the introduction by our competitors of products embodying new technologies or features.

In addition to the impact of the 2.3% excise tax on our results of operations beginning January 1, 2013 following enactment of the Patient Protection and Affordable Health Care Act (H.R. 3590), our business, financial condition, results of operations and cash flows could be significantly and adversely affected if this legislation

9

ultimately results in lower reimbursements for our products or reduced medical procedure volumes or if certain other types of healthcare reform programs are adopted in our key markets.

In the United States, healthcare providers that purchase our products (e.g., hospitals, physicians, dentists and other healthcare providers) generally rely on payments from third-party payors (principally federal Medicare, state Medicaid and private health insurance plans) to cover all or a portion of the cost of our musculoskeletal products. These third-party payors may deny reimbursement if they determine that a device used in a procedure was not in accordance with cost-effective treatment methods, as determined by the third-party payor, or was used for an unapproved indication. Third-party payors may also decline to reimburse for experimental procedures and devices. In the event that third-party payors deny coverage or reduce their current levels of reimbursement, we may be unable to sell certain products on a profitable basis, thereby materially adversely impacting our results of operations. Further, third-party payors are continuing to carefully review their coverage policies with respect to existing and new therapies and can, without notice, deny coverage for treatments that may include the use of our products.

In March 2010, the U.S. Congress adopted and President Obama signed into law comprehensive healthcare reform legislation through the passage of the Patient Protection and Affordable Health Care Act (H.R. 3590) and the Healthcare and Education Reconciliation Act (H.R. 4872). Among other initiatives, these bills impose a 2.3% excise tax on domestic sales of medical devices following December 31, 2012, which is estimated to contribute approximately $20 billion to healthcare reform. The law was upheld by a Supreme Court decision that was announced on June 28, 2012. Various healthcare reform proposals have also emerged at the state level. Outside of the excise tax, which has impacted our results of operations following December 31, 2012, we cannot predict with certainty what healthcare initiatives, if any, will be implemented at the state level, or what the ultimate effect of federal healthcare reform or any future legislation or regulation will have on us. However, an expansion in government’s role in the U.S. healthcare industry may lower reimbursements for our products, reduce medical procedure volumes and adversely affect our business and results of operations, possibly materially.

Outside of the United States, reimbursement systems vary significantly from country to country. In the majority of the international markets in which our products are sold, government-managed healthcare systems mandate the reimbursement rates and methods for medical devices and procedures. If adequate levels of reimbursement from third-party payors outside of the United States are not obtained, international sales of our products may decline. Many foreign markets, including Canada, and some European and Asian countries, have tightened reimbursement rates. Our ability to continue to sell certain products profitably in these markets may diminish if the government-managed healthcare systems continue to reduce reimbursement rates.

Our business, financial condition, results of operations and cash flows could be significantly and negatively affected by substantial government regulations.

Our products are subject to rigorous regulation by the FDA and numerous other federal, state and foreign governmental authorities. Overall, there appears to be a trend toward more stringent regulation throughout the world, and we do not anticipate this trend to dissipate in the near future.

In general, the development, testing, manufacturing and marketing of our products are subject to extensive regulation and review by numerous governmental authorities both in the United States and abroad. The regulatory process requires the expenditure of significant time, effort and expense to bring new products to market. In addition, we are required to implement and maintain stringent reporting, labeling and record keeping procedures. The medical device industry also is subject to a myriad of complex laws and regulations governing Medicare and Medicaid reimbursement and healthcare fraud and abuse laws, with these laws and regulations being subject to interpretation. In many instances, the industry does not have the benefit of significant regulatory or judicial interpretation of these laws and regulations. In certain public statements, governmental authorities have taken positions on issues for which little official interpretation was previously available. Some of these positions appear to be inconsistent with common practices within the industry but have not previously been challenged.

Various federal and state agencies have become increasingly vigilant in recent years in their investigation of various business practices. Governmental and regulatory actions against us can result in various actions that could adversely impact our operations, including:

• | the recall or seizure of products; |

• | the suspension or revocation of the authority necessary for the production or sale of a product; |

10

• | the suspension of shipments from particular manufacturing facilities; |

• | the imposition of fines and penalties; |

• | the delay of our ability to introduce new products into the market; |

• | the exclusion of our products from being reimbursed by federal and state healthcare programs (such as Medicare, Medicaid, Veterans Administration health programs and Civilian Health and Medical Program Uniformed Service (“CHAMPUS”); and |

• | other civil or criminal sanctions against us. |

Any of these actions, in combination or alone, or even a public announcement that we are being investigated for possible violations of these laws, could have a material adverse effect on our business, financial condition, results of operations and cash flows.

In many of the foreign countries in which we market our products, we are subject to regulations affecting, among other things, clinical efficacy, product standards, packaging requirements, labeling requirements, import/ export restrictions, tariff regulations, duties and tax requirements. Many of the regulations applicable to our devices and products in these countries, such as the European Medical Devices Directive, are similar to those of the FDA. In addition, in many countries the national health or social security organizations require our products to be qualified before they can be marketed with the benefit of reimbursement eligibility. Failure to receive or delays in the receipt of relevant foreign qualifications also could have a material adverse effect on our business, financial condition, results of operations and cash flows.

As both the U.S. and foreign government regulators have become increasingly stringent, we may be subject to more rigorous regulation by governmental authorities in the future. Our products and operations are also often subject to the rules of industrial standards bodies, such as the International Standards Organization (“ISO”). If we fail to adequately address any of these regulations, our business will be harmed.

Certain provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act currently or in the future will require us to report on “conflict minerals” used in our products and the due diligence plan we put in place to track whether such minerals originate from the Democratic Republic of Congo and adjoining countries. The implementation of these requirements could affect the sourcing and availability of minerals used in certain of our products.

We, like other companies in the orthopedic industry, are involved in ongoing governmental investigations, the results of which may adversely impact our business and results of operations.

In September 2010, we received a Civil Investigative Demand (“CID”) issued by the U.S. Department of Justice Civil Division pursuant to the False Claims Act. The CID requests that we provide documents and testimony related to allegations that we and OtisMed Corp. and Stryker Corp. have violated the False Claims Act relating to the marketing of, and payment submissions for, OtisMed’s OtisKnee™ (a registered trademark of Otis Med) knee replacement system. We have produced responsive documents and are fully cooperating in the investigation. We can make no assurances as to the time or resources that will be needed to devote to this inquiry or its final outcome.

In February 2010, we received a subpoena from the Office of the Inspector General of the U.S. Department of Health and Human Services requesting various documents relating to agreements or arrangements between physicians and our Interpore Cross subsidiary for the period from 1999 through the present and the marketing and sales activities associated with Interpore Cross’ spinal products. We are cooperating with the request of the Office of the Inspector General. We can make no assurances as to the time or resources that will be needed to devote to this inquiry or its final outcome.

In April 2009, we received an administrative subpoena from the U.S. Attorney’s Office for the District of Massachusetts requesting various documents relating primarily to the Medicare reimbursement of and certain business practices related to our EBI subsidiary’s non-invasive bone growth stimulators. It is our understanding that competitors in the non-invasive bone growth stimulation market received similar subpoenas. We received subsequent subpoenas in connection with the investigation in September 2009, June 2010 and February 2011 along with several informal requests for information. We are producing responsive documents and are fully cooperating in

11

the investigation. We can make no assurances as to the time or resources that will be needed to devote to this investigation or its final outcome.

In April 2009, we became aware of a qui tam complaint alleging violations of the federal and various state False Claims Acts filed in the United States District Court for the District of Massachusetts, where it is currently pending. Biomet, Parent and several of our competitors in the non-invasive bone growth stimulation market were named as defendants in this action. The allegations in the complaint are similar in nature to certain categories of requested documents in the above- referenced administrative subpoenas. The U.S. government has not intervened in the action. We are vigorously defending this matter and intend to continue to do so. We can make no assurances as to the time or resources that will be needed to devote to this investigation or its final outcome.

On September 25, 2007, we received a letter from the SEC informing us that it was conducting an informal investigation regarding possible violations of the Foreign Corrupt Practices Act (“FCPA”), in the sale of medical devices in certain foreign countries by companies in the medical devices industry. The FCPA prohibits U.S. companies and their officers, directors, employees, shareholders acting on their behalf and agents from offering, promising, authorizing or making payments to foreign officials for the purpose of obtaining or retaining business abroad or otherwise obtaining favorable treatment and this law requires companies to maintain records which fairly and accurately reflect transactions and to maintain internal accounting controls. In many countries, hospitals and clinics are government-owned and healthcare professionals employed by such hospitals and clinics, with whom we regularly interact, may meet the definition of a foreign official for purposes of the FCPA. If we are found to have violated the FCPA, we may face sanctions including fines, criminal penalties, disgorgement of profits and suspension or debarment of our ability to contract with government agencies or receive export licenses. On November 9, 2007, we received a letter from the Department of Justice (“DOJ”) requesting any information provided to the SEC be provided to the DOJ on a voluntary basis.

On March 26, 2012, Biomet entered into a Deferred Prosecution Agreement (“DPA”) with the DOJ and a Consent to Final Judgment (“Consent Agreement”) with the SEC related to these investigations by the DOJ and the SEC. Pursuant to the DPA, the DOJ has agreed not to prosecute the Company in connection with this matter, provided that the Company satisfies its obligations under the agreement over the next three years. In addition, pursuant to the terms of the DPA, an independent external compliance monitor has been appointed to review the Company’s compliance with the DPA, particularly in relation to the Company’s international sales practices, for at least the first 18 months of the three year term of the DPA. The Company agreed to pay a monetary penalty of $17.3 million to resolve the charges brought by the DOJ. The terms of the DPA and the associated monetary penalty reflect the Company’s full cooperation throughout the investigation.

The Company contemporaneously reached a Consent Agreement with the SEC to settle civil claims related to this matter. As part of the Consent Agreement, Biomet agreed to the SEC’s entry of a Final Judgment requiring Biomet to disgorge profits and pay prejudgment interest in the aggregate amount of $5.6 million.

From time to time, we have been, and may be in the future, the subject of additional investigations. If, as a result of these investigations described above or any additional investigations, we are found to have violated one or more applicable laws, our business, financial condition, results of operations and cash flows could be materially adversely affected. If some of our existing business practices are challenged as unlawful, we may have to modify those practices, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Compliance with the terms of the DPA requires cooperation by many employees and others and may divert substantial financial and human resources from our other business activities.

On March 26, 2012, Biomet entered into the DPA with the DOJ related to the DOJ’s FCPA investigation. Pursuant to the Deferred Prosecution Agreement, the DOJ has agreed not to prosecute the Company in connection with this matter, provided that the Company satisfies its obligations under the agreement over the next three years. In addition, pursuant to the terms of the Deferred Prosecution Agreement, an independent external compliance monitor has been appointed to review the Company’s compliance with the Deferred Prosecution Agreement, particularly in relation to the Company’s international sales practices, for at least the first 18 months of the three year term of the Deferred Prosecution Agreement.

Compliance with this agreement requires substantial cooperation of our employees, distributors and sales agents and the healthcare professionals with whom they interact. These efforts not only involve expense, but also require management and other key employees to focus extensively on these matters.

12

We could be subject to further governmental investigations or actions by other third parties as a result of our settlement with the DOJ and the Office of the Inspector General of the U.S. Department of Health and Human Services (“OIG-HHS”).

We are subject to various federal and state laws concerning healthcare fraud and abuse, including false claims laws and anti-kickback laws. Violations of these laws are punishable by criminal and/or civil sanctions, including, in some instances, fines, imprisonment and, within the United States, exclusion from participation in government healthcare programs, including Medicare, Medicaid and Veterans Administration (“VA”) health programs. These laws are administered by, among others, the DOJ, the OIG-HHS and state attorneys general. Many of these agencies have increased their enforcement activities with respect to medical device manufacturers in recent years.

As a result of our settlement with the DOJ and SEC related to the FCPA investigation described above, we may be subject to further governmental investigations by foreign governments or other claims by third parties arising from the conduct subject to the investigation.

We intend to review and take appropriate actions with respect to any such investigations or proceedings; however, we cannot assure you that the costs of defending or fines imposed in resolving those civil or criminal investigations or proceedings would not have a material adverse effect on our financial condition, results of operations and cash flows.

The current global economic uncertainties may adversely affect our results of operations.

Our results of operations could be substantially affected not only by global economic conditions, but also by local operating and economic conditions, which can vary substantially by market. Unfavorable conditions can depress sales in a given market and may result in actions that adversely affect our margins, constrain our operating flexibility or result in charges which are unusual or non-recurring. Certain macroeconomic events, such as the current adverse conditions in the global economy, including most recently with the market disruptions caused by the economic and political challenges facing specific Eurozone countries such as Greece, Ireland, Italy, Portugal, and Spain, could have a more wide-ranging and prolonged impact on the general business environment, which could also adversely affect us. These economic developments could affect us in numerous ways, many of which we cannot predict. Among the potential effects could be an increase in our variable interest rates, an inability to access credit markets should we require external financing, and further impairments of our goodwill and other intangible assets. In addition, it is possible that further deteriorating economic conditions, and resulting federal budgetary concerns, could prompt the federal government to make significant changes in the Medicare program, which could adversely affect our results of operations. We are unable to predict the likely duration and severity of the current disruption in financial markets and adverse economic conditions, or the effects these disruptions and conditions could have on us.

We are subject to cost-containment efforts of group purchasing organizations, which may have a material adverse effect on our financial condition, results of operations and cash flows.

Many customers of our products have joined or developed group purchasing organizations in an effort to contain costs. Group purchasing organizations negotiate pricing arrangements with medical supply manufacturers and distributors, and these negotiated prices are made available to a group purchasing organization’s affiliated hospitals and other members. If we are not one of the providers selected by a group purchasing organization, affiliated hospitals and other members may be less likely to purchase our products, and if the group purchasing organization has negotiated a strict compliance contract for another manufacturer’s products, we may be precluded from making sales to members of the group purchasing organization for the duration of the contractual arrangement. We have observed a trend in accelerating average sales price declines due to bundled purchases through group purchasing organizations. Our failure to respond to the cost-containment efforts of group purchasing organizations may cause us to lose market share to our competitors and could have a material adverse effect on our sales, financial condition, results of operations and cash flows.

We conduct a significant amount of our sales activity outside of the United States, which subjects us to additional business risks and may adversely affect our results due to increased costs.

During the nine months ended February 28, 2013 and the fiscal year ended May 31, 2012, we derived approximately 38% and 40% of our net sales from sales of our products outside of the United States, respectively. We intend to continue to pursue growth opportunities in sales internationally, which could expose us to additional

13

risks associated with international sales and operations. Our international operations are, and will continue to be, subject to a number of risks and potential costs, including:

• | changes in foreign medical reimbursement policies and programs; |

• | unexpected changes in foreign regulatory requirements; |

• | differing local product preferences and product requirements; |

• | diminished protection of intellectual property in some countries outside of the United States; |

• | differing payment cycles; |

• | trade protection measures, import or export licensing requirements and compliance with economic sanctions laws and regulations; |

• | the application of U.S. and U.K. regulatory and anti-corruption laws to our international operations; |

• | difficulty in staffing, training and managing foreign operations; |

• | differing legal regulations and labor relations; |

• | potentially negative consequences from changes in tax laws (including potential taxes payable on earnings of foreign subsidiaries upon repatriation); and |

• | political and economic instability. |

In addition, we are subject to risks arising from currency exchange rate fluctuations, which could increase our costs and may adversely affect our results. The U.S. dollar value of our foreign-generated revenues varies with currency exchange rate fluctuations. Measured in local currency, the majority of our foreign-generated revenues were generated in Europe. Significant increases in the value of the U.S. dollar relative to foreign currencies could have a material adverse effect on our results of operations.

Recently, there have been widely publicized concerns with respect to the overall stability of the Euro as a single currency, given the economic and political challenges facing several Eurozone countries, including Greece, Ireland, Italy, Portugal and Spain. The collapse of the Euro as a common European currency, the withdrawal of one or more member countries from the EU or continuing deterioration in the creditworthiness of the Eurozone countries could adversely affect the Company’s revenues, financial condition or results of operations.