DB1/ 78413207.3 SEI INVESTMENTS COMPANY 2014 OMNIBUS EQUITY COMPENSATION PLAN NONQUALIFIED STOCK OPTION GRANT This STOCK OPTION GRANT AGREEMENT (this “Agreement”), dated as of (the “Date of Grant”), is delivered by SEI Investments Company (the “Company”) to (the “Grantee”). RECITALS A. The SEI Investments Company 2014 Omnibus Equity Compensation Plan (the “Plan”) provides for the grant of options to purchase shares of Company Stock. The Committee has decided to make a nonqualified stock option grant as an inducement for the Grantee to promote the best interests of the Company and its shareholders. B. The option grant confirmed hereby is subject in all respects to the terms and conditions of the Plan and the actions and determinations of the Committee under the Plan, and any provision hereof, to the extent inconsistent with the Plan, is null and void. NOW, THEREFORE, the parties to this Agreement, intending to be legally bound hereby, agree as follows: 1. Grant of Option. (a) Subject to the terms and conditions set forth in this Agreement and in the Plan, the Company hereby grants to the Grantee a nonqualified stock option (the “Option”) to purchase shares of Company Stock (“Shares”) at an Exercise Price of $ per Share. The Option shall become exercisable according to Section 2 below. (b) The Grantee hereby acknowledges the receipt of a copy of the official prospectus for the Plan. Copies of the Plan and the official Plan prospectus are available at the Company’s intranet site (http://www.corp.seic.com/portal/) or by contacting the Company’s Human Resources Department at . This Agreement is made pursuant to the Plan and is subject in its entirety to all applicable provisions of the Plan. Capitalized terms used herein and not otherwise defined will have the meanings set forth in the Plan. EXHIBIT 10.2

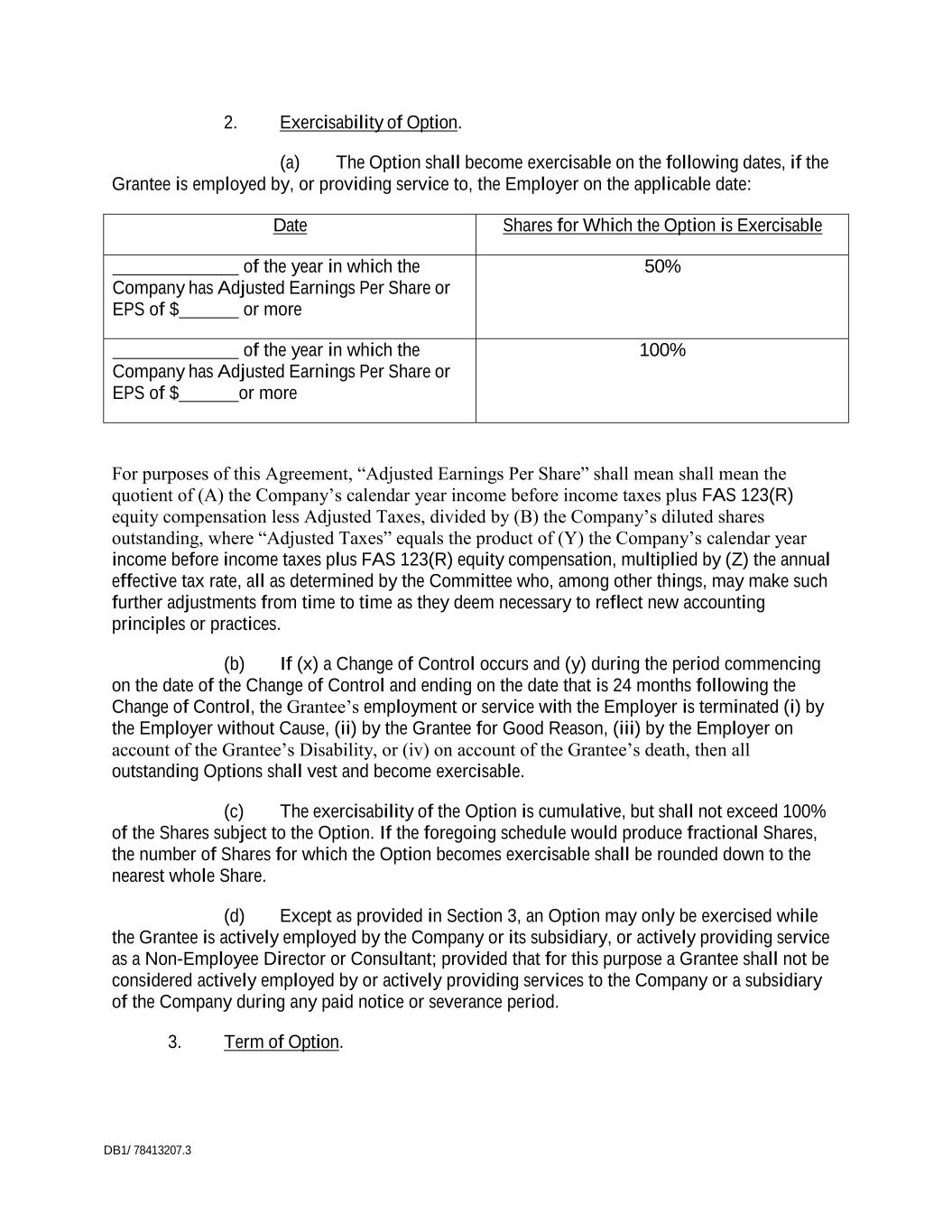

DB1/ 78413207.3 2. Exercisability of Option. (a) The Option shall become exercisable on the following dates, if the Grantee is employed by, or providing service to, the Employer on the applicable date: Date Shares for Which the Option is Exercisable of the year in which the Company has Adjusted Earnings Per Share or EPS of $ or more 50% of the year in which the Company has Adjusted Earnings Per Share or EPS of $ or more 100% For purposes of this Agreement, “Adjusted Earnings Per Share” shall mean shall mean the quotient of (A) the Company’s calendar year income before income taxes plus FAS 123(R) equity compensation less Adjusted Taxes, divided by (B) the Company’s diluted shares outstanding, where “Adjusted Taxes” equals the product of (Y) the Company’s calendar year income before income taxes plus FAS 123(R) equity compensation, multiplied by (Z) the annual effective tax rate, all as determined by the Committee who, among other things, may make such further adjustments from time to time as they deem necessary to reflect new accounting principles or practices. (b) If (x) a Change of Control occurs and (y) during the period commencing on the date of the Change of Control and ending on the date that is 24 months following the Change of Control, the Grantee’s employment or service with the Employer is terminated (i) by the Employer without Cause, (ii) by the Grantee for Good Reason, (iii) by the Employer on account of the Grantee’s Disability, or (iv) on account of the Grantee’s death, then all outstanding Options shall vest and become exercisable. (c) The exercisability of the Option is cumulative, but shall not exceed 100% of the Shares subject to the Option. If the foregoing schedule would produce fractional Shares, the number of Shares for which the Option becomes exercisable shall be rounded down to the nearest whole Share. (d) Except as provided in Section 3, an Option may only be exercised while the Grantee is actively employed by the Company or its subsidiary, or actively providing service as a Non-Employee Director or Consultant; provided that for this purpose a Grantee shall not be considered actively employed by or actively providing services to the Company or a subsidiary of the Company during any paid notice or severance period. 3. Term of Option.

DB1/ 78413207.3 (a) The Option shall have a term of ten years from the Date of Grant and shall terminate at the expiration of that period, unless it is terminated at an earlier date pursuant to the provisions of this Agreement or the Plan. (b) The Option shall automatically terminate upon the happening of the first of the following events: (i) The expiration of the 90-day period after the Grantee ceases to be employed by, or provide service to, the Employer, if the termination is for any reason other than Disability, death or Cause. (ii) The expiration of the one-year period after the Grantee ceases to be employed by, or provide service to, the Employer on account of the Grantee’s Disability. (iii) The expiration of the one-year period after the Grantee ceases to be employed by, or provide service to, the Employer, if the Grantee dies while employed by, or providing service to, the Employer or within 90 days after the Grantee ceases to be so employed or provide such services on account of a termination described in subparagraph (i) above. (iv) The date on which the Grantee ceases to be employed by, or provide service to, the Employer for Cause. In addition, notwithstanding the prior provisions of this Section 3, if the Grantee engages in conduct that constitutes Cause after the Grantee’s employment or service terminates, the Option shall immediately terminate. (v) Notwithstanding the foregoing in this Section 3(b), to the extent the Option vests and becomes exercisable in accordance with Section 2(b) above, the Option will remain exercisable for 12 months following the termination of the Grantee’s employment or service. (c) Notwithstanding the foregoing, in no event may the Option be exercised after the date that is the tenth anniversary of the Date of Grant. Any portion of the Option that is not exercisable at the time the Grantee ceases to be employed by, or provide service to, the Employer shall immediately terminate. 4. Exercise Procedures. (a) Subject to the provisions of Sections 2 and 3 above, the Grantee may exercise part or all of the exercisable Option by giving the Company written notice of intent to exercise in the manner provided in this Agreement, specifying the number of Shares as to which the Option is to be exercised and the method of payment. Payment of the Exercise Price shall be made in accordance with procedures established by the Committee from time to time based on the type of payment being made but, in any event, prior to issuance of the Shares. The Grantee shall pay the Exercise Price (i) in cash or by check, (ii) if permitted by the Committee, by delivering Shares owned by the Grantee and having a Fair Market Value on the date of exercise equal to the Exercise Price or by attestation to ownership of Shares having an aggregate Fair

DB1/ 78413207.3 Market Value on the date of exercise equal to the Exercise Price, (iii) by payment through a broker in accordance with procedures permitted by Regulation T of the Federal Reserve Board, (iv) with approval of the Committee, by surrender of all or any part of the vested Shares for which the Option is exercisable to the Company for an appreciation distribution payable in Shares with a Fair Market Value at the time of the Option surrender equal to the dollar amount by which the then Fair Market Value of the Shares subject to the surrendered portion exceeds the aggregate Exercise Price payable for those Shares, or (v) by such other method as the Committee may approve, to the extent permitted by applicable law. The Committee may impose from time to time such limitations as it deems appropriate on the use of Shares to exercise the Option. (b) The obligation of the Company to deliver Shares upon exercise of the Option shall be subject to all applicable laws, rules, and regulations and such approvals by governmental agencies as may be deemed appropriate by the Committee, including such actions as Company counsel shall deem necessary or appropriate to comply with relevant securities laws and regulations. The Company may require that the Grantee (or other person exercising the Option after the Grantee’s death) represent that the Grantee is purchasing Shares for the Grantee’s own account and not with a view to or for sale in connection with any distribution of the Shares, or such other representation as the Committee deems appropriate. (c) All obligations of the Company under this Agreement shall be subject to the rights of the Company as set forth in the Plan to withhold amounts required to be withheld for any taxes, if applicable. Subject to Committee approval, the Grantee may elect to satisfy any tax withholding obligation of the Employer with respect to the Option by having Shares withheld up to an amount that does not exceed the minimum applicable withholding tax rate for federal (including FICA), state and local tax liabilities. (d) In the event that the relationship of the Grantee and the Company terminates on or after December 31 of a year but before the issuance of an auditor’s opinion for that confirms that a vesting has occurred, then the Option shall be exercisable for such vested shares after the date of issuance of such audit opinion during the remainder of the term of the option determined pursuant to Section 3(b). For the avoidance of ambiguity, if the Grantee’s option terminates pursuant to Section 3(b)(iv) on or after December 31 of a year and before such auditor’s opinion is issued, the Option is terminated and the Grantee shall not be entitled to exercise the Option to acquire the shares which would have vested as a result of the issuance of such auditor’s opinion. 5. Change of Control. Except as set forth in Section 2 above, the provisions of the Plan applicable to a Change of Control shall apply to the Option, and, in the event of a Change of Control, the Committee may take such actions as it deems appropriate pursuant to the Plan. 6. Restrictions on Exercise. Except as the Committee may otherwise permit pursuant to the Plan, only the Grantee may exercise the Option during the Grantee’s lifetime and, after the Grantee’s death, the Option shall be exercisable (subject to the limitations specified in the Plan) solely by the legal representatives of the Grantee, or by the person who acquires the right to exercise the Option by will or by the laws of descent and distribution, to the extent that the Option is exercisable pursuant to this Agreement.

DB1/ 78413207.3 7. Grant Subject to Plan Provisions. This grant is made pursuant to the Plan, the terms of which are incorporated herein by reference, and in all respects shall be interpreted in accordance with the Plan. The grant and exercise of the Option are subject to interpretations, regulations and determinations concerning the Plan established from time to time by the Committee in accordance with the provisions of the Plan, including, but not limited to, provisions pertaining to (i) rights and obligations with respect to withholding taxes, (ii) the registration, qualification or listing of the Shares, (iii) changes in capitalization of the Company and (iv) other requirements of applicable law. The Committee shall have the authority to interpret and construe this Agreement and the Option pursuant to the terms of the Plan, and its decisions shall be conclusive as to any questions arising hereunder. 8. Entire Agreement. This Agreement contains the entire agreement of the parties with respect to the Option granted hereby and may not be changed orally but only by an instrument in writing signed by the party against whom enforcement of any change, modification or extension is sought. 9. No Employment or Other Rights. The grant of the Option shall not confer upon the Grantee any right to be retained by or in the employ or service of the Employer and shall not interfere in any way with the right of the Employer to terminate the Grantee’s employment or service at any time. The right of the Employer to terminate at will the Grantee’s employment or service at any time for any reason is specifically reserved. 10. No Shareholder Rights. Neither the Grantee, nor any person entitled to exercise the Grantee’s rights in the event of the Grantee’s death, shall have any of the rights and privileges of a shareholder with respect to the Shares subject to the Option, until Shares have been transferred on the Company’s books. 11. Assignment and Transfers. Except as the Committee may otherwise permit pursuant to the Plan, the rights and interests of the Grantee under this Agreement may not be sold, assigned, encumbered or otherwise transferred, except by will or the laws of descent and distribution to immediate family members, or such other specified entity created for the exclusive benefit of the Grantee’s immediate family members. In the event of any attempt by the Grantee to alienate, assign, pledge, hypothecate, or otherwise dispose of the Option or any right hereunder, except as provided for in this Agreement, or in the event of the levy or any attachment, execution or similar process upon the rights or interests hereby conferred, the Company may terminate the Option by notice to the Grantee, and the Option and all rights hereunder shall thereupon become null and void. The rights and protections of the Company hereunder shall extend to any successors or assigns of the Company and to the Company’s parents, subsidiaries, and affiliates. This Agreement may be assigned by the Company without the Grantee’s consent. 12. Applicable Law. The validity, construction, interpretation and effect of this instrument shall be governed by and construed in accordance with the laws of the Commonwealth of Pennsylvania, without giving effect to the conflicts of laws provisions thereof 13. Notice. Any notice to the Company provided for in this instrument shall be addressed to the Company in care of the Chief Financial Officer at the Company’s corporate

DB1/ 78413207.3 headquarters, and any notice to the Grantee shall be addressed to such Grantee at the current address shown on the payroll records of the Employer, or to such other address as the Grantee may designate to the Employer in writing. Any notice shall be delivered by hand, sent by telecopy or enclosed in a properly sealed envelope addressed as stated above, registered and deposited, postage prepaid, in a post office regularly maintained by the United States Postal Service. 14. Application of Section 409A of the Code. This Agreement is intended to be exempt from section 409A of the Internal Revenue Code of 1986, as amended (the “Code”) and to the extent this Agreement is subject to section 409A of the Code, it will in all respects be administered in accordance with section 409A of the Code. 15. Clawback Rights. The Grantee agrees that the Grantee will be subject to any compensation, clawback and recoupment policies that may be applicable to the employees of the Company, as in effect from time to time and is approved by the Board or Committee, whether or not approved before or after the effective date of the Plan. 16. Statute of Limitations. The Grantee or any other person filing a claim for benefits under the Plan must file the claim within one year after the Grantee or other person knew or reasonably should have known of the principal facts on which the claim is based. 17. Optionee Acknolwedgements. By Grantee’s acceptance of the Option represented by this Grant Agreement, Optionee acknowledges and agrees, and this Option is conditioned upon such acknowledgement and agreement, that: (a) Grantee agrees to be bound by the terms and conditions of the Plan and this Agreement and accepts the Option. (b) The Grantee accepts as binding, conclusive and final, all decisions or interpretations of the Committee upon any questions arising under the Plan or this Agreement. (c) The Grantee acknowledges delivery of the Plan and the Plan prospectus together with this Agreement and acknowledges that additional copies of the Plan and the Plan prospectus are available at the intranet site at http://www.corp.seic.com/portal/ or by contacting the Company’s Human Resources Department at .

DB1/ 78413207.3 IN WITNESS WHEREOF, the Company has caused its duly authorized officers to execute and attest this Agreement, and the Grantee has executed this Agreement, effective as of the Date of Grant. SEI INVESTMENTS COMPANY By: Title: