SECURITIES EXCHANGE ACT OF 1934

|

Kentucky

(state or other jurisdiction of incorporation) |

001-31220

(commission file number) |

61-0979818

(irs employer identification no.) |

|

346 North Mayo Trail, Pikeville, Kentucky

(address of principal executive offices) |

41501

(zip code) |

|

|

Registrant’s telephone number, including area code (606) 432-1414

|

||

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee

is calculated and state how it was determined):

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

(5)

|

Total fee paid:

|

| ◻ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing

by registration statement number, or the Form or Schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

(2)

|

Form, Schedule, or Registration Statement No.:

|

|

(3)

|

Filing Party:

|

|

(4)

|

Date Filed:

|

|

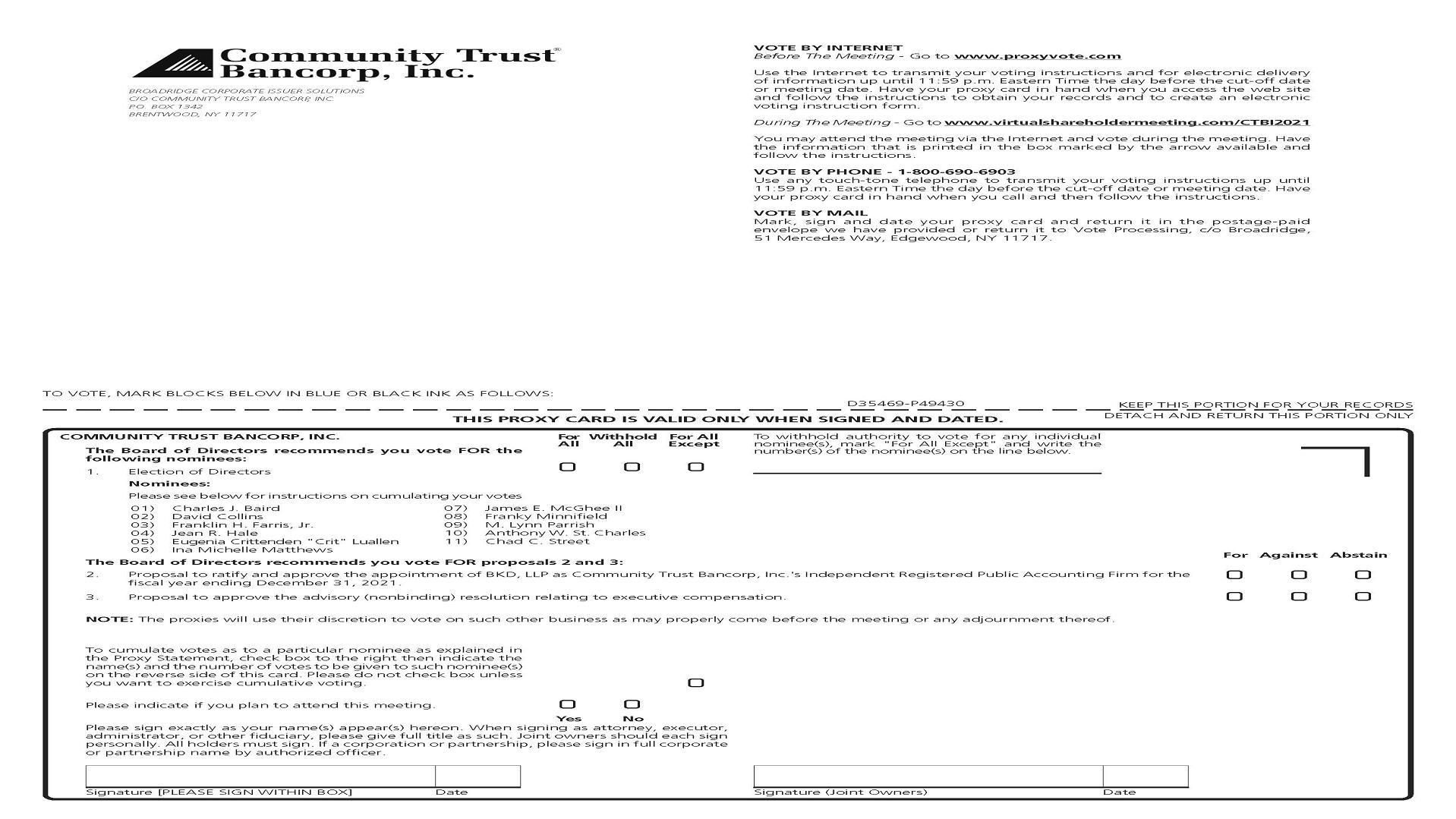

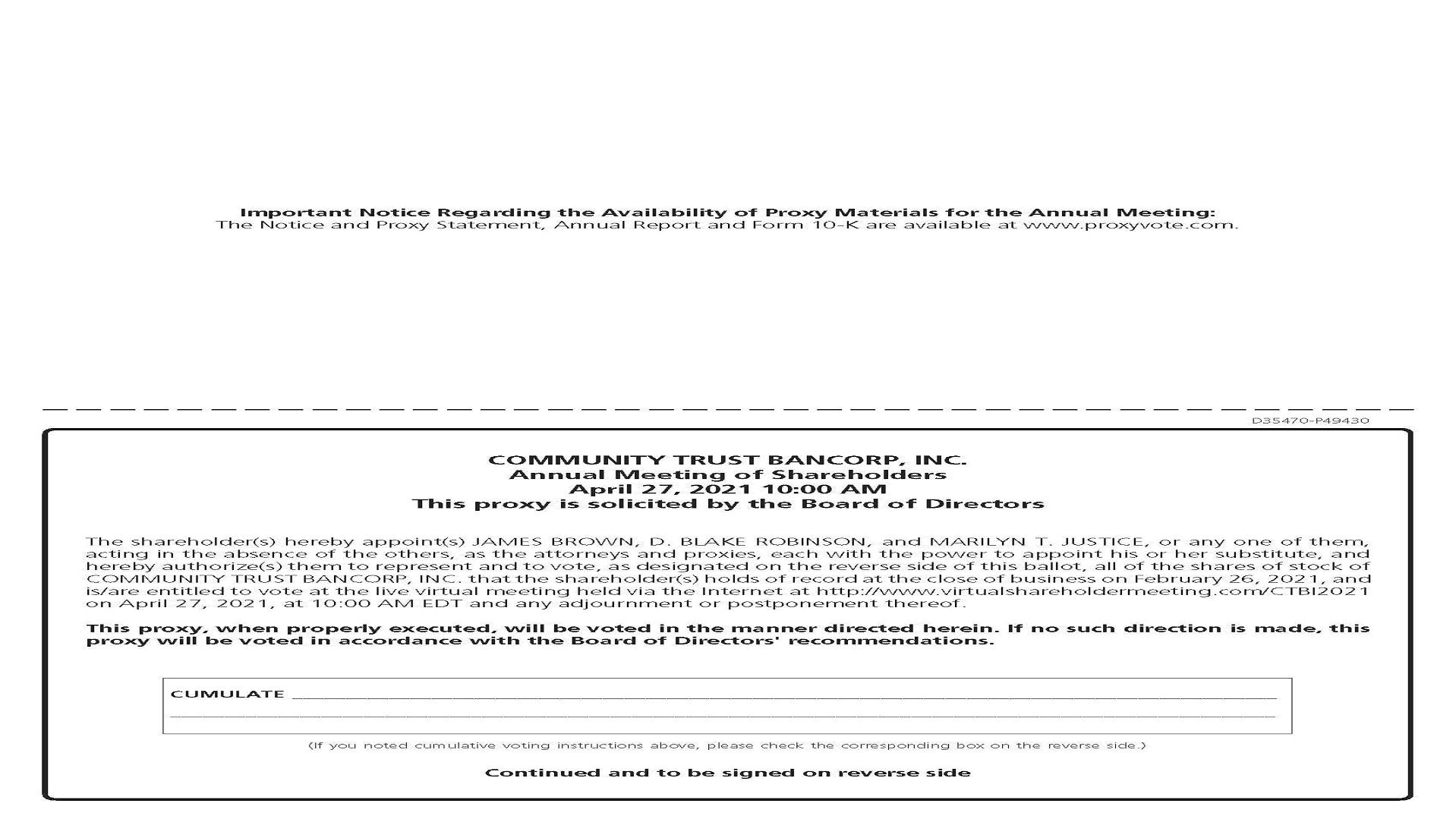

1.

|

To elect a Board of eleven directors to hold office until the next Annual Meeting of Shareholders and until their successors are elected and

qualify.

|

|

2.

|

To ratify and approve the appointment of BKD, LLP as CTBI’s Independent Registered Public Accounting Firm for the fiscal year ending December 31,

2021.

|

|

3.

|

To approve the advisory (nonbinding) resolution relating to executive compensation.

|

|

4.

|

To transact such other business as may properly come before the meeting or any adjournment thereof.

|

|

•

|

Notice of Annual Meeting of Shareholders

|

|

•

|

CTBI’s Proxy Statement

|

|

•

|

CTBI’s 2020 Annual Report to Shareholders

|

|

•

|

Form of Proxy

|

|

Beneficial Owner

|

Amount and Nature

|

Percent

|

|

Name and Address

|

of Beneficial Ownership

|

of Class

|

|

Community Trust and Investment Company

|

1,859,586 (1)

|

10.4%

|

|

As Fiduciary

|

||

|

100 East Vine St., Suite 501

|

||

|

Lexington, Kentucky 40507

|

||

|

BlackRock Inc.

|

1,309,315 (2)

|

7.3%

|

|

55 East 52nd Street

|

||

|

New York, NY 10055

|

||

|

Dimensional Fund Advisors LP

|

1,117,808 (3)

|

6.3%

|

|

100 Vanguard Blvd.

|

||

|

Malvern, PA 19355

|

|

(1)

|

The shares indicated are held by Community Trust and Investment Company, a subsidiary of CTBI, in fiduciary capacities as trustee, executor, agent,

or otherwise. Of the shares indicated, Community Trust and Investment Company has sole voting rights with respect to 1,263,030 shares and no voting rights with respect to 596,556 shares. Community Trust and Investment Company has sole

investment authority with respect to 473,629 shares, shared investment authority with respect to 92,925 shares, no investment authority with respect to 30,002 shares, and directed investment authority with respect to 1,263,030 shares;

786,979 shares are held by CTBI’s Employee Stock Ownership Plan (“ESOP”) and 476,051 shares are held by the 401(k) Plan. Each participant for whom shares are maintained in his or her ESOP or 401(k) Plan account is entitled to direct the

Trustee as to the manner in which voting rights will be exercised with respect to such shares. The Trustee will vote in its discretion all unallocated shares and all shares for which no voting instructions are timely received.

|

|

(2)

|

This information is taken from a Schedule 13G/A filed January 29, 2021 with respect to holdings of BlackRock Inc. subsidiaries as of December 31,

2020. The Schedule 13G/A reports sole voting power with respect to 1,279,945 shares and sole dispositive power with respect to 1,309,315 shares.

|

|

(3)

|

This information is taken from a Schedule 13G/A filed February 12, 2021 with respect to holdings of Dimensional Fund Advisors LP and its

subsidiaries as of December 31, 2020. The Schedule 13G/A reports sole voting power with respect to 1,056,685 shares and sole dispositive power with respect to 1,117,808 shares.

|

|

Amount and Nature of

|

Percent

|

||

|

Name

|

Beneficial Ownership

|

(1)

|

of Class

|

|

Charles J. Baird

|

204,190

|

(3)

|

1.1%

|

|

Nick Carter

|

3,000

|

(2)

|

|

|

Franklin H. Farris, Jr.

|

1,650

|

(2)

|

|

|

Jean R. Hale

|

153,565

|

(4)

|

(2)

|

|

Eugenia Crittenden “Crit” Luallen

|

0

|

(2)

|

|

|

James E. McGhee II

|

29,915

|

(2)

|

|

|

Franky Minnifield

|

9,385

|

(2)

|

|

|

M. Lynn Parrish

|

174,242

|

(5)

|

1.0%

|

|

Anthony W. St. Charles

|

10,061

|

(2)

|

|

|

All directors and executive officers as a group

(19 in number including the above named individuals)

|

847,622

|

(6)

|

4.8%

|

| (1) |

Under the rules of the Securities and Exchange Commission, a person is deemed to beneficially own a security if the person has or shares the power to vote or direct the voting of such security

or the power to dispose or to direct the disposition of such security. A person is also deemed to beneficially own any shares of which that person has the right to acquire beneficial ownership within sixty days. Shares of Common Stock

subject to options exercisable within sixty days are deemed outstanding for computing the percentage of class of the person holding such options but are not deemed outstanding for computing the percentage of class for any other person.

Unless otherwise indicated, the named persons have sole voting and investment power with respect to shares held by them. Beneficial ownership of CTBI Common Stock is shown as of the Record Date.

|

| (2) |

Less than 1 percent.

|

| (3) |

Includes 6,213 shares held as trustee under various trust agreements established by Mr. Baird’s mother, Florane J. Baird, for her grandchildren, 129,000 shares held as trustee of the Bryan M.

Johnson Testamentary Trust FBO Rosemary Dean, 30,800 shares held as trustee of the Carolyn A. Baird Family Trust, 220 shares held as trustee under various trust agreements established for Mr. Baird’s grandchildren, and 257 shares held by Mr.

Baird’s wife, over which Mr. Baird has no voting or investment power.

|

| (4) |

Includes 3,645 restricted shares awarded under CTBI’s stock ownership plans, 26,458 shares held in the ESOP, and 87,666 shares held in the 401(k) Plan which she has the power to vote.

|

| (5) |

Includes 113,796 shares held by Mr. Parrish’s wife, Jessica J. Parrish, as trustee of the Trust under the M. Lynn Parrish 2006 GRAT over which Mr. Parrish has no voting or investment power.

|

| (6) |

Includes 20,000 shares which may be acquired by all directors and executive officers as a group pursuant to options exercisable within sixty days of the Record Date.

|

|

Name

|

Position

|

Amount and Nature of Beneficial Ownership

|

Percent

of Class

|

|

|

James B. Draughn

|

Executive Vice President

|

37,704

|

(2)

|

(1)

|

|

James J. Gartner

|

Executive Vice President

|

1,694

|

(3)

|

(1)

|

|

Mark A. Gooch

|

Executive Vice President and Secretary

|

66,237

|

(4)

|

(1)

|

|

Charles Wayne Hancock

|

Executive Vice President

|

8,139

|

(5)

|

(1)

|

|

D. Andrew Jones

|

Executive Vice President

|

27,998

|

(6)

|

(1)

|

|

Larry W. Jones

|

Executive Vice President

|

13,266

|

(7)

|

(1)

|

|

Richard W. Newsom

|

Executive Vice President

|

35,555

|

(8)

|

(1)

|

|

Ricky D. Sparkman

|

Executive Vice President

|

29,449

|

(9)

|

(1)

|

|

Kevin J. Stumbo

|

Executive Vice President, CFO and Treasurer

|

24,467

|

(10)

|

(1)

|

|

Andy D. Waters

|

Executive Vice President

|

17,107

|

(11)

|

(1)

|

| (1) |

Less than 1 percent.

|

| (2) |

Includes 8,717 restricted shares awarded under CTBI’s stock ownership plans, 11,296 shares held in the ESOP, and 15,248 shares held in the 401(k) Plan which Mr. Draughn has the power to vote.

|

| (3) |

Includes 984 restricted shares awarded under CTBI’s stock ownership plans, 139 shares held in the ESOP, and 71 shares held in the 401(k) Plan which Mr. Gartner has the power to vote.

|

| (4) |

Includes 2,267 restricted shares awarded under CTBI’s stock ownership plans, 18,624 shares held in the ESOP, and 21,367 shares held in the 401(k) Plan which Mr. Gooch has the power to vote.

|

| (5) |

Includes 1,057 restricted shares awarded under CTBI’s stock ownership plans, 3,584 shares held in the ESOP, and 2,079 shares held in the 401(k) Plan which Mr. Hancock has the power to vote.

|

| (6) |

Includes 10,000 shares which Mr. Andrew Jones may acquire pursuant to options exercisable within sixty days of the Record Date, but over which he has no power to vote, and 1,003 restricted

shares awarded under CTBI’s stock ownership plans, 9,355 shares held in the ESOP, and 2,688 shares held in the 401(k) Plan which he has the power to vote.

|

| (7) |

Includes 1,224 restricted shares awarded under CTBI’s stock ownership plans, 1,656 shares held in the ESOP, and 1,859 shares held in an individual retirement account which Mr. Larry Jones has

the power to vote.

|

| (8) |

Includes 1,125 restricted shares awarded under CTBI’s stock ownership plans, 13,959 shares held in the ESOP, 12,536 shares held in the 401(k) Plan which Mr. Newsom has the power to vote, and

124 shares held by Mr. Newsom’s wife, over which Mr. Newsom has no voting or investment power.

|

| (9) |

Includes 1,125 restricted shares awarded under CTBI’s stock ownership plans, 9,397 shares held in the ESOP, 6,091 shares held in the 401(k) Plan, and 234 shares held in an individual

retirement account which Mr. Sparkman has the power to vote.

|

| (10) |

Includes 1,228 restricted shares awarded under CTBI’s stock ownership plans, 10,158 shares held in the ESOP, and 11,994 shares held in the 401(k) Plan which Mr. Stumbo has the power to vote.

|

| (11) |

Includes 10,000 shares which Mr. Waters may acquire pursuant to options exercisable within sixty days of the Record Date, but over which he has no power to vote, and 1,036 restricted shares

awarded under CTBI’s stock ownership plans and 5,241 shares held in the ESOP which he has the power to vote.

|

|

Director

|

2020 Fees Paid

|

||||

|

Charles J. Baird

|

$

|

46,100

|

(1) |

|

|

|

Nick Carter

|

52,700

|

(1) |

|

||

|

Franklin H. Farris, Jr.

|

55,900

|

||||

|

Jean R. Hale

|

0

|

(2) |

|

||

|

Eugenia Crittenden “Crit” Luallen

|

49,340

|

(1)(3) |

|||

|

James E. McGhee II

|

51,000

|

||||

|

Franky Minnifield

|

47,380

|

(3) |

|

||

|

M. Lynn Parrish

|

51,300

|

||||

|

Anthony W. St. Charles

|

46,200

|

||||

|

Total

|

$

|

399,920

|

|||

|

•

|

The Chief Executive Officer is the director most familiar with CTBI’s business and is best suited to lead discussions on important matters

affecting CTBI’s business;

|

|

•

|

The combination of the roles creates a firm link between management and the Board and facilitates the development and implementation of corporate

strategy; and

|

|

•

|

The combination of the positions contributes to a more effective and efficient Board, and the Board believes it does not undermine the Board’s

independence, particularly in light of the role played by the Board’s lead independent director.

|

|

2020

|

2019

|

|||||||

|

Audit fees

|

$

|

403,000

|

$

|

356,999

|

||||

|

Audit related fees

|

50,960

|

46,392

|

||||||

|

Subtotal

|

453,960

|

403,391

|

||||||

|

Tax fees

|

56,080

|

41,780

|

||||||

|

Total

|

$

|

510,040

|

$

|

445,171

|

||||

|

Median employee total annual compensation

|

$

|

35,091

|

||

|

Ms. Hale (PEO) total annual compensation

|

$

|

1,165,733

|

||

|

Ratio of PEO to median employee compensation

|

33.2:1.0

|

|||

|

•

|

Manage executive officer salaries toward the median of market values (i.e., the middle of the range of competitive practices), contingent on the

executives meeting or exceeding performance standards.

|

|

•

|

Increase the cash incentive opportunity under the Senior Management Incentive Compensation Plan (“Incentive Plan”).

|

|

•

|

Slightly reduce the stock-based incentive opportunity under the Incentive Plan in order to offset some of the increase in cash incentives and

control the potential dilution to shareholders that could result from the use of stock-based incentives.

|

|

•

|

Introduce a performance-based long-term incentive plan.

|

|

•

|

Assessment of Company Performance – The Committee considers various measures of company and industry

performance, including but not limited to asset growth, asset quality, earnings per share, return on assets, return on equity, total shareholder return, and execution of CTBI’s growth strategy and annual business plan. In addition, the

Committee considers general economic conditions within CTBI’s primary markets, as well as CTBI’s relationships with its regulators and the results of any recent exams. The Committee does not apply a formula or assign relative weights to

these measures. Instead it makes a subjective determination after considering such measures individually and collectively.

|

|

•

|

Assessment of Individual Performance – Individual performance assessments impact the compensation of all

CTBI employees, including the CEO and other Named Executive Officers. The Committee evaluates CEO performance relative to company performance and other factors, such as leadership, strategic planning, board relations, and relationships

with customers, regulators and others outside the company. As with its assessments of company performance, the Committee does not apply a formula or assign relative weights to any of these measures, and the measures deemed most important

by the Committee may vary from year to year. The process is subjective, but it results in an informed judgment of CEO performance. The Committee reviews the performance of other executive officers and considers the CEO’s recommendations

concerning the officers’ achievements. Additionally, the Committee applies its own judgment based on the interactions of the Board and/or the Committee with each executive officer, their contributions to CTBI’s performance and other

leadership accomplishments.

|

|

•

|

Total Compensation Review – The Committee annually reviews each executive’s base salary, annual incentive

compensation, and stock-based incentives. In addition to these primary compensation elements, the Committee reviews other executive compensation arrangements, including, for example, payments that could be required under various severance

and change in control scenarios. This “holistic” review process ensures that the Committee considers the executive’s total compensation prior to changing any single component.

|

|

•

|

Risk Management – The Committee reviews all incentive plans and compensation programs to insure the plans

do not create any risks that are reasonably likely to have a material adverse impact on CTBI.

|

|

•

|

Base Salaries

|

|

•

|

Annual Incentive Plan

|

|

•

|

Long-Term Incentive Plan

|

|

•

|

Benefits and Perquisites

|

|

•

|

Employment Contracts, Termination of Employment, and Change in Control Arrangements

|

|

|

Base Salary

|

Base Salary

|

% Increase

|

|||||||||

|

|

2020

|

2021

|

2020 to 2021

|

|||||||||

|

Jean R. Hale

Chairman, President, and Chief Executive Officer

|

$

|

675,000

|

$

|

700,000

|

3.70

|

%

|

||||||

|

|

||||||||||||

|

Kevin J. Stumbo

Executive Vice President, Chief Financial Officer and Treasurer

|

$

|

315,000

|

$

|

325,000

|

3.17

|

%

|

||||||

|

|

||||||||||||

|

Mark A. Gooch

Executive Vice President and Secretary

|

$

|

475,000

|

$

|

490,000

|

3.16

|

%

|

||||||

|

|

||||||||||||

|

James B. Draughn

Executive Vice President

|

$

|

302,000

|

$

|

312,000

|

3.31

|

%

|

||||||

|

|

||||||||||||

|

Larry W. Jones

Executive Vice President

|

$

|

300,000

|

$

|

309,000

|

3.00

|

%

|

||||||

|

•

|

Increase the profitability and growth of CTBI in a manner which is consistent with other goals of the company.

|

|

•

|

Pay for performance.

|

|

•

|

Provide an incentive opportunity which is competitive with other financial institutions in the Peer Group.

|

|

•

|

Attract and retain executive officers and other key employees and encourage excellence in the performance of individual responsibilities.

|

|

•

|

Motivate and appropriately reward those members of senior management who contribute to the success of CTBI.

|

|

•

|

Cash Payments. Based upon a recommendation of the Committee and approval by the Board of Directors, cash

payments were made to the Named Executive Officers (as shown in the chart below) due to the unique circumstances of 2020, the difficult conditions under which everyone worked, and the extraordinary performance of the executive team,

although CTBI did not achieve the minimum level of performance under the 2020 Incentive Plan. Such payments were made in reliance on the discretionary provisions set forth in the Plan’s governance

documentation.

|

|

Discretionary Cash Payments Awarded under the 2020 Annual Incentive Plan ($)

|

|

|

Jean R. Hale – Chairman, President and Chief Executive Officer

|

85,006

|

|

Kevin J. Stumbo – Executive Vice President, Chief Financial Officer, and Treasurer

|

23,801

|

|

Mark A. Gooch – Executive Vice President and Secretary

|

47,855

|

|

James B. Draughn– Executive Vice President

|

22,819

|

|

Larry W. Jones – Executive Vice President

|

22,668

|

|

•

|

Restricted Stock Awards. Based upon a recommendation of the Committee and approval by the Board of

Directors, restricted stock was also granted to the Named Executive Officers (as shown in the chart below) due to the unique circumstances of 2020, the difficult conditions under which everyone worked,

and the extraordinary performance of the management team, although CTBI did not achieve the minimum level of performance under the 2020 Incentive Plan. Using its discretion as defined in the Plan’s governance

documentation, the restricted stock was granted pursuant to the terms of CTBI’s 2015 Stock Ownership Incentive Plan. The restrictions on the restricted stock will lapse ratably over four years.

|

|

Discretionary Restricted Stock Grants Awarded under the 2020

Annual Incentive Plan (Shares)

|

|

|

Jean R. Hale – Chairman, President and Chief Executive Officer

|

728

|

|

Kevin J. Stumbo – Executive Vice President, Chief Financial Officer, and Treasurer

|

248

|

|

Mark A. Gooch – Executive Vice President and Secretary

|

451

|

|

James B. Draughn – Executive Vice President

|

244

|

|

Larry W. Jones – Executive Vice President

|

244

|

|

•

|

Maintain the cash incentives payable at the same levels as 2020 if results are within the performance ranges established by the Committee for ROAA

and EPS.

|

|

•

|

Maintain the stock-based incentives payable to Named Executive Officers at the same levels of the 2020 plan if results are within the performance

ranges established by the Committee for ROAA and EPS.

|

|

•

|

Maintain the continued service period of four years for executive officers to fully vest in stock awards made under the Incentive Plan, which vest

in 25% increments each year.

|

|

•

|

Continue to allow executives to earn modest cash and stock incentives if results are slightly below the target (base) level, so long as performance

meets or exceeds minimum levels of performance approved by the Committee; the minimum required level of ROAA performance was set at 98% of the target (base) level, and the minimum required level of EPS performance was also set at 98% of the

target (base) level; the portion of the cash and stock incentives earned for minimum levels of performance remain at 50% of the target (base) incentive award.

|

|

•

|

Continue to allow executives to earn target (base) level incentives if the goal for net income (about $68.5 million) is achieved.

|

|

•

|

Maintain the maximum incentive potential provided by the plan at 200% of the target (base) award, the same percentage applicable in the 2020 Plan.

|

|

Target*

|

Cash Incentive Award as a % of Salary

|

|||||||||||||||||||||||

|

ROAA

|

EPS

|

% of Target Award Earned

|

CTBI CEO

|

CTB CEO

|

Other NEOs

|

|||||||||||||||||||

|

1.29

|

%

|

$

|

3.76

|

50

|

%

|

25

|

%

|

20

|

%

|

15

|

%

|

|||||||||||||

|

Base

|

1.32

|

%

|

$

|

3.84

|

100

|

%

|

50

|

%

|

40

|

%

|

30

|

%

|

||||||||||||

|

1.35

|

%

|

$

|

3.93

|

150

|

%

|

75

|

%

|

60

|

%

|

45

|

%

|

|||||||||||||

|

1.38

|

%

|

$

|

4.02

|

200

|

%

|

100

|

%

|

80

|

%

|

60

|

%

|

|||||||||||||

|

Target

|

Stock Award as a % of Salary

|

|||||||||||||||||||||||

|

ROAA*

|

EPS*

|

% of Target Award Earned

|

CTBI CEO

|

CTB CEO

|

Other NEOs

|

|||||||||||||||||||

|

1.29

|

%

|

$

|

3.76

|

50

|

%

|

10

|

%

|

8.757

|

%

|

7.50

|

%

|

|||||||||||||

|

Base

|

1.32

|

%

|

$

|

3.84

|

100

|

%

|

20

|

%

|

17.515

|

%

|

15.00

|

%

|

||||||||||||

|

1.35

|

%

|

$

|

3.93

|

105

|

%

|

21

|

%

|

18.375

|

%

|

15.75

|

%

|

|||||||||||||

|

1.38

|

%

|

$

|

4.02

|

115

|

%

|

23

|

%

|

20.125

|

%

|

17.25

|

%

|

|||||||||||||

|

|

Award as a %

|

Award as a % of Salary

|

||

|

Cumulative Net Income vs. Target

|

of Target

|

CTBI CEO

|

CTB CEO

|

Other NEOs

|

|

90% of Target (Minimum)

|

25%

|

10.0%

|

7.5%

|

5.0%

|

|

93% of Target

|

50%

|

20.0%

|

15.0%

|

10.0%

|

|

96% of Target

|

75%

|

30.0%

|

22.5%

|

15.0%

|

|

100% of Target Cumulative

Net Income (Target)

|

100%

|

40.0%

|

30.0%

|

20.0%

|

|

103% of Target

|

120%

|

48.0%

|

36.0%

|

24.0%

|

|

107% of Target

|

135%

|

54.0%

|

40.5%

|

27.0%

|

|

110% of Target (Maximum)

|

150%

|

60.0%

|

45.0%

|

30.0%

|

|

2020 Cash Incentive Awarded Under the Long-Term Incentive Compensation Plan ($)

|

|

|

Jean R. Hale – Chairman, President and Chief Executive Officer

|

187,500

|

|

Kevin J. Stumbo – Executive Vice President, Chief Financial Officer, and Treasurer

|

42,000

|

|

Mark A. Gooch – Executive Vice President and Secretary

|

100,125

|

|

James B. Draughn – Executive Vice President

|

41,625

|

|

Larry W. Jones – Executive Vice President

|

42,000

|

|

Name and

Principal Position

|

Year

|

Salary

($)

|

Stock Awards

(1) ($)

|

Non-Equity Incentive Plan Compensation (2) ($)

|

All Other

Compensation

(3) ($)

|

Total Compensation

(4) ($)

|

|

Jean R. Hale,

|

2020

|

699,039

|

64,996

|

272,506

|

39,652

|

1,076,193

|

|

Chairman, President and

|

2019

|

648,077

|

125,005

|

342,500

|

37,551

|

1,153,133

|

|

Chief Executive Officer

|

2018

|

623,077

|

59,998

|

485,000

|

40,054

|

1,208,129

|

|

|

|

|

|

|

|

|

|

Kevin J. Stumbo,

|

2020

|

325,577

|

22,141

|

65,802

|

23,768

|

437,288

|

|

Executive Vice President,

|

2019

|

293,846

|

41,984

|

82,500

|

22,983

|

441,313

|

|

Chief Financial Officer

|

2018

|

278,077

|

19,128

|

120,750

|

23,609

|

441,564

|

|

and Treasurer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark A. Gooch,

|

2020

|

492,115

|

40,265

|

147,981

|

27,784

|

708,145

|

|

Executive Vice

|

2019

|

458,846

|

77,922

|

188,525

|

26,887

|

752,180

|

|

President and Secretary

|

2018

|

443,769

|

37,567

|

271,150

|

28,692

|

781,178

|

|

|

|

|

|

|

|

|

|

James B. Draughn,

|

2020

|

312,692

|

133,340

|

64,444

|

37,401

|

547,877

|

|

Executive Vice

|

2019

|

289,039

|

41,613

|

83,250

|

34,432

|

448,334

|

|

President

|

2018

|

276,563

|

19,868

|

121,050

|

31,539

|

449,020

|

|

Larry W. Jones,

|

2020

|

310,769

|

21,740

|

64,668

|

26,982

|

424,159

|

|

Executive Vice

|

2019

|

289,231

|

41,984

|

84,000

|

25,538

|

440,753

|

|

President

|

2018

|

279,256

|

20,262

|

123,000

|

25,847

|

448,365

|

|

(1)

|

The amounts in this column reflect the grant date fair value of all restricted stock awards granted during the years ended December 31, 2020, 2019,

and 2018, under CTBI’s stock ownership plans and in accordance with ASC Topic 718.

|

| (2) |

Non-Equity Incentive Plan Compensation includes amounts paid under the Senior Management Incentive Compensation Plan (“Incentive Plan”), which is open to all executive officers, market

presidents, and senior vice presidents of consolidated functions and the Executive Long-Term Incentive Plan which is open to all executive officers. Individuals below senior vice president level may be recommended and approved by the

Compensation Committee for special awards of options for extraordinary performance under the Incentive Plan. Non-Equity Incentive Plan Compensation for executive officers is earned based on CTBI reaching certain earnings per share and return

on assets goals after accruing for the cost of the incentive compensation. As described below under “Grants of Plan Based Awards,” certain discretionary cash incentive payments were made to the Named Executive Officers for 2020.

|

| (3) |

The compensation represented by the amounts for 2020, 2019, and 2018 set forth in the All Other Compensation column for NEOs is detailed in the following table.

|

|

Name

|

Year

|

Company Contributions to ESOP ($)

|

Company Contributions to 401(k) ($)

|

Perquisites ($)

|

Company Paid Life Insurance Premiums ($)

|

Dividends Received on Restricted Stock ($)

|

Total All Other Compensation ($)

|

|

(a)

|

(a)

|

(b)

|

|||||

|

Jean R. Hale

|

2020

|

11,400

|

13,000

|

-

|

7,823

|

7,429

|

39,652

|

|

2019

|

11,200

|

12,500

|

-

|

6,862

|

6,989

|

37,551

|

|

|

2018

|

11,000

|

12,250

|

-

|

6,014

|

10,790

|

40,054

|

|

|

|

|

|

|

|

|

|

|

|

Kevin J. Stumbo

|

2020

|

11,400

|

8,679

|

-

|

1,219

|

2,470

|

23,768

|

|

2019

|

11,200

|

8,448

|

-

|

1,050

|

2,285

|

22,983

|

|

|

2018

|

11,000

|

8,248

|

-

|

931

|

3,430

|

23,609

|

|

|

|

|

|

|

|

|

|

|

|

Mark A. Gooch

|

2020

|

11,400

|

9,750

|

-

|

1,998

|

4,636

|

27,784

|

|

2019

|

11,200

|

9,500

|

-

|

1,807

|

4,380

|

26,887

|

|

|

2018

|

11,000

|

9,250

|

-

|

1,613

|

6,829

|

28,692

|

|

|

|

|

|

|

|

|

|

|

|

James B. Draughn

|

2020

|

11,400

|

11,798

|

-

|

1,244

|

12,959

|

37,401

|

|

2019

|

11,200

|

12,500

|

-

|

1,114

|

9,618

|

34,432

|

|

|

2018

|

11,000

|

9,250

|

-

|

983

|

10,306

|

31,539

|

|

|

Larry W. Jones

|

2020

|

11,400

|

7,879

|

-

|

5,203

|

2,500

|

26,982

|

|

2019

|

11,200

|

7,608

|

-

|

4,369

|

2,361

|

25,538

|

|

|

2018

|

11,000

|

7,401

|

-

|

3,775

|

3,671

|

25,847

|

| (a) |

For further information regarding the ESOP and 401(k) Plans, see the Compensation Discussion and Analysis.

|

| (b) |

This column includes excess premiums reported as taxable compensation on the NEO’s W-2 for life insurance at three times salary. A similar insurance benefit at three times salary is provided

to all full-time employees on a nondiscriminatory basis.

|

|

Name

|

Grant

Date

|

Payouts Under Non-Equity Incentive Plan Awards (1)

($)

|

All Other Awards: Number of

Securities

Underlying

Options

Granted (2)

(#)

|

Exercise

or Base

Price

($/share)

|

Grant Date Fair Value of Equity Awards (3) ($)

|

|

Jean R. Hale

|

-

|

272,506

|

-

|

-

|

-

|

|

Restricted Stock Grant

|

01/28/2020

|

-

|

1,456

|

44.64

|

64,996

|

|

|

|

|

|

|

|

|

Kevin J. Stumbo

|

-

|

65,802

|

-

|

-

|

-

|

|

Restricted Stock Grant

|

01/28/2020

|

-

|

496

|

44.64

|

22,141

|

|

|

|

|

|

|

|

|

Mark A. Gooch

|

-

|

147,981

|

-

|

-

|

-

|

|

Restricted Stock Grant

|

01/28/2020

|

-

|

902

|

44.64

|

40,265

|

|

|

|

|

|

|

|

|

James B. Draughn

|

-

|

64,444

|

-

|

-

|

-

|

|

Restricted Stock Grant

|

01/28/2020

|

-

|

2,987

|

44.64

|

133,340

|

|

Larry W. Jones

|

-

|

64,668

|

-

|

-

|

-

|

|

Restricted Stock Grant

|

01/28/2020

|

-

|

487

|

44.64

|

21,740

|

| (2) |

Restricted stock grants were earned for performance during the year 2019 and granted on January 28, 2020 under the Incentive Plan. The restrictions on the restricted stock lapse ratably over

four years or upon a change in control of CTBI followed by certain employment termination events. In addition to these restricted stock grants, a management retention restricted stock award was granted to James B. Draughn for 2,500 shares.

The terms of this grant are consistent with the above described restricted stock grants, except the retention award will cliff vest at the end of five years.

|

| (3) |

The grant-date fair value of restricted stock grants was $44.64 per share, measured in accordance with ASC 718.

|

|

Name

|

Year Granted

|

Minimum ($)

|

Target ($)

|

Maximum ($)

|

|

Jean R. Hale

|

2020

|

67,500

|

270,000

|

405,000

|

|

2019

|

65,000

|

260,000

|

390,000

|

|

|

|

|

|

|

|

|

Kevin J. Stumbo

|

2020

|

15,750

|

63,000

|

94,500

|

|

2019

|

14,750

|

59,000

|

88,500

|

|

|

|

|

|

|

|

|

Mark A. Gooch

|

2020

|

35,625

|

142,500

|

213,750

|

|

2019

|

34,500

|

138,000

|

207,000

|

|

|

|

|

|

|

|

|

James B. Draughn

|

2020

|

15,100

|

60,400

|

90,600

|

|

2019

|

14,500

|

58,000

|

87,000

|

|

|

Larry W. Jones

|

2020

|

15,000

|

60,000

|

90,000

|

|

2019

|

14,500

|

58,000

|

87,000

|

|

Name

|

Shares Acquired on Exercise (#)

|

Value Realized (1) ($)

|

Shares Acquired on Vesting (#)

|

Value Realized (1)

($)

|

|

Jean R. Hale

|

0

|

--

|

1,892

|

84,542

|

|

Kevin J. Stumbo

|

0

|

--

|

615

|

27,472

|

|

Mark A. Gooch

|

0

|

--

|

1,187

|

53,044

|

|

James B. Draughn

|

0

|

--

|

627

|

28,016

|

|

Larry W. Jones

|

0

|

--

|

640

|

28,600

|

|

Name

|

Number of Securities Underlying Unexercised Options and Restricted Stock Grants at Fiscal Year-End

(1) (#)

|

Option Exercise Price ($)

|

Expiration Date (2)

|

Value of Unexercised In-the-Money Options and Restricted Stock Grants at Fiscal Year-End (3) ($)

|

||

|

Exercisable

|

Unexercisable

|

Exercisable

|

Unexercisable

|

|||

|

Jean R. Hale

|

||||||

|

Restricted Stock Grants:

|

||||||

|

Granted 01/24/17

|

0

|

418

|

-

|

01/24/21

|

-

|

15,487

|

|

Granted 01/23/18

|

0

|

609

|

-

|

01/23/22

|

-

|

22,563

|

|

Granted 01/29/19

|

0

|

2,280

|

-

|

01/29/23

|

-

|

84,474

|

|

Granted 01/28/20

|

0

|

1,456

|

-

|

01/28/24

|

-

|

53,945

|

|

Kevin J. Stumbo

|

||||||

|

Restricted Stock Grants:

|

||||||

|

Granted 01/24/17

|

0

|

134

|

-

|

01/24/21

|

-

|

4,965

|

|

Granted 01/23/18

|

0

|

194

|

-

|

01/23/22

|

-

|

7,188

|

|

Granted 01/29/19

|

0

|

766

|

-

|

01/29/23

|

-

|

28,380

|

|

Granted 01/28/20

|

0

|

496

|

-

|

01/28/24

|

-

|

18,377

|

|

Mark A. Gooch

|

||||||

|

Restricted Stock Grants:

|

||||||

|

Granted 01/24/17

|

0

|

264

|

-

|

01/24/21

|

-

|

9,781

|

|

Granted 01/23/18

|

0

|

381

|

-

|

01/23/22

|

-

|

14,116

|

|

Granted 01/29/19

|

0

|

1,422

|

-

|

01/29/23

|

-

|

52,685

|

|

Granted 01/28/20

|

0

|

902

|

-

|

01/28/24

|

-

|

33,419

|

|

James B. Draughn

|

||||||

|

Restricted Stock Grants:

|

|

|||||

|

Granted 01/24/17

|

0

|

5,000

|

-

|

01/24/22

|

-

|

185,250

|

|

Granted 01/24/17

|

0

|

138

|

-

|

01/24/21

|

-

|

5,113

|

|

Granted 01/23/18

|

0

|

202

|

-

|

01/23/22

|

-

|

7,484

|

|

Granted 01/29/19

|

0

|

759

|

-

|

01/29/23

|

-

|

28,121

|

|

Granted 01/28/20

|

0

|

487

|

-

|

01/28/24

|

-

|

18,043

|

|

Larry W. Jones

|

||||||

|

Restricted Stock Grants:

|

||||||

|

Granted 01/24/17

|

0

|

142

|

-

|

01/24/21

|

-

|

5,261

|

|

Granted 01/23/18

|

0

|

206

|

-

|

01/23/22

|

-

|

7,632

|

|

Granted 01/29/19

|

0

|

766

|

-

|

01/29/23

|

-

|

28,380

|

|

Granted 01/28/20

|

0

|

487

|

-

|

01/28/24

|

-

|

18,043

|

|

(2)

|

This column represents the date restrictions lapse on restricted stock grants.

|

|

(3)

|

Based on the per share closing price of $37.05 of our common stock at December 31, 2020.

|

|

Name

|

Severance Payment Equal to 2.99 Times Annual Base Salary

(1) ($)

|

Severance Payment Equal to 2.00 Times Annual Base Salary

(2) ($)

|

Acceleration of Restricted Stock Grants

(3) ($)

|

Acceleration of Performance Based Units Payable in Cash

(4) ($)

|

Total (Based on 2.99 Times Annual Base Salary)

(1) ($)

|

Total (Based on 2.00 Times Annual Base Salary)

(2) ($)

|

||||||||||||||||||

|

Jean R. Hale

|

$

|

2,018,250

|

$

|

1,350,000

|

$

|

176,469

|

$

|

152,500

|

$

|

2,347,219

|

$

|

1,678,969

|

||||||||||||

|

Kevin J. Stumbo

|

941,850

|

630,000

|

58,910

|

34,033

|

1,034,793

|

722,943

|

||||||||||||||||||

|

Mark A. Gooch

|

1,420,250

|

950,000

|

110,001

|

80,875

|

1,611,126

|

1,140,876

|

||||||||||||||||||

|

James B. Draughn

|

902,980

|

604,000

|

244,011

|

34,000

|

1,180,991

|

882,011

|

||||||||||||||||||

|

Larry W. Jones

|

897,000

|

600,000

|

59,317

|

34,750

|

991,067

|

694,067

|

||||||||||||||||||

| (1) |

Severance agreements with the NEOs require payment of an amount equal to 2.99 times annual base salary in the event of a change in control of CTBI followed by: (a) a subsequent involuntary

termination; or (b) a voluntary termination preceded by a change in duties.

|

| (2) |

Severance agreements with the NEOs require payment of an amount equal to 2.00 times annual base salary in the event of a voluntary termination not preceded by a change in duties subsequent to

a change in control of CTBI.

|

| (3) |

The restrictions on restricted stock issued prior to 2017 lapse immediately upon a change in control of CTBI. Restrictions on restricted stock issued in 2017 and after, lapse upon a change in

control of CTBI followed by certain employment termination events. The amounts shown for restricted stock represent the number of shares granted multiplied by the per share closing price at December 31, 2020 of $37.05.

|

| (4) |

Upon a change in control, followed by certain employment termination events, any then outstanding performance units shall become fully vested following the change in control, in an amount

which is equal to the greater of (a) the amount payable under the performance unit at the target cumulative net income level multiplied by a percentage equal to the percentage that would have been earned under the terms of the performance

unit agreement assuming that the rate at which the performance goal has been achieved as of the date of such change in control would have been continued until the end of the performance period; or (b) the amount payable under the performance

unit at the target cumulative net income level multiplied by the percentage of the performance period completed by the participant at the time of the change in control.

|