SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

American Pacific Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

AMERICAN PACIFIC CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MARCH 12, 2013

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the 2013 annual meeting of stockholders of American Pacific Corporation, a Delaware corporation, (the “Company”), will be held Tuesday, March 12, 2013, at 11:00 a.m. Local Time, at the Las Vegas Country Club, Rotunda Room, 3000 Joe W. Brown Drive, Las Vegas, Nevada 89109, for the following purposes:

| — | To elect John R. Gibson, Ian D. Haft, Jan H. Loeb and William F. Readdy as Class A directors until the annual meeting of stockholders in 2016 and until their respective successors have been duly elected and qualified. |

| — | To hold an annual advisory vote to approve the Company’s executive compensation. |

| — | To ratify the appointment of BDO USA, LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2013. |

| — | To transact such other business that may properly come before the annual meeting of stockholders or any adjournments or postponements thereof. |

Only stockholders of record at the close of business on January 14, 2013 may vote at the annual meeting of stockholders or any postponements or adjournments thereof. Whether or not you expect to attend the annual meeting of stockholders in person, we urge you to mark, sign, date and return the enclosed proxy card as promptly as possible in the provided postage-prepaid envelope to ensure your representation and the presence of a quorum at the annual meeting. Alternatively, you may vote via toll-free telephone call or the Internet by following the instructions on the proxy card. If you send in your proxy card or vote by telephone or the Internet, you may still decide to attend the annual meeting of stockholders and vote your shares in person. Your proxy is revocable in accordance with the procedures set forth in the proxy statement.

| By Order of the Board of Directors |

| /s/ Linda G. Ferguson |

| LINDA G. FERGUSON |

| Secretary |

January 28, 2013

Las Vegas, Nevada

AMERICAN PACIFIC CORPORATION

3883 Howard Hughes Parkway, Suite 700

Las Vegas, Nevada 89169

PROXY STATEMENT

Annual Meeting of Stockholders of American Pacific Corporation to be held on March 12, 2013

Some Questions You May Have Regarding this Proxy Statement

Why am I receiving these materials?

American Pacific Corporation, a Delaware corporation (the “Company” or “we,” “our” or “us”), is providing you this proxy statement, the accompanying proxy card and a copy of our annual report to stockholders for the fiscal year ended September 30, 2012 (“Fiscal 2012”) in connection with our annual meeting of stockholders (the “Annual Meeting”), to be held on Tuesday, March 12, 2013, at 11:00 a.m., Local Time, at the Las Vegas Country Club, Rotunda Room, 3000 Joe W. Brown Drive, Las Vegas, Nevada 89109, or at any adjournments or postponements thereof. As a stockholder of the Company, you are cordially invited to attend the Annual Meeting and are entitled and requested to vote on the matters described in this proxy statement. The accompanying proxy is solicited on behalf of the board of directors (the “Board”) of the Company. This proxy statement and the accompanying proxy card are being first sent or given to our stockholders beginning on or about January 29, 2013.

What is a “proxy”?

A “proxy” allows someone else (the “proxy holder”) to vote your shares on your behalf. The Board is asking you to allow any of the persons named on the proxy card (John R. Gibson, our non-executive Chairman of the Board, and Linda G. Ferguson, our Vice President-Administration and Secretary) to vote your shares at the Annual Meeting.

Who may vote at the meeting?

January 14, 2013 has been fixed as the record date for determining the holders of shares of our common stock entitled to notice of and to vote at the Annual Meeting. Only stockholders of record at the close of business on that date are entitled to attend and vote at the Annual Meeting. The only class of stock that is currently outstanding and that can be voted at the Annual Meeting is our common stock. Each outstanding share of common stock is entitled to one vote on each matter that comes before the Annual Meeting. In particular, each share of our common stock outstanding on the record date is entitled to one vote on each of the four (4) director nominees and one vote on each of the other matters to come before the Annual Meeting.

At the close of business on the record date, there were 7,777,524 shares of our common stock outstanding.

What matters will be voted on at the meeting and what is the vote required for each proposal?

The following matters are to be considered and voted on at the meeting:

| — | To elect John R. Gibson, Ian D. Haft, Jan H. Loeb and William F. Readdy as Class A directors until the annual meeting of stockholders in 2016 and until their respective successors have been duly elected and qualified. |

| — | To hold an annual advisory vote to approve the Company’s executive compensation. |

| — | To ratify the appointment of BDO USA, LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2013 (“Fiscal 2013”). |

We will also consider any other business that may properly come before the Annual Meeting or any adjournments or postponements thereof in accordance with Delaware law and our Amended and Restated By-laws.

The election of directors (Proposal No. 1) requires that each director receive a majority of the votes cast by those present in person or represented by proxy with respect to that director at the Annual Meeting. This means that the number of shares of stock voted “FOR” a director must exceed the number of votes cast “WITHHELD” for that director.

– 1 –

Each of Proposals No. 2 and 3 requires the affirmative vote of a majority of the votes cast by those present in person or represented by proxy and cast on the applicable proposal.

How does the Board recommend I vote?

Please see the information included in this proxy statement relating to each of the matters to be voted on. Our Board recommends that you vote:

| — | “FOR” the election of John R. Gibson, Ian D. Haft, Jan H. Loeb and William F. Readdy as Class A directors until the annual meeting of stockholders in 2016 and until their respective successors have been duly elected and qualified (Proposal No. 1); |

| — | “FOR” the approval, on an advisory basis, of the compensation of our named executive officers (Proposal No. 2); and |

| — | “FOR” ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for Fiscal 2013 (Proposal No. 3). |

What happens if additional matters are presented at the Annual Meeting?

Other than the items of business described in this proxy statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy to the proxy holders (John R. Gibson and Linda G. Ferguson), they will have the discretion to vote your shares in their best judgment with respect to any additional matters properly brought before the Annual Meeting in accordance with Delaware law and our Amended and Restated By-laws. Moreover, if for any reason any of our nominees is not available as a candidate for director, the persons named as proxy holders will vote proxies for such other candidate or candidates as may be nominated by the Board.

How do I vote?

Stockholders of Record. If you are a stockholder of record, you may vote by using any of the following methods:

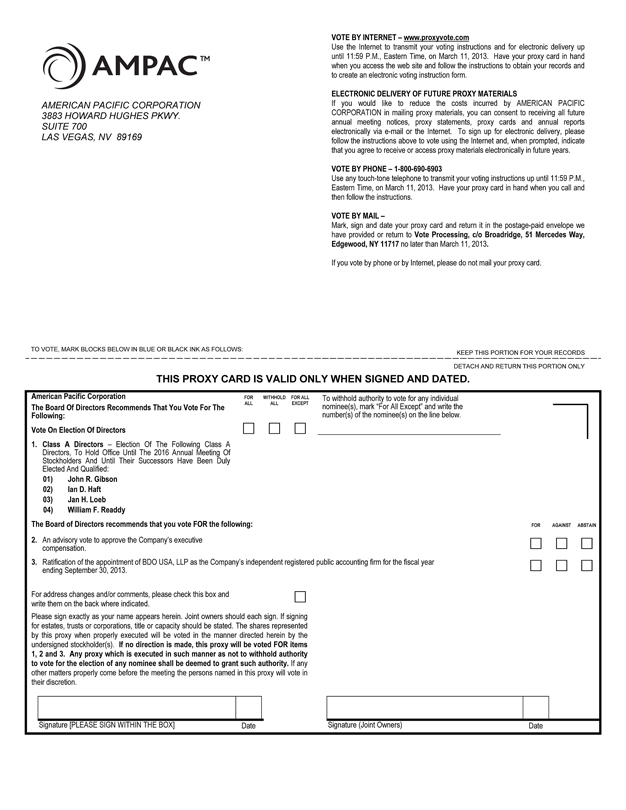

| — | VOTE BY INTERNET: You may use the Internet to transmit your voting instructions by going to http://www.proxyvote.com up until 11:59 P.M., Eastern Time, on March 11, 2013. When voting by Internet, you will need to have your proxy card in hand when you access the website and you will need to follow the instructions to obtain your records and to create an electronic voting instruction form. |

| — | VOTE BY TELEPHONE: You may use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M., Eastern Time, on March 11, 2013 by calling (800) 690-6903. You will need to have your proxy card in hand when you call and then follow the instructions. |

| — | VOTE BY MAIL: You may vote by marking, signing and dating your proxy card and promptly returning it in the postage-paid envelope we have provided or returning it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717, no later than March 11, 2013. |

The persons named as your proxy holders on the proxy card will vote the shares represented by your proxy in accordance with the specifications you make. Please carefully consider the information contained in this proxy statement. Whether or not you expect to attend the Annual Meeting in person, we urge you to vote by Internet or telephone, or by signing, dating and returning the enclosed proxy card as promptly as possible in the postage-paid envelope provided, to ensure your representation and the presence of a quorum at the Annual Meeting. Stockholders of record desiring to vote in person at the Annual Meeting may vote on the ballot provided at the meeting.

Beneficial Owners. If your shares are held in a brokerage account, by a bank, by a trustee, or by another nominee, please follow the voting instructions provided by your broker or other nominee. Most brokers or other nominees permit their customers to vote by telephone or by Internet, in addition to voting by signing, dating and returning the voting instruction form in the postage-paid envelope provided.

Beneficial owners desiring to vote in person at the Annual Meeting will need to contact the broker, bank, trustee, or other nominee that is the holder of record of their shares to obtain a “legal proxy” to bring to the Annual Meeting.

– 2 –

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, you are considered, with respect to those shares, the “stockholder of record.” The Notice of Annual Meeting of Stockholders, this proxy statement and our annual report to stockholders for Fiscal 2012 have been sent directly to you.

If your shares are held in a brokerage account, by a bank, by a trustee, or by another nominee, you are considered the “beneficial owner” of those shares. The Notice of Annual Meeting of Stockholders, this proxy statement and our annual report to stockholders for Fiscal 2012 have been forwarded (or otherwise made available) to you by your broker, bank, trustee or nominee. As the beneficial owner of the shares, you have the right to direct your broker, bank, trustee or nominee how to vote and you also are invited to attend the Annual Meeting. However, because a beneficial owner is not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker, bank, trustee or nominee that holds your shares, giving you the right to vote the shares at the Annual Meeting.

What constitutes a quorum, and why is a quorum required?

For business to be properly conducted and the vote of stockholders to be valid at the Annual Meeting, a quorum must be present. In order to have a quorum at the Annual Meeting, holders of a majority of our issued and outstanding shares of common stock as of the record date must be present, in person or by proxy, and entitled to vote. Shares represented at the Annual Meeting in person or by proxy but not voted, will nevertheless be counted for purposes of determining the presence of a quorum. Accordingly, abstentions and broker non-votes will be treated as shares that are present and entitled to vote for purposes of determining the presence of a quorum.

What will happen if I do not vote my shares?

Stockholders of Record. If you are the stockholder of record of your shares and you do not vote by proxy card, by telephone, via the Internet or in person at the Annual Meeting, your shares will not be voted at the Annual Meeting.

Beneficial Owners. If you are the beneficial owner of your shares, your broker, bank, trustee or other nominee may vote your shares only on those proposals on which it has discretion to vote. See further below at “What are ‘broker non-votes’?”

What if I do not specify how my shares are to be voted?

Stockholders of Record. If you are a stockholder of record and you submit a proxy, but you do not provide voting instructions, your shares will be voted:

| — | “FOR” the election of John R. Gibson, Ian D. Haft, Jan H. Loeb and William F. Readdy as Class A directors until the annual meeting of stockholders in 2016 and until their respective successors have been duly elected and qualified (Proposal No. 1); |

| — | “FOR” the approval, on an advisory basis, of the compensation of our named executive officers (Proposal No. 2); |

| — | “FOR” ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for Fiscal 2013 (Proposal No. 3). |

No matter currently is expected to be considered at the Annual Meeting other than the matters set forth in the accompanying Notice of Annual Meeting of Stockholders. However, if any other matters are properly brought before the Annual Meeting for action, it is intended that the shares of our common stock represented by proxies will be voted by the persons named as proxies in their discretion on such matters. Moreover, if for any reason any of our nominees is not available as a candidate for director, the persons named as proxies will vote for such other candidate or candidates as may be nominated by the Board.

Beneficial Owners. If you are a beneficial owner and you do not provide the broker, bank, trustee or other nominee that holds your shares with voting instructions, the broker or other nominee will determine if it has the discretionary authority to vote on the particular matter. Under the rules of the New York Stock Exchange, or NYSE, that govern brokers, brokers have the discretion to vote on routine matters but do not have discretion to vote on non-routine matters. Therefore, if you do not provide voting instructions to your broker, your broker may only vote your shares on some, but not all, of the proposals to come before the Annual Meeting. See further below at “What are ‘broker non-votes’?”

– 3 –

What are “broker non-votes”?

A broker non-vote occurs when a brokerage firm or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have authority to vote on that particular proposal without receiving voting instructions from the beneficial owner. Brokers are subject to the rules of the NYSE. The NYSE rules direct that certain matters submitted to a vote of stockholders are “routine” items and brokers generally may vote on these “routine” matters on behalf of beneficial owners who have not furnished voting instructions, subject to the rules of the NYSE concerning transmission of proxy materials to beneficial owners, and subject to any proxy voting policies and procedures of those brokerage firms. For “non-routine” proposals, brokers may not vote on the proposals unless they have received voting instructions from the beneficial owner, and to the extent that they have not received voting instructions, brokers report such number of shares as “non-votes”. Under current NYSE rules, the Company believes that Proposal No. 3 is considered a routine item. This means that brokers may vote in their discretion on this matter on behalf of clients who have not furnished voting instructions. However, under current NYSE rules, the Company believes that brokers who have not been furnished voting instructions from their clients will not be authorized to vote in their discretion on Proposals No. 1 or 2. Accordingly, for beneficial stockholders, if you do not give your broker specific instructions, your shares may not be voted on such proposals.

What if I abstain?

In accordance with the Company’s Amended and Restated By-laws, shares that are voted “abstain” on a matter will not be counted as a vote cast for such matter and, accordingly, will not be included in determining the number of shares voted at the Annual Meeting with respect to such matter.

How are abstentions and broker non-votes counted?

Abstentions and broker non-votes will be counted for purposes of calculating whether a quorum is present at the Annual Meeting, but will not be counted for purposes of determining the number of votes cast on a particular proposal. Thus, an abstention or broker non-vote will not impact our ability to obtain a quorum and will not otherwise affect the outcome of the votes on the proposals.

While our Restated Certificate of Incorporation, as amended, does not address the treatment of broker non-votes or abstentions, our Amended and Restated By-laws expressly provide that a share present at a meeting of stockholders, but for which there is an abstention or as to which a stockholder gives no authority or direction as to a particular proposal or director nominee, shall be counted as present for the purpose of establishing a quorum but shall not be counted as a vote cast.

Can I change or revoke my vote after I have delivered my proxy?

Stockholders of Record. Prior to the Annual Meeting, you may change your vote by submitting a later-dated proxy in one of the manners authorized and described in this proxy statement (such as via the Internet or by telephone). You may also give a written notice of revocation to our Secretary, so long as it is delivered to our Secretary at our principal executive offices, at 3883 Howard Hughes Parkway, Suite 700, Las Vegas, Nevada 89169, prior to the beginning of the Annual Meeting, or given to our Secretary at the Annual Meeting prior to the time your proxy is voted at the Annual Meeting. You also may revoke any proxy given pursuant to this solicitation by attending the Annual Meeting and voting in person by ballot. However, the mere presence of a stockholder at the Annual Meeting will not revoke a proxy previously given unless you follow one of the revocation procedures referenced above.

Beneficial Owners. If you hold your shares through a broker, bank, trustee or other nominee, please follow the instructions provided by your broker or other nominee as to how you may change your vote or obtain a “legal proxy” to vote your shares if you wish to cast your vote in person at the Annual Meeting.

Do I have to attend the Annual Meeting in person?

No, but stockholders are cordially invited to attend the Annual Meeting to be held on Tuesday, March 12, 2013, at 11:00 a.m., Local Time, at the Las Vegas Country Club, Rotunda Room, 3000 Joe W. Brown Drive, Las Vegas, Nevada 89109. Stockholders of record desiring to vote at the Annual Meeting should bring the enclosed proxy card, or may vote on a ballot provided at the meeting. Beneficial owners desiring to vote at the meeting will need to contact the broker, bank, trustee, or other nominee that holds their shares to obtain a “legal proxy” to bring to the Annual Meeting. For stockholders needing directions to the Annual Meeting, please call the Company’s Investor Relations Department, Telephone: (702) 735-2200.

– 4 –

Who will count the votes?

The final voting results will be tallied by the Inspector of Elections appointed by the Company in accordance with our Amended and Restated By-laws and Delaware law. The Inspector of Elections will separately tabulate affirmative and negative or withhold votes, abstentions and broker non-votes, as applicable. We have hired a third party, Broadridge Financial Solutions, Inc., to assist the Inspector of Elections in tabulating votes cast by proxy at the Annual Meeting.

Where can I find voting results of the meeting?

We will announce preliminary voting results at the Annual Meeting and intend to publish final results in a Form 8-K within 4 business days following the Annual Meeting.

Who will bear the cost for soliciting votes for the meeting?

We will bear all attendant costs in conjunction with proxy solicitation. These costs will include the expense of preparing and mailing proxy solicitation materials for the Annual Meeting and reimbursements paid to brokerage firms and others for their expenses incurred in forwarding such materials to beneficial owners of our common stock. We have hired Innisfree M&A Incorporated to solicit proxies for a fee of $75,000 plus a reasonable amount to cover expenses. We may conduct further solicitation personally, telephonically or by facsimile or mail, or by other means, through our officers, directors and employees, none of whom will receive additional compensation for assisting with the solicitation.

Can I access the Company’s proxy statement and annual report to stockholders for Fiscal 2012 via the Internet?

Pursuant to rules promulgated by the Securities and Exchange Commission (the “SEC”), we are providing access to our proxy statement and annual report to stockholders for Fiscal 2012 (collectively, “proxy materials”) both by sending this full set of proxy materials as well as a proxy card and by notifying you of the availability of our proxy materials through the Internet. The SEC’s rules allow companies to avoid sending to their stockholders paper copies of their proxy materials if, instead, they furnish the proxy materials over the Internet (so called “e-proxy”) and mail to their stockholders a Notice of Internet Availability of Proxy Materials (an “Internet Availability Notice”). However, companies are not required to use e-proxy and, in lieu of doing so, may continue to send to stockholders a full set of their proxy materials. We have chosen to follow this latter approach. But, we are still obligated to provide you with the following notice:

Important Notice Regarding the Availability of Proxy Materials for the

Stockholders’ Meeting to Be Held on March 12, 2013

The Notice of Annual Meeting of Stockholders, proxy statement and annual report to stockholders for Fiscal 2012 are available at www.apfc.com on the “Annual Meeting of Stockholders” page of the “Investors” section. At this website, copies of the Notice of Annual Meeting of Stockholders, proxy statement and the annual report to stockholders for Fiscal 2012 are available free of charge.

Do I have a dissenters’ right of appraisal?

Under Delaware law, stockholders are not entitled to appraisal rights in connection with any of the matters in this proxy statement.

What is “householding” and how does it affect me?

The SEC has adopted rules that permit companies and intermediaries (such as banks and brokers) to satisfy the delivery requirements for proxy statements and annual reports to stockholders with respect to two or more stockholders sharing the same address by delivering a single proxy statement and annual report addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies. Under this procedure, stockholders of record who have the same address and last name may receive only one copy of the Company’s proxy statement and annual report to stockholders, unless one or more of these stockholders notify us that they wish to continue receiving individual copies.

If you are eligible for householding, but you and other stockholders of record with whom you share an address currently receive multiple copies of our proxy statement or annual report to stockholders, and you wish to

– 5 –

receive only a single copy of each of these documents for your household, please contact: American Pacific Corporation, 3883 Howard Hughes Parkway, Suite 700, Las Vegas, Nevada 89169, Attention: Investor Relations Department, Telephone: (702) 735-2200.

If you participate in householding and wish to receive a separate copy of our proxy statement or annual report to stockholders, or if you do not wish to participate in householding and prefer to receive separate copies of these documents in the future, please contact our Investor Relations Department as indicated above. The Company undertakes, upon oral or written request, to deliver promptly a separate copy of the Company’s annual report to stockholders or proxy statement, as applicable, to a stockholder at a shared address to which a single copy of the applicable document was delivered.

Beneficial owners can request information about householding from their broker, bank, trustee, or other nominee.

Whom should I contact with other questions?

If you have additional questions about this proxy statement or the Annual Meeting or would like copies of this proxy statement, the form of proxy, the annual report to stockholders for Fiscal 2012 or our Annual Report on Form 10-K for Fiscal 2012, or would like copies of these documents relating to future stockholder meetings, please contact: American Pacific Corporation, 3883 Howard Hughes Parkway, Suite 700, Las Vegas, Nevada 89169, Attention: Investor Relations Department, Telephone: (702) 735-2200. You can also email the Investor Relations Department to make such requests at investorrelations@apfc.com or access the following website address to make such request: www.apfc.com on the “Information Request” page of the “Investors” section.

How can I communicate with the Company’s Board?

You may send communications to the Board in care of our Secretary, 3883 Howard Hughes Parkway, Suite 700, Las Vegas, Nevada 89169, or via email to: investorrelations@apfc.com. Please indicate whether your message is for the Board as a whole, a particular group or committee of directors, or an individual director. All such communications will be compiled by the Secretary and relayed promptly to the Board, applicable Board committee, or the individual director(s).

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

SIZE OF BOARD

Pursuant to our Restated Certificate of Incorporation, as amended, our Board shall not be less than three nor more than twelve directors and shall be divided into three classes, with such classes to be as nearly equal in number as possible. Currently the authorized number of directors is twelve. During Fiscal 2012, our Board consisted of twelve members, divided into three Classes -- four Class A directors; four Class B directors; and four Class C directors. Dean M. Willard, a Class A director, retired from the Board effective December 31, 2012. Fred D. Gibson, Jr., a Class C director, and Jane L. Williams, a Class B director, are each retiring from the Board effective March 12, 2013. At the Board meeting on January 8, 2013, the Board adopted a resolution providing that effective as of the Annual Meeting the size of the Board shall be reduced to: (i) ten members if Mr. Haft is elected as a Class A director at the Annual Meeting or (ii) nine members if Mr. Haft is not elected to the Board at the Annual Meeting. Each class serves for a term of three years and until their successors are duly elected and qualified. Typically, one class is elected each year. At the Annual Meeting, three Class A directors and one Class A director nominee are standing for election.

The Restated Certificate of Incorporation, as amended, requires that each director shall be elected by the vote of the majority of the votes cast with respect to that director. In the event a director who is running for election at an annual meeting does not receive the requisite amount of votes to be elected at such meeting, the incumbent director shall remain in office until the next annual meeting. At that time, two (2) classes of nominees will stand for election, and so on, providing that the holdover nominees shall run only for the remainder of their term.

BOARD NOMINATIONS

The Corporate Governance Committee performs various functions, including, among others, those of a nominating committee. The Corporate Governance Committee considers multiple sources for identifying and evaluating nominees for directors, including referrals from current directors and stockholders. The Corporate Governance Committee will consider director candidates recommended by stockholders.

– 6 –

Nominations of persons for election to the Board may be made at a meeting of stockholders: (a) by or at the direction of the Board, (b) by any nominating committee of the Board or committee of the Board performing similar functions, (c) by any person appointed by the Board for such purpose or (d) by any stockholder of the Company who is a stockholder of record at the time of giving of notice for such nomination, who shall be entitled to vote for the election of directors at the meeting and who complies with the timely notice procedures below.

Director candidate nominations from stockholders of the Company must be provided pursuant to the process set forth in the Company’s Amended and Restated By-laws as described below.

Nominations of directors by stockholders must be made pursuant to a timely notice in writing to the Secretary of the Company for bringing business before a meeting of stockholders. To be timely, a stockholder’s notice must be delivered to or mailed and received at the principal executive offices of the Company:

| (a) | in the case of an annual meeting, not less than 90 calendar days nor more than 140 calendar days prior to the first anniversary of the date on which the Company first mailed its proxy materials for the previous year’s annual meeting of stockholders; provided, however, that if the Company did not hold an annual meeting the previous year, or if the date of the annual meeting was changed by more than 30 days from the date of the previous year’s annual meeting, then to be timely such notice must be delivered to or mailed and received at the principal executive offices of the Company not later than the later of 40 calendar days prior to the date of the annual meeting or the 10th calendar day following the day on which public announcement of the date of the annual meeting was first made; and |

| (b) | in the case of a special meeting at which directors are to be elected, not later than the close of business on the 10th calendar day following the day on which public announcement of the date of the special meeting was first made. |

The stockholder’s notice shall set forth:

| (a) | as to each person whom the stockholder proposes to nominate for election or re-election as a director (i) the name, age, business address and residence address of the person, (ii) the principal occupation or employment of the person, (iii) the class and number of shares of the Company which are beneficially owned by the person, and (iv) any other information relating to the person that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (including such person’s written consent to being named, if applicable, in the proxy statement as a nominee and to serving as a director if elected); |

| (b) | as to the stockholder giving the notice, (i) the name and record address of the stockholder, and (ii) the class and number of shares of the Company which are beneficially owned by the stockholder; |

| (c) | as to the stockholder giving the notice and any Stockholder Associated Person (as defined below), to the extent not set forth pursuant to the immediately preceding clause, whether and the extent to which any hedging or other transaction or series of transactions has been entered into by or on behalf of, or any other agreement, arrangement or understanding (including, but not limited to, any short position or any borrowing or lending of shares of stock) has been made, the effect or intent of which is to mitigate loss or increase profit to or manage the risk or benefit of stock price changes for, or to increase or decrease the voting power of, such stockholder or any such Stockholder Associated Person with respect to any share of stock of the Company; and |

| (d) | as to the stockholder giving the notice and any Stockholder Associated Person, (i) whether and the extent to which any option, warrant, convertible security, stock appreciation right, or similar right with an exercise or conversion privilege or a settlement payment or mechanism at a price related to any class or series of shares of the Company, whether or not such instrument or right shall be subject to settlement in the underlying class or series of capital stock of the Company or otherwise, or any other direct or indirect opportunity to profit or share in any profit derived from any increase or decrease in the value of shares of the Company (a “Derivative Instrument”) is directly or indirectly beneficially owned, (ii) any rights to dividends on the shares of the Company owned beneficially by such stockholder that are separated or separable from the underlying shares of the Company, (iii) any proportionate interest in shares of the Company or Derivative Instruments held, directly or indirectly, by a general or limited partnership in which such stockholder is a general partner or, directly or indirectly, beneficially owns an interest in a general partner and (iv) any performance-related fees (other than an asset-based fee) that such stockholder is entitled to based on any increase or decrease in the value of shares of the Company or Derivative |

– 7 –

| Instruments, if any, as of the date of such notice, including without limitation any such interests held by members of such stockholder’s immediate family sharing the same household (which information shall be supplemented by such stockholder and beneficial owner, if any, not later than 10 days after the record date for the meeting to disclose such ownership as of the record date). |

For purposes of the above, “Stockholder Associated Person” of any stockholder means (i) any person controlling or controlled by, directly or indirectly, or acting in concert with, such stockholder, (ii) any beneficial owner of shares of stock of the Company owned of record or beneficially by such stockholder and (iii) any person controlling, controlled by or under common control with such Stockholder Associated Person.

The Company may require any proposed nominee to furnish such other information as may reasonably be required by the Company to determine the eligibility of such proposed nominee to serve as a director of the Company. At the request of the Board, any person nominated by the Board for election as a director shall furnish to the Secretary of the Company that information required to be set forth in a stockholder’s notice of nomination which pertains to the nominee. No person shall be eligible for election as a director of the Company unless nominated in accordance with the procedures set forth in the Company’s Amended and Restated By-laws. Notwithstanding the foregoing, a stockholder shall also comply with all applicable requirements of the Exchange Act and the rules and regulations thereunder with respect to the matters set forth above. As clarified in the Amended and Restated By-laws adopted by the Board in March 2011, a stockholder who complies with the notice procedures set forth in such Amended and Restated By-laws is permitted to present the nomination at the meeting of stockholders but is not entitled to have a nominee included in the Company’s proxy statement or information statement in the absence of an applicable rule of the SEC requiring the Company to include a director nomination made by a stockholder in the Company’s proxy statement or information statement.

The Corporate Governance Committee determines the required selection criteria and qualifications of director nominees based upon the Company’s needs at the time nominees are considered. Qualifications for Board membership may include, among others, the highest personal and professional integrity, demonstrated exceptional ability and judgment, broad experience in business, finance, or administration, ability to serve the long-term interests of the Company’s stockholders, sufficient time to devote to the affairs of the Company, and contribution to the Company’s overall corporate goals. The Corporate Governance Committee seeks to ensure that the composition of the Board at all times adheres to the independence requirements of The NASDAQ Stock Market LLC and reflects a range of talents, ages, skills, diversity, background, experience and expertise, particularly in the areas of management, leadership, corporate governance and experience in the Company’s and related industries, sufficient to provide sound and prudent guidance with respect to our operations and interests.

In addition to the above considerations, the Corporate Governance Committee considers criteria such as skill, diversity, experience with businesses and other organizations of comparable size, experience as an executive with a publicly-traded company, the interplay of the candidate’s experience with the experience of other Board members, the extent to which the candidate would be a desirable addition to the Board and any committees of the Board, and any other factors that the Corporate Governance Committee believes to be in the best interests of the Company and its stockholders. It is the policy of the Corporate Governance Committee to evaluate director candidates recommended by stockholders in the same way it evaluates director candidates recommended by any other source. In particular, the Corporate Governance Committee will consider the same criteria for candidates regardless of whether the candidate was identified by the Corporate Governance Committee, by stockholders, or any other source. While the Corporate Governance Committee and Board do not have a specific diversity policy, the Corporate Governance Committee considers, as noted above, diversity, including diversity of background and experience, in evaluating director candidates. Each individual is evaluated in the context of our Board as a whole, with the objective of recommending a group of nominees that can best promote the success of the business and represent stockholder interests through the exercise of sound judgment based on diversity of experience and background. The Corporate Governance Committee also assesses the effectiveness of its consideration of diversity as part of its annual review of qualifications of directors for nomination to the Board.

The Corporate Governance Committee identifies and evaluates nominees for director, including nominees recommended by stockholders, the process for which involves (with or without the assistance of a retained search firm) compiling names of potentially eligible candidates, vetting candidates’ qualifications, conducting background and reference checks, conducting interviews with candidates and/or others (as schedules permit), meeting to consider and recommend final candidates to the Board and, as appropriate, preparing and

– 8 –

presenting to the Board an analysis with regard to particular, recommended candidates. The Corporate Governance Committee has the sole authority to retain and terminate any search firm used to identify candidates for the Board, although such retention is not required.

BOARD NOMINEES

The Board, upon recommendation by the Corporate Governance Committee, nominated the following individuals to stand for election at the Annual Meeting to serve as Class A directors until the annual meeting of stockholders in 2016, and until the election and qualification of their respective successors: John R. Gibson, Ian D. Haft, Jan H. Loeb and William F. Readdy.

All nominees, except Ian D. Haft, are currently directors. Mr. Haft was recommended to the Board and the Corporate Governance Committee by Cornwall Master LP, a stockholder of the Company. Mr. Haft was nominated for election to the Board in accordance with the terms of the Company’s Settlement Agreement, dated January 14, 2013, with Cornwall Master LP, Cornwall Capital Management LP, Cornwall GP, LLC, CMGP LLC, and James Mai (collectively, the “Cornwall Group”). Pursuant to the terms of the Settlement Agreement, the Cornwall Group agreed, among other things, to withdraw its director nominations, including of Mr. Haft, for election at the Annual Meeting and the Company agreed, among other things, to reduce the size of the Board from twelve to ten members and to nominate and recommend to the Company’s stockholders Mr. Haft for election to the Board at the Annual Meeting. Each nominee has agreed to be named in this proxy statement and to serve as a director, if elected.

For biographical information about each of the director nominees see “Board of Directors” below.

BOARD OF DIRECTORS

The following table sets forth the names and ages (as of January 14, 2013) of the current members of our Board, as well as their respective Board Class and current standing Board committee assignments.

|

Name |

Age |

Class |

Director |

Term to |

Committee Memberships | |||||

|

John R. Gibson (1) |

75 |

A |

12/88 |

2016 (2) |

Retirement Benefits | |||||

|

Jan H. Loeb (1) |

54 |

A |

01/97 |

2016 (2) |

Audit, Chairman Compensation Environmental, Health & Safety | |||||

|

William F. Readdy (1) |

60 |

A |

11/09 |

2016 (2) |

Environmental, Health & Safety Retirement Benefits | |||||

|

Barbara Smith Campbell |

63 |

B |

11/09 |

2014 |

Audit Compensation, Chairman Corporate Governance | |||||

|

C. Keith Rooker, Esq. |

75 |

B |

12/88 |

2014 |

Audit Corporate Governance, Chairman Environmental, Health & Safety | |||||

|

Charlotte E. Sibley |

66 |

B |

12/10 |

2014 |

Compensation Corporate Governance Retirement Benefits | |||||

|

Jane L. Williams |

74 |

B |

11/93 |

(3) |

Audit Corporate Governance Retirement Benefits, Chairman | |||||

|

Joseph Carleone, Ph.D. |

66 |

C |

07/06 |

2015 |

- | |||||

|

Fred D. Gibson, Jr. |

85 |

C |

04/82 |

(3) |

Environmental, Health & Safety Retirement Benefits | |||||

|

Berlyn D. Miller |

75 |

C |

11/93 |

2015 |

Environmental, Health & Safety, Chairman Retirement Benefits | |||||

|

Bart Weiner |

55 |

C |

12/10 |

2015 |

Audit Compensation Corporate Governance |

– 9 –

| (1) | Nominee. |

| (2) | Terms to expire assuming election of current director nominees at the Annual Meeting and in each case until their respective successors are duly elected and qualified. |

| (3) | The director is retiring from the Board effective March 12, 2013. |

Business Experience and Qualifications of Directors and Director Nominees

Class A Directors

John R. Gibson has served as the non-executive Chairman of the Board of the Company since January 1, 2010. In July 1997, Mr. J. Gibson became Chief Executive Officer and President of the Company and in March 1998 he was appointed Chairman of the Board. He resigned his position as President of the Company in October 2006 upon the appointment of Dr. Carleone to the office of President and Chief Operating Officer of the Company. Prior to his retirement as an employee of the Company on December 31, 2009, Mr. J. Gibson also served as the Chief Executive Officer and President of a majority of the Company’s wholly-owned subsidiaries, including Ampac-ISP Corp., from 2004 until December 2009, AMPAC Farms, Inc. and American Pacific Corporation (a Nevada corporation), from 1997 to December 2009, and American Azide Corporation from 1993 to December 2009. Mr. J. Gibson also currently serves as a director of Ampac Fine Chemicals LLC, Ampac-ISP Corp., American Azide Corporation, American Pacific Corporation (a Nevada corporation) and Ampac Farms, Inc., each direct or indirect wholly-owned subsidiaries of the Company. Mr. Gibson also served until July 2012, as a director of each of the wholly-owned subsidiaries of Ampac-ISP Corp. including from 2008, Ampac Holdings Limited, Ampac ISP Dublin Limited and Ampac ISP UK Cheltenham Limited, and from 2004, Ampac ISP UK Westcott Limited. He was the Company’s Vice President-Engineering & Operations from March 1992 to July 1997. Prior to that time, he was the Director of Modernization of USS-POSCO Industries, a finishing mill for flat rolled steel products, a position he held for more than five years. Mr. J. Gibson is the brother of director Fred D. Gibson, Jr. and executive officer Linda G. Ferguson and the uncle of executive officer Dave A. Thayer.

Qualifications: Mr. J. Gibson brings to the Company deep and extensive knowledge of all the business units of the Company, what it takes to acquire and integrate, or grow businesses, and years of practical executive management experience in domestic and international operations and projects, involving major regulatory and legal challenges.

Ian D. Haft, age 42, has served as Principal and Chief Operating Officer of Cornwall Capital Management LP, a Registered Investment Advisor, and its predecessors, where he is part of a team responsible for managing investment funds comprising greater than $450 million in assets since 2009. Prior to joining Cornwall Capital, between 2008 and 2009, Mr. Haft was a Principal at GenNx360 Capital Partners, a private equity fund, where he focused on investments related to specialty chemicals and materials and components to industrial machinery. Prior to that, Mr. Haft was a Vice President at ACI Capital Co., LLC, where he focused on middle market leveraged buyouts and growth equity investments on behalf of two private equity funds, from 2002 to 2008 (he was promoted from Senior Associate in 2004). Mr. Haft began his career at The Boston Consulting Group in 1993 and also was employed at Merrill Lynch & Co. and The Blackstone Group before joining ACI Capital in 2002. Mr. Haft received a BA from Dartmouth College and a JD/MBA from Columbia University. Mr. Haft was nominated for election to the Board in accordance with the terms of the Company’s Settlement Agreement, dated January 14, 2013 with the Cornwall Group. Pursuant to the terms of the Settlement Agreement, the Cornwall Group agreed, among other things, to withdraw its director nominations, including of Mr. Haft, for election at the Annual Meeting and the Company agreed, among other things, to reduce the size of the Board from twelve to ten members and to nominate and recommend to the Company’s stockholders Mr. Haft for election to the Board at the Annual Meeting.

Qualifications: Mr. Haft brings to the Company nineteen years of experience working in alternative asset management, investment banking and management consulting. Through this experience, he has developed strong capabilities in business strategy, strategic analysis of industries and companies, mergers and acquisitions, valuation, debt and equity financing, derivatives and hedging, financial controls and regulatory compliance.

Jan H. Loeb is President and a director of Leap Tide Capital Management, Inc., a capital investment firm, a position he has held since 2007. From 2005 to 2007 he also served as a portfolio manager of Leap Tide Capital Management, Inc. Mr. Loeb has more than 30 years experience in capital investment and investment banking. From 2006 through August 2011, Mr. Loeb served as a director of Pernix Therapeutics Holdings, Inc.

– 10 –

(formerly Golf Trust of America, Inc.), a specialty pharmaceutical company primarily focused on the sales, marketing, and development of branded and generic pharmaceutical products primarily for the pediatric market. Mr. Loeb continues to serve as a consultant to Pernix. Mr. Loeb is also a director of TAT Technologies Ltd., a company that provides various products and services to military and commercial aerospace and ground defense industries, a position he has held since August 2009.

Qualifications: Mr. Loeb brings to the Company more than 30 years of capital investment and investment banking experience, and provides financial expertise, knowledge of the public equities and debt markets and public company management experience, as well as a strong understanding of Audit Committee functions, in part as a result of having served as the Chairman of the Audit Committee of Pernix from October 2007 through August 2011.

William F. Readdy served the United States as a naval aviator, astronaut, and civil service senior executive from 1974 to 2005. As a senior executive at the National Aeronautics and Space Administration (“NASA”), Mr. Readdy had responsibility for a $6.5 billion portfolio, including the Space Shuttle and International Space Station programs, as well as NASA’s four largest field test centers: Johnson Space Center, Kennedy Space Center, Marshall Spaceflight Center and Stennis Space Center. Retiring from NASA in September 2005, Mr. Readdy established Discovery Partners International LLC, a consulting firm providing strategic planning, risk management, safety and decision support to aerospace and high-technology industries. Since its formation, Mr. Readdy has served as Managing Partner. In addition, Mr. Readdy currently serves on the board of directors of Astrotech Corporation, a commercial aerospace company that provides facilities and support services necessary for the preparation of satellites and payloads for launch, design and fabrication of equipment and hardware for space launch activities, propellant services support for spacecraft, and commercialization of space-based technologies into real-world applications. Mr. Readdy is also chairman of GeoMetWatch, Inc., a startup company offering commercial satellite weather products. Additionally, Mr. Readdy has served as a chairman and director of several non-profit organizations with a particular focus on STEM education.

Qualifications: Mr. Readdy brings to the Company tremendous background and experience with NASA, the U.S. Department of Defense and with the aerospace industry in general, which are primary focuses of the Company. He is an acknowledged expert on safety, operations, and risk management. He also brings to the Company an extensive knowledge of public policy, program management and contracting matters involving military, aerospace and defense programs.

Class B Directors

Barbara Smith Campbell is President of Consensus, LLC, a company which she founded in 2005 and which provides strategic tax and regulatory planning for businesses located or contemplating relocating to Nevada. Prior to starting Consensus, LLC, Ms. Campbell served as a member of the State of Nevada Tax Commission for 5 consecutive terms and as its Chairman from 1996 to 2005. In 1993, she joined Mandalay Resort Group and served as Director of Finance for Mandalay Development. Following a merger between MGM Mirage and Mandalay Resort Group, Ms. Campbell served as Vice President of Finance for MGM Grand Resorts Development until late 2005. Ms. Campbell continues to serve as a Trustee for the Donald W. Reynolds Foundation and as an Advisory Board member of Amerco, parent company of U-Haul International, Inc., positions she has held since 1998 and 2005, respectively. She currently serves as Chairman of the Board of the Silver State Health Insurance Exchange which will implement the Affordable Care Act in the State of Nevada. Her past board of directors’ positions include serving as a director of the Federal Home Loan Bank of San Francisco where she served as Chairman of the Audit Committee. Additionally, she has served on numerous charitable and non-profit boards.

Qualifications: Ms. Campbell brings over 30 years of experience in finance, development of new assets and risk management having administered over $4 billion dollars in new development and expansion projects in multiple jurisdictions across the United States. As past Chairman of the Nevada Tax Commission, she brings over 25 years of experience in regulatory processes and procedures.

C. Keith Rooker, Esq. was the Executive Vice President of the Company from 1988 to July 1997, and was also a Vice President of the Company from 1985 to 1988 and the Company’s Secretary and General Counsel from 1985 to July 1997. Since his retirement from the Company in 1997, Mr. Rooker has continually been in private practice, first with the Las Vegas, Nevada law firm of Rooker & Gibson, and thereafter with successor firms, most recently as the Managing Partner in the Las Vegas, Nevada and Salt Lake City, Utah law firm of Rooker Rawlins LLP. In 2011, Rooker Rawlins terminated its practice; however, Mr. Rooker continues to practice law in Las Vegas and Salt Lake City, and engage in related business activities.

– 11 –

Qualifications: In addition to his work directly with the Company, as summarized above, Mr. Rooker was legal counsel to the Company from 1969 until he joined the Company’s executive staff in 1985, and was a director of the Company’s predecessor, Pacific Engineering & Production Co. of Nevada from 1973 until joining the Company’s Board in 1988. He brings to the Company and the Board years of knowledge of the Company’s operations, management, products and strategies, as well as strong analytical skills in commercial and financial matters and substantial experience in critical aspects of risk analysis, crisis recovery and management.

Charlotte E. Sibley is Principal in Sibley Associates, a pharmaceutical and biotech consulting firm. Until December 2010, Ms. Sibley was a Senior Vice President of Shire plc, a leading specialty biopharmaceutical company, a position she held since 2005. Ms. Sibley served from 2003 to 2004 as Vice President of Millennium Pharmaceuticals, Inc., an integrated biopharmaceutical company subsequently acquired by Takeda Pharmaceutical Company Limited. Ms. Sibley served as Vice President of Pharmacia Corporation from 1999 to 2003 and held various director positions in the business information and market research units of Bristol-Myers Squibb Company. Since 2010, she has also served as a director for two private companies: Mind Field Solutions, which uses neuroscience tools to improve healthcare decision-making, and Galileo Analytics, a leader in the field of claims data analysis. Ms. Sibley is also President of the Marketing Research Institute International, and has served as a Board Member since 2009, and First Vice President on the Corporate Healthcare Business Women’s Association (HBA) Board, and has served as a Director since 2010. She has served as an Adjunct Professor at Columbia University Graduate School of Business since 2004, and has been a member of the Pharmaceutical Executive Editorial Advisory Board since 2008. Ms. Sibley has also served on the Advisory Board for the St. Joseph’s University Executive MBA Program since 2009. She holds an MBA in finance and marketing from the University of Chicago Booth School of Business and an AB in French and German from Middlebury College. Ms. Sibley was appointed to the Board in accordance with the terms of the Company’s Settlement Agreement, dated as of December 14, 2010, with the Golconda Group. Pursuant to the terms of the Settlement Agreement, the Golconda Group agreed, among other things, to withdraw their director nominations, including of Ms. Sibley, for election at the 2011 annual meeting of stockholders and the Company agreed, among other things, to expand the size of the Board from ten to twelve members and to elect each of Ms. Sibley and Mr. Weiner to the Board. In addition, under the terms of the Settlement Agreement, the Board agreed to nominate and recommend to the Company’s stockholders Ms. Sibley for re-election to the Board at the 2011 annual meeting of stockholders.

Qualifications: Ms. Sibley brings to the Company extensive global experience spanning over 30 years in strategy, leadership development, and building effective insight and analytic functions. Her experience on Wall Street as a securities analyst for the pharmaceutical industry, coupled with her many years in seven major biopharmaceutical companies, bring breadth and a strategic perspective to the Company.

Jane L. Williams is the President, Chairman and Chief Executive Officer of TechTrans International, Inc. of Houston, Texas, a provider of technical language support services, a position she has held since 1993. During 2011, Ms. Williams was the winner of the Ernst & Young Entrepreneur of the Year 2011 Gulf Coast Area, and her firm was honored as a Houston Business Journal Fast 100 Winner, awarded to fast-growing private companies. Before founding TechTrans International, Inc., Ms. Williams was a consultant to businesses in the aerospace industry for more than five years. Ms. Williams was a director of Western Electrochemical Company, the Company’s former principal operating subsidiary, from 1989 until 1995. Additionally, Ms. Williams serves on a number of charitable and not-for-profit boards. Ms. Williams is retiring from the Board effective March 12, 2013.

Qualifications: As the founder and CEO of a highly successful international enterprise, Ms. Williams brings to the Company a strong entrepreneurial awareness, a keen insight into financial affairs, practical management skills and experience in negotiations and contracting with U.S. and foreign governments.

Class C Directors

Joseph Carleone, Ph.D. became President and Chief Executive Officer of the Company on January 1, 2010, after serving as President and Chief Operating Officer of the Company since October 15, 2006. Dr. Carleone also currently serves as President and director of American Pacific Corporation (a Nevada corporation), Ampac-ISP Corp., American Azide Corporation, and Ampac Farms, Inc., as well as a director of Ampac Fine Chemicals LLC and AMPAC Fine Chemicals Texas, LLC, each direct or indirect wholly-owned subsidiaries of

– 12 –

the Company. Dr. Carleone also served until July 2012, as a director of each of the wholly-owned subsidiaries of Ampac-ISP Corp. including from 2008, Ampac Holdings Limited, and from 2010, Ampac ISP Dublin Limited, Ampac ISP UK Cheltenham Limited, and Ampac ISP UK Westcott Limited. From September 2007 through December 2009, Dr. Carleone served as a director for Reinhold Industries, Inc., a diversified manufacturer of advanced custom composite components and sheet molding compounds for a variety of applications in the United States and Europe. From November 2005 through September 2006, Dr. Carleone served as Senior Vice President and Chief Product Officer of Irvine Sensors Corporation, a technology company engaged in the design, development, manufacture and sale of security products, software, vision systems and miniaturized electronic products and higher level systems for defense, information technology and physical security for government and commercial applications, and from March 2003 through November 2005, he served as a member of the board of directors of Irvine Sensors Corporation. Dr. Carleone also served as President of Aerojet Fine Chemicals LLC, a business unit of GenCorp Inc., and Vice President of GenCorp Inc., a manufacturer of aerospace and defense products and systems with a real estate segment, from September 2000 to November 2005. From 1999 to 2000, he was Vice President and General Manager of Remote Sensing Systems at Aerojet. In addition, he served as Vice President, Operations at Aerojet from 1997 to 2000.

Qualifications: Dr. Carleone has held senior executive positions in fine chemicals, aerospace and defense contracting. He brings to the Company this broad and relevant experience as well as significant experience managing a variety of new business ventures and transitioning them into fully operational business units.

Fred D. Gibson, Jr. joined the Board following the merger of Pacific Engineering & Production Co. of Nevada and the Company in May 1982. Mr. Gibson served as Vice Chairman of the Board until 1985 when the American Pacific Corporation stock holdings were purchased from the founder and principal owner, John Wertin. Prior to his retirement from the Company in 1997, Mr. F. Gibson served as Chief Executive Officer, Chairman of the Board and President of the Company and Chairman and Chief Executive Officer of each of the Company’s subsidiaries, from 1985 to July 1997, and Chairman of the Board of the Company until March 1998. Mr. F. Gibson also currently serves as a director of Ampac-ISP Corp., American Pacific Corporation (a Nevada corporation), American Azide Corporation, and Ampac Farms, Inc., each direct or indirect wholly-owned subsidiaries of the Company. He also served as Chairman, President and Chief Executive Officer of Pacific Engineering & Production Co. of Nevada, the predecessor company to American Pacific Corporation, from April 1966 until May 1988. For more than five years and until July 2002, Mr. F. Gibson was a director of Sierra Pacific Resources (now NV Energy), an electric utility. He has also been a director of Cashman Equipment Company, a distributor of Caterpillar Equipment, for more than five years. For more than five years, Mr. F. Gibson has been a private consultant to the Company, and may provide consultation services on an “as requested” basis in the future. He is the brother of director John R. Gibson and executive officer Linda G. Ferguson, and uncle of executive officer Dave A. Thayer. Mr. F. Gibson is retiring from the Board effective March 12, 2013.

Qualifications: From his long experience as a director of major enterprises and his exceptional knowledge of the Company, Mr. F. Gibson brings to the Company mature and thoughtful judgment and perspective on developing and pursuing strategic objectives.

Berlyn D. Miller has been Chief Executive Officer of Berlyn Miller & Associates, a business development and government relations consulting firm, since 1997 and in such role, during the latter half of the fiscal year ended September 30, 2011, provided consulting services to the Company pertaining to the Company’s environmental remediation project in Henderson, Nevada. Mr. Miller currently serves as a member of the Colorado River Commission of Nevada, a position appointed by the Governor of Nevada. He was a director of First National Bank of Nevada and its successor First Interstate Bank of Nevada from 1980 until 1996. Mr. Miller was also a director of Western Electrochemical Company, the Company’s former principal operating subsidiary, from 1989 until 1995. Mr. Miller was the Chairman, President and Chief Executive Officer of ACME Electric of Las Vegas, Nevada, a construction contractor, until 1997, a position he held for more than five years. Mr. Miller also serves on a number of not-for-profit boards.

Qualifications: Mr. Miller brings to the Company extensive experience with financial institutions, executive business management, business development, construction real estate and governmental, regulatory and legislative affairs.

Bart Weiner provides business consultation services to pharmaceutical and biotechnology companies. From 2001 to 2008, Mr. Weiner served as President and Group Chief Operating Officer of GfK Healthcare, a leading provider of health care marketing research and consulting. GfK Healthcare is part of GfK Group of Nuremberg,

– 13 –

Germany, the third largest market information company in the world. Mr. Weiner was appointed to the Board in accordance with the terms of the Company’s Settlement Agreement, dated as of December 14, 2010, with the Golconda Group. Pursuant to the terms of the Settlement Agreement, the Golconda Group agreed, among other things, to withdraw their director nominations, including of Mr. Weiner, for election at the 2011 annual meeting of stockholders and the Company agreed, among other things, to expand the size of the Board from ten to twelve members and to elect each of Mr. Weiner and Ms. Sibley to the Board. In addition, under the terms of the Settlement Agreement, it was agreed that the Board would nominate and recommend to the Company’s stockholders Mr. Weiner for re-election to the Board at the 2011 annual meeting of stockholders.

Qualifications: Mr. Weiner brings to the Company three decades of experience as a lead consultant and executive with expertise in advising companies on a variety of strategic and marketing development decisions. He has extensive knowledge in areas of pharmaceuticals and biotechnology. This experience has provided, and continues to provide, the Company with a valuable perspective.

BOARD OF DIRECTORS’ MEETINGS AND COMMITTEES AND GOVERNANCE MATTERS

Director Meetings and Independence

During Fiscal 2012, the Board and its committees held the following number of meetings: Board, 7; Audit Committee, 4; Compensation Committee, 4; Corporate Governance Committee, 3; Environmental, Health & Safety Committee, 2; and Retirement Benefits Committee, 2. Each director attended at least 75% of the aggregate meetings of the Board and the committees of the Board on which the director served that were held during Fiscal 2012.

It is a policy of the Board to encourage directors to attend each annual meeting of stockholders. Such attendance allows for direct interaction between stockholders and members of the Board. All of the directors on the Board attended the 2012 annual meeting of stockholders, with the exception of Mr. Loeb.

The Board has determined that each of Ms. Campbell, Mr. Loeb, Mr. Miller, Mr. Rooker, Ms. Sibley, Mr. Weiner and Ms. Williams, is an “independent director” as defined in Rule 5605(a)(2) of the Rules of The NASDAQ Stock Market LLC (the “NASDAQ Rules”) and that Mr. Willard was an independent director as defined in Rule 5605(a)(2) prior to his retirement. Additionally, the Board has determined that Mr. Haft, if elected at the Annual Meeting, will be an “independent director” as defined in Rule 5605(a)(2). The Board also has determined that each member of the Corporate Governance Committee, the Compensation Committee and the Audit Committee meets such independent director requirement. In addition, the Board has determined that each member of the Audit Committee is independent within the meaning of Section 10A(m)(3) of the Exchange Act and Rule 10A-3(b)(1) thereunder, and satisfies the requirements for membership in the Audit Committee as set forth in Rule 5605(c)(2)(A) of the NASDAQ Rules and as set forth in the Company’s Amended and Restated Audit Committee Charter, a copy of which is available on the Company’s website at www.apfc.com on the “Corporate Governance” page of the “Investors” section.

In making its independence determination regarding Mr. Miller, the Board considered that Mr. Miller provided consulting services to the Company with respect to the Company’s environmental remediation project in Henderson, Nevada, for which Mr. Miller was paid a consulting fee of $5,000 monthly, or $60,000 for such services rendered during Fiscal 2012.

In making its independence determination regarding each of Ms. Sibley and Mr. Weiner, the Board considered the terms of the Company’s Settlement Agreement, dated as of December 14, 2010, with the Golconda Group pursuant to which the Company agreed, among other things, to elect each of Ms. Sibley and Mr. Weiner to the Board.

In making its independence determination regarding Mr. Rooker, the Board considered that Mr. Rooker has an in-law, separated by more than one step, who works for the Company in a non-executive position.

In making its independence determination regarding Mr. Haft, the Board considered the terms of the Company’s Settlement Agreement, dated as of January 14, 2013, with the Cornwall Group pursuant to which the Company agreed, among other things, to nominate Mr. Haft for election to the Board.

The Company and each director have entered into the Company’s standard form of Indemnification Agreement between the Company and a director, the form of which agreement was previously filed by the Company as Exhibit 3.6 to the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2000.

– 14 –

Board Leadership Structure and Board’s Role in Risk Oversight

Our Board retains flexibility to select its Chairman of the Board and our Chief Executive Officer in the manner that it believes is in the best interests of our stockholders. Accordingly, the Chairman of the Board and the Chief Executive Officer may be filled by one individual or two.

The Board currently believes that having Mr. John R. Gibson serve as our non-executive Chairman of the Board and Dr. Carleone, who is also a director, serve as President and Chief Executive Officer is in the best interests of the stockholders. This separation allows the President and Chief Executive Officer to focus his primary efforts and responsibilities on the operational leadership and day-to-day management of the Company, while allowing the Chairman of the Board to focus on leading the Board in its fundamental role of providing advice to and oversight of management. At the same time, given Mr. J. Gibson’s extensive knowledge of, and prior years of service to and experience with, the Company, the current non-executive Chairman of the Board remains a valuable resource to the current President and Chief Executive Officer.

Both the full Board and its committees oversee the various risks faced by the Company. Management is responsible for the day-to-day management of the Company’s risks and provides periodic reports to the Board and its committees relating to those risks and risk-mitigation efforts.

Board oversight of risk is conducted primarily through the standing committees of the Board, the Chairmen of which are independent directors, with the Audit Committee taking a lead role on oversight of financial risks and in interfacing with management on significant risks or exposures and assessing the steps management has taken to minimize such risks. The Audit Committee also is charged with, among other tasks, oversight of management on the Company’s systems and policies with respect to risk monitoring, assessment and management. Members of the Company’s management, including our Chief Financial Officer and the Director of Internal Audit, periodically report to the Audit Committee regarding risks overseen by the Audit Committee, including quarterly with respect to the Company’s internal controls over financial reporting.

We believe that the structure of the Board’s role in risk oversight of the Company, with the standing committees of the Board taking the lead in such oversight, gives due consideration to the fact that our non-executive Chairman of the Board was formerly the Chief Executive Officer and primary day-to-day manager of the Company, while at the same time provides a measured approach for our non-executive Chairman of the Board to maintain an active and central leadership role with the full Board.

Board Committees

In May 2012, the committee structure of the Board was modified to eliminate the Finance Committee. Consequently, the Board now maintains five standing committees, the specific members of which are identified in the preceding table.

Audit Committee. The Audit Committee, which was established in accordance with Section 3(a)(58)(A) of the Exchange Act, oversees, among other things, the accounting and financial reporting processes of the Company and audits of the Company’s financial statements. A more detailed description of the duties of the Audit Committee is set forth in its charter, which is available to stockholders and others on the Company’s website at www.apfc.com on the “Corporate Governance” page of the “Investors” section. Please also see the Audit Committee Report found in this proxy statement. The Board has determined that each of Barbara Smith Campbell and Jan H. Loeb is an “audit committee financial expert” as defined in Item 407(d) of Regulation S-K. As noted above, the Board has determined that each of the Audit Committee members is independent within the meaning of Section 10A(m)(3) of the Exchange Act and Rule 10A-3(b)(1) thereunder, and satisfies the requirements for membership in the Audit Committee as set forth in Rule 5605(c)(2)(A) of the NASDAQ Rules and as set forth in the Company’s Amended and Restated Audit Committee Charter.

Compensation Committee. The Compensation Committee is responsible for, among other things, discharging the Board’s responsibilities relating to the compensation of the Company’s executive officers and directors and administering the Company’s incentive compensation plans and equity-based plans, including reviewing and evaluating the executive officer compensation program to align the interests of the executive officers with the business and financial goals of the Company, reviewing, evaluating and designing a director compensation package of a reasonable total value and aligned with long-term stockholder interests, and reviewing and approving incentive compensation plans and equity-based plans and administering and making awards under such plans. The Compensation Committee also has the authority to obtain advice and seek assistance from internal and external legal, accounting and other advisors, including consultants. It also may delegate its authority to subcommittees, if and when formed, and, in the case of individuals who are not

– 15 –

directors or executive officers of the Company, the Compensation Committee may delegate authority to senior management to administer and make awards under the Company’s incentive compensation plans and equity-based plans as in effect and adopted from time to time by the Board, subject to any applicable limitations under applicable law. The Charter of the Compensation Committee is available to stockholders and others on the Company’s website at www.apfc.com on the “Corporate Governance” page of the “Investors” section.

Corporate Governance Committee. The Corporate Governance Committee, which also acts as the Company’s nominating committee, is currently responsible for, among other things, developing and recommending to the Board a set of effective corporate governance policies and procedures applicable to the Company and the Board, and identifying, reviewing and evaluating individuals qualified to become Board members and recommending to the Board director nominees for election to the Board, and making recommendations to the Board regarding succession planning for executive officers of the Company. The Corporate Governance Committee additionally provides oversight of the Company’s directors and officers’ insurance coverage and may participate in developing major strategic and financial objectives for the Company, including, but not limited to, the Company’s strategic plan, annual budget and financial goals. The Corporate Governance Committee also has the authority to obtain advice and seek assistance from internal and external legal, accounting and other advisors, including consultants. In addition, the Corporate Governance Committee may delegate its authority to subcommittees, if and when formed. The Charter of the Corporate Governance Committee is available to stockholders and others on the Company’s website at www.apfc.com on the “Corporate Governance” page of the “Investors” section.

Environmental, Health & Safety Committee. The Environmental, Health & Safety Committee oversees the Company’s compliance with applicable environmental, safety and health standards, statutes and regulations, as well as oversight of the Company’s environmental remediation project in Henderson, Nevada.

Finance Committee. Prior to its dissolution, the Finance Committee had the responsibility to oversee special finance related transactions on an as-needed basis as determined by the Board.

Retirement Benefits Committee. The Retirement Benefits Committee administers the Company’s defined benefit pension plans, the supplemental executive retirement plan and the 401(k) plans, and oversees the performance of the managers of pension plan assets.

DIRECTOR COMPENSATION DETERMINATIONS AND CONSIDERATIONS

Non-employee directors’ compensation generally is determined and awarded by the Board. The Compensation Committee of the Board is responsible for, among other things, reviewing, evaluating and designing a director compensation package of a reasonable total value, typically based on comparisons with similar firms, and aligned with long-term interests of the stockholders of the Company, and reviewing director compensation levels and practices and recommending to the Board, from time to time, changes in such compensation levels and practices. These matters also include making equity awards to non-employee directors from time to time under the Company’s equity-based plans.