UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31, 2021

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from ________ to ________

Commission File Number:1-13107

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||||||||

| , | ||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| | ||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the new registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| þ | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

As of June 30, 2021, the aggregate market value of the common stock of the registrant held by non-affiliates was approximately $4.5 billion based on the closing price of the common stock on the New York Stock Exchange on such date (for the purpose of this calculation, the registrant assumed that each of its directors, executive officers, and greater than 10% stockholders was an affiliate of the registrant as of June 30, 2021).

As of February 15, 2022, the registrant had 61,671,559 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

AUTONATION, INC.

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2021

INDEX

| Page | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 5. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

PART I

ITEM 1. BUSINESS

General

AutoNation, Inc., through its subsidiaries, is the largest automotive retailer in the United States. As of December 31, 2021, we owned and operated 339 new vehicle franchises from 247 stores located in the United States, predominantly in major metropolitan markets in the Sunbelt region. Our stores, which we believe include some of the most recognizable and well-known in our key markets, sell 33 different new vehicle brands. The core brands of new vehicles that we sell, representing approximately 90% of the new vehicles that we sold in 2021, are manufactured by Toyota (including Lexus), Honda, Ford, General Motors, Stellantis, Mercedes-Benz, BMW, and Volkswagen (including Audi and Porsche). As of December 31, 2021, we also owned and operated 57 AutoNation-branded collision centers, 9 AutoNation USA used vehicle stores, 4 AutoNation-branded automotive auction operations, and 3 parts distribution centers.

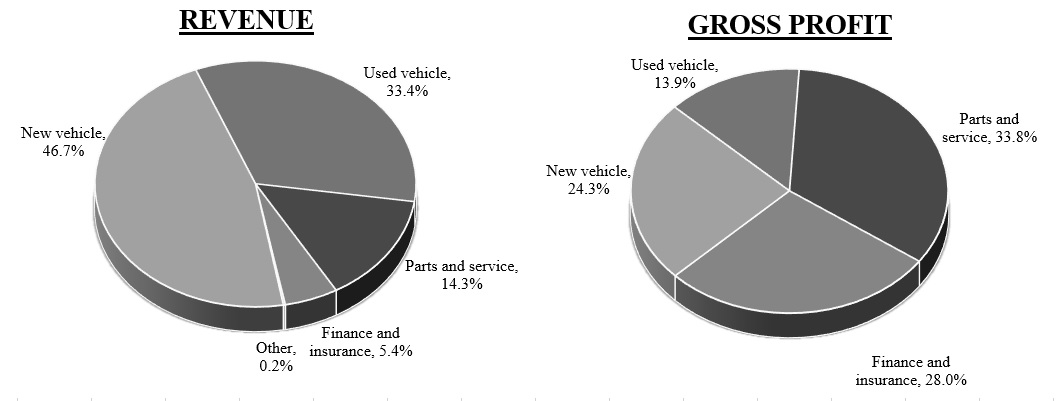

We offer a diversified range of automotive products and services, including new vehicles, used vehicles, “parts and service” (also referred to as “After-Sales”), which includes automotive repair and maintenance services as well as wholesale parts and collision businesses, and automotive “finance and insurance” products (also referred to as “Customer Financial Services”), which include vehicle service and other protection products, as well as the arranging of financing for vehicle purchases through third-party finance sources. The following charts present the contribution to total revenue and gross profit by each of new vehicle, used vehicle, parts and service, and finance and insurance sales in 2021.

For convenience, the terms “AutoNation,” “Company,” and “we” are used to refer collectively to AutoNation, Inc. and its subsidiaries, unless otherwise required by the context. Our store operations are conducted by our subsidiaries.

Reportable Segments

As of December 31, 2021, we had three reportable segments: Domestic, Import, and Premium Luxury. These segments are comprised of retail automotive franchises that sell the following new vehicle brands:

| Domestic | Import | Premium Luxury | |||||||||||||||||||||

| Buick | Ford | Acura | Nissan | Alfa Romeo | Lexus | ||||||||||||||||||

| Cadillac | GMC | Fiat | Subaru | Audi | Maserati | ||||||||||||||||||

| Chevrolet | Jeep | Genesis | Toyota | Bentley | Mercedes-Benz | ||||||||||||||||||

| Chrysler | Lincoln | Honda | Volkswagen | BMW | MINI | ||||||||||||||||||

| Dodge | Ram | Hyundai | Volvo | Jaguar | Porsche | ||||||||||||||||||

| Infiniti | Land Rover | Sprinter | |||||||||||||||||||||

1

The following table sets forth information regarding our new vehicle revenues and retail new vehicle unit sales for the year ended, and the number of franchises owned as of, December 31, 2021:

| New Vehicle Revenues (in millions) | Retail New Vehicle Unit Sales | % of Total Retail New Vehicle Units Sold | Franchises Owned | |||||||||||||||||||||||

| Domestic: | ||||||||||||||||||||||||||

| Ford, Lincoln | $ | 1,317.1 | 27,475 | 10.5 | 35 | |||||||||||||||||||||

| Chevrolet, Buick, Cadillac, GMC | 1,124.0 | 25,244 | 9.6 | 40 | ||||||||||||||||||||||

| Chrysler, Dodge, Jeep, Ram | 1,160.7 | 23,492 | 8.9 | 72 | ||||||||||||||||||||||

| Domestic Total | 3,601.8 | 76,211 | 29.0 | 147 | ||||||||||||||||||||||

| Import: | ||||||||||||||||||||||||||

| Toyota | 1,947.4 | 56,359 | 21.5 | 19 | ||||||||||||||||||||||

| Honda | 1,107.3 | 35,539 | 13.5 | 24 | ||||||||||||||||||||||

| Nissan | 194.3 | 6,642 | 2.5 | 7 | ||||||||||||||||||||||

| Other Import | 720.8 | 20,323 | 7.8 | 36 | ||||||||||||||||||||||

| Import Total | 3,969.8 | 118,863 | 45.3 | 86 | ||||||||||||||||||||||

| Premium Luxury: | ||||||||||||||||||||||||||

| Mercedes-Benz | 1,617.1 | 22,901 | 8.7 | 38 | ||||||||||||||||||||||

| BMW | 1,336.7 | 21,149 | 8.1 | 18 | ||||||||||||||||||||||

| Lexus | 378.4 | 7,770 | 3.0 | 3 | ||||||||||||||||||||||

| Audi | 355.5 | 5,887 | 2.2 | 10 | ||||||||||||||||||||||

| Jaguar Land Rover | 407.5 | 5,116 | 1.9 | 22 | ||||||||||||||||||||||

| Other Premium Luxury | 414.9 | 4,506 | 1.8 | 15 | ||||||||||||||||||||||

| Premium Luxury Total | 4,510.1 | 67,329 | 25.7 | 106 | ||||||||||||||||||||||

| $ | 12,081.7 | 262,403 | 100.0 | 339 | ||||||||||||||||||||||

The franchises in each segment also sell used vehicles, parts and automotive repair and maintenance services, and automotive finance and insurance products. For the year ended December 31, 2021, Premium Luxury revenue represented 36% of total revenue, Domestic revenue represented 31% of total revenue, and Import revenue represented 30% of total revenue. For additional financial information regarding our three reportable segments, refer to Note 22 of the Notes to Consolidated Financial Statements set forth in Part II, Item 8 of this Form 10-K.

Except to the extent that differences among reportable segments are material to an understanding of our business taken as a whole, the description of our business in this report is presented on a consolidated basis.

Business Strategy

We seek to create long-term value for our stockholders by being the best-run, most profitable automotive retailer in the United States. We believe that the significant scale of our operations, our digital customer experience, and the quality of our managerial talent allow us to achieve efficiencies in our key markets. To achieve and sustain operational excellence, we are pursuing the following strategies:

•Create an industry-leading automotive retail customer experience in our stores and through our digital channels.

We seek to deliver a consistently superior customer experience by offering a large selection of inventory, customer-friendly, transparent sales and service processes, and competitive pricing. We believe that this will benefit us by encouraging our customers to bring their vehicles to our stores for all of their vehicle service, maintenance, and collision repair needs and also by driving repeat and referral vehicle sales business.

We continue to make significant investments to build a seamless, end-to-end customer experience in our stores and through our digital channels, and to improve our ability to generate business through those channels. We have

2

enhanced the AutoNation Express experience - our integrated retailing solution that provides customers with a seamless and intuitive omnichannel vehicle shopping and purchase experience - by continuing to build omnichannel digital capabilities that provide a personalized digital customer experience online and in-store. Our customers are able to complete key automotive retail- and service-related transactions through our digital channels such as selecting and reserving a vehicle with a guaranteed price, scheduling a test drive, calculating payment options, receiving a certified trade-in or purchase offer for a vehicle that a customer wants to sell, applying for financing, selecting vehicle protection products, scheduling in-store pick up or home delivery, arranging service appointments, receiving service updates, and paying for maintenance and repair services online. We have also developed proprietary tools that leverage real-time customer data to guide and personalize the customer experience.

•Continue to invest in the AutoNation retail brand to enhance our strong customer satisfaction and expand our market share.

AutoNation is a brand that connects people and places. We continue to invest in the AutoNation retail brand, promoting personal transportation for America’s drivers, leading the charge to make transformational change in the automotive industry, and driving out cancer coast to coast. We are committed to delivering easy, transparent, and customer-centric services for our customers’ personal transportation needs.

The AutoNation retail brand includes our AutoNation USA used vehicle stores. We are expanding our AutoNation USA used vehicle store footprint and plan to build over 130 stores by the end of 2026. The first phase of the AutoNation USA store expansion will include extending AutoNation’s coast to coast footprint into new markets. AutoNation USA stores will continue to leverage the AutoNation brand, scale, exceptional used vehicle sourcing capabilities, and proven customer-centric processes to differentiate our Company and capture a larger share of the used vehicle market.

We offer AutoNation-branded Customer Financial Services products (including extended service and maintenance contracts and other vehicle protection products), AutoNation-branded parts and accessories, collision repair services at AutoNation-branded collision centers, and auction services at AutoNation-branded automotive auctions, as well as our One Price used vehicle centralized pricing and appraisal strategy, and our “We’ll Buy Your Car” program (under which customers receive a guaranteed trade-in offer honored for 7 days or 500 miles at any of our locations).

We expect that these initiatives and offerings will continue to expand and strengthen the AutoNation retail brand, improve the customer experience, provide new growth opportunities, and enable us to expand our footprint in our core and other markets.

•Leverage our significant scale and cost structure to improve our operating efficiency.

As the largest automotive retailer in the United States, we are uniquely positioned to leverage our significant scale so that we are able to achieve competitive operating margins by centralizing and streamlining various business processes. We strive to manage our new and used vehicle inventories so that our stores’ supply and mix of vehicles are in line with seasonal sales trends and also minimize our carrying costs. Additionally, we are able to improve financial controls and lower servicing costs by maintaining many key store-level accounting and administrative activities in our Shared Services Center located in Irving, Texas. We also leverage our digital capabilities to drive cost reductions and increased efficiency for the long-term success of our business. Finally, we leverage our scale to reduce costs related to purchasing certain equipment, supplies, and services through national vendor relationships.

Our business benefits from a well-diversified portfolio of automotive retail franchises. In 2021, approximately 39% of our segment income for reportable segments was generated by Premium Luxury franchises, approximately 33% by Import franchises, and approximately 28% by Domestic franchises. We believe that our business also benefits from diverse revenue streams generated by our new and used vehicle sales, parts and service business, and finance and insurance sales. Our higher-margin parts and service business has historically been less sensitive to macroeconomic conditions as compared to new and used vehicle sales.

Our capital allocation strategy is focused on growing long-term value per share. We invest capital in our business to maintain and upgrade our existing facilities and to build new facilities for existing franchises and new AutoNation USA

3

used vehicle stores, as well as for other strategic and technology initiatives. We also deploy capital opportunistically to complete acquisitions or investments, build facilities for newly awarded franchises, and/or repurchase our common stock and/or debt. Our capital allocation decisions are based on factors such as the expected rate of return on our investment, the market price of our common stock versus our view of its intrinsic value, the market price of our debt, the potential impact on our capital structure, our ability to complete acquisitions that meet our market and vehicle brand criteria and return on investment threshold, and limitations set forth in our debt agreements. For additional information regarding our capital allocation, refer to “Liquidity and Capital Resources – Capital Allocation” in Part II, Item 7 of this Form 10-K.

Operations

Each of our stores acquires new vehicles for retail sale either directly from the applicable automotive manufacturer or distributor or through dealer trades with other stores of the same brand franchise. We generally acquire used vehicles from customers, primarily through trade-ins and our “We’ll Buy Your Car” program, as well as through auctions, lease terminations, and other sources, and we generally recondition used vehicles acquired for retail sale in our parts and service departments. Used vehicles that we do not sell at our stores generally are sold at wholesale prices through auctions. See also “Inventory Management” in Part II, Item 7 of this Form 10-K.

Our stores provide a wide range of vehicle maintenance, repair, and collision repair services, including manufacturer recall repairs and other warranty work that can be performed only at franchised dealerships and customer-pay service work. Our parts and service departments also recondition used vehicles acquired by our used vehicle departments and perform preparatory work on new vehicles acquired by our new vehicle departments. In addition to our retail business, we also have wholesale parts operations, which sell automotive parts to both collision repair shops and independent vehicle repair providers. We also offer AutoNation PrecisionParts and AutoNation AutoGear, product and accessory lines that are integrated into our parts and service operations.

We offer a wide variety of automotive finance and insurance products to our customers. We arrange for our customers to finance vehicles through installment loans or leases with third-party lenders, including the vehicle manufacturers’ and distributors’ captive finance subsidiaries, and receive a commission payable to us from the lender. We do not directly finance our customers’ vehicle leases or purchases, and our exposure to loss in connection with these financing arrangements generally is limited to the commissions that we receive.

We also offer our customers various vehicle protection products, including extended service contracts, maintenance programs, guaranteed auto protection (known as “GAP,” this protection covers the shortfall between a customer’s loan balance and insurance payoff in the event of a casualty), “tire and wheel” protection, and theft protection products, many of which are AutoNation-branded. These products are underwritten and administered by independent third parties, including the vehicle manufacturers’ and distributors’ captive finance subsidiaries. We sell the products on a commission basis, and we also participate in future underwriting profit for certain products pursuant to retrospective commission arrangements with the issuers of those products.

4

As of December 31, 2021, we operated stores in the following states:

| State | Number of Retail Stores (1) | Number of Franchises | Number of Other Locations (2) | % of Total Revenue | ||||||||||||||||||||||

| Florida | 49 | 59 | 20 | 25 | ||||||||||||||||||||||

| Texas | 44 | 62 | 18 | 21 | ||||||||||||||||||||||

| California | 37 | 49 | 4 | 19 | ||||||||||||||||||||||

| Arizona | 16 | 18 | 4 | 6 | ||||||||||||||||||||||

| Colorado | 15 | 22 | 1 | 6 | ||||||||||||||||||||||

| Washington | 14 | 19 | 3 | 5 | ||||||||||||||||||||||

| Georgia | 16 | 25 | 4 | 4 | ||||||||||||||||||||||

| Nevada | 12 | 13 | 1 | 4 | ||||||||||||||||||||||

| Illinois | 7 | 8 | 1 | 2 | ||||||||||||||||||||||

| Tennessee | 8 | 12 | 1 | 2 | ||||||||||||||||||||||

| Maryland | 15 | 17 | 3 | 1 | ||||||||||||||||||||||

| New York | 4 | 6 | — | 1 | ||||||||||||||||||||||

| Ohio | 4 | 4 | 3 | 1 | ||||||||||||||||||||||

| Virginia | 2 | 2 | — | 1 | ||||||||||||||||||||||

| Alabama | 3 | 6 | — | 1 | ||||||||||||||||||||||

| Minnesota | 1 | 1 | — | 1 | ||||||||||||||||||||||

South Carolina (3) | 9 | 16 | 1 | — | ||||||||||||||||||||||

| Total | 256 | 339 | 64 | 100 | ||||||||||||||||||||||

(1)Includes franchised dealerships and AutoNation USA used vehicle stores.

(2)Includes collision centers, automotive auction operations, and parts distribution centers.

(3)Comprised of stores that were acquired at the end of the third quarter of 2021.

Agreements with Vehicle Manufacturers

Framework Agreements

We have entered into framework and related agreements with most major vehicle manufacturers and distributors. These agreements, which are in addition to the franchise agreements described below, contain provisions relating to our management, operation, advertising and marketing, and acquisition and ownership structure of automotive stores franchised by such manufacturers. These agreements contain certain requirements pertaining to our operating performance (with respect to matters such as sales volume, sales effectiveness, and customer satisfaction or loyalty), which, if we do not satisfy, adversely impact our ability to make further acquisitions of such manufacturers’ stores or could result in us being compelled to take certain actions, such as divesting a significantly underperforming store, subject to applicable state franchise laws. Additionally, these agreements set limits (nationally, regionally, and in local markets) on the number of stores that we may acquire of the particular manufacturer and contain certain restrictions on our ability to name and brand our stores. Some of these framework agreements give the manufacturer or distributor the right to acquire at fair market value, or the right to compel us to sell, the automotive stores franchised by that manufacturer or distributor under specified circumstances in the event of a change in control of our Company (generally including certain material changes in the composition of our Board of Directors during a specified time period, the acquisition of 20% or more of the voting stock of our Company by another vehicle manufacturer or distributor, or the acquisition of 50% or more of our voting stock by a person, entity, or group not affiliated with a vehicle manufacturer or distributor) or other extraordinary corporate transactions such as a merger or sale of all or substantially all of our assets. In addition, we have granted certain manufacturers the right to acquire, at fair market value, our automotive dealerships franchised by such manufacturers in specified circumstances in the event of our default under certain of our debt agreements.

Franchise Agreements

We operate each of our new vehicle stores under a franchise agreement with a vehicle manufacturer or distributor. The franchise agreements grant the franchised automotive store a non-exclusive right to sell the manufacturer’s or distributor’s

5

brand of vehicles and offer related parts and service within a specified market area. These franchise agreements grant our stores the right to use the relevant manufacturer’s or distributor’s trademarks in connection with their operations, and they also impose numerous operational requirements and restrictions relating to inventory levels, working capital levels, the sales process, marketing and branding, showroom and service facilities, signage, personnel, changes in management, and monthly financial reporting, among other things. The contractual terms of our stores’ franchise agreements provide for various durations, ranging from one year to no expiration date, and in certain cases manufacturers have undertaken to renew such franchises upon expiration so long as the store is in compliance with the terms of the agreement. We generally expect our franchise agreements to survive for the foreseeable future and, when the agreements do not have indefinite terms, anticipate routine renewals of the agreements without substantial cost or modification. Our stores’ franchise agreements provide for termination of the agreement by the manufacturer or non-renewal for a variety of causes (including performance deficiencies in such areas as sales volume, sales effectiveness, and customer satisfaction or loyalty). However, in general, the states in which we operate have automotive dealership franchise laws that provide that, notwithstanding the terms of any franchise agreement, it is unlawful for a manufacturer to terminate or not renew a franchise unless “good cause” exists. It generally is difficult, outside of bankruptcy, for a manufacturer to terminate, or not renew, a franchise under these laws, which were designed to protect dealers. In addition, in our experience and historically in the automotive retail industry, dealership franchise agreements are rarely involuntarily terminated or not renewed by the manufacturer outside of bankruptcy. From time to time, certain manufacturers assert sales and customer satisfaction performance deficiencies under the terms of our framework and franchise agreements. We generally work with these manufacturers to address the asserted performance issues. For additional information, please refer to the risk factor captioned “We are subject to restrictions imposed by, and significant influence from, vehicle manufacturers that may adversely impact our business, financial condition, results of operations, cash flows, and prospects, including our ability to acquire additional stores” in Part I, Item 1A of this Form 10-K.

Regulations

We operate in a highly regulated industry. A number of state and federal laws and regulations affect our business. In every state in which we operate, we must obtain various licenses in order to operate our businesses, including dealer, sales and finance, and insurance licenses issued by state regulatory authorities. Numerous laws and regulations govern how we conduct our business, including those relating to our sales, operations, finance and insurance, advertising, and employment practices. These laws and regulations include state franchise laws and regulations, consumer protection laws, privacy laws, escheatment laws, anti-money laundering laws, and other extensive laws and regulations applicable to new and used motor vehicle dealers, as well as a variety of other laws and regulations. These laws also include federal and state wage and hour, anti-discrimination, and other employment practices laws. See the risk factor “Our operations are subject to extensive governmental laws and regulations. If we are found to be in purported violation of or subject to liabilities under any of these laws or regulations, or if new laws or regulations are enacted that adversely affect our operations, our business, operating results, and prospects could suffer” in Part I, Item 1A of this Form 10-K.

Automotive and Other Laws and Regulations

Our operations are subject to the National Traffic and Motor Vehicle Safety Act, Federal Motor Vehicle Safety Standards promulgated by the United States Department of Transportation, and the rules and regulations of various state motor vehicle regulatory agencies. In addition, automotive dealers are subject to regulation by the Federal Trade Commission (the “FTC”). The imported automobiles, parts, and accessories we purchase are subject to United States customs duties and, in the ordinary course of our business we may, from time to time, be subject to claims for duties, penalties, liquidated damages, or other charges.

Our financing activities with customers are subject to federal truth-in-lending, consumer leasing, and equal credit opportunity laws and regulations, as well as state and local motor vehicle finance laws, leasing laws, installment finance laws, usury laws, and other installment sales and leasing laws and regulations, some of which regulate finance and other fees and charges that may be imposed or received in connection with motor vehicle retail installment sales and leasing. Claims arising out of actual or alleged violations of law may be asserted against us or our stores by individuals, a class of individuals, or governmental entities and may expose us to significant damages or other penalties, including fines and revocation or suspension of our licenses to conduct store operations. Our financing activities may also be impacted indirectly by laws and regulations that govern automotive finance companies and other financial institutions, including regulations adopted by the Consumer Financial Protection Bureau (the “CFPB”).

6

See the risk factor “Our operations are subject to extensive governmental laws and regulations. If we are found to be in purported violation of or subject to liabilities under any of these laws or regulations, or if new laws or regulations are enacted that adversely affect our operations, our business, operating results, and prospects could suffer” in Part I, Item 1A of this Form 10-K for additional information.

Environmental, Health, and Safety Laws and Regulations

Our operations involve the use, handling, storage, and contracting for recycling and/or disposal of materials such as motor oil and filters, transmission fluids, antifreeze, refrigerants, paints, thinners, batteries, cleaning products, lubricants, degreasing agents, tires, and fuel. Consequently, our business is subject to a complex variety of federal, state, and local requirements that regulate the environment and public health and safety.

Most of our stores utilize aboveground storage tanks and, to a lesser extent, underground storage tanks, primarily for petroleum-based products. Storage tanks are subject to periodic testing, containment, upgrading, and removal under the Resource Conservation and Recovery Act and its state law counterparts. Clean-up or other remedial action may be necessary in the event of leaks or other discharges from storage tanks or other sources. In addition, water quality protection programs under the federal Water Pollution Control Act (commonly known as the Clean Water Act), the Safe Drinking Water Act, and comparable state and local programs govern certain discharges from some of our operations. Similarly, certain air emissions from operations, such as auto body painting, may be subject to the federal Clean Air Act and related state and local laws. Certain health and safety standards promulgated by the Occupational Safety and Health Administration of the United States Department of Labor and related state agencies also apply.

Some of our stores are parties to proceedings under the Comprehensive Environmental Response, Compensation, and Liability Act, or CERCLA, typically in connection with materials that were sent to former recycling, treatment, and/or disposal facilities owned and operated by independent businesses. The remediation or clean-up of facilities where the release of a regulated hazardous substance occurred is required under CERCLA and other laws.

We have a proactive strategy related to environmental, health, and safety laws and regulations, which includes contracting with third-party vendors to inspect our facilities routinely in an effort to ensure compliance. We incur significant costs to comply with applicable environmental, health, and safety laws and regulations in the ordinary course of our business. We do not anticipate, however, that the costs of such compliance will have a material adverse effect on our business, results of operations, cash flows, or financial condition, although such outcome is possible given the nature of our operations and the extensive environmental, health, and safety regulatory framework. We do not have any material known environmental commitments or contingencies.

Markets and Competition

We operate in a highly competitive industry. We believe that the principal competitive factors in the automotive retail business are location, service, price, selection, and online and mobile offerings. Each of our markets includes a large number of well-capitalized competitors that have extensive automotive retail managerial experience and strong retail locations and facilities.

New vehicle unit volume has been impacted by reduced availability of inventory due to inventory shortages driven largely by certain component shortages and disruptions in the manufacturers’ supply chains. We expect that new vehicle inventory shortages will continue well into 2022. We have prioritized our capital expenditures towards opportunities with the greatest return potential. We plan to expand our AutoNation USA used vehicle store footprint by building over 130 new stores by the end of 2026.

According to industry sources, as of December 31, 2021, there were approximately 16,700 franchised automotive dealerships, which sell both new and used vehicles, in the United States. In addition, we estimate that there were approximately twice as many independent used vehicle dealers in the United States. We face competition from (i) several public companies that operate numerous automotive retail stores or collision centers on a regional or national basis, including franchised dealers that sell new and used vehicles, non-franchised dealers that sell only used vehicles, and manufacturers that sell directly to customers, (ii) private companies that operate automotive retail stores or collision centers in our markets, and (iii) online and mobile sales platforms. We compete with dealers that sell the same vehicle brands that we sell, as well as dealers and certain manufacturers that sell other vehicle brands that we do not represent in a particular market. Our new vehicle store competitors have franchise agreements with the various vehicle manufacturers and, as such,

7

generally have access to new vehicles on the same terms as we have. We also compete with other dealers for qualified employees, particularly for general managers and sales and service personnel.

In general, the vehicle manufacturers have designated marketing and sales areas within which only one franchised dealer of a given vehicle brand may operate. Under most of our framework agreements with the vehicle manufacturers, our ability to acquire multiple dealers of a given vehicle brand within a particular market is limited. We are also restricted by various state franchise laws from relocating our stores or establishing new stores of a particular vehicle brand within any area that is served by another dealer of the same vehicle brand, and we generally need the manufacturer to approve the relocation or grant a new franchise in order to relocate or establish a store. However, to the extent that a market has multiple dealers of a particular vehicle brand, as most of our key markets do with respect to most vehicle brands we sell, we face significant intra-brand competition.

We also compete with independent automobile service shops, service center chains, collision service operations, and wholesale parts outlets. We believe that the principal competitive factors in the parts and service business are price, location, expertise with the particular vehicle lines, and customer service. We also compete with a broad range of financial institutions in our finance and insurance business. We believe that the principal competitive factors in the finance and insurance business are product selection, convenience, price, contract terms, and the ability to finance vehicle protection and aftermarket products.

Insurance and Bonding

Our business exposes us to the risk of liabilities arising out of our operations. For example, liabilities may arise out of claims of employees, customers, or other third parties for personal injury or property damage occurring in the course of our operations. We could also be subject to fines and civil and criminal penalties in connection with alleged violations of federal and state laws or regulatory requirements.

The automotive retail business is also subject to substantial risk of property loss due to the significant concentration of property values at store locations. In our case in particular, our operations are concentrated in states and regions in which natural disasters and severe weather events (such as hail storms, hurricanes, earthquakes, fires, tornadoes, snow storms, and landslides) may subject us to substantial risk of property loss and operational disruption. Under self-insurance programs, we retain various levels of aggregate loss limits, per claim deductibles, and claims-handling expenses as part of our various insurance programs, including property and casualty, workers’ compensation, and employee medical benefits. Costs in excess of this retained risk per claim may be insured under various contracts with third-party insurance carriers. We estimate the ultimate costs of these retained insurance risks based on actuarial evaluations and historical claims experience, adjusted for current trends and changes in claims-handling procedures. The level of risk we retain may change in the future as insurance market conditions or other factors affecting the economics of our insurance purchasing change. Although we have, subject to certain limitations and exclusions, substantial insurance, we cannot assure you that we will not be exposed to uninsured or underinsured losses that could have a material adverse effect on our business, financial condition, results of operations, or cash flows.

Provisions for retained losses and deductibles are made by charges to expense based upon periodic evaluations of the estimated ultimate liabilities on reported and unreported claims. The insurance companies that underwrite our insurance require that we secure certain of our obligations for deductible reimbursements with collateral. Our collateral requirements are set by the insurance companies and, to date, have been satisfied by posting surety bonds, letters of credit, and/or cash deposits. Our collateral requirements may change from time to time based on, among other things, our claims experience.

Seasonality

In a stable environment, our operations generally experience higher volumes of vehicle unit sales in the second and third quarters of each year due in part to consumer buying trends and the introduction of new vehicle models. Also, demand for vehicles and light trucks is generally lower during the winter months than in other seasons, particularly in regions of the United States where stores may be subject to adverse winter conditions. However, we typically experience higher sales of Premium Luxury vehicles, which have higher average selling prices and gross profit per vehicle retailed, in the fourth quarter. Revenue and operating results may be impacted significantly from quarter to quarter by changing economic conditions, vehicle manufacturer incentive programs, and actual or threatened severe weather events.

8

Trademarks

We own a number of registered service marks and trademarks, including, among other marks, AutoNation® and AutoNation USA®. Pursuant to agreements with vehicle manufacturers, we have the right to use and display manufacturers’ trademarks, logos, and designs at our stores and in our advertising and promotional materials, subject to certain restrictions. We also have licenses pursuant to various agreements with third parties authorizing the use and display of the marks and/or logos of such third parties, subject to certain restrictions. The current registrations of our service marks and trademarks are effective for varying periods of time, which we may renew periodically, provided that we comply with all applicable laws.

Human Capital

Employees

At AutoNation, nothing drives our success more than how we hire, train, and retain great people. We value the dignity of all employees and are committed to maintaining a work environment where all associates are valued and treated with respect. As of December 31, 2021, we employed approximately 22,200 full-time and part-time associates, approximately 170 of whom were covered by collective bargaining agreements.

We seek to develop and foster a diverse and inclusive work environment based on ethics and integrity where all associates can devote their best efforts to their jobs. Employee feedback is core to our culture and when we understand what employees need, it creates a better workplace for everyone. From time to time, we survey the satisfaction of our employees and seek input from employees on what is working and where we have opportunities for improvement, which helps us shape the future of AutoNation.

Diversity and Inclusion

We are committed to an inclusive and welcoming environment where each individual feels valued, respected, and heard. In 2020, we launched ONE AutoNation, an employee-focused initiative designed to embrace diversity in thought and action, promote inclusion despite our differences, and foster ongoing opportunities for learning, growth, and leadership. Our ONE AutoNation mission is to keep driving forward towards a more inclusive world. Our associates are guided by our policies, procedures, and training programs to ensure everyone is treated with respect and has opportunities to reach their full potential.

Through ONE AutoNation, we established our Diversity & Inclusion Council in order to ensure a more diverse workforce and cultivate a culture of belonging at AutoNation. Through ongoing education and collaboration, the Council is dedicated to enhancing the associate experience in an atmosphere that values, respects, and celebrates our differences. In addition, we support a number of employee business resource groups (“BRGs”) that are an integral part of our diversity and inclusion strategy. Our BRGs provide employees with the opportunity to engage with colleagues based on shared interests such as ethnic backgrounds, gender, and sexual orientation.

Leadership, Training, and Development

We believe that investment in leadership, training, and development opportunities helps us to prepare our associates with the skills they need while improving engagement and retention. We provide a range of formal and informal learning programs, which are designed to help our associates continuously grow and strengthen their skills throughout their careers, including: (1) General Manager University, designed to develop existing and future leaders at our stores; (2) Leader Education and Development for high-potential Associates (LEAD) program, designed to facilitate development for our up-and-coming talent; (3) Lead & Learn webinar events, a series of training courses designed to provide fresh perspectives and relevant content to support employee growth and leadership development; and (4) AutoNation’s Mentor Program, created to offer opportunities for associates to accelerate their personal and professional development through regular interactions specific to career growth and expansion within the organization.

See “Corporate Social Responsibility – Our Workplace” below for more information on human capital measures and objectives that we focus on in managing the business.

Corporate Social Responsibility

We strive to conduct our business in an ethical and socially responsible way, and we are sensitive to the needs of the environment, the communities in which we operate, our customers, our suppliers, our shareholders, and our associates.

9

The Environment

We are committed to managing our environmental impact and continually work to reduce it where practicable. The following highlights some of our environmental stewardship initiatives:

•Driving Electrified: As America transitions increasingly toward electric vehicles (“EV”), we have added and continue to add EV charging capabilities at many of our locations. Many of these locations offer EV charging free of charge to customers. In addition, given the growing popularity of EVs, we have also created a “Driving Electrified” section of our purchasing website to help customers shop and compare different vehicles.

•Product offering: We offer a wide variety of environmentally friendly vehicles, including electric and hybrid vehicles. We expect our manufacturer partners to continue to enhance their offerings of these types of vehicles.

•Building and maintenance: As we build new facilities and expand our AutoNation USA network, we take various measures to reduce our environmental impact, such as improving energy efficiency, reducing water consumption, sourcing materials locally, improving air quality, and pursuing alternative energy sources for our facilities. Our corporate headquarters building in Fort Lauderdale, Florida, is LEED Gold Certified, and is one of several LEED certified properties that we occupy.

•Recycling: In addition to adhering to recycling statutes, we try to maximize our recycling efforts where practicable, whether water, oil, tire rubber, scrap metal, paper, plastic, car batteries, radiator cores, or other materials.

•Stewardship: We have implemented an Environmental, Health and Safety Compliance Program, which includes training and consulting support at our dealerships and other operating entities.

Our Communities

We are committed to supporting the communities in which we operate. We encourage our associates to be active members in the communities where they live and work through volunteerism and charitable giving. Cancer touches nearly everyone and that is why supporting cancer research and treatment is so important to us. We have transformed our brand through our “Drive Pink” initiative. More than a charitable focus on cancer research and treatment, Drive Pink is a core element of our corporate culture and has impacted customers, associates, and our communities in meaningful ways.

We fund national cancer research and treatment facilities from coast to coast through our philanthropic activities. Through the combined efforts of our 22,200 associates, vendors, partners, customers, and executive leadership, we have raised and donated over $30 million to support the world-class AutoNation Institute for Breast Cancer Research and Care, the Moffitt Cancer Center, the Breast Cancer Research Foundation, Cleveland Clinic, and other leading cancer facilities.

Our presence is felt at local community-based cancer events, as teams of our associates represent AutoNation at runs, walks, and other fundraisers. Yearly, AutoNation celebrates Drive Pink Across America Day by providing our associates with opportunities to deliver thousands of gift bags to local hospitals in our markets for patients undergoing cancer treatment.

Vehicles sold at our AutoNation locations are fitted with a pink license plate frame as a symbol of our commitment to “driving out” cancer. More than two million pink license plate frames have been distributed to date.

Our Business and Our Customers

We are proud to be America’s largest and most recognized automotive retailer, and we strive to create transparency and establish unparalleled trust with our customers or others with whom we do business.

•Ethical standards: We have a Code of Business Ethics in place to help support our commitment to business ethics and responsibility. This Code describes our standards of business conduct and the steps AutoNation takes to ensure that our standards are understood and followed. Each AutoNation associate throughout the organization is expected to comply with the standards set forth in the Code. We also maintain a 24-hour Alert-Line for associates to anonymously report any Company policy violations under our Business Ethics Program.

•Customer satisfaction: We seek to deliver a consistently superior customer experience by offering a large selection of inventory, customer-friendly, transparent sales and service processes, and competitive pricing in a clean and safe

10

environment. We measure customer satisfaction and loyalty on a regular basis with a mission to deliver a peerless customer experience.

•Supplier relationships and sustainable procurement: We purchase products and services at a fair value regardless of the manufacturer or provider, while conducting our operations according to high standards of business conduct and all applicable legal requirements. We are also a member of an affiliate of the National Minority Supplier Development Council, which focuses on advancing business opportunities for certified minority business enterprises.

Our Workplace

AutoNation values the dignity of all employees and is committed to maintaining a work environment where all associates are valued and treated with respect. We seek to develop and foster a diverse and inclusive work environment based on ethics and integrity where all associates can devote their best efforts to their jobs.

•Respect in the Workplace: At AutoNation, we provide equal employment and promotional opportunities for all associates, as well as any individual applying for employment without regard to race, religion, sex, sexual orientation, gender identity or expression, national origin, age, disability, or any other protected characteristic as defined by applicable federal, state, or local law. We are committed to maintaining a work environment free from sexual and other harassment.

•Employee benefits: We offer a variety of employee benefits, such as competitive salaries/compensation plans, incentive compensation potential, and health and welfare benefits. Many of the valuable benefits we offer are free to our associates, including an innovative Company-paid cancer insurance plan that provides financial assistance to associates, their spouses, and their children who are diagnosed with cancer. This Company-paid benefit is offered by fewer than 5% of companies nationally and it underscores our commitment to driving out cancer.

•Healthy living: We encourage our associates and their families to be mindful of their physical and mental health, and we offer programs that provide free and confidential support services for a multitude of issues, such as legal, family/marital, and stress/anxiety, among others. We also provide a complimentary biometric screening for our associates and their spouses to raise their awareness of certain factors that can affect their health and increase the risk for heart disease, diabetes, or stroke. In addition, employees are eligible to receive annual company contributions to a health savings account from the company based on the type of coverage selected.

•Diversity: We endeavor to attract and retain diverse and talented people throughout our Company by engaging in diversity and inclusion initiatives, including our One AutoNation Program and other programs specifically designed to develop diverse groups of leaders and to recruit current and former military personnel, among others.

Cybersecurity Risk Management

We have developed and continue to enhance our cybersecurity governance program to protect the security of our computer systems, software, networks, and other technology assets against unauthorized attempts to access confidential information or to disrupt or degrade business operations. Our cybersecurity governance program is an integrated IT risk management process that aims to (1) proactively manage cyber and information security risks at AutoNation; (2) implement the internal controls required by cybersecurity regulatory requirements as well as AutoNation’s information security control objective documents and information security standards, and (3) improve the efficiency, maturity, and effectiveness of technology functions and processes.

We regularly evaluate new and emerging risks and ever-changing legal and compliance requirements and examine the effectiveness and maturity of our cyber defenses through various means, including internal audits, targeted testing, incident response exercises, maturity assessments and industry benchmarking. In addition, we dedicate significant resources to securing our systems and protecting confidential information such as firewalls, endpoint protection and behavior analysis tools, among others.

Despite our efforts to ensure the integrity of our computer systems, software, networks, and other technology assets, we may not be able to anticipate, detect, or recognize threats to our systems and assets, or to implement effective preventive measures against all cyber threats, especially because the techniques used are increasingly sophisticated, change frequently, are complex, and are often not recognized until launched. See the risk factor “A failure of our information systems or any

11

security breach or unauthorized disclosure of confidential information could have a material adverse effect on our business” in Part I, Item 1A of this Form 10-K.

Corporate Governance

Our Board of Directors is committed to sound corporate governance principles and practices, which are set forth in our Corporate Governance Guidelines that serve as a framework within which our Board conducts its operations. The Corporate Governance and Nominating Committee of our Board is charged with reviewing annually, or more frequently as appropriate, the Guidelines and recommending to our Board appropriate changes in light of applicable laws and regulations, the governance standards identified by leading governance authorities, and our Company’s evolving needs.

Our Board of Directors consists of a diverse group of leaders. Many of them have experience serving as executive officers or on boards and board committees of major companies. Many of them also have extensive corporate finance and investment banking experience as well as a broad understanding of capital markets. A majority of our Board of Directors is independent, and each of the members of our audit, compensation, and corporate governance and nominating committees is independent. Each of our directors must stand for re-election annually and are elected by a majority of our shareholders. In addition, Rick L. Burdick, one of our independent directors, currently serves as our Chairman of the Board.

Investor Relations

Our relationship with our shareholders is an important part of AutoNation’s success. We have an investor outreach program committed to engaging with current and prospective stockholders and obtaining their perspectives. Our integrated outreach team engages proactively with our stockholders by participating in activities such as quarterly financial results conference calls, industry conferences and events, and one-on-one meetings.

Information about our Executive Officers

The following sets forth certain information regarding our executive officers as of February 17, 2022.

| Name | Age | Position | Years with AutoNation | Years in Automotive Industry | ||||||||||||||||||||||

| Michael Manley | 57 | Chief Executive Officer and Director | 1 | 34 | ||||||||||||||||||||||

| James R. Bender | 66 | President and Chief Operating Officer | 22 | 45 | ||||||||||||||||||||||

| Joseph T. Lower | 55 | Executive Vice President and Chief Financial Officer | 2 | 2 | ||||||||||||||||||||||

| Marc Cannon | 60 | Executive Vice President and Chief Customer Experience Officer | 24 | 35 | ||||||||||||||||||||||

| C. Coleman Edmunds | 57 | Executive Vice President, General Counsel and Corporate Secretary | 26 | 26 | ||||||||||||||||||||||

Michael Manley has served as our Chief Executive Officer and a member of our Board of Directors since November 2021. Prior to joining AutoNation, Mr. Manley served as Head of Americas and as a member of the Group Executive Council for Stellantis N.V., one of the largest automotive original equipment manufacturers in the world, from January 2021 until October 2021. From July 2018 until January 2021, he served as Chief Executive Officer of Fiat Chrysler Automobiles N.V. (“FCA”), a predecessor to Stellantis N.V. Mr. Manley joined DaimlerChrysler (a predecessor to FCA) in 2000 and, prior to becoming FCA’s Chief Executive Officer, served in a number of management-level roles with increasing responsibility overseeing various aspects of FCA’s operations, including as Executive Vice President - International Sales & Marketing, Business Development and Global Product Planning Operations, Chief Executive Officer of Jeep, Chief Executive Officer of Ram, Chief Operating Officer for the Asia Pacific region, and FCA Global Council member.

James R. Bender has served as our President since April 2020 and as our Chief Operating Officer since July 2019. In January 2022, Mr. Bender provided notice that he intends to retire from the Company, effective March 4, 2022. Mr. Bender is responsible for new and used vehicle sales, as well as Customer Financial Services, After-Sales, Human Resources,

12

Corporate Development, and Manufacturer Relations. From January 2019 until July 2019, he served as our Executive Vice President, Sales, and from July 2019 until April 2020, he served as our Executive Vice President and Chief Operating Officer. Prior to becoming an Executive Vice President, Mr. Bender served as Region President of our Eastern Region, with responsibility for the states of Florida, Georgia, Alabama, Virginia, Tennessee, Ohio, and Maryland from February 2015 until December 2018, and as President of our former Florida Region from April 2004 until January 2015. Mr. Bender joined AutoNation in April 2000.

Joseph T. Lower has served as our Executive Vice President and Chief Financial Officer since January 2020. Mr. Lower is responsible for overseeing the finance department and for all financial controls and external reporting, financial planning and analysis, and accounting, as well as the tax, internal audit, treasury, investor relations, and corporate real estate functions. He is also responsible for our strategy department and the Company’s shared service center in Irving, Texas. Prior to joining AutoNation, Mr. Lower served as Executive Vice President and Chief Financial Officer of Office Depot, Inc. from January 2018 until January 2020. From November 2014 until April 2017, he served as Vice President and Chief Financial Officer of B/E Aerospace. Prior to joining B/E Aerospace, Mr. Lower held a number of management-level positions at The Boeing Company. In addition, among other finance positions, Mr. Lower spent six years with Credit Suisse in various investment banking roles, including positions in mergers and acquisitions and corporate finance.

Marc Cannon has served as an Executive Vice President since January 2017 and as our Chief Customer Experience Officer since April 2020. Mr. Cannon is responsible for marketing, communications, customer service, AutoNation.com, and public policy. From February 2016 until January 2017, he served as our Chief Marketing Officer, Senior Vice President of Communications and Public Policy, and from February 2007 until February 2016, he served as our Senior Vice President, Corporate Communications.

C. Coleman Edmunds has served as our Executive Vice President, General Counsel and Corporate Secretary since April 2017. From October 2007 through March 2017, Mr. Edmunds served as our Senior Vice President, Deputy General Counsel and Assistant Secretary. He joined AutoNation in November 1996. Prior to joining AutoNation, Mr. Edmunds was in private practice with the international law firm of Baker & McKenzie.

Available Information

Our website is located at www.autonation.com, and our Investor Relations website is located at investors.autonation.com. The information on or accessible through our websites and social media channels is not incorporated by reference in this Annual Report on Form 10-K. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended, are available, free of charge, on our Investor Relations website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (the “SEC”).

13

ITEM 1A. RISK FACTORS

Our business, financial condition, results of operations, cash flows, and prospects, and the prevailing market price and performance of our common stock may be adversely affected by a number of factors, including the matters discussed below. Certain statements and information set forth in this Annual Report on Form 10-K, including, without limitation, statements regarding the impact of the COVID-19 pandemic on our business, results of operations, and financial condition, the actions we are taking in response to the COVID-19 pandemic, our strategic initiatives, partnerships, or investments, including the planned expansion of our AutoNation USA used vehicle stores, our investments in digital and online capabilities, and other strategic initiatives, and other statements regarding our expectations for the future performance of our business and the automotive retail industry, as well as other written or oral statements made from time to time by us or by our authorized executive officers on our behalf, constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact, including statements that describe our objectives, plans, or goals are, or may be deemed to be, forward-looking statements. Words such as “anticipate,” “expect,” “intend,” “goal,” “plan,” “believe,” “continue,” “may,” “will,” “could,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Our forward-looking statements reflect our current expectations concerning future results and events, and they involve known and unknown risks, uncertainties, and other factors that are difficult to predict and may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by these statements. These forward-looking statements speak only as of the date of this report, and we undertake no obligation to revise or update these statements to reflect subsequent events or circumstances. The risks, uncertainties, and other factors that our stockholders and prospective investors should consider include, but are not limited to, the following:

Risks Related to Economic Conditions

The automotive retail industry is sensitive to changing economic conditions and various other factors, including, but not limited to, unemployment levels, consumer confidence, fuel prices, interest rates, and tariffs. Our business and results of operations are substantially dependent on new and used vehicle sales levels in the United States and in our particular geographic markets, as well as the gross profit margins that we can achieve on our sales of vehicles, all of which are very difficult to predict.

We believe that many factors affect sales of new and used vehicles and automotive retailers’ gross profit margins in the United States and in our particular geographic markets, including the economy, fuel prices, credit availability, interest rates, consumer confidence, consumer shopping preferences and the success of third-party online and mobile sales platforms, the level of personal discretionary spending, labor force participation and unemployment rates, the state of housing markets, vehicle production levels and capacity, auto emission and fuel economy standards, the rate of inflation, currency exchange rates, tariffs, manufacturer incentives (and consumers’ reaction to such offers), intense industry competition, the prospects of war, other international conflicts or terrorist attacks, global pandemics, severe weather events, product quality, affordability and innovation, the number of consumers whose vehicle leases are expiring, the length of consumer loans on existing vehicles, and the rise of ride-sharing applications. Changes in interest rates can significantly impact new and used vehicle sales and vehicle affordability due to the direct relationship between interest rates and monthly loan payments, a critical factor for many vehicle buyers, and the impact interest rates have on customers’ borrowing capacity and disposable income. Sales of certain vehicles, particularly trucks and sport utility vehicles that historically have provided us with higher gross profit per vehicle retailed, are sensitive to fuel prices and the level of construction activity. In addition, rapid changes in fuel prices can cause shifts in consumer preferences which are difficult to accommodate given the long lead-time of inventory acquisition. The imposition of new tariffs, quotas, duties, or other restrictions or limitations could increase prices for vehicles and/or parts imported into the United States and adversely impact demand for such vehicles and/or parts. Our vehicle sales, service, and collision businesses could also be adversely affected by changes in the automotive industry driven by new technologies, distribution channels, or products, including ride-sharing applications, subscription services, autonomous and electric vehicles, and accident avoidance technology.

Approximately 15.1 million, 14.6 million, and 17.0 million new vehicles, including retail and fleet vehicles, were sold in the United States in 2021, 2020, and 2019, respectively. Our performance may differ from the performance of the automotive retail industry due to particular economic conditions and other factors in the geographic markets in which we operate.

14

Economic conditions and the other factors described above may also materially adversely impact our sales of parts and automotive repair and maintenance services and automotive finance and insurance products.

The COVID-19 pandemic has disrupted, and may continue to disrupt, our business, results of operations, and financial condition going forward. Future epidemics, pandemics, and other outbreaks could also disrupt our business, results of operations, and financial condition.

The COVID-19 pandemic has led to disruptions in each of our markets and the global economy. Throughout the COVID-19 pandemic, federal, state, and local governments have implemented a number of countermeasures to mitigate the impact of the COVID-19 pandemic. As a result of the COVID-19 pandemic, we experienced significant declines in new and used vehicle unit sales and sales of our finance and insurance products, particularly during the first and second quarters of 2020. In addition, our parts and service business operated below full capacity during 2020 as a result of the countermeasures discussed above and a decrease in the average miles being driven in our markets during the COVID-19 pandemic. Since the onset of the pandemic, we have experienced a shortage of available new vehicles for sale. The reduced levels of new vehicle availability is currently expected to continue well into 2022; however, there is still significant uncertainty as to when new vehicle availability will improve.

The extent to which the COVID-19 pandemic ultimately impacts our business, results of operations, and financial condition will depend on future developments, which are highly uncertain and cannot be predicted, including the severity and duration of the COVID-19 pandemic, further actions that may be taken by federal, state, and local governments and third parties in response to the pandemic, the effectiveness of actions taken to contain the disease, the effect of government assistance programs, and other unforeseen factors.

Depending on the magnitude and duration of the COVID-19 pandemic, the disruption and adverse impact of the COVID-19 pandemic on our business, results of operations, and financial condition could be material. The COVID-19 pandemic also may heighten or exacerbate many of the other risks discussed herein. Even after the COVID-19 pandemic has subsided, we may continue to experience significant adverse effects to our business as a result of its economic impact, including any economic recession or downturn and the impact of such a recession or downturn on unemployment levels, consumer confidence, levels of personal discretionary spending, and credit availability. Future epidemics, pandemics, and other outbreaks could disrupt and have a similar adverse impact on our business, results of operations, and financial condition.

Risks Related to Vehicle Manufacturers

Our new vehicle sales are impacted by the incentive, marketing, and other programs of vehicle manufacturers.

Most vehicle manufacturers from time to time establish various marketing and sales incentive programs designed to spur consumer demand for their vehicles, particularly during periods of excess supply and/or in a flat or declining new vehicle market. These programs impact our operations, particularly our sales of new vehicles. Since these programs are often not announced in advance, they can be difficult to plan for when ordering inventory. Furthermore, manufacturers may modify and discontinue these marketing and incentive programs from time to time, which could have a material adverse effect on our results of operations and cash flows.

In prior years, our new vehicle unit volume and new vehicle gross profit on a per vehicle retailed basis were adversely impacted by certain manufacturers’ disruptive marketing and sales incentive programs based upon store-level growth targets established by those manufacturers (commonly referred to as “stair-step” incentive programs), which result in multi-tier pricing and adversely impact our ability to compete with other dealers. If those manufacturers continue to use such incentive programs or if other manufacturers adopt similar incentive programs, our operating results could be adversely impacted.

We are dependent upon the success and continued financial viability of the vehicle manufacturers and distributors with which we hold franchises.

The success of our stores is dependent on vehicle manufacturers in several key respects. First, we rely exclusively on the various vehicle manufacturers for our new vehicle inventory. Our ability to sell new vehicles is dependent on a vehicle manufacturer’s ability to design, manufacture, and allocate to our stores an attractive, high-quality, and desirable product mix at the right time and at the right price in order to satisfy customer demand. Second, manufacturers generally support their

15

franchisees by providing direct financial assistance in various areas, including, among others, floorplan assistance and advertising assistance. Third, manufacturers provide product warranties and, in some cases, service contracts to customers.

Our stores perform warranty and service contract work for vehicles under manufacturer product warranties and service contracts, and direct bill the manufacturer as opposed to invoicing the store customer. At any particular time, we have significant receivables from manufacturers for warranty and service work performed for customers. In addition, we rely on manufacturers to varying extents for original equipment manufactured replacement parts, training, product brochures and point of sale materials, and other items for our stores. Our business, results of operations, and financial condition could be materially adversely affected as a result of any event that has a material adverse effect on the vehicle manufacturers or distributors that are our primary franchisors.

The core brands of vehicles that we sell, representing approximately 90% of the new vehicles that we sold in 2021, are manufactured by Toyota (including Lexus), Honda, Ford, General Motors, Stellantis, Mercedes-Benz, BMW, and Volkswagen (including Audi and Porsche). We are subject to a concentration of risk in the event of adverse events or financial distress, including bankruptcy, impacting one or more of these manufacturers.

Vehicle manufacturers may be adversely impacted by economic downturns or recessions, significant declines in the sales of their new vehicles, natural disasters, increases in interest rates, adverse fluctuations in currency exchange rates, declines in their credit ratings, liquidity concerns, labor strikes or similar disruptions (including within their major suppliers), supply shortages or rising raw material costs, rising employee benefit costs, vehicle recall campaigns, adverse publicity that may reduce consumer demand for their products (including due to bankruptcy), product defects, litigation, poor product mix or unappealing vehicle design, governmental laws and regulations (including fuel economy requirements), tariffs and other import product restrictions, the rise of ride-sharing applications, or other adverse events. These and other risks could materially adversely affect any manufacturer and impact its ability to profitably design, market, produce, or distribute new vehicles, which in turn could materially adversely affect our ability to obtain or finance our desired new vehicle inventories, our ability to take advantage of manufacturer financial assistance programs, our ability to collect in full or on a timely basis our manufacturer warranty and other receivables, and/or our ability to obtain other goods and services provided by the impacted manufacturer. In addition, vehicle recall campaigns could materially adversely affect our business, results of operations, and financial condition.

Vehicle manufacturers worldwide have recently faced production disruptions caused by a shortage of automotive microchips. The shortage is reported to be due to the overall high demand for microchips in the global economy. Prolonged shortages of new vehicle inventory could result in lower new vehicle sales volumes and a decrease in the total amount of gross profit we derive from new vehicle sales, which could adversely affect our business. Additionally, the shortage of new vehicles has increased market demand for used vehicles, raising both revenue and gross profit per used vehicle retailed, but also increasing our costs of acquiring used vehicle inventory. Resolution of the microchip shortage should lead to an increase in the supply of new vehicles, which may adversely affect levels of profitability on both new and used vehicles.

Our business could be materially adversely impacted by the bankruptcy of a major vehicle manufacturer or related lender. For example, (i) a manufacturer in bankruptcy could attempt to terminate all or certain of our franchises, in which case we may not receive adequate compensation for our franchises, (ii) consumer demand for such manufacturer’s products could be materially adversely affected, (iii) a lender in bankruptcy could attempt to terminate our floorplan financing and demand repayment of any amounts outstanding, (iv) we may be unable to arrange financing for our customers for their vehicle purchases and leases through such lender, in which case we would be required to seek financing with alternate financing sources, which may be difficult to obtain on similar terms, if at all, (v) we may be unable to collect some or all of our significant receivables that are due from such manufacturer or lender, and we may be subject to preference claims relating to payments made by such manufacturer or lender prior to bankruptcy, and (vi) such manufacturer may be relieved of its indemnification obligations with respect to product liability claims. Additionally, any such bankruptcy may result in us being required to incur impairment charges with respect to the inventory, fixed assets, and intangible assets related to certain franchises, which could adversely impact our results of operations and financial condition.

16

We are subject to restrictions imposed by, and significant influence from, vehicle manufacturers that may adversely impact our business, financial condition, results of operations, cash flows, and prospects, including our ability to acquire additional stores.

Vehicle manufacturers and distributors with whom we hold franchises have significant influence over the operations of our stores. The terms and conditions of our framework, franchise, and related agreements and the manufacturers’ interests and objectives may, in certain circumstances, conflict with our interests and objectives. For example, manufacturers can set performance standards with respect to sales volume, sales effectiveness, and customer satisfaction or loyalty, and can influence our ability to acquire additional stores, the naming and marketing of our stores, our digital channels, our selection of store management, product stocking and advertising spending levels, and the level at which we capitalize our stores. Manufacturers also impose minimum facility requirements that can require significant capital expenditures. Manufacturers may also have certain rights to restrict our ability to provide guaranties of our operating companies, pledges of the capital stock of our subsidiaries, and liens on our assets, which could adversely impact our ability to obtain financing for our business and operations on favorable terms or at desired levels. From time to time, we are precluded under agreements with certain manufacturers from acquiring additional franchises, or subject to other adverse actions, to the extent we are not meeting certain performance criteria at our existing stores (with respect to matters such as sales volume, sales effectiveness, and customer satisfaction or loyalty) until our performance improves in accordance with the agreements, subject to applicable state franchise laws.

Manufacturers also have the right to establish new franchises or relocate existing franchises, subject to applicable state franchise laws. The establishment or relocation of franchises in our markets could have a material adverse effect on the financial condition, results of operations, cash flows, and prospects of our stores in the market in which the franchise action is taken.