August 29, 2016

VIA ELECTRONIC MAIL

Board of Directors

Farmer Bros. Co.

13601 North Freeway, Suite 200

Fort Worth, Texas 76177

Ladies and Gentlemen:

Farmer Bros. Co. (“Farmer Bros.” or the “Company”) is a business that I care deeply about. It is a business that my grandfather, Roy Edgar Farmer, founded over 100 years ago in southern California. It is a business that survived two world wars, a Great Recession and a Great Depression. It is the only business for which my father, Roy F. Farmer, and my brother, Roy Edward Farmer, have worked. It is a business that is in my DNA. It is a business that, I believe, has lost its way.

We are deeply troubled by what we have witnessed at Farmer Bros. since Mike Keown became CEO of the Company in March 2012.

We have witnessed Mr. Keown admittedly pack the Board of Directors of Farmer Bros. (the “Board”) with what are essentially three personal appointees, effectively giving him control of the Board.1 How can the Board properly oversee Mr. Keown or hold him accountable when he and his hand-picked directors are in control?

We have witnessed the erosion of employee morale under Mr. Keown’s leadership, not to mention the 300 or so employees who lost their livelihood as part of his misguided decision to quickly move Farmer Bros.’ headquarters to Texas.

We have witnessed Mr. Keown waste tens of millions of stockholder dollars on ill-advised strategic initiatives rather than returning capital to stockholders.

We have witnessed the current Board members award excessive compensation to management and themselves, all while Mr. Keown lays off hundreds of long-term employees.

These are all practices that my father and grandfather would never have dreamed of. Simply stated, Mr. Keown and his Board have lost touch with the core values that Farmer Bros. was founded on and that contributed to its success.

Board of Directors

Farmer Bros. Co.

August 29, 2016

Page 2

We believe that all stockholders deserve a Board that listens to them and that, consistent with the Board’s fiduciary obligations, appropriately responds to their concerns. We have tried to express our concerns to Mr. Keown and the Board in a constructive manner, but we have been rebuffed at just about every turn. As the largest stockholder of Farmer Bros., beneficially owning 3,832,964 shares of common stock constituting approximately 23% of the Company’s shares outstanding, we are no longer willing to stand idly by. It is time to restore the corporate culture, spirit and employee morale of Farmer Bros. As such, Save Farmer Bros. intends to nominate a slate of candidates for election at the Company’s 2016 Annual Meeting of Stockholders (the “2016 Annual Meeting”) to replace Mr. Keown and two of his hand-picked Board appointees, Charles Marcy and Christopher Mottern. The upcoming 2016 Annual Meeting will represent a critical opportunity for all stockholders to bring about a positive and much-needed change in leadership.

Make no mistake about it, the interests of the Farmer family members who comprise the Save Farmer Bros. group are fully aligned with the interests of all Farmer Bros. stockholders. Our goals are to restore profitable growth, restore a positive corporate culture, link executive pay with performance, avoid the loss of key employees and improve accountability to stockholders through implementing best practices in corporate governance. These are improvements that, if implemented, would benefit all stockholders.

As described more fully below, Save Farmer Bros. has a number of significant concerns with management and the current Board, including:

|

|

1)

|

The Board and Management’s Refusal to Have a Dialogue – For the past 12 months, Mr. Keown and the Board have been almost entirely unresponsive to our attempts to initiate a constructive dialogue.

|

|

|

2)

|

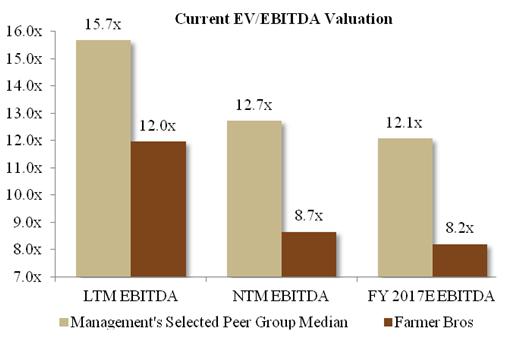

Management’s Poor Track Record of Value Creation – Farmer Bros. is undervalued on a trailing and forward EBITDA basis relative to management’s selected peer group.

|

|

|

3)

|

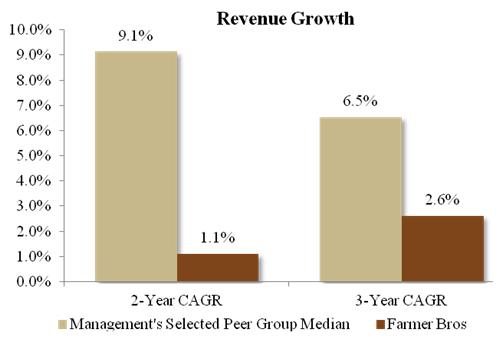

Management’s Poor Operating Performance – Recently the Company’s revenue growth has been stagnant. Compounding this issue is that operating margins are low, which is likely related to its bloated SG&A expenses, among other factors.

|

|

|

4)

|

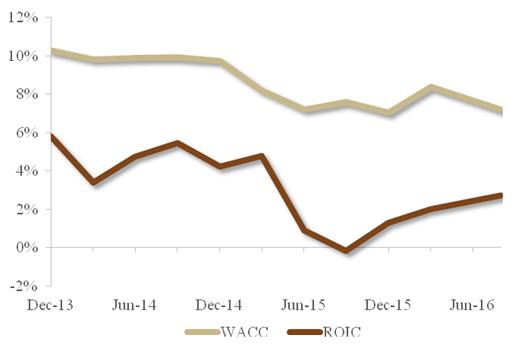

Management’s Poor Capital Allocation Decisions – Recently, Mr. Keown and the Board have made several questionable capital allocation decisions that have failed to yield significant gains for stockholders, including (i) the relocation of the Company’s corporate headquarters to Texas, (ii) the attempt at expanding into e-commerce, (iii) the investments in the Company’s long haul fleet, (iv) the rebranding of the Company’s long haul fleet, (v) the energy sustainability initiative in Torrance, (vi) the purchase of exorbitantly expensive equipment in Torrance and Houston and (vii) the effort to expand the Company’s footprint in spices. If there were any doubt, the fact that Farmer Bros.’ return on invested capital is significantly lower than its cost of capital demonstrates how poor these capital allocation decisions have been.

|

Board of Directors

Farmer Bros. Co.

August 29, 2016

Page 3

|

|

5)

|

The Board’s Numerous Corporate Governance Shortfalls – We do not believe that the Board is representing the long-term interests of its stockholders, as the Board has failed at some of the most basic corporate governance best-practices.

|

***************

|

1)

|

The Board and Management’s Refusal to Have a Dialogue

|

In August 2015, I wrote a letter to the Board describing my concerns regarding the direction of the Company, as well as its current reputation. I never received a response. Therefore, in October 2015, I delivered another letter with the hope that the Board would address my concerns. Unfortunately, again, my concerns were not addressed. As it was becoming clear that the Board did not respect the severity of my concerns, I attended the Company’s 2015 Annual Meeting of Stockholders in Fort Worth, Texas (the “2015 Annual Meeting”) with the hope that my questions and concerns would be addressed. Unfortunately, even my most fundamental concern, what the Company is doing to increase stockholder value, went unanswered.

Within days of the 2015 Annual Meeting, I requested a full transcript of the meeting. Rather than providing me with the transcript, Mr. Keown and the Board forced me to go through various legal channels in order to receive the transcript, which was only delivered more than seven months after my request. The Company likely incurred significant legal expenses in its attempt to prevent its largest stockholder from receiving a transcript of the 2015 Annual Meeting. These expenses represent a complete waste of stockholder capital.

|

2)

|

Management’s Poor Track Record of Value Creation

|

Mr. Keown enjoys boasting about the Company’s total stockholder return during his tenure as CEO.2 We do not believe he is to credit for the Company’s improved stock price performance during his tenure. Rather, we believe that most of the improvement has been due to the fact that Mr. Keown’s tenure started from an artificially depressed baseline, as well as the significant boost to the stock price when an earnings restatement revealed that the earnings prior to his arrival were not as bad as previously reported.3 The witnessed increases in Farmer Bros.’ stock price do not appear to reflect improved operating performance. We firmly believe that superior management and Board leadership would have taken much more advantage of the Company’s considerable market opportunities and produced far better operating results and unlocked much more stockholder value than has Mr. Keown.

Board of Directors

Farmer Bros. Co.

August 29, 2016

Page 4

We believe a better way to gauge Mr. Keown and the Board’s performance is to look at valuation. Farmer Bros. is significantly undervalued on both a trailing and forward EBITDA basis, when compared to management’s selected peer group.

Source: Capital IQ

Note: Management’s selected peer group defined in Farmer Bros.’ Form 10-K, filed September 14, 2015 as B&G Foods, Inc.; Coffee Holding Co. Inc.; Dunkin' Brands Group, Inc.; National Beverage Corp.; SpartanNash Co.; Inventure Foods, Inc.; and Treehouse Foods, Inc. (Boulder Brands, Inc. excluded as it is no longer a publicly traded company).

In our view there is a simple explanation for why Farmer Bros. is undervalued by the investment community: Mr. Keown and the Board’s lackluster operating performance, poor capital allocation decisions and numerous corporate governance shortfalls.

|

3)

|

Management’s Poor Operating Performance

|

Mr. Keown and the Board’s track record of poor operating performance is clearly demonstrated by the Company’s lagging revenue growth, ballooning costs and depressed margins.

Board of Directors

Farmer Bros. Co.

August 29, 2016

Page 5

Sales is the lifeblood of the Company’s business, and yet we are not convinced that growing revenue is a priority for Mr. Keown or the Board. Just take a look at the following chart and ask yourself if it indicates that revenue growth is a priority.

Source: Capital IQ

Note: Management’s selected peer group defined in Farmer Bros.’ Form 10-K, filed September 14, 2015 as B&G Foods, Inc.; Coffee Holding Co. Inc.; Dunkin' Brands Group, Inc.; National Beverage Corp.; SpartanNash Co.; Inventure Foods, Inc.; and Treehouse Foods, Inc. (Boulder Brands, Inc. excluded as it is no longer a publicly traded company).

To add insult to injury, not only has the Company’s revenue growth lagged, but its operating margin is lower than most of management’s selected peer group. A major symptom of the problem is the Company’s bloated SG&A expense, which, as a percentage of revenue, is the largest among management’s selected peer group at 34.5% over the last twelve months.4 If you add the Company’s restructuring costs incurred since announcing that Farmer Bros. was relocating its headquarters to Texas, then the Company’s SG&A as a percentage of revenue increases to 38.2% over the last twelve months.5

|

4)

|

Management’s Poor Capital Allocation Decisions

|

Recently, Mr. Keown and the Board have made several questionable capital allocation decisions that have failed to yield positive gains for stockholders, including the relocation of the corporate headquarters to Texas, the attempt at expanding into e-commerce, the investments in the Company’s long haul fleet, the rebranding of the Company’s long haul fleet, the energy sustainability initiative in Torrance, the purchase of exorbitantly expensive equipment in Torrance and Houston and the effort to expand the Company’s footprint in spices.

Board of Directors

Farmer Bros. Co.

August 29, 2016

Page 6

It is unclear as to what the vision of Mr. Keown and the Board is, as key capital allocation decisions seem to contradict each other. Between 2012 and 2014, the Company invested in mechanical upgrades6 and a rebranding of the fleet operation.7 Initially, the rebranding focus appeared to make sense, as it was meant to provide visibility and increase name recognition. However, Mr. Keown inexplicably sold the fleet in 2015 (barely two years after the launch of the new focus) to facilitate a different strategic initiative – the transition to Third Party Logistics (“3PL”).8 It is deeply concerning that Mr. Keown and the Board would exhibit such poor judgment that resulted in a flip-flop on a costly capital allocation decision within only 24 months. This is just one example of how Mr. Keown and the Board’s decision making is all over the place. Indeed, Mr. Keown’s history of poor capital allocation decisions leaves us to wonder if even the transition to 3PL was thoroughly and properly analyzed, or will Mr. Keown announce yet another major value destructive and capital intensive strategic pivot in the near term?

Consistent with this theme of poor capital allocation decision making, we believe Mr. Keown and the Board demonstrated their lack of thoroughness when they choose to execute the relocation of the Company’s corporate headquarters to Texas, while simultaneously launching its Vendor Management Inventory Initiative, 3PL and selling the assets related to its spice products division. Any of these corporate events individually would presumably consume much of management’s time and energy. The implementation of all four simultaneously raises significant concerns as to whether each strategy, and its respective timing, was properly analyzed.

Another example of the Company’s unclear direction related to the corporate relocation was the decision to install costly production line equipment in Torrance, California during FY 2012 and FY 2013.9 Again, why invest stockholders’ money only to make significant financial changes not too long thereafter? According to Mr. Keown “the Torrance facility has over time become outdated and inefficient….”10 Over time?! Does Mr. Keown base all of his expensive capital allocation decisions on a 24 month investment horizon? What is his plan for the Torrance equipment installed in FY 2012 and FY 2013 now that the Company is moving to Texas?

The corporate relocation was undertaken to annually save $18 million-$20 million by, among other things, the Company being able recruit greater talent at a lower cost.11 In the span of fourteen months, the announced expected costs of the corporate relocation ballooned from a range of $80 million-$90 million to a range of $120 million-$129 million.12 On top of the skyrocketing costs, we never imagined that the Board and management’s compensation would be greatly increased, despite Texas’ widely acknowledged lower cost of living.13 What does Mr. Keown and the Board have to say to the approximately 300 former Farmer Bros. employees in Torrance who lost their livelihood due to the corporate relocation? Is it that cost cutting only applies to non-executives? What could possibly be the justification for such an increase in compensation? How does this add to the $18 million-$20 million in annual savings that Mr. Keown promised the corporate relocation would create?14 It seems that despite their acknowledgement of the importance of cost-control, Mr. Keown and the Board are unwilling to sacrifice their bloated salaries and undeserved bonuses.

Board of Directors

Farmer Bros. Co.

August 29, 2016

Page 7

Mr. Keown’s poor capital allocation decisions are clearly demonstrated when comparing the Company’s return on invested capital to its cost of capital.

Source: Bloomberg

If Mr. Keown’s investments are unable to attain returns in excess of the Company’s cost of capital, then it is time to return capital to stockholders.

|

5)

|

The Board’s Numerous Corporate Governance Shortfalls

|

According to the Farmer Bros. Corporate Governance Guidelines “Directors should possess the highest personal and professional ethics, integrity, and values and should be committed to representing the long-term interests of the Company’s shareholders.”15 We do not believe the Board is actually “representing the long-term interests” of stockholders. After nearly half of a decade under Mr. Keown, the Board has failed to implement some of the most basic corporate governance best-practices. These failures include having limited stockholder representation on the Board, having poor executive compensation practices and having dramatically increasing director compensation.

We believe there is a troubling misalignment of interests between the Board and stockholders. Outside of Jeanne Farmer Grossman, the independent directors own a mere 0.4% stake in the Company.16 Accordingly, there is a lack of significant stockholder representation on the Board. We believe that stockholders, as the true owners of the Company, need to have a strong voice at the Board level. Such a voice promotes greater accountability and creates an environment that forces other directors to consider new and innovative ways to positively impact stockholder value.

Board of Directors

Farmer Bros. Co.

August 29, 2016

Page 8

It seems apparent to us that with so little “skin in the game” the Board does not have the same commitment to stockholder value as we do. We believe a culture focused on long-term value creation and stockholder accountability requires placing stockholder representatives on the Board who have a significant financial commitment to the Company along with relevant experience. This requirement ensures the proper alignment of interests between the Board and stockholders.

When it comes to executive compensation, the Board is not successfully aligning the executive compensation program to stockholder demands. This is reflected in the Board’s response to the Company’s declining “say-on-pay” results. In 2011, 88% of stockholders supported the Company’s executive compensation.17 In 2012, 2013, 2014 and 2015 the “say-on-pay” votes were 63%, 67%, 68% and 60%, respectively.18 “Say-on-pay” results have dropped to a level that should concern the Board, yet nothing has been done to remedy those poor results which is apparent by the continued low approval of stockholders.

Ironically, as the Company’s “say-on-pay” support has dwindled, since 2011, the annual number of Compensation Committee meetings has nearly doubled. Is the Compensation Committee actually trying to bring compensation more in line with what stockholders are demanding? The following facts should cause all stockholders to question whether Mr. Keown and the Board truly have stockholders’ best interests in mind or, rather, are they looking out for their own interests by lining their pockets at stockholders’ expense.

Fact: The base salary for each named executive officer position increased in FY 2015.19

This increase in salary was approved despite the Company’s relocation to a lower cost of living area and newer executives having less tenure at Farmer Bros. Again, we note that each named executive officer received a raise, while approximately 300 Torrance-based employees lost their livelihood.

Fact: The Board has limited its transparency when it comes to executive bonus triggers. Starting in FY 2015, the trigger has not been disclosed by the Compensation Committee.20

Do any Farmer Bros. employees other than the affected named executive officers even know what the triggers are?

Fact: The largest stockholder on the Board was replaced as Compensation Committee Chair after serving in the role for only two years.21

We believe the removal of Jeanne Farmer Grossman, the Board’s largest stockholder, as Chair of the Compensation Committee reflects an attempt to stifle any differing views on the Board, which is contrary to proper corporate governance. This view is supported by the fact that her replacement as Chair was one of Mike Keown’s own effective appointees, Randy Clark. Also, we do not believe it is simply a coincidence that following Ms. Farmer Grossman’s removal as Chair, the Compensation Committee began keeping the bonus triggers confidential.

Board of Directors

Farmer Bros. Co.

August 29, 2016

Page 9

Fact: Management received a significant bonus which was specifically created for FY 2015 despite failing to meet performance targets and worse performance, as compared to FY 2014.22

A special bonus was created under the shroud of all the hard work that was done by management for the relocation efforts.23 Note that prior to Mr. Keown becoming CEO and prior to his effective appointment of directors, the Board did not see it fit to award management a special bonus in FY 2011, another year management did not meet performance targets.24

Fact: In FY 2015, the Board awarded Mr. Keown 22,862 more stock options than it was authorized to award.25

In response to its limits to authorizing stock options, the Board merely created a “New Option” for Mr. Keown totaling 22,862 shares.26

Fact: Many Board fees increased or were created in FY 2015.27

A fee for the Chairman of the Board was created in FY 2015, as was a fee for the Nominating and Governance Committee Chair, Charles Marcy.28

Fact: Every non-executive director’s total compensation increased in FY 2015.29

Director compensation increased despite the Company’s poor financial performance in FY 2015.

TIME FOR A CHANGE

The sad truth is painfully obvious. Farmer Bros., its officers and employees, as well as all stakeholders, need fresh leadership to realize the full potential of our stock price. What we do not need any longer is a CEO and Board members who are unresponsive to the needs and concerns of the stockholders, unresponsive to the opportunities for growth, and incapable of creating stockholder value on the basis of operating performance. We have never been more concerned about our Company. To be completely frank, what we are seeing and hearing from Mr. Keown and the Board disturbs us deeply. Farmer Bros. has been in existence for over one hundred years because of proper management and cost efficient leadership. Sorry to say, it does not appear that these principles are valued by Mr. Keown. Stockholders deserve better. While our fellow stockholders may not have the same deep familial and emotional connection that we have to Farmer Bros., we are all aligned in the sense that we want to see the Company succeed and our respective investment grow in value.

Board of Directors

Farmer Bros. Co.

August 29, 2016

Page 10

We are committed to making sure that the Board is doing everything in its power to make the right decisions that will continue to propel this Company on a path to prosperity for decades to come. To that end, and despite that our efforts to improve Farmer Bros. may have created frictions within the Farmer family, it is our firm belief that a refreshment of the Board is necessary to ensure that decades of prosperity indeed happens. As such, we are dedicated to affecting this Board change and are preparing to nominate a slate of highly qualified candidates for election to the Board at the 2016 Annual Meeting. We look forward to helping restore the stockholder-friendly principles and employee-friendly culture that once defined this company that we continue to care so deeply about.

|

Very truly yours,

Carol Farmer Waite

Save Farmer Bros.

|

Board of Directors

Farmer Bros. Co.

August 29, 2016

Page 11

1 Source: www.linkedin.com/in/mike-keown (“Dramatically strengthened Board of Directors recruiting 3 of 7 new Directors all of whom are ex-CEOs with skills in strategy, supply chain management, audit, governance, and marketing.”).

2 Source: www.linkedin.com/in/mike-keown (“Drove 4X stock improvement in 48 months.”).

3 Source: Farmer Bros. Form 8-K, filed September 11, 2013.

4 Source: Capital IQ.

5 Source: Capital IQ.

6 Source: Farmer Bros. Q4 2014 Earnings Call held September 9, 2014 (“CapEx in fiscal 2014 included additional investments in our fleet….”).

7 Source: Farmer Bros. Form 10-k, filed September 10, 2012 (“Unified brand: We have developed a unified corporate identity for our business nationwide that is reflected in… many of our fleet vehicles….”).

8 Source: Farmer Bros. Form 10-Q, filed February 9, 2016 (“In December 2015, the Company announced its plans to replace its long-haul fleet operations with third party logistics ("3PL") and a vendor managed inventory initiative.”).

9 Source: Farmer Bros. Form 8-K, filed December 12, 2012.

10 Source: Farmer Bros. Q2 2015 Earnings Call, held February 5, 2015 (emphasis added).

11 Source: Farmer Bros. Q2 2015 Earnings Call, held February 10, 2015.

12 Source: Farmer Bros. Form 8-K, filed February 5, 2015; Farmer Bros. Form 8-K, filed March 10, 2016.

13 Source: Farmer Bros. Form DEF 14A, filed October 28, 2015.

14 Source: Farmer Bros. Form 8-K, filed March 10, 2016.

15 Source: Farmer Bros. Form DEF 14A, filed October 28, 2015.

16 Source: Farmer Bros. Form DEF 14A, filed October 28, 2015.

17 Source: Institutional Shareholder Services.

18 Source: Institutional Shareholder Services.

19 Source: Farmer Bros. Form DEF 14A, filed October 28, 2015.

20 Source: Farmer Bros. Form DEF 14A, filed October 28, 2015; Farmer Bros. Form DEF 14A, filed October 28, 2014.

21 Source: Farmer Bros. Form DEF 14A, filed October 28, 2015.

22 Source: Farmer Bros. Form DEF 14A, filed October 28, 2015.

23 Source: Farmer Bros. Form DEF 14A, filed October 28, 2015.

24 Source: Farmer Bros. Form DEF 14A, filed October 28, 2011.

25 Source: Farmer Bros. Form 8-K, filed June 8, 2016.

26 Source: Farmer Bros. Form 8-K, filed June 8, 2016.

27 Source: Farmer Bros. Form DEF 14A, filed October 28, 2015.

28 Source: Farmer Bros. Form DEF 14A, filed October 28, 2015.

29 Source: Farmer Bros. Form DEF 14A, filed October 28, 2015.