UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of | (I.R.S. Employer | |

incorporation or organization) | Identification No.) |

(Address of principal executive offices) (Zip code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ◻

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Accelerated filer ☐ | |

Non-accelerated filer ☐ | Smaller reporting company |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

Aggregate market value of Common Stock held by non-affiliates at June 30, 2021:

$

Number of shares of Common Stock outstanding at February 18, 2022:

Documents Incorporated By Reference

The following document is incorporated by reference in Part III of the Annual Report on Form 10-K to the extent described therein: Proxy statement for the annual meeting of shareholders of Matson, Inc. to be held April 28, 2022.

TABLE OF CONTENTS

i

MATSON, INC.

FORM 10-K

Annual Report for the Fiscal Year

Ended December 31, 2021

PART I

ITEM 1. BUSINESS

| A. | COMPANY OVERVIEW |

Matson, Inc., a holding company incorporated in the State of Hawaii, and its subsidiaries (“Matson” or the “Company”), is a leading provider of ocean transportation and logistics services. The Company consists of two segments, Ocean Transportation and Logistics.

Ocean Transportation: Matson’s Ocean Transportation business is conducted through Matson Navigation Company, Inc. (“MatNav”), a wholly-owned subsidiary of Matson, Inc. Founded in 1882, MatNav provides a vital lifeline of ocean freight transportation services to the domestic non-contiguous economies of Hawaii, Alaska and Guam, and to other island economies in Micronesia. MatNav also operates premium, expedited services primarily from China to Long Beach, California, and provides services to Okinawa, Japan and various islands in the South Pacific, and operates an international export service from Dutch Harbor, Alaska to Asia. In addition, subsidiaries of MatNav provide stevedoring, refrigerated cargo services, inland transportation and other terminal services for MatNav and other ocean carriers on the Hawaiian islands of Oahu, Hawaii, Maui and Kauai, and in the Alaska locations of Anchorage, Kodiak and Dutch Harbor.

Matson has a 35 percent ownership interest in SSA Terminals, LLC, a joint venture between Matson Ventures, Inc., a wholly-owned subsidiary of MatNav, and SSA Ventures, Inc., a subsidiary of Carrix, Inc. (“SSAT”). SSAT currently provides terminal and stevedoring services to various carriers at eight terminal facilities on the U.S. West Coast, including three facilities dedicated for MatNav’s use. Matson records its share of income from SSAT in costs and expenses in the Consolidated Statements of Income and Comprehensive Income, and within the Ocean Transportation segment due to the nature of SSAT’s operations.

Logistics: Matson’s Logistics business is conducted through Matson Logistics, Inc. (“Matson Logistics”), a wholly-owned subsidiary of MatNav. Established in 1987, Matson Logistics extends the geographic reach of Matson’s transportation network throughout North America and Asia, and is an asset-light business that provides a variety of logistics services to its customers including: (i) multimodal transportation brokerage of domestic and international rail intermodal services, long-haul and regional highway trucking services, specialized hauling, flat-bed and project services, less-than-truckload services, and expedited freight services (collectively, “Transportation Brokerage” services); (ii) less-than-container load (“LCL”) consolidation and freight forwarding services (collectively, “Freight Forwarding” services); (iii) warehousing, trans-loading, value-added packaging and distribution services (collectively, “Warehousing” services); and (iv) supply chain management, non-vessel operating common carrier (“NVOCC”) freight forwarding and other services.

Our Mission and Vision:

Our mission is to move freight better than anyone. Our vision is to create value for our shareholders by:

| ◾ | Being our customers’ first choice, |

| ◾ | Leveraging our core strengths to drive growth and increase profitability, |

| ◾ | Improving the communities in which we work and live, |

| ◾ | Being an environmental leader in our industry, and |

| ◾ | Being a great place to work. |

1

| B. | BUSINESS DESCRIPTION |

(1) | OCEAN TRANSPORTATION SEGMENT |

Ocean Transportation Services:

Matson’s Ocean Transportation segment provides the following services:

Hawaii Service: Matson’s Hawaii service provides ocean carriage (lift-on/lift-off, roll-on/roll-off and conventional services) between the ports of Long Beach and Oakland, California; Tacoma, Washington; and Honolulu, Hawaii. Matson also operates a network of inter-island barges that provide connecting services from its hub at Honolulu to other major Hawaii ports on the islands of Hawaii, Maui and Kauai. Matson is the largest carrier of ocean cargo between the U.S. West Coast and Hawaii.

Westbound cargo carried by Matson to Hawaii includes dry containers of mixed commodities, refrigerated commodities, food and beverages, retail merchandise, building materials, automobiles and household goods. Matson’s eastbound cargo from Hawaii includes automobiles, household goods, dry containers of mixed commodities and livestock. The majority of Matson’s Hawaii service revenue is derived from the westbound carriage of containerized freight.

China Service: Matson’s expedited China-Long Beach Express (“CLX”) service is part of an integrated service that carries cargo from Long Beach, California to Honolulu, Hawaii, to Guam, and then to Okinawa, Japan. The vessels continue to Ningbo and Shanghai, China, where they are loaded with cargo to be discharged primarily in Long Beach, California at a Matson-exclusive terminal operated by SSAT. These vessels also carry cargo destined for Hawaii which originated in Guam, Micronesia, Okinawa, China and other Asian countries. Matson provides container transshipment services from many locations in Asia including Hong Kong and Xiamen, China to the United States via the ports of Ningbo and Shanghai, China.

In May 2020, as a result of increased market demand, Matson launched its second expedited service to the U.S. West Coast with the China-Long Beach Express Plus (“CLX+”) service. The CLX+ service uses chartered vessels and operates weekly from Ningbo and Shanghai, China where they are loaded with cargo to be discharged primarily at Long Beach, California, calling at an SSAT operated terminal.

In July 2021, Matson launched a temporary, third expedited service to the U.S. West Coast with the China-California Express (“CCX”) service to meet continued high market demand. The CCX service uses Matson-owned vessels and departs Shanghai, China every three out of five weeks with direct service to Oakland, California and then to Long Beach, California. Cargo at both Oakland and Long Beach, California, is discharged at Matson exclusive terminals operated by SSAT. Matson expects the CCX service to operate through the October peak season of 2022. Matson’s expedited China service currently consists of the CLX, CLX+ and the CCX services.

Eastbound cargo from China to Long Beach, California consists mainly of garments, e-commerce related goods, consumer electronics, footwear and other merchandise.

Guam Service: Matson’s Guam service provides weekly carriage between the U.S. West Coast and Guam, as part of its CLX service. Matson also provides weekly connecting service from Guam to the Commonwealth of the Northern Mariana Islands. Cargo destined to these markets is similar to that described under “Hawaii Service” above.

Japan Service: Matson’s Japan service provides carriage to the port of Naha in Okinawa, Japan, as part of its CLX service. This service mainly carries general sustenance cargo and household goods supporting the U.S. military.

Micronesia Service: Matson’s Micronesia service provides carriage between the U.S. West Coast and the islands of Kwajalein, Ebeye and Majuro in the Republic of the Marshall Islands, the islands of Yap, Pohnpei, Chuuk and Kosrae in the Federated States of Micronesia, and the Republic of Palau. Cargo destined for these locations is transshipped through Guam and consists mainly of general sustenance cargo.

Alaska Service: Matson’s Alaska service provides ocean carriage between the port of Tacoma, Washington, and the ports of Anchorage, Kodiak and Dutch Harbor, Alaska. Matson also provides a barge service between Dutch Harbor and

2

Akutan in Alaska, and transportation services to other locations in Alaska including the Kenai Peninsula, Fairbanks and the North Slope.

Northbound cargo to Alaska consists mainly of dry containers of mixed commodities, refrigerated commodities, foods and beverages, retail merchandise, household goods and automobiles. Southbound cargo from Alaska primarily consists of seafood, household goods and automobiles.

In September 2020, Matson launched its Alaska-Asia Express (“AAX”) service that provides carriage of dry and frozen seafood from Dutch Harbor, Alaska to Ningbo and Shanghai, China. The AAX service utilizes CLX+ vessels on their westbound trip to China. Matson also provides transshipment services from Ningbo and Shanghai, China to other locations in Asia.

South Pacific Service: Matson’s New Zealand Express (“NZX”) service provides carriage of general sustenance cargo between Auckland, New Zealand and select islands in the South Pacific, including Fiji (Suva and Lautoka), Samoa (Apia), American Samoa (Pago Pago), the Cook Islands (Rarotonga and Aitutaki), Tonga (Nukualofa and Vava’u), and Niue. Matson’s NZX service also provides transshipment services to the islands of Nauru and the Solomon Islands (Honiara). Additionally, Matson provides slot charter arrangements for the transportation of cargo from major ports on the east coast of Australia to ports in the South Pacific islands. The NZX service also distributes and sells domestic bulk fuel to a variety of these islands.

Matson’s South Pacific Express (“SPX”) service provides carriage of general sustenance cargo from the U.S. West Coast to ports in the South Pacific islands using vessel sharing agreements with other carriers. The SPX service provides direct calls to Tahiti (Papeete), American Samoa (Pago Pago) and Samoa (Apia) in the South Pacific. Cargo destined for other ports including Tonga (Nukualofa) and the Cook Islands (Rarotonga and Aitutaki) is then transshipped in Apia, Samoa to the NZX service for delivery to its final destination. Northbound SPX cargo originating in the South Pacific is transshipped from the NZX service with other carriers to the U.S. West Coast. Cargo destined for Hawaii or Washington is further transshipped in Oakland, California for delivery to its final destination.

In June 2021, Matson launched its new China-Auckland Express (“CAX”) service that operates from Shanghai, China to Auckland, New Zealand to meet increased demand from China. The CAX service departs Shanghai every two out of five weeks and transports cargo consisting mainly of garments, e-commerce related goods, consumer electronics, footwear and other merchandise.

Terminal and Other Related Services:

Matson provides stevedoring, refrigerated cargo services, inland transportation, container equipment maintenance and other terminal services (collectively, “terminal services”) at terminals located on the Hawaiian islands of Oahu, Hawaii, Maui and Kauai; and in the Alaska terminal locations of Anchorage, Kodiak and Dutch Harbor.

SSAT currently provides terminal and stevedoring services to various carriers at eight terminal facilities on the U.S. West Coast, including three facilities dedicated for MatNav’s use, in Long Beach and Oakland, California; and in Tacoma, Washington.

Matson utilizes the services of other third-party terminal operators at all of the other ports served by its vessels.

Vessel Management Services:

Matson contracts with the U.S. Department of Transportation to provide vessel management services to manage and maintain three Ready Reserve Force vessels on behalf of the U.S. Department of Transportation Maritime Administration.

3

Vessel Information:

Vessels:

Matson’s fleet includes both owned and chartered vessels. Matson’s owned vessels represent an investment of approximately $2.2 billion. The majority of Matson’s owned vessels are U.S. flagged and Jones Act qualified vessels, and operate in the Hawaii, China, Guam, Japan, Micronesia and Alaska services. Details of Matson’s active and reserve vessels as of December 31, 2021 are as follows:

Usable Cargo Capacity | Vessel | |||||||||||||||||

Containers | Vehicles | Design | Approximate | Charter | ||||||||||||||

| Year |

| Official |

|

| Reefer |

|

|

|

|

| Speed |

| Deadweight |

| Expiration | ||

Name of Vessels | Built | Number | TEUs (1) | Slots | Autos | Length | (Knots) (2) | (Long Tons) | Date (3) | |||||||||

Vessels-Owned: | ||||||||||||||||||

DANIEL K. INOUYE (4) | 2018 |

| 1274136 |

| 3,220 |

| 408 | — |

| 854’ 0” |

| 23.5 |

| 51,000 |

| — | ||

KAIMANA HILA (4) | 2019 | 1274135 | 3,220 | 408 | — | 854’ 0” | 23.5 |

| 54,000 |

| — | |||||||

MANOA (4)(9) |

| 1982 |

| 651627 |

| 2,824 |

| 408 |

| — |

| 860’ 2” |

| 23.0 |

| 35,000 |

| — |

MAHIMAHI (4)(9) |

| 1982 |

| 653424 |

| 2,824 |

| 408 |

| — |

| 860’ 2” |

| 23.0 |

| 35,000 |

| — |

LURLINE (4) | 2019 | 1274143 | 2,750 | 432 | 500 | 869’ 5” | 23.0 | 51,000 | — | |||||||||

MATSONIA (4) | 2020 | 1274123 | 2,750 | 432 | 500 | 869’ 5” | 23.0 | 51,000 | — | |||||||||

MANULANI (4)(9) |

| 2005 |

| 1168529 |

| 2,378 |

| 284 |

| — |

| 712’ 0” |

| 22.5 |

| 38,000 |

| — |

MAUNAWILI (4)(9) |

| 2004 |

| 1153166 |

| 2,378 |

| 326 |

| — |

| 711’ 9” |

| 22.5 |

| 37,000 |

| — |

MANUKAI (4)(9) |

| 2003 |

| 1141163 |

| 2,378 |

| 326 |

| — |

| 711’ 9” |

| 22.5 |

| 38,000 |

| — |

R.J. PFEIFFER (4)(9) |

| 1992 |

| 979814 |

| 2,245 |

| 300 |

| — |

| 713’ 6” |

| 23.0 |

| 28,000 |

| — |

MOKIHANA (4) |

| 1983 |

| 655397 |

| 1,994 |

| 354 |

| 1,323 |

| 860’ 2” |

| 23.0 |

| 30,000 |

| — |

MAUNALEI (4)(9) |

| 2006 |

| 1181627 |

| 1,992 |

| 328 |

| — |

| 681’ 1” |

| 22.1 |

| 33,000 |

| — |

MATSON KODIAK (4)(9) |

| 1987 |

| 910308 |

| 1,668 |

| 280 |

| — |

| 710’ 0” |

| 20.0 |

| 20,000 |

| — |

MATSON ANCHORAGE (4)(9) |

| 1987 |

| 910306 |

| 1,668 |

| 280 |

| — |

| 710’ 0” |

| 20.0 |

| 20,000 |

| — |

MATSON TACOMA (4)(9) |

| 1987 |

| 910307 |

| 1,668 |

| 280 |

| — |

| 710’ 0” |

| 20.0 |

| 20,000 |

| — |

KAMOKUIKI (5) |

| 2000 |

| 9232979 |

| 707 |

| 100 |

| — |

| 433’ 9” |

| 17.5 |

| 8,000 |

| — |

OLOMANA (6) | 2004 | 9184225 | 645 | 120 | — | 388’ 7” | 14.0 | 8,000 | — | |||||||||

IMUA (6) |

| 2004 |

| 9184237 |

| 645 |

| 90 |

| — |

| 388’ 6” |

| 15.0 |

| 8,000 |

| — |

LILOA II (6) |

| 2006 |

| 9184249 |

| 630 |

| 90 |

| — |

| 388’ 6” |

| 15.0 | 8,000 | — | ||

PAPA MAU (6) |

| 1999 |

| 9141704 |

| 521 |

| 68 |

| — |

| 381’ 5” |

| 14.0 |

| 6,000 |

| — |

Vessels-Chartered: | ||||||||||||||||||

MATSON HAWAII (6) | 2009 | 9386471 | 4,360 | 326 | — | 849’ 3” | 23.3 | 52,000 | July 2023 | |||||||||

NAVIOS FELICITAS (6)(10) | 2010 | 9395953 | 4,360 | 326 | — | 849’ 0” | 24.6 | 51,000 | January 2022 | |||||||||

MATSON LANAI (6) | 2007 | 9334143 | 4,253 | 400 | — | 855’ 2” | 24.3 | 50,000 | June 2025 | |||||||||

MATSON MAUI (6)(10) | 2007 | 9340764 | 4,253 | 400 | — | 854’ 8” | 24.5 | 50,000 | February 2026 | |||||||||

MATSON KAUAI (6) | 2008 | 9353278 | 4,218 | 350 | — | 841’ 4” | 24.8 | 52,000 | January 2025 | |||||||||

MATSON OAHU (6) | 2006 | 9308015 | 3,461 | 550 | — | 783’ 8” | 23.0 | 42,000 | April 2023 | |||||||||

MATSON MOLOKAI (6) | 2007 | 9338084 | 2,824 | 586 | — | 728’ 10” | 22.0 | 39,000 | May 2025 | |||||||||

MATSON NIIHAU (6) | 2005 | 9294159 | 2,824 | 586 | — | 728’ 10” | 21.0 | 39,000 | March 2023 | |||||||||

Barges-Owned: | ||||||||||||||||||

MAUNA LOA (4)(7) |

| 2013 |

| 1247426 |

| 500 |

| 78 |

| — |

| 362’ 6” |

| — |

| 13,000 |

| — |

HALEAKALA (4)(8) |

| 1984 |

| 676972 |

| 335 |

| 78 |

| — |

| 350’ 0” |

| — |

| 5,000 |

| — |

Barges-Chartered: | ||||||||||||||||||

ILIULIUK BAY (4)(8) |

| 2013 |

| 1249384 |

| 178 |

| — |

| — |

| 250’ 0” |

| — |

| 4,000 |

| December 2022 |

| (1) | Twenty-foot Equivalent Units (“TEU”) is a standard measure of cargo volume correlated to a standard 20-foot dry cargo container. |

| (2) | Vessel Design Speed may vary from the operating speed of the vessel. |

| (3) | Charter expiration date represents the approximate earliest month the vessel can be returned to its owner. Some vessel charter agreements include options to further extend the charter period. |

| (4) | U.S. flagged and Jones Act qualified vessel or barge. |

| (5) | U.S. flagged vessel. |

| (6) | Foreign flagged vessel. |

| (7) | Flat-deck barge. |

| (8) | Lift-on/lift-off barge equipped with a crane. |

| (9) | Vessel installed with exhaust gas cleaning systems (commonly referred to as “scrubbers”). |

| (10) | Navios Felicitas was returned to its owner in January 2022 and replaced by Matson Maui, which was placed into service in February 2022. |

Matson is constructing a new U.S. flagged and Jones Act qualifying flat-deck barge at a cost of approximately $25.0 million for operation within its Hawaii neighbor island service. The new barge is expected to be delivered in the first half of 2022.

4

Vessel Emission Regulations:

Being a leader in environmental stewardship is one of Matson’s core values. Matson’s vessels transit through some of the most environmentally sensitive areas in the United States including the Hawaiian Islands and the coasts of California, Oregon, Washington and Alaska. Matson is focused in particular on reducing transportation emissions, including carbon dioxide, nitrous oxide, particulate matter and sulfur dioxide through improvements in vessel fuel consumption, choice of fuel types and the development of more fuel-efficient transportation solutions. Matson further contributes positively to the environment by testing and deploying leading technologies as the fleet is modernized.

The International Maritime Organization (“IMO”), to which the U.S. and over 100 other countries are signatories, is a specialized agency of the United Nations that sets international environmental standards applicable to vessels operating under the flag of any signatory country. Effective January 1, 2020, the IMO imposed regulations that generally require all vessels to burn fuel oil with a maximum sulfur content of ≤0.5 percent (“IMO 2020”). There are three main options for a vessel to meet the IMO 2020 requirements: (1) burn low sulfur fuel oil (“LSFO”), (2) install exhaust gas cleaning systems (commonly referred to as “scrubbers”) on vessels to reduce sulfur emissions from heavy fuel oil (“HFO”), or (3) switch to lower emission fuels such as liquefied natural gas (“LNG”), which requires converting existing vessels or constructing new vessels with LNG-capable engines and fuel tanks. With respect to North America, all waters, with certain limited exceptions, within 200 nautical miles of U.S. and Canadian coastlines have been designated emission control areas (“ECAs”). Since January 1, 2015, U.S. Environmental Protection Agency regulations have reduced the fuel oil maximum sulfur content in designated ECAs to ≤0.1 percent or the equivalent emissions by the use of scrubbers. In addition, since August 1, 2012, the California Air Resource Board and U.S. Environmental Protection Agency under the Vessel General Permit regulations have reduced the fuel oil maximum sulfur content to ≤0.1 percent within 24 miles of the California coastline and within Puget Sound.

All of Matson’s vessels in the Alaska and Hawaii services are designed to operate in compliance with IMO 2020 and ECA regulations as applicable, and can use LSFO. In the Alaska and Hawaii services, Matson installed scrubbers on ten diesel engine-powered vessels to allow them to use HFO and still comply with IMO 2020 and ECA regulations. Matson also maintains vessels which may operate as dry-dock relief or for emergency activation purposes under an EPA approved ECA permit enabling the use of fuel oil with a maximum sulfur content of ≤0.5 percent within the North America ECA or at any time on IMO compliant fuels. Matson’s Aloha and Kanaloa Class vessels burn compliant LSFO. These vessels are also equipped with dual-fuel engines and can be converted to run on LNG. All of Matson’s other vessels use LSFO to meet IMO 2020 and ECA emission standards.

In June 2021, the IMO adopted new greenhouse gas (“GHG”) emission requirements applicable to ships. Beginning with a company’s first annual, intermediate or renewal survey for an international air pollution prevention certificate on or after January 1, 2023, all containerships with more than 10,000 dead weight tons will be required to meet specified Energy Efficiency Existing Ship Index (“EEXI”) levels. EEXI is a one-time certification measuring a ship’s theoretical carbon dioxide (CO2) emissions per transport work based on its design parameters. After 2023, containerships with over 5,000 gross tonnage (“GT”) will be required to meet annual Carbon Intensity Indicator (“CII”) requirements that become increasingly stringent towards 2030. CII measures how efficiently a ship transports goods, and uses actual CO2 emissions to determine an annual rating from A to E. For ships that achieve a D rating for three consecutive years or an E rating in a single year, a corrective action plan needs to be developed as part of the vessels’ Ship Energy Efficiency Management Plan (“SEEMP”) and approved. For a discussion on the Company’s planned future capital expenditures to comply with these regulations, see Part II, Item 7 of this Form 10-K. For more information on Matson’s environmental stewardship initiatives, including GHG emission reduction goals, see Matson’s Sustainability Report and other information available at www.matson.com/sustainability.

Hawaii Terminal Modernization and Expansion Program:

During 2020, Matson completed the first phase of its program to modernize and renovate its terminal facility at Sand Island, Honolulu, Hawaii. As part of this phase, Matson completed the installation of three new 65 long-ton capacity gantry cranes, upgraded and renovated three existing cranes, demolished four outdated cranes, and installed upgrades to the electrical infrastructure at the terminal.

During 2021, as part of the second phase, Matson completed the installation, energization and transition to a new redundant main switchgear. Additional projects for this phase relate to improvements to its existing backup power

5

generators, installation of new above ground fuel storage tanks, a battery energy storage system, and other upgrades at the terminal, and are expected to be completed within the next three years.

The next phase represents a broader and long-term terminal expansion program at the Sand Island terminal facility. Matson expects to expand into Pier 51A and portions of Pier 51B after Pasha Hawaii (“Pasha”) relocates to the newly constructed Kapalama container terminal facility planned for 2024. From 2022 to 2024, Matson will be performing surveying, planning and design work in preparation for this expansion.

Ocean Transportation Equipment:

As a complement to its fleet of vessels, Matson owns a variety of equipment including cranes, terminal equipment, containers and chassis, which represents an investment of approximately $0.8 billion as of December 31, 2021. Matson also leases containers, chassis and other equipment under various operating lease agreements.

Operating Costs:

Major components of Matson’s Ocean Transportation operating costs are as follows:

Direct Cargo Expense includes terminal handling costs including labor, purchased outside transportation and other related costs.

Vessel Operating Expense includes crew wages and related costs; fuel, pilots, tugs and line related costs; vessel charter expenses; and other vessel operating related expenses. Matson purchases fuel oil, lubricants and gasoline for its operations and also pays fuel-related surcharges to other third party transportation providers.

Operating Overhead includes equipment repair costs, equipment lease and repositioning expenses, vessel repair and maintenance costs, depreciation and dry-docking amortization, insurance, port engineers and other maintenance costs, and other vessel and shoreside related overhead.

Competition:

The following is a summary of major competitors in Matson’s Ocean Transportation segment:

Hawaii Service: Matson’s Hawaii service has one major U.S. flagged Jones Act competitor, Pasha, which operates container and roll-on/roll-off services between the ports of Long Beach, Oakland and San Diego, California to Hawaii. A U.S. flagged Jones Act barge operator, Aloha Marine Lines, also offers barge service between the Pacific Northwest and Hawaii.

Foreign-flagged vessels carrying cargo to Hawaii from non-U.S. locations also provide alternatives for companies shipping to Hawaii. Other competitors in the Hawaii service include proprietary operators and contract carriers of bulk cargo, and airfreight freight carriers.

Matson operates three strings of vessels to Hawaii. These strings provide customers an industry-leading five departures from ports on the U.S. West Coast to Hawaii every week – two each from Long Beach and Oakland, California and one from Tacoma, Washington. Each of these strings operates on a fixed day-of-the-week schedule. Two of the vessel strings continue from Honolulu to China before returning to Long Beach. Matson’s frequent sailings and punctuality permit customers to reduce inventory carrying costs. Matson also competes by offering one of the most comprehensive services to customers, including: the only container service to and from the three largest U.S. West Coast ports; the most efficient terminal network on the U.S. West Coast with three exclusive use terminals provided by SSAT; a dedicated inter-island barge network which is integrated with Matson’s line haul schedule; roll-on/roll-off service from Long Beach and Oakland; a world-class customer service team; and efficiency and experience in handling cargo of many types.

Alaska Service: Matson’s Alaska service has one major U.S. flagged Jones Act competitor, Totem Ocean Trailer Express, Inc., which operates a roll-on/roll off service between Tacoma, Washington and Anchorage, Alaska. There are also two U.S. flagged Jones Act barge operators, Alaska Marine Lines, which mainly provides services from Seattle, Washington to the ports of Anchorage and Dutch Harbor, and other locations in Alaska, and Samson Tug & Barge,

6

which mainly serves Western Alaska and other locations. The barge operators have historically shipped lower value commodities that can accommodate a longer transit time, as well as construction materials and other cargo that are not conducive to movement in containers. Foreign-flagged vessels provide alternatives for companies shipping cargo (mainly seafood) from the Alaska ports of Kodiak and Dutch Harbor. Other competition includes air freight and over-the-road trucking services. Matson’s AAX service has two major competitors, CMA CGM and Maersk Lines, which provide services between Dutch Harbor, Alaska and Asia.

Matson offers customers twice weekly scheduled service from Tacoma, Washington to Anchorage and Kodiak, Alaska, and a weekly service to Dutch Harbor, Alaska. The Company also provides a barge service between Dutch Harbor and Akutan in Alaska. Matson is the only Jones Act containership operator providing service to Kodiak and Dutch Harbor in Alaska, which are the primary loading ports for southbound seafood. Matson offers dedicated terminal services at the Alaska ports of Anchorage, Kodiak and Dutch Harbor performed by Matson, and at the port of Tacoma, Washington performed by SSAT. Matson’s AAX service also offers customers a service from Dutch Harbor, Alaska to Ningbo and Shanghai, China, with transshipment services from those ports to other locations in Asia.

China Service: Major competitors to Matson’s China service include large international carriers such as CMA CGM, OOCL, ZIM, Evergreen and Maersk. Other competition includes air freight carriers.

Matson’s China service competes by offering fast and reliable service from the ports of Ningbo and Shanghai in China, and feeder services from other Asian ports of origin, to Long Beach and Oakland, California. Matson provides fixed day-of-the-week arrivals and industry leading cargo availability. Matson’s service is further differentiated by best-in-class stevedoring services provided by SSAT, Matson dedicated terminal space, access to Shippers Transport Express off-dock container yards for faster truck turn times, Matson-dedicated equipment including chassis to speed cargo availability, one-stop intermodal connections, and world-class customer service. Matson also provides intermodal services in coordination with Matson Logistics. Matson has offices located in Shanghai, Shenzhen, Xiamen, Ningbo and Hong Kong, and has contracted with terminal operators in Ningbo and Shanghai.

Guam Service: Matson’s Guam service has one major competitor, APL, a U.S. flagged subsidiary of CMA CGM, which operates a weekly U.S. flagged container feeder service connecting the U.S. West Coast to Guam and Saipan, via transshipments to U.S. flagged feeder vessels in Yokohama, Japan and Busan, South Korea. Waterman operates a roll-on/roll-off service, which periodically calls at Guam. There are also several foreign carriers, including CMA CGM, that call at Guam from foreign origin ports.

Matson offers customers a weekly service to Guam as part of the CLX service from three ports on the U.S. West Coast. Matson’s ocean transit time, frequent sailing and reliable on-time performance provides an industry-leading service to its customers.

Japan Service: Matson’s Japan service has one major competitor, APL, which operates a weekly U.S. flagged containership service from the U.S. West Coast to the port of Naha in Okinawa, Japan.

Matson offers customers a weekly service to the port of Naha in Okinawa, Japan as part of the CLX service from three ports on the U.S. West Coast.

Micronesia and South Pacific Services: Matson’s Micronesia and South Pacific services have competition from a variety of local and international carriers that provide freight services to the area.

Customer Concentration:

Matson serves customers in numerous industries and carries a wide variety of cargo, mitigating its dependence upon any single customer or single type of cargo. The Company’s 10 largest Ocean Transportation customers account for approximately 15 percent of the Company’s Ocean Transportation revenue. For additional information on Ocean Transportation revenues for the years ended December 31, 2021, 2020 and 2019, see Note 2 to the Consolidated Financial Statements in Item 8 of Part II below.

7

Seasonality:

Historically, Matson’s Ocean Transportation services have typically experienced seasonality in volume, generally following a pattern of increasing volume starting in the second quarter of each year, culminating in a peak season throughout the third quarter, with subsequent decline in demand during the fourth and first quarters. This seasonality trend is amplified in the Alaska service primarily due to winter weather and the timing of southbound seafood trade. As a result, earnings have tended to follow a similar pattern, offset by periodic vessel dry-docking and other episodic cost factors, which can lead to earnings variability. In addition, in the China trade, volume is typically driven primarily by U.S. consumer demand for goods during key retail selling seasons. Freight rates are impacted mainly by macro supply and demand variables.

Since 2020, Matson’s typical seasonal trends have been impacted by the global pandemic which has resulted in elevated levels of demand experienced in our Ocean Transportation services. Matson’s expanded services in China and other locations have resulted in significant increases in volume during the second half of 2020 and throughout 2021. Supply chain congestion and elevated levels of demand are expected to impact the Company’s Ocean Transportation services during 2022.

Maritime Laws and the Jones Act:

Maritime Laws: All interstate and intrastate marine commerce within the U.S. falls under the Merchant Marine Act of 1920 (commonly referred to as the Jones Act).

The Jones Act is a long-standing cornerstone of U.S. maritime policy. Under the Jones Act, all vessels transporting cargo between covered U.S. ports must, subject to limited exceptions, be built in the U.S., registered under the U.S. flag, be manned predominantly by U.S. crews, and owned and operated by U.S.-organized companies that are controlled and 75 percent owned by U.S. citizens. U.S. flagged vessels are generally required to be maintained at higher standards than foreign flagged vessels and are subject to rigorous supervision and inspections by, or on behalf of, the U.S. Coast Guard, which requires appropriate certifications and background checks of the crew members. Under Section 27 of the Jones Act, the carriage of cargo between the U.S. West Coast, Hawaii and Alaska on foreign-built or foreign-documented vessels is prohibited.

During the years ended December 31, 2021, 2020 and 2019, approximately 41 percent, 62 percent and 72 percent, respectively, of Matson’s Ocean Transportation revenues came from the Hawaii and Alaska trades that were subject to the Jones Act. Matson’s Hawaii and Alaska trade routes are included within the non-contiguous Jones Act market. The commerce of both Hawaii, as an island economy, and Alaska, due to its geographical location, are dependent on ocean transportation. The Jones Act ensures frequent, reliable, roundtrip service to these locations. Matson’s vessels operating in these trade routes are Jones Act qualified and maintained in compliance with such requirements.

Matson is a member of the American Maritime Partnership (“AMP”), which supports the retention of the Jones Act and similar cabotage laws. The Jones Act has broad support from both houses of Congress and the Executive Branch. Matson believes that the geopolitical environment has further solidified political support for U.S. flagged vessels because a vital and dedicated U.S. merchant marine is a cornerstone for a strong homeland defense, as well as a critical source of trained U.S. mariners for wartime support. AMP seeks to inform elected officials and the public about the economic, national security, commercial, safety and environmental benefits of the Jones Act and similar cabotage laws. Repeal of the Jones Act would allow foreign-flagged vessel operators that do not have to abide by all U.S. laws and regulations to sail between U.S. ports in direct competition with Matson and other U.S. domestic operators that must comply with all such laws and regulations.

Other U.S. maritime laws require vessels operating between Guam, a U.S. territory, and U.S. ports to be U.S. flagged and predominantly U.S. crewed, but not U.S. built.

Cabotage laws are not unique to the United States, and similar laws exist around the world in over 90 countries, including regions in which Matson provides ocean transportation services. Any changes in such laws may have an impact on the services provided by Matson in those regions.

8

Rate Regulations and Fuel-Related Surcharges:

Matson is subject to the jurisdiction of the Surface Transportation Board with respect to its domestic ocean rates. A rate in the non-contiguous domestic trade is presumed reasonable and will not be subject to investigation if the aggregate of increases and decreases is not more than 7.5 percent above, or more than 10 percent below, the rate in effect one year before the effective date of the proposed rate, subject to increase or decrease by the percentage change in the U.S. Producer Price Index. Matson generally seeks to provide a 30-day notice to customers of any increases in general rates and other charges, and passes along decreases as soon as possible.

Matson’s Ocean Transportation services engaged in U.S.-foreign commerce are subject to the jurisdiction of the Federal Maritime Commission (“FMC”). The FMC is a federal independent regulatory agency that is responsible for the regulation of international ocean-borne transportation to and from the U.S.

Matson applies a fuel-related surcharge rate to its Ocean Transportation customers. Matson’s fuel-related surcharge is correlated to market rates for fuel prices and other factors, and is intended to help Matson recover fuel-related expenses.

Other Environmental Regulations:

In addition to the vessel emission regulations discussed above, Matson’s operations are required to comply with other environmental regulations and requirements including the Oil Pollution Act of 1990, the Comprehensive Environmental Response Compensation & Liability Act of 1980, the Rivers and Harbors Act of 1899, the Clean Water Act, the Invasive Species Act and the Clean Air Act. Matson is also subject to state regulations affecting terminal and vessel emissions, such as the requirement to shut down vessel generator engines while at berth at California ports and switch to shore electrical power. The Company actively monitors its operations for compliance with these and other regulations.

For more information on Matson’s environmental stewardship initiatives, including its environmental goals, see Matson’s Sustainability Report and other information available at www.matson.com/sustainability.

(2) | LOGISTICS SEGMENT |

Logistics Services:

Matson Logistics provides the following services:

Transportation Brokerage Services: Matson Logistics provides intermodal rail, highway, and other third-party logistics services for North American customers and international ocean carrier customers, including MatNav. Matson Logistics creates award winning benefits and value for its customers through volume purchases of rail, motor carrier and ocean transportation services, augmented by services such as shipment tracking and tracing, accessibility to its private fleet of 53-foot intermodal containers and single-vendor invoicing. Matson Logistics operates customer service centers and has sales offices throughout North America.

Freight Forwarding Services: Matson Logistics provides LCL consolidation and freight forwarding services primarily to the Alaska market through its wholly-owned subsidiary, Span Intermediate, LLC (“Span Alaska”). Span Alaska’s business aggregates LCL freight at its cross-dock facility in Auburn, Washington for consolidation and shipment to its service center in Anchorage and a network of other facilities in Alaska. Span Alaska also provides trucking services to its Auburn cross-dock facility and from its Alaska based cross-dock facilities to final customer destinations in Alaska.

Warehousing and Distribution Services: Matson Logistics operates two warehouses in Georgia and two warehouses in Northern California providing warehousing, trans-loading, value-added packaging and distribution services.

Supply Chain Management and Other Services: Matson Logistics provides customers with a variety of logistics services including purchase order management, customs brokerage, LCL and full container load NVOCC freight forwarding services. Matson Logistics has supply chain operations in North America, China and other locations.

9

Operating Costs:

Matson Logistics’ operating costs primarily consist of the costs of purchased transportation, leases of warehouses, cross-dock and other facility operating costs, salaries and benefits, and other operating overhead.

Competition:

Matson Logistics competes with hundreds of local, regional, national and international companies that provide transportation and third-party logistics services. The industry is highly fragmented and, therefore, competition varies by geography and areas of service.

Matson Logistics’ transportation brokerage services compete most directly with C.H. Robinson Worldwide, Hub Group, XPO and other freight brokers and intermodal marketing companies, and asset-invested market leaders such as J.B. Hunt. Competition is differentiated by the depth, scale and scope of customer relationships; vendor relationships and rates; network capacity; real-time visibility into the movement of customers’ goods; and other technology solutions. Additionally, while Matson Logistics primarily provides surface transportation brokerage, it also competes to a lesser degree with other forms of transportation for the movement of cargo.

Matson Logistics’ freight forwarding services compete most directly with a variety of freight forwarding companies that operate within Alaska including Carlile, Lynden, American Fast Freight and Alaska Traffic Company.

Customer Concentration:

Matson Logistics serves customers in numerous industries and geographical locations. The Company’s 10 largest logistics customers account for approximately 25 percent of the Company’s Logistics revenue. For additional information on Logistics revenues for the years ended December 31, 2021, 2020 and 2019, see Note 2 to the Consolidated Financial Statements in Item 8 of Part II below.

Seasonality:

In general, Matson Logistics’ services are not significantly impacted by seasonality factors, with the exception of its freight forwarding service to Alaska which may be affected by winter weather and the seasonal nature of the tourism industry. However, Matson’s Logistics businesses are being impacted by the global pandemic which has resulted in elevated levels of demand for our Logistics services that is expected to continue during 2022.

| C. | EMPLOYEES AND LABOR RELATIONS |

Human Capital Strategy:

In support of Matson’s vision to be a great place to work for all employees, the Company focuses on a variety of human capital programs that have been developed to attract, retain and motivate its employee workforce. As a company that operates in various global locations, the Company’s human capital programs are designed to reflect the unique market practices in each geographic location. The Company’s success depends in part on employing a diverse, talented and engaged workforce that reflects its local communities, supports an environment of high standards and performance, and thrives in the Company’s collaborative and respectful culture.

10

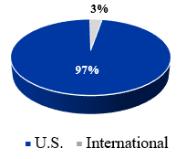

During 2021, Matson had 4,259 employees worldwide, of which 147 employees were based in international locations and 3,040 employees were covered by collective bargaining agreements with unions. These numbers include seagoing personnel who rotate through billets (as described below) and temporary employees, but do not include employees of SSAT or other non-employee affiliates such as agents and contractors. The composition of Matson’s workforce by geography is as follows:

Matson’s fleet of active vessels requires 392 billets to operate. Each billet corresponds to a position on a vessel that typically is filled by two or more employees because seagoing personnel rotate between active sea-duty and time ashore. These amounts exclude billets related to Matson’s foreign flagged chartered vessels where the vessel owner is responsible for its seagoing personnel. Matson’s vessel management services also employed personnel in 32 billets to manage three U.S. government vessels.

Diversity, Equity and Inclusion:

For many years, Matson has been committed to improving diversity, providing equal pay for equal work and creating an inclusive culture. According to the U.S. Bureau of Labor Statistics, traditionally the shipping industry’s workforce has been predominately represented by white males. While Matson’s workforce is representative of many of the communities where it operates, the Company has taken steps to do more to change the status quo within the Company and industry. In 2021, the Company continued to advance many of its diversity, equity and inclusion efforts. This includes continuing its efforts to analyze pay among various employee groups to confirm pay equity across the Company. Externally, the Company supports programs intended to help build a diverse talent pool for Matson and its industry. In 2020, the Company committed $100,000 toward creation of new Matson scholarships to be offered in conjunction with 16 higher education institutions and maritime academies in its communities with the goal of increasing diversity among those pursuing studies in transportation and logistics. The first scholarships were granted in Fall 2021. Separately, the Company committed more than $200,000 to fund paid internships with the goal of providing professional work experience opportunities and promoting the Company and the industry to a diverse group of students in its various regional locations. The first internships under this program are anticipated for Summer 2022.

The composition of Matson’s domestic shoreside workforce by gender and race in 2021 is as follows (data for seagoing personnel is not available to the Company):

The composition of management positions within Matson’s domestic shoreside workforce by gender and race in 2021 is as follows (data for seagoing personnel is not available to the Company):

11

“Minority” in these graphs refers to any employee who self-identifies as such under the categories established by the Equal Employment Opportunity Commission.

Total Rewards Programs:

Matson provides a highly competitive and balanced total rewards program designed to attract, retain and motivate its employees. While factors such as job, location and business unit ultimately determine which plans an employee may be eligible for participation, the Company’s total rewards offering includes market competitive base salaries, cash and equity incentives, recognition awards, health and welfare benefits, and employee and employer funded retirement plans. The Company believes that management level positions should have a portion of pay aligned with its short- and long-term business objectives. Accordingly, the Company’s total rewards program contains several pay-for-performance components tied to individual, business unit and company performance, as well as Matson stock price performance.

Succession and Career Planning:

Matson’s workforce is characterized by uniquely skilled, long-tenured employees. To create career pathways for future leaders while planning for the loss of retiring employees, the Company takes a proactive approach to succession and career planning. The Company focuses on providing the next generation of promising talent with the tools they need to build their own careers at Matson. In 2021, 46 percent of open positions were filled through internal promotions. The Company also provided approximately 3,200 hours of employee training and development, while giving annual performance reviews to its non-union workforce.

For more information on Matson’s human capital programs, see our Sustainability Report which is available at www.matson.com/sustainability.

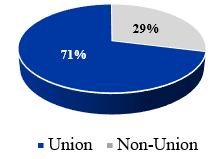

Bargaining Agreements:

Matson’s shoreside and seagoing employees are represented by a variety of unions. As shown in the chart below, union employees comprise 71 percent of Matson’s global workforce.

Matson has collective bargaining agreements with these unions that expire at various dates in the future, including as early as 2022. While Matson believes that it will be able to renegotiate these collective bargaining agreements with its various unions as they expire without any significant impact on its operations, no assurance can be given that such agreements will be reached without slow-downs, strikes, lockouts or other disruptions that may adversely impact Matson’s operations.

Additionally, Matson and SSAT are members of the Pacific Maritime Association (“PMA”), which on behalf of its members negotiates collective bargaining agreements with the International Longshore and Warehouse Union (“ILWU”) on the U.S. West Coast. The PMA/ILWU collective bargaining agreements cover substantially all U.S. West Coast longshore labor. In August 2017, the ILWU agreed to extend its contract with the PMA to July 1, 2022. The Company believes that the renegotiation of this contract will be completed during 2022.

Multi-employer Pension and Post-retirement Plans:

Matson contributes to a number of multi-employer pension and post-retirement plans. Matson has no present intention of withdrawing from, and does not anticipate the termination of any of the multi-employer pension plans to which it contributes (see Notes 11 and 12 to the Consolidated Financial Statements in Item 8 of Part II below for a discussion of withdrawal liabilities under certain multi-employer pension plans).

12

| D. | AVAILABLE INFORMATION |

Matson makes available, free of charge on or through its Internet website, Matson’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after it electronically files such material with, or furnishes them to, the U.S. Securities and Exchange Commission (“SEC”). The address of Matson’s Internet website is www.matson.com. This website is provided for convenience only, and the contents of our website do not constitute a part of and are not incorporated by reference into this Form 10-K.

The SEC maintains an Internet website that contains reports, proxy and information statements, and other information regarding Matson and other issuers that file electronically with the SEC. The address of the SEC’s Internet website is www.sec.gov.

ITEM 1A. RISK FACTORS

The following material factors, events and uncertainties may make an investment in the Company speculative or risky and should be reviewed carefully. The Company’s business faces the material risks set forth below; however, these risk factors do not identify all risks the Company faces, and additional risks or uncertainties that are currently unknown or are not currently believed to be material may occur or become material. The occurrence of these or the events and uncertainties described below may, in ways the Company may not be able to accurately predict, recognize or control, adversely affect the Company’s business, financial condition, operating results, cash flows, liquidity, demand, revenue, growth, prospects, reputation or stock price. All forward-looking statements made by the Company or on the Company’s behalf are qualified by the risks described below.

Risks Related to the Jones Act

Repeal, substantial amendment, or waiver of the Jones Act or its application would have an adverse effect on the Company’s business.

The Merchant Marine Act of 1920 (commonly referred to as the Jones Act) regulates all interstate and intrastate marine commerce within the U.S. If the Jones Act were repealed, substantially amended or waived and, as a consequence, competitors were to enter the Hawaii or Alaska markets with lower operating costs by utilizing their ability to acquire and operate foreign-flagged and foreign-built vessels and/or being exempt from other U.S. regulations, the Company’s business would be adversely affected. In addition, the Company’s position as a U.S. citizen operator of Jones Act vessels would be negatively impacted if periodic efforts and attempts by foreign interests to circumvent certain aspects of the Jones Act were successful. If maritime cabotage services were included in the General Agreement on Trade in Services, the United States-Mexico-Canada Agreement, or other international trade agreements, or if the restrictions contained in the Jones Act were otherwise altered, the shipping of cargo between covered U.S. ports could be opened to foreign-flagged or foreign-built vessels and could have other adverse impacts to our business. In the past, the Prime Minister of the United Kingdom has suggested that the Jones Act should be a topic of trade negotiations between the U.S. and the United Kingdom.

The Company’s business would be adversely affected if the Company were determined not to be a U.S. citizen under the Jones Act.

Certain provisions of the Company’s articles of incorporation protect the Company’s ability to maintain its status as a U.S. citizen under the Jones Act. If non-U.S. citizens were able to defeat such articles of incorporation restrictions and own in the aggregate more than 25 percent of the Company’s common stock, the Company would no longer be considered a U.S. citizen under the Jones Act. Such an event could result in the Company’s ineligibility to engage in coastwise trade and the imposition of substantial penalties against it, including seizure or forfeiture of its vessels.

13

Risks Related to the Company’s Operations

Changes in economic conditions or governmental policies, including from the COVID-19 pandemic, have affected and could in the future affect the Company.

The transportation industry in which the Company operates has been impacted by fluctuations, volatility, downturns, inflation, recessions and other economic shifts or market instabilities, as well as the development of and changes in governmental policies and relations, across the jurisdictions in which it operates. These adverse economic conditions may also impact customers’ business levels and needs. Within the United States, a weakening of economic drivers in Hawaii and Alaska, which include tourism, military spending, construction, personal income growth and employment, the weakening of consumer confidence, market demand, and the economy in the U.S. Mainland, inflation, and the effect of a change in the strength of the U.S. dollar against other foreign currencies may reduce the demand for goods, adversely affecting inland and ocean transportation volumes or rates. In addition, overcapacity in the global or transpacific ocean transportation markets, a change in the cost of goods or currency exchange rates, pressure from U.S. or foreign governments, imposition of tariffs and uncertainties regarding tariff rates or a change in international trade policies could adversely affect freight volumes and rates in the Company’s China service.

Since March 2020, the COVID-19 pandemic has harmed the U.S. and global economies, shut down or limited many business operations, led to port closures, and disrupted manufacturing, rail services, supply chains, travel, drayage of containers and transportation of goods for extended periods of time. In the United States and in many other countries worldwide, public health officials and state and local governments have recommended or mandated a range of precautions to mitigate the spread of COVID-19 and its variants as they evolve and fluctuate in their global impacts. The full impact of such disruptions on the Company’s business remains uncertain.

The pandemic and related uncertainties and restrictions have previously reduced tourism in the markets the Company serves, including Hawaii, Guam and Alaska, and led to increased unemployment and weakened consumer demand in certain segments, including reduced demand for freight that the Company would otherwise carry in those tradelanes. Fluctuations in the price of oil and reduced demand from the decline in air or car travel in response to COVID-19 could further impact the Alaskan economy, which in turn could impact the Company’s business. In addition, the global macroeconomic effects of the pandemic and related impacts on the Company’s customers’ business operations, including financial difficulties or bankruptcies, may persist for an indefinite period, even after the pandemic has subsided.

In the Company’s China service, as a result of the pandemic, the Company has experienced increased demand for its expedited ocean services. As the pandemic subsides, supply and demand trends normalize and supply chain congestion eases, the high volumes and rates the Company has experienced will eventually decline, but the Company cannot predict the timing or size of such decline. These declines will reduce revenues, but certain fixed costs will remain. For example, the Company cannot terminate leases early for chartered vessels in the CLX+ service.

The high volumes of freight from China and supply chain congestion at U.S. West Coast ports have contributed to an industry-wide shortage of containers and chassis, resulting broadly in delays, backlog, limited throughput, cancelled sailings, and service interruptions within tradelanes and supply chains, as well as long lead times for new equipment. There have also been labor shortages at U.S. ports related to record cargo volume, the overall employment environment and wage pressures, and outbreaks of COVID-19 which has also contributed to supply chain and port congestion. If the Company cannot secure sufficient equipment or labor, or unload vessels on a timely basis to meet customers’ needs and schedules, customers may seek to have their transportation and logistics needs met by others on a temporary or permanent basis.

The Company’s operations have also been impacted by the pandemic. The Company’s employees are restricted in their ability to travel. The Company may be further impacted if its employees, including mariners aboard our vessels, are otherwise restricted from or unable to perform their duties, or if the Company’s or SSAT’s terminals are temporarily closed due to a COVID-19 outbreak. Some vessel dry-dockings could also be delayed or become more expensive if shipyards are unable to accommodate demand or obtain parts in a timely manner or if necessary personnel are not allowed to travel to the shipyards.

Due to the continuing uncertainty around the duration, breadth and severity of the COVID-19 pandemic, including resurgences or mutations of the virus and the actions taken to contain the virus or treat its impact, including the

14

availability, distribution, efficacy and public acceptance of vaccines, the ultimate impact on the Company’s business, financial condition, operating results or cash flows are difficult to predict with certainty at this time. Additional or unforeseen effects from the COVID-19 pandemic may give rise to additional risks or instigate or amplify the other risks described throughout these Risk Factors.

The shipping industry is competitive, and the Company has been impacted by new or increased competition.

The Company may face new competition by established or start-up shipping operators that enter the Company’s markets. The shipping industry is competitive with limited barriers to entry, especially in international tradelanes. Ocean carriers can shift vessels in and out of tradelanes or charter vessels to manage capacity and meet customer demands. For example, in 2020 and 2021, in response to rising demand, several new carriers entered the China tradelane in competition with the Company’s China service. The entry of a new competitor or the addition of new vessels or capacity by existing competition on any of the Company’s routes could result in a significant increase in available shipping capacity that could have an adverse effect on the Company’s volumes and rates.

The loss of or damage to key customer or agent relationships may adversely affect the Company’s business.

The Company’s businesses are dependent on their relationships with customers and agents, and derive a significant portion of their revenues from the Company’s largest customers. The Company’s business relies on its relationships with the U.S. military, freight forwarders and non-vessel owning common carriers, large retailers and consumer goods manufacturers, as well as other larger customers. For more information regarding the Company’s significant customers, see the discussion in Part I, Item 1 of this Annual Report.

The Company could also be adversely affected by any changes in the services, or changes to the costs of services, provided by third party vendors such as railroads, truckers, terminals, agents and shipping companies, including charter vessel owners. Service structures and relationships with these parties are important in the Company’s intermodal business, as well as in the China, Guam, Micronesia, Japan, Alaska export and South Pacific services.

The loss of or damage to any of these key relationships may adversely affect the Company’s business and revenue.

The Company is dependent upon key vendors and third-parties for equipment, capacity and services essential to operate its business, and if the Company fails to secure sufficient third-party services, its business could be adversely affected.

The Company’s businesses are dependent upon key vendors who provide terminal, rail, truck, and ocean transportation services. If the Company cannot secure sufficient transportation equipment, capacity or services from these third-parties at reasonable prices or rates to meet its or its customers’ needs and schedules, customers may seek to have their transportation and logistics needs met by others on a temporary or permanent basis. If this were to occur, the Company’s business, results of operations and financial condition could be adversely affected.

An increase in fuel prices, changes in the Company’s ability to collect fuel-related surcharges, and/or the cost or limited availability of required fuels on the U.S. West Coast may adversely affect the Company’s profits.

Fuel is a significant operating expense for the Company’s Ocean Transportation business. The price and supply of fuel are unpredictable and fluctuate based on events beyond the Company’s control. Increases in the price of fuel may adversely affect the Company’s results of operations. Increases in fuel costs also can lead to increases in other expenses, such as energy costs and costs to purchase outside transportation services. In the Company’s Ocean Transportation and Logistics services segments, the Company utilizes fuel-related surcharges, although increases in the fuel-related surcharge may adversely affect the Company’s competitive position and may not correspond exactly with the timing of increases in fuel expense. Changes in the Company’s ability to collect fuel-related surcharges also may adversely affect its results of operations.

Effective January 1, 2020, the IMO imposed a world-wide regulation generally requiring that all ships burn compliant fuel oil with a maximum sulfur content of less than or equal to 0.5 percent. Currently, LSFO is typically priced higher than HFO due to the need for further oil refinement. In some market instances, the prices between the two products could be inverted. There is no guarantee that the Company’s contracts to secure LSFO or HFO on the U.S. West Coast will secure quantities in sufficient amounts and at a reasonable cost. In addition, prolonged use of LSFO on some

15

Matson vessels could degrade engine performance or lead to higher maintenance costs. The Company’s ability to recover the higher costs of IMO 2020 compliant fuel through fuel-related surcharges, the availability of LSFO, and the potential impact on vessel performance may adversely affect the Company’s operations, business and profit.

Evolving stakeholder expectations related to environmental, social and governance (“ESG”) matters exposes the Company to heightened scrutiny, additional costs, operational challenges and a number of risks.

Investors, advisory firms, employees, customers, suppliers, governments and other stakeholders are increasingly focused on, and establishing expectations for, ESG matters and related corporate practices, disclosures and initiatives. These evolving expectations may impact the Company’s reputation, business and attractiveness as an investment, employer or business partner to the extent the Company – including its initiatives, goals and reporting – meets or is perceived to meet those expectations, including as a result of any third-party rating or assessment. The adoption and expansion of ESG-related legislation and regulation have also resulted and may again result in increased capital expenditures and compliance, operational and other costs to the Company.

The Company’s public disclosures on its climate, sustainability, human capital and other ESG initiatives include its goals or expectations with respect to those matters, including greenhouse gas (“GHG”) emission reduction targets. These disclosures are aspirational and based on standards and frameworks for presenting and measuring progress that are not harmonized and are still developing, assumptions that may change, and disclosure controls and procedures that continue to evolve. The Company’s initiatives and goals may not be favored by certain stakeholders and could impact the attraction and retention of investors, customers and employees, as well as the Company’s willingness to do business with other companies or customers. Efforts to achieve the Company’s initiatives and goals face numerous risks and may be unsuccessful, result in additional costs or experience delays, and as a result may have a material negative impact on the Company, including its brand, reputation and stock price.

The Company may not be timely or successful in completing its fleet upgrade initiatives, which may result in significant costs and adversely impact the Company’s ability to meet its climate goals.

The Company’s four new Aloha and Kanaloa class vessels include dual fuel capable engines that can run on LSFO or liquefied natural gas (“LNG”). In November 2021, the Company announced plans to install tanks, piping and cryogenic equipment on Daniel K. Inouye and to re-engine Manukai to operate on LNG. The Company also expects to begin LNG installations on Kaimana Hila, Lurline and Matsonia, and to build three new LNG-ready vessels. In addition, the Company is in the process of building a new neighbor island flat-deck barge. The Company anticipates making significant capital expenditures in connection with these fleet initiatives. These initiatives may be hindered by substantial delays and long lead times for necessary equipment, including as a result of ongoing supply chain congestion, other residual impacts from the COVID-19 pandemic, increased demand across the industry for LNG installations and conversions, and new ship-building. Additional operating costs may be incurred to the extent additional ships are needed to maintain schedule integrity while such updates and installations are performed. Once completed, operation of these vessels may be slowed to the extent they present new maintenance requirements or unforeseen complications.

Use of LNG fuel may not result in anticipated GHG emission reductions, and the Company’s investments in LNG-ready vessels may be insufficient to meet the Company’s previously announced GHG emission reduction goals on a timely basis or at all. There is no guarantee that the Company will be able to secure LNG via bunker barges or other methods on the U.S. West Coast in sufficient amounts to fuel its vessels or at a reasonable cost, as increased demand for LNG could decrease available supply of LNG and increase prices. Governments have in the past and may again in the future impose tariffs on LNG that also may increase supply costs. As a result of these risks, the Company may not fully realize the benefits of these investments.

The Company’s operations are susceptible to weather, natural disasters, maritime accidents, spill events and other physical and operating risks, including those arising from climate change.

As a maritime transportation company, the Company’s operations are vulnerable to disruption as a result of weather, natural disasters and other climate-driven events, such as rising temperatures, sea levels and storm severity, bad weather at sea, hurricanes, typhoons, tsunamis, floods and earthquakes, as well as a maritime accident, oil or other spill, or other environmental mishap. Climate change has increased and may continue to increase the frequency, severity and uncertainty of such events. Such events interfere with the Company’s ability to provide on-time scheduled service, resulting in increased expenses and potential loss of business associated with such events. In addition, severe weather

16

and natural disasters can result in interference with the Company’s terminal operations and may cause serious damage to its vessels and cranes. These impacts could be particularly acute in certain ports in Alaska where the Company is dependent on a single crane. The Company’s vessels and their cargoes are also subject to operating risks such as mechanical failure, collisions and human error.

The occurrence of any of these events may result in damage to or loss of vessels, containers, cargo and other equipment, increased maintenance expense, loss of life or physical injury to its employees or people, pollution, or the slow down or suspension of operations. These events can expose the Company to reputational harm and liability for resulting damages and possible penalties that, pursuant to typical maritime industry policies, it must pay and then seek reimbursement from its insurer. Affected vessels may also be removed from service and thus would be unavailable for income-generating activity.

The Company’s casualty and liability insurance policies are generally subject to large retentions and deductibles and may not cover all losses the Company may incur. Some types of losses, such as losses resulting from a port blockage, generally are not insured. In some cases, the Company retains the entire risk of loss because it is not economically prudent to purchase insurance coverage or because of the perceived remoteness of the risk. Other risks are uninsured because insurance coverage may not be commercially available. Finally, the Company retains all risk of loss that exceeds the limits of its insurance.

The Company may be impacted by transitional and other risks arising from climate change.

The Company may be impacted by transitional and other risks arising from climate change and the global shift toward a low carbon future. Organizational, industrial and governmental shifts in operations as well as legal and regulatory requirements to reduce or eliminate emissions and/or increase efficiency may require the Company to increase expenditures, make changes to existing infrastructure, vessels and equipment and shift its business model. For example, the maritime industry is moving toward deployment of clean energy technologies and use of electricity powered by renewable energy sources to power terminal operations as a way to reduce shoreside greenhouse gas emissions. As the Company and SSAT increase their reliance on the power grid at terminals, including for cold-ironing and ground service fleets, the Company may experience increased risks related to power outages, brown outs or black outs. The likelihood of these risks is compounded by uncertainties regarding the reliability of renewable energy sources as well as any increased frequency of extreme weather events that may disrupt the generation or transmission of electricity. In addition, compliance with new climate change requirements or regulations such as the IMO’s requirements related to EEXI and CII could require Matson’s fleet to slow down if efficiency improvements or transitions to alternative fuels together are not enough to reduce GHG emissions sufficiently, thus impacting Matson’s expedited business model and competitive advantage. New environmental requirements for vessel performance and operation could also require the Company to accelerate the building of new vessels, increase the construction costs for new vessels and equipment to accommodate even newer technology as it emerges while today’s technology becomes obsolete, initiate unexpected retrofit projects for existing vessels, retire older vessels earlier than expected, or render reserve vessels unusable. If these outcomes were to occur, the Company’s business, results of operations, cash flows and financial condition could be adversely affected.

In addition to the COVID-19 pandemic, the Company faces risks related to actual or threatened health epidemics, pandemics or other major health crises, which could significantly disrupt the Company’s business.

The Company’s business could be impacted adversely by the effects of public health epidemics, pandemics or other major heath crises (which the Company refers to collectively as public health crises). Actual or threatened public health crises may have a number of adverse impacts, including volatility in the global economy, impacts to the Company’s customers’ business operations, reduced tourism in the markets the Company serves, or significant disruptions in ocean-borne transportation of goods, logistics demand and supply chain activity, caused by a variety of factors such as quarantines, factory and office closures, port closures, or other government-imposed restrictions, any of which could adversely impact the Company’s business, financial condition, operating results and cash flows.

The Company’s significant operating agreements and leases could be replaced on less favorable terms or may not be replaced when they expire.

The significant operating agreements and leases entered into by the Company in its businesses, including those related to terminals, chartered vessels and warehouses as well as those with SSAT, expire at various points in the future and may

17

not be replaced with comparable assets with the specifications necessary for the Company’s or SSAT’s businesses or could be replaced on less favorable terms, thereby adversely affecting the Company’s future financial position, results of operations and cash flows.

The Company may face unexpected dry-docking or repair costs for its vessels.