form10k.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______

Commission file number 000-00565

(Exact name of registrant as specified in its charter)

|

Hawaii

|

|

99-0032630

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Identification No.)

|

822 Bishop Street

Post Office Box 3440, Honolulu, Hawaii 96801

(Address of principal executive offices and zip code)

808-525-6611

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| |

Name of each exchange

|

|

Title of each class

|

on which registered

|

|

Common Stock, without par value

|

NYSE

|

Securities registered pursuant to Section 12(g) of the Act:

None

Number of shares of Common Stock outstanding at February 15, 2012:

41,871,540

Aggregate market value of Common Stock held by non-affiliates at June 30, 2011:

$1,980,995,573

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer x

|

Accelerated filer o

|

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Smaller reporting company o

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Documents Incorporated By Reference

Portions of Registrant’s Proxy Statement for the 2012 Annual Meeting of Shareholders (Part III of Form 10-K)

TABLE OF CONTENTS

PART I

| |

Page

|

| |

|

|

|

|

Items 1 & 2.

|

|

Business and Properties

|

1

|

| |

|

|

|

|

A.

|

|

Transportation

|

2

|

| |

|

(1)

|

Freight Services

|

2

|

| |

|

(2)

|

Vessels

|

3

|

| |

|

(3)

|

Terminals

|

3

|

| |

|

(4)

|

Logistics and Other Services

|

3

|

| |

|

(5)

|

Competition

|

4

|

| |

|

(6)

|

Labor Relations

|

7

|

| |

|

(7)

|

Rate Regulation

|

7

|

| |

|

|

|

|

|

B.

|

|

Real Estate

|

7

|

| |

|

(1)

|

General

|

7

|

| |

|

(2)

|

Planning and Zoning

|

8

|

| |

|

(3)

|

Development Projects

|

8

|

| |

|

(4)

|

Leased Portfolio

|

11

|

| |

|

|

|

|

|

C.

|

|

Agribusiness

|

13

|

| |

|

(1)

|

Production

|

13

|

| |

|

(2)

|

Marketing of Sugar

|

14

|

| |

|

(3)

|

Sugar Competition and Legislation

|

14

|

| |

|

(4)

|

Land Designations and Water

|

15

|

| |

|

|

|

|

|

D.

|

|

Employees and Labor Relations

|

16

|

| |

|

|

|

|

|

E.

|

|

Energy

|

17

|

| |

|

|

|

|

F.

|

|

Available Information

|

18

|

| |

|

|

|

|

Item 1A.

|

|

Risk Factors

|

19

|

| |

|

|

|

|

Item 1B.

|

|

Unresolved Staff Comments

|

29

|

| |

|

|

|

|

Item 3.

|

|

Legal Proceedings

|

29

|

| |

|

|

|

|

Item 4.

|

|

Mine Safety Disclosures

|

31

|

| |

|

|

Executive Officers of the Registrant

|

31

|

PART II

|

Item 5.

|

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

32

|

| |

|

|

|

|

Item 6.

|

|

Selected Financial Data

|

35

|

| |

|

|

|

|

Item 7.

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

38

|

| |

Page

|

| |

|

|

|

|

Items 7A.

|

|

Quantitative and Qualitative Disclosures About Market Risk

|

60

|

| |

|

|

|

|

Item 8.

|

|

Financial Statements and Supplementary Data

|

61

|

| |

|

|

|

|

Item 9.

|

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

111

|

| |

|

|

|

|

Item 9A.

|

|

Controls and Procedures

|

111

|

| |

|

|

|

|

A.

|

|

Disclosure Controls and Procedures

|

111

|

| |

|

|

|

|

B.

|

|

Internal Control over Financial Reporting

|

111

|

| |

|

|

|

|

Item 9B.

|

|

Other Information

|

111

|

PART III

|

Item 10.

|

|

Directors, Executive Officers and Corporate Governance

|

112

|

| |

|

|

|

|

A.

|

|

Directors

|

112

|

| |

|

|

|

|

B.

|

|

Executive Officers

|

112

|

| |

|

|

|

|

C.

|

|

Corporate Governance

|

113

|

| |

|

|

|

|

D.

|

|

Code of Ethics

|

113

|

| |

|

|

|

|

Item 11.

|

|

Executive Compensation

|

113

|

| |

|

|

|

|

Item 12.

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

113

|

| |

|

|

|

|

Item 13.

|

|

Certain Relationships and Related Transactions, and Director Independence

|

113

|

| |

|

|

|

|

Item 14.

|

|

Principal Accounting Fees and Services

|

113

|

PART IV

|

Item 15.

|

|

Exhibits and Financial Statement Schedules

|

114

|

| |

|

|

|

|

A.

|

|

Financial Statements

|

114

|

| |

|

|

|

|

B.

|

|

Financial Statement Schedules

|

114

|

| |

|

|

|

|

C.

|

|

Exhibits Required by Item 601 of Regulation S-K

|

114

|

| |

|

|

|

|

Signatures

|

123

|

| |

|

|

Consent of Independent Registered Public Accounting Firm

|

125

|

ALEXANDER & BALDWIN, INC.

FORM 10-K

Annual Report for the Fiscal Year

Ended December 31, 2011

PART I

ITEMS 1 & 2. BUSINESS AND PROPERTIES

Alexander & Baldwin, Inc. (“A&B” or the “Company”) is a multi-industry corporation with its primary operations centered in Hawaii. It was founded in 1870 and incorporated in 1900. Ocean transportation operations, related shoreside operations in Hawaii, and intermodal, truck brokerage and logistics services are conducted by a wholly-owned subsidiary, Matson Navigation Company, Inc. (“Matson”), and its subsidiaries. Property development, commerial real estate and agribusiness operations are conducted by A&B and certain other subsidiaries of A&B.

The business industries of A&B are generally as follows:

|

|

A.

|

Transportation - carrying freight, primarily between various U.S. Pacific Coast, Hawaii, Guam, China and other Pacific island ports; arranging domestic and international rail intermodal service, long-haul and regional highway brokerage, specialized hauling, flat-bed and project work, less-than-truckload, expedited/air freight services, and warehousing and distribution services; and providing terminal, stevedoring and container equipment maintenance services in Hawaii.

|

|

|

B.

|

Real Estate - engaging in real estate development and ownership activities, including planning, zoning, financing, constructing, purchasing, managing and leasing, selling and exchanging, and investing in real property.

|

|

|

C.

|

Agribusiness - growing sugar cane in Hawaii; producing bulk raw sugar, specialty food-grade sugars and molasses; marketing and distributing specialty food-grade sugars; generating and selling, to the extent not used in A&B’s operations, electricity; and providing general trucking services in Hawaii, including sugar and molasses hauling, and mobile equipment maintenance and repair services. In March 2011, the Company executed an agreement to lease land and sell coffee inventory and certain assets used in a coffee business it previously operated to Massimo Zanetti Beverage USA, Inc.

|

For information about the revenue, operating profits and identifiable assets of A&B’s industry segments for the three years ended December 31, 2011, see Note 14 (“Industry Segments”) to A&B’s financial statements in Item 8 of Part II below.

Separation Transaction: On December 1, 2011, the Company announced that its Board of Directors unanimously approved a plan to pursue the separation of the Company to create two independent, publicly traded companies:

|

·

|

A Hawaii-based land company with interests in real estate development, commercial real estate and agriculture (composed of the Real Estate and Agribusiness segments described above), which will retain the Alexander & Baldwin, Inc. name; and

|

|

·

|

An ocean transportation company serving the U.S. West Coast, Hawaii, Guam, Micronesia and China, and a domestic logistics company under the Matson name (composed of the businesses in the Transportation segment described above).

|

The separation is expected to be completed in the second half of 2012.

On February 13, 2012, the Company entered into an Agreement and Plan of Merger to reorganize itself as a holding company incorporated in Hawaii. The holding company structure will help facilitate the separation by allowing the Company to organize and segregate the assets of its different businesses in an efficient manner prior to the separation and facilitate the third party and governmental consent and approval process. In addition, the holding company reorganization will help preserve the Company’s status as a U.S. citizen under certain U.S. maritime and vessel documentation laws (popularly referred to as the Jones Act) by, among other things, limiting the percentage of outstanding shares of common stock in the holding company that may be owned (of record or beneficially) or controlled in the aggregate by non-U.S. citizens (as defined by the Jones Act) to a maximum permitted percentage of 22%. For more information on the Jones Act and its effect on the Company, see “Description of Business and Properties – Transportation – Jones Act.”

DESCRIPTION OF BUSINESS AND PROPERTIES

A. Transportation

(1) Freight Services

Matson’s Hawaii Service offers containership freight services between the ports of Long Beach, Oakland, Seattle and the major ports in Hawaii on the islands of Oahu, Kauai, Maui and Hawaii. Roll-on/roll-off service is provided between California and the major ports in Hawaii. Matson is the principal carrier of ocean cargo between the U.S. Pacific Coast and Hawaii. Principal westbound cargoes carried by Matson to Hawaii include dry containers of mixed commodities, refrigerated commodities, packaged foods, building materials, automobiles and household goods. Principal eastbound cargoes carried by Matson from Hawaii include automobiles, household goods, dry containers of mixed commodities, food and beverages, and livestock. The majority of Matson’s Hawaii Service revenue is derived from the westbound carriage of containerized freight and automobiles.

Matson’s Guam Service provides weekly containership freight services between the U.S. Pacific Coast and Guam. Additional freight destined to and from the Commonwealth of the Marianas Islands, the Republic of Palau and the island of Yap in the Federated States of Micronesia is transferred at Guam to and from connecting carriers for delivery to and from those locations.

Matson’s Micronesia Service offers container and conventional freight service between the U.S. Pacific Coast and the islands of Kwajalein, Ebeye and Majuro in the Republic of the Marshall Islands and the islands of Pohnpei, Chuuk and Kosrae in the Federated States of Micronesia. Cargo is transferred at Guam to a Matson-operated ship that provides bi-weekly service to and from those islands. Matson also carries cargo originating in Asia to these islands by receiving cargo transferred from other carriers in Guam.

Matson’s China Service is part of an integrated Hawaii/Guam/China service. This service employs five Matson containerships in a weekly service that carries cargo from the U.S. Pacific Coast to Honolulu, then to Guam. The vessels continue to the ports of Xiamen, Ningbo and Shanghai in China, where they are loaded with cargo to be discharged in Long Beach. These ships also carry cargo destined to and originating from Guam, the Commonwealth of Northern Marianas, the Republic of Palau and the Republic of the Marshall Islands. In 2011, Matson operated a second vessel string for part of the year that employed five chartered containerships in a weekly service that carried cargo from the U.S. Pacific Coast directly to the ports of Hong Kong, Yantian and Shanghai in China, where they also loaded cargo to be discharged in Long Beach. Operation of the second vessel string was terminated in the third quarter of 2011.

See “Rate Regulation” below for a discussion of Matson’s freight rates.

(2) Vessels

Matson’s owned fleet consists of 10 containerships (excluding three containerships time-chartered from third parties that serve the Micronesia and discontinued the second China string); three combination container/roll-on/roll-off ships; one roll-on/roll-off barge and two container barges equipped with cranes that serve the neighbor islands of Hawaii; and one container barge equipped with cranes that is available for charter. The 17 Matson-owned vessels in the fleet, with the oldest vessel acquired in 1978, represent an investment of approximately $1.2 billion expended. The majority of vessels in the Matson fleet has been acquired with the assistance of withdrawals from a Capital Construction Fund (“CCF”) established under Section 607 of the Merchant Marine Act, 1936, as amended.

Vessels owned by Matson are described on page 4.

As a complement to its fleet, Matson owns approximately 34,000 containers, 14,000 container chassis and generators, 900 auto-frames and miscellaneous other equipment. Capital expenditures incurred by Matson in 2011 for vessels, equipment and systems totaled approximately $44 million.

(3) Terminals

Matson Terminals, Inc. (“Matson Terminals”), a wholly-owned subsidiary of Matson, provides container stevedoring, container equipment maintenance and other terminal services for Matson and other ocean carriers at its 105-acre marine terminal in Honolulu. Matson Terminals owns and operates seven cranes at the terminal, which handled approximately 355,900 lifts in 2011 (compared with 351,200 lifts in 2010). The terminal can accommodate three vessels at one time. Matson Terminals’ lease with the State of Hawaii runs through September 2016. Matson Terminals also provides container stevedoring and other terminal services to Matson and for other vessel operators on the islands of Hawaii, Maui and Kauai. Capital expenditures incurred by Matson Terminals in 2011 for terminals and equipment totaled approximately $1.7 million.

SSA Terminals, LLC (“SSAT”), a joint venture of Matson Ventures, Inc., a wholly-owned subsidiary of Matson, and SSA Ventures, Inc. (“SSA”), provides terminal and stevedoring services at U.S. Pacific Coast terminal facilities to Matson and numerous international carriers, which include Mediterranean Shipping Company (“MSC”), China Shipping, CMA/CGM, Hapag Lloyd, OOCL, NYK Line and Maersk. SSAT operates six terminals: two in Seattle, one of which is operated by SSA Terminals (Seattle), LLC, a joint venture with China Shipping Terminals (USA) LLC (“China Shipping”) where ownership is split SSAT 66.7% and China Shipping 33.3%, two in Oakland, one of which is operated by SSA Terminals (Oakland), LLC, a joint venture with NYK Terminals (Oakland), Inc. (“NYK”) where ownership is split SSAT 80% and NYK 20%, and two in Long Beach, one of which is operated by SSA Terminals (Long Beach), LLC, a joint venture with ownership divided equally between SSAT and Terminal Investment Limited, an affiliate of MSC.

(4) Logistics and Other Services

Matson Logistics, Inc. (“Matson Logistics,” formerly known as “Matson Integrated Logistics, Inc.”), a wholly-owned subsidiary of Matson, is a transportation intermediary that provides rail, highway, air, warehousing and other third-party logistics services for North American customers and international ocean carrier customers, including Matson. Through volume purchases of rail, motor carrier, air and ocean transportation services, augmented by such services as shipment tracking and tracing and single-vendor invoicing, Matson Logistics is able to reduce transportation costs for its customers. Matson Logistics is headquartered in Concord, California, operates seven regional operating centers, has sales offices in over 35 cities nationwide, and operates through a network of agents throughout the U.S. Mainland.

Matson Logistics Warehousing, Inc. (“Matson Logistics Warehousing,” formerly known as “Matson Global Distribution Services, Inc.”) is a wholly-owned subsidiary of Matson Logistics that principally provides warehousing and distribution services. With the acquisition of a regional warehouse company in Northern California in 2008, Matson Logistics Warehousing’s service menu was expanded to include operating a Foreign Trade Zone. (Matson Logistics Warehousing has a license with the City of Oakland to operate Foreign Trade Zone #56 on behalf of the City and, as a result, has designated parts of its warehouses for customers desiring duty free storage.) Through Matson Logistics Warehousing, Matson Logistics provides customers with a full suite of domestic and international transportation services.

(5) Competition

Matson’s Hawaii Service has one major containership competitor, Horizon Lines, Inc., that serves Long Beach, Oakland, Tacoma and Honolulu. The Hawaii Service also has one additional liner competitor, Pasha Hawaii Transport Lines, LLC that operates a pure car carrier ship, specializing in the carriage of automobiles, large pieces of rolling stock, such as trucks and buses, and household goods. Matson’s Guam Service had one major competitor, Horizon Lines, Inc., until November 2011 when Horizon Lines ended its service to that area. Until that time, Horizon Lines served Guam with weekly service from Long Beach, Oakland and Tacoma to Guam. Several foreign carriers also serve Guam with less frequent service, along with Waterman Steamship Corporation, a U.S.-flagged carrier, which periodically calls at Guam.

Other competitors in the Hawaii Service include two common carrier barge services, unregulated proprietary and contract carriers of bulk cargoes, and air cargo service providers. Although air freight competition is intense for time-sensitive and perishable cargoes, inroads by such competition in terms of cargo volume are limited by the amount of cargo space available in passenger aircraft and by generally higher air freight rates. Over the years, additional barge competitors periodically have entered and left the U.S.-Hawaii trades, mostly from the Pacific Northwest.

Matson vessels are operated on schedules that provide shippers and consignees regular day-of-the-week sailings from the U.S. Pacific Coast and day-of-the-week arrivals in Hawaii. Matson generally offers an average of three sailings per week, though this amount may be adjusted according to seasonal demand and market conditions. Matson provides over 150 sailings per year, which is greater than all of its domestic ocean competitors’ sailings combined. One westbound sailing each week continues on to Guam and China, so the number of eastbound sailings from Hawaii to the U.S. Mainland averages two per week with the potential for additional sailings. This service is attractive to customers because more frequent arrivals permit customers to reduce inventory costs. Matson also competes by offering a more comprehensive service to customers, supported by the scope of its equipment, its efficiency and experience in handling containerized cargo, and competitive pricing.

MATSON NAVIGATION COMPANY, INC.

OWNED FLEET

| |

|

|

|

|

|

Usable Cargo Capacity

|

| |

|

|

|

Maximum

|

Maximum

|

Containers

|

Vehicles

|

Molassess

|

| |

Official

|

Year

|

|

Speed

|

Deadweight

|

|

|

|

|

Reefer

|

|

|

|

|

|

Vessel Name

|

Number

|

Built

|

Length

|

(Knots)

|

(Long Tons)

|

20’

|

24’

|

40’

|

45’

|

Slots

|

TEUs(1)

|

Autos

|

Trailers

|

Short Tons

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diesel-Powered Ships

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R. J. PFEIFFER

|

979814

|

1992

|

713’ 6”

|

23.0

|

27,100

|

107

|

--

|

1,069

|

--

|

300

|

2,245

|

--

|

--

|

--

|

|

MOKIHANA

|

655397

|

1983

|

860’ 2”

|

23.0

|

29,484

|

52

|

--

|

950

|

--

|

342

|

1,994

|

1,323

|

38

|

--

|

|

MANULANI

|

1168529

|

2005

|

712’ 0”

|

23.0

|

29,517

|

4

|

--

|

1,040

|

128

|

284

|

2,372

|

--

|

--

|

--

|

|

MAHIMAHI

|

653424

|

1982

|

860’ 2”

|

23.0

|

30,167

|

150

|

--

|

1,494

|

--

|

408

|

2,824

|

--

|

--

|

--

|

|

MANOA

|

651627

|

1982

|

860’ 2”

|

23.0

|

30,187

|

150

|

--

|

1,494

|

--

|

408

|

2,824

|

--

|

--

|

3,000

|

|

MANUKAI

|

1141163

|

2003

|

711’ 9”

|

23.0

|

29,517

|

4

|

--

|

1,115

|

64

|

284

|

2,378

|

--

|

--

|

--

|

|

MAUNAWILI

|

1153166

|

2004

|

711’ 9”

|

23.0

|

29,517

|

4

|

--

|

1,115

|

64

|

284

|

2,378

|

--

|

--

|

--

|

|

MAUNALEI

|

1181627

|

2006

|

681’ 1”

|

22.1

|

33,771

|

424

|

--

|

984

|

--

|

328

|

1,992

|

--

|

--

|

--

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Steam-Powered Ships

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KAUAI

|

621042

|

1980

|

720’ 5-1/2”

|

22.5

|

26,308

|

74

|

128

|

708

|

--

|

270

|

1,644

|

44

|

--

|

2,600

|

|

MAUI

|

591709

|

1978

|

720’ 5-1/2”

|

22.5

|

26,623

|

74

|

128

|

708

|

--

|

270

|

1,644

|

--

|

--

|

2,600

|

|

MATSONIA

|

553090

|

1973

|

760’ 0”

|

21.5

|

22,501

|

36

|

45

|

789

|

26

|

258

|

1,727

|

450

|

85

|

4,300

|

|

LURLINE

|

549900

|

1973

|

826’ 6”

|

21.5

|

22,213

|

6

|

--

|

777

|

38

|

246

|

1,646

|

761

|

55

|

2,100

|

|

LIHUE

|

530137

|

1971

|

787’ 8”

|

21.0

|

38,656

|

296

|

--

|

861

|

--

|

188

|

2,018

|

--

|

--

|

--

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barges

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WAIALEALE (2)

|

978516

|

1991

|

345’ 0”

|

--

|

5,621

|

--

|

--

|

--

|

--

|

36

|

--

|

230

|

45

|

--

|

|

MAUNA KEA (3)

|

933804

|

1988

|

372’ 0”

|

--

|

6,837

|

--

|

276

|

24

|

--

|

70

|

379

|

--

|

--

|

--

|

|

MAUNA LOA (3)

|

676973

|

1984

|

350’ 0”

|

--

|

4,658

|

24

|

24

|

124

|

16

|

78

|

335

|

--

|

--

|

2,100

|

|

HALEAKALA (3)

|

676972

|

1984

|

350’ 0”

|

--

|

4,658

|

24

|

24

|

124

|

16

|

78

|

335

|

--

|

--

|

2,100

|

______________________________________________________

|

(1)

|

“Twenty-foot Equivalent Units” (including trailers). TEU is a standard measure of cargo volume correlated to the volume of a standard 20-foot dry cargo container.

|

|

(2)

|

Roll-on/Roll-off Barge.

|

During 2011, approximately 77% of Matson’s revenues generated by ocean services came from trades that were subject to the Jones Act. The carriage of cargo between the U.S. Pacific Coast and Hawaii on foreign-built or foreign-documented vessels is prohibited by Section 27 of the Merchant Marine Act, 1920, commonly referred to as the Jones Act. The Jones Act is a long-standing cornerstone of U.S. maritime policy. Under the Jones Act, all vessels transporting cargo between covered U.S. ports must, subject to limited exceptions, be built in the U.S., registered under the U.S. flag, manned by predominantly U.S. crews, and owned and operated by U.S.-organized companies that are controlled and 75% owned by U.S. citizens. U.S.-flagged vessels are generally required to be maintained at higher standards than foreign-flagged vessels and are supervised by, as well as subject to rigorous inspections by, or on behalf of, the U.S. Coast Guard, which requires appropriate certifications and background checks of the crew members. Our trade route between Hawaii and the U.S. Pacific Coast represents the non-contiguous Jones Act market. Vessels operating on this trade route are required to be fully qualified Jones Act vessels. Other U.S. maritime laws require vessels operating between Guam, a U.S. territory, and U.S. ports to be U.S.-flagged and predominantly U.S.-crewed, but not U.S.-built. Foreign-flag vessels carrying cargo to Hawaii from non-U.S. locations also provide competition for Matson’s Hawaii Service. Asia, Australia, New Zealand, Mexico, South America and South Pacific islands have direct foreign-flag services to Hawaii.

Matson is a member of the American Maritime Partnership (formerly known as the Maritime Cabotage Task Force), which supports the retention of the Jones Act and other cabotage laws that regulate the transport of goods between U.S. ports. Cabotage laws, which reserve the right to ship cargo between domestic ports to domestic vessels, are not unique to the United States; similar laws are common around the world and exist in over 50 countries. In general, all interstate and intrastate marine commerce within the U.S. falls under the Jones Act, which is a cabotage law. As island economies, Hawaii and Guam are highly dependent on ocean transportation. The Jones Act ensures frequent, reliable, roundtrip service to keep store shelves stocked, reduces inventory costs and helps move local products to market. The Company believes the Jones Act enjoys broad support from President Obama and both major political parties in both houses of Congress. The Company believes that the ongoing war on terrorism has further solidified political support for the Jones Act, as a vital and dedicated U.S. merchant marine is a cornerstone for a strong homeland defense, as well as a critical source of trained U.S. mariners for wartime support. Repeal of the Jones Act would allow foreign-flag vessel operators, which do not have to abide by U.S. laws and regulations, to sail between U.S. ports in direct competition with Matson and other U.S. operators, which must comply with such laws and regulations. The American Maritime Partnership seeks to inform elected officials and the public about the economic, national security, commercial, safety and environmental benefits of the Jones Act and similar cabotage laws.

Matson has operated its China Long Beach Express Service, CLX1, since February 2006. Matson provides weekly containership service between the ports of Xiamen, Ningbo and Shanghai and the port of Long Beach. Enroute to China, the ships stop at Honolulu, then Guam, carrying cargo destined to those areas. From Honolulu, connecting service is provided to other ports in Hawaii. From Guam, connecting service is provided to other Pacific islands. The ships then continue from Guam to the ports of Xiamen, added in 2009, Ningbo and Shanghai, and return directly to Long Beach. Matson operated a second China Long Beach Express Service, CLX2, between August 2010 and September 2011 when this service was terminated. Major competitors in the China Service include well-known international carriers such as Maersk, COSCO, Evergreen, Hanjin, APL, China Shipping, Hyundai, MSC, OOCL, KLine and NYK Line. Matson competes by offering fast and reliable freight availability from Shanghai to Long Beach, providing fixed day arrivals in Long Beach and next-day cargo availability, offering a dedicated Long Beach terminal providing fast truck turn times, an off-dock container yard and one-stop intermodal connections, using its newest and most fuel efficient ships and providing state-of-the-art technology and world-class customer service. Matson operates offices in Hong Kong, Xiamen, Ningbo and Shanghai, and has contracted with terminal operators in Xiamen, Ningbo and Shanghai.

Matson Logistics competes with thousands of local, regional, national and international companies that provide transportation and third-party logistics services. The industry is highly fragmented and, therefore, competition varies by geography and areas of service. At a national level, Matson Logistics competes most directly with C.H. Robinson Worldwide and the Hub Group. Competition is differentiated by the depth, scale and scope of customer relationships; vendor relationships and rates; network capacity; and real-time visibility into the movement of customers’ goods and other technology solutions. Additionally, while Matson Logistics primarily provides surface transportation brokerage, it also competes to a lesser degree with other forms of transportation for the movement of cargo, including air services.

(6) Labor Relations

The absence of strikes and the availability of labor through hiring halls are important to the maintenance of profitable operations by Matson. In the last 40 years, only once-in 2002, when International Longshore and Warehouse Union (“ILWU”) workers were locked out for ten days on the U.S. Pacific Coast-has Matson’s operations been disrupted significantly by labor disputes. See “Employees and Labor Relations” below for a description of labor agreements to which Matson and Matson Terminals are parties and information about certain unfunded liabilities for multiemployer pension plans to which Matson and Matson Terminals contribute.

(7) Rate Regulation

Matson is subject to the jurisdiction of the Surface Transportation Board with respect to its domestic rates. A rate in the noncontiguous domestic trade is presumed reasonable and will not be subject to investigation if the aggregate of increases and decreases is not more than 7.5 percent above, or more than 10 percent below, the rate in effect one year before the effective date of the proposed rate, subject to increase or decrease by the percentage change in the U.S. Producer Price Index (“zone of reasonableness”). Matson raised its rates in its Hawaii service, effective January 2, 2011, by $120 per westbound container and $60 per eastbound container and its terminal handling charges by $175 per westbound container and $85 per eastbound container. Matson raised its rates in its Guam service, effective January 30, 2011, by $120 per westbound and eastbound container and its terminal handling charges by $175 per westbound and eastbound container. Rising fuel-related costs caused Matson to raise its fuel-related surcharge from 21.75 percent to 26.5 percent in its Hawaii service and from 23.25 percent to 28 percent in its Guam service, effective February 27, 2011. Dramatic increases in fuel costs caused Matson to raise its fuel-related surcharge to 35 percent in its Hawaii service and 36.5 percent in its Guam service, effective March 27, 2011. As a result of the sustained surge in fuel prices, Matson raised its fuel-related surcharge to 43.5 percent in its Hawaii service and 45 percent in its Guam service, effective May 1, 2011. Due to sustained near record high fuel prices, Matson raised its fuel-related surcharge to 47.5 percent in its Hawaii service and 49 percent in its Guam service, effective June 12, 2011. As a result of subsequent declines in bunker fuel prices, Matson decreased its fuel-related surcharge to 45.5 percent in its Hawaii service and to 47 percent in its Guam service, effective August 28, 2011. Matson again decreased its fuel-related surcharge to 42.5 percent in its Hawaii service and to 44 percent in its Guam service, effective September 25, 2011. Matson further decreased its fuel-related surcharge to 40.5 percent in its Hawaii service and 42 percent in its Guam service, effective October 9, 2011. Matson raised its rates in its Hawaii service, effective January 1, 2012, by $175 per westbound container and $85 per eastbound container and its terminal handling charges by $50 per westbound container and $25 per eastbound container. As a result of rising bunker fuel prices and other energy related costs, Matson increased its fuel-related surcharge to 45.5 percent in its Hawaii service, effective February 26, 2012. Matson’s China Service is subject to the jurisdiction of the Federal Maritime Commission (“FMC”). No such zone of reasonableness applies under FMC regulation.

B. Real Estate

(1) General

As of December 31, 2011, A&B and its subsidiaries, including A&B Properties, Inc., owned approximately 88,166 acres of land, consisting of approximately 87,695 acres in Hawaii and approximately 471 acres on the U.S. Mainland, as follows:

|

Location

|

No. of Acres

|

| |

|

|

|

|

Maui

|

|

67,240

|

|

|

Kauai

|

|

20,375

|

|

|

Oahu

|

|

70

|

|

|

Big Island

|

|

10

|

|

|

TOTAL HAWAII

|

|

87,695

|

|

| |

|

|

|

| |

|

|

|

|

Texas

|

|

150

|

|

|

California

|

|

100

|

|

|

Georgia

|

|

63

|

|

|

Utah

|

|

55

|

|

|

Colorado

|

|

36

|

|

|

Washington

|

|

27

|

|

|

Nevada

|

|

21

|

|

|

Arizona

|

|

19

|

|

|

TOTAL MAINLAND

|

|

471

|

|

As described more fully in the table below, the bulk of this acreage currently is used for agricultural, pasture, watershed and conservation purposes. A portion of these lands is used for urban purposes or planned for development. An additional 2,990 acres on Maui, Kauai and Oahu are leased from third parties, and are not included in the tables. The tables do not include approximately 1,200 acres under joint venture development.

|

Current Use

|

No. of Acres

|

| |

|

|

|

|

Hawaii

|

|

|

|

|

Fully entitled Urban (defined below)

|

|

750

|

|

|

Agricultural, pasture and miscellaneous

|

|

57,775

|

|

|

Watershed/conservation

|

|

29,170

|

|

| |

|

|

|

|

U.S. Mainland

|

|

|

|

|

Fully entitled Urban

|

|

471

|

|

|

TOTAL

|

|

88,166

|

|

A&B and its subsidiaries are actively involved in the entire spectrum of real estate development and ownership, including planning, zoning, financing, constructing, purchasing, managing and leasing, selling and exchanging, and investing in real property.

(2) Planning and Zoning

The entitlement process for development of property in Hawaii is complex, time-consuming and costly, involving numerous State and County regulatory approvals. For example, conversion of an agriculturally-zoned parcel to residential zoning usually requires the following approvals:

|

|

·

|

amendment of the County general plan to reflect the desired residential use;

|

|

|

·

|

approval by the State Land Use Commission to reclassify the parcel from the Agricultural district to the Urban district;

|

|

·

|

amendment of the Community Plan; and

|

|

|

·

|

County approval to rezone the property to the precise residential use desired.

|

The entitlement process is complicated by the conditions, restrictions and exactions that are placed on these approvals, including, among others, the requirement to construct infrastructure improvements, payment of impact fees, restrictions on the permitted uses of the land, requirement to provide affordable housing and mandatory fee sale of portions of the project.

A&B actively works with regulatory agencies, commissions and legislative bodies at various levels of government to obtain zoning reclassification of land to its highest and best use. A&B designates a parcel as “fully entitled” or “fully zoned” when all of the above-mentioned land use approvals have been obtained.

(3) Development Projects

A&B is pursuing a number of projects in Hawaii, including:

Maui:

(a) Maui Business Park II. In 2008, A&B received final zoning approval for 179 acres in Kahului, Maui, representing the second phase of its Maui Business Park project, from agriculture to light industrial. The zoning change approval is subject to various conditions, such as providing land for affordable housing and a wastewater treatment plant. In 2009, the County granted preliminary approval of several subdivision applications within the project, preliminary design of project infrastructure was completed, and construction drawings for a water system were submitted for approvals. In 2010, A&B continued to process permits and construction drawings for subdivision improvements through various State and County agencies, and commenced demolition of existing structures to prepare for construction of subdivision improvements. In 2011, the project’s offsite private water system was completed, including two potable-quality wells, storage and transmission systems. Construction of subdivision improvements for the first phase of the project was delayed due to permit issues. Limited construction of subdivision improvements commenced in December 2011.

(b) Wailea. In October 2003, A&B acquired 270 acres of fully-zoned, undeveloped residential and commercial land at the Wailea Resort on Maui, planned for up to 1,200 homes, for $67.1 million. A&B was the original developer of the Wailea Resort, beginning in the 1970s and continuing until A&B sold the resort to the Shinwa Golf Group in 1989.

A&B has since sold 29 single-family homesites at Wailea’s Golf Vistas subdivision and six bulk parcels: MF-4 (10.5 acres); MF-15 (9.4 acres); MF-5 (8.4 acres); MF-9 (30.2 acres); a three-acre business parcel within the 10.4-acre MF-11 parcel; and a 4.6-acre portion of the 15.6-acre B I & II parcel. The 25-acre MF-8 parcel was developed in a joint venture with Armstrong Builders into 150 duplex units, with 12 units available for sale. Due to limited demand for vacant lots, A&B is evaluating development scenarios for its 12 single-family ocean-view lots at the 7.4-acre MF-11 parcel and nine half-acre estate ocean-view lots at the 6.7-acre MF-19 parcel. A&B continues to evaluate development scenarios for the remaining 153 acres, including MF-7 (13 acres), MF-10 (13.7 acres) and B-1 (11.0 acres).

(c) Haliimaile Subdivision. A&B’s application to rezone 63 acres and amend the community plan for the development of a 150- to 200-lot residential subdivision in Haliimaile (Upcountry, Maui) was approved by the Maui County Council in September 2005. In 2006, onsite infrastructure design work was submitted to County agencies, but design approval has been deferred until an acceptable water source can be confirmed.

(d) Aina ‘O Kane. Aina ‘O Kane is planned to consist of 103 residential condominium units in five four-story buildings, with 20,000 square-feet of ground-floor commercial space, in Kahului. In 2010, A&B installed the project’s water meters and, in July 2011, a two-year extension of the Special Management Area (SMA) permit was secured. The project is positioned for development when market conditions improve.

(e) Kahului Town Center. The redevelopment plan for the 19-acre Kahului Shopping Center block reflects the creation of a traditional “town center,” consisting of approximately 440 residential condominium units and 240,000 square feet of retail/office space. This project is on hold until market conditions improve.

Kauai:

(f) Kukui`ula. In April 2002, A&B entered into a joint venture with DMB Communities II (“DMBC”), an affiliate of DMB Associates, Inc., an Arizona-based developer of master-planned communities, for the development of Kukui`ula, a 1,000-acre master planned resort residential community located in Poipu, Kauai, planned for up to 1,500 resort residential units. In 2004, A&B exercised its option to contribute to the joint venture up to 40 percent of the project’s future capital requirements. In May 2009, A&B entered into an amended agreement with DMBC to increase A&B’s ownership participation in Kukui`ula in exchange for more favorable participation rights to future cash and profit distributions, while limiting DMBC’s future contributions to $35 million. In 2011, all resort core amenities were completed and opened for business, including the 18-hole golf course, the community’s clubhouse, pool and spa facilities. The project’s 78,900-square-foot commercial center, The Shops at Kukui’ula, is 75 percent leased. A total of 81 residential lot sales had closed as of December 31, 2011, and a 4.2-acre commercial parcel was sold in 2011. Several developer agreements are under negotiation on various bulk parcels with one agreement executed in 2011. Under the agreement, the joint venture receives a payment for each lot when construction of the home is completed and sold by the contractor. At a 5.4-acre developer parcel, planned for 15 homes, construction was completed on a “lodge” model unit and two lodge units have been sold, with construction expected to be completed in 2012. The capital contributed by A&B to the joint venture included approximately $222 million of cash contributions as of December 31, 2011, and $30 million representing the value of land initially contributed. DMBC has contributed $188 million, which includes the amended $35 million mentioned above.

Oahu:

(g) Waihonua at Kewalo. In 2010, A&B acquired a fully-entitled high-rise condominium development site in the Kakaako district of Honolulu on Oahu. During 2011, construction plans were prepared and processed for approvals for the 341-unit high-rise development. Condominium documents were approved in November and sales and marketing commenced in December, with favorable initial results. Subject to meeting satisfactory pre-sale requirements, construction is projected to commence in 2012.

(h) Gateway at Mililani Mauka Shopping Center. In December 2011, A&B acquired a 4.3-acre development parcel within the 7.4-acre Gateway at Mililani Mauka Shopping Center on Oahu, including an existing, fully-leased 5,900 square-foot multi-tenant retail building and four fully-infrastructured building pads. Gateway is currently improved with a McDonald’s, a Tesoro gas station and mini-mart, and a new Longs/CVS Drugstore (under construction). A&B plans to develop an additional 28,400 square feet of retail space on the development parcel.

(i) Waiawa. In August 2006, A&B entered into a joint venture agreement with an affiliate of Gentry Investment Properties for the development of a 1,000-acre master-planned primary residential community (530 residential-zoned acres) in Central Oahu. The master development agreement between Kamehameha Schools ("KS") and Gentry was terminated and, in 2011, KS, Gentry and A&B agreed upon settlement terms and are no longer pursuing development of the project, which resulted in a $6.4 million reduction in the carrying value of A&B’s investment.

(j) Keola La`i. In 2008, A&B completed construction of a 42-story condominium project near downtown Honolulu, consisting of 352 residential units, averaging 970 square feet, and four commercial units, with the majority of the residential units and two commercial units closed in 2008. Six residential units and the remaining commercial unit closed in 2011. Three residential units are available for sale.

Big Island of Hawaii:

(k) Ka Milo at Mauna Lani. In April 2004, A&B entered into a joint venture with Brookfield Homes Hawaii Inc. to acquire and develop a 30.5-acre residential parcel in the Mauna Lani Resort on the island of Hawaii, planned for 137 single-family units and duplex townhomes. A total of 27 units were constructed in 2007 and 2008, with all 27 units sold following the last three closings in 2011. A newly-constructed unit also closed in 2011. The venture is proceeding with its revised development plan, focusing on more single-family units.

U.S. Mainland:

During 2011, A&B explored the sale of certain Mainland joint venture investments, resulting in the sale of its Bridgeport Marketplace investment. The Company regularly evaluates its development activities and strategies, including joint venture development plans with its partners, for project feasibility.

(l)Bakersfield. In November 2006, A&B entered into a joint venture with Intertex P&G Retail, LLC, for the planned development of a 575,000-square-foot retail center on a 57.3-acre commercial parcel in Bakersfield, California. The parcel was acquired in November 2006. Although development plans remain on hold due to current economic conditions, the venture continues negotiations with a national anchor tenant and is evaluating development options.

(m)Bridgeport Marketplace. In July 2005, A&B entered into a joint venture with Intertex Bridgeport Marketplace, LLC for the development of a retail center in Valencia, California. Construction of the center was completed in 2009, and A&B sold its interest in the venture in March 2011.

(n)Crossroads Plaza. In June 2004, A&B entered into a joint venture with Intertex Hasley, LLC, for the development of a 56,000-square-foot mixed-use neighborhood retail center on 6.5 acres in Valencia, California. The property was acquired in August 2004. The sale of a pad site building closed in 2007, and construction of the center was completed in 2008. As of December 31, 2011, the center was 91 percent leased.

(o)Palmdale Trade & Commerce Center. In December 2007, A&B entered into a joint venture with Intertex Palmdale Trade & Commerce Center LLC, for the planned development of a 315,000-square-foot mixed-use commercial office and light industrial condominium complex on 18.2 acres in Palmdale, California, located 60 miles northeast of Los Angeles and 25 miles northeast of Valencia. The parcel was contributed to the venture in 2008. The venture is negotiating with a potential tenant for a 300,000 square-foot build-to-suit facility.

(p) Santa Barbara Ranch. In November 2007, A&B entered into a joint venture with Vintage Communities, LLC, a residential developer headquartered in Newport Beach, California, for the planned development of a 1,040-acre exclusive large-lot subdivision, located 12 miles north of the City of Santa Barbara. In 2008, due to worsening economic conditions, A&B suspended further investment in the project and recognized a $3.0 million impairment. In 2010, based on market conditions, the Company took an additional impairment loss of approximately $1.9 million.

(4) Leased Portfolio

An important source of income and cash flow is the lease rental income A&B receives from its portfolio of commercial income properties, consisting of approximately 7.9 million leasable square feet of commercial building space as of December 31, 2011.

(a) Hawaii Properties

A&B’s Hawaii commercial properties portfolio consists of retail, office and industrial properties, comprising approximately 1.4 million square feet of leasable space as of December 31, 2011. Most of the commercial properties are located on Maui and Oahu, with smaller holdings in the area of Port Allen, on Kauai, and Kona, on the island of Hawaii. The average occupancy for the Hawaii portfolio was 91 percent in 2011, versus 92 percent in 2010. Lower occupancy was primarily due to lower occupancy at the 238,300 square-foot Komohana Industrial Park on Oahu. In 2011, A&B sold the 61,500-square-foot Wakea Business Center II on Maui, the 28,100-square-foot Apex Building on Maui and two leased fee parcels. In December 2011, A&B acquired a 4.3-acre parcel on Oahu within the Gateway at Mililani Mauka shopping center, including a fully-leased 5,900 square-foot retail building, planned for development of an additional 28,400 square feet of retail space.

The primary Hawaii commercial properties owned as of year-end 2011 were as follows:

|

Property

|

Location

|

Type

|

Leasable Area

(sq. ft.)

|

| |

|

|

|

|

Komohana Industrial Park

|

Kapolei, Oahu

|

Industrial

|

238,300

|

|

Maui Mall

|

Kahului, Maui

|

Retail

|

185,700

|

|

Waipio Industrial

|

Waipahu, Oahu

|

Industrial

|

158,400

|

|

Kaneohe Bay Shopping Center

|

Kaneohe, Oahu

|

Retail

|

123,900

|

|

Waipio Shopping Center

|

Waipahu, Oahu

|

Retail

|

113,800

|

|

P&L Warehouse

|

Kahului, Maui

|

Industrial

|

104,100

|

|

Lanihau Marketplace

|

Kailua-Kona, Hawaii

|

Retail

|

88,300

|

|

Port Allen (4 buildings)

|

Port Allen, Kauai

|

Industrial/Retail

|

87,400

|

|

Kunia Shopping Center

|

Waipahu, Oahu

|

Retail

|

60,400

|

|

Kahului Office Building

|

Kahului, Maui

|

Office

|

58,300

|

|

Lahaina Square

|

Lahaina, Maui

|

Retail

|

50,200

|

|

Kahului Shopping Center

|

Kahului, Maui

|

Retail

|

43,200

|

|

Kahului Office Center

|

Kahului, Maui

|

Office

|

32,900

|

|

Stangenwald Building

|

Honolulu, Oahu

|

Office

|

27,100

|

|

Judd Building

|

Honolulu, Oahu

|

Office

|

20,200

|

|

Maui Clinic Building

|

Kahului, Maui

|

Office

|

16,600

|

|

Lono Center

|

Kahului, Maui

|

Office

|

13,400

|

|

Gateway at Mililani Mauka

|

Mililani, Oahu

|

Retail

|

5,900

|

(b) U.S. Mainland Properties

On the U.S. Mainland, A&B owns a portfolio of commercial properties, acquired primarily by way of tax-deferred exchanges under Internal Revenue Code Section 1031. A&B’s Mainland commercial properties portfolio consists of retail, office and industrial properties, comprising approximately 6.5 million square feet of leasable space as of December 31, 2011. A&B’s mainland commercial properties’ occupancy rate of 92 percent improved from 85 percent in 2010. Although there is some improvement in the leasing environment in certain mainland markets, rents in most markets, while showing improvement over 2010, remain below 2007 levels.

In 2011, A&B completed the sales of the 139,500-square-foot Arbor Park Shopping Center in San Antonio, Texas. Also in 2011, A&B completed the acquisitions of the 84,000-square-foot Union Bank facility in Everett, Washington, and the 146,900-square-foot Issaquah Office Center in Issaquah, Washington.

A&B’s mainland commercial properties owned as of year-end 2011 were as follows:

|

Property

|

Location

|

Type

|

Leasable Area

(sq. ft.)

|

| |

|

|

|

|

Heritage Business Park

|

Dallas, TX

|

Industrial

|

1,316,400

|

|

Savannah Logistics Park

|

Savannah, GA

|

Industrial

|

1,035,700

|

|

Midstate 99 Distribution Center

|

Visalia, CA

|

Industrial

|

789,100

|

|

Sparks Business Center

|

Sparks, NV

|

Industrial

|

396,100

|

|

Republic Distribution Center

|

Pasadena, TX

|

Industrial

|

312,500

|

|

Activity Distribution Center

|

San Diego, CA

|

Industrial

|

252,300

|

|

Centennial Plaza

|

Salt Lake City, UT

|

Industrial

|

244,000

|

|

Meadows on the Parkway

|

Boulder, CO

|

Retail

|

216,400

|

|

1800 and 1820 Preston Park

|

Plano, TX

|

Office

|

198,800

|

|

Ninigret Office Park X and XI

|

Salt Lake City, UT

|

Office

|

185,500

|

|

San Pedro Plaza

|

San Antonio, TX

|

Office/Retail

|

171,900

|

|

Rancho Temecula Town Center

|

Temecula, CA

|

Retail

|

165,500

|

|

2868 Prospect Park

|

Sacramento, CA

|

Office

|

162,900

|

|

Issaquah Office Center

|

Issaquah, WA

|

Office

|

146,900

|

|

Little Cottonwood Center

|

Sandy, UT

|

Retail

|

141,600

|

|

Concorde Commerce Center

|

Phoenix, AZ

|

Office

|

140,700

|

|

Deer Valley Financial Center

|

Phoenix, AZ

|

Office

|

126,600

|

|

Northpoint Industrial

|

Fullerton, CA

|

Industrial

|

119,400

|

|

Broadlands Marketplace

|

Broomfield, CO

|

Retail

|

103,900

|

|

Union Bank

|

Everett, WA

|

Office

|

84,000

|

|

2890 Gateway Oaks

|

Sacramento, CA

|

Office

|

58,700

|

|

Wilshire Shopping Center

|

Greeley, CO

|

Retail

|

46,500

|

|

Royal MacArthur Center

|

Dallas, TX

|

Retail

|

44,100

|

|

Firestone Boulevard Building

|

La Mirada, CA

|

Office

|

28,100

|

C. Agribusiness

(1) Production

A&B has been engaged in the production of cane sugar in Hawaii since 1870. A&B’s current agribusiness and related operations consist of: (1) a sugar plantation on the island of Maui, operated by its Hawaiian Commercial & Sugar Company (“HC&S”) division, (2) renewable energy operations on the island of Kauai, operated by its McBryde Resources, Inc. subsidiary, (3) its Kahului Trucking & Storage, Inc. (“KT&S”) and Kauai Commercial Company, Incorporated (“KCC”) subsidiaries, which provide several types of trucking services, including sugar and molasses hauling on Maui, mobile equipment maintenance and repair services on Maui, Kauai, and the Big Island, and self-service storage facilities on Maui and Kauai, and (4) Hawaiian Sugar & Transportation Cooperative (“HS&TC”), a single member agricultural cooperative that provides raw sugar marketing and transportation services solely to HC&S. HS&TC owns the MV Moku Pahu, a Jones-Act qualified integrated tug barge bulk dry carrier, which is used to transport raw sugar from Hawaii to the U.S. West Coast and coal from the U.S. West Coast to Hawaii.

HC&S is Hawaii’s only producer of raw sugar, producing approximately 182,800 tons of raw sugar in 2011 (compared with 171,800 tons in 2010). The primary reasons for the increase in production were improved yields on the plantation due to better agronomic practices, a higher average age of the crop at harvest, and increased delivery of irrigation water. HC&S harvested 15,063 acres of sugar cane in 2011 (compared with 15,488 in 2010). Yields averaged 12.1 tons of sugar per acre in 2011 (compared to 11.1 in 2010). As a by-product of sugar production, HC&S also produced approximately 53,100 tons of molasses in 2011 (compared to 52,800 in 2010).

In 2011, approximately 18,700 tons of sugar (compared to 16,300 tons in 2010) were processed by HC&S into specialty food-grade sugars under HC&S’s Maui Brand® trademark or repackaged by distributors under their own labels. This increase in production was due to longer, steady production runs throughout the harvesting season, enhanced operation of the specialty brand sugar production line, and more efficient labor operations.

In March 2011, the Company executed an agreement to lease land and sell coffee inventory and certain assets used in a coffee business it previously operated to Massimo Zanetti Beverage USA, Inc. (“MZB”), including intangible assets. The Company has retained fee simple ownership of the land, buildings, power generation, and power distribution assets, but no longer operates the coffee plantation.

HC&S and McBryde Sugar Company, Limited (“McBryde”), a subsidiary of A&B, produce electricity for internal use and for sale to the local electric utility companies. HC&S’s power is produced by burning bagasse (the residual fiber of the sugar cane plant), by hydroelectric power generation and, when necessary, by burning fossil fuels. McBryde produces power solely by hydroelectric generation. The price for the power sold by HC&S and McBryde is equal to the utility companies’ “avoided cost” of not producing such power themselves. In addition, HC&S receives a capacity payment to provide a guaranteed power generation capacity to the local utility. See “Energy” below for power production and sales data.

(2) Marketing of Sugar

Approximately 90 percent of the bulk raw sugar produced by HC&S in 2011 was purchased by C&H Sugar Company, Inc. (“C&H”). C&H processes the raw cane sugar at its refinery at Crockett, California and markets the refined products primarily in the western and central United States.

The remaining 10 percent of the raw sugar was used by HC&S to produce specialty food-grade sugars, which are sold by HC&S to food and beverage producers and to retail stores under its Maui Brand® label, and to distributors that repackage the sugars under their own labels. HC&S’s largest food-grade sugar customers are Cumberland Packing Corp. and Sugar Foods Corporation, which repackage HC&S’s turbinado sugar for their “Sugar in the Raw” product line.

Hawaiian Sugar & Transportation Cooperative (“HS&TC”), a sugar grower cooperative in Hawaii (of which HC&S currently is the only member), has a supply contract with C&H ending in December 2012. Pursuant to the supply contract, the cooperative sells raw sugar to C&H at a price equal to the New York No. 16 Contract settlement price, less a volume-based discount.

(3) Sugar Competition and Legislation

Hawaii has traditionally produced more sugar per acre than most other major producing areas of the world, but that advantage is offset by Hawaii’s high labor costs and the distance to the U.S. Mainland market. Hawaiian refined sugar is marketed primarily west of Chicago. This is also the largest beet sugar growing and processing area and, as a result, the only market area in the United States that produces more sugar than it consumes. Sugar from sugar beets is the greatest source of competition in the refined sugar market for the Hawaiian sugar industry.

The U.S. Congress historically has sought, through legislation, to assure a reliable domestic supply of sugar at stable and reasonable prices. The current legislation is the Food Conservation and Energy Act of 2008, which expires on December 31, 2012 (“2008 Farm Bill”). The two main elements of U.S. sugar policy are the tariff-rate quota (“TRQ”) import system and the price support loan program. The TRQ system limits imports from countries other than Canada and Mexico by allowing only a quota amount to enter the U.S. after payment of a relatively low tariff. A higher, over-quota tariff is imposed for imported quantities above the quota amount. Also, a new but limited sucrose ethanol program was added in 2008, which allows sugar to be diverted into ethanol production when the market is deemed to be oversupplied.

The 2008 Farm Bill reauthorized the sugar price support loan program, which supports the U.S. price of sugar by providing for commodity-secured loans to producers. A loan rate (support price) of 18.50 cents per pound (“¢/lb”) for raw cane sugar was in effect for the 2010 and 2011 crops. The loan rate increases to 18.75 ¢/lb for the 2012 and 2013 crops (the last year of the bill). The U.S. rates are adjusted by region to reflect the cost of transportation. The 2010 adjusted crop loan rate in Hawaii is 16.52 ¢/lb. The Company does not currently participate in the sugar price support loan program.

In 2005, the U.S. approved a trade pact with Central America and the Dominican Republic, known as the Central America-Dominican Republic-United States Free Trade Agreement. In 2006, the first year of the agreement, additional sugar market access for participating countries amounted to about 1.2 percent of current U.S. sugar consumption (107,000 metric tons), which will grow to about 1.7 percent (151,000 metric tons) in its fifteenth year.

Implementation of the North American Free Trade Agreement (NAFTA) began in 1994. This agreement removed most barriers to trade and investment among the U.S., Canada and Mexico. Under NAFTA, all non-tariff barriers to agricultural trade between the U.S. and Mexico were eliminated. In addition, many tariffs were eliminated immediately or phased out. Starting in 2008, Mexico was permitted to ship an unlimited quantity of sugar duty-free to the U.S. each year.

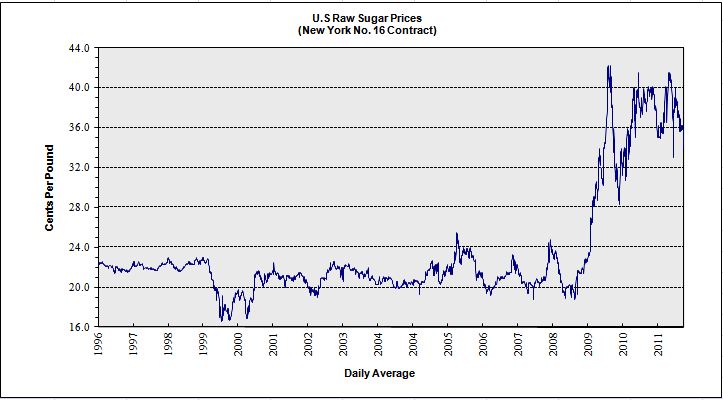

U.S. raw sugar prices remained relatively stable and flat for over thirty years. The full implementation of NAFTA in 2008, which unified the U.S. and Mexican sugar markets, increased price volatility. In 2009, a tight NAFTA supply/demand outlook and a soaring world raw sugar market combined to push U.S. raw sugar prices to 29-year highs. Prices have remained at high levels for most of 2011. A chronological chart of the average U.S. domestic raw sugar prices, based on the average daily New York No. 16 Contract settlement price for domestic raw sugar, is shown below (not adjusted for inflation):

(4) Land Designations and Water

The HC&S sugar plantation, the only remaining sugar plantation in Hawaii, consists of 43,300 acres, with approximately 35,500 acres under active sugar cane cultivation.

On Kauai, approximately 3,000 acres are cultivated in coffee by Massimo Zanetti Beverage USA, Inc., which leases the land from the Company. Additional acreage is cultivated in seed corn and used for pasture purposes.

The Hawaii Legislature, in 2005, passed Important Agricultural Lands (“IAL”) legislation to fulfill the State constitutional mandate to protect agricultural lands, promote diversified agriculture, increase the State’s agricultural self-sufficiency, and assure the availability of agriculturally suitable lands. In 2008, the Legislature passed a package of incentives, which is necessary to trigger the IAL system of land designation. In 2009, A&B received approval from the State Land Use Commission for the designation of over 27,000 acres on Maui and over 3,700 acres on Kauai as IAL. These designations were the result of voluntary petitions filed by A&B.

It is crucial for HC&S to have access to reliable sources of water supply and efficient irrigation systems. HC&S conserves water by using “drip” irrigation systems that distribute water to the roots through small holes in plastic tubes. All but a small area of the cultivated cane land farmed by HC&S is drip irrigated.

A&B owns 16,000 acres of watershed lands in East Maui, which supply a portion of the irrigation water used by HC&S. A&B also held four water licenses to another 30,000 acres owned by the State of Hawaii in East Maui, which over the last ten years have supplied approximately 58 percent of the irrigation water used by HC&S. The last of these water license agreements expired in 1986, and all four agreements were then extended as revocable permits that were renewed annually. In 2001, a request was made to the State Board of Land and Natural Resources (the “BLNR”) to replace these revocable permits with a long-term water lease. Pending the conclusion by the BLNR of this contested case hearing on the request for the long-term lease, the BLNR has renewed the existing permits on a holdover basis. A&B also holds rights to an irrigation system in West Maui, which provided approximately 14 percent of the irrigation water used by HC&S over the last ten years. For information regarding legal proceedings involving A&B’s irrigation systems, see “Legal Proceedings” below.

D. Employees and Labor Relations

As of December 31, 2011, A&B and its subsidiaries had approximately 2,100 regular full-time employees. About 880 regular full-time employees were engaged in the agribusiness segment, 1,101 were engaged in the transportation segment, 42 were engaged in the real estate segment, and the remaining were in administration. Approximately 48 percent were covered by collective bargaining agreements with unions.

At December 31, 2011, the active Matson fleet employed seagoing personnel in 197 billets. Each billet corresponds to a position on a ship that typically is filled by two or more employees because seagoing personnel rotate between active sea duty and time ashore. Approximately 25 percent of Matson’s regular full-time employees and all of the seagoing employees were covered by collective bargaining agreements.

Historically, collective bargaining with longshore and seagoing unions has been complex and difficult. However, Matson and Matson Terminals consider their relations with those unions, other unions and their non-union employees generally to be satisfactory.

Matson’s seagoing employees are represented by six unions, three representing unlicensed crew members and three representing licensed crew members. Matson negotiates directly with these unions. Matson’s agreements with the Seafarer’s International Union, the Sailors Union of the Pacific and the Marine Firemen’s Union were renewed in mid-2008 through June 2013. Contracts that Matson has with the American Radio Association were renewed in mid-2009 through August 15, 2013. Contracts that Matson has with the Masters, Mates & Pilots (“MM&P”) and the Marine Engineers Beneficial Association (“MEBA”) for ships built prior to 2003 were renewed in mid-2009 through August 15, 2013. Contracts that Matson has with MM&P and the MEBA for ships built after 2003 expire on August 15, 2013 and include provisions for a wage reopener, which was negotiated in mid-2009 to cover the remaining contract period. Matson’s MEBA contracts were extended on December 29, 2011 and now expire on August 15, 2018.

SSAT, the previously-described joint venture of Matson and SSA, provides stevedoring and terminal services for Matson vessels calling at U.S. Pacific Coast ports. Matson, SSA and SSAT are members of the Pacific Maritime Association (“PMA”) which, on behalf of its members, negotiates collective bargaining agreements with the ILWU on the U.S. Pacific Coast. A six-year PMA/ILWU Master Contract, which covers all Pacific Coast longshore labor, was negotiated in 2008 and will expire on July 1, 2014. Matson Terminals provides stevedoring and terminal services to Matson and other vessel operators calling at Honolulu and on the islands of Hawaii, Maui and Kauai. Matson Terminals is a member of the Hawaii Stevedore Industry Committee, which negotiates with the ILWU in Hawaii on behalf of its members. In 2008, Matson signed six-year agreements with each of the ILWU units, which will expire on July 1, 2014.

During 2010, Matson maintained its collective bargaining agreements with ILWU clerical workers in Honolulu and Oakland, which are in effect through June 2014. The bargaining agreement with ILWU clerical workers in Long Beach was renegotiated in 2010 for another three-year period. The health & welfare and pension provisions were not renegotiated; however, the parties agreed to match the provisions that are negotiated between the ILWU clerical workers in Long Beach and the other employers. Those negotiations are continuing and are expected to be finalized in 2012.

During 2011, Matson contributed to multiemployer pension plans for vessel crews. If Matson were to withdraw from or significantly reduce its obligation to contribute to one of the plans, Matson would review and evaluate data, actuarial assumptions, calculations and other factors used in determining its withdrawal liability, if any. In the event that any third parties materially disagree with Matson’s determination, Matson would pursue the various means available to it under federal law for the adjustment or removal of its withdrawal liability. Also, Matson participates in a multiemployer pension plan for its office clerical workers in Long Beach. Matson Terminals participates in two multiemployer pension plans for its Hawaii ILWU non-clerical employees. For a discussion of withdrawal liabilities under the Hawaii longshore and seagoing plans, see Note 10 (“Employee Benefit Plans”) to A&B’s consolidated financial statements in Item 8 of Part II below.

Bargaining unit employees of HC&S are covered by two collective bargaining agreements with the ILWU. The agreements with the HC&S production unit employees and clerical and technical employees bargaining units cover approximately 640 workers and expire on January 31, 2014. The bargaining unit employees at KT&S also are covered by two collective bargaining agreements with the ILWU. The bulk sugar employees’ agreement expires on June 30, 2014 and the agreement with all other employees expires on March 31, 2012, with renegotiations expected to begin in March 2012. There are two collective bargaining agreements with KCC employees represented by the ILWU. These agreements expire on April 30, 2012, with renegotiations expected to begin in April 2012.

E. Energy