UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark one)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________to _________

Commission File Number

(Exact name of registrant as specified in its charter) |

| ||

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification Number) |

(Address of principal executive offices)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act:

None |

(Title of each class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

SEC 1673 (04-20)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☒ | Smaller reporting company | ||

|

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to the previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10-D1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of June 30, 2023, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $

Note.—If a determination as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstances, provided that the assumptions are set forth in this Form.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of March 21, 2024, there were

DOCUMENTS INCORPORATED BY REFERENCE

None

INDEX

| 2 |

| Table of Contents |

PART I

Forward-Looking Statements

This Annual Report on Form 10-K (the “Annual Report”) contains forward‑looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The events described in forward‑looking statements contained in this Annual Report may not occur. Generally, these statements relate to business plans or strategies, projected or anticipated results or other consequences of our plans or strategies, projected or anticipated results from acquisitions to be made by us, or projections involving anticipated revenues, earnings, costs or other aspects of our operating results. The words “may,” “will,” “expect,” “believe,” “anticipate,” “project,” “plan,” “intend,” “estimate,” and “continue,” and their opposites and similar expressions are intended to identify forward‑looking statements. We caution you that these statements are not guarantees of future performance or events and are subject to a number of uncertainties, risks and other influences, many of which are beyond our control, which may influence the accuracy of the statements and the projections upon which the statements are based. Factors which may cause actual results and outcomes to differ materially from those contained in the forward-looking statements include, but are not limited to, the risks and uncertainties discussed in Part I Item 1A (“Risk Factors”) of this Annual Report.

Any one or more of these uncertainties, risks and other influences could materially affect our results of operations and whether forward‑looking statements made by us ultimately prove to be accurate. Our actual results, performance and achievements could differ materially from those expressed or implied in these forward‑looking statements. We undertake no obligation to publicly update or revise any forward‑looking statements, whether from new information, future events or otherwise except as required by law.

| 3 |

| Table of Contents |

ITEM 1. BUSINESS.

(a) Business Development

General

As used in this Annual Report, references to the “Company,” “we,” “us,” or “our” refer to Kingstone Companies, Inc. (“Kingstone”) and its subsidiaries.

We offer property and casualty insurance products through our wholly-owned subsidiary, Kingstone Insurance Company (“KICO”). KICO is a New York domiciled carrier writing business through retail and wholesale agents and brokers. KICO is actively writing personal lines and commercial auto insurance in New York, and in 2023 was the 15th largest writer of homeowners insurance in New York. KICO is also licensed in the states of New Jersey, Rhode Island, Massachusetts, Connecticut, Pennsylvania, New Hampshire, and Maine. For the years ended December 31, 2023 and 2022, respectively, 88.3% and 80.6% of KICO’s direct written premiums came from the New York policies. We refer to our New York business as our “Core” business and the business outside of New York as our “non-Core” business.

In addition, through our subsidiary, Cosi Agency, Inc. (“Cosi”), a multi-state licensed general agency, we access alternative distribution channels. See “Distribution” below for a discussion of our distribution channels. Cosi receives commission revenue from KICO for the policies it places with others and pays commissions to these agencies. Cosi retains the profit between the commission revenue received and the commission expense paid. Net Cosi revenue is deducted against commission expense and Cosi-related expenses are included in other operating expenses. Cosi-related operating expenses are not included in our stand-alone insurance underwriting business and, accordingly, its expenses are not included in the calculation of our combined ratio as described below.

Recent Developments

| Developments During 2023 | |

|

|

|

| · | Catastrophe Reinsurance Coverage |

Effective July 1, 2023, KICO decreased the top limit of its catastrophe reinsurance coverage from $345,000,000 to $325,000,000, which, at the time, equated to more than a 1-in-100 year storm event according to the primary industry catastrophe model that we follow.

| · | A.M. Best Rating |

On July 6, 2023, A.M. Best withdrew KICO’s ratings as KICO requested to no longer participate in A.M. Best’s interactive rating process.

| · | Withdrawal from New Jersey |

On October 2, 2023, the New Jersey Department of Banking & Insurance acknowledged KICO’s request to withdraw from the state effective January 1, 2024. The Department requested that KICO complete the withdrawal over a two year period.

| 4 |

| Table of Contents |

| Developments During 2022 | |

|

|

|

| · | Debt Exchange |

On December 9, 2022, we entered into a Note and Warrant Exchange Agreement (the “Exchange Agreement”) with several holders (the “Exchanging Noteholders”) of our outstanding 5.50% Senior Notes due 2022 (the “2017 Notes”). On the date of the Exchange Agreement, the Exchanging Noteholders held 2017 Notes in the aggregate principal amount of $21,545,000 of the $30,000,000 aggregate principal amount of 2017 Notes then outstanding.

At the closing of the Exchange Agreement, the Exchanging Noteholders exchanged their respective 2017 Notes for, among other things, new 12.0% Senior Notes due December 30, 2024 in the aggregate principal amount of $19,950,000 (the “2022 Notes”).

| · | Catastrophe Reinsurance Coverage |

Effective July 1, 2022, KICO decreased the top limit of its catastrophe reinsurance coverage from $500,000,000 to $345,000,000, which, at the time, equated to more than a 1-in-100 year storm event according to the primary industry catastrophe model that we follow.

| · | A.M. Best Rating |

In July 2022, A.M. Best downgraded KICO’s financial strength rating from B+ (Good) to B (Fair) and Long-Term Issuer Credit Rating (ICR) from “bbb-” (Good) to “bb” (Fair) due to a significant deterioration in KICO’s risk-adjusted capitalization. Such deterioration was driven by a sizeable increase in KICO’s net probable maximum loss (“PML”) as a result of its latest reinsurance renewal and a decline in surplus from weather-related losses and dividend payments by KICO in 2022. The outlook for each of these credit ratings was revised to “negative” from “stable”. Concurrently, A.M. Best’s public rating for Kingstone Companies, Inc. was withdrawn.

(b) Business

Property and Casualty Insurance

Overview

Property and casualty insurance companies provide policies in exchange for premiums paid by their customers (the “insureds”). An insurance policy is a contract between the insurance company and its insureds where the insurance company agrees to pay for losses that are covered under the contract. Such contracts are subject to legal interpretation by courts, sometimes involving legislative rulings and/or arbitration. Property insurance generally covers the financial consequences of accidental losses to the insured’s property, such as a home and the personal property in it, or a business owner’s building, inventory and equipment. Casualty insurance (also referred to as liability insurance) generally covers the financial consequences related to the legal liability of an individual or an organization resulting from negligent acts and omissions that cause bodily injury and/or property damage to a third party. Claims for property coverage generally are reported and settled in a relatively short period of time, whereas those for casualty coverage may take many years to settle.

| 5 |

| Table of Contents |

We derive substantially all of our revenue from KICO, including revenues from earned premiums, ceding commissions from quota share reinsurance, net investment income generated from our investment portfolio, and net realized gains and losses on investment securities. We also collect a variety of policy fees including installment fees, reinstatement fees, and non-sufficient fund fees related to situations involving extended premium payment plans. Earned premiums represent premiums received from insureds, which are recognized as revenue over the period of time that coverage is provided (i.e., ratably over the life of the policy). All of our policies are 12 month policies; therefore, a significant period of time can elapse between the receipt of insurance premiums and the payment of insurance claims. During this time, KICO invests the premiums, earning investment income and generating net realized and unrealized gains and losses on associated investments. Our holding company earns investment income from its cash holdings.

Our expenses include the insurance underwriting expenses of KICO and other operating expenses. Insurance companies incur a significant amount of their total expenses from losses incurred by policyholders, which are referred to as claims. In settling these claims, various loss adjustment expenses (“LAE”) are incurred such as insurance adjusters’ fees and legal expenses. In addition, insurance companies incur policy acquisition costs. Policy acquisition costs include commissions paid to producers, premium taxes, and other expenses related to the underwriting process, including employees’ compensation and benefits.

Other operating expenses include our corporate expenses as a holding company. These corporate expenses include legal and auditing fees, executive employment costs, and other costs directly associated with being a public company.

The key measure of relative underwriting performance for an insurance company is the combined ratio. An insurance company’s combined ratio is calculated by taking the ratio of incurred loss and LAE to earned premiums (the “loss and LAE ratio”) and adding it to the ratio of policy acquisition and other underwriting expenses to earned premiums (the “expense ratio”). A combined ratio under 100% indicates that an insurance company is generating an underwriting profit prior to the impact of investment income. After considering investment income and investment gains or losses, insurance companies operating at a combined ratio of greater than 100% can also be profitable.

Business; Strategy

We are a multi-line regional property and casualty insurance company writing business exclusively through retail and wholesale agents and brokers (“producers”) appointed by our wholly-owned subsidiary, KICO. We are licensed to write insurance policies in New York, New Jersey, Connecticut, Maine, Massachusetts, New Hampshire, Pennsylvania and Rhode Island. KICO is actively writing its property and casualty insurance products in New York. Additionally, our subsidiary, Cosi, a multi-state licensed general agency, receives commission revenue from KICO for the policies it places with others and pays commissions to these agencies.

We seek to deliver an attractive return on capital and to provide consistent earnings growth through underwriting profits and income from our investment portfolio. Our goal is to allocate capital efficiently to those lines of business that generate sustainable underwriting profits and to avoid lines of business for which an underwriting profit is not likely. Our strategy is to be the preferred multi-line property and casualty insurance company for selected producers in the geographic markets in which we operate. We believe producers place profitable business with us because we provide excellent, consistent service to insureds and claimants. Producers also value our broad underwriting appetite coupled with competitive rate and commission structures.

| 6 |

| Table of Contents |

Our principal objectives are to grow profitably while managing risk through prudent use of reinsurance in order to strengthen our capital base. We generate underwriting income through adequate pricing of insurance policies and by effectively managing our other underwriting and operating expenses. We are pursuing profitable growth through existing producers in existing markets, by developing new geographic markets and producer relationships, and by introducing niche products that are relevant to our producers and insureds.

For the year ended December 31, 2023, our gross written premiums totaled $200.2 million, a decrease of 0.5% from the $201.2 million in gross written premiums for the year ended December 31, 2022.

Product Lines

Our product lines include the following:

Personal lines - Our largest line of business is personal lines, consisting of homeowners, dwelling fire, cooperative/condominium, renters, and personal umbrella policies. Personal lines policies accounted for 92.6% of our gross written premiums for the year ended December 31, 2023.

Livery physical damage - We write for-hire vehicle physical damage only policies for livery and car service vehicles and taxicabs. These policies insure only the physical damage portion of insurance for such vehicles, with no liability coverage included. These policies accounted for 7.3% of our gross written premiums for the year ended December 31, 2023.

Other - We write canine legal liability policies and have a small participation in mandatory state joint underwriting associations. These policies accounted for 0.1% of our gross written premiums for the year ended December 31, 2023.

Our Competitive Strengths

Long History of Operations

KICO has been in operation in the State of New York since 1886. We have consistently sought to grow the amount of profitable business that we write by introducing new products, increasing volume written with our Select producers in existing markets, and developing new producer relationships and markets. The extensive heritage of our insurance company subsidiary and our commitment to the markets in which we operate is a competitive advantage with producers and insureds.

Strong Producer Relationships

Within our producers’ offices, we compete with other property and casualty insurance carriers available to those producers. We carefully select the producers that distribute our insurance policies and continuously monitor and evaluate their performance. We believe our insurance producers value their relationships with us because we provide excellent, consistent personal service coupled with competitive rates and commission levels. We have consistently been rated by insurance producers as above average in the important areas of underwriting, claims handling and service.

| 7 |

| Table of Contents |

We offer our Select producers access to a variety of personal lines and specialty products, including some that are unique to us. We provide a multi-policy discount on homeowners policies in order to attract and retain more of this multi-line business. We have had a consistent presence in the New York market and our producers value the longevity of the relationship. We believe that the excellent service provided to our Select producers, our broad product offerings, and our competitive prices provide a strong foundation for profitable growth.

Sophisticated Pricing, Underwriting and Risk Management Practices

We believe that a significant underwriting advantage exists due to our local market presence and expertise. Our underwriting process evaluates and screens out certain risks based on their prior loss experience, cost of reinsurance, property condition, insurance scoring and driving record, and then is augmented by information collected from physical property inspections. We maintain certain policy exclusions that reduce our exposure to risks that can create severe losses. We target a preferred risk profile in order to reduce adverse selection from risks seeking the lowest premiums and minimal coverage levels.

Our underwriting procedures, premiums and policy terms support the goal of underwriting profitability of our personal lines policies. We adhere to a quarterly indication process and perform a rate review in each state and for each product at least annually. In 2022, we introduced our new Select homeowners, condo/tenant and dwelling fire programs in New York. This product incorporates by-peril rating and a host of new data sources to better match rate to risk. We have also updated property replacement costs to address inflation.

We manage coastal risk exposure through the use of individual catastrophe risk scoring, the inclusion of hurricane deductibles, non-renewals and the prudent use of reinsurance. We measure our risk exposure regularly and adjust our underwriting to manage growth in our probable maximum loss (PML).

Effective Utilization of Reinsurance

Our reinsurance treaties allow us to limit our exposure to the financial impact of catastrophe losses and to reduce our net liability on individual risks. Our reinsurance program is structured to enable us to grow our premium volume while maintaining regulatory capital and other financial ratios within thresholds used for regulatory oversight purposes.

Our reinsurance program also provides income from ceding commissions earned pursuant to quota share reinsurance contracts. The income we earn from ceding commissions subsidizes our fixed operating costs, which consist of other underwriting expenses. Quota share reinsurance treaties transfer a portion of the profit (or loss) associated with the subject insurance policies to the reinsurers.

Scalable, Low-Cost Operations

We focus on efficiently managing our expenses and invest in tools and processes that improve the effectiveness of underwriting risks and processing claims. We evaluate the costs and benefits of each new tool or process in order to achieve optimal results. While the majority of our policies are written for risks in downstate New York, our Kingston, New York location provides a low-cost operating environment.

| 8 |

| Table of Contents |

We continue to invest in improving our online application and quoting systems for our personal lines products. We have leveraged a paperless workflow management and document storage tool that has improved efficiency and reduced costs. We provide an online payment portal that allows producers and insureds to make payments and to view policy information for all of our products in one location. Our ability to control the growth of operating and other expenses while expanding our operations and growing revenue is a key component of our business model and is important to our financial success.

In 2022, we completed the implementation of Kingstone 2.0, an effort to modernize the Company. Kingstone 2.0 included strategic hiring, development of the Select product, investments in new systems and retirement of the legacy systems. We also adopted a framework of stronger rating, underwriting and catastrophe management disciplines. As a result, Kingstone 2.0 positioned the Company to be better able to navigate today’s challenging environment. In 2023, we embarked on a new strategy to optimize our in-force business, which we coined as “Kingstone 3.0”. The four pillars of this new strategy entail:

| 1. | Aggressively reducing the non-Core book of business, which has had a disproportionately negative impact on underwriting results. |

| 2. | Adjusting pricing to stay ahead of loss trends, including inflation. |

| 3. | Tightly managing reinsurance requirements and costs, using risk selection and other underwriting capabilities to manage the growth rate of our PML. |

| 4. | Continuing expense reduction focus with a goal of reducing the net expense ratio to 33% by year-end 2024. |

See detailed description of Kingstone 2.0 and Kingstone 3.0 in Part II, Item 7 (Management’s Discussion and Analysis of Financial Condition and Results of Operations) in this Annual Report.

Underwriting and Claims Management Philosophy

Our underwriting philosophy is to target niche segments for which we have detailed expertise and can take advantage of market conditions. We monitor results on a regular basis and our Select producers are reviewed by management on at least a semi-annual basis.

We believe that our rates are appropriately competitive with other carriers in our target markets. We do not seek to grow by competing based solely upon price. We seek to develop long-term relationships with our Select producers who understand and appreciate the path we have chosen. We carefully underwrite our business utilizing industry claims databases, insurance scoring reports, physical inspection of risks and other individual risk underwriting tools. We write homeowners and dwelling fire business in coastal markets and are cognizant of our exposure to hurricanes. We have mitigated this risk through appropriate catastrophe reinsurance and application of hurricane deductibles. We handle claims fairly while ensuring that coverage provisions and exclusions are properly applied. Our claims and underwriting expertise supports our ability to grow our profitable business.

Distribution

We generate business through our relationships with over 700 producers. We carefully select our producers by evaluating numerous factors such as their need for our products, premium production potential, loss history with other insurance companies that they represent, product and market knowledge, and agency size. We only distribute through agents and have never sought to distribute our products direct to the consumer. We monitor and evaluate the performance of our producers through periodic reviews of volume and profitability. Our senior executives are actively involved in managing our producer relationships.

| 9 |

| Table of Contents |

Each producer is assigned to a staff underwriter and the producer can call that underwriter directly on any matter. We believe that the close relationship and personal service received from their underwriters is a principal reason producers place their business with us. Our producers have access to a KICO producer interface and website portal that provides them the ability to quote risks for various products and to review policy forms and underwriting guidelines for all lines of business. We send out frequent “Producer Grams” in order to inform our producers of updates at KICO.

Competition; Market

The insurance industry is highly competitive. We constantly assess and make projections of market conditions and appropriate prices for our products, but we cannot fully know our profitability until all claims have been reported and settled.

Our active policyholders are located primarily in the downstate regions of New York State, our Core business. Under Kingstone 3.0, we are reducing our non-Core Northeast markets, which include New Jersey, Rhode Island, Massachusetts and Connecticut. In addition, we are licensed to write insurance policies in Maine, New Hampshire and Pennsylvania.

In 2022, we made the decision to reduce our footprint outside New York due to profitability concerns. We entered these states to diversify Kingstone’s footprint starting in 2017, and they have had a disproportionate impact on our underwriting results, especially in 2022. We have attempted to address these challenges and achieve profitability with a series of rate and underwriting actions, but the impact we have worked towards was largely nullified by inflation. In addition to a new business moratorium in our non-Core states of Connecticut, Massachusetts, New Jersey and Rhode Island, we have been actively non-renewing policies subject to regulatory constraints and have materially lowered commission rates to our producers. Subject to our withdrawal agreement with the state of New Jersey, we will be non-renewing our entire book in such state over a two year period starting January 1, 2024. These actions reduced the size of our policies in force outside New York by 48% in 2023.

In 2023, KICO was the 15th largest writer of homeowners insurance in the State of New York, according to data compiled by S&P Capital IQ. Based on the same data, in 2023, we had a 1.6% market share for this business. We compete with large national carriers as well as regional and local carriers in the property and casualty marketplace in New York and other states. We believe that many national and regional carriers have chosen to limit their rate of premium growth or to decrease their presence in Northeastern states due to the relatively high coastal population and associated catastrophe risk that exists in the region. Additionally, some of our largest competitors historically have stopped writing business this year.

| 10 |

| Table of Contents |

Loss and Loss Adjustment Expense Reserves

We are required to establish reserves for unpaid losses, including reserves for claims loss adjustment expenses (“LAE”), which represent the expenses of settling and adjusting those claims. These reserves are balance sheet liabilities representing estimates of future amounts required to pay losses and loss expenses for claims that have occurred at or before the balance sheet date, whether already known to us or not yet reported. We establish these reserves after considering all information known to us as of the date they are recorded.

Loss reserves fall into two categories: case reserves for reported losses and LAE associated with specific reported claims, and reserves for losses and LAE that are incurred but not reported. We establish these two categories of loss reserves as follows:

Reserves for reported losses - When a claim is received, we establish a case reserve for the estimated amount of its ultimate settlement and its estimated loss expenses. We establish case reserves based upon the known facts about each claim at the time it is received and we may subsequently adjust case reserves as additional facts and information about the claim develops.

IBNR reserves - We also estimate reserves for loss and LAE amounts incurred but not reported (“IBNR”). IBNR reserves are calculated in bulk as an estimate of ultimate losses and LAE less reported losses and LAE. There are two types of IBNR; the first is a provision for claims that have occurred but are not yet reported or known. We refer to this as ‘Pure’ IBNR, and due to the fact that we write primarily quickly reported property lines of business, this type of IBNR does not make up a large portion of KICO’s total IBNR. The second type of IBNR is a provision for expected future development on known claims, from the evaluation date until the time claims are settled and closed. We refer to this as ‘Case Development’ IBNR and it makes up the majority of the IBNR that KICO records. Ultimate losses driving the determination of appropriate IBNR levels are projected by using generally accepted actuarial techniques.

The liability for loss and LAE represents our best estimate of the ultimate cost of all reported and unreported losses that are unpaid as of the balance sheet evaluation date. The liability for loss and LAE is estimated on an undiscounted basis, using individual case-based valuations, statistical analyses, and various actuarial procedures. The projection of future claim payments and reporting patterns is based on an analysis of our historical experience, supplemented by analyses of industry loss data. We believe that the reserves for loss and LAE are adequate to cover the ultimate cost of losses and claims to date. However, because of uncertainty from various sources, including changes in claims settlement patterns and handling procedures, litigation trends, judicial decisions, and economic conditions, actual loss experience may not conform to the assumptions used in determining the estimated amounts for such liabilities at the balance sheet date. As adjustments to these estimates become necessary, they are reflected in the period in which the estimates are changed. Because of the nature of the business historically written, we believe that we have limited exposure to asbestos and environmental claim liabilities.

We engage an independent external actuarial specialist (the “Appointed Actuary”) to opine on our recorded statutory reserves. The Appointed Actuary estimates a range of ultimate losses, along with a range and recommended central estimate of IBNR reserve amounts. Our carried IBNR reserves are based on an internal actuarial analysis and reflect management’s best estimate of unpaid loss and LAE liabilities, and fall within the range of those determined as reasonable by the Appointed Actuary.

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Principal Revenue and Expense Items” in Item 7 of this Annual Report and Note 2 and Note 11 in the accompanying consolidated financial statements for additional information and details regarding loss and LAE reserves.

| 11 |

| Table of Contents |

Reconciliation of Loss and Loss Adjustment Expenses

The table below shows the reconciliation of loss and LAE on a gross and net basis, reflecting changes in losses incurred and paid losses:

|

| Years ended |

| |||||

|

| December 31, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

|

|

|

|

| ||||

Balance at beginning of period |

| $ | 118,339,513 |

|

| $ | 94,948,745 |

|

Less reinsurance recoverables |

|

| (27,659,500 | ) |

|

| (10,637,679 | ) |

Net balance, beginning of period |

|

| 90,680,013 |

|

|

| 84,311,066 |

|

|

|

|

|

|

|

|

|

|

Incurred related to: |

|

|

|

|

|

|

|

|

Current year |

|

| 82,856,483 |

|

|

| 85,690,180 |

|

Prior years |

|

| (7,273 | ) |

|

| 2,699,862 |

|

Total incurred |

|

| 82,849,210 |

|

|

| 88,390,042 |

|

|

|

|

|

|

|

|

|

|

Paid related to: |

|

|

|

|

|

|

|

|

Current year |

|

| 49,146,173 |

|

|

| 49,602,585 |

|

Prior years |

|

| 35,853,838 |

|

|

| 32,418,510 |

|

Total paid |

|

| 85,000,011 |

|

|

| 82,021,095 |

|

|

|

|

|

|

|

|

|

|

Net balance at end of period |

|

| 88,529,212 |

|

|

| 90,680,013 |

|

Add reinsurance recoverables |

|

| 33,288,650 |

|

|

| 27,659,500 |

|

Balance at end of period |

| $ | 121,817,862 |

|

| $ | 118,339,513 |

|

Our claims reserving practices are designed to set reserves that, in the aggregate, are adequate to pay all claims at their ultimate settlement value.

Loss and Loss Adjustment Expenses Development

The table below shows the net loss development of reserves held as of each calendar year-end from 2013 through 2023.

The first section of the table reflects the changes in our loss and LAE reserves after each subsequent calendar year of development. The table displays the re-estimated values of incurred losses and LAE at each succeeding calendar year-end, including payments made during the years indicated. The second section of the table shows by year the cumulative amounts of loss and LAE payments, net of amounts recoverable from reinsurers, as of the end of each succeeding year. An example with respect to the net loss and LAE reserves of $17,139,000 as of December 31, 2013 is as follows. By December 31, 2015 (two years later), $10,629,000 had actually been paid in settlement of the claims that relate to liabilities as of December 31, 2013. The re-estimated ultimate reserves two years later for those claims as of December 31, 2013 had grown to $18,332,000.

The “cumulative redundancy (deficiency)” represents, as of December 31, 2023, the difference between the latest re-estimated liability and the amounts as originally estimated. A redundancy means that the original estimate was higher than the current estimate. A deficiency means that the current estimate is higher than the original estimate.

| 12 |

| Table of Contents |

(in thousands of $) |

| 2013 |

|

| 2014 |

|

| 2015 |

|

| 2016 |

|

| 2017 |

|

| 2018 |

|

| 2019 |

|

| 2020 |

|

| 2021 |

|

| 2022 |

|

| 2023 |

| |||||||||||

Reserve for loss and loss adjustment expenses, net of reinsurance recoverables |

|

| 17,139 |

|

|

| 21,663 |

|

|

| 23,170 |

|

|

| 25,960 |

|

|

| 32,051 |

|

|

| 40,526 |

|

|

| 64,770 |

|

|

| 62,647 |

|

|

| 84,311 |

|

|

| 90,680 |

|

|

| 88,529 |

|

Net reserve estimated as of One year later |

|

| 18,903 |

|

|

| 21,200 |

|

|

| 23,107 |

|

|

| 25,899 |

|

|

| 33,203 |

|

|

| 51,664 |

|

|

| 64,811 |

|

|

| 62,632 |

|

|

| 87,011 |

|

|

| 90,673 |

|

|

|

|

|

Two years later |

|

| 18,332 |

|

|

| 21,501 |

|

|

| 24,413 |

|

|

| 26,970 |

|

|

| 42,723 |

|

|

| 55,145 |

|

|

| 65,113 |

|

|

| 65,339 |

|

|

| 88,418 |

|

|

|

|

|

|

|

|

|

Three years later |

|

| 18,687 |

|

|

| 22,576 |

|

|

| 25,509 |

|

|

| 33,298 |

|

|

| 43,780 |

|

|

| 56,346 |

|

|

| 67,291 |

|

|

| 67,135 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Four years later |

|

| 19,386 |

|

|

| 23,243 |

|

|

| 28,638 |

|

|

| 33,342 |

|

|

| 43,973 |

|

|

| 58,048 |

|

|

| 68,612 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Five years later |

|

| 19,449 |

|

|

| 25,442 |

|

|

| 28,506 |

|

|

| 33,120 |

|

|

| 43,774 |

|

|

| 57,957 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six years later |

|

| 20,265 |

|

|

| 25,353 |

|

|

| 28,849 |

|

|

| 32,936 |

|

|

| 43,777 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Seven years later |

|

| 20,069 |

|

|

| 25,445 |

|

|

| 28,734 |

|

|

| 32,617 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Eight years later |

|

| 20,129 |

|

|

| 25,324 |

|

|

| 28,499 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine years later |

|

| 19,963 |

|

|

| 25,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ten years later |

|

| 19,853 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cumulative redundancy (deficiency) |

|

| (2,714 | ) |

|

| (3,537 | ) |

|

| (5,329 | ) |

|

| (6,657 | ) |

|

| (11,726 | ) |

|

| (17,431 | ) |

|

| (3,842 | ) |

|

| (4,488 | ) |

|

| (4,107 | ) |

|

| 7 |

|

|

|

|

|

(in thousands of $) |

| 2013 |

|

| 2014 |

|

| 2015 |

|

| 2016 |

|

| 2017 |

|

| 2018 |

|

| 2019 |

|

| 2020 |

|

| 2021 |

|

| 2022 |

|

| 2023 |

| |||||||||||

Cumulative amount of reserve paid, net of reinsurance recoverable through |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

One year later |

|

| 6,156 |

|

|

| 8,500 |

|

|

| 8,503 |

|

|

| 9,900 |

|

|

| 15,795 |

|

|

| 23,075 |

|

|

| 27,454 |

|

|

| 20,137 |

|

|

| 32,419 |

|

|

| 35,854 |

|

|

|

| |

Two years later |

|

| 10,629 |

|

|

| 12,853 |

|

|

| 14,456 |

|

|

| 17,187 |

|

|

| 26,168 |

|

|

| 35,924 |

|

|

| 35,142 |

|

|

| 30,262 |

|

|

| 47,547 |

|

|

|

|

|

|

|

| |

Three years later |

|

| 13,571 |

|

|

| 16,564 |

|

|

| 19,533 |

|

|

| 23,484 |

|

|

| 32,704 |

|

|

| 40,264 |

|

|

| 42,365 |

|

|

| 40,702 |

|

|

|

|

|

|

|

|

|

|

|

| |

Four years later |

|

| 16,166 |

|

|

| 19,838 |

|

|

| 22,816 |

|

|

| 27,203 |

|

|

| 35,510 |

|

|

| 45,085 |

|

|

| 49,581 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Five years later |

|

| 17,262 |

|

|

| 21,976 |

|

|

| 25,210 |

|

|

| 28,833 |

|

|

| 37,846 |

|

|

| 48,650 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Six years later |

|

| 18,265 |

|

|

| 23,280 |

|

|

| 26,298 |

|

|

| 30,141 |

|

|

| 39,596 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Seven years later |

|

| 18,954 |

|

|

| 24,146 |

|

|

| 26,945 |

|

|

| 30,693 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Eight years later |

|

| 19,511 |

|

|

| 24,633 |

|

|

| 27,013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Nine years later |

|

| 19,635 |

|

|

| 24,654 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Ten years later |

|

| 19,640 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net reserve - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

December 31, |

|

| 17,139 |

|

|

| 21,663 |

|

|

| 23,170 |

|

|

| 25,960 |

|

|

| 32,051 |

|

|

| 40,526 |

|

|

| 64,770 |

|

|

| 62,647 |

|

|

| 84,311 |

|

|

| 90,680 |

|

|

| 88,529 |

|

* Reinsurance Recoverable |

|

| 17,364 |

|

|

| 18,250 |

|

|

| 16,707 |

|

|

| 15,777 |

|

|

| 16,749 |

|

|

| 15,671 |

|

|

| 15,728 |

|

|

| 20,154 |

|

|

| 10,638 |

|

|

| 27,660 |

|

|

| 33,289 |

|

* Gross reserves - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

| 34,503 |

|

|

| 39,913 |

|

|

| 39,877 |

|

|

| 41,737 |

|

|

| 48,800 |

|

|

| 56,197 |

|

|

| 80,499 |

|

|

| 82,801 |

|

|

| 94,949 |

|

|

| 118,340 |

|

|

| 121,818 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net re-estimated reserve |

|

| 19,853 |

|

|

| 25,200 |

|

|

| 28,499 |

|

|

| 32,617 |

|

|

| 43,777 |

|

|

| 57,957 |

|

|

| 68,612 |

|

|

| 67,135 |

|

|

| 88,418 |

|

|

| 90,673 |

|

|

|

|

|

Re-estimated reinsurance recoverable |

|

| 22,135 |

|

|

| 23,289 |

|

|

| 21,143 |

|

|

| 20,390 |

|

|

| 20,504 |

|

|

| 18,535 |

|

|

| 14,944 |

|

|

| 19,105 |

|

|

| 10,524 |

|

|

| 27,209 |

|

|

|

|

|

Gross re-estimated reserve |

|

| 41,988 |

|

|

| 48,489 |

|

|

| 49,642 |

|

|

| 53,007 |

|

|

| 64,281 |

|

|

| 76,492 |

|

|

| 83,556 |

|

|

| 86,240 |

|

|

| 98,942 |

|

|

| 117,882 |

|

|

|

|

|

Gross cumulative redundancy (deficiency) |

|

| (7,485 | ) |

|

| (8,576 | ) |

|

| (9,765 | ) |

|

| (11,270 | ) |

|

| (15,481 | ) |

|

| (20,295 | ) |

|

| (3,057 | ) |

|

| (3,439 | ) |

|

| (3,993 | ) |

|

| 458 |

|

|

|

|

|

(Components may not sum to totals due to rounding)

| 13 |

| Table of Contents |

Reinsurance

We purchase reinsurance to reduce our net liability on individual risks, to protect against possible catastrophes, to remain within a target ratio of net premiums written to policyholders’ surplus, and to expand our underwriting capacity. Participation in reinsurance arrangements does not relieve us from our obligations to policyholders. Our reinsurance program is structured to reflect our obligations and goals.

Reinsurance via quota share allows a carrier to write business without increasing its underwriting leverage above a level determined by management. The business written under a quota share reinsurance structure obligates a reinsurer to assume some portion of the risks involved, and gives the reinsurer the profit (or loss) associated with such in exchange for a ceding commission.

Effective December 31, 2021, we entered into a quota share reinsurance treaty for our personal lines business, which primarily consists of homeowners’ and dwelling fire policies, covering the period from December 31, 2021 through January 1, 2023 (“2021/2023 Treaty”). Upon the expiration of the 2021/2023 Treaty on January 1, 2023, we entered into a new 30% quota share reinsurance treaty for our personal lines business, covering the period from January 1, 2023 through January 1, 2024 (“2023/2024 Treaty”).Upon the expiration of the 2023/2024 Treaty on January 1, 2024, we entered into a new 27% quota share reinsurance treaty for our personal lines business, covering the period from January 1, 2024 through January 1, 2025 (“2024/2025 Treaty”).

Excess of loss contracts provide coverage for individual loss occurrences exceeding a certain threshold. The quota share reinsurance treaties inure to the benefit of our excess of loss treaties, as the maximum net retention on any single risk occurrence is first limited through the excess of loss treaty, and then that loss is shared again through the quota share reinsurance treaty. Our maximum net retention under the 2021/2023 Treaty and excess of loss treaties for any one personal lines occurrence for dates of loss on or after December 31, 2021 through January 1, 2024 was $700,000. Effective January 1, 2024 through January 1, 2025, our maximum net retention under the 2024/2025 Treaty increased to $730,000. Effective January 1, 2022, we entered into an underlying excess of loss reinsurance treaty (“Underlying XOL Treaty”) covering the period from January 1, 2022 through January 1, 2023. The Underlying XOL Treaty provides 50% reinsurance coverage for losses, other than from a named storm, of $400,000 in excess of $600,000. Effective January 1, 2023, the Underlying XOL Treaty was renewed covering the period from January 1, 2023 through January 1, 2024. From January 1, 2022 through January 1, 2024, under the Underlying XOL Treaty, our maximum net retention for any one personal lines occurrence was further reduced from the retention of $700,000 under the 2021/2023 Treaty and the 2023/2024 Treaty to $500,000. From January 1, 2024 through January 1, 2025, under the Underlying XOL Treaty, our maximum net retention for any one personal lines occurrence was reduced from the retention of $730,000 under 2024/2025 Treaty to $530,000.

We previously earned ceding commission revenue under the quota share reinsurance treaties based on a provisional commission rate on all premiums ceded to the reinsurers as adjusted by a sliding scale based on the ultimate treaty year loss ratios on the policies reinsured under each agreement. The sliding scale provided minimum and maximum ceding commission rates in relation to specified ultimate loss ratios. Under the 2021/2023 Treaty and the 2023/24 Treaty, KICO received a fixed provisional rate with no adjustment for sliding scale contingent commissions. Under the 2024/2025 Treaty, KICO will receive a fixed provisional rate with no adjustment for sliding scale contingent commissions.

The 2021/2023 Treaty, 2023/2024 Treaty and 2024/2025 Treaty are on a “net” of catastrophe reinsurance basis, as opposed to the “gross” arrangement that existed in prior treaties. Under a “net” arrangement, all catastrophe reinsurance coverage is purchased directly by us. Since we pay for all of the catastrophe coverage, none of the losses covered under a catastrophic event will be included in the quota share ceded amounts.

| 14 |

| Table of Contents |

In 2023, we purchased catastrophe reinsurance to provide coverage of up to $325,000,000 for losses associated with a single event. One of the most commonly used catastrophe forecasting models prepared for us indicates that the catastrophe reinsurance treaties provide coverage in excess of our estimated probable maximum loss associated with a single more than one-in-100 year storm event. Effective December 31, 2021 through January 1, 2023, losses on personal lines policies are subject to the 2021/2023 Treaty, which covered 26% of catastrophe losses and resulted in a net retention by us of $7,400,000 of exposure per catastrophe occurrence. Effective January 1, 2023 through January 1, 2024, losses on personal lines policies were subject to the 2023/2024 Treaty, which covered 12.5% of catastrophe losses and resulted in a net retention by us of $8,750,000 of exposure per catastrophe occurrence. Effective January 1, 2024 through January 1, 2025, losses on personal lines policies will be subject to the 2024/2025 Treaty, which will cover 5.0% of catastrophe losses and will result in a net retention by us of $9,500,000 of exposure per catastrophe occurrence. From July 1, 2020 through June 30, 2022, we had reinstatement premium protection on the first $70,000,000 layer of catastrophe coverage in excess of $10,000,000. Effective July 1, 2022 and through June 30, 2023, we had reinstatement premium protection for $9,800,000 of catastrophe coverage in excess of $10,000,000. Effective July 1, 2023 and through June 30, 2024, we have reinstatement premium protection for $12,500,000 of catastrophe coverage in excess of $10,000,000. This protects us from having to pay an additional premium to reinstate catastrophe coverage for an event up to this level.

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Principal Revenue and Expense Items” in Item 7 of this Annual Report and Note 2 and Note 11 in the accompanying consolidated financial statements for additional information.

Ratings

Many insurance buyers, agents, brokers and secured lenders use the ratings assigned by ratings agencies to assist them in assessing the financial strength and overall quality of the companies with which they do business and from which they are considering purchasing insurance or in determining the financial strength of the company that provides insurance with respect to the collateral they hold. Financial strength ratings are intended to provide an independent opinion of an insurer’s ability to meet its obligations to policyholders and are not an evaluation directed at investors. We currently have a Demotech rating of A (Excellent) which qualifies our policies for banks and finance companies. Demotech is the rating agency most commonly used by carriers focused on coastal property risks. The previous ratings from A.M. Best and Kroll Rating Agency for KICO and Kingstone Companies, Inc. were withdrawn at our request.

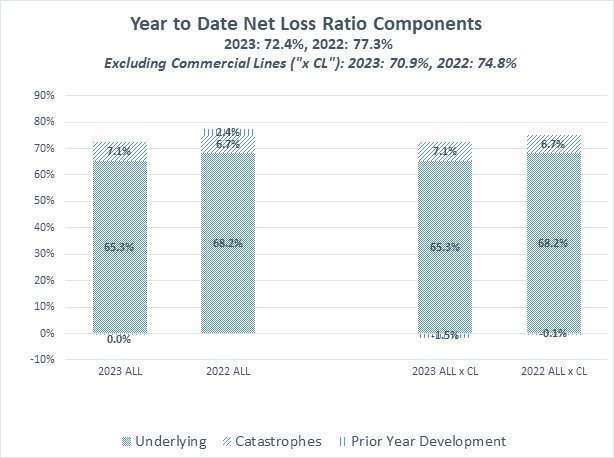

Catastrophe Losses

In 2023 we had catastrophe losses, which are defined as losses from an event for which a catastrophe bulletin and related serial number has been issued by the Property Claims Services (PCS) unit of the Insurance Services Office (ISO). PCS catastrophe bulletins are issued for events that cause more than $25 million in total insured losses and affect a significant number of policyholders and insurers. Our predominant market, downstate New York, was affected by several events during 2023, one of which was a named storm, and one was a major freezing event. The effects of catastrophes during 2023 increased our net loss ratio by 7.1 percentage points. We were affected by several events during 2022, including the remnants of Hurricane Ida, as one of the named storms. The effects of catastrophes during 2022 increased our net loss ratio by 6.7 percentage points.

| 15 |

| Table of Contents |

Government Regulation

Holding Company Regulation

We, as the parent of KICO, are subject to the insurance holding company laws of the state of New York. These laws generally require an insurance company to register with the New York State Department of Financial Services (the “DFS”) and to furnish annually financial and other information about the operations of companies within our holding company system. Generally, under these laws, all material transactions among companies in the holding company system to which KICO is a party must be fair and reasonable and, if material or of a specified category, require prior notice and approval or acknowledgement (absence of disapproval) by the DFS.

Change of Control

The insurance holding company laws of the state of New York require approval by the DFS for any change of control of an insurer. “Control” is generally defined as the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of the company, whether through the ownership of voting securities, by contract or otherwise. Control is generally presumed to exist through the direct or indirect ownership of 10% or more of the voting securities of a domestic insurance company or any entity that controls a domestic insurance company; however, the ownership of less than 10% of such voting securities could constitute control under certain circumstances. Any future transactions that would constitute a change of control of KICO, including a change of control of Kingstone Companies, Inc., would generally require the party acquiring control to obtain the approval of the DFS (and in any other state in which KICO may operate). Obtaining these approvals may result in the material delay of, or deter, any such transaction. These laws may discourage potential acquisition proposals and may delay, deter or prevent a change of control of Kingstone Companies, Inc., including through transactions, and in particular unsolicited transactions, that some or all of our stockholders might consider to be desirable.

State Insurance Regulation

Insurance companies are subject to regulation and supervision by the department of insurance in the state in which they are domiciled and, to a lesser extent, other states in which they conduct business. The primary purpose of such regulatory powers is to protect individual policyholders. State insurance authorities have broad regulatory, supervisory and administrative powers, including, among other things, the power to grant and revoke licenses to transact business, set the standards of solvency to be met and maintained, determine the nature of, and limitations on, investments and dividends, approve policy forms and rates, and in some instances to regulate unfair trade and claims practices.

KICO is required to file detailed financial statements and other reports with the insurance regulatory authorities in the states in which it is licensed to transact business. These financial statements are subject to periodic examination by the insurance regulators.

| 16 |

| Table of Contents |

In addition, many states have laws and regulations that limit an insurer’s ability to withdraw from a particular market. For example, states may limit an insurer’s ability to cancel or not renew policies. Furthermore, certain states prohibit an insurer from withdrawing from one or more lines of business written in the state, except pursuant to a plan that is approved by the insurance regulatory authority. The state regulator may reject a plan that may lead to market disruption. Laws and regulations, including those in New York, that limit cancellation and non-renewal and that subject program withdrawals to prior approval requirements may restrict the ability of KICO to exit unprofitable markets. Such laws did not affect KICO’s ability to withdraw from the commercial liability market in New York State in 2019 and the commercial auto market in New York State in 2015.

Federal and State Legislative and Regulatory Changes

From time to time, various regulatory and legislative changes have been proposed in the insurance industry. Among the proposals that either have been or are being considered are the possible introduction of Federal regulation in addition to, or in lieu of, the current system of state regulation of insurers, and proposals in various state legislatures. Some of these proposals have been enacted to conform portions of their insurance laws and regulations to various model acts adopted by the National Association of Insurance Commissioners (the “NAIC”).

In 2017, the DFS implemented new comprehensive cybersecurity regulations, which became effective on March 1, 2017, with transitional implementation periods. On November 1, 2023, the DFS adopted substantive amendments updating the 2017 cybersecurity regulations. The adopted regulations require that a covered entity’s chief information security officer (“CISO”) have sufficient authority to ensure that cybersecurity risks are appropriately managed and require the CISO to report material cybersecurity issues. Covered entities are further required under the amendments to implement asset inventory management, develop and implement a business continuity and disaster recovery plan, and maintain backups protected from unauthorized alterations or destruction. The regulations update certain cybersecurity event reporting requirements, including notice and explanation of extortion payments, and amends the April 15 annual reporting requirement to include a written acknowledgment of any areas of material noncompliance and remediation plans signed by the entity’s highest-ranking executive and the CISO. Finally, the regulations update the factors the Superintendent may consider in assessing violations.

The newly-adopted regulations also apply newly enhanced requirements around periodic system testing, record keeping and maintenance of written incident and recovery plans. They further mandate specific technical approaches such as blocking common passwords and the use of multifactor authentication in certain instances.

In 2010 the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) became law. It established a Federal Insurance Office (the “FIO”) within the U.S. Department of the Treasury. The FIO is initially charged with monitoring all aspects of the insurance industry (other than health insurance, certain long-term care insurance and crop insurance), gathering data, and conducting a study on methods to modernize and improve the insurance regulatory system in the United States. In December 2013, the FIO issued a report (as required under the Dodd-Frank Act) entitled “How to Modernize and Improve the System of Insurance Regulation in the United States”, which stated that, given the “uneven” progress the states have made with several near-term state reforms, should the states fail to accomplish the necessary modernization reforms in the near term, “Congress should strongly consider direct federal involvement.” The FIO continues to support the current state-based regulatory regime, but will consider federal regulation should the states fail to take steps to greater uniformity (e.g., federal licensing of insurers.) In its September 2022 Annual Report on the Insurance Industry (the “Report”), the FIO provided an overview of its statutory responsibilities and its role. The Report then summarized the FIO’s key activities since those described in its prior Annual Report on the Insurance Industry. The Report observed that, in 2021, the property/casualty sector direct premium written was $798 billion, a 9% growth over 2020 levels, the highest annual growth in the past decade. In September 2021, the FIO issued a Preemption Report. This document noted “that during the fiscal year ending September 30, 2021, FIO did not take any action regarding the preemption of any state insurance measures that were inconsistent with a covered agreement.” In addition to reviewing the financial status of the property/casualty industry, the Report includes Topical Updates and FIO activities, climate change, mitigation and resilience and Cyber Risks, Ransomware, and Cyber Insurance. The FIO’s September 2023 annual report made similar observations as prior years, including noting in the preceding year’s Preemption Report a lack of “any action regarding the preemption of any state insurance measures that were inconsistent with a covered agreement.” The 2023 report further noted that, since the 2022 report, the FIO issued a proposal for the collection of data from insurers to assess climate-related risks across the United States. The request for comment explained that the FIO proposes to collect data from property and casualty insurers regarding current and historical underwriting data on homeowners’ insurance at the zip code level, in order to “assist FIO’s assessment of climate-related exposures and their effects on insurance availability for policyholders, including whether climate change may create the potential for any major disruptions of private insurance coverage in regions of the country that are particularly vulnerable to climate change impacts.”

| 17 |

| Table of Contents |

On December 20, 2020, the Terrorism Risk Insurance Program Reauthorization Act of 2019 was enacted and is now scheduled to expire on December 31, 2027. The Terrorism Risk Insurance Program serves as a federal “backstop” for insurance claims related to acts of terrorism.

On November 15, 2021, the DFS issued its final Guidance for New York Domestic Insurers On Managing the Financial Risks from Climate Change. On June 15, 2022, the DFS released its 2021 annual report. The report references the creation of a standalone Climate Division, which was the source of the aforementioned guidance.

In 2021, the Governor of the State of New York signed into law, effective January 28, 2022 and subsequently clarified by law taking effect March 15, 2023, legislation that seeks to prevent homeowner insurers from discriminating solely on the basis of breed of dog.

In 2021, the Comprehensive Insurance Disclosure Act was enacted in New York State. This law, as amended by a subsequent chapter amendment, requires any defendant to provide to the plaintiff, within a limited timeframe, proof of existence and the contents of any insurance agreement under which any person or entity may be liable to satisfy part or all of a judgment and details what the information and documentation includes. The new law applies to actions commenced on or after December 31, 2021.

In 2022, the New York legislature passed legislation to greatly expand wrongful death actions. This bill sought to expand the categories of claimants and scope of losses for which a wrongful death lawsuit could be brought. The bill was vetoed in January 2023. It was again passed in identical form in 2023 and again vetoed in December 2023.The bill was reintroduced in identical form in February 2024.

In 2023, two related bills were chaptered amending the time periods available to an insurer for the investigation and settlement of claims arising out of states of emergency and disasters. This bill codified elements of existing regulations but shortened certain time periods and added additional reporting requirements. Specifically, the law requires that, within fifteen business days after receiving all the items, statements, and forms that the insurer required from the claimant for a non-commercial claim not suspected to be related to arson, the insurer advise the claimant in writing whether the insurer has accepted or rejected the claim. An insurer would be allowed two extensions of fifteen additional business days to continue its investigation, provided that the insurer notifies the claimant of the reasons additional time is needed for the investigation, with the second extension being available if the property is inaccessible. Commercial claims are granted a one-time thirty-day extension to determine whether the claim should be accepted or rejected, and additional thirty-day extensions are available if certain written notifications are made. If the insurer has accepted the claim, the claimant will have to be notified of the amount the insurer is offering to settle the claim and of all applicable policy provisions regarding the claimant's right to reject and appeal the insurer's offer. If the insurer rejects the claim, the insurer will have to inform the claimant of all applicable policy provisions regarding the claimant's right to appeal the decision including policy information, insurer contact information and DFS complaint filing procedure information. An insurer will be required to pay the claim not later than four business days from the settlement of the claim.

| 18 |

| Table of Contents |

The DFS released a proposed circular letter regarding the use of “external consumer data and information sources (“ECDIS”) and artificial intelligence systems (“AIS”) by insurers. In broad strokes it reiterates the need to make sure that AI processes do not lead to outcomes that run afoul of the extensive body of existing anti-discrimination laws, including use of credit as governed by Insurance Law Article 28 credit usage. The circular letter does not have the force of law, but articulated DFS’ expectations about the use of AIS and ECDIS. In the past, the release of a circular letter has preceded the issuance of draft and eventually final regulations in the area addressed.

State Regulatory Examinations

As part of their regulatory oversight process, state regulatory authorities conduct periodic detailed examinations of the financial reporting of insurance companies domiciled in their states, generally once every three to five years. Examinations are generally carried out in cooperation with the insurance regulators of other states under guidelines promulgated by the NAIC. The DFS commenced its examination of KICO in 2023 for the years 2019 through 2022. The examination is expected to be completed in 2024.

Risk-Based Capital Regulations

State regulatory authorities impose risk-based capital (“RBC”) requirements on insurance enterprises. The RBC Model serves as a benchmark for the regulation of insurance companies. RBC provides for targeted surplus levels based on formulas, which specify various weighting factors that are applied to financial balances or various levels of activity based on the perceived degree of risk, and are set forth in the RBC requirements. Such formulas focus on four general types of risk: (a) the risk with respect to the company’s assets (asset or default risk); (b) the risk of default on amounts due from reinsurers, policyholders, or other creditors (credit risk); (c) the risk of underestimating liabilities from business already written or inadequately pricing business to be written in the coming year (underwriting risk); and (d) the risk associated with items such as excessive premium growth, contingent liabilities, and other items not reflected on the balance sheet (off-balance sheet risk). The amount determined under such formulas is called the authorized control level RBC (“ACL”).

The RBC guidelines define specific capital levels based on a company’s ACL that are determined by the ratio of the company’s total adjusted capital (“TAC”) to its ACL. TAC is equal to statutory capital, plus or minus certain other specified adjustments. KICO’s TAC is above the ACL. As of December 31, 2023, the ratio of TAC to ACL was 4.45 and is in compliance with New York’s RBC requirements.

| 19 |

| Table of Contents |

Dividend Limitations

Our ability to receive dividends from KICO is restricted by the state laws and insurance regulations of New York. These restrictions are related to surplus and net investment income. Dividends may be paid, without the need for DFS approval, from unassigned surplus and are restricted to the lesser of 10% of surplus or 100% of investment income (on a statutory accounting basis) for the trailing 36 months, less dividends by KICO paid during such period. At December 31, 2023, unassigned deficit was $7,661,958, and, accordingly, dividends may not be paid without DFS approval. See Item 5 (“Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities – Dividends”) of this Annual Report for a further discussion as to KICO’s ability to pay dividends to us.

Insurance Regulatory Information System Ratios

The Insurance Regulatory Information System (“IRIS”) was developed by the NAIC and is intended primarily to assist state insurance regulators in meeting their statutory mandates to oversee the financial condition of insurance companies operating in their respective states. IRIS identifies thirteen industry ratios and specifies “usual values” for each ratio. Departure from the usual values on four or more of the ratios can lead to inquiries from individual state insurance commissioners as to certain aspects of an insurer’s business. As of December 31, 2023, KICO had one ratio outside the usual range.

Accounting Principles

Statutory accounting principles (“SAP”) are a basis of accounting developed by the NAIC. They are used to prepare the statutory financial statements of insurance companies and to assist insurance regulators in monitoring and regulating the solvency of insurance companies. SAP is primarily concerned with measuring an insurer’s policyholder surplus. Accordingly, statutory accounting focuses on valuing assets and liabilities of insurers at financial reporting dates in accordance with appropriate insurance law and regulatory provisions applicable in each insurer’s domiciliary state.

Generally accepted accounting principles (“GAAP”) are concerned with a company’s solvency, but are also concerned with other financial measurements, principally results of operations and cash flows. Accordingly, GAAP gives more consideration to appropriate matching of revenue and expenses and accounting for management’s stewardship of assets than does SAP. As a direct result, different types and amounts of assets and liabilities will be reflected in financial statements prepared in accordance with GAAP as compared to SAP.

Statutory accounting practices established by the NAIC and adopted in part by New York insurance regulators determine, among other things, the amount of statutory surplus and statutory net income of KICO and thus determine, in part, the amount of funds that are available for KICO to pay dividends to Kingstone Companies, Inc.

Legal Structure

We were incorporated in 1961 and assumed the name DCAP Group, Inc. in 1999. On July 1, 2009, we changed our name to Kingstone Companies, Inc.

Employees

As of December 31, 2023, we had 84 employees. None of our employees are covered by a collective bargaining agreement. We believe that our relationship with our employees is good.

| 20 |

| Table of Contents |

Availability of Information