EXHIBIT I

EIB Statutory Bodies

The composition of the Bank’s statutory bodies, the curricula vitae of their members and additional information on the remuneration arrangements are regularly updated and posted on the EIB’s website: www.eib.org.

Board of Governors

Chairman Belgium Bulgaria Czech Republic Denmark Germany Estonia Greece Spain France Ireland Italy Cyprus Latvia Lithuania Luxembourg Hungary Malta Netherlands Austria Poland Portugal Romania Slovenia Slovakia Finland Sweden United Kingdom

Giulio TREMONTI Didier REYNDERS Plamen ORESHARSKI Miroslav KALOUSEK Bendt BENDTSEN Peer STEINBRÜCK Ivari PADAR

Georgios ALOGOSKOUFIS Pedro SOLBES MIRA Christine LAGARDE Brian LENIHAN

Giulio TREMONTI Charilaos STAVRAKIS Atis SLAKTERIS Rimantas ŠADŽIUS Jean-Claude JUNCKER János VERES

Toni FENECH Wouter BOS Wilhelm MOLTERER Jacek ROSTOWSKI

Fernando TEIXEIRA DOS SANTOS Varujan VOSGANIAN

Andrej BAJUK Ján POČIATEK Jyrki KATAINEN Anders BORG Alistair DARLING

(Italy)

Ministre des Finances

Minister for Finance

Ministr financí

Økonomi- og erhvervsminister

Bundesminister der Finanzen

Rahandusminister

Minister of Economy and Finance

Vicepresidente Segundo del Gobierno y Ministro de Economía y Hacienda

Ministre de l’Économie, de l’industrie et de l’emploi

Minister for Finance

Ministro dell’Economia e delle Finanze

Minister of Finance

Finanšu ministrs

Finansų ministras

Premier Ministre, Ministre d’État, Ministre des Finances

Pénzügyminiszter

Minister of Finance, Economy and Investment

Minister van Financiën

Bundesminister für Finanzen

Ministra Finansów

Ministro de Estado e das Finanças

Ministrul Finanţelor Publice

Minister za finance

Minister financií

Valtiovarainmisteri

Finansminister

Chancellor of the Exchequer

Audit Committee

Chairman Maurizio DALLOCCHIO Senior Professor of Corporate Finance at SDA Bocconi School of Management, Holder of

Lehman Brothers, Chair of Corporate Finance, Bocconi University, Milan

Members Constantinos KARMIOS Chief Accountant, Treasury of the Republic of Cyprus, Cyprus Ortwin KLAPPER Former Chief Executive Officer of Bank Austria Creditanstalt Leasing Group, Managing Director of Mizuho Corp. Bank-BA Investment Consulting, Chairman of the Multilease Association, Brussels/Bratislava

Observers Nikolaos PHILIPPAS Associate Professor and Member of the University Senate, University of Piraeus, Greece, Member of the Board of Directors of Piraeus Port Authority

Éric MATHAY Company auditor, cabinet Bollen, Mathay & Co., Brussels José RODRIGUES DE JESUS Chartered Auditor, Oporto

Management Committee

President Philippe MAYSTADT The EIB’s President also chairs the Bank’s Board of Directors. Vice-Presidents Philippe de FONTAINE VIVE CURTAZ

Torsten GERSFELT Simon BROOKS Carlos da SILVA COSTA Matthias KOLLATZ-AHNEN Eva SREJBER

Marta GAJĘCKA Dario SCANNAPIECO

Situation at 21 May 2008

1

Board of Directors

The Board of Directors consists of 28 Directors, with one Director nominated by each Member State and one by the European Commission. There are 18 Alternates, meaning that some of these positions will be shared by groupings of States.

Furthermore, in order to broaden the Board of Directors’ professional expertise in certain fields, the Board is able to co-opt a maximum of six experts (three Directors and three Alternates), who participate in the Board meetings in an advisory capacity, without voting rights.

Directors

Olivier HENIN Directeur adjoint, responsable de la Cellule Marchés financiers internationaux, Ministère des Finances,

Brussels

Dimiter IVANOVSKI Deputy Minister, Ministry of Finance, Sofia

Zdeněk HRUBÝ Member of the Board of Directors of the EIB, Prague

Sigmund LUBANSKI Kontorchef, Økonomi- og Erhvervsministeriet, Copenhagen

Carsten PILLATH Ministerialdirektor, Abteilungsleiter Europapolitik im Bundesministerium der Finanzen, Berlin

Aare JÄRVAN Secretary General, Department of EU and International Affairs, Ministry of Finance, Tallinn

Konstantinos MOUSOUROULIS Secretary General, Ministry of Development, Athens

Isabel RIAÑO IBÁÑEZ Directora General, Dirección General de Financiación Internacional, Ministerio de Economía y Hacienda,

Madrid

Claire WAYSAND Chef du service des politiques macroéconomiques et des affaires européennes, direction générale du

Trésor et de la politique économique, ministère de l’Économie, de l’industrie et de l’emploi

Kevin CARDIFF Deputy Secretary General, Banking, Finance and International Division, Department of Finance, Dublin

Ignazio ANGELONI Direttore per i Rapporti finanziari internazionali, Dipartimento del Tesoro, Ministero dell’Economia e

delle Finanze, Rome

Kyriacos KAKOURIS Senior Economic Officer, Ministry of Finance, Nicosia

Irena KRUMANE Chairwoman, Financial and Capital Market Commision, Riga

Migle TUSKIENE Director, European Union and International Affairs Department, Ministry of Finance,Vilnius

Gaston REINESCH Directeur général, Ministère des Finances, Luxembourg

János ERÖS Chief Executive Officer, Magyar Fejlesztési Bank Zrt., Budapest

Vince GRECH Director General (Financial Administration), Ministry of Finance and Economic Affairs, Valetta

Pim VAN BALLEKOM Financial Counsellor, Permanent Representation of the Netherlands to the EU, Brussels

Kurt BAYER Stellvertretender Generaldirektor für Wirtschaftspolitik und Internationale Finanzinstitutionen,

Bundesministerium für Finanzen, Vienna

Katarzyna ZAJDEL-KUROWSKA Undersecretary of State, Ministry of Finance, Warsaw

M.-Alexandra da COSTA GOMES Membro do Conselho de Administração do BEI, Lisbon

Eugen TEODOROVICI Secretary of State, Ministry of Economy and Finance, Bucharest

Sibil SVILAN President of the Board and CEO, SID Bank Inc., Ljubljana

Katarina KASZASOVÁ Director General of the State Reporting Section, Ministry of Finance, Bratislava

Tytti NORAS Lainsäädäntöneuvos, valtiovarainministeriö, Helsinki

Kurt Arne HALL Finansråd, Internationella avdelningen, Finansdepartementet, Stockholm

Stephen PICKFORD Director Europe, H.M. Treasury, Finance Directorate, London

Klaus REGLING Director-General, Directorate-General for Economic and Financial Affairs, European Commission, Brussels

Experts

Pierre RICHARD Président du conseil d’administration, Dexia SA, Paris

Rainer MASERA Presidente del Gruppo Istituzioni Finanziarie (GIF), Lehman Brothers, Rome

Timothy STONE Chairman, Global Infrastructure and Projects Group, KPMG, London

Alternates

Karl-Ernst BRAUNER Ministerialdirektor, Bundesministerium für Wirtschaft und Arbeit, Berlin

Ralph MÜLLER Leiter des Referats Haushalt der Europäischen Union, Bundesministerium der Finanzen, Berlin

Benoît de la CHAPELLE BIZOT Chef du bureau ”Stratégie et coordination européenne”, Direction du Trésor et de la politique économique,

ministère de l’Économie, de l’industrie et de l’emploi, Paris

Jean-Michel SEVERINO Directeur général, Groupe Agence Française de Développement, Paris

Giampaolo BOLOGNA Dirigente, Direzione del Contenzioso Comunitario, Dipartimento del Tesoro, Ministero dell’Economia

e delle Finanze, Rome

Pietro MASCI Direttore dell’Ufficio per le relazioni istituzionali con la Banca europea per gli investimenti, Paesi del

Mediterraneo e dei Balcani, Dipartimento del Tesoro, Ministero dell’Economia e delle Finanze, Rome

Jean-Christophe GRAY Head of EU Coordination and Strategy, HM Treasury, London

Tamsyn BARTON Head of EU Department, Department for International Development, London

Alicia VARELA Subdirectora General, Subdirección General de Instituciones Financieras Europeas, Ministerio de

Economia y Hacienda, Madrid

Rudolf de KORTE Plaatsvervangend lid van de Raad van Bewind van de EIB, Wassenaar

Michael SOMERS Chief Executive, National Treasury Management Agency, Dublin

Ştefan NANU General Director, General Department of Treasury and Public Debt, Ministry of Economy and Finance,

Bucharest

Madis ÜÜRIKE Advisor to the Ministry of Finance, Ministry of Finance, Tallinn

Kristina SARJO Finanssineuvos, Kv. toiminnot -yksikön päällikkö, Rahoitusmarkkinaosasto, valtiovarainministeriö,

Helsinki

Zsuzsanna VARGA Director General, Department of International Relations, Ministry of Finance, Budapest

Andrej KAVČIČ Head of International Finance Department, Ministry of Finance, Ljubljana

(…) …

Dirk AHNER Director General, Regional Policy Directorate-General, European Commission, Brussels

Alternate experts

Óscar FANJUL Vicepresidente, Omega Capital S.L., Madrid

Antoni SALA Advisor to the CEO, Bank Gospodarstwa Krajowego, Warsaw

Detlef LEINBERGER Mitglied des Vorstandes, Kredianstalt für Wiederaufbau, Frankfurt/Main; Mitglied des Verwaltungsrats

des EIF

Situation at 21 May 2008

2

EIB Financing Activity

In 2007, the European Investment Bank (EIB) lent a total of 47.8bn euros (1) in support of the objectives of the Euro-pean Union: 41.4bn in the Member States of the Union and EFTA, and 6.4bn in the partner countries.

The Bank’s strategic orientations are reflected in a number of objectives defined in the Bank’s Corporate Operational Plan. For the period 2007-2009, six priority strategic objectives have been defined for financing operations in the Member States of the European Union: economic and social cohesion and convergence; fostering innovation; developing trans-European networks and their access routes; protecting and improving the environment; supporting small and medium-sized enterprises (SMEs); and promoting secure, competitive and sustainable energy supplies.

• Economic and social cohesion and convergence in the European Union remains the Bank’s prime operational priority. In 2007, individual financing operations aimed at reducing economic disparities between the regions totalled 22.2bn; activity promoting convergence in the less developed regions accounted for

13.8bn. More than half of the projects were carried out in the transport and energy sectors.

• By fostering innovation, the EIB Group assists the development of a knowledge-based economy. Since the launch of the Innovation 2010 Initiative (i2i) in 2000, the Bank has already signed loans worth 56bn. In 2007, it advanced a total of 10.3bn in three areas: research, development and innovation (7.2bn); education and training (1.3bn); and information and communications technologies (1.6bn). The European Investment Fund (EIF) also supports i2i by taking stakes in venture capital funds (2).

• Efficient communications and energy transfer networks are a key factor in economic integration. Since 1993, the Bank has been supporting the development of trans-European networks (TENs) and has become the leading provider of long-term funds for these networks within the European Union. In 2007, the Bank lent 7.4bn for transport TENs and 1bn for energy TENs in the European

Union. In the neighbouring countries it also provided finance totalling 916m for projects involving major transport arteries and 375m for energy supplies.

• In 2007, individual loans for capital projects relating to the environment amounted to 14.6bn, accounting for 31 % of total lending. The bulk of loans went to projects in the European Union (13bn). Financing centred on the urban environment (5.6bn), combating climate change (4.5bn), water treatment and pollution reduction (4.3bn), and a range of projects involving nature conservation, environmental efficiency and waste management (123m).

• Support for investment by SMEs is intended to give them easier access to credit, or even equity capital. In 2007, the EIB was thus able to support indirectly, via commercial banks and investment funds, an estimated 162 000 or so SMEs within the Union. To that end, it granted 5bn in the form of medium and long-term credit lines, enabling banks to lend to SMEs on better terms, and its subsidiary, the EIF, provided guarantees totalling 1.4bn to SMEs and invested 521m via venture capital funds.

• Energy has been made a specific priority in the COP for the period 2007-2009. Projects meeting this objective involve the following: renewable energies; energy efficiency; research, development and innovation; and security of internal and external supplies. In 2007, the Bank provided loans totalling 6.8bn to support projects in the energy sector, including a record 2.1bn for renewable energy.

The Bank operates in the partner countries of the Union in accordance with the lending mandates renewed by the Council in December 2006. In 2007, EIB backing for EU development aid and cooperation policy in the partner countries amounted to 6.4bn.

• In South-Eastern Europe (3), where the Bank makes loans to support economic development and promote accession to the European Union, financing operations totalled 2.9bn.

(1) Unless otherwise indicated, all amounts are expressed in EUR.

(2) See section on EIF Activity.

3

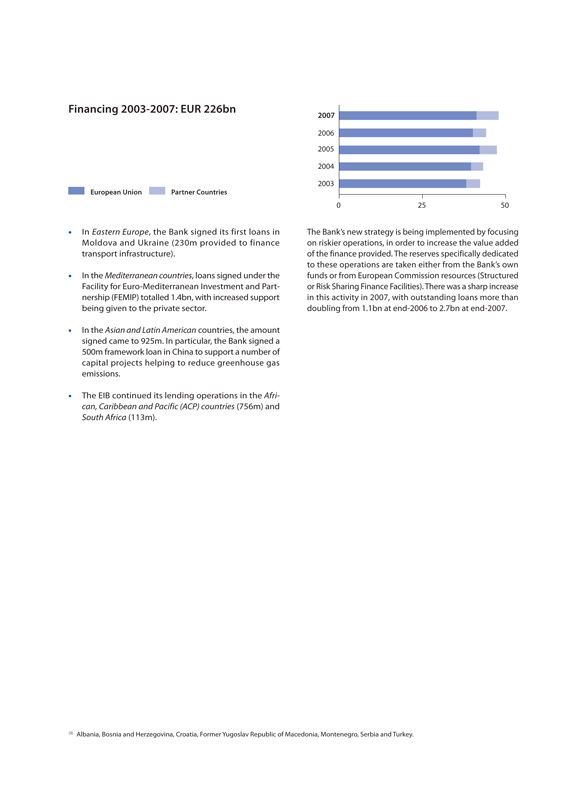

Financing 2003-2007: EUR 226bn

European Union

Partner Countries

• In Eastern Europe, the Bank signed its first loans in Moldova and Ukraine (230m provided to finance transport infrastructure).

• In the Mediterranean countries, loans signed under the Facility for Euro-Mediterranean Investment and Partnership (FEMIP) totalled 1.4bn, with increased support being given to the private sector.

• In the Asian and Latin American countries, the amount signed came to 925m. In particular, the Bank signed a 500m framework loan in China to support a number of capital projects helping to reduce greenhouse gas emissions.

• The EIB continued its lending operations in the Afri-can, Caribbean and Pacific (ACP) countries (756m) and South Africa (113m).

2007

2006

2005

2004

0

25

50

The Bank’s new strategy is being implemented by focusing on riskier operations, in order to increase the value added of the finance provided. The reserves specifically dedicated to these operations are taken either from the Bank’s own funds or from European Commission resources (Structured or Risk Sharing Finance Facilities). There was a sharp increase in this activity in 2007, with outstanding loans more than doubling from 1.1bn at end-2006 to 2.7bn at end-2007.

(3) Albania, Bosnia and Herzegovina, Croatia, Former Yugoslav Republic of Macedonia, Montenegro, Serbia and Turkey.

4

EIB Borrowing Activity

A leading sovereign-class international debt issuer

Resilient funding in turbulent times

The EIB’s funding activities were resilient during the turmoil that overshadowed capital markets in the course of 2007, thereby sustaining a continued competitive offering of loan products. In 2007, the Bank raised a total of EUR 55bn (4) via 236 transactions in 23 currencies, including four currencies in synthetic format. In September, in parallel with progress in its lending programme and loan disbursements, the Bank increased its funding ceiling from EUR 50bn to EUR 55bn. The funding volume of EUR 55bn was significantly larger than in the 2006 funding programme (EUR 48bn).

Such results were underpinned by the Bank’s top-quality credit standing and a strategic and responsive approach to markets. The continuing support from EU sovereign shareholders remains a cornerstone of the Bank’s credit standing.

The market’s favourable overall reception for the Bank in 2007 was reflected in an award for Sovereign/Supranational/Agency/Regional Issuer of the Year from the International Financing Review.

A reliable benchmark

In this challenging environment the Bank benefited from the strength of its benchmark programmes in its core currencies (EUR, GBP and USD), which generated funding for EUR 38bn (69 % of the total). This represents a significant increase versus 2006 (EUR 28bn or 59 %). Benchmark funding in core currencies demonstrated the Bank’s bellwether appeal, with benchmark volumes growing year on year in each of the three core currencies. The strong presence across the yield curve across all three currencies (EUR, GBP and USD) remained a strong distinguishing feature. Targeted issues in the three core currencies in plain vanilla and structured format were substantial, amounting to EUR 8bn (EUR 12bn in 2006), with EUR and USD issues providing the bulk of the volume.

EUR: strong reception for benchmarks

In EUR a total of 27 transactions were conducted in 2007, raising EUR 20.5bn in all, or 37.5 % of the total funding programme for the year. Four new euro-denominated benchmarks or Euro Area Reference Notes (‘EARN’TM) were issued, compared with the two typically issued in recent years. This provided the largest source of benchmark funding for the Bank (EUR 16bn). The transactions were two EUR 5bn EARNs in 5 and 10-year maturities, as well as two EUR 3bn EARNs, a long 17-year and an innovative 7-year issue, the latter offering a new benchmark maturity to the market. Two of these EARNs were launched following the outbreak of severe market turmoil over the summer.

The favourable market reception for the EARN benchmark transactions was supported by a consistent strategic approach, that has delivered a highly comprehensive and liquid yield curve. The Bank remained the only borrower to complement sovereigns with benchmark issues of EUR 5bn size outstanding in maturities from three years to 30 years. As of end-2007, EARNs outstandings reached EUR 74bn across 15 issues. Structured bonds in EUR amounted to EUR 1.4bn (roughly 30 % of all EIB structures in 2007). In addition, a EUR 2bn targeted bond was issued in the two-year segment.

A significant innovation, reflecting EU leadership in tackling climate change, was the Climate Awareness Bond (CAB) under the Bank’s EPOS (European Public Offering of Securities) format – the second of its kind launched by the EIB. This EUR-denominated structured issue offered a unique combination of environmental features, including earmarking of proceeds for projects supporting cleaner energy, as well as an option to purchase and cancel CO allowances via the European Union’s Emissions Trading 2 Scheme. The CAB also offered a vehicle for ongoing EU financial market integration, as the first public bond offering across all 27 EU Member States, facilitated by the passporting mechanism in the EU Prospectus Directive (5) and associated EPOS documentation. The issue was syndicated among an unusually large number of banks and reached an exceptional size for a structured issue (EUR 600m).

(4) Volume of EUR 54.7bn raised under the global borrowing authorisation given by the Board of Directors for 2007, including ‘pre-funding’ of EUR 77m completed in 2006 for 2007.

(5) The European Public Offering of Securities, or “EPOS” format, was first launched in 2006 and allows the Bank to leverage the EU Prospectus Directive, which sets out an efficient mechanism for the “passporting” of prospectuses in the Member States of the European Union: a prospectus approved by the competent authority in one Member State (“home country regulator”) can be used as a valid prospectus in any other Member State (“host Member State”) without the need for any further prospectus approval (“mutual recognition”).

5

Borrowing activity 2003-2007: 245bn

2007

2006

2005

2004

2003

0 10 20 30 40 50 60

EUR GBP

USD

Others

GBP: largest non-gilt issuer

In GBP the Bank maintained its position as the largest non-gilt issuer, with a total outstanding sterling debt representing over 9 % of the total GBP non-gilt market at end-2007 (6). The Bank made 58 transactions, raising a total of GBP 7.5bn (EUR 11bn) or 20.1 % of the total programme for the year. During 2007, 13 different maturities were tapped and there were three new benchmark lines across the yield curve (2011, 2019 and 2044). As of end-2007, the Bank’s sterling yield curve, which extends to 2054, amounted to GBP 39bn in 22 bonds.

In addition, two new long-dated inflation-linked issues were launched with maturities in 2017 and 2022, both based for the first time on the gilt model in terms of maturity and calculation methodology for coupons and final redemptions.

USD: largest non-US issuer in Global format

The Bank remained the largest non-US issuer of Global benchmarks, raising a record volume of USD 15bn (EUR 11.3bn). In USD, 28 transactions were executed raising a total of USD 19.1bn (EUR 14.4bn), or 26.3 % of the total programme for the year. Five Global USD 3bn benchmarks were issued across major maturities: 3-year (twice),

5-year and 10-year (twice). In aggregate this was the largest amount raised by the Bank in any single year through the issuance of USD Global bonds. With its second 3-year USD 3bn issue, the Bank reopened the benchmark USD market for triple-A rated issuers in the wake of the summer turmoil. 2007 also saw a sustained interest for non-Global transactions, which included two 7-year Eurodollar issues, raising in total USD 2.25bn (EUR 1.7bn). Structured transactions amounted to USD 1.8bn (EUR 1.3bn).

Strong diversification: issuance in 23 currencies

Outside the three core currencies, EUR 8.8bn was raised in 16 other currencies. In addition, EUR 262.4m was issued in synthetic format in four additional currencies (booked under payment and settlement currencies in EUR and USD).

Innovation in other European and neighbouring country currencies

The largest volume of issuance in this region was in Nordic currencies, for a total of EUR 1.5bn. A noteworthy result was the Bank’s issuance in Swedish krona (SEK), where it raised a total of SEK 8.2bn (EUR 893m), nearly tripling the volume of 2006. The Bank strengthened and extended its SEK yield curve with new 17- and two 28-year issues, both plain vanilla and inflation-linked, and the 28-year maturity went beyond the longest sovereign tenor. Issuance in other Nordic currencies included the Icelandic króna (ISK), Danish krone (DKK) and Norwegian krone (NOK).

In Swiss francs (CHF), the Bank launched four transactions with maturities between 2019 and 2036 (totalling CHF 725m/EUR 445m), reflecting the demand for top-quality long-dated bonds.

The Bank maintained its developmental activities in new and future Member States and EU neighbouring country currencies. Volumes amounted to EUR 1.5bn equivalent, raised via 26 transactions, with Turkish lira (TRY) providing the bulk of the volume. Other issuance currencies were Bulgarian leva (BGN), Hungarian forint (HUF), Polish zloty (PLN), Romanian leu (RON) and Russian rouble (RUB).

| (6) |

Source: Barclays Sterling Non-Gilt Index, 31 December 2007. |

6

In TRY, the Bank maintained its leading position. The Bank issued across 14 transactions for a total of TRY 2bn (EUR 1.1bn). It launched a 2-year TRY 1bn benchmark issue, the largest-ever single tranche Eurobond (of TRY 1bn), providing a new liquid reference for the market. The Bank also issued a TRY 150m zero-coupon bond due 2022, which was the longest maturity in the TRY Eurobond market.

The Bank made its debut in the domestic market for Romanian leu (RON), with a RON 300m (EUR 90m) 7-year bond. This was the longest-dated and largest RON bond at the time of issuance. The Bank also built on its presence in the international Bulgarian leva (BGN) market with a new BGN 55m (EUR 28m) 5-year bond issue.

The Bank also made its debut in the non-synthetic Russian rouble (RUB) market, where two bonds were launched: a RUB 2bn (EUR 57m) 10-year and a RUB 2bn (EUR 57m) 5-year bond.

Japan and Asian/Pacific currencies: leadership and scale

Among the non-core currencies in 2007, the largest source of funding – and hence the Bank’s fourth-largest currency – was Japanese yen (JPY), with JPY 349bn (EUR 2.2bn) being raised. The Bank became the largest high-grade issuer of Global bonds in this currency. The public JPY issuance, supported by international demand from Europe and the US, did brisk business, particularly in the first half of the year. A highlight was the issuance of the first fixed-rate

5-year Global yen bond from a supranational since 1992.

This was also the largest yen transaction from a foreign issuer in 2007 and won an award for Yen Bond of the Year from the International Financing Review.

In Australian dollars (AUD) the Bank was the largest foreign (“Kangaroo”) issuer, raising a total of AUD 1.6bn (EUR 941m). It attracted interest early in the year with two 10-year issues. It also re-opened the Kangaroo sector in September, following the outbreak of severe market turbulence, with a shorter-dated AUD 500m transaction. The EIB was the only issuer that managed to keep transaction sizes of around AUD 500m in the Kangaroo market in the second half of 2007.

The New Zealand dollar (NZD) was a major source of funding in 2007, generating EUR 1.3bn equivalent. Among high-grade borrowers, the Bank launched the largest fixed-rate transaction in the “Kauri” bond market for foreign issuers, a NZD 800m (EUR 439m) 5-year issue.

Americas (ex-US): recognition for benchmark size in Canada

In Canadian dollars (CAD), the Bank issued the largest

30-year foreign (“Maple”) transaction, for CAD 850m (EUR 560m), as well as some smaller similarly long-dated transactions. Among high-grade borrowers, the Bank was the first to issue a publicly marketed zero-coupon bond, that attained benchmark status. Total issuance in this currency amounted to CAD 1bn (EUR 659m).

In Latin America the Bank continued its issuance activities in Brazilian real (BRL) in synthetic format, raising an equivalent of EUR 185m across eight transactions.

African currencies: developmental impact widens

In 2007 the Bank launched 13 transactions in four African currencies totalling EUR 311m equivalent. This underlines the scale and diversity of its developmental role in the region’s capital markets, and provides a stepping stone towards potential lending in local currency. The largest contributor was the South African rand (ZAR) market, delivering EUR 234m equivalent. The Bank issued for the first time in Ghanaian cedi (GHS) and Mauritian rupee (MUR), in both cases providing top-quality alternatives for investors in markets with very limited supply. In MUR, the EIB was the first non-domestic issuer and provided a new benchmark for the market. Issuance in Botswanan pula (BWP), GHS and MUR (EUR 77m in total) was in synthetic format, with payment and settlement in EUR.

7

“The way to buy Europe” Snapshot of the EIB as an issuer

Joint EU sovereign ownership underpins top-class credit quality and means EIB bonds can be seen as “the way to buy Europe”.

? The EIB is one of the largest and most frequent borrowers in the international capital markets. In 2007 it issued a total of EUR 55bn.

? Ownership by all EU sovereigns means EIB bonds offer a unique and diversified sovereign-class investment.? The Bank has been consistently rated Aaa/AAA/AAA by Moody’s/Standard & Poors/Fitch.

? The Bank’s strategic approach to markets involves a strong focus on liquidity and transparency. It therefore offers comprehensive benchmark programmes in the Bank’s three core currencies (EUR, GBP and USD). Where possible and appropriate, it also builds a benchmark presence in other currencies. It also conducts tailor-made issuance across a wide range of currencies and products.

? The Bank has historically contributed to the development of capital markets in currencies of new and future EU Member States, and selected EU partner countries. Here issuance in local currencies can support the development of lending activities.

8

Borrowings signed and raised in 2007(7) vs. 2006 (EUR million)

Before swaps: After swaps:

2007 2006 2007 2006

EUR 20 531 37.5 % 17 439 36.3 % 42 766 78.1 % 31 820 66.2 %

BGN (*) 28 0.1 %

CZK 18 0.04 % 18 0.04 %

DKK 134 0.2 % 235 0.5 % 134 0.2 % 235 0.5 %

GBP 11 023 20.1 % 8 392 17.5 % 6 123 11.2 % 3 067 6.4 %

HUF 108 0.2 % 110 0.2 % 108 0.2 % 97 0.2 %

PLN 27 0.1 % 32 0.1 % 27 0.1 % 32 0.1 %

RON 90 0.2 %

SEK 893 1.6 % 309 0.6 % 403 0.7 % 309 0.6 %

Total EU 32 835 60 % 26 535 55 % 49 562 91 % 35 577 74 %

AUD 941 1.7 % 1 840 3.8 %

BGN (*) 102 0.2 %

CAD 659 1.2 %

CHF 445 0.8 % 703 1.5 %

HKD 101 0.2 %

ISK 261 0.5 % 501 1.0 %

JPY 2 198 4.0 % 1 277 2.7 %

NOK 196 0.4 % 424 0.9 % 63 0.1 % 88 0.2 %

NZD 1 344 2.5 % 933 1.9 %

RUB 115 0.2 %

TRY 1 097 2.0 % 1 095 2.3 %

USD 14 400 26.3 % 14 225 29.6 % 5 099 9.3 % 12 305 25.6 %

ZAR 234 0.4 % 312 0.7 % 80 0.2 %

Total non-EU 21 890 40 % 21 515 45 % 5 162 9 % 12 473 26 %

Total 54 725 100 % 48 050 100 % 54 725 100 % 48 050 100 %

(*) Bulgaria joined the EU on 1 January 2007.

(7) Resources raised under the global borrowing authorisation given by the Board of Directors for 2007, including ‘pre-funding’ of EUR 77m completed in 2006 for 2007.

9

Audit and Control

Audit Committee – The Audit Committee is an independent statutory body, appointed by, and answerable directly to, the Board of Governors. In compliance with formalities and procedures defined in the Statute and Rules of Procedure, the Audit Committee’s role is to verify that the Bank’s operations have been conducted and its books kept in a proper manner and to obtain assurance on the effectiveness of the internal control systems, risk management and internal administration. The Audit Committee has overall responsibility for the auditing of the Bank’s accounts. The Committee provides statements each year on whether the financial statements, as well as any other financial information contained in the annual accounts drawn up by the Board of Directors, give a true and fair view of the financial position of the Bank, the EIB Group, the Investment Facility and the FEMIP Trust Fund. The Governors take note of the statements by the Committee and of the conclusions in the annual reports of the Audit Committee when reviewing the Annual Report of the Board of Directors.

In fulfilling its role, the Committee meets with representatives of the other statutory bodies, reviews the financial statements and accounting policies, takes note of the work performed by the internal auditors, oversees and supervises the external auditors, safeguards the independence and integrity of the external audit function, and coordinates audit work in general. Regular meetings with the Bank services and reviews of internal and external reports enable the Committee to understand and monitor how Management is providing for adequate and effective internal control systems, risk management and internal administration.

External Auditors – The external auditors report directly to the Audit Committee, which is empowered to delegate the day-to-day work concerning the audit of the financial statements to them. The Audit Committee designated the firm Ernst & Young in 2004, after consultation with the Management Committee. The contract will expire on the date on which the Board of Governors approves the 2008 financial statements. The external auditors are not allowed to carry out any work of an advisory nature or act in any other capacity that could compromise their independence when performing their audit tasks. A summary of services provided by the external auditors and the associated fees is published each year by the Bank, in accordance with best practice.

Inspectorate General – The Inspectorate General for the EIB Group comprises three independent control functions, to which the Bank attaches great importance.

Internal audit. Catering for audit needs at all levels of management of the EIB Group and acting with the guarantees of independence and of professional standards conferred upon it by its Charter, Internal Audit examines and evaluates the relevance and effectiveness of the internal control systems and the procedures involved. It is also finalising the introduction and maintenance of an internal control framework covering all key operational activities of the Group. Action Plans agreed with the Bank’s departments are a catalyst for improving procedures and strengthening controls. Hence, Internal Audit reviews and tests controls in critical banking, information technology and administrative areas on a rotational basis using a risk-based approach.

Ex post evaluation. Ex post evaluations cover the EIB’s activities and have been extended to the Group through the evaluation of the venture capital activities of the EIF and an interim evaluation of the FEMIP Trust Fund. The evaluation studies and reports enable the EIB Group to learn from past experience. Ex post evaluations are published on the web-site of the Bank (or EIF), thereby contributing to the transparency and accountability of the EIB Group.

Fraud investigations. Under internal procedures to combat fraud, the Inspector General has authority to conduct inquiries into allegations of possible fraud or corruption involving EIB funds. The Bank may also call upon external assistance or experts in accordance with the requirements of the inquiry, and works closely with the services of the European Anti-Fraud Office (OLAF). In addition, the Inspector General provides, when required, an independent recourse mechanism for investigating complaints that the European Ombudsman considers to be outside his remit.

Compliance Office – The Office of the Group Chief Compliance Officer (OCCO) identifies the compliance risk of any of the members of the EIB Group, assesses or advises on compliance-related questions by expressing opinions or making recommendations either upon request or on its own initiative, monitors the risk and reports it. More specifically, OCCO is responsible for the observance of guidelines, policies and procedures adopted from time to time by the members of the EIB Group on money laundering, fraud and terrorism and actively promotes the compliance of the members of the EIB

10

Group with current best standards of good professional practice, with the codes of conduct and with compilations of best practices.

Management Control – Within the Strategy and Corporate Centre Directorate, the Strategy, Management Control and Financial Control Department brings together the functions responsible for management control – namely strategy, budget and associated analyses, partnership coordination, financial control and process improvement, plus European Court of Auditors relationship management – and integrates them with functions responsible for macroeconomic research and corporate responsibility policies and corporate

governance issues. This structure ensures that the overall strategic and financial planning and reporting processes are reviewed with the aim of coordinating the achievement of the Bank-wide objectives and ultimately that the results achieved are monitored. Key tools include the Corporate Operational Plan, financial accounting and control systems, and the budget and associated control systems. A suite of integrated reports facilitates evaluation of the financial situation in relation to strategy, institutional and operational objectives and business plans. Management Control provides an opinion on internal proposals to the Management Committee that have a strategic, budgetary/financial, corporate responsibility or organisational impact.

11

50

1958 2008

EIB Group

Financial Statements

12

Consolidated Results for the Year

The EIB Group balance sheet total increased slightly and the profit to be appropriated decreased during the year 2007. The result of the Group for the reporting date stands at EUR 843 million, compared to an ordinary consolidated result of EUR 2 260 million for 2006, representing a decrease of EUR 1 416 million. It should be noted that an additional contribution from the sum released from the Fund for general banking risks amounting to EUR 975 million produced a final balance on the consolidated profit and loss account of EUR 3 235 million for the year ended 31 December 2006.

The main contributing factors influencing the consolidated result either positively or negatively are as follows:

Negative impacts:

• The result on financial operations, which mainly comprises the net results on derivatives, loans and borrowings, with application of the fair value option under IAS 39, decreased by EUR 1 393 million (see Note N). The major impact is the decrease related to borrowings designated at fair value and their related swaps for EUR 1 295 million. This decrease mainly stems from the widening of credit spreads in the capital markets as a consequence of the flight to quality that took place after the sub-prime crisis. Indeed, the market price of EIB bonds decreased much less than the market price of the associated hedging swaps, generating an unrealised book loss. Of course, since the intention of the Group is to hold these financial instruments until maturity, it is expected that this book loss will be neutralised when the cash flows of the bonds and the hedging swaps are unwound.

• The credit loss expense, together with the movements in the specific provision for credit risk, resulted in a loss of EUR 17 million, compared with a profit of EUR 102 million in 2006, a negative impact of EUR 120 million.

• The impairment losses on shares and other variable-yield securities resulted in a negative impact of EUR 113 million (see Note E).

Positive impacts:

• The net result of interest and similar income and charges stands at EUR 1 863 million for 2007, i.e. a positive impact on the result of EUR 173 million (items 1 and 2 of the Income Statement – see Note M).

• General administrative expenses (see Note Q) decreased, having a positive impact on the result of EUR 6 million. This was mainly due to a reduction in expenses relating to the Group’s defined-benefit post-employment schemes under IAS 19, as compared with 2006.

• All other profit and loss items gave rise to an overall net increase of EUR 30 million.

13

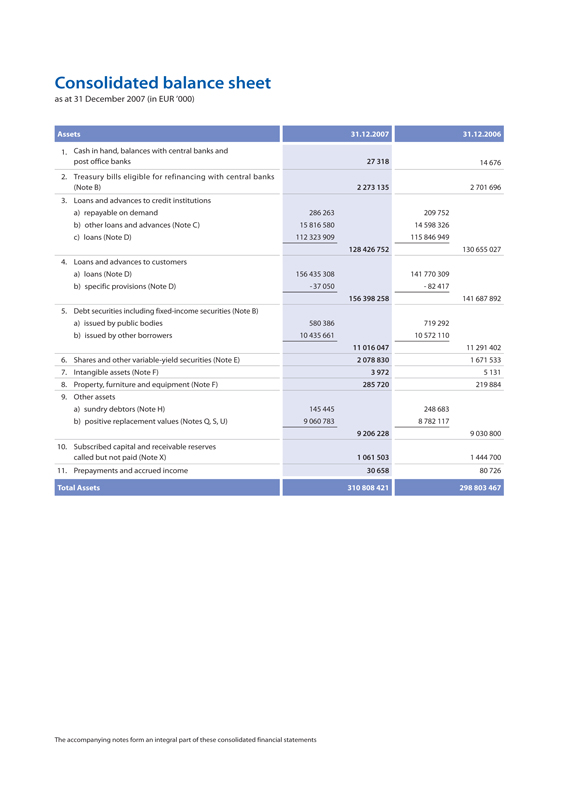

Consolidated balance sheet

as at 31 December 2007 (in EUR ‘000)

Assets 31.12.2007 31.12.2006

1. Cash in hand, balances with central banks and post office banks 27 318 14 676

2. Treasury bills eligible for refinancing with central banks (Note B) 2 273 135 2 701 696

3. Loans and advances to credit institutions

a) repayable on demand 286 263 209 752

b) other loans and advances (Note C) 15 816 580 14 598 326

c) loans (Note D) 112 323 909 115 846 949

128 426 752 130 655 027

4. Loans and advances to customers

a) loans (Note D) 156 435 308 141 770 309

b) specific provisions (Note D) -37 050 -82 417

156 398 258 141 687 892

5. Debt securities including fixed-income securities (Note B)

a) issued by public bodies 580 386 719 292

b) issued by other borrowers 10 435 661 10 572 110

11 016 047 11 291 402

6. Shares and other variable-yield securities (Note E) 2 078 830 1 671 533

7. Intangible assets (Note F) 3 972 5 131

8. Property, furniture and equipment (Note F) 285 720 219 884

9. Other assets

a) sundry debtors (Note H) 145 445 248 683

b) positive replacement values (Notes Q, S, U) 9 060 783 8 782 117

9 206 228 9 030 800

10. Subscribed capital and receivable reserves called but not paid (Note X) 1 061 503 1 444 700

11. Prepayments and accrued income 30 658 80 726

Total Assets 310 808 421 298 803 467

The accompanying notes form an integral part of these consolidated financial statements

14

Liabilities 31.12.2007 31.12.2006

1. Amounts owed to credit institutions (Note I)

a) with agreed maturity dates or periods of notice 341 757 218 967

341 757 218 967

2. Debts evidenced by certificates (Note J)

a) debt securities in issue 259 280 003 251 742 473

b) others 892 400 1 090 202

260 172 403 252 832 675

3. Other liabilities

a) sundry creditors (Note H) 1 429 085 1 311 427

b) sundry liabilities (Note H) 37 457 39 739

c) negative replacement values (Notes Q, S, U) 12 945 900 9 903 281

14 412 442 11 254 447

4. Accruals and deferred income (Note G) 270 724 344 285

5. Provisions

a) Pension plans and health insurance scheme (Note K) 1 038 545 945 254

1 038 545 945 254

Total Liabilities 276 235 871 265 595 628

6. Capital (Note X)

- Subscribed 164 808 169 163 653 737

- Uncalled -156 567 760 -155 471 050

8 240 409 8 182 687

7. Consolidated reserves

a) reserve fund 16 480 817 16 365 374

b) additional reserves 6 067 178 2 511 342

22 547 995 18 876 716

8. Funds allocated to structured finance facility 1 250 000 1 250 000

9. Funds allocated to venture capital operations 1 690 940 1 663 824

10. Profit for the financial year:

Before appropriation from Fund for general banking risks 843 206 2 259 612

Appropriation for the year from Fund for general banking risks (Note L) 0 975 000

Profit to be appropriated 843 206 3 234 612

Total Equity 34 572 550 33 207 839

Total Liabilities & Equity 310 808 421 298 803 467

15

Consolidated income statement

for the year ended 31 December 2007 (in EUR ’000)

31.12.2007 31.12.2006

1. Interest and similar income (Note M) 14 051 950 13 521 846

2. Interest expense and similar charges (Note M) -12 188 607 -11 831 731

3. Income from shares and other variable-yield securities 68 247 29 869

4. Fee and commission income (Note P) 85 924 89 298

5. Fee and commission expense (Note P) -1 842 -589

6. Result on financial operations (Note N) -676 792 716 303

7. Other operating income (Note O) 26 526 28 881

8. General administrative expenses (Note Q) -365 980 -372 156

a) staff costs (Note K) -280 100 -298 220

b) other administrative costs -85 880 -73 936

9. Depreciation and amortisation (Note F) -20 027 -18 257

a) intangible assets -2 984 -3 250

b) tangible assets -17 043 -15 007

10. Credit loss expense -17 465 102 191

11. Impairment losses on shares and other variable-yield securities (Note E) -118 728 -6 043

12. Profit for the period 843 206 2 259 612

13. Transfer from (+) / to (-) the fund for general banking risks (Note L) 0 975 000

14. Profit to be appropriated 843 206 3 234 612

The accompanying notes form an integral part of these consolidated financial statements.

16

|

Statement of movements in consolidated own funds

for the year ended 31 December 2007 (in EUR ’000)

Subscribed capital Callable Capital Fund for general banking risks (**) Funds allocated to Structured Finance Facility Funds allocated to venture capital operations Reserve fund Additional reserves Other AFS reserve Profit of the year before appropriation Total consolidated own funds

At 31 December 2005 163 653 737 -155 471 050 915 000 500 000 1 679 333 16 365 374 1 701 423 154 867 1 246 884 30 745 568

Appropriation of prior year’s profit 0 0 60 000 500 000 0 0 686 884 0 -1 246 884 0

Transfer to additional reserves 0 0 0 0 -15 509 0 15 509 0 0 0

Transfer from additional reserves 0 0 0 250 000 0 0 -250 000 0 0 0

Changes in fair value during the year 0 0 0 0 0 0 0 202 659 0 202 659

Net profit of the year 0 0 0 0 0 0 0 0 2 259 612 2 259 612

At 31 December 2006 163 653 737 -155 471 050 975 000 1 250 000 1 663 824 16 365 374 2 153 816 357 526 2 259 612 33 207 839

Contribution of Bulgaria and Romania as of January 2007 (***) 1 154 432 -1 096 710 0 0 0 115 443 57 489 0 0 230 654

Appropriation of prior year’s profit 0 0 -975 000 0 0 0 3 234 612 0 -2 259 612 0

Transfer to additional reserves (*) 0 0 0 0 27 116 0 -27 116 0 0 0

Changes in fair value during the year 0 0 0 0 0 0 0 290 851 0 290 851

Net profit of the year 0 0 0 0 0 0 0 0 843 206 843 206

At 31 December 2007 164 808 169 -156 567 760 0 1 250 000 1 690 940 16 480 817 5 418 801 648 377 843 206 34 572 550

(*) An amount of EUR’000 27 116 resulting from the value adjustments on venture capital operations at 31 December 2006 has been transferred from the Additional Reserves to the Funds allocated to venture capital operations.

(**) Before appropriation of current year profit.

(***) As at 1 January 2007, the subscribed capital increased from EUR’000 163 653 737 to EUR’000 164 808 169, by virtue of the contributions of two new Member States: Bulgaria and Romania. As a consequence of this capital increase, the two new Member States contributed to their share of Paid-in capital (EUR’000 57 722), and also their share of the Reserves and General Provisions (EUR’000 172 932) for the amounts outstanding as of 31 December 2006.

The accompanying notes form an integral part of these consolidated financial statements.

17

Consolidated Cash flow Statement

as at 31 December 2007 In EUR ‘000

31.12.2007 31.12.2006

A. Cash flows from operating activities:

Profit for the financial year 843 206 2 259 612

Adjustments:

Unwinding of the discount relating to capital and reserve called, but not paid in -45 663 -61 508

Allowance to provision for guarantees issued 0 -30 969

Depreciation and amortisation on tangible and intangible assets 20 027 18 257

Impairment losses on venture capital operations 118 728 12 190

Decrease/Increase in accruals and deferred income -73 561 10 493

Decrease/Increase in prepayments and accrued income 57 845 -34 009

Investment portfolio amortisation -17 454 -18 180

Changes in replacement values on derivatives others than those associated with borrowings and loans -1 526 786 -272 582

Profit on operating activities -623 658 1 883 304

Net loans disbursements -39 910 416 -35 391 121

Repayments 19 984 413 21 143 605

Effects of exchange rate changes on loans 8 104 408 3 778 695

Increase in prepayments and accrued income on loans -219 593 -72 258

Adjustment of loans (fair value option) 899 229 1 268 470

Changes in replacement values on derivatives associated with loan -777 549 -1 323 349

Decrease/Increase in operational portfolio 1 090 330 -7 200

Increase in venture capital operations -153 690 -160 886

Impairment losses on loans and advances -45 367 -210 083

Increase in shares and other variable-yield securities -49 207 -29 913

Decrease/Increase in other assets 103 238 -67 359

Increase/Decrease in other liabilities 213 740 -140 234

Net cash from operating activities -11 384 122 -9 328 329

B. Cash flows from investing activities:

Securities matured during the year 328 790 444 272

Purchases of securities 0 -323 639

Increase in asset backed securities -1 995 637 -943 224

Purchase of property, furniture and equipment -82 879 -54 778

Purchase of intangible fixed assets -1 825 -2 235

Net cash from investing activities -1 751 551 -879 604

C. Cash flows from financing activities:

Issue of borrowings 54 678 538 45 549 825

Redemption of borrowings -35 348 649 -39 904 317

Effects of exchange rate changes on borrowings and swaps -8 408 498 -4 709 148

Adjustments of borrowings (fair value option) -553 677 -6 299 275

Changes in replacement values on derivatives associated with borrowings 1 368 022 4 302 267

Decrease/Increase in accrual and deferred income on borrowings and swaps 157 800 -253 792

Paid in by Member States 630 824 300 996

Increase/Decrease in commercial paper 514 480 -207 278

Increase/Decrease in amounts owed to credit institutions 122 790 -174 081

Net cash from financing activities 13 161 630 -1 394 803

18

Summary statement of cash flows:

Cash and cash equivalents at beginning of financial year 18 296 391 29 899 127

Net cash from:

(1) operating activities -11 384 122 -9 328 329

(2) investing activities -1 751 551 -879 604

(3) financing activities 13 161 630 -1 394 803

Cash and cash equivalents at end of financial year 18 322 348 18 296 391

Cash analysis:

Cash in hand, balances with central banks and post office banks 27 318 14 676

Bills maturing within three months of issue 2 192 187 3 473 637

Loans and advances to credit institutions:

Accounts repayable on demand 286 263 209 752

Term deposit accounts 15 816 580 14 598 326

18 322 348 18 296 391

The accompanying notes form an integral part of these consolidated financial statements.

19

European Investment Bank Group

Notes to the consolidated financial statements

as at 31 December 2007

Note A – Significant accounting policies

A.1. Basis of preparation

Statement of compliance

The European Investment Bank (the “Group”) consolidated financial statements (the “Financial Statements”) have been prepared in accordance with international financial reporting standards (IFRS), as endorsed by the European Union.

The accounting policies applied are in conformity, in all material respects, with the general principles of the Directive 86/635/EEC of the Council of the European Communities of 8 December 1986 on the annual accounts and consolidated accounts of banks and other financial institutions, as amended by Directive 2001/65/EC of 27 September 2001 and by Directive 2003/51/EC of 18 June 2003 on the annual and consolidated accounts of certain types of companies, banks and other financial institutions and insurance undertakings (the “Directives”). However, the Financial Statements do not include any management report. The Group prepares an Activity Report which is presented separately from the Financial Statements and its consistency with the Financial Statements is not audited.

Basis of consolidation

The Financial Statements comprise those of the European Investment Bank (the “Bank” or the “EIB”) having its registered office at 100, boulevard Konrad Adenauer and those of its subsidiary, the European Investment Fund (the “Fund” or the “EIF”), having its registered office at 43, avenue J.F. Kennedy, Luxembourg. The financial statements of the Fund are prepared for the same reporting year as the Bank, using consistent accounting policies.

After aggregation of the balance sheets and income statements, all intra-group balances, transactions, income and expenses resulting from intra-group transactions are eliminated.

The Bank holds 65.78 % (2006: 61.20 %) of the subscribed capital of the EIF and therefore has applied the principles pronounced by IAS 27 in preparing consolidated financial statements. Hence, the Group combines the financial statements of the EIB and the EIF line by line by adding together like items of assets, liabilities, equity, income and expenses.

Minority interests represent the portion of profit or loss and net assets not owned, directly or indirectly, by the Bank and are presented under item 6. Result on financial operations in the consolidated income statement and under item 3. Other liabilities - b) sundry creditors (Note A.4.21) in the consolidated balance sheet.

Assets held in an agency or fiduciary capacity are not assets of the Group and are reported in Note W.

A.2. Significant accounting judgements and estimates

In preparing the Financial Statements, the Management Committee is required to make estimates and assumptions that affect reported income, expenses, assets, liabilities and disclosure of contingent assets and liabilities. Use of available information and application of judgement are inherent in the formation of estimates. Actual results in the future could differ from such estimates and the differences may be material to the Financial Statements.

The most significant use of judgements and estimates are as follows:

Fair value of financial instruments

Where the fair values of financial assets and financial liabilities recorded on the balance sheet cannot be derived from active markets, they are determined using a variety of valuation techniques that include the use of mathematical models. The input to these models is taken from observable markets where possible, but where this is not feasible, a degree of judgement is required in establishing fair values. The judgements include considerations of liquidity and model inputs such as correlation and volatility for longer dated derivatives.

Impairment losses on loans and advances

The Group reviews its problem loans and advances at each reporting date to assess whether an allowance for impairment should be recorded in the consolidated income statement. In particular, judgement by management is required in the estimation of the amount and timing of future cash flows when determining the level of allowance required.

Such estimates are based on assumptions about a number of factors and actual results may differ, resulting in future changes to the allowance. In addition to specific allowance against individually significant loans and advances, the Bank also makes a collective impairment test on exposures which, although not specifically identified as requiring a specific allowance, have a greater risk of default than when originally granted.

20

Valuation of unquoted equity investments

Valuation of unquoted equity investments is normally based on one of the following:

• recent arms length market transactions;

• current fair value of another instrument that is substantially the same;

• the expected cash flows discounted at current rates applicable for items with similar terms and risk characteristics; or

• other valuation models.

The determination of the cash flows and discount factors for unquoted equity investments requires significant estimation. The Group calibrates the valuation techniques periodically and tests them for validity using either prices from observable current market transactions in the same instrument or from other available observable market data.

As at 31 December 2007, there were no differences between the transaction price at initial recognition and the fair value that would be determined at that date using the valuation technique mentioned above.

Impairment of equity investments

The Group treats available-for-sale equity investments as impaired when there has been a significant or prolonged decline in the fair value below its cost or where other objective evidence of impairment exists. The determination of what is “significant” or “prolonged” requires judgment. The Group treats “significant” generally as 20 % or more and “prolonged” greater than 6 months. In addition, the Group evaluates other factors, including normal volatility in share price for quoted equities and the future cash flows and the discount factors for unquoted equities.

Pension and other post employment benefits

The cost of defined benefit pension plans and other post employment medical benefits is determined using actuarial valuations. The actuarial valuation involves making assumptions about discount rates, expected rates of return on assets, future salary increases, mortality rates and future pension increases. Due to the long term nature of these plans, such estimates are subject to significant uncertainty.

A.3. Changes in accounting policies

The accounting policies adopted are consistent with those of the previous financial year except as follows:

The Group has adopted the following new and amended IFRS and IFRIC interpretations during the year. Adoption of these revised standards and interpretations did not have any effect on the financial performance or position of the Group.

They did however give rise to additional disclosures, including in some cases, revisions to accounting policies.

• IFRS 7 Financial Instruments: Disclosures

• IAS 1 Amendment - Presentation of Financial Statements

• IFRIC 9 Reassessment of Embedded Derivatives

• IFRIC 10 Interim Financial Reporting and Impairment.

The principal effects of these changes are as follows:

IFRS 7 Financial Instruments: Disclosures:

This standard requires disclosures that enable users of the Financial Statements to evaluate the significance of the Group’s financial instruments and the nature and extent of risks arising from those financial instruments. The new disclosures are included throughout the financial statements. While there has been no effect on the financial position or results, comparative information has been revised where needed.

IAS 1 Presentation of Financial Statements:

This amendment requires the Group to make new disclosures to enable users of the financial statements to evaluate the Group’s objectives, policies and processes for managing capital. These new disclosures are shown in Note X.3.

IFRIC 9 Reassessment of Embedded Derivatives:

IFRIC 9 states that the date to assess the existence of an embedded derivative is the date that an entity first becomes a party to the contract, with reassessment only if there is a change to the contract that significantly modifies the cash flows.

IFRIC 10 Interim Financial Reporting and Impairment:

The Group adopted IFRIC Interpretation 10 as of 1 January 2007, which requires that an entity must not reverse an impairment loss recognised in a previous interim period in respect of goodwill or an investment in either an equity instrument or a financial asset carried at cost.

Standards issued but not yet effective:

The following IFRS and IFRIC interpretations were issued with an effective date for financial periods beginning on or after 1 January 2008. The Group has chosen not to early adopt these standards and interpretations before their effective dates.

IFRS 8 Operating Segments:

This standard is to be applied for annual periods beginning on or after 1 January 2009. This standard requires disclosure of information about the Group’s operating segments and replaced the requirement to determine primary and

21

secondary reporting segments of the Group. The Group plans to adopt this standard at its effective date.

IFRIC 14 IAS 19 – The Limit on a Defined Benefit Asset, Minimum Funding Requirements and their Interaction:

This interpretation is to be applied for annual periods beginning on or after 1 January 2008. The interpretation addresses how to assess the limit under IAS 19 Employee Benefits, on the amount of the surplus that can be recognised as an asset, in particular, when a minimum funding requirement exists. The Group plans to adopt this interpretation at its effective date or at the date of endorsement by the European Union, if later, and does not anticipate any significant impacts on its financial statements.

IAS 23 – Amendment – Borrowing costs:

This standard is to be applied for annual periods beginning on or after 1 January 2009. This amendment eliminates the option of expensing all borrowing costs and requires borrowing costs to be capitalized if they are directly attributable to the acquisition, construction or production of a qualifying asset. Accordingly, borrowing costs will be capitalized on qualifying assets with a commencement date after 1 January 2009. The Group plans to adopt this revised standard at its effective date or at the date of endorsement by the European Union, if later, and does not anticipate any significant impacts on its financial statements.

IAS 27R – Consolidated Financial Statements:

This standard is applicable for annual periods beginning on or after 1 July 2009 and must be adopted simultaneously with the adoption of IFRS 3R. The revised IAS 27 will require entities to account for changes in the ownership of a subsidiary, which does not result in the loss of control, as an equity transaction and therefore will not give rise to a gain or loss in income. In addition losses incurred by a subsidiary will be required to be allocated between the controlling and non-controlling interests, even if the losses exceed the non-controlling equity investment in the subsidiary. Finally on loss of control of a subsidiary, entities will be required to re-measure to fair value any retained interest, which will impact the gain or loss recognised on the disposal linked to the loss of control. The Group plans to adopt this revised standard at its effective date or at the date of endorsement by the European Union, if later and does not anticipate any significant impacts on its financial statements.

A.4. Summary of significant accounting policies

A.4.1. Foreign currency translation

The Financial Statements are presented in euro (EUR), as the functional currency and the unit of measure for the capital accounts and for presenting its Financial Statements.

The Group conducts its operations in euro, in the other currencies of the Member States and in non-EU currencies.

Its resources are derived from its capital, borrowings and accumulated earnings in various currencies and are held, invested or lent in the same currencies.

Foreign currency transactions are translated, in accordance with IAS 21, at the exchange rate prevailing on the date of the transaction.

Monetary assets and liabilities denominated in currencies other than in euro are translated into euro at the exchange rate prevailing at the balance sheet date. The gain or loss arising from such translation is recorded in the consolidated income statement.

Non-monetary items that are measured in terms of historical cost in a foreign currency are translated using the exchange rates at the dates of the initial transactions. Non-monetary items measured at fair value in a foreign currency are translated using the exchange rates at the date when the fair value was determined.

Exchange differences on non-monetary financial assets are a component of the change in their fair value. Depending on the classification of a non-monetary financial asset, exchange differences are either recognized in the income statement or within the equity reserves.

Exchange differences arising on the settlement of transactions at rates different from those at the date of the transaction, and unrealised foreign exchange differences on unsettled foreign currency monetary assets and liabilities, are recognized in the consolidated income statement.

The elements of the consolidated income statement are translated into euro on the basis of the exchange rates prevailing at the end of each month.

A.4.2. Derivatives

All derivative instruments of the Group are measured at fair value through profit and loss account on the consolidated balance sheet and are reported as positive or negative replacement values. Fair values are obtained from quoted market prices, discounted cash flow models and option pricing models, which consider current market and contractual prices for the underlying instrument, as well as time value of money, yield curve and volatility of the underlying.

The Group uses derivative instruments mainly for hedging market exposure on borrowings and lending transactions, and also as part of its asset and liability management activities to manage exposures to interest rate and foreign currency risk, including exposures arising from forecast transactions. The Group applies the amended Fair Value Option of IAS 39 when balance sheet items, together with one or more derivative transactions meet the

22

eligibility criteria of the amended Fair Value Option, more in particular when a significant reduction of the accounting mismatch is thus obtained.

The Group currently does not use any of the hedge accounting possibilities available under IAS39.

The majority of the Group’s swaps are concluded with a view to hedging specific bond issues. The Group enters into currency swaps, in which, at inception, the proceeds of a borrowing are converted into a different currency, mainly as part of its resource-raising operations and, thereafter, the Group will obtain the amounts needed to service the borrowing in the original currency.

Macro-hedging swaps used as part of asset/liability management are marked to market (fair value) using internal valuation models. In general, derivative instruments transacted as economic hedges are treated in the same way as derivative instruments used for trading purposes, i.e. realized and unrealized gains and losses are recognized in Result on financial operations. Accrued interest on derivatives is part of the fair value recorded in the consolidated income statement and in the consolidated balance sheet.

A derivative may be embedded in a “host contract”. Such combinations are known as hybrid instruments and arise predominantly from the issuance of certain structured debt instruments. If the host contract is not carried at fair value with changes in fair value reported in the consolidated income statement, the embedded derivative is separated from the host contract and accounted for as a stand-alone derivative instrument at fair value if, and only if, the economic characteristics and risks of the embedded derivative are not closely related to the economic characteristics and risks of the host contract and the embedded derivative actually meets the definition of a derivative.

A.4.3. Financial assets

Financial assets are accounted for using the settlement date basis.

A.4.4. Cash and Cash Equivalents

The Group defines cash equivalents as short-term, highly liquid securities and interest-earning deposits with original maturities of 90 days or less.

A.4.5. Fee income

The Group earns fee income from a diverse range of services it provides to its customers. Fee income can be divided into two broad categories:

• income earned from services that are provided over a certain period of time, for which customers are generally billed on an annual or semi-annual basis, and

• income earned from providing transaction-type services.

Fees earned from services that are provided over a certain period of time are recognised on an accrual basis over the service period. Fees earned from providing transaction-type services are recognized when the service has been completed. Fees or components of fees that are performance linked are recognized when the performance criteria are fulfilled. Issuance fees and redemption premiums or discounts are amortised over the period to maturity of the related borrowings, unless those borrowings are measured at fair value, in which case the recognition in the consolidated income statement is immediate.

A.4.6. Securities lending

In April 2003, the Group signed an agreement for securities lending with Northern Trust Global Investment acting as an agent to lend securities from the Investment Portfolio, B1 “Credit Spread” portfolio and B3 “Global Fixed income” portfolio.

Securities lent are recorded at the amount of cash collateral received, plus accrued interest. Securities received as collateral under securities lending transactions are not recognized in the consolidated balance sheet unless control of the contractual rights that comprise these securities received is gained. Securities lent under securities lending transactions are not derecognised from the consolidated balance sheet unless control of the contractual rights that comprise these securities transferred is relinquished. The Group monitors the market value of the securities lent on a daily basis and provides or requests additional collateral in accordance with the underlying agreement.

Fees and interest received or paid are recorded as interest income or interest expense, on an accrual basis.

A.4.7. Treasury bills and other bills eligible for refinancing with central banks and debt securities including fixed-income securities and other variable-yield securities

With a view to clarifying management of its liquid assets and consolidating its solvency, the Group has established the following portfolio categories:

A.4.7.1. Held for trading portfolio

The held for trading portfolio (see Operational portfolio B3 in Note B) comprises listed debt securities issued and guaranteed by financial establishments, which are owned by the Group (“long” positions). Securities held in this portfolio are marked to market in the consolidated balance sheet, any gain or loss arising from a change in fair value being included in the consolidated income statement in the period in which it arises.

Gains and losses realized on disposal or redemption and unrealized gains and losses from changes in the fair value of trading portfolio assets are reported as Net trading income in the account “Result on financial operations”.

23

Interest income on trading portfolio assets is included in interest income.

The determination of fair values of trading portfolio assets is based on quoted market prices in active markets or dealer price quotations, pricing models (using assumptions based on market and economic conditions), or management’s estimates, as applicable.

A.4.7.2. Held-to-maturity portfolio

The held-to-maturity portfolio comprises the Group’s Investment portfolio and the operational portfolio A1 of EIB (see Note B).

The Investment portfolio consists of securities purchased with the intention of holding them to maturity. These securities are issued or guaranteed by:

• Governments of the European Union, G10 countries and their agencies;

• Supranational public institutions, including multinational development banks.

These securities are initially recorded at the purchase price, or more exceptionally the transfer price. The difference between entry price and redemption value is amortised prorata temporis over the remaining life of the securities.

The Group has decided to phase out the investment portfolio of the Bank, by ceasing to invest the redemption proceeds of matured securities in the portfolio.

The Operational portfolios A1 of the Group are held for the purpose of maintaining an adequate level of liquidity in the Group and comprise money market products with a maximum maturity of twelve months, in particular, treasury bills and negotiable debt securities issued by credit institutions. The securities are held until their final maturity and presented in the Financial Statements at their amortized cost.

The Asset Backed Securities portfolio mainly consists of obligations in the form of bonds, notes or certificates issued by a Special Purpose Vehicle (SPV) or a trust vehicle. These securities are classified as held to maturity and recorded at purchase price. Value impairments are accounted for, if these are other than temporary.

A.4.7.3. Available for sale portfolio

The available for sale portfolio comprises the securities of the operational money market portfolio A2 and of the operational bond portfolios B1 and B2 (see Note B), the operational portfolio of the Fund, shares, other variable-yield securities and participating interests (see Note B). Securities are classified as available for sale where they do not appropriately belong to one of the other categories of financial instruments recognised under IAS 39, i.e. “held for trading” or “held-to-maturity”. The Management

Committee determines the appropriate classification of its investments at the time of the constitution of a portfolio, financial instruments within one portfolio have always the same classification. Available-for-sale financial investments may be sold in response to or in anticipation of needs for liquidity or changes in interest rates, credit quality, foreign exchange rates or equity prices.

Available for sale financial investments are carried at fair value. They are initially recognised at fair value plus transaction costs. Unrealised gains or losses are reported in consolidated reserves until such investment is sold, collected or otherwise disposed of, or until such investment is determined to be impaired. If an available for sale investment is determined to be impaired, the cumulative unrealised gain or loss previously recognised in own funds is included in consolidated income statement for the period. A financial investment is considered impaired if its carrying value exceeds the recoverable amount. Quoted financial investments are considered impaired if the decline in market price below cost is of such a magnitude that recovery of the cost value cannot be reasonably expected within the foreseeable future. For non-quoted equity investments, the recoverable amount is determined by applying recognized valuation techniques.

Financial assets are derecognised when the right to receive cash flows from the financial assets have expired or where the Group has transferred substantially all risks and rewards of ownership. On disposal of an available for sale investment, the accumulated unrealised gain or loss included in own funds is transferred to consolidated income statement for the period. Gains and losses on disposal are determined using the average cost method. Interest and dividend income on available-for-sale financial investments are included in “interest and similar income” and “income from securities with variable yield”. Interest on available-for-sale debt securities and other fixed income securities calculated using the effective interest method is recognised in the income statement. Dividends on equity investments are recognised in the income statement when the Group’s right to receive payment is established.

The determination of fair values of available for sale financial investments is generally based on quoted market rates in active markets, dealer price quotations, discounted expected cash flows using market rates commensurate with the credit quality and maturity of the investment or based upon review of the investee’s financial results, condition and prospects including comparisons to similar companies for which quoted market prices are available.

Venture capital operations and participating interests held represent medium and long-term investments and are measured at fair value, by using fair value measurement techniques including entity inputs, in absence of liquid market prices, commonly used by market participants. However, some are accounted for at cost when the

24

fair value cannot be reliably measured. The nature of those investments is such that an accurate fair value can be determined only upon realization of those investments. The estimation by the Group of a fair value for venture capital investments for which the method and timing of realization have not yet been determined is therefore considered to be inappropriate in those instances. All venture capital operations are subject to review for impairment.

The Group assesses at each balance sheet date whether there is any objective evidence that a financial asset or a group of financial assets is impaired. A financial asset or a group of financial assets is deemed to be impaired if, and only if, there is objective evidence of impairment as a result of one or more events that has occurred after the initial recognition of the asset (an incurred “loss event”) and that loss event (or events) has an impact on the estimated future cash flows of the financial asset or the group of financial assets that can be reliably estimated.

In the case of equity investments classified as available-for-sale, this would include a significant or prolonged decline in the fair value of the investments below its cost. Where there is evidence of impairment, the cumulative loss measured as the difference between the acquisition cost and the current fair value, less any impairment loss on that financial asset previously recognised in the consolidated income statement is removed from equity and recognised in the income statement. Impairment losses on equity investments are not reversed through the consolidated income statement; increases in their fair value after impairment are recognised directly in equity. In contrast, if in a subsequent period, the fair value of a debt instrument classified as available-for-sale increases and the increase can be objectively related to an event occurring after the impairment loss was recognised, the impairment loss is reversed through the income statement.

A.4.8. Loans and advances to credit institutions and customers

Loans and receivable include loans where money is provided directly to the borrower. A participation in a loan from another lender is considered to be originated by the Group, provided it is funded on the date the loan is originated by the lender.

Loans and receivable are recognized in the assets of the Group when cash is advanced to borrowers. They are initially recorded at cost (their net disbursed amounts), which is the fair value of the cash given to originate the loan, including any transaction costs, and are subsequently measured at amortized cost using the effective interest rate method.

Where loans meet the eligibility criteria of the amended Fair Value Option and have been designated as at Fair Value through Profit and Loss, they are measured at their fair value. The fair value measurement technique used is based on a discounted cash flow technique.

A.4.8.1. Interest on loans

Interest on loans originated by the Group is recorded in the consolidated income statement (interest and similar income) and on the consolidated balance sheet (loans and advances) on an accruals basis.

A.4.8.2. Reverse repurchase and repurchase operations (reverse repos and repos)

A reverse repurchase (repurchase) operation is one under which the Group lends (borrows) liquid funds to (from) a credit institution which provides (receives) collateral in the form of securities. The two parties enter into an irrevocable commitment to complete the operation on a date and at a price fixed at the outset.

The operation is based on the principle of delivery against payment: the borrower (lender) of the liquid funds transfers the securities to the Group’s (counterparty’s) custodian in exchange for settlement at the agreed price, which generates a return (cost) for the Group linked to the money market.